4

Prospects for the Future

What are the prospects for the decade ahead? What are the general trends, and what are the factors that could introduce significant changes in these trend lines? The current picture is one of U.S. predominance in biotechnology and continuing technology transfer to Japan, based on the unique role of innovative U.S. biotechnology firms and U.S. universities as the dynamic foundation for commercial R&D.

The overall lead that U.S. firms enjoy today in biotechnology R&D is, however, insufficient to guarantee future competitive success. Japanese firms present a significant competitive challenge, one likely to grow in the years ahead. Japanese companies involved in biotechnology believe that it is critical technology, and they are developing broad-based strategies, in cooperation with their government, to use biotechnology as a base to move into diverse new business areas.

The NRC working group expects biotechnology to surge in significance in the decade ahead. The number of U.S. companies will continue to expand overall, despite some consolidation. The structure of the industry will change, showing less concentration in the health care field.

The U.S. today has some important advantages over Japan_the involvement of university researchers in new and innovative companies and a vibrant venture capital market. In 1991 nearly $4 billion in equity capital was raised in the United States. This new financing provides U.S. biotechnology firms with a stronger hand in negotiating linkages. We are witnessing the creation of a new paradigm_small U.S. biotechnology companies

are linking up with larger U.S. companies and U.S. universities. This triad arrangement holds the promise of strengthening the foundation for the industry through faster commercialization.

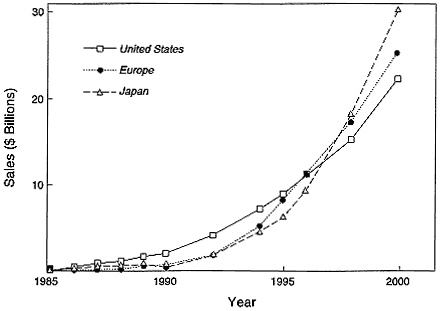

Estimates of the biotechnology market in the United States, Japan, and Europe in the year 2000 vary considerably. According to an analysis by the North Carolina Biotechnology Center, the Japanese market will see sales of $30 billion in the year 2000, exceeding sales in the United States or Europe. Other estimates by CEOs project sales in the United States of $50 billion by the end of the decade.70 Other indications of the importance of the industry are that (1) sales of biotechnology products by U.S. industry are nearing $3 billion, (2) the equity value of public companies in the biotechnology sector grew by nearly 40 percent in 1990, (3) the biotechnology sector was the number-one performer for 1990 according to Dow Jones.71 (See Figure 3.)

Looking to the future, U.S. biotechnology firms will continue to proliferate. While consolidation among companies (and acquisition of some) will continue, the rate of start-ups in the United States will exceed the rate of consolidation; thus, net industry growth will continue. However, industry growth (by numbers of companies) may slow. For example, during the 1980s, there were 50 to 75 start-ups each year; during the first half of the 1990s the rate is likely to decrease.

Small biotechnology firms will probably form strategic alliances with large foreign and domestic companies at earlier and earlier stages in their growth/existence. During the 1980s, many biotechnology firms formed strategic alliances with corporate partners in periods when capital was expensive and becoming increasingly difficult to obtain. This trend caused most partnering to be done by the larger biotechnology firms whose principal purpose was to obtain capital. As we move through the 1990s, the general purposes of these alliances will change, as will their character and purpose:

-

Alliances will be formed earlier and earlier in a biotechnology firm's existence. Today we see biotechnology firms forming alliances shortly after formation, even sometimes as a precursor to obtaining venture capital. These alliances are a de facto validation of the new biotechnology firms (thereby encouraging venture and other investment) and also bring specific technical resources to both sized companies. For the bigger players, the technology is increasingly unavailable to them in other forms. (A Nobelprize-caliber scientist with cutting-edge technology for further development may be willing to create his or her own company and partner the technology for further development with a large corporate partner but may be unwilling to become an employee of a large company.) Thus, a new paradigm for

FIGURE 3 Biotechnology sales, 1985–2000. Source: Mark Dibner.

-

innovation is occurring: cutting-edge technology being efficiently (in terms of both time and financing) developed in new small biotechnology firms, rather than through large corporate R&D groups that partner with small companies to develop new technology. In this probable scenario the effective development of tomorrow's products through new technology is more likely through Partnering than large company investment in core technology.

-

The smaller companies' interest in partnering will be less for the purpose of obtaining capital (although that will always be useful), than for synergy in developing the technology and downstream access to regulatory support, thus defraying some costs of the clinical trials and withstanding potential regulatory delays. Also, partnering will be a vehicle to achieve some form of integration (i.e., manufacturing, marketing, distribution, support).

-

Large U.S. and European companies will increasingly be the panners in these early stages (due to compatibility of cultures, markets, and comfort with partnering), with Japanese companies involved in later stages. When access to Japanese regulatory processes and Japanese Asian markets becomes more important, partnering with Japan will begin. Since the time frames to complete Japanese linkages are often longer, and thus more costly to small U.S.-based biotechnology firms, the probability of large numbers of U.S.-Japanese strategic alliances in these earlier stages is low.

U.S. biotechnology firms are generally developing a new structural paradigm. Rather than emerge as an industry generating a lot of fully integrated pharmaceutical/chemical/agricultural or food-type companies, only a few (less than 3 percent) fully integrated companies are likely to emerge. Most will integrate in niches but be more strategically linked and parmeted, thereby building value and survivability but not growing up to look like Merck or Monsanto. Only a handful of large fully integrated companies will emerge. In the past 50 years, only one major U.S.-based pharmaceuticals company with sales in excess of $1 billion_Syntex_has emerged in this way. As an industry, the biotechnology industry will spawn a few more Syntex's but not many.

Hundreds of strategically linked and niched companies will spawn and survive. (These firms will be self-sustaining and vertically integrated in some markets or geographical regions, but will be strategically linked to large foreign and domestic partners in other areas.) The U.S. government can play an active role in this process through mechanisms such as support for industry-driven R&D institutes that focus on areas of generic technology necessary for future applications.

Large U.S. companies in pharmaceuticals, chemicals, energy, and food will increasingly look to the biotechnology world as a vehicle to integrate new technology development. Investments in emerging technologies and early-stage development of products (even through venture capital funds) will therefore be outsourced from the biotechnology world, rather than through capital investment in corporate R&D.

Japanese companies will increasingly pay attention to the U.S. biotechnology industry. However, U.S. biotechnology firms' preferred linkage partners will be European and U.S.-based companies because of cultural compatibility and efficiency. Over time a model will emerge in which Japanese companies will come to parity with U.S. and European companies as potential partners for biotechnology firms, but this will occur over a longer period of time (toward the end of the 1990s). Selectively, we will see acquisition of biotechnology firms by foreign-based investors, with the Japanese companies lagging behind both the European and the American companies as acquirers.

On the other end of the spectrum, Japanese companies are increasing, and will continue to increase, their investment in technology directly with the U.S. academic sector, in lieu of (or in addition to) linkages with small firms. As academic institutions around the world, and principally in the United States, look for corporate support for continued funding, Japanese companies are likely to become increasingly involved. Only very specific technology and product-related links are likely to be the focus of strategic linkages between Japanese companies and U.S.-based biotechnology firms.

Japan will continue to increase its investment in the basic research

sciences at a slow rate. The gap among the U.S., European, and Japanese science bases will diminish as we approach the year 2000, but the United States will continue to dominate in the 1990s. It is unlikely that the Japanese companies will attract large numbers of U.S. scientists to move to Japan. Therefore, the trend will be for Japanese companies to build research facilities in the United States as a vehicle to develop and export technology and completed products to Japanese companies for worldwide commercialization.

Since the worldwide pharmaceuticals industry is not dominated by Japanese companies, nonhealth care biotechnology (i.e., electronics, energy, chemicals) is more likely to be developed by them first. Conversely, healthcare-related biotechnology will more likely be developed and partnered by U.S. and European companies (a world in which they dominate).

U.S.-based biotechnology firms are not likely to have the resources to establish the necessary manufacturing, marketing, and sales infrastructure to support the development of their Japanese operations. Therefore, as U.S.-based industry commercializes its products, it will use Japanese linkages for the purpose of establishing marketing, manufacturing, and sales presence in Japan.

With respect to intellectual property rights, differences between Japan's first-to-file system and the U.S. first-to-invent system will cause U.S. biotechnology firms to continue to establish their own intellectual property protection in the United States and Europe and to look to Japanese companies as their partners to establish intellectual property protection in Japan.72 Many CEOs of U.S. biotechnology firms perceive a gap between U.S. and Japanese intellectual property protection to be a major hindrance to their independent participation in the Japanese market. In other words, U.S. biotechnology firms will establish their own regulatory interfaces with U.S. authorities (or partner with large U.S.-based companies) and will establish their own European-based regulatory interfaces (or partner with European-based companies). In Japan, in contrast, U.S. firms will not establish their own regulatory interfaces but will partner with Japanese companies to facilitate their interfaces. In some cases the U.S.-based biotechnology firms will partner with U.S. and European companies for worldwide regulatory interfaces, with special linkages to Japanese firms for the Japanese market.

Historically, biotechnology R&D has been developed largely in the United States and to a lesser extent in Europe. As we move through the 1990s, Europe will move quickly but will not achieve parity with the United States. As the end of the 1990s, Japan will become increasingly important as a source of technology development. In this regard, U.S.-based biotechnolo-

gy firms will begin to partner with Japanese companies for access to new intellectual capital by the end of the decade.

It is likely that the future scenario will reflect U.S.-based development of health-care-related technologies and products with partnering with Japanese companies for access to Japanese markets. At the same time, nonhealth care technology can be expected to develop more quickly in Japan and U.S.-based companies will seek strategic alignment with Japanese companies to access these technologies for the U.S. and worldwide markets.

To understand any scenario for the future of the U.S. biotechnology industry, one needs to be reminded of the intimate linkage the industry has had to date with a capital market, a market that has generally been very supportive of biotechnology firms. Should this change in the United States during the 1990s, there will be more Japanese linkages as sources of capital, and, therefore, more strategic alignments.

The overall conclusion drawn by the NRC working group is that current trends will continue but that there may be some new developments in Japan that bear careful analysis and response. U.S. industry has some very important assets, but these must be managed in order to ensure that it remains strongly competitive in global biotechnology markets.