2

A Model for Monitoring Access

For most people, the frightening prospect of being unemployed, losing health insurance coverage, having inadequate insurance benefits, or living in a rural community without a physician raises one vital access-related question: Will I be able to get the care I need if I become seriously ill? At any given time in the United States, comparatively few people are seriously ill. National surveys reveal that 90 percent of Americans believe that they are in good to excellent health. Despite this record of good health, more than 75 percent of Americans have some contact with a doctor each year; only 4 percent have not seen a doctor within the past five years (National Center for Health Statistics, 1989). The reason for this seeming contradiction, of course, is that we expect more from medical care than the treatment of serious illness; we want it to keep us healthy and to ease our discomfort and disability during short bouts of illness. The care we might receive goes well beyond the physician's office to other settings and practitioners—from therapists to visiting nurses, from hospital emergency departments to public health clinics. The one-on-one interaction of provider and patient in an array of settings is often called the personal health care system.

Certain barriers can make gaining access to the personal health care system difficult. Lack of transportation, inadequate health insurance, and language difficulties are a few of the many hurdles that may stand between someone who is sick and needs health care. More broadly, barriers can create inequitable circumstances for the poor and certain minority populations. The poor and minorities not only have more difficulty getting services,

but they also are in general less healthy. This may be due to not only the amount of care they receive but also the content, quality, and continuity of what care they do receive.

Access to services is not an end in and of itself. The purpose of gaining access to the personal health care system is to achieve one or more of an array of possible health outcomes—not only avoidance of untimely death and relief of acute symptoms but also maintenance of long-term functioning and relief from anxiety about the meaning of symptoms. This said, however, it should be emphasized that the relationship between desired benefits of positive health outcomes and health care services is not clear-cut. Even countries that have reduced many of the barriers faced by those in the United States by establishing universal health care still experience differences in access to health care according to social class (Illsley and Svensson, 1990). Moreover, other mechanisms in addition to medical care, such as environmental control, education, and occupational safety, contribute to the health of populations.

Despite the difficulties of sorting out the effects of health care services from those of other factors, society has a stake in monitoring how equitably its investment in health services is working, by being able to identify who has access problems and why. The challenge before the IOM committee was to identify a limited set of different personal health care services in which the connection between timely receipt of care and desired outcomes is relatively strong. These indicators can then be used to track changes in access over time and differences in access across groups in society.

DEFINING ACCESS

Access is a shorthand term used for a broad set of concerns that center on the degree to which individuals and groups are able to obtain needed services from the medical care system. Often because of difficulties in defining and measuring the term, people equate access with insurance coverage and having enough doctors and hospitals in the areas in which they live. But having insurance or nearby health care providers is no guarantee that people who need services will get them. Conversely, many who lack coverage or live in areas that appear to have shortages of health care facilities do, indeed, receive services.

Perhaps the most extensive effort to sort out the meanings of access and the related concept of equity was mounted by the 1983 President's Commission for the Study of Ethical Problems in Medicine and Biomedicine and Behavioral Science Research. The commission described society's ethical obligation to ensure access as follows: "Equitable access to health care requires that all citizens be able to secure an adequate level of care without excessive burdens" (President's Commission for the Study of Ethical Problems

in Medicine and Biomedicine and Behavioral Science Research, 1983, p. 4). As the commission pointed out, however, transforming this moral obligation into reality is difficult because it involves deciding what constitutes an adequate level of care, what should be considered an excessive burden, and how to know when these standards have been reached or even exceeded.

As the IOM committee considered ways to resolve these conceptual problems, it became clear that health outcomes are as integral to the concept of access as is the use of services. Certain questions assumed central importance—for example, who is not receiving preventive services or medical treatment that would make a difference for health status? Who is not receiving care that eases pain, improves functioning, or alleviates anxiety? With equity of access to health services, the answers to these questions should not be affected by race, ethnic origin, income, geographical location, or insurance status.

Based on these considerations, the committee defined access as follows: the timely use of personal health services to achieve the best possible health outcomes. Importantly, this definition relies on both the use of health services and on health outcomes to provide yardsticks for judging whether access has been achieved. The test of equity of access involves determining whether there are systematic differences in use and outcome among groups in society and whether these differences are the result of financial or other barriers to care.

A standard of "the best possible health outcome" is admittedly an ideal goal. Particularly in a society that limits the resources devoted to health care, all that medical science can offer is an optimistic target, unattainable for every patient. Social critics commenting on the health care scene have reminded us from time to time that, even if we could afford it, more medical services are not necessarily a good thing, nor are more services frequently the best road to good health for a society faced with tradeoffs about the best social investments it could make (Evans and Stoddart, 1990; Illich, 1975).

In applying its definition of access the committee sought to occupy a practical middle ground between all care that people might want or believe they needed and the view that medical care can make an important difference in people's lives. The definition forces us to identify those areas of medical care in which services influence health status and then to ask whether the relatively poorer outcomes of some population groups can be explained by problems related to access. The definition also emphasizes the need to move beyond standard approaches that rely mainly on enumerating the presence of health care providers, the number of uninsured, or encounters with health care providers to detect access problems.

For a health outcome to be a useful indicator of access problems, one

must be able to take into account many factors other than medical care that may contribute to differences in outcome among groups, including those factors that may not be easily overcome by medical care. This problem can be addressed by focusing on health outcomes for which the connection between services and desired benefits is as unambiguous as possible. For example, it is known that Pap smears allow early diagnosis of cervical cancer, which leads to better chances of survival. Thus, the incidence of invasive cervical cancer, an outcome measure, may be a good indicator of access to primary care services. In contrast, mortality from pancreatic cancer would not make a good access indicator because there is no reliable screening test for the disease nor is there a good prognosis for survival even with early detection.

Employing the utilization of health care services as an indicator of health care access also has limitations. Some people are prone to overuse medical care, whereas others may underuse it for reasons that have little to do with access barriers. Others use more services because they need more. For example, the poor may use a greater amount of care because they are more likely to have health problems than those with higher-income levels. To interpret utilization indicators unambiguously, efforts must be made to account for need and appropriateness of services.

MEASURING ACCESS

Indicators

To the extent that they reflect objective conditions and social values, indicators can mobilize sociopolitical pressures to raise the overall health levels of the population. They can also provide insight into how well medical knowledge is being applied in a given society to a given population. They offer as well a way of tracking how well a society is discharging its responsibilities for the organization and delivery of health care (Elinson, 1974).

The systematic and periodic reporting of statistics to describe social change and inform policy choices is not new, although it came into its own as the "social indicator movement" in the 1960s (DeNeufville, 1975; Land and Spilerman, 1972). Although some might argue that the widespread enthusiasm of the 1960s for social indicators has waned, the notion of indicators to measure progress in the health arena has continued to be strong, as demonstrated by the U.S. Year 2000 health objectives and the World Health Organization Year 2000 activities (U.S. Public Health Service, 1991).

Generally, an indicator is a sign or symptom that points to the existence of a phenomenon or to a change of status in a phenomenon over time (Andrews, 1989). The phenomenon of interest in the IOM Access Monitoring

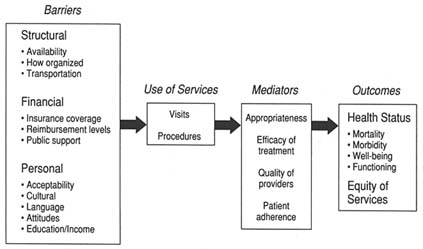

FIGURE 2-1 Model of access to personal health care services.

Project, depicted graphically in Figure 2-1, is the dynamic of participation in the personal health care system: namely, that access problems are created when barriers cause underuse of services, which in turn leads to poor outcomes. In particular, the committee was interested in identifying, quantifying, and relating aspects of three parts of the model—barriers, utilization, and outcomes—that point to problems that individuals or groups have in gaining access to the health care system. The challenge for the committee was to find indicators of utilization and outcomes that vary according to the financial, structural, and personal barriers discussed below.

Indicators have been likened to an automobile temperature gauge. "Even though it reports only one thing—coolant temperature at a specific place in the engine—and does not give temperature readings at all points in the engine, it nevertheless does serve as a useful indicator of the general state of the engine with respect to temperature" (Andrews, 1989, p. 27). Similarly, the access monitoring indicators recommended by the committee are intended to sense when and where access problems occur in the personal health care system. They cannot explain the exact causes of these problems, but they do provide a basis for generating theories about why differences in access exist among populations. Indicators "are indirect or partial measures of a complex situation, but if measured sequentially over time they can indicate direction and speed of change and serve to compare different areas or groups of people at the same moment in time" (World Health Organization, 1981, p. 12).

Indicators will not always move in the same direction. Some may

increase, some may decline, and others may show no change. Although this makes overall assessments more complicated, it can be useful for highlighting problems and gains in specific areas.

It is important not to confuse the purposes that drive the development and use of indicators with those of research studies that seek to explicate the causes of access differentials among population subgroups. A major reason to disaggregate access indicators is to be able to track subgroups of policy interest, such as racial and ethnic groups, the uninsured, and the poor. Researchers, however, are engaged in seeking to identify all the possible variables of interest and to determine their relative contribution to the variability seen in access measures. That information ultimately is quite useful for developing and interpreting indicators.

The literature on social indicators makes a distinction between descriptive and analytic indicators, the latter being grounded in theoretical models in which an interrelationship among variables is explicit. For example, the interrelated components of economic models are indicators whose variation tells us a great deal about the functioning of the economic system (Rossi, 1980). In the case of health care access models, the committee has provided a framework for the access indicators, but it will require years of tracking and further research to begin to approach the sophistication of economic models.

Utilization Indicators

One of the most common ways of determining whether access to health care has been realized is to look at the frequency of visits to a health care provider or the use of medical procedures. Surveys attempting to explore the nature of access have investigated various properties of utilization: who provided the care (physician, dentist); the care setting (office, outpatient department); the purpose of the visit (preventive, curative, custodial); and, finally, the frequency and continuity of use (Aday et al., 1980).

The IOM Access Monitoring Project sought to capture these dimensions of utilization in the selection of indicators. The utilization indicators encompass the services of various types of providers in different settings, including primary and specialty physicians and dentists. Data permitting, it is the committee's aim to broaden the utilization measures to other types of providers. Indirectly, these services are captured by outcome measures that should reflect effective services of nonphysician practitioners. For example, effective prenatal care services for poor pregnant teenagers should incorporate nutrition services, which may be provided by dieticians. In addition to type of provider and setting, the committee chose indicators that would cut across the personal health care system to include, at a minimum,

prevention, early case finding, chronic disease care, surgical procedures, and primary care visits.

Outcome Indicators

For all their usefulness, utilization rates, if used alone to gauge equity of access, can be problematic. A poor mother who brings her asthmatic child to a clinic but cannot afford to purchase the prescribed medication may have a visit recorded, but few would consider that she had adequate access. A poor pregnant woman with a drug addiction requires many more services than most middle-class women if she is to deliver a healthy baby. A physician may be reluctant to order an expensive diagnostic test for an uninsured patient while erring on the side of overutilization for someone with adequate insurance. Thus, the poor and uninsured may enter the medical system, but it is difficult to tell whether they receive the services they need. An additional limitation of using utilization of health care services as a way to measure access is that it is frequently impossible to track all the services people need when they need them, especially for complex chronic diseases.

Looking at health care outcomes is a complementary approach to measuring access. Outcomes can be measured in terms of survival; states of physiological, physical, and emotional health; and satisfaction (Lohr, 1988). Carefully selected outcome indicators, based on such measures as death rates, disease incidence, and conditions that require hospitalization, indirectly provide clues about access barriers that may be impeding appropriate care.

Health researchers and policymakers interested in assuring and improving quality of care have focused their attention on outcome measures as a way of assessing it. For example, a list of diseases amenable to treatment were identified in the 1970s as ''sentinel" measures of quality (Rutstein et al., 1976). They were sentinel in the sense that high rates of death from these diseases indicated a quality-of-care problem. This idea was adapted to identify conditions that were sentinel for access problems—a technique described in Chapter 3.

Utilization and Its Relationship to Health Care

Mediating Factors

Access is only one of several mediating factors that stand between the use of health care services and desired health outcomes. These mediating factors must be taken into account in selecting indicators and in drawing

conclusions about equity of access. In any particular case a given service may not have a positive outcome because (1) it is inappropriate for that patient, (2) some percentage of all disease processes may not respond to the appropriate treatment, (3) the treatment is of questionable efficacy, (4) the disease defeats the best that medical care can offer, (5) the diagnostic and treatment skills of the provider are below acceptable standards, or (6) the patient does not follow the treatment regimen.

The effects of the first three factors can be minimized by selecting services and related outcomes for which the value of a service is relatively unquestioned because, on average, the intervention has demonstrated benefits. In addition, there should be little variation in practice styles that affect when and how to intervene medically.

The second two mediating factors are more difficult to deal with. It is known that in some instances the poor receive care from so-called Medicaid mills, which provide perfunctory services of questionable quality. Even when the poor receive services from hospital outpatient departments or emergency rooms, or in public health clinics, the care may be fragmentary and lack continuity from one visit to the next. These examples may more properly fall under the heading of quality than access, but often the two concepts overlap.

Lack of patient adherence to treatment regimens can range from refusal to take a prescribed medicine to the drug addict's inability to make major lifestyle changes. The distinction between the personal responsibility of the patient for his or her own health and the sociocultural barriers that interfere with good health service outcomes is often difficult to make. How far should the health care system go to compensate for personal factors that may inhibit a patient from complying with the provider's advice? Most would agree that a clinic in the midst of a Southeast Asian refugee community should find a way to have translators available and that the clinic staff should be knowledgeable about the patients' cultural attitudes. In other situations the responsibilities of those who provide health care are less clear. The committee hopes to stimulate productive debate on the factors that mediate the effects of health care services as people attempt to interpret the results of access monitoring.

In summary, no matter how generally efficacious a particular health service may be, a good health care outcome cannot always be guaranteed. The most important consideration is whether people have the opportunity for a good outcome—especially in those instances in which medical care can make a difference. When those opportunities are systematically denied to groups in society because they face barriers to care, there is an access problem that needs to be addressed.

Barriers to Access

There are three primary types of barriers to health care. Structural barriers are impediments to medical care directly related to the number, type, concentration, location, or organizational configuration of health care providers. Financial barriers may restrict access either by inhibiting the ability of patients to pay for needed medical services or by discouraging physicians and hospitals from treating patients of limited means. Personal and cultural barriers may inhibit people who need medical attention from seeking it or, once they obtain care, from following recommended posttreatment guidelines.

These barriers interact in complicated ways. The simple presence or absence of a barrier does not guarantee that one can predict whether services can be obtained. For example, many women without insurance receive prenatal services from community health centers or public health clinics. In some cases these services may better meet their needs than the care women with insurance coverage receive. In addition, many who live in areas designated as having a shortage of health care professionals actually have physicians available to them locally or are willing to travel to the nearest physician. In contrast, many people live in areas with high physician-to-population ratios but are unable to secure needed services (Berk et al., 1984).

Structural Barriers

The post-World War II solution to health care access problems was to expand the basic supply of hospital beds and later, in the 1960s, the supply of health care professionals. The federal government adopted a policy of capacity building at the local level partly in recognition of the fact that the recently enacted Medicare and Medicaid entitlements would strain the health care delivery system by increasing the demand for medical care. Community health centers, the national health service corps, and other programs designed to increase the number of health care professionals in underserved areas were seen as mechanisms by which local communities could take advantage of the broader availability of public insurance. The legacy of this period was to measure access in terms of beds, facilities, and providers in relation to population.

With the strain that growing demand placed on public budgets, however, the 1960s gave way to a move from expansion to constraining capacity in the 1970s through regulatory mechanisms such as certificate-of-need programs. During the 1980s, disillusionment with planning and regulatory approaches led to greater reliance on market forces to control costs.

How health care resources are organized in the 1990s may be as important for improving access as the production of hospital beds and health

professions schools was in an earlier period. Much of the substance of the current national discourse on organizing care derives from the objective that people neither over- nor underutilize care but instead receive care that is appropriate to their condition. The aim is to improve access by redistributing health resources in society—not so as to deny the haves for the sake of the have-nots—but to improve quality for all with judicious use of health care. For the insured with severe or multiple chronic diseases, access to the complicated mix of services that will keep them functioning optimally may necessitate some type of case manager or coordinator. For the poor and uninsured, case management takes on the added meaning of being able to meld public health and social services with personal health care (Enthoven, 1988). Hopes are being pinned to the notion that devising the best mix of risk sharing among payers, patients, and providers will result in a good balance between cost control and quality.

The implicit lesson from this brief historical overview is that most structural barriers to access have their roots in the way health care is financed. Despite a greatly enlarged physician force and the existence of some 600 community health centers, many of today's poor still find it difficult to identify physicians who will accept Medicaid. A major reason for this dilemma is Medicaid's low reimbursement rates. Practitioners seek locations in which they can generate sufficient revenues to support a practice, and these areas often are not easily reached by those living in rural areas or urban neighborhoods with a high concentration of poverty. Racial discrimination and the disinclination of providers to offer discounts and charity care may be other explanations.

Patients who do not succeed in identifying a private physician or health center most often rely on local emergency rooms and hospital outpatient clinics for their primary medical care. Some hospitals have tailored the organization of their services to accommodate this patient population. By its nature, however, emergency care lacks the necessary continuity to deal with many medical problems that are treated more adequately when there is a regular provider of care.

Financial Barriers

The costs of health care, which have risen faster than most services in the economy and faster than real incomes, have made it virtually infeasible for most people to pay directly for any sizable portion of their medical bills when illness strikes. Even maternity care—once an affordable service on a middle-class income—is almost an unthinkable expense now without health insurance. Added to this is the fact that there are growing numbers of families in poverty. The 13.5 percent poverty rate in 1990—up from 12.8 percent a

year earlier—is higher than at any time in the 1970s. The most recent high, however, was the 15 percent rate in 1983 (Bureau of the Census, 1991).

The ability to pay for medical care is closely linked to having public or private health care coverage. Financial barriers to health care access may manifest themselves in several ways: eligibility/insurability, benefit coverage, and reimbursement levels. When insurance fails, it is the responsibility of direct service delivery programs to act as a safety net.

The three major surveys that have regularly monitored the size of the uninsured population all have shown an upward trend of about 25 percent over the past 10 or more years even though they differ somewhat on the exact counts. The National Medical Expenditure Survey in 1977 recorded that 12.3 percent of the population under 65 years of age was uninsured, a proportion that increased to 15.5 percent a decade later (Short et al., 1988). The National Health Interview Survey also reported an increase—from 12.5 percent in 1980 to 15.7 percent in 1989. The Current Population Survey (CPS) of the Census Bureau showed increases throughout the 1980s, although a change in the wording of the questionnaire in 1986 makes trend interpretation difficult. Recently, the CPS reported that the proportion of nonelderly uninsured was 16.6 percent of the population. This 1990 figure was an increase from the 1988 level of 15.9 percent with no insurance (Employee Benefits Research Institute, 1992).

The poor and minorities bear a heavy share of the burden of lack of insurance. In 1990, 55 percent of the uninsured were in families with annual incomes of less than $20,000. Although blacks constitute only 12.7 percent of the U.S. population, they represent 17.4 percent of those without health care coverage. The corresponding figures for Hispanics are 9.3 percent and 19.6 percent (Employee Benefits Research Institute, 1992).

The issue of health care coverage is a question not only of the absence or presence of insurance but also underinsurance—the depth or adequacy of coverage. As the cost of medical care relative to income soars, individuals find it increasingly difficult to maintain the breadth of their coverage. Furthermore, employers are likely to shift some proportion of premium cost increases to their employees through the employee contribution route and benefit restrictions. Underinsurance could affect access when policies do not cover preexisting medical conditions, when they require copayments and deductibles that cause delays in necessary care, or when they fail to cover certain categories of benefits (e.g., mental health services). Underinsurance is a difficult concept to gauge operationally because there is an inherent value judgment involved in setting criteria for what services should be covered and how much in out-of-pocket costs should be borne by individuals. In many cases cost sharing has been promoted as a way to reduce overutilization. In terms of access, underinsurance is interpretable only in

TABLE 2-1 Percentage of the Elderly Covered Only by Medicare by Race, Selected Years

|

Race |

1980 |

1984 |

1989 |

|

Total |

22.7 |

20.0 |

16.8 |

|

Racea |

|||

|

White |

21.0 |

18.5 |

14.7 |

|

Black |

40.6 |

34.5 |

37.9 |

|

Ratio black/white |

1.9 |

1.9 |

2.6 |

|

a Includes persons not covered by private insurance or Medicaid. SOURCES: Unpublished data from the National Center for Health Statistics; National Health Interview Surveys, National Center for Health Statistics (1990c). |

|||

the context of the economic circumstances of an individual in relation to the extent of coverage in his or her specific insurance policy.

Because most elderly people are entitled to Medicare benefits, they are frequently neglected in discussions of access. But Medicare benefits are not comprehensive; consequently, most elderly also carry supplemental private insurance. As Table 2-1 illustrates, less than 20 percent of the elderly have only Medicare. The table also shows that there are some important differences by race, suggesting the potential for underinsurance of these groups and the consequent need to monitor their access problems. In addition to these long-standing issues of comprehensiveness, the effect of recent reforms, including physician reimbursement rules, on access is something that the Physician Payment Review Commission set up by Congress is planning to monitor.

The millions of Americans without health insurance coverage do not necessarily go without care. Much of their care is financed through direct service delivery programs supported by federal, state, and local budgets or is delivered by institutional and individual providers in the form of free or reduced-price services. Included are the budgets of public hospitals, health department clinics, facilities run by the Department of Veterans Affairs, and community health center clinics. A host of special programs enacted by states and localities operate as a health safety net for those who do not qualify for Medicaid. This safety net can be threatened by government budget cuts or the inability of programs to keep pace with increased demand when there are downturns in the economy.

Personal and Cultural Barriers

When population subgroups that share personal characteristics—such as education levels or attitudes—systematically underuse services that make

a difference to health, there is good reason to believe that a problem exists in equity of access. The problem can often be addressed by modifying structural or financial barriers in ways that compensate for patient lack of education or negative patient attitudes about the way care is organized.

The importance of considering the effect of personal and cultural factors on access is heightened by the nation's changing demography. For example, in the late 1980s the foreign-born portion of the U.S. population reached 7 percent from a low of 4.9 percent in 1970. The number of immigrants living in the United States is at an all-time high of 18 million (Fix and Passel, 1991).

Other industrialized nations that have addressed many of the fundamental financial and structural barriers to access are now focusing on cultural determinants of service use and health outcomes that contribute to inequalities in their societies. As Lagasse and his colleagues (1990) note,

Like motherhood and childbirth, and their related practices, disease has to be considered in a cultural context…. We define "health culture" as a set of rules—either implicit or explicit—which determine the behavior of social subjects in relation to their health. Those rules may be obligations or interdictions, repulsions or desires, likes or dislikes. They may be determinants for the body's use or the body's perceptual status, the distribution of the roles inside the family concerning health and disease, the choice of alternative ways to solve health problems (traditional or scientific approach, official or "parallel" medicines), the definition of the limits between normal and abnormal situations in the somatic, psychological, psychosocial, familial or other domains. (p. 238)

For various subpopulations in the United States, insurance and provider availability are necessary but not sufficient for obtaining access to health care. Migrant farmworkers, refugees, newly arrived immigrants, the functionally illiterate, and the homeless—who are likely to have worse-than-average health status—may need translators, outreach workers, and sensitive practitioners to overcome cultural and other barriers to care that could make a difference in their health status.

Much recent research on access problems in the Hispanic and black communities has sought to disentangle the role of cultural factors from other barriers. Most of these studies have found that financial and structural barriers, rather than lack of acculturation, explain most differences in the use of health care services. It has been argued that access problems faced by non-English-speaking patients are more appropriately viewed as a structural defect in the health care delivery system rather than as part of some larger cultural construct.

The Relationship of Access Barriers to Indicators

As is evident from the foregoing discussion, there are no clear demarcation lines among the types of barriers to access. They are highly interrelated—part of the complex processes involved in seeking health care and achieving good outcomes from that care. Nevertheless, they allow us to begin thinking about how measures of access (utilization and outcome) vary according to measures of equity (financing, structural, and personal/cultural factors). The number of uninsured, poor, and ethnic and racial minorities is growing. How well has the health care system adjusted to these changing realities?

In the next chapter the committee proposes a set of outcome and utilization indicators. The extent and direction of change in these indicators should reflect the efforts of policymakers to reduce barriers to care.

REFERENCES

Aday, L. A., Anderson, R., and Fleming, G. 1980. Health Care in the U.S.: Equitable for Whom? Beverly Hills, Calif.: Sage Publications.

Andrews, F. 1989. Developing indicators of health promotion: Contribution from the social indicators movement. In: Health Promotion Indicators and Actions. S. B. Kar, ed. New York: Springer Publishing Co., pp. 29–49.

Berk, M. L., Bernstein, A., and Taylor, A. K. 1984. The use and availability of medical care in health manpower shortage areas. Inquiry 20(Winter):369–380.

Bureau of the Census, U.S. Department of Commerce. 1991. Statistical Abstract of the United States, 1991, 11th ed. Washington, D.C.: U.S. Government Printing Office, pp. 462–466.

DeNeufville, J. I. 1975. Social Indicators and Public Policy: Interactive Processes of Design and Application. Amsterdam: Elsevier.

Elinson, J. 1974. Toward sociomedical health indicators. Social Indicators Research 1:59–71.

Employee Benefits Research Institute. 1992. Sources of Health Insurance and Characteristics of the Uninsured: Analysis of the March 1991 Current Population Study. An EBRI Special Report and Issue. Brief No. 123. Washington, D.C.: EBRI.

Enthoven, A. C. 1988. Managed competition: An agenda for action. Health Affairs 7(3):25–47.

Evans, R. G., and Stoddart, G. L. 1990. Producing health, consuming health care. Social Science and Medicine 31:1347–1364.

Fix, M., and Passel, J. 1991. The Door Remains Open. Recent Immigration to the United States and a Preliminary Analysis of the Immigration Act of 1990. Document No. PRIP–VI–14. Washington, D.C.: The Urban Institute.

Illich, I. 1975. Medical Nemesis: The Expropriation of Health. Toronto: Mclleland and Stewart.

Illsley, R. and Svensson, P. G., eds. 1990. Health Inequities in Europe. Special issue of Social Science and Medicine 31:229–236.

Lagasse, R., Humblet, P. C., Lenaerts, A., Godin, I., and Moens, G. F. 1990. Health and social inequities in Belgium. Social Science and Medicine 31:237–248.

Land, K. C. and Spilerman, S., eds. 1972. Social Indicator Models. New York: Russell Sage Foundation.

Lohr, K. N. 1988. Outcome measurement concepts and questions. Inquiry 25:37–50.

National Center for Health Statistics. 1989. Current Estimates from the National Health Interview Survey. Series 10, No. 176. Hyattsville, Md.: NCHS.

President's Commission for the Study of Ethical Problems in Medicine and Biomedicine and Behavioral Science Research. 1983. Securing Access to Health Care: The Ethical Implications of Differences in the Availability of Health Services , vol. 1. Washington, D.C.: President's Commission.

Rossi, R. J. 1980. The Handbook of Social Indicators: Sources, Characteristics, and Analysis, New York: Garland STPM Press.

Rutstein, D. D., Berenberg, W. B., Chalmers, T. C., et al. 1976. Measuring the quality of medical care: A clinical method. New England Journal of Medicine 294:582–588.

Short, P. F., Monheit, A. C., and Beauregard, K. 1988. Uninsured Americans: A 1987 Profile. Rockville, Md.: National Center for Health Services Research and Health Care Technology Assessment.

U.S. Public Health Service. 1991. Healthy People: National Health Promotion and Disease Prevention Objectives. DHHS Pub. No. (PHS) 91-50212. Washington, D.C.: U.S. Government Printing Office.

World Health Organization. 1981. Development of Indicators for Monitoring Progress Towards Health for All by the Year 2000. Geneva: WHO.