2

What are Likely Categories of Loss and Damage?

Chapter 2 provides a basis for understanding how loss estimates are generated for different categories of losses and damages. Specific issues that will be addressed include: What loss-estimation methodologies currently exist? How satisfactory are inventories for these approaches? In relation to actual losses, how good are these estimates? Are there methodologies for estimating nonstructural losses? What data bases are available from which projections of nonstructural losses can be made?

Mr. Christopher Arnold is an architect and the president of Building Systems Development in California. He is a Fellow of the American Institute of Architects, elected for his contributions to research in the architectural aspects of seismic design. Mr. Arnold is also a member of the NAS/NRC Committee on Earthquake Engineering and has served on that committee's panel on loss-estimation methodologies. Mr. Arnold will present an overview of loss-estimation approaches.

Dr. Don G. Friedman is the director of the Natural Hazards Research Program at the Travelers Insurance Company. Dr. Friedman has 35 years of experience in the assessment of casualty and damage potentials of natural disasters for the insurance industry, federal agencies, and most recently for the All-Industry Research Advisory Council. His presentation focuses on risk-assessment models and the types of data necessary to estimate casualty and property loss potentials from a catastrophic earthquake.

Professor Kathleen Tierney is an associate professor of sociology and the research director of the Disaster Research Center at the University of Delaware. She is the author of a number of monographs, articles, and book chapters focusing on various hazard- and disaster-related topics, induding socioeconomic consequences of earthquakes. She is a member of the Advisory Committee for the National Earthquake Hazard-Reduction Program. The topic of Professor Tierney's presentation is on loss estimation and public policy from a social science perspective.

Professor Robert W. Kling is from Colorado State University. Dr. Kling has a doctoral degree in economics from the University of Kansas and has recently been involved in three National Science Foundation (NSF) projects that have addressed different aspects of social and economic effects of different types of natural hazards. The result of one of these projects is a work entitled Natural Hazards Damage Handbook: A Guide to the Uniform Definition, Identification, and Measurement of Damages from Natural Hazard Events. In his presentation, Dr. Kling focuses on the loss of the cultural environment from a catastrophic earthquake.

PRESENTATION OF CHRISTOPHER ARNOLD

This section provides an outline of the methods that are currently used for developing estimates of loss, and an outline of the nature of loss focusing on one particular building in the Loma Prieta earthquake. The information on loss-estimation methods is based on the Academy panel study on estimating losses from future earthquakes conducted under the chairmanship of Bob Whitman a few years ago. But the following information does not necessarily represent the views of the panel or the Academy.

The typical parameters of a loss-estimation study shows that the following things have to be determined before developing a specific study:

-

the type of loss (e.g., casualties, the number of homeless, the functionality of essential facilities, and economic impact);

-

the kinds of facilities (i.e., all buildings or structures and essential facilities like hospitals and lifelines);

-

the degree of certainty, and some feel for the degree of detail which is necessary—these obviously have very large cost and time implications; and

-

the time span and the kind of seismic risk.

Perhaps the number of earthquakes which might occur in a time span is of particular interest. Either a predicted earthquake or an actual historic earthquake may be used. Studies have been done, for instance, that show the impact of the 1923 Kwanto earthquake on today's Tokyo. Also, before developing a loss-estimation study, questions of geographic scale—local, regional, state, or national—must be addressed.

Typically, the kind of loss-estimation studies that have been done, other than those which may have been done for very specific purposes such as the inventory of a large corporation's set of buildings, are studies such as the NOAA studies of the San Francisco Bay area in the 1970s; the FEMA studies in selected cities, such as St. Louis and Boston; or the midwestern six-city study. These have provided damage estimates that are expressed in dollar terms and estimates of casualties. They tended to deal with all buildings, although some of them have focused somewhat on essential facilities such as hospitals. The degree of certainty is probably low. The degree of detail, because of the cost of producing the study, is also low. The estimates of seismic risk typically use the modified Mercalli scale, for better or for worse. It is at least generally understood and accepted, and has been commonly used as a way of defining the seismic risk. These studies typically have been at a regional or large-city level.

The use of these studies has primarily been political. They have been used to assist the politics of earthquake-hazard mitigation and the process of consciousness raising, and they have also been used to support some of the commercial aspects of the "earthquake industry," under the new circumstances by which the earthquake problem is starting to become a recognized industry.

Recognizing that these studies generally have a large amount of scientific qualification on the way in which they have been done and the authority of the statements, the political use of these studies has been to look for the large numbers" and to use those to attempt to increase earthquake awareness and hazard-mitigation activities.

The methodology of loss estimation is extremely simple and obvious. Some time ago Mr. Arnold wrote a paper on this, which stated that methodologies are cheap, but data is very, very expensive. All studies follow the same basic methodology:

-

develop an inventory of building stock;

-

define the seismic risk that applies to those buildings; and

-

utilize a mechanism for relating motion, damage, and loss so that damage to the inventory can be estimated.

This is then typically converted into the dollar loss that is received from exposure to a given seismic risk, as applied to that inventory, and out of that comes a loss estimate definition. That is the general methodology. To focus on one particular aspect of it, the inventory and the motion-damage-loss mechanism must use the same building classification, therefore a classification for defining the inventory of buildings must be developed that has to be the same classification used to apply the motion-damage-loss mechanism to the inventory. That sounds obvious and simple but, in fact, it has proven to be rather difficult.

Table 2-1 shows a classification system for buildings which is very widely used; it was developed originally by Karl Steinbrugge for the Insurance Service Offices in the Bay Area and has been slightly modified since. It is a simple and broad classification, with 21 different building types. One who is unfamiliar with buildings may think that is a lot. In fact, it is a very small classification because when a building inventory is inspected, every building must be assigned to one of these 21 types. Within each type there will be a great deal of variation; that presents difficulties, but nevertheless this is a very widely used system.

Another system was developed somewhat later under a program called ATC-13 (Applied Technology Council Study Number 13). This was a FEMA-sponsored study which was intended to bring the loss-estimation technique to a more advanced level. It was also intended originally to go right through to loss-estimation studies which would be used to estimate economic losses, industrial capacity losses, and so on. That was never quite achieved, but a lot of the study intent was accomplished. The study uses a rather more complete classification system than the Insurance Services method. The classification system has 40 building types instead of 21, so that it is a slightly freer-grained classification system.

For any study, the inventory is critical, because this is the whole basis upon which you are going to assign your loss estimation. Unlike other aspects of loss estimation, an actual inventory exists. In other words, there is a finite

TABLE 2-1 Construction Classes Used in the ISO and NOAA/USGS Methods

|

Building Class |

Brief Description of Building Subclasses |

|

1A-1 |

Wood and stuccoed frame dwellings regardless of area and height |

|

1A-2 |

Wood and stuccoed frame buildings, other than dwellings not exceeding three stories in height or 3,000 square feet in ground floor area |

|

1A-3 |

Wood and stuccoed frame structures not exceeding three stories in height regardless of area |

|

1B |

Wood frame and stuccoed frame buildings not qualifying under class 1A |

|

2A |

One-story, all metal; floor area less than 20,000 square feet |

|

2B |

All metal buildings not under 2A |

|

3A |

Steel frame, superior damage control features |

|

3B |

Steel frame, ordinary damage control features |

|

3C |

Steel frame, intermediate damage control features (between 3A and 3B) |

|

3D |

Steel frame, floors and roofs not concrete |

|

4A |

Reinforced concrete, superior damage control features |

|

4B |

Reinforced concrete, ordinary damage control features |

|

4C |

Reinforced concrete, intermediate damage control features (between 4A and 4B) |

|

4D |

Reinforced concrete, precast reinforced concrete, lift slab |

|

4E |

Reinforced concrete, floors and roofs not concrete |

|

5A |

Mixed construction, small buildings and dwellings |

|

5B |

Mixed construction, superior damage control features |

|

5C |

Mixed construction, ordinary damage control features |

|

5D |

Mixed construction, intermediate damage control features |

|

5E |

Mixed construction, unreinforced masonry |

|

6 |

Buildings specifically, designed to be earthquake resistant |

number of buildings of certain kinds. The problem is that it almost never exists in any published form, and the costs of achieving that are astronomical; when one talks about defining an inventory, he is really defining some kind of simulation or subterfuge for the actual inventory that exists.

The Academy panel spent 2 days discussing this inventory question: how is it determined? and how is an inventory defined? For instance, the census does not reveal the things about buildings needed to determine loss estimation. Assessor's records do not indicate the things needed to know about loss estimation. The top half of Figure 2-1 shows an idealized version of achieving

an inventory, in which the buildings would have some sort of computerized system that would send out their accurate vital statistics. The lower picture in Figure 2-1 shows the way inventories are actually done: A small number of people gather together in a room and assign buildings to their correct classification. You will find that the smoke-filled room reoccurs rather often in the loss-estimation methodology.

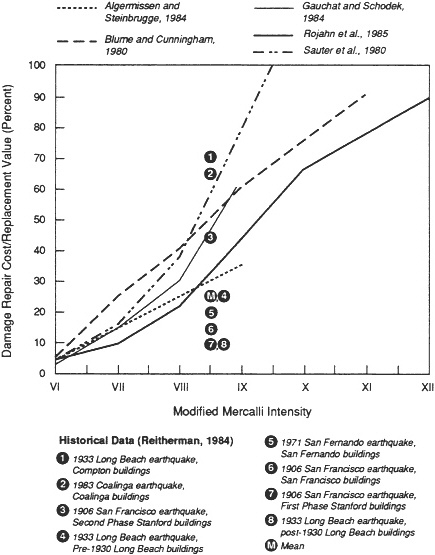

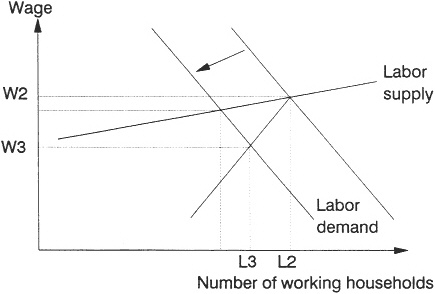

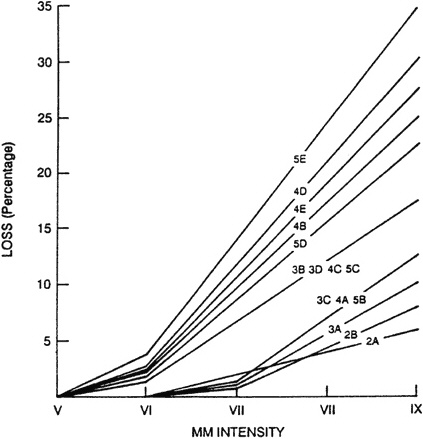

The loss and damage mechanism, developed primarily by Karl Steinbrugge, is critical and is shown in Figure 2-2. It is simple and relatively easy to apply. The designations of the building classification system are shown as the curves: the modified Mercalli intensity is on one axis and the per

FIGURE 2-2 Loss ratio versus modified Mercalli intensity (mean damage ratio curves). From: Estimating Losses from Future Earthquakes, p. 29, National Research Council, 1989; Source: Algermissen and Steinbrugge, 1984.

centage loss is on the other axis. Select a given type of building, such as unreinforced masonry, and find the curve for it, then find the modified Mercalli intensity, and establish a percentage loss. These are obviously very gross figures; as they are studied, all kinds of reasons why they may be inaccurate can be though of. This, however, is currently the level at which these estimates are done.

The ATC-13 process developed a somewhat more elaborate methodology, and the team was also interested in making the methodology more transparent. Rather than the smoke-filled room, the idea was to have a methodology in which its method of development was clear and could continue as more information came in. The project developed a general matrix, called a damage probability matrix, which defines damage states in words. These are defined numerically and can in turn be developed into a dollar-loss estimate related to the modified Mercalli scale. The estimates, of course, vary according to the building type.

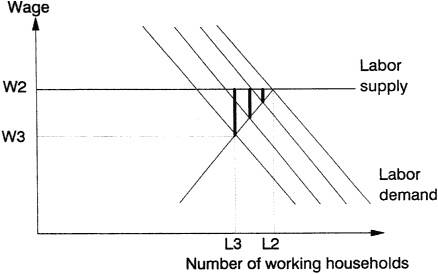

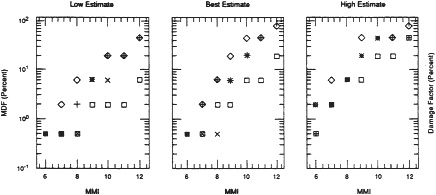

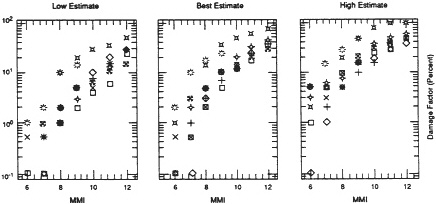

The actual estimates were developed by expert committees in a delphi process with a number of experts filling in forms and, in effect, voting on their estimates of the correct numbers. Figure 2-3 shows the scatter: for one particular class of building, the low estimate, the best estimate, and the high estimate. The symbols show the estimates of specific people. There were two rounds, with a fairly small number of people involved. The object of the two rounds was to try and reduce the aberrations in the estimating, although sometimes the aberrations may be correct and the ''enforced'' agreement may not be correct.

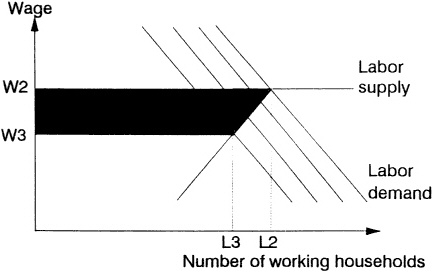

Nevertheless, the process arrives at a set of numbers that can be used in the actual matrices. Figure 2-4 shows the ATC-13 matrix for facility class 18, which is a low-rise, concrete, movement-resistant, frame-building type. It can be seen that the matrix shows fairly small amounts of damage at even the high modified Mercalli figures, and 100 percent damage would be expected in this class of building for any modified Mercalli figure. One can agree or disagree with that, but this procedure enables a dollar figure to be arrived at for a given building type related to a range of modified Mercalli figures.

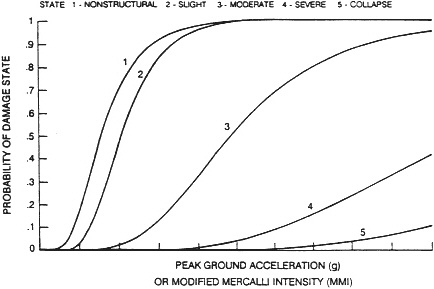

There is another system which has been used. This is the "fragility curve," which was developed by a consultant and used for one of the FEMA studies (Figure 2-5). This is really a rearrangement of the same basic material, in which the peak ground acceleration or Mercalli intensity is used. The numbers 1, 2, 3, 4, and 5 represent different damage states. All these systems are pushing around the rather small amount of real data that there is about the effects of earthquakes on actual buildings.

The above is the essence of how loss estimating is done. The question then comes up as to how accurate is the information that is received from this sort of process. Figure 2-6 shows one of the studies that was done for the Academy report, in which the curves represent different estimates of damage to wood-frame buildings based on various research studies which people have done at different times. The black spots are actual recorded damage, so the range of variation between different consultants' estimates and how those

FIGURE 2-3 Expert responses to round one damage factor questionnaire for Facility Class 18—low-rise moment-resisting ductile concrete-frame buildings. Note: Each symbol represents the estimates of one specific person.

FIGURE 2-4 Expert responses to round two damage factor questionnaire for Facility Class 18—low-rise moment-resisting ductile concrete-frame buildings. Note: Each symbol represents the estimates of one specific person.

FIGURE 2-5 Fragility curves for wood-frame buildings. FROM: Estimating Losses from Future Earthquakes, p. 38, National Research Council, 1989;

Source: Kircher and McCann, 1983.

estimates relate to actual damage is clear. Not nearly enough of this sort of validation exercise is being done. So far, a number of loss estimates have been done, but very little in the way of validation. Validation is rather expensive and does not seem to have the sort of appeal to the research community that other aspects of the earthquake problem have, but it is very critical and very important. As earthquake occurrences, such as Whittier and Loma Prieta, continue more information is developed but methodologies are not being reviewed and validated like they should be.

A frequent subject of interest in loss estimation is deaths and injuries. This is perhaps even more vague than the dollar-loss aspect, but there is a table in the ATC-13 study which, again, was developed in a smoke-filled room by a small number of people (Table 2-2). By applying this table, depending on the damage state, some estimate of injuries and deaths can be calculated. This may not be very accurate, but it is certainly much more useful than just speculating about the number of injuries and deaths.

Some of the Academy committee members pushed to try and get some numerical estimate of accuracy. The engineers were rather reluctant to do this, but some numbers were published that are interesting. One was that estimates for single-family wood-frame houses, where there is a lot of experience, might perhaps be accurate to within a factor of about 1.5. For run-of-the-mill

TABLE 2-2 Injury and Death Rates in Relation to Damage

commercial-type buildings, the accuracy might be within a factor of 3, and for buildings in areas where there is not a lot of seismic activity, outside California, the accuracy was perhaps an order of magnitude—a factor of 10. In scientific terms this is very inaccurate. In other terms, however, it may be useful. It is useful to know whether there will be hundreds of houses down or thousands of houses down.

Table 2-3 shows the result of a study that was part of the Academy study, which compared the ATC-13 and the Steinbrugge figures. This shows that for wood-frame buildings, for instance, the ATC-13 study has a damage ratio of 8.8. The Steinbrugge study has a ratio of 8 or 12, depending on the kind of building, so that is fairly close. If one looks at tilt-up, ATC-13 shows a damage ratio of 16 percent; the Steinbrugge curve shows a damage ratio of 30. Again, depending on the viewpoint, this is a wild spread, or it is quite useful in terms of what it is used for.

A new development in loss estimation has been its entry into the commercial area. An example of a commercial project, to some extent sponsored by the insurance industry, and really directed at providing information of specific value to the insurance industry, is a project based on research done originally at Stanford University. The Insurance Investment Risk Assessment System (IRAS) Project is a computerized system in which for a given site or region damage to an individual building or an inventory of

TABLE 2-3 Comparison of Some Building Damage Ratios (D/R)

|

U.S. Geological Survey (USGS) and ATC-13 @ MM IX |

||||

|

ATC-13 Name |

No. |

D/R |

USGS Code |

D/R |

|

wood frame |

1 |

8.8 |

1A |

12 old 8 new |

|

light metal |

2 |

5.6 |

2A small |

6 |

|

|

|

|

2B large |

8 |

|

VRM |

|

|

|

|

|

low |

75 |

42.0 |

5E |

35 |

|

medium |

76 |

52.9 |

|

|

|

braced steel frame |

|

|

|

|

|

medium |

13 |

11.3 |

3A |

10 |

|

high |

14 |

14.0 |

|

|

|

concrete DMRF |

|

|

|

|

|

low |

18 |

8.7 |

4A |

13 |

|

medium |

19 |

10.3 |

|

|

|

high |

20 |

12.5 |

|

|

|

Tilt-up |

21 |

15.8 |

4D |

30 |

|

SOURCE: H. Degenkolb |

||||

buildings can be estimated and the cost/benefit of retrofitting can be provided. Losses can be related to any valid earthquake expressed as a maximum risk or averaged to determine the probable expected losses in a given time frame.

This type of system is a new development which represents a new evolution. Such systems still essentially follow the same methodological basis and use the same information, but output is provided in a much more usable form. At the moment, this particular system applies only to California, in which the hazard is fairly well defined.

What, in fact, is a loss? These studies end with a dollar figure which represents the damage to the building, converted into a dollar figure for replacement. But, there is much more to it than that. The loss does not stop at the damage.

The Hyatt Regency Hotel in Burlingame, near San Francisco Airport, is a new, 400-bed hotel that was completed about a year before the Loma Prieta earthquake, and is a 400-bed hotel. It is a rather nice building architecturally; like most of the Hyatt Regency Hotels, it is built around an

atrium, which is a 10-story lobby. It has an interesting translucent fabric roof, which is supported on light steel frames. The restaurants and bars in the center of the atrium, underneath which are the main meeting areas within the hotel, can be seen looking down from the galleries. It is an interesting architectural plan.

The hotel suffered some damage in the Loma Prieta earthquake. It suffered some nonstructural damage, but this was symptomatic of some structural damage within the building. This building may be subject to litigation, so little information is available. The following summary is based on published information, which may or may not be correct. The structural damage consisted of some severe but repairable damage to concrete beams and shear walls in the lower portions of the building.

The hotel was fully occupied, and nobody was killed or injured, but it was decided that the damage was severe enough to justify closing the building, so the building was closed, repaired, and reopened on July 20, 1989, nine months after the earthquake.

The loss has been quoted as $12 million in damage repair costs and $12 million in lost revenues between October and July, while the hotel was dosed. This might be described as a $12 million direct loss and a $12 million indirect loss. The cost of construction was about $54 million, so perhaps the direct loss was on the order of 25 percent (which probably would not have shown up using typical loss-estimation methods).

Because the loss to the Hyatt Company was insured, the loss was to the insurance company. The building was rebuilt, so this represented a gain to the architects and engineers; the figure of $5 million in fees has been quoted, though this may not be true. Two separate engineering firms have been involved in the hotel's rehabilitation work. There have been arguments and controversy, so perhaps $5 million may be correct. The building contractors have gained money, and the local construction labor force in Burlingame has gained money. Attorneys have gained, to date, something on the order of a few hundred thousand dollars. In fact, this situation represents a new redevelopment project, an unexpected redevelopment project for the contracting industry in that area.

Some people lose, some people gain. It could be argued that the insurance companies have not lost. The insurance companies are simply prodding their services. When an architect designs a building for someone, the work should not be regarded as a loss; it is a service that is the architect's job to provide. It is only a loss if an error is made in calculating what it will cost to provide the plans. Thus, if the insurance companies make up Hyatt's loss, they are simply providing a similar service. The Hyatt company obviously had not paid an equivalent sum in premiums in the year in which the hotel existed, but the insurance industry is not based on that sort of arithmetic.

Hyatt's loss of revenue was balanced out by other airport hotels, which gained revenue. It has been quoted that, because of Loma Prieta, Bay Area hotels lost about 10 percent of new business. A lot of tourists did not show up, but business travel continued. No study has yet been done, for instance, that

relates the loss of tourist trade to the increase in researchers' trade after the Loma Prieta earthquake; there may be a net gain in trade.

Other airport hotels, downtown hotels, and possibly other cities gained (some people may have gone to Los Angeles rather than San Francisco). Hyatt closed the hotel, but they also reduced their costs. They lost revenue, but they also did not have to support the hotel, so their costs were reduced. On the loss side, Hyatt lost profit, and some employees lost their jobs. Vendors who provided services to the hotel, such as food and laundry suppliers, lost. It is also unknown how much they could make up their losses from the other hotels. In addition, there were some additional insurance losses in terms of paying off the employees.

The city of Burlingame lost $120,000 in business tax, but Burlingame gained in building permits for the new work that was done, so that was probably a standoff. Therefore, the question of loss is not easy to evaluate. There are gainers and losers, and under certain circumstances, what happens is not a loss but a redistribution of resources; there seems to be a kind of conservation-of-energy principle at work.

Clearly, it is only under certain circumstances that this situation would apply. In this case the loss is really a redistribution, because the general business continues; the people continue to come to San Francisco and the San Francisco airport; the hotel is rebuilt, so that there was a reconstruction project for the construction industry; and the hotel reopened. If the general economy of the region or the country breaks down, obviously this situation does not apply. Also, there are other cases in Loma Prieta where clearly the situation did not apply and where there were significant losses. But, if this sort of individual case is multiplied by 100,000 to 200,000 times, a picture of the complexity of the total economic situation is revealed.

PRESENTATION OF DON G. FRIEDMAN

Three topics will be addressed in this presentation. First, a brief discussion is given of changes in loss-estimation procedures that Travelers Insurance Company has used over the past three decades. There has been significant progress in the development of sophisticated methodologies. Unfortunately, the successful, practical application of these procedures is severely hampered by the lack of appropriate input information, such as geographical inventories of buildings of various types, their damage susceptibilities to earthquakes, and consequent casualty-producing potentialities.

The second topic outlines the need to gain a better general understanding of the major factors that occasionally combine to produce a natural disaster and, subsequently, determine its severity. The need to know more about the disaster-producing mechanism was necessary so that this information could be used as a supplement to, or a replacement for, the often inadequate or inaccurate results obtained from specific applications of the numerical models when appropriate data was not available as input to these computerized procedures.

The last topic is an illustration of the use of natural-disaster knowledge in making risk assessments when sufficient input data is not available for the numerical models. This illustration attempts to answer the question of whether a useful estimate currently can be made of the casualty- and damage-producing potentials of low- and medium-rise buildings (insured and uninsured) due to a catastrophic earthquake in the central or eastern United States. It also describes the various types of information that would be needed if a large-scale effort were made to develop a more credible estimate.

Useful recent information includes results of a 1990 Federal Emergency Management Agency (FEMA)-sponsored study on Estimated Future Earthquake Losses for St. Louis City and County, Missouri;1 a 1985 FEMA study on An Assessment of Damage and Casualties for Six Cities in the Central United States Resulting from Earthquakes in the New Madrid Seismic Zone;2 a United States Geological Survey (USGS) 1983 workshop on The 1886 Charleston, South Carolina, Earthquake and its Implications for Today;3 and a 1990 expert group review of a Metropolitan Boston Earthquake Loss Study.4

To carry out this illustration, there is a need to clarify the meaning of "catastrophic earthquake." Should it be defined in terms of the earthquake's magnitude, its epicenter location, its probability of occurrence, or the casualties and damages that it could produce? In order to examine the use of alternative definitions of a catastrophic earthquake, the fatality and building-damage potentials of a 1990 recurrence of the 1811 New Madrid, 1886 Charleston, and 1755 Cape Ann (near Boston) earthquakes have been estimated, along with a number of lesser-magnitude events with epicenters at the locations of the three major events. The implications of defining a catastrophic earthquake in terms of its physical characteristics such as its magnitude and location rather than the losses that it might produce are examined with the use of a catastrophe index. The use of this index denotes

the wide range of uncertainty in loss estimates when sufficient input information is not available.

Uses of Natural-Disaster-Loss Estimations in an Insurance Operation

A large, multiline insurer can have hundreds of millions to billions of dollars of exposure, which is spread haphazardly across hazard-prone areas. Insurance companies make decisions with regard to these risks using whatever data are available. To attempt to answer these questions, a better understanding was needed of the major factors that combine to produce a natural disaster and determine its severity. Numerical modeling and computer simulation techniques have been used to provide this understanding.

In the following discussion, reference will be made to natural disasters caused by hurricanes. Disasters caused by intense hurricanes occur more frequently than high-magnitude earthquakes, but these hurricanes have many similarities with destructive earthquakes, including loss-estimation methodologies.

Loss-estimation procedures for earthquake-caused disasters depend upon the interaction of the geographical pattern of ground motion with the spatial array of the population or properties at risk (elements-at-risk) and their loss vulnerabilities. What happens when an element-at-risk is exposed to ground motion of a given severity is defined as its vulnerability. A hurricane, with its accompanying high-wind pattern, can affect large segments of the population and the built environment. A hurricane-loss-estimation methodology evaluates the interaction of the wind-speed pattern with this geographical distribution of the elements-at-risk and their loss vulnerabilities. Currently, earthquake-hazard evaluations of insured exposures of an insurance company are made using, when possible, ZIP code areas as the geographic designator for locating element-at-risk data. In this way, effects of local influences such as local ground conditions or areas of potential liquefaction can be included in the analysis. However, the elements-at-risk location is not always available within a ZIP code area or even within a county. In these situations, the geographical distribution of the statewide totals must be approximated. How useful is the output of these estimation procedures? It depends on the problem at hand and the accuracy of input information data on the elements-at-risk locations and their other characteristics.

Numerical Modeling of Earthquake-Caused Natural Disasters

In the past, when an estimate was needed of the damage-producing potential of earthquakes for the total building inventory (insured and uninsured) in California and elsewhere, very little credible information could be found on buildings, by type and loss vulnerability, even on a statewide basis. To attempt to answer damage-potential questions on the overall inventory of buildings in spite of the lack of specific element-at-risk information, these losses have been numerically approximated through ''what-if'' analysis procedures.5,6

Early computer simulations modeled the geographical pattern of ground motion on bedrock and then superimposed the effects of local ground conditions, which were approximated on a 0.1 degree latitude and longitude grid system, using broad definitions taken from a geology map of California. This approach was encouraging because of the similarities of the simulated ground-motion patterns and the actual isoseismal patterns of past California earthquakes.

The type and quality of available input information for defining an earthquake's physical characteristics, the resulting ground-motion patterns, and the effects of local influences have vastly improved over the past quarter century. The USGS now has computerized estimates of local ground conditions on a much finer scale. In addition, research seismologists and engineers have developed a much better understanding of the earthquake mechanisms and the response characteristics of various types of buildings to a range of possible ground-motion frequencies and durations. The development of new physical measures of ground-motion severity may lead to the replacement of the qualitative modified Mercalli intensity (MMI) scale as a primary measure of ground-motion intensity of future earthquakes. However, for loss-potential evaluations of the recurrence of earlier events, the MMI scale is the only measure that is presently available for estimating ground-motion patterns of these past earthquakes.

The geographical pattern of ground motion of earthquakes can be expressed in terms of physical measures that are specific to various types of buildings—for example, pseudo-acceleration to evaluate damage to low-rise buildings. As a result of these improvements, the numerical modeling and simulation of the disaster-producing mechanism of earthquakes is much more sophisticated than it was in the past. However, a major problem is still the lack of appropriate input information on the elements-at-risk to effectively utilize them.

An additional improvement is in the specification of damage vulnerabilities of various types of buildings to given levels of ground-motion severity. These vulnerabilities can be expressed in terms of structural and nonstructural damage potentials: statistical distributions of the degree of damage expectancy, including the percentage of buildings that might collapse. This latter information is useful in determining the casualty-producing

potentialities of these structures. The problem is that these vulnerability characteristics, with a few exceptions,1,2 have not been determined for building inventories in the earthquake-prone areas, especially in the central and eastern United States.

Another important development in earthquake-loss estimations is the awareness that a moderate-magnitude earthquake can produce the same severity of ground motion as a great earthquake. The difference is that in a moderate-magnitude event, the area affected by this strong motion is much smaller, and the average duration of significant shaking is shorter. The higher-magnitude event is assumed to produce a larger MMI than the moderate-magnitude earthquake, given the same ground-motion severity at a specific location.

Approximating the Natural-Disaster-Producing Mechanism

The second topic deals with attempts to satisfy some information needs by obtaining a better understanding of how and why natural disasters are produced. If one is willing to accept the numerical modeling and computer simulation concept, various what-if questions can be asked. For example, it can be hypothesized that a particular type of building with its characteristic vulnerability has a uniform geographical distribution of maximum possible density. The ground-motion patterns of each of a series of earthquakes of different magnitudes then can be mathematically superimposed upon this building-at-risk pattern, and the overall damage-producing potential of these earthquakes can be simulated. When the estimate of the total loss-producing potential of each earthquake is plotted versus its Richter magnitude, a nonlinear relationship is obtained. This result suggests that a great-magnitude earthquake has a much greater overall damage-producing potential than a moderate- or minimal-magnitude one. Reasons for the nonlinearity include: the size of the area affected, the severity and duration of the strong ground motion, and the mix of ground-motion frequencies.

Fortunately, this overall damage-producing potential of an earthquake, related to its magnitude, is never fully realized, because the elements-at-risk do not have geographical distributions of maximum possible density over large enough areas to be encompassed by the entire ground-motion pattern of the quake. Therefore, the actual realized loss production of an earthquake depends on how the ground-motion pattern happens to overlap the geographical distribution of elements-at-risk. A moderate earthquake centered on the Newport-Inglewood fault in southern California under a large area of densely clustered elements-at-risk can have a much larger actual damage-producing potential than a high-magnitude earthquake on the Garlock fault along the edge of the Mojave Desert or a great earthquake on the San Andreas fault north of San Francisco, where there are fewer elements-at-risk.

The importance of this interaction of the severity pattern of the event with the spatial array of the elements-at-risk in determining actual damage

production was highlighted by last year's Hurricane Hugo. If the storm had taken a westward track across the Georgia coastline, where there are relatively fewer exposures, it probably would have been a $1 billion storm. Instead, Hugo directly hit Charleston, causing about $4 billion in insured losses. If it had moved northward across the North Carolina coastline, following the track of highly damaging Hurricane Hazel of 1954, it would have produced about $7 billion in losses. Finally, if Hugo had come up the East Coast with a landfall on western Long Island, with the same intensity that it had at its Charleston landfall, there could have been losses of $18 billion.

The same-strength storm with different tracks had a wide range of possible damage productions, depending upon its final interaction with the geographical distribution and density of the elements-at-risk.7 Hugo's status as a catastrophic event depended on this interaction. The same type of relationship holds for the earthquake hazard. An individual earthquake can have a much different actual damage-producing potential, depending on its magnitude and the location of its epicenter relative to the spatial array and density of vulnerable elements-at-risk. Consequently, the combination of an earthquake's magnitude and its epicentral location relative to the elements-at-risk is of utmost importance in determining its actual loss-producing potential.

This raises the question: what is a catastrophic earthquake or hurricane? Certainly, the physical magnitude of the event is an important factor, but perhaps of equal importance is how its severity pattern (ground motion of an earthquake or high wind of a hurricane) happens to overlay the usually haphazard spatial array and density of the exposed elements-at-risk that are susceptible to loss.8 A plot of the landfall location of the 247 hurricanes that have crossed the United States coastline since 1870, classified by their physical intensity at landfall as expressed in terms of the five-unit Saffir-Simpson scale, represents a hurricane climatology. If each of these storms recurred in 1990, would all of the Saffir-Simpson code 4 or code 5 storms be considered "catastrophic hurricanes" loss producers? Definitely not! The interaction of severity (high wind) patterns of these storms with coastal clusters of the elements-at-risk determines their "actual" damage production. Many code 3 storms, if they were to recur today, would produce greater losses than the code 4 or code 5 storms because of their particular paths relative to the geographical distribution of the elements-at-risk that are susceptible to damage.

The 1990 loss-producing potentials of all of the 247 landfalling hurricanes, when tabulated against their Saffir-Simpson intensity at landfall, produces a pattern of estimated loss productions of less than $100 million and greater than $1 billion (Table 2-4). There is not a close relationship between hurricane intensity and damage production. For example, 28 percent of the code 3 storms produced simulated losses of less than the $100 million, and 22 percent had a potential of exceeding $1 billion. Because of this analysis, the Saffir-Simpson intensity scale was deemed an inadequate measure of the actual damage-producing potential of hurricanes. Essentially, the scale is an

TABLE 2-4 Percentage of Past Hurricanes with a Simulated 1990 Recurrence that Produce Various Loss Potentials when Grouped by Storm Intensity

|

Saffir-Simpson Intensity at Landfall |

|||||

|

Simulated Loss |

Code 1 (minimal) |

Code 2 |

Code 3 |

Code 4 |

Code 5 (maximal) |

|

< $100 million |

82 |

57 |

28 |

5 |

0 |

|

> $1 billion |

0 |

10 |

22 |

59 |

67 |

indicator of losses to a hypothetically uniform distribution of properties of maximum density.

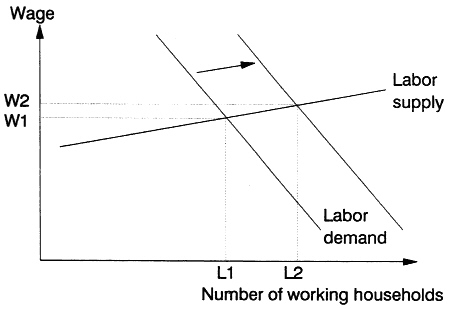

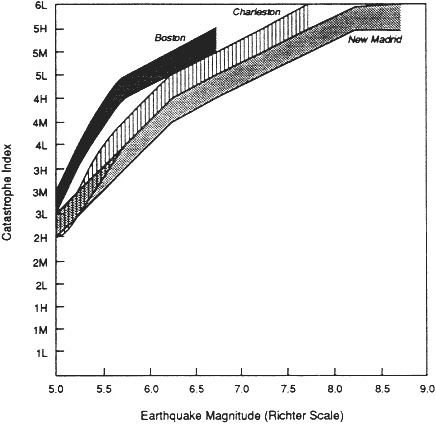

A "catastrophe index"9 was developed to provide a more realistic representation of the actual damage-producing potential of individual storms or earthquakes than the physical scales that are currently in use. Table 2-5 lists the computed catastrophe index versus the Saffir-Simpson intensity at landfall for the simulated 1990 recurrence of each past storm. A wide range of these damage potential indicies exists within the various hurricane intensity categories. There is a much closer correspondence between the intensity of a landfalling hurricane and its subsequent damage-producing potential, based on a worst case scenario, denoted by a "+" symbol in Table 2-5. Use of the catastrophe index carries the loss-estimation procedure an additional step by taking into account the effects of factors such as the hurricane's landfall location and inland track (or the magnitude and epicenter location of an earthquake) relative to the geographical distribution and damage susceptibilities of the elements-at-risk.

The geographical distribution of the catastrophe index, assuming a 1990 recurrence of each of the 247 landfalling hurricanes, is very different from the distribution of these storms grouped by their Saffir-Simpson intensity. The catastrophe index analysis also can be used to demonstrate how various combinations of an earthquake's magnitude and epicenter location, relative to the geographical distribution of elements-at-risk, can be utilized to better understand the pertinent characteristics of a catastrophic earthquake in the central or eastern United States.

Loss Potentials of a Catastrophic Earthquake in the Central and Eastern United States

The third topic to be covered is an illustration of some of the earthquake-loss-estimation problems that currently exist because of the lack of appropriate input data to the various loss-estimation models. To begin, an

TABLE 2-5 Catastrophe Index Resulting from the Simulated Present-Day Recurrence of 247 Past Hurricanes (1871–1990) Listed Versus Each Storm's Saffir-Simpson Intensity at Landfall

|

Hurricane Intensity at Landfall (Saffir-Simpson Scale) |

|||||||

|

Catastrophe Index |

Damage potential (current dollars) |

Code 1 |

Code 2 |

Code 3 |

Code 4 |

Code 5 |

Total |

|

1L |

1.00 – 2.49 million |

7 |

0 |

0 |

0 |

0 |

7 |

|

1M |

2.50 – 4.99 million |

8 |

3 |

0 |

0 |

0 |

11 |

|

1H |

5.00 – 9.99 million |

13 |

2 |

0 |

0 |

0 |

15 |

|

2L |

10.00 – 24.90 million |

24 |

10 |

4 |

0 |

0 |

38 |

|

2M |

25.00 – 49.90 million |

17 |

10 |

5 |

0 |

0 |

32 |

|

2H |

50.00 – 99.90 million |

8 |

11 |

9 |

1 |

0 |

29 |

|

3L |

100.00 – 249.9 million |

9 |

14 |

14 |

2 |

0 |

39 |

|

3M |

250.00 – 499.9 million |

7 |

5 |

13 |

2 |

0 |

27 |

|

3H |

500.00 – 999.9 million |

1 |

2 |

6 |

4 |

1 |

14 |

|

4L |

1.00 – 2.49 billion |

0 |

6 |

10 |

5 |

2 |

23 |

|

4M |

2.50 – 4.99 billion |

0 |

0 |

4 |

5 |

0 |

9 |

|

4H |

5.00 – 9.99 billion |

0 |

0 |

0 |

3 |

0 |

3 |

|

5L |

10.00 – 24.99 billion |

+ |

0 |

0 |

0 |

0 |

0 |

|

5M |

25.00 – 49.99 billion |

|

+ |

0 |

0 |

0 |

0 |

|

5H |

50.00 – 99.99 billion |

|

|

+ |

0 |

0 |

0 |

|

6L |

100.00 – 249.9 billion |

|

|

|

+ |

0 |

0 |

|

Total |

|

94 |

63 |

65 |

22 |

3 |

247 |

|

The "+" symbol represents the catastrophe index for a worst case scenario in which the insured properties have an unrealistic uniform geological distribution of maximum possible density across the entire area affected by the storm's spatial pattern of high winds. |

|||||||

analysis has been made of the fatality and building (residential and commercial) damage-producing potential of a simulated 1990 recurrence of the 1811 New Madrid earthquake, the 1886 Charleston earthquake, and the 1755 Cape Ann earthquake near Boston. To account for the importance of the combination of an earthquake's magnitude and location relative to the elements-at-risk in determining its actual damage production (i.e., its catastrophic event status), these potentials also have been estimated for a number of quakes of successively lower magnitudes located at the New Madrid, Charleston, and Cape Ann epicenters. A catastrophe index, which has been determined for each of the scenario earthquakes, is used to define the characteristics of a catastrophic earthquake in the central or eastern United States.

Choice of the scenario earthquakes was made by considering the ten strongest events with epicenters in the central and eastern United States during historic times (Table 2-6). Different scales for representing the strength (magnitude) of the earthquakes are listed in the table. In the following discussions involving earthquake magnitude, the scales will be specified, because they are quite different for higher-magnitude events.

Of the seven largest-magnitude earthquakes with United States epicenters, five were located in the New Madrid seismic zone within a 100-mi strip that runs from northeastern Arkansas to southeastern Missouri. Four of these Richter magnitude 8+ events occurred within several months of one another between late 1811 and early 1812. The fifth earthquake, which occurred in 1895, had a lower-magnitude (Richter 6.7) and was located about 30 mi north of the February 1812 epicenter. The other two events had epicenters near Charleston, South Carolina, and Cape Ann, Massachusetts.

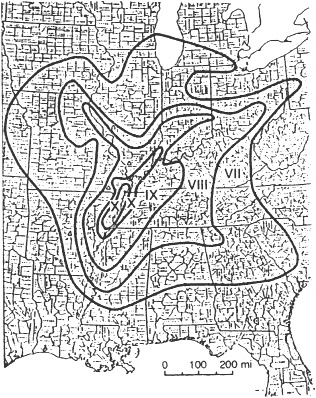

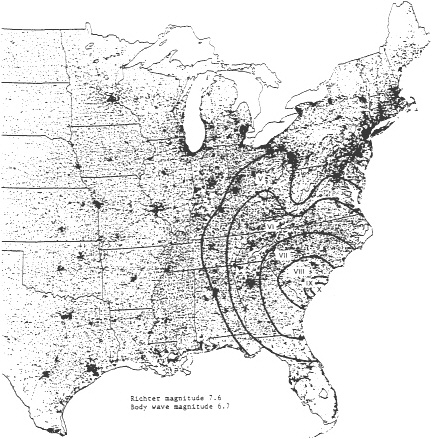

A composite map of the maximum ground motion resulting from the four Richter 8 + earthquakes in 1811 and 1812 is shown as the right-hand map in Figure 2-7. It covers a much larger area than the pattern of any one of the individual events that it represents, because the epicenters of the four quakes were not at the same location but were displaced northward along a 60-mi line. As a result, the ground-motion patterns of each event also were displaced northward, thereby overlapping one another. The composite map shows the largest ground-motion severity of the overlapped patterns in each affected locality. It has been assumed, without evidence, that a 1990 recurrence of the 1811 and 1812 seismic activity would be in the form of a single 8 + event and not the series that originally occurred. As a result of this assumption, it was not feasible to use this composite ground-motion mad of the 1811 and 1812 events, which was prepared by the USGS in 1985.10 Note that the USGS attempted to include the probable effects of local ground conditions as indicated by the distorted shape of the ground motion severity pattern in Figure 2-7.

The only immediately available estimate of the ground-motion pattern associated with any of the four 8+ New Madrid events in 1811 and 1812 is the Richter magnitude 8.6 earthquake that occurred at 2 a.m. on December 16, 1811.11 Because of a lack of observations of the effects of this event to the

TABLE 2-6 Occurrence Date, Location, and Magnitude of the Ten Largest Earthquakes that Affected the Central and Eastern United States and Southern Canada in Historic Times

|

Date |

Epicenter Location |

Maximum MMI Io |

Surface Wave Magnitude (Richter Scale) Ms |

Body Wave mb |

|

United States Epicenters |

||||

|

Feb. 7, 1812 |

New Madrid zone |

XI–XII |

8.7 |

7.3 |

|

Dec. 16, 1811 (2am) |

New Madrid zone |

XI |

8.6 |

7.2 |

|

Jan. 23, 1812 |

New Madrid zone |

X–XI |

8.4 |

7.1 |

|

Dec. 16, 1811 (8am) |

New Madrid zone |

X–XI |

8.3 |

7.0 |

|

Aug. 31, 1886 |

Charleston, SC |

X |

7.6 |

6.7 |

|

Oct. 31, 1895 |

Charleston, MO |

IX |

6.7 |

6.3 |

|

Nov. 18, 1755 |

Cape Ann (Boston) |

VIII |

6.0 |

5.9 |

|

Southeastern Canadian Epicenters |

||||

|

Feb. 5, 1663 |

St. Lawrence River region |

IX–X |

7.2 |

6.5 |

|

Nov. 18, 1929 |

Grand Banks, Newfoundland |

(IX–X) |

7.2 |

6.5 |

|

Feb. 28, 1925 |

St. Lawrence River region |

VIII |

7.0 |

6.4 |

west of the Mississippi River, only a partial ground-motion pattern could be constructed by researchers.

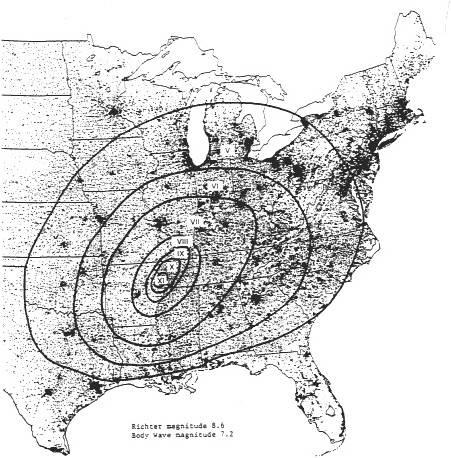

In order to utilize this pattern in the analysis, the ground-motion contours were extrapolated to the west of the Mississippi to provide an approximately symmetrical pattern about the epicenter. The smooth contours indicate that the effects of local ground conditions have not been included. This pattern was superimposed upon a population density map to simulate its overlapping with the current spatial array of the elements-at-risk (population and buildings) as shown in Figure 2-8. Note that the nearest dense cluster of exposures to the strongest ground motion of this particular earthquake is in the Memphis metropolitan area. A Richter 8 + earthquake with an epicenter farther north in the New Madrid seismic zone would generate very strong ground motion closer to the large duster of exposures in the St. Louis metropolitan area.

Because of the importance of the combination of an earthquake's location and magnitude in determining its loss-producing potential, it was necessary also to estimate the ground motion patterns associated with lesser-magnitude events that have the same epicenter location as the December 16 (2 a.m.) earthquake. As demonstrated in Table 2-6, there is an empirical relationship among the measures of magnitude. The USGS10 used this relationship to approximate the composite severity patterns of earthquakes of lower magnitude (Richter 7.6 and 6.7) that have the same epicenters as the Richter 8+ event (Figure 2-7). In the conversion procedure, the USGS assumed that the shape of the ground-motion pattern would not change with a reduction in the earthquake's magnitude and that the modified Mercalli intensity could be reduced in the overall pattern by one unit in order to obtain an approximation for a Richter 7.6 event, and reduced by two units overall to denote a Richter 6.7 event.

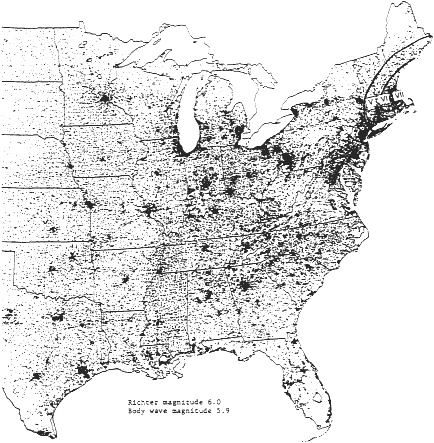

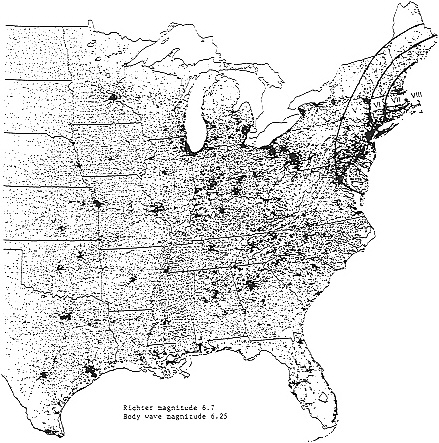

Similar combinations of earthquake magnitudes and locations; were needed to represent earthquake-prone sections of the eastern United States-Charleston, South Carolina, and Boston, Massachusetts. Using the same procedure, the 1886 Charleston earthquake and the 1755 Cape Ann earthquake listed in Table 2-6 were modeled to estimate the loss-producing damage potentials if such events were to recur in 1990. Figures2-9 and 2-10 show the superposition of these ground-motion patterns on the elements-at-risk spatial array.

Some earthquake experts suggest that a Cape Ann earthquake of magnitude 6.0 is not necessarily the largest possible earthquake in this seismic zone.3 To estimate the possible loss-producing effects of a higher-magnitude earthquake with a Cape Ann epicenter, the USGS10 procedure was reversed to estimate the ground-motion pattern of a stronger, Richter magnitude 6.7, quake at the Cape Ann location. One unit of modified Mercalli intensity was added to each of the ground-motion categories defined by Street and LaCroix.12 The enlarged pattern of the effects of a Richter 6.7 event, superimposed on the 1990 elements-at-risk density map (Figure 2-11) indicates that, although the area affected by the VII-or-above intensities is small

compared with that of the New Madrid and Charleston quakes, the strong ground-motion area overlaps one of the largest dusters of densely packed elements-at-risk in the United States.

One of the important information needs for making estimates of losses caused by earthquakes in the central and eastern United States is a mapping of local ground conditions and possible liquefaction areas, as has been done by the USGS in California. Another need, of equal importance, is for the development of a more realistic, physical, measure of ground motion that can be used as a replacement for the qualitative (and in many instances unsatisfactory) modified Mercalli intensity scale. Ideally, this new measure could be translated into an estimate of the ground motion of past earthquakes. However, for the purposes of this illustration, the only ground-motion measures that are available for three of the strongest past earthquakes are the modified Mercalli intensity patterns.

Estimation of Earthquake-Caused Fatalities

Because most earthquake-caused deaths and injuries result from damaged buildings, the casualty-estimation procedure should be based in some manner upon building damage, especially with respect to the percentage of structures that might have serious structural and nonstructural problems. Ideally, an estimation procedure for determining the casualty and damage potentials of these scenario earthquakes should have detailed information on the number and spatial distribution of each type of building in affected areas, along with their characteristics relating to damage and casualty-producing potentialities. Important considerations would be such items as the type and quality of construction, age, condition of upkeep, local ground conditions, building code in effect at time of construction, contents, usage, and number of occupants at various times of the day. Unfortunately, a spatial inventory of buildings and their characteristics is not available in these earthquake-prone areas of the central and eastern United States. However, one of the purposes of this illustration is to attempt to obtain order-of-magnitude estimates of the casualty and damage potentials from scenario earthquakes based on information that is available. The approach taken is described below.

The number of persons within each of the ground-motion categories for four scenario earthquakes (Figures 2-8 through 2-11) plus four others of lesser magnitude were estimated by overlaying in turn the ground-motion patterns on a map of counties in the central and eastern United States. The number of persons within each ground-motion-severity pattern in each of the affected states was summed for each earthquake.

Table 2-7 lists the cumulative number of persons in various ground-motion categories from MMI V-or-more to IX-or-more for each of eight earthquakes. The largest number of persons that would be affected is estimated to exceed 120 million in areas with ground motions of MMI V-or-more during a Richter 8.6 New Madrid earthquake. A Richter 6.0 Cape

TABLE 2-7 Estimate of the Number of Persons Who Would be Exposed to Various Levels of Ground-Motion Severity Caused by Each of the Scenario Earthquakes

|

|

Magnitude |

|

Number of Persons (thousands) |

||||

|

|

Richter |

Body Wave |

Ground-Motion Severity (Modified Mercalli Intensity Scale) |

||||

|

|

Ms |

mb |

V or More |

VI or More |

VII or More |

VIII or More |

IX or More |

|

Earthquake |

|||||||

|

New Madrid |

6.0 |

5.9 |

4,380 |

2,140 |

420 |

130 |

0 |

|

New Madrid |

6.7 |

6.25 |

21,920 |

4,380 |

2,140 |

420 |

130 |

|

New Madrid |

7.6 |

6.7 |

50,440 |

21,920 |

4,380 |

2,140 |

420 |

|

New Madrid |

8.6 |

7.2 |

120,790 |

50,440 |

21,920 |

4,380 |

2,140 |

|

Charleston |

6.7 |

6.25 |

23,330 |

11,060 |

2,830 |

620 |

290 |

|

Charleston |

7.6 |

6.7 |

43,530 |

23,330 |

11,060 |

2,830 |

620 |

|

Boston (Cape Ann) |

6.0 |

5.9 |

17,730 |

7,190 |

2,690 |

0 |

0 |

|

Boston (Cape Ann) |

6.7 |

6.25 |

45,990 |

17,730 |

7,190 |

2,690 |

0 |

Ann earthquake could affect over 2.5 million persons within areas where strong ground motions equalled or exceeded MMI VII. The size of this exposure is much larger than the 400,000 persons that are estimated to be affected by a New Madrid earthquake of Richter magnitude 6.0. If the Cape Ann earthquake had a magnitude of Richter 6.7, over 7 million people would be subjected to ground motion of MMI VII-or-more compared with about 3 million in a Charleston (Richter 6.7) earthquake and about 2 million in a New Madrid (Richter 6.7) event.

Estimation of casualties resulting from each of the ground-motion categories was made by use of fatality rates versus modified Mercalli intensity relationships, which were applied to the number of persons exposed in each of the ground-motion-severity categories within each state for each of the eight scenario earthquakes. The rates were expressed in terms of the number of deaths per 100,000 exposures. Relationships between fatality rate and ground-motion severity were developed from three fatality scenarios:

Fatality Scenario 1: This relationship was developed using an estimate of the number of deaths that might be expected, by state, if the 1886 Charleston earthquake recurred, based on information given in a USGS workshop report.3 For this illustration, these fatality estimates were related to the assumed ground-motion-severity pattern of the earthquake from which a best-fitting, nonlinear curve was drawn.

Fatality Scenario 2: The scenario i relationship based on the South Carolina information was calibrated by use of results of a Boston study, which estimated the number of fatalities that might be expected due to building damage in Boston and some of its suburbs resulting from a present-day recurrence of the 1755 Cape Ann earthquake during working hours on a weekday.4

Fatality Scenario 3: This fatality-versus-ground-motion relationship was based on fatality rates that were estimated in FEMA's six-city and St. Louis studies. Estimates of the number of deaths that could occur as a result of building damage caused by a repeat of a New Madrid (Richter 8+) earthquake were made in the 1990 FEMA study of St. Louis city and St. Louis county1 and in six other Midwest cities in a 1985 FEMA study.2 Implied fatality rates were determined using the fatality estimates and the estimated numbers of persons in these towns and cities at the time of the simulated earthquake as reported in the FEMA studies.

These rates were then related to the ground-motion severity that was hypothesized by FEMA for each of the locations. Because a range of MMIs was mapped across the study areas, a single, ''weighted'' MMI was determined for each city by overlaying a grid system on the maps of the seven Midwest cities and St. Louis county. The average MMI for each location was obtained by assuming that the MMI scale is continuous and by weighing various MMI values by the percentages of the total town or city area that they represented. Because of a lack of information on the spatial distribution of buildings within these localities, it was necessary to assume that they were uniformly distributed.

Ideally, fatality rates should be based on expected damage to various types of buildings in areas affected by each of the eight scenario earthquakes. Since this information is not available, it was necessary to assume that the death rates estimated by FEMA in the eight midwestern locations could be related to the attendant MMI and then used as a universal relationship between fatality rate and ground-motion severity for other values of MMI in the central and eastern United States that would be affected by each of the scenario earthquakes. In developing these vulnerability relationships, it was assumed that the fatality rate would be very small when the ground motion was MMI V (1 death per million exposures).

Table 2-8 summarizes state-by-state estimates of fatalities resulting from each of the eight scenario earthquakes using the three vulnerability scenarios. An inspection of this table indicates that there is a multiple of 4 or 5 in the estimated number of fatalities between the lowest values (using scenario 1) and the highest values (using the scenario 3 relationship). A 1990 repeat of the Richter 8.6 New Madrid earthquake could cause somewhere between 7,000 and 27,000 fatalities, depending on the scenario used and assuming that the sets of underlying assumptions are realistic.

Even though the available information cannot provide fatality estimates with a high degree of accuracy, the implied interactions between the earthquake's magnitude, its location relative to the spatial array of the elements-at-risk, and the fatality vulnerability relationships emphasize the importance of considering these particular factors when attempting to define the fatality-producing characteristics of a catastrophic earthquake in the central and eastern United States.

Estimation of Earthquake-caused Building Damage

Estimation of building damage resulting from each of the eight scenario earthquakes also was based solely on the use of immediately available data. Ideally, to estimate building damage due to ground motion, an analysis similar to that carried out in FEMA's six-city and St. Louis studies1,2 should be done for each city or town in the affected areas. At present, there is a discouraging lack of useful information on various types of buildings, their numbers, spatial distribution, and vulnerability characteristics in the central and eastern United States.

The only immediately available information on the spatial distribution of buildings was obtained by estimating the total value of residential and commercial buildings by county, using data given in a recent report prepared by the Insurance Research Council,13 which listed the total value of residential and commercial buildings insured against the wind peril in each of the coastal counties along the Gulf and East coasts. This represents a large percentage of the total building inventory. For the purposes of this study, these numbers were related to the population in the counties, permitting the development of a relationship between size of county population and the total value of insured

TABLE 2-8 Estimate of the Number of Fatalities Caused by Each of the Hypothetical Earthquakes and the Three Fatality-Vulnerability Scenarios

|

|

Magnitude |

|

Number of Fatalities |

|||

|

|

Richter |

|

Body Wave |

Fatality-Vulnerability Scenario |

||

|

Earthquake |

Ms |

mb |

1 |

2 |

3 |

|

|

New Madrid |

6.0 |

5.9 |

90 |

340 |

480 |

|

|

New Madrid |

6.7 |

6.25 |

430 |

1,460 |

2,200 |

|

|

New Madrid |

7.6 |

6.7 |

1,990 |

5,220 |

7,880 |

|

|

New Madrid |

8.6 |

7.2 |

6,890 |

18,110 |

26,930 |

|

|

Charleston |

6.7 |

6.25 |

690 |

2,430 |

3,620 |

|

|

Charleston |

7.6 |

6.7 |

3,360 |

8,490 |

13,000 |

|

|

Boston (Cape Ann) |

6.0 |

5.9 |

250 |

1,260 |

1,570 |

|

|

Boston (Cape Ann) |

6.7 |

6.25 |

1,550 |

5,040 |

8,170 |

|

residential and commercial buildings in the county. The relationship changes with an increase in county population. The spatial extent of the county was not taken into account in the analysis. These relationships for coastal counties were assumed to be universally applicable and were used to convert the population of counties affected by ground-motion patterns of the scenario earthquakes into rough estimates of their residential and commercial building exposures. It was assumed that if county population rather than ZIP code population were used, the mix of the number and type of commercial buildings relative to residential structures as a function of town or city size (urban versus suburban and rural conditions) would be minimized.

Based on this analysis, about 50 percent of the total United States insured residential building values of $6.3 trillion would be affected by ground motions of MMI V-or-more intensity if there were a recurrence of the Richter 8.6 New Madrid earthquake. Strong ground motion (VII-or-greater) would affect about $213 billion of residential buildings caused by a hypothetical Richter 6.7 Cape Ann earthquake as compared with an exposure of $69 billion for a Richter 6.7 Charleston earthquake or $54 billion with a Richter 6.7 event located at the New Madrid epicenter zone. About $6 trillion of the $13 trillion total insured commercial building values in the United States would be affected by ground motions of MMI V-or-more during a repeat of the 1811 (Richter 8.6) earthquake. The overall accuracy of these estimates (based on a conversion from county population to a measure of insured building values) is not known.

Translation of this building-exposure information into a measure of the damage-producing potential of various ground-motion severities was accomplished by constructing and applying three damage-vulnerability relationships similar in form to the ones used for estimating fatalities. These relationships were based on three damage scenarios.

Damage Scenario 1: To obtain an estimate of the minimum damage-producing potential, it was assumed that all of the residential buildings in the central or eastern United States that are affected by the scenario earthquakes would be of frame construction, which has one of the lowest damage susceptibilities to earthquake-caused losses. A relationship given in FEMA's 1990 St. Louis report1 between frame-building damage expectancy and modified Mercalli ground-motion intensity was used.

Damage Scenario 2: The relationship between ground-motion severity and residential building damage was based on the best-fitting curve through a plot of the implied percentages of value lost for residential-type buildings (insured and uninsured) in the six cities analyzed in the 1985 FEMA study2 and St. Louis city and St. Louis county in the 1990 FEMA report.1 The estimated total value of residential buildings in each of these six cities was obtained using the population-versus-insured-residential-building values that were obtained from the coastal county information. These estimates of insured building values were used as an index for approximating the value of all residential buildings (insured plus uninsured as defined in the FEMA studies).

The spatially weighted MMIs for each of the eight areas were used in plotting these implied percentages-of-value-lost data.

Damage Scenario 3: The relationship between residential building damage and modified Mercalli intensity was based solely on information given in FEMA's St. Louis report on expected damage versus ground-motion severity (MMI) weighted by the mixture of residential building types in St. Louis county.

By applying each of these three damage-vulnerability scenarios in the simulated recurrence of the Richter 8.6 New Madrid earthquake, a range of estimated residential damages between $38 billion and $65 billion was found. This range is consistent with an upper bound estimate of about $50 billion for residential building damage made by Algermissen in a 1990 USGS paper.14 A repeat of the Richter 7.6 Charleston earthquake would cause between $19 billion and $32 billion in residential building (insured and uninsured); between $5 billion and $9 billion of residential damage would occur due to a recurrence of the Richter 6.0 Cape Ann earthquake near Boston.

This same procedure was used to estimate the ground-motion-caused damage potential to commercial buildings. Loss estimates were based on a set of three damage-vulnerability scenarios similar in form to those for residential-type structures. A 1990 recurrence of the Richter 8.6 New Madrid earthquake would cause between $37 billion and $105 billion in commercial building damage. A repeat of the Charleston (Richter 7.6) quake would produce commercial building damages somewhere between $18 billion and $52 billion, and a 1990 recurrence of the Richter 6.0 Cape Ann event would cause between $5 billion and $15 billion in damage.

Estimation of Building Damages by Fire Following an Earthquake

Significant building damages also can be caused by fire that follows some high-magnitude earthquakes. No quantitative estimates or estimating procedures were found in the literature regarding the damage potential of this peril in the central or eastern United States. Therefore, to provide at least an order-of-magnitude estimate for this possibility, an approach used by the Insurance Research Council (formerly the All-Industry Research Advisory Council) in California15 was adapted for conditions east of the Rockies. It was assumed that the major contribution to fire-caused damage would be from individual buildings or small groups of adjacent structures.

Again, three vulnerability scenarios were constructed based on relationships that were derived from information in the AIRAC study of Los Angeles and San Francisco fire-following-earthquake susceptibilities. In that study, the fire-fighting capabilities in various communities were taken into account (e.g., the number of firetrucks available and the dependability of the water supply under earthquake conditions). Because of the lack of this type of information for the central and eastern United States, it was necessary to assume that a

first approximation to the fire-following-earthquake damage production could be obtained by an averaging across the range of individual community fire-fighting capabilities so that the damage-producing potential of this hazard could be related directly to ground-motion severity. It is assumed that, as the duration and severity of the ground motion increases, the number of fire ignitions caused by the earthquake increases, and the capability of the fighters to limit damage to individual structures or the spread of the fire to adjacent buildings decreases, given the need for high-priority search-and-rescue activities for firemen, equipment and communication failures, broken waterlines, and debris and congestion in the streets.

The three fire scenarios were applied to the estimates of total (residential and commercial) building values, by ground-motion-severity categories, for each of eight scenario earthquakes. For purposes of this analysis, it was assumed that residential and commercial building damage caused by ground motion was independent of the fire losses and that the damage threshold is at MMI V, where the average fire-loss potential on nonearthquake days would occur. A repeat of the Richter 8.6 New Madrid earthquake in 1990 would cause fire damages ranging between $7 billion and $25 billion. A recurrence of the Richter 7.6 Charleston event would produce fire losses between $3 billion and $13 billion, and the Richter 6.0 Cape Ann quake could cause fire losses between $300 million and $2.5 billion.

Loss Expectancies Based on Various Combinations of Earthquake Magnitude and Epicenter Locations

Table 2-9 is a state-by-state tabulation of earthquake-caused building damages using the middle (scenario 2) vulnerability relationship for ground motion and fire damage to residential and commercial buildings resulting from a repeat of the Richter 8.6 New Madrid earthquake. Because of the likely low degree of accuracy of these estimates, the relative ranking of the states by damage expectancy is probably more realistic than the absolute values of the loss estimates.

Table 2-10 shows the probability of earthquake occurrence for two magnitudes of earthquakes in the New Madrid zone, the southern United States, and the New England region during the 1990s. Tables 2-11a and 2-11b list fatality and building-damage potentials implied by various combinations of earthquake magnitude and location in the central and eastern United States, using the scenario 2 vulnerability relationships. These potentials increase at different rates as the simulated earthquake's magnitude is increased to its maximum likely value at the New Madrid, Charleston, and Cape Ann epicenters. The rate differences are caused by interactions of the geographical pattern of ground-motion severity and duration with the particular spatial array, density, and vulnerability of the elements-at-risk near each of these three seismic sources.

TABLE 2-9 Estimated Building-Damage Losses by State Resulting from a 1990 Recurrence of the December 16, 1811, New Madrid Earthquake with a Richter Magnitude 8.6, Based on Damage Vulnerability Scenario 2

|

|

|

Damage (millions of dollars) |

||

|

|

Fire |

Ground-Motion Damage |

Total |

|

|

State |

Damage |

Residential |

Commercial |

Damage |

|

Alabama |

291 |

1,152 |

956 |

2,399 |

|

Arkansas |

2,646 |

8,978 |

23,726 |

35,350 |

|

Georgia |

29 |

114 |

112 |

255 |

|

Illinois |

853 |

3,427 |

3,875 |

8,155 |

|

Indiana |

688 |

2,696 |

2,318 |

5,702 |

|

Iowa |

1 |

4 |

4 |

9 |

|

Kansas |

1 |

5 |

4 |

10 |

|

Kentucky |

1,222 |

4,795 |

6,082 |

12,099 |

|

Louisiana |

206 |

804 |

681 |

1,691 |

|

Maryland |

0 |

1 |

1 |

2 |

|

Michigan |

1 |

3 |

3 |

7 |

|

Minnesota |

0 |

0 |

0 |

0 |

|

Mississippi |

650 |

2,683 |

2,551 |

5,884 |

|

Missouri |

1,581 |

5,854 |

9,806 |

17,241 |

|

Nebraska |

0 |

0 |

0 |

0 |

|

New York |

0 |

1 |

1 |

2 |

|

North Carolina |

17 |

67 |

67 |

151 |

|

Ohio |

462 |

1,744 |

1,593 |

3,799 |

|

Oklahoma |

38 |

154 |

125 |

317 |

|

Pennsylvania |

0 |

2 |

2 |

4 |

|

South Carolina |

9 |

35 |

34 |

78 |

|

Tennessee |

3,619 |

13,185 |

28,055 |

44,859 |

|

Texas |

35 |

138 |

116 |

289 |

|

Virginia |

4 |

17 |

16 |

37 |

|

West Virginia |

8 |

30 |

28 |

66 |

|

Wisconsin |

0 |

1 |

1 |

2 |

|

Total |

12,361 |

45,890 |

80,157 |

138,408 |

TABLE 2-10 Probability of Earthquake Occurrence in the Decade Before the Year 2001 (in Percentages)

|

|

Earthquake magnitude |

|

|

Region |

Richter 6.25 Body wave 6.00 |

Richter 8.25 Body wave 7.00 |

|

New Madrid seismic zone |

13 |

2 |

|

Southeastern United States |

11 |

2 |

|

New England |

8 |

1 |

The catastrophe index (Table 2-5), which incorporates the effects of these interactions, can be utilized to more clearly denote important characteristics of a catastrophic earthquake in the central or eastern United States. The lowest and highest damage estimates (scenarios 1 and 3) for various combinations of earthquake magnitude and location have been converted to the catastrophe index scale and plotted in Figure 2-12. Hatched areas define the range of estimates for the three epicenter locations, caused by the choice of vulnerability scenario.