Implications of Japan's "Soft Crisis": Forcing New Directions for Japanese Electronics Companies

WILLIAM F. FINAN AND CARL WILLIAMS

INTRODUCTION

There is a clear need in the United States to understand the implications of Japanese successes in scientific and technical fields. But the focus of this paper will be on a different facet of Japanese technology development: how do Japanese firms respond when they are unable to maintain an adequate technical development program in a critical technical field? This concern is very different from several decades ago when the concern in Japan was to overtake the Western lead in critical technologies. In examining this problem in Japan, we are in some sense looking at a mirror image of the problem that has surfaced in the United States, namely, how most effectively to allocate scarce resources to key areas in order to maintain competitiveness in critical technologies.

Japan is currently facing a situation in which there is a growing relative scarcity of engineering talent at all levels as demand outstrips supply. In other words, there are simply not enough indigenous resources (i.e., new engineering graduates and university-based advanced research programs) to fill the expected future demand for technical expertise inside Japan. Already, Japanese high technology companies are encountering strategic technical fields where they cannot develop sufficient indigenous talent in a reasonable time frame. This prevents or delays them from mounting an effective autonomous development effort. As these delays and shortcomings become more common, we believe the outcome will be a significant restructuring of Japanese interaction with the U.S. scientific and engineering community.

This state of affairs cuts across the spectrum of engineering disciplines to a lesser or greater extent. However, the shortage of skilled technical labor is particularly acute in the field of software engineering. In fact, the term "soft crisis" has been used to refer to the lack of adequate software engineering talent in Japan.1 Therefore, we will begin by examining the source of the labor shortage problem in software engineering fields, and explanations for the inability of Japanese educational institutions to respond to this problem.

In order to illustrate possible solutions to this "soft crisis", this paper will focus on a subfield of the software engineering industry known as integrated circuit computer-aided design (IC CAD).2 It is a field related to the design of complex ICs, and therefore it is a field of critical importance to IC firms as design complexity of ICs has increased—an importance that will further increase in the future.3

We will then outline various measures taken to address this shortage, and draw some implications for the United States of these actions taken by Japanese firms.

PROBLEMS CONFRONTING THE JAPANESE SOFTWARE ENGINEERING INDUSTRY

The problems confronting the Japanese software engineering industry can be summarized as follows:

-

The "soft crisis" is a function of the explosion in the growth of the Japanese software industry in bumping up against a fairly inelastic supply of software engineers.

-

Japanese educational institutions have proved to be inadequate to the task of increasing the supply of software engineers. They continue to act as a bottleneck because the Japanese universities are slow to reorient their programs to emerging fields—if they are able to do so at all.

The pressures of the "soft crisis," together with the inadequate response of Japanese universities, will force the Japanese companies to resort increasingly

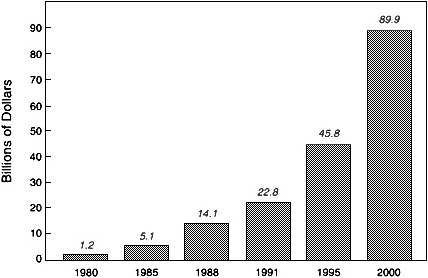

Figure 1 Japanese market for software-related products. Source: Japan Information Service Industry Association.

to ''nonconventional" means to solve the software engineering shortage. In order to outline what form these nonconventional means are taking on, we will describe how Japanese firms are dealing with the shortage in the IC CAD field.

Description of the "Soft Crisis"

The software market in Japan is expected to increase substantially in the next few years. The programming services and software products market, of which CAD is a subset, amounted to approximately $14 billion in 1988. Sales are expected to explode to $90 billion by the year 2000 in constant 1988 exchange rates4 (see Figure 1).

Japanese firms are encountering difficulties in recruiting the qualified technical labor necessary to meet this explosion in the software industry. The bulk of technical labor is recruited from the available pool of college and technical school talent. However, for a variety of systemic and exogenous factors, this pool is currently inadequate to meet the demand for

technical labor and, further, is projected to decline relatively over the next decade. One striking illustration of the acuteness of this shortage of graduates is in the IC CAD field. It is estimated that the United States has at least a 5 to 1 and perhaps as much as a 10 to 1 advantage in terms of qualified CAD engineering personnel. 5 Other strategic areas that are tied to software engineering are experiencing a similar magnitude of shortage.

Shortcomings of the Japanese Educational System

Generally, new hires for skilled technical positions by Japanese firms come from the annual crop of college graduates. Because of the "lifetime employment" tradition, there has historically been relatively little recruitment of midcareer professionals, a practice termed "lateral hiring." Therefore, Japanese companies are directly affected by the profile of the Japanese college population.

There are really two facets to the problem of the adequacy of supply of software engineers. First, the evidence suggests that, increasingly, Japanese students are not interested in entering science-and engineering-related programs. At the same time, the Japanese universities are not responding to the changing requirements of emerging technical fields. Committed to programs that relate to older technical fields, they have been slow to increase their offerings in newer technical fields. Combined, the reduced supply and the inability to shift resources towards a software-related teaching curriculum leave Japanese companies in a real bind.

As long as the college-age population was expanding and, in particular, those fields of study important to engineering were expanding as a fraction of the total, there was no real difficulty with respect to sufficient engineering labor. However, the population of college-age Japanese is currently peaking. In the future, not only will the number of science and engineering graduates decline as the general student population declines over the coming years, but career preferences are serving to exaggerate this decline relative to the overall graduate population. Evidence reveals that more and more Japanese university students in the major Japanese universities are gravitating toward the disciplines of business, law, and finance.

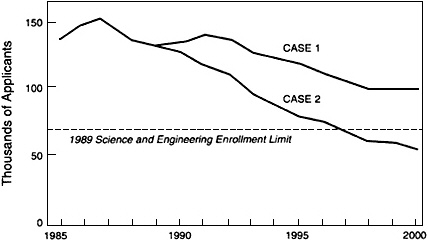

A recent study by the Japanese National Institute of Science and Technology Policy (NISTEP) examined this phenomenon. NISTEP projected the number of applicants to science and engineering programs through the year 2000. Two cases were examined.6 In the first case, the ratio of applicants to science/engineering programs to the overall college-age population

Figure 2 Scenarios for science and engineering program application trends. Note: Case 1—The ratio of applicants to science/engineering programs to the overall student population remains the same as the ratio observed in 1989. Case 2—The rate of decrease experienced over the period 1987–1989 is assumed to continue. Source: National Institute for Science and Technology Policy.

was assumed to remain the same as the ratio observed in 1989. In the second case, the rate of decrease of the number of applicants, as experienced over the period 1987–1989, was assumed to continue. In both cases the trend for science/engineering applicants is down over the next 10 years (see Figure 2). However, estimates based upon the second case show a more drastic decline. In this case, by 1995, the overall number of applicants may not even be enough to match the actual enrollment levels of 1989. By the year 2000, total applicants to science and engineering programs could drop to approximately 55,000. This is dramatically below the level of 65,000 enrolled science and engineering students in 1989, a decade before.

At the same time that the scientific and engineering talent pool is declining, institutional rigidities in the Japanese educational system inhibit the supply of trained recruits for Japanese firms. In particular, there are usually quotas on the number of students that are admitted to the various disciplinary fields. These quotas are a result of decisions made by the Ministry of Education and the entrenched engineering faculty in the leading universities. In fact, in an attempt to bypass these bottlenecks, the Ministry of International Trade and Industry (MITI) has instituted measures to promote the establishment of "information colleges," with the aim of dramatically

increasing the numbers of trained software engineers. However, this approach has not made a substantial impact on the overall shortage problem.

These estimates of the growing software engineer shortage strongly suggest that Japanese high technology companies—which require an ever increasing number of science and engineering graduates—will face severe problems in the future.

RESPONSES OF JAPANESE FIRMS TO THE SOFT CRISIS

In order to address the growing shortage of software engineers, Japanese companies will be forced to resort to nonconventional means—that is, nonconventional for Japanese firms. To illustrate this, we will summarize how Japanese companies in the IC CAD field are addressing the shortage.7 Some of these solutions are rather innovative and serve to indicate practices that may be adopted by broader segments of Japanese industry in the future.

First of all, there is a clear trend in the IC CAD field to resort to nontraditional sources of CAD software talent. In the past, Japanese companies would usually shift internal labor resources to key sectors, utilizing well-developed internal training programs. This approach to personnel development will continue to predominate in the face of the software shortage. However, Japanese firms are beginning to realize that they must look to labor resources outside of the typical pool of Japanese males; that is, there will be increased hiring of women and foreigners. Also, there will likely be increased raiding of competitors ("lateral hires") for scarce talent, a tactic that has rarely been used in the "lifetime employment" culture of corporate Japan.8 Both of these developments suggest that, as the shortage of software engineers becomes more acute in Japan in the future, these trends will be reinforced.

Another response by Japanese firms to the pressures of the engineering shortage is to open research facilities offshore. A number of Japanese firms have begun investing in software research by setting up laboratories overseas and hiring top research talent away from native firms. As opposed to earlier research labs, these facilities will be more than simply listening posts or showcase facilities. They are specifically intended to expand the

|

7 |

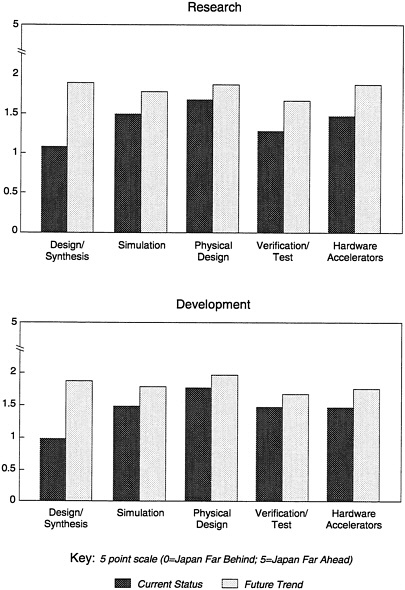

IC CAD is a technical field where Japanese managers believe they are lagging behind the state of technical developments in the United States (see Figure 3). This competitive environment is forcing Japanese firms to adopt a more flexible set of policies towards technical development in this area. Because of the shortage of talented software engineers and the lack of a strong, sophisticated CAD research base in the academic community, Japanese CAD firms are compelled to be heavily dependent upon outside firms as a source of CAD tools. |

|

8 |

Finan and Frey, op. cit., pp. 51–52. |

engineering pool, including CAD design, to which the Japanese companies have access.9

IMPLICATIONS FOR THE UNITED STATES

The ''soft crisis" and the changing Japanese strategies to deal with it have implications for U.S. science and technology policy vis-à-vis Japan. To list a few:

-

Japanese firms will be actively bidding to attract scarce engineering talent in the United States. How successful this thrust will be depends, in part, on the success that Japanese firms have in managing highly skilled engineering talent. Japanese car firms who have successfully operated design centers in the United States demonstrate that it is feasible to do this.

-

Japanese firms will be forced to accept a certain amount of dependence upon foreign sources of key technology in certain areas. Therefore, Japanese firms will seek to ensure that, in those areas where they have to remain strategically reliant on U.S. (or European) firms for critical technologies, those technologies will not become bottlenecked—that is, that they will continue to have unfettered access at reasonable prices to the necessary technology.

-

Traditional Japanese corporate culture will undergo changes as Japanese firms resort to such nonconventional practices as lateral hiring. This will result in "spin-off" bonuses for U.S. firms; namely, U.S. firms will have greater access to the Japanese engineering establishment through greater ability to laterally hire highly skilled Japanese engineers into U.S. laboratories and firms located in Japan.

There are further implications for U.S. firms that go beyond recruiting issues. An understanding of conditions surrounding problems facing Japanese competitors, such as the soft crisis, will contribute to the ability of U.S. firms to take advantage of the shifting structures of Japanese corporate culture as Japanese firms respond to these problems. U.S. companies can reap benefits from changes in corporate culture in Japan; adoption of flexible policies will help ensure the realization of these benefits.