Japanese Control of R&D Activities in the United States: Is This Cause for Concern?

EDWARD M. GRAHAM

INTRODUCTION

Since the middle 1980s, the research and development expenditures of Japanese-controlled firms operating in the United States have significantly increased. This is true not simply in absolute terms but also in relative terms; that is, the percentage of total R&D expenditures in the United States accounted for by Japanese-controlled firms has increased dramatically. This comes at a time when total nondefense R&D expenditures by the United States as a percentage of national income have not kept pace with similar expenditures (again as a percentage of national income) in Japan.

Is the rise in U.S. R&D expenditures accounted for by Japanese firms a cause for major concern from a U.S. interests perspective? This issue is examined in this paper. The next section details some of the salient facts. The final section probes whether or not these facts are cause for worry.

THE RISE IN JAPANESE CONTROL OF U.S. R&D

During the second half of the 1980s, Japanese direct investment in the United States increased dramatically (Table 1), reflecting rapid increase in control of U.S. business activities by Japanese multinational corporations. During the early years of this surge, most of this investment was of the "green fields" variety (i.e., the creation of entirely new business activities in the United States), but beginning in 1987, Japanese direct investors moved increasingly towards acquisition of existing U.S. firms as the primary mode of new entry.

TABLE 1 Japanese Direct Investment in the United States, 1984–1990 (in million dollars)

|

Year |

Flow During Year |

Position at Year End |

|

1984 |

4,374 |

16,044 |

|

1985 |

3,394 |

19,313 |

|

1986 |

7,268 |

26,284 |

|

1987 |

8,791 |

34,421 |

|

1988 |

17,287 |

51,126 |

|

1989 |

17,425 |

67,319 |

|

1990 |

17,336 |

83,498 |

|

SOURCE: Bureau of Economic Analysis, U.S. Department of Commerce, compiled from August issues of Survey of Current Business, various years. |

||

The surge in Japanese direct investment in the United States coincided with a general perception on the part of many U.S. business leaders and economists that U.S.-owned business firms operating in advanced technology industries were becoming significantly less competitive relative to their Japanese rivals and that this loss of competitiveness was not a phenomenon that could be corrected via macroeconomic adjustments such as revaluation of the yen. Rather, it was widely perceived that the loss was due to some combination of factors such as declining rates of R&D expenditure in the United States relative to Japan, "short termism" and other managerial failures by U.S. business leaders, low U.S. rates of domestic capital formation, flagging U.S. educational performance, and a poor policy environment for U.S. technology.

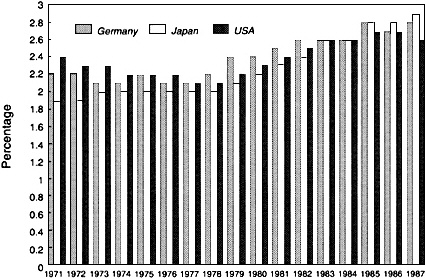

Figures 1 and 2 provide some supporting evidence for the position that U.S. competitiveness is falling relative to Japan and that this is due in part to falling relative expenditures on R&D. Total U.S. R&D expenditure as a percentage of the gross national product (GNP) was significantly higher than corresponding percentages in Japan or Germany during the early 1970s, but by the middle 1980s both nations were outperforming the United States by this measure. This is true in spite of the fact that total U.S. R&D expenditures as a percentage of GNP were at a minimum during the late 1970s and have risen since then. Otherwise put, the trend in R&D expenditure as a percentage of national product has been upward in all three countries, but this percentage has risen significantly faster in both Germany and Japan than in the United States. Because GNP has grown significantly faster in Japan than in the United States, total R&D expenditures in Japan have grown even faster relative to those in the United States than the figure would suggest.

Figure 1 G-3 R&D expenditures as % of GNP, 1971–87. Source: Prepared at Institute for International Economics from U.S. National Science Foundation base data.

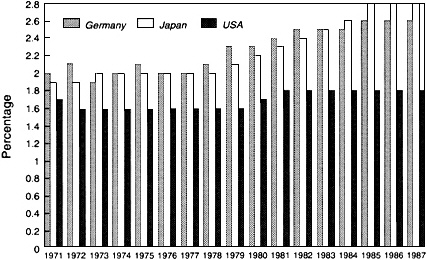

Figure 2 G-3 Nondefense R&D expenditure as % of GNP, 1971–87. Source: Prepared at Institute for International Economics from U.S. National Science Foundation base data.

A much higher percentage of R&D expenditure in the United States is undertaken for defense than in either Japan or Germany. Figure 2, indicating nondefense R&D as a percentage of GNP, illustrates the difference vividly. Even in 1971 this percentage was significantly higher for both Japan and Germany than for the United States, and the relative difference has grown considerably since then. Unlike total R&D as a percentage of GNP, in the United States nondefense R&D as a percentage of GNP has hardly grown at all since the late 1970s; and indeed, from 1983 onward, if anything the trend is slightly downward. Thus, virtually all of the U.S. increase in total R&D as a percentage of GNP during the 1980s has been defense related. By contrast, nondefense R&D expenditure as a percentage of national product has risen markedly in both Japan and Germany since the late 1970s. In the case of Japan, the rise has been dramatic, while the rise for Germany is significantly less than for Japan although still marked.

The data portrayed in Figures 1 and 2 go only through 1987, but they are, alas, the most recent available. Unfortunately, there is little to suggest that the relative U.S. position has improved since that year.

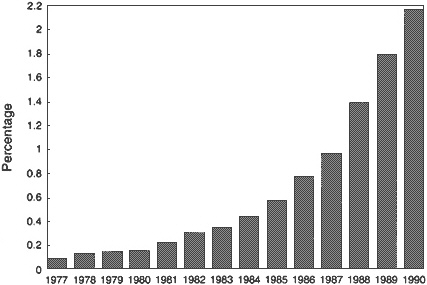

During the 1980s, as already noted, Japanese direct investment in the United States rose dramatically, and with this has come a sharp rise from a level of almost nothing in the research and development done in the United States by Japanese-controlled corporations. The rise in control of domestic business entities by Japanese firms is depicted in Figure 3, which indicates the foreign direct investment (FDI) stock of U.S. affiliates of Japanese firms as a percentage of the net worth of U.S. nonfinancial corporations. It should be noted that FDI is a balance of payments flow concept that roughly measures the total change in the foreign investors' share of the net worth at historic cost of U.S. enterprises deemed to be under the control of foreign investors. The cumulative stock of these flows (the ''foreign direct investment position of the United States") is thus the total current value of the foreign share of this net worth measured at historic value. (In 1991, the Department of Commerce began issuing figures representing estimates of the current market and replacement values of this stock.) This stock includes both (paid-in) investment and retained earnings. It also includes the net indebtedness between the U.S. affiliate and its foreign parent, a figure considered by the Department of Commerce as near equity.

Thus, the FDI stock figures that are the numerators for the bars shown in Figure 3 are (roughly) measures of net worth held by Japanese investors in activities they control in the United States. Thus, the ratios in this figure roughly compare "apples to apples," as opposed to many other presentations of the relative importance of FDI where the comparisons are "apples to oranges" (e.g., the ratio of FDI to GNP). As can be seen from the figure, the percentage of net worth of U.S. nonfinancial corporations controlled by Japanese direct investors increased eighteenfold from 1977 to 1989—a truly

Figure 3 FDI stock of U.S. affiliates of Japanese firms as % of U.S. non-financial corporations, 1977–1990. Source: Prepared at Institute for International Economics from U.S. Department of Commerce, Bureau of Economic Analysis, base data.

spectacular increase. But at the same time, even at the end of 1989, the total percentage of net worth of U.S. nonfinancial corporations held by Japanese direct investors, 1.8 percent, was really still quite low. At the Institute for International Economics we have estimated that this percentage rose to something like 2.1 percent at the end of 1990. In 1991, the rate of increase of this percentage appears to have slackened substantially, although it is too early to say this for sure because the relevant data is incomplete and subject to revision.

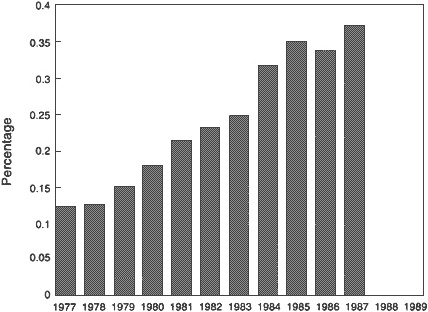

The percentage of U.S. GNP accounted for by domestic U.S. affiliates of Japanese firms also grew dramatically during the 1980s. By 1987 (the latest year for which data currently are available) this percentage was about 0.34 percent, up from about 0.13 percent in 1977 (Figure 4). The reader will note that the percentage of U.S. GNP accounted for by U.S. affiliates of Japanese firms in 1987 is much lower than the percent of U.S. nonfinancial corporate net worth held by Japanese direct investors; the latter is shown on Figure 3 to be about 1 percent in that year. There appear to be two reasons for the difference in these two measures. First, the nonfinancial corporate sector accounts for considerably less than the whole of the

Figure 4 Value-added of U.S. affiliates of Japanese firms as % of U.S. GNP. Source: Prepared at Institute for International Economics from U.S. Department of Commerce, Bureau of Economic Analysis, base data.

U.S. economy, and most Japanese FDI is in the nonfinancial corporate sector. Thus, a measure of the Japanese presence in the corporate sector is bound to be much higher than a measure of the Japanese presence in the economy as a whole. Second, the figure reported by the Bureau of Economic Analysis of the U.S. Department of Commerce for value-added by U.S. affiliates of Japanese corporations in 1987 (the numerator for the percentages in Figure 4) is a preliminary one that is subject to revision, and this author suspects that it is too low; my guess is that 0.4 to 0.45 percent would be more accurate.

Whatever the case, the percentage of U.S. GNP accounted for by domestic firms controlled by the Japanese was less than one half of 1 percent in 1987, not an enormous number. This percentage has doubtlessly increased since then, given considerable additions to the amount of Japanese FDI in the United States. Even so, however, it is very safe to say that at the moment, U.S. affiliates of Japanese firms account for less than I percent of U.S. GNP; the author's best guess is that this figure is about three-fourths of 1 percent.

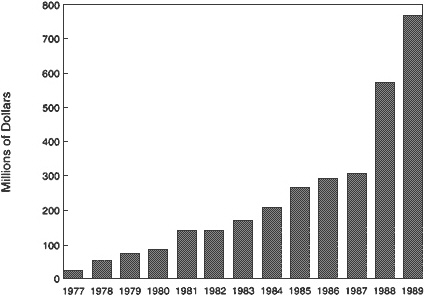

Along with Japanese control has come a significant increase in R&D activity undertaken by domestic affiliates of Japanese firms. Total annual R&D expenditures by such affiliates are detailed in Figure 5. These expenditures increased by 2.5 times just between 1987 and 1989. The years 1988 and 1989 were characterized by large-scale takeovers of U.S. firms by Japanese investors, and exactly how much of the increase in these expenditures is accounted for by takeovers (and hence transfer of R&D activity from domestic to Japanese control) cannot, alas, be determined directly from the data publicly available. While much of the increase is doubtlessly due to these takeovers, it is not likely that all of it is, a case supported by indirect evidence to be presented shortly. As previously noted, prior to 1987 most Japanese foreign direct investment in the United States entered in the form of green fields investment rather than acquisition (see Table 2), but acquisitions have been predominant from 1987 onwards.

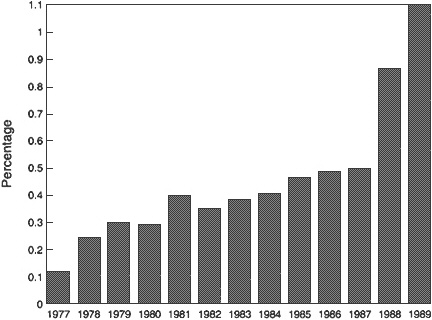

As might be expected given the evidence already presented, the fraction of total U.S. R&D accounted for by U.S. affiliates of Japanese firms has also risen dramatically in recent years. Figure 6 presents relevant data; the reader should note that the denominator in this figure is total company-

Figure 5 R&D of U.S. Affiliates of Japanese firms. Source: Prepared at Institute for International Economics from U.S. Department of Commerce, Bureau of Economic Analysis, base data.

TABLE 2 Japanese Acquisitions and New Establishments in the United States, 1987–1989 (in million dollars)

|

|

1987 |

1988 |

1989 |

1990 |

|

Acquisitions |

3,340 |

12,233 |

11,204 |

15,875 |

|

New establishments |

3,666 |

3,956 |

6,206 |

4,584 |

|

Source: Bureau of Economic Analysis, U.S. Department of Commerce, Survey of Current Business, May 1991. |

||||

funded R&D, not all U.S. R&D. The R&D of U.S. affiliates of Japanese firms jumped from about 0.5 percent of total U.S. company funded R&D in 1987 to about 1.1 percent in 1989. This increase of 2.2 times was less than the increase in the absolute amount of R&D done by these affiliates (2.5 times), reflecting the fact that the total amount of R&D done by companies did in fact increase over these two years.

Figure 6 R&D of U.S. affiliates of Japanese firms as % of total U.S. R&D (company-funded). Source: Prepared at Institute for International Economics from U.S. Department of Commerce, Bureau of Economic Analysis, base data.

TABLE 3 Measures of Performance of Manufacturing Subsidiaries of Non-U.S. Parent Firms by Country of Origin of Parent and of All U.S. Manufacturing Industry, 1987

|

Measure/ Country of Origin |

Value Added per Worker |

Compensation per Worker (thousand dollars) |

R&D per Worker |

|

United Kingdom |

44.5 |

28.5 |

1.72 |

|

Germany |

49.2 |

36.5 |

5.23 |

|

Netherlands |

43.7 |

34.7 |

NA |

|

France |

47.5 |

35.5 |

3.16 |

|

All Europe |

45.9 |

32.0 |

3.17 |

|

Japan |

49.8 |

35.1 |

2.88 |

|

All nations |

48.6 |

32.9 |

3.61 |

|

All U.S. manufacturing |

46.0 |

31.1 |

2.87 |

|

SOURCE: Calculated by Institute for International Economics using base data from the Bureau of Economic Analysis, U.S. Department of Commerce. |

|||

As is indicated in Table 3, by two measures, value-added per worker and compensation per worker, U.S. affiliates of Japanese-controlled firms in the manufacturing sector outperformed affiliates of firms from all other nations in 1987, the most recent year for which these data are available. This might be because of selection bias (i.e., Japanese firms might be operating in more capital-intensive industries than firms from other nations, where output per worker tends to be high). The data do not permit testing of whether or not selection bias is significant, unfortunately. By the measure of research and development per worker, however, U.S. manufacturing affiliates of Japanese firms do not compare favorably with U.S. manufacturing affiliates of continental European firms, but do outperform the affiliates of U.K.-based firms. Given the growth of R&D in the United States by affiliates of Japanese firms since 1987, the Japanese figure has almost surely risen since then. We estimate research and development per worker by U.S. affiliates of Japanese firms in the manufacturing sector now to be about $4,000 per year.

The percentage of net worth of nonfinancial corporations accounted for by Japanese FDI increased by 1.9 times between 1987 and 1989 (i.e., was about 90 percent higher in 1989 than in 1987; see Figure 3), whereas R&D done by U.S. affiliates of Japanese corporations as a percentage of total company-funded U.S. R&D was (from the figures just cited) about 120 percent higher in 1989 than in 1987. If the ratio of R&D expenditures to net worth were constant across all companies (it of course is not!), these numbers would suggest that about three-fourths of the jump in R&D expenditures by

these affiliates between 1987 and 1989 is accounted for by acquisitions (the three-fourths figure is calculated as the ratio of the net worth ratio increase to the R&D ratio increase, or 90/120) and hence about one-fourth came from other sources, notably establishment of new R&D operations under Japanese control or expansion of such operations already under Japanese control in 1987. Impressionistic evidence suggests however that the R&D intensity of the major Japanese acquisitions during 1987–1989 (which included CBS Records, Columbia Pictures, Rockefeller Center, etc.) was if anything less than that of existing Japanese-controlled activities in the United States in 1987 (which included the major automotive investments plus significant operations in the electronics sector), and hence the author's guess is that the three-fourths figure is too high and the one-fourth figure too low; the author's ''guesstimate" is that perhaps as much as one-third of the total increase in Japanese-controlled R&D in the United States between 1987 and 1989 was due to creation of new R&D operations or expansion of existing ones, whereas something like two-thirds of this increase represented transfer of existing R&D operations from domestic to Japanese ownership. These figures should be taken for what they are, that is, rather crude estimates and not precise measurements.

Whatever the case, it is clear from Figure 6 that as spectacular as the rate of increase of R&D done in the United States by Japanese-controlled firms has been, the annual total remains a small fraction of total U.S. company-funded R&D. Also, the amount of this R&D is remarkably commensurate with the overall level of Japanese-controlled activity in the economy. About 1.8 percent of nonfinancial corporate net worth is held by Japanese foreign direct investors, and about 1.1 percent of company funded R&D is done by U.S. affiliates of these investors. Given the author's guess that these affiliates account for about 0.75 percent of U.S. GNP, it would appear that they are making a slightly larger contribution to the nation's R&D effort than to the U.S. national product.

There at present exists remarkably little data on precisely where Japanese direct investors are placing their R&D dollars and what their motivation is for doing so. What evidence that does exist does not always tell the same story. For example, one story often told by critics of Japanese FDI is that most R&D done by U.S. affiliates of Japanese firms is of the "commercial listening post" variety. By this account, this R&D is not really R&D in the normal sense of the word, but rather is some combination of market research (so that products actually engineered in Japan can be tailored to the U.S. market) and industrial espionage. But another story often told by these critics is that Japanese firms are buying up small high technology ventures wherein important state-of-the-art technologies are being developed. The usual assumption here is that the basic motive of the investor is to snatch away the technology and transfer it quickly back to Japan. This

latter may indeed happen, but the large increases in the expenditures of U.S. affiliates of Japanese corporations detailed in Figure 5 argue against this being the story of the typical Japanese takeover; the fact is that these expenditures have been growing very rapidly, and this is not consistent with a story of Japanese corporations buying U.S. high tech ventures for the sole purpose of gutting them or "hollowing them out."

A rather opposite story has been told to this author by a number of Japanese business persons and economists. This is that the ultimate intent of many large Japanese firms operating in the United States is to create major R&D centers here, with an emphasis on basic and precommercial research. The rationale for this is that whereas Japan excels in product design and manufacturing innovation, it still significantly lags the United States in fundamental scientific disciplines. Comparative advantage, if one likes, resides in U.S. basic science and technology, but in Japanese applied technology. Unable as in the past to be able to count upon licensing and other indirect means of acquiring precommercial technologies from the United States, major Japanese firms will now seek to obtain these directly by controlling the relevant activities in the United States.

Whatever the logic of this position, it is not entirely clear that recent trends actually have been in this direction either. Press reports have appeared pertaining to U.S. R&D activities of the large, vertically integrated Japanese electronics firms such as NEC, Fujitsu, Hitachi, Sony—precisely the firms most likely to perform large-scale basic research.1 These activities to date appear (on the basis of largely anecdotal evidence) to be quite modest in scale. The U.S. laboratories of such firms, for example, employ many fewer employees than do the laboratories in Japan. Modest scale at the level of the individual firm is, of course, consistent with the data presented above, indicating an overall Japanese R&D presence in the United States of modest scale albeit growing rapidly. But, correspondingly, the U.S. laboratories of most Japanese firms are quite new, and in some cases they appear to be building capabilities quite consistent with the "focus on

basic research story." Whether they will grow into major basic R&D facilities is an issue that only time can resolve.

Creation of basic R&D operations in the United States is not wholly inconsistent with listening post activity.2 The reason why has to do with the fact that the results of basic research are not necessarily manifested in commercial benefits that accrue directly to the organization that performs the research, but rather that these results take the form of new knowledge that must be further developed before tangible commercial benefits accrue to anyone. The knowledge itself can rarely be retained within a single organization; rather, it diffuses from the organization via modes such as scholarly articles and informal exchanges between research personnel at professional meetings. The commercialization of the knowledge might then take place within some other organization rather than the one that actually performed the initial research. The key idea is that in order to avail itself of such knowledge, an organization must both be plugged into the network of entities that generate basic knowledge and possess a minimum set of internal capabilities necessary to recognize potentially valuable information and to internalize this information in a way that can lead to commercial opportunity.

By this account, basic R&D activity by any firm (and not just Japanese-controlled ones!) serves to some extent as a listening post. The activity serves not simply to generate new knowledge that is used exclusively within the firm, but also to pick up and further develop new knowledge that is generated within other organizations. Clearly, for this latter function to be effective, an organization must actually be generating new knowledge as well as tapping in on the new knowledge generated by other organizations. But it is entirely plausible that basic R&D activities simultaneously are generators of new knowledge and receivers of other new knowledge generated elsewhere.

Thus, basic R&D activities of Japanese firms in the United States might very well be both listening posts and generating stations at the same time. Why, in order to be such a listening post, would the activity have to be actually located in the United States? After all, journal articles can be read in Japan, and Japanese-based research personnel can attend professional meetings in the United States. The principal reason is that a U.S. location is likely to enable more effective "networking" within the U.S. R&D community than a comparable facility located in Japan. For instance, it is probably easier to hire topflight U.S. citizens to work at a U.S. facility under the control of a Japanese corporation than to work at a similar facility in Japan.

Is the possibility of such listening post activity problematic from a U.S. interests perspective? This issue is taken up in the next section.

JAPANESE-CONTROLLED RESEARCH AND DEVELOPMENT IN THE UNITED STATES AND U.S. INTERESTS

To evaluate where U.S. interests lie with respect to Japanese control of R&D activities in the United States, one ideally would calculate the costs and benefits associated with these, including all costs associated with such intangibles as "loss of control of technology," including the loss that might occur through basic R&D listening posts as described immediately above. This, alas, would be a nearly impossible task, and all that is attempted here is a qualitative evaluation of what the costs and benefits are likely to be without any effort to quantify these.

The benefits of any R&D activity accrue to four sets of parties; the first three are producers (i.e., the firm that conducts the activity, or, more accurately, ultimately the owners of the firm); consumers (i.e., users of the products of the firm); and the public at large (where the "public" is not any of the above). Those benefits that accrue to the public at large are often called "external benefits" or "externalities.'' The fourth set of parties that can also capture some of the benefits are suppliers of inputs to the firm conducting the R&D. These suppliers include the firm's employees, whose marginal productivities (and hence wages) might be positively affected by product and process innovations resulting from R&D. They also include suppliers of purchased inputs to the firm, to whom technologies might be transferred in order that these technologies be embodied in the inputs.

For example, the Japanese automotive firms have shown some willingness to work with U.S.-controlled suppliers of auto parts so as to increase the quality of these parts, and this entails technology transfer. If these same suppliers then use this technology to improve quality of parts delivered to other manufacturers, the benefit of this technology transfer will accrue not just to the supplier itself, but to other auto firms and ultimately to the users of the autos.

However, it is also alleged that Japanese firms supply their latest and best technologies to customers and suppliers that are members of the same keiretsu family of firms prior to supplying these to non-keiretsu firms.3 This could be problematic if the supplying firm holds a dominant market position and is able to use its technology to monopolize the market. But to the extent that such problems occur, they must be evaluated with care. A

certain amount of monopoly power on the part of an innovator of a new technology is seen by most persons expert in the economics of technological innovation as a necessary evil in a technologically dynamic industry (indeed, patents in principle grant a temporary monopoly to an innovator). What has been termed the "keiretsu problem" may in fact be little more than the way Japanese firms institutionalize this power. (Otherwise put, the same degree of monopoly power held by non-Japanese innovators, but manifested via different institutional arrangements, may be seen as quite tolerable; nobody complains too loudly if IBM develops internally a new microchip and supplies it only to other IBM operations.) But neoclassical economists generally contend that monopoly power is bad per se; this power is to be tolerated as a necessary precondition for innovation (or for economy of scale, or other sources of economic benefits), but only to the degree that is necessary for innovation to proceed (or for the other benefits to accrue). There is a level of monopoly power that is not acceptable and that cannot be justified on grounds of technological dynamism or any other economic basis. We shall return to this set of issues in the final pages of this paper.

Issues of market dominance aside, too much current discussion of the costs and benefits of foreign control of domestic R&D activity is predicated implicitly on the assumption that all benefits accrue to the producer or to the ultimate owner of the producer. This simply is not true. Some benefits from domestic R&D activities undertaken by a firm that is foreign owned will be captured by users of the firm's products, the public at large, suppliers to the firm, and even, as the example above shows, possibly the firm's competitors. Most of these persons will be Americans.

All else being equal, however, U.S. interests would be better served if any given R&D activity were under domestic U.S. ownership rather than Japanese (or any other foreign) ownership. The reasons are straightforward: those benefits from the activity that are captured by the firm would ultimately accrue to domestic owners rather than foreign ones.

That having been said, it must also be said that "all else being equal" does not hold. In the extreme, domestic ownership of an R&D activity might not be an option.4 In such cases, a discussion of the pros and cons of

foreign ownership of the activity boils down to whether it is better that the activity exist in the United States under foreign ownership or not exist at all (or exist somewhere other than the United States). A less extreme case would be a small, high technology company that is a candidate to be acquired by a foreign firm. The foreign investor might have the resources and will to develop the company's technology to a point where it is socially useful, whereas without the foreign investor the company would suffer a significant risk of faltering before the technology is fully developed. There are reasons why this can occur that go beyond an appeal to market failure (in this case, market failure would occur if the company failed to develop a socially useful technology that would earn its backers an adequate return because it could not raise the resources necessary to do so): the technology held by the company might, for example, complement technology held by the foreign investor in such a way that the value of the two technologies combined was greater than the sum of the values of the two technologies when kept separate.5

Thus, one issue that must be resolved when discussing whether foreign ownership of a domestic research and development activity is in U.S. interests is whether or not that activity is "additive." That is, it must be determined whether or not the activity represents an addition to the U.S. R&D base or simply transfer of ownership and control from domestic ownership to foreign ownership.

If the R&D activity is additive, it is much more likely to be beneficial to overall U.S. interests than if it is not. Even if foreign owners capture some of the benefits from the activity, other benefits will remain in the U.S. economy, such as is suggested above, those captured by users, suppliers (if these are domestically owned), and the public at large. Presumably these will exceed the costs to the economy of the activity. It must be noted here however that this last need not necessarily hold: the activity will use inputs such as U.S. R&D talent and might bid up the price of inputs, to the detriment of other activities. In principle, the opportunity costs associated with these inputs could exceed the benefits accruing to the United States. But in practice this seems (to this author at least) to be very unlikely. As noted in the previous section, the percentage of U.S. R&D activity that is under foreign control is quite small, and it seems unlikely that this activity would greatly affect input prices.

Even if the activity is not additive, it is not invariably to the detriment of the United States for it to be under foreign ownership. An issue here is

whether or not the activity is likely to generate more benefits as part of the foreign parent firm's organization than if it is not. As suggested earlier, it is possible that the competence (and value in terms of potential to generate benefits) of a U.S. R&D activity that comes under foreign control is enhanced by this control: complementarities might exist between the new owner and the activity that enhance the value of both.

But against this of course must be weighed any benefits captured by the foreign owner that otherwise would be captured by Americans. These would include any "first-mover" advantages that might accrue from control of the relevant technologies (to the extent that these are captured by the owner or by close affiliates of the owner, e.g., other members of a keiretsu; here it must be remembered that benefits resulting from first-mover advantages might accrue to customers or suppliers as well as to the innovating firm itself). Foreign ownership does imply that some benefits will be captured by foreigners, and if the activity is not additive, these may be ones that otherwise would be captured by Americans.

On the balance then, where will the U.S. interests lie? The standard presumption regarding R&D is that this type of activity generates significant externalities, and these almost by definition will be captured by Americans if the activity is located on American soil irrespective of the ownership. Some of these have the character of a public good and may be captured by persons other than Americans but this would happen irrespective of ownership. What are known in the recent literature on clustering of economic activities as thick market externalities will almost surely be enhanced by R&D activities under foreign ownership but located on U.S. soil, and benefits will result that are captured by Americans. A full description of "thick market externalities" is beyond the scope of this paper, but these can be described in a nutshell as the propensity of R&D activities to be located in close proximity to other activities, because the combination of activities in close proximity to one another generates a pool of resources that can be tapped by all activities.6

The listening post function of basic R&D activity described at the end of the previous section of this paper really amounts to participation in these thick market externalities. Is such participation by Japanese-controlled entities desirable? The answer depends in large part upon whether or not as a result these entities bring something to the party as well as take something away. To some extent, this rests upon whether or not these activities generate any new knowledge that can be tapped by American participants in the network (and so, again, the issue is whether or not the Japanese-controlled activities are additive). But it also depends upon whether the U.S.-based

activity is able to tap into the R&D activities in Japan of the Japanese parent firm, and to bring knowledge from these into the U.S. network. I know of no study attempting to determine whether or not either of these actually occurs, and indeed the answer might be "it is too early to tell."

Also relevant to this issue of whether basic R&D listening post activity is consistent with U.S. interests is an issue of reciprocity: are U.S.-owned firms able to "plug" themselves into Japanese networks inside of Japan? Recent research on this matter suggests that in fact numerous U.S. firms have been able to do so.7 To the extent that this is so, and given that diffusion of technology is generally held ultimately to be to the advantage of society at large, even if it were to be determined that Japanese R&D listening posts bring little knowledge into U.S. R&D networks relative to the information they derive from these networks, it might be foolish to attempt to shut these activities down if to do so risked reciprocal action on the part of the Japanese government. Two-way transfer of technology is almost surely a positive-sum game. There almost surely would be net costs both to the United States and to Japan of closing off this transfer, and reciprocal access to each other's thick market externalities is almost surely jointly beneficial even if the case could be made that one party would benefit at the expense of the other if one nation were to be unilaterally open to listening posts of the other while the second were to be closed in this regard.

On the whole, I would think that the case is strong that net benefits are generated by foreign-owned R&D activities located in the United States even without appeal to reciprocity. The case is enhanced if the foreign owner possesses complementary technologies (or, perhaps more pertinent, technological capabilities) that enhance the value of the output of the activity, and the case is rather strong that Japanese firms that acquire or establish U.S. R&D facilities likely will possess such complementary assets. It is especially enhanced if indeed Japanese firms enlarge basic research in the United States to the extent that the U.S. activities are able to generate (as well as capture) basic knowledge. The externalities associated with basic research are generally believed to be significantly higher per unit of input than for applied R&D.

The case in favor of foreign-owned R&D activity is also enhanced if the firms undertaking the R&D source components or other inputs from domestically-owned suppliers, given that these suppliers are capturing some of the benefits from the R&D. But the case is somewhat weakened if

Japanese-controlled firms only establish backwards linkages with firms that are members of a keiretsu. However, backward linkages with domestically-owned suppliers should not be regarded as a necessary criterion for there to be net benefits to the United States from foreign-owned R&D activity.

As already noted, the main issue centering on keiretsu is that linkages among keiretsu members could result in undesirable levels of dominance by a keiretsu. There doubtlessly will be continuing discussions, with friction, at the official level between the United States and Japan regarding competition policy and the apparent willingness of the Japanese government to tolerate higher levels of industry concentration than are seen as desirable in the United States. But with respect to affiliates of Japanese keiretsu member firms operating directly in the United States market, there are unilateral actions that U.S. antitrust authorities could take to remedy anticompetitive practices. Thus, although these practices might very well be objectionable, the problems in many instance could be remedied via application of U.S. antitrust laws.

Even so, there will be cases where foreign ownership of a particular R&D activity or high technology will not be in U.S. national interests. Some of these will fall under the rubric of national security.8 But while legitimate national security exceptions exist, it is easy to envisage "national security" becoming a rationalization for xenophobic policies that serve no national interest, security or otherwise. Therefore, national security exceptions to an otherwise open policy towards foreign ownership of economic activity (including R&D activity) should be truly exceptional. While there are legitimate national security exceptions, the danger of allowing national security to be abused is almost surely far greater than the dangers to security of foreign ownership of firms operating in the United States. Where foreign ownership is disallowed in a specific case, the reasons for disallowing this ownership should be clear, specific, and compelling.