3

Employment-Based Health Benefits Today

[Employment-based benefits are] . . . the shotgun marriage of medical care and industrial relations.

Herman Somers and Anne Somers, 1961

As described in the first two chapters of this report, the special union between the workplace and medical expense protection is a major and distinctive feature of the U.S. health care system. Despite the leveling off in the proportion of the population covered by employment-based health benefits in the 1970s and 1980s and, indeed, the decrease in coverage from 66 percent in 1988 to 64 percent in 1990, employer spending on health benefits continues to increase as a fraction of business receipts and labor compensation. The persistent escalation of health benefit costs has prompted employers to become ever more involved in the design and management of their health benefit plans and to experiment with an ever-wider variety of techniques in an effort to contain their costs.

Although the employers' role in financing health benefits is important, their role in determining whether and how to offer coverage is equally significant. This chapter provides a detailed picture of employment-based health benefits in the late 1980s and early 1990s. It examines the following six questions:

-

Who is covered by employment-based health benefits and who is not?

-

What kinds of health plans are offered and what services and providers do these plans cover?

-

What limits are placed on this coverage?

-

What do employment-based health benefit programs cost employers and employees?

-

Who bears the financial risk for employment-based programs?

-

What other kinds of health-related benefits do employers offer?

Although this kind of summary discussion can cover general patterns and major sources of variability in employee health benefits, it cannot portray the full diversity that currently characterizes employment-based health benefits in the United States.1Chapter 4 elaborates on the theme of diversity and on the complexities employers face in making and implementing decisions about health benefits in different organizational environments.

DATA SOURCES

This chapter relies on data from four basic sources: the Bureau of the Census in the Department of Commerce, the Bureau of Labor Statistics in the Department of Labor (DOL), the Health Insurance Association of America (HIAA), and the Health Care Financing Administration (HCFA) in the Department of Health and Human Services. Although information from these sources is generally consistent, differences in definitions of terms, sampling procedures, and units of analysis require that some care be taken in interpreting data and analyses from different sources. Even data drawn from the same source may be subjected to somewhat different analytic procedures by different analysts, who are then likely to develop somewhat different inferences. Readers who want a more detailed understanding of the data sources used here should consult the methodology sections and table notes in the relevant source documents.

The Current Population Survey (CPS) of the Bureau of the Census is directed at households and does not include individuals in nursing homes, prisons, and other institutions. Because of changes in questions and population groups surveyed starting with the March 1988 survey, data covering health insurance status in 1987 and later are not comparable with data for earlier years. For analysis of the CPS data on health coverage collected during March of each year, this report relies on the analysis of the March 1991 data published by the Employee Benefit Research Institute (EBRI, 1992d).2

DOL statistics refer only to workers (not family members) who participate in an employer-sponsored health plan; the numbers include those em-

|

1 |

Chapter 1 notes that employment-based health benefits typically involve a single employer sponsor but that some involve multiple employers and unions. The data and discussion in this chapter do not distinguish sponsor characteristics. |

|

2 |

For the March CPS, the basic question on private health insurance status asks respondents whether—other than government-sponsored policies—health insurance can be obtained privately or through a current or former employer or union and whether anyone in the household was covered by health insurance of this type at any time during the preceding calendar year. Follow-up questions ask who in the household was covered, what the specific source of coverage was, and whether it was financed in part or whole by an employer or union. In addition, the May CPS asks whether the respondent's employer offers a health plan, whether the respondent and dependents are covered by it, and if not, why. The analysis by Long and Marquis (1992) cited later in this chapter combines information from the March and May surveys. |

ployees who have not yet completed any required waiting periods. DOL's Bureau of Labor Statistics now surveys small private establishments (under 100 employees) and state and local governments during one year and medium and large private establishments in alternate years.

The data generated by HIAA also come from surveys of employers, but the unit of analysis is, for the most part, the firm rather than the individual (HIAA, 1990, 1991a,c). The estimates of aggregate health care expenditures come from the HCFA. HCFA bases these estimates on its own data, information from the Census Bureau and the Bureau of Economic Analysis in the Commerce Department, and results from surveys conducted by the U.S. Chamber of Commerce.

This chapter also uses certain additional sources, including surveys conducted by the Department of Health and Human Services, the General Accounting Office (GAO), the Treasury Department, the U.S. Chamber of Commerce, and private consulting firms. Surveys conducted by consulting firms may provide the only relatively recent information on issues such as use of self-insurance arrangements, decisions about retiree health benefits, or use of financial incentives to reward or penalize off-the-job behavior. Unfortunately, these surveys, which generally question firm benefit managers and use the firm as the level of analysis, often have low response rates overall and even lower response rates for certain specific questions (DiCarlo and Gabel, 1989).3

WHO IS AND IS NOT COVERED BY EMPLOYMENT-BASED HEALTH BENEFITS?

The first parts of this section report generally on who has employment-based coverage and who does not.4A discussion of factors affecting the availability of coverage follows.

Covered Workers and Family Members

Employment-based health coverage may be provided directly through one's own employer or union or indirectly through a family member's workplace.5

In 1990, almost two-thirds of all Americans under age 65, an estimated 138.7 million people, were covered by employment-based health benefits (see Table 1.1, Chapter 1). This group was about evenly split between those who received coverage directly from their employer and those who received it indirectly through a family member. Analyses from the Rand Corporation using March 1988 CPS data indicate that 11 percent of those eligible for direct employer coverage turn it down because they have other coverage and only 2 percent decline coverage without having other coverage (Long and Marquis, 1992). Many employers require employee participation unless the employee has other coverage.

In 1990, only 9 percent of the nonelderly had private insurance that was not employment based; another 14 percent were covered by Medicaid or some other public program. Virtually all of the elderly are covered by Medicare, although—as discussed below—some have supplemental benefits from a former employer. For the relatively small percentage of those aged 65 through 69 who are employed, federal law requires that any employment-based health benefits serve as primary coverage.

Employment-based coverage is most common for full-time, full-year workers (Table 3.1). Among individuals aged 18 to 64 who were working on a full-time, full-year basis in 1990, some 70 percent had employment-based coverage directly from their own employer, former employer, or union, and another 10 percent of this group received such coverage indirectly through a family member. In contrast, among those who worked on a part-time, full-year basis, only 22 percent reported direct employment-based coverage, whereas 38 percent reported indirect coverage. Among nonworkers aged 18 to 64, just over 40 percent had employment-based coverage, and, not surprisingly, most of this coverage was indirect, although some nonworkers have coverage through former employers. Almost one-third of this group, moreover, had coverage through Medicaid or some other public program.

Virtually all organizations that offer coverage to employees also offer coverage to family members, although such coverage is less likely than individual coverage to be fully financed by the employer. In 1990, in addition to nonemployed adults with indirect coverage, about 60 percent of children received employment-based coverage indirectly through a family

|

|

the term for purposes of allowing deductions and exemptions on personal income tax returns. However, individuals eligible for health benefit coverage are not always dependents (as defined by the IRS), and dependents are not necessarily eligible for coverage. Two examples illustrate these points. On the one hand, a small number of employers have expanded access to health benefits by extending coverage to domestic partners, some covering only same-sex partners and others covering both same-sex and opposite-sex partners (Schachner, 1992). On the other hand, some states have mandated coverage for individuals who clearly qualify as dependents (e.g., newborns) but who have sometimes been excluded from conventional insurance plans. Table 3.5 shows categories of eligibles mandated by some states. |

TABLE 3.1 Percentage of Individuals with Selected Sources of Health Insurance by Own Work Status, 1990

|

|

Private Health Insurance |

|

|||||||

|

|

Number (millions) |

Total |

Total employer |

Direct employer |

Indirect employer |

Other private |

Publicly Sponsored |

No Health Insurance Coverage |

|

|

|

Total |

Medicaid |

|||||||

|

Own Work Status, Ages 18-64 |

|

||||||||

|

Full Year, Never Unemployed |

96.2 |

85.6 |

77.4 |

63.3 |

14.1 |

8.2 |

4.0 |

1.4 |

12.7 |

|

Full time |

83.6 |

86.9 |

80.0 |

69.6 |

10.5 |

6.9 |

3.6 |

1.1 |

11.7 |

|

Part time |

12.6 |

76.8 |

59.9 |

21.8 |

38.1 |

16.9 |

7.0 |

3.6 |

18.8 |

|

Full Year, Some Unemployment |

13.9 |

58.5 |

50.3 |

35.0 |

15.3 |

8.2 |

10.1 |

7.0 |

34.2 |

|

Part Year |

13.7 |

68.4 |

51.6 |

16.1 |

35.6 |

16.8 |

14.2 |

9.9 |

21.5 |

|

Nonworker |

27.8 |

53.2 |

40.8 |

8.0 |

32.7 |

12.5 |

31.6 |

21.1 |

21.6 |

|

Own Work Status, All Nonelderly |

|

||||||||

|

Child |

64.2 |

67.9 |

60.4 |

0.1 |

60.3 |

7.6 |

20.6 |

18.7 |

15.3 |

|

Family-head worker |

75.6 |

79.9 |

71.3 |

66.7 |

4.6 |

8.6 |

6.4 |

3.5 |

16.3 |

|

Nonfamily-head worker |

48.3 |

81.9 |

71.7 |

36.3 |

35.4 |

10.2 |

4.9 |

2.1 |

15.7 |

|

Nonworker |

27.8 |

53.2 |

40.8 |

8.0 |

32.7 |

12.5 |

31.6 |

21.1 |

21.6 |

|

SOURCE: Adapted from EBRI, 1992d, Tables 2 and 22. Based on EBRI analysis of March 1991 Current Population Survey. |

|||||||||

News reports suggest that some employers are deliberately encouraging their employees to switch their coverage to a spouse's plan or are trying to protect themselves from such practices or both (Block, 1992). A few organizations no longer offer family coverage if the family member has coverage available from his or her own employer. Others now require extra payments for coverage of family members who decline coverage elsewhere (sometimes modifying or eliminating charges if the other worker's wages are low or the premium contribution is very high). Others use flexible benefit plans (discussed later in this chapter) to discourage this option. Overall, the employed individuals most affected by such restrictions are thought to be ''secondary" wage earners who work for organizations that offer less comprehensive benefits than those available to "primary" wage earners.

Although the increased participation of women in the work force and the growth of two-worker families might have been expected to increase the availability of health benefits to individuals and families, this does not appear to have happened. Data from the NMES surveys show that (1) "the percentage of households in which both spouses were offered employment-related coverage has remained constant over the decade [1977 to 1987]" and (2) "the proportion of households in which neither spouse has job-related health benefits available has actually increased" (Schur and Taylor, 1991, p. 161).

Uninsured Workers and Family Members

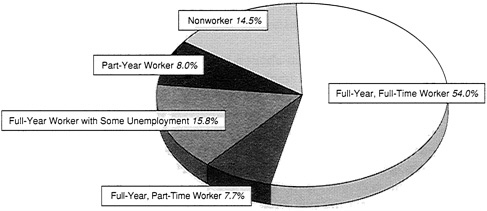

For 1990, some 35.7 million nonelderly Americans, nearly 17 percent of those under age 65, reported that they had no private or public health benefits during the year. About 85 percent of these individuals lived in families headed by a worker, and about half were full-time, full-year workers and their family members (Figure 3.1).

Lack of employment-based coverage is common for low-wage workers. Among civilian wage and salary workers with poverty-level incomes working on a full-time, full-year basis in 1990, only one-third had direct employ-

FIGURE 3.1 Work status of the family head for the 35.7 million Americans under age 65 who were without health insurance, 1990. (See glossary for definition of work status categories.) SOURCE: Adapted from EBRI, 1992d. Reproduced with permission from EBRI Issue Brief Number 123, Sources of Health Insurance and Characteristics of the Uninsured, analysis of the March 1991 Current Population Survey.

ment-based coverage, compared with three-quarters of those with higher incomes (EBRI, 1992a). For all workers aged 18-64 earning less than $10,000 a year in 1991, about 30 percent had indirect employment-based coverage and 16 percent had direct coverage. This group includes many part-time workers (Long and Marquis, 1992). Decreases in employment-based coverage in the period 1988 to 1990 were concentrated among low-wage workers.

Young workers are also less likely to have coverage than older workers. An Urban Institute analyst working from March 1988 CPS data found that 42 percent of workers aged 18 to 24 were without employment-based coverage, compared with about 20 percent of those aged 35 to 44 (Swartz, 1992).

The numbers above are conservative because they include only those who were without insurance for all of 1990, not those who were uninsured for only a portion of the year. When Census Bureau analysts looked at their data for a 28-month period starting in 1987, they found that some 61 million people spent at least one month without insurance from any public or private source (Rich, 1992).

Workers or their family members may lack coverage for several reasons. A worker's employer (1) may not offer coverage at all, (2) may offer coverage only to selected categories of workers, such as those who work over some number of hours per week, (3) may require an employee contribution to the premium that the worker is unable or unwilling to pay, or (4) may exclude the worker or family member because of a preexisting health

problem or because they have not completed a required waiting period (See Northwestern National Life Insurance Company, 1989, for examples of restrictions).

One analysis indicated that about 6 percent of workers are ineligible for the coverage offered by their employer, most because they worked less than full-time, some because they had not completed a required waiting period (Long and Marquis, 1992). That same analysis indicated that those individuals who declined employer-offered insurance but had no other coverage (only 2 percent of all those offered coverage) tended to earn less, work part-time, be younger, and have experienced more change in employment status than those who accepted coverage. They were, thus, similar to those who worked for firms that did not offer coverage at all. This means that voluntary strategies to extend employment-based coverage may need to include subsidies to stimulate employee ability and willingness to pay for coverage as well as incentives to encourage employers to offer insurance.

Encouraging employers who do not offer coverage to do so has not proved easy. Even when lower-cost, "bare bones" coverage is made available, many small employers still do not offer it. Employer participation rates in targeted demonstration projects aimed at uninsured workers in small groups have been quite low, generally 10 percent or less (Helms et al., 1992). Those assessing these projects argue that cost remains a barrier for many small employers. In addition, some employers do not believe that employers have any responsibility to offer coverage. Others argue that their workers have other sources of coverage, and some claim that their workers would rather have higher wages than health benefits (McLaughlin and Zellers, 1992). Other surveys show that the high cost of health insurance is cited by employers as a primary reason they do not offer coverage to their employees (HIAA, 1990, 1991a; Edwards et al., 1992).

Retirees

Roughly one-third of those over age 65 have retained some employment-related health benefits, most of which are secondary to Medicare coverage but some of which serve—by law—as primary coverage for workers aged 65 to 69.6 Although retirees aged 65 and over accounted for about 60

percent of retirees who received some coverage from a former employer, about 40 percent of covered retirees are under age 65 (GAO, 1990a,b). Of retirees under age 65, only about one-third have employment-based health benefits (EBRI, 1992c). Because most younger retirees are not eligible for Medicare, employment-based health benefits may be their only source of coverage. Some, however, may be covered under a spouse's plan or some other source. Men and higher-income workers are more likely to have retiree coverage than women and lower-income workers (EBRI, 1991d, 1992c).

According to DOL statistics for 1989, about 42 percent of employees who participate in health plans offered by medium and large private establishments work for organizations that offer some employer-financed coverage for retirees (DOL, 1990). In contrast, for small establishments (fewer than 100 workers), the comparable figure is only about 17 percent (DOL, 1991). According to the GAO (1990a), only 2 percent of firms with fewer than 25 employees provide retiree coverage, but many of these firms report that they have no retired employees.

A small percentage of employers cover only retirees under age 65 or only retirees aged 65 and over, but most employers that offer retiree coverage cover both groups (DOL, 1990). Generally, employees who leave a company before they retire are not eligible for retiree health benefits (Mercer-Meidinger-Hansen, 1989).

There is growing concern that employment-based coverage for retirees may decline as a result of two factors: cost pressures and a new accounting standard set by the Financial Accounting Standards Board (FASB) (GAO, 1990a; EBRI, 1992c; U.S. Senate 1992b). This standard, commonly called FAS 106, requires that future benefits promised to retirees be recognized as liabilities on a firm's financial statements.7 By some estimates, complying with the standard may cause organizations' net worth—as measured on their balance sheets—to drop up to 15 percent across all companies and may lead to declines in pretax earnings—as measured on their current operating statements—of up to 10 percent for some employers (EBRI, 1992c). Individual companies are still analyzing what FAS 106 means for them and what legal and financial options they have for modifying or eliminating coverage for current and future retirees. Some are increasing the retiree share of the premium, some no longer promise coverage after retirement to newly hired workers, and some are phasing out coverage for current retirees (Woolsey, 1992f). Many are taking steps one way or another to reduce their future obligations to retirees.

Sources of Variation in Employment-Based Coverage

The Current Population Survey, which uses the individual as the unit of analysis, shows that the prevalence of employment-based coverage is strongly associated with the size of the organization for which one works (EBRI, 1992d). For example, of wage and salary workers aged 18 to 64 who worked for employers with fewer than 25 employees, about 30 percent reported having coverage directly from their own employer, former employer, or union, and another 23 percent were covered under another's employment-based plan. In contrast, among those working for firms with 1000 or more employees, just over 70 percent had direct employer coverage, and only 13 percent had indirect employer coverage (Table 3.2).

Surveys that use the firm, not the individual, as the unit of analysis likewise show variations in coverage that are positively linked to firm size. A recent survey directed exclusively at small firms reported that health coverage for some or all workers was offered by half of firms with 2 to 5 workers, three-fourths of firms with 6 to 25 workers, and 90 percent of firms with 26 to 100 workers (Edwards et al., 1992). HIAA's broader survey, which used different categories, reported that 27 percent of firms with fewer than 10 employees offered benefits, compared with 73 percent of those with 10 to 24 workers and 87 percent of those with 25 to 99 workers (HIAA, 1991a; Sullivan and Rice, 1991). Overall, although only 42 percent of all firms surveyed by HIAA offered health coverage, an estimated 81 percent of employees worked for those firms.

HIAA data indicate that small firms with higher proportions of highly

TABLE 3.2 Variations by Size of Employer in Percentage of Wage and Salary Workers Aged 18 to 64 with Employer Health Coverage or No Coverage from Any Source, 1990

TABLE 3.3 Variations by Industry in Percentage of Wage and Salary Workers Aged 18 to 64 with Employer Health Coverage or No Coverage from Any Source, 1990

|

|

Percentage of Workers with Employer Coverage |

Percentage of Workers with No Coverage from Any Source |

||

|

|

Total |

Direct |

Indirect |

|

|

Agriculture |

39 |

24 |

15 |

39 |

|

Personal services |

50 |

30 |

20 |

30 |

|

Entertainment, recreation |

59 |

35 |

24 |

20 |

|

Construction |

59 |

46 |

13 |

31 |

|

Retail |

59 |

35 |

24 |

24 |

|

Business, repair services |

64 |

46 |

18 |

23 |

|

Professional |

77 |

55 |

22 |

11 |

|

Wholesale |

80 |

68 |

13 |

12 |

|

Transportation, utilities, communications |

82 |

75 |

8 |

11 |

|

Finance, insurance, real estate |

84 |

67 |

17 |

8 |

|

Manufacturing |

84 |

76 |

8 |

11 |

|

Mining |

86 |

80 |

—a |

10 |

|

Government |

85 |

71 |

14 |

7 |

|

a Number of respondents is too small for percentage to be statistically significant. SOURCE: Adapted from EBRI, 1992d, Table 23. Based on EBRI analysis of the March 1991 Current Population Survey. |

||||

paid workers are more likely to offer health benefits than are small firms with more low-paid workers. In general, firms that do not offer insurance employ higher proportions of low-wage and part-time workers and have higher rates of labor turnover than firms that do offer insurance (HIAA, 1990; Edwards et al., 1992).

Employment-based coverage also varies noticeably by type of industry. For example, Table 3.3 shows the striking variation in coverage across industries. Some of this variation reflects differences in the average size of firms in different sectors. Nevertheless, even in industries with low rates of offering coverage, firms with 25 or more employees were much more likely to offer coverage than smaller firms. According to HIAA data, in retail trade, 84 percent of larger firms but only 27 percent of smaller firms offered health coverage in 1990; for finance, the figures were 92 and 42 percent, respectively (HIAA, 1991a).

In addition to size and profit levels, another factor that may play a role in industry variations in coverage is what is variously called redlining or blacklisting. The terms refer to the practices of some insurers that refuse to

sell coverage to certain groups, such as law firms, physician groups, hair salons, and restaurants (Zellers et al., 1992).

The level of employment-based health coverage also varies by region. The percent of the nonelderly with employment-based coverage ranges from just under 60 percent in the West South Central, Pacific, and East South Central regions to over 70 percent in the New England region. The lowest levels of employment-based coverage are reported for Mississippi (50.4 percent), the District of Columbia (51.6 percent), and New Mexico (51.9 percent). Some regional variation may reflect differences in the average size of firms in different parts of the country.

WHAT TYPES OF COVERAGE ARE OFFERED?

Types of Health Plans

If the typical health plan offering of 20 years ago could be described as a "plain vanilla" plan with some limited variations in ingredients, health plans today come in a multitude of flavors that are not easily categorized. The following discussion distinguishes simply between conventional and network plans on the basis of whether the plans impose restrictions on the participant's choice of health care provider.

Both conventional and network plans are evolving so rapidly that general characterizations and comparisons can become quickly outdated. In addition, behind this dichotomy lies much variability, particularly among network health plans. Moreover, because a network plan that is more restrictive on one variable (such as coverage for out-of-network services or the extent to which access to specialists and other care is controlled by a primary care "gatekeeper") may be less so on others, it is difficult to array different types of network plans along a simple continuum. These caveats notwithstanding, group and staff model health maintenance organizations (HMOs) are generally considered to be more restrictive than independent practice associations (IPAs), and the latter are assumed to be more restrictive than preferred provider organizations (PPOs) and point-of-service (POS) plans (see glossary for definitions).

Conventional Plans

Conventional plans (which may also be called indemnity, fee-for-service, open panel, or freedom-of-choice plans) place few if any restrictions on the participant's choice of the health care practitioners and providers whose services are otherwise covered. They may and increasingly do incorporate managed care features such as prior review of proposed hospital

care, but they continue to pay health care practitioners and providers largely or entirely on a fee-for-service basis.

Conventional plans have a long history in the United States, are familiar to most employees, and are often the only type of plan offered by employers. For purposes of this discussion, the category includes Blue Cross and Blue Shield plans that have very broad-based participating hospital and physician programs (see Chapter 2) that may include up to 100 percent of area providers. Depending on specific plan practices in contracting with and paying providers, some plans could be categorized as weak network plans. The border separating conventional and network plans thus contains a "gray area."

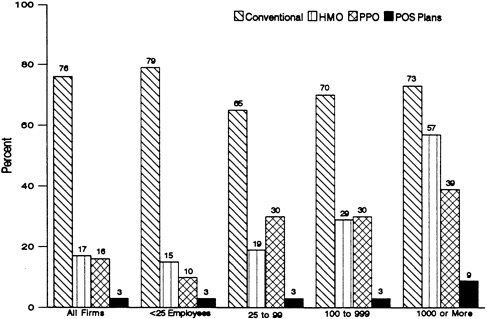

Among all employers offering coverage, HIAA (1990) found that 82 percent offered a conventional health benefit plan, either as the only plan or as one choice among others. As shown in Figure 3.2, larger firms were slightly less likely than smaller firms to offer such a plan. West Coast firms were also less likely to offer a conventional plan than firms in other regions. Currently, conventional plans enroll between three-fifths and three-quarters of all participants in employment-based health plans (DOL, 1990, 1991; Hoy et al., 1991).

FIGURE 3.2 Percentage of firms offering various types of health plans for firms offering a plan, by firm size, 1991. SOURCE: Unpublished data from HIAA Employer Survey.

Network Plans

Network plans, as the name implies, restrict coverage in whole or part to services provided by a specified network or group of physicians, hospitals, and other health care providers. Some network plans, such as various kinds of HMOs, limit nonemergency coverage entirely to network providers. Other plans, such as PPOs, POS plans, and open-ended HMOs, cover enrollees for some nonemergency services received from nonnetwork providers but typically impose higher deductibles, coinsurance, and other employee cost sharing for such care. In essence, employees can choose between network and nonnetwork services when they seek care rather than once a year when choices among health plans are made. A few employers have established their own networks, either by providing certain health services through company clinics and hospitals or by contracting directly with health care providers.

Network plans are sometimes termed closed or exclusive provider panels (if they exclude out-of-network coverage for nonemergency care), alternative delivery systems, or managed care plans, although each of these terms may be used in narrower, broader, or different ways. In particular, the term managed care may be applied to conventional plans that include certain utilization management strategies such as preadmission review and case management.

Network plans may pay physicians on a salaried, capitated, or modified fee-for-service basis. The modifications to fee-for-service payments may involve discounts to normal fees or acceptance by the provider of some risk for levels of use or expenses that are higher than planned. In addition to their payment arrangements, many network plans require members to designate a primary care physician who serves as "gatekeeper" for referrals to specialists and other services.

In the last decade, network-based health plans have grown greatly in numbers, enrollments, and variety (Table 3.4), partly because federal law required many employers to offer HMOs, partly because employers have seen these plans as vehicles for limiting increases in their health benefit costs, and partly because employers have considered choice of health plan attractive to employees. Across all firms surveyed by HIAA in 1990, 20 percent of covered employees were enrolled in HMOs, 13 percent in PPOs, and 5 percent in other network-based plans such as POS plans (HIAA, 1991a).8 More recent data suggest that POS plans are growing rapidly (Moskowitz, 1992). Only 123 HMOs offered such plans in 1990, compared with 256 in 1991 (Marion Merrell Dow, 1992).

TABLE 3.4 Percentage Distribution of Employees Across Types of Health Benefit Plans, 1987 to 1990

|

|

1987 |

1988 |

1989 |

1990 |

|

Conventional without utilization management |

41 |

28 |

18 |

5 |

|

Conventional with utilization management |

32 |

43 |

49 |

57 |

|

Health maintenance organization |

16 |

18 |

17 |

20 |

|

Preferred provider organization |

11 |

11 |

16 |

13 |

|

Point-of-service plan |

— |

— |

— |

5 |

|

Total network-based managed care |

27 |

29 |

33 |

38 |

|

Total nonnetwork plans |

73 |

71 |

67 |

62 |

|

SOURCE: Hoy et al., 1991, p. 19. Based on Health Insurance Association of America surveys, 1989 to 1991. Reprinted by permission of Health Affairs, Winter 1991. |

||||

Larger employers have been considerably more likely than smaller employers to offer HMOs and PPOs, but the differential is smaller for PPOs (HIAA, 1990). Regional differences and urban-rural differences contribute to additional variation in employers' offerings. These differences involve the availability of network plans (which can be difficult to establish in less populated areas), regional attitudes of physicians and others toward such plans, and state laws that may encourage or discourage such plans.

Covered Services

As described in Chapter 2, the growth of employment-based health benefits started with the growth of plans covering inpatient hospital care. Inpatient physician care came next, followed by coverage for physician office visits. In the 1970s, coverage for various other kinds of services, providers, and sites of care expanded, sometimes with a boost from state mandates. Examples of state-mandated benefits are arrayed in Table 3.5, which shows the categories of providers, conditions and services, and eligible individuals for which coverage is mandated under various state laws.9 In the face of charges that mandated benefits were increasing health care costs, encouraging more employers to self-insure, and benefiting providers more than patients, 25 states have since 1985 required that new mandates be subject to an objective evaluation of benefits and costs (Chollet, 1992b). Only one state with such a law has enacted any further mandates.

TABLE 3.5 Selected Examples of State-Mandated Health Coverage

Today, virtually all those covered by employment-based health plans are covered for inpatient hospital care (including prescription drugs), outpatient surgery, physician hospital and office services, and outpatient prescription drugs (DOL, 1990, 1991). In this last respect, most employment-based plans are more generous than Medicare, which does not cover outpatient drugs. A substantial majority of covered workers have some coverage for extended care facilities and home health services; fewer than half are covered for hospice care. Dental benefits are available to about two-thirds of health plan participants in medium and large private establishments but less than one-third of participants in small organizations.

Those covered by HMOs are more likely than those covered by fee-for-service plans to have benefits for home health care (99+ versus 72 percent) but less likely to have hospice benefits (30 versus 45 percent) (Burke, 1991). According to DOL (1990) data, nearly all those in HMOs are covered for routine preventive services, but only a small proportion of those in fee-for-service plans have such coverage, for example, 14 percent for immunizations and inoculations and 22 percent for well baby care. HIAA, however, reports conflicting numbers for well baby care, estimating that 50 percent of enrollees in conventional plans have such coverage (HIAA, 1990).

Cost Sharing and Other Limits on Coverage

Aside from services or conditions that are categorically excluded from coverage, employees may face a variety of limits on the medical care expenses their health plan will cover. These limits may take the form of

-

patient cost-sharing, such as deductibles and coinsurance (most common in conventional plans) and per-visit copayments (most common in HMOs);

-

caps on the volume or frequency of services, for example, a limit on the number of physician visits that will be covered during a year or in a 30-day period;

-

maximum amounts that a plan will pay for a specific service (e.g., $100 for a diagnostic test); or

-

maximum amounts that a plan will pay over an episode of care, a period of time, or an individual's lifetime (e.g., $250,000 or $1,000,000).

In addition, coverage may be limited under the terms of some utilization management programs that reduce or deny benefits for care judged medically unnecessary or care not reviewed in advance for appropriateness. Conventional health plans typically make the enrollee responsible for any added costs, whereas many network plans make the health care practitioner or provider responsible.

A deductible is the amount of eligible health care expenses that an insured individual must pay before a health plan begins to pay benefits.10 For health plan participants working for medium and large establishments, the average deductible in 1989 was about $160 for blue-collar workers and about $185 for white-collar workers (DOL, 1990); in 1990, the average deductible faced by workers participating in health plans offered by small establishments was just under $200 (DOL, 1991). In A. Foster Higgins's 1991 survey, firms reported a median deductible of $200, up from $150 in 1990. For family coverage, most health plans require that the individual deductible be met by each covered individual up to some maximum number of individuals (typically reached when three or four family members have met the individual deductible).

DOL (1990, 1991) reports that very few participants in employment-based health plans (under 2 percent) have deductibles (or premium contributions) that are linked to their earnings. To the extent that deductibles are intended to discourage use of medical care, the significance of a fixed dollar deductible is clearly less for higher-income workers. HMO members generally do not face deductibles but may have to pay defined dollar amounts

for specific services (e.g., $5 per office visit). Other network plans may have no or low deductibles for care received from network providers but may have deductibles for care outside the given network that are substantially higher than in a conventional health plan.

Coinsurance refers to coverage of eligible health care expenses that is split between the health plan and the enrollee. The most common split for coinsurance in conventional health plans is 80/20, meaning that 80 percent is paid by the health plan and 20 percent is paid by the employee (DOL, 1990, 1991). For individuals in PPOs who use network providers, about one-fifth have no coinsurance requirement, about one-third face a 90/10 split, and another one-fifth have an 80/20 division (Sullivan and Rice, 1991). When PPO enrollees go outside of the network, about half pay 20 percent coinsurance, about one-fifth pay 25 percent, and another one-fifth pay 30 percent. Forty percent coinsurance is required under some PPO contracts.

Cost sharing and coverage limits may be moderated by the caps that many employers place on out-of-pocket costs for employees. The size of such caps varies widely, with most workers covered by caps between $500 and $1,300 per individual (DOL, 1990, 1991). One-third of employees are in plans with no limit on the family out-of-pocket costs. Plans may not count the cost of some services against the out-of-pocket cap (for example, expenses for mental health services above the maximum coverage for those services). Plans that limit payments for physician services to a set fee or a reasonable charge may refuse to count enrollee payments in excess of these limits in determining whether a deductible or out-of-maximum is met. The result can be a substantial and to some degree unpredictable liability for health plan members.

Cost sharing and other limits on coverage may vary by type or place of service. For example, inpatient care may be covered more or less generously than outpatient care, and health plan members may pay more if they get brand name rather than generic drugs.

Mental health services are noteworthy for being covered less comprehensively than other services, a pattern that predates recent cutbacks in coverage (Shannon, 1992). Although over 95 percent of covered employees are in plans that cover services for mental illness, fewer than 20 percent are in programs that cover such illnesses to the same extent as other illnesses (DOL, 1990). For example, most plans place limits on the number of hospital days or visits covered, require higher levels of patient cost sharing, or set lower maximums on total plan payments; many do all three (Table 3.6). The explanations for these restrictions may lie in the stigma still attached to mental illness, the lack of evidence about the relative effectiveness of treatments of widely differing cost, and questions about the appropriateness of diagnoses and needs for starting and stopping care. A recent study conducted for the National Association of Psychiatric Hospitals indicated that costs for psychiatric care constitute about 8 percent of health plan

TABLE 3.6 Selected Types of Limits on Mental Health Services Among Several Health Benefit Plans

|

|

Federal Employee Program |

|

|||

|

|

Blue Cross/ Blue Shield High Option |

Typical Federal Plan |

Surveys of Private Firms |

||

|

Types of Limit |

A. Foster Higgins |

Hay/Huggins |

DOL |

||

|

Lifetime dollar maximum on adult inpatient mental health care |

$75,000 a person |

$43,500 a person |

58% of firms with this limit; $50,000 or less is most common |

18% of firms may have this limit; no data on most common |

33% of employees with this limit; no data on most common |

|

Annual limit on adult inpatient mental health care |

None specified |

None specified |

46% of firms with this limit; 30 days is most common |

45% of firms with this limit; 30 days is most common |

38% of employees with this limit; no data on most common |

|

Maximum number of mental health outpatient visits a year |

50 |

32 |

33% of firms have yearly limit on visits; no data on most common amount |

33% of firms have yearly limit on visits; 50 or fewer is most common |

34% of employees have yearly limit on visits; no data on most common amount |

|

Yearly dollar maximum on outpatient mental health care |

Based on the number of yearly visits and plan dollar copayments |

35% of the families in 8 of the 11 plans have stated yearly maximums; average maximum is $1,235 |

76% of firms with yearly dollar maximum; $2,000 or less is most common |

46% of firms with yearly dollar maximum; $2,000 or less is most common |

29% of employees with yearly dollar maximum; no data on most common amount |

|

Copayment for inpatient room and board |

20% |

43% |

72% of firms require some copayment; 20% is most common |

86% of firms require some copayment; 20% is most common |

72% of employees pay copayments; 20% is most common |

|

Copayment for inpatient professional services |

20% |

43% |

77% of firms require some copayment; 20% is most common |

20% copayment required by 53% of firms |

20% copayment required for 41% of employees |

|

Copayment for outpatient mental health services |

30% |

44% |

50% copayment required by 78% of firms |

50% copayment required by 55% of firms |

50% copayment required for 43% of employees |

|

SOURCE: Adapted from GAO, 1991b. |

|||||

costs, a figure that has remained fairly steady for two decades (Hay/Huggins, 1992).11

WHAT DO EMPLOYMENT-BASED HEALTH BENEFITS COST?

Premium Cost for Employer and Employee

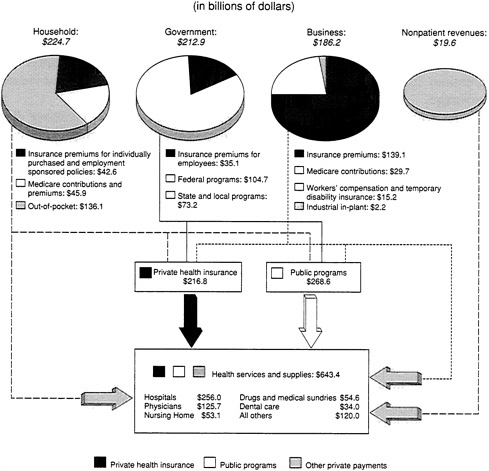

In 1990, public and private employers paid $174.2 billion in premiums on behalf of their employees (Figure 3.3). In addition, private employers spent another $47.1 billion in Medicare contributions, workers' compensation and temporary disability insurance premiums, and in-plant health services (Levit and Cowan, 1991). Households collectively spent $42.6 billion on premiums for individually purchased policies and employment-based health benefits and $45.9 billion for Medicare contributions and premiums. They also spent $136.1 billion for out-of-pocket expenses for medical care.12 Across all age groups, individual health spending as a share of adjusted personal income rose from 4.1 percent in 1980 to 4.7 percent in 1985 to 5.0 percent in 1990. As a share of income after taxes, the figure went from 4.8 percent in 1985 to 4.9 percent in 1989 (no data reported from 1980 or 1990) (Levit and Cowan, 1991).

According to DOL (1991) data, about three-fifths of workers participating in health plans offered by small private establishments had individual (self-only) coverage for which the premiums were fully paid by their employer. This compares to slightly less than half of workers in larger organizations. Approximately one-third of workers in both larger and smaller establishments received family coverage for which the employer paid the entire premium. More employers are requiring employees to pay a share of the premium cost than in the past (DOL, 1990). Nonetheless, the share of premiums paid by U.S. workers is not, on average, as high as it is for workers in countries such as Germany and the Netherlands (although cost sharing in the form of copayments or coinsurance is lower in these countries) (Kirkman-Liff, 1991).

|

11 |

Both judicial and legislative challenges to disparities in coverage for mental illnesses with a physical or organic basis versus coverage for other physical illnesses have been raised in recent years with mixed results. Neither judicial nor state legislative requirements for ''parity" reach self-insured employers. A recent proposal for a model mental health benefit in private health insurance noted that 10 of 26 health care reform bills introduced in the 102nd Congress did not explicitly require mental health coverage and most of the remainder provided special limits on such coverage (Frank, Goldman, and McGuire, 1992). At least one bill (S.2696) was introduced in 1992 that would provide for "health insurance protection for the costs of treating severe mental illnesses that is commensurate with protection provided for other illnesses" under any kind of health reform adopted in the future. |

|

12 |

This way of grouping expenditures differs from that used for Table 1.2 but is consistent with the grouping used to construct Figure 1.1. |

FIGURE 3.3 Flow of funds from sponsors of health care into the health care system in the United States, 1990. Nonpatient revenues include revenues from philanthropy and income from the operation of gift shops, cafeterias, parking lots, and educational programs, as well as those received from assets such as interest, dividends, and rents. Under "health services and supplies," "all others" includes home health care, other professional services, durable medical equipment, other personal health care, administration and net costs of insurance, and government public health activities. SOURCE: Levit and Cowan, 1991. Data from the Health Care Financing Administration, Office of the Actuary: Data from the Office of National Health Statistics.

According to HIAA (1991c) data, the total monthly premium for individual employment-based health coverage in 1990 was $145 for conventional health plans ($1,740 per year). For family coverage the total premium was $316 per month ($3,792 per year). Data for 1989 indicated that the employer paid on average 86 percent of the cost for individual coverage and 74 percent of the cost for family coverage (HIAA, 1990). Note that even though the percentage of the premium paid by employers may be less for family coverage, the absolute dollar amount may be more because the premium for family coverage is higher than the premium for individual coverage.

As with other summary statistics, the premium figures cited above disguise an enormous amount of variation in what specific employers and employees pay. For example, a recent study of health benefits for state employees showed that total monthly premiums for 1991 ranged from $78 in Hawaii and $85 in Mississippi to $204 in California and $241 in Massachusetts (Segal Company, 1991). The percentage of premium contributed by the employer ranged from 50 percent in Louisiana and 60 percent in Hawaii to 100 percent in 26 states. Differences in premiums reflect a variety of factors, such as differences in coverage (e.g., Hawaii has a $250 individual deductible and Massachusetts's deductible is $50) and differences in area hospital and other input costs.

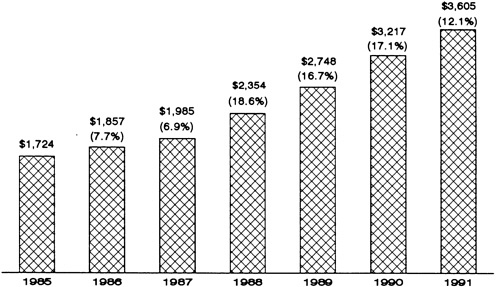

Although employment-based health benefit costs continue to increase more rapidly than general inflation, data from several sources suggest a modest slowing in the annual rate of increase in the last year or two (HIAA, 1991a,c; A. Foster Higgins, 1992). Figure 3.4 reports data from one survey on changes in average combined employee-employer spending on health benefits per worker from 1985 to 1991 (Geisel, 1992).13Table 3.7 shows HIAA data on rates of premium increases broken out for nonnetwork and network health plans for 1989, 1990, and 1991 (Hoy et al., 1991).

Administrative Expenses

HCFA attributes 5.8 percent, or $38.7 billion, of total national health expenditures to the costs of administering publicly financed health programs and philanthropic organizations and to the cost of private insurance net of benefit payments (Levit et al., 1991). Almost one-fifth of this amount involves the administrative costs of government health programs such as Medicare and Medicaid, and almost all the rest is accounted for by private health insurance. The HCFA estimates do not include expenses for the

FIGURE 3.4 Growth in health plan costs, expressed in total dollars per employee for 1985 to 1991 and percentage increase from previous year (includes employer and employee costs for indemnity plans, HMOs, dental plans, and vision and hearing plans). SOURCE: Geisel, 1992. Based on data from A. Foster Higgins, 1992.

employer's costs to administer health benefit and other health-related programs, expenses incurred by individuals, nor health care providers' administrative expenses (both insurance and not insurance related). Some administrative costs—for example, those expended in programs to deter fraud, detect and correct payment errors, and discourage inappropriate use of services—are intended to reduce overall payments for health services.

Total administrative costs for private insurance are typically broken

TABLE 3.7 Employer-Reported Percentage Premium Increases, by Plan Type, 1989 to 1991

|

Plan Type |

1989 |

1990 |

1991 |

|

Conventional |

20 |

17 |

14 |

|

Health maintenance organization |

16 |

16 |

13 |

|

Preferred provider organization |

18 |

15 |

13 |

|

All plans |

18 |

16 |

14 |

|

SOURCE: Hoy et al., 1991, p. 20. Based on Health Insurance Association of America surveys. Reprinted by permission of Health Affairs, Winter 1991. |

|||

down into such subcategories as general administration, claims administration, commissions, risk and profit charges, interest credit, and premium taxes. The percentage of costs attributed to the last two categories varies little or not at all by group size, but percentages for the other categories vary greatly. Overall, administrative expenses run a higher percentage of incurred claims expense for small employer groups than for large groups (CRS, 1988c). For example, administrative costs make up about 40 percent of claims expense among insured groups with 2 to 5 employees versus 16 percent for those with 100 to 499 employees and 5.5 percent for those with 10,000 or more employees. By way of comparison, administrative expenses for individually purchased health insurance make up approximately 40 percent of incurred claims expense but total approximately 2 percent for Medicare and 3 to 11 percent for Medicaid (Thorpe, 1992b).

Many factors contribute to the higher expenses associated with insuring small groups. For example, 100 groups of 20 employees generate higher marketing and service costs for insurers than does one group of 2000. In addition, small groups typically experience higher employee turnover than larger groups, and each added or dropped health plan member involves additional administrative expense. Also, because claims expense for small groups is less predictable (i.e., riskier), the risk charge increases.

Many believe that current administrative processes generate considerable inefficiency, that is, that the benefits of the procedures are not sufficient to justify the outlays. Estimates of the savings in hospital administrative and overhead costs if the United States adopted a Canadian-style single payer system range from $13 billion to $37 billion, and estimates of savings in insurance administrative and overhead costs range from $23 billion to $34 billion (Etheredge, 1992). This variability reflects the difficulties posed for national comparisons by differences in national health systems and health accounting practices (GAO, 1991a; Woolhandler and Himmelstein, 1991; Barer and Evans, 1992; Danzon, 1992; Poullier, 1992; Thorpe, 1992b). Estimates of additional expenditures that might result if certain administrative costs were eliminated also vary greatly, depending on what the estimates assume, for example, about the continued use of deductibles and coinsurance and utilization review. Government officials, insurers, and others have recently met to develop simpler, more standardized, and—it is hoped—less costly procedures for administering public and private health benefits, but it is too early to project the consequences.

Tax Expenditures

Another important element in the financing of health care benefits is the exclusion of employer-paid health insurance premiums from the calculation of an employee's taxable income. For 1992 the federal "tax expendi-

ture," that is, the tax revenue forgone as a result of this exclusion, is estimated to be $39.5 billion (Executive Office of the President, 1992). The deductibility of a portion of out-of-pocket expenditures by some individual taxpayers adds another $3 billion to the federal figure. Including estimates of revenues forgone by states that have similar or identical tax policies would further increase the total.

As is true for tax deductions, exemptions, and exclusions generally, higher-income individuals in higher tax brackets gain more in absolute dollars from the health benefit exclusion than do lower-income individuals. Were the exclusion to be eliminated or capped as called for in some health care reform proposals, the dollar burden would likewise be higher for the well-off. However, lower-income groups would likely find that the resulting increase in taxes constituted a greater percentage of their taxable income. One estimate of the impact of capping the exclusion at $1,080 for individual and $2,940 for family coverage indicates the new taxes would constitute 1.94 percent of income for those earning $5,000 to $19,999 but 1.09 percent for those earning $50,000 to $99,999 (EBRI, 1992b).

WHO BEARS THE RISK?

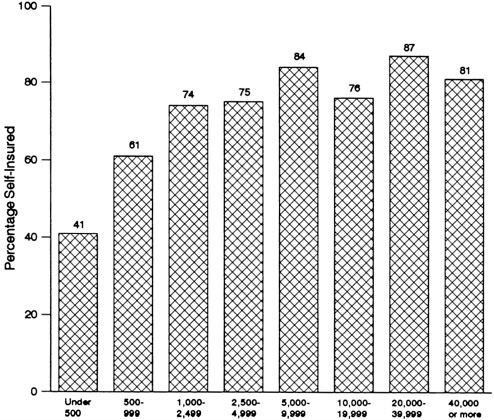

As noted in Chapter 1, insurance is a widely used mechanism for transferring risk to another party, an insurer, for a fee. Although many employers still use this mechanism, an increasing number bear all or most of the risk for employee health care expenses themselves; that is, they self-insure or self-fund their health benefits. The range of funding mechanisms available to employers extends from fully insured plans to fully self-insured arrangements, and the details can be difficult to understand (CRS, 1988a; HIAA, 1992). According to one recent survey (A. Foster Higgins, 1992) directed at medium and large firms, 35 percent of surveyed employers purchased insurance and 65 percent self-insured (up from 46 percent in 1986). Of the self-insured group, fewer than one-fifth were totally self-insured; that is, they reported no stop-loss coverage as described below. Among state governments, 16 of 50 are insured, as is the federal government (Segal Company, 1991). Figure 3.5 shows that the use of self-insurance varies with firm size.

As noted in Chapter 2, self-insured employers can avoid a number of costs either by virtue of the device itself or by virtue of rulings under the Employee Retirement Income Security Act (ERISA) of 1974. Self-insured plans are exempt from state mandates that certain types of benefits be provided; state limits on certain kinds of utilization management and provider contracting arrangements; solvency and prefunding requirements; defined claim settlement procedures; and mandatory participation in state risk pools or uncompensated care plans. Self-insured employers may also avoid risk

FIGURE 3.5 Percentage of firms self-insured by total number of employees, 1991.

SOURCE: A. Foster Higgins, 1992.

charges, reduce cash flow demands, and earn interest on funds that would otherwise accrue to insurers. Except to the extent that they buy stop-loss insurance, they avoid state taxes on insurance premiums.

Employers who purchase insurance have premiums established in a variety of ways, some of which require significant sharing of risk with the insurer and other insured groups and some of which do not. For groups perceived as too small to have predictable claims experience, insurers generally set premiums using a manual that provides rates based on claims experience for different classes of employers. Manual rates reflect differences in experience related to industry, region, age, gender, and other factors. These rates may be modified by underwriters on the basis of the actual claims experience (or perceived risk) of specific small groups and marketing considerations. High-risk individuals may be screened out of the group before rates are set, or they may be charged a higher rate than others in the group.

For larger groups, which have more predictable claims expenses, insurers generally "experience rate" on the basis of the group's past claims experience or anticipated future experience. In a few areas, such as Rochester, New York, large employers have forgone experience rating and have shared risk more broadly with other employers and individuals in the community as part of a broader strategy to keep health care widely affordable throughout the community and to discourage cost control based on risk segmentation rather than on the more effective and efficient production and use of health services (see Chapters 5 and 6 for further discussion).

To attract employer clients who might otherwise self-insure, insurers have devised variants of experience rating that minimize the payments that actually flow from employer to insurer (see HIAA, 1992, especially the table on p. 61, Part C). For example, under what is called a minimum premium arrangement, the employer deposits money to cover a defined portion of its expected claims expense into a bank account or trust fund from which the insurer, acting as an administrative agent, pays claims. These amounts may be exempt from state premium taxes and can earn investment income that accrues to the employer, not the insurer. The portion of the premium that is actually paid to the insurer essentially provides for insurance should claims expenses exceed the defined amount that the employer has paid into the trust fund.

An employer may establish another type of partial self-insurance arrangement wherein it covers claims expense up to a defined level and purchases stop-loss insurance for expenses above that level. Specific stop-loss coverage applies when claims for a individual health plan member exceed a defined level, whereas aggregate coverage applies when total claims exceed a designated amount (e.g., 125 percent of total expected claims expense). Employers may purchase both kinds of coverage with different maximums. A self-insured employer may purchase stop-loss coverage from an insurer but purchase administrative services from either the insurer or a separate administrative agent. Fully self-insured plans may also purchase administrative services only (ASO) from either kind of organization. Some employers, however, administer their own claims.

Both minimum premium plans and self-insurance with stop-loss coverage involve relatively little transfer of risk to the insurer. Both may involve the creation of a special trust into which the employer pays to cover its defined level of claims expense. The most common approach is to establish a "501(c)(9)" trust (also called a voluntary employee beneficiary association, or VEBA).

A final point on funding is that most employers fund health benefits for both active workers and retirees on a pay-as-you-go basis rather than setting aside funds to cover obligations for future retirees. As noted earlier, recent changes in financial accounting standards require employers to recognize

(but not prefund) promised retiree health benefits as liabilities on a firm's financial statements. When reported this way, liabilities may amount to 10 to 20 times the annual level of pay-as-you-go expenses (EBRI, 1992c). Over the long term the new accounting standards by themselves will have little impact on the organization's liabilities, expenses, or net worth, but this one-time "step up" in liabilities is prompting many employers to limit retiree health benefits in some way. Employers that plan to continue such benefits are becoming increasingly interested in tax-favored prefunding options. Current methods include setting aside assets in 501(c)(9) trusts, 401(h) accounts (defined benefit pension plans), and 401(k) plans.

WHAT OTHER HEALTH-RELATED BENEFITS DO EMPLOYERS OFFER?

Overview of Mandatory and Voluntary Programs

In addition to the medical expense coverage, employers may offer a variety of other health-related benefits. Some of these benefits are required by law; others are offered voluntarily.

Federal law imposes a payroll tax on employers (and employees) to help finance Medicare benefits and Social Security Disability Insurance. Workers' compensation benefits are required under a combination of federal and state laws. All but three states require employers to provide workers' compensation benefits, which are cash payments for workers killed, injured, or made ill in the course of work. The remaining three states give employers the choice between providing workers' compensation insurance or being subject to full liability for worker injuries as determined through litigation (EBRI, 1992a). In addition, federal and state governments have imposed on employers a variety of requirements intended to protect workers and others from occupational and environmental health hazards.

The array of benefits voluntarily provided by employers is considerably larger. These programs include

-

paid sick leave (sometimes including leave to care for ill family members);

-

short-or long-term disability insurance;

-

employee assistance programs (EAPs), which may provide counseling, referral, and services related to certain health problems, such as alcoholism;

-

health promotion programs, which may include on-and off-site screening services, exercise facilities, and other elements;

-

worksite health clinics or infirmaries, which may treat worksite injuries and provide routine health services (such as allergy shots) as a convenience to workers; and

-

worksite health and safety programs, which may involve strategies to eliminate or decrease general environmental and job-specific hazards associated with employment.

The rest of this discussion focuses on one mandatory health-related program—workers' compensation—and three voluntary programs involving health promotion, employee assistance, and flexible benefits. Each can interact with the design and operation of the basic program of health benefits in significant ways.

Workers' Compensation

About 87 percent of civilian wage and salary workers are covered under mandatory workers' compensation programs that are fully financed by employers. In 1989, approximately 30 percent of the $46 billion paid by employers for workers' compensation premiums went for medical care (EBRI, 1992a). More recently, the proportion of workers' compensation spending attributed to medical care has risen to an estimated 40 percent (Freudenheim, 1992a). Over 45 percent of workers' compensation expenditures are accounted for by cash compensation payments and about one-quarter by administrative and other costs. While national spending on health care went up by 117 percent between 1980 and 1988, workers' compensation expenditures for medical care increased by 199 percent (Warren and Gerst, 1992). Some observers suggest that part of this rapid rise in workers' compensation expenditures is an indirect result of employers' attempts to contain costs in their regular health benefit programs.

Many public and private decisionmakers are growing increasingly concerned about the financial problems facing workers' compensation programs and are exploring ways to integrate workers' compensation, disability, and health benefit programs (Freudenheim, 1992a; Traska, 1992; Warren and Gerst, 1992). One objective is better management and coordination of health care provision and health plan features and, thereby, better control of health care and administrative costs. A related objective is to eliminate any incentive for workers facing increased cost sharing and limits on provider choice in their health benefit program to claim that their health problems are work-related and thus compensable under the sometimes less restrictive workers' compensation programs.14

The most expansive proposal for reforming workers' compensation is to establish a single benefits program to cover medical expenses for injury and illness whether incurred on or off the job. This integrated program would apply the same provider payment, health promotion, and managed

care concepts to either sort of medical expense (Cannon, 1992; Fletcher, 1992; Garamendi, 1992). More limited proposals would not integrate the programs but would allow states to channel those with workplace injuries to HMOs or to physicians who agreed to cooperate with special fee schedules and utilization management programs. As part of overall efforts to control fraud, some states are comparing treatment and charge information for workers' compensation patients with data for patients covered under Blue Cross or other health benefit programs (Kerr, 1991). They are also instituting some of the same auditing and antifraud measures that Medicare, Blue Cross, and other health insurers use.

Proposals for integrating workers' compensation and health benefit programs raise many complex legal issues and are controversial. To be adopted and implemented, many would require changes in state laws and perhaps in ERISA as well as renegotiation of existing union contracts.

Health Promotion and Employee Assistance Programs

Rising health benefit costs and accumulating research on the correlations between health status and health care expenditures, absenteeism, and other associated business costs have combined with broad public interest in health promotion to increase employers' interests in strategies for achieving a healthier and less costly work force (Warner, 1990; Becker, 1991; EBRI, 1991b; Muchnick-Baku and McNeil, 1991; Muchnick-Baku and Orrick, 1991; Weiss et al., 1991; Conrad and Walsh, 1992). Because employers' costs for health benefits are not a fixed percentage of payroll (as are Social Security taxes) but are affected by the age, health status, and other characteristics of each employer's work force, employers may have an incentive for adopting more aggressive health promotion programs than would exist on grounds of worker productivity and employee relations alone.

Worksite health promotion and safety programs, which often overlap, may involve (1) health and safety activities specifically related to workplace hazards; (2) health promotion and education intended to promote healthful behavior, improved health status, and informed decisions about health care services; (3) appraisals of individual health status and behavior and feedback of information from such risk assessments to employees and others; and (4) positive or negative financial incentives related to health behavior or health status.15 Of the 300 quantitative objectives developed as part of the Healthy People 2000 plan to improve the health of Americans (U.S. Public Health Service, 1990), 17 focus on occupational health and safety and 3 focus on general workplace health promotion.

DOL (1990, 1991) statistics indicate that structured corporate wellness programs were offered to 23 percent of employees of medium and large firms but only 2 percent of those in small firms. Surveys that use the firm as the level of analysis indicate that at least one-third of employers report specific health promotion programs, such as smoking cessation, weight control, cholesterol screening, stress management, and exercise programs (EBRI, 1991b; A. Foster Higgins, 1992). Some of these programs may be managed through the employee assistance programs described below.

The actual or perceived link between health promotion programs and employment-based health benefits varies by program and employer. Some employers reinforce their health promotion messages with changes in their health benefit programs. For example, health plan coverage may be extended to preventive and wellness services that were previously not covered. Benefits for smoking cessation programs may take effect when workplace smoking bans go into effect. Departing from these more positive approaches, a few employers have sought to reduce or eliminate health plan coverage for illness or injury attributed to drugs, alcohol, or sexually transmitted disease (Kramon, 1989; Dowell, 1992).

Instead of focusing on coverage for specific kinds of medical services, some employers focus on the characteristics of the individual. Large employers have traditionally not engaged in "risk rating" (i.e., making higher-risk individuals and groups pay more for coverage or refusing coverage in part or whole), but some are now departing from this policy, and more are expressing interest in doing so (NYBGH, 1990; Frieden, 1991; Miller and Bradburn, 1991; Rowland, 1992; Woolsey, 1992b,c,d,e,g). Employers may link employees' premium contributions to behavior (e.g., smoking), health status (e.g., blood pressure), or claims expense (e.g., claims during a six-month period). Some reward the healthy with discounted premiums or rebates; others add surcharges for the less healthy. Alternative financial incentives include cash awards, credits for use in purchasing other benefits (e.g., life insurance), and credits or coupons for health examinations, exercise gear, and similar health-related items. Some programs waive penalties or make positive incentives available for those under a physician's care for a problem or attempting to improve their health. Most financial incentives appear to cost between $10 and $35 per month ($120 to $420 per year).

The most drastic actions that employers may take to avoid high-risk employees or change high-risk behavior come in the form of hiring bans and dismissal policies. The news media have paid considerable attention to these policies, particularly as they affect off-the-job behavior (Schiller et al., 1991; Sipress, 1991, Span, 1991; Woolsey, 1992d).16 The Americans

with Disabilities Act of 1990 may constrain some of this behavior, depending on how the act's definition of disabilities is interpreted by the courts and administrative agencies (see Chapter 5). Even before this act took effect, some courts were discouraging some kinds of discrimination.17 For example, Xerox was successfully sued several years ago for refusing to hire an obese individual on grounds that the person would likely increase the company's disability and life insurance costs. In addition, some states have also acted to protect some off-the-job behaviors, especially smoking, that have not been correlated with job performance.

Although EAPs are sometimes described as a type of health promotion program (DOL, 1990), they may involve fairly broad-based efforts to identify and help workers to resolve a variety of family and other personal problems that can affect job performance. In fact, many EAPs do focus on mental health and substance abuse problems of employees or their family members, and companies may need to resolve overlaps and inconsistencies among their EAP, health benefit, and managed mental health care programs. Employers may operate EAPs using company personnel, or they may contract for services from outside organizations. About half of the employees in medium and large establishments but fewer than 10 percent of those in small firms are eligible for EAPs (DOL, 1990, 1991).

A particular concern of workers has been that employers' actions to influence individual health behavior (1) not be substitutes for efforts to make the workplace safer, (2) not be used to shift blame to workers for problems associated with the work environment, and (3) not discriminate against workers by virtue of age, health status, and related characteristics (AFL-CIO, 1986). Some see corporate health promotion programs as potential means to "select or shape workers in the name of health, bypassing modern discrimination laws that have limited the employer's degrees of freedom to select and fire employees" (Conrad and Walsh, 1992, p. 104). Concern is increasing about some employers' interest in genetic screening to identify workers thought to be at higher-risk of incurring an occupational illness or injury or generating health insurance expenses (Office of Technol-

ogy Assessment, 1990; Rothstein, 1992). This issue is being studied by another Institute of Medicine committee, which plans to issue a report in 1993.

Flexible Benefits

Although not a health benefit program per se, various kinds of flexible benefit programs established by employers may significantly alter employment-based health benefits. Under provisions of the Internal Revenue Code, these programs allow individual employees some choice in the way benefit dollars are allocated and taxed (EBRI, 1991a). One arrangement, the flexible spending account, permits employees to set aside pretax dollars for dependent care or certain medical expenses; some include a contribution from the employer, and some do not. More broadly, flexible benefit plans may offer employees a choice between certain nontaxable and taxable benefits or even cash.

According to DOL statistics for 1989 and 1990, flexible benefits in some form were offered to nearly one-quarter of the employees in medium and large establishments but only 8 percent of those in small organizations (DOL, 1990, 1991; see also U.S. Chamber of Commerce Research Center, 1991 for other data). White-collar workers were more likely to have a flexible benefit program available than blue-collar workers. The DOL data do not provide information on the detailed features of such programs.

One reason organizations may introduce flexible benefit arrangements is to accommodate the diversity of today's work force. Another and often more important objective for employers may be to introduce a cap on increases in the cost of employee benefits—health benefits, in particular—and shift more of the burden of those increases to employees. Some employers have seen choice among more and less restrictive health plan options as a strategy for eliminating the plans that are most attractive to higher-risk or higher-cost individuals by allowing biased risk selection to make them unaffordable. Overall, for employees, flexible benefit programs may bring both advantages and disadvantages.

CONCLUSION

That most nonelderly Americans have reasonable health coverage through the workplace is clear. That certain kinds of employees and employers are more likely than others not to participate in this system is also clear. Those who work in low-wage jobs for small employers, those who willingly or unwillingly retire early, and those with seasonal or part-time jobs—and the families of these workers—are particularly vulnerable.

To supplement the general, often statistical portrait presented in this chapter, the next chapter examines in more detail what employer sponsorship of health benefits may involve for employers, employees, and health care providers. It stresses the array of decisions and tasks that employers may take on and the factors that affect their decisions.