5

Risk Selection, Risk Sharing, and Policy

Some of the . . . controversy reduces to a mundane debate about who will pay for whom and how much.

Douglas M. MacIntyre, 1962

Biased risk selection is always possible when individuals, employers, or other groups can choose whether or not to buy health coverage or whether to select one health plan instead of another. Unfortunately, this continual exercise of choice—a valued feature of individual liberty and of markets generally—can create both philosophical and practical problems in the health care arena. In particular, it can seriously diminish the degree to which the burden of health care expenses is shared among the well and the ill.

In addition, risk selection can lead health plans to compete for lower-cost enrollees and to avoid higher-cost individuals because the price and profit advantages from such tactics can outweigh the gains to be achieved by cost-effective management of health care and administrative services. Health care costs are highly skewed in their distribution. In any year, perhaps 5 percent of a population will account for 50 percent of expenditures, and 20 percent will account for 80 percent. Thus, any health plan (or employer) that is more successful at avoiding those who are likely to be in the small-group of higher utilizers will have a significant competitive advantage of a particular sort, but not the principal one desired by advocates of market-based strategies for health care reform.

The evolution and current structure of employment-based health benefits and proposals for change are difficult to understand and evaluate without a careful analysis of risk selection. This chapter reviews basic concepts, examines factors contributing to risk selection, considers evidence about its extent, and discusses key policy issues and proposals for managing the unwanted effects of risk selection. The focus is on employer groups,

not individual purchasers of health coverage, and on choices among health plans, not the choice to purchase or not purchase coverage.

BASIC CONCEPTS

As defined in Chapter 1, biased risk selection exists (1) when individuals or groups that purchase health coverage differ from nonpurchasers in their likelihood of incurring health care expenses or (2) when those who enroll in competing health plans differ in the level of risk they present to specific plans. The first kind of risk selection primarily involves the market for individual and small-group coverage in which those with higher-risks are thought to be more likely than those with lower risks to purchase insurance.1 The individual and small-group market also suffers from the second form of biased risk selection when higher-risk purchasers seek more generous or flexible coverage than lower-risk purchasers.

In general, because large employers almost universally provide health benefits and have more predictable costs, large groups present fewer problems with risk selection than either individuals or small groups. However, problems can arise in larger groups when they create an internal market by offering employees a choice among health plans and their higher-risk and lower-risk individuals select different plans.

One result of risk selection is risk segmentation, the clustering of individuals at higher and lower risk of incurring health care expenses in different health plans or insurance pools. As noted in Chapter 1, risk segmentation can also occur when insurers experience rate groups on the basis of their claims (cost) history and when larger, less risky employers depart the group insurance market—as most have—in favor of self-insurance.2

|

1 |

Some suggestive information on differences between enrollees with individual coverage (who must seek out coverage for themselves) and those with group coverage (who have it offered to them as a matter of routine) is available from an insurer who has not used medical underwriting to screen individual purchasers. Independence Blue Cross (Philadelphia), which offers individual coverage without medical underwriting on an open enrollment basis throughout the calendar year for its five-county service area, reports information on both its individual and its group enrollment. For 1987, its individual subscribers were 6 years older on average than its group subscribers, had a 46 percent higher hospital admission rate, and incurred costs that were 60 percent higher (Independence Blue Cross and Pennsylvania Blue Shield, 1988). Fifty-five percent of the individual subscribers were age 50 or over, compared with 35 percent of the group subscribers. |

|

2 |

Risk segmentation also can occur when individual choice is quite limited. As noted in Chapter 1, risk segmentation among the German sickness funds occurs because plans draw or are assigned their membership from occupational and other groups that differ in age, income, and other risk factors (Wysong and Abel, 1990). |

When a health plan, insurer, or employer attracts a less risky and less costly group than the average (or than its competitors), it has experienced favorable selection. A plan that attracts a more risky and costly membership has unfavorable or adverse selection. If the cost of health coverage is linked to the risk level of the pool of covered individuals, premiums for those who find themselves in groups with unfavorable selection will be higher, even if their own risk of medical care expense is low. The financial incentive then is for these lower-risk individuals to exit, making the remaining pool even more expensive, perhaps so expensive that even those most in need of the coverage cannot pay the premium and the plan fails.

Some argue that the solution to adverse selection is better information, so that everyone pays his or her exact risk-rated premium based on detailed personal information about health status, health behavior, work environments, and other factors affecting the risk of medical care expenses. This approach reflects a value judgment that the young and the healthy should not have to subsidize the old and the unhealthy (i.e., that risk segmentation is fair and desirable), a judgment with which the majority of this committee disagrees. For technical and practical reasons, perfect risk rating is unlikely if not impossible, so adverse selection related to information imperfections would still exist. (As described later in this chapter, technical problems also affect strategies to compensate for or discourage selection by risk adjusting employers' or governments' [not individuals'] payments to health plans.)

The policy problem with risk selection is not that it can put adversely affected health plans out of business. Rather, risk selection is a concern because it encourages socially unproductive competition based on risk selection rather than on cost-effective management of care for the ill and injured (GAO, 1991e; Hall, 1992; Light, 1992).3 Any strategy of health care reform that is based on competition and choices about health coverage should address these problems, and several options are discussed later in this chapter. Design of an appropriate strategy depends on an understanding of some of the factors that produce selection and the degree to which the insurers, the insured, and policymakers can manipulate them to exacerbate or control risk selection (Feldman and Dowd, 1991; GAO, 1991e; Light, 1992).

FACTORS CONTRIBUTING TO RISK SELECTION

Many factors have been identified by anecdote, theory, survey data, and other research as sources of favorable or unfavorable selection (see, generally, Pauly, 1974; Berki and Ashcraft, 1980; Berki et al., 1980; Luft et al., 1985; Neipp and Zeckhauser, 1985; Wilensky and Rossiter, 1986; Luft, 1987, 1991; Luft and Miller, 1988; Mechanic et al., 1990; Anderson, 1991b). These factors relate to the characteristics and choices of individuals, employers, and health plans.

Individual Factors

Individuals' choices about health plans are affected by a variety of characteristics that may not be easy to measure directly but that are correlated to more easily measured characteristics, such as age, gender, occupation, and income. The underlying characteristics that affect choice include

-

individuals' actual and perceived health status (and that of their spouses and children);

-

the knowledge and preferences individuals have about using and paying for health services and their willingness and ability to accept risk; and

-

their willingness and ability to engage in informed decisionmaking about joining, leaving, or continuing in a health plan.

The dynamics of individual choice among multiple health plans have not been studied in much detail, but one pilot effort suggests that individuals (1) examine only a few options, (2) are aware of coverage differences for their special needs (e.g., mental health care and pregnancy care), and (3) tend to understand traditional plans better than newer plans with their gatekeeper and other managed care features (Mechanic et al., 1990). Freedom to choose one's physician appears to be particularly important to those choosing conventional plans. Individuals with a significant ongoing relationship with a physician will tend to stay with the health plan that includes or covers that physician rather than switch to another plan.

Unpublished research on the Federal Employees Health Benefits Plan (discussed below) indicates that expected out-of-pocket costs (employee-paid premium and other cost sharing) is the single most important factor in decisionmaking for low-risk individuals. High-risk individuals focus first on plan benefits.

Employer Factors

Among small employers, some of the same factors that influence individuals' choices may likewise influence the decisions made by employers to

purchase health coverage or to seek a particular kind of insurance. Virtually all large employers provide broad health benefits, but smaller, more economically marginal employers may be particularly motivated to seek insurance if they have employees with health problems and may be especially sensitive to price in making the buy or no-buy decision.

As noted earlier, the major factor affecting risk selection for larger employers is the offering to employees of a choice of health plans (Luft, 1991). A multiple-choice health benefit program allows the individual risk factors identified above to operate within the employment group. In attempting to make individuals more cost conscious or to accommodate the varied personal circumstances of employees, employers may unintentionally—but sometimes deliberately—influence risk selection in a number of other ways, such as

-

requiring that individuals pay part of the premium;

-

limiting the employer contribution to the premium to a portion of the premium for the least expensive plan or otherwise structuring the premium contribution to favor a particular kind of plan;

-

offering a choice of more and less generous (high and low option) health plans and requiring employees to pay more for the more generous coverage;

-

including preexisting condition limitations or requiring specific kinds of coverage in some but not all health plans;

-

offering a flexible benefit program that encourages employees to select benefits on the basis of individuals' needs and preferences;

-

allowing employees to opt out of coverage entirely;

-

combining active employees and non-Medicare-eligible retirees in the same risk pool for purposes of setting the active employees' contribution to premium; and

-

frequently adding new health plans or major new features to existing plans.

The first seven of these employer actions make it attractive for healthier individuals to minimize their purchase of health coverage and to segregate themselves in different risk pools from less healthy individuals (Luft et al., 1985; Luft, 1991). The eighth action sets up a situation in which the sponsors of a new health plan with moderate benefits can ''low ball" premiums (set them lower than the benefits and employee population might seem to warrant) to encourage enrollment by low-risk individuals who are willing to "take a chance" because they are not currently using health services and do not anticipate the need for any. The selection advantage a health plan gains by this strategy may take years to fade.

Employers may also deliberately attempt to make specific types of health plans more or less attractive to high-risk individuals. For example, to en-

courage higher-risk individuals to enroll in plans thought to manage health care more efficiently, coverage may be restricted or cost sharing greatly increased for specific services in conventional self-insured plans but not in health maintenance organizations (HMOs). Alternatively, employers may treat their conventional plan as the insurer of last resort for individuals with costly problems, in particular, mental illness.

To the extent that some employers offer health benefits and others do not or some offer more generous or flexible coverage, these employers may attract higher-risk employees (either the workers themselves or their families) and also thus suffer from unfavorable risk selection. Employers—like insurers—may respond by reducing coverage for specific medical conditions, strengthening exclusions for preexisting conditions, making higher-risk individuals pay more for health benefits, and other practices. One major airline now permanently excludes coverage for preexisting conditions for new employees (Seeman, 1992). Although evidence of employers' efforts to protect themselves in these ways is limited, the rationale for protective strategies is strong enough to raise concerns not only about further segmentation of access to health benefits but also about the resulting distortions in labor markets.

The most drastic actions that employers may take to avoid high-risk employees come in the form of the explicit hiring bans and dismissal policies involving smokers, social drinkers, mountain climbers, and others that were described in Chapter 3. The current extent of such overt policies and similar covert practices is unknown.

Health Plan and Insurer Factors

Of much current interest to policymakers are the characteristics and strategies of health plans and insurers that may affect individuals' choices. These include

-

underwriting and pricing practices;

-

plan benefit design;

-

incentives for use of a network of practitioners and providers;

-

administrative procedures;

-

marketing strategies; and

-

general reputation.

As discussed below, health plans can manipulate their features and practices to varying degrees. Much of the controversy over risk selection relates to charges that some health plans deliberately "skim," "cream," or "cherry pick'' good risks or "blacklist," "redline," "churn," or otherwise avoid poor risks (GAO, 1991e; Chollet, 1992a; Hall, 1992; Zellers et al., 1992). This behavior is particularly associated with the small-group insurance market.

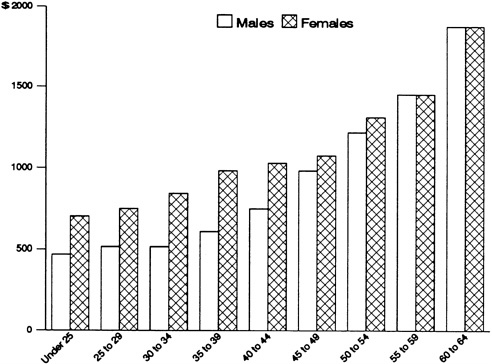

The most powerful tool that health plans have to limit or channel risk selection is medical underwriting, which allows them to classify risks, price them, and accept, reject, or limit coverage for individuals and groups. The most extreme form of underwriting is to exclude altogether from coverage individuals with certain characteristics, such as HIV infection, and entire categories of employers or occupations, such as hairdressers and lawyers—the latter for higher perceived risk of litigation. Coverage for a preexisting condition can also be barred temporarily or permanently. In addition, premiums for individual and small-group coverage are commonly based on individual risk factors, including both demographic characteristics and health status. Figure 5.1 shows how age and gender can affect premiums (CRS, 1988b). A health plan that does not use medical underwriting makes itself vulnerable to unfavorable risk selection if its competitors do engage in risk rating and similar practices.

Benefit design can crucially affect a health plan's potential for unfavorable or favorable risk selection. The range of relevant design features is broad and includes the types of services, providers, and sites of care cov-

FIGURE 5.1 Variation in average annual plan premiums for the typical health plan, by age and gender, 1986. SOURCE: Adapted from CRS, 1988b, Vol. 1, p. 41; original data from Hay/Huggins.

ered; the requirements for patient cost sharing; and caps on the volume, frequency, or duration of a covered service. Some benefits, in particular more extensive inpatient and outpatient mental health benefits, are thought to attract higher-cost patients. Other benefits, for example, fitness and other health promotion programs, may attract healthier individuals. A health plan that chooses (or is required by courts or legislatures) to cover expensive services, such as transplants, hospice care, or certain experimental treatments, when other plans can exclude such services will likely have both a more costly benefit package and a more costly membership.

Another characteristic that may contribute to risk selection is whether a health plan limits coverage to a specified network of physicians, hospitals, and other health care practitioners and providers. As defined in Chapter 3, conventional health plans place no or few limits on choice of provider, whereas network plans (e.g., HMOs, preferred provider organizations [PPOs], and point-of-service [POS] plans) reduce or exclude coverage for nonnetwork providers. Plans that limit coverage to a defined panel of practitioners and providers may be unattractive to individuals with chronic health problems who want flexibility in choosing medical specialists and who have established a relationship with a physician that they do not want to disrupt. In addition, individuals such as retirees who travel a lot outside the plan's service area may find a network plan difficult.

Network plans may also be vulnerable to risk selection. Independent practice associations (IPAs), PPOs, and other health plans whose physicians also see patients in other plans may attract some higher-risk individuals who would have to switch physicians if they changed to a staff model HMO. Similarly, mature HMOs will likely have a core of older patients with established physician relationships who are not interested in switching to a new HMO. The latter thereby gains a selection advantage. In addition, because plans with maximum choice of provider generally cost more, network plans with nominal copayments may incur adverse selection for some conditions, such as routine pregnancies.

The composition of a particular limited or closed provider panel is also relevant. For example, a network plan that includes a university hospital known for its care of a particularly costly medical problem is more likely to attract patients with this problem than a plan that excludes this hospital. A plan that includes more subspecialists is similarly vulnerable. In general, the potential for risk selection is one more factor (in addition to cost, quality, reputation, and geographic coverage) to be weighed when network plans consider the composition of their provider panels.

The lore of health plan efforts to avoid poorer risks also includes a variety of imaginative administrative practices (Luft and Miller, 1988). These include requiring individuals to visit health plan offices in order to enroll, permitting long appointment queues to develop for certain kinds of services,

requiring new female enrollees to change gynecologists and obstetricians regardless of whether their existing physician is part of the plan, and counseling sicker members to switch to other plans where they will have better coverage.

Marketing and sales strategies are particularly sensitive to risk selection issues. A health plan is more likely to seek or accept an advertising spot during a sports telecast than a spot during a program on the latest strategies for treating HIV infection. A health plan for the elderly that markets in senior centers is less vulnerable to unfavorable risk selection than one that markets in nursing homes.

A Case in Point

To illuminate the impact of individual, employer, and health plan factors, the experience of the Federal Employees Health Benefits Program (FEHBP), the oldest consumer-choice employer health program in the country, is instructive (Towers, Perrin, Forster & Crosby, Inc., 1988; CRS, 1989; Enthoven, 1989; Jones, 1989; U.S. House of Representatives, 1989; Welch, 1989; Wiener, 1990; GAO, 1992c; Washington Post, 1992; see also Chapter 2 of this report). Established in 1959 and operational in 1960, FEHBP has always offered numerous choices among fee-for-service plans and among HMOs. There is an annual "open season" during which any subscriber can switch from any plan to any other plan available in its geographic area. FEHBP has never allowed medical underwriting. It includes retirees as well as active employees and thus covers a very wide age range. It has always required premium cost sharing by the subscribers. A statutory formula sets the government contribution to any plan at 60 percent of the average premium of the six largest plans' high-option offerings. This contribution cannot, however, exceed 75 percent of the chosen plan's premium costs.

According to internal studies conducted by the Blue Cross and Blue Shield Association, a large majority of the 4 million contract-holders (or subscribers) in this program annually review their own health care plan and two or three others and consider making a change (though usually fewer than 10 percent actually make a change). The primary factors considered are out-of-pocket costs, perceived need for specific benefits, and sometimes the quality of plan services, such as claims processing. The weight assigned by individuals to each factor varies from year to year, depending on changes in individual circumstances.

The FEHBP has in fact suffered from serious risk selection problems, even for the plans with very large enrollments. Table 5.1 illustrates the impact of risk selection on premiums for three conventional health benefit plans in the federal program. An analysis of high-option and low- (or

TABLE 5.1 Estimated Impact of Biased Risk Selection on Premiums in a Multiple-Choice Program, Individual (self-only) Coverage, Federal Employees Health Benefits Program, 1989

|

|

Individual (self-only) Premium |

|

|

Plan |

Standardized Premium (actuarial value) |

Total Actual Premium |

|

Low-coverage plan |

$1,422 |

$ 833 |

|

Median-coverage plan |

1,700 |

1,502 |

|

High-coverage plan |

2,016 |

3,032 |

|

% Difference between low and high plans |

42% |

264% |

|

Discussion: The first column reports the standardized premium or actuarial value of the benefits in three FEHBP fee-for-service plans assuming a standardized or comparable group of enrollees in each. The actuarial value is based on the differences in covered services (for example, whether hospice services are covered) and patient cost sharing (for example, level of deductible and coinsurance). The plan with the most extensive benefits is worth 42% more in coverage than the low-coverage plan. The second column reports the actual premium for each plan, which reflects past utilization of health services. The premium for the high-coverage plan is 264% higher. The difference in the range of actual premiums is substantially greater than the difference in actuarial value. This shows how characteristics of enrollees choosing different plans (risk selection) affect premiums. SOURCE: Adapted from CRS, 1989, p. 123. |

||

standard) option plans managed by one insurer that were estimated to have the same actuarial value (despite their labels) found the actual (experience-related) premium for the high-option plan was 79 percent above that for the low-option plan (Welch, 1989). Adverse selection problems contributed significantly to the decision by several fee-for-service plans and dozens of HMOs to withdraw from the program during the late 1980s. For example, it was the major factor in the departure of Aetna, which was one of the original FEHBP participants and which had nearly 200,000 contracts in 1988 before it withdrew from the market. In general, there has been a market "shake-out," due in large part to risk selection.

Some efforts have been made to control or limit the extent of risk selection in FEHBP, and some changes made for other reasons may also have been helpful. First, benefit packages among the competing carriers have become more similar (for example, through changes in mental health benefits and dental benefits), and all are moving to incorporate more managed care features. Such correspondence reduces the differences in health plans that might attract or deflect high-risk individuals and encourage fre-

quent switching among health plans. Second, the government's Office of Personnel Management has not allowed new fee-for-service carriers to enter the program and has set community rating rules for newly participating HMOs that discourage "low ball" pricing to attract low-risk individuals. Third, because the government caps its contribution at 75 percent of any health plan's premium rather than paying a fixed dollar amount (which might cover all the premium for a low-cost plan), it mitigates somewhat the reward for enrolling in plans with particularly favorable selection.4 Finally, legislation made federal retirees over age 65 who retired after 1982 eligible for Medicare. When Medicare became the primary payer for this group, it significantly reduced the cost to FEHBP carriers and HMOs of their highest-cost enrollees.

EVIDENCE OF RISK SELECTION

Several researchers have presented or reviewed the evidence of risk selection (Berki and Ashcraft, 1980; Jackson-Beeck and Kleinman, 1983; Neipp and Zeckhauser, 1985; Price and Mays, 1985; Welch, 1985; Wilensky and Rossiter, 1986; Hellinger, 1987; Luft, 1987; Luft and Miller, 1988; Newhouse et al., 1989; Lichtenstein et al., 1991; Robinson et al., 1991). Although this evidence is not conclusive and the dynamics of the health insurance market are changing rapidly, the evidence taken as a whole does suggest that selection is fairly common and is related to the factors identified above. Nonetheless, it is important to note that (1) the health plans studied are not random or even representative of all plans and communities; (2) most studies have small "sample" sizes; (3) variations related to local delivery systems and cultures may be insufficiently identified; and (4) measures of risk (e.g., average age or average functional status) may inadequately capture important differences among groups.

Despite the shortcomings of the data, several policy-relevant findings are suggested by accumulated evidence, the direct experience of the committee members, and the perspective of experts consulted by the committee. First, risk selection is not confined to one type of health plan or benefit design. Both indemnity health plans and HMOs have been found to suffer from unfavorable selection. However, in competition with indemnity plans, HMOs overall are more likely to have experienced favorable selection than indemnity plans.

This difference between HMOs and conventional plans is clearest in studies comparing the utilization of those enrolling in HMOs ("leavers")

versus those remaining with conventional fee-for-service (FFS) health plans ("stayers"). It is less commonly identified when the comparisons of "leavers" and "stayers" involve measures of health status (e.g., patient perceptions, reported chronic conditions, and functional status) (Wilensky and Rossiter, 1986; Hellinger, 1987; Robinson et al., 1991; but see Lichtenstein et al., 1991). However, when existing enrollees in HMOs and FFS plans are compared (which is preferable to studying just "leavers'' and "stayers"), the health status measures tend to be more favorable for the HMO members. This finding could also be interpreted as demonstrating the impact of better preventive and curative care, although this has not been studied explicitly (Luft and Miller, 1988).

Second, the age of a health plan or its tenure in a particular health benefit program may affect its risk profile (Neipp and Zeckhauser, 1985; Grazier et al., 1986). New health plans, particularly network-based plans, are more likely to attract individuals who are younger and less likely to have an established relationship with a physician, although specifics of their benefit design can counter this selection advantage (Sorensen et al., 1980).

Third, enrollment, continuation, and disenrollment decisions all contribute to selection dynamics. Risk pools can be dramatically affected by who joins, who stays, and who leaves during various periods (Luft et al., 1989). Those who depart one plan voluntarily for another may differ from those whose departure from a plan is involuntary.

Fourth, classifications such as "low user of care" and "high user of care" are not permanent categories (Welch, 1985). Much utilization in any given period flows from acute events for which individuals do not usually require ongoing care in subsequent years. Both high and low users of care in one year are likely to "regress" toward the mean level of use over time, with most of the effect occurring in the second year (Newhouse et al., 1989). If health plan participants remain in their original pools, the benefit from attracting an individual who has used little care is likely to diminish somewhat.

In the small-group insurance market, the response of many underwriters to this phenomenon is "durational" rating. This practice sets low initial premiums for low-risk groups and then sharply increases rates at renewal time (Hall, 1992). (The literature does not mention an equivalent use of durational rating to lower rates for high-risk groups.) In contrast, in the large-group market in which employers offer multiple health plans, the effects of regression toward the mean may be offset by continued risk selection at each year's open enrollment.

Fifth, "stay or move" decisions by very high risk individuals may be particularly important. The impact on health plan costs of members who require very high levels of care has been repeatedly documented. Between 1 and 10 percent of a group will typically account for 30 to 70 percent of its

claim expense in a given year (Rosenbloom and Gertman, 1984; Alexandre, 1988; Berk et al., 1988). For example, a report on one large University of California indemnity health plan showed that just 227 individuals accounted for 42 percent of all reimbursable hospital charges for the 1982/83 contract year (Prudential Insurance Company, 1984 cited in Luft et al., 1985). In another university health plan, 0.4 percent of the Blue Cross enrollees filing claims accounted for 21 percent of reimbursements (Luft et al., 1985). How these individuals choose among health plans can have a marked effect on a plan's costs.5 Such selection is not easy to predict using the usual demographic measures of risk.

Sixth, if health status comparisons focus only on averages and not on what happens to the most or least healthy, they may be insensitive to some forms of risk selection. For example, one recent study of Medicare beneficiary enrollment in 23 HMOs (Lichtenstein et al., 1991) found that 9 HMOs showed favorable selection and 14 showed neutral selection when the comparisons were based on mean health status for each plan. In contrast, when the extremes were compared (i.e., proportions of the most disabled and the least disabled enrolled in each plan), 10 additional HMOs showed favorable selection. None of the 23 HMOs experienced unfavorable selection on either measure, and 4 showed neutral selection on both.

Seventh, even if the extent of risk selection is considered modest as reflected in the current data, health plans' actions may still be influenced by a strong fear of adverse selection or a strong conviction that the benefits of favorable selection are significant. The consequence may be the same protective strategies that would result from documented evidence of serious selection effects.

POLICY QUESTIONS

Risk selection and risk segmentation raise both philosophical and practical questions for employers, health plans, and public policymakers. These questions involve the fundamental, interrelated issues of equity, access, cost, and quality. This section considers how risk selection may affect each issue and concludes by discussing the implications of the Americans with Disabilities Act of 1990.

Equity

Americans are still debating a basic ethical question in health care, that is, whether all people should be guaranteed some appropriate level of health

coverage as a matter of public policy. This fundamental question aside, there remain in dispute other questions of equity or fairness. The basic issue is: should those who are good risks help finance health benefits and health care for bad risks or should individuals bear directly some or all of the cost associated with the level of risk they pose? Some differentiate between two kinds of risk—that based on factors beyond individual control (e.g., developing multiple sclerosis) versus that associated with factors at least partly within individual control (e.g., smoking and obesity, both of which appear to have a genetic as well as a behavioral component).

Conventional insurance theory, following the principle of "actuarial fairness," concludes that higher-risk individuals should pay more regardless of the type of risk in question (MacIntyre, 1962; Arrow, 1963; Fuchs, 1991; Intindola, 1991; Jose, 1991; Chollet, 1992a). Advocates of "actuarial fairness" go beyond the arguments of business necessity and economic efficiency to argue as a matter of principle that the cost of and access to coverage must be linked to an insured's risk class. They draw analogies to homeowners, life, and other forms of insurance. People cannot get homeowners insurance when their house is on fire or life insurance when they are dying. People with bad driving records pay more for auto insurance as do young people, who, as a group, have more accidents than older people. Why should insurance for medical expenses be different? Why should it be priced the same for the young and the old, the well and the ill, and other individuals or groups whose risk of health care expense differs? The concept of actuarial fairness has been applied most extensively to individual health coverage, to a lesser extent to small groups, and to a very limited degree to larger groups.6 However, some large employers have imposed premium differentials based on so-called life-style factors, such as smoking or high blood pressure (Frieden, 1991; Woolsey, 1992c,d).

An efficiency-related argument for premium differentials is based on two propositions: (1) not all people need, want, or can afford as much medical care and coverage as most health plans now provide and (2) those individuals should have the opportunity to contract for a lower level of benefit or standard of care in return for a lower premium (Havighurst, 1991). Concomitantly, those who need or want a higher standard of care should pay for it and should not be subsidized by those who need or want less.

Some accept the actuarial perspective on fairness as long as the pre-

mium differences across risk classes are not extreme and subsidies are available to low-income groups (Pauly et al., 1991). Others (Feldman and Dowd, 1991) focus less on the unfairness of low-risk individuals subsidizing high-risk individuals than on the unfairness of younger and often lower-income workers subsidizing older and often higher-income workers, as they may in large employment groups or other plans that do not use some form of risk rating. To correct this perceived inequity, premiums, deductibles, and other insurance cost sharing can be pegged to income, although such modifications are not feasible under some circumstances and do involve additional administrative cost.7

In contrast to the perspective of actuarial fairness is the principle underlying community rating and social insurance, a principle accepted by most members of this committee. The principle here is that the risk of medical care expenses should be shared very broadly and that broad risk sharing across a community can help keep rates within reach of both higher-risk and modest-income individuals. Because most people move from lower-risk to higher-risk status over time, community rating achieves a rough actuarial fairness if the time perspective is long enough.8 However, because low-income, low-risk individuals will find it difficult to divert income from food and shelter to health insurance whether or not their premiums are risk rated, subsidies will still be required to make insurance broadly available across income classes. Principles aside, community rating in this country's private insurance market has, for the most part, proved unsustainable in the face of competition based on experience rating for larger groups and medical underwriting for individuals and small groups.

Following the social insurance principle, policymakers in other countries have singled out health coverage or its equivalent as a social good that differs from auto, life, homeowners, and other forms of insurance. They have largely rejected the perspective of actuarial fairness as it relates to medical underwriting and risk rating.

In this country, federal and state policies vary in the degree to which they sanction differences in the cost and availability of health coverage

based on the risk presented by an individual or group. For example, almost all state insurance regulations permit risk-based premium differences, but they vary greatly in the limits they place on underwriting practices. Several states have attempted to preserve a degree of community rating and open enrollment through their regulation of Blue Cross and Blue Shield plans. However, the success of medically underwritten individual and small-group coverage and the spread of self-insurance for large groups have undermined these state policies. The federal Americans with Disabilities Act permits most medical underwriting, and the Employee Retirement Income Security Act of 1974 (ERISA) is silent on the issue.

As a consequence of the deterioration and fragmentation in community risk pools, states are increasingly looking for new risk-spreading strategies. A few have recently adopted limits on medical underwriting along the lines discussed later in this chapter (Freudenheim, 1992c). In addition, some have imposed taxes on insured health plans, health care providers, and other sources to support state-subsidized programs for high-cost and low-income individuals. One problem with such subsidy strategies is that, as noted in Chapter 2, ERISA generally protects employee health benefit plans from state-imposed premium or claims-based taxes and from other state regulations.

Access to Health Care

Risk selection can affect access to health care in at least four ways. First, to the extent that fear of unfavorable risk selection leads insurers to refuse coverage—in whole or part—to higher-risk individuals, those individuals may face barriers in obtaining needed health care. Second, if health plans fear that covering, providing, or improving specific services will attract higher-risks, they may limit coverage of those services even more than they might simply in pursuit of cost containment. Third, to the extent that some individuals are discouraged from selecting a health plan that fits their particular needs because the plan's premiums have been raised by unfavorable selection, the result may again be reduced access to appropriate health care. Fourth, if people worry that their use of health services may disqualify them from future insurance coverage, they may limit their use of needed services, fail to submit claims for covered expenses, or pressure physicians to record diagnoses that are less likely to attract an underwriter's attention. The last two actions add error to the data bases used for health care research and monitoring.

Strategies to control or compensate for risk selection may make health coverage more affordable and accessible for many high-risk individuals in the short run, but they will not by themselves make coverage more affordable in general. In fact, by limiting the degree to which low-risk individu-

als can segregate themselves in separate risk pools, such strategies may increase costs for those individuals by pooling them with higher-risk groups, including groups that previously could not obtain insurance (GAO, 1991d). This broader pooling could price health benefits out of reach for some lower-income people. On the other hand, decreasing the incentive for health plans to compete on the basis of risk selection should encourage competition based on efficient management and other practices, and such competition could limit the overall cost of health benefits.

In any case, lack of health coverage does not inevitably mean complete lack of health care, although it is associated with lower use of both outpatient and inpatient services (Davis and Rowland, 1983; Lewin/ICF, 1990; Hadley et al., 1991; Stern et al., 1991). Conversely, having health coverage does not remove all barriers to care (Long and Settle, 1984; PPRC, 1992b). For example, physical, cultural, geographic, and linguistic factors may limit access (Davis, 1991). Moreover, greater use of health care is not perfectly correlated with better health outcomes, presumably in part because some medical services have little or no benefit and in part because the palliative and other benefits of care may be difficult to measure. Nonetheless, evidence does suggest that being uninsured can be harmful to one's health (Hadley, 1982; Lurie et al., 1984; Pauly, 1992).

Cost

As noted earlier in this chapter, risk selection may make it easier for health plans to compete on the basis of who they enroll rather than on the basis of true cost containment. Without means of identifying or controlling such selection, purchasers of health plans may be unable to distinguish between premium differences based on risk selection and differences based on benefit design or management efficiency. One result is that competition among health plans may not serve the most important long-term objectives intended by its advocates.

Efforts to control or compensate for risk selection will not eliminate cost differences between larger and smaller groups because many other factors affect these costs. For example, health care use and costs are less predictable for small groups. Fixed administrative costs are spread across fewer individuals, and nonpayment of premiums is more likely among small groups. As pointed out in Chapter 3, working with 100 groups of 20 is more expensive than working with one group of 2,000. Further, to the extent that cost containment programs depend on employers to educate employees, monitor program operations, or apply economic leverage to influence provider behavior and prices, small size can also be a disadvantage.

As noted earlier, steps to control or compensate for risk selection may make health coverage more affordable for high-risk groups but may in-

crease costs for low-risk groups. Such steps may also affect the level and distribution of costs in other ways. For example, because reform in underwriting practices is intended to make insurance more available and because the presence of insurance tends to increase the use of care, reforms may increase health care costs. On the other hand, because those without insurance do not necessarily go without any care, even when they cannot pay for it out-of-pocket, the care they now receive must show up as costs to someone else.9

Hospitals, in particular, have emphasized the financial burden of the uninsured, or "uncompensated," care that they provide (by law, principle, or inadvertence) to ill and injured individuals. Private employers and insurers have complained about the shares of these costs that are shifted to them in the form of higher prices. In addition to this kind of "cost shifting," hospitals presumably absorb some of the marginal costs of this care through reduced employee compensation, cover some of it through philanthropic sources, and sometimes secure additional state and local tax appropriations.10 Controversy continues about (1) the existence and magnitude of the cost shift due to uncompensated care, (2) the degree to which some third-party payers can insulate themselves from it or add to it through ''inadequate" reimbursement to providers, and (3) the extent to which cost shifting should be regarded as inequitable (Coulam and Gaumer, 1991; National Association of Manufacturers, 1991; Blendon et al., 1992). Chapter 6 discusses this issue further.

Quality of Care

A recent Institute of Medicine study defined quality of care as "the degree to which health services for individuals and populations increase the likelihood of desired health outcomes and are consistent with current professional knowledge" (IOM, 1990b, p. 4). To the extent that fear of risk selection discourages health plans from covering certain kinds of appropriate medical services or deters more effective and efficient management of health services, it may diminish the quality of health care. To the extent that methods for controlling risk selection allow better assessment of differ-

|

9 |

Interestingly, one study has suggested that the employed uninsured may be more likely to generate uncompensated care (i.e., not pay their bills) than the unemployed uninsured (Campbell, 1992). If true, this might mean that the costs for mandated and subsidized employment-based coverage would produce more offsetting savings from reduced costs for uncompensated care than would expansion of care for the unemployed. |

|

10 |

For example, New Jersey established a formal cost-shifting arrangement that helped cover uncompensated care in hospitals through surcharges on third-party payers. As noted in Chapter 2, a federal court recently ruled that this system violated ERISA. |

ences in the health status of health plan members and channel health plan energies away from risk selection and toward management of health services and resources, they should improve quality of care. To date, most proposals for health care reform (regardless of what they would do about risk selection) focus on health care access and costs. Although they often lack specifics on these issues (e.g., how a global budget would work), they tend to be even less informative about quality assurance.

Implications of the Americans with Disabilities Act

One question for the future is how the Americans with Disabilities Act (ADA) may affect employers' efforts to limit health benefits for those with health problems. ADA prohibits discrimination in the conditions and privileges of employment (Feldblum, 1991; Jones, 1991; Rothstein, 1992). Disability is defined as it is under section 504 of the Rehabilitation Act of 1973, that is, "(A) a physical or mental impairment that substantially limits one or more of the major life activities of such individual; (B) a record of such an impairment; or (C) being regarded as having such an impairment." ADA took effect in 1992 for employers with 25 or more employees and goes into effect in 1994 for employers with 15 to 24 employees.

Under the act, employers cannot refuse to hire the disabled because company health benefit costs would increase. They also cannot question job applicants about disabilities except with respect to job-related functions. Medical examinations of job applicants are permitted only following a conditional offer of employment, must apply to all entrants, and must generate confidential records that are separate from other records. The law forbids compulsory non-job-related medical examinations once an employee is hired. In addition, employers may not deny all coverage under a health benefit plan for an individual with disabilities.

However, the act explicitly permits most health insurance underwriting practices based on or consistent with state law unless such practices are a "subterfuge" for discrimination. Either the statute itself or associated committee language indicates that insurers and employers may limit coverage for preexisting conditions, restrict or exclude coverage for certain procedures and treatments, and charge higher premiums for higher-risks. It would also appear that medical examinations or questionnaires may be legal if their only purpose is to establish, classify, or underwrite risks for a company health benefit plan. The act says nothing about the confidentiality of this information—or the information provided on claims forms, underwriting questionnaires, or medical records submitted during utilization review. Although it would be illegal to discriminate against a disabled individual on the basis of information from these records, access to personal medical

information still provides the opportunity and perhaps the stimulus to attempt covert discrimination (e.g., when layoffs are being planned).

Many uncertainties about the applicability of the law to health benefits will probably be resolved through litigation (Council on Ethical and Judicial Affairs, 1991; Feldblum, 1991; Juengst, 1991; Rothstein, 1992). At this time, major remaining questions include the following:

-

How are routine uses of medical underwriting, revisions of health benefit programs, and similar actions that have a disparate impact on individuals with a particular health condition to be distinguished from such actions employed as a subterfuge with the intention of discriminating? For example, how would one make the distinction in the case of an employer who singles out AIDS-related treatment for reduced coverage after an employee begins to file claims?11

-

How broadly might the courts interpret the prohibition on discrimination against those regarded as impaired? For example, could an employer refuse to hire an individual who was without any functional impairment but had a high cholesterol level or a genetic predisposition to disease (but no expressed illness)?

-

Does the law protect partly volitional conditions or behaviors such as obesity or tobacco use that also appear to have a genetic component?

The Equal Employment Opportunities Commission may yet issue further regulations to clarify some matters. Also, legislation has been introduced to extend the definition of disability to include a "genetic or medically identified potential of, or predisposition toward, a physical or mental impairment that substantially limits a major life activity" (Gostin and Roper, 1992, p. 249).

Although ADA may or may not be interpreted to protect certain workers, for example, smokers, some states have taken the initiative to prohibit employers from refusing to hire or continue to employ off-the-job smokers (Schiller et al., 1991; Sipress, 1991).12 The tobacco industry has successfully lobbied for these laws, but protection for other individual behavior or characteristics does not appear at this time to have much financial or other backing. Nonetheless, the more employers attempt to regulate this and other off-the-job employee behavior that does not affect job performance,

the more pressure is likely to grow for states to restrict what has been called "life-style discrimination" in hiring and benefits. Such state initiatives will not, however, apply to the benefit programs of self-insured employers as long as ERISA remains unchanged.

STRATEGIES FOR RESPONDING TO RISK SELECTION AND RISK SEGMENTATION

A variety of policies and techniques have been suggested to limit or adjust for risk selection. Some proposals deal primarily with problems in the small-group market. Others focus on problems experienced by larger groups. The broad options are summarized in Table 5.2.

With respect to these options, the committee believes that risk selection—both as a real phenomenon and as a threat perceived by health plans—is a serious enough problem to warrant strategies to discourage or compensate for it. Therefore, it rejects the first option (i.e., simply tolerating risk selection).

The second option, which would eliminate risk selection among health plans by eliminating choice among health plans, is noted here but not discussed at length because it is more politically than technically challenging. However, depending on the methods used to pay health care practitioners and institutions, this option might still permit or encourage health care providers to "skim" good risks. It thus would warrant attention to some of the issues discussed in this chapter.

The third option, single purchasers acting on their own, is one already open to employers, particularly larger employers. In contrast, implementing the components of the fourth option—a multifaceted, collective strategy— would require significant changes in current public policies and employer preferences and practices. It would also depend on extensive analysis and sophisticated answers to some difficult technical questions.

Limiting Underwriting Practices

Most proposals for limiting insurers' underwriting practices focus explicitly or implicitly on smaller employer groups (Blue Cross and Blue Shield Association, 1991a; GAO, 1991d, 1992b; HIAA, 1991a; National Association of Insurance Commissioners, 1991; National Health Policy Forum, 1991; Snook, 1991; Hall, 1992). Most would not apply to larger groups and self-insured groups at all. Table 5.3 highlights some key features on which proposals may vary.

The general objectives of underwriting reforms are to make health insurance more accessible to high-risk groups and individuals within these groups, to place uniform legal limits on the underwriting practices of all

TABLE 5.2 Some Possible Strategies for Responding to Biased Risk Selection

|

Tolerance • Accept risk selection and all but its most extreme consequences as an acceptable and fair outcome of relying on competitive markets, freedom of choice, and traditional underwriting principles. |

|

Elimination • Eliminate risk selection by eliminating competition among health plans and establishing a single health plan for the entire country. |

|

Single-Purchaser Action • Reduce or eliminate risk selection within an employer's health program by reducing the number of health plans offered or providing all options through a single insurer or equivalent mechanism. |

|

Collective Action • Reduce or compensate for risk selection through one or more of the following: (1) restrict underwriting practices (e.g., preexisting condition clauses and risk rating individual premiums) that limit the availability of coverage or set individual premiums on the basis of the risk posed by the individual or group; (2) manipulate or regulate the terms of health plan competition to limit the number of health plans, standardize benefit packages, create purchasing arrangements, and control other factors that may lead to adverse selection in a competitive market; (3) adjust employers' or governments' (but not individuals') payments to health plans to reflect the risk level of their membership; and (4) establish special mechanisms (e.g., reinsurance) for handling high-risk individuals. |

small-group insurers, and to reduce premium variations across groups.13 Beyond these broad objectives and underlying the differences in the details of proposals are several basic differences in perspective:

-

One difference involves competing perspectives on equity. Some proposals answer the equity questions posed in this chapter by affirming that premium differences based on certain risk factors (e.g., age and health history) and within certain fairly broad limits are fair, whereas others essentially reject that view.

-

Another and often related difference involves the degree to which the proposals recognize that unfavorable selection is a legitimate worry of

-

insurers and, accordingly, propose explicit mechanisms to deal with selection problems as they threaten health plans.

-

A third difference lies in the exceptions the proposals make to accommodate the special characteristics of various health plans (e.g., HMOs that lack needed data, insurers with a small market share, and Blue Cross and Blue Shield plans that want to bear a broader range of risk).

-

One further difference is that some reform proposals envision change through federal legislation, whereas others depend on voluntary state-by-state change.

As noted earlier, most small-group reforms would probably increase premiums for many employer groups now judged to be low risk according to current underwriting practices (GAO, 1991d; Hall, 1992). These groups would move from narrow low-risk pools to broader and more costly risk pools. If employers that now finance these premiums in whole or part responded by withdrawing from the small-group market (e.g., by dropping coverage, giving employees cash to purchase insurance on their own, or self-insuring), then premiums for the remaining employers could rise even more. Over the last decade, smaller and smaller groups have opted for self-insurance, a phenomenon that raises additional questions about plan solvency.

Some reform proposals go beyond underwriting regulations to recognize the price sensitivity of small-group and low-income purchasers in a

TABLE 5.3 Major Provisions on Which Proposals for Reform in Underwriting Practices May Differ

|

Access to Coverage (not including subsidies) |

|

• Definition of circumstances under which insurers must issue coverage to a group and all Of its members (sometimes labeled "guaranteed availability" or "guaranteed issue"). • Restrictions on preexisting condition limitations. |

|

Continuation of Coverage |

|

• Conditions under which insurers must renew existing insurance contracts (sometimes Labeled "guaranteed renewability"). • Provisions for continuing individual coverage without interruption and without new waiting periods for coverage following change of employment or employer's change of Insurer. |

|

Consumer Information |

|

• Disclosure of information about rating practices to consumers and regulators. |

|

Premium Variations |

|

• Definition of permissible bases for varying premiums across groups and limits on the Magnitude of these variations (sometimes described under the headings of rating bands and Classes of business). • Delineation of permissible bases for increasing premiums over time and limits on the magnitude of these increases. |

voluntary system. One response is to subsidize the voluntary purchase of health insurance by employers, employees, or both. Another response is to mandate coverage. Such a policy would necessarily eliminate risk selection as it arises from the decisions of groups or individuals to purchase or not purchase insurance but would not affect selection effects related to choices among health plans. Both approaches have been questioned on grounds of political feasibility, the latter in the short term, the former in both the short and the long term (Brown, 1992).14

A third possible response to the affordability problem is to reduce the rate of increase in health care costs, which would, over the long term, help to make insurance more affordable for both individuals and society. Unfortunately, as Chapter 6 discusses, many doubts exist about the potential long-term effectiveness of both current and proposed cost containment strategies.

One question that needs more analysis is how different proposals would affect insurers with unfavorable selection (e.g., those that have covered higher-risk groups). If these insurers find that permissible premiums are insufficient to cover their risk and are introduced without an adequate period for adjustment, they might withdraw from the market. The remaining available alternatives might be less satisfactory or possibly nonexistent. The issue here is not whether reform would lead to a reduction in the total number of companies operating in the small-group market but whether it would permit a sufficient cadre of responsible insurers to survive over the long term. Some committee members believe a reduction in the number of health insurers—now numbering well over 1,000—would actually promote a more manageable and accountable market for purchasers, providers, and regulators.

Finally, whether small-group reform should be undertaken on a state-by-state basis or mandated on a uniform federal basis is partly a strategic issue and partly an issue of power. State governments may move on insurance reform even if the federal government does nothing more than debate. On the other hand, if one believes that certain underwriting practices are unacceptable and that a number of states will not act to eliminate them, then the argument favors uniform national policy (Light, 1992).

Managing or Regulating Competition

Consolidating Choices or Risk at the Employer Level

Some employers have responded to concerns about risk selection by reducing or consolidating choices among health plans (Darling, 1991; Gold,

|

14 |

Conceivably, such subsidies would not have to be as high to discourage the dropping of coverage as to encourage new purchases, but this distinction might have little practical policy relevance (see Chapter 3). |

1991). In particular, they have reduced the number of HMOs they offer. This strategy also may simplify the analysis of risk selection among the remaining plans as well as reduce the complexity of plan administration and employee decisionmaking.

Others have sought to preserve choice by bringing risk under a single umbrella through a "total replacement" package. One approach under this option is to find a single insurer that will underwrite (in full or part) two or more health plan choices, for example, an HMO and an indemnity plan, or those options plus a PPO. Under such dual-or triple-option arrangements, employees still chose among the two or three plan options on a periodic basis and face separate premiums for each option. The theory is that this approach will eliminate the incentive for health plan competition based on risk selection within the employer group because the same insurer fully or partially underwrites all options within the employer group. It would leave untouched the incentives for insurers to compete to attract low-risk employer groups.

A simpler approach—at least descriptively—is the point-of-service health plan, which (1) does not require that a yearly choice be made between network and nonnetwork enrollment and (2) does not establish different premiums for those choosing in-network versus out-of-network services. Instead, employees may choose at the point of service whether they want to use nonnetwork services and pay more for that choice (usually up to some limit). POS plans may be part of a replacement strategy or a consolidation strategy, as in the core case study presented in Chapter 4. Depending on the payment arrangements for network providers, these plans may shift some of the selection problem to the network providers. If the provider network is not attractive to individuals with chronic illnesses, then the plans may shift the burden to these individuals.

Replacement and consolidation strategies have been criticized for restricting employee choice among health plans and potentially discouraging innovation. In addition, if an employer becomes dissatisfied with the POS plan or the "umbrella" carrier for dual-or triple-option programs and switches to another plan or carrier, the switch may disrupt patient-physician relationships and interfere with continuity of care. Overall, because consolidation strategies are relatively new and subject to little or no independent evaluation, their impact on employer or employee costs, quality of care, and employee relations has yet to be demonstrated.

Regulating the Terms of Competition at the Community Level

Other approaches to consolidation would operate at the community level, not at the level of the individual employer. They would create a system of health plan certification and purchasing cooperatives to streamline the purchase of health benefits on a state or regional basis. Some proposals are

aimed at the small-group market; others would cover large groups as well. Proposals that have the control of risk selection as a major objective generally would not allow multiple cooperatives to operate in the same area and would discourage or prohibit coverage through noncertified health plans.

Purchasing cooperatives would consolidate the role of purchasing agent for small employers and would operate somewhat like large employers now do when they screen, select, and monitor a choice of health plans for their employees. They could also administer a policy of risk adjusting employer (or employer and government) contributions to health plans. Depending on the certification criteria and their enforcement, the certification mechanism could shrink the number of insurers and health plans and thus result in further consolidation of the risk pool. Still, for the individual who had previously been offered a single health plan by a small employer, some choice of plans would become available.

The consolidation of the purchaser role is part of a broader concept of "managed competition." Some comprehensive managed competition strategies propose to regulate various kinds of health plan practices that encourage risk selection and complicate comparisons of health plan performance (Enthoven, 1988a,b; Ellwood, 1991; Enthoven and Kronick, 1991; Kronick, 1991a,b, 1992). Table 5.4 lists some of the targets of these proposals.

TABLE 5.4 Some Steps Proposed to Manage or Limit Health Plan Competition Based on Risk Selection

|

Health Plan Features |

|

• Definition of standard benefit package(s) to limit features intended to discourage Enrollment by high-risk individuals. • Requirements for health plans to contract with certain types of providers (e.g., tertiary Care centers) so as not to discourage membership by high-risk individuals. |

|

Consumer Protection Processes |

|

• Regulation and monitoring of enrollment and disenrollment processes and results and Surveys of membership satisfaction to limit and detect deliberate risk selection and Discrimination. • Regulation and monitoring of marketing practices to limit selective or discriminatory marketing. • Specification of information to be made available to consumers and regulators and of Complaint-handling mechanisms. • Limits on medical underwriting. • Risk adjustment of employer or government payments to health plans. |

|

Oversight and Management Structures |

|

• Creation of one or more official bodies to implement the program and certify health Plan compliance. • Creation of regional purchasing cooperatives to select and oversee health plans that small (or all) employers would be required to offer. |

Some proposals include a variety of other features that are not aimed at risk selection but are instead concerned with providing coverage for low-income individuals (e.g., through some kind of subsidy) or increasing cost-conscious behavior.

The first of the elements in Table 5.4—standardized benefit packages— is included in a wide array of proposals for health care reform (including those that would deal with risk selection by establishing a single national health insurance system). The definition of a standard benefit package poses a number of practical and theoretical challenges (Chollet, 1992b; IOM, 1992a). What principles will be applied in defining basic benefits? How will they reflect consumer, provider, payer, and other perspectives? Will they be sensitive to differences among patients with the same medical condition? What procedures will be followed to determine and update coverage features? There are a variety of ways of answering these questions, and considerable disagreement and uncertainty have been provoked by the approaches that have actually been tried. (Chapter 7 suggests these issues should be part of the government's research agenda.) The debate over the Oregon strategy for defining basic benefits, which was part of its Medicaid reform strategy, is a vivid case in point.15

Standardizing benefits will limit the choices available to individuals and possibly constrain desirable innovations in benefit design. However, the strategic use of benefit design to attract good risks and discourage bad risks appears to be so appealing that it will—if not limited—almost certainly undermine other steps to control risk selection and limit the advantages to be gained from such control.

Monitoring health plan enrollment, disenrollment, and marketing strategies has been tried in the Medicare program to control abuses that might arise as the government encouraged beneficiaries to enroll in HMOs. These efforts have had some successes, but reviews have, in general, been mixed (GAO, 1991d; Welch, 1991). Obviously, the larger the number of insurers that choose to or are able to persist in a highly regulated market, the larger the number of separate entities that would have to be monitored.

Most proposals that go under the "managed competition" label envision the creation of a quasi-public body or bodies to oversee the creation and maintenance of a regulated market and to serve as a purchasing agent for the self-employed, small employers, and perhaps others (see, for example,

Enthoven, 1988a; Etheredge, 1990; Resnick, 1992). Depending on the specifics of the proposal, there might be (1) one or more purchasing agents; (2) relatively open or highly selective procedures to select or qualify participating health plans; (3) voluntary or mandatory participation by employers and others; and (4) requirements that employers offer at least one qualified plan, only qualified plans, or all qualified plans. To the extent that proposals provide for multiple purchasing agencies, voluntary participation by employers, and limited standardization of coverage, they would almost certainly create their own problems of risk selection.

One critical question is whether the oversight and management entity (or entities) called for by proposals for managed competition can be made sufficiently accountable for its exercise of power. The converse question is whether any governmental or quasi-governmental entity can withstand the pressures that historically have led to constant expansions in coverage without regard to cost-effectiveness and budget constraints. Another issue is how vulnerable the protections offered by such a body would be to changing partisan tides regarding regulation and deregulation.

Risk Adjusting Payments to Health Plans

Fundamental to a number of proposals for health care reform, especially those based on ''managed competition," are methods to adjust how employers, governments, purchasing cooperatives, or other entities pay health plans based on the risk presented by their enrollees. Unlike medical underwriting, the idea is not to adjust the premium paid by the individual health plan member but rather to adjust the premium contribution from the employer, government, or other entity.16 The focus of risk-adjusted payment is on group insurance rather than on individually purchased coverage. The objectives are to reduce the financial advantage obtained from strategies to attract low-risk individuals and avoid high-risk individuals and to reduce the extent to which individuals are penalized for being members of a plan that has attracted higher-risk individuals.

Policy and Strategic Issues

Several criteria for risk adjustment schemes have been suggested (Welch, 1985; Newhouse et al., 1989; Anderson et al., 1990; Anderson, 1991b; Bowen

and Slavin, 1991; Luft, 1991; Robinson et al., 1991). Commonly mentioned criteria specify that a method should be

-

based on characteristics of plan enrollees, not characteristics of the delivery system (e.g., inefficient management of health problems);

-

related to individual need for health care rather than taste for more or less care;

-

resistant to individual or organizational manipulation or "gaming" (e.g., misreporting health status);

-

feasible to administer for many types of employers and health plans (e.g., HMOs, fee-for-service plans, and large and small groups); and

-

compatible with other policy objectives (e.g., encouraging responsible use of medical care).

In general, the strategies for risk adjustment attempted to date have not met one or more of the above criteria. A strategy need not be perfect to be helpful, but the most feasible of existing methods have not yet demonstrated enough power and practicality to serve their intended policy purposes. Several types of risk adjustment strategies are discussed below.

Beyond the question of what kind of data should be and can be used to assess and adjust for risk is the question whether the adjustment should be prospective or retrospective or some combination of the two. Prospective adjustments permit health plans to budget and manage expected revenue and allow the adjusted premium contributions for individuals to be used during open enrollment periods. Retrospective adjustments are less administratively demanding and allow collection of some information (and therefore permit adjustments) that would not otherwise be feasible. Retrospective adjustments may also be helpful in monitoring health plans for selectively encouraging disenrollment of high-cost individuals. However, they may create problems should a health plan have to "refund" payments after its fiscal year has ended. This problem would be lessened by a system that was primarily prospective in administration with retrospective adjustments for specifically defined situations.

Another issue related to risk adjustment strategies involves the definition and stability of the entire population to which the adjustments would be applied. If groups and individuals can easily join or leave the pool or if multiple, competing pools (e.g., competing purchasing cooperatives) are possible, then the problem of risk selection is unlikely to be resolved. Some kind of required pooling arrangement, such as the mandatory purchasing entities proposed in some "managed competition" legislation, may be necessary as part of an effective strategy to control risk selection.

Improved risk assessment methods have value beyond the applications discussed above. For example, one concern about Medicare's method of paying for care provided to patients with end-stage renal disease is whether

it adequately adjusts for differences in the severity of illness of patients across time or different providers (IOM, 1991). The same concern has been raised about Medicare's prospective payment system for hospitals (Gertman and Lowenstein, 1984; Iezzoni, 1989; Iezzoni et al., 1991; McGuire, 1991; Schwartz et al., 1991). In addition, efforts to compare the performance of health care providers are complicated by uncertainties about differences in their patient populations, especially when claims-based administrative data are used (Chassin et al., 1987; Greenfield, 1988; IOM, 1990b; Park et al., 1990; PPRC, 1992b). Similarly, although the IOM and others have argued that assessments of the effectiveness of different medical treatments need to move beyond highly controlled and artificial clinical trials to real-world settings, this move is made more difficult by the absence of inexpensive, practical methods of relating differences in outcomes to differences in patient risk (IOM, 1992a). Thus, improved risk adjustment methodologies may have multiple uses.

Techniques for Risk Adjusting Payments to Health Plans

Assessments of risk adjustment techniques involve both policy and technical challenges (Welch, 1985; Newhouse et al., 1989; Anderson et al., 1990; Anderson, 1991b; Bowen and Slavin, 1991; Luft, 1991; Robinson et al., 1991). The policy challenge is to determine whether adjusting government or employer contributions for a particular individual risk factor (e.g., use of over $50,000 in medical services) is consistent with other policy objectives (e.g., avoiding incentives for inefficient use of resources). The technical challenge is to devise appropriate measures of health risk that use readily available or easily collectible data and that are valid predictors. Specific risk adjustment techniques may use (1) demographic information, (2) data on health service utilization, (3) measures of health status, or some combination of these.

Demographic Measures

In some respects, the demographic approach to risk adjusting the health plan contributions of employers and governments parallels insurers' use of such variables to establish premiums for individually purchased insurance. The most familiar demographic risk adjusters are age and gender. The Medicare formula for paying HMOs (the average adjusted per capita cost, or AAPCC) includes these variables plus Social Security disability status, welfare status, and institutional status (e.g., nursing home residence). (The complete calculation is more complex and takes other factors such as geographic location into account.) Risk adjusters have also included education,

income, occupation or job classification, length of employment, and marital status (Robinson et al., 1991).

A major advantage of demographic data such as age and gender is that they tend to be more available than data on health care utilization or health status. The disadvantage is that demographic factors are relatively crude indicators of risk; for example, variations in health status, utilization, and cost within demographic categories can be quite substantial. One study of the Medicare AAPCC found that it could explain less than 1 percent of the variation in Medicare spending for the elderly (Lubitz et al., 1985). Few observers regard demographic data as sufficient elements of a successful risk adjustment strategy.

Prior Use and Cost Measures