1

Background and Introduction

Lloyd and Anne Ridge's daughter, Beth, is doing well 12 months after being diagnosed with acute lymphoblastic leukemia. Although she experiences some side effects from maintenance chemotherapy, Beth's prospects are good—over half the children with the disease achieve long-term remission and probable cure. Lloyd is profoundly grateful for the advances in chemotherapy that have made this possible. He remembers his childhood friend who died 40 years ago when this leukemia was invariably and quickly fatal. Lloyd is also grateful for the health insurance offered by his employer. It paid for care from top-notch physicians and hospitals and kept the family from financial hardship. The personnel office also helped sort out a couple of problems with insurance claims for Beth's care.

* * * *

One year later, Beth Ridge continues in good health. However, Lloyd Ridge has new worries. Lloyd knows his employer is concerned about its increasing costs and is considering a new health plan. It could force the Ridges to use a limited network of physicians and hospitals or pay a much higher proportion of the ongoing costs for Beth's checkups and maintenance chemotherapy. Even more threatening is the small but real chance that the company will reduce its work force. If Lloyd lost his job, the family could not switch to coverage through Anne's job because she works as a freelance editor with no fringe benefits. They could, under federal law, continue group coverage, at their own expense, for at least 18 months, but Lloyd worries that he would face covert discrimination by another employer or insurer because of Beth's history. Lloyd and Anne do not even think about their old dream of going into business for themselves. Individually purchased health insurance to cover Beth would be expensive or perhaps not even available at any price.

To make the many accomplishments of modern medicine available to Americans such as Beth Ridge, the United States depends heavily on a voluntary system of employment-based health benefits. Although neither federal nor state law generally requires employers to finance health coverage for employees and their families, almost two-thirds of all Americans under age 65 receive health benefits through the workplace.

Sixty years ago, when the full capacity of modern medicine was just beginning to be mobilized, such benefits barely existed. Indeed, few had access at that time to health insurance from any private or public source. Since World War II, most American workers and their families have come to rely on health insurance provided through the workplace. Recent trends in the general economy and in the health sector have, however, generated considerable uncertainty about the continued availability of such coverage. An individual's probability of losing health benefits, being trapped in a job or on welfare because a new job comes without health coverage, or facing disruptions in established relationships with physicians is growing. Many employees and employers are increasingly concerned—even fearful—about their inability and the inability of governments, insurers, and medical professionals to deal effectively with problems related to the availability, cost, and quality of health benefits and health care.

The United States is unique among advanced industrialized nations in the way it relies on employers to voluntarily sponsor and finance health benefits for workers and their families. In this system, not only are employers free to offer or not offer coverage, most have extensive discretion in determining what specific benefits are to be offered, how they are to be administered, whether employees must participate, what share of the cost employees must pay, and what will be done to control costs. As a consequence, American workers have particular reason to factor the availability and quality of workplace health benefits into employment decisions, collective bargaining, and other interactions with employers.

An understanding of the link between employment and health benefits and the relationship between private and public spheres of decisionmaking about health care delivery and financing is essential to an informed debate about restructuring the nation's health care financing and delivery system. Such an understanding, in turn, requires an appreciation of the social, economic, and political dynamics that created employment-based health insurance and the advantages and disadvantages that accrue to its sponsors and participants and the society as a whole. This report is intended to help build this necessary understanding by

-

describing employment-based health benefits and their relationship to the overall structure of health care financing and delivery in this country;

-

identifying the important features, strengths, and limitations of this system;

-

assessing strategies or actions that might improve the performance of this system; and

-

defining an agenda for future research.

EMPLOYMENT-BASED HEALTH BENEFITS IN CONTEXT

In the United States the strong link between health benefits and the workplace developed through a combination of historical coincidences and deliberate decisions. Its emergence depended on the voluntary initiative of many private individuals and groups, the largely unintended impetus of federal tax and labor laws, the collective bargaining strategies of trade unions, and the political failure of proposals for universal, public health insurance. Beginning in the early 1930s, this system of voluntary employment-based health benefits experienced three decades of rapid growth. In the 1960s and 1970s, major government programs were established to cover the elderly, the disabled, and some of the poor—groups ill-suited to private insurance. Today, neither government nor employment-based coverage reaches many low-income or high-risk workers and their families, especially those who work for small firms, those who are employed on a part-time or seasonal basis, and those who are chronically ill but not disabled.

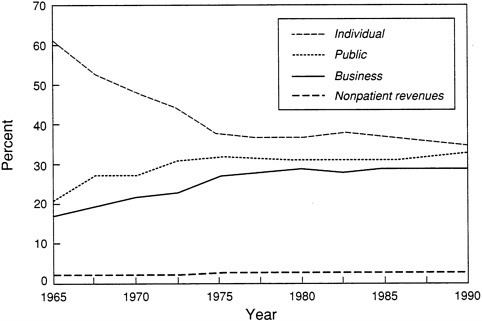

The relative importance of private and public sources of health benefits and health care spending is summarized in Tables 1.1 and 1.2 and Figure 1.1. These tables reveal a number of facts:

-

Seventy-three percent of all Americans below the age of 65 have private health coverage, the great majority through programs sponsored by private and government employers and unions.

-

Almost 36 million Americans below the age of 65—17 percent—have no health benefits.

-

Of the uninsured, 30.5 million—85 percent—live in families headed by a worker, most of whom work for firms with fewer than 100 employees.

-

Ninety-six percent of all Americans 65 and over are covered by public programs, many have supplementary private coverage (some of it employer sponsored), and only 1 percent have no coverage.

-

Public program spending accounts for nearly 40 percent of all spending on health care services and supplies, and employers and households account for roughly equivalent shares of the remainder.

-

In the past three decades, health care expenditures have become a considerably larger fraction of government and business spending, but out-of-pocket consumer expenditures have increased more modestly as a share of personal income. As a result, households now directly finance a much smaller proportion of health care than they did 30 years ago, and government and business finance a greater share.

TABLE 1.1 Nonelderly and Elderly Americans with Selected Sources of Health Insurance, Employee Benefit Research Institute Analysis of the March 1991 Current Population Survey

|

|

Nonelderly (below age 65) |

Elderly (age 65 and over) |

||

|

|

No. (millions) |

% |

No. (millions) |

% |

|

Total population |

215.9 |

100 |

30.1 |

100 |

|

Total with private health insurance |

158.3 |

73 |

20.6 |

68 |

|

Employer coverage |

138.7 |

64 |

10.0 |

33 |

|

Other private coverage |

19.7 |

9 |

10.6 |

35 |

|

Total with public health insurance |

29.2 |

14 |

28.9 |

96 |

|

Medicare |

3.5 |

2 |

28.8 |

96 |

|

Medicaid |

21.6 |

10 |

2.6 |

9 |

|

CHAMPUS/CHAMPVAa |

5.9 |

3 |

1.1 |

4 |

|

No health insurance |

35.7 |

17 |

0.3 |

1 |

|

In family headed by worker |

30.5 |

15 |

NAb |

NA |

|

In family headed by nonworker |

5.2 |

2 |

NA |

NA |

|

NOTE: Details may not add to totals because individuals may receive coverage from more than one source. a Includes only the retired military and members of their families provided health coverage through the Civilian Health and Medical Program for the Uniformed Services and the Civilian Health and Medical Program for the Department of Veterans Affairs. Excludes active duty military personnel and members of their families. b NA = not available. SOURCE: Adapted from EBRI, 1992d, Tables 1 and 8. |

||||

Although the proportion of the nonelderly population covered by employment-based health benefits leveled off during the 1970s and even decreased from 66 to 64 percent between 1988 and 1990, business spending on health benefits continues to grow as a fraction of their total labor compensation and after-tax profits (Levit et al., 1991). Business health spending stood at 7 percent of total labor compensation in 1990, up from 2 percent in 1965 and 5 percent in 1980. For the nation as a whole, about 12 percent ($666.2 billion) of the nation's gross national product was accounted for by spending on health care (including noncommercial health research and construction) in 1990, up from 6 percent in 1965 and 9 percent in 1980.

This rising commitment of resources to health care services reflects a complex set of interacting influences. These include a generally rising standard of living, an aging population, more comprehensive health care coverage, the influence of new technologies and medical practices, an incentive structure that encourages high medical spending (e.g., third-party

TABLE 1.2 Trends in Government, Individual, and Business Spending in Selected Years, 1965 to 1990

|

|

Government Health Spending as Percentage of Total Government Spendinga |

Individual Health Spending as Percentage of Adjusted Personal Incomeb |

Business Health Spending as Percentage of Totalc |

||

|

|

Federal |

State |

Gross Private Domestic Product |

Total Labor Compensation |

|

|

1965 |

9 |

12 |

4.2 |

1.0 |

2.0 |

|

1970 |

15 |

12 |

4.1 |

1.7 |

3.1 |

|

1975 |

17 |

14 |

4.3 |

2.1 |

3.9 |

|

1980 |

18 |

14 |

4.1 |

2.7 |

4.9 |

|

1985 |

17 |

15 |

4.7 |

3.3 |

6.1 |

|

1986 |

16 |

15 |

4.7 |

3.4 |

6.3 |

|

1987 |

16 |

15 |

4.9 |

3.4 |

6.2 |

|

1988 |

16 |

15 |

4.9 |

3.6 |

6.5 |

|

1989 |

17 |

15 |

4.9 |

3.7 |

6.9 |

|

1990 |

18 |

15 |

5.0 |

3.9 |

7.1 |

|

a For detailed definitions and data sources, see Levit et al. (1991), especially Table 2 and accompanying discussion. b For detailed definitions and data sources, see Levit and Cowan (1991), especially Table 4 and accompanying discussion of tables and revisions in methods. c For detailed definitions and data sources, see Levit and Cowan (1991), especially Table 3 and accompanying discussion of tables and revisions in methods. SOURCE: U.S. Health Care Financing Administration, Office of the Actuary, and other sources, as presented in Levit et al. (1991). |

|||||

payments on an open-ended fee-for-service reimbursement basis), tax policy, and growing administrative costs (including malpractice costs).

Although international comparisons can provide a useful context for discussion, they can also be misleading, given the different ways in which nations provide health care and report health care spending and the complexities in calculating appropriate exchange rates. Table 1.3 presents trend data for six advanced industrial countries using three different measures of health spending: total health expenditures as a percentage of gross domestic product;1 an index (1970 = 1.0) of the cumulative change in per capita health spending (in national currencies); and per capita spending denomi-

FIGURE 1.1 Percentage of expenditures for health services and supplies, by payer, 1965 to 1990. See Table 1.2 for description of differences in categorizing of public and private spending. SOURCE: Based on analysis by the Health Care Financing Administration, Office of the Actuary; data from the Office of National Health Statistics as presented in Levit and Cowan, 1991. (The legend for this table in the source document inadvertently switched the labels for the business and public spending curves [HCFA, personal communication, June 4, 1992].)

nated in U.S. dollars. The United States stands out for its high overall level of health care spending, although other countries have generally shared the experience of rapid growth in per capita spending in recent decades. This country is also noteworthy for the relatively low proportion of total health care spending that is accounted for by public sources. That figure is just over 40 percent in the United States (with workers' compensation counted as public spending) versus 95 percent in Norway (the highest), 87 percent in the United Kingdom, and over 70 percent in France, Germany, and Japan (Schieber and Poullier, 1991).

The trends in U.S. health care spending have focused national attention on the question: what contribution do such high and growing expenditures make to the health status and quality of life of the U.S. population and the productivity of its work force? To date, health services research has not documented this contribution very precisely, but it has raised serious questions about the appropriateness and effectiveness of many health care services. These questions have prompted government, employers, and others

to seek better methods for judging the value of specific medical services, assessing the performance of health care providers, and evaluating whether medical resources—from surgery to pharmaceuticals—are appropriately priced by existing markets and practices.

Although employers both here and abroad often have an important role in financing health benefits, U.S. employers are unique in the discretion they have in determining whether and how to offer health coverage to current and former employees and their family members. This voluntary system of employment-based health insurance has helped bring many Americans advantages that may not be so widely experienced elsewhere. It has encouraged creativity in the design of health benefit plans to suit different preferences and circumstances. Some major employers have played a visible role in the movement for more research on the outcomes of medical care and for more accountability from providers for the cost and quality of the care they offer. In addition, some have used their purchasing power and skills to reinforce consumers' and patients' efforts to articulate and follow through on demands that health plans be sensitive to enrollees' concerns, questions, and problems. The growth and structure of employment-based health benefits (including the methods used to pay for medical care) have undoubtedly been important—albeit hard to document—stimuli for the advances in biomedical science, medical education, and medical services and technologies. These advances have made the U.S. health care system overall the most technically and clinically sophisticated and dynamic in the world.

Moreover, despite widespread public concern about health care costs and the problems of the uninsured, most of those with employment-based health benefits find them satisfactory or highly satisfactory and rate them most important among workplace benefits. When a recent public opinion survey developed by the Employee Benefit Research Institute and the Institute of Medicine asked who should bear the most responsibility for providing health benefits for full-time employees and their dependents, 48 percent of those surveyed identified employers, 31 percent the federal government, 14 percent individuals, and 3 percent said "all the same" (Appendix A). Employers too appear to favor a continued employer role—though generally not a mandatory one—rather than a fully public system of health coverage (Cantor et al., 1991). Although the public is ambivalent about the desirability of many government actions, they clearly favor government requirements that employers provide health benefits for full-time workers and dependents (Appendix A).

On the other hand, countries that leave employers with little but a statutory financing role in health benefits are afflicted less or not at all by issues that greatly worry decisionmakers here—for example, millions of working people without health benefits, high administrative costs and com-

TABLE 1.3 Selected International Comparisons of Health Spending, for Selected Years, 1970 to 1989

|

|

Canada |

France |

Germany |

||||||

|

|

%GDPa |

NPCSb |

US$c |

%GDP |

NPCS |

US$ |

%GDP |

NPCS |

US$ |

|

1970 |

7.1 |

1.0 |

274 |

5.8 |

1.0 |

192 |

5.9 |

1.0 |

199 |

|

1975 |

7.2 |

1.96 |

478 |

7.0 |

2.21 |

365 |

8.2 |

2.12 |

422 |

|

1980 |

7.4 |

3.63 |

806 |

7.6 |

4.60 |

656 |

8.5 |

3.16 |

749 |

|

1985 |

8.5 |

6.46 |

1,315 |

8.5 |

8.61 |

991 |

8.6 |

3.98 |

1,046 |

|

1986 |

8.8 |

7.08 |

1,427 |

8.5 |

9.31 |

1,036 |

8.5 |

4.16 |

1,082 |

|

1987 |

8.8 |

7.67 |

1,507 |

8.5 |

9.82 |

1,088 |

8.6 |

4.34 |

1,139 |

|

1988 |

8.6 |

8.27 |

1,581 |

8.6 |

10.63 |

1,173 |

8.9 |

4.72 |

1,250 |

|

1989 |

8.7 |

8.97 |

1,683 |

8.7 |

11.57 |

1,274 |

8.2 |

4.63 |

1,232 |

|

1970-80d |

|

13.8 |

|

16.5 |

|

12.2 |

|

||

|

1980-89d |

|

10.6 |

|

10.8 |

|

4.3 |

|

||

|

1970-89d |

|

12.2 |

|

13.8 |

|

8.4 |

|

||

|

a Percentage of gross domestic product. b Growth in nominal per capita health spending. Index year is 1970. The value for later years is 1.0 plus the percentage increase in spending over 1970. Thus, the 3.63 figure for Canada in 1980 means that per capita spending in Canada in 1980 was 263 percent higher than in 1970. |

|||||||||

plexity, and insurer refused to cover high-risk individuals. Because health coverage is not portable (i.e., does not continue automatically from job to job), many U.S. workers feel locked into jobs they would rather leave. Increasing numbers worry that unilateral actions by their employer will put them and their families into the ranks of the uninsured. Small employers face many difficulties in providing any coverage at all. Many larger employers are now dubious about their capacity to manage costs, anxious about legal liability that could arise from some of their cost containment measures, and worried that their health benefit costs make them less competitive. In addition, state officials are frustrated because federal laws limit their ability to regulate (directly or indirectly) the health benefits offered by self-insured employee benefit plans and complicate programs to finance care for the uninsured, underinsured, and uninsurable. Rounding out the litany of disaffected parties, health care practitioners and institutions object to what they see as misguided and ineffective bureaucratic micromanagement of medical practice generated by employer, insurer, and government efforts to control costs and increase accountability.

For many, the most troubling element in national comparisons is not that the United States is different or even more expensive. Distinctiveness is often a matter of pride, as are high expenditures for a socially valued

|

|

Japan |

United Kingdom |

United States |

||||||

|

|

%GDPa |

NPCSb |

US$c |

%GDP |

NPCS |

US$ |

%GDP |

NPCS |

US$ |

|

1970 |

4.4 |

1.0 |

126 |

4.5 |

1.0 |

146 |

7.4 |

1.0 |

346 |

|

1975 |

5.5 |

2.51 |

252 |

5.5 |

2.49 |

272 |

8.4 |

1.79 |

592 |

|

1980 |

6.4 |

4.72 |

515 |

5.8 |

5.74 |

454 |

9.3 |

3.35 |

1,059 |

|

1985 |

6.5 |

6.30 |

785 |

6.0 |

9.10 |

658 |

10.6 |

5.65 |

1,700 |

|

1986 |

6.7 |

6.66 |

828 |

6.0 |

9.79 |

697 |

10.8 |

6.08 |

1,813 |

|

1987 |

6.8 |

7.10 |

907 |

5.9 |

10.75 |

747 |

11.1 |

6.62 |

1,955 |

|

1988 |

6.7 |

7.47 |

978 |

5.9 |

11.81 |

793 |

11.3 |

7.32 |

2,140 |

|

1989 |

6.7 |

7.79 |

1,035 |

5.8 |

12.85 |

836 |

11.8 |

8.12 |

2,354 |

|

1970-80d |

|

16.8 |

|

19.1 |

|

12.9 |

|

||

|

1980-89d |

|

5.7 |

|

9.4 |

|

10.3 |

|

||

|

1970-89d |

|

11.4 |

|

14.4 |

|

11.7 |

|

||

|

c Per capita health spending in denominated U.S. dollars. d Compound annual rate of growth over the time period. SOURCE: Schieber and Poullier, 1991. For further definitions and descriptions, this reference should be consulted. |

|||||||||

service. No pride, however, can be derived from the fact that although this country spends so much more on health care than other countries (nearly 40 percent more per capita in 1989 than the second ranking nation, Canada), it leaves a larger fraction of its population uninsured and has not achieved clearly superior health outcomes.2

People in other economically advanced nations are not without concerns about their systems for financing and delivering health care. They, too, worry about increased health care spending and about access problems

experienced by special population groups. These common concerns—shared by countries with quite different ways of organizing and financing health care delivery—suggest that some of the challenges are not primarily a function of particular national institutions. Instead, they may be related to other influences, such as the developments in biomedical science and medical technology that affect a nation's definition of what constitutes appropriate health care.

Policymakers elsewhere are weighing the merits of market-based approaches versus communitywide regulatory responses to costs, access, and quality, and some are considering the adoption of hospital payment methodologies, quality assessment tools, and other innovations developed here. Nonetheless, few if any of these nations seem likely to assign employers a major role beyond financing coverage. All appear certain to retain an explicit or implicit social contract that links individuals to each other and their government in a collective agreement that basic health services should be available to all and that those who are better off—economically, physically, and mentally—should assist those who are less well off. No such social contract links Americans.

OVERVIEW OF REPORT

The rest of this chapter discusses the rationale for this study, explains how it relates to the debate over health care reform, and defines the key concepts and terms used in this report. This last discussion is lengthy and involves sometimes tedious or intricate distinctions among terms that are used in widely differing and often confusing ways by insurers, health services researchers, and policymakers. An understanding of the report's terminology is necessary for a clear understanding of the analyses and recommendations presented in later chapters.

In Chapter 2, the committee recognizes the importance of understanding the historical roots of current conditions and debates. It examines how voluntary employment-based health benefits have evolved in this country over the past century and how various efforts to establish state or national health insurance programs have fared. Both this chapter and Appendix B discuss the Employee Retirement Income Security Act of 1974, which has significantly increased the discretion employers have in structuring and administering their health benefit programs.

Chapter 3 provides an overview of employment-based health benefits today: who is covered for what services at how much cost and under what conditions? In Chapter 4, which includes a case study, the focus turns to the decisions and tasks faced by employers as they manage a program of health benefits and some of the implications of these decisions for employees and health care providers. Chapter 5 examines the problems of risk

selection and risk segmentation created when individuals, employers, or others can choose whether or not to offer or accept health coverage or whether to choose one health plan over another.

Chapter 6 considers the issue of health care costs—how to understand them, what employers and others are doing to control them, and why it is important to focus on the value obtained for health care spending rather than simply on total expenditures. The final chapter presents the committee's findings on the key features, strengths and weaknesses of the current system, possible directions for change, and research issues.

WHY THIS STUDY?

Given the virtual blizzard of recent reports and proposals on health care reform, what purpose is served by an Institute of Medicine study of employment-based health benefits? The principal justification for this study, which was requested by the Senate Appropriations Committee, is that surprisingly little exists in the way of a broad analysis of the strengths and weaknesses of organizing health coverage around the workplace on a voluntary basis. The problems facing the uninsured and the small employer and its employees have been fairly thoroughly described, although not resolved. However, the core of the employment-based system—large employer groups—has been less systematically examined. The situations of both large and small groups and the interrelations between them need to be considered.

A broader examination of employment-based health benefits is certainly relevant for public officials, private groups, and policy analysts who wish—for whatever reasons—to build on the present system. Even for those who believe in fully public insurance, this study may suggest some advantages in employment-based insurance that they are overlooking or some defects that are unwittingly being built into their proposals for change. The same holds true for those devoted to the kinds of market solutions that would abandon employment-based health benefits in favor of a focus on the individual consumer. Should particular advocates not find any reasons to modify their own proposals, they might nonetheless profit from a clearer understanding of what they propose to replace, the transition questions posed by such replacement, and the potential for seriously overstating the comparative advantages of their favored strategies.

Relation to the Debate over Health Care Reform

It was in the highly charged context of an intensifying national debate about health care reform that this study was conducted and the committee's report developed. This committee, however, was not charged with developing a proposal for general reform in health care financing and delivery, nor

was its mission to prepare a comprehensive description and analysis of such proposals. (The preface discusses the origins and activities of this study in more detail.) There is no shortage of such descriptions and analyses by other parties (see, for example, Blendon and Edwards, 1991; Blue Cross and Blue Shield Association, 1991b; CBO, 1991a; EBRI, 1992b; Association of American Medical Colleges, 1992). Because there is, however, little in-depth analysis of voluntary employment-based health benefits, the committee chose this as its focus, believing that such analysis would be useful to analysts and policymakers regardless of their views about health care reform.

Members of the committee disagreed among themselves about the merits of continuing to rely on voluntary, workplace-based health coverage, as is discussed further in Chapter 7. Such differences of opinion notwithstanding, the committee has attempted to devise analyses and findings related to employment-based health benefits that are cognizant of and relevant to the debate over health care reform.

In this report, the U.S. system of voluntary employment-based health benefits is from time to time compared with other nations' systems and with proposals for health care reform in this country. When this report describes another country's system or a particular reform proposal as employment-based, it means that employers have or would have some significant discretion in designing or managing health benefits for their employees. A governmentally mandated health insurance program in which the employer's involvement is limited to administering a payroll tax and handling routine paperwork is employment-based in only the narrowest technical sense. As a system or proposal moves away from this limited role and adds discretion for the employer, there is a grey area where analysts can and do disagree in their categorizations.3,4

Health care reform proposals and health care systems in other countries vary greatly in important details. Some of the major dimensions of varia-

tion include whether the approach (1) is compulsory or voluntary; (2) if compulsory, mandates employer provision or individual purchase of coverage; (3) provides for competitive private health plans or a single public plan; (4) involves extensive or limited regulation; (5) perpetuates, expands, or eliminates separate means-tested, age-related, or other special public programs; (6) continues a significant role for some or all employers; (7) places the major direct financing burden on the individual, the employer, or the government; (8) relates an individual's cost for coverage to his or her income; and (9) relates the individual's cost for coverage to his or her health status or expected level of medical expenses.

Although specific proposals for U.S. health care reform may involve various combinations of positions on these dimensions, some combinations are more common than others in the most frequently mentioned proposals (see detailed comparisons of a variety of specific proposals in the references cited earlier in this section). Broad alternatives include

-

compulsory public or statutory plans, which (1) cover all or most of those in an area under a single program and (2) rely on employers for some financing but little else (example: Canadian system);

-

systems based on competitive markets for the mandatory individual purchase of insurance with little or no incentive for employer involvement and limited regulation (examples: Heritage Foundation proposal; Responsible National Health Insurance plan);

-

systems based on competitive markets for the mandatory or voluntary purchase of insurance by individuals with extensive regulation of competitors and variable roles for employers and public programs (examples: several "managed competition" proposals; proposal from California Insurance Commissioner John Garamendi);

-

systems that either mandate employer-provided coverage or give employers the option of either providing coverage or contributing to a public program for their employees (examples: Hawaii for the first; Pepper Commission for the second); and

-

voluntary systems that expand subsidized or public coverage and extend regulation of insurance practices (examples: Steelman Commission; U.S. Chamber of Commerce).

With the exception of access, many of the central questions about alternative systems are not expressly touched on by the above distinctions. For example, most comprehensive proposals include—indeed emphasize—specific cost containment strategies, processes for monitoring the quality of care, and principles for determining what care will be covered.

Proposals that are otherwise quite different may be similar in some respects. For example, formal procedures to define covered benefits based on evidence of effectiveness appear in proposals for single national health insurance programs and so-called managed competition proposals (third option above). Similarly, some form of global budgeting has accompanied proposals for mandatory employment-based coverage and proposals for a single health program.

Another IOM report (forthcoming) discusses quality, cost, financing, and other issues that should be addressed explicitly in specific proposals for health care reform. This report takes a different approach in Chapter 7, one more inductive than deductive. It identifies steps policymakers could take to ameliorate some of the problems with the current system of voluntary employment-based health benefits.

Issues and Concerns

To guide its examination of voluntary employment-based health benefits, the committee identified several key issues and concerns. Briefly stated, these issues and concerns involve

-

access to appropriate health care services and improved health status;

-

risk sharing for medical care expenses among the well and the ill, the high-cost and the low-cost individual, and those at higher and lower risk of future expenses;

-

portability of medical expense protection and continuity of medical care for individuals;

-

desirable innovation in health care, biomedical science and technology, and health care administration;

-

privacy of information about individual health status and health benefit costs and potential misuse of that information;

-

total health care costs, costs for health services of no or limited value, and overall productivity of resource allocation; and

-

complexity for individuals, employers, practitioners, and others.

Although the emphasis in this report is on voluntary employment-based health benefits rather than the entire system of health care financing and delivery in the United States, it was often difficult to separate the role of such benefits from other factors. This was particularly true in the examination of health care costs and cost containment strategies.

The committee did not assume that equity in health coverage ensured equity in access to health care nor that either coverage or access ensured equity in health outcomes.5 Moreover, equity in coverage for those with some attachment to the work force does not imply equity for those without such an attachment.

In addition, the committee recognizes that trade-offs among objectives must be considered in any evaluation of the present system and alternatives to it. Improving access to health coverage and health care for workers now uninsured or underinsured will tend to mean increased costs, even if actions are taken to reduce unnecessary care, limit payments to providers, and otherwise try to contain some kinds of costs.

The committee endeavored to consider the perspectives of the individual, the employer, the health care provider, and the public policymaker and also tried to understand the particular values that inform these views. Each perspective reflects broadly different experiences, needs, philosophies, and objectives. Nonetheless, much variation exists within each category, and substantial overlap is present across categories.

For example, in some respects, large employers may have less in common with very small employers than with their own employees. Individuals who are insured undoubtedly differ from the uninsured in the nature and intensity of their concerns about employment-based benefits, and any given individual may reflect one set of concerns when considering the purchase of insurance and another when faced with an acute need for health care. Likewise, leaders of health care institutions not only differ among themselves but also may experience role conflicts as they act as provider, employer, health insurer, or consumer. The same holds true for a large number of other firms and service organizations involved to some degree in the provision of health-related services and products. With over 12 percent of the gross domestic product generated in the health sector, many organizations, communities, and governmental bodies become very "anxious" about prospective adjustments in resources committed to health care. After all, if health care costs are high, so are health care incomes, and those who receive them can be expected to protect their positions. To the extent that public policymakers strive to represent the interests of different groups, they naturally find conflicting as well as common ground.

Policymakers here and elsewhere face difficult and fundamental questions about alternative uses of limited resources and about directions for health care policy. One of the most explosive is: how is health care to be rationed (whether explicitly or not) in a society that is unable or unwilling to pay for all medical services that contemporary medical science can pro-

vide? How will the paradox be dealt with that consumers, providers, and policymakers desire high-quality medical care but disagree about the proportion of national resources that must be transferred to the health sector to achieve this result? How will public policy deal with the tendency for new developments in medical science to increase the demand for care and its costs? Can technological innovation be maintained but directed in greater part to areas in which significant gains in health outcome or other values can be achieved at lower cost? These questions are critical to decisions about the specific future role of employment-based health benefits.

At this time, broad goals for improved access, equity, effectiveness, and efficiency in health care garner general endorsements but no clear agreement on how the tensions among these goals should be resolved. The country is not yet near consensus on the specific policies and actions needed to move from general goals to actual improvements in the performance of the health care system.

KEY CONCEPTS AND TERMS AS USED IN THIS REPORT

The language of insurance can be quite arcane, and insurers, researchers, and others do not always use terms in the same way when they discuss the roles and functioning of insurance. Even a single source can switch between more and less technical usage, treat technically distinguishable terms as synonyms, or fail to make definitions explicit. A number of concepts and terms that are particularly central to this report and its analyses are discussed below. Others are discussed in later chapters, in particular, Chapters 3 and 5. In addition, a glossary at the end of this report provides definitions for other terms the committee thought might not be widely understood or might be understood somewhat differently among readers of this document.

Early on, the Institute of Medicine decided to describe this project as a study of employment-based health benefits, not as a study of employment-based health insurance. One rationale was to reinforce the project's emphasis on the role of the employer—not the insurer or other agent—as the major private sponsor and purchaser of health benefits. This rationale notwithstanding, much of this report is about insurance in one form or another.

Employment-Based Health Benefits

Although this report often refers to "an" employer as sponsor and decisionmaker, the reality is more complex than implied by this linguistically convenient phrasing. For example, several million individuals are covered by multiple employer plans of various sorts, some of which are administered jointly by representatives of the employers and employees

(see Chapter 2 for further discussion). In addition, some unions sponsor health benefit programs, and many employers negotiate their health plans with unions. Other employers make unilateral benefit decisions, with direct employee input ranging from nil to modest.

Health benefits for most of those under age 65 are defined as employment based because employers in the United States, particularly large and nonunionized employers, have substantial discretion in making decisions about the existence and features of health benefits for workers and their families. Even small employers have considerable discretion in a few areas such as deciding whether or not to offer health benefits or how much to pay of the cost of any coverage offered. As noted earlier, a governmentally mandated or statutory health insurance program in which the employer's involvement is limited to administering a payroll tax and handling routine paperwork is employment-based in only the narrowest technical sense.

Social Insurance and Private Insurance

Definitions of social insurance vary.6 For purposes of this report social insurance for health care expenses is broadly and perhaps ideally defined as a national policy, backed by statutes, with the following features (see, for example, Glaser, 1991; Saltman, 1992):

-

Most or all individuals are protected against the costs of health care, most often under arrangements that are either compulsory or automatic.

-

The amounts that individuals pay for this protection are not explicitly linked to their use of or need for care.

-

A standard, fairly comprehensive level of benefits or services is available to covered individuals without regard to income.

-

Most covered individuals make earmarked contributions for coverage through payroll taxes or similar devices.

-

Government tax and other policies directly or indirectly generate the revenues and subsidies to make all this possible, in particular, for the poor.

To use several other important concepts, social insurance—in ideal form— is universal (or very nearly so), compulsory or automatic (or very nearly

so), largely uniform in basic benefits, and community rated (that is, priced without regard for individual characteristics such as age or health status). Purely means-tested programs, such as Medicaid, are not covered by the definition. Also, direct government provision of health care, such as is undertaken in Britain, is generally not considered to fit the definition of social insurance. In addition, Switzerland, where all but 2 percent of the people are covered under subsidized voluntary insurance or canton-based compulsory insurance (Glaser, 1991), has no explicit national policy of automatic or compulsory insurance and therefore does not conform.7

Under a social insurance scheme, private organizations can be involved in program administration and health care delivery. In addition, private health insurance may coexist with social insurance. For example, in Germany, higher-income individuals, who are not required to join the statutory sickness funds, may purchase coverage privately, and members of sickness funds may also supplement their statutory health benefits with additional private coverage.

The United States lacks a social insurance policy for health care expenses except for certain limited groups (primarily the elderly). For most of those under age 65, health insurance is not compulsory or automatic. Many are unwillingly without coverage, and some choose not to protect themselves when they could. Individuals or groups with high past use or high expected future use may be charged more for coverage with the implicit or explicit backing of public policy. Public policy also allows substantial competition and variation among private insurers with respect to enrollment, benefits, premiums, and other matters.

Small and Large Groups

Much of the debate over health care reform involves the problems faced by small employers and their employees in obtaining and affording health insurance. In actuarial terms, smallness is a problem because the predictability of expenses for health care increases as a function of group size, and insurance depends on such predictability. In policy terms, small groups are often seen as more economically vulnerable and less administratively capable of dealing with regulatory requirements than larger employers and therefore as warranting special policy treatment. Many laws do not require compliance by employers below a certain size, which often but not always is defined as 24 or fewer employees. On the other hand, for data collection

purposes, the Department of Labor uses 99 or fewer employees as the break point for small groups, and some insurers may not experience-rate or even sell to groups with fewer than 100 or 200 members. For insurance and public policy purposes, coverage for an entity with only one or two employees is usually categorized as individual rather than small-group coverage.

In sum, definitions of small and large groups are somewhat arbitrary and contingent on the concerns of those doing the defining. In this report the definitions used in major sources of data are indicated as appropriate.

Risk, Insurance, and Benefits

Risk is the chance of loss; its essence is uncertainty (see, generally, MacIntyre, 1962; Donabedian, 1976; Mehr, 1983; HIAA, 1992). In the case of health insurance, risk relates to the chance of health care expenses arising from illness or injury.8 People attempt to deal with such risk in many ways: by avoiding it (no hang gliding), reducing it (no french fries), carrying it themselves (no claims for small expenses), or transferring it. Insurance is widely used by individuals and organizations as a mechanism for transferring risk.

In order to function as a method for transferring and spreading risk, insurance requires the pooling of individuals at risk. What is highly uncertain for a single individual can often be predicted reasonably well for a reasonably large group. When individuals buy insurance, they accept a predictable "small loss (the premium) in order to lessen or eliminate uncertain heavy losses; average loss is substituted for actual loss" (MacIntyre, 1962, p. 20).

In conventional terms, insurance may be defined as the protection against significant, unpredictable financial loss from defined adverse events that is provided under written contract in return for payments (premiums) made in advance. The contract may be with an individual or a group.

Benefits are conventionally defined as the amounts payable for a loss under a specific insurance contract (indemnity benefits) or as the guarantee that certain services will be paid for (service benefits). Here, health benefits may broadly refer either to covered services or to the amount of financial protection available. The latter is typically expressed with reference to various financial limits such as deductibles, coinsurance, copayments, and maximum amounts payable.

As used in this report, employment-based health benefits include conventionally insured programs and programs that are fully or partly self-insured by employers (who retain risk and cover net losses through internal resources). Self-insured programs may be fully or partly administered by the employer, by an insurer offering administrative services only (ASO), or by an independent or third-party claims administrator (TPA). In addition, employment-based benefits may come in the form of health services provided directly through employer-owned clinics or other arrangements.

The term prepayment has sometimes been used interchangeably with the term insurance. Other times, it is reserved for arrangements whereby a health plan agrees to provide defined health services (as a health maintenance organization has traditionally done) or to pay for defined health care services (as most Blue Cross plans have traditionally done). In these latter senses, prepayment is contrasted with indemnity insurance, in which the agreement is to make defined cash payments for expenses incurred.

The term health plan has no unique technical meaning. It is sometimes used interchangeably with health benefits, but it also incorporates the notion of management or sponsorship, particularly as reflected in the growth of geographically delimited networks of health care practitioners and institutions, utilization management programs, and similar elaborations on older insurance programs. This report adopts a broad use to cover traditional insurance and network arrangements. When referring generally to the health plan or plans offered by employers, this report sometimes uses the term health benefit program.

Insurable Events

A central insurance concept is that of the insurable event (Faulkner, 1940; MacIntyre, 1962; Donabedian, 1976). Conventional insurance principles describe an insurable event as one that is (1) individually unpredictable and unwanted, (2) relatively uncommon and significant, (3) precisely definable and measurable, (4) predictable for large groups, and (5) unlikely to occur to a large portion of insured simultaneously.

The relatively slow development of private health insurance (in comparison with private fire and life insurance) and its current complexity can in part be explained by the deviation of medical care and associated expenses from all but the last of these principles. Medical care use is not necessarily beyond control by the insured, unwanted, uncommon, or precisely definable. Several examples can illustrate the insurability problems presented by quite ordinary aspects of medical care:

-

Some services such as physician office visits are not individually unpredictable and may be very much at the discretion of a patient; patient preferences certainly influence courses of treatment for many medical problems.

-

Some services such as a yearly physical or an extra day in the hospital following surgery or childbirth may be welcome to some patients.

-

Although some insured services (e.g., major surgery) are relatively uncommon, others (e.g., physician visits and prescriptions) are not.

-

Determining the specific content, value, or necessity of a particular medical service is a continuing challenge, as demonstrated by the growth of utilization management and technology assessment programs, the ongoing refinement of nomenclature systems and payment schedules for physician services, and similar developments.

-

The promotion or mandating of coverage for routine, relatively low cost preventive services and for events that may be planned, such as pregnancy, has led to further departures from the principle of insurance for significant unpredictable losses toward a policy of entitlement to coverage for a wide array of services.

Moral Hazard, Biased Selection, Risk Segmentation, and Underwriting

The features just described make insurance for health care particularly vulnerable to what is sometimes called moral hazard, a value-laden term for the tendency of insured individuals to behave differently from uninsured individuals (Donabedian, 1976; Mehr, 1983; Arnott and Stiglitz, 1988, 1990). In its most traditional usage, moral hazard is identified with an increased probability of loss due to various kinds of unethical or imprudent behaviors on the part of an insured individual. These behaviors include extravagance, malingering, indifference to accident avoidance, claims fraud, dishonest failure to disclose a known hazard as part of an application for insurance, and imprudent failure to purchase insurance until the hazard is at hand (e.g., one's house is burning down).

In the health insurance arena, moral hazard has been most widely used to label a rather different behavioral effect of insurance: the propensity of insured individuals to seek and accept more medical care than they would if they lacked insurance. Such higher use of health care by the insured need not be the result of profligacy, carelessness, or other morally dubious behavior on the part of patient or practitioner, although it may be in some instances. It is no easy task for even the most well-intentioned of patients, clinicians, and health insurers to distinguish between necessary and unnecessary care, and unequivocal evidence about the effectiveness of specific services for special problems is in short supply. Furthermore, discussions of the problems of the uninsured and underinsured make clear that increased access to and use of needed care are central objectives of providing health coverage to these individuals. In this report, the term moral hazard is avoided in favor of more neutral references to the expected (but difficult to

control or regulate) effect of health insurance on the demand for and supply of medical services.

Nor does this report apply the term moral hazard, as is sometimes done, to the tendency of individuals to make choices among different health insurance plans based on which plan best meets their needs. In this usage, the hazard for insurers is that individuals make health insurance choices using knowledge of their risk status that is more complete than that available to (or even sought by) insurers. Those who expect to need dental care or complicated surgery may choose health plans with coverage to fit these needs and may typically do so without behaving dishonestly or deceptively. Those who do not expect to need care may take a chance on a high-deductible health plan without being irresponsible or imprudent. In this analysis, individuals making these kinds of decisions are regarded as rational consumers, although the combined effect of these decisions may have consequences such as risk segmentation that many would regard as undesirable.

Whether characterized as moral hazard or rational decisionmaking, the behavior just described is one aspect of an especially difficult problem in health insurance, biased risk selection. Biased risk selection is a nonrandom process that occurs (1) when the individuals or groups that purchase insurance differ in their risk of incurring health care expenses from those who do not or (2) when those who enroll in competing health plans differ in the level of risk they present to each plan. When a health plan, an insurer, or—in some cases—an employer attracts a less risky or costly group than the average (or the competition), it has experienced favorable selection. A group with a more risky or costly membership has experienced unfavorable or adverse selection.

The committee does not view the term biased risk selection as pejorative, and it views the factors or behaviors contributing to biased risk selection (described further in Chapter 5) as sometimes desirable or at least acceptable and sometimes undesirable. Again, reasonable individual and organizational behavior can sometimes have undesirable social consequences. In any case, for the sake of simplicity, the remainder of this report refers just to risk selection.

For purposes of this report, risk selection is viewed as a process related to individual or group choices that is influenced by a variety of individual, employer, and insurer characteristics. Its most serious potential consequence— the clustering of higher-and lower-risk individuals in different health plans or the exclusion of higher-risk individuals from coverage altogether—is described here as risk segmentation.9 In other discussions, the terms are

often used interchangeably, but some use the term selection to describe individual behavior and the term segmentation to describe insurer practices.

Risk segmentation, in the sense used here, can also result from the strategic or competitive business practice of experience rating, wherein insurers offer better rates (premiums) to groups with lower claims experience (expense) than to groups with higher past or anticipated experience. Experience rating has largely replaced community rating, which—at its purest—rates all risks equally across a particular community.

Another kind of risk segmentation happens when larger, relatively low risk employers choose to self-insure and leave conventional insurers with populations more heavily weighted toward riskier (in the sense of less predictable) individual and small-group purchasers. In turn, risk segmentation can result within a self-insured group when employees are offered a choice of health plans.

To control, discourage, or preclude selective enrollment by high-risk, high-expense individuals, insurers have developed an array of underwriting practices to classify, price, and otherwise set the terms under which they select those they will insure. These practices include medical examinations and questionnaires that provide information about an applicant's health status or past use of care, required waivers of medical record confidentiality, limits or exclusions on coverage for preexisting health problems, exclusions or limits on coverage for certain types of businesses or industries, waiting periods before coverage applies, and higher rates for higher-risk categories of individuals or groups. It is these practices that have been targeted for modification or elimination by many proposals for small-group reform.

In this report the term risk rating is used to broadly describe the linking of an individual's health risk to some individual financial penalty or reward, whether it be a higher or lower premium or a rebate for low users of care or other approach. Chapter 5 considers risk rating as a business practice, a fairness issue, and a tool for behavior modification.

To control costs stemming from the effects of insurance on the behavior of consumers and providers, insurers and others have devised a variety of practices, in particular, requirements that individuals share part of the cost of using services covered by insurance. Chapter 6 describes these and other strategies to limit the use of health care, to control health care costs in general, and to relate both use and cost of care to its expected value in improving health status and function.

CONCLUSION

As the twenty-first century approaches, there is a widespread sense that the entire U.S. health care system, including the system of employment-based health benefits, needs significant restructuring. This perception has reinvigorated debates in the United States about the obligations of richer or

healthier individuals to help poorer or sicker individuals, the virtues of voluntary versus compulsory insurance, the role of the private versus the public sector in ensuring access to needed health care, and the effectiveness of market versus regulatory strategies to contain costs and ensure value. For some, the conclusion is that market forces are not being allowed to work and need to be strengthened by various regulatory changes (hence the term regulated or managed competition). Others conclude that market forces have not worked and cannot work given the nature of health care and health insurance and that existing market structures should therefore be replaced in part or whole by public programs of various sorts. For all, the current, central position of employment-based health benefits is a major factor to be reckoned with in considering the feasibility and specifics of proposals for health care reform.