9

Sectoral Views

The Research University

JOHN T. PRESTON

I am going to discuss the Massachusetts Institute of Technology (MIT), which unlike many universities is interested in intellectual property for a slightly different reason than you might imagine. We are driven by one goal, and that goal is to use intellectual property to see our technology embedded in products, thereby serving the public good. A secondary goal is to make money from patents. Serving the public good is important because universities such as MIT are funded to a first approximation by the U.S. government. Therefore, MIT's image is closely tied to the public benefit it can demonstrate from its inventions and ideas. Let me give you a couple of examples. When we look at technology transfer there are two possible strategies. We can say, "Let us heavily protect the technology with patents and then license the patents exclusively," or "Let us ignore intellectual property or diminish the value of intellectual property and transfer it for the public good at a relatively low cost." I am of the opinion that the cheaper it is to take a technology and get it to the market, the better it is to lower intellectual property rights and grant low-cost nonexclusive licenses. The more expensive it is to get the technology to the market, the better it is to patent and grant an exclusive license.

For example, if I invent aspirin today, and I publish the formula for

aspirin in Science magazine next month, without patenting, no company will spend $150 million going through Food and Drug Administration approval to commercialize aspirin knowing that the second company will not have to amortize the large investment. In the case of a novel pharmaceutical, one should generally patent inventions to commercialize them. However, if I develop a computer program such as X-Windows, where there is a relatively low cost to take that program from the point of development and get it embedded into products and out into industry, or when there is a desire to make it a standard, maybe the best thing to do is to license it for free. In fact, our license agreement for X-Windows has only one constraint. It costs nothing, by the way, but the one constraint is that you preserve MIT's name on the copyright notice. You can do anything else you want with it.

So I am coming from a slightly different point of view than most of the authors here, and I want to start by saying that I agree with about 90 percent of what John Armstrong says in Chapter 8, but I am going to discuss the 10 percent that I question, or disagree with.

Before I get into that, however, it is to look at some figures—important because they explain the economic incentives for commercializing technology. In other words, if we do not understand the driving motives for commercializing technology, we cannot create policy for intellectual property.

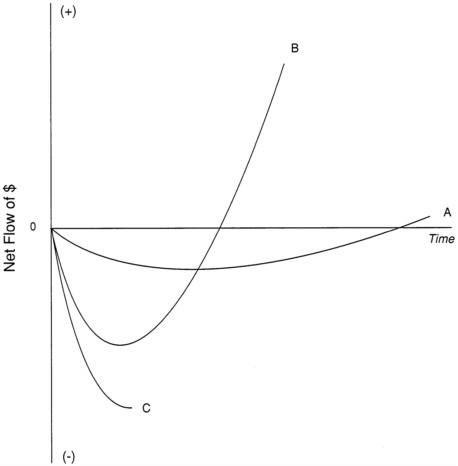

Figure 9-1 gives three scenarios for developing technology. In terms of the investment of money, the first scenario is curve A, which shows a very small investment of money over a long period of time to develop the technology. I call this the minimalist curve, and it is typical, quite frankly, of large U.S. companies. I am going to return to that point, but it is also typical of behavior when intellectual property is not a valuable asset to developing the technology.

The problem with curve A is (1) it gives a long window of opportunity for competition, and (2) the people running these businesses are spending too much time looking for money.

Curve B is the optimum curve in which significant resources are infused early on. If you have heavy protection of intellectual property, it drives your behavior more toward curve B. By the way, one thing this graph does not show is that if the total amount of investment to commercialize a technology is very small, it drives curves A and B closer together. This graph assumes that the total investment to get into the market is very large, which drives curves A and B apart. You can see that over a long period of time, curve B will make a lot more money than curve A. Japanese businesses are curve B companies because they sacrifice short-term profit for long-term gains and market share. Curve C is what happens when you throw too much money at a technology. You can actually corrupt the

FIGURE 9-1 Three Scenarios for Developing Technology

management of a company by giving them too much money. Often this leads to spending money on the wrong things. I would sell stock in any company that buys a corporate jet, for example. I call this the Taj Mahal syndrome.

The point I am making is that what we want to do is use intellectual property to drive people to invest more rapidly in developing the technology in the short term, like curve B, to capture the market and to get products on the market more quickly.

If you think about the behavior mode of U.S. companies, one of the problems with curve B is that in the short term you are losing money relative to the companies on curve A.

In other words, if I am a manager of a company that is investing in capital equipment, technology, patents, and intellectual property along curve B, how can I look like a hero? I can look like a hero by cutting all curve B

investments down to the least I can get away with and still look credible (curve A). I make more profit in the short term from a smaller investment, and I get promoted to destroy a bigger chunk of the company. I call this behavior the MBA syndrome. I confess that I am an MBA.

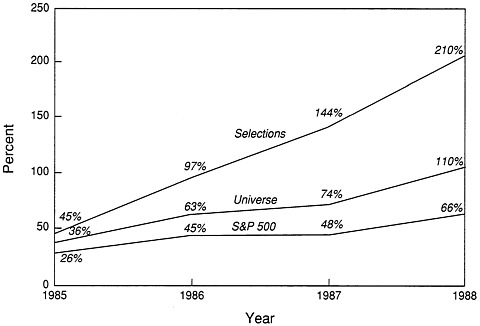

Figure 9-2 shows the stock performance of three groups of U.S. companies and demonstrates the importance of the curve B behavior mode. The lowest line is the stock performance of the Standard and Poor's 500 during the five years from 1984 through 1988. It went up 66 percent during this period. The group of companies right above it, called Universe, is a large group of companies chosen by a single criterion. Does one family own 10 percent or more of the shares of that company (e.g., Motorola, Corning, Ethyl, and DuPont)? IBM would have made it back in the 1970s when the Watson family owned more than 10 percent. The theory is that family companies are more willing to sacrifice short-term profitability for long-term gains, and in fact, the tax system in the United States drives them to sacrifice short-term profitability for long-term gains. Note that these companies outperformed the Standard and Poor 500 twofold during this period. I find that my license agreements tend to go to the Motorolas, the DuPonts, and the Ethyls, and not to the General Motors, and the reason is that they are willing to invest in intellectual property and commercializing technology more than General Motors and the broadly traded public companies.

FIGURE 9-2 Stock Performance of Three Groups of U.S. Companies

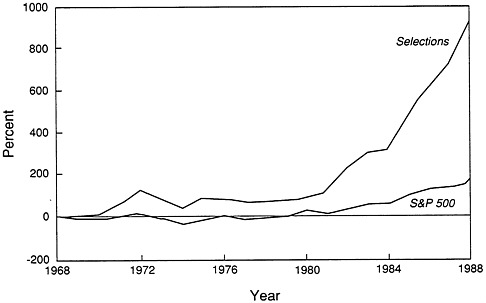

FIGURE 9-3 Cumulative Returns to Standard and Poor's 500 and Selected Family Managed Companies

Astonishingly, these data indicate stock performance twice as good as the Standard and Poor 500 in four years by that one single criterion. The "Selections" are publicly traded companies that (1) are 10 percent or more family owned like the Universe companies and (2) have significant family involvement in managing the company. There were actually 12 criteria for the Selections. I cannot give them to you because this work was done by an MIT alumnus who trades money for a living. He is Mark Cunningham, Vice President of Alliance Capital, and this is his competitive advantage. He has outperformed the stock market very regularly by a wide margin.

Figure 9-3 shows that the Selections outperformed the Standard and Poor's 500 by an order of magnitude (tenfold) over 20 years. When the market is doing well, they grow rapidly relative to the broadly publicly traded companies.

Now that we understand what is driving the development of intellectual property, let me discuss two of the things that John Armstrong mentions in Chapter 8. One is avoiding sui generis laws for intellectual property protection.

I disagree with this position because the crisper you make the laws, the easier it is for me to know whether I am infringing on an IBM product or IBM is infringing on one of mine.

The easier that is known or the crisper the laws, the better it is for the world economy because we spend less money litigating and hiring lawyers

to work in a gray area. Anything that we can do to change this gray area into something that is black and white would be, in my opinion, really, really good.

The other point I want to make is that in considering sui generis, and our entire intellectual property system, one of the things that has not been discussed is the method used to enforce intellectual property right (IPR) laws. When you go into court you can have one of two scenarios: You are going to win or you are going to lose. Yet you may be going in with a very gray issue—for instance, look and feel in the software area is a very gray issue in my opinion. Yet one company is going to come out as winner and one as loser. What should at least be a topic of discussion is whether or not mediation or some other form of resolving disputes should be attempted before going to court. I have seen mediation work in billion-dollar settlements, and I think it is a much cheaper approach.

The second point I wanted to make about Chapter 8 actually dovetails with this. Armstrong favors using the existing framework. The existing framework in which you go to court to enforce your patents and copyrights again creates a problem from my point of view in that it favors large entities over small ones. In other words, as a university or a small start-up company going to court against IBM, you can almost predict who is going to win based on who has the deepest pockets. Who is going to be able to enforce its position better? Who is going to be able to hire the best lawyers? Mediation would perhaps help improve the quality of settlements.

Let me just make one final point. Rather than discussing only matters on which I disagree with John Armstrong, let me mention some about which I agree.

The general conference does not present a balanced view on intellectual property in the following sense. When the originators of intellectual property such as IBM, MIT, and AT&T enforce strong intellectual property laws, developing countries can make an argument that this is unfair. However, if you look at it on balance, we are transferring much more for free than we are protecting. In other words, if I purchase a new computer from IBM and design a competitive computer without infringing any of IBM's patents, the cost for me to design that competitive computer is cheaper than the cost IBM paid in the first place to design its computer. We are not looking at enforcement of intellectual property in a balanced way. When IBM enforces a patent or when anyone enforces a patent, the balanced way to look at it is that the company is transferring much more for free in that product than it is enforcing in intellectual property.

The Federal Government

BRUCE MERRIFIELD

Some of you have heard of Hernando DeSoto, a Peruvian who has written a book based on a seven-year study of Latin American economies. The bottom line of the book is that the definition of an underdeveloped country is one in which the entrepreneurial function has been made illegal. You can immediately translate that to the former Eastern Bloc countries and to a lot of other centrally controlled countries around the world.

Unfortunately, you can also translate it to some of our big Neanderthal companies in this country in which the entrepreneurial function virtually has been made illegal, but the important understanding there is that before entrepreneurial activity can thrive, intellectual property protection is required. Moreover, incentives that will allow this to happen also are needed.

Basically the world has changed. Ninety percent of everything we know in the sciences has been generated in the last 30 years. It will double again in the next 15. Product and process life cycles in electronics have collapsed to a few years, 2 to 3, rarely more than 5 to 10 years in most other industries, making existing facilities and equipment obsolete often long before their useful lives can be realized. This process really accelerated after World War II, in 1945, when Vannevar Bush wrote a report to the president identifying research as the endless frontier. The National Science Foundation was funded, and since then, we have pumped about a trillion dollars into our academic infrastructure in this country, more than any other nation can even begin to match. As a result of that, last year we spent about $25 billion on basic research, 10 times more than any other nation, but it is the source, the wellspring, for all the critical technologies—the 20 or so critical technologies that will dominate the twenty-first century. Moreover, any company that is not investing, not only in incremental improvements in its existing operations (just to maintain current cash flow) but also, simultaneously, in next-generation technology, may not survive the next decade.

There is a basic paradigm shift here in management strategy which says that wealth can no longer be measured in terms of ownership of fixed physical assets that can be obsolete in a few years. Wealth now has to be measured in terms of ownership or at least time critical access to proprietary, knowledge-intensive, high-value-added, technology-driven systems.

It is important, however, that we understand the significance of this paradigm shift for the developing countries. We now have a historically unprecedented opportunity to raise the quality of life of every nation in the world through expansion of their economies. Moreover, this is in the enlightened self-interest of the United States and all developed countries. For example, in the Marshall Plan after World War II, we pumped billions of

dollars into Europe and Japan. Do you know who was the primary beneficiary of that investment? It was the United States because as those economies expanded, they offered tremendous opportunities for further investment and export.

As we help expand the developing country economies, the benefit will come back to us many times over. The problem is how to do that effectively. As we know, the communications revolution has created a situation in which capital can flow with the speed of light anywhere in the world. Technology also can follow rapidly wherever it is well treated, which means wherever intellectual property rights are respected.

Any rice paddy in the world can be transformed in 6 to 12 months by the big international construction people, to a state-of-the-art automated facility operated by $2 an hour labor. Nothing like this has ever happened before in history on this scale. Moreover, intellectual property protection can enhance foreign investment in these developing countries.

A model for doing this was developed at the U.S. Department of Commerce. We call it the Modern Marshall Plan. It is basically a joint venture arrangement in which a professionally trained function in each country first searches out emerging opportunities in the developing country. It is important to start with technology that interests the developing country. The second step is to match the foreign nation's company with a U.S. company to provide the missing skill, resources, and capabilities for jointly developing new technology. It is a win-win situation that multiplies the market potential, shares the risk in development, and accelerates development times.

The first pilot model with Israel has been remarkably successful. I think now there are more than 225 joint venture companies that have commercialized technology, with greater than $1 billion in sales, and something like a 90 percent success ratio. We have translated that model to a number of other countries. In India, for example, there have been remarkable results. Thirty-five out of thirty-six initiatives that were funded are now starting commercial operations. That is a pretty high success ratio. Basically every nation has latent entrepreneurial potential. India has 80 million educated people, and when that operation was established in Bombay (with some trepidation, admittedly), within about 6 weeks 300 proposals had swamped that office from all over India. Tremendously exciting things emerged, some of them low tech but many of them extraordinarily high tech in concept, and many of those are now going commercial.

This model, moreover, begins to create an incentive in the developing country for intellectual property rights because as indigenous companies develop their own technology, they understand the need for intellectual property protection, and put pressure on their own governments to provide that protection. This is important, because democracy cannot exist in a developing country without a small-business middle class that has a stake in

political economic stability. Therefore, the first step in developing democracy is to help develop the middle class. That is really what we have here in the United States. Few of us probably realize what a remarkable small business entrepreneurial culture we really do have. We have 15 million companies in this country. Of them 98 percent have less than 500 people; 90 percent fewer than 100 people. We have been, for the last decade, creating 650,000 to 700,000 new small businesses every year in the United States. Between 1980 and 1990, 20 million (net) new jobs were generated, 70 to 80 percent of them in these small businesses.

It is this bottom-up entrepreneurial revolution that creates much of the innovation and also the jobs. It is the small-business middle class that is needed to sustain democracy, and that is the model that can help us expand the economies of developing countries. It involves enlightened self-interest, and it is important that we provide incentives for this process.

The U.S. Agency for International Development (AID) provided the initial seed funding in India, and I think AID now sees this as a model for a much more extensive effort. The World Bank has yet to understand this model, but perhaps one day it will.

The important thing to understand, though, is that we now have historically unprecedented opportunities to raise the quality of life of all nations. For the first time in history we have point-to-point contact with any point on the surface of the earth. We can bring education through interactive video educational systems to any person on the earth. There are 4 billion people around the world just as smart as you and I who have never had access to education. We can change the global village in the next 25 years more than anyone might imagine, if we provide effective incentives and begin to develop the procedures that we well understand. We do not have to reinvent the wheel that has already been demonstrated. The Israel and India models can work with countries in the former Eastern Bloc, South Africa, and the Ivory Coast. It is currently operating in Chile and Finland. Even France has adopted the model, with rather remarkable success. It is called the FACET program over there.

To summarize, the opportunities we now have are historically unprecedented. We have the advanced technology that we need to share in international collaborative efforts, and as we do so, we will be the primary beneficiaries. I see a federal role here, which provides incentives, and a catalytic function that can help create such collaborative efforts on an international scale. I hope we can all work together to make that happen.

U.S. Industry

GEORGE W. McKINNEY III

I may be a relatively rare bird here in the sense that I have run three companies. I worked for a large company, Corning Glass Works, where I was in charge of business planning and corporate development; I worked for a major venture capital firm; and I was the first president of American Superconductor, a company that has been deeply involved in intellectual property with the high-temperature superconducting field. I currently spend 80 percent of my time doing venture activities and 80 percent running a company called Environmental Quality Corporation, which is involved in novel developments in the area of source reduction and pollution prevention.

In intellectual property I think there are significant differences between the mental images mentioned earlier that form the historical background, and the realities of the world we are in. I would like to raise five issues. I do not think anybody here is going to run out and cause change to occur, but these are areas in which we have to think about why change is not occurring. In that sense, I disagree with John Armstrong's position (Chapter 8) that we have a good system, it is working well, and we should not mess with it too much.

Let me raise the first issue. We talk about invention and intellectual property, and we think of the inventions of the world, which can be counted in the hundreds, in contrast to the vast majority of developments in intellectual property that are evolutionary.

Let us stop and consider the issue of true inventions. The reason I am concerned about this is that I deal with small companies, universities, national laboratories, and government laboratories, and I believe the majority of what is happening in this country is happening outside the large corporate structure. When we get big inventions, they do not necessarily happen in large companies. As somebody who lived through the early phases of high-temperature superconductivity in 1987, I was surprised to learn that there would not be a basic patent awarded to the Nobel Prize laureates from IBM who, in fact, invented oxide superconductors. No one, to my knowledge, questions that they invented a fundamental concept, but their application fails to meet somebody's definition.

I automatically say that this is a failure of the patent system because whether they would be willing, à la John Preston at MIT, to write an X-Window style (everybody is free to use) license is up to them. The idea that we have a system in which they could not achieve a fundamental patent is appalling.

I am concerned about this as we move to a first-to-file system. For a large company, the idea of $10,000 or $20,000 to file a patent is disruptive. I know at Corning when we had to file 50 to 60 patents to get into the optical waveguide business, that was a problem. For a small entrepreneur, an inventor, the idea of needing $15,000 or $20,000 up front, and taking all of this time (which should be going into research) to write an initial patent, is frightening.

I believe in first to file. I believe that we have to go to a global system that requires it, but I believe this country should lead in the development of—this is my first suggestion—a very simple, probably two-page description of an invention that will hold your place in first to file. This would cost nothing more than time, a notebook, and an application fee, and you would then have six months to finish up the due diligence. This application would be aimed primarily at true invention. One variant I would support is granting a window for filing to those who are ''first to publish."

The second area I would like to discuss is our emphasis on invention rather than application. The original purpose of patents, as discussed earlier is in fact to encourage application, encourage commercialization, and the economic benefits.

Anybody who is familiar with the Small Business Innovation Research program knows that we have spent millions of dollars encouraging people in this country to do research that they have no motivation to commercialize. We know that one of the reasons large companies are moving away from internal research is precisely because a great deal of that research has not been commercialized. As a country, our concerns focus on commercialization.

I come out of a manufacturing background during my first few years of working. We do not emphasize cost-effectiveness enough. We emphasize in our intellectual research the idea of the invention that increases the performance by an ever so small amount. That idea has been driven in this country by the fact that so much of our research has come out of military and defense-supported areas in which it was critical to have the ability to get that last decimal point of performance accuracy.

I worry about cost-effectiveness. At Corning I was involved in the development of the emission control substrate that is in almost all cars. It is coated with a catalyst that is used to remove noxious fumes.

The fact of the matter is if you imagine a complex structure 2 feet long with 500 holes that extend the entire length, made out of ceramic, you would not expect it to cost about $1.00 to make. That cost is possible if it is made in quantities of 10 million to 20 million; you could never do it by manufacturing quantities of 100 to 1,000.

So many of our technologies in this country are oriented the other way.

I believe we have to redevelop in this country the passion to get things applied.

For that reason I would like to see a patent system that extends the time period of a patent for applications and, if the originator of a patent is able to apply it, grants those extensions. I think this is key in concept to problems in the drug industry where, in fact, it takes so many years to get the drug to commercialization and the period has been entirely used up by then.

The third idea I would like to discuss is the issue of globalization in fact, not just in word. At Corning there was no question from anybody as far as I can tell, that Corning Glass Works scientists, led by Bob Maurer, developed the glass that makes optical waveguides as we know them and optical communications possible. If someone wants to challenge me on that scientific fact, they are welcome to do so.

Those patents were issued in the United States seven years before they were issued in Japan. During those seven years they went unissued in Japan, Sumitomo was able to (1) go into manufacturing using an illegal process and (2) develop a competing process that allowed it to stay in business.

I consider that inexcusable—a failure of the patent system. I would recommend strongly, if anybody has the ability to make it happen, that there be a system in which, within two years of issuance by the first country, there is a presumption of issuance in all of the treaty countries.

The fourth concept I would like to discuss is the real confusion between evolutionary minor developments, which are so important to businesses, and inventions. The vast majority of these evolutionary developments are not inventions. They are things anybody who is an expert in the field could have done if he put his mind to it, and in some cases, they are being done simultaneously.

This is also an area in which small companies have problems in competing with big companies. When I was a managing partner of American Research and Development, one of our portfolio investments was a company called Fusion Systems. Those of you who know intellectual property will recognize Fusion as the company that makes ultraviolet (UV) lamps and has had a long-standing fight with Mitsubishi. There is no question again that Fusion invented the concept of the modern high-intensity UV lamp. Mitsubishi got an early example of it, proceeded to reverse engineer it, and then patented every variant imaginable in Japan. It went to Fusion and said, "If you want to sell in Japan you need to cross-license this—by the way, that includes rights to sell in the United States."

I consider that to be an inexcusable failure of the world patent system. I think the only benefit that should come from these minor variations is permission to compete, if you own the basic technology. I would like to see

patents for minor developments done away with. It would certainly simplify the system.

The last issue is a deep concern as we have faster and faster paces of technology with flurries of inventions. I was in the superconducting field at its beginning. I can point to one intellectual property case in which four patents were filed within 30 days by four competing companies for the same precise invention, all of which were done independently. What benefit is served to anyone by awarding that patent to the person who happened to file it on March 28, versus the person who filed it on March 29, or the person who filed it on April 10 or April 15? I would strongly advocate that as long as independent invention is involved and there is no publication cycle in between, that there be a window in which simultaneous invention is presumed and awarded—that the inventors be forced to share the rights. During periods of rapid invention this will allow Digital to compete with IBM to compete with NEC, knowing full well that the cycle of technology invention may be days, not years.