3

Strengths and Weaknesses of the U.S. Technology Enterprise

The revolution in production systems, the shifting global balance of technological power in the context of deep interdependence, and the rising geopolitical premium on economic strength, together present major challenges as well as opportunities to the U.S. technology enterprise. Considering the U.S. economy's recent legacy of large fiscal and trade deficits, slow productivity growth, and the slow growth of U.S. living standards, these trends demand that economic development become a priority objective of U.S. national technology strategy. If the nation is to address and master this new economic imperative, it must first take stock of the strengths and weaknesses of the nation's technology enterprise as revealed by the recent political, economic, and technological trends in the global economy.

STRENGTHS OF THE U.S. TECHNOLOGY ENTERPRISE

Among the many strengths of the U.S. technology enterprise, four warrant particular attention in light of the global trends examined in Chapter 2:

-

The large scale, broad scope, and relative openness of the U.S. basic research enterprise.

-

The size, wealth, openness, and technological sophistication of the U.S. domestic market.

-

The nation's capacity for spawning new technology-intensive industries, products, and services.

-

The continuing competitive strength and global reach of many U.S. high-tech industries.

As the following discussion makes clear, these four strengths are closely

interrelated. Each both contributes and attests to the nation's deep-seated institutional and human resource capacity for creating new scientific and technological knowledge, new products, and new industries. Although the committee firmly believes these strengths should be sustained and built upon, it is now clear that these strengths alone will not enable the United States to meet successfully the technology-related challenges of a global economy. The committee also notes that most of these strengths, when pushed too exclusively, may, in fact, create deficiencies in other parts of the nation's technology enterprise.

A Large, Productive Basic Research Enterprise

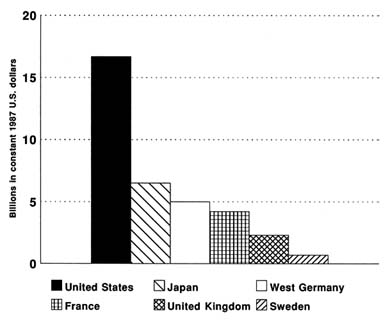

Largely a product of decades of generous funding by federal mission agencies, the U.S. basic research enterprise has the potential to continue to provide the country with unique advantages in both the creation and the assimilation of new scientific and technological knowledge (see Figure 3.1).

FIGURE 3.1 Basic research expenditures, by country: 1988. NOTE: Data represents total 1988 R&D expenditures multiplied by latest available ratio of basic research to total R&D spending. Latest ratio for Germany and Sweden is from 1987; the U.K., 1981. SOURCE: National Board (1991, p. 344; 1992, p. 73).

The U.S. basic research enterprise draw its strength from many sources, including

-

The sheer magnitude of financial and human resources dedicated to research.1

-

The multiplicity and diversity of U.S.-based research organizations, including universities, government laboratories, industrial laboratories, and independent research institutes, each characterized by different modes of setting research agendas.

-

The high mobility of U.S. technical personnel.2

A particularly important factor in the strength of the U.S. basic research enterprise is that its largest, broadest,and probably most creative segment resides primarily within U.S. universities. The openness of the U.S. academic research enterprise to the free flow of ideas and talent from throughout the world, its integral relationship with advanced scientific and technical education, and the large scope it provides for initiative of individual scientists at relatively early stages in their careers have all contributed to U.S. preeminence in the creation of new scientific and technical knowledge.

The scale and character of U.S. academic research, in turn, have given the United States distinct qualitative and quantitative advantages in the cultivation of a large, diverse population of highly skilled research scientists and engineers. The outstanding reputation of U.S. universities in scientific and engineering research has been a magnet for some of the very best international scientific and engineering talent.3 Throughout the 1980s, U.S. universities awarded over half of all doctoral degrees in engineering and nearly a third of all doctoral degrees in the sciences to foreign-born students, many of whom have stayed to work in the United States (National Research Council, 1988; National Research Council, Office of Scientific and Engineering Personnel, unpublished data, 1992). Thus, the strength of the U.S. university-based research enterprise has contributed significantly to the infusion of diverse cultures, intellectual traditions, and technical practices into the U.S. technology enterprise, thereby enriching it.

Clearly the United States' unrivaled capacity for basic research and the human resource dividends it yields are major assets for the U.S. technology enterprise. However, the often single-minded pursuit of excellence and leadership in basic research within academia spills over into an undervaluation of other types of technical activity in industry, thereby indirectly weakening the ability of U.S. industry to develop, assimilate, and manage technology effectively for economic advantage. The preoccupation with technical originality throughout academic science and engineering and the preoccupation with phenomenological research and development of tools for analysis within engineering have led to an underemphasis on holistic design experience, manufacturing, and technology management in the curricula and research

portfolios of U.S. engineering schools, particularly those that tend to be pacesetters.4 By equating innovation with R&D and overvaluing the pursuit of original knowledge relative to excellence in execution, many engineering schools have helped to create, or at least to sustain, dysfunctional walls between research and other downstream technological activities in American industry.5

A Large, Sophisticated Domestic Market

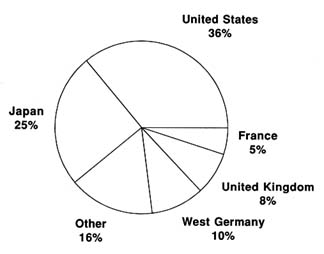

The size, affluence, and sophistication of the U.S. domestic market continue to provide a rich test bed and large demand for technologically advanced products and services. Despite its relatively slow growth in recent decades, U.S. per capita income (measured in purchasing power parity) is still the highest of the world's seven largest industrialized economies. The U.S. economy is still more than two and half times the size of Japan's. And the U.S. market continues to absorb more than 35 percent of world's total output of high-technology products (see Figure 3.2). U.S.-based

FIGURE 3.2 Home market share of world consumption of high-tech products: 1988.

NOTE: Total high-tech consumption by the 25 member countries of the Organization for Economic Cooperation and Development are used as a proxy for world consumption. SOURCE: Data from National Science Board (1991, pp. 401, 409).

companies should have an advantage in exploiting the strengths of this market for new product development and market growth, especially through the opportunity for collaboration between producers and sophisticated user firms.

The openness of the U.S. economy to foreign direct investment and trade has greatly increased the exposure of U.S-based industry and U.S. consumers to foreign technology and know-how, and promises to increase technology transfer into the United States from abroad as foreign technical competence and economic strength increase. Moreover, together with the nation's comparatively strong antitrust laws and efficient factor market,6 the U.S. government's commitment to open markets has ensured a high level of competition within most sectors of the U.S. economy, thereby providing a powerful stimulus to productivity-enhancing innovation throughout U.S. industry.

At the same time, many of the major strengths of the U.S. domestic market have also contributed (albeit indirectly) to current vulnerabilities of the nation's technology enterprise. For most of the past 40 years, the United States has been the only country in the world with a large enough domestic market to sustain numerous scale-intensive industries. For much of this period, exports and the sales of foreign affiliates of U.S.-based companies were perceived as a bonus to corporate strategies focused heavily on the large and prosperous U.S. market.7 Import penetration of the U.S. economy was minimal during most of the postwar period, and the challenge of foreign competition was perceived as minor compared with that of other domestic firms.8 As a result, until recently there have been few strong incentives for the vast majority of U.S.-based companies to adapt their products to different requirements of foreign markets, or look abroad for new product or process technology.

Moreover, the very openness of the U.S. domestic market to foreign competition has also proved a double-edged sword. The committee is convinced that foreign competition has stimulated much productivity-enhancing innovation throughout U.S. industry, and, on balance, has greatly benefited U.S. consumers as well as the management, stockholders, and work force of U.S.-based companies that have been able to respond effectively to the challenge. Yet foreign competition has also inflicted heavy economic adjustment costs on many American companies, industries, and communities that have for one reason or another been less successful at meeting the foreign challenge. In a few cases, failed adjustment to foreign competition (whether "fair" or "unfair") has resulted in serious decline of resident technical and manufacturing capability in areas deemed important to the nation's long-term technical, economic, military, or political interests—for example, in semiconductor manufacturing equipment.9

Incubator of New Industries, Products, and Services

The strength of the basic research enterprise, and the size and wealth of the domestic market, together with the highly entrepreneurial character of U.S. capitalism, have fostered an unrivaled indigenous capacity for creating new technology-intensive products, services, and industries. The U.S. political economic system affords many institutional and regulatory incentives for the creation of new businesses. Strict antitrust laws, forgiving bankruptcy laws, a host of financial intermediaries willing and able to supply capital for new ventures, and a deep-rooted culture of entrepreneurship have all contributed to a U.S. capacity for new business creation (and destruction) unequaled throughout the world (Ergas, 1987; Florida and Kenney, 1990).

Building on this strong base, the U.S. system of support for basic research, with its strong dependence on the initiative of individual investigators, has also fostered a strong entrepreneurial culture among academic scientists and engineers. Many universities have become incubators of small, high-tech firms built around new products or services that have occasionally given rise to entire new industries, such as biotechnology and magnetic resonance imaging. To an extent far greater than their counterparts abroad, U.S. private investors have long demonstrated a willingness to support the start-up of high-tech companies. In addition, the United States has the world's largest and most highly developed venture capital market, which not only makes capital available to high-tech start-ups, but also serves as an effective mechanism for information networking among small firms (Bygrave and Timmons, 1992).10

The downside of this "high-tech" subset of U.S. entrepreneurial culture with its focus on being first to create a new product or service is that it is often associated with a lack of follow-through in downstream engineering and continuous improvement, especially in manufacturing, after initial success. To a large extent, this lack of follow-through can be attributed to the managerial and organizational shortcomings of U.S. companies (which are discussed at greater length below). However, it is also evident that the U.S. system of allocating investment capital, despite its unrivaled capacity for spawning new companies, does not do as good a job as it should at making available to technology-oriented businesses the patient capital they need to commercialize their technologies, to grow, or to modernize (National Academy of Engineering, 1992; Porter, 1992). Whether the product of poor management, the inaccessibility of patient capital, or other factors, the end result has been that market leadership has migrated abroad in many high-growth, high value-added industries or products that were pioneered by U.S. high-tech start-ups (Florida and Browdy, 1991; Florida and Kenney, 1990).

The Strength of U.S. High-Tech Industries

The continuing competitive strength and global reach of many U.S.-owned companies in high-tech industries, such as aerospace, pharmaceuticals, chemicals, oil refining, computers, and software, contribute greatly to the strength of the nation's technology enterprise. These firms, which continue to excel in the "high end" of their respective global product markets, cultivate organizational competence and human technical resources worldwide. Although their contribution to the technological capability of other nations is significant and growing, these firms conduct the vast majority of their technically advanced, high-value-added work in the United States.11 They generate financial resources that are reinvested in their corporate technology bases and through them in the nation's technology base. These firms account for a large share of U.S. manufactured exports and imports (much of this trade is intracompany, between the U.S. parent companies and their affiliates abroad). They represent major vectors for technology diffusion into and out of the United States, as do, increasingly, the U.S. affiliates of foreign firms. Admittedly, the flow of technology through multinational companies has been predominately one-way out of the United States in the past.12 However, as the level of technological capability abroad continues to rise, both U.S.-owned multinationals and the U.S. affiliates of foreign-owned firms are likely to draw increasingly upon technological capabilities abroad to augment the industrial innovative capacity of the U.S. economy.

In certain respects, however, the early dominance of U.S. high-tech firms in world markets has weakened the U.S. technology enterprise. In the 1970s many of these firms took too much comfort in their dominance of the most technically sophisticated high end of their product markets (for example, customized microprocessors as compared with dynamic random access memory chips, or DRAMs; sophisticated computers as compared with consumer electronics; customized, numerically controlled machine tools as compared with standardized tools) (Alic et al., 1992). In the process, they overlooked the fact that the necessary financial resources and manufacturing knowledge for maintaining their strength in high-end, low-volume, and high-margin product markets could not be sustained without a continuing presence in important related mass markets. This strategic miscalculation has helped undermine the long-term technological competitiveness of many of these firms and of the broader base of U.S. industries to which they are closely tied.

WEAKNESSES OF THE U.S. TECHNOLOGY ENTERPRISE

Ultimately the ability of the United States to exploit the strengths of its technology enterprise for sustained economic development will depend on

how rapidly and effectively the nation redresses the major weaknesses of the enterprise. The committee identifies the following six closely interrelated weaknesses as the greatest technology-related obstacles to meeting the nation's economic development challenge:

-

Outmoded management philosophies, organizational frameworks, and human resource strategies of many U.S. public- and private-sector producers of goods and services.

-

Insufficient investment in, and poor quality of, U.S. work force training and continuing education, particularly at the nonsupervisory level.

-

Inadequate investment by U.S.-based companies in competitive production processes, plant, and equipment.

-

Low civilian R&D intensity of U.S. economic activity and insufficient breadth of the nation's civilian R&D portfolio, including underinvestment in growth- and productivity-enhancing technologies that are high-risk or whose benefits are difficult for individual investors to appropriate.13

-

Insufficient awareness of, and interest in, technology originating outside their institutional boundaries on the part of many U.S. companies and federal laboratories.

-

Lack of a strong institutional structure for federal technology policy in support of national economic development, and the segregation of technology policy from domestic and foreign economic policy at the federal level.

While the strengths are relatively discrete and well documented, the weaknesses of the U.S. technology enterprise are more subtle and interconnected. They are one step removed from easily measurable performance indicators that would directly demonstrate them. There are no comparative measures that directly show the relative decline in the ability of U.S.-based companies to generate, absorb, master, and manage technology to achieve sustainable competitive advantage in world markets—only anecdotal evidence or case histories. Furthermore, even in industries in which most companies have lost market share or withdrawn from the market, there are usually one or two companies that are still world competitive. Nevertheless, these weaknesses have manifested themselves collectively in indicators such as the following:

-

A decline in global market share of some U.S. high-tech industries during the past two decades and a significant reduction in the nation's long-standing trade surplus in high-tech products.14

-

Prolonged low U.S. productivity growth rates (for both labor and total factor productivity) relative to a number of its major industrial competitors (Organization for Economic Cooperation and Development, 1992a).

-

Slow product-development and innovation cycle time of U.S. companies in a number of large industries in comparison with their Japanese counterparts (Bebb, 1990; Clark and Fujimoto, 1991).

-

A ''quality" gap that emerged between U.S. firms and their foreign competitors in a number of industries during the 1970s and 1980s.

-

Slow adoption of advanced production technologies by U.S. manufacturers relative to their Japanese competitors.15

The following discussion addresses each of the six major weaknesses in the U.S. technology enterprise that have collectively contributed to the lackluster performance of many U.S.-based firms and the U.S. economy overall as revealed by these indicators. While the six weaknesses are addressed in sequence, the committee considers all six to be closely interrelated and, to a large extent, mutually reinforcing.

Outmoded Managerial and Organizational Approaches

Many U.S.-based companies are having great difficulty in their efforts to increase productivity, improve quality, lower costs, and increase the speed with which they develop and deliver competitive new products and services. Primary responsibility for this decline rests with outdated managerial and organizational practices of U.S. companies with regard to production, innovation, and human resources. Although there has been some progress in recent years, a considerable fraction of American industry and government has yet to respond to an ongoing revolution in production systems that has been gathering momentum since the early 1970s.

The prevailing managerial and organizational practices in U.S. industry developed in response to the rapid diffusion of mass production technology around the turn of the century and have not changed significantly since that time. Admittedly, there has always been considerable variation in organizational practice among firms within a given industry as well as across industries. However, the dominant organizational framework in most sectors of American industry for at least the last half century has been one of rigid, large decision-making hierarchies overseeing a functionally compartmentalized production system and work force. Within this framework the many constituent functions in the product realization process—R&D, design, industrial engineering, production, and marketing—have often been treated as discrete activities linked in sequence to reduce the need for interfunctional communication and to lower intrafirm transaction costs. Innovation within this organizational framework has also been treated as a sequential process; the development of new product or process technologies has been regarded as the preserve of a relatively insulated R&D department, or, as in the case of many manufacturing and service companies, an activity performed by outside vendors and suppliers but not in-house (Gomory, 1989; Kline, 1990; Lee, 1992).

The functional compartmentalization between innovation and production has, in turn, involved a high degree of functional specialization of the work force in many industries. In the highly trained technical work force (scientists and engineers), excessive specialization has contributed to a widening cultural, or communication, gap between R&D personnel and production engineers (Armstrong, 1993; Gomory, 1992). As noted above (pp. 63–64), this cultural gap has been perpetuated, if not exacerbated, by the way in which would-be industrial scientists and engineers are educated and trained in American universities. All too many U.S. university science and engineering faculties continue to prepare R&D scientist and engineers with little appreciation or understanding of design and production engineering. At the same time, many practicing design and production engineers in U.S. companies are ill-prepared to work effectively with R&D personnel either to help shape the company's research agenda or to absorb and apply the results of research performed in-house or outside the firm.

For the vast majority of the industrial work force, functional specialization has led to increasingly narrow job classifications, a generally low expectation of what a nonsupervisory worker can contribute, and a failure to take advantage of the firsthand experience and ideas of frontline workers. Within his context, much of American corporate management has come to regard investments in technology as a way to substitute for rather than upgrade the skills and performance of the work force. Management of a functionally specialized work force and compartmentalized production systems, in turn, has required large managerial bureaucracies (relative to a firm's total work force) in which responsibility and authority are centralized. Furthermore, the organization of work has demanded managerial strategies that emphasize vertical "top-down" control rather than horizontal coordination (Carnevale, 1991; National Center on Education and the Economy, 1990).

Many of these same organizational and managerial practices that structure production and innovation in a majority of U.S. companies are also reflected in these firms' arm's-length, adversarial relationships with customers and suppliers. Some companies value suppliers primarily for their ability to meet customer specifications at lowest cost and view them as easily replaceable. Similarly, customers for final products and services are often viewed as undiscriminating in areas other than price and incapable of articulating their needs and preferences except through market transactions. Although the number of notable exceptions is growing, a majority of U.S. companies continue to show little appreciation for sources of innovation beyond their own R&D laboratory or company borders (Kodama, 1991; Roussel et al., 1991; von Hippel, 1988).

Although oversimplified and overgeneralized, this summary of the distinguishing features of the way a majority of U.S. companies organize and

manage production, innovation, and their work force explains why so much of U.S. industry is having difficulty developing and using technology to sustained competitive effect. Companies will not achieve the fundamentals of competitive performance in this new environment—continuous improvement of product quality, shorter product development cycles, higher rates of productivity growth, continuous product and process innovation, and rapid response to changing markets—unless they radically change the way they organize and manage the product realization process in its entirety, particularly their most valuable assets, human resources (Dertouzos et al., 1989; Heim and Compton, 1992; Kline, 1991; Quinn, 1992; Womack et al., 1990).

Although most of the attention of late has been focused on these issues of organization and management as they apply to production, work, and innovation in manufacturing firms, it is increasingly apparent that these same organizational and managerial problems also plague the majority of U.S. service providers (private and public).16 A number of service industries have achieved impressive productivity growth through the application of new information and transportation technologies. However, the U.S. service economy as a whole, which at present accounts for more than 74 percent of U.S. gross national product and 77 percent of U.S. employment, has experienced levels of productivity growth significantly below that of the U.S. manufacturing sector over the past decade (Kendrick, 1988; Quinn, 1988; Roach, 1988, 1991).17

The broad outlines of the changes needed are generally understood and have been collected and broadly disseminated throughout the United States under various concepts such as total quality management, concurrent engineering, flexible manufacturing, or lean production. However, the following impediments to widespread adoption and diffusion of modern organizational and managerial methods in U.S. industry remain formidable:18

-

Widespread managerial resistance to change.

-

A legacy of mutual mistrust between labor and management.

-

A work force often ill prepared by education, training, and managerial expectations to participate more broadly and flexibly, and assume greater responsibility in new work organizations.

-

A lack of appropriate metrics and "benchmarks" against which to measure the new parameters of organizational performance.

-

An entrenched reluctance to look beyond company boundaries for sources of useful innovation.

Gaps in Work Force Training and Continuing Education

The committee believes that the skills, capacity for continuous learning, and effective management of a nation's work force largely determine that

nation's ability to attract and retain high-value-added, high-skill industries as well as its ability to absorb and exploit new technology for economic benefit. As the preceding discussion makes clear, U.S. producers of goods and services must adopt more productive approaches to the organization of work and the management and motivation of their work force if they expect to cultivate and take full advantage of their skills, ingenuity, and creativity. Indeed, a number of recent studies suggest that the greatest impediments to improving the performance of U.S. labor markets have more to do with inadequate demand for high-skilled labor than with inadequate supply (Carnevale, 1991; Mishel and Teixeira, 1992). Nevertheless, the changing nature of work organization and content in many industries, and the new demands these changes place on the U.S. work force, underline major weaknesses in the scope and quality of the nation's efforts in job-related training and continuing education.

The United States has one of the largest, most diversified, though poorly coordinated training enterprises in the world. In the United States, work-related training and continuing education are provided by a broad spectrum of private and public institutions, including two-year colleges and technical institutions, noncollegiate postsecondary vocational schools, four-year colleges and universities, apprenticeship programs, professional associations, unions, vendors, and employers. However, across this vast and diverse U.S. training enterprise, there are few common standards, the quality of training is uneven, and important subsets of the nation's current and potential work force are poorly served, particularly with regard to job-related training and continuing education within industry (Carnevale et al., 1990a,b; Lynch, 1992; National Center on Education and the Economy, 1990; U.S. Congress, Office of Technology Assessment, 1990b; U.S. General Accounting Office, 1992b).19

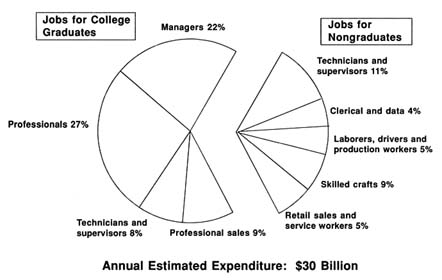

On average U.S. companies invest slightly more than 1 percent of payroll on training in comparison with competitors in other countries that invest on average as much as 6 percent of their payrolls (Marshall and Tucker, 1992a).20 One-half of 1 percent of U.S.-based companies account for nearly all of the $30 billion currently invested by U.S. industry in formal training, and only 10 percent of the nation's work force participates in company-financed training activities (Carnevale et al., 1990a; Marshall, 1992). Moreover, as Figure 3.3 shows, most of U.S. industry's training dollars are used to provide training and continuing education for its college-educated supervisory and professional work force, while relatively little is allocated to its non-college-educated and, for the most part, nonsupervisory work force.21 The U.S. allocation of training resources stands in marked contrast to that of its major industrial competitors (including Germany and Japan) that have developed extensive training programs for nonsupervisory workers in general and for new entrants to the work force, in particular (Organization for

FIGURE 3.3 Distribution of U.S. private-sector expenditure on formal training.

SOURCE: After National Center on Education and the Economy (1990, p. 49).

Economic Cooperation and Development, 1991a; U.S. Congress, Office of Technology Assessment, 1990b).

Although the United States sends a larger percentage of its high-school graduates to colleges or universities than any other industrialized nation, non-college-bound U.S. high-school graduates have few opportunities to participate in school-to-work training programs (Lynch, 1992; U.S. General Accounting Office, 1990b). It is estimated that U.S.-based apprenticeship programs and similar school-to-work transition programs involve less than 2 percent of all 17- to 25-year-olds and less than 0.3 percent of the total U.S. civilian work force. In contrast, German apprenticeship programs engage roughly 75 percent of all German 17-to 25-year-olds, and over 60 percent of the German work force has completed an apprenticeship (Marshall and Tucker, 1992b; U.S. Congress, Office of Technology Assessment, 1990b).22

The liabilities that follow from the low level of U.S. investment in training and continuing education for the nation's nonsupervisory work force (both entry-level and established workers) are further compounded by the excessively narrow, task-specific focus of the relatively limited amount of training this segment of the work force receives.23 Because of its narrow

focus, such training does little to prepare workers to broaden their skill base or to participate and contribute more broadly to the overall organizational goals of their employer. When combined with the lack of industrywide standards for training and apprenticeship, such a narrow training curriculum makes it increasingly difficult for these workers to move to other companies and areas of work. In marked contrast to the U.S. approach, job-related training and apprenticeship programs in Germany, Japan, and a number of other industrial countries offer better balance between general competence training and job-specific training (Northdurft, 1989; U.S. Congress, Office of Technology Assessment, 1990b).

Underinvestment in Production Processes, Methods, and Equipment

In addition to placing a premium on changes in work organization and investments in work force development, global competition and the revolution in production systems have also underlined the importance of sustained investment in production processes, methods, and equipment to corporate and national productivity and competitiveness.24 Recent U.S. industrial history is replete with examples of companies that have failed to reap adequate returns on extensive investment in automated production equipment because they failed to attend to the socio-organizational aspects of the effective use of the new capital equipment within the production system as a whole.25 Nevertheless, international comparisons of rates of private industry investment in plant and equipment in general, and equipment embodying advanced manufacturing in particular suggest that on average U.S. industry is falling behind its major foreign competitors in capital investment per employee.

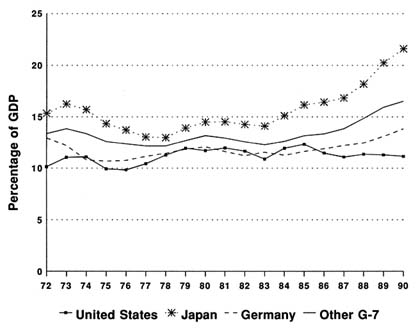

U.S. private-sector fixed investment in plant and equipment has fluctuated around 12 percent of GDP during the last decade, following roughly the same pattern as Germany. However, at 12 percent in 1990, the U.S. rate of investment was little more than half that of Japan (see Figure 3.4). The results of a comparative international survey of diffusion rates for a number of advanced manufacturing technologies (numerically controlled [NC] machine tools, industrial robots, computer-aided design [CAD], flexible manufacturing cells and systems) indicate that the diffusion of most of these technologies was much less advanced in the United States than in Japan as of 1988 (see Chapter 2, Figure 2.2).26

More recent surveys indicate that while U.S. investment rates in computer-integrated manufacturing equipment (CAD, programmable controllers, local area networks, and NC machines) grew rapidly during the 1980s, most of this investment was accounted for by large firms, firms with more than 500 employees (Kelley and Brooks, 1988, 1991; U.S. Congress, Office of Technology Assessment, 1990b). Small U.S. companies continue to be

FIGURE 3.4 Private industry expenditure on plant and equipment as a percentage of gross domestic product: 1972–1990. NOTE: G-7 (Group of Seven) countries are Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States.

SOURCE: Council on Competitiveness (1992).

particularly slow at adopting these advanced manufacturing technologies, not only relative to their large U.S. counterparts but also relative to small foreign firms (Shapira et al., 1992; Tornatsky and Luria, 1992).27

The causes of low investment and slow diffusion rates are hotly debated and complex. The most frequently cited explanations are the nation's low savings rate, the comparatively high cost of patient capital, the relative inaccessibility of capital for many small technology-oriented businesses, and the short-term planning and performance criteria of U.S. businesses with regard to technology investments (i.e., poor management of technology) (National Academy of Engineering, 1992; Porter, 1992). Clearly, all of these factors contribute to the problem, although some (managerial behavior and capital access for small firms, for instance) may be more politically tractable than others (raising the nation's savings rate or reducing the cost of patient capital). In any event, failure to address these impediments

to sustained investment in the modernization of U.S. industry's capital plant can only further diminish the nation's ability to use technology effectively to increase its overall economic and technological strength.

The Economy's Low Civilian R&D Intensity and Narrow R&D Portfolio

Changes in the character of global competition and innovation, declining defense budgets, and the shifting relationship between military and civilian technology have posed challenges to the U.S. R&D enterprise. Shrinking defense procurement, the diminished contribution of defense R&D to the nation's commercial technology base, and the recent slowdown in U.S. industrial R&D spending have all focused attention on a growing disparity between the intensity of civilian R&D (business-funded R&D in particular) in the U.S. economy and that of its foremost competitors abroad, as documented in more detail in Chapter 2, pp. 41–43.

Imbalances and Gaps in U.S. Company R&D Portfolios

The committee is convinced that many sectors of U.S. industry are not investing enough in research and development to remain internationally competitive over the medium to long term. Furthermore, the committee believes that the majority of U.S. industrial R&D performers are not managing their current R&D portfolios as effectively as they should. There is considerable evidence to suggest that the portfolios of U.S. companies engaged in R&D may be characterized as follows:

-

Too little R&D related to scanning and assimilating new technological knowledge relative to total company investment in "original" in-house R&D (Mansfield, 1988a,b: Mathis, 1992; Roussel et al., 1991).

-

Too little process-related R&D relative to product-related R&D (Caravatti, 1991; Dertouzos et al., 1989; Mansfield, 1988b).

-

Too little R&D related to incremental improvements of existing products and processes and to downstream follow-through on new product breakthroughs (Florida and Browdy, 1991; Florida and Kenney, 1990).

Just as private industry bears the principal responsibility for increasing its investment in research and development overall to meet the demands of global competition, so too are private companies chiefly responsible for overhauling their commercial R&D strategies and restructuring their R&D portfolios to this end. But it is clear that U.S. public policies and the U.S. higher education system have an important impact (both positive and negative) on the level, composition, and management of private-sector commercial R&D. For instance, the committee believes that current U.S. tax treatment

of private-sector R&D does not provide sufficient incentive to private-sector investment in commercial R&D. The incremental approach of the current U.S. Research and Experimentation (R&E) Tax Credit, though fiscally "cheap," does little to encourage sustained R&D investment across business cycles. Moreover, the R&E Tax Credit cannot be extended to industry-sponsored R&D in universities and other institutions, or the industrial contribution to R&D performed as part of a consortium that involves government laboratories. In this manner, federal tax policy may discourage the very leveraging, networking, and refocusing of the national R&D infrastructure so greatly needed for sustained economic development.

Similarly, federal procurement practices that force companies producing for both commercial and defense markets to erect walls between R&D and downstream activities make it difficult and expensive for these firms to manage their total R&D resources effectively (Adelman and Augustine, 1992; Center for Strategic and International Studies, 1991; Gansler, 1992). Finally, many observers contend that U.S. engineering and management schools have aggravated the problems of technology management within many U.S. companies by failing to teach effective technology management to their students.

Gaps in the Nation's R&D Portfolio: The Generic Technology Challenge

The committee believes the nation is underinvesting in a number of generic infrastructural, pathbreaking, and otherwise high-leverage technologies that could greatly increase the productivity and long-term growth of the U.S. economy, as well as the competitiveness of U.S.-based industry.28 As argued in Chapter 2, rising technical intensity and complexity in many industries have raised the cost and uncertainty of many technology-related investment opportunities to the point where individual firms are increasingly likely to underinvest in promising areas of industrial technology (Tassey, 1992). A growing number of private companies have responded to this challenge by engaging in R&D alliances, joint ventures, and consortia to share risks and costs associated with the development of a broad spectrum of generic technologies (Hagedoorn and Schakenraad, 1993; Mowery, 1987; Organization for Economic Cooperation and Development, 1991b; Tassey, 1992; Vonortas, 1989).

Accordingly, with varying degrees of intensity and effectiveness, governments in industrial nations have actively fostered, and in some cases partially underwritten, collaborative arrangements within the private sector and between the public and the private sectors in many areas of generic technology. Nevertheless, recent assessments of the current and projected position of the United States in many important areas of generic technology confirm that the combined U.S. public- and private-sector effort in generic technologies is inadequate to maintain or improve the nation's current geopolitical

and global economic position (Council on Competitiveness, 1991; Gamota and Frieman, 1988; National Critical Technologies Panel, 1991; Rogers, 1991; Tassey, 1992; U.S. Department of Commerce, 1990, 1992b) (see Table 3.1).

There are currently many avenues through which the U.S. federal government provides limited support to the development of commercially relevant generic technology. The spin-off from defense-related R&D to civilian infrastructural and pathbreaking technology development has declined significantly in recent decades. But the U.S. Department of Defense continues to support dual-use technology development in a number of specific technological areas critical to aerospace, semiconductor manufacturing, computing, display technology, advanced manufacturing, and other sectors.29 The National Institutes of Health continue to underwrite much of the R&D infrastructure for the emerging biotechnology industry. There are also long-standing as well as recent, albeit limited, initiatives by the government to support development of commercially relevant generic technologies through other federal agencies. These include the intramural research programs in the areas of standards, measurement and testing at the National Institute of Standards and Technology (NIST), the establishment and growth of NIST's young Advanced Technology Program, the promotion of Cooperative Research and Development Agreements between select federal laboratories and U.S. firms, and the establishment of university-based Engineering Research Centers by the National Science Foundation.30

Nevertheless, despite a plethora of old and new programs, the share of total federal government investment in R&D directly relevant to the needs of industrial and general economic development (with the notable exceptions of aerospace and biotechnology) remains minuscule, particularly in comparison with that of other nations (see Table 3.2).31 In 1989 the federal government allocated only 0.2 percent of its total R&D budget explicitly to "industrial development" and less than 8 percent of the total to all socioeconomic objectives related to economic development (agriculture, energy, industrial development, and infrastructure). By comparison, Japan spent more than 32 percent and Germany, France, and the United Kingdom between 19 and 23 percent of their respective public R&D monies on "economic development" activities. Between 5 and 13 percent of their public R&D budgets were dedicated to "industrial development" alone.

Despite a growing consensus regarding the need for greater public-and private-sector effort to close the emerging generic technology gaps in the nation's civilian technology base, formidable political as well as analytical impediments to public-sector action remain. Political resistance to an expanded federal government role in civilian technology has weakened. However, the benefits of public-sector investments in areas of commercially relevant infrastructural and pathbreaking technology are diffuse, hard to

TABLE 3.1 U.S. Competitive Position in Critical Technologies

|

Technologies in which the United States is Strong |

Technologies in which the United States is Competitive |

|

Materials and Associated Processing Technologies |

Materials and Associated Processing Technologies |

|

Bioactive biocompatible materials |

Catalysis |

|

Bioprocessing |

Chemical synthesis |

|

Drug discovery techniques |

Magnetic materials |

|

Emissions reduction |

Metal matrix composites |

|

Genetic engineering |

Net shape forming |

|

Recycling and waste processing |

Optical materials |

|

|

Photoresists |

|

Engineering and Production Technologies |

Polymers |

|

|

Polymer matrix composites |

|

Computer-aided engineering |

Process controls |

|

Systems engineering |

Superconductors |

|

Electronic Components |

Engineering and Production Technologies |

|

Magnetic information storage |

|

|

Microprocessors |

Advanced welding |

|

|

Computer integrated manufacturing |

|

Information Technology |

Human factors engineering |

|

Animation and full motion video |

Joining and fastening technologies |

|

Applications software |

Measurement techniques |

|

Artificial intelligence |

Structural dynamics |

|

Computer modeling and simulation |

|

|

Data representation |

Electronic Components |

|

Data retrieval and update |

Logic chips |

|

Expert systems |

Sensors |

|

Graphics hardware and software |

Submicron technology |

|

Handwriting and speech recognition |

|

|

High-level software languages |

Information Technologies |

|

Natural language |

Broadband switching |

|

Neural networks |

Digital infrastructure |

|

Operating systems |

Digital signal processing |

|

Optical character recognition |

Fiber-optic systems |

|

Processor architecture |

Hardware integration |

|

Semantic modeling and interpretation |

Multiplexing |

|

Software engineering |

Spectrum technologies |

|

Transmitters and receivers |

|

|

|

Powertrain and Propulsion |

|

Powertrain and Propulsion |

Alternate fuel engines |

|

Air-breathing propulsion |

Electrical storage technologies |

|

Low emission engines |

Electric motors and drives |

|

Rocket propulsion |

|

|

Technologies in which the United States is Weak |

Technologies in which the United States is Losing Badly or has Lost |

|

Materials and Associated Processing Technologies |

Materials and Associated Processing Technologies |

|

Advanced metals |

Display materials |

|

Membranes |

Electronic ceramics |

|

Precision coating |

Electronic packaging materials |

|

|

Gallium arsenide |

|

Engineering and Production Technologies |

Silicon |

|

|

Structural ceramics |

|

Design for manufacturing |

|

|

Design of manufacturing processes |

Engineering and Production Technologies |

|

Flexible manufacturing |

|

|

High-speed machining |

Integrated circuit fabrication and test equipment |

|

Integration of research, design, and manufacturing |

Robotics and automated equipment |

|

Leading-edge scientific instruments |

|

|

Precision bearings |

Electronic Components |

|

Precision machining and forming |

Electrolminescent dislays |

|

Total quality management |

Liquid crystal displays |

|

|

Memory chips |

|

Electronic Components |

Multichip packaging systems |

|

Actuators |

Optical information storage |

|

Electro photography |

Plasma and vacuum fluorescent displays |

|

Electrostatics |

Printed circuit board technology |

|

Laser devices |

|

|

Photonics |

|

|

Powertrain and Propulsion |

|

|

High fuel economy/power density engines |

|

|

SOURCE: Council on Competitiveness (1991, pp. 31–34). |

|

measure, and slow to mature, and this diminishes their political appeal. The need for elected representatives and government officials to demonstrate concrete, short-term results to their constituencies may discourage them from investing much political capital in such initiatives. Moreover, the theoretical and empirical bases and the institutional frameworks for identifying and deciding how much to fund worthy areas of infrastructural or pathbreaking technology are weak and poorly developed.32

Underinvestment in Technical Outreach

The growth of technical competence abroad, the revolution in production systems, and the increasing pace, intensity, and multidisciplinary character

of technological innovation in general have all underscored the importance of greater interaction among the many public- and private-sector actors (domestic and foreign) involved in the creation, development, and use of technology.33 Yet, there is evidence to suggest that the vast majority of U.S.-based companies have little interest in technology originating outside their own institutional boundaries, beyond U.S. borders, or outside the normal technological scope of the company. 34

During the postwar era of U.S. technological preeminence, the costs to the nation of the widespread reluctance of individual U.S.-based firms to tap domestic sources of innovation beyond their own in-house R&D labs were barely perceived (Mathis, 1992; Roussel et al., 1991). With foreign technical capabilities lagging most U.S. industries, there were rarely strong incentives for U.S. firms or the U.S. government to look abroad for improved technology. However, in a technologically multipolar world, the persistence of U.S. industry's ''not-invented-here" outlook, which is mirrored in a number of federal mission laboratories, represents a serious liability of the U.S. technology enterprise (Lee and Reid, 1991).

Today, the flow of new ideas, technology, and know-how through global networks of firms, universities, and other institutions is anything but

TABLE 3.2 Government R&D Support by Socioeconomic Objective, by Country: 1989

"one-way" out of the United States. As documented in Chapter 2, the competitive strength of many U.S.-based companies depends in no small way on their ability to access technically demanding markets and technological assets abroad. Furthermore, the contribution of foreign-owned multinational companies to the U.S. technology base is significant and growing.35

Ultimately, the nature of high technologies is such that the nation as a whole can no longer hope to retain world leadership in more than a few key "technology clusters." The breadth of high technologies necessary for competitive performance in a dynamically evolving world economy with a growing multiplicity of players is such that the United States must be prepared to remain close to the world frontier in a wide range of advanced technologies to be able to exploit them rapidly when unexpected opportunities present themselves. In many new or technologically revitalized industries where the product cycles are rapid or the up-front costs of market entry are high, "catch-up" strategies are so costly as to be unviable if the U.S. position lags the world frontier to any significant extent (Ross, 1992).

Nevertheless, despite these trends there is considerable evidence that many U.S.-based firms are less interested and less effective at harnessing foreign technological capabilities and markets than their major foreign competitors. Despite widely acknowledged foreign competence and leadership in many areas of high technology, the United States continues to lead the world in disembodied technology exports (patents, licenses, etc.) and runs a large surplus in its technological balance of payments (see Table 3.3). Meanwhile its principal economic rivals, Germany and Japan, though major creators of new technology in their own right, remain among the world's largest importers of disembodied technology and continue to run overall technological balance-of-payments deficits.36

Long-standing, large imbalances in the exchange of scientific and engineering personnel between the United States and other countries also attest to a relative lack of interest in foreign technological competence on the part of U.S. industry and the U.S. technological work force more generally.37 Finally, despite continuing growth in the U.S. population of multinational companies, trade and foreign direct investment data show that the vast majority of smaller U.S. manufacturing enterprises, not to mention service providers, are only marginally, if at all, involved in foreign markets (Nothdurft, 1992).38

While firmly convinced that many of the impediments to the exploitation of foreign markets and technology of U.S. firms are self-imposed, the committee also recognizes that structural or policy-induced asymmetries of access among national markets and technology enterprises often disadvantage U.S.-based firms in their international competition. 39 Regardless of their causes, in an age of deepening economic and technological interdependence among nations, international asymmetries of access to markets and

TABLE 3.3 International Patent and License Transactions, Selected Countries: 1990 (in billions of U.S. dollars)

|

Country |

Receipts |

Expenditure |

Balance |

|

United States |

16.4 |

3.1 |

13.3 |

|

Japan |

2.3 |

2.5 |

-0.2 |

|

Germany |

5.4 |

6.5 |

-1.1 |

|

France |

1.8 |

2.5 |

-0.7 |

|

United Kingdoma |

1.9 |

2.0 |

-0.1 |

|

a 1989 data. SOURCE: Organization for Economic Cooperation and Development, unpublished data, 1993. |

|||

technology affect the course of international competition. Ultimately, they also affect the comparative advantage of nations in ways that increase international political and economic friction and threaten to undermine the existing world trading system.

Improving the long-term access of U.S.-based firms to foreign high-tech markets and technology in a way that continuously upgrades U.S. industrial and technological portfolios and strengthens the international trading system will not be accomplished easily or quickly. It will require an aggressive and long-term commitment by the U.S. government to leadership, negotiation, and mutual accommodation on a broad range of policy issues, from trade and direct investment to intellectual property rights, international technical standards, and national R&D subsidies. Nevertheless, the committee believes there is much U.S. industry and government can do together to harness global technology and markets more effectively. Specific goals and policy actions toward this objective are addressed in Chapter 4.

The Nonsystem of Technology Policymaking

During the past decade, changes in the global economic and technological environment and the continuing relative decline of U.S. economic competitiveness have amplified liabilities associated with the highly decentralized, poorly coordinated nature of U.S. technology policymaking and its historically weak links to U.S. economic policymaking (domestic and foreign) at the federal level. These liabilities, in turn, have challenged U.S. policymakers to look for new ways to organize or coordinate federal technology policy at the federal level and to focus it more effectively on stimulating technology development and deployment for civilian economic growth and development. Although a number of creative and modestly successful initiatives to this end have been launched by the federal government since

the late 1970s, the problems of poor communication and coordination and weak integration of federal technology policy with federal economic policy persist.

As discussed in Chapter 1, the intelligence and operational responsibilities for informing, formulating, and implementing public- and private-sector policy responses to the diverse and rapidly changing technology-related challenges facing the U.S. economy are highly dispersed. A multitude of private-sector think tanks, university-based analysts, and industry associations, as well as municipal, state, and federal government agencies are involved in technology-related data collection, analysis, and policy formulation and implementation. During the past decade, state governments, in particular, have amassed considerable experience with policies and programs designed to harness technology for economic development (Carnegie Commission, 1992a; Clarke and Dobson, 1991; Feller, 1992a,b; Shapira et al., 1992). In many respects, this decentralized, distributed nonsystem of analysis and policy action remains a source of great strength; it continues to provide for high-quality analysis and a unique breadth of public and private policy experimentation.

Nonetheless, communication, coordination, and institutional learning among the constituent elements of the enterprise (at both the federal and state levels) remain weak. As a result, the lessons of successful or failed policy initiatives are poorly disseminated throughout the enterprise as a whole and often quickly forgotten. In addition, the system is poor at identifying and setting priorities among challenges to the technology enterprise with direct consequences for national economic performance, and particularly poor at building constituencies in support of action at the national level.

CONCLUSION: THE NEED FOR CHANGE

Collectively, the strengths and weaknesses of the U.S. technology enterprise make clear that both private-sector technology strategies and public-sector technology policies need to change significantly for the nation to remain the world's leading economic and technological power. To harness and build on its areas of strength, the nation must redress the major weaknesses of the technology enterprise. In so doing the nation must also recognize that these weaknesses are closely interrelated and cannot be addressed effectively in sequence. Broadening the scope and improving the balance of the U.S. portfolio of technological activities to meet the challenges of a new global order require that the public and private sectors work together to achieve the following goals:

-

Modernize the managerial philosophies, organizational frameworks, and human resource strategies of U.S. companies.

-

Raise the level and quality of work force training and continuing education.

-

Increase investment in production processes, methods, and equipment.

-

Expand, diversify, and upgrade the nation's civilian R&D effort.

-

Seek out and exploit foreign technology and markets more extensively and effectively.

-

Develop a strong institutional framework for federal technology policy in support of national economic development, and integrate the planning and implementation of federal technology policy with that of national domestic and foreign economic policy.

Clearly, some of these weaknesses are more closely linked to public policy decisions than others. In many instances the primary responsibility lies with private company decisions or the leadership of the nation's universities. In no case does responsibility—for a weakness or a "fix"—fall exclusively to one group. In the following, concluding chapter of this report, the committee sets forth conclusions and policy recommendations it believes will help the nation meet these challenges.

Notes

|

12. |

See Table 3.3 for the magnitude of the U.S. technological balance of payments surplus (license and royalty receipts in excess of payments) in recent decades. |

|

13. |

See Chapter 1, pp. 17–18, and note 28 below, for discussion of emerging areas of underinvestment in the U.S. technology base and definitions of "infrastructural" and "pathbreaking" technologies. These concepts were taken from Alic et al. (1992, chapter 10). |

|

14. |

Between 1980 and 1988 the U.S. share of global markets for high-tech manufactured products declined from 40 to 37 percent. Most of the decline in U.S. market share occurred in three product groups—engines and turbines; office and computing machinery; and radio, television, and communication equipment (National Science Board, 1991, pp. 402–403). |

|

15. |

See Chapter 2, pp. 38–39, 43–44, for further discussion. |

|

16. |

Indeed, in many ways the boundaries between services and manufacturing are blurring; many service industries today draw on much the same technology base as manufacturing. For further discussion of the challenge to and potential of the U.S. service sector, see U.S. Congress, Office of Technology Assessment (1987); Guile and Quinn (1988a,b); Quinn (1992). |

|

17. |

Data from the Organization for Economic Cooperation and Development indicate that U.S. manufacturing productivity grew about 55 percent between 1980 and 1991 compared with gains by Japan and Germany of less than 40 percent. However, significantly lower productivity growth in the U.S. service sector dropped U.S. overall productivity growth to about a third of the average 1.5 percent growth rate for all OECD or advanced industrialized countries as a whole. In February 1993 the U.S. Department of Commerce released production figures that showed the first significant jump in service sector productivity in decades in the fourth quarter of 1992. With service sector productivity rising, overall productivity growth for the U.S. economy rose 4 percent over the quarter, raising the annual rate to 2.7 percent (5 times the annual average for the preceding 5 years). The causes of the recent service productivity surge are not entirely clear. Nor is there cause for certainty that service sector productivity will continue to grow as fast in the future. However, the latest Department of Commerce productivity data highlights the extent to which improvements in service sector productivity can boost the overall productivity growth of the U.S. economy. See "U.S. Productivity Shows Best Gains in 20 Years," Financial Times, February 1993. |

|

18. |

The following list of impediments to technology adoption draws heavily on Heim (1992), and Heim and Compton (1992). |

|

19. |

A recent study by the U.S. General Accounting Office notes that the federal government alone runs 125 programs spread across 14 agencies that provide employment and training services for adults and out-of-school youth. Many of these programs serve the same client groups with similar services. Adding to the chaos these programs operate for the most part without any uniform definitions or requirements (U.S. General Accounting Office, 1992b). |

|

20. |

In a 1991 report, the Organization for Economic Cooperation and Development (1991a, p. 160) cautions that "[e]xisting statistics on training are not comparable, and often they are not particularly transparent with respect to what is or is not to be considered training. It currently makes little sense, therefore, to compare levels of descriptive statistics on training incidence or training expenditures from one country to another." |

|

21. |

In 1990 the U.S. General Accounting Office (1990b) reported that public subsidies for U.S. college students were more than seven times larger than those of non-college-bound youth. |

|

22. |

According to an analyst in the U.S. Department of Labor's Office of Work-Based Learning, there are more apprentice trainers and teachers in Germany than there are apprentices in the United States (personal communication, U.S. Department of Labor, 1992). |

|

23. |

The German apprenticeship system does a much better job of developing the skills of technicians and craft workers than the more fragmented U.S. nonsystem of vocational education and training. Large Japanese firms rely heavily on supervisors and managers to provide instruction on the factory floor, but because of emphasis on long-term or lifetime employment in Japan, there is also more emphasis on development of multiple skills and capabilities extending beyond the requirements of a particular job assignment (U.S. Congress, Office of Technology Assessment, 1990b, pp. 83–95). |

|

24. |

There is a growing body of evidence that links higher rates of investment in process technology and production equipment with improved cost-competitiveness and higher rates of productivity growth in manufacturing (Edquist and Jacobsson, 1988; DeLong and Summers, 1990). |

|

25. |

See, for example, Alic et al. (1992, chapter 10), Jaikumar (1989), and Tani (1989); for examples from the service sector, see Roach (1988, 1991). |

|

26. |

See also Edquist and Jacobsson (1988) for a multicountry comparison of diffusion rates for advanced manufacturing equipment during the mid-1980s. |

|

27. |

As of the late 1980s, it is estimated that no more than 10–12 percent of installed machine tools in the United States were numerically controlled. These surveys also show that (i) plants engaged in defense production adopt advanced manufacturing technology more readily than plants serving principally commercial markets; (ii) plants owned by firms with high R&D-to-sales ratios adopt these technologies more rapidly; and (iii) the relationship between plant age and technology usage is weak (Casagrande, 1992; Dunne, 1991; Kelley and Brooks, 1988, 1991; Kelley and Watkins, 1992). |

|

28. |

The terms "generic technology" and "precompetitive technology" have been used loosely in much of the current discussion over the proper government role in civilian technology to describe a broad range of technologies for which the rationale and operational implications for government support vary considerably. The committee believes it is important to distinguish between various types of "generic" technology according to differences in time horizons, differences in the mix of business and technical risks and rewards, and differences in beneficiaries. The typology set fourth in the recent study Beyond Spinoff (Alic et al., 1992), which identifies three different types of generic technology, is particularly useful in this respect: •Pathbreaking technology—emphasizing technical challenge; •Infrastructural technology—emphasizing productivity improvement and breadth of application; and •Strategic technology—emphasizing the importance to the nation of the industries to which the technology applies. For elaboration of these types of three generic technology, operational criteria for identifying each type, and implications for public policy and public R&D investments, see Alic et al. (1992, chapter 12). See also Chapter 1, p. 17 for brief descriptions of pathbreaking and infrastructural technologies that draw on this taxonomy. |

|

29. |

In the wake of the 1990 Congressional Budget Agreement, the Defense Department's role in support of "dual-use" technology received an additional boost. The budget agreement established "fire-walls" between the defense and nondefense budget categories for the purposes of allocating spending cuts to help reduce the federal budget deficit. Given the tight constraints on the nondefense portion of the budget and mounting pressures within Congress for action to redress emerging weaknesses in the nation's civilian technology base, a number of small-scale programs designed to strengthen the nation's industrial technology base were categorized as "dual-use" and written into successive defense authorization and appropriations bills. As a result, the Department of Defense now administers a number of programs that are closely related to the missions and competence of civilian agencies such as the Department of Commerce and the Department of Labor. See ''Huge Funding Surge is Soon to Greet Dual-Use Programs," New Technology Week 7(7) (February 16, 1993):1–2. |

|

30. |

For an overview of the history and recent evolution of the these programs, see Committee on Science, Engineering, and Public Policy (1992, pp. 65–67) and National Academy of Engineering (1989). |

|

31. |

Because some nations define or classify R&D expenditures differently than others, international comparisons such as these are fraught with difficulties. Nevertheless, the very fact that the United States allocates such a relatively small percentage of its total public R&D dollars to objectives it classifies as "industrial development" sheds considerable light on international differences in public R&D priorities. |

|

32. |

The nature of the civilian R&D investments needed to bridge emerging gaps in the nation's technology base poses serious challenges to sound public policy action in this area. Infrastructural R&D investments such as those aimed at the development of engineering methods, the compilation and validation of technical data, the development and characterization of materials, measurement tools, and instrumentation, and the refinement of manufacturing processes are generally low cost and low technical risk and are believed to have a high payoff to society as a whole. However, such R&D is rarely "high-profile," and the returns are cumulative over a number of years, widely diffused across a broad spectrum of firms or industries, and therefore difficult to measure. Research and development investments relevant to pathbreaking technologies, while perhaps more appealing to many because of their potentially high economic reward, are above all fraught with high technical risk and characterized by highly uncertain and possibly long-delayed economic payoffs. While these very characteristics of pathbreaking technology discourage adequate private-sector R&D investment and provide the rationale for public-sector support, they also ensure a high failure rate and make measurement of returns on such investments extremely difficult. See note 28 above for further discussion. For a useful survey of how the German and Japanese governments select technology areas for public R&D subsidies, see U.S. Department of Commerce (1992b). |

|

33. |

By organizing to tap external sources of innovation, firms often become more effective at integrating the innovation process within their own corporate borders. |

|

34. |

The preliminary results of an international survey of senior technical executives conducted by MIT's Industrial Liaison Program and PA Consulting Group suggest that U.S. firms have not taken advantage of outside sources of technology such as joint ventures, suppliers, and university-sponsored research to the same extent as their European and Japanese counterparts. However, U.S. executives interviewed expected to rely more on external technology in the future. For a review of the survey's findings as presented at a 10 December 1992 MIT symposium on Strategic Management of Technology: Global Benchmarking, see "How U.S. Companies Measure Up," Science vol 259, 1 Jan. 1993. p. 23. See also Mansfield (1988a,b). |

|

35. |

In fact, R&D performed by affiliates of foreign multinationals in the United States is growing considerably faster than R&D performed by foreign affiliates of U.S. multinationals abroad as foreign companies move to take advantage of the excellent R&D capabilities in the United States (see Bureau of Economic Analysis, Foreign Direct Investment in the United States [ongoing series] and National Science Foundation, Industrial R&D [ongoing series]. See also Chapter 2, pp. 47–51 above. |

|

36. |

This seems to suggest a U.S. lag in the adoption and use of new technology relative to its rivals despite its continuing strength in the origination of new technology licensed to others. Sweden, for example, has adopted process innovations far more rapidly in recent years than the United States, even though it has originated relatively few (Edquist, 1990). |

|

37. |

Federal agencies and most U.S. corporations are notorious for cutting the travel budgets of their R&D personnel whenever general cost-cutting measures are called for. Despite the existence of National Science Foundation programs to support the exposure of U.S. industry-based scientists and engineers to foreign R&D enterprises, U.S. industry has not availed itself of these programs to any significant extent. |

|

38. |

According to Nothdurft (1992) only 10 percent of U.S. firms are regular exporters and 15 percent of all exporting firms account for 85 percent of all exports. |

|

39. |

For indicators of asymmetry of market access between Japan and other industrialized countries, see data on import penetration and the relative importance of foreign-controlled firms (foreign direct investment) in the major industrial economies in Tables 2.3 and 2.4 in Chapter 2. Intra-industry trade data also underline the anomalous position of Japan among advanced industrialized countries. See Lincoln (1990). It should be noted that there is considerable debate as to the magnitude and causes of these apparent differences in the level of foreign penetration of national economies, and, hence, whether it is even useful or accurate to explain these differences in terms of asymmetries of access (Japan Economic Institute, 1991; Krugman, 1991; Lawrence, 1991 a,b; Lincoln, 1990; Saxonhouse, 1989, 1991; Takeuchi, 1989). |