Appendix B

U.S.-Japan Technology Linkages in Airframes and Aircraft Systems

During the study process, the committee was briefed on U.S.-Japan cooperation and competition in various segments of the aircraft industry by industry and other experts. The material here and in Appendix C draws heavily on the insights of these experts and also incorporates information from published sources when this was available. Through this process, the committee was able to gain access to information on linkages that would otherwise be unavailable. On some points—particularly points of interpretation related to sensitive business issues—published sources of information do not exist. Readers should keep in mind that these accounts rely on individual expert viewpoints and interpretations.

BOEING COMMERCIAL TRANSPORT ALLIANCES WITH JAPAN

In the more than 20 years since the YS-11 program was canceled, Japanese activities in the airframe segment have been carried out mainly through alliances between the heavy industry manufacturers and Boeing. In the Boeing perspective, Japan is important as a market, collaborator, and potential competitor. As a wealthy island nation, Japan is a highly developed market for

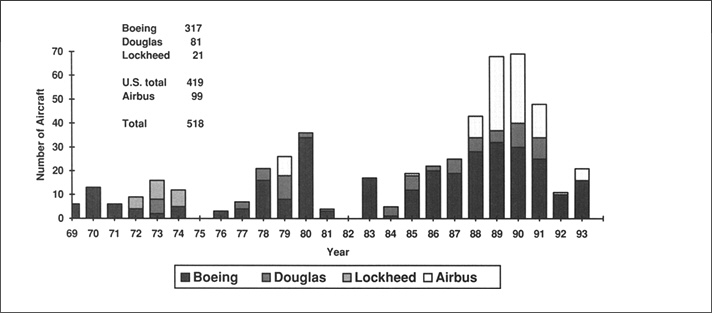

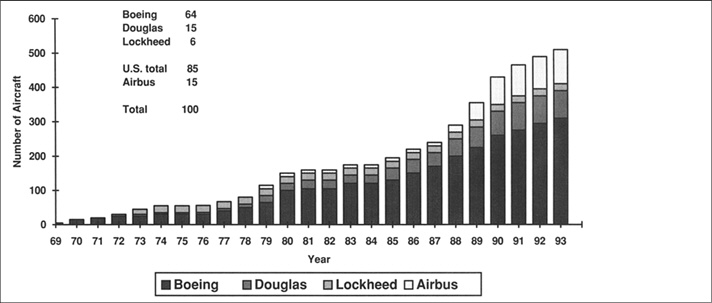

commercial airplanes and the largest foreign customer country for Boeing, even though the level of domestic air travel is low relative to the wealth of the country because of geography and the highly efficient rail system (see Figure B-1). Boeing projects that the total commercial jet market in Japan between 1993 and 2010 will be $60.5 billion in 1993 dollars (440 airplanes), second to the U.S. total of $280 billion and ahead of the rapidly growing Chinese market ($41 billion). Japan Air Lines (JAL) is the largest customer for Boeing's largest airplane, the 747 (having bought a total of 114); All Nippon Airways (ANA) is the largest foreign buyer for the 767 (having bought 82 thus far).

Boeing has procured parts and equipment from Mitsubishi Heavy Industries (MHI), Kawasaki Heavy Industries (KHI), and Fuji Heavy Industries (FHI) since the start of the 747 program in the late 1960s, with MHI and FHI supplying Boeing on the 757 and KHI on the 737. With the 767 program in the late 1970s and now the 777, the Boeing-Japan interaction has moved from one in which the Japanese companies ''build parts to specification,'' to actual design and engineering interaction from the earliest stages of product development. Table B-1 lists the components built by the three "heavies" on various Boeing aircraft; while Table B-2 shows the involvement of other suppliers.

In looking at the U.S. versus foreign content of Boeing aircraft, on average U.S. content is 85 percent by dollar value across all models, and 60 to 70 percent of subcontracted work is given to U.S. firms. The big change over the past 20 years is the main fuselage sections. Northrop builds most of these parts on the 747, whereas most of the fuselage of the more recent 767 and new 777 models is built in Japan. However this has led to only a moderate shift in U.S. versus foreign content because the fuselage does not constitute a large percentage of the value of an airplane. Foreign content of the 777 will be 16.7 percent including engines (12.6 percent not including engines); foreign content is 12.2 percent for the 767 and 14.6 percent for the 757.1 When describing their participation in Boeing programs, the Japanese companies use figures for percentage of the airframe by value, which are higher.

767 Program

Boeing had worked with the Japanese companies in the late 1960s when they supplied parts for the 747. Discussions concerning closer collaboration on future aircraft started in 1970; the 767 program was launched in 1978 and a contract was signed with the Japanese to supply parts. The first ship sets were delivered in early 1980. In 1991 the two sides renegotiated for a second 500

sets. Boeing's primary motive in entering the alliance was the perception that Japanese participation would provide some market leverage. There were no formal offsets, laws, or requirements. Boeing negotiated a similar work share arrangement on the 767 with Italy's Aeritalia.

The 767 is a wide-body twinjet that can carry 260 passengers in a mixed-class configuration. In some versions, the range of the 767 exceeds 6,000 miles. The agreement was for a fixed-price purchase of the first 500 ship sets, which incorporated learning curve cost reductions over time. Boeing calculates Japanese work share as 15 percent of the airframe—this does not include airframe systems and constitutes about 6 to 7 percent of the total value of the airplane. This is a nonequity role. The Japanese have taken cost and market risks, and have covered their own tooling and other investments. The Japanese government provided funding through success-conditional loans for much of this investment. Boeing negotiated using its own production costs as a standard rather than bidding the work out competitively. Earlier procurements from the Japanese were competitively bid, as was some of the work the Japanese do on other models outside of these risk-sharing agreements. For example, FHI won the worldwide competition for the replacement of the 757 wing flap.

The first 500 ship sets were not guaranteed, which means that the Japanese consortium assumed the total risk for its work share. The price was fixed in dollars, which means that the exchange rate fluctuations during the 1980s played havoc with the planning of the Japanese companies. Since the yen appreciated overall, this has put cost pressures on the three heavies. Boeing believes that at this point the Japanese companies have made money on the 767 program overall, but results have varied greatly by year.

Boeing had already made the major design decisions when the 767 deal was signed with the Japanese. During the detailed engineering stage of the program, Japanese engineering personnel were stationed at Seattle for up to a year. Technology transfer between Boeing and its foreign partners was essentially limited by the hardware choices—Boeing did not give the Japanese (or the Italians) sensitive parts of the airframe. Engineering data exchange was conducted on a "need-to-know" basis. The Japanese were given engineering data necessary to design their parts through digital data transmission or magnetic tape. The Japanese were trained in computerized design techniques. Considerable transfer of component design technology occurred, but this constituted "old" technology from Boeing's standpoint. Transfer to the Japanese through program subcontracting probably allowed Boeing a higher return on this asset than alternate technology transfer mechanisms (such as licensing) would have, and the business arrangements were competitive.

TABLE B-1 Japanese Three Heavies: Boeing Involvement

|

|

Mitsubishi |

|

Kawasaki |

|

Fuji |

|

747 |

• Inboard trailing edge flap |

747 |

• Outboard trailing edge flap |

747 |

• Aileron • Spoiler |

|

767 |

• Section 46 fuselage panel • Entry and cargo doors |

767 |

• Sections 43 and 44 fuselage • Wing inspar ribs |

767 |

• Wing box fairing • Mlg. door |

|

757 |

• Stringers |

737 |

• Wing inspar ribs |

757 |

• Outboard flaps |

|

777 |

• Section 46 body panels • Passenger and bulk cargo doors • Section 48 tailcone |

777 |

• Section 43 body panels • Section 44 body panels • Section 45 keel beam • Section 12 wing inspar ribs • Cargo doors |

777 |

• Section 11 wing box • Sections 11 and 45 integration • Section 49 wing box fairing • Mlg. doors |

|

SOURCE: Boeing. |

|||||

TABLE B-2 Japanese Aerospace Industry Involvement in Boeing Programs

|

Manufacturing |

Representative items and activities |

Programs involved |

|||||||

|

|

|

707 |

727 |

737 |

747 |

757 |

767 |

7J7 |

777 |

|

Japan Aircraft Manufacturing Co. |

Structural components |

|

|

|

|

x |

(x) |

|

|

|

ShinMaywa Industry Co. |

Structural components |

|

|

|

|

(x) |

x |

|

x |

|

Japan Aircraft Manufacturing Co. |

Galleys, lavatory modules |

|

x |

x |

x |

x |

x |

|

x |

|

Teijin Seiki Co. |

Actuators, servos |

|

|

x |

x |

x |

x |

x |

x |

|

Shimadzu Corp. |

Gear boxes, valves, actuators |

|

|

x |

x |

x |

x |

|

(x) |

|

Kayaba Industry Co. |

Valves, actuators |

|

|

x |

|

x |

x |

x |

|

|

Yokahama Rubber |

Lavatories, honeycomb core products |

|

|

x |

x |

x |

x |

|

|

|

Nippon Miniature Bearing |

Bearings, motors |

|

|

|

x |

x |

x |

|

|

|

Mitsubishi Electric Corp. |

Valves, actuators |

|

|

|

x |

x |

x |

|

|

|

Matsushita Electric Corp. |

Entertainment systems, panel-mounted radio speakers, CRTs |

x |

x |

x |

x |

x |

x |

x |

|

|

Sumitomo Precision Products Co. |

Landing gear structures |

|

|

|

|

(x) |

(x) |

|

|

|

Koito Manufacturing Co. |

Lights |

|

|

x |

x |

x |

x |

|

|

|

Tokyo Aircraft Instrument Co. |

Instruments |

|

|

|

x |

x |

x |

|

|

|

Sumitomo Electric Industries |

Fiber optic couplers |

|

|

|

|

|

|

x |

|

|

Suwa Seikosha Co. |

Flat-panel displays |

|

|

|

|

|

|

x |

|

|

NEC Corp. |

Digital autonomous terminal access communications systems |

|

|

|

|

|

|

x |

|

7J7/YXX

The next Boeing-Japan collaboration was on the M program, also known as the YXX in Japan. A memorandum of understanding (MOU) was signed in 1986 confirming Japanese participation as an equity partner in the development of a 150-seat short- to medium-range twinjet. This project would have constituted a significant increase in the Japanese role over the 767. The Japanese, through the Japan Aircraft Development Corporation, would have held 25 percent of the equity and would have been involved in all phases of design, production, and marketing. When the 1986 MOU was signed, the deal attracted considerable attention and some criticism.2 Boeing argued that for each job created in Japan by the program, 23 would be created in the United States. Due to the subsequent shelving of the program, the collaboration returned to a lower profile. As in other collaborative international programs, U.S. government approvals—such as a Department of Commerce technical data export license—were needed for this project. The Departments of Commerce and Defense tend to take a restrictive stance on certain technologies such as those related to composites, but sensitivity is generally limited to design knowhow rather than manufacturing processes.

Intensive discussions about market projections and other areas were initiated to start up the 7J7 relationship. A collaborative research program also commenced, with Boeing sharing some summary data from its generic subsonic research and the Japanese companies sharing data from the work they were doing with National Aerospace Lab and internally in fluid dynamics and the testing of new composite materials, flaps, and slats. Boeing sees high-speed aerodynamics as the fundamental technology to protect, and there has been no collaboration with the Japanese in high speed.

Although some support is still provided by the Japanese government, the 7J7 program has not yet been launched, and the short-term prospects are not particularly favorable. The market for the 150-seat aircraft has not coalesced. At the low end, it overlapped with Boeing's existing 737; at the high end, with the 757. Two technical developments outside of the Boeing-Japan negotiations have influenced this course of events. First, Boeing wanted to utilize an unducted fan turboprop engine, which it was working on with GE and which would deliver significant gains in fuel economy.3 However, falling fuel prices in the mid and late 1980s made fuel economy a less critical concern for airlines. Secondly, contrary to earlier expectations, Boeing was able to extend the life of the 737 by fitting it with high bypass engines. The company had thought that

the more advanced engine would not fit under the wing, but a solution was engineered, partly through computational fluid dynamics work at the National Aeronautics and Space Administration (NASA) Ames Research Center.4 Because of the success of the extended 737 and prospective competition from the Airbus A320, a brand new airplane in the 150-seat class was much less compelling strategically for Boeing. More recently, Boeing has decided to develop an advanced version of the 737, pushing development of an all-new aircraft in that market segment further into the future.5

Both Boeing and the Japanese had put a significant amount of money into the program, and there is still a strong incentive for the Japanese not to let it formally die. The 7J7 continues to command a line item in the budget of the Ministry of International Trade and Industry (MITI). Low-level technical collaboration continues, but closer cooperation was delayed until the next major Boeing program, the 777.

777

Boeing, the three heavy industry companies, and the Japanese government worked out a "program partnership" for the 777 twinjet, which is due to enter airline service in 1995 and will seat 328 with a range of 5,000 miles in its initial version.

The structure of the deal itself is very similar to the 767, although Boeing originally offered equity participation similar to that contemplated for the 7J7. While the Japanese were interested in an equity share, Boeing set a minimum amount, and the Japanese were not prepared to assume a risk of that size. The 777 is a much larger airplane than the 7J7 was conceived to be, with correspondingly higher development costs. Development costs for an all-new jet such as the 777 are estimated to run about $5 billion.6 As an equity partner, the Japanese heavies would be participating at a significantly higher level, and the business justification had to be compelling to their top managements. Apparently, the companies were not willing to assume that great a risk, despite some apparent pressure from the government to do so.

The Japanese ended up with nonequity participation and some increase in their role compared to the 767. There are differences between the two programs, the most obvious being increased Japanese work share. Boeing calculates that on the 777, the heavies are building 20 percent of the airframe,

which is about 8 to 9 percent of the value of the airplane. The Japanese partners essentially build all of the fuselage parts except for the nose section. The increased share was not a negotiating issue—it was offered by Boeing. Also, rather than a contract for a fixed number of ship sets, the 777 agreement is in effect for the life of the program.

The Japanese are also more involved in designing the components that they are manufacturing. There were many more Japanese engineers involved in 777 development than in 767 development, with several hundred sent to Seattle during the most intensive design phase. Yet, as with the 767, the Japanese are limited in the engineering effort to their own work package. Structural testing—and the software and models needed to obtain results—are not shared, only the end results necessary for the Japanese to design the parts they will build. For example, Japanese engineers had access to the load data for the wing center section because they designed and will manufacture the wing box, but data on the outboard section were not made available. The most significant increases to the Japanese work share are the 777's wing box and the pressure bulkhead, both of which were designed and built by the heavies. Both are critical and somewhat tricky to manufacture, but they do not constitute "advanced technology" from Boeing's perspective.

The 777 is introducing several significant technical advances. The CATIA three-dimensional computer design system was used to make the design process as "paperless" as possible. CATIA was originally developed by Dassault Aviation of France, but Boeing has also made proprietary improvements. The full impact of CATIA will be known as the first aircraft are built and delivered. The process has not saved on the number of engineers needed to design the aircraft, but the hope is that it will cut down on the number of design modifications that have to be made after production begins. Boeing estimated that it would have 50 percent fewer modifications on the 777 than on the 767. As this is written, Boeing was running at the rate of 10 percent of 767 changes—a 90 percent improvement. The value of CATIA will be in the reduction of recurring costs by eliminating a significant percentage of the design anomalies that normally require correction during production of the first 30 or 40 ship sets. In addition to CATIA's role in streamlining the design process, the availability of design data in a digital form has enabled considerable manufacturing advances. This is discussed in more detail below.

Through a system of passwords, the access of Japanese engineers on-site and working at the computer system in Japan that Boeing set up for the 777 project is limited. The CATIA design software itself is "locked up," as is work on parts of the airplane unrelated to the Japanese work share. Attempts to get around the system would set off alarms. Japanese engineers went through a basic CATIA user's course, which takes about a week. Because the Japanese cannot access the software, it would not be possible for them to make improvements on CATIA in conjunction with the 777 program.

On-site, the visiting Japanese engineers were given access only to certain buildings, and sensitive manufacturing sites were accessible only with a Boeing

escort. When two engineering teams get together, communication and information exchange naturally occur, most of which is beneficial to the project. How did Boeing control the people-to-people flow of technology? First, within Boeing, analysis and testing of the design are done by a separate group of engineers from those who work on design with the Japanese heavies. It is fairly straightforward to segment information on a need-to-know basis even within the company. Boeing provided a briefing to engineering and manufacturing personnel who would come in contact with the overseas partners, conveying the basic message that they should provide only what would be needed for the partners' work share. A management committee reviewed and decided on questions that arose in gray areas.

As in any program of this size, various management issues came up during the negotiations and design process. For example, after Boeing had determined how much work to give the heavies, the Japanese partners needed to reach agreement on dividing the work share. Apparently, this process was not completely straightforward. Also, once work got under way, the engineering resources of the heavies were stretched by the simultaneous demands of 777 and FS-X design work. Although the quality of the Japanese engineering effort was always outstanding, some adjustments were necessary during the design phase to keep the program on schedule. Also, from the Japanese perspective, the dispatch of large numbers of engineers to Boeing became quite expensive. The heavies would prefer to conduct as much of the interaction as possible within Japan in order to minimize travel and expatriate living expenses.

From a business and program development point of view, the partnership with Japan on the 777 has been very beneficial for Boeing. Since the product has not been introduced and its success in the market is not yet known, it is difficult to measure the bottom-line benefits, but order information thus far is promising. All three of the major Japanese airlines have ordered the 777.

Boeing's policy is to limit dependence on suppliers in the structures and airframe area (as opposed to the engine and avionics areas, where the breadth of technology is so great that the company has no choice but to be dependent). Boeing maintains the capability to manufacture all the components it buys from the Japanese. MITI has recently told Boeing that it wishes to encourage manufacturing technology transfer from Japan to the United States and has offered its assistance. Because of Boeing's relationship with the heavies, it is largely aware of what happens on the manufacturing side, and it reports no difficulties in obtaining access to technologies improved upon by Japanese partners. For example, one of the Japanese companies had developed a robotic skin polisher and responded positively to Boeing's request to license it. Another example is the method of laying up thick composite structures that Boeing learned from FHI in conjunction with the latter's work on the 767 main landing gear door. Boeing had been running structures of that size through the autoclave three times. FHI developed a method of laying up the composite material that required only two runs through the autoclave.

This open attitude might be different if Boeing were a potential competitor. For example, outside of the partnership with the three heavies, Boeing is contracting with Toray for composite materials to be used for the 777's tail. Boeing was interested in developing a second source, and Toray did license some of its technology to a U.S. firm, but in the end a competitive U.S. bid did not emerge. As a ''next best'' solution, Toray has built a facility in the Puget Sound region to supply Boeing.

Japanese Advanced Manufacturing Capabilities

During its study mission to Japan in June 1993, the committee had an opportunity to tour the manufacturing facilities of the Japanese heavies and several smaller aircraft suppliers. The committee was particularly impressed with the manufacturing capabilities of Japanese industry—much of it devoted to participation in the 777 and other Boeing programs. Here are selected examples of advanced aircraft manufacturing capabilities possessed by one or more of the heavies:

-

Fuselage panel drilling and riveting: In addition to its utility in the design process, CATIA allows for significant manufacturing process advances. By using the design data base to run manufacturing processes, much of the tooling that has traditionally been necessary for aircraft manufacturing can be eliminated. Using CATIA in conjunction with numerically-controlled machine tools to improve processes was inherent in the system from the beginning, but the Japanese have significant latitude in designing their own processes along with Japanese or foreign machine tool makers. Processes that the Japanese develop for the 777 must be approved by Boeing.

The Japanese have realized much of CATIA's potential in driving manufacturing in the fuselage panel drilling and riveting processes. Particularly impressive is the use of pogo sticks to support aluminum skins in drilling and riveting fuselage panels. The height and angle of the sticks as well as the hole locations are set according to the CATIA data base for particular panels. In addition to eliminating tooling, this reduces manufacturing cycle time and improves quality.

-

Preparing aluminum skins: Preparation of the aluminum skin for the panel requires chemical-milling of the panel around the window openings. Masking for the chemical-milling is prepared on a new large-scale numerically controlled five-axis, carbon dioxide laser that cuts a rubber mask laid on the panel. This machine also operates from the CATIA design data base. After chemical-milling, the skin is stretch formed to take the radius of the fuselage and is then trimmed and polished on another five-axis robotic machine.

-

Processes for thick aluminum parts: Although the aluminum skins used for many parts of the fuselage are thin enough to be shaped through chemical milling and stretch forming, some of the thicker parts would be made more susceptible to wear if this method were employed. Instead, thicker parts are

-

shotpeened. The Japanese possess the advanced machinery necessary for this process and have acquired the complex know-how needed to use it.

All of the milling operations are done on large numerically controlled machines. To shape the curvature of the wing center section skin, a special machine generates the curved shape by shotpeening the skin in a controlled process while simultaneously shotpeening the surface for fatigue strength.

The machines used to mill the wing stringers are very high-speed, numerically controlled horizontal mills, about 15 feet long, that shape the stringers from a solid bar of aluminum. The wing spars are also milled on a universal five-axis numerically controlled machine.

-

Composites manufacturing: The Japanese heavies have made significant investments in composites manufacturing. Some of these are related to non-Boeing programs (such as the FS-X). Several Japanese companies possess the latest equipment to do immersion ultrasonic inspection of very large-scale composite aircraft structures. The equipment is also numerically controlled with automatic recording of inspection data, and is designed to detect subsurface flaws or lack of bonding in the composite structures. On the engineering side, the committee saw some excellent work being done on composite cloth configurations aimed at solving the fundamental problem of delamination in composite structures.

The overall impression is that various fundamental technologies have been distributed among the major players in the Japanese industry. From manufacturing processes involving fuselage structural components, to more highly loaded structures such as wing sections, to lightweight composite structures, which include moderately stressed composite landing gear doors as well as more highly loaded carbon fiber wing structures, Japanese aircraft manufacturing capabilities are state of the art.

The heavy investment in the most advanced robotic numerically controlled machines is clearly aimed at gaining a leadership position in high-quality, low-cost manufacturing. Although quality and manufacturing cost have always been a high priority in the U.S. aircraft industry, along with leadership in aerodynamics and systems integration, the committee gained a clear impression that the Japanese have placed a very high priority on winning in the arena of manufacturing quality while achieving cost leadership.

Boeing Manufacturing Capabilities

A subgroup of this committee also had an opportunity to visit several of Boeing's Washington State facilities that will manufacture the 777. During the past three years, Boeing has invested in excess of $2 billion in new factories, equipment, and office facilities aimed at achieving a quantum improvement in product quality and manufacturing productivity. This description of Boeing's capabilities is included to illustrate the scale of investment and types of advanced manufacturing technology currently required to stay competitive in the aircraft industry, to balance the discussion of Japanese capabilities, and to

highlight the sorts of investments that most U.S. aircraft manufacturers are currently unable to make.

For example, the 777 assembly building in Everett includes all of the elements required for final aircraft assembly. The operation starts with buildup of spars and wing skins using the latest robotic riveting and bolting equipment. There are four huge fixtures for final assembly of left-hand and right-hand wing sections. Fuselage barrel sections are assembled from panels supplied by the Japanese heavies in huge "rollover" fixtures that permit access to assembly of the floor beams, with the floor assembled overhead and the barrel section rotated 180 degrees from its normal position. The floor beams are carbon fiber composite structures, the first such application of composites in Boeing commercial aircraft. The first 777 was rolled out on April 9, 1994, with plans to commence flight tests in June 1994.

The Auburn sheet metal shop is another new facility in which up to 10,000 different structural components, from simple brackets to the huge hydroformed beams that connect the wings through the wing box, are manufactured. Facilities include very large, new, horizontal milling machines for cutting multiple elements of complex geometric shapes. The machining center is computer driven from dispatch of raw material through delivery of finished parts. The machining instructions are contained on compact discs that are inserted in the machine by the operator. The plant contains some of the world's largest hydroforming and stamping equipment.

These investments will likely enable Boeing to achieve major improvements in cycle time. Previously it took an average of 40 days to process a part from order input to product output. Today it takes about nine days, the objective being a five-day cycle. Current efforts are focused on reducing product variability by using techniques such as statistical process control.

The Fredrickson wing spar and skin mill facility is also new. In this plant are four huge wing skin milling machines with vacuum milling beds up to 210 feet in length. Each machine is capable of milling two wing skins simultaneously. In addition, there are similar special milling machines for machining the wing spars. The plant includes special facilities for shotpeening the spars and edges of the wing skins, automated anodizing, and painting. The plant delivers the complete wing skins and spars to the Everett facility, where the wing skin-spar assembly is completed.

Boeing has also made significant investments in composites manufacturing capability at Fredrickson. The facility includes four large-scale tape lay-up machines, with the entire process carried out in an atmospherically controlled (positive-pressure) building. Two new 40-foot-diameter autoclaves, with front and rear door loading, are operational. All trimming and cutting operations are done by a computer-controlled water jet cutter. The compound curved structures are supported on a pogo stick bed driven by the CATIA data base.

Impacts

Thus far, Boeing's relationships with Japan have been quite beneficial to it in a business and strategic sense. Boeing's basic philosophy is that Japan will be a major player in aircraft, and that it is preferable for the major firms to be teamed with Boeing rather than allied with one of Boeing's rivals or mounting an independent challenge. The Japanese have not collaborated in a significant way with either Airbus or McDonnell Douglas on commercial transports, and have not become an independent force thus far. Airbus has been actively looking for Japanese participation in its programs. The Eurpean consortium has sold A320s and A340s to ANA, with ANA obtaining important European landing rights at about the same time. Kawasaki has one contract for the A321, which is the first supply contract between one of the heavies and an Airbus partner.

Boeing has received high-quality components delivered on time at a price that U.S. suppliers would be very hard pressed to beat. The risks assumed by the Japanese (in the form of success-conditional loans by the government and the companies' own investments) have allowed Boeing to avoid the high financial leveraging necessary for earlier projects like the 747. The Boeing relationship has provided the Japanese heavies with a relatively low-cost, low-risk means of entering the global airframe field. Participation in Boeing programs—particularly the 777—has allowed the Japanese heavies to implement advanced manufacturing techniques in producing modern technology aircraft, but they have not obtained Boeing's most critical technologies.

Perhaps the most critical technology in design is knowing how to make the end product do what it is supposed to do on paper. This is a very difficult process, one that even established players find daunting. Boeing's track record is quite strong in this area. Because the engines are a critical determinant of performance, Boeing audits the engine makers to assess whether new products are likely to meet targeted performance specifications and then estimates the size of any shortfall. This engine audit process is a part of Boeing's organizational knowledge base. Another closely held management technology is the know-how needed to guide a program through the safety certification process and to interact with the Federal Aviation Administration and air safety agencies of other governments.

Up to this point, the Japanese have been content to continue in the role of risk-sharing supplier. The heavies will likely continue to receive government support for Boeing projects as long as they can show that they are receiving increased work shares with greater technical sophistication. Aerospace is a significant but not overwhelming share of the overall business of the heavies. Defense and commercial aircraft programs must compete for resources with other divisions, and the road to the chairmanship of MHI, KHI, or FHI has not traditionally led through the aerospace division. The companies have not significantly "grown" their aerospace activities—there are perhaps 2,000 to

3,000 aerospace engineers in Japan, whereas Boeing employed 9,000 on the 777 program alone.

Although Japanese defense budget cuts will likely increase industry's appetite for commercial work, Japan also faces some constraints as it reassesses its long-term strategy. The Japanese heavies have failed twice in independent programs, and it is Boeing's policy not to participate in a program at less than 50 percent equity. Further, significant participation in McDonnell Douglas commercial programs might be more costly and risky than continuing with Boeing, and collaboration with Airbus is problematic because the heavies would presumably need to take work share away from the Airbus members themselves. In the case of Boeing, the Japanese are largely building components that Boeing would have contracted out anyway.

Although it is important to recognize the constraints currently facing the Japanese aircraft industry, there is still no question that Japan has built a considerable aircraft technology and business base over the past several decades. Significant changes in the global environment, including the emergence of the Russian industry and other new players, may present Japan's aircraft industry with opportunities to move beyond existing constraints. Japanese capabilities, particularly in manufacturing, will allow its industry to continue expanding its global role into the next century.

MCDONNELL DOUGLAS

Commercial Programs

McDonnell Douglas's involvement in Japan stretches back over 40 years. JAL has operated a variety of Douglas products (DC-3, DC-4, DC-6, DC-7, DC-8, DC-10, and MD-11) since 1951. Japan Air Systems (JAS), the major domestic carrier along with ANA, is also a longtime Douglas customer. In addition, the trading company Mitsui & Co. played a major role in financing the launch of the MD-11 program. Yet in contrast to growing involvement by Japanese airframe manufacturers in Boeing programs over the past two decades, Japanese firms have remained subcontractors in McDonnell Douglas commercial programs.

Still, even this limited involvement has led to growing Japanese capability in a number of structures and components areas, particularly composites. In the early 1970s, MHI won a contract to supply the metallic tail cone for the DC-10, and is now manufacturing a composite tail cone for the MD-11. Also, FHI supplies a composite outboard aileron for the MD-11, which meets the targeted weight at a cost equivalent to aluminum. Table B-3 shows the Japanese suppliers for the MD-11 program.

McDonnell Douglas has had several other collaborative relationships with Japanese companies and the Japanese government over the years in aerospace fields such as satellite launch vehicles and helicopters. However, the interaction

TABLE B-3 Japanese Suppliers on the MD-11 Program

|

Manufacturer |

Product |

|

Fuji Heavy Industries |

Outboard aileron |

|

Nippon Hikoki |

Underwing barrel |

|

ShinMaywa (through Rohr Industries) |

Wing/tail pylon |

|

Yokohama Rubber |

Portable water tank |

|

Teijin Seiki |

Elevator activator |

|

|

Sleet activator |

|

SOURCE: McDonnell Douglas. |

|

in fighter aircraft is the one most relevant to this study and constitutes a good starting point for a discussion of U.S.-Japan collaboration in military aircraft.

Military Programs: F-15 Licensed Production

U.S.-Japan licensed production of the F-15 was an important step in the evolution of U.S.-Japan collaborative military programs. As noted earlier, Japanese companies had assembled the North American F-86 in the 1950s, and moved on to the licensed production of the more advanced Lockheed F-104 in the 1960s, and the McDonnell Douglas F-4 in the 1970s. In the mid-1970s, Japan began to consider options for replacing the older fighters in the Air Self Defense Force (ASDF) arsenal. The F-15 was chosen over several rivals mainly because of its weaponry, radar, and other aspects of its technological sophistication as an "air superiority" fighter. This decision and the subsequent licensed production agreement were reached relatively soon after the fighter was first deployed in the United States.

There were early security concerns in the U.S. Defense Department over the transfer of advanced technology through F-15 licensed production. Japan is still the only U.S. ally that has been allowed to produce the aircraft. Concerns about the economic and competitive implications of F-15 technology transfers were raised only after the program was launched.7 In initially deciding to go forward, the broad strategic and political rationale for Japanese production—primarily a greater contribution to regional security from a more militarily capable Japan—prevailed without a great deal of contention in the U.S. Government.

The United States was committed to provide technologies and data necessary for Japanese production of the F-15, with the exception of items such as design data, radar, electronic countermeasures, software, and source codes, which were classified as "nonreleasable." The extent of this "black boxing" was greater than in the F-4 program and, according to some experts, provided a motivation for Japanese industry to pursue the independent Japanese development of the country's next fighter in the mid-1980s. Still, the technology transfer was substantial in terms of quantity, and it has been argued that the level of technology transferred through F-15 licensed production was higher than in previous bilateral programs.8Table B-4 shows the technologies transferred to Japan by McDonnell Douglas in the F-4 and F-15 programs.

Much of the technology transfer connected with the F-15 program has taken place through commercial licensing and technical assistance agreements between individual companies. Although these agreements are subject to U.S. government export approval, Department of Defense (DOD) program officers and even McDonnell Douglas are not equipped to stay fully abreast of technology transfers at the subcontractor level. At the government level, Japanese industry and government have continued to request technical information connected with the F-15, including releasability requests for technologies that the U.S. had provided in black boxes. There was sometimes disagreement among DOD management over these requests, with the F-15 system program office inclined to urge denial and higher levels tending to approve.

It was often difficult to balance Japan's justifications with concerns about protecting U.S. design know-how. Economic concerns about the potential for F-15 technology aiding Japan's commercial aircraft capabilities gained credence as the program progressed. Japan generally justified requests by claiming that release of a given technology would speed production schedules, reduce maintenance times, alleviate parts shortages, and reduce the costs of maintaining large inventories of spares. Some of these requests were understandable—a number of the U.S.-made components had high failure rates, with repair sometimes requiring shipment back to the United States. Japanese companies also reported cases in which American supplier counterparts either lost orders for spare parts or filled duplicate orders. This materially affected the operations of Japan's deployed F-15s and provided an impetus for independent development of the FS-X.

Still, requests for technical information, Japanese delegations, and other mechanisms were often used in attempts to gain information that was only indirectly connected with Japan's capability to produce and maintain the aircraft. When consideration of the next-generation fighter began in the mid-1980s, DOD officials were also forced to consider whether Japanese requests

TABLE B-4 Military Aircraft Contribution

were really motivated by a desire for technology that could aid the development of an indigenous fighter. In some cases, the competitive implications were felt more quickly. Soon after Japan Aviation Electronics (JAE) was licensed to produce Honeywell's ring laser gyro-inertial navigation unit, it began marketing a similar system.9 In the case of the AP-1 mission computer manufactured by IBM, the American company observed the Technology Research and Development Institute (TRDI) and Japanese corporate R&D programs targeted at developing a domestic mission computer for the FS-X, and decided not to contribute to these efforts by licensing its technology. The Japanese programs proved successful anyway—the FS-X mission computer will be indigenous. These two cases illustrate the difficulties faced by U.S. companies in making licensing decisions in areas where Japanese companies are capable and where government and industry are determined to reduce dependence on foreign suppliers. The potential for short-term licensing income, the competitive implications of technology transfer and other factors must be carefully balanced.

In assessing the significance of F-15 licensed production for the development and technological capability of Japan's aircraft industry, analysts present a mixed picture. On the commercial side, a large number of Japanese suppliers make similar components for the F-15 and for the Boeing 777.10 However, many of these Japanese suppliers were already making similar components for Boeing prior to the launch of the F-15 program. The F-15 work was beneficial in enabling Japanese suppliers to invest in new equipment more rapidly, to make incremental improvements in technology, and to cross-fertilize capabilities from military to commercial work and from aircraft manufacturing to other businesses. This process was aided by the close integration of Japan's military and civilian industrial bases in aircraft.11 The disagreement among analysts centers on the ultimate significance of F-15 technology transfers for commercial aircraft competitiveness, as distinct from the benefits presented by the work itself.

The impact is somewhat clearer on the military side. There is general agreement that the F-15 experience lifted the confidence of Japan's aircraft industry and that Japanese companies receiving technology through F-15 production were in a better position to supply the subsequent FS-X program. The denial of U.S. technology also had an impact. The black boxes provided a focus for TRDI and industry R&D efforts and motivated Japanese industry to pursue an indigenous FS-X. Still, the difficulties that have been widely reported in connection with the development of the FS-X show that the Japanese did not gain the capability to independently design and develop an advanced fighter through F-15 licensed production. Although the experience lifted the confidence of Japanese industry to perhaps unjustifiable levels, subsequent developments have exposed continuing weakness in certain key areas.

FS-X

Sweeping conclusions about the FS-X are premature since the development phase is only now reaching a conclusion, and critical issues such as the actual performance and procurement of the aircraft have yet to be resolved. However, it is safe to say that the process of structuring this Japan-U.S. codevelopment program marked something of a watershed in Japan's security policies and U.S.-Japan relations.

Soon after the launch of F-15 licensed production, the Japan Defense Agency (JDA), the Air Self Defense Force, and industry began considering options for replacing the domestically developed F-1 fighter. Although the F-1

only entered service in 1977, its limitations made it "useless for any real combat from the day it was deployed."12

Even prior to some of the negative F-15 experiences with repairs and spare parts, Japanese industry and some elements in the government began the process with a presumption in favor of a domestically developed fighter. Increasing domestic content, gaining greater managerial control over the program than was possible in a coproduction arrangement, and controlling costs (costs of licensed U.S. aircraft increased by an average factor of four with each program from the F-86 to the F-15) were all considerations. Perhaps the most important factor was an underlying sense that Japan's position in the aircraft industry was fragile and that passing up domestic development would consign Japan to a follower role forever.13 However, some Japanese policymakers were more cautious. Even at the early stage—before U.S.-Japan relations became a major factor in the decision—some MITI officials worried about industry overreaching. There was also a general recognition that even an "indigenous" fighter would require significant foreign inputs and technology (engines, systems integration).

Although the process of considering options began in the early 1980s, the U.S. government did not involve itself very extensively. By the time serious feasibility studies were launched in 1986, the momentum in Japan for a domestic aircraft was quite strong. The JDA set specifications that could not be met by existing aircraft, and MHI completed preliminary designs for a domestic aircraft—with an unrealistically low estimate of development costs.14 During 1986, DOD became increasingly concerned with the specifications and low development cost estimates, and began a more aggressive push for the FS-X to be based on an existing U.S. design. The McDonnell Douglas F-18 and the General Dynamics F-16 were the leading candidates. DOD's report in 1987 that the cost of a new Japanese design would be two or three times higher than MHI and JDA estimates gave support to Japanese opponents to the indigenous option in the Ministry of Foreign Affairs and elsewhere. In October 1987, after a heated struggle within the Japanese bureaucracy and in the wake of the Toshiba Machine "incident," the United States and Japan reached an agreement to "codevelop" an FS-X based on the F-16 design.

From the start, the two countries conceived codevelopment differently, making it an attractive political solution but ensuring problems later. The Japanese assumed that a Japanese company would manage the process of developing an indigenous aircraft, with selected foreign technologies incorporated as necessary. The U.S. conceived the joint improvement of an existing aircraft, with a priority on ensuring "flowback" of Japanese technology based on know-how transferred by the United States.

Through late 1987 and 1988, an MOU for the development program was negotiated. DOD aimed for a 40 percent U.S. development work share (excluding work on the engines), but this posed problems for the Japanese because more than half of the development costs were stated to go toward domestically developed avionics. A U.S. share of 40 percent would mean that there would be very little development work left for Japanese companies in areas such as composite wing technology. The MOU was finally signed in late 1988.

With the Bush administration coming into office in early 1989, congressional concerns over the FS-X agreement were raised in confirmation and other hearings. Contentious debate over the agreement continued through the spring of 1989, with opponents arguing that F-16 technology transfers would contribute to Japanese competitiveness in commercial and military aircraft, to the long-term detriment of U.S. industry; that ''off-the-shelf'' Japanese procurement of F-16s would cut the huge U.S. trade deficit with Japan while addressing Japan's security needs more economically; and that Japanese technical capabilities were not high enough for the flowback provisions to deliver many benefits to the United States. U.S. proponents argued that significant U.S. participation in the FS-X program was better than none at all, that Japanese procurement of unmodified F-16s was not a realistic scenario, and that flowback would bring considerable benefits.

In the end, congressional opponents were not able to stop the FS-X agreement, but they were able to force DOD to gain a "clarification" of several key points. First, the Japanese explicitly committed to a 40 percent U.S. work share during the development phase and to providing access to Japanese-developed technologies. Second, the denial of several key F-16 technologies—including computer source codes, software for the fly-by-wire flight control system, and other avionics software—was made explicit. The Japanese had perhaps been counting on getting this technology, but DOD had never allowed technology transfer in these areas before—to Japan or any other country.

The clarification exercise probably had little material impact on what would actually transpire during the development phase, but it did serve to illustrate that U.S. policy toward defense technology collaboration with Japan could no longer be made without considering the economic impacts. The episode threw into sharp relief the contrast between the contentious divisions over Japan policy in the United States and the much more united front—albeit with some bureaucratic infighting—that Japan presents to the United States in bilateral negotiations. In addition, the contention left heightened resentment on both sides. Many Japanese opinion leaders, in particular, resent codevelopment as having been forced on Japan by the United States.

The development phase is now nearing completion, and first flight is projected for September 1995. Development was delayed during 1991 and 1992—in part because of sanctions placed on JAE after it was found to have violated export controls. Some observers expect that the development phase will

be termed a "success," but the prospects for actual procurement are still uncertain.

Consideration of the U.S.-Japan MOU on FS-X production was slated to begin in 1994. One complication is possible disagreement over development issues, particularly flowback. The original development MOU defined four areas of nonderived technology, meaning that U.S. companies could license technologies in those areas for a fee, but would be entitled to Japanese developments in other areas at no charge. 15 Some observers believe that this designation was arbitrary and made subsequent Japanese requests to reclassify other technologies inevitable. In early 1993, news reports indicated that JDA was indeed demanding the reclassification of fifty technologies.16 Although the FS-X is politically dormant as this is written, controversy could be reignited over the issue of derived versus nonderived technologies or over the production MOU.

By keeping in mind the considerable remaining uncertainties, it is possible to identify some key questions concerning the implications of the FS-X as a U.S.-Japan technology linkage and to catalogue areas in which analysts generally agree or disagree. The three key issues are as follows: (1) What are Japanese aircraft capabilities as illustrated by the FS-X? (2) What will be the impact of technology transfers from the United States to Japan? (3) What is the value of technology transfers from Japan to the United States?

On the first point, it is already evident that the FS-X will not be the "superplane" that the Japanese originally claimed it would be. Some of the technologies that Japan was originally planning to incorporate (canards) did not perform as well as expected and have been removed from the design. Despite some attempts to blame the U.S. side for cost and schedule problems, there is no question that the original Japanese projections of FS-X capabilities were unrealistic and that the hubris evident in the late 1980s has been deflated to some extent.17

The long-term implications of United States to Japan technology transfer are still unclear. Although the source codes and other critical items listed above were not transferred, the considerable modification of the F-16 necessitated the transfer of design and systems integration technology from the United States to Japan—a first in bilateral military programs. Although much of this technology is "old," analysts have pointed out that Japan has developed competitive

capabilities starting from old know-how.18 While it appears that the level of technology transfer to Japan that is occurring through the FS-X program is higher than what occurred in connection with the F-15, the extent to which the Japanese will be able to capitalize on it—in military as well as commercial aircraft development—is still an open question.

Finally, there is also considerable disagreement about the value of Japanese technology developed for the program that U.S. industry will have access to (either as flowback or through licensing). Observers disagree on the quality of Japan's phased array radar technology. While General Dynamics is reported to have found the flowback of composite wing technology from Mitsubishi to be useful, with the sale of the fighter division to Lockheed—which has been viewed as superior to General Dynamics in composites technology—the ultimate value of technology transfer in this area is uncertain. It is safe to say that the value of the technology flow to the United States is nowhere near the value that has flowed to Japan through this program.