Appendix C

U.S.-Japan Technology Linkages In Aeroengines1

Because jet propulsion is the key enabling technology underlying commercial and military aviation as we know it today, the engine industry plays a special role in the aircraft supplier base. U.S.-Japan technology linkages in the engine business are extensive and long-standing, and they cover a range of mechanisms. The global context of growing international alliances in the commercial and military jet engine businesses is also important. The experiences of the two American engine makers—General Electric and Pratt & Whitney—have been somewhat different.

GE AIRCRAFT ENGINES

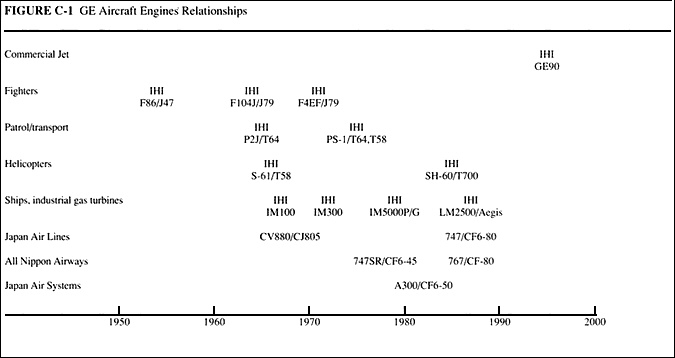

As a corporation, General Electric has a 90-year history of involvement with Japan. GE Aircraft Engines has been involved with Japan for more than 40 years (see Figure C-1). GE was involved with the first Japanese postwar military aircraft program starting in 1953 with the J47 engine for the Japanese version of the F-86 fighter. Over the next several decades, GE's J79 engine was chosen to power the Japanese versions of the F-104 and F-4. GE's relationships with Japan during this period involved sending kits to Ishikawajima-Harima Heavy Industries (IHI) for assembly and testing, with some components manu

factured by IHI. Collaboration took similar forms on several military turboprop and helicopter programs. GE also has a long-standing relationship with IHI in aero-derivative marine and industrial engines. The IHI connection has provided GE entree to the Japanese Marine Self Defense Force (MSDF), helping it to fundamentally displace Rolls Royce over the years.

As for activities in commercial jet engines, it is important to remember that GE did not emerge as a true force in the commercial business until the 1970s. GE's first sales to Japan were to Japan Air Lines (JAL) in the mid-1960s, with the CJ805 engine on the Convair 880. This engine was a derivative of the J79, had a number of in-service problems, and did not live up to its technical expectations. At that point, GE exited the commercial market for a time, reentering in 1971 with the next generation of high-bypass technology with the CF6-6 and CF6-50 engines for the DC10-10 and the DC10-30. This was followed by the introduction of the CF6-50 engine on the 747 and the Airbus A300 in 1973. GE learned several lessons that it put to work over the next several decades. As a result of the CJ805 experience, GE built an excellent customer support organization. Specific to Japan, GE learned that it is important to completely fulfill the expectations of Japanese customers. GE did not make another commercial sale in Japan until it reentered the commercial engine business in the late 1970s and did not make a sale to JAL until the mid-1980s, when JAL selected the CF6-80C2 for their 747-400s.

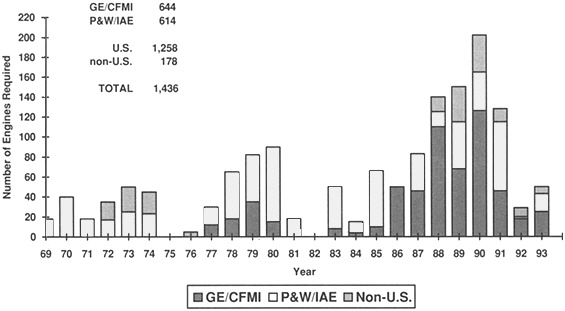

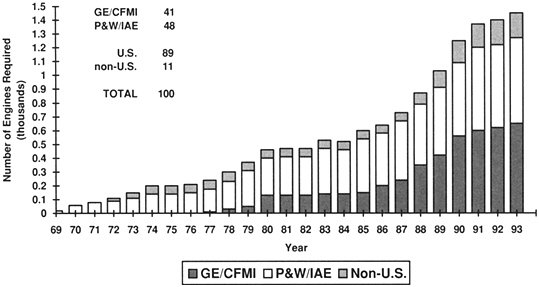

The opportunity to reenter Japan came when All Nippon Airways (ANA) decided to upgrade and expand its fleet with the latest generation of wide-body aircraft. The initial opportunity with ANA led to a tremendous fleet of follow-on sales for 747s, 767s, and A320s. Japan Air Systems is also a major customer (see Figure C-2). The big competitive issue today involves engine selection for the 777s that JAL has already ordered. As the Japanese airlines have expanded their fleets to accommodate more traffic growth, GE's market share has increased. This has recently been augmented by the sale of CFM56-powered Air-bus aircraft in Japan. One interesting characteristic of the Japanese airlines is that they generally do not want to be the first to buy a major new aircraft or engine. They desire the company of at least one other major airline to ensure that the needed support will be available if there is a problem. The manufacturer's product support infrastructure is a major consideration in the selection of the engine.

GE has focused its engine collaboration in Japan with IHI. The major collaborative programs relevant to this study are the GE90 and the F110 engine for the FS-X. In addition to GE, IHI collaborates with Pratt & Whitney, Rolls Royce, and others. This contrasts to GE's European partner, France's Snecma, which has limited itself to GE. GE does not consider this a problem, because IHI has not involved itself in technical development programs for competitive engines, even though its involvement with programs such as the PW4000 or the Rolls Royce Trent may be large in terms of manufacturing work share. Further, GE's collaboration with IHI in developing a commercial engine is fairly recent,

having only begun with the GE90. As for possible GE partnering with other Japanese engine companies, a good opportunity for collaborating with Mitsubishi Heavy Industries (MHI) or Kawasaki Heavy Industries (KHI) has not presented itself, and GE has not felt compelled to seek one out.

GE90

The GE90 is the first of what GE hopes will be a new family of large engines to power the next generation of commercial transports. In the late 1980s, GE determined that the derivative path of the CF6 family had served its purpose, and decided on developing a new family of engines based on proven technology. This program was centered around the thrust requirements of Boeing's 777 family of aircraft. The major question was how the program would be structured. In order to spread risk, obtain maximum leverage of development resources, and gain global market opportunities, it was decided that the program would be structured around GE's existing international relationships. Snecma, the French engine maker that is GE's partner in the CFM International joint venture, is the anchor in Europe, with a 25 percent share of the program. It also made sense to include Italy's Fiat because of its long-standing relationship with GE and expertise in several specific engine components. Because of the long, ongoing relationship with IHI, GE decided to approach it about participation in the new program. IHI holds an 8 percent share in the program, the same as Fiat. Participation in developing future derivatives is an opportunity available to the partners.

Up to this point, GE's colloboration with IHI had not extended beyond manufacturing. With the GE90, each partner is responsible for designing and developing its specific part of the engine. Snecma has designed and will build the compressor. IHI is responsible for several stages of turbine disks for the low-pressure turbine, the blades in those disks, and the long shaft that goes between the low-pressure turbine and the fan. IHI's interests and the ultimate content of its work share are close to what GE envisioned when approaching IHI at the outset.

In addition to design and development responsibility, program participation requires partners to make considerable capital investments in testing and manufacturing infrastructure. Because of the size and airflow of the GE90, huge new test cells are required. IHI has proceeded to make the necessary investment to build a test cell (Snecma has also built a GE90 test cell, while GE itself has built two). In addition, substantial tooling investments were also necessary to accommodate parts with the large diameter of the GE90. Partners were prepared to make these investments because of the future potential of the product.

The partnership extends for the life of the program. All commitments are measured in dollars. Typically, in a program relationship of this type, partners earn money in one of two ways. First, they may be reimbursed for their work

share at a fixed price, so that profits or losses are made to the extent that actual costs fall below or above the fixed price; alternatively, partners may gain a share of net revenues on the sale of engines proportional to their program share.

In the actual agreement, various protocols and rules set out partner responsibilities fairly specifically. For example, if the Federal Aviation Administration needs to extend flight tests or if there are other unanticipated costs that extend to the entire engine, the partners share these costs. If, however, there is a problem with a specific part of the engine, fixing that problem is the responsibility of the partner that designed and built the part. Generally, international partners make an up-front investment at the outset of the program in recognition of the unique contributions of the principal partner in the areas of marketing and support infrastructure, and of its established reputation in the industry. Finally, although the partners may have no formal role in marketing the engine, they do participate in support of sales campaigns in certain cases.

The GE90 is currently undergoing testing and certification; it is scheduled to enter service in 1995. Although it is not possible to assess the bottom-line impacts on the participants, GE is pleased with the partnership and with IHI's contribution to this point. The disks and turbine blades were impeccably designed and manufactured the first time around. GE has also learned some useful lessons from IHI. For example, IHI developed the casting method for the high aspect ratio turbine blades. GE gave IHI the aerodynamic coordinates on tape, which IHI quickly translated into tooling. At that point, the attachment of the blade to the disk or the tip shroud had not yet been designed. IHI said that since the major technical challenge would be to develop a good casting of the airfoil, knowing the specifics of the attachment and tip shroud was unnecessary. IHI delivered the casting in six weeks, with lumps of metal at each end that could be machined later. This fast prototyping provided insight to a "best practice" that has broad application. Under GE's old process, which had involved special casting drawings and required numerous signatures and procedures to approve changes or finalize the design, it would take a year to build tooling and prove out the casting process. In examining its process, GE realized that it was encumbered by procedures necessary for military engines, carried over to the commercial side. Making use of best practices, GE is reviewing and changing its processes for commercial engines to reduce the product development cycle time.

The origin of IHI's blade casting capability is worth noting. IHI had been developing structural and airfoil casting capability throughout its domestic network. A major advancement was realized in 1978 when as part of the F100 license agreement IHI acquired the right to cast the low-pressure turbine airfoils of equiaxed material. At that time, it was refused rights to the directionally solidified high-pressure turbine foils. In 1983 IHI acquired the rights to directionally solidified processes and materials. With this and the aid of the Technology Research and Development Institute (TRDI), IHI continued casting de-

velopment and began to produce monocrystal airfoils with limited success. In 1988, the United States Air Force agreed to let IHI procure monocrystal material to use in its casting process. IHI is currently in production with airfoils of their own monocrystal process using procured material. Although the most advanced monocrystal process is not used for the GE90 blades, they are nonetheless very challenging to make, and GE rates IHI's process very highly.

F110

After a fierce competition, GE's F110 engine was selected over Pratt & Whitney's F100 as the engine for the FS-X. From the Japanese standpoint, the two major considerations were probably the higher gross weight of the FS-X aircraft and the thrust growth potential of the F110 engine.

Development work is currently going forward between GE and IHI. This involves integrating the engine with the FS-X airframe and developing the installation features. Since the engine will not be markedly different from the F110 used on the F-16 fighter, the development phase is a relatively simple process and will not involve a great deal of technology transfer or new technology development. The Japanese aim to build as much of the engine as possible from the outset, but U.S.-Japan negotiations on an FS-X production memorandum of understanding (MOU) have not been completed as of this writing. In the case of the F100, Japanese production under license has eventually reached about 75 percent.2

Other Collaboration

GE and IHI collaborate in several other areas. The HYPR program is covered below. In addition, in July 1992 the two companies signed a broad MOU to develop selected technologies jointly. GE initiated the MOU because it realized that opportunities to learn from IHI will increasingly arise as IHI develops its own technologies through independent efforts and as part of Japanese government-sponsored programs. GE would provide some of its know-how in exchange. The MOU provides an umbrella structure for identifying and pursuing specific opportunities. As of this writing these opportunities are under discussion, but no specific initiatives have been formalized.

GE's formal technology transfer procedures are followed on each specific program undertaken with IHI (or any other partner). First, the business unit

that wishes to transfer technology applies to a senior management technology council, which approves or disapproves specific transfers in light of the overall strategic position of GE Aircraft Engines. If the technology transfer is approved at this level, GE submits an application to the Department of State for an export license, and then to the Department of Defense (DOD) and the Department of Commerce as necessary. GE's licensed production contracts with IHI—going back to the J47—include flowback provisions in which GE will obtain improvements that IHI makes in its technology. In addition, GE rotates engineers through Japan and IHI in order to keep abreast of the Japanese partner's manufacturing and technological capabilities, as well as to manage collaborative programs. Where possible, GE uses engineers with Japanese language ability and provides language training for its employees stationed in Japan.

In addition to the technology development program, the two companies collaborate extensively on derivative engines for marine and industrial use. The LM2500, a derivative of the CF6, is used in Aegis-class cruisers and frigates, including the MSDF fleet. The engine is also used in electrical cogeneration. The GE division that makes power systems, of course, has its own extensive business and collaborative interests in Japan. However, conventional power systems take up to seven years to plan and complete. A cogeneration package using an aero-derivative engine can be put on line in about a year. IHI helps to manufacture and market these systems. For the LM2500 and the more recent LM5000—a derivative of the CF6-50—IHI has played a significant role in developing the product and aggressively marketing cogeneration systems.

PRATT & WHITNEY

Pratt & Whitney's (P&W) technology linkages with Japan are also extensive, and have included a slightly wider range of mechanisms and partners than GE's. P&W established a relationship with MHI in the 1930s that was interrupted by World War II, and has also linked with IHI and KHI. P&W's motivations for establishing technology linkages with Japan are similar to GE's—risk-sharing Japanese partners provide leverage for development funds; market access; a commitment to high quality, low-cost, and timely delivery; and increasingly new technology. Thus far, the cost and risk-sharing benefits have been most prominent. Although P&W closely monitors the technological capabilities of its Japanese partners—particularly in the manufacturing and materials areas—it has not incorporated Japanese developments to the extent that GE appears to be.

Manufacturing Alliances

Pratt & Whitney has undertaken a number of collaborative manufacturing ventures with Japanese partners over the years. These programs have covered both commercial and military engines, and have involved licensed production,

risk-sharing partnerships, long-term sourcing agreements, and subcontracted production.

In 1978, the F100 engine was selected as the engine to be used on Japan's F-15s. The first two complete engines—to be used by IHI in calibrating its testing equipment—were delivered in May 1979, and eight knock-down kits were delivered beginning in August 1980. In September 1981, IHI produced the first engine under license, and 290 F100-IHI-100 engines were made under this agreement through April 1990. Some of the materials and the electronic engine controls were held back by DOD, but IHI manufactures about 75 percent of the engine by dollar value.

Over the last several years, the F100 relationship has evolved further, as IHI incorporates improvements that P&W developed for the U.S. version of the F100. From April 1990 until September 1993, IHI produced under license the F100-IHI-100BJ—which incorporated an increased life core—at the rate of two engines per month. In September 1993, IHI began production of the IDEEC F100-PW-220E engine at the rate of two per month, and it was scheduled to begin retrofitting prior engines with 220E hardware at the rate of three per month in March 1994. The major advance in the 220E is digital electronic control. In all, IHI is scheduled to produce 472 F100s of all versions under the current contract.

P&W launched an earlier and less extensive military licensed production agreement in 1971 with MHI covering the JT8D-9 engine. MHI produced about 70 of the engines over 10 years for Japan's C-1 military transport. In 1984, MHI became a 2.8 percent risk-sharing partner in the manufacture of a derivative product, the 20,000-pound JT8D-200, which powers the McDonnell Douglas MD-80 series. Under this agreement, MHI is responsible for the manufacture of various turbine blades, disks, and cases. In joining an existing program, MHI had no development role.

P&W has two Japanese partners in the PW4000 program, a large engine that powers some versions of the Boeing 767 and whose derivatives will be carried on some versions of the Boeing 777. The engine was originally developed in the late 1970s. Kawasaki became a 1 percent risk-sharing partner in 1985, and it has continued at that level since then. It is responsible for manufacturing several airseals, a shaft coupling, and a pump. MHI signed on as a 1 percent risk-sharing partner in the PW4000 program in 1989, and since then its participation grew to 5 percent in 1991 and 10 percent in 1993. MHI is responsible for manufacturing various turbine blades and vanes, turbine and compressor disks, active clearance control components, and combustion chambers. Beginning participation at such a low level reflected P&W's desire to "test the waters" and establish a working relationship with its partners before investing a great deal in the alliance. The increase in MHI's share since 1989 has come about as a result of mutual satisfaction with the relationship and desire to expand it.

In addition to risk-sharing agreements with MHI and KHI in commercial engines, P&W has a long-term sourcing agreement with IHI to produce the big shaft connecting the high-and low-pressure turbines for the JT9D, PW2000, and PW4000. P&W has also subcontracted to MHI production of components for the JT8D (low-pressure turbine and low-pressure compressor disks) and JT9D (low-pressure turbine blades).

IHI now manufactures all of Pratt & Whitney's long shafts. Utilizing and improving upon the process transferred in connection with the F100 program, IHI has become a world-class center for the production of long shafts of more than 8 feet. As mentioned earlier, IHI will be manufacturing the long shaft for the GE90, and it manufactures all of Rolls Royce's shafts as well. This specialization is not uncommon in the engine business—Fiat dominates the manufacture of gear boxes, and Volvo is strong in casings. Although IHI's dominance in shafts raises issues of dependence and possible supply disruption, the engine "primes" manage this dependence by maintaining some capability of their own. It is also widely believed that any attempt by a supplier of critical engine components to use delay or denial to extract money or technology from the primes would spell death for that supplier in the international market. The focused manufacturing approach does carry significant benefits in terms of cost and quality.

INTERNATIONAL AERO ENGINES (IAE)

International Aero Engines is a global consortium that developed and is currently manufacturing and marketing the V2500 engine. It consists of Pratt & Whitney, Rolls Royce, Fiat, MTU, and Japan Aero Engines Company (JAEC).3 Although IAE currently has just one product—the V2500 engine—the alliance includes a 30-year commitment to produce engines in the 18,000 to 30,000-pound range and has provisions for studies of engines up to 35,000 pounds of thrust. As of this writing, 104 V2500s have been delivered, the order backlog stands at 284, and airlines hold options on 302 more.

The partner companies in IAE were responsible for developing as well as building their share of the engine. The lead partners—Pratt & Whitney and Rolls Royce—both hold 30 percent shares in the program. P&W is responsible for the high-pressure turbine and the combustion system, whereas Rolls Royce designed and manufactures the high-pressure compressor and the lubrication system. In addition to the program shares, P&W holds a separate contract for overall engine management and manages the electronic engine control. Rolls Royce manages the design and manufacture of the nacelle and is also responsi-

ble for V2500 training activities for airlines. Germany's MTU holds 11 percent, and builds the low-pressure turbine, whereas Fiat holds 6 percent and is responsible for the accessory gear box and turbine exhaust case. For both MTU and Fiat, V2500 responsibilities are similar to their participation in PW2037 development and manufacturing. JAEC holds 23 percent of IAE, and is itself a joint venture of IHI (with 60 percent of JAEC), Kawasaki (25 percent), and MHI (15 percent). JAEC is responsible for the fan and the low-pressure compressor. Although JAEC has representatives in the marketing department of IAE, P&W and Rolls Royce are fundamentally responsible for marketing. Technical support at the airlines is accomplished largely through P&W's existing system.

IAE and the V2500 program were carefully structured to minimize technology transfer between the partners. This was partly motivated by DOD concerns about transferring P&W's high-pressure turbine technologies, but it also reflects the competitive concerns of the partners.4 Like the CFM56, the GE90, and other collaboratively designed engine programs, the V2500 utilizes a modular design in which a complete engine can be assembled and tested without a great deal of knowledge exchange concerning the individual pieces. The benefits of risk and cost sharing, specialized manufacturing, and market leverage must be balanced against the built-in overhead cost and time disadvantages of involving so many companies, as well as the extra time and care required to negotiate interface designs that limit the flow of technology. Still, Pratt & Whitney will benefit to the extent that there are generic rules and practices arising from the V2500 experience that can be applied to managing future collaborative programs.

All of the non-U.S. members of IAE received support from their governments for their participation. Rolls Royce received a $150 million no-interest loan from the British government, slightly less than half of the cost of participation that it estimated at the outset, to be repaid through a royalty on each sale.5 JAEC has received annual payments of $20 million to $25 million from the Ministry of International Trade and Industry (MITI) since the start of the abortive FJR710 program in the early 1970s, and this support has continued through V2500 development, covering roughly 75 percent of JAEC's development costs, 66 percent of testing costs, and 50 percent of the production tooling and nonrecurring startup costs.6 Repayment with interest of these success-conditional loans is slated to commence when the program breaks even. Exact figures for government support extended to MTU and Fiat are more difficult to obtain.7

The V2500 faces tough competition from the CFM International CFM56, but appears to be gaining greater market acceptance over time. Although the formal IAE agreement requires the partners to work together on engines in the

18,000 to 30,000-pound range, the wording of the agreement is very complex and thrust is not the only determining requirement. One of the key aspects for companies in forming joint ventures and alliances is defining the product scope in a way that the partnership can be expanded if desirable from a business standpoint, but does not constrain the partners as they pursue their individual strategies.

HYPR AND OTHER JAPANESE GOVERNMENT PROGRAMS

The Japanese Supersonic/Hypersonic Propulsion Technology Program (JSPTP or HYPR), was launched by MITI in 1989, with funding originally set at $200 million over eight years. It is now expected that the program will be stretched to ten years. The ultimate goal of the program is the development of a scale prototype turbo-ramjet, Mach 5 methane-fueled engine. The program is administered by MITI through its Agency of Industrial Science and Technology and the quasi-governmental New Energy Development Organization. The specification of a Mach 5 methane engine was partially determined by Japanese bureaucratic politics. MITI was not able to obtain Ministry of Finance approval to fund a supersonic engine program, but it could utilize funds earmarked for energy conservation R&D if the targeted development utilized an alternative fuel such as methane.

The Japanese partners—IHI, Kawasaki, and MHI—receive 75 percent of the funding and take the lead on technology development and design. HYPR is significant in that it is the first of Japan's national R&D projects to contemplate international participation from the outset as an integral feature of the program. The foreign participants—who receive 25 percent of the funding—are Pratt & Whitney, GE, Rolls Royce, and Snecma. The formal agreement between MITI and the foreign engine companies was signed in early 1991. The process of negotiating the participation of the foreign engine companies was somewhat long and complex. The major stumbling block arose surrounding the treatment of intellectual property generated in the project. The standard treatment of intellectual property in Japan's government-sponsored R&D is that the government owns 50 percent and exercises effective control over the disposition of intellectual property rights (IPR). The four foreign companies, wanting to avoid possible future restrictions on IPR, joined together to negotiate with MITI as a united front. This process led to an agreement and a change in Japan's laws governing the administration of government-sponsored R&D. Purely domestic projects follow the same rules as always, but IPR is treated differently in designated international projects such as HYPR as a result of the change. The foreground results and patents of technology developed in the program are owned jointly by the foreign and Japanese companies that developed them. Individual companies can use their own results without restriction, but they must negotiate with MITI over fees if an outward license is contemplated. Access to patents

and technical information arising in other parts of the program is open, and technology can be licensed. The background technology that individual companies bring to the project is controlled by the owner.

The Japanese companies are taking the lead on various program elements. To this point, the participating U.S. companies report satisfaction with the progress of the work and the flow of information. From the point of view of GE and Pratt & Whitney, the main motivation for participating is that taking a leadership role in the Japanese program is preferable to a major supersonic/hypersonic engine program going forward without U.S. involvement. By participating, GE and Pratt & Whitney gain insights into the basic design decisions and capabilities of the Japanese members of HYPR. Besides, because of MITI funding, participation is not costly for the foreign firms. It was necessary for the two companies to touch bases with the Departments of Defense and Commerce at the outset, and to convince them of the rationale. Eventually, the U.S. government was persuaded that "riding in front of the stampede" made more sense than sitting on the sidelines. U.S. engine makers believe that as a major terminus for flights of the next-generation supersonic transport, Japan will inevitably be involved in its development. GE and Pratt & Whitney are collaborating on research funded by the National Aeronautics and Space Administration (NASA) on high-speed civil transport propulsion targeting an engine in the Mach 2 to 2.5 range. The NASA program involves a much higher funding level than Japanese government support of HYPR. The U.S. engine makers are not transferring technology from this work to the Japanese.

The basic interaction between foreign and Japanese companies in HYPR is participation in design review and analysis in designated program areas. GE or Pratt & Whitney will look at the designs of, respectively, IHI and KHI, critique the work, and coach them on possible new directions. Each of the foreign companies assigns five to ten engineers to the project. On the Japanese side, the HYPR management headquarters has a staff of 11, but a minimum of 500 engineers in the three companies charge at least part-time to the program.8

Since the program is currently in its fourth year and will probably run for ten, the impacts and implications cannot be assessed precisely. The eventual impact will depend a great deal on the timing and mechanism for developing propulsion for the next-generation supersonic transport. While foreign participation allows the major international players to gain knowledge about Japan's approach, the Japanese participants gain design insights from foreign coaching. Also, international participation in HYPR has itself served to give credibility to Japanese efforts to play a significant role in international advanced engine programs and to other Japanese government efforts to organize international R&D collaboration.

The Japanese government also funds several other programs that have implications for future aircraft propulsion systems. The one that is most closely linked to HYPR is the research program on high-performance materials organized under MITI's "Jisedai" or Next-Generation Technology Development funding pool. The program, which began in 1989 and is scheduled to run through 1996, is organized into two parts. One branch includes six government laboratories, while the other—which is known as the Research and Development Institute of Metals and Composites for Future Industries (RIMCOF) is composed of nine companies and four universities. RIMCOF itself was launched in 1981, and completed two MITI-sponsored R&D programs on composites and crystalline alloys from 1981 to 1988. Toray was the main industrial participant and beneficiary of the composites project.9 In the current project, the focus is on intermetallic compounds, heat-resistant fibers, composites, and reinforced intermetallic composites that could be utilized in supersonic or hypersonic engines.

Japanese government and industry have been working together on subsonic engine technologies as well. The Frontier Aircraft Basic Research Center Co., Ltd. (FARC) was established by the Key Technology Center in 1986 to develop the technology required for an advanced turboprop engine. FARC, which operated through the beginning of 1993, included 34 companies in all. In addition to the major engine and airframe "heavies," auto, materials, and machinery manufacturers are also involved.10

In addition to these ongoing programs, the Japanese government—mainly MITI and TRDI—are conducting a number of feasibility studies aimed at significantly upgrading Japan's engine testing facilities over the next decade. The most important of these is an altitude test facility to be built in Hokkaido at a projected total cost of $140 million.

JAPANESE CAPABILITIES IN THE AERO ENGINE BUSINESS

Japanese aircraft engine makers have effectively leveraged private and public resources in international alliances and public R&D projects to improve and deepen their technological and manufacturing capabilities. Individually or as a group, Japanese companies are well positioned to continue to participate in international engine development programs at increased levels of technical and manufacturing responsibility. Japan's government technology programs and corporate strategies are aimed at gaining world leadership in some aspects of propulsion materials and other critical technologies.

As in the aircraft systems segment, barriers to Japan's entry as a major player at the level of today's international engine "big three" remain. To begin

with, industry and government have not yet shown a willingness to invest the resources necessary to enter the market at that level. As in aircraft integration, this would require either a series of large, risky indigenous projects to establish technical and market credibility, or an acquisition. In the case of the American companies, DOD has guarded hot section technologies over the years. While it is currently difficult to conceive of a circumstance in which DOD would allow the transfer of these technologies through license or acquisition, the U.S. policy context is changing.

Japan's current technological capabilities are quite impressive in several areas of engine manufacturing and technolgy. The Japanese can manufacture most parts of a modern engine and can design key pieces. IHI in particular is quite strong in application of technology once it has mastered the basic concept. Its manufacturing practices—including total preventive maintenance—are very effective, as are its laser drilling capabilities. The proof of this is in the product—IHI and the other Japanese companies hold tolerances very well.

The Japanese engine makers do have significant weaknesses. Across the board, the Japanese companies are weak in software and lack sophistication in the analytical tools necessary to do world-class design. For example, when asked to design a compressor blade, the Japanese are capable of very competent mechanical design. However, it takes time for them to experiment and trade off the mechanical and aerodynamic features. The U.S. engine companies have computer programs that can optimize both mechanical and aerodynamic characteristics in designing blades.

The Japanese are aware of their weaknesses in software and systems integration methodology, and are asking more often for access to analytical tools in their international alliances. These are the technological "crown jewels" that the U.S. engine companies guard fiercely. Even if they were willing to transfer them, many of the the management methodologies are best learned by actually doing a complete engine program. In the case of some design tools, such as CATIA, the Japanese may possess the software, but they have only a thin experimental data base to plug into it to gain optimum value from the software. Finally, the Japanese engine makers have relatively high unit manufacturing costs and overhead, disadvantages that are currently being exacerbated by the latest yen appreciation.

MITI and the JDA have supported the Japanese aircraft and engine industries with the aim of helping them to become world leaders. There may be a certain amount of frustration that industry is not further along, given the significant amount of public funds spent on various aspects of aircraft development. There has been a recent willingness to allow or even encourage nontraditional Japanese players to test the waters. In the engine world, these are the largest auto companies—Toyota, Nissan, and Honda.

Despite these weaknesses, the Japanese have developed a significant manufacturing and technological base in the engine business. Government and industry continue to team in the development of advanced technologies—in mate

rials and other areas. The HYPR project illustrates a creative approach to international collaboration and reflects the long-term orientation of Japanese strategy making. While the global leaders in the industry are pursuing breakthrough new products, Japanese participation in international engine programs has increased over the past decade, and Japanese government-sponsored programs are aimed at developing a technology base to further expand this role. As in airframes, new directions in international collaboration—either with the Russians or other new partners, or through selective utilization of experts idled by worldwide defense cuts—are feasible strategies. In parallel with the airframe business, current global restructuring is challenging the Japanese as it is challenging other players. However, the rewards are likely to go to companies and nations committed for the long haul, as the Japanese clearly are.