3

Current Status Of U.S.-Japan Linkages

Drawing on published information, briefings from experts, and its study mission to Japan, the committee examined a wide range of U.S.-Japan technology linkages relevant to transport aircraft. The assessment included prime program partnerships and government-supported R&D programs as well as relationships at various levels of the supplier chain. This chapter summarizes the information on linkages the committee has collected; analyzes the motivations, mechanisms, and impacts of linkages; and highlights major themes and insights. More detailed materials on linkages are contained in Appendixes B and C.

AIRFRAMES

Linkages in Commercial Airframes

The most significant U.S.-Japan linkages in the commercial airframe segment are the series of program-based alliances concluded between Boeing and

the Japanese "heavies."1 To all accounts, this relationship has brought significant benefits to both sides.

From the start of the 747 program in the late 1960s through the subsequent 737 and 757 programs, Boeing procured parts and equipment from Mitsubishi Heavy Industries (MHI), Kawasaki Heavy Industries (KHI), and Fuji Heavy Industries (FHI). Starting with the 767 program in the late 1970s and continuing with the 777—which is scheduled to enter service in 1995—the Boeing-Japan interaction has evolved from one in which the Japanese companies "built parts to specification" to actual design and engineering interaction from the earliest stages of product development. The work share and the technical sophistication of the manufacturing tasks undertaken by the Japanese partners have also increased steadily over time.

Boeing's primary motivation for approaching the Japanese heavies about significant participation in the 767 program was the perception that the linkage might bring market leverage. The Japanese were probably most motivated by a desire to gain access to technology as well as indirect access to the global aircraft market. MHI, KHI, and FHI designed and now manufacture approximately 15 percent of the airframe of the 767, a wide-body twinjet. As "risk-sharing subcontractors," the Japanese partners assumed the risk for their nonequity share in the program, including tooling and other investment. The Japanese government provided funding through success-conditional loans for much of this investment.

Boeing, the three heavy industry companies, and the Japanese government through the JADC negotiated a "program partnership" for the subsequent 777 program. This alliance is similar to the 767 arrangement, although Boeing originally offered the Japanese partners significant program equity participation, which they were not willing to assume. The Japanese work share in the 777 program is higher than in the 767—Japanese partners essentially build all the fuselage parts except for the nose section, as well as the wing center section, the wing-to-body fairing, and landing gear doors.2 Indirect Japanese government support and Japan Development Bank loans have also been made available to the heavies for their participation in the 777 program.

Japanese technical responsibilities increased with the 777. There were many more Japanese engineers involved in 777 development than in 767 development, with several hundred sent to Seattle during the most intensive design phase. As was the case in the 767, the Japanese are limited in the engineering effort to their own work package.

On both the 767 and the 777 programs the direction of technology transfer was predominantly from Boeing to its Japanese partners. This took several forms, including data exchange and engineer training in the use of advanced computer design techniques. Boeing limited the transfer of its critical technologies by keeping to itself the design and manufacture of the most sensitive parts of the airframe as well as all the systems integration activities. Boeing also implemented management systems that allow engineering data exchange to be managed on a "need-to-know" basis. Some technology also flows to Boeing from Japanese companies, particularly approaches to manufacturing technology and processes.

In addition to the 767 and 777 partnerships, Boeing collaborated with the Japanese heavies on preliminary design and market definition work for a proposed 150-seat transport—the 7J7-YXX program. This program contemplated significant Japanese equity participation and interaction in areas such as marketing that the 767 and 777 partnerships did not encompass. Although the Japanese government still supports work related to the YXX, program launch has been put on hold.

The Boeing-Japan relationship appears to have delivered significant benefits to both sides that roughly parallel their likely initial motivations. In addition to aircraft sales in the Japanese market, the program partnerships have allowed Boeing to spread a significant part of the program financing load. To this point, the Japanese heavies have not entered partnerships with the other two major airframe manufacturers, and have not emerged as a significant competitive threat to Boeing. Boeing has also gained access to competitively priced, high-quality components.

For the Japanese heavies, the Boeing alliance has delivered technology and know-how, a significant stream of long-term business, relatively low-risk access to global aircraft markets, and government support in developing their technology and manufacturing bases. The Japanese participants have also hit some rough spots along the way. For example, exchange rate shifts during the 1980s and more recently, as well as the current market downturn, have made apparent some of the liabilities associated with risk sharing.

Perhaps most importantly, the Japanese heavies have developed a world-class manufacturing infrastructure and technology base for aircraft structures. This capability—largely built in conjunction with their work on Boeing programs—has implications for U.S. structures suppliers.

Japanese Capabilities in Structures Manufacture and Implications for U.S. Suppliers

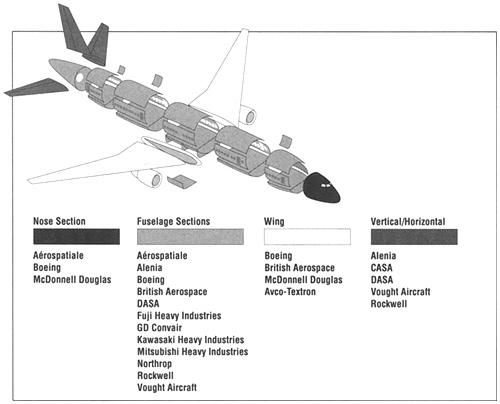

As described above, a major focus of Japanese industry in the production of commercial transports is in the area of structures, particularly supplying Boeing on the 767 and 777 programs. Figure 3-1 shows the global players in this area of aircraft manufacturing, broken down according to the parts of the aircraft

manufactured. The figure is not exhaustive, and it focuses on structure suppliers for large commercial transports—particularly wide bodies. The airframe ''primes" tend to retain manufacture of the wing (excluding control surfaces) and the nose section, the latter primarily because of its importance for integration activities as the "brain" of the aircraft.3

The basic manufacturing process for fuselage parts involves considerable subassembly. Premium aluminum skins are attached to aluminum "stringers" in order to create skin panel subassemblies. These panels are then attached to each other with large fuselage frames to form larger fuselage segment subassemblies, a complementary set of which is fitted together to form a hollow "barrel" section assembly. The barrels are then either "stuffed" with subsystems (i.e., electronics, hydraulic, and environmental systems), before being joined or joined into larger sections before being stuffed.

Various considerations, such as transportation, affect the manufacturing process. In the case of Airbus, for example, the fuselage sections manufactured by member companies are stuffed before being shipped to Toulouse, France, where they are joined together. This is similar to the process for some U.S. military programs such as the F/A-18, in which Northrop stuffs and tests sections before shipping them to McDonnell Douglas. In the case of the Boeing 767 and 777, the Japanese heavies ship the fuselage panels to Boeing, as Northrop, Rockwell, and Vought do for the 747, and Boeing assembles and stuffs the sections.

A number of factors—such as capital availability—influence the introduction of new technology into these processes, and some companies are more aggressive than others in applying new technology. The committee was very impressed with the technology level and breadth of the structures manufacturing capability possessed by the Japanese heavies. Perhaps the most striking aspect of this capability is the advances the heavies have made in combining technologies transferred from the United States with the world-class manufacturing practices widely followed in other Japanese industries to create new process technologies.

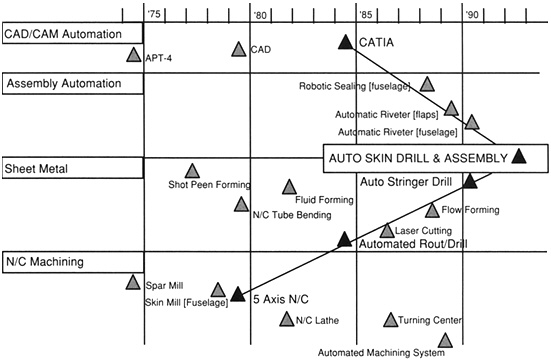

This is apparent in Japanese innovations in the skin panel process. Figure 3-2 shows estimated Japanese technical milestones in airframe structures. Some of the technologies, such as CATIA4 computer-aided design software (CAD), were purchased by the Japanese heavies or were transferred from the United States through commercial and military programs. For example, by integrating the CATIA data base, which contains the hole locations for all variations of stringers used on the 777, with an automated drill, the heavies have worked with their machine tool suppliers and/or divisions to develop an automated universal stringer drill station. Different stringer variations can all be drilled on this station by reprogramming, thereby eliminating the need for specialized

tools. The Japanese structure makers are utilizing CATIA-controlled five-axis machines to automate other structures manufacturing steps, such as the chemmilling and drilling of aluminum skins. A further notable feature of Japanese structures capability is its breadth across the three heavies. For example, center wing section panels manufactured at Fuji use thicker aluminum skins than the fuselage panels manufactured at the other two heavies and require different manufacturing processes. Taken as a whole, these manufacturing technology improvements are good illustrations of the well-honed process of technology improvement and deployment that exists in many of the best Japanese manufacturers. Robotics and other new machinery are developed and deployed by the heavies as part of a system that maximizes the impact of new technology on the entire manufacturing process. These manufacturing practices are well known in the automobile and other mass production industries, but the application of new technology to aircraft production—which involves much smaller production runs—is perhaps more challenging because of the difficulties of achieving scale economies. Japan's aircraft makers do not utilize technology for its own sake, but focus on process improvements that deliver a competitive advantage in terms of cost and quality. Although the basic process for improving and combining technologies, as well as some of the constituent technologies, already existed in Japan and had been applied and proven in other industries, several of the key manufacturing capabilities were transferred from the United States.

What are the implications for U.S. structures makers, who are challenged by pressures on the defense sides of their businesses as well as the globalization of commercial structures procurement? First, it is necessary for American companies to stay abreast of developments in Japan and elsewhere. It is usually not difficult for Americans to at least tour the factories of the Japanese heavies and see their manufacturing processes. Second, American companies must be aggressive in seeking to transfer Japanese technologies back to their operations. While companies such as Northrop, Vought, and Rockwell must focus their business strategies on future programs, they must also invest in new technologies and related equipment to remain competitive.

The Japanese example also shows that the challenges facing the American structures suppliers go beyond the imperative of monitoring and learning specific manufacturing innovations from Japanese competitors. In order to implement world-class manufacturing solutions that require large capital investments on the order of what the Japanese heavies have made, a significant business base is required. This can come only from participation in new programs, which is problematic for U.S. suppliers. Because American primes feel that procurement from Japanese and other foreign suppliers is a critical element in enabling sales in these markets (in some cases through formal offset requirements, or through informal signals and pressure in the case of Japan), U.S. structures suppliers must be particularly competitive in price, quality, and de

livery performance to match the Japanese heavies or other international suppliers.

Linkages in Military Airframes

Perhaps the most extensive U.S.-Japan technology linkages in aircraft manufacturing and—more recently—in design have occurred in military programs. Licensed production, coproduction, and codevelopment of military aircraft undertaken in the context of the U.S.-Japan security alliance have resulted in a significant transfer of U.S. technology to Japan. The two most important U.S.-Japan military aircraft linkages in the recent past have been licensed production of McDonnell Douglas's F-15 and codevelopment of the FS-X.

Japanese companies had assembled the North American F-86 in the 1950s, and had produced the Lockheed F-104 and the McDonnell Douglas F-4 under license in the 1960s and 1970s. Japanese licensed production of the F-15 beginning around 1980 was an important step in the evolution of Japan's aircraft industry and U.S.-Japan defense technology relations. Although there were early national security concerns in the U.S. Department of Defense (DOD) over the transfer of advanced technology, the broad U.S. strategic and political rationale for Japanese production—primarily a greater contribution to regional security from a more militarily capable Japan—prevailed without a great deal of contention in the U.S. government.

The United States provided technologies and data necessary for Japanese production of the F-15, with the exception of a number of items such as design data, radar, electronic countermeasures, software, and source codes classified as "nonreleasable." The extent of this "black boxing" was greater than in the F-4 program and provided a motivation for Japanese industry to pursue the independent Japanese development of the country's next fighter in the mid-1980s. Still, the technology transfer was substantial in terms of quantity, and some argue that the level of technology transferred through F-15 licensed production was significantly higher than in previous bilateral programs.5

Soon after the launch of F-15 production, the Japan Defense Agency (JDA), ASDF, and Japanese industry began considering options for replacing the domestically-developed F-1 fighter. Industry and some elements in the government began the process with a presumption in favor of a domestically-developed fighter. Increasing domestic content, gaining greater managerial control over the program than was possible in a licensed production arrangement, and controlling costs were all considerations. Another important factor was an underlying sense that Japan's position in the aircraft industry was fragile and that

passing up domestic development would consign Japan to a follower role forever.6

During 1986, by which time the momentum in Japan for domestic development had become quite strong, DOD began a more aggressive push for the FS-X to be based on an existing U.S. design. This resulted in an agreement to ''codevelop" an FS-X based on the design of the General Dynamics F-16. From the start, the two countries conceived codevelopment differently, making it an attractive political solution but ensuring problems later. The Japanese assumed that a Japanese company would manage the process of developing an indigenous aircraft, with selected foreign technologies incorporated as necessary. The U.S. conceived the joint improvement of an existing aircraft, with a priority on ensuring "flowback" of Japanese technology based on know-how transferred by the United States.

A U.S.-Japan memorandum of understanding (MOU) on FS-X codevelopment was signed in late 1988, but congressional concerns were raised during confirmation hearings of Bush administration officials in early 1989. Contentious debate over the agreement continued through the spring of that year, with opponents arguing that F-16 technology transfers would contribute to Japanese competitiveness in commercial and military aircraft, that "off-the-shelf" Japanese procurement of F-16s would cut the huge U.S. trade deficit with Japan while addressing Japan's security needs more economically, and that Japanese technical capabilities were not high enough for the flowback provisions to deliver many benefits to the United States. U.S. proponents of FS-X codevelopment argued that significant U.S. participation in the FS-X program was better than none at all, that Japanese procurement of unmodified F-16s was not a realistic scenario, and that flowback would bring considerable benefits.

In the end, congressional opponents were not able to stop the FS-X agreement, but were able to force DOD to gain a "clarification" of several key points. First, the Japanese explicitly committed to a 40 percent U.S. work share during the development phase and to providing access to Japanese-developed technologies. Second, the denial of several key F-16 technologies—including computer source codes, software for the fly-by-wire flight control system, and other avionics software—was made explicit.

The clarification exercise threw into sharp relief the contrast between the contentious divisions over Japan policy in the United States and the much more united front—albeit with some bureaucratic infighting—that Japan presents to the United States in bilateral negotiations. In addition, the contention left heightened resentment on both sides. Many Japanese opinion leaders, in particular, resent codevelopment as having been forced on Japan by the United States.

The development phase is now nearing completion, and first flight is projected for September 1995. Prospects for actual procurement are still uncertain.

If the FS-X goes into production, negotiation of a U.S.-Japan production MOU could be complicated by lingering disagreements over classifying derived and nonderived technologies, and U.S. work share.

In assessing the impact of U.S.-Japan collaboration in military programs on the technological capability of Japan's aircraft industry, analysts present a mixed picture. There is general agreement that Japanese companies receiving technology through F-15 licensed production were in a better position to supply the subsequent FS-X program. Impacts on the commercial side are less clear. At the supplier level, although a large number of Japanese suppliers make similar components for the F-15 and for the Boeing 777, many of these companies were supplying Boeing programs prior to the 777.7 Still, the importance of military work (which accounted for more than 73 percent of Japan's total aircraft industrial output in 1990) for Japan's aircraft manufacturing and technological capabilities should not be underestimated. For example, Ishikawajima-Harima Heavy Industries (IHI) developed the capability to manufacture the long shafts for aircraft engines through the F100 program (described below in the section on engine linkages) and has evolved into a global center of excellence for this component. In addition to supporting specific dual-use technologies, Japanese military procurement supports equipment spending and engineering employment that are available for utilization on the commercial side.

At the prime level, analysts have pointed out that the FS-X program is structured to develop systems integration skills—a major missing piece of the puzzle for Japan's overall capability in aircraft. Although source codes and other critical items were not transferred, the considerable modification of the F-16 necessitated the transfer of design and systems integration technology from the United States to Japan—a first in bilateral military programs. The extent to which the Japanese will be able to capitalize on this technology in the future—in military as well as commercial aircraft development—is still an open question. There is, however, no question that it is a help.

There is also considerable disagreement about the value of Japanese technology developed through the FS-X program to which U.S. industry will have access to (either as flowback or through licensing). According to some reports, Lockheed (which purchased the Fort Worth fighter division from General Dynamics in 1992) has found the flowback of composite wing technology from Mitsubishi to be useful.8 At this point, however, data are not being disseminated widely to U.S. industry, and some experts assert that a more systematic effort is needed to assess the value of FS-X technology flowback.

In the area of composites, the committee saw an interesting contrast between U.S. and Japanese systems of civil-military aircraft technology integra

tion. These differences have significant implications for U.S.-Japan linkages in a critical area of future aircraft technology development.

COMPOSITES

Japanese Capabilities and U.S.-Japan Linkages in Composites

As described above, most aircraft structures are made of aluminum and have been for more than fifty years. U.S. companies, most notably Alcoa, are leaders in producing the high quality aluminum used in aircraft and aerospace applications, holding more than 80 percent of the world commercial transport market excluding the former Soviet Union and China.

Although the U.S. position in aluminum is strong—a new alloy developed by Alcoa has been specified for use on the Boeing 777—composite materials have been gradually incorporated into airframe structures over the past two decades. They possess several properties—mainly higher specific strength and lower weight at high temperature—that make them potentially superior to aluminum as the primary material for aircraft structures.

Despite their desirable properties, composite structures present difficult manufacturing and design challenges. One of the primary barriers to increased use of composites in commercial transports is manufacturing cost.9 Currently, the carbon fiber-based thermoset composites that constitute the bulk of the composite materials used in commercial aircraft are too expensive to displace aluminum on a large scale. Yet despite the cost, airframe makers are convinced that the experience gained working with composites will bring costs down and constitutes a long-term investment in a critical capability.

There are two main areas of competitive activity in composites—fabricating structures and manufacturing basic materials. In fabrication, U.S. companies—including Boeing, McDonnell Douglas and others—have impressive capabilities on both the military and the commercial sides. The Japanese heavies possess superior capabilities in this area as well. They already supply composite structures such as tail cones and doors to both U.S. commercial airframe primes. In addition, MHI has developed through various programs culminating in the FS-X the capability to manufacture an entire composite wing in one piece through a process called "cocuring." The Japanese heavies have invested extensively in superior equipment (five-axis lay-up machines and autoclaves) for fabricating composite structures, and several companies have impressive R&D programs attacking key composites manufacturing issues. This invest-

ment and R&D activity indicate the importance that the Japanese aircraft industry places on developing world-class composites capabilities.

In the manufacture of basic composite materials—particularly carbon fiber—the Japanese position is even stronger than in fabrication. The current U.S.-Japan technological and competitive position in this area illustrates a number of the challenges the United States faces as DOD requirements become less important for driving the development and application of a range of technologies, particularly those relevant to the aircraft industry.

In the United States, DOD and the National Aeronautics and Space Administration (NASA) have provided major support over the years to develop a range of new advanced materials, and U.S. basic research at universities, and at national and industrial laboratories, is unmatched. Composites using carbon fiber have come furthest in their applicability, and a number of companies increased their production capacity in the late 1980s in anticipation of a large DOD demand base. However, since the late 1980s, the anticipated defense market has not materialized and a number of the U.S. manufacturers of carbon fiber have shut down or been sold to foreign investors.

Some of the leading producers of carbon fiber in the world are Japanese companies such as Toray, Toho, and Mitsubishi Rayon, which began making the materials to incorporate into sporting goods and other consumer products. This large manufacturing base has allowed them to focus on competing in the aircraft market with a longer-term view on the basis of competitive manufacturing costs. In addition to Toray's success in becoming the sole qualified supplier of carbon fiber and resin for the Boeing 777 composite tail, it has recently purchased the leading European manufacturer of carbon fiber. Toray did license a U.S. firm with its carbon fiber technology several years ago, but this did not result in establishing a price-competitive U.S. capability. A new Toray facility to be built near Seattle will weave and shape fibers made in Japan to Boeing specifications. Toray is interested in other aerospace applications, and in 1992 it purchased Composite Horizons, a small spin-off of Hughes Aircraft that manufactures composites for satellites.

Toray's competitive strategy and the nature of its alliances with U.S. companies highlight concerns about reciprocal technology transfer and market access in the field of advanced materials. For example, Toray has free access to the U.S. market, and is not restricted from working closely with Boeing and other lead users to hone its capabilities. It is also free to make manufacturing investments and high-technology acquisitions such as Composite Horizons. However, the committee heard that some U.S. materials makers have found it difficult to enter the Japanese market without forming an alliance with a Japanese company, often a potential competitor (although it is not a legal requirement). Such joint ventures generally do not provide opportunities for the U.S. partners to establish direct interactions with sophisticated customers in Japan who drive future development of components. The situation is evolving as U.S.

companies develop a variety of mechanisms to access growing markets for advanced materials in Japan and elsewhere.10

In contrast to the excellent but fragmented efforts of the United States in advanced materials, the Japanese approach of industry-government collaboration in this field leverages Japanese industry's existing strength in mass produced materials and incorporates focused government-funded research programs to target emerging applications. Basic research is conducted at a much lower level than in the United States, while basic research in U.S. universities is readily accessible to Japanese companies.11 Government-industry technology development programs tend to focus on processes that optimize the utility of existing fibers and materials that are widely available. Aircraft structures and propulsion are major applications targeted in these programs. Commercial and military-oriented investments are mutually supportive.

It is clear that the Japanese government and Japanese industry see materials development as an important entry point to participation in future international aircraft programs. In order for the United States to reap the economic rewards of the substantial R&D funds expended in this area, both government and industry need to face up to several new challenges. For government, funding R&D on materials that must "buy their way onto the airplane" will require different criteria and research mechanisms than the "performance at any price" imperatives of military-driven technology development. For U.S. industry, it will be necessary to build better collaboration between materials suppliers and users than has been exhibited on the commercial side up to now. In addition, the challenge facing U.S. makers of advanced materials in accessing the Japanese market remains considerable.

While Japan's advanced materials capability has progressed to the point where Toray is supplying the material for the largest composite primary structure to date made by the U.S. aircraft industry, cuts in defense demand have led to severe distress for U.S. manufacturers of carbon fiber, causing several to exit the business.

ENGINES

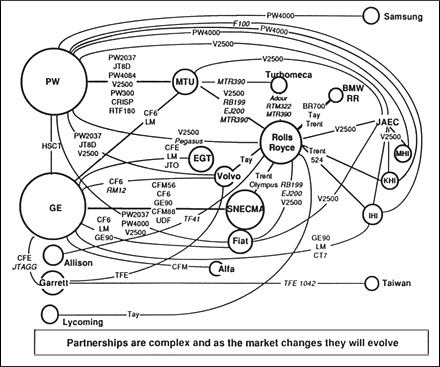

Because jet propulsion is the key enabling technology underlying commercial and military aviation as we know it today, the engine industry plays a special role in the aircraft supplier base. Both U.S. engine primes—GE Aircraft Engines and the Pratt & Whitney division of United Technologies—have extensive, long-standing technology linkages with Japan. The global context is important. Figure 3-3 illustrates the complex web of current international alliances in the commercial and military jet engine businesses. Both companies have been involved with Japan in military, commercial, and Japanese government-sponsored R&D programs.

GE has focused its engine collaboration in Japan with IHI,12 while IHI—as the leading Japanese company in aeroengines—collaborates with Pratt & Whitney and Rolls Royce as well as GE. GE-IHI linkages have a longer history on the military side. GE was involved with the first Japanese postwar military aircraft program starting in 1953, with the J47 engine for the Japanese version of the F-86 fighter. Over the next several decades, GE's J79 engine was chosen to power the Japanese versions of the F-104 and F-4. GE's relationships with Japan during this period involved sending kits to IHI for assembly and test, with some components manufactured by IHI. More recently, GE's F110 engine was selected as the engine for the FS-X, and IHI is collaborating with GE in developing interfaces for the aircraft.

GE's collaboration with IHI in the development of a large commercial engine is fairly recent, having only begun with the GE90. The GE90 is the first of what GE hopes to be a new family of large engines to power the next generation of commercial transports. When the program was conceived in the late 1980s, it was decided that a global program structured around GE's existing international relationships would best leverage resources. In addition to IHI, which has an 8 percent share in the program, Snecma holds a 25 percent share and Fiat 8 percent. Each partner is responsible for designing and developing its specific part of the engine. IHI is responsible for several stages of turbine disks for the low-pressure turbine, the blades in those disks, and the long shaft that goes between the low-pressure turbine and the fan. Further, program participation requires partners to make considerable capital investments in testing and manufacturing infrastructure. IHI has proceeded to make the necessary investment to build a test cell.

The GE90 is currently undergoing testing and certification, and is scheduled to enter service in 1995. Although it is not possible to assess the bottom-line impacts on the participants, GE is pleased with the partnership and with IHI's contribution and performance to this point. The disks and turbine blades were impeccably designed and manufactured the first time around. GE has also learned some useful lessons from IHI, particularly from the rapid prototyping that IHI did for the turbine blade casting.

FIGURE 3-3 International partnerships. Source: GE Aircraft Engines.

GE and IHI collaborate in several other areas. The HYPR program is discussed below. In addition, in July 1992 the two companies signed a broad MOU to jointly develop selected technologies. GE initiated the MOU because it realized that opportunities to learn from IHI will increasingly arise as IHI develops its own technologies through independent efforts and as part of Japanese government-sponsored programs. GE would provide some of its know-how in exchange. The MOU provides an umbrella structure for identifying and pursuing specific opportunities.

GE's formal technology transfer procedures are followed on each specific program undertaken with IHI (or any other partner). First, the business unit that wishes to transfer technology applies to a senior management technology council, which approves or disapproves specific transfers in light of the overall strategic position of GE Aircraft Engines. If the technology transfer is approved at this level, GE then submits an application to the Department of State for an

export license, and to DOD and Department of Commerce as necessary. GE's licensed production contracts with IHI—going back to the J47—include flow-back provisions in which GE will obtain improvements that IHI makes in its technology.

Pratt & Whitney's (P&W) technology linkages with Japan are also extensive, and have included a slightly wider range of mechanisms and partners than GE's. P&W established a relationship with MHI in the 1930s that was interrupted by World War II, and it has also linked with IHI and KHI. P&W's motivations for establishing technology linkages with Japan are similar to GE's—to gain market access in military engines, to gain access to high-quality components, to spread development burdens, and—increasingly—to gain access to Japan's growing technological capabilities.

In 1978, the F100 engine was selected to be used on Japan's F-15s. This relationship has evolved from complete engines delivered to IHI, to knockdown kits, to licensed production. Some of the materials and the electronic engine controls were held back by DOD, but IHI now manufactures about 75 percent of the engine by dollar value. IHI continues to incorporate improvements that P&W developed for the U.S. version of the F100. P&W launched an earlier and less extensive military licensed production agreement in 1971 with MHI covering the JT8D-9 engine for Japan's C-1 military transport. In 1984, MHI became a 2.8 percent risk-sharing partner in the manufacture of a derivative product, the 20,000-pound JT8D-200.

P&W has two Japanese partners in the PW4000 program, a large engine with several derivatives that powers some versions of the Boeing 747, 767, 777, and the Airbus A300, A310, and A330 aircraft. The engine was originally developed in the early 1980s. Kawasaki became a I percent risk-sharing partner in 1985, and has continued at that level since then. MHI signed on as a 1 percent risk-sharing partner in the PW4000 program in 1989, and its participation grew to 5 percent in 1991 and 10 percent in 1993. MHI is responsible for manufacturing various turbine blades and vanes, turbine and compressor disks, active clearance control components, and combustion chambers. The increase in MHI's share since 1989 has come about as a result of mutual satisfaction with the relationship and a desire to expand it.

In addition to risk-sharing agreements with MHI and KHI in commercial engines, P&W has a long-term sourcing agreement with IHI to produce the long shaft connecting the high-and low-pressure turbines for the JT9D, PW2000, and PW4000. IHI will manufacture all of Pratt & Whitney's commercial long shafts. Utilizing and improving upon the process transferred in connection with the F100 program, IHI has become a world-class center for the production of long shafts of more than 8 feet. As mentioned earlier, IHI will be manufacturing the long shaft for the GE90, and it manufactures all of Rolls Royce's shafts as well. This specialization is not uncommon in the engine business: Fiat dominates the manufacture of gear boxes, and Volvo is strong in casings. Although IHI's dominance in shafts raises issues of dependence and

possible supply disruption, the engine primes manage this dependence by maintaining some capability of their own. The focused manufacturing approach carries significant benefits in terms of cost and quality.

Pratt & Whitney is also a major partner in International Aero Engines (IAE), a global program that developed and is now marketing the V2500 engine. This program marked the first time the Japanese participated in a major engine development program. Pratt & Whitney and Rolls Royce are the lead partners—both hold 30 percent shares in the program. Germany's MTU holds 11 percent and Fiat 6 percent. Japan Aero Engine Company (JAEC) holds 23 percent of IAE, and is itself a joint venture of IHI (with 60 percent of JAEC), Kawasaki (25 percent) and MHI (15 percent). JAEC is responsible for the fan and the low-pressure compressor.

All of the non-U.S. members of IAE received support from their governments for their participation. JAEC has received annual payments of $20 million to $25 million from the Ministry of International Trade and Industry (MITI) since the start of the abortive FJR710 program in the early 1970s, and this support has continued through V2500 development, covering roughly 75 percent of JAEC's development costs, 66 percent of testing costs, and 50 percent of the production tooling and nonrecurring startup costs.1 Repayment with interest of these success-conditional loans is slated to commence when the program breaks even. The V2500 faces tough competition from the CFM International CFM56, but appears to be gaining greater market acceptance over time.

Both GE and P&W participate in the Japanese Supersonic/Hypersonic Propulsion Technology Program (JSPTP or HYPR), which was launched by MITI in 1989 as a $200 million, 8-year program (since extended to 10 years). The ultimate goal of the program is the development of a scale prototype turbo-ramjet, Mach 5 methane-fueled engine. The program is administered by MITI through its Agency of Industrial Science and Technology and the quasi-governmental New Energy and Industrial Technology Development Organization.

The Japanese partners—IHI, KHI, and MHI—receive 75 percent of the funding and take the lead on technology development and design. HYPR is significant in that it is one of the first of Japan's national R&D projects to contemplate international participation from the outset as an integral feature of the program. The foreign participants—who receive 25 percent of the funding—are Pratt & Whitney, GE, Rolls Royce, and Snecma. The formal agreement between MITI and the foreign engine companies was signed in early 1991. The process of negotiating this participation was somewhat long and complex, the major stumbling block being the treatment of intellectual property generated in the project. The four foreign companies joined together to negotiate with MITI as a united front. This process led to an agreement and a change in Japan's laws governing intellectual property rights in government-sponsored R&D.

From the point of view of GE and Pratt & Whitney, the main motivation for participating is that taking a role in the Japanese program is preferable to a major supersonic/hypersonic engine program going forward without U.S. involvement. By participating, GE and Pratt & Whitney gain insights into the basic design decisions and capabilities of the Japanese members of HYPR. Thanks to MITI funding, participation is not costly for the foreign firms. The U.S. engine makers believe that as a major terminus for flights of the next-generation supersonic transport, Japan will inevitably be involved in its development. As a separate initiative, GE and P&W are collaborating on NASA-funded research on high-speed civil transport propulsion targeting an engine in the Mach 2–2.5 range.

The basic interaction between foreign and Japanese companies in HYPR is participation in design review and analysis in designated program areas. Since the program is currently in its fourth year and will probably run for ten, the impacts and implications cannot be assessed precisely. The eventual impact will depend a great deal on the timing and mechanism for developing propulsion for the next-generation supersonic transport. While foreign participation allows the major international players to keep tabs on Japan's approach, the Japanese participants gain design insights from foreign coaching. Also, international participation in HYPR has itself served to give credibility to Japanese efforts to play a significant role in international advanced engine programs and to other Japanese government efforts to organize international R&D collaboration.

The Japanese government also funds several other programs that have implications for future aircraft propulsion systems. The one that is most closely linked to HYPR is the research program on high-performance materials organized under MITI's ''Jisedai" or Next-Generation Technology Development funding pool. The program began in 1989 and is scheduled to run through 1996. In addition to these ongoing R&D programs, the Japanese government—mainly MITI and the Technology Research and Development Institute—is conducting a number of feasibility studies aimed at significantly upgrading Japan's engine testing facilities over the next decade. JDA is also making funds available for a high-altitude test facility in Hokkaido.

Japanese aircraft engine makers have effectively leveraged private and public resources in international alliances and public R&D projects to improve and deepen their technological and manufacturing capabilities. Individually or as a group, Japanese companies are well positioned to continue to participate in international engine development programs at increased levels of technical and manufacturing responsibility. Japan's government technology programs and corporate strategies are aimed at playing a major role, if not one of world leadership, in advanced propulsion materials and other targeted critical technologies.

AVIONICS

Avionics is another critical part of modern transport aircraft. Advances in navigation and flight control systems have the potential to further reduce the cost and increase the safety of air travel. Commercial avionics is a $3 billion per year business worldwide. The two dominant players are American companies—the Collins division of Rockwell International and Honeywell. U.S.-Japan technology linkages are fairly extensive in this sector and take several characteristic forms depending on the market.

On the commercial side, U.S.-Japan linkages have been driven by changes in the nature of innovation in avionics hardware over the past 15 years. Up to the mid- or late 1970s, the bulk of hardware innovations incorporated into commercial avionics came from military electronics developments. Increasingly, however, avionics systems incorporate component technologies first developed for consumer electronics and high-demand computer applications. Over the past several decades, as Japanese companies achieved and extended their dominance in consumer electronics and gained strong positions in several areas of the semiconductor industry, Japan has become the major source for these hardware innovations. Although standard components can be incorporated into avionics black boxes in some areas, in others the performance requirements necessary for an avionics application go so far beyond the capabilities of the standard component that an extensive modification effort is necessary. This is the fundamental dynamic driving U.S.-Japan technology linkages in commercial avionics today.

The best current example of this trend is flat panel displays. The liquid crystal display (LCD) technology that was invented in the United States in the late 1960s has been nurtured and improved by a number of Japanese companies for more than 20 years. Passive and active matrix LCDs are now the dominant technology of flat panel displays in rapidly growing markets such as portable computers and hand-held television sets. Japanese companies such as Sharp and Hosiden are the leaders in this technology, and Japan currently holds more than 90 percent of the flat panel display market. Several small U.S. firms develop and manufacture some displays for military and other niche applications, but they do not have the capital to invest in the necessary manufacturing capability for large-scale production.

In developing the next-generation avionics systems that will be installed in the Boeing 777, both Collins and Honeywell clearly saw the advantages—mainly space and weight savings—of replacing cathode-ray tube displays with flat panels. Although both Collins and Honeywell briefly considered other alternatives, it soon became clear that the Japanese companies that currently dominate the world market were the best source of a cost-efficient solution. Collins teamed with Sharp and Toshiba, and Honeywell worked with Hosiden.

Whereas the necessity for acquiring this high value-added component was clear and compelling on the U.S. side, the Japanese display makers had to be

convinced to take up the task—avionics is not a large market compared to lap-top computers, and a significant commitment of engineering resources would be required. However, there were also compelling advantages for the Japanese display makers, such as the opportunity to lock in a long-term, profitable stream of business and to develop new capabilities for their displays.

Perhaps the most important benefits for the Japanese firms were the interrelated benefits of learning about technology and business methodology in a very high-image market. Although the American firms were very careful to employ the Boeing-like strategy of keeping these key suppliers limited to display development, technology transfer was necessary to enable the Japanese companies to solve the unique problems arising in the development of displays that meet avionics needs.

In terms of the immediate business and technical objectives, U.S.-Japan linkages in commercial avionics usually achieve their goals and bring the expected benefits to both sides. The U.S. integrator gains a reliable supply of high value-added components or subassemblies at a reasonable price, which helps add value for the end user. The Japanese partner gains steady business, technology, and learning benefits that can be applied to its core business or serve as a basis for further expansion in aircraft markets. For example, many new aircraft will incorporate flat panel displays in the cabin as part of passenger entertainment and communications systems as well as in avionics. The Japanese display makers can directly apply knowledge of the business methodologies of airframe makers and airlines to their efforts to market displays for these systems.

The downside of the flat panel display relationship was felt when the small American manufacturers filed an antidumping suit against the Japanese, and the International Trade Commission placed punitive tariffs on Japanese imports. Collins and Honeywell have been hurt by these duties, but would not consider transferring manufacturing out of the United States in response, as have several U.S. makers of laptop computers.

There are also extensive U.S.-Japan technology linkages in military avionics, but these are of a completely different character from the commercial supplier alliances. In order to gain access to the JDA market, U.S. avionics makers must often license production or enter other collaborative relationships with Japanese companies like Mitsubishi Electric or Japan Aviation Electronics. This often happens as part of a licensed production program such as the F-15.

In all of these relationships, the transfer of technology is almost exclusively from the United States to Japan. In the commercial field, the United States receives products in return for technology; and on the military side, market access.

What are the competitive issues posed by U.S.-Japan linkages in avionics? Is there a long-term danger that Japanese companies will become full-line avionics integrators? American avionics industry leaders recognize the considerable technological and manufacturing capabilities of Japanese electronics com

panies, and realize that they often deal from a position of weakness in seeking to gain access to component technologies. A high percentage of the value added in current avionics systems consists of Japanese components, and the percentage will very likely continue to rise. The avionics market might be appealing for the Japanese as a high-profile industrial market with some potential for driving technology development that could be applied to core businesses. Also, the Japanese are very aggressive in developing nonavionics electronic systems for aircraft (entertainment systems and satellite communications), as well as mass market applications of technologies that are closely related to avionics, such as automotive applications of GPS (already being marketed in Japan). Collins and Honeywell are interested in some of these markets, but they are not well entrenched.

However, while Japanese companies are capable of moving up the avionics food chain, there are significant capabilities that they do not yet possess, and there are few signs that Japanese industry or government is aggressively developing them. For example, the software and systems integration skills that are needed to develop the current generation of avionics is beyond current Japanese experience. Although the value of Japanese components is high, U.S. avionics companies do not anticipate a short-term challenge from Japan in the integration segment. They would prefer to have more leverage as they incorporate Japanese technologies into their systems, but believe that the lack of a U.S. consumer electronics industry is the main cause of the difficulties they have experienced.

From a U.S. policy perspective, the impacts and implications are more complex. The U.S. Department of Defense and other agencies have identified flat panel displays as a key technology for a range of industries. DOD's Advanced Research Projects Agency, the Department of Commerce's Advanced Technology Program, and Department of Energy laboratories have launched a number of technology development programs to help build competitive U.S. capabilities in this area. Avionics companies might be obvious ''lead users" in these efforts, but it does not appear that any U.S. avionics companies are currently involved in U.S. government-sponsored efforts. As in advanced materials, the flat panel display example illustrates that the challenges involved in planning and implementing an effective civilian technology policy are considerable.

OTHER COMPONENTS AND SUBSYSTEMS

Modern transport aircraft incorporate a large number of subsystems and components manufactured by a variety of large and small companies. Subsystems include electrical power systems, actuation systems, and landing gear. Each subsystem and the aircraft as a whole incorporate numerous and varied components such as gears, materials, and integrated circuits. Japanese companies have become quite prominent in some parts of the supplier base. For ex

ample, most of the precision bearings needed for aircraft engines are now manufactured in either Japan or Germany. Companies in those countries built on existing strengths in bearings to eliminate the remaining American companies from this high-performance segment. Bearings—like flat panel displays—represent a field in which Japanese companies entered aerospace markets because of capability acquired in more general-purpose markets.

Japanese success in supplying dedicated aircraft components and subsystems is more uneven. Teijin Seiki—whose original business was textile equipment—has achieved a prominent position in primary actuation systems and supplies all recent Boeing programs. Teijin Seiki is also actively building other parts of its aircraft subsystem business, partly through a joint venture with Sundstrand. Other Japanese companies such as Kayaba, Shinko Electric, and Yokohama Rubber have also gained success in some subsystem and component areas.

Because of the wide variety of products and companies involved, U.S.-Japan technology linkages in aircraft subsystems and components are difficult to characterize in a general way. In contrast to expanding relationships between U.S. primes and Japanese suppliers, there appear to be few linkages between U.S. and Japanese suppliers on the commercial side. Most U.S. supplier-Japanese supplier technology linkages have been formed in the context of Japanese military programs. Particularly in cases where U.S. systems have been coproduced or produced under license in Japan, JDA and Japanese industry generally pursue licensed production of U.S. subsystems and components that embody significant technology.

The STS Corporation joint venture between Sundstrand and Teijin Seiki raises a number of the relevant technology transfer and market access issues faced by U.S. suppliers wishing to participate in the Japanese aircraft market. Sundstrand's involvement in the Japanese aircraft market began in the late 1960s with licensed production of electric power generating system constant-speed drives by Teijin Seiki for Japanese military programs. This licensing arrangement evolved into the formation of a 50–50 joint venture company called STS Corporation about a decade ago.

Improved market access was Sundstrand's primary motivation, and it has seen tangible benefits in this regard. The original target was the military market, and a significant proportion of STS's sales still go to military programs. There appear to be market access benefits on the commercial side as well. Examples include STS's supply of the main fuel pump for the V2500 engine and Sundstrand's participation in the MD-12 actuation team with Teijin Seiki and Parker Hannifin.

As the venture markets Sundstrand's more mature technologies, the transfer of technology through the joint venture has been predominantly from Sundstrand to STS—while Teijin Seiki provides the personnel to staff the venture. STS participation in SJAC collaborative R&D programs may bring reverse technology transfer opportunities in the future.

Although the venture should be termed a success from the standpoint of the strategies of the two parent companies, it is an illustration of continuing U.S.-Japan technology and market access asymmetries. While Sundstrand found it prudent to team with a Japanese company in order to expand market opportunities in Japan (and even in the United States, in the case of the MD-12), there are few barriers to Teijin Seiki and other Japanese subcontractors selling directly to Boeing and other U.S. primes.

DISTINCTIVE FEATURES OF U.S.-JAPAN AIRCRAFT LINKAGES

Motivations and Benefits for the United States

The committee identified a number of significant motivating factors and benefits of expanding U.S.-Japan technology linkages in the aircraft industry. Significantly, these benefits are more likely to be realized by U.S. companies dealing from the strongest technological and business positions—the airframe and engine primes such as Boeing, Pratt & Whitney, and GE. Most of these benefits revolve around the generally superior performance of Japanese companies in this field as business partners.

Long-Term Commitment of Resources

Japan as a country, as well as the individual companies involved in the industry, is committed to a long-range strategy of aerospace growth. U.S. companies linking with Japan can be reasonably assured of their partner's commitment to invest despite the long-term payoffs typical in this industry. This is a particularly important benefit in view of the escalating costs of aircraft and engine development programs.

No Barriers

Apart from the difficulties that U.S. companies may experience in acquiring Japanese companies, there appear to be no formal barriers to aerospace cooperation—at least at the level of U.S. prime integrators.

Focus

Japanese partners generally have an unrelenting focus on meeting project schedules and target costs, once negotiated. They bring their notions of continuous improvement to the program and do not hesitate to invest to constantly improve quality.

Access to World-Class Manufacturing

Japan's focus on manufacturing processes is apparent throughout their aerospace units. Much of this know-how is available to U.S. partner companies if they are willing to make the investment needed to transfer the technology back home.

No Leakage

In the aerospace industry today it is common for individual Japanese companies to have partnerships or close relationships with several competitive companies at the same time. This provides an opportunity for "leakage" of plans, activities, and know-how from one competitor to another. U.S. companies who have partnered with Japanese aircraft companies have not experienced this problem.

U.S. Access to the Japanese Market

Although Japan has no aircraft offset requirements or other formal trade barriers in aircraft, market leverage has been a major motivator of linkages on the U.S. side. Airbus has managed to sell aircraft to Japan despite an absence of significant linkages. Generally speaking, however, a presence in Japan is seen as a prerequisite for participation in the market. Boeing and McDonnell Douglas have sourced portions of airframes in Japan to enable or promote sales to the Japanese airlines. Engine makers have also followed this strategy, whereas components manufacturers have followed a pattern of joint ventures as a means of gaining access as suppliers to the market for military aircraft in Japan. U.S. companies have also found, however, that cooperative programs do not ensure sales.

Risks for U.S. Industry and the United States

Juxtaposed to the benefits are the risks of technological collaboration with Japan. The committee identified a number of risks faced by participants in linkages and other U.S. companies.

Enabling Competitors

One risk faced by U.S. companies undertaking technology alliances with Japanese companies (or other foreign partners) is that technology transferred to a partner through the alliance, or developed independently thanks to the joint program revenue base, will be used by the Japanese partner to market a competing product. This can occur through military or commercial programs. At the prime airframe and engine levels, this risk has been realized by U.S. firms, but

not in relationship to Japan so far—some technologies, such as fly-by-wire transferred through the European F-16 coproduction program, were later used by Airbus. Some U.S. suppliers, particularly in the context of military programs, have faced Japanese competition from licensing partners—the ring laser gyro case cited in Appendix B is one example.

Displacement

Another risk faced by U.S. suppliers is that they will be displaced by Japanese competitors in the context of technology linkages with Japan formed by other U.S. companies. This is currently occurring in the aircraft structures area, for example, the displacement of Northrop as a components supplier on the 767 and 777.2

Dependence and Loss of Critical Capabilities

In some cases, Japanese strength in technologies developed in other industries and applied to aircraft may have the effect of stifling nascent U.S. capabilities. To U.S. industry, there is a danger that capabilities critical to the future of the industry will be completely absent in the United States, or that U.S. basic research feeds development and commercialization activity that largely occurs in Japan (as has happened in industries such as robotics). If the technology is critical enough, U.S. primes may find themselves in the position of having to transfer more of their own technology than they would like in order to access Japanese capabilities. Flat panel displays and some areas of advanced materials are examples in which this risk has been realized.

Market Access Problems

At both the prime and the supplier levels, but particularly in the case of suppliers, formal and informal Japanese trade and investment barriers necessitate the trade of technology for market access. Often, the only viable option that makes business sense to U.S. companies is a joint venture. In some cases this may be a low-risk strategy. In areas where direct contact with customers plays a major role in driving technology development, however, some companies have found that their joint ventures constrain their relations with other Japanese companies or serve to create powerful competitors.

Technology Access Problems

U.S. companies and the United States as a country have transferred far more technology to Japan than vice versa, particularly in the aircraft industry.

The United States runs the risk of forgoing significant opportunities to improve the competitiveness of its aircraft industry if the flow of technology from Japan is not increased—both through lowering Japanese barriers and through devoting more of its own resources to acquiring and assimilating the available information.

National Security

Particularly in military programs, there is always a risk that technology transferred overseas could come back to threaten U.S. national security; this is the rationale behind export controls. In the case of Japan, this risk has been judged to be quite low—a qualitatively higher level of technology transfer through aircraft and other military programs has been allowed for Japan than for other allies.3

Evolution of Linkage Mechanisms

U.S.-Japan linkages display several characteristic features in terms of mechanisms and trends:

-

For linkages formed by U.S. integrators in airframes and engines on the commercial side, interaction with Japanese companies generally begins with the establishment of a supply relationship. In the case of linkages of U.S. primes with the Japanese heavies, interaction has increased over time—often supported by Japanese government policy. Japanese companies are now or could ultimately become capable of manufacturing all the parts of modern commercial airframes and engines. In engines and airframes, the pattern may be shifting toward significant Japanese participation as partners in global programs managed by U.S. primes.

-

A relatively new mechanism is foreign participation in Japanese government-sponsored R&D programs such as HYPR. The future direction of this mechanism is unclear, but in addition to true joint development of new technologies, such programs also have a component of transferring existing knowledge from foreign firms with advanced capabilities to their Japanese competitors. Although the Japanese government has launched several international R&D programs since HYPR, none has focused on aircraft specifically.

-

At the prime level in military programs, the pattern has been one of U.S. technology transfer to Japan, with a dynamic of increasing Japanese responsibility and technological capability over time. The direction of U.S.-Japan military program links after the FS-X is unclear.

-

Linkages at the supplier level present a mixed picture. On the military side, U.S.-Japanese supplier links often occur in conjunction with large pro

-

grams and involve Japanese licensed production of the U.S. component. In cases where the U.S. company has a strong technological edge, these relationships sometimes extend over several programs and even evolve into collaboration in commercial fields. In other cases, such as the mission computer and the electric power generating system for the FS-X, Japanese companies have displaced U.S. companies by developing independent capabilities.

U.S. and Japanese Strengths and Weaknesses Underlying Linkages

Japanese Strength—Manufacturing Capability and Investment Resources

Japanese aircraft companies have demonstrated the creativity and resource commitment necessary to apply world-class technology to aircraft production. In addition to the aircraft industry itself, Japanese capabilities in areas such as composite materials and flat panel displays have been developed through investment in manufacturing excellence aimed at other markets, and are finding increasing application in aircraft. In contrast, some U.S. companies have found it difficult to invest in capital-intensive manufacturing processes in the United States in recent years.

Japanese Strength—Integrated, Supportive Policy Environment

A Japanese policy environment encouraging international alliances that transfer technology to Japan, civil-military integration in the domestic industry, and cooperation between companies helps to maximize the impact of Japan's technological strengths. Although the U.S. aircraft industry is dynamic, policy agendas are often fragmented and government agencies sometimes work at cross-purposes.

U.S. Strength—Systems Integration and Other Advanced Technologies

U.S. technological excellence across a wide range of aircraft technologies—particularly those associated with systems integration—is unmatched. U.S. industry, academic, and government R&D capabilities in aeronautics, propulsion, materials, and other associated fields are the foundation for future U.S. competitiveness in the global aircraft industry. Although Japan is making efforts to build wind tunnels and other necessary research infrastructure, considerable resources over a long time period will be necessary.

U.S. Strength—Long-Term Familiarity with Needs of the Global Market

Particularly at the level of integrating airframes, engines, and avionics, U.S. companies have maintained an aggressive global marketing presence that

facilitates the incorporation of customer needs into products, as well as the capabilities in safety certification necessary to sell products globally. The Japanese industry has tried to develop marketing and product support capabilities though international alliances, with some limited success.

Outcomes and Implications of U.S.-Japan Linkages

Japanese Capabilities and Strategy

Although Japan is missing some technological squares in the matrix of critical aircraft capabilities (systems integration, marketing), it currently possesses the necessary infrastructure to support an indigenous aircraft industry. Japanese companies and government are pursuing international alliances and technology development programs to fill in the missing pieces. Japan is making the necessary investments to increase its presence in the commercial aircraft market, focusing on manufacturing quality and cost leadership.

Japan has not launched an effort at the airframe or engine prime level to compete with U.S. firms; nor has it formed significant relationships with Airbus or other international players. Japan would likely become a formidable U.S. competitor if it decided to pursue either of these options, and government and industry are currently reevaluating their basic approach to the industry. In any case, Japan is a significant factor in the global aircraft industry. U.S. collaboration with Japan entails benefits and also some risks, but at this point it appears that continued cooperation is preferable to the alternatives.

Technology Transfer

Technology flow through U.S.-Japan linkages in the aircraft industry has been predominantly from the United States to Japan. Although historically, more technology has flowed through military than commercial programs, commercial alliances formed over the past 10 to 15 years have also transferred technology to Japan or in some cases, stimulated independent Japanese development when they were not given access. Although it appears that DOD and U.S. companies involved in military and commercial linkages have by and large protected critical technologies while reaping significant benefits from these relationships, the impacts of the most recent and significant technology transfers (through the FS-X and extensive commercial program links) are still unclear. The security environment that justified a pattern of extensive U.S. aircraft technology transfer to Japan is rapidly changing, and there is a need to take economic considerations into account. In view of the large U.S. stakes in this industry and the rapidly expanding Japanese capabilities in many significant technologies, a more balanced flow of aircraft technology between the two countries should be key to a continuation of mutually beneficial interaction, and

should be pursued by U.S. industry and government as a strategy and a major policy goal.

The U.S. Supplier Base

Although U.S. primes have by and large had good experiences in their relationships with Japan, evolving patterns of global manufacturing capability and industry restructuring—in which U.S.-Japan linkages are an important part of the context—already threaten existing parts of the U.S. supplier base and may prevent the development of U.S. commercial capabilities in a number of critical, emerging areas. This situation suggests the need to reexamine the manner in which technology development and related business activities are organized and funded in the United States, in order to promote more effective relationships between U.S. companies and between industry and government, as well as ensure retention of an innovative full-spectrum aerospace capability. Where the technologies impart both security and economic growth, there is a need for more attention and coordination among various government agencies to ensure effective use of public support for R&D and procurement relevant to industry, especially the supplier companies. Failure to address these issues implies continued erosion of the domestic U.S. supplier base and a concomitant increase in the probability of Japanese entry at the prime level as its supplier base becomes more developed.