APPENDIX J

FUEL REPROCESSING ECONOMICS

INTRODUCTION

Transmutation of transuranics (TRUs) and fission products that are recovered from spent fuel offers potential for improving the technology for long-term disposal of radioactive waste. Successful implementation of this integrated reprocessing/irradiation strategy would require a major financial commitment to the development, design, construction, and operation of a series of reprocessing plants and transmutation reactors based largely on as-yet unproven technology.

This appendix addresses various economic issues related to the use of transmutation as a primary waste management strategy, focusing primarily on future reprocessing costs under various plant ownership and financing arrangements. It also addresses the substantial institutional barriers that would inhibit private-sector financing of such a strategy in the United States.

HISTORICAL PERSPECTIVE

The nuclear industry of the early 1970s was characterized by rapidly increasing worldwide demand for generating commercial nuclear power capacity, rising uranium prices, and an impending shortage of uranium enrichment capacity. There was a consensus within the nuclear community that spent reactor fuel would be reprocessed to recover residual uranium and plutonium for recycle in light-water reactors (LWRs) and ultimately to fuel breeder reactors. Projected reprocessing costs were low, and there appeared to be an urgent need to reduce the rapidly increasing demand for virgin uranium in order to stem rising prices and prepare for early introduction of breeders. U.S. enrichment capacity was sufficiently committed by 1972 that the U.S. Atomic Energy Commission (AEC) closed the books on new orders for enrichment services.

Reprocessing and uranium and plutonium recycle in LWRs was expected to reduce total fuel-cycle cost relative to a once-through fuel-management scheme. Confidence that a reduction in cost would be realized was supported by commercial contracts for reprocessing services at unit prices below $20/kgHM in the late 1960s. The initial estimates of the cost premium for MOX fuel fabrication were as little as 20% above the comparable cost of fabricating virgin uranium fuel. Spent fuel was expected to be reprocessed within approximately 6 months following discharge from the reactor, so that recovered uranium and plutonium could be returned to the reactor with minimal delay.

Through the late 1960s, the U.S. outlook for nuclear power plants and for fuel-cycle facilities to undertake commercial uranium and plutonium recycle facilities was favorable. Two commercial facilities for reprocessing LWR spent fuel were constructed. The General Electric

plant at Morris, Illinois, was completed in 1968, and the Allied-General Nuclear Services plant at Barnwell, South Carolina, was completed in 1974. However, neither plant went into commercial service.

The 20-year period of nuclear optimism began to wane in about 1970 with growing public apprehension over the possibility of a major nuclear accident. This in turn prompted criticism of the AEC, which had the dual responsibilities for developing and promoting nuclear power and for regulating its implementation in the private sector. The passage in 1970 of the National Environmental Policy Act (NEPA) fundamentally changed the ground rules for nuclear plant siting and construction. NEPA added a requirement for the preparation of an environmental impact statement for all new major facilities, with provisions for public hearings on the statement before a construction permit could be issued.

Public dissatisfaction with AEC management of nuclear issues heightened with the revelations attending the cancellation of the planned high-level waste (HLW) repository near Lyons, Kansas. The public became aware that an approved waste repository site had not yet been secured to receive the steadily increasing quantity of spent fuel, as well as HLW from defense operations. In 1974 the Ford administration divided the AEC into two new organizations that separated the responsibilities for nuclear development and regulation. The new organizations were the Energy Research and Development Administration (ERDA) and the Nuclear Regulatory Commission (NRC). At the same time, Congress disbanded the powerful Joint Committee on Atomic Energy and reassigned its responsibilities among several congressional committees.

A new public concern arose when India tested a ''peaceful nuclear explosion" in 1974, rekindling an earlier controversy over the postulated link between nuclear power and nuclear weapons proliferation. This concern was heightened by the revelation that the Indian nuclear explosive contained nuclear weapons material produced in a reactor that was sold to India by Canada. The Indian nuclear test made it necessary for many nations, including several developing countries, to acquire their own facilities to enrich uranium or recover plutonium from spent reactor fuel. The growing controversy associated with the widespread commercial use of plutonium recycle came to a head in the highly contentious hearings on the Generic Environmental Statement on Mixed Oxide (GESMO) fuel, which the NRC had begun in late 1974 and which the Carter administration finally canceled in 1977.

In 1977, the Carter administration completed a review, begun by the Ford administration, of the plans to commercialize the breeder reactor and engage in plutonium recycle in the United States. In addition to placing greater emphasis on nonproliferation concerns, this review was based on projections of the growth in electric power demand that were much lower than the earlier projections of the AEC up to the mid-1970s. This reappraisal soon led to cancellation of breeder commercialization and plutonium recycle, leaving the Barnwell reprocessing plant without an operating license or a mission.

From 1977 to 1979, the United States joined other nations in the International Fuel Cycle Evaluation to reconsider the commercial use of plutonium. The U.S. Congress passed the Nuclear Nonproliferation Treaty of 1978, which placed restraints on foreign reprocessing of nuclear fuel of U.S. origin.

Several nations took issue with the change in nuclear ground rules implemented unilaterally by the United States. However, most ultimately agreed that steps to limit reprocessing and recycle would be prudent, although they retained reprocessing as a long-term option. The International Fuel Cycle Evaluation also reached agreement that spent fuel itself was a waste form that could be safely disposed of in a waste repository. Indeed, by 1977, the United States was strongly recommending that course, which was adopted and further promoted by several other nations, notably Sweden, that had small nuclear programs. However, the European reprocessors and Japan continued their plans to reprocess spent fuel from commercial reactors and to store the separated plutonium pending further development of their breeder programs.

When the U.S. ban on domestic fuel reprocessing was lifted in the early 1980s, the previously favorable political and institutional environment for nuclear energy no longer existed, and the economic incentives for reprocessing had changed markedly. The principal factors precluding the resumption of commercial reprocessing in the United States were as follows:

-

There was widespread cancellation of orders for new U.S. nuclear power plants, resulting in a precipitous decline in uranium concentrate prices from a peak of $44/lb U3O8 in mid-1979 to approximately $17/lb only 3 years later.

-

There was greatly increased worldwide uranium ore reserves as a result of major discoveries in Australia in the late 1970s and in Canada in the early 1980s.

-

The introduction of commercial gas centrifuge enrichment technology, completion of the Eurodiff gaseous diffusion plant, and the absence of new orders for U.S. nuclear power plants transformed the earlier forecast of a shortage of enrichment capacity to a condition of oversupply, resulting in major price reductions for enrichment services due to intense competition.

-

The Nuclear Waste Policy Act of 1982 provided no economic incentive for HLW vitrifications as opposed to direct disposal of spent fuel. Indeed, the disposal of spent fuel in a geologic repository remained the Department of Energy (DOE) policy, in conformance with the Nuclear Nonproliferation Treaty of 1978.

-

The capital cost of breeder reactors relative to LWRs proved to be higher than had been projected in the early 1970s, and the unit cost of fabricating MOX LWR and liquid-metal reactor (LMR) fuel also proved higher than projected, exhibiting a steady increase with time. Large-scale deployment of commercial breeder reactors, once envisioned to begin as early as the 1980s, was delayed indefinitely. It now appears that the need for an LMR to forestall rising uranium costs may not occur until the second half of the next century, or later.

-

The estimated cost to construct and operate commercial reprocessing plants increased due to several factors, including new regulations requiring containment of radioactive gases and solidification of the plutonium product, as well as the industry's recognition that fuel reprocessing should be treated as a high-risk venture, thereby increasing plant financing cost.

-

There was a lack of a clear economic incentive for reprocessing and closure of the LWR fuel cycle as a result of the above events. Reprocessing and recycle of plutonium would have required reopening of the contentious GESMO hearings.

These formidable barriers to reprocessing led U.S. utilities to continue with a once-through fuel cycle and prompted reoptimization of LWR fuel management schemes to use longer and higher burn-up cycles. This reduced the fissile uranium and plutonium content of the spent fuel, further reducing the incentive to reprocess.

Foreign interest in reprocessing continued, however, as those nations with limited economically recoverable domestic uranium resources saw reprocessing as an opportunity to reduce the increasing demand for uranium imports. In France, the 800-MTHM/yr UP3 reprocessing facility, as well as the 400-MTHM/yr expansion of UP2, were successfully designed, constructed, and operated. Construction of the 900-MTHM/yr Thermal Oxide Reprocessing Plant (THORP) in the United Kingdom was completed in 1992, and the facility is currently in start-up. In Japan, the 800-MTHM/yr Rokkashomura plant is currently under construction and is scheduled for operation in 2000.

RELATIVE ECONOMICS OF REPROCESSING VERSUS ONCE-THROUGH FUEL CYCLE

A study of LWR fuel-cycle costs was recently performed by the Nuclear Energy Agency (NEA) of the Organization of Economic Cooperation and Development (OECD). Their report, The Economics of the Nuclear Fuel Cycle (OECD/NEA, 1993), concluded that the levelized fuel cost for the once-through LWR fuel cycle is approximately 14% less than for the reprocessing cycle. Their analysis included a credit for both the uranium and the plutonium recovered through reprocessing.

Those countries that chose to reprocess their nuclear fuel based their decision on a number of factors other than cost. With limited natural uranium resources, they have a strong interest in being self-sufficient in energy production. They also take a longer-term look than the "what are the profits in the next quarter" attitude of many of the decisions made in the United States. This led them to a strategy that included recovery and recycle of uranium and plutonium from spent fuel and vitrifying the HLW produced as a solid waste form for interim storage until a permanent waste repository is in operation.

PRINCIPAL ISSUES IN DETERMINING WHETHER TO ADOPT REPROCESSING AND TRANSMUTATION AS A WASTE MANAGEMENT STRATEGY

Recycling and transmuting TRUs and fission products requires reprocessing. While transmutation proponents claim that this can be done as economically as a once-through fuel cycle, the cost of reprocessing is a key factor in the cost of transmutation. Marshaling the management, technical, and financial resources to design, construct, and operate the reprocessing plants and specialty reactors to recycle and transmute TRUs and fission products is influenced by a number of major issues. While certain issues are largely political/institutional,

they are nevertheless important, since they will influence the attitude of prospective lenders for these capital-intensive projects.

The principal issues are

-

the relative immaturity of certain aspects of nonaqueous (pyrochemical) reprocessing technology and of the advanced liquid-metal reactor (ALMR) technologies proposed to recycle and transmute the TRUs and fission products, and the magnitude of the development and demonstration program required before wide-scale implementation of a transmutation strategy can be implemented;

-

likely growth in the required capital, operating and maintenance, and decommissioning costs for pyrochemical reprocessing and ALMR power plants as concept definition evolves;

-

difficulty in obtaining a government financial commitment because of the expected high cost of transmutation technology development/implementation and the difficult-to-quantify benefits to public health and safety; and

-

difficulty in attracting private capital due to the perceived high technical/economical/institutional risk of reprocessing/transmutation projects relative to alternative opportunities for investment capital, resulting a higher cost of capital due to the higher perceived risk.

These issues apply not only to centralized, large-scale reprocessing plants but also to smaller onsite reprocessing plants, transmutation reactors, and an integrated complex of reprocessing plants and transmutation reactors. Overcoming these barriers will be a formidable challenge.

REPROCESSING-PLANT CAPITAL COSTS

While pyroprocessing technology is being considered for reprocessing spent fuel that is associated with transmutation of TRUs, this technology is not sufficiently mature that reliable reprocessing-plant capital and operating cost estimates can be prepared. Moreover, it is by no means certain that pyroprocessing will prove more economical than conventional aqueous reprocessing, for which the technology is relatively mature. While Argonne National Laboratory (ANL) prefers pyroprocessing technology, the fuel-cycle costs developed by General Electric (GE) for the ALMR program are apparently based on the cost of plutonium and uranium recovery by extraction/transuranic extraction (PUREX/TRUEX) aqueous technology for reprocessing LWR spent fuel to start and refuel ALMRs. The GE estimates are based on PUREX aqueous technology, combined with new TRUEX technology for high-yield recovery of all TRUs. The capital costs developed in this section, and the operating costs developed in the section Reprocessing-Plant Operating Costs are therefore based on aqueous reprocessing technology.

Capital Costs Associated With Reprocessing Plant Projects

Capital cost information was obtained from the open literature and private communications for three reprocessing plant projects: THORP (United Kingdom), UP3 (France), and Rokkashomura (Japan). UP3 is in operation, THORP is in the startup phase, and Rokkashomura is under construction. These three plants have annual throughputs in the range of 800 to 900 MTHM/yr, and each is based on aqueous PUREX technology.

THERMAL OXIDE REPROCESSING PLANT (THORP)

The THORP reprocessing plant, which is located at the Sellafield site in the United Kingdom, is owned by British Nuclear Fuels, plc. THORP services include fuel receipt and interim storage; reprocessing (including conversion of uranium and plutonium to oxide); HLW vitrification and intermediate storage; intermediate-level waste encapsulation, interim storage, and disposal; and low-level waste (LLW) disposal. The reprocessing-plant capital and operating costs used in this appendix are based on this scope of services.

The reported capital cost of the THORP facility ranges from £2,600 million ($4,700 million in 1992 dollars) reported by Wilkinson (1987) to £4,000 million ($6,800 million) reported by K. Uematsu (private communication, 1992). The most credible cost is £2,850 million ($4,560 million), which was reported in the July 1993 report The Economic and Commercial Justification for THORP (British Nuclear Fuel, 1993). This cost excludes interest during construction since the plant was financed through up-front payments by THORP customers.

The average annual plant throughout scheduled for the initial 10 years of operation is 700 MTHM/yr, but British Nuclear Fuel estimates that the plant can process 900 MTHM/yr (1,200-MTHM/yr capacity, with operation at a 75% capacity factor). The OECD/NEA study, which based its reprocessing plant costs on the THORP facility, assumed a plant throughput of 900 MTHM/yr as well.

UP3

UP3 is the most recent addition to the large French reprocessing complex at La Hague. It reportedly has a design capacity (annual throughout) of 800 MTHM/yr. UP3 has been in operation since 1990, providing complete services that range from spent-fuel storage through HLW vitrification.

COGEMA, the owner/operator of UP3, reported a total capital cost of ff 50 billion for UP3 plus the 400-MTHM/yr expansion of UP2 to 800 MTHM/yr. If two-thirds of the cost is allocated to UP3 (based on the ratio of plant capacities), the resulting UP3 capital cost would be approximately $5,800 million. COGEMA also reported that the design and construction of UP3 required 25 million engineering man-hours and 56 million man-hours of field construction (Reprocessing News, 1990). While no information was provided on the cost of equipment,

materials, interest during construction, and other such costs, factoring in these costs based on historical experience results in a capital cost of $6,670 million to construct a comparable facility in the United States.

ROKKASHOMURA PLANT

Japan Nuclear Fuel, Ltd. is currently constructing an 800-MTHM/yr reprocessing plant at the Rokkasho Village site. It is scheduled for operation in 2000. The technology is primarily French, with U.K. and German design input as well. This facility provides complete services, including HLW vitrification and storage for 8,200 waste canisters. The products are uranium and plutonium, with the plutonium diluted with uranium and converted to a 50/50 mixture of uranium/plutonium oxide.

Despite the lessons learned on the design and construction of the UP3 and THORP reprocessing plants, the constant dollar capital cost at Rokkashomura has not decreased significantly relative to these earlier plants. Reported capital costs for this facility range from $6,500 million (Chang, 1992) to $5,200 million (¥740 billion) (JGC, 1991). Because of the particularly stringent seismic design requirements in Japan, the cost of a facility of comparable capacity would probably be less in a region of lower seismicity.

Capital Costs Associated With Reprocessing Plant Studies

Capital costs associated with a number of studies were also evaluated, the most important being the June 1993 "final revised draft" of the OECD/NEA study The Economics of the Nuclear Fuel Cycle (OECD/NEA, 1993). The committee considers this study particularly credible, because it is based on cost data from the recently completed THORP plant and includes input from COGEMA, the owner/operator of UP3. The capital costs reported in the OECD/NEA study are shown in Table J-1.

The total estimated cost of £3,297 ($5,370) million is 15% higher than the reported actual cost of THORP of £2,850 million ($4,560 million without interest during construction). The reason for this cost difference is not evident, but it could be associated with the higher cost of construction at the "grass roots" site assumed in the OECD/NEA study as compared with the existing site on which THORP is located.

In addition to the above capital-cost estimates for actual plants and the OECD/NEA study, a number of other studies of reprocessing plant economics have presented estimates over the past decade. Examples include the following:

-

The 1990 study for a generic U.S. site estimated reprocessing-plant capital costs ranging from $2,725 million (government-owned plant) to $3,001 million (privately owned plant) for a reprocessing plant with an annual throughput of 1,500 MTHM/yr, 67% larger than the 900-MTHM/yr throughput of THORP (Gingold et al., 1991). These costs assumed a mature

TABLE J-1 OECD/NEA Reprocessing-Plant Capital Cost Estimate (900 MTHM/yr annual throughput).

|

Cost Component |

Capital Costa (1991 £ millions) |

|

Fuel Receipt and Storage |

100 |

|

Reprocessing Plant |

2,300 |

|

High-Level Waste |

|

|

Vitrification |

260 |

|

Interim storage |

59 |

|

Intermediate-Level Waste |

|

|

Encapsulation |

300 |

|

Interim storage |

38 |

|

Site Preparation and Services |

|

|

Site preparation |

229 |

|

Site services |

11 |

|

Total Capital Cost |

|

|

1991 £ millions |

3,297 |

|

1992 $ millions |

5,370 |

|

a Excludes interest during construction (see Table J-3). |

|

-

industry. The reprocessing plant involved aqueous PUREX technology together with new TRUEX technology for high-yield recovery of all TRUs.

-

The ALMR fuel-cycle assessment (M.L. Thompson, private communication, 1990) developed a capital cost of $6,100 million for a 2,700-MTHM/yr reprocessing plant, three times the capacity of THORP. This cost also includes facilities for MOX fuel fabrication services. As in the Gingold et al. study, the reprocessing plant involved aqueous PUREX technology together with new TRUEX technology.

-

McDonald (1993) presented a capital cost of $4,380 million for THORP (escalated from as-spent dollars to 1992 dollars).

-

An OECD/NEA report (1989), derived unit reprocessing costs based on an analysis of the THORP plant. Reported reprocessing costs were $570/kgHM for a 5%/yr return on capital and $750/kgHM for a 10%/yr return. Depending on the assumptions used for plant economic lifetime, these figures would indicate a plant capital cost ranging from approximately $6,000 to $7,000 million (for a 15 to 30-year plant economic life).

The capital costs estimated in the first two of the above studies are substantially below those experienced in the construction and operation of actual plants. This is particularly difficult to rationalize considering that the study plants include new TRUEX separations and have annual throughputs two to three times higher than THORP, UP3, and Rokkashomura. Assuming that reprocessing plant capital costs are proportional to the 0.6 power of plant capacity, scaling the Gingold estimates to a 900-MTHM/yr capacity would result in a capital cost of $2,010 million for a government-owned facility and $2,210 million for a privately owned facility. Similarly, the GEl capital cost would decrease to $3,160 million for a 900-MTHM/yr plant, less the cost of the fuel fabrication facilities included in the GE estimate. These costs are only one-third to one-half of the costs reported for actual plants of 800 to 900–MTHM/yr capacity.

Even lower estimates of capital costs were presented earlier by the ALMR project (Salerno et al., 1989) for PUREX/TRUEX reprocessing plants designed for high-recovery yield of all TRUs from LWR spent fuel. Two cost estimates were presented, one with an annual throughput of 300 MTHM and a second with an annual throughput of 2,500 MTHM. Their estimates, escalated from 1989 to 1992 dollars, were $227 million and $4,250 million, respectively. Scaling the 300-MTHM/yr plant estimate to 900 MTHM/yr would result in a cost of $440 million, while scaling the 2,700-MTHM/yr plant estimate to 900 MTHM/yr would result in a cost of $2,200 million. These estimates are far below the reported capital costs of actual plants. More important, they indicate an inverse economy of scale with plant throughput, which has not been observed or predicted in other studies.

Based on the above information, the committee concludes that reported capital costs for actual contemporary plants currently provide the most reliable basis for estimating the cost of future plants. Estimated capital costs reported in recent U.S. studies appear inexplicably low.

Summary of Estimates of Capital Cost

Table J-2 summarizes the capital costs reported for the above commercial facilities, as well as costs reported in more recent studies. Costs in year-end 1992 dollars were developed using historical escalation rates in the United States over the period that the plants were under construction. Costs expressed in foreign currencies were converted to U.S. dollars using the average exchange rate over the 10-year period from 1983 to 1992.

Interest During Construction

Since both the THORP and UP3 plants were financed largely through customer prepayments, it is the committee's understanding that the capital costs quoted in Table J-2 for these facilities do not include interest during construction. Financing costs for reprocessing plants are large because of the relatively long construction schedules. UP3 construction required 10 years (1981–1990), and THORP required 10 years (1983–1992). Rokkashomura construction started in 1993 and is scheduled for completion in 2000 (8 years). Preconstruction activities such as siting studies, permitting, and that portion of the engineering performed prior to construction start typically require an additional 2 to 3 years or more.

The OECD/NEA study indicated a construction schedule for the reprocessing plant of 11 years, which the committee assumes represents the total project schedule. Other facilities, such as the spent-fuel storage ponds, waste vitrification facility, and intermediate-level waste storage facility, had shorter schedules ranging from 5 to 8 years. The committee estimated the total cost of interest during construction by summing the financing cost for each of the major facilities.

For the government-owned plant, the interest rate for calculating interest during construction is simply the constant-dollar cost of interest on debt capital (4.0%). For the utility-owned plant, the appropriate rate is the weighted cost of capital (6.4%) (EPRI, 1993). For the privately owned plant, the committee used the cost of debt (8%), assuming project financing. The alternative, financing interest during construction with the average cost of capital (15.3%) appeared to be an unrealistic case due to its extremely high cost.

Since the distribution of the cash flow stream over the project schedule was not known, the committee applied a typical "S" curve to determine cumulative expenditures versus time. The shape of this curve is such that 50% of the constructed cost of each facility will have been spent 65% through the project schedule.

Applying these interest rates to the construction schedule for the various facilities in the reprocessing complex results in the total plant capital costs shown in Table J-3.

TABLE J-2 Reprocessing-Plant Comparison of Capital Cost

|

|

|

|

Capital Cost (Billions) |

Unit Capital Cost |

|

|

Reprocessing Plant/Study |

Yeara |

Processing Throughput MTHM/yr |

Foreign Currency |

1992 $ |

$/kgHM/yr |

|

Reprocessing Plants |

|

|

|

|

|

|

THORP (United Kingdom - Sellafield site) |

|

|

|

|

|

|

Wilkinson (1987) |

1987 |

900 |

£ 2.6 |

4.7 |

5,250 |

|

British National Fuel (private Communication, 1989) |

1989 |

900 |

£ 4.0 |

6.8 |

7,500 |

|

UP3 (France – LaHague site) |

|

|

|

|

|

|

UP3 + UP2 expansion |

1985 |

800+400 |

ff50 |

5.8 (UP3) |

7,230 |

|

UP3 (derived from engineering/construction man-hour estimates) |

1992 |

800 |

- |

7.3 |

9,100 |

|

Rokkashomura (Japan) |

|

|

|

|

|

|

Chang (1990) |

1990 |

800 |

- |

6.5 |

8,100 |

|

Uematsu (private communication, 1992) |

1989 |

800 |

¥840 |

5.2 |

6,510 |

|

Reprocessing Studies |

|

|

|

|

|

|

Generic U.S. site (Gingold et al., 1991) |

1990 |

1,500 |

- |

3.4 |

2,200 |

|

Plutonium Fuel - An Assessment (OECD/NEA, 1989) |

1989 |

700 |

- |

6.0–7.0 |

8,600–10,000 |

|

The Economics of the Nuclear Fuel Cycle (OECD/NEA, 1993) |

1991 |

900 |

£ 3.3 |

5.4 |

5,970 |

|

Review of Fuel Cycle Costs for the PWR and Fast Reactor (British National Fuel, 1987) |

1987 |

600 |

£ 1.7 |

3.1 |

5,150 |

|

ALMR Fuel Cycle Assessment - 1991 (GE, 1991) |

1991 |

2,700 |

- |

6.1 |

|

|

a Year is the base year for cost estimate. b Since this facility also provides fuel fabrication services, the unit capital cost for reprocessing only would be somewhat less than $2,300/kgHM of annual plant throughput. c THORP plant capacity changed to 900 MTHM/yr in all cases. |

|||||

TABLE J-3 Total Capital Cost (1992 $ millions)

|

Owner |

Constructed Cost |

Interest During Construction |

Capital Cost |

|

Government |

5,370 |

790 |

6,160 |

|

Utility |

5,370 |

1,300 |

6,670 |

|

Private Venture |

5,370 |

1,950 |

7,320 |

Capital Cost Uncertainties

Because of commercial considerations, insufficient information is available in the open literature to fully define the scope and financial parameters incorporated in the reported capital costs of these facilities. It is uncertain whether items such as research and development, owner engineering, site acquisition, environmental/regulatory activities, start-up, training, and decommissioning are included. Converting costs expressed in foreign currencies to U.S. dollars introduces considerable uncertainty. The use of customer advanced payments to finance both the THORP and UP3 plants further complicates the analysis of these reported costs. The range of costs reported for such facilities is nevertheless useful to assess the realism of the economic analyses presented in the various studies performed to estimate future LWR and ALMR reprocessing costs.

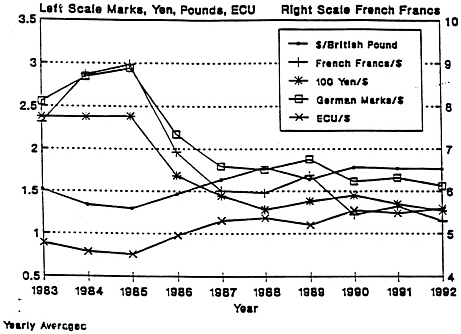

FOREIGN EXCHANGE RATES

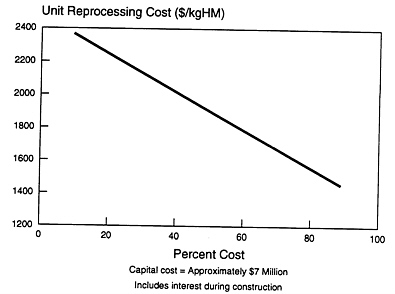

Converting capital costs expressed in foreign currencies to U.S. dollars introduces considerable uncertainty. As shown in Figure J-1, exchange rates varied considerably over the period during which the THORP and UP3 plants were constructed (International Financial Statistics , 1993). Where costs were reported in foreign currencies, the committee used the average exchange rates for the 10-year period from 1983 to 1992:

|

British pounds |

1.60 $/£ |

|

French francs |

6.70 FF/$ |

|

German marks |

2.08 DM/$ |

|

Japanese yen |

170 ¥/$ |

|

European Currency Units |

1.07 $/ECU |

Despite the uncertainties associated with currency conversion, the committee believes that reprocessing-plant capital and operating costs based on or derived from actual plants are superior to those derived from studies, except for the OECD/NEA study (1993) in which costs were derived from the THORP facility.

LABOR PRODUCTIVITY

Differences in labor productivity between the United States and the United Kingdom, France, and Japan introduce uncertainty in translating foreign capital costs to U.S. dollars. The committee made no attempt to adjust the estimates for such differences.

START-UP COSTS

The committee assumed that the capital cost presented in the OECD/NEA study includes start-up costs. If not, the capital cost would have to be increased substantially (by 50 to 100% of the $374 million annual operating costs).

REPROCESSING-PLANT OPERATING COSTS

For commercial reasons the amount of definitive information available for reprocessing-plant operating costs is extremely limited.

The OECD/NEA study (1993), reported an annual 1991 operating cost of £230 million ($374 million) based on the THORP plant. As shown in Table J-4, this includes waste processing, interim storage, and disposal (excluding HLW).

TABLE J-4 Operating Cost According to the OECD/NEA Study (900 MTHM/yr annual throughput).

|

Cost Component |

Operating Cost (1991 £ million/yr) |

|

Fuel Receipt and Storage |

11 |

|

Reprocessing Plant |

145 |

|

High-Level Waste |

|

|

Vitrification |

22 |

|

Interim storage |

2 |

|

Intermediate-Level Waste |

|

|

Encapsulation |

33 |

|

Interim storage |

1 |

|

Disposal |

5 |

|

Low-Level Waste |

|

|

Disposal |

11 |

|

Total Operating Cost |

|

|

1991 £ million/yr |

230 |

|

1992 $ million/yr |

374 |

British Nuclear Fuel, plc., reported that the present value of avoidable operating costs from not operating THORP for the initial 10 years, discounted at a rate of 2%, would be £1,560 million (British Nuclear Fuel, 1993). This equates to an annual cost of £174 million. Since the £174 million/yr excludes unavoidable costs (magnitude not stated), it would appear to be in reasonable agreement with the OECD/NEA value of £230 million stated above.

Operating costs reported in recent U.S. reprocessing plant studies are substantially below the OECD/NEA and British Nuclear Fuel, Ltd. values. Gingold developed an operating cost range of $179 to $184 million/yr for a 1,500-MTHM/yr reprocessing plant. GE estimated an operating cost of $259-million/yr for their 2,700-MTHM/yr plant. The GE cost appears to include consumables of approximately $145 million/yr associated with fuel fabrication operations. Deleting this cost to reflect reprocessing cost only would reduce operating costs to $114 million/yr, which appears very low in comparison with the estimates for THORP, particularly for a facility with an annual throughput three times larger than THORP.

The committee adopted the OECD/NEA operating cost estimate of £230 million/yr ($374 million/yr), since it is based on THORP and has been subjected to peer review.

FINANCING OF REPROCESSING/TRANSMUTATION REACTOR FACILITIES

Estimating unit processing costs from the capital and operating costs developed above requires definition of the financial structure of the prospective plant owner/operators and of the associated cost of debt and equity capital. The alternative financial structures might include:

-

private venture;

-

utility/industry consortium;

-

government; or

-

hybrid arrangement.

Each of these alternative arrangements is discussed below.

Private Venture

There are clear precedents for private ownership of both electric power generating facilities and chemical process plants. The prime examples of privately owned power plants, other than those owned by electric utilities, are cogeneration plants. These private ventures by independent power producers differ significantly from the proposed fuel-processing/transmutation facilities, however, in that cogeneration projects are based largely on demonstrated technology, and project financing is supported by power sales agreements with the utilities that purchase the electricity generated. The financial risk to the lenders is therefore relatively low.

Typical financing arrangements for cogeneration projects are

-

a relatively high debt-to-equity ratio (80–85% debt and 15–20% equity) because of the low perceived risk;

-

a nominal 15-18%/yr after-tax return on equity (11–14%/yr in constant dollars);

-

a nominal 10-11%/yr cost of long-term debt (6–7%/yr in constant dollars), approximately 300 basis points (3%) above the nominal rate on U.S. long-term treasury bonds; and

-

project financing supported by power sales agreements with the utility customer (without these agreements, the return on stockholder equity and the rate of interest on debt financing would have to be substantially higher).

An inflation rate of 4%/yr was assumed to convert nominal rates to constant dollar rates. The rate premium on both equity and debt financing would vary according to the perceived project risk. For example, a cogeneration plant using conventional gas turbines would pose less technical and economic risk than one based on a more advanced technology such as a pressurized fluidized-bed coal-fired boiler.

If it were possible to finance a reprocessing/transmutation project in the private sector, the required after-tax return on equity would be greater than that of current cogeneration projects because of the much higher technical, financial, and political/institutional risks associated with nuclear projects, particularly one based largely on new technology such as pyrochemical reprocessing. The required constant dollar after-tax return on equity might range from 14-18% as compared with 11-14% for a cogeneration project. The proportion of total capital represented by equity would likely be substantially higher than that typically required because of the higher risk associated with transmutation technologies.

With regard to the availability of debt financing, banks typically make loans up to a certain level of risk, with the rate increasing with risk. Beyond that level of risk, however, they are generally not prepared to lend at any rate of interest. The facilities associated with the reprocessing/transmutation complex may fall in this category unless some means of risk reduction (insurance, government risk-sharing, etc.) can be developed.

A pure private venture to design, build, own, and operate such a complex, without government financial guarantees, appears unrealistic. The level of risk appears unacceptably high to obtain the required financing due to:

-

immature, unproven technology;1

-

likely strong opposition from public interest groups;

-

high regulatory uncertainty (first-of-a-kind facilities);

-

general reluctance of financial community to finance nuclear projects;

-

potential adverse future changes in government policy that could preclude plant operation; and

-

the Barnwell reprocessing plant experience which is a major deterrent to new private reprocessing ventures.

The Department of Energy (DOE) assumes that private industry would finance, construct, and operate a large (2,700 MTHM/yr of LWR spent fuel) centralized reprocessing plant to obtain TRUs from spent fuel to start and refuel TRU-burning ALMRs. The plant would have to begin operation in 2010.2 The new reprocessing plant would be based on presently unproven pyrochemical technology, operating with more than tenfold lower process losses than yet achieved in commercial reprocessing facilities. To justify the market for the TRUs recovered from this new reprocessing plant, the utilities would have to commit to building over 20 large ALMRs. There would be no other market for the TRU product from the reprocessing plant. Being highly contaminated with fission products and minor actinides (neptunium, americium, and curium), the TRUs could not be used as MOX fuel in current LWRs.

To achieve the extent of TRU depletion sought by DOE's ALMR program, many subsequent replacement ALMRs would be required to further transmute the considerable TRU inventory remaining at the end of life of the first-generation ALMRs. Advanced commitments of these subsequent ALMRs and their progeny would also be required to obtain the claimed benefits to waste disposal.

These are hardly the conditions conducive to risk-capital financing of such a venture, particularly of the new and unique plant for reprocessing LWR spent fuel. Federal subsidies, guarantees, or ownership would be required. The extent of commitment that the U.S. government would be required to provide would be enormous and unprecedented.

As far as reprocessing is concerned, the above reference to ''immature, unproven technology" refers primarily to pyrochemical rather than PUREX aqueous reprocessing, since the former is in an early stage of development, while the latter is relatively mature. However, even a reprocessing plant using PUREX aqueous technology combined with the newer TRUEX process for high-yield recovery of actinides for transmutation would be unproven and difficult to finance.

Utility-Owned, TRU-Burning Nuclear Power Plant

In general, utilities are conservative, risk-adverse organizations. Their experience with the substantial cost growth resulting from nuclear power plant regulatory delays and adverse changes in regulatory requirements (such as the retrofits resulting from the accident at Three-Mile Island Unit II) has strengthened this management philosophy, making it much more difficult to enlist their participation in high-risk ventures.

The intermediate-term utility industry strategy for selecting future additions to nuclear generating capacity is based primarily on developing advanced LWRs. These evolutionary designs are expected to be founded on proven technology. Utilities understand the risks associated with advanced reactors and are actively participating in setting generic design criteria.

The rationale for utility ownership in a project requiring a special-purpose, non-LWR reactor technology to transmute radionuclides based on first-of-a-kind, nonproven technology

such as the integral fast reactor (IFR) and the accelerator transmutation of wastes (ATW) concepts is difficult to conceive:

-

Since the Nuclear Waste Policy Act of 1982 essentially relieves utilities of the responsibility for postirradiation processing and permanent disposal of spent fuel, they currently have no incentive to get involved as an owner in a high-risk actinide-burning venture.

-

Politically sensitive public utility commissions would be unlikely to approve utilities entering into a TRU transmutation venture, particularly when the utilities have no legal requirement or financial incentive to do so. Prudency hearings conducted after substantial financial commitments had been made (or after the plant has been completed) might reverse earlier agreements and disallow previously approved costs.

-

At a minimum, it would appear that some new type of government risk/cost sharing, far more extensive than on past projects/programs, would be necessary to attract utility participation.

Government-Owned Facility

Ownership of reprocessing plants in European countries has generally been confined to government corporations. They possess the unique ability to finance projects at low interest rates and are able to undertake complex, high-risk projects in the interest of national policy. Without such low-cost financing (from the government or from advance payments for services from plant-customers, as was the case for the THORP plant), reprocessing costs would be prohibitively high. Since the federal government is ultimately responsible for the safe disposal of spent fuel in the United States, it would be the logical entity to undertake a TRU-burning program, if such were possible within the institutional barriers of government.

Hybrid Organization

Some form of hybrid organization involving government, utilities, and private industry might feasibly own and operate a reprocessing/transmutation complex. Possibilities include government ownership of the reprocessing plants (high risk), with utilities or private investors owning the power plants. Alternatively, the government could own the entire complex, with a private sector operator. The government could also provide special legislation designed to limit project risk (one-stop licensing, long-term contracts for reprocessing and waste transmutation, exemptions from future regulatory changes, etc). For the purpose of this appendix, the committee did not examine the implications of such a hybrid ownership group on project economics.

DOE's ALMR project assumes a different hybrid organization. In this scenario, ALMRs are built and operated by electric utilities and collocated with integral fast reactor (IFR) facilities for receiving and recycling TRUs for ALMR spent fuel. A large, centralized facility for reprocessing LWR spent fuel would be owned and financed by a chemical company as a low-risk

venture. Here the institutional barrier would be even higher. Chemical companies normally expect a greater return on investment than do regulated utilities.

Government Ownership—The Only Alternative

Studies by DOE's ALMR project emphasize private ownership and financing of the ALMR reactors and associated reprocessing/fabrication facilities. However, the above discussion of alternative ownership arrangements leads us to the conclusion that government ownership of reprocessing and transmutation facilities is the only viable alternative at the outset. As stated earlier, the government is ultimately responsible for long-term disposal of HLW and is the only institution capable of overcoming the political/institutional issues. This is further supported in subsequent discussions of the relative cost of reprocessing under government, utility, and private (nonutility) financing arrangements.

Hundreds of years of reprocessing/transmutation will be required to achieve the TRU reduction argued by its proponents of transmutation concepts as necessary to permit geologic disposal. The complexity, the high potential costs of the reprocessing and transmutation system, and the extensive period over which the transition system must be committed to operate in order to benefit waste disposal raise serious questions as to the feasibility of such an unprecedented commitment even by the government.

ESTIMATED UNIT COSTS OF LWR REPROCESSING

Unit reprocessing costs were calculated for government, utility, and privately owned reprocessing plants, based on the ground rules shown in Table J-5. the assumed return on common equity and interest on debt are expressed in after-tax, constant (inflation-free) dollars. Utility parameters are based on the 1993 EPRI Technical Assessment Guide (EPRI, 1993). The cost of plant decommissioning was neglected. The resulting levelized unit reprocessing costs for a capital cost of $7,320 million (includes interest during construction), an annual operating cost of $374 million, and an annual plant throughput of 900 MTHM are as follows:

|

Plant Owner/Operator |

Unit Cost ($/kgHM) |

|

Government |

810 |

|

Utility |

1,330 |

|

Private |

2,110 |

COMPARISON WITH PUBLISHED REPROCESSING PRICES

Reprocessing unit prices reported in the literature for actual plants (THORP and UP3) typically range from approximately $600 to $1,400/kgHM. These prices reflect the relatively

TABLE J-5 Reference Case Parameters

|

Parameters |

Government |

Utility |

Private Venture |

|

Cost Assumptions |

|

|

|

|

Capital Cost ($ million)a |

6,160 |

6,670 |

7,320 |

|

Operating Cost ($ million/yr) |

374 |

374 |

374 |

|

Property Taxes and insurance (%/yr of initial capital cost) |

0 |

2 |

2 |

|

Annual Refurbishment Cost (%/yr of initial capital cost) |

1 |

1 |

1 |

|

Financial Structure |

|

|

|

|

Common Stock (%) |

0 |

46 |

70 |

|

Preferred Stock (%) |

0 |

8 |

0 |

|

Debt (%) |

100 |

46 |

30 |

|

Investment Returns and Interest Rates (constant $) |

|

|

|

|

Common Stock (%/yr) |

na |

8.5 |

16.0 |

|

Preferred Stock (%/yr) |

na |

4.1 |

na |

|

Debt (%/yr) |

4.0 |

4.8 |

9.0 |

|

Weighted Cost of Capital (%/yr) |

4.0 |

6.4 |

13.9 |

|

Tax Assumptions |

|

|

|

|

Income Tax Rate (%) |

na |

38 |

38 |

|

Tax Recovery Period (yr) |

na |

15 |

15 |

|

Investment Tax Credit (%) |

na |

0 |

0 |

|

Book Life (yr) |

na |

30 |

30 |

|

Annual Fixed Charge Rate (%) |

5.8 |

12.3 |

20.8 |

|

a Includes interest during construction. |

|||

low cost of capital associated with customer financing of plant capital costs through advanced payments for services for both the THORP and UP3 reprocessing facilities. Following are examples of reprocessing prices:

-

The OECD/NEA study developed a levelized reprocessing cost of 720 ECU/kgHM for their reference case, which used a 5% discount rate. They assumed a conversion rate of 1 $/ECU, but the committee applied a rate of 1.07 ECU/$, consistent with the committee's use of average rates for the period 1983 to 1992. This results in a unit reprocessing cost of $770/kgHM, similar to the cost of $810/kgHM developed for a government-owned plant.

-

A private communication among Cliff Weber, Department of Energy, Headquarters and European representatives (from both the United Kingdom and France) that was based on OECD input reported prices of $1,400/kgHM for the first 10 years of operation and $600 to $700/kgHM beyond 10 years of operation. The weighted average of these prices over 30 years is $870 to $930/kgHM.

-

Suzuki (1994) quoted a unit price of ¥200 million per metric ton for reprocessing services from the Rokkashomura reprocessing plant in the period from 2000 to 2020. At the current yen-to-dollar currency conversion rate, this is equivalent to approximately $1,800/kgHM. • COGEMA confirmed a unit price of FF 6,000/kgHM ($1,250/kgHM) for the first 10 years of UP3 operation (Nuclear Fuel, 1987). This price includes waste vitrification and interim storage. It was indicated that after the year 2000, once the plant investment has been largely amortized, the cost might be reduced by 30-40% due an expected increase in plant throughput and the reduced charge for depreciation.

-

British Nuclear Fuel, Ltd., indicated it offered German utilities unit price of DM 1,250/kg ($670/kgHM) to reprocess their fuel in THORP.

The committee recognizes that reprocessing prices are not the same thing as reprocessing costs, especially in an environment where there are currently only two reprocessing plants offering commercial reprocessing services. Also, the quoted prices reflected the higher cost of reprocessing services during the initial 10-year amortization period. However, comparing calculated costs with reported prices for government ownership provides a measure of whether derived costs are credible as compared with prices charged in the marketplace. Our estimated unit cost of $882/kgHM (levelized over the assumed plant life of 30 years) for a government-owned reprocessing plant falls within the price range of $600 to $1,400/kgHM reported for actual government/corporation-owned plants.

In contrast to reprocessing prices reported for THORP and UP3, unit costs reported in most reprocessing plant studies are typically much lower, ranging from about $237 to $600/kgHM. A study by Gingold et al. (1991), The Cost of Reprocessing Irradiated Fuel from Light Water Reactors: An Independent Assessment, reported unit reprocessing prices of $237/kgHM for a government-owned facility and $489/kgHM for a privately owned (nonutility) facility. The GE study for the ALMR program was based on a very large (2,700 MTHM/yr) reprocessing facility. The size of this facility is unprecedented for a commercial reprocessing plant. GE did not report unit reprocessing costs, but using their capital cost of $5,976 million,

their constant-dollar annual fixed-charge rate (utility owner) of 9.246%/yr, their annual operating cost of $114 million, and an annual plant throughput of 2,700 MTHM results in a unit reprocessing cost of $247/kgHM. The unit cost for reprocessing only would be even lower after deleting the capital charges and operating-related costs associated with the fuel fabrication facility.

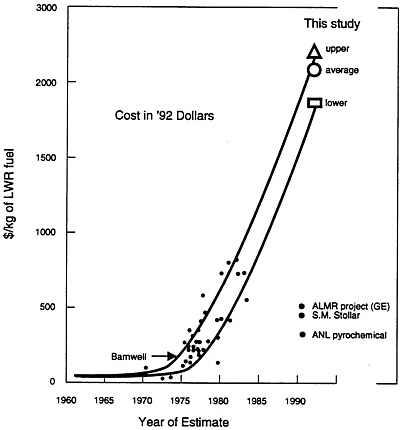

In a 1983 paper, Wolfe and Judson noted that the estimates of LWR unit reprocessing costs in constant dollars increased substantially from 1975 to 1983 (Figure J-2). Figure J-2 also provides the current estimates of the unit costs for reprocessing plants constructed in the United States, which are derived from estimated costs for contemporary plants in the United Kingdom, France, and Japan. Financial parameters were applied for a private venture in the United States, assuming optimistically that the financing is characteristic of a low-risk project in the chemical industry. The unit costs reflect an inflation-free economy. The unit costs estimated for these three sources fall on extensions of the band of reprocessing costs shown by Wolfe and Judson, but at a level several-fold higher. What may be financially valid for a government-owned European plant that is financed with customer prepayments for reprocessing services, and that has relatively low annual charges on capital investment, is not necessarily applicable to the same plant constructed by private industry in the United States.

Also shown in Figure J-2 are two recent estimates by the ALMR project of costs for reprocessing LWR fuel, one for an aqueous plant (Taylor et al., 1991) and the other for a pyrochemical process (Chang, 1993). Each plant has a throughput of 2,700 MTHM/yr, with high-yield recovery of all actinides and volatile fission products. The estimated unit costs for these two processes vary from $500/kgHM to $350/kgHM. The latter is about eightfold less than the estimated cost for the UP3 plant in France and the new Rokkashamura plant in Japan, neither of which is designed for high-yield recoveries.

Also shown in Figure J-2 are the unit costs estimated in 1991 (Gingold et al., 1991) for aqueous reprocessing and pyrochemical processing. The Stoller estimates are near those made by GE, but they are substantially below the costs for the new British, French, and Japanese reprocessing plants.

Based on these comparisons, there is reason to question the validity of all the recent U.S. estimates for the cost of reprocessing LWR spent fuel. The estimates for aqueous plants are far below the costs inferred from the European and Japanese benchmarks. Since it was difficult to come up with reasonably accurate estimates for the one process for which some information is available, it is questionable that reliable estimates could now be made of the pyrochemical process for LWR spent fuel, which is in a relatively primitive stage of development.

COMPARISON WITH OECD/NEA BREAKEVEN REPROCESSING PRICE

The 1993 OECD/NEA study presented levelized LWR fuel-cycle costs for both the reprocessing and direct disposal options for the back-end of the fuel cycle. The levelized cost (mills per kilowatt-hour) of the reprocessing option was found to be approximately 12% higher than the cost of direct disposal.

FIGURE J-2 Current estimates of the unit costs for reprocessing plants constructed in the United States.

NOTES: All estimates are for aqueous reprocessing, except Argonne National Laboratory's estimate for high-recovery pyrochemical reprocessing. Estimates by General Electric and Stoller include TRUEX additions for high recovery of actinides. The capital charge rate is for a low-risk private venture in the United States in an inflation-free economy.

Data shown in small circles are from Wolf and Judson (1983). Results of this study are for PUREX aqueous reprocessing based on data from France □, Japan ∆, and the United Kingdom ○

A reprocessing cost of 720 European currency unit (ECU)/kgHM was used in the analysis, which is equivalent to $720/kgHM, assuming a long-term currency exchange rate of 1 ECU/$ assumed by the OECD/NEA. The breakeven reprocessing unit cost would be $387/kgHM for a 5% discount rate and $327/kgHM for a 10% discount rate. Although it was not the purpose of the Committee on Separations Technology and Transmutation Systems to evaluate the relative economics of the reprocessing and direct disposal options, the very low breakeven cost compared with the costs developed in the study by the committee is indicative of the challenge in judging whether TRU burning is an economical alternative to high-level waste disposal.

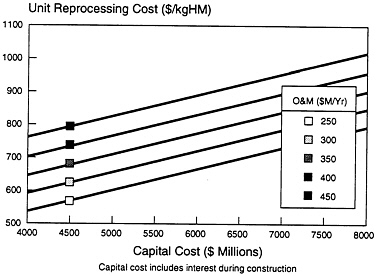

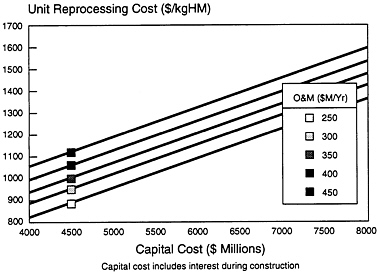

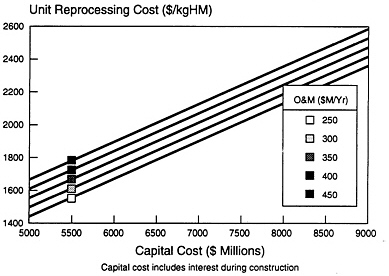

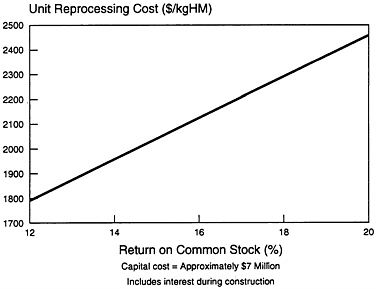

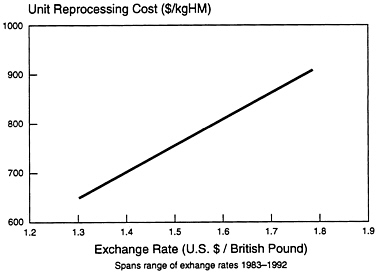

REPROCESSING-COST SENSITIVITY STUDIES

Sensitivity studies of unit reprocessing costs were performed around the reference cases presented above to illustrate the impact of changes in assumed plant capital and operating cost, financing rate, financial structure, and currency exchange rate. A plant throughput of 900 MTHM was used in all cases.

Figure J-3, J-4 and J-5 illustrate the sensitivity of unit reprocessing cost to variations in capital and operating cost for government, utility, and nonutility private-venture financing assumptions. Figure J-6 illustrates the effect of varying the debt-to-equity ratio for the privately financed case. The unit reprocessing cost decreases rapidly as the debt-to-equity ratio is increased. This simplified analysis ignores the likely increase in the interest on debt capital that would result from the increased project financial risk associated with the higher debt-to-equity ratios. Figure J-7 shows the sensitivity of unit reprocessing cost to return on equity capital and the associated impact of corporate income taxes, and Figure J-8 illustrates the sensitivity of unit reprocessing cost for a government-owned plant to changes in the currency exchange rate between British pounds and U.S. dollars.

POTENTIAL SAVINGS FOR NTH-OF-A-KIND PLANTS

Because centuries of ALMR operation would be required to achieve the reduction in actinide inventory proposed by the ALMR project, additional reprocessing plants would be required as the earlier plants reach the end of their design life, even without further growth in the total amount of installed nuclear power generating capacity. The capital cost of follow-on (replicated) plants would be less as a result of savings in design costs and the learning experience from designing and constructing the first unit. While the committee did not attempt to quantify potential Nth-of-a-kind cost savings, the 25 million man-hour engineering effort quoted by COGEMA for UP3 provides a basis for quantifying design cost savings.

Assuming U.S. engineering costs of $65/hr, the cost of designing the first plant would be $1,620 million. If a standardized, prelicensed facility could be replicated for only one-third to one-half of this amount, total capital cost could be reduced by approximately $500 to $1,000 million.

THRESHOLD COST OF LWR FUEL REPROCESSING FOR ALMR USE

The ALMR project proposes to start and refuel future ALMRs using plutonium and other TRUs recovered from LWR spent fuel so as to reduce the quantity of transuranics that would otherwise go to a geologic repository. The project also proposes to use TRUs from LWR fuel for reloads of the nonbreeding ALMRs. However, if the cost of reprocessing LWR spent fuel is too great, it will be less expensive to start first-generation ALMRs with virgin uranium enriched to approximately 30-40% 235U.

If start-up with enriched uranium does not prove to be too expensive for an ALMR to be economically competitive with alternative energy sources, this could be a viable approach to introducing ALMRs for generating electric power. However, such ALMRs would not be a viable means for transmutation of TRUs in LWR spent fuel. Assuming a uranium ore cost of $30/lb of U3O8 and a separative work cost of $80/kg separative work unit (SWU) available on the international market, the threshold cost of LWR reprocessing was estimated by Argonne National Laboratory (ANL) (Chang, 1992) to be $350/kgHM. This should also include any cost increment for fabricating ALMR fuel from TRUs, over and above the cost of fabricating makeup fuel from enriched uranium. If the reprocessing/refabrication cost exceeds $350/kgHM, it will be cheaper (and easier) to start and refuel with enriched uranium. There would then be no economic fuel-cycle incentive for the transmutation ALMRs to be started and fueled with actinides from LWR spent fuel to aid the disposal of waste from LWRs.3

On this basis, ANL established a target for its new development of pyrochemical processing of LWR spent fuel to cost less than $350/kgHM. ANL now estimates that the cost of pyrochemical reprocessing of LWR spent fuel will be $350/kgHM. The project assumes that the reprocessing facility will be centralized, high throughput, and financed by a private venture typical of low-risk ventures in the chemical industry. Comparing the threshold value of $350/kgHM with the estimated unit cost of a large private-venture reprocessing plant presented above in Estimated Unit Costs of LWR Reprocessing, the ANL IFR concept must be able to reduce the unit cost by a factor of about six below that based on contemporary costs for large-scale aqueous reprocessing. The disparity in estimated unit costs would be even greater if the reference aqueous facility were modified by adding TRUEX to obtain high recoveries for transmutation. This is a forbidding target, even if the expected large diseconomy of the small scale of the integrated pyrochemical reprocessing is ignored. An independent estimate made in 1991 by S.N. Stoller (see Gingold et al., 1991) for EPRI concluded that unit reprocessing cost for an investor-owned plant for pyrochemical reprocessing of LWR spent fuel would be 57% greater than that for an aqueous reprocessing facility of the same throughput.

DOE expects the ALMR program to establish technical feasibility by 1995. Technical feasibility must include some measure of practicability. How the development program is expected to contribute to some resolution of these large uncertainties and disparities in cost

estimates for pyrochemical reprocessing by 1995, or even later, in a facility operating at far lower throughput than that now projected for the LWR spent-fuel reprocessing, and not under NRC regulations, has not been explained.

ANL Estimates of the Cost of Pyrochemical Reprocessing of ALMR Recycle Fuel

The ANL IFR concept that a reprocessing plant for ALMR recycle fuel could be economically colocated with an ALMR power plant is challenged by cost analyses reported in GE's 1991 fuel-cycle assessment for the ALMR project (Taylor et al., 1991). The estimated fuel-cycle cost is due to the costs of reprocessing and fabrication, less a credit of 2.0 mills/kW·h for uranium recovered in reprocessing LWR spent fuel, the uranium to be sold for reuse in fabricating LWR fuel. The calculated fuel-cycle cost for a single colocated IFR, with a nominal throughput of 20 MTHM/yr, is 8.9 mills/kWh in 1991 dollars. This is compared with an estimated fuel cost of 5.4 mills/kWh if a centralized reprocessing facility is used to reprocess ALMR fuel discharged from eight 3-block ALMRs, at a throughput of 200 MTHM/yr. A considerable economy of scale would evidently result from a centralized facility.

GE reported the following costs for the fuel-cycle facilities:

|

Location |

Colocated |

Central |

|

Nominal throughput (MTHM/yr) |

20 |

200 |

|

Facility equipment cost (first-of-a-kind), $ millions |

105 |

518 |

|

Annual manpower (nth-of-a-kind), $ millions/yr |

10.4 |

32.8 |

|

Operating consumables (nth-of-a-kind), $ millions/yr |

17.4 |

143 |

The estimated capital cost of the recycle facility is estimated to increase by a factor of nearly five for a tenfold increase in plant throughput, which is equivalent to the 0.69 power of the plant throughput. The data in the ALMR project's 1991 fuel-cycle report show considerable economic penalty associated with the small scale of colocated IFR facilities.

The ALMR project's 1991 report also shows an economic penalty of about 0.3 mills/kW·h for recycling all TRUs for transmutation to achieve low inventories for waste disposal. ANL's pyroprocessing/fabrication system is to be remotely operated and maintained. One of the best U.S. benchmarks for sizing equipment for remote operation and maintenance of high-activity reprocessing systems is the 1981 detailed independent study by Bechtel (Jones, 1981) of a proposed hot experimental facility for processing fast-breeder fuel, sponsored by DOE through the Oak Ridge National Laboratory. Although the process is aqueous instead of pyrochemical and the throughput is higher, it appears that the volume of process cells is dominated by the size of the remote fabrication equipment. The process equipment for the hot experimental facility is divided into two main process cells, arranged in parallel and interconnected with a decontamination and maintenance cell. The two process cells are about 40 feet wide by 610 feet long by 80 feet high, for a total volume of about 2 million cubic feet. A review of the layout shows that the volume is dominated by the equipment for remote manipulation and maintenance.

Based on the Bechtel study, it appears that ANL may need a more thorough engineering analysis of the complexity and size of remote manipulation and maintenance operations.

HISTORICAL COST GROWTH ON PROJECTS EMPLOYING ADVANCED TECHNOLOGIES

The ALMR project has adopted pyrochemical separations for reprocessing ALMR discharge fuel and for reprocessing LWR spent fuel. New and improved technologies are involved. The technical and economic challenges are enormous, particularly for the pyrochemical reprocessing of LWR spent fuel. Reprocessing LWR fuel is the critical early-lead item for deployment of the ALMR systems according to DOE's proposed schedule.

The RAND Corporation conducted several studies designed to identify the principal factors that caused the substantial capital cost overruns and performance shortfalls characteristically experienced on pioneer projects. These studies were intended to enable project planners to make more realistic estimates of likely cost growth in moving a new technology from the research and development stage through the design, construction, and operation of a production-scale facility.

The following are some of the major conclusions of the RAND report (Merrow et al., 1981):

-

Severe underestimation of capital costs is the norm for all advanced technologies.

-

Capital costs are repeatedly underestimated for advanced chemical process facilities, just as they are for advanced energy process plants. Furthermore, the performance of advanced energy plants constantly falls short of what was predicted by designers and assumed in financial analyses.

-

Greater than expected capital costs and performance shortfalls not anticipated by conventional estimating techniques can be explained in terms of the characteristics of the particular technology and the amount of information incorporated into estimates at various points in project develop.

-

Most of the variation found in cost-estimation error can be explained by (1) the extent to which the technology departs from that of previous plants, (2) the degree of definition of the project's site and related characteristics, and (3) the complexity of the plant. • Most of the variation in plant performance is explained by the measures of new technology and whether a plant produces solid materials.

Nuclear fuel reprocessing plants using aqueous technology have experienced such cost growth and performance shortfalls as well. Despite the extensive experience base acquired during the processing of spent fuel from defense production reactors, application of PUREX technology to commercial reactor-fuel reprocessing proved to be technically challenging. Current unit prices for LWR reprocessing services are nearly an order of magnitude greater than the optimistic estimates of the early 1970s. Now that the technology has matured, however,

costs should be relatively stable. Part of the increase in cost is attributable to much tougher regulations that were not in place when some of the early LWR plants (e.g., Barnwell and Exxon in the United States) were designed. ANL had to upgrade the EBR-II LWR reprocessing facility prior to performing its demonstration in the early 1990s.

The limited experience with pyrochemical reprocessing of LWR fuel as proposed by the ALMR program offers no compelling argument that current cost estimates will not increase as detailed designs emerge or that such reprocessing would be less costly than conventional aqueous reprocessing of LWR fuel, or even less costly than a PUREX facility augmented with the aqueous TRUEX process to achieve high-yield recovery of TRUs for ALMR transmutation.

Pyrochemical reprocessing represents a substantial departure from aqueous (PUREX) technology. It is characterized by first-of-a-kind components, remote maintenance, solids handling, etc. Many of the factors that were identified in the RAND study as having caused cost overruns and performance shortfalls on previous projects would appear reasonable.

SUMMARY AND CONCLUSIONS

The transmutation of actinides and fission products recovered from spent fuel offers the potential for improving the technology for long-term disposal of radioactive waste. Successful implementation of this integrated reprocessing/irradiation strategy would require a major financial commitment to the development, design, construction, and operation of a series of reprocessing plants and transmutation reactors both of which are based largely on as-yet unproven technology.

The most reliable cost data for reprocessing services is that associated with aqueous processing of spent LWR fuel. Pyroprocessing technology, which is being considered by both ANL and GE for reprocessing ALMR fuel, has not yet evolved to the point where estimates of capital and operating costs can be prepared with sufficient confidence to estimate future unit prices of reprocessing services. Moreover, it is by no means certain that pyroprocessing will prove more economical than conventional aqueous reprocessing for which the technology is now relatively mature.

The LWR reprocessing capital costs used in this study to develop life-cycle unit reprocessing costs were derived from information reported for the THORP, UP3, and Rokkashomura plants, all of which have an annual throughput of 800 to 900 MTHM/year. Reported capital costs ranged from $5,300 to $7,400 million for these plants. When scaled to a common annual throughput of 900 MTHM/yr, these costs are typically two to three times greater than the capital costs presented in recent reprocessing plant studies for new U.S. plants.

Very little information is available in the open literature with regard to operating costs for the above three plants. The committee adopted the operating cost presented in the 1993 OECD/NEA study of the nuclear fuel cycle, which is $386 million/yr when converted to 1992 U.S. dollars.

Unit reprocessing costs were calculated for government-owned, utility-owned, and privately owned reprocessing plants. The ground rules assumed for each case are those shown previously in Table J-5. The capital and operating costs, developed from OECD/NEA, were

$5,770 million ($6,160 to $7,320 million with interest during construction) and $374 million/yr, respectively. Plant throughput was 900 MTHM/yr.

The resulting levelized unit reprocessing costs are

|

Owner/Operator |

Unit Cost ($/kgHM) |

|

Government |

810 |

|

Utility |

1,330 |

|

Private venture |

2,110 |

Based on the above comparisons, there is good reason to question the validity of all the recent U.S. estimates for the cost of reprocessing LWR spent fuel. Given that the estimates for aqueous plants ranging from $237 to $600/kgHM are so far below the costs inferred from the European and Japanese benchmarks, it is questionable that more reliable estimates could now be made of the pyrochemical process for LWR spent fuel, which is in a relatively primitive stage of development.

The committee concludes that if it were cost effective, government ownership of reprocessing and transmutation facilities would be the only realistic alternative. The government is ultimately responsible for long-term disposal of HLW and is the only institution potentially capable of overcoming the complex political/institutional issues associated with reprocessing and transmutation. This responsibility may be difficult to achieve in the United States considering that, historically, government opposition to reprocessing has been the principal deterrent to its implementation outside the defense materials production facilities. Government ownership is nevertheless the logical choice when considering the relative cost under government, utility, and private (nonutility) financing arrangements. However, studies by DOE's ALMR project emphasize private ownership and financing of the ALMR reactors and associated reprocessing/fabrication facilities, which the committee considers an unrealistic expectation.

Achieving the high degree of confidence in the cost and performance estimates that is necessary for a private corporation (including a utility) to commit the capital resources to proceed with an transmutation demonstration project would require a very extensive development and demonstration program, likely funded primarily by the government. A government project might be able to accept a higher level of risk, but the enormous magnitude of the commitment over 100 years or more would challenge even the federal government's ability to undertake such a project.

REFERENCES

Chang, Y. I. 1992. Responses to STATS Subcommittee on Transmutation questions, Idaho Falls, Idaho, March 12-13, 1992.

Chang, Y. I. 1993. Economic potential of pyroprocessing. Presentation to the STATS Subcommittee on Transmutation, Washington, D.C., March 8, 1993.

Electric Power Research Institute (EPRI). 1993. Technical Assessment Guide, Vol. 3: Electricity Supply. Palo Alto, Calif.: EPRI.

Gingold, J. E., R. W. Kupp, D. Schaeffer, and R. L. Klein. 1991. The Cost of Reprocessing Irradiated Fuel From Light Water Reactors: An Independent Assessment. (S. M. Stoller). NP-7264. Palo Alto, Calif.: EPRI.

International Financial Statistics. 1993. March.

Jones, F. J. (Bechtel Corporation). 1981. Conceptual Design Report, Hot Experimental Facility. Vol. 1. ORNL/CFRP-81/4. Oak Ridge, Tenn.: Oak Ridge National Laboratory.

McDonald, R. 1993. Future clouded for UK's THORP reprocessing plant. Nuclear Waste News. January 21.

Merrow, E. W., K. E. Phillips, and C. W. Myers. 1981. Understanding Cost Growth and Performance Shortfalls in Pioneer Process Plants. RAND/R-2569-DOE. Santa Monica, Calif.: RAND Corporation.

Nuclear Fuel. 1987a. p. 6. June 29.

Nuclear Fuel. 1987b. p. 7. September 7.

Organization for Economic Cooperation and Development/Nuclear Energy Agency (OECD/NEA). 1989. Plutonium Fuel—An Assessment. Report by an Expert Group. OECD/NEA, Paris.

Organization for Economic Cooperation and Development/Nuclear Energy Agency (OECD/NEA). 1993. The Economics of the Nuclear Fuel Cycle. Final Revised Draft. OECD/NEA, Paris.

Salerno, L. N., M. L. Thompson, B. A. Hutchins, and C. Braun. 1989. ALMR Fuel Cycle Economics. Paper presented at the Small and Medium Reactors Seminar, San Diego, Calif. August.

Suzuki, A. 1994. Burning up Actinides and Long-Lived Fission Products? - A Japanese Prospective. Proceedings of the NATO Workshop on Managing the Plutonium Surplus, Applications and Options, Royal Institute of International Affairs, London. January.

Taylor, I. N., M. L. Thompson, and D. C. Wadekamper. 1991. Fuel Cycle Assessment - 1991. GEFR-00897. San Jose, Calif.: General Electric.

Wilkinson, W. L. 1987. THORP takes BNFL into twenty-first century. Nuclear Engineering International. August, p. 32.

Wolfe, B., and B. F. Judson. 1983. Fuel recycle in the U.S.—Significance, status, constraints and prospects. Pp. 134-136 in Proceedings of the Fourth Pacific Basin Conference. ISBNO-919307-30-2. Vancouver, Canada: Canadian Nuclear Association.