3

Trends and Issues for Future Coal Use

The present chapter reviews those factors likely to influence coal use, especially U.S. domestic coal use, over the periods of interest to this study, namely, near-term (1995-2005), mid-term (2006-2020), and long-term (2021-2040) planning horizons. The introductory section on markets for coal and coal utilization technologies highlights the importance of coal to the U.S. economy and addresses international issues to the extent that they are likely to influence U.S. coal use and U.S. development of coal-based technologies. A major part of the chapter is devoted to a discussion of coal use for electricity generation, the single largest consumer of coal in the United States. Recent changes in the electric utility industry are considered, especially regarding the commercialization of new coal-based power generation technologies and opportunities for joint production of electricity and other products. Following a brief overview of projected U.S. electricity requirements, trends in the availability and use of competing energy sources for power generation are discussed. Issues associated with other uses of coal, namely, the manufacture of clean fuels and other products, are then addressed. Finally, the chapter discusses the environmental regulations affecting coal use.

DOMESTIC AND INTERNATIONAL MARKETS

Overview of Coal Markets

Coal is a major international commodity used primarily for generating electricity and producing coke for steelmaking. The first use is increasing steadily; the latter use is constant to slightly declining.

Coal-exporting countries can be divided into two classes. For the first group,

including the United States, South Africa, Poland, and parts of the former Soviet Union, coal exports are a fraction of a substantial domestic market. Other countries mine primarily for export. The leading country in this class is Australia, with Colombia and Venezuela also increasing coal exports rapidly (IEA, 1993a). China is a special case: it is the world's largest coal producer, but almost all of its coal is consumed domestically (Doyle, 1987). However, with investment in transportation networks and some automation, China could quickly become a major force in international coal markets. Japan is the world's largest coal importer, while the fastest import growth is occurring in the rapidly developing Pacific Rim countries, especially Taiwan and South Korea (DOE, 1993a).

In the United States, as elsewhere, coal production has a significant impact on the domestic economy. A recent study from the Pennsylvania State University notes that the direct contribution of coal production to the economy has a value of $21 billion annually, while indirect contributions reach $132 billion (Energy Daily, 1994).

Over the past 10 years, many changes have occurred in the U.S. coal industry. Although more coal is still produced in states east of the Mississippi River, coal production in the west has increased dramatically; in 1988 Wyoming surpassed Kentucky as the largest producing state. This shift in coal production initially was a result of changes in environmental regulation that favor low-sulfur Western coal. Subsequent factors have been the competitive cost of Western coal and a lower cost for its rail transport to markets traditionally served by Eastern coal. These trends are expected to continue, with environmental constraints on coal combustion becoming more stringent.

Transportation costs are more generally a critical determinant of the competitiveness of coal from different sources. On the Gulf and Atlantic coasts of the United States, South American coals are very competitive with U.S. coals on a delivered price basis. For example, Colombian coal currently is $3 to $6/per metric ton cheaper than U.S. coals (Coal Week International, 1994). About 10 percent of the coal used in the United States during the first decade of the next century will likely be imported (EIA, 1994a).

Another change in the industry has been the continued decrease in the price paid for coal at the mine. For mines producing 10,000 tons per year or more, the average price at the mine decreased in 1992 for the tenth straight year, to $21.03 per ton (NCA, 1993a).1 This trend of decreasing coal prices is expected to persist for the near-term, keeping coal a relatively low-cost energy source for the United States.

Coal exports contribute significantly to the U.S. balance of payments. Of the total 1992 U.S. coal production of 998 million tons, 103 million tons were exported, primarily to Europe (57 percent), Asia (20 percent), and North America

(15 percent) (IEA, 1993a). Coking coal exports amounted to $2.7 billion and steam coal to $1.5 billion. Most U.S. exports are metallurgical coals, purchased because of their high product quality and consistency, which are important parameters in making coke. However, coke production worldwide is decreasing, as environmental regulations and newer technology change the way steel is produced and as other materials are substituted for steel. Despite increasing international markets for steam coal, this sector of the U.S. export market is expected to remain flat or decrease, because U.S. coal is not competitive on a delivered-price basis with South American and South African coals in Europe and the Middle East, nor with Australian and Indonesian coals in Asia. For example, U.S. coal with an energy content of 12,000 Btu/lb is delivered to Rotterdam from Baltimore at a price of $1.51/106 Btu, while similar coal from Colombia is delivered at $1.31/106 Btu and from South Africa at $1.27/106 Btu (Coal Week International, 1993). These and other competitor producing countries are expanding their coal exporting capability. Thus, exporting U.S. clean coal technology will probably not open any significant new markets for U.S. steam coal.

Markets for Coal Utilization Technology

The most important international markets for coal utilization technologies are for electricity generation. Two major market components have been identified, namely, the construction of new generating capacity and the retrofit and rehabilitation of existing plants (DOE, 1993a). More than half of the new capacity market will be in China, where projected capacity additions are approximately three times those of South Asia, the second largest market. China's need for new capacity through 2010 is more than four times that of all the industrialized countries combined. The world retrofit market, which is driven largely by environmental considerations, is about 25 percent larger in total size than the market for new capacity. About 45 percent of the retrofit market lies in developing countries, notably China. Significant markets also exist in Eastern Europe and the former Soviet Union (DOE, 1993a).

The demands for new and retrofit capacity represent potentially large export markets for U.S. technology. Many of the advanced power generation and environmental control technologies being developed under DOE's CCT program might achieve the two principal market requirements: high-efficiency and minimal environmental impacts. It is very difficult, however, to project the extent of U.S. participation in these international markets. Determining factors will include the effectiveness of foreign competition, the rate of industrialization in the less developed countries, the economic balance between coal costs and the capital costs of new technology, and the environmental constraints within the purchasing countries.

Environmental constraints will have some of the greatest impacts on international sales of coal-related technology. These environmental constraints will de-

pend on the degree of industrialization and urbanization. Urbanization is accompanied by environmental problems so acute that even developing countries strained for capital resources cannot ignore them. In Turkey, for example, which is seeing a massive population shift from rural to urban areas, in major cities there is a shift from indigenous coal to imported natural gas as a home heating fuel, and scrubbers for sulfur dioxide removal are being retrofitted on power plants that use high-sulfur, usually low-rank, local coal. In China coal gasification is being used to ameliorate some critical instances of pollution (Coal and Synfuels Technology, 1993). The motivation to reduce coal-related pollution may be domestically driven or may be a response to environmental requirements imposed by aid donors and international financial institutions. The World Bank now considers environmental impacts as a primary factor in evaluating proposed projects (DOE, 1993b).

Other major factors affecting coal technology markets will be the balance between the costs of mining and transporting coal and the higher capital costs of cleaner, more efficient plants. Where coal is abundant, mining and transportation costs are low, and environmental requirements are minimal, there will be little driving force to use the more expensive technologies. Such circumstances generally hold now in China. As environmental constraints develop or fuel prices increase, there will be incentives to use more efficient and cleaner technologies. Indeed, China, with its abundant coal reserves, rapidly industrializing economy, and large population, is undoubtedly the largest potential market for U.S. clean coal technology over the long-term. For the near-term, however, new power plants in China will most likely use well-demonstrated technology and cheap Chinese coal to produce low-cost power.

Domestic markets for coal utilization technologies are discussed in the remaining sections of this chapter, with emphasis on opportunities and requirements for electricity generation.

COAL USE FOR DOMESTIC ELECTRICITY GENERATION

Electric power generation is by far the largest market for coal in the United States, representing over 80 percent of annual coal consumption. Assessing current and projected electricity demand is thus essential to understanding the future role of coal and the scope of an appropriate RDD&C program. The following section reviews the changing structure of the U.S. electric utility industry, current projections of future electricity demand, and the outlook for competing sources of energy for power generation over the time periods of interest for this study.

Changing Structure of the Electric Utility Industry

The electric utility industry has been subject to extensive price and entry regulation virtually from its beginning almost a century ago. Like other formerly heavily regulated industries, such as transportation, telecommunications, and

natural gas, the electric utility industry has seen notable changes of regulatory structure and practice in recent years.

The Public Utility Regulatory Policy Act of 1979 (PURPA) and subsequent regulation and legislation, at both state and federal levels, have permitted non-utility generators (NUGs) to sell power to the transmission grid. PURPA provided the first opportunity since the development of the modern regulatory system for entry into the utility franchise by requiring electric utilities to purchase power offered by cogenerators, small power producers, and other qualifying facilities when the price of purchased power was below the utility's own avoided cost. Independent power producers (IPPs) were excluded from the provisions of PURPA, but later changes, such as enactment of EPACT that allows utilities and non-PURPA generators to compete on a wider scale in the wholesale power market, permitted and even encouraged electric utilities to acquire additional capacity and power from NUGs without regard to PURPA's qualification requirements (Harunuzzaman et al., 1994). Increasingly, access to the transmission and distribution network is being proposed for a variety of currently captive customers. Although there are many problems to be resolved, deregulation of the electric utility industry is expected to continue, to probably intensify, and to become one of the dominant strategic concerns of electric utility managers.

For this report the question at issue is how the industry's deregulation should shape DOE's coal program. The principal areas of concern appear to be the power generation industry's ability to develop and adopt promising new technology and the availability of electricity produced jointly with other products, as in cogeneration of power and steam.

Introduction of New Technology

The electric utility industry's former regulatory structure provided a highly favorable environment for introducing new technology: the return of prudently incurred costs was allowed, reducing commercialization risks. The efficiency of conventional coal-fired power plants increased markedly from the early 1900s until the 1960s without the benefit of significant federal R&D funding. Beginning in the 1960s, the industry commercialized nuclear power based on federally funded R&D. Since the early 1970s the industry has also funded significant R&D through the EPRI, with most members' contributions incorporated into the rate structures approved by regulatory commissions.

As regulatory structures loosen and competition intensifies, new entrants and less-protected utilities may be unwilling or unable to accept the risks of commercialization or to fund industrywide R&D. In this regard the power generation industry differs markedly from the pharmaceutical and telecommunications industries, for example, largely because of the nature of its product. The influence of increasing competition in the electric utility industry can already be observed in the reliance on NUGs for additional increments of capacity and in the shift of

EPRI's focus toward activities of more short-term benefit to its members. A recent report from the National Regulatory Research Institute (Harunuzzaman et al., 1994) notes that the technical and financial risks inherent in adopting innovative generation technologies may bias technology choices in favor of conventional options. As a result of these trends, the future development and implementation of advanced power generation technologies will likely become increasingly dependent on federal funding of R&D and on federal participation in commercializing new technology, at least in the near-term. Federally supported R&D is unlikely to be an adequate substitute for industry-funded R&D over all timeframes. However, in the near-term some federal support may facilitate more rapid development of technological solutions to problems of national importance, such as reducing the environmental impact of coal-based power generation as required by EPACT, Title XIII, Section 1301.

The Availability of Coproducts

Under traditional regulation, electric utilities specialized in, and had a monopoly on, the production and distribution of electricity. Sizeable economies of scale were realized under this arrangement, but it did not encourage the capture of economies that result from coproducing electricity and other products, such as steam. Electric utilities did provide steam to some customers but generally only in the centers of large and usually older cities because of the economics of distributing steam. In most cases customers who needed steam for industrial processes produced their own. They might also generate electricity, but for a variety of reasons, including regulation, they could not sell excess electricity to the local electric utility.

The recent changes in the electric utility industry sketched above have created the opportunity to realize economies where electricity, or the fuels to generate electricity, are the by-product of some other industrial process. These processes typically operate at a smaller scale than the conventional electric utility generating unit, and this feature has meshed well with smaller-capacity additions demanded by recent slower electricity growth. The joint production of electricity and steam has been the main beneficiary of these changes to date. Coproduct systems are discussed further in Chapter 6. The gas turbine combined-cycle systems now being installed that use natural gas as a fuel also offer opportunities to use clean coal-based gases, either as an integral part of the power generation system or obtained as a fuel from a separate supplier.

Projected Electricity Requirements

Table 3-1 gives growth rates observed and projected by the Energy Information Administration (EIA) for U.S. electricity demand from 1960 through 2010. According to the most recent EIA projections (EIA, 1994a), electricity demand

TABLE 3-1 Annual Growth in Gross Domestic Product and Electricity Demand by Decade, 1960-2010 (percent)a

will grow 1.0 to 1.5 percent per year to 2010, while the gross domestic product over the same period will grow 1.8 to 2.4 percent annually, for ''low" and "high" economic growth cases. The decrease in electricity demand growth relative to growth in the gross domestic product through 2010 is expected to result primarily from energy efficiency improvements associated with demand-side management and compliance with the directives of EPACT. The industrial sector is the fastest-growing demand sector in the EIA projections.

Alternative estimates from Data Resources, Inc. (DRI)/McGraw-Hill suggest that the trend in electric demand growth will average 2.0 percent per year from 1993 to 2010, during which time there will be a 2.3 percent annual increase in the gross domestic product (Makovich and Smalley, 1993). These projections assume a smaller impact of demand-side management on electricity demand than the EIA projections.

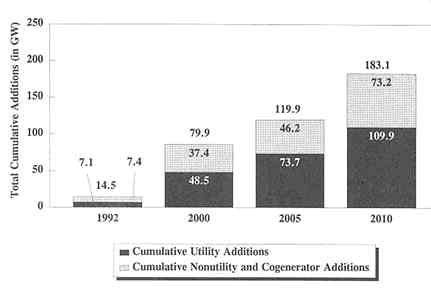

EIA projections of new capacity needs to meet new demands and to offset plant retirements are summarized in Figure 3-1 (EIA, 1994a). These new capacity requirements are in addition to the augmentation of existing resources through electricity imports and through plant life extension and repowering (see below). Between 1990 and 2010, utilities are expected to install 110 GW of new capacity in the EIA reference case but retire 60 GW, for a net capacity increase of 50 GW. In response to legislative changes aimed at making electricity production more competitive, NUGs and cogenerators are expected to add an additional 73 GW, accounting for a large share (40 percent) of total new capacity additions of 183 GW over the forecast period. Figure 3-1 shows that new capacity will be needed particularly between 2000 and 2010, during which time repowering and other options will be insufficient to meet increased demand. The surplus capacity of the 1980s still persists in some areas, and it will probably not be completely employed in many areas until the turn of the century. Thus, projected capacity additions lag projected increases in demand (Makovich and Smalley, 1993).

Table 3-2 compares several forecasts of total U.S. generating capacity in 2000 and 2010. Detailed comparison of these estimates is difficult because of

FIGURE 3-1 EIA reference case projections for new capacity additions. Source: EIA, 1994a).

differences in the reporting of generating capacity, such as the inclusion or exclusion of cogeneration capacity. However, all the projections for 2010 indicate a need for significant generating capacity increases compared with the 1992 value of 742 GW (EIA, 1994a). An energy forecast that relies less on historical trends and more on market forces and rapid deployment of new, high-efficiency technologies projects a total generating capacity in 2010 of 712 GW (The Alliance to

TABLE 3-2 Various Projections of Total U.S. Generating Capacity, 2000 and 2010 (GW)

Save Energy et al., 1992). Despite these different assumptions, coal is still projected to be a major energy source for power generation in 2010.

The additional generating capacity does not necessarily require the construction of new plants. Repowering, broadly defined to include any activity that stabilizes or reverses the age-induced deterioration of generating units (Makovich and Smalley, 1993), can result in improved efficiency and increased generating capacity at less than replacement cost. According to some projections, an emphasis on repowering—including performance optimization, component replacement, component refurbishment, life extension, and/or unit upgrading—is likely over the next decade (Makovich and Smalley, 1993). This forecast trend is consistent with the low number of scheduled power plant retirements reported to the North American Reliability Council for the period through 2003. Although a large number of the fossil-fuel-fired steam plants operating today are nearing the end of their nominal life (40 to 45 years), utilities appear to be planning to continue using them for the foreseeable future (EIA, 1994b).

The choice of technologies to meet additional generating capacity requirements depends on both peak load and baseload needs. Peak load is the maximum load during a specified period of time, whereas baseload is the minimum amount of power required during a specified period at a steady state. According to EIA projections (EIA, 1994a), there will be a need through 2010 for flexible generating technologies, such as gas-fired or oil- and gas-fired combined-cycle and combustion turbine systems, designed primarily to meet peak and intermediate load requirements but able to meet baseload requirements as needed. Peak load requirements are anticipated to increase from 589 GW in 1994 to 804 GW in 2010 (Makovich and Smalley, 1993).

Energy Sources for Power Generation

How much of the projected demand for electricity is likely to be supplied by coal? This section addresses the major competing sources of energy for electric power generation over the time periods of interest for this study. More extensive discussions can be found in the various references cited throughout this section.

Coal

The coal base of the world is large, some 1,145 billion tons. The top two producing countries are China and the United States. The U.S. demonstrated reserve base (DRB) of coal is now estimated to be 474 billion tons (EIA, 1992). The DRB is the amount of coal that can potentially be mined by surface or underground methods. The amount of coal that can be extracted economically using available technology, taking into consideration the laws, regulations, economics, and usages that affect coal production, is the recoverable portion of the DRB; EIA currently uses an estimate of 56 percent of the DRB, which equals 265

TABLE 3-3 Various Coal Consumption Forecasts, 2000 and 2010 (in millions of tons)

billion tons. Estimates of recoverable reserves vary with location. They are typically about 60 percent of DRB for eastern underground mines and 90 percent of DRB for western surface mines (NCA, 1993b). 2 Resource limitations are not expected to be important within the time horizon considered in this study.

All projections for U.S. coal consumption indicate that coal will continue to be a major source of fuel for electricity generation up to and beyond 2010. A range of forecasts is shown in Table 3-3. Estimates of coal's share of the power generation market in 2010 range from 45 to 58 percent, slightly lower on average than the current value of 56 percent. New coal-steam units are expected to account for 25 percent (42 GW) of all new capacity additions through 2010, with approximately three-fourths of the new coal-fired capacity coming online after 2000 (EIA, 1994a). This 42 GW of new coal capacity is equivalent to 140 new power plants in the 300-MW size range.

Natural Gas

In recent years natural gas has become the fuel of choice for new capacity

TABLE 3-4 National Petroleum Council Estimate of Remaining Recoverable Domestic Natural Gasa,b

|

Wellhead Pricec (1992 dollars/106 Btu) |

Current Technology (Tcf) |

Advanced Technologyd (Tcf) |

Resource/1992 Consumption (Years)e |

|

Unspecified |

1,065 |

1,295 |

72 |

|

$3.74 |

600 |

825 |

46 |

|

$2.67 |

400 |

600 |

33 |

|

a These amounts include production in Alaska, which, at higher prices, might be delivered to the lower 48 states and which, for the unspecified price and advanced technology case, was estimated to be 13 percent of the total resource. b Total U.S. natural gas production up to 1990 was approximately 700 Tcf. c The EIA projects a wellhead price rise to $3.50/million Btu by 2010 (EIA, 1994a). The price to a utility is greater than the wellhead price and may vary by region. In 1992 the average wellhead price was $1.75/thousand cubic feet (Mcf), whereas the delivered price to electric utilities was $2.36/Mcf (EIA, 1994a). d Improvements in imaging of underground structure, in fracturing to improve production rate, and in other production-related technologies that are believed to be reasonable extrapolations of the current state of the art. e U.S. consumption in 1992 was 18 Tcf. Source: Potential Gas Committee (1993). |

|||

additions because of its lower prices and lower capital investment requirements and more stringent environmental rules. While domestic gas resources are adequate to support this trend in the near- term, the depletion of domestic gas resources will likely result in their reduced availability and higher prices within the time period considered in this study.

Estimates of the remaining technically recoverable domestic natural gas resource provide some perspective on the future use of natural gas for power generation. A comparison of such estimates has been prepared by the Potential Gas Agency at the Colorado School of Mines (Potential Gas Committee, 1993). Assuming current technology and unspecified prices in the lower 48 states, and varying assumptions on access to potential gas fields, the estimates ranged from a low of 650 trillion cubic feet (Tcf), the value used in formulating the 1991 National Energy Strategy, to the Gas Research Institute (GRI) 1993 estimate of 1,100 Tcf. The National Petroleum Council estimate of 870 Tcf falls between these extremes. Table 3-4 gives National Petroleum Council estimates of the effect of wellhead price on the recoverable resource.

Dividing the total amount of gas by the current annual consumption provides a rough measure of the time before depletion, assuming constant consumption (see Table 3-4). The actual time will depend on consumption rate, which is expected to rise for the next decade and then decrease as finding and production

TABLE 3-5 U.S. Natural Gas Supply and Disposition, 1992-2010 (quads)

|

Category/Source |

1992 |

2000 |

2005 |

2010 |

Annual Growth (percent) |

|

Production |

|||||

|

EIA |

18.51 |

19.63 |

20.87 |

20.89 |

0.7 |

|

GRI |

18.10 |

20.00 |

21.20 |

22.40 |

1.2 |

|

Net Imports |

|||||

|

EIA |

2.49 |

2.95 |

3.32 |

3.86 |

2.5 |

|

GRI |

2.10 |

3.10 |

3.70 |

3.80 |

3.3 |

|

Total Supply |

|||||

|

EIA |

21.00 |

22.58 |

24.19 |

24.75 |

0.9 |

|

GRI |

20.20 |

23.20 |

24.90 |

26.20 |

1.5 |

|

Total Consumption |

|||||

|

EIA |

20.15 |

22.67 |

24.31 |

24.89 |

1.2 |

|

GRI |

20.30 |

23.10 |

NA |

26.10 |

1.4 |

|

Power Generation |

|||||

|

EIA |

2.86 |

4.36 |

5.24 |

5.10 |

3.3 |

|

GRI |

2.88 |

3.91 |

NA |

4.32 |

2.3 |

|

NA, not available. Sources: EIA (1994a), GRI (1994). |

|||||

costs increase with progressive resource depletion. Major technological advances would extend the period of economic gas production.

EIA and GRI projections for the supply of natural gas and its disposition (see Table 3-5) indicate that domestic production and imports will increase to meet demand. The increase in domestic production will require the use of new gas recovery technology, which will account for 29 percent (7.5 quads3) of the 2010 gas supply. By 2010, gas imports will have risen to approximately 15 percent (3.8 quads) of the total supply, and power generation will consume between 4 and 5 quads of gas, or approximately 18 percent of the supply.

Projections for delivered gas prices for electric utilities are summarized in Table 3-6. Both EIA and GRI projections show these prices increasing, EIA more so than GRI. As natural gas prices increase, there will be a point at which coal-derived electricity is more economical. For greenfield natural gas-fired combined-cycle units versus coal gasification combined-cycle units, this crossover price is in the range of $4.00 to $5.00/million Btu.4 The crossover gas price

TABLE 3-6 Projected Natural Gas Prices for Electric Utilities (dollars/ million Btu)

|

Source |

1992 |

2000 |

2005 |

2010 |

Annual Growth (%) |

|

EIA |

2.28 |

3.03 |

3.88 |

4.43 |

3.8 |

|

GRI |

2.47 |

3.15 |

NA |

3.78 |

2.4 |

|

NA, not available. Sources: EIA (1994a), GRI (1994). |

|||||

depends on a number of factors, such as the capacity factor at which the power-generating unit is operated, the lifetime of the investment, and the delivered price of coal. The price range just given represents capacity factors between 50 and 70 percent, coal prices between $1.00 and $1.60/million Btu (between $21.0 and $33.6 per ton), and a power plant lifetime of 30 years. A higher-capacity factor may apply to advanced coal plants; this would decrease the crossover price, while a shorter amortization period would raise it.

Similar analyses can be made for repowering applications using coal-fueled integrated gasification combined-cycle (IGCC) or pressurized fluidized-bed combustion (PFBC) technology. Under the same assumptions as before, coal-based systems become economical when gas prices reach $3.50 to $4.50/million Btu.5 The gas price projections in Table 3-6 suggest that advanced coal technology will become more economical than gas for both repowering and greenfield applications between 2005 and 2010.

Construction of a power plant in 2005, for example, will involve assessing the likelihood of increasing gas prices and decreasing supply during the 30-year (or longer) plant lifetime. In addition, extended growth in high-priority residential and commercial gas consumption is anticipated (EIA, 1994a). Thus, the EIA projection that new electric generating capacity will depend primarily on coal after 2000 seems well founded.

Liquefied Natural Gas

In considering the outlook for natural gas in the United States, attention must also be given to liquefied natural gas (LNG). Small amounts of LNG are presently imported into the United States. More importantly, there are huge, low-cost reserves of natural gas in the Pacific Basin and Middle East that, when liquefied, can be transported across oceans. Thus, the cost at which LNG can be imported operates as a limit on the domestic price of natural gas and on the price that would be paid for gas produced from domestic coal.

The process through which natural gas is liquefied, transported at cryogenic temperatures, and regasified is unique and costly and was economic only when domestic gas prices were higher than currently. Several LNG facilities were built on the East and Gulf coasts of the United States during the 1970s. At the time, domestic natural gas availability was limited, and rolled-in pricing permitted the high LNG cost to be cross-subsidized by low-priced, regulated gas. 6 However, LNG projects in the United States were abandoned once the domestic natural gas price decreased as a result of deregulation, and new proposals by potential exporters have not succeeded. An advantage of LNG for power generation is that it can be stored and used to meet peaking requirements without the need to construct larger pipelines.

In view of these considerations, LNG will not figure as an economic source of energy for power generation until natural gas prices rise to approximately $5/ 106 Btu. In the United States, coal gasification and other options should be economic at lower prices.

Oil

If crude oil prices were to fall to $12/bbl or less, coal might find a competitor for power generation in low-sulfur residual or distillate fuel. Although world reserves of crude oil are not as large as those of natural gas, they are still very large, and the cost of landing crude oil in the United States is substantially less than comparable costs for LNG. Distillate can be used in combined-cycle power generation systems as a substitute for natural gas, LNG, or coal-derived gas. The use of cheaper residual fuel is not currently feasible in turbines, but at a low enough price (less than $1.50/106 Btu, or approximately $9.50/bbl) it could displace coal in some existing boilers, as it did in the past.

Nuclear Power

Nuclear power accounted for 21 percent of U.S. electric power generation in 1993 and 14 percent of total U.S. generating capacity. However, no new commercial orders for U.S. nuclear power plants are anticipated until well after 2000. Nonetheless, recognizing the future attractiveness of electricity from nuclear fission, in part because of the potential for simpler, more economical nuclear plants, U.S. suppliers, nuclear utilities, the federal government, and EPRI are supporting the development of advanced light-water reactor designs (both evolu-

tionary 1,300-MW units and mid-size 650-MW units), to be available for order by the mid-1990s. Modular high-temperature gas reactor and advanced liquid metal reactor designs are under development. Although these designs may be available as early as 2005, their adoption is uncertain. While concern over greenhouse gas emissions could increase the attractiveness of nuclear power plants relative to coal, the economic and environmental issues associated with plant operation and waste disposal are likely to impede any significant growth of nuclear capacity in the near to mid-term. In the committee's base scenario, significant deployment of new nuclear power plants is unlikely until after 2020.

Considering installed and anticipated nuclear power plants in the United States and worldwide, there is no prospect of a uranium shortage before 2020. However, a significant expansion of nuclear power thereafter could challenge accessible uranium supplies. If supply constraints forced up uranium prices after 2020, the continued use of nuclear-based electricity would require technology development on fast breeder reactors and fusion reactors. The support of further development and use of nuclear power in the United States and worldwide will depend on growth in overall electricity demand, regulatory evolution, the direction of the global climate change debate, and resolution of public concerns with operational safety and waste disposal. Policy actions that increase the cost of fossil fuel use would make nuclear power more competitive.

Renewable Energy

Most electricity from renewable resources in the United States comes from hydroelectric power, which in 1993 accounted for about 10 percent of installed generating capacity and 9 percent of electricity generation. Other renewable sources accounted for 0.3 percent of electricity generation in 1993: geothermal, biomass wastes (almost all forest industry, with a small contribution from municipal solid waste), modest but growing amounts from wind turbine "farms," and distributed high-value, high-cost, solar photovoltaic power.

Cost reductions in renewables have resulted from persistent R&D, field experience, and manufacturing automation made possible through federal and private investments. EPRI has projected cost ranges for wind, photovoltaic, and biomass, assuming favorable locations (Table 3-7). These data indicate likely decreases in cost over the next 15 years, together with changes in the relative economics of different renewable sources. Although wind and biomass may be attractive for specific applications in favorable locations, it is clear that renewables could not meet energy demands across the economy as a whole (Preston, 1994). Many utilities look at renewable technologies as a strategically valuable set of contingency options if prices rise substantially or fossil fuel use is curtailed. For example, policy actions to tax emissions would make renewables more competitive. While renewable energy sources are expected to gain a larger share of the U.S. power generation market (16 percent by 2010, according to EIA, 1994a),

TABLE 3-7 Comparative Costs of Electricity from Wind, Photovoltaic, and Biomass Sources (cents/kWh)

|

Source |

1990 |

2000 |

2010 |

|

Wind |

8-10 |

4 |

3-4 |

|

Photovoltaic |

37-53 |

11-32 |

9-16 |

|

Biomass |

5-9 |

5-6 |

4-5 |

|

Source: Preston (1994). |

|||

they are not expected to become dominant sources of bulk power generation during the periods addressed in this study.

COAL USE FOR LIQUID AND GASEOUS FUELS

While electric power generation is expected to be the principal use of coal in the near- to mid-term periods, liquid and gaseous fuels derived from coal have the potential to compete with natural gasand petroleum-based fuels in the mid and long-term. The outlook for coal-derived liquid and gaseous fuels is discussed in Chapter 6.

Resource Base for Petroleum and Bitumen7

Liquid hydrocarbon resources can be classified on the basis of viscosity as conventional petroleum, heavy oil, and tar (or bitumen).8 Because of its low viscosity, petroleum tends to accumulate in large pools with natural gas and is relatively cheap to produce, with high resource recovery. In general, it contains less sulfur than the heavier hydrocarbons and can be refined to specification fuels more easily and cheaply than heavy oils and tars. While large resources of heavy oils and tars have been found, current production is restricted by the higher production and refining costs. Estimates of world and U.S. petroleum resources are shown in Table 3-8.

Petroleum finding and production costs for major producers are currently well below the international price, which includes profit taken by producing countries and by private investors, and is the result of an extremely complex combination of economic and political factors. As low-cost resources are depleted and production costs rise, the trading cost can be expected to rise.

TABLE 3-8 World and U.S. Petroleum Resources

|

Source |

1992 Resource Consumption (billion bbl)a |

Total Resource (billion bbl) |

Resource/1992 Consumption (years) |

|

World |

20.4 |

1,700c |

83 |

|

United Statesb (domestic) |

3.1 |

99-204d |

32-66 |

|

a Data from EIA (1994a). b Total U.S. petroleum consumption in 1992 was 6.2 billion bbl, with about 50 percent accounted for by oil imports (EIA, 1994a). If total consumption were used for the last column, the resource/ consumption value for the United States would decrease to 16-33 years. c See Riva (1991). d Low number based on current technology and price of $20/bbl; high number based on advanced technology and price of $27/bbl (NRC, 1993). |

|||

In addition to conventional petroleum, there are substantial resources of heavy oil and bitumen9 (Riva, 1991). The total world resource for heavy oil is estimated to be 600 billion bbl (equal to 35 percent of the conventional petroleum resource). About 50 percent of the heavy oil resource occurs in Venezuela and about 30 percent in the Middle East. The total resource for tar sands is approximately 3,500 billion bbl, but only 5 to 10 percent of this amount is currently considered to be economically recoverable. Here Canada is dominant, with 75 percent of the world total. Both heavy oil and bitumens require more costly production and refining than conventional petroleum and are not competitive with petroleum at current prices.

To compete with coal for power generation, heavy oils and bitumen would require pollution control similar to that required for coal, because of their high sulfur and metals content. To compete with coal at approximately $1.4/million Btu,10 the delivered price of tars would need to be about $9/bbl or less. The above considerations support the assumption that unrefined tars and heavy oils will not displace a significant amount of coal for power generation in the foreseeable future.

OTHER USES OF COAL

Coal still has some limited uses as a fuel outside the utility sector. Industry burns coal as a boiler fuel to raise steam. Limited use is also seen commercially in

a variety of smaller boiler designs and some U.S. households continue to burn coal for space heating (EIA, 1994a). The primary use of coal not combusted directly is the production of metallurgical coke, which is both the fuel and the source of the reducing agent (carbon monoxide) in smelting various ores. The most important application of metallurgical coke is for reduction of iron ores in blast furnaces. EIA projections (reference case) of domestic coal consumption for these applications through 2010 are shown in Table 3-9. Data on coal use for electricity generation are included for comparison.

The only anticipated growth in demand (except for electricity generation) is industrial steam, due largely to growth in coal use for cogeneration in the chemical and food processing industries. The utilization of coke in the iron and steel industry is steadily diminishing for several reasons. First, improvements in blast furnace technology have significantly reduced the amount of coke required to produce a ton of iron. Second, there has been a major shift away from the use of blast furnaces toward the use of electric furnaces that use scrap steel. This change has reduced the demand for freshly produced pig iron or steel, reducing the need for coke. Third, the domestic iron and steel industry has suffered from competition with imported steel products, further reducing the domestic use of coke. No major upturn in the demand for metallurgical coke is foreseen for the periods of interest to this study.

The conversion of coal to metallurgical coke yields by-product hydrocarbon mixtures commonly known as coal tar. The value of coal tar as a source of chemicals or synthesis material for other products began to be recognized in the 1870s. For about 75 years, until the end of World War II, virtually the entire organic chemical industry was based on the utilization of coal tar. However, in the past half-century the organic chemical industry has derived substances principally from petroleum and natural gas, although coal tar is still a useful source of certain specialty chemicals, such as aromatic hydrocarbons with multiple fused aromatic rings, and coal tar pitch has some niche applications that cannot be satisfied by petroleum-derived pitch. When imported petroleum increases in cost, coal could once again become a source of chemical products, though any large

TABLE 3-9 Projections for Domestic Coal Consumption by End Use, 1990-2010 (million short tons)a

market for chemicals based on coal is not likely to develop until it becomes practical to produce gaseous and liquid fuels from coal.

Coals have a variety of other specialized uses, most of them low-volume applications. For example, anthracites can be used as filter material for tertiary water treatment processes. Lignites have some ion-exchange behavior and can be used in some cases as inexpensive ion-exchange ''resins." These applications include wastewater treatment (e.g., the removal of chromium from electroplating wastes) and the concentration of ions, such as gold, in hydrometallurgy. Lignites can also be converted into so-called humic acids, which are useful soil amendments and can be nitrated to form fertilizers. There is also interest in converting coals, particularly those of high carbon content, into carbon-based materials, such as graphites. Most of the R&D on these niche applications is taking place outside the United States. At the present time, no significant domestic markets for these applications are anticipated during the period addressed in this study.

ENVIRONMENTAL ISSUES FOR COAL USE

Environmental concerns will have the greatest influence on future coal use for power generation in the industrialized countries (IEA, 1993b). In the United States, coal-fired power plants are already subject to a range of emission controls that will likely become increasingly stringent and wide ranging over the periods addressed by this study. Current and possible regulations governing emissions from coal-fired power plants are summarized below, along with information on the current status of control technologies. Appendix D reviews recent trends in U.S. regulatory policy and technology approaches to address environmental issues. Emissions control technologies are discussed in more detail in Chapter 7.

National ambient air quality standards for particulate matter, sulfur dioxide (SO2), nitrogen dioxide (NO2), and photochemical ozone were promulgated under the 1970 Clean Air Act to protect human health and welfare throughout the country.11 The primary drivers of technology innovation to control air quality over the past two decades have been pollutant-specific emission standards for new and existing air pollution sources, together with the ambient air quality standards, both promulgated by federal and state governments.

In contrast to ambient air quality standards, aimed at protecting human health, acid deposition regulations guard against cultural and ecological concerns, including damage to aquatic systems, forests, visibility, and materials. Anticipation of acid rain controls was the main factor motivating SO2 and nitrogen oxides

(NOx, a mix of NO and NO2) control technology development during the 1980s. The acid deposition provisions of the 1990 Clean Air Act amendments (CAAAs) established for the first time an absolute cap on total U.S. SO2 emissions, with provisions for emissions trading to achieve the required overall reduction in utility emissions most cost-effective ly. A reduction in NOx emissions was also mandated, although no cap on total emissions was established.

Significant progress has been made over the past decade in the capability of commercial systems to reduce SO2, NOx, and particulate emissions from pulverized coal-fired power plants. Emissions trends for a new pulverized coal power plant burning medium-sulfur coal are shown in Figure 3-2. Air pollution control devices today achieve emission levels well below federal NSPS. The most effi-

FIGURE 3-2 Trend in emission rates of criteria air pollutants from a new pulverized coal power plant. Percentage reductions are relative to an uncontrolled power plant based on a dry-bottom tangentially fired boiler firing bituminous coal of 10,000 Btu/lb heating value and containing 2.5 percent sulfur, 12 percent ash, and 10,000 Btu/lb. Percentages on the bars are percent reductions relative to uncontrolled emissions of that component. NSPS = New Source Performance Standards. FGD = flue gas desulfurization (wet magnesium-enhanced lime). FF = fabric filter (baghouse). ESP = electrostatic precipitator. LNB = low NOx burner. SCR = selective catalytic reduction.

cient wet scrubbers reduce SO2 emissions to about one-fourth to one-sixth of NSPS requirements (98 percent control). The most efficient commercial systems yield particulate emissions of about one-half to one-quarter NSPS levels (99.9 percent control). U.S. technology for power plant NOx control has focused on combustion modification methods that currently reduce emissions to about one-half to two-thirds of NSPS levels (50 to 60 percent control). In Japan and Germany, postcombustion controls achieving up to 80 percent NOx reduction (about one-third to one-sixth NSPS levels) are in widespread use on low-sulfur coal plants. These controls have not yet been deployed in the United States, but such systems are now being demonstrated at U.S. plants as part of DOE's CCT program, and several are offered commercially. Post combustion NOx controls that employ selective catalytic reduction have been installed on several gas-fired power plants, including combustion turbines, to meet state and local air quality requirements. Over the next 10 years, new requirements for NOx reductions at existing and new coal-based power plants are likely to achieve national ambient air quality standards for tropospheric ozone. Also possible are new standards for fine particulates. Future NOx controls would likely exceed the modest reductions (10 percent of 1980 levels) already required for acid deposition control.

Title III of the 1990 CAAAs lists 189 substances as "air toxics," subject to maximum-achievable control technology when emitted at rates of 10 to 25 tons per year from designated industrial and other sources. Emissions of these hazardous air pollutants from fossil-fueled power plants were exempted from the CAAAs provisions pending further study by the U.S. Environmental Protection Agency (EPA). Air toxics of primary concern to utilities are the 10 to 20 trace substances commonly found in coal, including arsenic, mercury, selenium, nickel, cadmium, and other heavy metals. The basis for regulating emissions of these species from electric utilities would be an EPA finding of an unacceptable health risk or an ecological risk to one or more regions of the country named in the 1990 CAAAs (Zeugin, 1992). Independent of EPA action, however, individual states may impose regulations or guidelines on emissions of hazardous air pollutants.

Current worldwide concern over potential global warming may pose the greatest long-term threat to expanded coal use, primarily because of the emissions of the "greenhouse gas" carbon dioxide (CO2) from coal combustion. Over the mid to long-term, CO2 emission reductions may be critical to address these concerns, although policy measures could force such reductions sooner. At the present time there is significant scientific uncertainty regarding timing, magnitude, and consequences of increased greenhouse gas emissions. Inevitably, such uncertainty is reflected in varying views about the need for CO2 emissions controls. However, the preponderance of scientific opinion—as reflected, for example, by a recent NRC study (NRC, 1992b)—suggests that the threats are of sufficient concern to warrant some initial actions. Together with some 150 other nations, the United States is already committed to a program of CO2 reduction by virtue of being a signatory to international agreements stemming from the 1992

United Nations Conference on the Environment. Such reductions are currently voluntary, although the Clinton administration is aggressively and successfully pursuing utility participation. The EPACT also involves utilities in programs to establish baseline CO2 emissions.

The most cost-effective method of reducing CO2 emissions from power generation and other coal-based systems is to improve the systems' overall efficiency. DOE's strategic objectives for its Advanced Power Systems Program are consistent with this approach (see Chapter 2). Technology exists to remove CO2 from combustion gases and other coal-based gas streams, but the costs of doing so are high (MIT, 1993), and no proven methods yet exist for disposing of the collected CO2. Beyond the 2040 planning horizon considered in the present study, very high-temperature nuclear reactors might be used as an energy source in fossil fuel conversion processes, such as steam gasification of coal, to reduce their greenhouse gas emissions (NRC, 1990).

Methane from coal mining is also of concern as a greenhouse gas. It has been estimated that in the United States approximately 3.6 million metric tons of coalbed methane is released each year in this process. A large percentage of this total is from underground mining. 12 About 30 percent of concentrated methane from wells in the coal seam is now collected and used. The ventilation air exhaust, which typically contains less than I percent methane, is not generally collected and makes up over 70 percent of the total methane released to the atmosphere from coal mining (CIAB, 1992). Estimates indicate that the greenhouse effect of the methane released from underground coal mining represents up to 8 or 9 percent of the greenhouse effect of the CO2 released in burning the mined coal.13 For a 40 percent thermal efficiency power plant, the additional greenhouse effect of methane released from coal mining is equivalent to decreasing the plant's efficiency by up to about 2 percent. Control of coal mine methane emissions, therefore, has less potential for reducing greenhouse gases than achieving higher plant efficiency through the use of advanced technology. However, methane emissions from coal mining are independent of coal use in combustion equipment; current understanding of global warming issues suggests that they are

of sufficient magnitude to justify development of appropriate technology for their control.

Emissions of nitrous oxide (N20), another greenhouse gas, also arise from coal combustion. Because N20 is formed primarily at relatively low temperature and pressure, the largest emissions rates are associated with atmospheric fluidized-bed combustion systems. Overall, N20 emissions from coal combustion worldwide are estimated to contribute less than 1 percent of total global warming emissions. The primary sources of N20 worldwide are fertilizers and agricultural wastes (NRC, 1992b).

Coal-fired electric power plants and fuel conversion processes are subject to state and federal regulations to protect the quality of surface waters, ground water, and drinking water. The principal environmental concerns are thermal discharges to waterways (discharges prohibited for new plants) and various chemical emissions, including heavy metals, organics, suspended solids, and other aqueous constituents found in power plant waste streams. In recent years there has been increasing attention to control of hazardous or toxic trace chemical species and a general tightening of effluent emission standards at existing and new facilities (Rubin, 1989). High-volume wastes, such as flyash from coal-fired power plants, have been declared "nonhazardous," with only some low-volume wastes such as boiler cleaning sludges falling under the "hazardous" category. The latter require more rigorous treatment and involve much higher disposal costs to avoid surface or ground water contamination. Nonetheless, to control the release of suspended solids and other chemical constituents of high- and low-volume wastes, water treatment systems similar to those found in other industrial processes are an integral requirement for modern power plants.

The large volumes of solid waste that must be disposed of, particularly ash from coal, represent a growing problem because of concern over contamination of ground water and surface waters and the decreased availability of landfill sites for waste disposal. Ash solubility and its effects on ground water can be greatly reduced by processes that fuse ash, resulting in products that can be used as construction materials, such as gravel substitutes. While research on the conversion of solid wastes to higher-value products has shown that by-product and reuse options are technically feasible, such conversion methods currently are not able to absorb the large quantities of material produced and often are not economical in today's markets. Another disposal option, especially applicable to western open-face mines where coal is transported by rail, is returning waste to the coal mine.

To an increasing extent, federal NSPS levels for power plants no longer set the benchmark for environmental control performance. Rather, state and local determinations of "lowest-achievable emission rates" now set the critical requirements in many cases. A related trend is the adoption by some state public utility commissions of "externality adders," economic costs added to the nominal cost of power generation that reflect the environmental damages due to emissions that

escape control. Increasingly, state public utility commissions are requiring externality costs to be included in comparing different investment options and associated environmental impacts and risks. The effect is to put further downward pressure on all emissions from coal-based power systems.

SUMMARY

The principal findings from the preceding review, summarized here, form the basis for the strategic planning scenarios developed by the committee and presented in Chapter 4.

Coal supplies are expected to be abundant for the periods considered in this study. The steady decline in domestic coal prices over the past 10 years is a trend expected to continue in the near- term. In the mid to long-term (2006 through 2040), coal production costs are expected to be stable. Given the continuing availability of low-cost domestic coal, and the evolutionary rather than revolutionary nature of changes in energy consumption patterns in the United States, coal will likely continue to satisfy a significant part of growing U.S. energy demands over the next several decades.

Electricity demand is projected to grow through 2010 as the U.S. economy grows. Estimates of new capacity requirements over the next 15 years differ widely, but there appear to be significant markets for retrofit and repowering options, as well as for new capacity construction. Changes in regulatory structure and practice in the electric utility industry since 1979 have contributed to a trend toward more widely distributed, smaller-scale power generation facilities that have relatively low risk and low capital costs. In addition, increased competition is reducing the willingness of the utility industry to develop and deploy advanced power generation technologies that are perceived as having higher risk.

In the near-term, natural gas-fired systems will likely be the primary source of new capacity additions, driven by demands for peak and intermediate power, low gas prices, and low capital costs relative to coal. However, coal is expected to remain the largest single energy source for power generation, and resource limitations for domestic natural gas, combined with a substantial need for new baseload generating capacity between 2006 and 2040, are anticipated to result in a resurgence of coal-based power generation facilities in the mid-term period. In the longer term, growth of nuclear energy using advanced reactor designs is possible, and such energy could begin displacing coal after 2020. Renewable energy sources are expected to play a growing role in U.S. electric power generation, but they are not anticipated to become a large source of bulk electricity within the periods covered by this study.

Environmental concerns will probably be the most significant influence on future coal use in the United States, and requirements to reduce the environmental and health risks of waste streams from coal technology are expected to grow more stringent. In the near- to mid-term periods, control of SO2, NOx, and fine

particulate air pollutants, solid wastes, and possibly air toxics, will continue to determine the acceptability of coal-based systems, with state and local environmental requirements posing the most restrictive demands on power plant emissions. However, concern over global warming could present the greatest long-term threat to coal use because of the CO2 emissions from coal combustion. Reducing CO2 emissions over the mid- to long-term periods may be critical to maintaining coal's viability as an energy source. The most cost-effective method of reducing CO2 emissions from power generation and other coal-based systems is to improve their overall efficiency.

Expansion of coal-based power generation is anticipated in the developing nations, notably China, and major international markets exist for coal utilization technologies. In the near-term, capital investment requirements are expected to be a controlling consideration in most foreign markets. Foreign requirements to minimize conventional pollutant and greenhouse gas emissions will lag those imposed in the United States, but their introduction is expected to have a large impact on international sales of coal-based technologies, especially in the mid- to long-term periods.

World petroleum resources are sufficiently large, and production costs sufficiently low, that prices for imported oil will continue to be governed primarily by political and institutional factors. Oil prices are expected to increase over time. However, international political events and disruptions could produce high price volatility in any time period. When time-averaged imported oil prices exceed $25 to $30/bbl, use of heavy oil and tar from North and South America becomes competitive with conventional petroleum. If production of gaseous and liquid fuels from coal can compete in this price range, a major market for coal beyond power generation could develop. Coal-derived gaseous and liquid fuels could also be used in chemicals production.

REFERENCES

Carter, M.D. and N.K. Gardner. 1993. Coal Availability Studies: A Federal and State Cooperative Project. Reston, Virginia: U.S. Geological Survey.

CIAB. 1992. Global Methane Emissions from the Coal Industry. Coal Industry Advisory Board, Global Climate Committee, International Energy Agency. Paris: Organization for Economic Cooperation and Development.

Coal and Synfuels Technology. 1993. Chinese cities get funds gasification. Coal and Synfuels Technology 14(47): 47.

Coal Week International. 1993. World steam coal prices. Coal Week International 14(51): 4-5.

Coal Week International. 1994. Current steam coal prices. Coal Week International 15(32): 4.

DOE. 1993a. Market Potential for Clean Coal Technology Exports: Update Estimates. Working paper submitted to the Office of Fossil Energy, U.S. Department of Energy by Resource Dynamics Corp. under contract DE-AC01-92FE62489.

DOE. 1993b. Foreign Markets for U.S. Clean Coal Technologies, working draft, Dec. 21. Report to the U.S. Congress by the U.S. Department of Energy, Washington, D.C.

Doyle, G. 1987. China's Potential in International Coal Trade. London: International Energy Agency.

EIA. 1992. Coal Production 1992. Energy Information Administration, U.S. Department of Energy. Washington, D.C.: DOE.

EIA. 1994a. Annual Energy Outlook 1994. Energy Information Administration, U.S. Department of Energy, DOE/EIA-0383(94). Washington, D.C.: DOE.

EIA. 1994b. Supplement to the Annual Energy Outlook 1994. Energy Information Administration, U.S. Department of Energy, DOE/EIA-0554(94). Washington, D.C.: DOE.

Energy Daily. 1994. The impact of coal in the U.S. economy cited in study unearths coal's economic benefits. Energy Daily 22(108): 4.

GRI. 1994. Baseline Projection of U.S. Energy Supply and Demand, 1994 Edition. Chicago: Gas Research Institute.

Harunuzzaman, M., T.P. Lyon, E.H. Jennings, K. Rose, G. Iyyuni, M. Eifert, and T. Viezer. 1994. Regulatory Practices and Innovative Generation Technologies: Problems and New Rate-Making Approaches. NRRI 94-05. Columbus, Ohio: National Regulatory Research Institute.

IEA. 1993a. Coal Information 1992. International Energy Agency. Paris: Organization for Economic Cooperation and Development.

IEA. 1993b. Annual Report 1992-1993: International Energy Agency. Paris: Organization for Economic Cooperation and Development.

Makovich, L., and G. Smalley. 1993. The electric power industry forecast 1993-2010. Electrical World 207(11): 17-21, 24.

MIT. 1993. A Research Needs Assessment for the Capture, Utilization and Disposal of Carbon Dioxide from Fossil Fuel-Fired Power Plants. Report for the U.S. Department of Energy under grant no. DE-FG02-92ER30194. Cambridge: Energy Laboratory, Massachusetts Institute of Technology.

NCA. 1993a. Coal Data 1993 Edition. Washington, D.C.: National Coal Association .

NCA. 1993b. Facts About Coal, 1993. Washington, D.C.: National Coal Association.

NRC. 1990. Fuels to Drive Our Future. Energy Engineering Board, National Research Council. Washington, D.C.: National Academy Press.

NRC. 1992a. Rethinking the Ozone Problem. Board on Environmental Studies and Toxicology and the Board on Atmospheric Sciences and Climate, National Research Council. Washington. D.C.: National Academy Press.

NRC. 1992b. Policy Implications of Greenhouse Warming. Committee on Science, Engineering, and Public Policy, National Research Council. Washington, D.C.: National Academy Press.

NRC. 1993. Advanced Exploratory Research Directions for Extraction and Processing of Oil and Gas. Board on Chemical Sciences and Technology, National Research Council. Washington, D.C.: National Academy Press.

Potential Gas Committee. 1993. Potential Supply of Natural Gas in the United States. Golden, Colorado: Potential Gas Agency, Colorado School of Mines.

Preston, G.T. 1994. Testimony to the U.S. Senate Committee on Energy and Natural Resources, March 8.

Riva, J.P., Jr. 1991. Dominant Middle East oil reserves critically important to world supply. Oil and Gas Journal 89(38): 62-68.

Rohrbacher, T.J., D.D. Teeters, L.M. Osmonson, and M.N. Plis. 1993. USBM Coal Recoverability Program: 1993 Review of Results, Draft. Denver, Colorado: U.S. Department of the Interior, Bureau of Mines.

Rubin, E.S. 1989. The implications of future environmental regulations on coal-based electric power. Annual Review of Energy. Vol. 14. Palo Alto, California: Annual Reviews.

The Alliance to Save Energy, American Gas Association, and Solar Energy Industries Association. 1992. An Alternative Energy Future. Washington, D.C.: The Alliance to Save Energy.

Zeugin, L.E. 1992. Managing Hazardous Air Pollutants: Implications of the 1990 Clean Air Act Amendments for Coal Combustion. Proceedings of the Ninth Annual International Pittsburgh Coal Conference, October 1992, Pittsburgh, Pennsylvania. Pittsburgh: University of Pittsburgh.