4

Analyses of the D&D Cost Estimates for the GDPs

Two cost estimates for the D&D of the U.S. GDPs were developed in 1991 in developing legislation to establish the USEC. Under contract to the DOE, Ebasco and TLG developed two separate cost estimates incorporating different assumptions (DOE, 1991a,b). In addition, MMES had developed an earlier cost estimate in 1988, and subsequent to the Ebasco and TLG work, DOE employed SAIC to review the Ebasco estimate and provide an additional estimate (MMES, 1988; DOE, 1991c, 1992). These four estimates, which are summarized in Table 4-1, are reviewed in this chapter to identify and compare the major cost elements in the D&D of the GDPs. (See Appendix J for further details on the cost estimates.)

These cost estimates are also considered together with actual D&D experiences at other nuclear facilities. For example, the D&D of the Capenhurst GDP in the United Kingdom by BNFL is particularly valuable because the Capenhurst plant had components, systems, and structures very similar to those of the U.S. plants (Baxter and Bradbury, 1991a,b; Clements, 1993, 1994a; Spencer, 1988). The D&D of the Shippingport Atomic Power Station in Pennsylvania, which is well documented, is also relevant because this power plant was a DOE-owned facility that was decommissioned following DOE orders and U.S. regulatory requirements (Crimi, 1987, 1988a, 1988b, 1992, 1994). The Capenhurst and Shippingport D&D projects are also reviewed in this chapter, and conclusions are drawn on aspects of their success relevant to the D&D of the GDPs.

Previous Cost Estimates

The cost estimates summarized in Table 4-1 are reviewed and compared in the following sections, and the principal reasons for the differences are identified. Every cost estimate depends on its assumptions. Thus, when comparing cost estimates for the same job, it is important to compare the underlying assumptions to ensure that they are similar or that those assumptions that differ can be identified. For example, in the cost estimates developed by Ebasco and TLG, some assumptions were specified by DOE, with additional assumptions made by Ebasco and TLG (see Appendix J for these assumptions).

TABLE 4-1 Summary of Previous GDP D&D Cost Estimates (1992 dollars)

|

Estimator |

Total Cost (billions $) |

Total Years |

Average Annual Spending (million $/Year) |

|

MMES |

12.3 |

NAa |

NA |

|

Ebasco |

16.1 |

38 |

420 |

|

TLG |

13.9 |

17.5 |

800 |

|

SAIC |

9.5 |

26 |

365 |

|

a Not available. SOURCE: MMES (1988), DOE (1991a,b,c, 1992). |

|||

The 1988 MMES Study

In July of 1988, MMES produced the "Modernization Study D&D Review" at the request of the Energy Projects Branch, Richland Operations Office, DOE. This review projected the costs for D&D of the shutdown facilities at the Oak Ridge GDP. The costs, calculated in 1990 dollars, were developed by applying the "Hanford Cost Estimating Formula" to the Oak Ridge GDP. This method applies a broadly based unit cost factor (in dollars/ft3 of waste) for each of three scenarios (protective [safe] storage, entombment, and return to greenfield status) to the volume of waste estimated to result from D&D at the Oak Ridge GDP. Under the protective storage assumption, the initial cost was projected to be $166 million, with annual costs of $22 million (MMES, 1988). Under the entombment scenario, the costs rose to $2.3 billion. Under the greenfield assumption, costs rose to $8.10 billion, including a 40 percent contingency (all costs given in 1990 dollars).

Estimated remedial action costs at the Oak Ridge GDP of $2.75 billion are included in the MMES 1988 greenfield estimate. Eliminating the cost of remedial action (because site remediation of soils and groundwater was not included in the Ebasco or TLG estimates) reduces the original $8.10 billion estimate to $5.35 billion. Converting the $5.35 billion estimate to 1992 dollars yields the estimate of $5.72 billion.1

Because the MMES estimate is for the Oak Ridge GDP only, the committee extrapolated this estimate to arrive at a value for all three GDPs. This extrapolation was performed by calculating the ratio of the total cost for D&D of all GDPs to the cost for D&D of the Oak Ridge GDP, using the Ebasco cost estimate. The Ebasco cost estimate was used in calculating this ratio because of the more detailed analysis of the Paducah and Portsmouth plants as compared with the TLG estimate. Multiplying the MMES Oak Ridge GDP estimate by this ratio

(2.17) results in an estimate for the total GDP complex of $12.3 billion in 1992 dollars, including contingency. The validity of this calculation depends on the assumption that the population of support facilities and other site resources considered in the MMES-Hanford estimate is the same or quite similar to the population examined in the Ebasco estimate.

The 1991 Ebasco and TLG Estimates

Four bottom-up estimates were prepared by Ebasco in 1991, beginning in May and ending with the final version in September (see Appendix J, Table J-2; DOE, 1991a). The principal differences in the consecutive Ebasco estimates were reductions in scope, changing some of the original assumptions, and a reduction in overhead rates. The total cost for the final Ebasco estimate was $16.1 billion in 1992 dollars, including contingency. Ebasco examined the Oak Ridge GDP in detail, using available drawings to develop inventories of equipment and building surface areas. The estimates of the direct labor and materials costs were prepared using unit cost factors, that is, calculating the costs for labor and equipment needed to perform a task once and multiplying that unit cost factor by the number of times that task would be performed during the D&D, to obtain the total cost for the activity. D&D costs for the Portsmouth and Paducah GDPs were then estimated by scaling the Oak Ridge D&D estimates by the ratio of the gross square footage of buildings at the Portsmouth and Paducah plants to the gross square footage of similar buildings at the Oak Ridge GDP.2

Such an approach is reasonably good for structures that are very similar in size and content but becomes less and less reliable as the similarity of the structures and their contents diverge. The approach also neglects differences in local labor rates, productivity, and other site-specific cost parameters. Costs to prevent criticality during D&D should be greatest at Oak Ridge. Paducah has low enrichment levels, and criticality is not a significant concern at the plant. DOE is using gaseous ClF3 (chlorine trifluoride) to remove deposits from the highly enriched uranium sections at Portsmouth, and the USEC is obligated to remove uranium deposits from the two plants that represent a criticality risk. Hence, extrapolating D&D costs from Oak Ridge should provide an overestimate of D&D costs for the other two sites.

A major cost element in the Ebasco estimate was the construction and operation of two large facilities for the decontamination and volume-reduction of the plant components, the high-assay and low-assay decontamination facilities.3 The function of the first was to decontaminate and disassemble material contaminated with highly enriched uranium. Each of these structures was postulated to be about the size of a gaseous diffusion process building and to contain a multitude of process systems for the decontamination and segmentation of the system components. In addition, the Ebasco estimate postulated the construction of a new administration building at the Oak Ridge GDP, with space for several thousand persons, to house administrative functions during the multiyear decommissioning process.

Another bottom-up estimate was prepared by TLG (DOE, 1991b). This estimate used the same plant equipment inventories developed by Ebasco and included the same new decontamination and administration facilities as the Ebasco estimate. TLG used some unit cost factors for D&D operations that they had developed during their many years of estimating decommissioning costs for nuclear power plants and developed other new unit cost factors for D&D of the specialized equipment in the GDPs, such as converters and compressors. The TLG D&D cost estimate amounted to $13.9 billion in 1992 dollars, including contingency.

Comparison of the Ebasco and TLG Estimates for the Five Process Buildings at the Oak Ridge GDP

Table 4-2 compares some of the principal parameters affecting the Ebasco and TLG estimates for the five gaseous diffusion process buildings at the Oak Ridge GDP. The two estimates differ significantly in estimated waste volume and waste management costs, differ about 4 percent in labor hours and about 5 percent in D&D (including the decontamination facilities) cost, but cannot be directly compared in the area of scrap/salvage because they relied on different units.

Both Ebasco and TLG postulated the construction and operation of two large new facilities for a multiplicity of decontamination and segmentation processes for the contaminated process equipment removed from the process buildings. These processes include gaseous ClF3 treatment and high-pressure water washing decontamination, plasma-arc and oxyacetylene segmentation, and incineration of selected wastes.

The large differences between Ebasco and TLG in estimated waste volume and waste disposal cost arise from different assumptions. Ebasco assumed significant volume reduction of major components, while TLG postulated sealing the openings on the major components and shipping them to the disposal site intact. Ebasco assumed very short transport distances, with burial near the plant site. TLG assumed transport to the Nevada Test Site for burial. Ebasco assumed disposal charge rates ranging from about $14/ft3 to $33/ft3, and TLG assumed a value of $8/ft3 for waste disposal. Despite its assumed low disposal charge rate, the TLG waste management cost estimate of $634 million is about 1.8 times larger than the Ebasco estimate of $352 million because of the assumed much larger waste volume (3.5 times larger) and the much longer transport distances.

The total direct labor hours to dismantle and remove equipment and to decontaminate and demolish the structures are very similar, differing by only about 4 percent. However, this result may be fortuitous because, although both studies used the same equipment inventories, the unit cost factors they assumed for removal of the components vary widely, as shown in Table 4-3. The ratio of the TLG unit cost factor to the Ebasco unit cost factor (TLG/Ebasco) for the same activity ranges from about 0.3 to nearly 7. Obviously, in any new cost estimate it will be necessary to review all unit cost factors to ensure that the factors reasonably represent the realities of a decommissioning job.

Historically, the unit cost factor approach results in a conservative (high) estimate of the cost of accomplishing a series of tasks, especially for performing the same set of tasks many

TABLE 4-2 Comparison of Major Parameters in the Ebasco and TLG Cost Estimates

|

Parameter |

Ebasco |

TLG |

|

Waste volume |

9.072 million ft3 |

32.14 million ft3 |

|

Waste management costa |

$352.3 million (1992 $) |

$633.8 million (1992 $) |

|

Scrap/Salvage |

1,527,168 ft3 |

5,571 tons |

|

Direct labor |

41.31 million person hours |

42.98 million person hours |

|

$3.3 billion (1992 $) |

$3.7 billion (1992 $) |

|

|

High- and low-assay decontamination facilitiesc |

$2.1 billion (1992 $) |

$1.45 billion (1992 $) |

|

NOTE: Values are for the five process buildings at the Oak Ridge GDP only, not including support buildings. a Values include packaging, transport, disposal, and contractor overhead and profit but not contingency. b Includes waste management costs but not for the high-assay and low-assay decontamination facilities costs. c Includes both construction and operation costs. The difference in the estimates arises primarily from the different operating lifetimes postulated by Ebasco (11 years) and TLG (8 years). |

||

TABLE 4-3 Comparison of Selected Unit Cost Factors for Equipment Removal Used in the Oak Ridge GDP Cost Estimates

|

Activity |

Units |

Ebasco |

TLG |

TLG/Ebasco |

|

Process piping |

($/linear foot) |

303.52a |

89.12 |

0.29 |

|

Fire protection |

($/linear foot) |

36.42a |

15.95 |

0.44 |

|

Converters |

($/unit) small |

10,852 |

27,835 |

2.56 |

|

|

($/unit) large |

16,019 |

32,917 |

2.05 |

|

Light fixtures |

($/unit) |

96.14a |

279.51 |

2.91 |

|

Decon structures |

($/square foot) |

15.06a |

48.57 |

3.22 |

|

Raceways |

($/linear foot) |

3.36a |

23.42 |

6.96 |

|

NOTE: Values include contractor overhead and profit. a Average values, derived by dividing total cost over five GDP process buildings by total number of linear feet, units, or area, as appropriate, given by Ebasco for those five buildings. |

||||

times, because the performance improvements from learning will generally reduce cost (McNeil and Clark, 1966). For the D&D of the GDPs, if the plants are cleaned up sequentially, as assumed in the Ebasco estimate, experience gained from the D&D in the first building should certainly improve performance in the rest of the buildings at the first plant and subsequent plants.

Ebasco and TLG used different bases for estimating project overhead costs, but arrived at similar results. The management structures postulated in the two estimates contain similar cost elements. However, because of the manner in which the costs were developed in the two studies, it is difficult to make direct comparisons. Both structures include significant levels of staffing for the category Program Integration, which includes program management, obtaining permits from appropriate regulatory agencies, and large staffs providing engineering, operations, and health and safety services. Staffs are also provided for industrial safety, waste management, and analytical services. Other cost elements included are security staff (Ebasco only), nuclear insurance and taxes (TLG only), planning and procedure preparation (Ebasco only), and miscellaneous items such as utility costs. By collecting all elements appropriate for program integration for each estimate, the results are similar: Ebasco, $1.897 billion, 30.0 percent of the total; TLG, $1.967 billion, 32.6 percent of the total. TLG postulated 1,430 people/year on the overhead staff during the 8 years of D&D at the Oak Ridge GDP. An indirect measure of the number of overhead staff postulated by Ebasco suggests about 500 people/year during 11 years of D&D at Oak Ridge. The smaller number of indirect staff assumed in the Ebasco estimate is balanced by the much longer period of D&D operations it assumes, resulting in similar total indirect costs.

SAIC Analysis of the Ebasco Estimate for DOE

DOE hired SAIC to evaluate the Ebasco cost estimate and to develop a revised estimate based on the Ebasco estimate (DOE 1991c, 1992). The SAIC estimate, identified as the Working Decommissioning Cost Estimate, used a top-down analysis, developed by examining the cost impact of changing key Ebasco assumptions, rather than an independent bottom-up estimate, like those developed by Ebasco and TLG. The basic differences between Ebasco and SAIC estimates are summarized in Table 4-4 (see Appendix J for details).

Although the SAIC estimate details dozens of potential cost reductions, much of the potential cost decrease it proposes results from reductions in the categories of Support Facilities and Waste Management and in indirect costs and contingency (DOE, 1992).

In the SAIC estimate, the direct cost of the support facilities was reduced from $2.436 billion in the Ebasco estimate to $359 million. This $2 billion decrease resulted from eliminating the high-assay decontamination facility, decreasing the capital cost of the low-assay decontamination facility from $646 million to $294 million, primarily by lowering the cost estimates for the facility's decontamination systems, and reducing its annual operating costs from $40 million to $14 million as a result of its reduced treatment capacities. An assumed lower disposal rate of $8/ft3, and on-site disposal, reduced direct costs for waste management from $689 million to $446 million for low-level radioactive and hazardous wastes. (See Appendix J for more details on waste management costs.)

TABLE 4-4 Ebasco and SAIC Estimated D&D Costs for the GDPs (billions of 1992 dollars)

|

|

Estimated Costs |

|

|

Cost Element |

Ebasco |

SAIC |

|

Direct costs |

|

|

|

Waste management |

0.689 |

0.446 |

|

D&D activities |

3.412 |

3.931 |

|

Support facilities |

2.436 |

0.359 |

|

Total direct costs (D) |

6.537 |

4.736 |

|

Indirect (I) (% of direct) |

2.811 (43) |

0.663 (14) |

|

Subtotal (D+I) |

9.348 |

5.399 |

|

Construction management (CM) (% of D+I) |

0.467 (5) |

0.270 (5) |

|

Subtotal (D+I+CM) |

9.815 |

5.669 |

|

Contractora (% of D+I+CM) |

0.491 (5) |

0.283 (5) |

|

Total (D+I+CM+ contractor) |

10.306 |

5.952 |

|

Contingency (% of total) |

3.195 (31) |

1.190 (20) |

|

Total (D+I+CM+contractor+contingency) |

13.501 |

7.142 |

|

Program Integration (PI) (direct) |

1.796 |

2.251 |

|

Indirect (% of PI direct) |

0.772 (43) |

0.000 (0) |

|

Grand Total |

16.069 |

9.393 |

|

a For example, the management and operating (M&O) contractor. SOURCE: DOE (1991a,c, 1992). |

||

Finally, the largest reductions from the Ebasco estimate resulted from changes in the indirect rates (43 percent to 14 percent) and contingency rates (31 percent to 20 percent), which are multipliers of direct construction and operations labor costs in preparing the total cost estimate. In addition, the indirect rate applied to the Program Integration function was reduced from 43 percent to zero, based on the reasoning that program integration is an indirect cost. These reductions recommended in the SAIC cost estimate decreased the total estimated cost from about $16.1 billion to about $9.3 billion (1992 dollars).

Identification Of Major Cost Elements

The five principal cost elements in the Ebasco and TLG studies are summarized in Table 4-5. The focus in this comparison is on estimates for D&D of the Oak Ridge site, because all of the bottom-up cost analyses were performed for the Oak Ridge GDP. (The Portsmouth and Paducah D&D costs were developed from the Oak Ridge GDP costs using ratios of gross square footages for similar buildings, as described previously.)

Ebasco's estimated base cost for the Oak Ridge GDP was about $5.40 billion, including contractor overhead and profit, but without the 5 percent adders for construction management and management and operating contractor operations and without contingency. The TLG base cost was about $5.15 billion, including all indirect costs, but without contingency. Both values include the cost of construction and operation of the high- and low-assay decontamination facilities. The totals differ by about 5 percent. However, there are wide disparities in the relative magnitudes of the major cost elements, which are related to the differences in the unit cost factors used by each study and to differences between the studies in assumptions about the levels and locations of contamination within the facilities.

The components of the equipment removal cost element show large differences between the two studies, as shown in Table 4-6. Because these costs are based on the same inventories of materials, the large cost differences arise from the large differences in the unit cost factors developed for these activities by the two contractors.

A review of removal costs during the CIP/CUP at the Paducah and Portsmouth GDPs (see chapters 3 and 6, and Table 6-2) and, more recently, in removing converters from the Oak Ridge GDP for transfer to Portsmouth or Paducah, suggests that when the closure and decontamination activities needed to permit transport between sites are eliminated, the likely cost for removal of a large converter will be between $4,000 and $5,000; considerably less than either the $16,000 postulated by Ebasco or the $33,000 postulated by TLG. Using this newer estimate, converter removal costs would be between $20 million and $25 million for the Oak Ridge GDP, compared with the $62 million estimated by Ebasco, and the $145 million estimated by TLG.

The wide difference in structure decontamination costs in the Ebasco and TLG estimates appears to arise from the TLG assumption that all walls and ceilings are contaminated, and the costs for decontaminating these surfaces are much higher than for floors. The average TLG unit cost factor for building decontamination is $48.57/ft2 of surface. The Ebasco average unit cost factor is $15.06/ft2 of surface, which is more representative of floors only.

TABLE 4-5 Principal Cost Drivers for the Oak Ridge GDP (billions of 1992 dollars)

|

|

Ebasco |

TLG |

||

|

Cost Element |

Cost |

Percentage of Total Estimate |

Cost |

Percentage of Total Estimate |

|

Remove equipment from structures |

1.25 |

23.1 |

1.55 |

30.1 |

|

Construct and operate the new facilitiesa |

2.10 |

38.9 |

1.45 |

28.2 |

|

Decontaminate the empty structuresb |

0.26 |

4.8 |

0.83 |

16.1 |

|

Indirect staffing |

1.44 |

26.7 |

0.69 |

13.4 |

|

Waste management |

0.35 |

6.5 |

0.63 |

12.2 |

|

Total base cost |

5.40 |

|

5.15 |

|

|

a Includes high- and low-assay decontamination facilities and administration building. b Includes floors, walls, ceilings, and building structural members. |

||||

TABLE 4-6 Comparison of Estimated Costs for Equipment Removal and Decontamination Activities at the Oak Ridge GDP (millions of 1992 dollars)

|

Component |

Ebasco |

TLG |

|

Fire protection |

78 |

36 |

|

Converters |

62 |

145 |

|

Process piping |

215 |

63 |

|

Light fixtures |

3.2 |

9.3 |

|

Electrical raceways |

12.2 |

85 |

|

Building decontamination |

260 |

830 |

As discussed in Chapter 6, the waste management costs estimated by Ebasco were inflated by the arbitrary selection of small waste containers for which list price was paid and by the construction and operation of multiple waste processing and disposal sites. The TLG estimated waste management costs were inflated by lack of volume reduction of equipment, by the long transport distance to the low-level radioactive waste disposal site, and by construction and operation of multiple waste processing facilities.

Two general observations can be made, based on the above discussion. First, careful attention must be paid to the detailed development of the many unit cost factors used in the analyses to ensure that these factors are reasonable; even small errors in these factors are important because of the many units to be dealt with in these huge facilities. Second, the size of the support staff and services, which represents about 27 percent of the Ebasco and 13 percent of the TLG base cost, should be minimized to the extent possible.

Time Profile Of Income And Expenditures For The D&D Fund

EPACT, which set forth the conditions for privatizing the U.S. gaseous diffusion enrichment facilities, established a fund for the D&D of the GDPs. EPACT also provided for the remediation of the sites and provided the government's share of the remediation costs at a number of sites that produced uranium and thorium for the government's nuclear energy programs in the past to the extent that available funds will allow.

As noted in Chapter 1, EPACT called for deposits to the D&D Fund of $480 million per fiscal year (to be annually adjusted for inflation) for 15 years, for a total of $7.2 billion (1992 dollars). The nuclear electric utilities that had utilized the products of the enrichment facilities in the past were required to provide funding of up to $150 million per year for 15 years, for a total of $2.25 billion (1992 dollars). To make up the balance, the federal government was to make appropriations of $330 million (1992 dollars) annually for 15 years. The fund is also limited in how much can be expended from it each year; namely, the annual government appropriation (supposedly $330 million) or the balance contained in the fund, whichever is less.

During fiscal years 1993 and 1994, the fund received electric utility payments of $303 million and government appropriations of $198 million and received interest payments on its assets of $10 million (Fulner, 1994). During those 2 years, the fund dispersed $165 million for environmental restoration projects, including remedial action and D&D projects (DOE-OR, 1994). Future utility contributions are uncertain. For example, a recent court decision ordered DOE to refund $15 million, with interest, to Yankee Atomic. The utility had paid $15 million into the D&D Fund because their plant had been permanently shutdown prior to enactment of EPACT and because their enrichment contracts had been on a fixed-price basis (Newman, 1995).

The postulated annual expenditures and the number of years of duration of the D&D projects at the GDPs are given in the Ebasco, TLG, and SAIC cost estimates (DOE, 1991a,b; 1992). Ebasco forecast an average spending rate of $420 million per year for 38 years, for a total of $16.1 billion in 1992 dollars. TLG forecast an average spending rate of $800 million per year for 17.5 years, for a total of $13.9 billion in 1992 dollars. SAIC forecast an average spending rate of $365 million per year for 26 years, for a total of $9.5 billion in 1992 dollars.

Comparing these estimated expenditures with the level of funding proposed for the D&D Fund shows that the fund would be inadequate to cover just the costs of D&D of the GDPs, without considering the expenditures being made for remedial actions at several other sites—even if the federal government were to make its payments into the fund regularly. Thus, it appears that controls will be required on expenditures from the fund to ensure that at least some of the needed funds will be available when D&D of the GDPs begins.

Estimating U.S. GDP D&D Costs From Capenhurst D&D Costs

Valuable experience has accumulated through the D&D of nuclear fuel processing plants and nuclear power stations. The project most relevant to the U.S. enrichment plants is the D&D of the Capenhurst GDP in the United Kingdom (see Chapter 3 for more on the technologies used at Capenhurst and Appendix H for additional detail on its D&D). Although Capenhurst was a foreign plant, its D&D planning and execution nevertheless provide a roadmap for developing an effective management approach, selecting appropriate D&D techniques, and estimating the cost of the D&D for the U.S. enrichment plants (Clements, 1994a, 1993).

Capenhurst Plant Description

The Capenhurst GDP was a uranium enrichment facility operated by BNFL from 1956 to 1982. The facility produced highly enriched uranium for military purposes and low-enriched uranium for commercial nuclear power reactors. D&D was initiated following plant shutdown in 1982, with completion scheduled for late 1995.

The Capenhurst enrichment cascade consisted of 4,808 stages, each containing a converter housing the diffusion barrier material that separates the 235U and 238U isotopes, a compressor and associated drive motor, a cooler, and interstage piping and valves. Cascade components were housed in a single process building 1,200 m long by 150 m wide. The 4,808 stages were on the ground floor, and auxiliary equipment (such as electrical systems and heating, ventilation, and air conditioning systems) was located on the second floor. There were seven different sizes of converters and compressor drive motors, the latter ranging up to 300 hp. The cascade equipment was arranged in process cells containing 8 to 12 stages each.

Although the physical size of the Capenhurst plant was substantially smaller than the U.S. GDPs, there are many similarities between these facilities:

- similar process flowsheets and cascade arrangement;

- multistory, steel-frame and concrete buildings with transite siding;

- stages grouped into cells;

- Freon®-cooled stages;

- same species of radiological contamination, including uranium (depleted through fully enriched), 99Tc, and 237Np;

- large quantities of hazardous materials, such as asbestos and polychlorinated biphenyls (PCBs), and Freon®;

- mixture of aluminum and nickel-plated stage components;

- steam-heated autoclaves for feed vaporization; and

- purge cascade for removal of light gases.

The principal differences between Capenhurst and the U.S. GDPs are the following:

- Physical size and separative work capacity of the U.S. plants are substantially larger, by a factor of five or six.

- Most of the large interstage piping at Capenhurst was aluminum, whereas U.S. GDPs use nickel-plated steel exclusively.

- U.S. GDPs have a larger number of support facilities requiring D&D than did Capenhurst.

- Capenhurst cascade equipment was located on the first floor of the process building, whereas such equipment is located on the second floor in the U.S. plants.

- A part of the Capenhurst site is to be used for other enrichment activities; no return to greenfield status is assumed for the entire site; it is not certain whether the U.S. GDPs will be cleaned to greenfield status.

Capenhurst Project Description

A great deal of effort went into researching and developing cost-effective methods for the Capenhurst D&D, including the following:

- selection of a cost-effective and safe means of disassembling the plant;

- suitable size-reduction techniques and compatible ventilation/filtration systems;

- decontamination processes to deal specifically with transuranic and fission products on steel, aluminum, copper, and other metals;

- engineering of safety into process equipment;

- ensuring compatibility of waste streams with regulatory constraints; and

- maximizing the recycling of decontaminated materials for the commercial market.

The main objectives of the development activities were to minimize the waste streams resulting from D&D by maximizing recycling of system materials for unrestricted reuse and to find off-the-shelf commercial equipment that, with or without modification, would meet the D&D program needs.

Before shutting down the plant, radiological and criticality data were gathered for use in planning and executing the dismantling, decontamination, and disposal operations. Gaseous decontamination using ClF3 was used to remove the bulk of the residual uranium deposits.

A detailed D&D plan was developed. The initial phase involved cutout, removal, sealing, and outdoor storage of the cascade components, which allowed part of the process building housing the cascade to be demolished, and the land was reused for siting a gas centrifuge enrichment facility. Other parts of the process building were reused to house equipment for size reduction, chemical decontamination, and melting of metal pieces that were difficult to decontaminate.

The D&D was accomplished with a relatively small health physics staff. Capenhurst health physicists participated extensively in the D&D planning effort. Procedures were written defining the health physics requirements for the various D&D operations. D&D workers were then thoroughly trained to qualify them to perform the work according to these procedures and make the surveys necessary to ensure protection of worker health and safety. Health physics support required during D&D execution was, therefore, minimal during routine operations. Health physicists were consulted from time to time to address special problems. Very low-levels of exposure were experienced by the work force. (For example, the mean total dose for 1993 was 0.03 mSv; see Appendix H.)

The decontamination and disassembly process consisted of the following activities:

- build small special shops within existing structures for removal of high-assay material;

- gaseous decontamination, prior to plant shutdown, to convert solid uranium deposits, primarily UO2F2, to volatile fluoride compounds for removal in the gaseous phase;

- plant characterization to identify and quantify residual deposits of radioactive materials;

- removal of nonradioactive hazardous materials, such as asbestos and PCBs;

- removal and interim storage of plant equipment, and removal of cell structures;

- size-reduction of components and dry mechanical removal of uranium deposits;

- aqueous chemical decontamination;

- melting of metals that were difficult to decontaminate;

- removal of process and ancillary building structures; and

- disposal of radioactive and hazardous wastes.

Many plant materials, such as structural steel and concrete, required only minimal decontamination before disposition.

Estimating Oak Ridge Costs by Scaling Capenhurst Costs4

Because the technology used in the Capenhurst plant is very similar to that in the U.S. enrichment plants, the reported D&D costs at Capenhurst can be scaled to estimate the costs for D&D at the Oak Ridge GDP. The reported total cost (funds expended) of the Capenhurst D&D project (£86 million) are broken down into 12 cost elements in Table 4-7. Adjusted for currency exchange rates and inflation to 1994 dollars, the £86 million becomes $160 million (Clements, 1994a,b; Lobsenz, 1995). The adjusted cost elements themselves are then scaled to estimate D&D costs for the Oak Ridge GDP using ratios appropriate for each cost element, as described below.

Some of the cost elements are related to the amount of process equipment (converters, compressors, piping) in the plant. To approximate this ratio of Oak Ridge to Capenhurst equipment, the weights of converter shells are used, derived from data in Table 4-8 and from the following text. The number of converters in the Capenhurst plant was 4,808 with a total weight of 14,300 tons, and the fraction of converter weight from converters having steel shells is 0.33 (Clements, 1995). The converter shall weights are used as surrogates for equipment volumes, hazardous and radioactive waste volumes, pretreatment surface areas, disassembly labor, and equipment surface areas decontaminated, as described later in this section. It is necessary to adjust the weight of the Capenhurst aluminum shells to the weight those shells would be if they were made of steel because all of the Oak Ridge GDP shells are made of steel. This adjustment is made by calculating the weight of the aluminum shells and multiplying that weight by the ratio of densities (steel, 7.86 g/cm3; aluminum, 2.7 g/cm3). The weight of the Capenhurst shells, steel plus adjusted aluminum, is found to be 25,933,334 lb and the weight of the steel shells at the Oak Ridge GDP is 57,053,640 lb. The resulting ratio of shell weights (Oak Ridge to Capenhurst) is 2.20.

Other cost elements are proportional to the areas of the surfaces in the structures, and most are affected by the difference in direct labor rates at Capenhurst and in the United States. The derivations of all of the appropriate scaling factors are presented in the following paragraphs and are applied to the Capenhurst cost elements in Table 4-7 to develop a cost estimate of the cost of D&D at the Oak Ridge GDP. The estimated Oak Ridge GDP costs are then multiplied by the ratio of the D&D cost for all three GDPs to the Oak Ridge GDP cost, based on the Ebasco cost estimate, to estimate the cost of D&D for the total U.S. GDP complex.

TABLE 4-7 Scaling of Capenhurst Costs to Estimate D&D Costs for the Oak Ridge GDP

|

|

Capenhurst |

Oak Ridge Estimate |

||

|

Cost Element |

(million £) |

(million $)a |

Scaling Factorb |

(million $) |

|

Pretreatment |

2 |

3.72 |

2.00 |

7.44 |

|

Planning and management |

10 |

18.60 |

1.80 |

33.49 |

|

Technology development |

17 |

31.63 |

1.50 |

47.44 |

|

Characterization |

2 |

3.72 |

3.885 × 1.35c |

19.52 |

|

Disassembly |

20 |

37.21 |

3.144 × 1.35c |

157.93 |

|

Removal and treatment of hazardous materials |

2 |

3.72 |

2.20 × 1.35c |

11.05 |

|

Decontamination |

10 |

18.60 |

2.598 × 1.35c |

65.25 |

|

Metal melting |

2 |

3.72 |

6.76 × 1.35 |

33.96 |

|

Health and safety |

2 |

3.72 |

3.885 × 1.50 |

21.68 |

|

Monitoring (including analytical) |

7 |

13.02 |

3.885 × 1.35 |

68.30 |

|

Radioactive waste treatment and disposal |

3 |

5.58 |

22.38; 447.57 |

|

|

Overhead |

8 |

14.88 |

1.50 |

22.33 |

|

Total |

86 |

160.0 |

|

|

|

a Escalated to 1994 pounds Sterling converted to dollars using a currency conversion of $1.60 per pound Sterling. b The number of significant figures shown is for computational accuracy and does not imply precision to that many significant figures. c This 1.35 factor is the ratio of wage rates for Oak Ridge to Capenhurst. d This 1.35 factor is the ratio of low-level waste disposal rates in the United States and the United Kingdom (see text). e Assumes 95% recycle, 5% waste as at Capenhurst (see text). f Assumes 0% recycle, 100% waste. SOURCE: Clements (1994a,b); Lobsenz (1995). |

||||

TABLE 4-8 Weight of Process Equipment at the Oak Ridge GDP

|

|

Type of Converters (size) |

||||

|

|

"25"a |

"27" |

"0" |

"00"b |

"000"b |

|

Number of converters |

3,018 |

540 |

300 |

600 |

640 |

|

Weight of a unit (lb) |

7,392 |

10,175 |

24,820 |

26,890 |

63,500 |

|

Weight of all units (tons) |

11,154 |

2,747 |

3,723 |

8,067 |

20,320 |

|

Total weight |

46,011 tons = 92,022,000 lb |

||||

|

Shell weight |

0.62 × 92,022,000 lb = 57,053,640 lb |

||||

|

a Comprised of four sizes (1, 2, 3, 4). b Average weight for "00" and "000" converters may actually be somewhat higher, but there are actually many weights depending on components used during assembly. SOURCE: Person (1995); MMES (1992). |

|||||

The ratio of floor surface areas of the Oak Ridge to Capenhurst buildings is another important parameter in some of the scaling factors (250.2 acres/64.4 acres = 3.885). The direct labor rates also influence many of the cost elements. From the 1991 Ebasco estimate, the fully burdened direct labor cost (including all the indirect costs and fees identified in Table 4-4) is about $60,540 per person per year, while the same cost for the Capenhurst operations was about $45,000 per person per year, with a resulting scaling factor of 1.35.

Assuming that the pretreatment process uses the mobile gaseous ClF 3 system postulated in the Ebasco estimate, the corresponding materials costs (proportional to equipment internal surface area) and labor costs comprise about 76.7 percent and 23.3 percent of the total, respectively. Thus, the pretreatment scaling factor is (0.767)(2.200) + (0.233)(1.350) = 2.00.

Planning and management costs are scaled by the ratio of exempt labor costs ($150,000/person year at the Oak Ridge GDP and $100,000/person year at Capenhurst), or 1.5. This cost element is also increased by the much larger number of buildings to be handled in the U.S. GDPs. However, because the buildings are so similar, an increase of about 20 percent is postulated to be adequate. Thus, the total scaling factor becomes 1.5 × 1.2 = 1.8.

Technical development costs are scaled by the ratio of exempt labor costs, 1.5, and characterization costs should be proportional to the ratio of building floor surface areas, 3.885.

Disassembly costs should be proportional to the amount of process equipment disassembled and to the amount of building support equipment disassembled. From the 1991 Ebasco estimate, the fraction of total disassembly cost due to process equipment is about 0.44, and the fraction due to building support equipment is about 0.56. Thus, the scaling factor is (0.44)(2.200) + (0.56)(3.885) = 3.144.

The scaling factor for hazardous materials removal and treatment is assumed to be proportional to the amount of asbestos present, which is proportional to the amount of process equipment, represented by the scaling factor 2.200.

Decontamination should be proportional to the amount of process equipment cleaned and to the amount of building surface cleaned. From the 1991 Ebasco estimate, the fractions of decontamination costs arising from process equipment and from building floor surfaces are about 0.764 and 0.236, respectively. The resulting scaling factor is (0.764)(2.200) + (0.236)(3.885) = 2.598.

Metal melting costs should be proportional to the amount of metal melted. Assuming the same fractions of total metal are melted at both locations, the scaling factor is the ratio of the full-density volumes of metals from the plants (see Table H-3 in Appendix H) or 6.76.

Health and safety activities should be proportional to the total size of the plants, or the plant floor areas, 3.885.

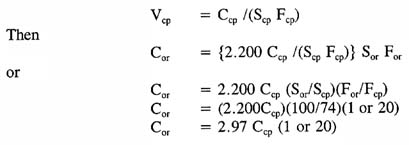

The radioactive waste disposal costs at Capenhurst (cp) and at Oak Ridge GDP (or) can be expressed by

where V is the volume of waste generated, S is the unit cost for disposal (in $/ft3), and F is the fraction of the total waste generated that is disposed of in a low-level radioactive waste disposal facility, with the rest of the waste having been cleaned and recycled. The volumes of waste generated are proportional to the quantity of process equipment, that is, Vor = 2.200 Vcp, and

The third factor in the equation (100/74 = 1.35) is based on an assumed average disposal charge for low-level radioactive waste disposal in the United States of $100/ft3 and in the United Kingdom of $74/ft 3.5 The last term in the equation is 1 when the same fractions (assumed to be 5 percent) of waste are disposed and is 20 when all of the Oak Ridge GDP waste from D&D

is disposed (100/5). Because disposal rates dominate this cost element, the differences in direct labor rates are neglected.

Table 4-7 shows the scaling factors and the costs for the D&D of the Oak Ridge GDP derived using these scaling factors. The resulting total cost for the Oak Ridge GDP, based on scaling the Capenhurst costs by appropriate factors, is about $510 million when 95 percent of the waste is recycled, and about $936 million when none is recycled. To estimate the cost for D&D of the total U.S. GDP complex, the cost derived for the Oak Ridge GDP is multiplied by the ratio from the Ebasco cost estimates for Oak Ridge to that of the total GDP complex, namely 2.17, which yields estimated costs of about $1.11 billion or $2.03 billion, respectively, for the recycle and no-recycle cases for the whole U.S. GDP complex.

The committee recognizes that using simple ratios of quantities to make an order-of-magnitude estimate of the cost of D&D for a much larger plant such as the Oak Ridge GDP is a very simplified approach to a complex comparison with many uncertainties. This approach understates the Oak Ridge D&D costs somewhat because this plant has substantially more ancillary facilities and structures than does Capenhurst. The size of the equipment at Oak Ridge is considerably larger, and the base cost at Capenhurst reflected the savings that resulted from recycling decontaminated materials. On the other hand, factoring should clearly overstate the Oak Ridge D&D costs because it does not reflect the potentially significant cost savings associated with economies of scale. In any event, it is not readily apparent to the committee why the current U.S. cost estimate should be from 8 to 15 times larger than the cost obtained by scaling the Capenhurst cost according to plant size and material quantities.

Although this very simplified factoring of the Capenhurst estimate is clearly no substitute for a detailed cost comparison, it nevertheless provides a reasonable approximation for the potential cost reductions that might be achieved in the U.S. GDP D&D program.

The Shippingport Reactor D&D Project

The Shippingport Atomic Power Station consisted of a four-loop nuclear steam supply system, a radioactive waste processing facility owned by DOE, and a 100 MW (electric) turbine-generator and balance-of-plant owned by Duquesne Light Company. The station, located 35 miles north of Pittsburgh, Pennsylvania, was shut down in 1982 and defueled in 1984. Planning for D&D began in 1979 and was completed in 1984. Actual D&D began in 1985 and was completed in 1990. This project is an example of a successful DOE D&D project, in that it was completed ahead of schedule and below budget (Murphie, 1991).

The decommissioning operations were managed by General Electric, the decommissioning operations contractor, which reported directly to DOE, without any management and operating contractor on the site. Much of the active D&D effort was carried out by fixed-price subcontractors. The Shippingport Station Decommissioning Project was estimated to cost $98.3 million and take 5.5 years. It was completed 6 months ahead of schedule at a cost of $91.3 million, $7 million under budget (Crimi, 1987, 1988a, 1988b, 1992, 1994).

The Shippingport project posed management and technical challenges similar to those that will be faced in D&D of the U.S. GDPs, including removal of hazardous materials, such as asbestos and PCBs, and fluids processing to remove radioactive contaminants. The principal differences are the much larger scale of the GDP D&D, the possibility of a criticality accident at the GDPs, and the repetitive nature of the GDP systems and structures that would permit more extensive use of robotics and automated systems. Three important lessons were learned from the Shippingport project: careful planning and preparation avoid undue delays and work interruptions and are cost effective; simplifying the project organizational structure is cost effective; and, finally, using available commercial technology to the greatest extent possible also saves money and time. These lessons are directly applicable to the D&D of the GDPs.

Conclusions And Recommendations

Previous D&D Cost Estimates

Conclusions

- The cost estimates were developed for a defined scenario, apparently without using tradeoff studies to determine the most cost-effective approaches for D&D. Thus, many of the scenario bases are less than optimal, resulting in high cost estimates.

- The Ebasco and TLG estimates were based on a common inventory of buildings and equipment and arrived at similar results. However, this agreement appears somewhat fortuitous considering the wide differences between the unit cost factors and the waste treatment and disposal assumptions. Both estimates ignored the potential cost and schedule reduction from productivity increases that characteristically result when performing repetitive activities. Also, the staffing levels postulated in both estimates appear excessive, reflecting the generally very conservative unit cost factors developed and used in the analyses.

- The largest single element in the cost estimates is the construction and operation of low- and high-assay decontamination facilities, an assumption that represents 30 to 40 percent of the total D&D cost and reflects the large size of the structures, the multiplicity of decontamination and volume-reduction technologies postulated to be used in them, and the very large staffs assumed to operate these processes. Apparently, the choice was made in the Ebasco study to include these large, new facilities without any tradeoff evaluations to determine the optimal processes to be used or whether it was feasible to use existing structures to house the decontamination and volume-reduction processes.

Recommendation

Tradeoff evaluations to determine optimal D&D processes and the feasibility of using existing structures should be performed to help establish the technical baseline for the project prior to beginning detailed planning and cost estimating for D&D of the GDPs.

Cost to D&D the GDPs

Conclusion

Previously estimated D&D costs for the three U.S. GDPs range from about 60 to 100 times the expected final cost of $160 million for the D&D of the Capenhurst GDP (over 90 percent complete at the end of 1994). Considering that the size of the three GDPs combined is only about 10 to 12 times larger than Capenhurst in physical size, the previous U.S. estimates appear extremely high.

Recommendation

DOE should very carefully review its earlier estimates and have a new cost estimate developed that would evaluate the various opportunities for cost reduction identified in this report (see Chapter 6) and should incorporate those approaches that appear most cost effective. The cost-estimating methodology used should incorporate recent advances in sensitivity analysis to calculate the influence of alternative assumptions and their probability distributions on the estimated total cost of D&D.

Adequacy of the D&D Fund

Conclusion

The planned cash flows into the D&D Fund of $480 million per year for 15 years, for a total of $7.2 billion, will not be sufficient to support the expenditures projected in the Ebasco, TLG, or SAIC cost estimates, even without taking into account the ongoing expenditures from the fund for various remediation activities throughout the GDP complex. It appears almost certain that the fund will be expended well before the GDPs can be completely decommissioned or that the D&D must be completed for far less than indicated by any of the previous cost estimates. Thus, it would appear prudent to consider proceeding in a stepwise manner, accomplishing the most important D&D tasks (from a cost and risk viewpoint) first, and continuing with tasks of less immediate importance as funds become available.

Experience from Other D&D Projects

Conclusion

DOE's preparation of a new cost estimate to evaluate alternative approaches to D&D of the GDPs should focus on four essential activities:

- establishing the basic D&D criteria, and conducting tradeoff studies and demonstration programs to select the most cost-effective technologies;

- preparing a detailed D&D execution plan;

References

Baxter, S.G. and P. Bradbury. 1991a. Decommissioning of the Gaseous Diffusion Plant at BNFL (British Nuclear Fuels Limited) Capenhurst (undated). Chester, United Kingdom: BNFL.

Baxter, S. G. and P. Bradbury. 1991b. BNFL's Capenhurst Diffusion Plant Decommissioning. Chester, United Kingdom: BNFL.

Clements, D.W. 1993. BNFL Capenhurst works. Minimizing nuclear waste by special recovery techniques. Presented at the 4th International Environmental and Waste Management Conference, held April 18–21, 1993 in Knoxville, Tennessee.

Clements, D. 1994a. Capenhurst Diffusion Plant Decommissioning, BNFL, Enrichment Division. Presented to the Committee on Decontamination and Decommissioning of Uranium Enrichment Facilities, National Academy of Sciences, Washington, D.C., March 28, 1994.

Clements, D. 1994b. Personal communication from D. Clements, BNFL, to Ray Sandberg, July 11, 1994.

Crimi, F. 1987. Physical decommissioning of the Shippingport Atomic Power Station. ANSAO 54. P. 42 in the Proceedings of the Fuel Cycle and Waste Management Session of the American Nuclear Society Fuel Cycle and Waste Management Conference held June 7, 1987 in Dallas, Texas. La Grange Park, Illinois: American Nuclear Society.

Crimi, F. 1988a. Shippingport: A Relevant Decommissioning Project. TANSAO 56. P. 72 in the Proceedings of the 1988 Annual American Nuclear Society Meeting held on June 12–16, 1988 in San Diego, California. La Grange Park, Illinois: American Nuclear Society.

Crimi, F. 1988b. Comparing anticipated and real costs of decommissioning from Shippingport. Presented at a Nuclear Decommissioning Costs and Funding Methods Seminar sponsored by the Northwest Center for Professional Education held April 7–8, 1988 in Arlington, Virginia.

Crimi, F. 1992. Shippingport station decommissioning experience. P. 6.A-1 in the Proceedings of the 8th Pacific Basin Conference held April 12–16, 1992 in Taipei, Taian. Taipei, China: The Nuclear Energy Society.

Crimi, F. 1994. Physical Decommissioning of the Shippingport Atomic Power Station. Presented to the Committee on Decontamination and Decommissioning of the Uranium Enrichment Facilities, National Academy of Sciences. Washington, D.C. June 15, 1994.

DOE (U.S. Department of Energy). 1991a. Environmental Restoration of the Gaseous Diffusion Plants. Technical Summary Document, vol. 1. Oak Ridge, Tennessee: Ebasco Environmental for DOE. October.

DOE. 1991b. Preliminary Cost Estimate for D&D of the Gaseous Diffusion Plants. Document S14-25-002. Bridgewater, Connecticut: TLG Engineering for Systematic Management Services for DOE. September.

DOE. 1991c. Analysis and Review of Detailed Background Information: Ebasco October 16, 1991 Submittal for Decommissioning the Gaseous Diffusion Plants. Washington, D.C.: SAIC (Science Applications International Corporation) for the U.S. Department of Energy. December 19.

DOE. 1992. Working Decommissioning Cost Estimate (WDCE) for The Gaseous Diffusion Plants. Washington, D.C.: SAIC for U.S. Department of Energy. July 10.

DOE-OR (DOE Oak Ridge Operations Office). 1994. Environmental Restoration Projects Paid Out of the D&D Fund, FY 1994 and 1995. Oak Ridge, Tennessee: DOE OR. September 26.

Clinton, W.J. 1994. P. 276 in the Economic Report of the President. Washington, D.C.: U.S. Government Printing Office.

Fulner, J.C. 1994. The D&D Fund. Presented to the Committee on Decontamination and Decommissioning of Uranium Enrichment Facilities, Portsmouth GDP site, Piketon, Ohio, August 23, 1994.

IMF (International Monetary Fund). 1993. International Financial Statistics Yearbook. October.

Lobsenz, G. 1995. BNFL takes aim at multi-billion dollar DOE cleanup market. The Energy Daily. June 23. 23 (120): 3–4.

MMES (Martin Marietta Energy Systems). 1988. Costs for Decontamination and Decommission of Shutdown Surplus Buildings at ORGDP (Oak Ridge Gaseous Diffusion Plant). Oak Ridge, Tennessee: MMES.

MMES. 1992. K-25/K-27 Buildings Historical Characterization. K/D-6052. Oak Ridge, Tennessee: MMES.

McNeill, T.F. and D.S. Clark. 1966. Cost Estimating and Contract Pricing. New York: American Elsevier Publishing Company, Inc.

Murphie, W. 1991. Greenfield decommissioning at Shippingport: Cost management and experience. The Energy Journal. 12:119–132.

Newman, P. 1995. Yankee Atomic wins cleanup case against DOE. The Energy Daily. July 5. 23 (126): 4.

Person, G. 1995. Personal communication from Gary Person, K-25 Decontamination and Decommissioning (D&D) Group, to Richard Smith, October 24, 1995.

Spencer, A. 1988. Decommissioning and decontamination of enrichment facilities. Presentation given to the 15th Annual Meeting of the World Nuclear Fuel Market held October 16-19, 1988 in Seville, Spain.