4

Research

The overarching recommendations in Chapter 2 were developed to enhance the accessibility and relevance, organizational efficiency, institutional strengths, and accountability of LGCA research and education. The recommendations stress broad stakeholder input, regional and multi-institutional approaches, and synergies among teaching, research, and extension. They also put emphasis on outcomes and critical evaluation. In this chapter, the discussion focuses on the research function—specifically on four institutional features of the LGCA research system:

- federal research monies and the share of competitively awarded funds in the total federal support of food and agricultural research;

- the institutional status of the 1890s in research;

- public-private partnering in research; and

- inter- and multidisciplinary research funding.

Alternative models for allocating competitive grant funds for food and agricultural research are also reviewed.

The National Interest

The national interest in maintaining a high-quality, productive research base in food and agricultural sciences is compelling and multifaceted. U.S. consumers are demanding more from the domestic food and agricultural system than the system is accustomed to providing. Aside from wholesome, abundant, and reasonably priced food, consumers expect environmental enhancement, increased food safety and nutritive value, and opportunities for small-scale farmers (Reichelderfer, 1991). These are public goods toward which, historically, only minor proportions of the agricultural research effort have been devoted.

In the 1960s the Green Revolution initiated the use of food crop hybrid varieties and improved management systems, dramatically increasing food grain production. Since then, however, much has been learned about the potential some of the modern production practices have to degrade the natural resources on which food production ultimately relies. Rates of gain in average rice yield have recently slowed throughout Asia; and

yields have actually declined in some countries, despite the continuous introduction of improved rice varieties—a phenomenon thought to be related to the decreasing productivity of intensively cultivated soils (Pingali, 1994). These developments are important because over the next 30 years world population is expected to grow by nearly 100 million people per year, with most growth occurring in developing regions (Prinstrup-Anderson and Pandya-Lorch, 1994).

The United States has provincial as well as altruistic reasons for its interest in preventing world population growth from translating into global poverty, widespread malnutrition, and environmental degradation. Global political, social, and economic stability are necessary for the realization of expanded markets for U.S. industrial as well as agricultural goods. Market expansion relies absolutely on the availability and implementation of technologies and policies that increase agricultural production, while simultaneously enhancing and sustaining social and natural systems. A sound research base is needed as the foundation for development and application of those technologies and policies.

Historically, high social rates of return,1 estimated to be between 30 and 50 percent, have resulted from investment in agricultural research (Alston and Pardey, 1995b). These estimates compare favorably with returns on conventional investments in the private sector (Fuglie et al., 1996), which suggests a system is in place capable of maintaining a high-quality, productive research base in food and agricultural sciences. Yet, challenges and potential opportunities lie ahead as that system adapts to a changing ecology of science, characterized by constraints on federal funding, increased public awareness of social problems that research has been unable to resolve, and consequential public dissatisfaction with science and government (Byerly and Pielke, 1995).

Ensuring a Sustainable High- Quality, Productive System

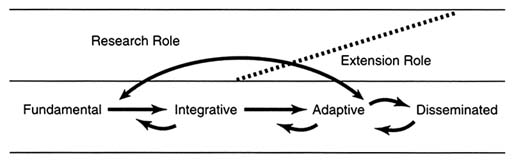

Ensuring a socially, economically, and ecologically sustainable food and agricultural system requires scientific advancements across the entire scope of a discovery-integration-dissemination-application continuum, identified by Boyer (1990). This committee uses "research continuum"—denoting interactions among fundamental, integrative, adaptive, and disseminated research—to refer to what is described by Boyer (1990) and Malone (1994) as the "cascade of knowledge."

Fundamental research on the structure and functions of systems as small as genes, as critical as cells, as complex as organisms, and as large as agroecosystems is the essential basis of the discoveries needed to advance food and agricultural performance.

Integrative research is needed to combine fundamental discoveries and thus gain the comprehensive knowledge required to develop more targeted practices, technologies, or policies. Independent, fundamental research programs have been useful in the discovery of (a) the gene that confers resistance in a particular food crop species to a particular plant disease of viral origin; (b) similar chemical compositions of plant leaves in a variety of wild and cultivated plant species that exhibit natural resistance to viral plant pathogens; (c) disease-resistance characteristics of crop species bred for high yields; and (d) the relative, economic values of different attributes of crop species' varieties. These separate discoveries by scientists in different disciplines (genetics, plant physiology, crop breeding, and economics) have their greatest potential value realized when related to one

|

The Cascade of Knowledge Sustainable human development is the basic goal of advancing knowledge and education. The "cascade of knowledge" is the essential operating principle for assuring that research and education work toward that goal. An overarching challenge for the twenty-first century will be to manage human affairs on planet Earth in a manner that will enable … sustainable human development. Sustainable human development is characterized by economic growth that emphasizes the quality rather than the quantity of that growth. It distributes equitably the benefits of that growth. It … regenerates rather than degrades the life-supporting capacity of the environment. Human progress on planet Earth is presently on a path of exponential and asymmetric demographic and economic growth that is unsustainable, inequitable, and unstable. Critical factors in reconciling needed and equitable economic growth with maintenance of global environmental quality are: rates of population growth and gains in economic productivity; the distribution of these rates among … countries; the efficiency of the technological infrastructure that converts natural resources into goods and services; and the behavior of individuals and institutions in the socioeconomic system who consume those products and utilize those services. Each of these factors is powerfully influenced by the cascade of knowledge. This cascade consists of the discovery, integration, dissemination, and application of knowledge concerning the nature and interaction of matter, energy, living organisms, information, and personal behavior. A global knowledge strategy is needed to develop this cascade worldwide. The strategy will require unprecedented collaboration among the physical, biological, and social sciences, engineering, and the humanities. New modes of communication and cooperation will be required among: academia; business and industry; … government; private organizations; and individuals at the grass-roots. The mission of institutions of higher education involves knowledge in all of its aspects. They, therefore, have a special opportunity and responsibility to exercise leadership in the development of a global knowledge strategy (based on the cascade of knowledge and dedicated toward human sustainable development). SOURCE: Malone, T. F. 1994. Sustainable Human Development: A Paradigm for the 21st Century. Paper developed for the National Association of State Universities and Land Grant Colleges. Research Triangle Park, N.C.: Sigma Xi Center. |

another in exploring alternative avenues for making crops more disease resistant without sacrificing other valued characteristics.

Adaptive research is needed to apply the findings of integrative research to actual production, processing, marketing, consumption, or environmental systems. This will result in development and testing of specific, practical solutions to existing food, agricultural, or natural resource problems. For instance, it is known that adding the intestinal enzyme, phytase, to poultry or hog feed can decrease the amount of phosphorus in animal excretions and thus reduce the environmental threat posed by animal waste.

Research is still needed, however, to identify such things as the best delivery system for phytase and the implications of its use in determining optimal agronomic (or maximum legal) rates of manure spreading on crop fields. Adaptive research is essential to determining the institutional arrangements affecting distribution of costs and benefits of phytase use among contract hog or poultry producers, firms that integrate production, processing and marketing of pork and poultry products, and consumers of both meat products and environmental goods.

Dissemination of the fundamental, integrative, and adaptive research assures that the innovations and applications discovered thereby are transferred to those individuals, groups, firms, or government bodies that can use them to accomplish personal and collective benefits.

The research continuum is not strictly linear. Feedback can and must occur, for example, when adaptive research indicates there is a critical gap in fundamental knowledge or when an integrative research result directly alters the value of disseminated research (Figure 4-1). The feedback loops on which the research continuum or "cascade of knowledge" rely directly depend on the integration of research and extension throughout a large area of the continuum (see Recommendation 4). For that reason, the committee consciously avoids contrasting the value of or need for basic or fundamental research with that of applied research; the argument itself is without value. The benefits of fundamental research to society cannot be realized without follow up through integrative and adaptive research. In turn, applied research relies on new discoveries and, itself, discovers new needs for fundamental investigation.

The Federal Role

As discussed in Chapter 2, federal support is needed for and should be targeted to research that results in the provision of public goods that cross or transcend political boundaries. Basic or fundamental research meets the public-goods criteria because it creates new knowledge that is generic, nonappropriable, and openly available, and it may be done with no specific application in mind (National Academy of Sciences, 1995). Integrative, adaptive, and disseminated research directed at the provision or enhancement of public goods, such as environmental quality, public health and safety, equity and economic opportunity, and informed public decision making, also meet the public-goods criteria. Federal support may be justified also when the commercial markets for the research products are too small for adequate private gain or when the private sector's incentive to invest in research is otherwise low in relation to the anticipated benefits to producers and consumers. There are multiple public funding sources for basic biological science research (for example, National Science Foundation [NSF] and National Institutes of Health [NIH]) and the private sector is most likely to pursue or support adaptive research with commercial potential; therefore, the committee believes there is a special need for further federal support of integrative research in the continuum of food and agricultural systems research.

FIGURE 4-1 The research continuum.

Data are not available to determine the percentage of agricultural research expenditures allocated to fundamental, integrative, adaptive, or disseminated research categories. The CRIS system, however, does stipulate that research investigators should report how much of each research project is basic research and how much is applied research. The data show that applied research accounts for more than one-half of the LGCA research conducted with formula funds, congressionally designated special research grants, state appropriations, and industry grants. On the other hand, LGCA research conducted with USDA-administered competitive grants and other federal agency grants is much more heavily weighted toward basic research (Ballenger and Kouadio, 1995).

Structure And Performance Of The Current Land Grant Research System

The fundamental structure for the research system based in the land grant colleges of agriculture was established in 1887 by the Hatch Act. It is stated in that act that general, federal research support would be routinely provided to state agricultural experiment stations and administered through USDA. Such is still the case, and legislated formulas established in 1955 for federal research fund allocation also remain in effect today (National Research Council, 1995a). There have been, however, significant changes: the addition of "special grants" program funds in 1965 (Public Law 89-106) and the initiation of a Competitive Research Grants program in 1977 (Title XIV of the National Agricultural Research, Extension, and Teaching Policy Act)—awards not limited to the experiment stations. The Food, Agriculture, Conservation, and Trade Act of 1990 (the 1990 farm bill) expanded the competitive grants program by creating the NRI.

What is important now is whether this long-lived structure and the institutional arrangements influencing the nature, quality, and direction of LGCA research are still adequate and appropriate. Can this structure meet the research challenges of the future, federal budget problems, and growing demands for accountability?

Federal Research Funds and Allocation Mechanisms

Federal research and development (R&D) funds totaled $69 billion in 1994. Less than $1.5 billion (approximately 2 percent of total federal R&D or $6 per person) was used for R&D conducted or administered by USDA (Table 4-1). Evidence from the economics literature of the high social rate of return flowing from investments in agricultural research, coupled with the sizeable national interest in the performance and sustainability of the U.S. food and agricultural system, suggest the nation's investment in agricultural research is indeed a modest one.

Of total USDA-administered support for agricultural research in 1994, roughly 70 percent supported intramural research and information activities of USDA agencies, 15 percent was allocated by formula to the LGCAs and their experiment stations, and less than 7 percent was awarded competitively to institutions including but not restricted to experiment stations (Table 4-1). Compared with research administered by other federal agencies, USDA-administered R&D funding is distinguished in three ways. First, it is the only federal research funding of which a portion is distributed to a fixed number of institutional recipients by a formula. Second, compared with federal support of research designated for generating knowledge in basic science, medicine, energy, and the environment, the proportion of competitively awarded agricultural funding is exceptionally small. Only the Department of Defense has a smaller proportion of "merit reviewed" and competitively awarded research funding. Finally, of the agencies shown in Table 4-1, USDA has, by far, the largest intramural proportion of federal R&D expenditures.

The fact that 15 percent of competitively awarded federal funds are allocated by formula to the experiment stations is part of the reason for the small proportion of those total funds for agricultural research. The historical and continuing rationale for formula funding is that it assures the pursuit of food and agricultural research, which often has site-specific requirements, across all states whose economies rely on agricultural production and rural vitality and contribute to the nation's food supply. The distribution of this

TABLE 4-1 Federal Agency Research and Development Support, 1994

|

Agency |

Total for R&D and R&D Facilities ($million)a |

Allocated via Merit Review and Competition (percent)d |

|

|

U.S. Department of Defensee |

35,800 |

26 |

5.2 |

|

U.S. Department of Health and Human Servicesf |

10,697 |

21 |

79.0 |

|

U.S. Department of Energy |

6,880 |

21 |

46.0 |

|

National Science Foundation |

1,984 |

2 |

98.0 |

|

U.S. Department of Agriculture |

1,484 |

70 |

6.6 |

|

U.S. Environmental Protection Agency |

440 |

25 |

19.0 |

|

Total |

68,923 |

28 |

36.0 |

|

a Actual outlays for 1994, as reported in tables developed by the Office of Management and Budget (OMB), Budget Analysis and Systems Division (January 30, 1995). b Calculated from data in Table C-9, Federal Funds for Research and Development, Vol. 42, Fiscal years 1992, 1993, 1994, National Science Foundation, NSF 94-328. c It should be noted that some intramural research funds do get allocated to academic and other research institutions via agency contracts and cooperative research agreements. d Calculated from OMB data, Budget Analysis and Systems Division (January 30, 1995), reporting "merit reviewed scientific research with peer evaluation and competitive selection." Includes intramural research meeting this criteria, as well as (mostly) extramural research. e Military agencies. f The National Institutes of Health (NIH) alone represents 94 percent of HHS obligations for R&D; and intramural research represents 19 percent of NIH R&D. NIH's own data show the total for R&D and R&D facilities to be $10,328,117 ($million), of which 11 percent is intramural research (i.e., NIH data show a smaller percentage of intramural funding [National Institutes of Health, 1994]). |

|||

funding is based on a formula related to farm and rural populations (National Research Council, 1995a). Formula funding contributes to the diffusion throughout the nation of food and agricultural system research and also has other advantages.

- The stability and flexibility of research supported by formula funding facilitates pursuit of long-term research goals and multidisciplinary and extradisciplinary research. Some argue that such research is unlikely to be requested through current competitive granting vehicles, which provide shorter-term funding specific to topical areas that shift over time according, in part, to the scientific and political popularity of researchable issues. A special class of long-term research particularly important in agriculture is "maintenance research," which is required to reinvigorate past research gains that over time have deteriorated. For example, new plant varieties may perform well for several years but then yield less as predatory insects or diseases evolve (Blakeslee, 1987). One study indicates that maintenance research accounts for as much as one-third of all production-oriented agricultural research in the United States (Adusei and Norton, 1990).

- Formula funding has permitted the evolution, peculiar to LGCAs, of a system in which the time and effort of many faculty appointments are split among some combination of research, extension, and teaching. Those faculty whose research appointments are wholly or partially funded by federal formula funds and/or their state matching funds, who also have extension or teaching appointments or both, automatically manifest an inherent linkage of research with ongoing extension and teaching activities. This close, structural linkage of individual researchers, and the experiment stations where they work, to extension and teaching responsibilities is a unique and valued feature of the LGCA-based agricultural research system. When it works (and the pressures on those linkages were discussed in Chapter 2), it facilitates development of a cascade of knowledge.

- The availability of stable research funding through formula allocation reduces the proportion of researchers' time spent applying for competitive grants. Because grant application processes are time consuming and can have low rates of success, formula funding means that relatively more of a researcher's time can be devoted to actually performing the funded research (Huffman and Evenson, 1993).

On the other hand, noncompetitive funding, by formula or congressionally designated special grants, is inherently inequitable, inefficient, and lacking in accountability.

- The exclusion of research institutions other than the experiment stations from more than $200 million in federal agricultural research funds is unfair. Equally important, it precludes a completely efficient process for matching those researchers uniquely qualified to address specific food and agricultural problems with the funding to address those problems (Alston and Pardey, 1995).

- Formula funds and special grants have carried with them no effective means for accountability in terms of how they have been used by state institutions or whether they have been devoted to research issues that justify federal support. There is no generally accessible public record, including the CRIS system, that documents and provides a rationale for the specific uses of formula funds by the experiment stations.

- Research conducted with formula and special grant funds is not automatically subject to peer review. Despite a large number of valid criticisms of the way peer review tends to operate, even its most vocal critics see peer review, at least as reformed to operate more equitably and efficiently, as the key to quality control in scientific endeavor (Chubin and Hackett, 1990).

The lack of competitive funds designated for agricultural research multiplies the incentive for experiment station and other food and agricultural scientists to seek such funds competitively from other sources. In 1992 experiment station research at 1862 LGCAs was supplemented by $226 million in funds from NIH, NSF, the Department of Energy, the Environmental Protection Agency, and other federal funding sources (National Research Council, 1995a). A majority of these supplemental funds are presumed to be competitive as most are attributable to NIH and NSF, whose research allocation processes are almost exclusively project-based and competitive. There is some consternation within the agricultural community that, by virtue of the greater availability of these funds relative to funding designated for food and agricultural research, some of the best and brightest of the experiment station researchers have avoided food and agriculture system issues and research needs.

The committee concludes that there is a need to preserve the advantages offered by formula funding, particularly their facilitation of linked research, extension, and teaching programs (which is the basis for Recommendation 4). However, the relative lack of competitively awarded and peer-reviewed research specific to food and agricultural system issues places severe limitations on the ability of the land grant system and other research institutions to meet the research challenges of the future.

A large role for competitive funding in agricultural research would lessen the perception that agricultural research is separate and insulated from the rest of the scientific community.

RECOMMENDATION 9. The federal government should increase competitive funding of food and agricultural research projects. The funding level for competitive grants should be no less than the $500 million authorized by Congress for the National Initiative for Research in Agriculture, Food, and the Environment (NRI). Additionally, the share of total federal research support awarded competitively to projects and individuals (including teams) on the basis of peer-reviewed merit should be increased. Recognizing fiscal constraints, options for increasing the share include (a) directing funds to research from other USDA budget categories, particularly as a means of reinvesting savings on agricultural subsidies; (b) transferring to competitive grants programs

|

A Profile of Two State Agricultural Experiment Station Researchers Professor F: A Plant Scientist Supported Primarily by Formula Funds Professor F works in the Plant Science Department in a College of Agriculture in the Great Plains. His primary responsibility is to develop new varieties of wheat with desirable agronomic characteristics including high yield, desirable baking characteristics when ground to flour, and resistance to drought, mildew, and insects. This scientist's specialty is insect resistance, and he currently concentrates on resistance to the Russian wheat aphid, although other agronomic characteristics must continually be monitored. At any given time, thousands of strains of wheat and their crosses are being studied. Typically, from identifying a desired new trait in wheat (such as aphid resistance) to releasing a new variety to farmers or seed companies takes 12–15 years. Note that many varieties in various stages of development for several purposes are continually being researched, but a new variety is released from this laboratory only every 3 to 4 years, and a truly exceptional variety that is widely adopted about once each decade. When that occurs, however, the economic impact averages millions of dollars/year for many years. This scientist collaborates with similar plant breeders at seven other state experiment stations; they test each other's varieties in a spectrum of climates and the serendipitous differences that occur from year to year and site to site such as rainfall, temperature, and insect damage. In addition to field experiments, Professor F does considerable laboratory work, particularly in defining the nature of aphid damage to plants. This is done in a secure greenhouse to contain the aphids. Current lab work concentrates on correlating concentrations and timing of appearance of a minor chemical component in wheat stems resistant to aphids. If measurement of this chemical can be substituted for measuring aphid damage, much more rapid progress in plant breeding will be possible because the chemical is easier and less expensive to measure than the more subjective current measures of aphid damage. Professor F has an 80 percent research, 20 percent extension appointment. He deals with questions and problems concerning probable insect damage to wheat and other grain crops. In addition to providing advice on an ad hoc basis, he organizes two field days each year and has a circuit of meetings with wheat farmers that takes 10 days each winter. Although Professor F teaches no formal courses, he usually has two graduate students (one masters and one doctorate level) working under him at any given time; and their theses are written under his direction and with his resources. He also has services of a three-quarter time technician and hires two undergraduates on an hourly basis in the summer. About 90 percent of his annual funding of $190,000 is from formula funds; the remaining 10 percent comes from the State Wheat Board. These funds have been stable over the years, but technically are specified by the director of the state experiment station. Professor C: A Plant Scientist Supported Primarily by Competitive Grants Professor C works in a Plant Science Department in a college of agriculture in the ''Corn Belt." Her primary responsibility concerns the biology of how the |

|

cells of a newly developing plant get to be shoots or roots. It appears that the first cells produced after germination can be induced to develop in either direction, and of course for the plant to survive, both are needed. In some kinds of plants, when moisture is limited, more of the cells become roots, but with abundant moisture, the balance switches toward shoots. In other plants, it appears that temperature regulates this ratio instead of moisture, with higher temperature inducing more roots. Professor C is trying to understand how these plants take moisture or temperature information and use it to regulate differentiation into roots or shoots. She uses molecular approaches, studying plant genes that are activated by compounds that the plant makes itself. Interestingly, one of these compounds seems to affect shoot growth negatively and root growth positively; at low concentration, shoots grow and at high concentration, roots grow preferentially. However, it is not clear how this chemical is made, how its production is regulated, or how it manifests its effects. Note that Professor C isn't really trying to solve any practical problem, although she believes that the information she is generating may be extremely valuable in future plant breeding applications. One example used to justify her work on grant applications is to induce extra root growth in situations where plants germinate in cold, wet conditions but likely will encounter hot, dry ones later in the season. Professor C has a 50 percent teaching, 50 percent research appointment. She teaches one course each semester, a course on molecular biology of plant growth to graduate students in the fall and a junior-level botany course in the spring. She also advises eleven undergraduate students, primarily on curricular matters; she has a half-time technician and one Ph.D. graduate student, plus a post-doctoral student. Her salary funding is 50 percent resident instruction (teaching) funds from the University and currently 40 percent from a competitive grant funded by the National Science Foundation. She also usually applies each year for funding from USDA through the NRI (National Research Initiative) Competitive Grants Program. She has managed to have either an NSF or USDA grant funded at any given time over the past decade, in the $65,000–70,000 per annum range; she even had a 6-month period that included funding from both. She is concerned that there could be a spell when there will be no funding from either source, since only 10–15 percent of proposals typically are funded. In such a case, Professor C would be assigned additional teaching duties; she likely could get $10,000–15,000 from the experiment station director for 1 or 2 years with the hope that one of her competitive grant applications would be funded the following year. |

a portion of the funds currently distributed to experiment stations by formula and special grants; and (c) drawing on USDA intramural noncompetitive research funding. Consistent with Recommendation 1, a two-tier review system similar to that of NIH should be used at the federal level to guarantee that public benefits as well as scientific merit guide the selection of research proposals.

In recognizing that new monies for competitively funded research implies funding trade-offs in an era of fiscal constraints, the committee refers to the conclusions and

|

Competitive Grants The terms competitive grants and peer review mean different things to different people under different circumstances. The broad philosophy of these funding concepts is to fund research (or other projects) according to merit rather than some other criterion—for example, dividing resources equally among qualified applicants or constituencies. The challenge is to define and evaluate merit. Ideally, the organization providing the resources defines merit, and qualified reviewers who have been screened to minimize or eliminate vested interest (usually termed "peers," though they may not be peers technically), evaluate proposals. With this system, the best-qualified and most capable people and organizations usually obtain funding for research, so, in theory, the return on investment is optimized. A problem, however, is defining what research is to be done. At the "basic" end of the research spectrum, the more limiting the criteria, the higher the probability of excluding a good idea that no one thought of previously but that might revolutionize a field. Therefore, to cast as wide a net as possible for good ideas, delimiters are minimized. For example, one might ask for proposals concerning biology of plants of agricultural importance. At the "applied'' end of the spectrum, there might be a solicitation for research on methods of decreasing nitrate levels in the Chesapeake Bay; to be more specific, one could stipulate "nitrates originating from hog manure." Very specific criteria often limit eligibility, and this may or may not be appropriate. Most nongovernment agencies, foundations, and businesses use competitive grants mechanisms, although they may have other names like "requests for proposals." If absolute criteria are set, the process equates with competitive bidding on contracts. The National Institutes of Health (NIH) uses a two-tier review system to guarantee both the scientific merit and public benefits of competitively selected research proposals. The first-tier review is by a group of scientific peers. The second-tier review is by a council of scientists and nonscientists that may take program and public priorities into account in making adjustments in funding decisions. In practice, the NIH councils have their impact largely at the margin of funding decisions, although they have the authority for more significant intervention (National Institutes of Health, 1992). |

recommendations of two recent reports from the National Research Council and the National Academy of Sciences.

In Investing in the National Research Initiative (National Research Council, 1994a), the National Research Council's Board on Agriculture reaffirms its earlier (National Research Council, 1989) support for a much expanded competitive grants program for agricultural research. This committee concurs with the board's belief that competitive grants are the mechanism best suited to stimulate new fundamental research activities in specific areas of science and that they have unique advantages for food and agricultural systems research in relation to formula funds, special grants, and intramural research2: they are responsive and flexible, they attract a broad range of scientists from public and private institutions, and they cast a wide net—that is, they capture proposals that produce new alliances, new initiatives, and new approaches.

Allocating Federal Funds for Science and Technology, a National Academy of Sciences (NAS) (1995) report, addresses mechanisms for allocating federal research funds. The authoring committee recommends that federal science and technology funding should give preference to projects and people, rather than institutions, and that the awarding of grants should be based on competitive merit review. That report concludes (p. 25) that in relation to merit review of academic research,

… merit review of in-house (that is, intramural) research is much more difficult because federal research scientists and engineers are in the civil service and still retain salary and benefits even if they are not productive or their area has lower priority or has become obsolete. That problem is a perennial one in the periodic reviews of federal laboratories.

Although the NAS committee recognized the important role for federal laboratories in a balanced program of federal science and technology, this conclusion underpinned its recommendation that federal funding should generally favor academic institutions because of their flexibility and inherent quality control.

Encouraging Participation and the Potential for Success

The committee also recognizes that as funds are redirected over time toward competitive grants programs, some experiment stations and colleges of agriculture will be at a disadvantage. As indicated in the Profile report (National Research Council, 1995a), the experiment stations that garner the largest shares of their research expenditures from competitive grants programs (administered by USDA, NIH, NSF, etc.) tend to be those associated with large research universities. Many LGCAs and experiment stations do not fit this description. The committee believes that competitive grants programs for food and agricultural research must be structured and administered so as to encourage participation by and potential for success to all institutions, particularly small and mid-sized institutions and those not among the top 100 universities and colleges receiving federal funds for science and engineering. One way to do this is to continue and further strengthen the role of USDA in the federal government's Experimental Program for Stimulating Competitive Research (EPSCoR).3

RECOMMENDATION 10. USDA should continue its role in enhancing participation and success in competitive grant programs by all institutions in order to build human capital nationwide in food and agricultural research. For example, it should (a) continue to designate 10 percent of the enlarged competitive grants pool for institutions in USDA-EPSCoR states; (b) allocate 5 percent of competitive grants for 1890 institutions, while maintaining capacity building grants; and (c) streamline the federal competitive grants application process without sacrificing accountability or the adequacy of information on which to judge scientific merit.

Revising the Formula

The committee believes the current formula for allocation of formula funds for contemporary food and agricultural systems research does not reflect the broadened constituency, which is predominately urban and suburban. Current and future research is neither just—nor even primarily—for the benefit of farmers and rural residents. Although this fact is reflected in changes in the names of many land grant colleges of agriculture, it is not reflected in how their formula funding is calculated.

RECOMMENDATION 11. A new formula by which food and agricultural research funds are allocated within the land grant system should be designed and implemented to accurately reflect the full range of food and agricultural research beneficiaries.

Although reluctant to propose a precise equation for reallocations by formula, the committee recommends the consideration of variables such as states' proportionate contributions to total U.S. population, relative poverty rates, or shares of cash receipts from farm and food marketing as appropriate reflections of the LGCA system's broadened contemporary customer base. These variables could be used in many different ways as the basis for a revised allocation formula instead of, or in addition to, percentages of rural and farm populations. The committee stresses that the new formula should be applied to total allocations among states, not limited to annual, incremental increases (as changes are presently accommodated). It would expect, however, that such changes be phased in over an adequate adjustment period, rather than implemented immediately.

Any modification of the formula will result in some state agricultural experiment stations losing and others gaining some formula funding. The committee therefore suggests that a range of alternative formulas, and their implications, be studied to identify the ideal way to revise outdated formulas.

The Status of the 1890 Institutions

Federal legislation requires that state governments match the federal formula-based contribution to research conducted at the experiment stations located at 1862 institutions; in fact, states contribute far more than their matching requirements. However, no such requirement applies to federal contributions to research based at the 1890 institutions. Consequently, according to USDA's CRIS system, only 2 percent of the food and agricultural research funds at 1890 institutions come from state budgets. This means that every federal dollar for food and agricultural research at an 1862 institution goes at least twice as far as does a dollar of federal support to 1890 institutions.

Aside from the obvious inequity among institutions within the land grant system, this discrepancy in federal funding requirements also means that the clientele of the 1890 institutions are less likely, than is the clientele of the 1862 universities, to receive adequate research attention. The 1890s have been uniquely focused on issues, problems, and needs of African-American and other ethnic minority groups, small-scale and limited-resource farmers, and low-income rural and urban families (Godfrey and Franklin, 1992; Mayes, 1992; Rasmussen, 1989). The CRIS data indicate, as documented in the Profile report (National Research Council, 1995a), that 1890s devote significantly larger shares of their research resources to social sciences issues pertaining to people, communities, and institutions than do 1862s, in addition to those resources that they devote to food and nutrition issues. Forty percent of all farm-operator households are located in southern states (where the 1890 colleges are located); 60 percent of all farm-operator households classified as limited-opportunity households are also located in southern states (see Chapter 2 for a definition of "limited-opportunity farm-operator household") (U.S. Department of Agriculture, Economic Research Service, 1996).

The committee makes the following recommendation for the purpose of enhancing the vital role of the 1890 institutions as providers of access to underrepresented segments of the population and important contributors to food and agricultural systems research.

RECOMMENDATION 12. The federal government should require that states match formula research funds going to 1890 institutions in the same manner as is required for 1862 institutions.

The committee recognizes the possibility that a few states may refuse to match the federal funds; it feels, nonetheless, that the time for this recommendation has arrived. If political processes within the states do not bring about a state match, and some 1890 institutions consequently lose their federal formula funds, it could mean the loss of 80 to 100 percent of these colleges' research funding base. Recognizing this potential consequence forces the question of whether, for example, having a system of 15 well-funded 1890 institutions is better or worse than having a system of 17 inadequately supported institutions.

Public-Private Partnerships in Research Funding at LGCAs

Until the 1970s, funding by private industry of research at most land grant colleges of agriculture was comparatively rare. By the 1980s such funding had become more common. In the 1990s private industry funding is accepted and even encouraged by administrators and by federal policy. A growing amount of private funding comes from diffuse end users, such as dairy farmers who support research with checkoff funds. The following five factors contribute to increased funding by private industry at colleges of agriculture.

- The cost of research has risen faster than general inflation because of, for example, costs related to complying with regulations, use of more sophisticated equipment, and complexity of problems tackled.

- The number of researchers in colleges of agriculture has grown slightly over the past 25 years, even in the face of downsizing tenure-track positions at many institutions and eliminating many departments in, for example, poultry science, dairy science, horticulture, and entomology.

- Federal and state funding for agricultural research has not grown nearly as rapidly as the costs of doing research, leaving a considerable deficit that necessitated downsizing and turning to alternative sources of funding.

- Private industry needs the kinds of expertise and equipment found at LGCAs, and often it is much less expensive to use these than to duplicate them, particularly for sporadic needs.

- Private industry has resources for research not always available to any given land grant university, such as specialized equipment, expertise, animals, and capital.

During the 1980s there was considerable discussion by all universities about using public facilities for research conducted with private funding. Efforts were made to deal with issues like patenting, licensing, consulting, publication rights, royalties, and conflict of interest. Although such funding is now widespread, most is in the form of simple contracts between industry and universities without any direct financial remuneration to university scientists other than as a potential source of funds to pay their university-mandated salaries. There are, however, instances in which university scientists become part owners of start-up companies, leading to more direct potential conflicts of interest. Surprisingly, even this degree of involvement of university scientists generally is reasonably well accepted. This is in part the result of efforts to deal with potential conflicts before contracts are finalized and to keep the process open to public scrutiny. Even so, the following concerns remain, especially on the part of some constituencies.

- Does the university really benefit sufficiently—for example, are overhead charges and royalties high enough?

- Does this kind of activity taint objectivity of university scientists?

- Is a larger-than-desirable infrastructure being maintained, resulting in, for example, training artificially high numbers of graduate students in some fields?

|

Checkoff Funds One method of funding research needs of diffuse end users, such as soybean or hog farmers, is a self-assessment mechanism known as checkoff funding. These commodity checkoff programs are established by authority in either federal or state legislation to be used for research and promotion. A referendum requiring two-thirds or majority approval by voting producers is required in federally mandated programs. Some state programs, however, do not require referendums. Some programs have a refund provision when producers request funds within a given time period. Some of the federal programs include provisions that a percentage of funds remain in the state where funds originate to be used for programs of research and promotion that might meet needs of that state or region. The primary objective of most checkoff funds is to promote marketing of the commodity but nearly all have research components, even if only to evaluate the effectiveness of the promotion. One great advantage of checkoff funding mechanisms is that those funding these programs set criteria for research and promotion. |

There also are many perceived benefits of industry-university collaborations in addition to maintaining funding levels and, thereby, avoiding marked downsizing. These include

- more efficient use of intellectual and other resources from a societal standpoint,

- opportunities for students to experience some aspects of working in industry,

- more rapid movement of graduating students into appropriate first positions and the resulting more rapid and efficient recruitment to fill industry positions, and

- incentives for "intellectual engines," like start-up companies, that in turn foster whole industries, like biotechnology.

Clearly, industry-university relationships have strengthened lately, particularly in food and agricultural sciences, and this trend may accelerate. Those who make decisions about federal funding of agricultural research will continue to face two broad realities: (1) the private sector is providing considerable resources for agricultural research at public institutions; and (2) federal legislation can have significant effects on such arrangements by, for example, providing tax incentives to support these activities.

With these realities in mind, the committee concludes that public policy must be flexible enough to ensure that private resources can be used to leverage public support for agricultural research when that research is consistent with federal goals. At the same time, continued vigilance is needed to avoid conflicts of interest in such research support, and this is best dealt with by having policies and procedures that, as much as possible, prevent problems before they start.

The committee further concludes that a more in-depth look at public-private partnerships, including publication rights, royalties, and patents, is needed. In conjunction, the implications for objectivity, academic freedom, and the types of research conducted with public funds is an important area of further study.

Alternative Mechanisms for Allocating Competitive Grants

Refining the federal-state partnership to address (a) the equity and efficiency of allocating federal funds for agricultural research, (b) priority setting and stakeholder involvement, and (c) public-private partnerships in agricultural research is constrained by the limited number of mechanisms used to provide federal support. An examination of alternative mechanisms may reveal new opportunities for the land grant system and its federal partner and complement the recommendations for change the committee has made with regard to specific elements of the agricultural research system.

At present, federal funding for extramural agricultural research is provided as formula funds, special grants for specific projects and institutions mandated by Congress, contracts, and competitive and peer-reviewed grants. Lesser-used mechanisms include cooperative agreements, small-business innovation research (SBIR) grants, and collaborative research and development agreements (CRADAs) with private industry. Although the variety of mechanisms suggests considerable flexibility, the system is, in practice, rather rigid for individual scientists or groups of scientists with a new, meritorious idea for research. This is true even for scientists who have experiment station appointments. A range of seldom-used alternative mechanisms does, however, exist, particularly in the design of competitive grants programs.

Preproposals

One way to reduce the paperwork and time consumption associated with processing competitive grant applications is to institute a preproposal step. Applicants would submit brief (2 or 3 page) preproposals for evaluation; the most meritorious would then be eligible for further consideration as full proposals. For example, if funding is available for 100 grants, only the most promising 200 to 300 preproposals would be eligible for resubmission as a full proposal. This would greatly decrease time spent on both proposal preparation and evaluation. Furthermore, this system can relatively quickly sort out proposals that do not fit subject matter criteria or are from unqualified investigators.

A related approach being tested in some NIH study sections is a system of triage. On receipt, standard competitive proposals are briefly evaluated by small committees, and the weakest one-third are rejected. This saves time because only two-thirds of the applications are fully reviewed, and the other one-third of applicants know of a nonfunding decision quickly rather than after the usual 6 months required for full evaluation. This permits rewriting and resubmission for the next round of funding, which is every 4 months at NIH.

Chunk Grants

Another mechanism used by some agencies, and under consideration by others, is the "chunk grant," in contrast to conventional full resource-recovery grants. Chunk grants might be for $50,000 per year for 2 or 3 years or might take the form of separate competitions for, for example, $20,000 or $50,000 portions of larger grants. With this scheme, the number of grants to be given is predetermined—hypothetically, 200 $100,000 grants; there is no negotiation over precise budgeting, budget justification, or overhead charges. Within the proposal there still might be considerable explanation of how funding would be used, but it is a much simpler approach and allows the investigator to allocate funds as deemed necessary.

Another appeal of this method is its honesty. Researchers cannot accurately predict what their precise financial needs will be 3 or 4 years after proposal preparation. Chunk grants and separate competitions eliminate the need for future-oriented guesstimates, and there still would be oversight and auditing to ensure funding is used legitimately.

Some perceive a considerable fringe benefit from such grants in that many investigators would be quite productive with $50,000 per year. This approach could ultimately

result in funding more investigators who devote less time to developing proposals with low probabilities of funding.

Percentage Funding

One method of increasing the distribution, though not necessarily the efficiency, of funding is to fund proposals for only a percentage of the amount requested. This has frequently been used by NIH study sections, funding all proposals at 75 percent of requested amounts, which results in funding 33 percent more proposals.

A variation is to fund by merit percentile. For example, if funding is available for 10 percent of applications, funding is instead allocated to the most meritorious 20 percent of proposals. Of those funded, the top one-third might be funded at 70 percent of funds requested, the middle one-third at 50 percent, and the bottom one-third at 30 percent (each representing about 7 percent of proposals submitted). This might work especially well for chunk grants, allocated at $70,000, $50,000, and $30,000 per year, depending on rating.

The major objection to this approach for conventional grants is that researchers may not receive the resources needed to do the proposed work well or that they may be encouraged to inflate their anticipated research costs.

Performance-Based Funding

Performance-based funding mechanisms have also been advocated. For example, established investigators with a good track record could count on a given amount of funding annually as long as they remained productive, as determined by broad peer review of their publications and the performance of their trainees. This is pretty much the basis for selecting and maintaining investigators funded by the Hughes Foundation. Funding by the Medical Research Council in the United Kingdom is partially based on this system. This approach, though criticized by some as elitist, is effective in getting good research accomplished; and funding is terminated when performance slips. Although the number of individuals funded usually is limited, this approach is only a small variation from methods used to fund centers or institutes.

Another proposed method of performance-based funding is to pay by the paper (or report) produced. An excellent paper might be worth $20,000, a good one $10,000, and a fair one $5,000, with no funding for mediocre papers—all evaluations, of course, determined by unbiased peer review.

Summary

All of these systems have advantages and disadvantages. As a balance is sought among independence, excellence, security, fairness, getting the most relevant research per dollar, and considerations of training personnel and extension benefits, it becomes clear that a palette of funding mechanisms is desirable. In some cases, two or more mechanisms might be the best option, even within a program. For example, within the USDA competitive grants program, with sufficient resources, there may be room for chunk grants and performance-based funding of centers in addition to the current full resource-recovery competitive grants.

The committee believes USDA could experiment more extensively with alternative mechanisms for the allocation of federal research funds. Pilot projects of selected mechanisms could be established and evaluated, with evaluation focusing on compatibility between private and public research funding, the opportunity cost of grant application, administrative efficiency in competitive granting processes, and compatibility with more explicit research agenda-setting and prioritization processes.

Funding Interdisciplinary and Multidisciplinary Research

The committee believes there is a special case to be made for mechanisms of funding inter- or multidisciplinary research, such as special divisions of competitive grants programs. The need for multi- and interdisciplinary research is great, but the following problems arise.

- Interdisciplinary work can be difficult to initiate because researchers in different fields must learn each others' languages and cultures. It may take a year or more just to frame hypotheses and develop methods to test them. Some have advocated $20,000 proposal preparation grants for these situations.

- Giving appropriate credit to the individuals involved may be complex, affecting salary, promotion, and tenure decisions or professional recognition. The contributions of young investigators, particularly, may be difficult to discern, especially on papers authored by five or more scientists. Young people have difficulty establishing their own reputations in these settings and are often advised to avoid such involvements early in their careers.

- Multidisciplinary proposals are more difficult to evaluate than monodisciplinary proposals because with multidisciplinary proposals experts from various areas must be able to integrate dissimilar information. Typically, multidisciplinary proposals fare badly in competition with proposals that are simpler and easier to evaluate by traditional peer-review panels.

- Multidisciplinary proposals tend to be long-term and expensive, often equal in length and cost to several more conventional grants. Peer reviewers tend to prefer to fund three grants rather than only one. Also, because of their long-term aspects, results of such research are unavailable for years, making evaluation and funding of renewals additionally problematic.

Despite these challenges, the committee believes there is a strong case to be made for enhancing opportunities through competitive grants programs for inter- and multidisciplinary research, particularly at the integrative research stage in the research continuum. Consequently, the committee strongly endorses

- special divisions of competitive grants programs designated for inter- and multidisciplinary projects and the use of interdisciplinary peer-review panels and processes;

- an emphasis on multi- and interdisciplinary programs by federally supported regional centers and multi-institution consortia (see Recommendation 3); and

- an emphasis on inter- and multidisciplinary projects and programs supported by combined federal formula funds for research and extension (see Recommendation 4).

Conclusions

The past accomplishments of agricultural research conducted at the land grant university colleges of agriculture provide no rationale for maintaining the status quo in the face of new research needs and paradigms and a rapidly changing operating environment. The recommendations made by this committee in this chapter are aimed at capitalizing on lessons learned from science policy on a broader front and at recognizing the expanded public mandate that now affects the system and its accountability.

The high rates of return on the public's investment in agricultural research and extension (estimated to be between 30 and 50 percent) provide compelling evidence that the institutional structures that have characterized the LGCA research system have served the nation well, including the mandate to link research to public needs through extension, the federal-state partnership, and the institutional base of support in the form of formula funding for research and extension. Nonetheless, in light of changes in society's interests in food and agriculture, new opportunities in science, developments in science policy, and fiscal realities, some important changes in funding policy should occur. In particular, there should be an enhanced role for competitive grants programs and merit-based review. Enhancing the role for these mechanisms would make it

possible to capitalize on new opportunities in food and agricultural system science, to amplify the quality of research, and to draw on the large pool of scientific resources beyond the experiment station. At the same time, formula funds can continue to be an effective means of research support. In addition to supporting long-term applied research needs of particular crops, livestock, and regions (National Research Council, 1989), formula funds support the unique aspects of land grant research, particularly the linkages to public needs through extension.

Nonetheless, the committee feels, as evidenced by the recommendations in this chapter and in Chapter 2, some important changes should occur in the use and allocation of formula funds. In particular, these funds should be used more creatively and innovatively to enhance the integration of research, extension, and teaching in the spirit of the land grant philosophy and mandate and to promote multidisciplinary approaches that are strongly needed in food and agriculture (Recommendation 4). Additionally, experiment station scientists and extension service specialists who are beneficiaries of formula funding should be encouraged to collaborate with and draw on the scientific resources and knowledge beyond the colleges of agriculture; formulas should be reconfigured to reflect the contemporary spectrum of food and agricultural research and extension issues and beneficiaries (Recommendation 11); and, in the interest of equity and the importance of serving limited-resource producers and consumer groups, states should be required to match federal formula funds to 1890s in the same manner as required for 1862s (Recommendation 12).