2

Income and Wealth of Older American Households: Modeling Issues for Public Policy Analysis

Alan L. Gustman and F. Thomas Juster

This paper is concerned with the economic behavior determining the income and wealth of older American households, and with our capacity to analyze the effects of public policies determining their income and wealth. It begins by providing a structure for relating the outcomes of interest to leading behavioral models. This is followed by descriptive statistics indicating the relative importance of the major components of income and wealth. The paper then assesses the current state of models, describing what is known about the behavior of individuals and firms that affects income and wealth determination, what is not known, and what kinds of models and data are needed to do an adequate job of understanding income and wealth outcomes and the effects of policies meant to influence these outcomes. The final part of the paper considers an array of policy changes that might be expected to influence the income and wealth of older households.

CONCEPTUAL OVERVIEW

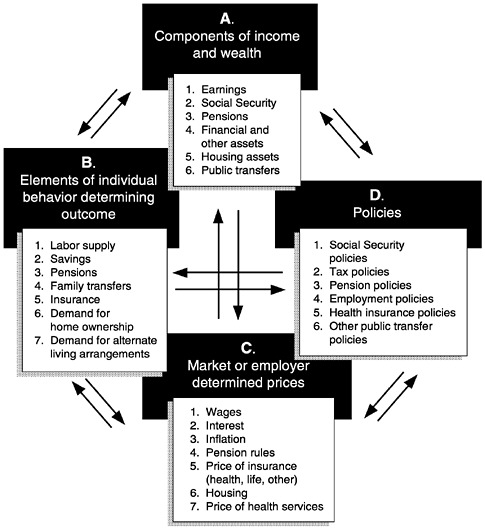

Figure 2-1 indicates the major components of income and wealth of the older population and the elements of behavior of individuals, of markets, and in the public sector that determine these income and wealth outcomes. Box A repre

The authors are grateful to the National Institute on Aging for research support. Helpful comments by Gary Engelhardt, Anna Lusardi, Andrew Samwick, Jonathan Skinner, Tim Smeeding, and Steve Venti are very much appreciated.

FIGURE 2-1 Framework for analysis from the perspective of an individual's decisions.

sents a matrix of income and wealth outcomes. The outcomes are delineated by type of income, but the matrix is meant to represent the full dimension of time and cohort effects, as well as the various sources of heterogeneity in outcomes. Box B lists the behavioral decisions. They include the basic decisions of labor supply and savings, as well as other behaviors that must receive attention for a full understanding of wealth and income. Below that in Box C is an array of market-determined outcomes that are taken as exogenous to the individual, such as the features of the pension plan, determined by the employer subject to market constraints. The right-hand box, D, lists some of the basic categories for the

policies that will be discussed. The arrows indicate that each box helps to determine elements in other boxes.

A central focus of the paper is the behavior of individuals and the efforts of firms to accommodate the behavior and preferences of individuals. Our aim is to determine whether the analyses of the various dimensions of behavior indicated in Figure 2-1 are sufficiently reliable to support policy analysis, and if not, what additional is research is required to improve the quality of the available behavioral models. As a result of our analysis, we conclude that among the key dimensions of behavior, we have greater confidence in the retirement models for use in policy analysis than in models of saving or pensions. Models of savings and pensions continue to wrestle with behavioral issues that remain unresolved at a more fundamental level than the questions that confront retirement modeling. But we also find that none of the models of behavior in any one area takes sufficient account of the behavior along other dimensions. These behaviors may interact in important ways, and most of the literature ignores these interactions.

COMPONENTS OF INCOME AND WEALTH OF OLDER HOUSEHOLDS

To measure the importance of the major components of income and wealth, we begin with descriptive data on income and wealth outcomes for recent cohorts. The relevant data include the Current Population Survey (CPS), where we use 1992 income data analyzed by Grad (1994); the Survey of Income and Program Participation (SIPP), where we use 1991 wealth data analyzed by Poterba, Venti, and Wise (1994); the Health and Retirement Survey (HRS), where we use income data from 1991 and wealth data from 1992; and the Asset and Health Dynamics Among the Oldest Old (AHEAD) survey, where we use income data from 1992 and wealth data from 1993.

These data sets are complementary. CPS covers the entire age range, as does SIPP, but the income and wealth data from these surveys, especially the wealth data, tend to be underestimates relative to either HRS or AHEAD; in both HRS and AHEAD, new survey technologies have been introduced that result in substantially smaller biases resulting from missing data components. But while HRS and AHEAD appear to have data of somewhat higher quality, they represent particular cohorts and do not include a full range of age distributions. HRS includes the birth cohorts of 1931 to 1941, while AHEAD includes the birth cohorts of 1923 and before.

The data in Table 2-1 provide a useful overview of the sources of income and wealth for households that are in a transition stage between work and retirement—those 65 to 69 years of age. For these households, earnings comprise a little under 30 percent of total income; Social Security comprises another 30 percent, while pensions and income from assets each comprise a bit under 20 percent. On the asset side, if both Social Security income flows and pension

TABLE 2-1 Sources of Money Income and Wealth for 65- to 69-Year Olds

|

Income and Wealth Source |

Share of Aggregate Income of Aged Units (%) |

Average Wealth From Indicated Source as a % of Total Net Worth |

|

Earnings |

28.9 |

|

|

Social Security |

29.9 |

31.9 |

|

Pensions |

18.8 |

19.9 |

|

Financial and other assets |

18.7 |

27.8 |

|

Public assistance |

0.7 |

|

|

Other income |

3.1 |

|

|

Housing |

|

20.8 |

|

Total |

100.1 |

100.4 |

|

SOURCE: Income percentages are from Grad (1994, Table VII.1). Grad's figures are based on the 1992 CPS. Wealth percentages are computed from Poterba, Venti, and Wise (1994, Table 1). Their data are from SIPP and are reported for 1991. |

||

income flows are capitalized, the two make up a little over half of total wealth, with the other half coming from conventionally measured net worth—the sum of financial and other assets and housing equity.

From these data we can see the extent of the underestimation problem in the measurement of assets: Assets in Table 2-1 are based on data from SIPP, where conventionally defined net worth (the total of financial and other assets plus housing equity) for these 65- to 69-year-olds had a mean value of roughly $150,000 in 1991; SIPP households aged 55 to 64, a younger age group that typically has smaller net worth than the 65-to-69 group, had a mean 1991 total of about $140,000. In contrast, the HRS data on net worth for households between 51 and 61, where asset holdings would be expected to be smaller still, had a mean 1992 value of approximately $240,000—a figure that is approximately 60 percent larger than the Table 2-1 estimate. And the AHEAD net-worth data, for an age group much older than the SIPP 65- to 69-year-olds and one that would therefore be expected to have a much lower asset level, had a 1993 mean value for conventionally defined net worth of approximately $170,000—higher than the 65- to 69-year-olds in Table 2-1.

Note that the data in Table 2-1 are missing some components. For example, one would generally prefer to include imputed income from housing equity in the income definition and might well include imputed values for services provided by Medicare and Medicaid. The wealth data might include present discounted values for Supplemental Security Income, other welfare payments, and transfers. According to Hurd (1990b, Table 18), these are not negligible sources of income or wealth. It is also worth noting that although the capitalized value of future Social Security or pension benefits, which is included as part of wealth, appropriately reflects the consumption value of these assets, it represents a relatively

inflexible source of economic support. To some extent that is also true of housing equity, although here the inflexibility lies as much in consumer choice as in legal or institutional constraints. But it is certainly clear that Social Security wealth cannot be bought and sold, nor can pension wealth, and while housing equity can be bought or sold, most households appear to treat housing equity as an immutable fact of economic circumstances, not an asset that can be used to smooth consumption flows in future years.

An important feature of both income and wealth is their heterogeneity among households. Households are always heterogeneous in the types and amounts of income and wealth that they own, but that heterogeneity is likely to grow as households move into older age groups. And both distributions, especially the wealth distributions, are highly skewed in that medians are small relative to mean values.

The heterogeneity of the income sources received by older households is documented in Tables 2-2 and 2-3. Table 2-2 shows the detailed structure of income from HRS (for age groups in their 50s), and for AHEAD (for age groups

TABLE 2-2 Income Components, HRS and AHEAD, in Thousands of Dollars

|

|

Age of Household Head |

|||||

|

Income Source |

51–55a |

56-61a |

70–74b |

75–79b |

80–84b |

85+b |

|

Earnings |

40.6 |

32.4 |

4.0 |

1.5 |

1.0 |

0.2 |

|

Pensions |

1.0 |

2.8 |

16.6 |

15.9 |

12.4 |

10.4 |

|

Social Security |

0.1 |

0.2 |

10.2 |

10.4 |

9.4 |

8.2 |

|

Private pension |

0.9 |

2.6 |

6.4 |

4.5 |

3.0 |

2.2 |

|

Capital Income |

5.1 |

5.9 |

2.1 |

2.9 |

2.6 |

1.8 |

|

Disability |

0.4 |

0.6 |

1.1 |

0.8 |

0.7 |

0.8 |

|

Welfare |

0.3 |

0.3 |

1.1 |

0.8 |

0.7 |

0.8 |

|

Unemployment |

0.4 |

0.3 |

1.1 |

0.8 |

0.7 |

0.8 |

|

Other |

0.2 |

0.2 |

1.1 |

0.8 |

0.7 |

0.8 |

|

Total |

48.0 |

42.4 |

24.8c |

21.9c |

17.8c |

15.7c |

|

Household members other than respondent or spouse |

4.9 |

4.7 |

3.0 |

2.8 |

3.7 |

5.0 |

|

Total |

52.9 |

47.1 |

27.8 |

24.7 |

21.5 |

20.7 |

|

a1991 HRS data. b1992 AHEAD data. cDerived from an independent question, not from summing the components. The sum of components is generally lower than the above total for technical reasons (mainly the use of unfolding brackets for the total income question). SOURCE: 1991 HRS data for ages 51 to 61; 1992 AHEAD data for ages 70 to 85+. |

||||||

TABLE 2-3 Components of Income, AHEAD Sample

|

Income Component and Age Group |

Mean for Sample |

Mean if Greater Than Zero ($) |

Percentiles ($) |

||||

|

10 |

25 |

50 |

75 |

90 |

|||

|

Wage Income |

|

|

|

|

|

|

|

|

70–74 |

4,059 |

18,989 |

0 |

0 |

0 |

0 |

8,000 |

|

75–79 |

1,463 |

14,934 |

0 |

0 |

0 |

0 |

0 |

|

80–84 |

1,013 |

15,586 |

0 |

0 |

0 |

0 |

0 |

|

85+ |

162 |

12,776 |

0 |

0 |

0 |

0 |

0 |

|

Capital Income |

|

|

|

|

|

|

|

|

70–74 |

2,089 |

6,923 |

0 |

0 |

0 |

240 |

4,620 |

|

75–79 |

2,941 |

9,396 |

0 |

0 |

0 |

318 |

4,800 |

|

80–84 |

2,605 |

9,182 |

0 |

0 |

0 |

300 |

5,000 |

|

85+ |

1,798 |

6,987 |

0 |

0 |

0 |

0 |

3,600 |

|

Social Security Income |

|

|

|

|

|

|

|

|

70–74 |

10,246 |

10,259 |

4,440 |

6,516 |

9,480 |

13,000 |

15,900 |

|

75–79 |

10,374 |

10,390 |

4,800 |

6,420 |

9,210 |

12,696 |

16,308 |

|

80–84 |

9,384 |

9,411 |

4,608 |

6,000 |

8,208 |

11,724 |

14,712 |

|

85+ |

8,248 |

8,276 |

4,236 |

5,550 |

7,578 |

9,492 |

12,000 |

|

Pension Income |

|

|

|

|

|

|

|

|

70–74 |

6,404 |

10,660 |

0 |

0 |

2,680 |

7,218 |

16,080 |

|

75–79 |

4,539 |

8,647 |

0 |

0 |

1,200 |

4,644 |

11,604 |

|

80–84 |

2,964 |

6,714 |

0 |

0 |

0 |

2,964 |

9,540 |

|

85+ |

2,247 |

6,366 |

0 |

0 |

0 |

2,247 |

6,900 |

|

Other Income |

|

|

|

|

|

|

|

|

70–74 |

1,109 |

6,126 |

0 |

0 |

0 |

0 |

2,400 |

|

75–79 |

773 |

4,652 |

0 |

0 |

0 |

0 |

1,861 |

|

80–84 |

740 |

4,076 |

0 |

0 |

0 |

0 |

1,861 |

|

85+ |

773 |

4,189 |

0 |

0 |

0 |

0 |

2,160 |

|

Other family Members Income |

|

|

|

|

|

|

|

|

70–74 |

3,026 |

19,870 |

0 |

0 |

0 |

0 |

13,162 |

|

75–79 |

2,839 |

19,719 |

0 |

0 |

0 |

0 |

13,162 |

|

80–84 |

3,689 |

22,379 |

0 |

0 |

0 |

0 |

13,162 |

|

85+ |

4,979 |

21,386 |

0 |

0 |

0 |

6,571 |

13,162 |

|

Total Family Income |

|

|

|

|

|

|

|

|

70–74 |

27,778 |

|

8,280 |

12,460 |

19,304 |

29,723 |

49,200 |

|

75–79 |

24,754 |

|

7,428 |

10,374 |

16,539 |

25,004 |

42,374 |

|

80–84 |

21,515 |

|

6,528 |

9,398 |

13,992 |

22,561 |

38,352 |

|

85+ |

20,723 |

|

6,564 |

8,400 |

13,000 |

20,476 |

35,064 |

in their 70s and 80s). Total household income is of course substantially larger for the HRS sample than for AHEAD, partly because of cohort differences in earnings but mainly because of age differences. The HRS households are about 30 years younger than the AHEAD households that are ages 80 and over, and thus there has been 30 years worth of economy-wide improvement for the HRS cohort compared with the AHEAD 80 and older cohort. In addition, the AHEAD data

reflect the fact that the replacement of earnings by the sum of Social Security benefits and pensions is at much lower than a one-to-one ratio for most households.

The income component data in Table 2-2 do not contain any surprises. Earnings are the dominant source of income for the HRS cohorts in their 50s, while pensions, especially Social Security, are the dominant source of income for households in the AHEAD cohorts. Earnings are relatively unimportant for households in the AHEAD age range, and the pattern of private pension income, which is about three times as high among AHEAD cohorts in the 70- to 74-year-old group as in the 85 and older group, is explainable both by cohort differences and by the growing incidence of widowhood among older households in the AHEAD cohorts. Finally, earnings of household members other than the HRS or AHEAD survey respondent and spouse are an important source of family income, especially for the oldest AHEAD cohort (those 85 years of age or older).

The heterogeneity of income components for the AHEAD cohort shows up very clearly in Table 2-3, which contains sample means, means for households with positive income in a particular category, and percentile distributions. Not surprisingly, hardly any AHEAD age groups have wage income, all the way up to the 90th percentile. Equally surprising to some, capital income is zero for the entire lower half of the AHEAD distribution, is only a few hundred dollars for AHEAD cohorts up as high as the 75th percentile, and becomes a substantial sum only when we get around the 90th percentile, where the amounts are several thousand dollars rather than several hundred dollars. The only income sources that are at all widely distributed among AHEAD households are Social Security income, which virtually everyone receives, and pension income, which is received by the upper half of the distribution in the younger age cohorts and by the upper quarter in the older age cohorts. For each age category and percentile, pension income exceeds Social Security income in the AHEAD sample for only one age cohort and one of the percentiles shown—the 90th percentile for the 70-to 74-year-olds. As we note later, it looks as if this pattern will be a bit different when the HRS cohorts get to be in the AHEAD age range, although that will depend in part on changes over time in the proportion of jobs providing pensions and in the proportion of pensions that contain survivors' rights.

The heterogeneity in economic status among older households is even more pronounced when we examine the data on net worth. Tables 2-A1 to 2-A7 in the Appendix contain estimates of total net worth, net worth in the form of housing equity, and net worth less housing equity for various HRS and AHEAD classifications of households. For HRS, we divide the sample into couples, single men, and single women (Table 2-A1), by racial/ethnic groups (blacks, Hispanics, and all others including whites, Table 2-A2); and by 1991 income (Table 2-A3). For the AHEAD sample, we show data for couples and singles in Table 2-A4 (total net worth) and Table 2-A5 (net worth excluding home equity), as well as for racial/ethnic groups in Tables 2-A6 (total net worth) and 2-A7 (net worth exclud-

ing home equity). For the AHEAD data, we show separate estimates for four age groups: 70 to 74, 75 to 79, 80 to 84, and 85 and up.

The principal message from this set of net-worth tables is that wealth is highly unevenly distributed among the older population: both in the HRS and the AHEAD samples, married couples have substantially higher levels of wealth than single men or single women, even after implicit correction for household size; the disparities are substantially larger for net worth less housing equity than for total net worth, since housing equity itself is somewhat more evenly distributed than most other assets; minority households have substantially fewer assets than whites by an order of magnitude of 4 or 5 to 1 in mean values, and an order of magnitude more like 10 to 1 for net worth less housing equity.

For the AHEAD data, there are of course substantial differences by age group as well as by family composition and racial/ethnic group. In general, older households have smaller net worth, other things equal, although the differences by age are surprisingly small for couples up through the age of 80 to 84. The most striking disparities in the AHEAD data are those shown by the tabulations of net worth excluding home equity, both by family composition and by racial/ethnic group, divided according to age group. For the family composition data, fully half the single women had net financial assets excluding home equity of under $ 10,000 regardless of age—the 70-to-74 group and the 85 and older group have just about the same (minimal) assets. Single men are a little better off, but fully half of this group have under $20,000 of net worth excluding home equity. For couples, in contrast, the median net worth excluding home equity is a little over $55,000 for the 70-to-74 age group and is still about $20,000 for the 85 and older age group. As would be expected, there are some very wealthy subcategories of households in the sample: AHEAD households in the 90th percentile among couples have over $400,000 of net worth excluding home equity, and almost $600,000 net worth in total, for those with heads age 70 to 74. Even for couples age 85 and up, AHEAD households have over a quarter of a million dollars in net worth excluding home equity at the 90th percentile and over $400,000 of total net worth. For minority households in the AHEAD sample, it is essentially correct that fully half of all black and Hispanic households have close to zero net worth excluding home equity, regardless of age, and even at the 75th percentile, neither black nor Hispanic households have as much as $20,000 of net worth excluding home equity in any of the AHEAD age groups. To all intents and purposes, most minority households can be thought of as having negligible financial asset holdings in old age.

Income Distribution Issues

The income and wealth data show substantial disparity among households, and the disparities appear to be a bit greater for households 70 and over than for

others. One way to look at issues of income distribution is to examine the economic circumstances associated with private pensions.

Two alternative models might be contrasted. In one model, the existence of a private pension, since it involves a cost to the employer, provided less current income during the working years. On that model, households with substantial pensions would have had less current income than other comparably situated households; during retirement, they would be expected to have more pension income than others, but less income from capital and from Social Security benefits.

In an alternative model, the market is such that jobs that carry pensions are also apt to carry higher current income than other jobs, perhaps because only those with high wage rates want pensions, given the tax advantages of pensions and the low Social Security replacement rate for high wage jobs. Hence households with pensions will have more favorable economic circumstances generally as they move toward retirement. On that model, households with substantial pension income would also be expected to have substantial capital income relative to other households (because of their higher current income while working) and to have higher Social Security benefits (again because of their more favorable current income while working). In short, an important issue is, do households with jobs that carry substantial pensions have offsetting differences in other sources of retirement income, or do the differences tend to cumulate—those with pensions having more of other forms of retirement income as well?

Tables 2-4 and 2-5 show comparisons for both the HRS and the AHEAD sample. For HRS (Table 2-4), we contrast households in which both respondent and spouse have jobs with pension rights, households where one has a job with pension rights and the other a nonpension job, and households where neither has

TABLE 2-4 Earnings and Capital Income by Pension Status, HRS Households Working for Pay and Not Self-Employed

|

|

|

Mean Values ($000) |

||

|

Whether Pension Income |

% of Cases |

Earnings |

Capital Income |

Total Income |

|

Singles |

|

|

|

|

|

Yes |

66.8 |

29.0 |

2.4 |

37.1 |

|

No |

33.2 |

14.9 |

1.3 |

23.3 |

|

Couplesa |

|

|

|

|

|

Both Have |

57.1 |

64.4 |

4.0 |

75.0 |

|

One Has |

34.6 |

49.7 |

2.9 |

62.1 |

|

Neither Has |

8.3 |

36.7 |

5.3 |

49.2 |

|

NOTE: All categories weighted by the HRS household population weight. a Both spouses in the couple households are working. |

||||

TABLE 2-5 Pension, Social Security, and Capital Income by Whether Pension Income and Age, AHEAD Householdsa

a job with pension rights although both have jobs. We also show data for singles who work, with and without pensions on their job. We tabulate current earnings for these HRS households, and also tabulate capital income. For the AHEAD households (Table 2-5), we divide the sample into households receiving some pension income versus those receiving none, and tabulate pension income, Social Security benefits, capital income, and total income for each of the AHEAD age groups.

It is clear enough from the data, especially the AHEAD data, that favorable economic circumstances cumulate rather than offset. Both for the HRS age range and for the various AHEAD age ranges, households either expecting or receiving pension income have substantially higher nonpension income (capital income and job earnings in the case of HRS households, Social Security benefits and capital income in the case of AHEAD households). For the AHEAD sample, where the differences are clearest and the analysis is least ambiguous, households receiving pension income have close to twice as much total income as other households.

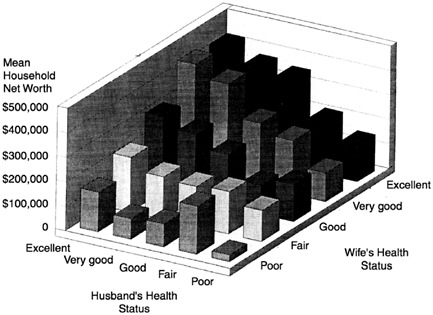

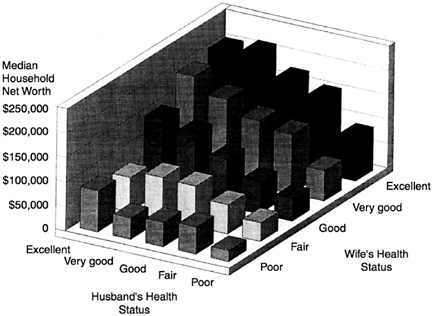

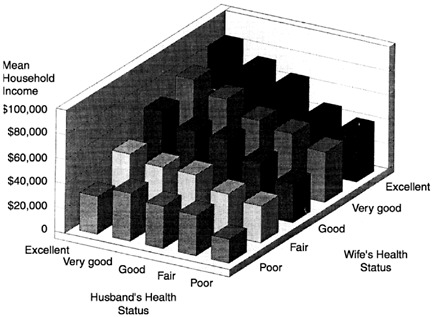

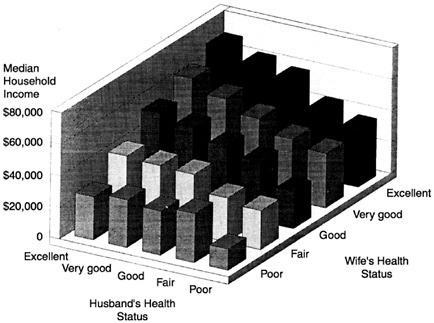

Finally, we show a mapping of the relationship between health status and both income and wealth for HRS households (see Appendix, Figures 2-A1 to 2-A4).

Although these data come from a cross section and therefore are not helpful on questions of causality, the strength of the relationship between health and wealth or health and income is quite remarkable, whether measured by relationships involving means or medians. For the net-worth measure, couples where both spouses are in either excellent or very good health have net worth in the area of $400,000, while households where both spouses are in fair or poor health tend to have net worth of less than a quarter of that. These differences are even sharper for median net worth and are almost as large for either mean or median household income. Interestingly enough, if there is any difference in the relationship between household financial variables and health for the male or female spouse, it appears that the health of the female spouse is more systematically related to the household's financial well-being than the health of the male spouse.

MODELS OF INDIVIDUAL AND FIRM BEHAVIOR EXPLAINING RETIREMENT INCOME AND WEALTH

This section briefly considers what we know and do not know about the dimensions of behavior that are central to an understanding of how policies affect retirement incomes and retirement wealth. The discussion covers labor supply decisions, savings behavior, pension plan determination, and the determination of Social Security income at the level of the individual. Also discussed are the behaviors determining family structures and transfers, and the demand for housing.

Income from Earnings Based on Labor Supply Decisions

To project earnings, it is necessary to explain patterns of labor force participation among older workers on jobs offering different wage rates.1 Thus, an important part of the approach to understanding the determination of the earnings of older individuals, and the effects of public policies on earnings, is to apply a conventional intertemporal model of labor supply and to use the labor supply outcome together with the wage to determine earnings.

The conventional model for explaining labor force behavior into retirement is dynamic. Subject to a series of constraints, including the wage offer for full-time work, the wage offer for part-time work, and the rate of pension accrual (including its option value), as well as the corresponding rate of accrual in Social Security benefits and other factors, the individual reaches a decision on whether to continue working full time, part time, or not at all. In this approach, the parameters of a utility function are estimated so as to maximize the likelihood of observing the sequence of outcomes realized for each individual, subject to the constraints created by the elements of the opportunity set (Fields and Mitchell, 1984; Burtless and Moffitt, 1984, 1985; Gustman and Steinmeier, 1986b;

Berkovec and Stern, 1991; Rust, 1990; Stock and Wise, 1990a, 1990b; Lumsdaine, Stock, and Wise, 1990, 1992a, 1992b).

Different versions of the model have proved capable of explaining some major features of data reflecting labor supply of older individuals and their retirement. These include the spikes in the retirement hazard, most commonly at age 65, but at 55 for some and 62 for others. The models also explain the fact that two thirds of retirees proceed directly from full-time work to retirement, the relatively short duration of partial retirement, the coincidence of retirement decisions by husbands and wives, and some (about a quarter) of that portion of the trend to earlier retirement observed from 1970 through the mid-1980s (see Gustman and Steinmeier, 1986b, 1994a; Anderson, Gustman and Steinmeier, 1994).

Recent contributions have been made on a number of dimensions, adding to the richness of the dynamic specification, considering reaction to risk as well as expected values, incorporating interdependence of decisions at the level of the family, entertaining the possibility of retirement behavior that is influenced by liquidity constraints, and enriching the array of nonfinancial considerations employed in the model.2

Despite all of this work, there are many basic questions about retirement behavior that have not yet been addressed. Although we have made important progress in improving the dynamic and stochastic structures of retirement models, considerable work remains before we incorporate in a single setting the full array of behaviors in relation to uncertainty, mistakes, revisions, surprises, and random shocks. For example, Rust (1990) and Berkovec and Stern (1991) omit any consideration of the relation of pension incentives to labor market outcomes, by either focusing on the portion of the sample without a pension or simply ignoring the existence of the pension. In estimating these models, it will be important to measure pension incentives using data collected from worker descriptions as well as from firms.3

Findings based on the HRS by Brown (1993) suggest that some workers who accept an offer of a retirement window from one employer actually continue working, sometimes accepting another full-time job. This implies that some elements of mobility models (e.g., as in Allen, Clark, and McDermed, 1993; Gustman and Steinmeier, 1993) will have to be incorporated within retirement models that, to date, have analyzed the departure from a full-time job as if it always involved a substantial cessation of economic activity. Brown's findings are especially troublesome for studies that define retirement as exit from the payroll of a single firm. What is required for the models of Lumsdaine, Stock, and Wise (1992a, 1992b), for example, is to incorporate wages from work after retirement, as in the study of retirement from the Air Force by Ausink and Wise (1993), but allowing for the joint choices of work or retirement after leaving the job.

One test that is natural to impose on available studies is whether a model satisfactorily explains major social trends and policy outcomes. The weakness of

available labor supply and retirement models is reflected in the limited ability of such models to explain the trend to earlier retirement satisfactorily. For example, for the period from 1970 through the mid-1980s, simple decomposition analyses that would explain the trend on the basis of changes in the composition of workers' demographic characteristics or employment cannot successfully explain the trend to earlier retirement (Ruhm, 1992; Anderson, Gustman, and Steinmeier, 1994). With the use of structural retirement models, some of the trend (about a quarter of the trend in the 1970s and 1980s) can be explained by the changes in pensions and Social Security.4 We still do not have enough confidence in the implied substitution and income effects from these models to have a firm handle on the causes of these trends.5 Also disturbing in this context are the strong implications of the pension literature that pensions are designed to meet the preferences of covered workers (Gustman, Mitchell, and Steinmeier, 1994), so that even those portions of the trend to earlier retirement that are associated with changing Social Security and pension benefit formulas may reflect the effects of changing tastes, rather than the changing incentives in the opportunity set.

Cohort-specific characteristics may be important determinants of retirement and of retirement trends. Some potential candidates for cohort effects include the change associated with the increasing participation of women throughout their lifetime, the changing structure of the division of labor in the household (more male hours, fewer female hours; see Juster and Stafford, 1991), and the changes in employer attitudes induced by the different histories and expectations about labor force commitment of the members of different cohorts. The literature does not, however, do a very good job of isolating cohort effects when explaining trends in retirement. Only time will tell whether these changes are adequately represented by differences in measurable characteristics among families or whether behavior will differ among subsequent cohorts because of cohort-specific effects.

Efforts are just beginning to expand the methodology available for examining the interdependence of family retirement decisions in a structural model, for incorporating measures reflecting job conditions or difficulty of work, and more generally for understanding the relation of financial measures, and of imperfections in capital markets, to retirement outcomes (see the discussion in Hurd, 1993, and Rust and Phelan, 1993, for example).

The roles of imperfect information, complex calculations, and responses to uncertainty remain to be sorted out and satisfactorily modeled for inclusion in behavioral analyses of relevant policies. An extensive set of questions in HRS on expectations and attitudes about risky choices has been used to analyze relevant aspects of decision making in the context of the complex choices facing the potential retiree (Barsky et al., 1993), but this information has not been incorporated in a structural retirement model.

Many questions also remain about the relation of behavior to expectations. Formal models of the retirement decision assume that workers make decisions in

each period to maximize utility over their remaining lifetime. While some theoretical progress has been made in modeling such decisions in the presence of uncertainty, empirical work inevitably pretends that workers either know the value of future income streams associated with various choices or make rational expectations forecasts, and that they also know the ''length of the planning horizon"—that is, how long they will live. The analysis of the relation of retirement expectations to incentives is encouraging (Hurd and McGarry, 1993a), but many questions remain unanswered. Previous research has suggested that there will be some whose expectations are unreasonable (Mitchell, 1988; Gustman and Steinmeier, 1989; Bernheim, 1988, 1989). In particular, there is a tail of the distribution with individuals who expect their benefits to be larger than is called for by their firm's pension plan, given their work and earnings history. More generally, we need to know how expectations are formed, how they are revised, and what differences there are in the formation of expectations and behavior for those who correctly report their constraints and for those who do not.

When the role of health status is measured in structural retirement models, it is measured by relatively direct questions about whether the individual suffers from health problems that impede work or other activities.6 Researchers are aware that reported health status may involve an ex post rationalization, with an individual reporting he retired owing to ill health when that was not the motivating factor. This problem will be substantially remedied once panel data become available for estimating structural retirement models with HRS. The medical information is sufficiently detailed that it will be possible to isolate the effect of poor physical health from that of self-rationalization in the health measures used.

Savings and Wealth Determination

Savings and consumption analysis are major areas of economic research in both microeconomics and macroeconomics. From the perspective of aging research, analyses pertaining to life cycle, precautionary, and bequest motives are of particular interest.7 Sophisticated econometric models have been estimated with microdata on the basis of equations derived with each of these behavioral motivations in mind, and recent work has attempted to explain wealth and savings outcomes on the basis of more than one of these behavioral motivations. There has also been useful empirical research that imposes somewhat less structure but focuses on major features of the data related to cohort and age effects. In addition, there is a line of research that questions whether savers can make the sophisticated calculations called for by dynamic stochastic models of savings.

Life-Cycle Analysis

A basic prediction of the simple life-cycle model is that with a rising mortality hazard, once the sum of the time preference and the mortality hazard exceed

the interest rate, consumption and wealth will fall with increasing age. A good deal of relevant evidence has been collected and is presented in Hurd (1990b), who argues that if panel data are used and are corrected for the effects of mortality, profiles of bequeathable wealth do turn down at plausible ages and are consistent with the life-cycle model.8

A number of anomalies have encouraged researchers to expand the model of savings beyond a perfect capital market/life-cycle specification. Nevertheless, the forward-looking consumer continues to characterize the central agent of many models of savings behavior.

Precautionary Models of Savings

The individual faces a wide range of risks that might promote saving. If there are liquidity constraints or other factors creating incomplete markets for insurance, then a precautionary motive for saving may be important. If there are high rates of time preference, then the precautionary motive may dominate savings behavior even if the capital market is perfect. In precautionary models where agents display prudence, a precautionary motive may lead them to choose not to borrow, so they appear to be credit constrained.

A basic fact puzzling researchers of savings is why such a large number of individuals reach retirement with little or no savings. This raises the question of whether the predominance of an alternative motivation for saving beside the life-cycle model, and in particular precautionary saving, might account for the wide heterogeneity in observed outcomes. Other researchers have been motivated by evidence that suggests to them that the young don't borrow, the old don't decumulate, and consumption growth is positive even when the interest rate is low or negative in a certain period (see Zeldes, 1989a). An analysis of precautionary motives must explain both how expectations are formed and what the reaction is to risk. In microlevel studies there have been analyses of the properties of some of the major risks facing the individual, including pensions, earnings, length of life, and ill health (Skinner, 1988; Carroll, 1992; Guiso, Jappelli, and Terlizzese, 1992; Samwick, 1993b, 1994; Hubbard, Skinner, and Zeldes, 1994b). In the context of these analyses, it is also hoped that it will be possible to solve such puzzles as why consumption tracks income so closely (see Hall and Mishkin, 1982; Carroll and Summers, 1991), a phenomenon that suggests the importance of liquidity constraints (Zeldes, 1989a), and perhaps also to better understand how the saving motivation is affected by the availability of insurance (Hubbard, Skinner, and Zeldes, 1995).

Researchers are investigating the best way to categorize and measure the effects of and the reactions to risk, distinguishing risk aversion from prudence, analyzing their properties, and exploring the impact of these different features of preferences (Kimball, 1990, 1993).9

Bequest Motive

An alternative motivation for saving is to provide a bequest for one's heirs. The bequest motivation may be simple, as in dividing a fixed sum among one's heirs, or it may be complex, as in leaving a benefit in accordance with need or specifying a strategic arrangement in exchange for certain services from one's children (see, e.g., Becker, 1991; Bernheim, 1991; and Bernheim, Shleifer, and Summers, 1985). The fact that one leaves a bequest does not mean the bequest was intended or that it was the amount that would have been delivered in a world with perfect foresight. In the absence of efficient annuity markets or insurance by families, individuals may be forced to underconsume to avoid outliving their assets (Kotlikoff and Spivak, 1981; Davies, 1981; Abel, 1985). Nor is it optimal for everyone to want to leave a bequest—for example, children may be better off than their parents. Also, it is possible that consumption declines with age and bequests follow because, for some, the capacity to consume declines with age (Borsch-Supan and Stahl, 1991).

The evidence on the operation of a bequest motive is very mixed. The question is how important the bequest motive is relative to other motives for saving, including the basic life-cycle motivation. Consider the contradictory findings in a recent paper by Smith (1994). On the one hand, he finds that HRS respondents who believe that leaving an inheritance is very important have accumulated significantly more wealth ($85,000) than those who do not think that bequests are important.10 On the other hand, using panel data from the Panel Study of Income Dynamics (PSID), he finds, consistent with Hurd (1987),11 no linkage between savings and number of children ever born. Kotlikoff and Summers (1981) suggest that the bequest motive accounts for the bulk of observed wealth, while Modigliani (1988) disagrees (see, however, Kotlikoff's, 1988, reply).

Although the life-cycle model considers the calculations of the individual or couple in isolation, research on bequest motives involves adopting intergenerational or family-based models for analyzing consumption and savings. There is interest not only in the extent to which bequests are a motivation for savings, but also in what determines the amounts of bequests and the division of bequests among children and others. (Analysis of the effects of intergenerational linkages include Becker's analyses collected in Becker, 1991; Barro, 1974; and Bernheim, 1991.)

Research Integrating These Motives

Efforts at integrating these various explanations for savings do not yet involve estimating full structural models. One approach is to create simulation models on the basis of parameters obtained from original estimation as well as from other independent sources and to use the models to simulate the paths of

asset accumulation. For example, Hubbard, Skinner, and Zeldes (1995) attempt to integrate a precautionary model of savings with a life-cycle model, while including the effects of asset-based means testing in social insurance programs. A related approach assumes that high rates of discounting govern the life-cycle motivation, but there also is a precautionary motive operating in the context of a model with liquidity constraints, and creating the need for buffer stocks against adverse events (see Carroll, 1992; Carroll and Samwick, 1994; Samwick, 1994). The relative weight given in these models to life-cycle retirement savings and precautionary savings varies. Nevertheless, the models do incorporate responses to risks such as those from earnings variation, health outcomes, and uncertain length of life. These models do seem capable of reproducing important features of the data, in particular, low levels of savings in early years, differences in savings among income groups, and savings and then dissaving through the life cycle.

Research that Imposes Only Limited Structure

Some empirical analyses of asset composition rely on specifications that impose as little structure to the underlying model and error terms as possible, employing considerably less structure than some formal empirical models of life cycle and precautionary savings. (See, e.g., the models of Venti and Wise, 1987, 1990, and Poterba, Venti, and Wise, 1993, for studies that attempt to separate cohort and age effects on savings.) When not much structure is imposed, that limits the ability to predict the effects of policy changes; if the structure that would otherwise be assumed is incorrect, this limitation is appropriate. The alternative is to impose a specific functional form, a process that will reveal more of the key parameters required for policy analysis, on the assumption that the structure that is imposed is correct. Otherwise, the imposition of too much structure will create bias in the estimated coefficients and will foster misleading policy analysis. Because of the continuing debate about the behavior underlying the savings decision, the extent to which these models should impose a particular structure continues to be a subject of disagreement (Venti and Wise, 1993; Engen and Gale, 1993).

In some sense those who do not impose a great deal of structure on their empirical estimates have a different methodological perspective. Especially when investigating the effects of well-defined policy changes, they are applying a quasi-experimental approach in which their major aim is to distinguish the effects of that policy, such as the adoption of rules permitting Individual Retirement Accounts (IRAs) or 401(k) savings plans. They are not, however, attempting to isolate the effects of the components of the policy. Often those who have a tight structural model in mind do not estimate the full structural model but a reduced form of one type or another. When that is the case, the parameter estimates obtained may be subject to a number of interpretations. Nevertheless, they may

provide useful information even if the full structural model is incorrectly specified.

Research Arguing that Full Optimization is Unlikely

Thaler (1994) argues that a number of findings in the savings literature are inconsistent with the predictions from leading models (see also Deaton, 1991; Zeldes, 1989a, 1989b). This in turn leads him to suggest that the leading models are probably not accurately describing behavior. Among the reasons is the difficulty of the assumed optimization. The assumed optimization requires the solution to a dynamic programming problem that when specified to include the array of risks that are encountered, requires a supercomputer to solve and is too hard even for as if behavior, especially because the behavior is not repeated but occurs only once in the lifetime. Moreover, because the problem is so complex, easy rules of thumb do not bring us close to the right answer. Bounded rationality and lack of self-control lead Thaler to suggest an approach to savings based on mental accounts, in which substitution among types of savings meant for different purposes is highly imperfect. Bernheim (1993) expresses doubts that the population is sufficiently economically literate, and he has discussed the importance of providing adequate information through the Social Security system. There is not sufficient understanding of the limitations in our computational abilities to predict the effects of providing potential retirees with increased information, as the new Social Security Administration initiative to inform individuals as to their entitlements will do.

Continuing Controversy in the Savings Literature

A major question in the savings area is how to reconcile the findings and models that have been developed with different behavioral motivations in mind. A number of the approaches to retirement savings summarized above are fundamentally inconsistent with one another. In addition, the relevant facts remain in dispute.12 When policy innovations arise, such as the availability of IRAs and 401(k)s, either new savings is generated or it is not. (For discussion of the continuing debate on this topic, see Venti and Wise, 1987; Poterba, Venti, and Wise, 1993, 1994; Gale and Scholz, 1994; Engen, Gale, and Scholz, 1994. For a critique of the last study, see Bernheim, 1994.) Either those with pension or housing wealth reduce their holdings of financial assets proportionately, or they do not.13 Without resolving these questions, which requires resolving ongoing controversies in the literature, we are in no position to judge the effects of a number of important policies that will affect savings.

The difficulties that modelers have faced in explaining these facts are widely appreciated. Some argue that it is a matter of integrating the various motivations and constraints into a single framework (see Hubbard, Skinner, and Zeldes, 1994a,

1994b). Some suggest that many of the outcome differences may be due to unmeasurable differences in taste and that selection issues will be difficult to unravel (Bernheim, 1994). Others suggest that in analyzing savings behavior, we are at the limits of the usefulness of a model that assumes full information and complete and rational decision making (Thaler, 1994). The question of the importance of each of these motivations for savings has yet to be resolved.

With regard to the analysis of savings, a fundamental task is to reconcile the competing explanations for the observed behavior. The puzzling differences in savings outcomes within the population, the failure to explain low savings rates and the counterintuitive findings on the substitution among different types of non-tax favored savings, tax-favored savings vehicles such as IRAs, 401(k)s, and pensions, and other savings vehicles, provide an opportunity to reconcile these results. A basic question in the savings literature is whether it will be possible to explain observed behavior with a significantly modified life-cycle model that integrates some of the other leading explanations for savings behavior. The weights given to these various motivations are unclear and at times appear inconsistent. It is possible that a different mix of theories may be required at different points in the income distribution to explain the variety of behaviors observed for those with different incomes. Alternatively, it may be necessary to pay much greater attention to the difficulties of making life-cycle calculations, incorporating rules of thumb and importing ad hoc or nonconventional explanations for imperfect substitutability among various types of savings instruments, the very high apparent rate of time preference among younger workers, the wide heterogeneity in savings, and the high frequency of zero savers.

Pensions and Social Security

At the Level of the Individual

At the level of the individual's decision, Social Security and pension income are the result of joint choices determining labor supply and benefit acceptance. The provisions of Social Security and pensions are taken as exogenous to the choices the individual will make. The pension benefit coverage, pension formulas, and earnings histories of each individual determine potential pension incomes in retirement, conditional on the choice of retirement date and on the timing of pension and Social Security acceptance (see Burkhauser, 1979, and Rust and Phelan, 1993, among others).

It is a straightforward procedure to apply retirement models to explain the effects of changes in Social Security and pension policies on retirement outcomes and on incomes from pensions and Social Security in retirement.14 However, there are some questions that arise from findings that suggest both that individuals may not fully understand the rules governing Social Security and that they

may be liquidity constrained; the second possibility has been recognized but is not incorporated in most dynamic life-cycle models of labor supply.15

Analysis of the incentives from pension plans suggests that if the pension formula is not actuarially fair, this may have a significant effect on the ultimate level of pension wealth. Changes in pensions and Social Security may induce further changes in savings behavior. But to predict the second-order effects of these changes will require a greater understanding of savings behavior than we now have.

Pension Plan Determination at the Level of the Firm

A basic building block in the conventional model explaining the demand for private pensions is the tax-favored status of the pension. Even the simplest models of why Firms adopt pensions predict that workers like to substitute the tax-favored savings available under pension plans for private savings and that it is in the interest of firms to accommodate this demand (see, e.g., Woodbury, 1983; Woodbury and Huang, 1991). Early studies of the reaction between pensions and savings suggested greater savings by those who were covered by pensions (Cagan, 1965; Katona, 1965). A survey by Munnell and Yohn (1992) of studies conducted in the 1970s and 1980s suggests that there is substitution but that it is imperfect. More recent studies using actual rather than expected pension amounts or coverage suggest that the substitution is weak or nonexistent. If lifetime income is controlled for, those with higher employer-provided pension assets do not exhibit lower personal retirement saving.16

There is a substantial literature arguing that the firm has other motivations for pensions. Given its goal of maximizing profits subject to constraints from the production technology and factor supply curves, and operating within the implicit contract, the firm is hypothesized to choose parameters of pension plans to allocate compensation optimally among wages, pensions, and other fringes to influence employment, worker productivity, and other dimensions of costs.

Undoubtedly the tax-favored status of pensions contributed importantly to their spread in the post-World War II period (Ippolito, 1986). It is therefore quite surprising that the evidence is ambiguous that those with pensions reduce their savings in other forms. There are other questions about the behavioral mechanisms driving the determination of the coverage, terms, and amounts of pension savings, choice of plan types, explanations for pension backloading, and relationships of pensions to wages, turnover, and other dimensions of labor quality. Many of the human resource motivations that are said to underlie or buttress the demand for pensions are not consistent with the data.

Consider the questions that may be raised about the elaborate models of implicit contracts in which pensions are used as a tool of human resource policy to screen workers on the basis of unmeasured ability and to prevent shirking. Elements of these models that are not consistent with the data include the pre-

sumption that pensions provide a strong incentive against mobility in the years following hire and initial training (the incentive is really quite weak), that mobility is lower from pension-covered jobs because of pension backloading (mobility is lower from pension-covered jobs whether the pension is defined benefit and backloaded or defined contribution and not significantly backloaded), and that workers are inhibited from shirking because they are afraid they will lose their backloaded benefits if fired from a job offering a defined benefit plan (workers have only a modest understanding, if that, of the incentives in their pension plans). (For discussions of these and related predictions from conventional models of pensions that attribute the attraction of firms to pensions to their human resource properties, see Gustman and Steinmeier, 1989; Gustman and Mitchell, 1992; Gustman, Mitchell, and Steinmeier, 1994; and Gustman and Steinmeier, 1995a.)

Anomalies appear in studies with overidentifying restrictions. In turnover models we find that constraints requiring identical coefficients for wage and pension terms are violated and that the estimated coefficients differ by orders of magnitude. Within models of compensating wage differentials for pensions, the findings are not robust. And it is apparent from examining empirical work that identification has sometimes been forced, for example, by instrumenting on what are clearly endogenous variables—using some pension characteristics as instruments in a model that is designed to explain pension and wage outcomes (for details, see Gustman, Mitchell, and Steinmeier, 1994).

The conventional models also generate other predictions that do not accord with the data, raising concern for our ability to predict how private pensions will respond to changes in pension policies, in tax policies, or in the Social Security system.

Among the empirical regularities that pension studies attempt to explain are the basic result that compensation accrual and productivity do not correspond in each year of attachment and the existence of other unique labor market institutions, such as mandatory retirement provisions, which were commonplace before they were banished by law. Researchers have also tried to understand why defined benefit pensions are backloaded (that is accrue more in later than in earlier years), why union pensions are underfunded relative to nonunion pensions, why workers are less likely to leave pension-covered jobs than jobs without pensions, why firms grant post-retirement benefit increases, and other puzzles (see, e.g., Lazear, 1979, 1983; Ippolito, 1983, 1985a, 1985b, 1986, 1987). They have also attempted to generate predictions from models of long-term worker attachment and to test those predictions (see, e.g., Hutchens, 1986, 1987; Stern and Todd, 1993). Other efforts have described the differences in pension outcomes among demographic, firm, and industry groups and by unionization and other factors. Among the major differences in pension outcomes are differences in plan types, that is, whether the plan is defined benefit or defined contribution.17 Still other studies have focused on documenting the trends in pension outcomes

and explaining the reasons for these trends. (Relevant studies are reviewed in Gustman, Mitchell and Steinmeier, 1994.) After rising during the 1960s and 1970s, pension coverage ceased to grow in the middle 1980s. Now there is evidence that the upward trend in coverage, especially for defined contribution plans, may have resumed in just the last year or two (Employee Benefit Research Institute, 1993).18

Despite all of the efforts to explain the regularities in pension-related outcomes, most testing looks for partial relationships in the context of multivariate single-equation models. There has been no structural analysis of firms analogous to that available for analyzing behavior and policies from the perspective of the individual. This greatly limits our ability to use the available empirical work on pensions to predict the effects of pension regulations and policies on income and wealth outcomes. A basic reason there has been no structural analysis of firms is that the data are not available at the level of the firm. (For a discussion of the data that are available, the shortcomings in the data, and what would be required to support policy analysis, see Gustman and Mitchell, 1992.) And with all of the remaining questions about the importance of the competing motivations determining pension design, it is premature to impose a comprehensive model.

In sum, the pension literature is very far from generating empirical estimates of a reliable behavioral model. We certainly have no model with sufficient structure that it can be used to predict the effects of pension policies on the basic pension outcomes, including pension amounts, plan characteristics, insurance features, or other outcomes that would be useful in understanding how pension policies will affect retirement incomes and wealth. Nor can we predict the effects of these policies on wages.

Research on Family Structures and Transfers

There is some research linking earnings, wealth, and savings behavior to family structure. Earnings equations consistently find that earnings are higher among married individuals. With regard to savings and wealth, Smith (1994), for example, finds that married couples have higher assets and savings than unmarried individuals, even after standardizing for differences in incomes and using longitudinal data to distinguish the effects of selectivity of marital state, in which lower income families are more likely to dissolve. Thus, the need for help in old age is likely to be affected by the history of marital status. And, of course, the availability of help in old age is going to depend on whether unmarried individuals were ever married and whether they had children.

Living arrangements in old age are different from those at younger ages, reflecting not only the course of the life cycle as children leave home, but also the effects of mortality. Women are more likely to survive than men, so older households are more likely to include a single woman than a single man. When the survivor is a woman, however, the household is likely to be poorer. (See

Hurd and Wise, 1989, and Burkhauser, Holden, and Feaster, 1988, for studies addressing the economic status of widows.) Nevertheless, increases in real income over time have resulted in a halving of the fraction of older women living with relatives (Hurd, 1990b).

Work on family structure and transfers analyzes a range of decisions by families to transfer assets among members, from bequests through transfers from children or siblings to their parents. Moreover, decisions for multiple generations to live together affect decisions about the need to purchase (and save or insure for) different types of care outside the home, such as nursing home care. The basic structure of behavioral models ranges from Becker's seminal work (1991), including matching models that underlie the decision to form and leave a family and intergenerational models of transfers that have been used to explain bequests and caregiving to patents, to econometric models of household dissolution (Borsch-Supan, 1989, 1990; and Borsch-Supan, McFadden, and Schnabel, 1993), to analysis of housing demand by the elderly (Feinstein and McFadden, 1989), to models of demand for nursing homes (Garber and MacCurdy, 1990).

Integrated structural models have not yet been estimated. (For reduced form analyses using the HRS and PSID, see McGarry and Schoeni, 1994). HRS and AHEAD are going to provide excellent data for testing the integrated models of family relationships that are currently being refined. (For summaries and recent research, see Soldo and Hill, 1993.) These data are going to tightly constrain explanations, forcing researchers to integrate explanations based on intergenerational insurance, altruism, and bargaining models. But researchers have a considerable way to go before we have structural models of the type needed to simulate the effects of changes in tax policies, income and wealth testing of benefits, or health benefit policies, on the full array of outcomes that may be generated, including not only living arrangements but an understanding of the feedback on the income and wealth of the older family unit.

We are only beginning to explore the questions related to family structure and transfers, and their linkage to labor supply, savings, and pension determination. Living arrangements are a first outcome that will be investigated with more sophisticated models. We have mentioned the rising interest in models of joint labor supply behavior. Structurally, this is going to involve the introduction of bargaining models. Bargaining models are also a natural for trying to understand savings behavior. But to learn a lot more about the relation of family prospects to these dimensions of behavior is going to require specification of a credible mechanism and careful measurement of the threat price. These models will need to be extended to an intergenerational setting to resolve some of the continuing controversy about the motivations for bequests. We have yet to determine the motivation for dividing bequests and whether bequests are treated as a form of insurance. Analogous issues also arise about the transfer of time and money from children to parents, including the issue of how and why responsibilities get divided among children.

It appears that intergenerational linkages may be important in explaining the differences in savings behavior among countries (see Poterba, 1994). Where appropriate credit markets are not well developed, generations are more likely to be living together, and intergenerational transfers will be more of an everyday occurrence. There are models of the family as annuity market (Kotlikoff and Spivak, 1981). These behavioral models and changes in behavior with the rise of Social Security suggest that intergenerational linkages are no longer as important as they once were, but that family linkages should nevertheless be explicitly considered when analyzing the determination of labor market and savings behavior.

Research on Housing

Housing wealth peaks for older households between 55 and 70. About four out of five older households own a home. At least until they reach their early 70s, home owners do not draw down on their housing wealth. Although it may be argued that stickiness in housing wealth reflects the fixed costs of location, older home owners do not adjust housing equity even when they move (Venti and Wise, 1989). There is some evidence that individuals over 70 do draw down on their housing wealth, but not at a rate that would be suggested by life-cycle consumption (Sheiner and Weil, 1992). This suggests that housing wealth may be useful for a bequest motive or that it is an asset that is held to meet precautionary motives in old age. In the latter case we may find that the median older person is not downsizing, but that a person in the bottom of the income distribution who is in a bad state is. Still, it does not appear that housing wealth is a close substitute for other forms of wealth, which are presumably held to meet similar goals.19 Moreover, while people do spend a portion of windfall gains to their housing assets, they incorporate changes in housing wealth in their other asset holdings only when housing assets decline in value (Engelhardt, 1994). Nor are the elderly enthusiastic about accepting reverse mortgages. In fact, Venti and Wise (1990) calculate that drawing down housing wealth through reverse mortgages would supplement the incomes of older families by only 10 percent. This suggests that housing equity could not substantially supplement the incomes of older Americans.

Large transaction costs make it difficult to isolate the relation of housing wealth to models of savings discussed above. Hurd (1990b) cites evidence on changes in housing wealth among those who turn over their housing that he feels is consistent with the life-cycle model. Nevertheless, he prefers testing the life-cycle model by using wealth data that exclude housing wealth. All of these findings leave us with a collection of facts, but raise a number of questions about how housing demand fits in with other dimensions of savings and wealth behavior.

RECONCILING RESEARCH ON LABOR SUPPLY, SAVINGS, AND PENSIONS

At least as disturbing as the formidable array of questions about our leading models within each of the separate areas of inquiry—labor supply, savings, and pension determination—is the inconsistency among these three areas of inquiry. Research in each area of behavior ignores findings from the other areas of behavior. For example, many models of savings assume that retirement is fixed, so insurance against unexpected earnings risk afforded by a flexible retirement date is ignored. Even when related behavior is not ignored, it is oversimplified. In structural retirement models, for example, savings is assumed either to be motivated by life-cycle savings, with savings choices made in the context of a perfectly operating capital market, or to occur in a world where income and consumption are assumed to be identical.20

Mechanically, with three major behavioral models, there are six linkages that we would like to understand. We would like to understand the linkages from labor supply to savings behavior and pension plan determination, from savings behavior to labor supply and pension plan determination, and from pension plan determination to labor supply and savings.

We are not talking here about effects that have a secondary impact on the mode of behavior under examination. Thus, for example, consider the consequence when most structural retirement models greatly oversimplify the motivations for savings and assume either that earnings are being reallocated to finance consumption in accordance with a simple life-cycle motivation in a perfectly operating capital market21 or that lending and borrowing is not at all possible (see, e.g., Rust and Phelan, 1993). As is well known, if those approaching retirement with no liquid assets are overannuitized, they may time their retirement decision to regulate not only the amount of leisure, but also the path of consumption over time.22 If that is the case, then parameters estimated in models that assume perfectly operating capital markets may be misleading, perhaps significantly so. On the other hand, we know that savings behavior is heterogeneous. Certainly those who approach the retirement date with some liquid assets are less likely to be overannuitized, and thus should not be influenced by the age 62 early retirement provisions of Social Security. Thus, the assumption that all retirees in a certain class are liquidity constrained is also likely to lead to bias, perhaps significantly so.

Moreover, policy changes that are viewed as benign in standard retirement models may have significant behavioral consequences if liquidity constraints play an important role, as they do in some models of precautionary savings. For example, according to most structural retirement work, moving the early retirement age under Social Security from 62 to 65 should have little effect, so long as the present values are not disturbed. Under the current system, benefits adjustments for work after 62 are actuarially fair. Even if liquidity constraints would

normally inhibit borrowing, there should be little effect from having to wait for Social Security benefits that late in the life cycle, since all life cycle savings should have been completed. Yet if significant numbers of people enter retirement lacking financial wealth, as appears to be the case, then as suggested by Rust and Phelan's work, moving the retirement age from 62 to 65 will indeed have the effect of raising the retirement age. Consequently, the effects of certain policies will be misunderstood in retirement models that do not incorporate the effects of savings behavior.

The difficulties in understanding savings behavior thus have implications not only for the determination of income from nonpension savings, but also for understanding retirement behavior and thus for the path of income from earnings.

Consider next the implications of retirement research for the models of savings behavior. From the perspective of the precautionary model of savings, certain motivations cannot be insured by changing labor supply behavior. But certainly some variations in wages can be insured against by postponing retirement. Indeed, over the life cycle, it may also be possible to adjust to certain shocks by changing the allocation of work within the family or changing hours of work once the shock is resolved. Nevertheless, most savings models, even models of precautionary demand, take labor supply and retirement behavior as fixed (see, however, Samwick, 1994). Assuming fixed retirement dates can have adverse consequences for savings research for other reasons. As pointed out early in the savings literature, those who have preferences that favor early retirement, or who are working for firms that encourage early retirement, may be observed to have higher savings rates. To the extent that these considerations are ignored, it will appear that they will have higher life-cycle savings. In fact, the amount of life-cycle savings may be lower for early retirees once their shorter period of attachment to the labor force is taken into account.

Pension research also has implications both for retirement research and for savings research. With regard to retirement research, the issue of the possible endogeneity of pensions may be raised. Pensions are determined by the firm with the preferences of covered workers in mind. This raises the question of whether the effects of pension incentives on retirement are exaggerated. It is possible to argue that those now approaching retirement age could not have foreseen the sharp changes in pensions over the past two decades and thus did not select their jobs on the basis of a taste for early retirement.23 Nevertheless, it still is in the firm's interest to shape the pension to accord with worker preferences. Thus a relationship between early retirement provisions in pension plans and retirement outcomes may to some extent reflect the firm's efforts to accord with their own workers' tastes, leading to an overstatement of the effect of pension incentives on retirement.

With regard to savings research, one cannot help but be puzzled by recent findings that those with pensions do not reduce their saving correspondingly. If we correctly hold constant factors associated with differences in tastes and stan-

dardize for incomes, it is hard to conceive of a model in which pensions should not substitute for financial savings, or at least for that portion of financial savings meant to finance retirement. Not only are pensions a tax-favored form of savings, but the defined benefit plans carry one of the few opportunities to purchase an annuity with a price that is not substantially increased by the effects of adverse selection. Moreover, the penalties are small enough that many forms of pension savings can meet the demands for other types of savings, such as saving to pay for the children's college educations. Somewhere in the process, one suspects that preferences are being changed as firms and unions provide information about the importance of retirement savings or for other reasons. This information must in turn be affecting the demand for financial savings, creating an unmeasured linkage between pensions and financial savings.

We have already seen that savings research has implications for pension research. The recent evidence that substitution between pensions and savings is weak or nonexistent is not consistent with the standard tax-based explanation for pensions.24 It is not that we doubt that the favorable tax treatment of pensions underlies much of the growth of pensions (Ippolito, 1986). It does appear, however, that any effort to fit a model of pension demand must go beyond the mechanical substitution of pension for nonpension savings and provide an explanation for the empirical findings in available studies of pensions.

There are no simple fixes for these problems. But they do provide an important agenda for future research.

MODELS AND DATA NEEDED TO UNDERSTAND THE INCOMES AND WEALTH OF OLDER AMERICANS

In each of the separate areas of behavior, the direction that research is taking is appropriate. The basic outlines of dynamic retirement models are established. The models of savings behavior require further integration of competing motivations into a single framework. Models of pensions will require a further understanding of the motivation of the demand for pensions by workers as well as the behavior underlying human resource policies of the firm and their importance in shaping pensions. The question is how long it will take and how much progress will be required before we are in good enough shape to analyze the effects of the detailed policies specified in the next section.

The question facing those who would wish to use structural modeling as a basis for policy analysis in the more immediate future is, do we know enough about behavior to be comfortable imposing a model with sufficient structure to allow analysis of the effects of detailed changes in policy? A basic test of any model, and of the structure it imposes, is whether the model can explain major features of the data. If the structure is wrong in some fundamental way, we should be able to find important characteristics of the data that the model cannot explain. In the case of models of savings, retirement, and pensions that would be

used for policy analysis, there are much data that could and should be brought to bear before policy analysis based on the model is taken seriously. Approaches that create complex models by borrowing parameters from various sources face significant problems. Presumably to avoid the kind of specification error that occurs when parameters are estimated in the context of a partially specified set of behavioral equations, we should eventually expect structural equations of more complex models to be estimated directly from data. Only in the area of retirement modeling have we come close to meeting this criterion.

There may be classes of models that achieve a balance, providing sufficient structure to analyze effects of complex policies while resisting any temptation to overparameterize, thus avoiding potential errors of the type we have been discussing. To the extent that the investigator has sufficiently good intuition, the policy analysis that emerges may not be badly biased by the failure to specify all dimensions of behavior fully. It is difficult to determine exactly when this goal has been achieved, but there are sufficient data to put any model through its paces.