7

A Framework for Analyzing Future Retirement Income Security

Gary Burtless

Over the past couple of decades Americans have become increasingly anxious about their prospects for enjoying a comfortable income in old age. Until recently this concern focused mainly on the Social Security system, which had a highly publicized brush with insolvency in the early 1980s. Most young workers now lack confidence that they will receive Social Security pensions as generous as those received by the current generation of retirees. Indeed, many claim skepticism they will collect any Social Security benefits at all.

Distrust by younger workers has been fueled by popular and academic analyses that claim currently promised benefits are too high to be financed under the present tax schedule. Even though the Social Security program has enjoyed comfortable and growing surpluses since the mid-1980s, the retirement of the huge baby boom generation after 2010 may force the system into insolvency unless benefits are cut or payroll taxes increased. If survey respondents' views are accepted at face value, many young workers apparently believe benefits will be slashed or eliminated entirely.

More recently analysts have begun to consider the risks facing other components of the U.S. retirement income system. A popular image to describe that system is the three-legged stool, consisting of Social Security benefits, employer pensions, and private retirement saving. The financial risks facing employer pensions have recently been analyzed by Sylvester Schieber and John Shoven

I am grateful to John Hambor, Eric Hanushek, Marvin Kosters, and Alicia Munnell for helpful comments on an earlier version of the paper.

(1994). Douglas Bernheim (1993) has examined the adequacy of private saving among prime-age workers. Both sets of authors demonstrate that the retirement income stool could be quite wobbly by the time the baby boom generation reaches retirement. Schieber and Shoven point out that the value of pension assets may fall sharply when a large generation of new retirees attempts to convert financial market assets into retirement consumption. Bernheim argues that, even if asset values were to be secure, the current saving rate of baby boom workers would be grossly inadequate to ensure them a comfortable standard of living after they retire.

All three pillars of the retirement income system are influenced by public policy. Social Security is a creation of the federal government. Private pension plans are heavily regulated by federal legislation and regulatory agencies. Public employee pension plans have been established and continue to be maintained by federal, state, and local government officials. Nonpension household saving is influenced by tax policy as well as by public regulation of the institutions that hold the bulk of nonpension financial assets. If the future income flows from these retirement income sources seem less secure than they once did, part of the explanation may be that defective laws or poor public regulation have undermined the safety of the system. A simpler explanation, of course, is that the long-term economic outlook has worsened, leaving Americans with less confidence in the future than they had 20 years ago. Even if public policies were optimal, young and middle-aged workers would feel greater anxiety about their prospects for enjoying a comfortable retirement.

How realistic are the fears of current workers? Is it likely that the Social Security system will default on promised benefits within the life spans of people who are now contributing to the system? Will private pensions and nonpension savings be adequate to finance comfortable retirement consumption in the next century? The federal government regularly publishes a document that helps answer these questions—the Annual Report of the Social Security trustees (see Social Security Administration, 1994). This report offers detailed forecasts of the future financial operations of the Social Security Trust Fund under alternative assumptions about trends in the economy and the future size and age distribution of the population. Though the reports contain clear evidence that Social Security and Medicare are not sustainable under current law and using plausible assumptions about the future, they provide little guidance about the size or timing of the benefit cuts that would be needed to protect the solvency of the programs. In addition, they shed no light on the financial prospects of the employer pension system, nor do they evaluate current saving patterns of active workers in relation to sensible retirement income goals. Readers of the reports are correct to feel anxious about the sustainability of Social Security and Medicare under present law. But they are given little information to decide how the programs should be changed or whether greater reliance on private retirement income would improve workers' prospects for a safe income in old age.

The goal of this paper is to offer a framework for analyzing retirement income security over the next several generations. I suggest a procedure to assess the risks facing each of the main sources of retirement income and summarize the overall income prospects of future generations of retired workers.1 The proposed analysis extends the methodology currently used by the Social Security actuary to evaluate Old Age, Survivors and Disability Insurance (OASDI) solvency. In essence I urge that private pension solvency and future benefit levels be assessed using methods similar to those now used by the Social Security actuary. In addition, private saving accumulations of successive generations of workers should be predicted using alternative models of household saving behavior. Finally, the results of the separate analyses of the three major legs of the retirement income stool should be combined in a macroeconomic model that makes explicit the relationship between aggregate saving and investment in one period and output, saving, and investment in subsequent periods. As we shall see, this last step requires a fundamental revision in the methods currently used by the Social Security actuary, for it involves development of an explicit model of national income, investment, and saving. The OASDI trustees' Annual Report now treats future national income as fixed and traces out the implications for Social Security of the assumed path of future gross domestic product. In the proposed framework, the net savings accumulated through Social Security, the employer pension system, and nonpension household saving would affect potential national income (and hence retirement consumption) in future periods through its effect on the capital stock and the net foreign assets owned by U.S. residents.

The ultimate goal of retirement income forecasting is to improve decision making in the near term. A good forecasting model can inform voters and policy makers in two ways. It can suggest reforms in the current legal or regulatory environment that might improve the effectiveness of the retirement system or one of its major components. A good set of forecasts can also help individuals decide how much to save privately in light of the uncertainty surrounding public and private pension promises. The forecasting model should therefore yield explicit measures of the uncertainty of model forecasts, reflecting uncertainty arising because basic parameters are estimated with wide confidence bounds and because analysts do not agree about the correct model to describe the determination of income and saving.

The main concern about retirement income security is the fear that future retirees will be left with too little income from Social Security, employer pensions, and nonpension saving to enjoy consumption levels in retirement as high as those they enjoyed while working. Of equal concern to many observers is the situation of future workers. Will heavy payroll tax burdens reduce workers' earnings so much that their living standards could fall below current levels? A good forecasting model should produce estimates of net real earnings and retirement income replacement rates for successive generations of active and retired workers.

In setting retirement policy, a goal of the social planner might be to minimize the risk that future workers will suffer reductions in after-tax real wages in comparison with current wage levels. Another objective might be to avoid situations in which future retiree cohorts receive combined retirement incomes below, say, 70 percent of their net earned incomes while they were at work. These suggested ''objectives" of retirement income policy might strike some readers as odd. A more natural objective is to maximize the expected present value of future welfare, subject perhaps to a minimum income guarantee for old or disabled persons. I suspect, however, that avoiding steep reductions in consumption during retirement and sharp increases in payroll tax burdens while actively employed are the main concerns most people have in mind when they express anxiety about the future of Social Security or private pensions. The proposed model would allow these concerns to be examined in a systematic way.

The remainder of the paper focuses narrowly on the provision of cash income in retirement. It ignores the large fraction of retirement consumption that is financed with public insurance and in-kind programs, including Medicare, public housing, and food stamps. The analytical framework could be extended to cover these consumption subsidies, but the extension will be left to future analysts.

In the next section I describe the current methods used by the Social Security actuary to evaluate OASDI solvency and show how they can be extended to analyze private pensions and nonpension household saving. The extension will require development of simple or more elaborate models of pension accrual and household saving. The approach to modeling recommended in this paper is dynamic microsimulation. The information requirements for this kind of model are also described. Since microsimulation is a costly and somewhat controversial approach to forecasting, the subsequent section considers alternatives to microsimulation and weighs the pros and cons of the alternative approaches. The section titled "Macroeconomic Policy" introduces a straightforward model of aggregate output, investment, and saving and shows how such a model can be used to combine the results from detailed models of the determinants of Social Security solvency, employer pension accruals, and nonpension saving. Combining the models for the separate components of retirement income into a larger model of the economy has several advantages. It permits the analyst to impose sensible cross-restrictions on equations that determine the individual components of private and public saving. It offers a macroeconomic framework for determining prices and rates of return on financial assets held by pension plans and private savers. Most important, it specifies the link between saving decisions that are made in one period and the wages, potential consumption levels, and investment opportunities available in later periods. Of course, economists do not agree on the model that best describes the relationship among these variables. As a result, any sensible forecasting model must permit analysts to show the effects on the forecast of using an alternative set of assumptions about saving behavior and income determination.

The section called "Cycles" considers the effect of cycles in economic variables that are crucial to the solvency of Social Security and private pensions. Although business cycles are not particularly important to the long-term solvency of Social Security, they play a larger role for private pensions and can have an enormous effect on the private retirement incomes of particular worker cohorts. The paper concludes with a brief summary.

MICRO MODELS OF RETIREMENT INCOME

The starting point for analyzing future retirement income flows is an accurate representation of the Social Security and employer pension entitlements for which workers will become eligible over the next two or three generations. A reasonable baseline assumption is that these entitlements will be accumulated for the foreseeable future under current laws and private pension fund practice. This is the assumption used by the Social Security actuary in evaluating the current financial status of the OASDI Trust Funds, for example. Although the assumption leads to some clear internal inconsistencies, it is useful for showing the implications of current law and administrative practices if they are left unchanged. The most straightforward and probably most accurate method of predicting the trend in employer pension and private saving accumulation is to impute earnings and pension and saving accruals to representative workers from successive cohorts. This method also has the advantage of permitting analysts to examine the distribution of retirement income flows within a generation. The approach to forecasting just described is commonly called dynamic microsimulation.

Social Security Forecasts

The Annual Report of the Social Security Trustees contains detailed financial information on the current and future status of the OASDI programs. In recent years the report has offered an evaluation of the trust funds under three sets of assumptions, labeled low-cost, intermediate, and high-cost, corresponding to optimistic, moderate, and pessimistic projections of the future solvency of Social Security. The forecast period extends over the next 75 years. The Social Security actuary's predictions are derived from a cell-based model that projects the number of people with given characteristics who are expected to contribute to the Social Security program as well as the number who will be eligible for and collect benefits. Each projection is painstakingly derived based on an extensive set of detailed assumptions about future economic and demographic trends. The most important assumptions can be summarized in terms of the long-run values of a handful of critical variables. The crucial demographic assumptions define future birth rates, mortality rates by gender at each age, age-specific disability rates, and net immigration into the United States. The critical economic assumptions describe the long-run trend in output per worker, annual price change, real interest

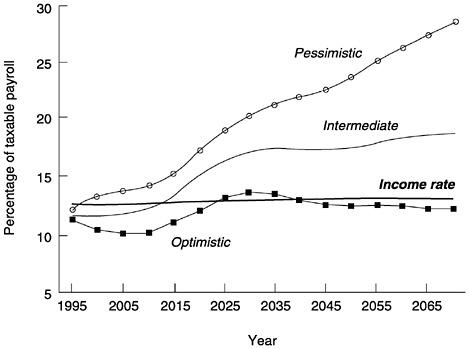

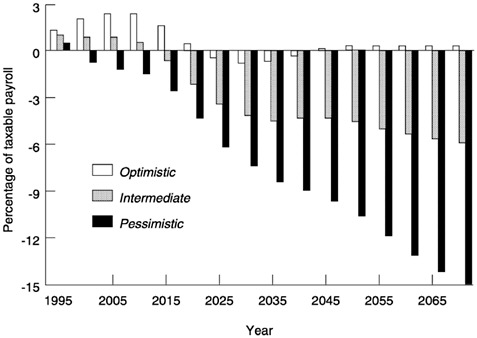

rates, changes in labor force participation by age and gender, and the trend in untaxed fringe benefits as a percentage of labor compensation. Figures 7-1 and 7-2 show forecasts of future income, outgo, and Trust Fund operating surpluses (excluding interest payments) under the three sets of assumptions used in the 1994 Annual Report (Board of Trustees).

When embodied in an actuarial model, the trustees' assumptions can be used to build up a picture in each future year of the age and gender distribution of all active workers, of workers who contribute to the Social Security system, and of recipients of OASDI pensions. In addition, the actuarial model yields a forecast in each future year of average labor compensation and the average covered wage and taxable earnings of U.S. workers, the average benefit received by new claimants in a variety of categories, and the change in the average nominal value of benefits in force, taking into account price inflation and the mortality experience of people who were previously collecting benefits. Although the Trustees' Annual Report does not include estimates of the average replacement rate received by successive cohorts of Social Security claimants, such estimates could be produced using information generated by the actuarial model. The report also includes no estimates of the future increases in payroll taxes or reductions in Social Security benefits that would be needed to restore the program to long-term solvency. Such estimates, however, could be derived in a straightforward manner based on statistics contained in the report (see Aaron and Burtless, 1989).

One reason the trustees' Annual Report does not include estimates of the adjustments in taxes and benefits that would be necessary to keep Social Security out of bankruptcy is the maintained assumption that future taxes and benefits will be determined under the law in effect when the reports are prepared. This is a reasonable basis for evaluating the solvency of the system under current law, but it is not very helpful to pensioners who wonder whether they will be able to collect full benefits over their entire retirement. Nor does it provide much guidance to young workers who would like estimates of the tax rate they will face in 20 years and the benefits they can expect to collect in retirement. Yet the evidence in the 1994 Annual Report clearly shows that some modification in contribution rates or benefits will be needed if the pessimistic or intermediate assumptions in the report turn out to be correct (see Figures 7-1 and 7-2).

No one can offer a reliable prediction of future policy changes, of course, but the Annual Reports could offer simple descriptions of specific changes that would restore long-term solvency under the low-cost, intermediate, and high-cost assumptions.2 For example, what is the amount of the payroll tax increase in 2010 that would eliminate the long-run imbalance under the pessimistic and intermediate assumptions? If the normal retirement age were raised in 2-month increments every calendar year starting in 2027, how much would the retirement age have to rise to eliminate the long-term imbalance?3

To reliably analyze the fortunes of different cohorts under Social Security, the current actuarial model should be supplemented with a dynamic microsimu

FIGURE 7-1 OASDI cost rates under alternative assumptions, 1995–2070. SOURCE: Social Security Administration (1994).

lation model that depicts the lifetime experiences of a representative sample of workers from successive cohorts. The justification for this strategy is described under "Rationale for Dynamic Microsimulation" below. One example of a dynamic microsimulation model is the Dynamic Simulation of Income Model (DYNASIM) maintained by the Urban Institute (see Orcutt et al., 1976; Johnson, Wertheimer, and Zedlewski, 1983; Johnson and Zedlewski, 1983). Although a dynamic simulation model can be far less elaborate than DYNASIM, the general approach would be similar. For representative members of each cohort, the model would predict marriage, births, divorce and remarriage, education, disability, labor force participation, annual earnings, Social Security contributions, self-employment, job turnover, retirement, OASDI entitlements, and death. Birth, marriage, divorce, remarriage, employment, and mortality rates would be identical to those assumed in the Social Security forecast. Annual employment and earnings totals, by gender and age, would correspond to detailed projections now prepared by the Social Security actuary for each year in the projection period. Social Security benefits would be calculated for insured workers when they are predicted to retire or become disabled. The main output of the simulation model is a set of demographic, labor force, and Social Security benefits histories for each member of the sample. The Social Security Administration is in an unusual

FIGURE 7-2 OASDI cash surpluses under alternative assumptions, 1995–2070.

SOURCE: Social Security Administration (1994).

position to create representative and accurate earnings histories, for its administrative files contain the lifetime earnings records of millions of current and past contributors to Social Security. Moreover, the Social Security benefit records often contain some relevant information about family composition and relationships. In many cases, these records provide data about the child and spouse dependents of retired and deceased workers.

An advantage of the microsimulation strategy is that it allows straightforward calculation of the average Social Security replacement rate and rate of internal return on contributions for successive cohorts of retirees. More important, microsimulation allows analysts to examine the distribution of replacement rates within cohorts. While this exercise might seem uninteresting under the maintained assumption that current OASDI law remains unchanged, it is more interesting when analysts attempt to measure the effects of reforms that will be needed to restore actuarial balance in the Social Security system. How many individuals or families would face extraordinarily low earnings-replacement rates in old age? The most important advantage of the strategy, however, is that it can be extended in a straightforward way to predict the accumulation of employer-sponsored pension credits and nonpension personal saving. This extension is nearly impossible to achieve using the cell-based modeling strategy currently

used by the Social Security actuary. Cell-based modeling strategies are especially unsuited to predicting private pension entitlements and their relationship with Social Security retirement benefits.

Employer-Sponsored Pensions

The microsimulation strategy must be extended if it is to be applied to calculation of employer pension saving. Unlike the Social Security system, which is a uniform, compulsory program covering nearly all active workers, the employer pension system consists of over 700,000 individual plans covering a little over half the work force (Paine, 1993). Some employer-sponsored plans are compulsory for all workers on the employer's payroll, whereas others are voluntary and do not allow workers to participate unless they make contributions to the plan. There are two basic types of plans, defined benefit and defined contribution; these have fundamentally different patterns of accumulation of fund assets and worker entitlements. Many workers are covered by both types of plans. While it is possible to forecast the accumulation of fund assets under employer pension plans without reference to the accumulations of individual workers, it is essentially impossible to predict future retirement income flows for future cohorts without detailed predictions of the entitlements of representative workers in the cohort.

This overview suggests it is much more difficult to accurately predict employer pension accruals than Social Security accruals in a dynamic microsimulation model. In addition to the information needed to forecast Social Security benefits, the analyst requires information on each worker's industrial attachment, tenure with a particular employer, pension plan coverage on each job, decision to be covered by the plan if it is voluntary, choice of contribution level (if applicable), accrual of benefit entitlements under the plan, and lump-sum withdrawals from pension plans (if these are permitted). Since employers have increasingly preferred to offer defined contribution rather than (or in addition to) defined benefit plans, the analyst must also define a baseline assumption on whether and how rapidly this trend will continue. Although formidable, these analytical obstacles are not insurmountable. Sheila Zedlewski (1984) has used the DYNASIM model to describe the pattern of individual pension accrual and retiree income through 2020.4

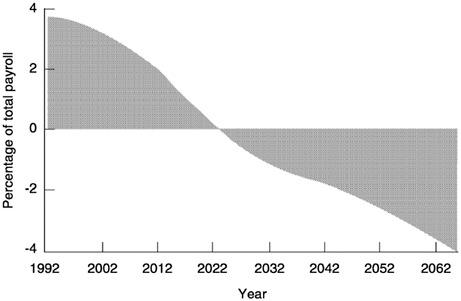

Existing microsimulation models must be broadened if they are to provide an accurate representation of the pattern of aggregate fund accumulation and deaccumulation that will occur over the next few generations. Schieber and Shoven (1994) recently estimated the 75-year outlook for pension fund reserves using assumptions similar to those in the Social Security trustees' intermediate projection. Figure 7-3 shows their forecast of net inflows and outflows for employer pension funds under the assumption that current employer and employee contribution rates are maintained and the benefit structure of defined benefit plans

FIGURE 7-3 Net pension saving divided by total payroll, 1992–2065. SOURCE: Schieber and Shoven (1994).

remains unchanged. Notice that the pattern of asset accumulation and de-accumulation is similar to that for Social Security under the intermediate demographic and economic assumptions (Figure 7-2). Assets will be added to the funds over the next two decades and then drawn down after the baby boom generation retires.

To duplicate Schieber and Shoven's estimates in a microsimulation model, the analyst must calculate and then sum the worker and employer contributions to individual plans, calculate fund earnings on previous asset holdings, and subtract lump-sum withdrawals to active workers and pension payments to current retirees. If simple assumptions are used about the returns on fund assets, these calculations are straightforward for defined contribution plans. The calculations are more complicated for defined benefit plans since the amount of contribution is dependent on the actuarial rule the employer uses in funding its plan, changes in the value of the assets held in the fund, the amount of past underfunding or overfunding, and tax regulations that may produce a discrepancy between the economic value of a pension promise and the amount the firm is permitted to contribute to the fund. It is practically impossible to accurately impute the exact distribution of fund contributions for representative workers covered by over 100,000 defined benefit plans, where each fund is faced with a unique funding obligation. So long as the sum of defined benefit contributions across workers is close to a sensible total and so long as pension credits are accurately assigned to

individual workers, this shortcoming of the microsimulation approach is not serious.

For each worker included in the microsimulation, the suggested approach generates a work history, an estimate of retirement benefits earned under employer defined benefit plans, an estimate of assets and pension annuities earned under defined contribution plans, and an estimate of Social Security monthly benefits at disability or retirement, including spousal or dependent benefits. The sum of these income flows represents the total annuity income available to most retirees. (Because it is hard for individuals to purchase fair annuities, few Americans convert other private savings into annuities after they retire.) The worker's replacement rate is calculated as the real after-tax value of annuity income in some year of retirement divided by average real after-tax wages during some period of his or her active career.

For each year in the forecast period, the proposed simulation yields estimates of aggregate contributions of workers and employers to private pension plans and Social Security, earnings on the assets held by the funds and the Social Security Trust Fund, and disbursements to pensioners and workers who withdraw assets from retirement plans before retirement.

To implement this strategy, analysts will need to make predictions of the returns earned by pension funds on their assets. The Social Security projections are straightforward because they require a prediction of only one interest rate, the average rate on U.S. Treasury securities. Since nearly all of the assets held by the Social Security Trust Fund can be sold at par, the fund does not face any capital risk from movement in asset prices. Pension funds hold a much wider variety of assets, and most of them are exposed to capital market risk. For Treasury and corporate bonds in pension fund portfolios, the risk might be small since funds can time the maturity of their bonds to match their anticipated liabilities. Bonds are therefore held to maturity, and the capital risk from early redemption is minimal. If pension fund portfolios include equities, the funds will be exposed to stock market risk. The risk seems particularly high after 2010 when many funds will be liquidating assets to pay pensions to their baby boom retirees (see Figure 7-3).

Schieber and Shoven (1994) assume a relatively fixed rate of return over their forecast period, but as they point out, this assumption is questionable unless we can identify a large and affluent group of investors who want to buy assets when the pension funds will attempt to sell them. For the purpose of creating a baseline simulation, Schieber and Shoven have nonetheless selected a reasonable assumption—average rates of return on different classes of assets will be stable and similar to those enjoyed by investors in the past. To perform simulations corresponding to the Social Security's optimistic and pessimistic forecasts, this assumption could be scaled up or down as appropriate. The basic procedure is useful for evaluating the returns earned in defined benefit plans and the average return in defined contribution plans. It is incomplete, however, for evaluating the

benefits workers can expect to receive under defined contribution plans. On average, these plans will probably earn the market rate of return. But individual workers can earn substantially more or less depending on the investment success of their plan. The microsimulation model must reflect this diversity of actual experience by imputing a distribution of returns to workers enrolled in different defined contribution plans.

In any event, private pension fund modeling requires the analyst to make more extensive and detailed assumptions about returns and asset prices than are required in the Social Security forecast. More important, these assumptions are crucial in assessing the retirement income flows workers can expect in retirement. Most future income of the Social Security system is derived from taxes imposed on wages; relatively little is derived from returns on its asset portfolio. (In the intermediate and pessimistic forecasts, net interest received by the Trust Fund over the full 75-year projection period is negative.) Workers enrolled in defined contribution plans derive much more of their retirement income from returns on their investments. If these investments perform poorly, for an individual or an entire cohort, retirement income will be depressed. If they perform well, private pension income could exceed Social Security benefits for a majority of future retirees. A notable advantage of microsimulation is that it permits the analyst to examine the distribution of individual outcomes for retirement income. Some individuals will enjoy exceptionally high private retirement incomes; others will obtain meager pensions. This diversity of experience is difficult to analyze using aggregate or cell-based prediction strategies.

Household Saving

The imputation of personal saving is very easy if the analyst accepts a simple model of saving. It is notoriously difficult if the analyst believes that most consumers follow a life-cycle rule and recalibrate their consumption path every time they receive new information about economic variables that affect expected future earnings, asset prices, or real returns. The more complex the saving rule followed by consumers, the greater the advantage of using dynamic microsimulation to predict future saving levels.

Under a simple model of saving, persons save a fixed proportion of their current net income in a savings account that earns the average rate of return on financial assets typically held by households (i.e., on household savings outside of pension plans). Saving rates may vary by age and family circumstances. The saving rate by age and household type can be estimated for a cross section of the population using a variety of surveys, including the Consumer Expenditure Survey, the Survey of Consumer Finances, and the Survey of Income and Program Participation. Individuals accumulate assets (including their homes and businesses) according to a fixed assumption about the rate of personal, nonpension saving at each age. Though this assumption could conceivably yield reasonable

estimates of aggregate personal saving in each year (see the section "Rationale for Dynamic Microsimulation"), it offers a poor method for imputing saving and wealth accumulation to individual households. The impressive fact about saving rates in a cross section is that they differ so widely among families, even among families that otherwise appear to be very similar (see Bosworth, Burtless, and Sabelhaus, 1991). Partly as a result, wealth in the United States is distributed much more unequally than income. If analysts wish to replicate the actual distribution of wealth and saving, they must impute individual asset accumulation using a sophisticated variant of the age-determined saving rule just described.5

Implementing a life-cycle consumption rule within a microsimulation model is a much more difficult undertaking, especially if we assume that consumers form their expectations in a fully rational way (see Auerbach and Kotlikoff, 1983, 1984). This approach is certainly worth pursuing if analysts accept the premises of the model, but it requires a large investment if it is to duplicate the observed pattern of household saving. Many economists are skeptical of the model because simple versions of it are not very successful in accounting for important aspects of personal saving. For example, many American workers enter retirement without any assets. A large percentage of workers who do have assets apparently continue to add to them after they retire. Neither fact is easy to reconcile with simple versions of the life-cycle model.

Whatever saving model is adopted, the analyst must determine whether individuals take pension saving and accrual of Social Security benefit rights into account when they decide how much to save outside of pension funds. If pension accruals are taken into account, individuals in generous pension plans will save less than similar individuals who are not covered by a pension. The evidence for this proposition at the individual level is not persuasive although that may be because workers with a high propensity to save are attracted to employers that offer generous pension plans. At any rate, it may be more natural to resolve this issue when treating the issue of aggregate saving than when imputing annual saving rates to individuals represented in the microsimulation sample (see below). Given the goals of the microsimulation, the most important objectives of the imputation procedure are to reliably predict aggregate private saving in each year of the forecast period, by age cohort, and to generate plausible estimates of the distribution of nonpension wealth around the time of each cohort's retirement. It is less important that year-by-year predictions of nonpension saving be accurate at the individual level.

DYNAMIC MICROSIMULATION

Rationale

The approach to forecasting outlined in the previous section relies heavily on dynamic microsimulation. Some baseline assumptions of the forecast, such as

fertility trends, average wage growth, and labor force participation, may be based on Social Security actuarial reports. But most predictions of the model will rest on a method of forecasting that differs sharply from the one used by the Social Security actuary.

There are several alternatives to dynamic microsimulation. One alternative is the cell-based method of forecasting often used by Social Security Administration analysts. Under this approach, analysts predict program costs or outcomes for specific population groups (such as widows reaching age 60) instead of representative households. The approach is inexpensive and can be reliable when analysts are interested in forecasting only a small number of outcomes (e.g., average Social Security entitlements and labor force participation rate). It seems less useful if analysts wish to predict a large number of outcomes (average pension accumulation in a defined contribution plan, average entitlement in a defined benefit pension plan, average savings, average earnings, etc.) or if it is important to understand the distribution of outcomes within population cells. For example, the analyst or policy maker may be interested in obtaining an estimate of the percentage of households that will receive combined Social Security and private pensions that replace less than 30 percent of pre-retirement wage earnings. This kind of estimate is difficult or impossible to derive using cell-based forecasting methods, unless the cells represent very narrow groups of the population. (In that case, of course, the practical difference between microsimulation and the cell-based method is negligible.)

Another alternative to microsimulation is macroeconomic forecasting. A macroeconomic model predicts economy-wide outcomes, such as the unemployment rate, the real return on Treasury securities, and average labor compensation, based on appropriate theory and a set of simultaneously determined equations estimated with aggregate time series data. This kind of model can be effectively used to predict a wide variety of variables that determine the level and adequacy of future retirement incomes (see ''Macroeconomic Policy" below). Macroeconomic models are less useful for predicting outcomes when a wide diversity of outcomes across households is likely to occur. For example, a macroeconomic model offers the most appropriate framework for estimating the average real rates of return on tangible and financial assets. It is less suitable for imputing the distribution of rates of return that will be enjoyed by different classes of investors or individual households.

While it is essential to know the economy-wide rate of return enjoyed by U.S. investors, in forecasting future retirement income flows it is also important to understand how these returns will be distributed across different pension plans and households. Dynamic microsimulation provides a suitable framework for imputing returns to individual plans and households. Of course, analysts may lack reliable information about how rates of return are distributed across classes of investors and individual households. Microsimulation estimates may therefore depend on guesses about the distribution of returns. While this may appear

to be a less reliable basis for prediction than macroeconomic models, in fact it is not. A macroeconomic model yields a single prediction of the rate of return on a particular asset (say, corporate equities). But it is well known that some fund managers obtain higher returns than the market average while a majority achieve worse returns. Under these circumstances, it is more accurate to predict diversity in the investment return of pension funds than to assume identical returns, even if the exact distribution of returns across funds is unknown. Moreover, by clearly defining the kind of information that is needed to describe the distribution of returns across pension funds and households, construction of the dynamic microsimulation model has helped define a research area where more empirical data are needed.

Disadvantages

The dynamic simulation approach outlined under "Micro Models of Retirement" has several disadvantages. Some are described in the National Research Council's survey of microsimulation modeling (Citro and Hanushek, 1991; see especially pp. 114–122). Complex simulation models require a heavy investment of time and effort from skilled researchers and programmers. The models themselves are often unwieldy and require a highly trained staff to ensure that policy simulations are appropriately performed. Detailed information about a wide variety of human behaviors is needed if the model is to provide a realistic picture of the future labor force status and family relationships of U.S. residents. In addition to accurate baseline data covering a representative sample of households, the simulation model requires plausible models of behavior for a wide range of social and economic interactions. It is unclear whether current models of behavior are accurate enough to provide a reliable guide to population dynamics over the next 20 years, much less over the 75-year time horizon examined by the Social Security actuary.

In spite of these difficulties, it is hard to conceive of a practical alternative approach to the analysis of future retirement income flows. The basic goal of the Social Security system and employer pension plans is to provide an adequate level of retirement income to retired and disabled workers and their dependents. The goal is not only to offer adequate retirement incomes on average but to offer adequate incomes to all workers who spend most of their careers in full-time jobs. To determine whether the U.S. retirement income system accomplishes that goal, it is necessary to predict retirement income flows for a sample of representative workers. Prediction of the population average replacement rate or of average replacement rates within population cells cannot reveal whether the distribution of replacement rates across individuals is accomplishing the goal of the retirement system. In particular, if Social Security benefits are sharply reduced and powerful incentives offered for additional private pension and retirement saving

accumulation, predictions from a microsimulation model are needed to show how replacement rates may be distributed among retirees.

Analysts can take practical steps to minimize the disadvantages of microsimulation. To ensure that the results are understandable to ordinary users, the basic simulation model should be kept fairly simple. If evidence for a particular model of behavior is weak or highly controversial, analysts should use straight-forward and clearly described assumptions, rather than a complex behavioral model, to predict crucial aspects of behavior, for example, job turnover, job entry, marriage, remarriage, divorce, or childbearing. The goal of the modeling exercise is to predict the distribution of retirement incomes and evaluate the impact of alternative policies on the distribution of incomes and contribution rates; the goal is not to test the implications of cutting-edge models of social and economic behavior. In predicting job exit, for example, the probability of exit could be assumed to be correlated with just three or four characteristics of the worker (say, age, gender, wage, and current tenure on the job). This simple assumption precludes many sophisticated models of job turnover, for example, those that link worker turnover to the pattern of private pension accrual. The sophisticated models of behavior may be correct, but there is no reason to embed these models in the basic simulation model until it is clear that they enjoy broad acceptance in the social scientific community. Since social scientists are often uncertain about the correct model of behavior, it is in fact desirable to examine in a systematic way the sensitivity of predictions to alternative behavioral assumptions or models (see below).

The disadvantages of microsimulation relative to other methods of analysis and prediction are easy to exaggerate. Microsimulation requires the analyst to spell out explicitly the relationship between individual characteristics and behavioral outcomes (e.g., between age, job tenure, and job exit). Policy makers and many analysts are uncomfortable making detailed predictions for behaviors about which empirical knowledge is weak. Aggregate and cell-based prediction methods do not seem to require this kind of detailed modeling. Yet these methods implicitly rest on assumptions about detailed behavioral relationships that are explicitly treated in dynamic microsimulation modeling. For example, a cell-based prediction methodology may yield the prediction that 55 percent of 60- to 64-year-old retirees in 2020 will qualify for private pensions that have an average value of one-third of the economy-wide wage. Even though the cell-based prediction strategy may appear to embody no explicit assumption about the relationship between age, job tenure, and the probability of job exit, the fact is that some such assumption is implicit in the prediction that the average pension will amount to one-third—rather than one-quarter or one-half—of the economy-wide monthly wage. An important difference between dynamic microsimulation and other prediction strategies is that the microsimulation analyst is forced to be more explicit and detailed in selecting behavioral assumptions. This represents a strength rather than a weakness of the approach. Analysts can plainly see which

behavioral relationships are crucial for purposes of predicting future retirement benefits and retirement income burdens. Government agencies can focus their research budgets on understanding these relationships rather than on topical areas that are less critical to evaluating retirement income policy.

MACROECONOMIC MODELING

The results from the microsimulation models of Social Security, private pensions, and nonpension household saving can be combined in a natural way in a macroeconomic model. In fact, the macroeconomic model represents a crucial advance over current Social Security actuarial forecasts for the purposes of policy evaluation. It permits analysts to predict the change in national saving, and hence in future output, that the Social Security system and other retirement programs cause. In addition, it allows analysts to model explicitly the relationship between different components of public and private saving.

The Social Security projections are based on the premise that future taxes and benefits will be determined under current law. As we have seen, this yields an internal inconsistency, because two of the three projections suggest that the Trust Fund will be exhausted long before the end of the 75-year planning horizon. The probable effect of this imbalance is that taxes will be raised or benefits reduced sometime before the Trust Fund is depleted.

In addition to this policy inconsistency, there is an economic inconsistency in the forecast. Under the intermediate assumptions of the 1994 trustees' report (Social Security Administration, 1994), OASDI tax revenue will exceed benefit outlays by 0.2 percent of gross domestic product in 2010; in 2065, predicted tax revenue will fall short of benefit payments by 2.0 percent of gross domestic product. Over the same period, the predicted cash deficit of Medicare-Part A will climb from 1.0 percent of gross domestic product to 3.4 percent of gross domestic product (Social Security Administration, 1994, p. 185). Over a 55-year period, the combined cash operating deficit of Social Security and Medicare-Part A is predicted to climb by 4.6 percent of gross domestic product. (Under the high-cost assumptions in the report, the combined deficit will grow by nearly 10 percent of gross domestic product.) Unless other federal taxes rise by a third or non-OASDI government outlays fall sharply, the intermediate forecast implies that the federal deficit will more than double. Aggregate saving and net domestic investment may fall, limiting the rise in national income and real wages. This effect is ignored in the trustees' forecast, because future growth rates are generated by growth in the labor force and the assumed steady growth in average labor productivity. If productivity growth is affected by domestic investment and saving, as most economists believe, an important channel of effect is missed.

Determination of Aggregate Output

In a standard growth model, national output is produced by combining the factors of production. In the Cobb-Douglas production function, capital (K) and labor (L) are combined in period t to produce total output (Y),

(1)

where A(t) is an efficiency parameter that rises from year to year as a result of technical progress. Labor supply in period t is assumed to be fixed and can be taken either from the Social Security actuary's forecast or directly from the dynamic microsimulation model. The capital stock is not mentioned in the Social Security forecast. It must be calculated in a base year using information published by the Department of Commerce and then projected in future years as the capital stock in the base period plus the cumulative sum of domestic investment, I, over the projection period, with a constant geometric rate of depreciation, δ:

(2)

The compensation rate for labor, w, and the gross rate of return on capital, r, are determined by the marginal conditions

(3)

and

(4)

The rate of interest on financial assets, as well as the gross profitability of businesses, is tied to movements in r.6

Aggregate U.S. saving (S) is divided between domestic investment and net foreign investment, IF:

(5)

If the United States were a closed economy, IF would be zero by definition. Annual additions to the capital stock could be calculated simply from knowing S. Since the United States is an open economy, IF can be positive or negative depending on whether the nation runs a surplus or deficit in its trade account.

National saving consists of government saving (SG) and private saving (SP)

(6)

where

(7)

and

(8)

Government saving is the difference between taxes (T) and spending (G). It is convenient to divide public saving into the Social Security operating surplus (Social Security taxes less benefit payments) and the surplus or deficit in the remainder of government operations (TO − GO).7 Private saving consists of pension saving (SPen), nonpension household saving (SHH), and other private saving (SO), primarily retained corporate earnings.

The model described in equations (1) through (8) can be solved after specifying the relationships that determine public and private saving and the division of national saving between domestic and foreign investment.8 As a starting hypothesis, we might assume that net foreign investment is zero or is a constant but modest fraction of national output. Domestic investment will then vary directly with movements in national saving. If gross saving is a fixed percentage of gross domestic product—say, 18 percent of Y—then equations (1), (2), (3), and (5) can be used to solve for the technical efficiency factors in (1) that would exactly reproduce the Social Security actuary's 75-year forecast of future gross domestic product and average worker compensation. Deviations from this baseline assumption about the determinants of national saving will produce deviations in the future path of investment, national output, wages, pension accruals, and Social Security surpluses and deficits (see Aaron, Bosworth, and Burtless, 1989, pp. 55–82, 131–33).

Alternative Saving Models

Many analysts will be dissatisfied with the assumptions underlying the Social Security forecast and with the saving assumptions described in the previous paragraph. An alternative approach is to specify the rate of growth of A(t) a priori and then prepare a baseline forecast using the analyst's preferred public and private saving functions. For example, suppose the analyst believes that government dissaving will average 3 percent of gross domestic product for the foreseeable future while SO will average 3 percent of gross domestic product. Since SG and SO always sum to zero under these assumptions, future saving will be determined solely by pension saving and nonpension household saving. Estimates from the microsimulation model yield predictions of the sum of SPen and SHH for each year of the forecast period.9 Note that variations in national saving under these assumptions occur solely because of the predicted aging of the U.S. popu-

lation, which is the main factor causing pension saving and nonpension household saving to vary over time.

Several theories of saving can be expressed as restrictions on the saving equations, (6) through (8). For example, the Ricardian equivalence theorem implies that any deviation of SG from its baseline path will be offset by an equal and opposite deviation in SP; S will be left unchanged.10 This hypothesis is not very helpful for establishing a baseline path of SG or SP, but it does imply that a variety of policies intended to boost public saving will have little if any effect on national saving or future output. Suggestions that federal deficits be slashed or Social Security surpluses increased are futile under this interpretation, since private savers will reduce their saving by an offsetting amount.

A similar though less sweeping theory is sometimes advanced to explain worker reactions to employer pension plans. Well-informed workers recognize that their employers set aside part of compensation in a retirement saving plan. When saving in the pension plan is increased but remains less than the amount workers would otherwise save for retirement, they will promptly reduce their household saving to offset the increased pension plan saving. If saving in the plan exceeds the amount the workers would otherwise save, they reduce their savings to zero and borrow from lenders up to their borrowing limit. The pension plan will affect overall personal saving only to the extent that workers are prevented from borrowing as much as they would like. According to this theory, the simulation model should attempt to explain SPen+SHH. The division of private saving into separate pension and nonpension components is meaningless. Moreover, federal tax or regulatory policies that attempt to restrict contributions into pension plans or to encourage employers to establish new plans will have only a limited influence on saving. Workers will offset the effect of the changes in pension contributions by adjusting SHH.11

The most popular theory to explain saving is the life-cycle/permanent income model. In principle, this theory should explain all saving by households, including saving in and out of pension plans. Martin Feldstein (1974) extended the theory to explain workers' reactions to Social Security pensions. Since these pensions substitute for retirement saving that workers would otherwise have been forced to do on their own, Feldstein reasoned that Social Security could reduce workers' incentive to save. His evidence persuaded him that it did, though many economists remain skeptical of this evidence. Feldstein's extension of the basic life-cycle model is not easy to describe in terms of equations (6) through (8). However, future reductions in the generosity of Social Security pensions would certainly be expected to increase the amount of private saving, either in employer pension plans or in other household accounts.

If the life-cycle/permanent income model is correct, households will be induced to change their saving behavior by changes in their earnings prospects and movements in the real after-tax interest rate. Unfortunately, economists do not know whether an increase in the rate of return increases or decreases the amount

consumers will choose to save. At different points in the life cycle, the effect of an interest rate increase is likely to differ. A dynamic microsimulation model thus offers a suitable context for implementing the life-cycle model in a sensible way. No two economists would agree, however, on the best way to implement the life-cycle theory in a realistic model of household decision making. One reason, mentioned earlier, is that the theory has a hard time explaining the behavior of a large percentage of Americans. Theorists are thus forced to modify the basic theory to account for obvious empirical contradictions.12 Different theorists have proposed different modifications to rescue the basic theory.

One implication of nondynastic versions of the life-cycle model is that consumers will have different reactions to a change in the expected real rate of return depending on their position in the life cycle. (This begs the question of how consumers decide whether a change in the observed rate of return can be interpreted as a change in the permanent rate.) In response to an increase in real returns, young consumers without any assets may raise their saving. Older consumers can reduce their saving, assuming increased rates have not caused them to experience capital losses. The effect on aggregate saving may be ambiguous and may depend on the distribution of income and wealth across age groups; even for a population with a fixed age structure, it may cycle over time. The best way to investigate these issues is with a dynamic microsimulation model that realistically reflects the age distribution of the population over a very long time horizon. The fact remains, however, that economists have proven more adept at designing simulation models than achieving consensus on the crucial parameters of the individual life-cycle consumption function.

CYCLES

The discussion so far has rested on the assumption that many crucial variables attain a stable steady-state path. Predicted cycles in some variables depend mainly on the demographic cycle: predicted labor force growth will slow and eventually stop; after a period of relative stability through 2010, the fraction of the population over 65 will climb rapidly and then rise more slowly. Except in their most pessimistic forecast, the Social Security trustees ignore the possibility that the economy will ever enter a recession. In their most pessimistic projection, the trustees assume two recessions will occur within the next 10 years. Over the following 65 years, the pessimistic forecast assumes steady unemployment and productivity growth.

Because the trustees assume that critical economic and demographic variables will eventually attain stable values, their forecast omits uncertainty arising from sudden and unexpected swings in important variables—real interest rates, productivity growth, birth rates, and price inflation. Equation (4) in the macroeconomic model allows the possibility that saving-induced swings in the investment rate can produce changes in the real rate of return. But the model essentially

accepts the trustees' forecast that productivity, births, and prices will follow steady and predictable paths over the forecasting horizon.

This assumption may have little practical significance for the Social Security forecast. So long as the interest rate and inflation achieve the predicted average levels over the projection period, the long-term actuarial balance of Social Security will probably be little affected. It would be interesting, however, to systematically investigate whether this is true. If real interest rates are low when the Trust Funds have a large balance but then rise as the funds are depleted, the Social Security program will obviously be in a worse position than if the same average rate of return were sustained over the 75-year planning period. Moreover, if productivity improvement is rapid in the years immediately before the baby boom generation retires and then slows down after 2015, the Trust Fund may be in worse financial shape than if productivity improves smoothly over 75 years.13

Cycles in critical economic variables can have an even larger impact on employer pensions and private saving. Few defined benefit employer pensions are indexed to inflation, for example, so their real value drops sharply if inflation climbs by, say, 4 percent. Even if the average 75-year inflation rate is 4 percent, as assumed in the intermediate Social Security projection, this will be small comfort to workers who happen to retire during a period when inflation averages 8 percent. For Social Security pensions, the rise in inflation has a small effect on expected real pensions during retirement; higher inflation reduces the real value of pensions slightly. For most employer-sponsored pensions, the effect will be much more dramatic. As noted earlier, swings in the real interest rate can also produce large effects on the fortunes of private pension funds and private savers. They will have much smaller effects on the financial status of Social Security.

To systematically analyze the risks facing future retiree income, it seems essential to take cycles seriously. Even if cycles make little difference in the long run, they can have large and devastating consequences for particular cohorts of workers and retirees. At a minimum, analysts should investigate the impact of irregular cycles on some of the critical variables, notably, the rate of improvement in technical efficiency (A(t)), price inflation, unemployment, market rates of return on different categories of assets, births, and mortality improvement. One lesson that recent history has taught is that each of these variables has an important cyclical component. Even if we cannot describe a completely convincing theory to explain this cyclical variation, it is important to evaluate its impact on each major component of retirement income. I suspect that plausible cyclical variability in certain variables will have a larger influence on some sources of retirement income than on others. When weighing reforms in different elements of the retirement income system, analysts and policy makers should understand how cycles can affect each leg of the income stool.

CONCLUSION

This paper suggests a modeling strategy to evaluate retirement income security over the next two or three generations. The strategy combines dynamic microsimulation with a simple macroeconomic growth model. Microsimulation is needed to accurately predict the retirement income sources of successive worker cohorts. It offers a natural way to implement the most popular theory of household saving, the life-cycle/permanent income model. Analysts who prefer simpler models can easily implement them using either the microeconomic or the macroeconomic component of the model. The macroeconomic model is essential to understanding the feedback effects of higher or lower retirement saving on future output, wages, and rates of return, all of which help determine the living standards of successive cohorts of workers and retirees.

The proposed strategy can be implemented in discrete steps. An initial step requires the creation of a straightforward dynamic microsimulation model predicting labor force status, job tenure and turnover, private pension and Social Security accrual, and household saving behavior for a representative sample of U.S. workers. This model can be based on existing dynamic simulation models or it can be derived from reanalysis of good cross-sectional or longitudinal files, including the Survey of Income and Program Participation and the Panel Study of Income Dynamics. A second step is to ensure that aggregate predictions from the microsimulation model duplicate predictions of the Social Security actuarial model (e.g., predictions of the age distribution of the population, of the number of persons eligible for and receiving OASDI, of the average Social Security benefit, of Social Security contributions, and of average compensation and taxable wages). At this point the microsimulation component of the model can be utilized in practical policy analysis. The model can be used, for example, to analyze the impact of growing inequality in the distribution of money wages and fringe benefits (see Levy and Murnane, 1992) and the implications of growing earnings inequality for Social Security replacement rates and financial obligations. Earnings inequality and its implications for pension entitlements are much harder to examine using the cell-based forecasting methods of the Social Security actuarial model.

The next step in implementing the model is to develop a macroeconomic model in which aggregate savings are divided into domestic uses and foreign investment. The model may be either simple or complex although for purposes of long-run simulation it probably makes sense to keep the model straightforward and understandable. (Elaborate models of the aggregate economy are typically used to forecast over fairly short periods, usually less than 5 years and almost always less than 10 years. The models are usually elaborate because they are used to forecast many more variables than analysts will be interested in here.) The macroeconomic model must not only explain how savings is divided across alternative uses; it must also account for growth in the capital stock, worker productivity, and wages, and it must explain market rates of return on different

classes of assets. As a first approximation, the predictions of the model should be consistent with the productivity, wage, and interest rate forecasts in the Social Security trustees' report. After completion of this step, the model can be used to analyze the realism of the forecasts in the trustees' report. Do the trustees' predictions of interest rates and productivity make sense in view of the likely availability of future savings? What kind of assumptions about future public and private saving are needed to make the trustees' predictions plausible? The model can also be used for practical policy simulation. If Social Security taxes were immediately increased to reduce the long-term imbalance in the Trust Funds, would the resulting increase in public saving adversely affect private pension returns? If so, would private pensions fall? By how much?

The first implementation of the microsimulation and macroeconomic models will probably be simple and almost certainly unrealistic. The realism of the model can eventually be improved by introducing more elaborate and accurate behavioral modeling. A long-run goal of the exercise is to improve the reliability of the forecasts through improvement in basic knowledge available to simulation designers. Model development can help in selecting topics for empirical research by highlighting the behavioral relationships that are critical for the purpose of reliable forecasting. Even where economists remain divided about the correct representation of economic behavior, the simulation approach is helpful in showing the sensitivity of forecasts to changes in assumptions about critical behavioral relationships.

Actuaries and economists do not have good enough models or information to forecast reliably. It is important under these circumstances to alert users of forecasts to the uncertainty in the forecast. The current Annual Report of the OASDI Trustees (Social Security Administration, 1994) already contains information that can help users understand the uncertainty behind the intermediate projections. In particular, it contains estimates of future national income and Social Security solvency using more pessimistic and more optimistic assumptions than those used to make the intermediate projection. This information can and should be improved, not only in the trustees' report but also in any comprehensive forecast of future retirement income flows. As a first step, analysts should attempt to describe the likelihood of the pessimistic and optimistic assumptions about critical economic and demographic variables. This analysis should be based on evidence from as far back in the historical record as it is possible to go; the forecast should not be dominated by experience of the very recent past. In defining the pessimistic and optimistic assumptions used in any long-term forecast, analysts should attempt to select optimistic and pessimistic assumptions that are about equally likely (or unlikely) to occur. Even if the analyst does not choose an intermediate set of assumptions that is exactly midway between the optimistic and pessimistic assumptions, it still makes sense to select the extreme assumptions so that they bound the likely experience in a symmetrical way.

In selecting the optimistic and pessimistic assumptions, analysts should also

consider the historical experience to see whether favorable outcomes in some of the critical variables have been systematically correlated with unfavorable outcomes in other critical variables. If such correlation exists, optimistic and pessimistic assumptions should be selected to reflect this fact.

Broad interest in retirement issues has been spurred by growing awareness among specialists and ordinary citizens that Social Security may not be able to pay promised benefits. Voter anxiety is understandable. The population is aging, and the proportion of Americans older than 65 will climb rapidly after 2010 under almost any reasonable assumption about future births and deaths. The predictable aging of the U.S. population has led analysts to investigate whether there are predictable consequences of population aging. Many potential consequences have been identified, including effects on Social Security reserves and payroll tax rates, saving patterns, and living standards in retirement.

The focus on predictable demographic variables is somewhat ironic. The outlook for Social Security solvency and future living standards has worsened for a variety of reasons, but the predictable aging of the population is far from the most important. A more salient reason for increased pessimism about the future is the decline in productivity improvement, that is, in the annual growth of A(t) in

FIGURE 7-4 Multifactor productivity growth, selected periods, 1948–1990. SOURCE: Baily, Burtless, and Litan (1993).

equation (1). Figure 7-4 shows changes in the rate of improvement in multifactor productivity from 1948 through 1990. These estimates represent our best guess of the rate of improvement in pure technical efficiency. Estimates are shown separately for the nonfarm business economy and the entire business economy. With either measure, the rate of improvement in technical efficiency has slowed sharply over the postwar period. Slower multifactor productivity growth has a much more dramatic effect on future retiree or worker living standards than expected changes in the age distribution of the population. If technical efficiency in production were to improve as fast between 1994 and 2034 as it did between 1948 and 1968, future workers would enjoy far higher living standards than today's workers, even if the payroll tax doubles between 1994 and 2034.14

One goal of the alternative forecasts in the Social Security trustees' report is to alert readers to the influence of differences in underlying assumptions. This paper argues that the effects of differing assumptions should be evaluated for employer pensions and private savings as they are for Social Security solvency. As a starting point, analysts should examine the implications for future pensions and private household saving of the optimistic, intermediate, and pessimistic assumptions currently used in the trustees' report.

In addition, we should systematically examine the consequences of alternative assumptions about the determination of aggregate saving and the allocation of saving between domestic and foreign investment. Not only are analysts uncertain about the future path of fundamental technical and demographic variables, such as productivity growth, birth rates, and mortality improvement; they are also uncertain about the correct model to use in predicting private and aggregate saving. As it happens, aggregate saving crucially affects the future income available to be divided between workers and retirees. A prudent policy maker would demand some information about the implications of this model uncertainty.

Finally, current methods of the Social Security actuary could be extended in a logical way to assess the consequences of cyclical variation in economic and demographic variables. Because the current forecasts do not consider the effects of cycles that occur more than 10 years from now, they can miss significant threats to the solvency of Social Security and to replacement rates available to future workers. The omission is likely to be even more important for private sources of retirement income, including both private pensions and financial assets held by retirees. An interesting topic for future research is the optimal design of public policy in light of the different risks that face the three legs of the retirement income stool.

NOTES

REFERENCES

Aaron, H.J., B. Bosworth, and G. Burtless 1989. Can America Afford to Grow Old? Washington, D.C.: Brookings Institution.

Aaron, H.J., and G. Burtless 1989. Fiscal policy and the dynamic inconsistency of Social Security forecasts. The American Economic Review, Papers and Proceedings 79(2):91–96.

Auerbach, A.J., and L.J. Kotlikoff 1983. National savings, economic welfare, and the structure of taxation. Pp. 459–493 in M. Feldstein, ed., Behavioral Simulation Methods in Tax Policy Analysis. Chicago, Ill.: University of Chicago Press.

1984. Social Security and the economics of the demographic transition. Pp. 255–275 in H.J. Aaron and G. Burtless, eds., Retirement and Economic Behavior. Washington, D.C.: Brookings Institution.

Baily, M.N., G. Burtless, and R.E. Litan 1993. Growth with Equity: Economic Policymaking for the Next Century. Washington, D.C.: Brookings Institution.

Bernheim, B.D. 1987. Ricardian equivalence: An evaluation of theory and evidence. Pp. 263–304 in NBER Macroeconomics Annual. Cambridge, Mass.: MIT Press.

1993. Is the Baby Boom Generation Preparing Adequately for Retirement? New York: Merrill Lynch.

Bosworth, B., G. Burtless, and J. Sabelhaus 1991. The decline in saving: Evidence from household surveys. Brookings Papers on Economic Activity 1:183–256.

Burtless, G. 1994. The uncertainty of Social Security forecasts in policy analysis and planning. Pp. 1–20 in Public Trustees, Social Security and Medicare Boards of Trustees, Future Income and Health Care Needs and Resources for the Aged. Baltimore, Md.: Social Security Administration.

Citro, C.F., and E.A. Hanushek, eds. 1991. Improving Information for Social Policy Decisions: The Uses of Microsimulation Modeling. Vol. I, Review and Recommendations. Washington, D.C.: National Academy Press.

Feldstein, M.S. 1974. Social Security, induced retirement, and aggregate capital accumulation. Journal of Political Economy 82(5):905–926.

Gramlich, E.M. 1989. Budget deficits and national saving: Are politicians exogenous? Journal of Economic Perspectives 3(2):23–36.

Haveman, R.H., and J. Lacker 1984. Discrepancies in Projecting Future Public and Private Pension Benefits: A Comparison and Critique of Two Micro-Data Simulation Models. Research on Poverty Special Report 36. Madison, Wisc.: University of Wisconsin.

Hubbard, R.G., J. Skinner, and S.P. Zeldes 1994. Expanding the life-cycle model: Precautionary saving and public policy. The American Economic Review, Papers and Proceedings 84(2):174–179.

Johnson, J., R. Wertheimer, and S.R. Zedlewski 1983. The Family and Earnings History Model. Urban Institute Project Report 1434-03. Washington, D.C.: Urban Institute.

Johnson, J., and S.R. Zedlewski 1983. The Jobs and Benefits History Model. Unpublished manuscript. Urban Institute, Washington, D.C.

Kennell, D.L., and J.F. Sheils 1990. PRISM: Dynamic simulation of pension and retirement income. Pp. 137–172 in G.H. Lewis and R.C. Michel, eds., Microsimulation Techniques for Tax and Transfer Analysis. Washington, D.C.: Urban Institute Press.

Levy, F., and R.J. Murnane 1992. U.S. earnings levels and earnings inequality: A review of recent trends and proposed explanations. Journal of Economic Literature 30(3):1333–1381.

Orcutt, G., S. Caldwell, R. Wertheimer II, S. Franklin, G. Hendricks, G. Peabody, J. Smith, and S. Zedlewski 1976. Policy Exploration Through Microanalytic Simulation. Washington, D.C.: Urban Institute Press.

Paine, T.H. 1993. The changing character of pensions: Where employers are headed. Pp. 33–40 in R.V. Burkhauser and D.L. Salisbury, eds., Pensions in a Changing Economy. Washington, D.C.: Employee Benefit Research Institute.

Ross, C.M. 1991. DYNASIM2 and PRISM: Examples of dynamic modeling. Pp. 121–140 in C.F. Citro and E.A. Hanushek, eds., Improving Information for Social Policy Decisions: The Uses of Microsimulation Modeling. Vol. II, Technical Papers. Washington, D.C.: National Academy Press.

Schieber, S., and J.B. Shoven 1994. The Consequences of Population Aging on Private Pension Fund Saving and Asset Markets. NBER Working Paper #4665. Cambridge, Mass.: National Bureau of Economic Research.

Seater, J.J. 1993. Ricardian equivalence. Journal of Economic Literature 31(1):142–190.

Social Security Administration 1994. 1994 Annual Report of the Board of Trustees, Federal OASI and DI Trust Funds. Washington, D.C.: U.S. Social Security Administration.

Zedlewski, S.R. 1984. The private pension system to the year 2020. Pp. 315–341 in H.J. Aaron and G. Burtless, eds., Retirement and Economic Behavior. Washington, D.C.: Brookings Institution.