3

Factors Affecting Labor Supply Decisions and Retirement Income

Robin L. Lumsdaine

Recent retirement research has focused on factors affecting the retirement decision, reflecting the notion that retirement has become voluntary (Quinn, Burkhauser, and Myers, 1990, document the transition over the last four decades from ''involuntary" retirement due to health reasons to the current situation in which most people choose to retire). Leonesio (1993a) cites the "life-cycle view of work, saving, and consumption" as the motivating influence behind the behavioral focus of the retirement literature, particularly with regard to decisions about Social Security, pensions, leaving a career job, and accepting post-retirement work. Recognizing the life-cycle view, economists have concentrated not just on the final decision to retire but on the individual's whole history of labor force participation decisions.

Owing to both the projected shortfall in Social Security and an overall anticipated labor shortage, recent policy has focused on ways to alter these labor supply decisions, particularly with regard to affecting retirement behavior and income. Gustman, Mitchell, and Steinmeier (1994) and Hurd (1993) identify some of the factors that influence the retirement decision. Gustman, Mitchell, and Steinmeier consider factors affecting the individual, such as health status, retirement status of spouse, additional family needs, and the individual's savings

Financial support for this paper from the National Institute on Aging, grant number R37-AG00146, and the Center for Economic Policy Research at Princeton University is gratefully acknowledged. This paper has benefited substantially from comments on earlier drafts by Constance Citro, Marjorie Honig, John Rust, and participants at the panel conference.

and consumption patterns, while Hurd surveys some of the institutional causes that lead individuals to retire at different ages, such as fixed employment costs, the Social Security earnings test, and pre-existing condition clauses in health insurance. In addition, the perceived financial condition of the employer may play a role in an individual's decision to leave a firm.

This paper examines the determinants of some of the key labor supply decisions and their relationship to retirement behavior and retirement income. In order to determine which policies will have the most desirable effects at the lowest cost, we need to assess the relationships and interactions among direct and indirect influences. Some of the questions that have been debated are the following: Will increasing the Social Security early and normal retirement ages create a substitution toward increased disability applications? Have increasing life expectancies resulted in more productive years of life or just prolonged years of nonwork life? Is the relationship between longevity and the ability to work becoming weaker as labor-intensive jobs are a smaller proportion of available jobs? How do individuals formulate expectations about the future and how do they incorporate uncertainty into their decisions? What would be the impact of universal health coverage on labor force participation?

This paper will investigate the data and research methodology needed to answer questions such as these. The first section summarizes some of the trends in factors affecting labor force participation decisions and retirement income. The ability to predict future trends is critical to forecasting the success of proposed changes in policy aimed at ensuring adequate retirement income. The next five sections focus on specific key areas that potentially affect the labor supply decision, the transition to retirement, and associated retirement income: Social Security, pensions and early retirement "window" plans, disability, Medicare and other forms of health insurance, and job characteristics. Each of these sections begins with a summary of questions and currently available techniques for addressing them. I then identify future research priorities, focusing on data and methods necessary to understand the extent of the interaction among these areas and how policies aimed at specific areas will ultimately affect retirement behavior and income. I present conclusions in the final section.

SUMMARY OF TRENDS

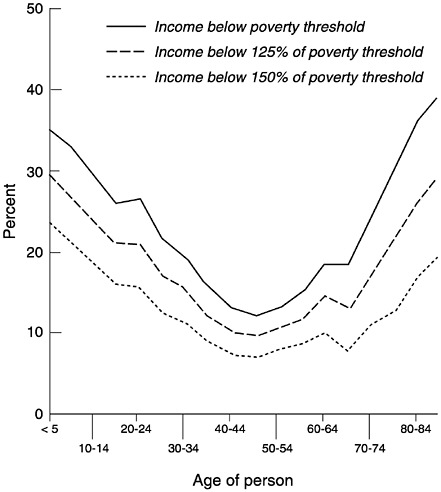

While legislation over the last few decades has aimed to reduce the incidence of poverty among the elderly, the threat of poverty has not been eradicated, as shown in Figure 3-1. As individuals age, the probability of being at or near the poverty line increases substantially. One group of elderly particularly at risk are the nearly one-third of Americans over age 65 that live alone, most often women:

For the millions of elderly people who live alone, the threats of impoverishment, loss of independence, loneliness and isolation are very real. Many have serious health and economic problems that our society and our governments are

FIGURE 3-1 Percentage of persons below poverty and near poverty thresholds, by age, 1990. SOURCE: Radner (1993a).

neglecting. These conditions persist despite the substantial improvements that Social Security and health and income assistance programs have made in the lives of most older Americans over the past 20 years (Kasper, 1988).

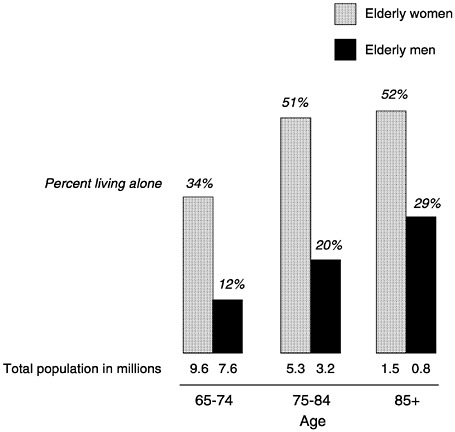

Women currently account for more than four-fifths of the elderly living alone, as seen in Figure 3-2. Poverty rates for the elderly are also expected to be concentrated on single women in the future, despite expectations that the elderly as a group will have higher standards of living than previous cohorts (Kingson, 1992). Radner (1993b) considers income, wealth, and combined income-wealth measures and finds that the economic status of widows living alone is significantly worse than that of other groups of elderly.

Across all ages, uncertainty about Social Security is increasing. Concerns

FIGURE 3-2 Percentage of elderly women and men living alone. SOURCE: Kasper (1988).

over the budget deficit have threatened the current levels of Social Security benefits. Even if benefits are held at their current levels, the aging of the baby boom population poses an additional strain on the Social Security Trust Fund. Combined, these two concerns have undermined confidence regarding adequate income for future generations of elderly.

Despite concerns over the adequacy of Social Security retirement income, the wealth of the elderly remains surprisingly low. The typical American family with a household head age 60 to 65 has very little retirement saving, with median liquid wealth equal to about $6,600 (Venti and Wise, 1992). Lumsdaine and Wise (1994) document various components of elderly wealth and labor force participation and discuss their interaction. Auerbach, Kotlikoff, and Weil (1992) note that the incomes of the elderly are becoming increasingly annuitized as a result of increases in pension benefits and Social Security during the early 1980s. They note that the fraction of elderly income attributable to these two sources

rose from 40 percent in 1967 to 55 percent in 1988, a 37 percent increase. Increased annuitization could make retirement income planning easier by reducing future uncertainty. However, it is not the fraction of annuitization that is important for the adequacy of retirement income, but the amount.

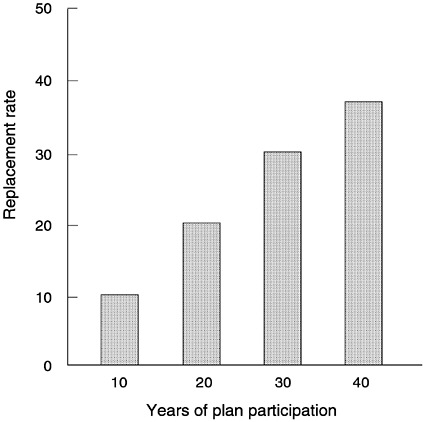

There is additional evidence that the elderly will continue to find themselves with inadequate income to carry them through retirement. The American Society of Pension Actuaries (ASPA) found that employees receive only limited investment advice when it comes to retirement planning. What advice is given often occurs within 1 or 2 years of retirement. ASPA recommends four vehicles for improving one's retirement income. At the individual level, income is expected to come from personal savings, Social Security, pension, and supplemental work after retirement. At the macro level, they emphasize a need for universal coverage and replacement rates targeted as high as 85 percent of final pay for low-income workers and 73 percent for higher income workers. In 1990, average replacement rates for Social Security varied from 28 percent for maximum earners to 56 percent for low wage earners. Currently only 12 percent of employers surveyed have pension plans that are designed around specific replacement rate goals. Of those that do have specific replacement rate goals, the target replacement rate falls far short of those recommended by ASPA (Employee Benefit Plan Review, 1994a). Figure 3-3 shows average replacement rates for defined benefit plan participants in 1989. Evidence in Mitchell (1992) concurs; for representative workers in defined benefit plans with 30 years of service, replacement rates ranged from 34.6 percent for individuals with final earnings of $15,000 to 29.8 percent for individuals with final earnings of $40,000. Fewer years of service substantially lowered replacement rates at all levels; for example, a worker with only 10 years of service could expect a maximum replacement rate of 12.1 percent. According to reports in Employee Benefit Plan Review (1994b), using the Consumer Expenditure Survey, replacement rates for lower income individuals in 1993 were nearly the same as in 1988; the replacement rates for higher income individuals had gone up dramatically.

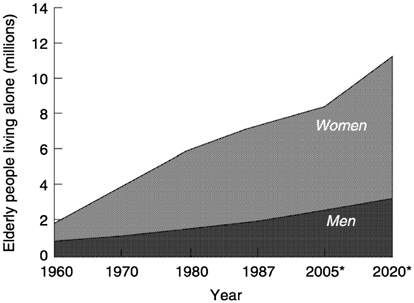

Of particular concern is the adequacy of retirement income for women (for a review of the literature, see Weaver, 1994). Although the proportion of elderly living alone is expected to remain constant in the future, the percentage that are women is projected to increase, as seen in Figure 3-4. In addition to having longer life expectancies, women have traditionally been more likely to experience gaps in service, leading to reduced Social Security and pension benefits. As more women enter the labor force, concern over adequacy of retirement income for women may decrease. In 1959, 40 percent of women above age 16 were in the labor force, compared with 60 percent in 1989 (U.S. Department of Labor, 1992). Additional evidence suggests improvements in earnings that will lead to higher Social Security benefits. Over roughly the same time period, the percentage of women over 62 receiving Social Security benefits on the basis of their own work history has increased from 43.3 percent to 59.7 percent (see Table 3-1). It

FIGURE 3-3 Average replacement rate for defined benefit pension plan participants, medium and large private establishments, 1989. NOTE: Calculations based on retirement at age 65 with annual salary of $35,000 in final year. SOURCE: U.S. Department of Labor (1992:Chart 20).

is not clear that there have been similar improvements in pension benefits. Even and MacPherson (1994) note that "pension coverage for women is less likely to convert into pension receipt at retirement" (p. 562). In addition, the average level of benefits for women is between 55 percent and 62 percent of the average level of benefits for men. Even and Macpherson estimate that one-third of the gap in coverage between men and women is attributable to women's absence from the labor force (their work history). Some of the policies that have been proposed to address this disparity are earnings sharing, homemaker credits, and caregiving credits (Employee Benefit Plan Review, 1994a, from Ferber, 1993).

While an obvious solution to the threat of inadequate retirement income is a shortened retirement phase (through either prolonged work, delayed retirement, or earlier mortality), trends both in labor force participation and life expectancies suggest that retirement savings will need to be stretched over more years of life

FIGURE 3-4 Composition of elderly people living alone. NOTE: Asterisked years are projections. SOURCE: Kasper (1988).

rather than fewer. Labor force participation rates of the elderly are decreasing, particularly among men. Table 3-2 compares labor force participation rates of men and women at various ages between 1970 and 1990. While male labor force participation rates have decreased dramatically, corresponding rates for women have increased in the first three groups but have declined in the 62-to-64 and 65+ age groups. As a result, the gap between male and female labor force participation has narrowed over the last two decades, by about 15 percentage points for those aged 50 to 62 (Peracchi and Welch, 1994). In addition, the modal labor

TABLE 3-1 Percentage of Women Over Age 62 Receiving Social Security on the Basis of Their Own Work History

|

Year |

Percent |

|

1960 |

43.3 |

|

1970 |

50.6 |

|

1980 |

56.9 |

|

1988 |

59.7 |

|

SOURCE: U.S. Department of Labor (1994) and Lingg (1990) (primary source). |

|

TABLE 3-2 Labor Force Participation Rates (percent)

|

|

Age |

||||

|

Gender and Year |

45–54 |

55–59 |

60–61 |

62–64 |

65+ |

|

Men |

|

||||

|

1970 |

94.3 |

89.5 |

82.6 |

69.4 |

26.8 |

|

1990 |

90.7 |

79.8 |

68.8 |

46.4 |

16.4 |

|

Women |

|

||||

|

1970 |

54.4 |

50.4 |

41.4 |

32.3 |

9.7 |

|

1990 |

71.2 |

55.3 |

42.9 |

30.7 |

8.7 |

|

SOURCE: Bureau of the Census (1992, Table 622). |

|||||

TABLE 3-3 Life Expectancy and Projections Among White Men and Women, Age 65 (in years)

|

|

Actual |

Projected |

||

|

Gender and Scenario |

1980 |

1990 |

2000 |

2020 |

|

Men |

14.2 |

15.2 |

|

|

|

I |

|

15.3 |

15.6 |

|

|

II |

|

15.9 |

16.7 |

|

|

III |

|

16.4 |

18.0 |

|

|

Women |

18.4 |

19.1 |

|

|

|

I |

|

18.9 |

19.1 |

|

|

II |

|

19.6 |

20.4 |

|

|

III |

|

20.2 |

21.9 |

|

|

SOURCE: U.S. National Center for Health Statistics (1990) (actual) and Hurd (1994b) (projections). |

||||

force participation transition age moved from 65 in 1968 to 62 in 1991 (Quinn and Burkhauser, 1992; Peracchi and Welch, 1994).

In addition to declining labor force participation trends, life expectancies are also increasing. Table 3-3 shows life expectancies and projections for white men and women under three different demographic scenarios (these are described in Hurd, 1994b). In the last decade, the life expectancy for men has increased by 1 year. Depending on the projection used, even scheduled increases in the Social Security eligibility age, aimed at encouraging later retirement, will not keep up with the increasing life expectancies. The elderly population is itself aging. In 1980, 40 percent of individuals 65+ were over age 75. It is expected that by 2000,

FIGURE 3-5 Recipients of Social Security payments, 1940–1990. SOURCE: U.S. Department of Labor (1992:Chart 25).

this proportion will rise to 50 percent. As individuals age, the threat of poverty rises substantially. In 1990, one-fifth of persons age 85 or older had income levels at or below the poverty threshold (Radner, 1993b).

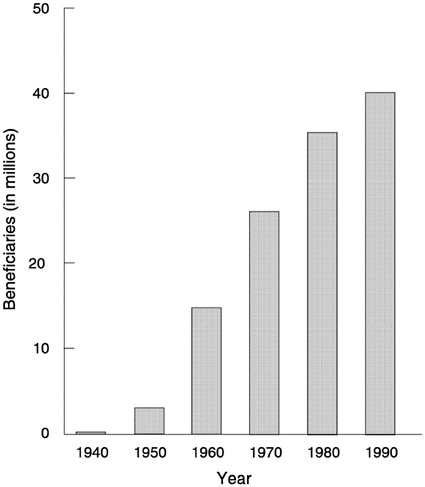

Because of these trends, the ratio of the retired population to the working population is expected to rise from 0.21 in 1990 to 0.27 in 2020 to 0.37 in 2035 (Congressional Budget Office, 1993). The number of Social Security beneficiaries has also increased dramatically, as shown in Figure 3-5. To remain solvent, the current Social Security system will have to impose an increasingly large tax burden on the shrinking working population in order to support the growing elderly population.

SOCIAL SECURITY

In 1990, nearly 40 percent of the income of the elderly (65+) was from Social Security (Congressional Budget Office, 1993). In addition, 57 percent of the elderly obtained more than half their income from Social Security; 24 percent obtained more than 90 percent from this source (Hurd, 1994a). Almost 95 percent of elderly households reported receiving Social Security benefits (Hurd, 1994a; Congressional Budget Office, 1993); these benefits are an especially important component of income for households in the lower income brackets and are the largest single source of income for all but the highest income quintile of the elderly (Reno, 1993). It is projected that for retirees in the bottom half of the income distribution in 2019, 60 percent to 70 percent of retirement income will come from Social Security (Kingson, 1992). As a result of pressures on the Social Security system and rising health care costs, concern that the income of the elderly will be inadequate has created debate over how to increase retirement income, accompanied by legislation aimed at effecting such an increase.

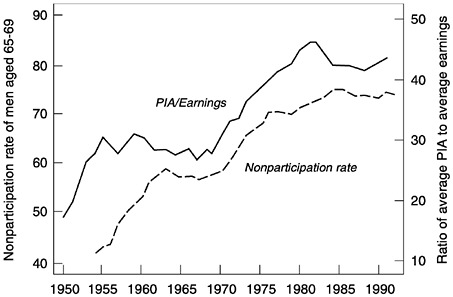

Because Social Security affects so much of the elderly population, it is the obvious place to start in discussing broad-based policy changes that influence retirement behavior and income. Previous research considering the effects of changes in Social Security policy on retirement and labor force participation includes Gustman and Steinmeier (1991) and Feldstein and Samwick (1992). As Table 3-2 showed, it is clear that labor force participation rates decline precipitously among individuals that have reached the Social Security early and normal retirement ages (62 and 65, respectively). Using aggregate time series data, Stewart (1995) provides further evidence of the influence of Social Security, demonstrating that ratios of primary insurance amount (PIA) to earnings closely mirror the nonparticipation rate of men ages 65 and older, as shown in Figure 3-6. However, evidence in Bondar (1993) suggests that individuals with high pre-retirement earnings (as estimated based on PIA amount) are most likely to continue to work and earn high post-retirement earnings. In addition, replacement rates (PIA/earnings) are higher for low wage individuals, suggesting that the labor force participation decline is being driven by precisely the individuals for whom concerns over retirement income adequacy are the largest. Therefore, discussions about the government's role in ensuring adequacy of retirement income have focused on the Social Security program and its ability to meet the needs of a growing elderly population.

Researchers have also become increasingly aware of the Social Security system's inability to adequately provide for many women in their retirement. This is due partly to the societal norms under which the system was designed (i.e., around the "traditional" one-earner family) and to differences in men's and women's labor force history and attachment. Ferber (1993) provides evidence that the earnings gap, along with male/female differences in labor force participation and tenure, has declined, but not disappeared.

FIGURE 3-6 The PIA/earnings ratio and the nonparticipation rate of men aged 65–69 in the labor force. NOTE: PIA is the primary insurance amount. SOURCE: Stewart (1995).

In order to increase labor force participation and decrease the burden on the Social Security system, current Social Security policy dictates an increase in the normal retirement age from 65 to 67. Those born in 1937 will be the last group with a normal retirement age of 65. Those born in 1960 will be the first with a normal retirement age of 67. Many believe that this increase is too gradual. In addition, the level of benefit reduction at age 62 will gradually increase from 20 percent to 30 percent. The earnings test will be liberalized; it currently affects only individuals below age 70. To try to reduce some of the perceived inadequacies of the Social Security system, an earnings-sharing proposal (where the Social Security benefit is based on the earnings of the household, not just on individuals) and a two-part payment system have also been suggested. The latter is an attempt to meet the dual roles of the Social Security system—to provide a basic amount of coverage to all elderly (not just wage earners and their spouses) and to provide an additional payment proportional to wages. As mentioned earlier, additional proposals include caregiving and homemaker credits, but the current design (of supporting wage earners in retirement based on revenues from current wage earners) does not suggest an obvious answer to the question of who will pay for such credits.1

The earnings test component of Social Security, which applies to individuals below age 70 (the age limit was 72 prior to 1983), is viewed as a significant barrier to continued work. In addition, the earnings test is more liberal for Social

Security recipients above age 65 than for those aged 62 to 64. In 1990, the benefit reduction rate was decreased for individuals 65 and over from one-half to one-third. That is, for individuals aged 62 to 64, for every $2 of earnings above the maximum allowable limit, an individual's Social Security benefit is reduced by $1, while the same reduction is applied to every $3 of earnings for those age 65 and over.

Bondar (1993) studies individuals affected by the earnings test in 1989. Among Social Security beneficiaries, 75 percent were retired workers; 36 percent of these had their entire benefit withheld. He notes that in addition to Social Security beneficiaries, there is a potentially large group of individuals who are discouraged from applying for Social Security benefits because they know their benefits will be withheld. This group is unobservable and their existence therefore limits the accuracy with which predictions about potential policy changes can be made. It is estimated that approximately 40 percent of insured men and women age 62–64 do not file for benefits and that about 5 percent of men and 15 percent of women age 65 and older do not.

Honig and Reimers (1989) argue that the returns to eliminating the earnings test are decreasing with the proliferation of private pensions, which often encourage individuals to withdraw completely from the labor force. This suggests that in modeling the impact of Social Security policy, it is important to include private pensions; omitting this crucial interaction may prove misleading. Evidence of this is also given in Stock and Wise (1990a) and Lumsdaine, Stock, and Wise (1996a), who demonstrate via simulation, using data from two individual Fortune 500 firms, that for individuals with pension plan availability, changes in Social Security policy will have very little effect. They attribute this to the relative magnitudes of pension versus Social Security benefits. However, for individuals who rely solely on Social Security, changes will have a much larger effect. In addition, Lumsdaine, Stock, and Wise (1996a) show that even for individuals who have access to both a pension plan and Social Security, the complete elimination of Social Security would have a significant impact on labor supply behavior.

Leonesio (1993a:54), in summarizing the literature and findings regarding the Social Security earnings test, concludes:

… research suggests that retirement decisions are influenced by the availability and generosity of Social Security and private pensions, health status, job characteristics, wage offers, family circumstances, and personal preferences for work versus leisure time. These other contributing factors that encourage or enable retirement appear to be dominant.

In order to promote continued work and to partially offset the effect of the earnings test for workers age 65 to 69, the delayed retirement credit (the amount added to one's annual Social Security benefit to take into account nonreceipt in previous months, due either to the earnings test or to postponement of applica-

tion) has increased over the last decade, from 1 percent to 3 percent in 1983 and to 4 percent in 1989. It will continue to increase by 0.5 percent every other year until reaching a maximum of 8 percent in 2010, with the age past which it is applied increasing as the normal retirement age increases. This is designed to be approximately actuarially fair using current mortality probabilities. Although this is an alternative to the relaxation of the earnings test, it may achieve similar results, aiding those with higher benefits (earnings) more. In terms of behavioral impact, however, the two may differ substantially depending on the structure of individual preferences (see Honig and Reimers, 1989:endnote 1). Whether or not this policy will succeed in its goal of eliminating the cost associated with continuing to work depends on assumptions about the future, both at a macroeconomic level (e.g., the stability of tax rates) and at a microeconomic level (e.g., individual earnings profiles).

Research seems to suggest that the labor supply impact of these liberalizations will not be substantial (Gustman and Steinmeier, 1991; Leonesio, 1990). Gustman and Steinmeier (1991) conduct a simulation study using the Survey of Consumer Finances (SCF) to assess the impact of changing the delayed retirement credit from 3 percent to 8 percent and of eliminating the earnings test. The SCF has the advantage of also containing information about pension plans. Gustman and Steinmeier incorporate many details such as pensions that other studies omit and include a number of stochastic terms representing such things as health status. Their results suggest that the impact on labor supply would be modest, increasing labor force participation by about 3.5 percent per year for individuals age 65 to 69. In particular, the average date of retirement would increase by about 3 weeks. They argue that this is because individuals will adjust to policy changes by altering their time of application for benefits rather than modifying their labor supply behavior. In addition, they argue that no single delayed retirement credit is appropriate for all individuals.

Mitchell (1991) considers four changes in the Social Security benefit formulas: (1) raising the normal retirement age, (2) delaying the cost-of-living adjustment, (3) increasing the delayed retirement credit, and (4) increasing the penalty for early retirement. All are intended to increase labor force participation and delay retirement and are representative of policy currently being implemented. Mitchell (1991) simulates the retirement response to these changes via a logit model. Despite drastic changes in benefit amounts, the predicted impact of an increased penalty for early retirement is modest; retirement for men is delayed by 3 months. The other simulations yield smaller results; these findings are consistent with those of Gustman and Steinmeier (1991) and Lumsdaine, Stock, and Wise (1992, 1996b). For women, the impacts are even less pronounced. Using time series data, Stewart (1995) predicts a much larger effect than previous studies based on microdata of changes in Social Security provisions. In particular, he attributes nearly 40 percent of the decline in labor force participation rates to Social Security. Of the four changes considered, Mitchell finds it is the final

change that contains the most powerful financial incentives to alter labor supply behavior. Stewart (1995) concurs, citing liquidity constraints as the reason many individuals wait for the Social Security early retirement age to exit the labor force. Increasing the penalty for early retirement will cause more individuals to be liquidity constrained and therefore unable to finance an exit from the labor force. In particular, there is evidence that such changes will have a substantial effect on the fraction of elderly families at or near the poverty level, precisely those that are likely to be liquidity constrained. In 1988, 68 percent of new retired worker Social Security awards for men (74% for women) were made prior to the normal retirement age (Kingson, 1992); it is therefore unlikely that changes to this later age would have substantial effects on retirement behavior.

Leonesio (1993b) describes other Social Security policies that have been proposed in an attempt to encourage prolonged work by the elderly. His conclusion is that ''changes in Social Security programs of the type and magnitude that are politically feasible in the foreseeable future are unlikely to produce large changes in retirement patterns" (p. 47). This brings into question the expenditure invested in examining Social Security policy. Perhaps the focus should be in areas thought to have greater effects. In documenting previous results by a variety of researchers (e.g., Burtless and Moffitt, 1984, 1985; Fields and Mitchell, 1984), he notes that the effects of increases in monthly benefit levels tend to be modest; a 10 percent increase (decrease) is associated with a corresponding increase (decrease) of the retirement age by about 1 month. In fact, the effects of all policy changes he reviews are described in terms of months, not years. He argues, however, that this is because it is also necessary to examine the effects of Social Security policy changes on related decisions that may affect the retirement decision.

While much of the literature on Social Security (and retirement behavior more generally) has used reduced-form models, which can document correlations and explanatory power, structural models are important for assessing potential policy impacts. As noted by Rust (1989), early research on Social Security used a life-cycle consumption model, which, in its simplest form, predicts that individuals will decumulate their wealth towards the end of their lives. This is contrary to observations on savings behavior of the elderly. However, a more general life-cycle model, with rigidities such as liquidity constraints or a bequest motive, provides a dynamic context in which to model behavior. Rust formulates a dynamic programming model in which workers use an optimal decision rule to choose their retirement date. The control variables are consumption expenditures and the decision regarding retirement; the model allows for uncertainty in the state variables, which are things like life expectancy, health status, and retirement earnings. One of the elements missing from Rust's (1989) model is pension benefits. This is due to data limitations in the Retirement History Survey (RHS); such limitations will be less apparent in the new Health and Retirement Survey (HRS).

Despite significant research devoted to the impact of Social Security provisions, debate still continues as to the relative importance of Social Security on the retirement decision and retirement income. Part of the difficulty lies in attempts to predict responses in a heterogeneous population. Inferences depend crucially on the sample studied and on additional factors and sources of income. There is also disagreement about the validity and accuracy of using reduced-form models to predict the effects of policy changes; even among structural models, static and dynamic approaches can result in very different predictions.

PENSIONS AND WINDOW PLANS

What can be done to alleviate the projected shortfall in Social Security? One solution is to rely on pensions for supplemental income. Income from pensions accounts for about 18 percent of all income of elderly (65+). The proportion of elderly households receiving income from all types of pensions in 1990 was 44 percent (Congressional Budget Office, 1993). This proportion and its relative importance vary considerably along demographic lines. For example, while 57 percent of elderly couples age 65 and older report receiving a pension, only 32 percent of unmarried women do (Reno, 1993). It is projected that for those in the upper half of the retirement income distribution in 2019, 30 percent to 40 percent of cash income will come from private pension benefits (Kingson, 1992, citing a Congressional Budget Office projection). Two-thirds of individuals in the HRS report having pension coverage (Gustman, Mitchell, and Steinmeier, 1994). Of these, 42 percent have only defined benefit plans, while 16 percent have only defined contribution plans. It is becoming increasingly common for employees to face a number of choices regarding pension plan and saving for retirement. According to a survey by Merrill Lynch, as reported in the Employee Benefit Plan Review 1994b), "only 61% of preretirees have savings and investments apart from an employer-sponsored pension plan."

Reimers and Honig (1992) cite difficulties in inference on labor supply behavior with nationally representative data owing to a lack of detailed pension plan information. This is particularly important when analyzing the behavior of men, for whom pension benefits are a greater proportion of retirement income. "The lack of pension information means not only that one cannot estimate the effect of pensions, but also that one cannot obtain unbiased estimates of the effects of other variables" (p. 3).

It has also been shown that for firms, pension plans can be a useful tool for affecting workers' behavior. Clark, Gohmann, and McDermed (1988) note that defined benefit plans in particular provide incentives for employees to remain at a specific firm and to refrain from behavior that might lead to their dismissal. They note that "firms with high costs of hiring and high monitoring costs also will tend to use defined benefit plans" (p. 11). In addition, firms can use defined benefit plans to alter retirement behavior. Ruhm (1994) provides evidence that

pension coverage is associated with increased attachment to the labor force through certain ages, followed by decreased probability of attachment at later ages.

Lumsdaine, Stock, and Wise (1992) use data from a single Fortune 500 firm to illustrate the dangers of drawing inferences without pension information for individuals that, in fact, have access to a pension plan. In simulating the effects of eliminating Social Security early retirement using information on both types of retirement income, they estimate between a 9 percent and a 15 percent reduction in retirement rates of individuals ages 62 to 65; if pension information is not incorporated, the reduction is estimated to be between 43 percent and 72 percent. In addition, the interaction between Social Security and pension plan provisions is well documented—the General Accounting Office (1989) estimates that 42 percent of pension plans used some method of integration in computing benefits.

While pension coverage rates have remained reasonably stable over the last 20 years (Table 3-4; see U.S. Department of Labor, 1994), the percentage of pension-covered workers enrolled in primary defined benefit plans has declined dramatically, from 87 percent in 1975 to 68 percent in 1987 (Ruhm, 1994, citing Beller and Lawrence, 1992). Clark, Gohmann, and McDermed (1988) argue that in response to increased pension regulation and to legislation, the 1980s have seen a shift from defined benefit to defined contribution pension plans. Reno (1993) notes that this shift accounts for only 10 percent of the growth in primary defined contribution coverage; the majority of the growth is due to new plans, both primary and supplemental. Defined benefit plans are often based on final salary (or an average of the final few years) and take the responsibility of saving for retirement away from the individual. To the extent that individuals fail to save adequately for their retirement, this may not be a negative characteristic. In a survey of 944 major U.S. employers, 96 percent of defined benefit plans did not require employee contributions (Hewitt Associates, 1990). Even firms that have a defined benefit plan as their primary plan often offer a defined contribution plan to supplement the primary plan. Defined contribution plans often allow for more mobility than defined benefit plans. Particularly popular are 401(k) plans, where the employee shares in the responsibility for his/her retirement income by contributing jointly with the employer. By 1987, they were primary plans for 8 percent of private plan participants—supplemental for an additional 23 percent (Reno, 1993, citing Beller and Lawrence, 1992). An additional attractive feature is that the employee can make supplemental voluntary tax-deferred contributions (Reno, 1993). The observed increase in defined contribution plans means increased portability. "Without portability, the average private pension participant receives benefits 15% lower than if all benefits were fully portable" (Marks and Seefer, 1992:57). However, there is also evidence that portable benefits are often received as a lump sum; this option undermines the security such plans are intended to provide. Prior to receipt of the pension distribution, the risk of investment performance of the pension funds in defined contribution plans is

TABLE 3-4 Coverage Rates, Employer-Provided Pensions, 1979–1987 (percent)

|

Panel |

1979 |

1980 |

1981 |

1982 |

1983 |

1984 |

1985 |

1986 |

1987 |

|

Panel Aa |

|||||||||

|

Total |

44.9 |

44.9 |

44.3 |

43.8 |

43.4 |

42.4 |

42.8 |

42.6 |

40.8 |

|

Male |

51.5 |

51.0 |

50.1 |

48.9 |

48.3 |

47.1 |

47.5 |

47.0 |

45.1 |

|

Female |

37.0 |

37.5 |

37.3 |

37.7 |

37.7 |

37.0 |

37.4 |

37.6 |

36.0 |

|

Panel Bb |

|||||||||

|

Total |

47.1 |

46.5 |

45.6 |

44.7 |

44.1 |

43.7 |

44.1 |

44.2 |

42.2 |

|

SOURCE: U.S. Department of Labor (1994) and Parsons (1991a). a Civilian wage and salary workers covered by pension plans. b Households with one or more members covered by employer-provided pension plans. |

|||||||||

borne by the employee. In addition, recipients are able to use distributions for other purposes (Woods, 1993). Reno (1993) notes that in 1988, only 11 percent of workers with previous lump-sum distributions reported rolling it all into a tax-deferred retirement account.

Policy changes in private pension plan provisions have occurred in a variety of ways, from the extreme form of liquidation of the existing company plan2 to special "window" (incentive) plans targeted at a particular group of workers. Such plans have sometimes accompanied a restructuring or downsizing of the firm and have tended to be fairly generous. As a result, these plans, which often target a specific group of workers and provide special incentives to retire (leave the firm), have a profound effect on the labor force participation rates of the target group.

Literature Review and Previous Methodology

Much of the literature on pension plans and retirement is based on results using static models. These include least squares models as well as limited dependent variable specifications (e.g., Clark, Gohmann, and McDermed, 1988, using plan choice (DB or DC) as the dependent variable, Lumsdaine, Stock, and Wise (1992) and Samwick (1994), using retirement as the dichotomous dependent variable, Even and Macpherson (1994), using coverage as the dependent variable, Haveman, deJong, and Wolfe (1991), using labor market participation as the dependent variable, Gustman and Steinmeier (1993b), using job separation as the dependent variable), median regression (Samwick, 1994), and proportional hazard models. These different types of models have systematically documented the effects of pension plan provisions on the retirement decision and retirement

income. They have been less successful in predicting the effects of a change in policy.

Gustman and Steinmeier (1993b) address the notion that pension plans reduce labor mobility (create "job lock"). Using separation as the dependent variable in a reduced-form probit model, they find that pension plans are not a substitute for wage compensation; instead compensation in pension-covered jobs is higher. The "compensation premium"—rather than the nonportability of pension plans—accounts for increased attachment to the firm. Defined contribution plans, which are more portable, exhibit similar effects on mobility.

Allen, Clark, and McDermed (1993) note that the observed lower mobility among pension-covered workers may be due to both a bonding effect (as noted by Gustman and Steinmeier, 1993b) and a sorting effect, that is, that workers with certain observable characteristics prefer pension jobs.3 They find evidence of "self-selection of workers with low odds of turnover into jobs covered by pensions" (p. 476). Understanding and modeling such selection issues is critical to interpreting and predicting the impact of changes to pension plans.

A careful review of pension legislation over the last decade is in Clark, Gohmann, and McDermed (1988), who use a probit model with plan choice as the dependent variable to consider the impact of regulation on a firm's choice of pension plan type. They find that the probability of a firm's offering at least one defined benefit plan has declined throughout the last decade. The shift towards defined contribution plans as a result of favorable tax treatments and anti-age-discrimination regulation is indicative of the way that firms can respond to government legislation. This casts doubt on the efficacy of government plans to alter the labor force composition via Social Security changes; Lumsdaine, Stock, and Wise and others have argued that firms may well offset potential effects via their pension plans.

Luzadis and Mitchell (1991) also find that the regulatory environment has significant impact on employer-sponsored pension incentives, most noticeably with regard to Social Security policy changes. There is also evidence that the observed dynamics pertain to the "buyout" hypothesis, that is, that firms encourage certain individuals to leave. Both of these findings emphasize that response to pension plan provisions should be modeled in a dynamic context, which acknowledges the flexibility employers have to manipulate plan characteristics and incentives.

A number of models have been used to capture more of the dynamic decision process of individuals. Such dynamic models are critical to understanding actual behavior. The benefit of dynamic behavioral models is the potential for policy analysis. The model's parameters can be estimated under a base-case scenario, and a variety of dynamic policies can be assessed. Unfortunately, exactly modeling such dynamics in a way that mirrors reality is difficult, if not impossible. It is therefore necessary to make simplifying assumptions in order to achieve tractability. In addition, there is debate as to what the goal of mirroring reality seeks to

accomplish—do we want to imitate the decision-making process, or are we satisfied with achieving similar outcomes and the ability to predict future outcomes accurately?

Gustman and Steinmeier (1986) ignore uncertainty and assume perfect markets in constructing a life-cycle model of retirement. Their model specifies reduced wages for diminished work effort. They use the RHS data set and maximum likelihood estimation. They note that the peaks in retirement rates at ages 62 and 65 are completely attributable to Social Security, pension provisions, and mandatory retirement. Simulations implementing the shift of the Social Security normal retirement age to 67 produce a corresponding shift in the latter peak in retirement rates.

Stock and Wise (1990a, 1990b) proposed the "option value" model, where individuals retire at the age that achieves the maximum gain from the choice of postponing retirement versus retiring in the current period. The motivation for their model is from Lazear (1979), which suggests that by delaying retirement, individuals retain the option to retire at a later date, under potentially more advantageous terms. In the Stock-Wise model, individuals reassess their options at each new time period. The model is fairly flexible in that it allows for correlated individual-specific errors and features a parsimonious specification. Correlated errors in a dynamic setting are difficult to model analytically, as the model would involve high orders of integration. The tractable simplification, in this case, is that individuals maximize the present discounted value of expected wealth.4 In addition, a parameter is included to take into account the possibility that an individual values a dollar associated with work differently from a dollar associated with leisure. Stock and Wise use data from a single Fortune 500 firm. These data consist of a panel of individual earnings histories over a number of years. In addition, the data are well suited for analyzing the validity of the model; parameter estimates can be obtained from data from one year and used to predict behavior in subsequent years. The results of such an analysis, as well as the incorporation of individual-specific errors that follow an AR(1) process, are in Stock and Wise (1990b).

Stock and Wise (1990a) also consider a number of simulations to assess the effects of potential policy changes. Using the parameters obtained under the base specification, they simulate the effects of increasing the firm's early retirement age, increasing the Social Security early retirement reduction factor, and increasing the Social Security early retirement age. Subsequent papers by Lumsdaine, Stock, and Wise (1990, 1994) have considered modifications to the base model.

Lumsdaine, Stock, and Wise (1992) compare a simpler, static model (probit), two dynamic programming models with uncorrelated individual-specific errors, and the option value model. They find that the three dynamic models perform significantly better in terms of fit and prediction than do static probit models. A separate issue, raised by Lumsdaine, Stock, and Wise (1992), is what the goal should be with these increasingly complex models (see also Burtless, 1989).

There are clear gains in inference from using dynamic models over the static ones. If the goal is to mirror the observed pattern of behavior, these models do quite well. However, it may also be desirable to mimic the actual decision-making process that an individual undergoes. In this case, it is hardly plausible that the average individual will utilize the level of complexity specified in these dynamic models. In addition, usually the more complicated the model, the more simplifying assumptions necessary to retain tractability. It is therefore necessary to ensure that models are robust to misspecification and to determine the impact of these assumptions and their relation to actual behavior.

Lumsdaine, Stock, and Wise (1994) compare the behavior of men and women. Contrary to common belief, for individuals in the specific firm they consider, the actual behavior is quite similar; this is also reflected in the parameter estimates and the predicted behavior. Because there are only two transition states, maximum likelihood is feasible; a modified simulated annealing (random search method, not requiring second or even first derivatives of the relevant function) is at times employed in estimation. Dynamic models that allow for multiple choices (transition states) usually need to employ integral approximation techniques to retain tractability.

Window plans, when analyzed with the corresponding individual firm's pension details, provide a convenient way to test a model out of sample; the model is estimated under the normal pension provisions, and the estimates are then used to predict the effects of the window plan. Lumsdaine, Stock, and Wise (1990, 1991) evaluate the effect of a window plan in the same Fortune 500 firm that Stock and Wise (1990a, 1990b) considered. Lumsdaine, Stock, and Wise (1991) find that the predicted effects typically match the actual effects well, the notable exception being at age 65, when the models always underpredict the retirement effect. Lumsdaine, Stock, and Wise (1990) use a beta distribution to approximate the firm's pension plan in order to investigate whether the firm could have achieved its potential goals more efficiently. A beta distribution provides a parsimonious flexible functional form that allows the pension schedule to vary continuously (thus providing determination of exact schedules without being bound by discretization). Lumsdaine, Stock, and Wise then consider potential motivations that the firm may have had for offering a window plan, based on economic theory, and investigate whether the firm could have structured its plan more efficiently, subject to the budgetary restrictions that it faced. If the main motivation was to reduce the current size of its labor force immediately, the firm acted close to optimally.

In a more recent paper, Lumsdaine, Stock, and Wise (1996a) simulate the effects of a number of different policy changes, using data from another Fortune 500 firm. Besides confirming their earlier results using this alternative data set, they investigate the effects on labor force participation of changes in the Social Security early and normal retirement ages, the private pension plan provisions,

the interaction of changes in both Social Security and pensions, retiree health insurance, forced reductions in workload, and other policies.

The evidence associated with this body of literature is relatively clear. For those people who will receive pension benefits, the magnitude of the expected benefit is such that pension plan provisions can strongly influence their retirement decision.

What we would like to know

An important aspect of modeling the determinants of retirement behavior and retirement income is understanding how Social Security and pensions interact with other forms of retirement savings. In particular, do they provide additional savings or are they substitutes for alternative forms? Much of the research has focused on shortfalls in retirement income or benefit levels for individual retirees. From a macroeconomic perspective, it is important (Day, 1993) to assess the trade-off between generations as part of the cost/benefit analysis. Day cites overwhelming support across all ages for maintaining or increasing Social Security benefit levels, but suggests that younger workers may not completely understand how these levels would be raised. Attitudes towards taxes and attitudes towards benefits are only weakly correlated. Day claims this is because attitudes towards taxes are more likely to be driven by self-interest whereas attitudes towards benefits are more ideological in nature.

Another significant source of uncertainty is how firms will react to changing labor force participation and needs. Will they support government policy to encourage older workers to continue working, or will they try to counterbalance the Social Security effects via manipulation of their pension plan provisions? The upward-sloping wage curve makes it difficult for firms to retain older workers in a cost-effective way. In addition, anecdotal evidence of firms' rehiring retirees who have opted for a window plan, often at higher consulting wages, suggests that firms have difficulty convincing the "right" (less productive) people to retire; a more systematic assessment of firm behavior would provide insight as to the frequency with which this occurs. Note that economic theory would predict that workers with a high opportunity cost of leaving (those that would have difficulty finding an equivalent job) would be less likely to accept a window plan. The results of Lumsdaine, Stock, and Wise (1991) are not inconsistent with this theory and anecdotal evidence; they do, however, suggest that firms may be operating under rather myopic, short-term objectives (such as paring down the size of their labor force, without regard to overall productivity or future productivity) when offering window plans.

It is also clear that individuals do not always have an accurate perception of the components of their expected retirement income. A study by Merrill Lynch (as reported in Employee Benefit Plan Review, 1994b) found that of individuals ages 45 to 64, 36 percent cited pensions as their expected most important source

of retirement income. In reality, only 10 percent of income comes from pensions, according to a U.S. Department of Health and Human Services report (Radner, 1993a). A poll by the Employee Benefit Research Institute found that nearly half of all respondents believed that $150,000 or less was what they needed in order to fund their retirement. In addition, only one-third of individuals correctly chose the range of dollar amounts that included the maximum Social Security benefit when given four choices. Additional evidence of inaccurate understanding of the Social Security earnings test rules by the elderly is found in Leonesio (1993b).

While much of the literature on pensions has focused on coverage, in considering individuals most at risk in terms of potential future income inadequacy, it is important to consider pension receipt, not pension coverage. Gender differences in pension coverage become even more pronounced when measuring receipt; women are much more likely to experience interruptions in labor force attachment and are thus less likely to meet vesting requirements in a pension plan than men.5 In 1992, median income from private pensions for male recipients was approximately twice that of female recipients, at all 5-year age intervals for individuals above age 65 (Grad, 1994). When tenure is controlled for, coverage rates are fairly similar, as shown in Table 3-5. Another reason that women are particularly at risk is the earnings gap. The coverage rates for men and women

TABLE 3-5 Job Tenure and Pension Coverage of Full-Time Private Sector Workers, by Gender, 1988 (percent)

|

Years With Primary Employer |

Women |

Men |

|

Job Tenure |

|

|

|

All tenures |

100 |

100 |

|

Less than 1 year |

19 |

17 |

|

1 to 4 years |

37 |

33 |

|

5 to 9 years |

18 |

17 |

|

10 to 14 years |

10 |

11 |

|

15 to 19 years |

6 |

7 |

|

20 years or more |

5 |

11 |

|

Pension Coverage |

|

|

|

All tenures |

43 |

50 |

|

Less than 1 year |

13 |

18 |

|

1 to 4 years |

37 |

39 |

|

5 to 9 years |

63 |

62 |

|

10 to 14 years |

70 |

73 |

|

15 to 19 years |

72 |

77 |

|

20 years or more |

75 |

82 |

|

SOURCE: Korczyk (1992, Table 6.11). |

||

TABLE 3-6 Earnings Distribution and Pension Coverage Rates Among Full-Time Private Sector Workers, by Gender, 1988 (percent)

|

Earnings |

Women |

Men |

|

Earnings distribution |

|

|

|

Total |

100 |

100 |

|

Less than $10,000 |

23 |

10 |

|

$10,000 to $19,999 |

47 |

31 |

|

$20,000 to $29,999 |

21 |

25 |

|

$30,000 to $49,999 |

9 |

27 |

|

$50,000 and over |

1 |

8 |

|

Pension coverage rate |

|

|

|

All earnings |

43 |

50 |

|

Less than $10,000 |

13 |

13 |

|

$10,000 to $19,999 |

46 |

36 |

|

$20,000 to $29,999 |

64 |

63 |

|

$30,000 to $49,999 |

75 |

74 |

|

$50,000 and over |

77 |

79 |

|

SOURCE: Korczyk (1992, Table 6.6). |

||

are very similar at similar earnings levels; disparity arises owing to the concentration of women in the lower part of the earnings distribution, as shown in Table 3-6. Multiple vesting further increases the gender gap. Among men age 50 to 59 who were working full time in 1988, 15 percent were vested in a previous job (24% of workers age 60 and older) while among women in both age groups only 5 percent to 6 percent were so vested (Woods, 1993).

There is some evidence that for women, pension coverage is associated with increased attachment to the labor force in later life (Pienta, Burr, and Mutchler, 1993). Possible explanations for this counterintuitive observation include a selection effect and the need to make up for an earlier discontinuous work history in terms of vesting and the earnings gap. This explanation is supported by evidence in Ruhm (1994), who finds that for men in the RHS, late entry into a pension-covered job is associated with increased attachment to the labor force, even more than for non-pension-covered individuals.

In addition, pension coverage may be leveling off (recall Table 3-4). Quinn, Burkhauser, and Myers (1990) suggest that if increasing pension coverage is responsible for the observed trend towards early retirement, a leveling off of coverage may signal a corresponding increase in average retirement ages relative to current projections. Defined contribution participants seem to compose one-third of all pension participants, as compared with one-sixth 15 years earlier. In addition, more employers are offering supplementary coverage; this is most often in the form of a defined contribution plan. The proliferation of these plans also

suggests that the incentives to retire early, usually associated with defined benefit plans, are weakening. However, defined benefit plans are relaxing their requirements for receipt of benefits; see the sources cited in Quinn and Burkhauser (1992) for evidence that this promotes early retirement.

Much of the literature has used large aggregate data sets to investigate the influence of pension plans on the retirement decision. The advantage of using large data sets is that they may be more representative of the population and therefore more useful for policy evaluation. The disadvantage is the loss of heterogeneity, which typically arises from the absence of details for each individual pension plan. In order to control for some of this loss of heterogeneity, Stock and Wise (1990a, 1990b) use data from one particular Fortune 500 firm. The size of the firm allows for an adequate sample while providing a level of detail regarding the pension plan provisions that is not found in more aggregate data sets.

The obvious benefit of using data from a single firm is the use of detailed pension plan information and earnings records. However, such an approach is not necessarily representative of the aggregate population. An important research priority should be obtaining better earnings records, in a more timely manner, while still maintaining confidentiality. Data on Social Security earnings records would provide an entire wage history for each individual; tax data from the Internal Revenue Service would supplement this with information on additional assets, which are critical for evaluating the adequacy of retirement income and savings. While some information would still have to be imputed (e.g., expected future levels), the level of imputation would be much more accurate than what is currently available; imputations from aggregate data do not effectively capture the heterogeneity in the population.

More recent data sets, such as the HRS, link extensive survey responses on work history, health status, and assets to pension plan detail from the individual's specific firm. This provides hope of estimating more dynamic models using broader based studies that are more representative of the population. In addition, evidence in Hurd and McGarry (1993a) suggests that workers' subjective probabilities of working past ages 62 and 65 reflect details of their pension plan provisions. In particular, the probability of working past age 65 for individuals with no pension plan is more than double the corresponding probability among workers with pension plans that allow for full benefits by age 62. Additional subjective questions, such as how large benefits are expected to be, will, in future years, be matched with actual receipt in order to draw inferences about expectations. The HRS also asks what form the benefit is expected to be received in (e.g., lump sum, annuity). Many other subjective questions about work and perceptions of and interactions with areas related to work are also asked, and additional information regarding early retirement window plans is also requested.

While many researchers have noted the significant effect of pension plan provisions and have estimated it to be much larger than the effect of changes in

Social Security provisions, it is important to emphasize that for the fraction of the population that relies solely on Social Security benefits, changes to Social Security will have a profound effect. This is discussed in Hurd (1994b) and Lumsdaine, Stock, and Wise (1996a). Pension benefits are thought to be of more importance when the relative magnitudes of actual benefits for individuals that have them are considered; Social Security benefits may be more important when the aggregate (or even the median) impact of policy changes is assessed.

It has been documented (Kotlikoff and Wise, 1985, 1987) that pension plans, particularly defined benefit plans, have incentive effects that firms can use to manipulate the composition of their employees. Federal regulations have sought to limit these incentive effects (Clark, Gohmann, and McDermed, 1988). For example, the Age Discrimination in Employment Act protects older workers from the threat of mandatory retirement. Quadagno and Hardy (1991) argue that ''private firms developed extensive early retirement packages that provided incentives for early retirement and disincentives for continued employment" (p. 471).

The recessions of 1973–1974 and 1981–1982 provided additional inducements for firms to offer early retirement programs; window plans allowed firms to target a specific group of workers for attrition without resorting to layoffs. Window plans were perceived as being highly lucrative and beneficial to the employee; firms meanwhile were able to limit future pension liability (Quadagno and Hardy, 1991).

Ironically, while legislation has sought to limit the incentive effects of pension plans, window plans have fallen under less regulation and therefore remain a powerful tool by which firms can seek to influence workers' participation decisions. As the relation between window and pension plans would suggest, the existence of a window plan, along with to whom it is offered, varies considerably across demographic lines. As antidiscrimination legislation has increased, window plans remain one of the few ways that employers can legally discriminate among workers (in targeting a specific subset of workers) and over time (historically, as mentioned above, window plans have been prevalent during periods of downsizing). As a result, window plans should continue to be a major policy focus for the next decade.

As we learn more about individual responses to window plans and how they affect labor force participation decisions, it will be equally important to model firm response and consider whether firms have increased utilization of window plans in light of the more favorable regulatory environment (relative to pensions) or decreased it (perhaps because the wrong people are leaving). Detailed questions about window plans should be included in surveys of firms such as the SCF's Pension Provider Supplement and the Bureau of Labor Statistics' Employee Benefits Survey.

Because window plans can vary considerably, studies documenting their effects have focused on a single window plan. Data on window plans are difficult

to obtain, as they must be gathered directly from the firm. The HRS is the first survey to contain detailed questions about window plans. It is hoped that analysis of the responses to these questions will lead to a broader understanding of the magnitude of the individual incentive effects and the potential implications for aggregate impacts on labor force participation.

From a modeling perspective, window plans have offered a unique type of "natural experiment" in the literature of the previous decade. Because there had been no historical precedent for such alterations to pension plans, initially they were unanticipated. Therefore models could be estimated using pre-window-plan provisions and then used to predict the effects of the window plan, in effect creating an out-of-sample test of model predictability. With the current proliferation of window plans among firms and even within the same firm, research methodology requires a change of focus. Models that study the effects of window plans will need to consider how expectations are formulated and incorporated into an individual's retirement decision. Just as the existence of a window plan can induce additional retirements, the absence of one may inhibit retirements if employees expect one to be offered in the near future. Smith (1994) provides further caveats regarding the interpretation of window plans as an out-of-sample test of the model, citing endogeneity of other factors influencing departure rates, such as the perceived financial condition of the firm. This endogeneity could result in a change in the model parameters, a change that is not captured by the current form of policy simulation.

With focus shifting to issues of solvency of government programs, private sources of retirement income, such as pension plans, as well as individual savings, will become increasingly important. As discussed earlier, Auerbach, Kotlikoff, and Weil (1992) note that the income of the elderly is becoming increasingly annuitized; shifts from defined benefit to defined contribution plans suggest that this trend may not continue. Future research needs to focus not only on the availability of outside sources of retirement income but also on the form of the distribution of this income. With the increase in popularity of defined contribution plans, individuals have more options regarding their distributions and a substantial fraction of individuals elect a lump-sum payment.

Policy in recent years has begun to focus on "preservation" of retirement benefits (Woods, 1993) by enacting legislation that imposes stiff penalties for failing to roll pre-retirement distributions into a qualified retirement plan.6 Woods (1993) finds that many pre-retirement lump-sum distributions went to individuals who were either vested in or covered by but not vested in another pension plan. He argues that there should be less concern about potential consumption of a lump-sum distribution for these individuals, especially as such distributions tend to be of fairly small magnitude (the median amount is $2,830). Of the individuals who show no source of additional pension income, Woods finds that many saved or invested the entire distribution, concluding that concern over choice of distri-

bution is of secondary importance to more general concerns over how to increase coverage.

Much of the previous literature has focused on pre-retirement lump-sum distributions; caution should be exercised in using such results to draw inferences on the adequacy and preservation of post-retirement analogs. Analysis of the HRS will reveal whether pre-retirement patterns of distribution choice and savings reflect post-retirement behavior. The obvious concern is that lump-sum distributions return too much responsibility for retirement saving to the individual; legislation has attempted to enforce the need for adequate retirement-related savings vehicles. Additional research on post-retirement distribution choices is clearly needed.

In terms of modeling, as Gustman and Steinmeier (1986) point out, the use of life-cycle models requires computation of earnings histories. These are often imputed either from self-reported recollections or, in the case of individual firm records, from company records. In the latter case, transitions between jobs are not documented. Stock and Wise (1990a, 1990b) use a log linear autoregressive wage equation to impute earnings histories and forecast future earnings. Because the time dimension of the panel in their firm was substantially shorter than that used by Stock and Wise, Lumsdaine, Stock, and Wise (1994, 1996a) use a fixed effects model. In addition, in most of the dynamic models, future wage uncertainty is not allowed. Thus, the potential accuracy of our models and our ability to predict the effects of policy changes are limited by our earnings forecasts. Furthermore, other types of uncertainty (such as demand by firms for future labor) and individuals' expectations about them (such as inferences about a firm's financial condition or the probability of a layoff after the announcement of a window plan) may significantly contribute to an individual's uncertainty. This suggests that future dynamic models may need to incorporate beliefs about changes in the system itself. Such "macro" risks may contribute far greater uncertainty than "idiosyncratic" risks (such as wage uncertainty or health risks). Accurate forecasts of firm response and behavior are critical to understanding what workers will be doing on the supply side of the labor market.

While the models of Lumsdaine, Stock, and Wise fit retirement rates well at most ages, they systematically fail to capture the magnitude of the retirement rate at age 65. They attribute this underprediction to "social custom," an interpretation criticized by Rust and Phelan (1993), who argue instead that the cause is the omission of other key considerations, most noticeably, Medicare.

DISABILITY

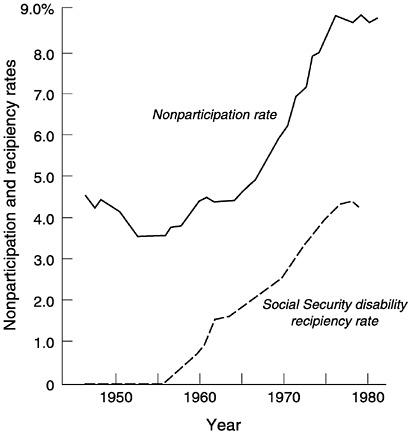

There is increasing discussion about the relation between Social Security disability insurance and retirement and about the possibility that liberalization of disability benefits is partially responsible for declines in labor force participation (see discussion in Rust, 1989; Lewin-VHI, 1994). In addition to the link with

retirement, there is also evidence that policy variables influence applications for disability. There is a positive correlation between disability applications and unemployment rates. Others have cited a negative correlation between labor force participation and the generosity of benefits as measured by the replacement ratio (benefits to wages). It seems (Quinn and Burkhauser, 1992; Bound and Waidmann, 1992; Waidmann, Bound, and Schoenbaum, 1995) that applications for disability increased over the 1970s and declined in the 1980s. Measuring disability is difficult, however, because some people who are disabled will just choose to retire (or some people will leave when eligible for retirement when, if they were completely healthy, they would have continued working). Furthermore, disability may result not in complete exit from the labor force but in a reduction in the number of hours worked.

Another indication of the link between disability and retirement is that to the extent that individuals are likely to exaggerate their disability conditions, only about half of the rejected applicants return to work (Bound, 1989). One potential reason is that workers filing a disability claim must wait 5 months from the time they leave their jobs to receive benefits. In addition, disability benefits, like Social Security benefits, are subject to an earnings test at $500 per month. Both of these features inhibit subsequent labor force participation. Some of the literature on this subject suggests an equivalency between the decision to apply for disability benefits and a decision to withdraw from the labor force (i.e., disability is a substitute form of retirement). Indeed, disability benefits convert to retirement benefits at age 65. If policy is aimed at keeping individuals in the work force, the findings of Bound (1989) and Burkhauser et al. (1992) suggest that such efforts should target individuals before they begin the application process.

As mentioned above, the timing of application for disability benefits seems to be correlated with the replacement rate; a higher rate means earlier application on aggregate. In addition, a higher rate is associated with a shorter waiting time before applying after the onset of a health condition (Burkhauser et al., 1992). Other variables that affect the timing of application include savings and the extent to which the employer could accommodate the disability.

The prevalence of disability among working age persons in the United States is estimated to be between 7 percent and 14 percent (Lewin-VHI, 1994). This rate has fluctuated over the last three decades, as Table 3-7 partially illustrates. Recent trends in disability insurance have seen a growth in both applications and awards. Much of this is attributable to changes in aggregate macroeconomic variables, such as unemployment. In addition, qualifying rules were liberalized in 1984; this has contributed to the observed growth in awards (Lewin-VHI, 1994). From 1988 to 1992, applications increased by 29 percent (40% using the redefined measure of applications, which excludes technical denials and duplicate applicants). Although gender-specific data on applications are not available before 1988, in 1992 60.9 percent of applicants were male. It is argued that some of the recent growth in application (and resulting awards) may be due to demo-

TABLE 3-7 Percentage of Working-Age Population Disabled, by Sex, 1962–1984, Various Years and Sample Sizes

|

|

Percentage |

Actual Number of Observations |

|||

|

Year |

Male |

Female |

Total |

Male |

Female |

|

1962 |

9.5 |

4.8 |

7.0 |

218 |

120 |

|

1968 |

13.0 |

8.2 |

10.5 |

911 |

746 |

|

1973 |

12.8 |

9.3 |

11.0 |

1434 |

|

|

1976 |

14.6 |

7.5 |

10.9 |

491 |

304 |

|

1980 |

11.9 |

9.6 |

10.7 |

501 |

416 |

|

1982 |

10.6 |

9.1 |

9.6 |

441 |

380 |

|

1984 |

10.5 |

8.6 |

9.5 |

461 |

454 |

|

NOTE: Calculations by the authors from Current Population Survey data for various years; see text. SOURCE: Haveman and Wolfe (1989: Table 1). |

|||||

graphic trends (e.g., the increase in female labor force participation, the aging of the baby boom cohort). The number of awards over the same time period rose 54 percent. Similar dramatic growth spurts occurred in the early 1970s. The fraction of Social Security disability-insurance awards to women has risen, most likely as a result of rising applications (in 1992, this fraction was 37%). The ratio of awards to applications (the "allowance rate") has fluctuated, in recent years ranging from 0.29 in 1982 to 0.49 in 1992. In addition, toward the late 1980s, more individuals were applying concurrently for Social Security disability insurance and supplemental security income. These applications accounted for between 60 percent and 69 percent of the growth in applications in 1992; they accounted for about 48 percent in 1988. Lewin-VHI (1994) document substantial variation across states in the growth of applications from 1988 to 1992. For example, North Dakota had a 4 percent increase in concurrent applications; for Rhode Island, the increase was 134 percent.

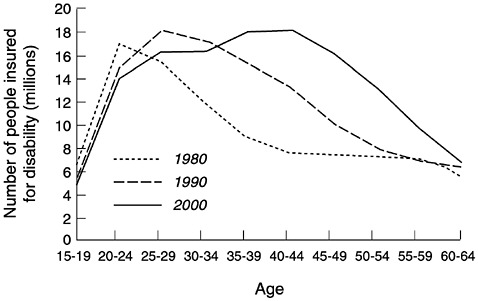

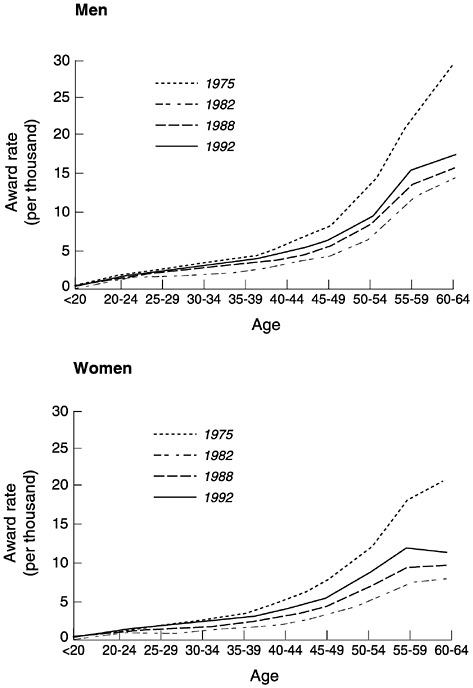

The size of the disability-insured population has increased as well. "From 1970 to 1992, the average annual growth rate was 1.48 percent for men and a much larger 3.91 percent for women" (Lewin-VHI, 1994:IV.2). The growth appears to be slowing. The award rate for women is below (roughly 80% of) the award rate for men. The age-distribution of the adult disability-insured population declines with age past age 35, as seen in Figure 3-7. The percentage of men age 55 to 64 receiving Social Security disability-insurance benefits has grown from 5.3 percent in 1965 to 10.5 percent in 1985 (Bound, 1989; Lewin-VHI, 1994). Because award rates are correlated with age (see Figure 3-8), an increasing elderly population suggests an increased burden in the future on Social Security disability insurance.

In contrast to Social Security and pensions, replacement rates for new Social

FIGURE 3-7 Age distribution of the people insured for disability, by 5-year age cohort, 1980, 1990, 2000. SOURCE: Lewin-VHI (1994:Exhibit IV.A.3).

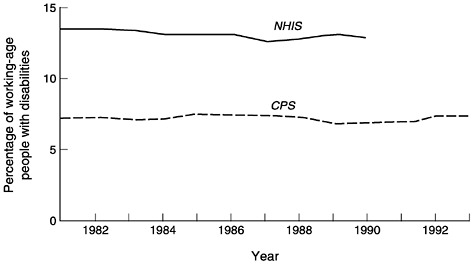

Security disability-insurance beneficiaries are generous. At the first quartile, replacement rates over the last decade have been approximately 55 percent for men; for women they have been close to 85 percent. At the median, replacement rates are 46 percent for men and 61 percent for women. Nevertheless, it is apparent that individuals should not rely on disability payments as their primary source of retirement income before age 65. While the Social Security trust fund is projected to have a surplus through 2015 and become exhausted in 2044, the disability insurance trust fund is expected to become insolvent in 1995 (Congressional Budget Office, 1993). In 1977, the denial rate on disability applications was increased owing to financial pressures (Lewin-VHI, 1994). During subsequent years, evidence suggests that the increased denial rate was responsible for a decrease in applications (Parsons, 1991c; Lewin-VHI, 1994). This episode in history may provide useful insight into projections of future disability determination and receipt of award. Over the last decade, the prevalence of disability in the United States among working age persons has remained constant, as shown in Figure 3-9.

Literature Review and Previous Methodology

Common static models for investigating disability insurance include least squares and instrumental variables (because of correlation using self-reported

FIGURE 3-8 Social Security disability insurance award rates for men and women, selected years, 1975–1992. NOTE: Award rates for men (women) are calculated as the number of awards to men (women) divided by thousands of men (women) insured for disability.

SOURCE: Lewin-VHI (1994:Exhibits IV.A.4, IV.A.5).

FIGURE 3-9 The prevalence of disability in the United States among working age persons from 1981 to 1990 as measured by the Current Population Survey and the National Health Interview Survey. NOTE: NHIS data available only to 1990. SOURCE: Lewin-VHI(1994:Exhibit IV.D.1).