2

Market-Based Approaches for Stimulating Remediation Technology Development

The market for new environmental technologies, including those for contaminated site cleanup, peaked in 1990. During the 1980s, investors had flocked to the remediation technologies market in response to major new laws (the 1980 Comprehensive Environmental Response, Compensation, and Liability Act and the 1984 amendments to the Resource Conservation and Recovery Act) requiring cleanup of the nation's waste sites. Investors assumed that the very large number of contaminated sites, combined with strict federal enforcement of the new regulations, would create a large market for innovative cleanup technologies and saw the potential for high returns from environmental investments.

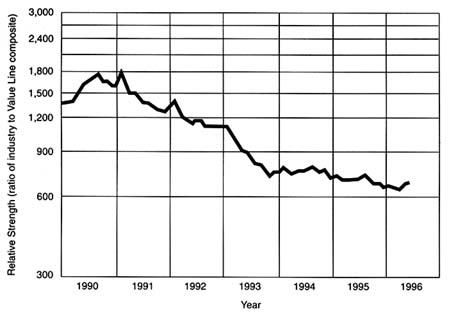

Investors' predictions about the remediation technologies market were not borne out. As shown in Figure 2-1, by 1993 the strength of stocks in environmental companies, including those involved in remediation, had plummeted to a less than half of its peak value, and it has continued to decline. Despite the billions of dollars per year spent on remediation and other environmental programs, companies have struggled to bring new remediation technologies to the market. The lack of affordable commercial technologies has, in turn, led to resistance to attempting to clean up sites and to a push for the use of risk-based corrective action approaches (see Chapter 1). This move to limit the number of site cleanups based on technical feasibility of cleanup and/or risk factors has further weakened the market for remediation technologies.

This chapter explains why the remediation technologies market has been so much weaker than initially predicted. It recommends ways to increase the market demand for innovative remediation technologies by moving to a system that relies on market pull, rather than regulatory push, to guide technology selection. Under this new system, the costs of leaving contaminants in place and delaying

FIGURE 2-1 Relative strength of environmental company stocks traded on the U.S. stock exchange during 1990–1996. The ratio shown is stock value for the candidate industry normalized to the Value Line composite stock value, with August 1971 serving as the base index of 100. SOURCE: Reprinted, with permission, from Value Line, Inc. (1996). © 1996 by Value Line, Inc.

remediation would be explicit and consistent, allowing owners of contaminated sites to compare these costs with those of installing a remediation technology and cleaning up the site.

FATE OF INNOVATIVE TECHNOLOGY VENDORS

While successful examples of the introduction of innovative technologies for waste site remediation exist, such examples are relatively rare. As explained in Chapter 1, the range of technologies used to clean up hazardous waste sites is still quite limited. For example, although 14 general types of innovative technologies have been chosen for cleanup of contaminated soil at Superfund sites, 4 of these technologies—soil vapor extraction, thermal desorption, ex situ bioremediation, and in situ bioremediation—account for the bulk of projects. All other types of innovative soil cleanup remedies were selected for a total of fewer than 6 percent of Superfund sites where soil cleanup is under way (see Figure 1–7 in Chapter 1). Innovative remedies for ground water contamination are used at only 6 percent of

Superfund sites (EPA, 1996a). Thus, considering the magnitude of the waste site remediation problem, the number of types of innovative technologies in use is small, and vendors of innovative technologies have had difficulty capturing market share.

Start-up companies founded on trying to market new remediation technologies have generally fared poorly. Table 2-1 shows the recent stock value of the seven companies that have gone public based on marketing of a technology for waste site remediation. As shown in the table, the stock price of six of these seven companies has dropped since the initial public offering.

In today's market, remediation technologies are generally provided by large consulting firms offering a diverse range of environmental services, rather than by small companies offering "boutique" services focused on a specific niche of the market. There is little possibility that a firm offering a specialized technology will survive. The remediation industry is increasingly consolidating and diversifying, with fewer and fewer firms available to provide remediation technologies. In 1995, for example, there were 55 acquisitions of U.S. environmental services firms and in 1996 there were 73 acquisitions (ENR, 1996b). The one company in

TABLE 2-1 Stock Value of Selected Remediation Technology Companies

Table 2-1 whose stock value increased after the initial public offering, Thermo Remediation, markets a system for thermally treating petroleum-contaminated soils but has increasingly diversified its services. It is affiliated with companies that collect and recycle used motor oil, provide wastewater processing services, and remove radioactive contaminants from soils. In addition, in December 1995 Thermo Remediation acquired Remediation Technologies Inc., an engineering/construction firm that provides a range of environmental services.

While research continually generates new ideas for how to clean up contaminated sites, small firms that have been founded based on new research ideas have not fared well. The inability of small firms with new ideas to survive discourages innovation. Large, service-oriented firms generally provide their clients with "safe" technologies rather than risking a new approach that might perform better than the traditional one but that also has a chance of failing.

ELEMENTS OF THE REMEDIATION TECHNOLOGY MARKET

As is evident from the lack of success of new ventures in bringing remediation technologies to the market, the remediation market is difficult to enter. In part, this is a result of barriers to innovation that are a construct of the regulatory process, but it is also in part a result of the inherent fragmentation of the remediation market. The market is fragmented by client type and, more importantly, by site type.

The clients for remediation technologies can be grouped into two broad categories: (1) private-sector, including a broad range of company types and sizes, and (2) public sector, including federal agencies, primarily the Departments of Defense (DOD) and Energy (DOE). About one-third of the remediation market consists of contaminated sites owned by the federal government (Russell et al., 1991), while the remainder consists of privately owned sites. Within the private-sector market, there is wide variation by client type and site size. For example, most of the contaminated sites shown in Table 1-2 in Chapter 1 are leaking underground storage tanks, many of them owned by small gasoline stations, while the larger, more complex sites are usually owned by large industries or groups of industries. Similarly, the characteristics of the public sector remediation market vary because of the wide variation in the agencies (ranging from the U.S. Department of Agriculture to the DOE) responsible for contaminated sites. The factors of importance to one public agency differ from those important to other agencies, which, in turn, differ from those important to large private corporations, which differ from those of greatest importance to gasoline stations or other small enterprises with contaminated sites. Further complicating matters, clients (whether public agencies or private industries) are usually represented by consultants, who may have their own concerns about technology performance. Thus, technology vendors need to develop different sales strategies, depending on the client and the client's consultant.

A much more difficult problem for remediation technology vendors is the fragmentation of the remediation market based on site type. A technology that works well for cleaning up a particular contaminant, such as petroleum hydrocarbons, in a particular geologic setting, such as a sandy aquifer, may not work at all for the same contaminant in a different geologic setting, such as a fractured rock aquifer. As a result, in the remediation business it is often not possible to market "widgets" that the client can simply plug in and use. Almost always, those "widgets" must be accompanied by significant technical expertise on how to apply the system in the site-specific setting. Such expertise is usually provided by consultants. Technology vendors therefore must either diversify to provide consulting services themselves or must convince consultants hired by their client that the new technology has merit.

REGULATORY BARRIERS TO INNOVATION

The regulatory structure for implementing hazardous waste cleanups, especially at Superfund and Resource Conservation and Recovery Act (RCRA) sites, has added to the inherent difficulties that remediation technology vendors face in bringing new products to the market. The fundamental problem with these programs is that they rely on regulatory push rather than market pull to create demand. The process of technology selection is strictly regulated. At the same time, the penalties for failing to initiate remediation promptly are insufficient. The result is that companies responsible for cleanups often delay remediation rather than trying new technologies because they perceive no economic gain from accelerated cleanup. Providers of new technologies have trouble staying in business while awaiting client and regulatory acceptance of their processes. Although the federal government has sponsored numerous initiatives, from the Superfund Innovative Technologies Evaluation program to the Strategic Environmental Research and Development Program, to promote innovative technology development (see Chapter 5), without the necessary market demand in place the technologies developed under these programs will not become widely used.

At Superfund and RCRA sites, technology selection is often a negotiated process between the regulators and the regulated. The market for new technologies becomes stifled for two reasons. First, regulatory restrictions limit a customer's freedom to choose a remediation technology and adapt the remedy over time as new technologies emerge. Second, the ability to arbitrate a cleanup often removes the incentive for improved solutions. In other market sectors, such as the computer and information technology industry, customers create demand for new technologies because they have freedom to choose and desire improved solutions. New technologies are then developed through a process of trial and error. New companies depend on early users to "de-bug" a new technology and use that information to make the necessary adjustments and improvements before the technology or product is released for commercialization. This type of gradual

diffusion and adoption of technology has not worked effectively, except in a few cases, in increasing the market share for innovative remediation technologies. The Superfund and RCRA corrective action programs leave little room for customer (or consultant) choice and no room for a "try as you go" concept. Regulators must "sign off" on the customers' choice of a technology through an official Superfund record of decision or RCRA corrective action plan. Mechanisms for adjusting the remedy once it is officially approved are bureaucratically cumbersome and provide a disincentive to change the selected remedy even if a much better solution evolves.

In many instances, it is less costly for a company to delay remediation through litigation than to select a technology and begin cleanup. The incentive to delay rather than begin cleanup reduces market demand for remediation technologies. For example, the Congressional Budget Office has estimated that the average cost to clean up a private-sector Superfund site is $24.7 million (Congressional Budget Office, 1994b). Yet, analysis of corporate annual reports and financial statements shows that companies typically report a liability of about $1 million for sites where they have not yet begun cleanup. Thus, many companies are faced with a choice of cleaning up and taking an immediate cash drain of, on average, $25 million or carrying a $1 million annual liability with some litigation and assessment costs. Under these circumstances, there is little question that delay is the preferred alternative, because spending for full remediation might cause a company to lose a major portion, or all, of its cash reserves. The RAND Corporation sampled 108 firms with annual revenues of less than $20 billion involved in the cleanup of Superfund sites and found that transaction costs associated with legal work accounted for an average of 21 percent of these firms' spending at Superfund sites; spending on transaction costs exceeded 60 percent of the cost share for more than one-third of the firms (Dixon et al., 1993). The U.S. General Accounting Office (GAO) has estimated that Fortune 500 companies spend fully a third of their costs at Superfund sites on legal expenses such as disputing cost shares with other potentially responsible parties and negotiating remedy selection with the Environmental Protection Agency (EPA) (GAO, 1994b). At many sites, this extensive litigation serves the purpose of delaying remediation expenses.

Adding to the incentive to delay are the possibility that waste site cleanup regulations will change and the inconsistent enforcement of existing regulations. Like other laws and regulations implementing them, Superfund and RCRA have been subject to political swings. For example, current political pressure for Superfund reform is tending toward less stringent cleanup standards and requiring cleanup at a narrower range of sites. In 1995, a bill for Superfund reform, H.R. 2500, was introduced to the U.S. House of Representatives that would eliminate the requirement to consider all applicable or relevant and appropriate requirements in setting cleanup goals, meaning essentially that goals would be relaxed; eliminate the preference for treating contaminated water rather than developing alternative water supplies; make responsible parties liable only for

damages to resources that are currently being used; and limit the number of new Superfund sites identified each year to 30. Other bills introduced to Congress have proposed eliminating or limiting retroactive liability for contaminated sites. Some organizations are lobbying to incorporate in Superfund the risk-based corrective action standards being developed by the American Society for Testing and Materials; use of these standards would substantially decrease the number of sites at which active cleanup would be required. Taken together, these proposals would significantly reduce the level of cleanup responsible parties are liable to undertake. If companies and responsible government agencies knew for certain that existing cleanup standards would be strictly enforced, there would be an incentive to clean up sites sooner. However, shifting political forces and changing legislative agendas, combined with a lack of sufficient penalties for failing to comply with existing regulations, reward those who wait for political relief.

Further encouraging delay in cleanup, economic incentives for carrying out remediation are lacking under current policies. Companies perceive remediation as a tax on earnings and a drain on their bottom line, rather than as an activity undertaken in the company's economic self interest. Although remediation ex-

TABLE 2-2 Earnings Used to Support Environmental Remediation at Selected U.S. Corporations (1994, millions of dollars)

|

Company |

Sales |

Earnings |

Remediation Expenses |

Percent of Earnings to Support Remediation |

|

Allied Signal |

12,817 |

759 |

66 |

8.7 |

|

Amoco |

30,362 |

1,789 |

119 |

6.7 |

|

ARCO |

17,199 |

919 |

160 |

17.4 |

|

Chevron |

35,130 |

1,693 |

182 |

10.8 |

|

DuPont |

39,333 |

2,727 |

91 |

3.3 |

|

General Electric |

60,109 |

4,726 |

98 |

2.1 |

|

General Motors |

154,951 |

4,900 |

105 |

2.1 |

|

Monsanto |

8,272 |

622 |

52 |

8.4 |

|

Sun Company |

9,818 |

90 |

60 |

66.7 |

|

TOTAL |

367,991 |

18,225 |

933 |

5.1 |

|

SOURCE: Actual expenses as reported in 1994 corporate annual and 10-K statements. |

||||

penses have a significant impact on the profit margins of many large U.S. corporations, improvement in remediation technologies has not been linked to improved financial performance. Table 2-2 shows that for several large corporations, an average of about 5 percent of corporate earnings goes toward supporting remediation expenses. Yet, managers at companies often are unaware of the true cost of their remediation activities because they frequently do not account for remediation costs and report them to shareholders. For example, a Price Waterhouse survey of securities issuers in 1992 found that as many as 62 percent of responding companies had known environmental liabilities that they had not yet recorded in their financial statements (Blackwelder, 1996).

In the absence of assessing the liability for cleaning up contaminated sites and posting this liability on corporate balance sheets, there is no economic driver for improved remediation. As an analogy, companies are required to assess and fully report future pension and health care liabilities, providing an incentive to control pension and health care costs. This incentive is lacking for remediation. To the contrary, if a company were to voluntarily assess all of its future remediation costs and post the total on its balance sheet, the value of the company would be reduced, creating a disadvantage relative to companies that do not report this liability. Companies cannot show that spending more resources on remediation will result in improved earnings or reduced liabilities. It therefore becomes difficult for companies and their consultants or advisors to see the financial benefit of early remediation. For investors, the lack of financial drivers is especially troublesome because capital providers are primarily in the business of creating the highest possible rate of return for a given level of risk. Without being able to identify the value provided to the customer by a new technology, investors have difficulty estimating their potential investment returns and tend to shy away from the remediation sector to more familiar markets. As shown in Table 2-3, venture capital investment in environmental technologies (including remediation and other environmental technologies) is more than an order of magnitude lower than investment in other modern technologies such as biotechnologies and communications systems. While total venture capital investments have nearly doubled since 1992, venture capital investment in environmental technologies has declined by nearly 70 percent.

In part because of the incentives to delay remediation and in part because of the long series of regulatory steps involved in selecting a cleanup remedy for a site, the time line for selecting and installing a remediation technology can be very long and can vary unpredictably from site to site. According to the Congressional Budget Office, for example, the average time between when a site is proposed for listing on the Superfund National Priorities List (NPL) and completion of construction of the cleanup remedy was 12 years for the first 1,249 sites on the NPL (Congressional Budget Office, 1994a). Although the EPA in the early 1990s instituted administrative reforms to try to speed cleanup of NPL sites, a recent GAO analysis showed that cleanup completion times increased between 1989

TABLE 2-3 Venture Capital Disbursements, 1991–1995

|

|

Amount Invested ($ millions) |

||||

|

Industry |

1991 |

1992 |

1993 |

1994 |

1995 |

|

Communications and networking |

608.7 |

588.1 |

881.4 |

875.5 |

1,375.7 |

|

Electronics and computers |

370.9 |

384.3 |

274.0 |

474.8 |

463.8 |

|

Semiconductors and components |

163.4 |

189.9 |

244.5 |

189.3 |

301.7 |

|

Software and information services |

461.9 |

547.2 |

528.0 |

745.7 |

1,239.1 |

|

Medical compounds |

498.3 |

700.4 |

715.0 |

720.5 |

715.5 |

|

Medical devices and equipment |

474.5 |

468.8 |

421.9 |

463.3 |

607.1 |

|

Health care services |

141.9 |

221.0 |

322.6 |

326.2 |

492.6 |

|

Retailing and consumer products |

267.8 |

213.5 |

544.5 |

529.1 |

1,206.9 |

|

Environmental |

64.6 |

93.8 |

65.8 |

54.5 |

29.0 |

|

Other |

276.1 |

574.9 |

502.1 |

641.4 |

1,000.1 |

|

TOTAL |

3,328.1 |

3,981.9 |

4,499.8 |

5,020.3 |

7,431.5 |

|

SOURCES: VentureOne Corp., 1996. |

|||||

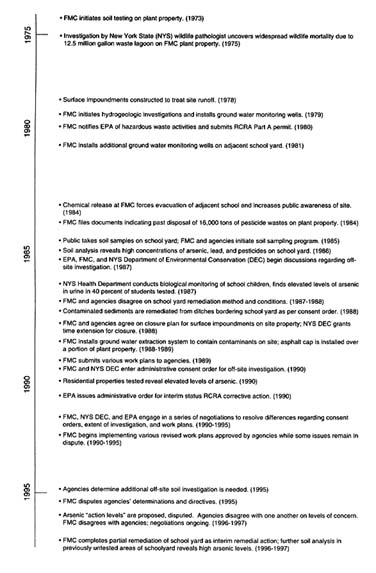

and 1996 (Guerrero, 1997). Figure 2-2 shows the remediation time line for a site that provides an extreme example of delay in remediation: a RCRA site where, more than 20 years after contamination was discovered, a final remedy is not yet in place.

While remediation of all but the simplest sites requires a significant investment of time because of the technical difficulty of site characterization and remediation technology design, the financial disincentives to initiate remediation and time-consuming bureaucratic procedures can greatly increase the uncertainties associated with predicting the timing of remediation projects, as shown in Figure 2-2. Unpredictable time delays make it very difficult for technology developers and funders to forecast cash flow. Start-up technology providers have gone out of business for lack of cash flow while waiting for final regulatory approval to use their technology at a large enough number of sites to stay solvent (see Box 2-1).

FIGURE 2-2 Time line of events associated with the investigation and cleanup of an active FMC pesticide production facility in Middleport, New York. The plant site is governed under RCRA; off-site contamination is governed under Superfund. In 1975, significant wildlife mortality led to the discovery of soil and ground water contamination from plant pesticides and wastes, including arsenic. At present, only partial remedies have been implemented. Disputes between the facility owner and the regulatory agencies have delayed cleanup for more than two decades. SOURCES: FMC, 1984, 1995; Stone, 1975; Conestoga-Rovers & Associates, 1986; NYS DEC, 1987, 1996; NYS DOH, 1987; M. Hinton, NYS DEC, personal communication, 1997.

|

BOX 2-1 GRC Environmental: Cash Flow Problems Due to Slow Acceptance of an Innovative Remediation Technology In the late 1980s, a company known as GRC Environmental had developed a patented technology for cleaning up polychlorinated biphenyls (PCBs) and dioxin in soil. The technology and company appeared destined for success. GRC had demonstrated its technology at the pilot scale. PCB and dioxin cleanup was scheduled to occur at a large number of sites. The technology's main competitor, incineration, was losing favor with regulators and the public. The technology, an alkaline substitution process that operates at elevated temperature, had a particular advantage over incineration in that it produced no harmful byproducts. However, although the company was able to obtain regulatory approval to use its technology at one site, it went out of business for lack of approval to use the method at a large enough number of sites to maintain a consistent cash flow (Houlihan, 1995). GRC experienced great difficulty in landing its first job contract. The venture capitalists who funded the company attributed this difficulty to distrust that the technology would be approved by regulators. GRC finally secured a contract for a first job, a Superfund site in Houston, only because the site presented so many challenges that the primary contractors had been unsuccessful in achieving cleanup goals (Houlihan, 1995). One of the primary technical difficulties at the site was that the soil was clay, which is very difficult to clean. Further, during the cleanup, Houston experienced its heaviest rain in years, interfering with equipment operation. Technically, GRC's cleanup of the Houston site was a success in that it restored the soil to the satisfaction of regulators. However, the job was a financial failure (Houlihan, 1995). Because of the lack of additional contracts to provide cash flow and the backlog of expenses from the Houston site, GRC had to file for bankruptcy. GRC had invested too much of its capital to construct the system in Houston, and it had been unable to obtain the additional jobs that could have kept the company solvent even with losses at the Houston site. |

The lack of predictable timing is of particular concern to investors because they are unable to project investment returns. Worse, there is a disincentive for investors to provide funds early in the technology development cycle because the technology does not appreciate in value until just before it becomes commonly accepted. Thus, there is insufficient reward for the additional risk of having provided capital at the early stage of development.

Like the remedy selection time line, the end point that a technology must

achieve and the pathway for achieving regulatory approval are unclear. While drinking water standards historically have been selected as cleanup goals at most sites (National Research Council, 1994), this is not always the case. The GAO reviewed cleanup standards for ground water and soil in 21 states in 1996 and found that the standards vary widely (GAO, 1996b). In an earlier review, the GAO found that soil cleanup goals for polycyclic aromatic hydrocarbons at 14 Superfund sites ranged from 0.19 to 700 parts per million (Hembra, 1992). The variation was a function of what decision regulators made about the future use of the site, but the factors weighed in making this decision were unclear. For example, cleanup standards varied among sites that were equally near to residential areas.

Current Superfund and RCRA regulations allow for wide discretion by regulators about what level of cleanup should be required at a given site, and individual regulators may reach their decisions about cleanup end points using different methods. Administration of Superfund and RCRA is carried out by EPA's ten regional offices, and each office has somewhat different strategies for setting cleanup goals. Furthermore, sites having the same geophysical and contaminant characteristics may be subject to different legal requirements depending on whether the site is a federal Superfund site, included on a state list of contaminated sites, or governed by the RCRA corrective action program. For example, in a review of compliance with Superfund and RCRA requirements at DOE facilities, the GAO concluded that although the Superfund and RCRA programs have broadly similar objectives, ''the two programs differ in their highly detailed sets of procedural regulations and guidelines and in the particulars of their implementation" (GAO, 1994a). According to the GAO, for example, remedies for RCRA sites are typically selected for relatively small unit areas, while Superfund cleanups are generally regulated over broad geographic areas. Without clear, consistent regulatory requirements on how to receive approval for a remediation technology, it is difficult for technology developers to prove to potential customers that their technology is acceptable to regulators, even if the developer has cost and performance data. Thus, technology developers and customers may find themselves in a Catch 22: the customer wants to be assured that the technology will be accepted by regulators, but the regulator wants to see the technology in operation before providing the permit, meaning that the developer first needs to sell the technology to a customer.

Lack of consistent performance standards for remediation technologies, combined with inherent uncertainties about technology performance, has resulted in customers most often seeking a technology that can achieve regulatory compliance, rather than one that can reach a specific end point. Remediation technologies are thus more of a legal product than a technological one, and there is little or no premium for improved solutions to subsurface contamination problems. Either a technology meets the approval of regulators and has high value, or it does not meet regulatory approval and has no value. That is, a company must meet regula-

tory approval for a given site, and anything more does not provide additional value to the site owner. If a site owner has received regulatory approval for a remediation strategy at a site and new technologies become available that can improve cleanup at equal or lower costs, there is no reason for the site owner to engage in additional remediation once legal compliance is achieved.

In summary, the processes for implementing Superfund and RCRA have reduced the potential market demand for new remediation technologies. Under these programs, delay is preferable to initiating cleanup, in part because companies perceive that remediation is not in their self interest. The time line for selecting remediation technologies is lengthy and unpredictable, making it hard for technology start-up companies to stay in business while they await approval of their first customer's contract. The end points that a remediation technology must achieve are often negotiated and vary from site to site, and current regulatory policy provides no premium for solutions that exceed the regulatory requirements. Customer freedom to choose new technologies and to adapt solutions over time as better technologies emerge is highly restricted. All of these factors contribute to the weakening of the market for waste site remediation technologies.

It is important to note that the market for new technologies is stronger in the underground storage tank (UST) cleanup program than in the Superfund and RCRA corrective action programs. In part, the relative strength of the UST market reflects the fact that spills from underground storage tanks are much simpler to clean up than contamination at RCRA and Superfund sites (National Research Council, 1994). Underground storage tanks typically contain just one type of contaminant (usually petroleum hydrocarbons, which are relatively easy to clean up), and they affect a relatively small area. However, the greater use of innovative technologies in the UST market also reflects the greater freedom to choose innovative technologies allowed in the regulations governing these cleanups. UST cleanups are controlled at the state and local levels, rather than the federal level. Customers have freedom to choose a remediation technology for UST sites, and the job of regulators is simply to ensure that the site has been cleaned up to the required level. State regulators have expressed concern that inadequate oversight of UST cleanups due to the rush to remediate and redevelop these sites has in some cases resulted in incomplete cleanup of the sites. To prevent such situations, customer freedom to choose remediation technologies must be accompanied by strong regulatory enforcement of cleanup goals.

OTHER BARRIERS TO INNOVATION

Not just regulatory programs but also the actions of remediation clients have frustrated attempts to commercialize innovative remediation technologies.

In the private-sector remediation market, companies can be hesitant to share information about their contaminated sites. This lack of information sharing makes it very difficult for technology vendors to predict the potential size of the

market for their product and to establish sites to which future clients can be referred for evidence of the technology's performance. Very few companies are completely open about their remediation needs, given the negative public image and increased regulatory scrutiny this would create. Thus, technology providers and investors have poor information about the distributions of sites having characteristics suitable for application of their technologies. The EPA's Technology Innovation Office has prepared reports that assess market opportunities for innovative remediation technologies in the southeastern and mid-Atlantic states (EPA, 1995b, 1996b), but these reports, while a useful starting point, lack the detailed information about contaminants, type and volume of contaminated media, and hydrogeologic characteristics of the sites that are essential for allowing technology developers to easily identify whether their technologies might be applicable at a given site. Lack of information about the size of the various market segments makes it very difficult for technology developers and investors to predict their potential sales. In addition, because many companies are concerned about the negative public image associated with having contaminated property, few are willing to have their property used as a reference site for a remediation technology. For new technologies, establishing a "blue chip" list of customers is critical. The presence of such customers can attest to the value of the new technology, and the established sites where the technology has been used can serve as reference sites for other customers. It is especially difficult for remediation companies to establish a list of reference sites in the private-sector market.

In the public-sector market, inadequate cost containment has decreased the incentives for selecting innovative technologies. Often, federal remediation contractors are placed on "auto pilot" after being awarded the cleanup contract on a cost-reimbursable basis, so there is little incentive for cost effectiveness (GAO, 1995b). According to an audit by the GAO (1995b), cost overruns are common to remediation efforts at federal sites, due in part to inadequate oversight of contractors. GAO found evidence of fraud, waste, and abuse by federal remediation contractors (GAO, 1995b). With no incentive to reduce costs, there is no incentive to search for new solutions.

In summary, lack of information sharing in the private-sector remediation market and inadequate control over costs in the public sector remediation market create barriers to innovation that add to those that are inherent to the market itself and those created by the regulatory process.

CHARACTERISTICS OF FLOURISHING TECHNOLOGY MARKETS

The amount of venture capital invested in a given market is an indication of the perceived health of the market and the drive for innovation. Venture capital investors to a great extent seek the path of least resistance. They try to achieve the greatest return possible for any given level of risk. Venture capital thus flows

quickly from one industry to another, depending on which industries are perceived as offering the greatest potential for profits from new technologies. In considering how to reinvigorate the market for innovative solutions to hazardous waste site remediation, it is useful first to outline the characteristics of technology sectors that attract relatively large amounts of venture capital (see, for example, Table 2-3).

In general, the industries most successful in attracting venture capital, such as the software and medical drug markets, have the following characteristics:

-

Market is driven by performance and cost: Above all else, investors seek markets and industries where new technology can be leveraged to create a product or service that generates measurable value to the customer. That is, the customer must receive returns that they perceive as greater than the cost of the product. The enormous growth in the computer and software industry over the last two decades is a clear example of this phenomenon. Investors continue to pour capital into new computer companies to develop new products to solve the same problem either less expensively or more efficiently, or to enable the customer to perform a task that was not possible before. The market rewards those who are able to provide the product or service most efficiently. The trade-off between cost and performance is clear: improved performance costs more, and there is a large market for slightly lower performance at discounted prices.

-

Customers have freedom to choose: The most efficient markets are characterized by customer freedom to choose. In order to survive in free markets, companies must continue to develop improved products because the consumer has the freedom to choose any product or service. The consumer can at any time abandon one product in favor of a more effective or equally effective but less expensive alternative.

-

Rewards justify the risk of innovation: Technology innovation is traditionally encouraged by the opportunity to generate financial returns commensurate with the risk level of the venture. Greater risk generally carries with it the opportunity to create greater rewards. The typical remediation start-up company is not competing for investment capital against a number of similar remediation companies but against all other start-up companies; the risk profile of remediation firms needs to be less than or equal to the risk profile of other types of companies in which investors might choose to place their capital.

-

Market is quantifiable: In successful markets, extensive information about the size and characteristics of the market is available, enabling entrepreneurs and investors to predict their potential returns and tailor their technologies to meet market needs. Similarly, extensive information about performance and cost of existing technologies is available, allowing entrepreneurs and investors to gauge market needs.

-

Time to market is short and predictable: Successful markets tend to have a predictable and understandable path to the customer. The "rules" are known,

|

BOX 2-2 The Pharmaceutical Industry: How a High Level of Regulation Can Coexist with Innovation To obtain regulatory approval and enter the marketplace, a company with a new pharmaceutical drug must submit a "new drug application" (NDA) to the Food and Drug Administration (FDA). The NDA specifies manufacturing practices and contains safety and efficacy data based on a prescribed set of preclinical tests and three phases of clinical trials. Failure at any one of these stages can derail the project, and each new success brings new sources of funding. Before the FDA approves the NDA, it usually requires more work to better justify efficacy indications or potential side effects. The indications and side effects are then communicated to the market on labels and other information accompanying the approved drug. Any change in manufacturing practices requires prior approval of the FDA. While the level of government scrutiny in the drug industry is substantial, the hurdles that a new product must clear prior to regulatory approval are consistent and well established. Further, the approval process provides assurance to buyers and end users of drugs that the products are safe and effective, and this assurance helps underpin the market. Most pharmaceutical companies invest about 10 to 20 percent of their sales in R&D. The potential reward for this enormous R&D investment is the infrequently discovered "blockbuster" drug that may bring in excess of a billion dollars per year in sales over the remaining patent life. |

-

and if the market is regulated, the regulations are known and do not change significantly or rapidly over time. For example, the pharmaceutical industry is one of the most regulated markets, and one would expect it to be less attractive to investors because of the government approvals needed to bring a product to market. However, this sector is very well financed, despite the regulations, in part because the steps needed to obtain regulatory approval are clear (see Box 2-2). In rare cases, innovative remediation technology ventures have succeeded in commercializing their technologies by obtaining initial sales in markets unrelated to remediation in which the regulatory expectations are clear; Box 2-3 describes an example of one such venture, Thermatrix.

-

Level of competition is high, and change is rapid: Constant change in performance and cost attracts capital and investors in spite of the relatively high number of companies that do not succeed. This is because over time, investors can earn sufficient returns on their investments on a portfolio basis, in which multiple investments are made in the same category and individual losses are covered by successes. This portfolio approach is critical to overall return. The

|

BOX 2-3 Thermatrix, Inc.: Market Entry Through a Sector with Clear Regulatory Guidelines Thermatrix, Inc., owns rights to a technology that uses high heat in a porous ceramic medium to destroy contaminants and is a substitute for incineration (Jarosch et al., 1995; Schofield, 1995). The technology was originally developed for petroleum extraction in the oil shale program at Lawrence Livermore National Laboratory. After spending $25 million to develop the technology, the DOE abandoned it when the oil crisis ended and petroleum prices stabilized (Schofield, 1995). Three Livermore scientists left the lab to commercialize their invention. By the end of 1991, however, their company was insolvent and owed $2.5 million to creditors (Schofield, 1995). New management took over in 1992. Although the most promising application for the Thermatrix technology was site remediation, entering this market was seen as too risky because (1) the time to market was too long given the company's debts and minimal available capital; (2) no funding was available for demonstration projects; and (3) consultants, rather than clients, usually choose the remediation technology and have a preference for tested approaches because of their lower risk (Schofield, 1995). Therefore, company managers targeted the air pollution market first. The company obtained several customer orders based on regulatory receptivity to a viable alternative to incineration and corporate frustration with the permitting process for incinerators. The company provided money-back guarantees to clients to avoid having dissatisfied customers who could show evidence of a Thermatrix system that was not performing up to specifications. The next step was to enter the site remediation business. The first client was General Electric (GE), which is responsible for a Superfund site contaminated with PCBs where the record of decision specifies incineration, at a bid cost of $77 million (Schofield, 1995). Thermatrix approached GE managers directly and explained that the company's technology could destroy PCBs on the GE site for $6 million. A contract was entered to test the technology. Other applications followed. Capital for growth became more readily available. The company went public in June 1996 (see Table 2-1) |

-

sectors of the economy that are the most competitive are the ones in which change and technical innovation and development occur most rapidly. For example, the U.S. semiconductor industry is the world's largest supplier of semiconductors, but capital equipment in this industry has a shorter life span that in any other sector of the economy. New chip manufacturing methods force yesterday's tech-

-

nology into obsolescence on average every 18 months. For example, Intel introduced its first pentium chip in 1993 and by 1996 was working on the third generation of this chip. Despite this short life cycle and the high cost (on the order of $1 billion) of capital equipment needed to build a new manufacturing line, this industry has no problems attracting investment capital because of the large investment returns it offers. Thus, it is not change, but uncertainty and lack of success, that repels investor capital.

-

Prior ventures have proven successful: Above all else, what attracts capital (and people) to markets are successes. If a sector of the economy generates significant investment returns, capital will flow to that sector. Investors, like people in general, tend to follow others who have achieved success. Successes attract new capital and people, which in turn creates new companies, which in turn creates new successes. This phenomenon is responsible for the growth in high technology start-up companies concentrated in Silicon Valley, California, and along Boston's Route 128.

-

Business models are well developed: Investors, from venture capitalists to corporate investors and public underwriters, seek to understand the business plan that a new company will follow to exploit the value of its technology. The model is the critical blueprint that allows the entrepreneur to pull together technology and capital to build a company. For example, the success of Regenesis Bioremediation Products, Inc., in developing its oxygen release compound (see Box 2-4) was in part due to a carefully developed business plan that the company prepared prior to offering the product to the market. Such models are rare in the remediation technology industry. Lack of clear business models is an indication of insufficient success in the marketplace.

-

Experienced people are available to start new ventures: Established and growing industries have a steady stream of people who have started new ventures before and want to do so again. The computer industry provides examples of entrepreneurs who establish new companies, build them to the level at which their expertise is no longer relevant, and then leave to start up a new venture. The existence of such entrepreneurs is one of the critical assets the financial community evaluates in deciding whether to fund a new venture.

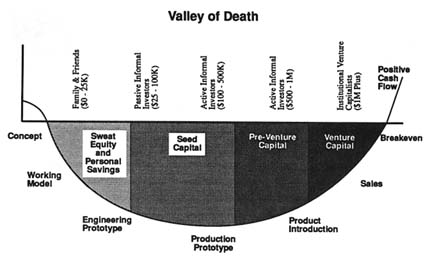

Strong, innovative markets with the above characteristics attract public and private investment to support basic research, efforts at commercialization, and growth. The most critical stage for investment capital is that between the research and development (R&D) phase of technology development and successful commercialization. Investors typically refer to this phase as the "Valley of Death" (see Figure 2-3) because so many start-up firms fail in this transition. Significant capital is available for the early stage of technology development and R&D. For example, the DOE alone provided $47 million in research grants in 1996 through its Environmental Management Science Program (Renner, 1996) for basic research on subsurface contamination and remediation technologies. Indeed, the

|

BOX 2-4 Regenesis Bioremediation Products: Carefully Developed Business Plan The Oxygen Release Compound (ORC) of Regenesis Bioremediation Products, Inc., is one of the few remediation technologies that has been successfully commercialized in recent years. The success of Regenesis in commercializing this product was due in part to a carefully conceived business plan that the company developed prior to marketing its product and in part to backing from a major, financially solvent corporation during the critical stages of development. ORC was developed to clean up low levels of dissolved petroleum hydrocarbons in the subsurface. The compound is a proprietary formulation of a metal peroxide that releases oxygen slowly when placed in the ground water environment. The oxygen thus released enhances aerobic bioremediation. The product is applied to the contaminated site in retrievable filter socks. ORC (under another name) was originally developed for use in preventing gardening soil from becoming anaerobic, and it is sold in many home garden centers. The parent company that spawned ORC is a wealthy plant and garden company. The financial support of this solvent corporation ensured that the developers of ORC would have adequate resources during the critical stage between R&D and commercialization. Development of ORC for the remediation market and incorporation of Regenesis was preceded by three years of product testing and demonstration. A scientific advisory board guided the research. A series of field trials verified product performance (Bianchi-Mosquera et al., 1994). Prior to offering ORC to the market, the product developers contracted for a market study by Arthur D. Little. The study was completed in the summer of 1993, and outside capital was raised in the fall of 1994. Regenesis Bioremediation Products was incorporated in March 1994 to continue product development and commercialization. Regenesis prepared a clearly focused market entry strategy based on the following principles:

Regenesis offered ORC to the market in February 1995. A year later, the product was being used in the remediation of 700 sites in the United States and Canada. |

FIGURE 2-3 The "Valley of Death:" the stage between development of a new concept and successful commercialization of the concept. SOURCE: Adapted from SBA 1994.

number of patents issued for technologies relating to "remediation" or "hazardous waste destruction or containment" increased from nearly zero in 1980 to more than 430 in 1993–1994, showing extensive innovation and suggesting a healthy level of R&D (see Table 2-4). Once a technology reaches a critical level of market acceptance, sufficient capital is usually available for growth and traditional commercial activity. In contrast, the stage between R&D and commercial sales is capital constrained because the amount of capital required to shift a technology from the lab bench to full-scale application is high, but the level of risk that it will fail is also high, making investors wary. Providers of capital at this critical "Valley of Death" stage are primarily driven by financial returns and not technical objectives; their sole purpose is to create wealth from the technology. It is often difficult for developers involved in the R&D phase, who are motivated by the desire to solve problems and prove the technical merit of their creation, to understand how to ''sell" the technology to investors. Backing from large, financially solvent corporations during the critical "Valley of Death" stage was essential to the success of the innovative remediation ventures Regenesis, described in Box 2-4, and Geosafe, described in Box 2-5, in commercializing their products.

Once investors can see that they have a chance to recoup their investments, capital will return to the remediation marketplace. The question is how to adapt current policies and client perceptions to remove some of the barriers that have driven investment capital away from the remediation market. The regulations governing contaminated site cleanup cannot be eliminated. Without regulatory pressure, it is unlikely that most companies would pursue remediation on

TABLE 2-4 Remediation Technology Patents

their own. The key is to implement remediation laws in a way that provides economic incentives for companies and the federal government to implement cleanups as quickly as possible, rather than delaying remediation until some future time.

CREATING MARKET INCENTIVES FOR REMEDIATION TECHNOLOGY DEVELOPMENT

The principal change necessary to move to a market-oriented approach to remediation technology development is to take advantage of the power of financial self interest rather than relying on the force of regulation alone. The objective is to develop a market that is quantifiable, with reasonably well-defined risks and a commensurate opportunity to create financial returns from solving problems. That is, both the vendor and the customer must perceive financial benefit from improved remediation of contaminated properties, while still protecting the interest of the affected public in ensuring that sites are cleaned up. Capital will flow to the remediation technology market when it becomes evident that new technologies can create real value for customers.

The use of market forces in creating demand for remediation is the premise behind brownfield programs, in which state and local agencies provide incentives for redevelopment of contaminated urban industrial sites. For example, some states have recently developed provisions whereby they will forego lawsuits against new owners of contaminated property in economically distressed areas provided the owners follow the procedures of the state's voluntary cleanup program (GAO, 1995a). Brownfield programs create a high economic incentive to cleanup these properties and redevelop them because many of the properties

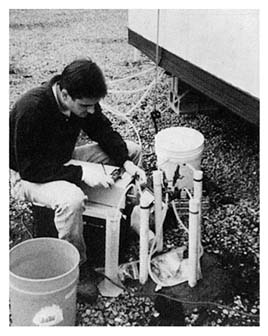

A former fuel storage and handling facility in California was demolished to make way for a marina. As part of the process, 13,000 m3 of petroleum contaminated soils were treated in above ground bioremediation cells. Courtesy of Fluor Daniel GTI.

occupy extremely valuable parcels of urban land. Anecdotal evidence suggests that the market incentives driving the redevelopment of brownfields can lead to careful consideration of innovative remediation technologies, because property developers have a strong incentive to complete the remediation as quickly and effectively as possible so they can sell or lease the rehabilitated land. For example, at a brownfield site in downtown Wichita, Kansas, the city chose an innovative in situ treatment approach over a conventional pump-and-treat system in part because the innovative method could be more easily modified to improve performance (see Box 2-6).

While brownfield programs are increasingly being implemented at the local and state levels, economic incentives for remediation are still lacking in major sectors of the remediation market, particularly at sites regulated under Superfund and RCRA. In fact, lenders, environmental attorneys, and local officials have reported that fear of liability stemming from the Superfund program have discouraged brownfield redevelopment (GAO, 1996a). For example, in Allegheny County, Pennsylvania, some former steel mill sites are still idle in part because their owners prefer to keep the sites rather than risking that environmental assessments prior to sale will reveal contamination that they are liable for cleaning up

|

BOX 2-5 Geosafe: Financial Backing from Battelle Essential for Survival Geosafe Corporation is commercializing an in situ vitrification (ISV) technology initially developed by Battelle Pacific Northwest Laboratory for the DOE. The time from the formation of Geosafe until the company received its first commercial sale (5 years) was relatively long, and financial backing from Battelle has been essential for ensuring the company's survival during several downturns in the transition from R&D to commercialization (J. E. Hansen, Geosafe Corporation, personal communication, 1995). ISV technology involves the in-place electric melting of earthen materials (EPA,1995a). The earthen media itself serves as the containment for the melt. The melt occurs at a temperature range of 1600 to 2000c. The high temperature causes the pyrolytic destruction and vapor-phase removal of organic contaminants. In addition, most metals are immobilized as oxides and incorporated into the vitrified product upon cooling. ISV was conceptualized in 1980, and the initial patent for the process was filed in 1981 and issued in 1983. Battelle built a prototype for DOE in 1985 and demonstrated it in an application in 1987. Geosafe Corporation formed in 1988 to attempt to commercialize the process, while the DOE continued research focused on developing new applications within the DOE community. Geosafe demonstrated ISV in 1989 and made its first commercial sale during 1993. Since then, Geosafe has sold the technology for use at three additional sites in the United States. The company is also marketing the technology in Australia and Japan through ISV Japan Ltd, and Geosafe Australia (C. Timmerman, Geosafe Corporation, personal communication, 1997). Geosafe encountered numerous difficulties prior to landing its first sale, and but for the financial backing of Battle might not have survived. The company lost an initial project due to a competitor's claims against the technology, which were later disproved. Geosafe spent significant resources refuting those claims and repairing the damage they caused. In addition, Geosafe attempted to expand the market for ISV too early, before the fundamental processes underlying ISV were fully understood. This premature market entry led to a series of unexpected testing problems that consumed time and resources. |

(GAO,1995a). Banks have chosen not to foreclose on properties for fear of being held liable for remediation (GAO. 1995a, 1996a).

To shift the remediation technology market from one that is driven almost solely by regulations to one that captures the power of economic self interest, federal and state regulatory agencies need to pursue five types of initiatives. First,

|

BOX 2-6 Wichita Innovative Remediation Plan In 1990, the Kansas Department of Health and Environment (KDHE) discovered chlorinated solvents in the aquifer directly under Wichita's downtown area (ENR, 1996a). Downtown commercial real estate activity came to a halt, and the city's downtown redevelopment program appeared doomed by the prospect of a Superfund listing. The site was immense, encompassing a 6.4-km (4-mile) long, 2.4-km (1.5-mile) wide area. Some $86 million worth of commercial and residential properties was affected in 8,000 parcels of land. Financial institutions, wary of Superfund liability, discontinued loans in the affected area, and one of Wichita's most important tax bases began to erode. City officials decided to take responsibility for site cleanup rather than letting it proceed under the Superfund program, in effect becoming a remediation broker for the property owners. The city took a series of actions to increase the market value of the property by reducing concerns of potential buyers that they might be held liable for contamination. The overall program has been a financial success for the city. By agreeing to take on responsibility for remediation, the city has increased the revenue generated in the downtown area. The Old Town area is being revitalized with more than 20 new businesses. In this case, remediation was profitable for the city because of the high commercial value of the property. In 1994, KDHE approved an innovative remedial plan (Olsen, 1996). The plan specified bioremediation as a possible remediation technology and required a pilot demonstration project. A "bio-curtain" comprising an in situ bioremediation trench and zero valent iron wall was tested. Bids were received for $18 million, $2 million more than conventional pump-and-treat technology. Although the innovative remedy was more expensive than the conventional one, the city selected it because of the potential that it could do a better job cleaning up the site than the conventional remedy and because of the potential for long-term cost savings to the city. The innovative approach, city engineers believed, could be more easily adapted to improve performance by optimizing microbial degradation of the contaminants. Also, they believed that costs for this approach would decrease after the initial application and that the city could implement the same strategy at other sites for a much lower cost. |

economic incentives for remediation need to be created. Second, enforcement of regulations needs to be more consistent. Third, the regulatory process for selecting cleanup goals and remediation technologies needs to be more predictable. Fourth, complete information about the size and nature of all sectors of the remediation market, public and private, must be made available. Fifth, more opportu-

Sampling from monitoring wells at a field demonstration of an in situ bioremediation system for the treatment of chlorinated solvents in Wichita, Kansas (see Box 2-6). Courtesy of Roger Olsen, Camp Dresser & McKee.

nities. need to be created to test innovative remediation technologies and verify their performance.

Economic Drivers

As described in this chapter, the remediation market is unique in its lack of economic drivers to accelerate the use of innovative technologies. If customers derived financial value and economic differentiation from improved remediation and accelerated cleanup, they would perceive remediation as an activity worth pursuing in part for their own self interest.

One way to create this self interest in large corporations is to improve corporate reporting of remediation liabilities to the Securities and Exchange Commission (SEC). The SEC currently has regulations for disclosure of environmental liabilities in documents such as quarterly and annual reports and security registration statements, but the guidelines are vague and subject to widely varying interpretation by accountants and corporate managers (see Box 2-7). As a result, companies often do not report remediation liabilities or fail to disclose the full magnitude of liabilities. Detailed guidelines should be developed for reporting of remediation liabilities, and sanctions for inaccurate or incomplete reporting should be increased. Consistent reporting of remediation liabilities to the SEC would help shift remediation from a cost center to a value-added activity. It would pro-

|

BOX 2-7 SEC Requirements for Reporting of Environmental Liabilities The SEC has general guidelines requiring publicly traded companies to disclose their liability for environmental remediation in documents such as quarterly and annual reports and security registration statements (SEC, 1993). However, these guidelines are subject to widely varying interpretation by accountants and corporate managers. Pressure by the SEC to disclose more has had limited effectiveness (Robb, 1993). Specifically, SEC Regulation S-K, 17 C.F.R 229.10, contains the following provisions about environmental reporting (Roberts and Hohl, 1994; Roberts, 1994):

Under a 1990 agreement, the EPA provides the SEC with information about compliance with environmental laws, including names of parties receiving Superfund notice letters, cases filed under RCRA and Superfund, concluded federal civil environmental cases, criminal environmental cases, and names of RCRA facilities subject to corrective action. However, companies often report that environmental liabilities from these programs do not have a "material" effect on their business. They report that until the cleanup goal and time line for each of their contaminated sites are known, assessing the cost of cleanup is not possible. |

vide large companies with a rational basis (reduced remediation liabilities on the corporate balance sheet) for measuring the value of remediation technologies. Recently, support has been growing for development of accounting practices that represent the full environmental costs of doing business, and consistent reporting of remediation liabilities would complement such full-cost accounting initiatives (see Box 2-8).

To provide for uniformity and credibility in corporate reporting of remediation liabilities, consistent standards for tabulating remediation liabilities would

|

BOX 2-8 Corporate Environmental Accounting Support has been gathering over the past few years for the notion that full corporate reporting of environmental costs and liabilities is an essential element of business for economic sustainability and environmental stewardship (Ditz et al., 1995). Full-cost environmental accounting describes "how goods and services can be priced to reflect their true environmental costs, including production, use, recycling, and disposal" (Popoff and Buzelli, 1993). Thus, full-cost environmental accounting requires the inclusion of costs once considered to be external to corporate financial decisions. Ditz et al. (1995) refer to full-cost environmental accounting as the maintenance of "green ledgers." Ditz et al. argue that "environmental costs are dispersed throughout most businesses and can appear long after decisions are made" primarily because "traditional accounting practices rarely illuminate environmental costs or stimulate better environmental performance." Environmental costs are often hidden and unrecognized in other categories. In case studies of several large corporations, Ditz et al. found that the true environmental costs of manufacturing operations were as high as 22 percent of operating costs. Full-cost environmental accounting and liability disclosure can help identify opportunities for cost savings that had not been previously recognized and exploited by managers. |

need to be developed. The American Institute of Certified Public Accountants in October 1996 issued a position paper calling for more forthright reporting of environmental remediation liabilities, but detailed standards for such reporting do not yet exist (American Institute of Certified Public Accountants, 1996). The model used for federal taxation of corporations could be employed in developing remediation liability reporting standards. That is, a national body such as the Federal Accounting Standards Board could establish generally accepted accounting principles for such reporting. Third-party auditors (certified public accountants, ground water professionals, engineers, or all of these) could audit the records of the reporting company to ascertain whether the reports were accurate. Third-party auditing would greatly reduce the regulatory burden of monitoring compliance, in effect privatizing the audit function. The thoroughness and accuracy of the audits would, in turn, be established by creating third-party liability for auditors who fail to comply with accepted practices in preparing an audit. The potential for liability would lead to careful training and supervision of auditors. Public accountants are accustomed to the risk of being held liable for faulty audits, and they typically carry insurance against it.

The Geneva-based International Standards Organization (ISO) in late 1996

released a standard, known as ISO 14001, that prescribes how corporations can establish management systems, including accounting procedures, for keeping track of how all of a company's activities affect the environment (Begley, 1996). The ISO standard could serve as a model for developing a management process and an accounting system specific to keeping track of contaminated sites. The standard is expected to become widely used as a model for corporate accounting of environmental impacts (Begley, 1996). For example, the DOD and other U.S. agencies are conditionally requiring their vendors to become certified under the standard.

To eliminate financial disincentives for companies to comply with remediation liability reporting requirements, Congress should establish a remediation "mortgage" program. The program would allow a company to depreciate all of the remediation costs it declares at the outset of a project over a 20- to 50-year period, rather than having to subtract the full liability from its balance sheet all at once. The program would not be a true mortgage program because it would not involve financial lending. However, it would be similar to a mortgage program in that, rather than having to bear the full burden of remediation liability at once, companies could charge part of the cost against earnings each year, much as a homeowner generally has 15 to 30 years to pay off debt. Such a program would ensure that companies would not risk losing a major portion of their value by accurately and completely reporting all remediation costs they are likely to face in the coming decades. That is, companies would not have to bear the full impact of remediation liability at once. A remediation "mortgage" would have the added advantage of providing companies with a cost target (the cost of the "mortgage") to beat.

Although federal agencies must be accountable to the public and have a responsibility to spend tax dollars wisely, remediation at government sites is less driven by financial concerns than remediation at privately owned sites. At federal sites, financial resource allocations are driven more by goals and negotiated milestones than by costs (GAO, 1995b). Thus, the public-sector remediation market is less subject to influence by financial stimuli than the private-sector remediation market. Nevertheless, financial incentives for considering innovative remediation technologies could be created by careful oversight of remediation contractors. Rather than hiring contractors on a cost-reimbursable basis, federal agency managers should hire remediation contractors on a fixed-price basis, in which the cost of achieving a specified goal is agreed upon in advance and clear milestones are established. To provide assurance that remediation is proceeding toward those milestones in an efficient manner and protect against waste and abuse of government resources, federal site managers should establish independent peer review panels to check progress at specified milestones. Limiting the amount that can be charged toward remediation of federal sites and providing for independent review of progress at those sites would provide incentives for remediation contractors to implement efficient, innovative solutions. In some cases, site complexities

will result in remediation costs much higher than those originally projected by the contractor. In such cases, the peer review panel could examine the request for a cost increase and determine whether it is technically justified.

Consistent Enforcement

A market that is a function of regulatory requirements as its core basis must at a minimum be consistent and predictable. For example, the U.S. tax system is based on self reporting, but it works because there are known and credible consequences for those who do not comply. Enforcement of waste site remediation requirements should be similarly consistent. Organizations will engage in remediation for two reasons: (1) because there is value in solving the problem or (2) because there are known negative consequences for noncompliance. It is imperative to have a predictable, known, and consistent enforcement mechanisms accompanied by high penalties. Without sufficient enforcement and penalties for noncompliance, the system rewards those who delay.

The financial resources and number of personnel dedicated to enforcement of waste site remediation regulations need to be increased so that those who do not comply are consistently penalized. In addition, enforcement penalties need to be higher than the costs of remediation to make noncompliance more costly than remediation. Third-party auditing of environmental liability, as described above, could be added to the existing set of regulatory enforcement tools. The EPA and the Department of Justice could pursue enforcement actions against companies whose audits reveal failure to comply with hazardous waste regulations.

Predictable Regulatory Requirements and Time Lines

The regulatory process for deciding on cleanup goals and selecting remediation technologies must be sufficiently uniform to justify the development cost of a new technology and thus leverage the cost over a wide group of customers. Consistency in the remedy selection process is not equivalent to establishing presumptive remedies that will be the preferred choice for cleaning up different types of contaminated sites. In fact, establishment of presumptive remedies runs counter to innovation by, in essence, freezing the menu of technologies at the point in time at which the presumptive remedies were developed. Rather, consistency in remedy selection processes means that the detailed steps in selecting remedies for two different sites having similar geophysical and contaminant characteristics should be similar, regardless of the regulatory program under which the sites are being cleaned up or the EPA office responsible for overseeing the sites. To increase the consistency of the remediation technology selection process, the EPA should conduct a detailed review of remedy selection procedures at Superfund and RCRA sites in its 10 regions. Based on this review, the EPA should deter-

mine the degree to which these procedures vary and should recommend how to make the process more consistent.

The EPA should also consider whether establishing national cleanup standards for ground water and soil would enhance the cleanup process by providing greater consistency. Such standards would be based on cancer and noncancer (such as neurological and reproductive) effects of contaminants, as well as ecosystem effects. They would need to include some mechanism to account for site-specific variations in the potential for human or ecosystem exposure to the contamination and in synergistic effects caused by the presence of multiple contaminants.

While national ground water and soil cleanup standards might benefit remediation technology developers by clarifying the level of performance that remediation technologies must achieve, the issue of whether such standards should be established is highly controversial and needs careful analysis. The Committee on Innovative Remediation Technologies could not reach consensus on whether such standards are advisable. Some members favored the establishment of standards because of the greater consistency they would provide and because such standards might create an incentive to achieve higher levels of cleanup, much as the establishment of standards for drinking water has spurred development of improved water treatment technologies. However, other members objected to recommending the establishment of national standards because they believe such standards might limit opportunities for site-specific judgment of appropriate cleanup levels by trained professionals. Nonetheless, the committee did agree that the issue of whether national ground water and soil cleanup standards should be established warrants careful consideration. Many states already have statewide cleanup standards for soil, ground water, or both. If national standards were developed, site-specific assessment could always be an alternative and may be more appropriate for large, complex sites. The EPA and the Congress should review the effectiveness of state cleanup standards and the rationale for establishing them and determine whether national standards for soil and ground water cleanup would help advance the state of development of cost-effective subsurface remediation technologies.

As part of this effort, the EPA should also establish guidelines that would indicate tentative time lines for reaching the various regulatory milestones (site investigation, remedy selection, remedy construction) at sites with varying degrees of complexity, with more complex sites having longer remediation time lines. Site-specific flexibility is essential to allow for more detailed studies and longer time lines where initial investigations reveal site complexities. Nonetheless, general guidance on remediation time lines based on site complexity would help technology developers anticipate with greater certainty how long they might have to wait before receiving a job contract. Although the EPA prepares quarterly management reports that document the average duration of stages in the process

of cleaning up Superfund sites, such averages are of limited use to remediation technology vendors because of the wide deviations from these averages and because the averages do not apply to cleanup efforts occurring outside of the Superfund program. To the extent possible, state-run remediation programs should follow the EPA's guidelines and general remedy selection processes.

To further increase the predictability of remediation time lines at Superfund sites, steps should be taken to reduce litigation associated with identifying potentially responsible parties. According to the GAO (1994b), factors that can help decrease the amount of litigation over who should pay for cleanup include careful work by the EPA to identify all potentially responsible parties up front, consistent enforcement against responsible parties who fail to meet regulatory requirements, and involvement of skilled mediators with the full group of responsible parties to negotiate their individual responsibilities.

Freedom to Choose

To provide incentives for innovation, customers must have the freedom to choose any remediation technology or group of technologies they desire in order to meet the required cleanup standards. Theoretically, regulators should be indifferent about how a company or federal agency cleans up a site, as long as the regulatory requirements for risk reduction are met. Current regulatory preapproval of remediation technologies should be curtailed. At the same time, the public will need assurance that in allowing this freedom, the public's goals for remediation are still achieved. Table 2-5 shows how companies could be allowed freedom to choose remediation technologies while still providing assurance to the public that cleanup standards will be achieved.

TABLE 2-5 Elements of a Regulatory System that Allows Freedom to Choose Remediation Technologies

|

Industry Goals |

Public Safeguards |

|

Performance-based regulation |

No increase in risk (no backsliding on standards); increased penalties and liability for noncompliance |

|

Flexibility in choosing treatment technology, including ability to change technology if a better alternative emerges |

Prior public notice of remediation plan, with full disclosure of contamination conditions |

|

Confidentiality of proprietary data |

Auditing of data by third parties |

|

Reduced cost |

Continuing right to litigate if standards are not met |