3

Operational Makeup of the Maritime Oil Transportation Industry

This chapter identifies the nature and extent of changes in tank vessel ownership and use in the maritime oil transportation industry since 1990. The committee analyzed the following factors:

- changes in the size distribution of vessels used and related trading patterns, including the use of the deepwater port and lightering zones

- changes in the age distribution of the world and U.S. trading fleets and scrapping patterns

- changes in vessel ownership, including trends in sales and transfers

To assess the impact of the Oil Pollution Act of 1990 (P.L. 101-380) (OPA 90) since its enactment, the committee compared data for 1990 (the last pre-OPA 90 year) with data for 1994 or 1995. Where possible, projections for the period 1995 through 2015 were analyzed to provide an indication of likely changes in the operational makeup of the fleet during the phaseout period for single-hull tank vessels.

The analysis treats the international fleet and the domestic (Jones Act) fleet separately because of their different trading patterns and composition. The international fleet carries crude oil and finished products to the United States from foreign sources, whereas the Jones Act fleet trades almost exclusively between U.S. ports, with an occasional cargo for foreign aid or for the Military Sealift Command going abroad. In addition, the composition of the two fleets is substantially different. The average age of vessels in the Jones Act fleet is greater than that of vessels in international trade.

Vessel Size and Trading Patterns

The makeup of the international fleet trading to the United States is determined primarily by U.S. requirements for oil imports and the geographical distribution of supplier nations. Most U.S. oil imports are crude oil. In 1994, for example, U.S. oil imports totaled 8.1 million barrels per day (MBD), of which 7.0 MBD were crude oil. The predominance of crude oil imports is expected to continue through 2015 (EIA, 1996).

The longer the distance that crude oil must travel before reaching the United States, the larger the tanker used is likely to be. The selection of tanker size is determined by logistics and economics. The economics of transporting long-haul crude usually favor the use of very large crude carriers (VLCCs). Many crude oil loading terminals overseas are located at ports that can accommodate fully loaded VLCCs. However, there are no ports on the U.S. east or Gulf coasts deep enough to accommodate such ships when fully loaded. Hence, there is a need for deepwater ports and lightering zones. The economic decision regarding tanker size is often based on a comparison between the higher chartering cost per barrel of crude oil shipped in small tankers and the lower chartering cost per barrel of oil shipped in larger tankers, combined with lightering costs or the cost of unloading at the Louisiana Offshore Oil Port (LOOP).1 Short-haul crude oil imports (e.g., from the Caribbean) are generally shipped in smaller tankers that either sail directly into U.S. ports or can be partially lightered so that most of the cargo remains on the tanker, which is then moved into port and unloaded.2

Trends between 1990 and 1994

The amount of crude oil and finished products imported into the United States by water increased by 19 percent from 1990 to 1994 (see Table 3-1).3 The Atlantic coast showed a decline of 6 percent, the Gulf coast an increase of 28 percent, and the Pacific coast an increase of 69 percent. The committee found that these changes in import patterns caused a change in the size distribution of oil tankers trading to the United States between 1990 and 1994. In 1990, the large crude carriers that use the LOOP or lightering areas in the Gulf of Mexico were the largest group in the Gulf compared to all others that entered Gulf ports (with or without local lightering), including crude carriers, fuel oil carriers, and product carriers. By 1994, as shown in Table 3-1, more cargo was being transported to the Gulf in 80,000 to 150,000-deadweight ton (DWT) vessels.

TABLE 3-1 Change in Tonnage, by Coast and Vessel Size, 1990-1994

|

|

Atlantic |

Gulf |

Pacific |

Total |

||||||||

|

Size Categorya |

1990 (106 tons) |

1994 (106 tons) |

Change (%) |

1990 (106 tons) |

1994 (106 tons) |

Change (%) |

1990 (106 tons) |

1994 (106 tons) |

Change (%) |

1990 (106 tons) |

1994 (106 tons) |

Change (%) |

|

10-40 |

14.5 |

5.9 |

-59 |

2.7 |

1.8 |

-33 |

1.5 |

1.2 |

−20 |

18.8 |

8.9 |

-53 |

|

40-80 |

28.3 |

20.7 |

-27 |

23.9 |

26.4 |

10 |

2.9 |

6.6 |

128 |

55.0 |

53.7 |

-2 |

|

80-150 |

61.7 |

72.8 |

18 |

77.8 |

122.2 |

57 |

6.8 |

9.6 |

41 |

146.4 |

204.6 |

40 |

|

150+ |

4.9 |

3.6 |

-27 |

102.6 |

114.8 |

11 |

2.4 |

5.6 |

133 |

109.9 |

123.9 |

13 |

|

Total |

109.5 |

102.9 |

6 |

206.9 |

265.2 |

28 |

13.6 |

23.0 |

69 |

330.1 |

391.2 |

19 |

|

aFor the purposes of the committee's analysis. oil tankers were categorized in four size ranges: 10,000 to 39.999 DWT (10-40); 40,000 to 79,999 DWT (40-80); 80,000 to 149.999 DWT (80-150); and 150,000 DWT or more (150+). |

||||||||||||

Table 3-1 also shows that the number of product tankers (vessels between 10,000 and 40,000 DWT) unloading in U.S. ports decreased by 53 percent, with decreases on all coasts but notably on the Atlantic. The sharp declines in tonnage carried in these vessels to the Gulf and Pacific coasts do not so much reflect a reduction in the movement of products and small lots of crude, but rather the increasing use of vessels of 40,000 to 45,000 DWT to carry products. On the Atlantic coast, there was a decrease in imports of products and a switch from small- and medium-sized vessels to tankers of more than 80,000 DWT to carry crude oil, but there was little change in volume.

Through the years, 40,000 to 80,000 DWT tankers have played a significant role in transporting oil to the Atlantic and Gulf coasts, but the amount of cargo carried to the United States in this size vessel decreased by 2 percent between 1990 and 1994. Only the Atlantic coast showed an actual decrease in cargo (minus 27 percent), with the Gulf showing an increase of 10 percent and the Pacific coast more than doubling.

The greatest increase in tonnage carried is seen in the 80,000 to 150,000 DWT category. This is explained partly by increased crude oil imports from South America and the Caribbean. This category of vessels is well suited to the short- and medium-haul trade, because they are able to deliver their cargo directly to the dock, unlike the larger vessels from long-haul destinations such as the Arabian Gulf.

The largest size category, 150,000+ DWT, also increased in 1994 versus 1990, although the increase was less than the overall increase in total imports. This reflected a change in the sources of crude oil rather than the influence of OPA 90 regulations.

Projected Trends between 1995 and 2015

There are indications that the United States will need more petroleum imports in 2015 than in 1994; projections suggest that a major share of the increase will be crude (EIA, 1996). Generally, oil imports from relatively close locations in the Western Hemisphere4 have a logistical cost advantage over imports from more distant locations. Thus, crude oil from the Western Hemisphere is likely to be the first choice of U.S. importers, although its availability may be restricted. In 1994, U.S. crude oil imports from the Western Hemisphere were 3.7 MBD. However, this figure is expected to decrease to 3.4 MBD by 2015 as demand in the Western Hemisphere outside the United States increases faster than production (EIA, 1996).

The limited availability of short-haul crude is expected to result in an increase in imports from more distant locations, such as the Arabian Gulf. Analyses

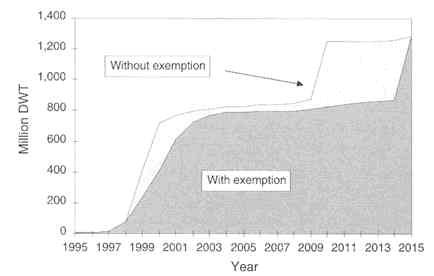

FIGURE 3-1 Projections of U.S. crude oil imports through 2015. Sources: 1990-1994 data from EIA, 1994; 2000-2015 data from EIA, 1996.

of U.S. Department of Energy projections indicate that long-haul crude imports into the United States are likely to increase by more that 2.5 MBD between 1994 and 2015 (Figure 3-1). Studies by the Petroleum Industry Research Foundation, Inc. (PIRA, 1992) and Wilson, Gillette & Co. (Wilson, Gillette, 1994) support the same conclusion.

The projected increase in long-haul crude imports will mean an increase in the number of large tankers trading to the United States. Long-haul crude oil imports arriving at the Gulf Coast are projected to increase from 2.4 MBD in 1994 to 5.1 MBD in 2015 (see Figure 3-2). The relative costs and availability of large single-hull and double-hull tankers will determine, in part, which type of vessel is used. In addition, the provisions of OPA 90 (Section 4115) are likely to have an influence on the composition of the VLCC fleet trading to the United States.

Currently there is only one deepwater port on the U.S. Gulf Coast. Figure 3-2 assumes a continuation of crude oil import operations at this facility following historical trends. Perceived economics will ultimately determine the potential for expanding this site or building new deepwater ports. Currently, two additional deepwater ports are under consideration for the U.S. Gulf Coast. Designated lightering areas can handle more oil than LOOP (see Figure 3-2), and some consideration is being given to designating more such areas.

Effects of OPA 90

The committee was unable to isolate any changes in trading patterns and sizes of vessels calling at U.S. ports between 1990 and 1994 that could be clearly

FIGURE 3-2 Projections of U.S. Gulf Coast lightered and deepwater port crude oil imports through 2015. Sources: 1990-1994 data from EIA, 1994; 2000-2015 data from EIA, 1996.

attributed to OPA 90 or to the International Convention for the Prevention of Pollution from Ships, adopted in 1973 and amended in 1978, Regulations 13F and 13G of Annex I (13F and 13G). However, some significant changes in trading patterns are anticipated over the next 20 years as single-hull vessels are phased out in accordance with OPA 90 and International Maritime Organization (IMO) requirements.

Smaller single-hull tankers that move directly into port or are partially lightered will be phased out by 2010 in accordance with OPA 90.5 In contrast, the deepwater port and lightering zone exemption to OPA 90 will allow large single-hull tankers to unload through 2015 at LOOP or in lightering zones designated by the

Coast Guard. The availability of such areas will extend the period for using large single-hull tankers in U.S. waters by five years compared to the time when other single-hull tankers must be phased out.

The significantly lower capital costs of older single-hull tankers will allow them to operate profitably even with lower charter rates than the more desirable double-hull tankers, and charterers are likely to take advantage of the lower rates. Even after taking into account the reduction in cargo and revenue due to adopting hydrostatically balanced loading (HBL), estimated at 8 percent, and the special survey costs necessary to extend their lives from 25 to 30 years (see Chapter 4), pre-MARPOL tankers should be able to operate at a profit at rates significantly lower than new double-hull tankers. Thus, the combination of the deepwater port and lightering zone exemption and potentially lower operating costs suggests that some single-hull tankers will continue to operate in U.S. waters until 2015. In this one respect, U.S. regulations are less restrictive than international rules, and the committee assumes that given favorable economics, shipowners will take maximum advantage of the exemption for single-hull VLCCs built between 1985 and 1993. Thus, some single-hull VLCCs may continue to trade to the United States until age 30.

The continued operation of older single-hull vessels to the U.S. deepwater port and lightering zones has caused some questions to be raised about the quality of vessels trading to the United States. In addition, the efforts of other countries to attract modern vessels with desirable safety features have heightened concern in some quarters that the quality of the international fleet trading to the United States may be compromised unless appropriate measures are taken. The possible introduction of incentives for early retirement of single-hull vessels trading to the United States has been raised in the course of congressional hearings6 and in the State of California.

Age Distribution and Scrapping Patterns

The committee's assessment of the operational makeup of the maritime oil transportation industry focuses on the part of the international oil transportation fleet that trades to the United States. However, it should be recognized that subject to regulatory and other restrictions, the entire world fleet is potentially able to trade to the United States. In practice it is not always possible to identify with confidence which vessels will come to the United States and which will not. Thus, even if the same numbers of vessels were to trade to the United States for two consecutive years, the actual vessels involved would not all be the same. As noted in Chapter 2, there are programs in various countries to encourage the use of newer vessels in their waters. These programs will increase competition for

newer vessels in the world market and may influence the age distribution of that portion of the world fleet trading to the United States. Therefore, in the context of its analysis of age distribution and scrapping patterns, the committee considered it appropriate to include a discussion of the features of the total world fleet before addressing the portion that trades to the United States.

World Fleet

Table 3-2 shows the change in the composition of the world fleet from 1990 to 1994 in terms of construction type—namely, double-hull tankers, single-hull tankers built prior to 1980 and mostly of pre-MARPOL configuration, and single-hull tankers built after 1980 (MARPOL tankers). The proportion of double-hull tankers increased from 4.0 percent in 1990 to 10.1 percent in 1994.

The scrapping profile for tankers in the world fleet over the period 1990 to 1995 is shown in Figure 3-3. A distinction is drawn between ships less than and more than 150,000 DWT. Data on the numbers of vessels scrapped during the same period are provided in Table 3-3. The average age at scrapping of larger tankers during the period was approximately 20 years, whereas for smaller tankers it was about 25 years (Figure 3-4). Data for the smaller tankers indicate a slight decrease in average age at scrapping through 1994, followed by a slight increase in 1995. Data for the 150,000 DWT and greater category show little variation in average scrapping age during the years of significant scrapping (i.e., 1992-1995).

Figure 3-5 shows the relationship between freight rates and the total tonnage of vessels scrapped from the world fleet between 1982 and 1995. Only a small number of ships were scrapped in 1990 and 1991, which were years of relatively high freight rates, whereas a much larger number of vessels were scrapped in 1992, a year of very low rates. As illustrated in Figure 3-5, scrapping rates appear to be influenced by economics, although there is some lag between cause and effect.

TABLE 3-2 Change in Composition of World Fleet between 1990 and 1994, by Hull Type as Percentage of Total Tonnagea

FIGURE 3-3 Scrapping profile for the world fleet, 1990-1995. Sources: Clarkson Research, 1991-1995, 1996a,b; Drewry, 1994; Tanker Advisory Center, 1996.

The most pronounced effect of Section 4115 of OPA 90 and MARPOL 13F and 13G on the world fleet so far has been an increase in the number of double-hull vessels. This trend is expected to continue during the mandatory phaseout periods. There is little indication that scrapping has been influenced by Section 4115. This observation is not unexpected; the required phaseout age is greater

TABLE 3-3 Tankers Scrapped per Year from World Fleet, 1990-1995

|

|

Deadweight Tonnage |

|||

|

Year |

10,000 to 150,000 |

150,000 or More |

Total |

|

|

1990 |

11 |

1 |

12 |

|

|

1991 |

29 |

1 |

30 |

|

|

1992 |

70 |

20 |

90 |

|

|

1993 |

91 |

31 |

122 |

|

|

1994 |

52 |

37 |

89 |

|

|

1995 |

64 |

33 |

97 |

|

|

Total |

317 |

123 |

440 |

|

|

Sources: Clarkson Research, 1991-1995, 1996a,b; Drewry, 1994, 1996. |

||||

FIGURE 3-4 Age of tankers scrapped from world fleet, 1990-1995. (a) < 150,000 DWT; (b) ≥ 150,000 DWT. Sources: Clarkson Research, 1990-1995, 1996a,b.

than the normal age at scrapping. No change in scrapping patterns is expected until the early part of the next century, particularly for smaller tankers.

Although Section 4115 and MARPOL 13F and 13G are expected to increase the scrapping of tankers in the world fleet in the future, they may not produce the massive scrapping anticipated by some observers. Section 4115 will have little impact on the retirement of large single-hull tankers ( 150,000 DWT or more) that are suitable for unloading within the lightering zones or at the deepwater port (see Figure 3-6). Moreover, tankers built with segregated ballast tanks (SBTs) during the boom of the 1970s can continue to operate until age 30 under IMO rules. Those without SBTs can trade through age 30 if they are fitted with SBTs or use HBL. The latter option involves a loss of capacity of between 5 and 13 percent for larger vessels.

In summary, the committee's analysis indicates that the majority of small-and medium-sized tankers in the world fleet will be scrapped before they reach the maximum age permitted by the regulations, unless historical scrapping patterns change significantly. Older vessels will be competing in a market where replacement vessels will be significantly more expensive to build, albeit more efficient to operate. Well-maintained and efficient older vessels should be able to

FIGURE 3-5 Freight rates and total tonnage scrapped from world fleet, 1982-1995. Note: Worldscale is the common designation for the New Worldwide Tanker Nominal Freight Rate Scale applying to the carriage of oil in bulk. The Worldscale Schedule is published annually by the Worldscale Association (London) and Worldscale Association (New York). Worldscale (WS) is a series of calculated costs for the voyages, as listed in the schedule, between designated ports for the Worldscale "standard" tanker (75,000 DWT). The Worldscale calculated voyage cost, in dollars per metric ton of cargo carried, is a benchmark used in negotiations between vessel owners or operators and charterers. Voyage charter rates are typically agreed to in terms of percentage of Worldscale (i.e., a charter at 125WS is for 125 percent of the calculated voyage cost of the standard tanker for that voyage). Sources: Clarkson Research, 1990-1995, 1996a; Jacobs & Partners, 1995.

earn a handsome return, thereby providing an incentive not to scrap. However, many vessels built during the boom of the 1970s are now reaching ages in the historical scrapping range, and the large number of these vessels may lead to a different scrapping scenario from that seen previously. The owners and operators of larger tankers are likely to take advantage of the lightering zone and deepwater port exemption to OPA 90, together with the HBL option allowed under IMO rules, and operate their vessels until age 30.

International Fleet Trading to the United States

Age and Scrapping Profiles

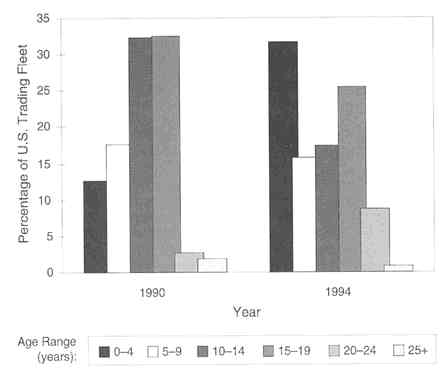

The average age of the U.S. trading fleet fell by 1.12 years from 1990 to 1994, even though the average age of the world fleet rose during the same period (see Table 3-4). Inspection of the age profile in Figure 3-7 indicates that the concentration of tankers trading to the United States in 1994 peaked in the

FIGURE 3-6 Deletions from world fleet due to OPA 90 and MARPOL, with and without lightering exemption for vessels of more than 150,000 DWT. Source: Navigistics, 1996.

youngest age group (0 to 4 years, built 1990 to 1994) and the fourth age group 15 to 19 years, built 1975 to 1979), with lower concentrations in intermediate age groups. Only 10 percent of total tonnage was carried in vessels more than 20 years of age, with 1 percent carried in vessels 25 years of age or older. The age profile was somewhat different in 1990, when the most common ages were 10 to 14 (built 1976 to 1980) and 15 to 19 years (built 1971 to 1975).

The explanation of these profiles lies in the economics of the market in the 1970s and 1980s. After 1976, the level of construction fell rapidly following the boom of the mid-1970s. Construction did not recover for some years, with relatively small expansions in the mid-1980s and after 1988. Thus, there is a "baby bust" generation, which is particularly noticeable in the 1981 to 1985 period. The latest wave of newbuildings, dating from 1988, had not yet made its mark on the youngest age bracket in the 1990 profile.

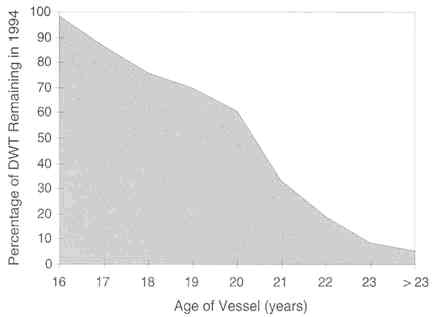

Examination of the estimated scrapping profile for vessels trading to the United States (Figure 3-8) indicates that for vessels built before 1978, scrapping typically occurred between 17 and 23 years of age. Only 6 percent of ships were still trading by age 23. The average life for tankers built in the 1970s has been about 20 years.7 There is no doubt that the economic crises of the period contributed to this relatively short life. Maintenance was not kept up to optimum levels,

TABLE 3-4 Changes in Age of U.S. Trading Fleet and World Fleet

FIGURE 3-7 Tonnage carried by vessels trading to the United States by age of vessel for 1990 and 1994.

FIGURE 3-8 Estimated scrapping profile for tankers trading to the United States. Note: Figure shows percentage of the fleet built in years up to 1978 that remained in existence as of March 1995. The reduction in number of vessels remaining reflects mainly demolition, except for a few total losses, and is provided as a guide to useful life expectancy. Sources: Drewry, 1994; Tanker Advisory Center, 1995.

and pre-MARPOL ships carried both cargo and ballast in the same unprotected tanks, which led to corrosion. Since about 1980 the use of SBTs has become common, and more recently the use of internal coatings (either partial on large ships or total on product carriers) has increased life expectancy, but these characteristics are not reflected in statistics on vessel age because the vessels have not yet reached the age of 20.

Port Calls and Cargo Discharge

The age characteristics of the international fleet trading to the United States can also be subdivided on a geographical basis (Table 3-5). The average age of the smaller tankers calling on the Atlantic coast increased from 1990 to 1994, whereas the average age of larger vessels decreased. Overall, the average age of vessels calling on the Atlantic coast decreased. The same pattern was found on the Gulf and Pacific coasts, with the average age of larger vessels decreasing and that of smaller vessels either showing little change or increasing. The overall

TABLE 3-5 Comparison of Average Age by Coast and Size Category

|

|

Atlantic |

Gulf |

Pacific |

||||||

|

Size Category |

1990 |

1994 |

Change |

1990 |

1994 |

Change |

1990 |

1994 |

Change |

|

10-40 |

15.9 |

16.8 |

0.9 |

14.5 |

14.6 |

0.1 |

8.4 |

14.2 |

5.8 |

|

40-80 |

9.3 |

11.4 |

2.1 |

11.7 |

12.7 |

1.0 |

9.6 |

10.6 |

1.0 |

|

80-150 |

11.1 |

8.6 |

-2.5 |

11.1 |

7.8 |

-3.3 |

8.1 |

6.6 |

-1.5 |

|

150+ |

14.2 |

10.4 |

-3.8 |

14.4 |

13.9 |

-0.5 |

14.7 |

2.2 |

-12.5 |

|

Total |

11.9 |

10.6 |

-1.3 |

11.9 |

10.1 |

-1.8 |

9.3 |

8.6 |

-0.7 |

average age of tankers calling on the Gulf coast decreased by 1.8 years: for the Pacific coast the reduction was 0.7 year.

Data on the number of port calls and tonnage carried per vessel in different age ranges are provided in Table 3-6. Comparison of the tonnage delivered by age of vessel in 1990 and 1994 indicates that vessels between 0 and 4 years and 20 to 24 years of age increased their amount of discharged oil significantly. The increased presence of newer vessels reflects the rise in new deliveries between 1990 and 1994 and the entry of these new-generation vessels in trade to the United States. The increase in the 20- to 24-year age bracket is indicative of the many vessels delivered during the mid-1970s construction boom.

The committee's analysis of the age distribution and scrapping patterns of the international fleet trading to the United States did not reveal any effects that can be attributed to OPA 90.

Vessel Ownership, Sales, and Transfers

Ownership trends in the world fleet are addressed prior to an analysis of ownership changes in the international fleet trading to the United States. Different trends in the world and U.S. trading fleets since 1990 could indicate that OPA 90 had an impact on ownership. However, changes in the sources of and demand for crude oil worldwide and associated economic factors could also cause differences.

For the purposes of the committee's analysis, vessel ownership was subdivided into three categories: oil companies, government (including government owned oil companies),8 and independent owners. Unlike the first two groups, where the national identity of the owner is clear, it is not always possible to identify the nationality of an owner of an independently owned tanker. The flag

TABLE 3-6 Average Size, Tonnage Carried, and Number of Port Calls, by Age of Vessel in the U.S. Trading Fleet for 1990 and 1994

|

|

1990 |

1994 |

|||||||||

|

Age Range (years) |

Port Calls |

Vessels |

Tonnage Carried (106 tons) |

Average Port Calls per Vessel |

Average Tonnage per Vessel (103 DWT) |

Port Calls |

Vessels |

Tonnage Carried (106 tons) |

Average Port Calls per Vessel |

Average Tonnage per Vessel (103 DWT) |

|

|

0-4 |

469 |

160 |

41.7 |

2.9 |

88,900 |

1,031 |

336 |

123.7 |

3.1 |

120,000 |

|

|

5-9 |

816 |

255 |

58.4 |

3.2 |

71,600 |

715 |

211 |

61.6 |

3.4 |

86,200 |

|

|

10-14 |

910 |

341 |

106.9 |

2.7 |

117,500 |

908 |

267 |

68.5 |

3.4 |

75,400 |

|

|

15-19 |

768 |

338 |

107.7 |

2.3 |

140,200 |

645 |

280 |

100.0 |

2.3 |

155,000 |

|

|

20-24 |

115 |

31 |

9.2 |

3.7 |

80,000 |

205 |

82 |

34.2 |

2.5 |

166.800 |

|

|

25 and older |

129 |

25 |

6.2 |

5.2 |

48,100 |

69 |

21 |

3.3 |

3.3 |

47,800 |

|

|

Total |

3,207 |

1,150 |

330.1 |

2.8 |

102,900 |

3,573 |

1,197 |

391.2 |

2.99 |

109,500 |

|

and citizenship of the owner of record are known but do not necessarily identify who holds beneficial or controlling interests in a vessel.

World Fleet

During the period 1990 to 1994, independent ownership in the world fleet grew, mainly at the expense of oil company ownership. The number of government-owned ships also dropped but not to the extent found in the oil company sector.

There are clear trends in the pattern of vessel sales for the world fleet as a whole from 1990 to 1994, as summarized in Table 3-7. Although government fleets bought approximately the same number of tankers as they sold over the period, the pattern varied from 1990, when they were net buyers, to 1994, when they became net sellers. Independent fleet owners had a net surplus of purchases over sales of almost 10 percent, whereas oil companies were net sellers in all years from 1990 to 1994. It is important to note, however, that this pattern among the oil companies started before the enactment of OPA 90. The oil companies' share of the world fleet has been decreasing steadily over the past 20 years. Recent changes have included the sale of its fleet by Texaco in favor of an alliance with Stena and Exxon's sale of its VLCC fleet and switch to using charters.

Based on information presented to the committee by industry representatives (see Appendix D), it is apparent that several factors are responsible for the reduction in size of the oil company fleet. In particular, low tanker charter rates and high owner liability have caused many oil companies to deploy their capital in other ways. The committee was unable to establish the relative importance of these two factors.

International Fleet Trading to the United States

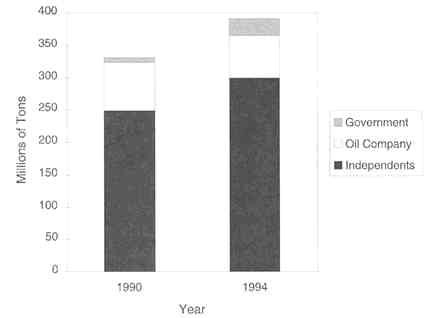

Between 1990 and 1994 the total tonnage of the international fleet trading to the United States increased by 18 percent, as shown in Figure 3-9. Over the same

TABLE 3-7 World Tanker Sales, 1990 to 1994

|

|

Seller |

||||

|

Buyer |

Government |

Independent |

Oil Company |

Total Sales |

|

|

Government |

24 |

59 |

5 |

88 |

|

|

Independent |

69 |

852 |

82 |

1,003 |

|

|

Oil company |

0 |

12 |

6 |

18 |

|

|

Total |

93 |

923 |

93 |

1,109 |

|

|

Sources: Clarkson Research, 1990-1995. 1996a,b; Drewry. 1994, 1995; Tanker Advisory Center, 1996. |

|||||

FIGURE 3-9 Changes in tonnage, by ownership category, for U.S. trading fleet between 1990 and 1994.

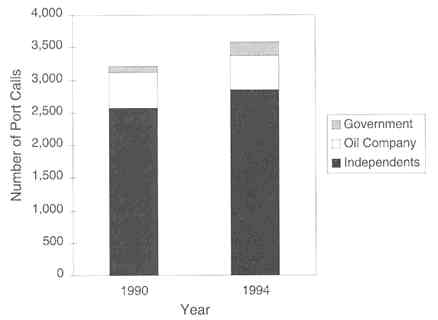

period the number of port calls increased only 11 percent (see Figure 3-10), indicating that the average size of ships rose. Within the broad ownership categories defined above, ships owned by governments and independents showed increases in both number of vessels and number of port calls. The number of oil company ships trading to the United States fell, although the number of port calls remained constant. The shift in ownership among vessels trading to the United States (more independents, fewer oil company) parallels the shift in ownership in the worldwide trading fleet. This was not the case for government-owned vessels, however. Government fleets in worldwide trade decreased between 1990 and 1994 (see Table 3-7), but government fleets trading to the United States increased by 35 vessels. This increase reflects a trend among oil producers—notably Saudi Arabia—to transport their crude oil to the United States in their own ships.

The total ownership figure for the U.S. trading fleet masks some significant data. The number of owners in the government and oil company categories is quite limited. The independent category is far more numerous and includes owners that have only one vessel as well as others whose fleets are in all respects comparable to those of the government or the oil companies.

As shown in Table 3-8, the Saudis increased their tonnage by more than nine times between 1990 and 1994, leaving all other state entities far behind. Kuwait increased its presence six fold; China, fivefold. Ecuador, Uruguay, Finland,

FIGURE 3-10 Changes in number of port calls, by ownership category, for U.S. trading fleet between 1990 and 1994.

TABLE 3-8 Tonnage of Government-Owned Fleets Trading to the United States, 1990 and 1994

TABLE 3-9 Tonnage of Oil Company Fleets Trading to the United States, 1990 and 1994

|

Company |

1990 Rank |

1990 Tonnage (103 DWT) |

1994 Rank |

1994 Tonnage (103 DWT) |

|

Chevron |

1 |

24,893 |

1 |

31,647 |

|

Exxon |

2 |

10,697 |

— |

0 |

|

Texaco |

3 |

8,754 |

4 |

4,048 |

|

Amoco |

4 |

5,578 |

5 |

3,982 |

|

BP |

5 |

5,379 |

7 |

810 |

|

Mobil |

6 |

5,347 |

3 |

9,762 |

|

Shell |

7 |

4,595 |

6 |

1,632 |

|

Total |

8 |

3,640 |

8 |

781 |

|

Conoco |

9 |

2,000 |

2 |

13,350 |

|

Coastal |

10 |

956 |

— |

0 |

|

Fina |

11 |

853 |

— |

0 |

|

Phillips |

12 |

702 |

— |

0 |

|

Hess |

13 |

518 |

9 |

500 (estimate)a |

|

Irving |

14 |

263 |

11 |

114 |

|

O.K. |

15 |

64 |

— |

0 |

|

Apex |

16 |

31 |

10 |

314 |

|

aHess had replaced its tank ship fleet with integrated tank barges by 1994. Therefore data for Hess for 1994 were not included in data provided by Institute of Shipping Analysis, which were restricted to tank ships. The estimate of Hess' transport was provided by the company. |

||||

Mexico, and Iraq disappeared from the list, the latter as a direct result of the Gulf War. The disappearance of Mexico from the top 14 rankings in 1994 probably reflects the use of chartered vessels.

Dramatic changes also occurred in oil company fleets trading to the United States between 1990 and 1994 (see Table 3-9). Total oil company tonnage fell from 74.3 million DWT in 1990 to 66.4 million DWT in 1994. Over this period, Conoco increased its volume nearly seven times to move into second place among oil companies. Chevron and Mobil also increased substantially, while Hess stayed approximately the same. The U.S. trading fleets of all other companies either shrank or disappeared. Texaco, Shell, and Total reduced their tonnage by 50 percent or more. Exxon, Fina, Coastal, and Phillips gave up their fleets trading to the United States entirely, apparently shifting cargo movements from their own ships to chartered vessels.

When the amount of cargo discharged is analyzed in terms of the three U.S. geographic areas and the three ownership categories, it can be seen that the ownership distribution of discharging vessels changed significantly between 1990 and 1994 (see Table 3-10). The increase in government-owned vessels and tonnage on the Gulf and Atlantic coasts was due, in large part, to the increased presence of government-owned VLCCs in the Gulf and to increased crude oil

TABLE 3-10 Change in Ownership of U.S. Trading Fleet by Coast, 1990 and 1994

|

|

Atlantic |

Gulf |

Pacific |

||||||

|

Ownership |

1990 (106 DWT) |

1994 (106 DWT) |

Change (%) |

1990 (106 DWT) |

1994 (106 DWT) |

Change (%) |

1990 (106 DWT) |

1994 (106 DWT) |

Change (%) |

|

Government |

2.3 |

3.5 |

53 |

3.9 |

21.4 |

448 |

0.9 |

0.8 |

-11 |

|

Independents |

87.5 |

88.6 |

1 |

152.2 |

195.9 |

29 |

8.9 |

14.5 |

63 |

|

Oil companies |

19.7 |

10.9 |

-45 |

50.8 |

47.8 |

-6 |

3.8 |

7.7 |

103 |

|

Total |

109.5 |

102.9 |

-6 |

206.9 |

265.2 |

28 |

13.6 |

23.0 |

69 |

imports from South America. The increased number of government-owned vessels trading to the Gulf coast came mainly from Saudi Arabia, Kuwait, and Venezuela (see also Table 3-8), reflecting a trend among oil producers to transport their own crude oil. The reduction in oil company activity on the Gulf and Atlantic coasts reflects their reduction in vessel ownership, particularly in trading to the United States.

The distribution of ownership on the Pacific coast did not change significantly in any sector. The Pacific trade is dominated by U.S. coastal trade from Alaska, and imports do not account for a major portion of Pacific traffic despite large percentage gains (21 percent in 1990 and about 31 percent in 1994).

Jones Act Fleet

The U.S. coastal fleet of tankers consists of 116 vessels, 23 of which have double hulls. No new vessels were added to the fleet between 1990 and 1995, and 37 were scrapped (see Table 3-11). The committee was unable to establish

TABLE 3-11 U.S. Flag Vessels Sold or Scrapped, 1990-1995

|

Year |

Scrapped |

Sold |

Total |

|

1990 |

2 |

7 |

9 |

|

1991 |

4 |

2 |

6 |

|

1992 |

6 |

3 |

9 |

|

1993 |

10 |

3 |

13 |

|

1994 |

5 |

7 |

12 |

|

1995 |

10 |

9 |

19 |

|

Total |

37 |

31 |

68 |

|

Sources: Clarkson Research, 1990-1995, 1996a,b. |

|||

whether any of the vessel sales were the result of OPA 90. There were no major changes in ownership or trading patterns during this period.

U.S. oceangoing barges play an important role in trade on both the Gulf and the East coasts but not the West coast. The total number of oceangoing barges is 93, of which 17 have double hulls. In addition, there are 13 integrated tug-barges, of which 3 have double hulls. Since the enactment of OPA 90, there have been only minor changes in the ownership and number of oceangoing barges and no flag changes.

Despite the apparent lack of influence of OPA 90 on the Jones Act fleet so far, Section 4115 is likely to have a strong impact in future years, as discussed in Chapter 5.

Findings

Finding 1. Changes in vessel trading patterns to the United States in the 1990 to 1994 period were influenced primarily by changes in crude oil sourcing. The most notable change was a decrease in VLCCs carrying long-haul imports from the Middle East and a corresponding increase in vessels of 80,000 to 150,000 DWT carrying short- and medium-haul imports from Latin America and the Caribbean.

Finding 2. Some relatively new (i.e., built between 1985 and 1992) large, single-hull tankers are expected to trade in U.S. waters until 2015 for both regulatory and economic reasons. The deepwater port and lightering zone exemption of OPA 90 permits such vessels to continue in service to the United States through 2015. After 2010 there will be restrictions on these vessels discharging elsewhere in the United States, although they can continue to trade internationally until they are 30 years old. Long-haul crude oil imports are expected to increase from present levels, providing an economic impetus for the use of VLCCs that discharge their cargo through deepwater ports or lightering zones. Thus, the scrapping of a significant number of vessels of more than 150,000 DWT will be postponed, in part as a result of the OPA 90 exemption.

Finding 3. The proportion of double-hull tankers in the world fleet increased from approximately 4 percent in 1990 to 10 percent in 1994, reflecting the requirements of OPA 90 and IMO regulations.

Finding 4. Between 1990 and 1994, the average age of the fleet trading to the United States decreased by approximately one year, whereas the average age of the world fleet increased by one year. Vessels in the youngest (0 to 4 years) and oldest (20 to 24 years) age groups carried increased tonnage. These changes reflect both the construction boom of the mid-1970s and the relatively large number of recent double-hull deliveries.

Finding 5. The independently owned part of the world fleet continued to grow between 1990 and 1994, primarily at the expense of oil company vessel

ownership; a similar trend was observed for the U.S. trading fleet. These changes in ownership patterns—some of which predate OPA 90—reflect a decision by some oil companies to leave the tanker business.

Finding 6. Government-owned fleets worldwide decreased between 1990 and 1994, whereas the percentage of government-owned tonnage trading to the United States increased from 2 percent to approximately 6.5 percent. This change largely reflects the growth in government-owned Saudi Arabian fleet tonnage trading to the United States. The sizes of the government-owned fleets of China and Kuwait operating to the United States also increased significantly.

References

Clarkson Research, Ltd. 1990. Tanker Register. London: Clarkson Research.

Clarkson Research, Ltd. 1991. Tanker Register. London: Clarkson Research.

Clarkson Research, Ltd. 1992. Tanker Register. London: Clarkson Research.

Clarkson Research, Ltd. 1993. Tanker Register. London: Clarkson Research.

Clarkson Research, Ltd. 1994. Tanker Register. London: Clarkson Research.

Clarkson Research, Ltd. 1995. Tanker Register. London: Clarkson Research.

Clarkson Research, Ltd. 1996a. Shipping Review and Outlook: Spring 1996. London: Clarkson Research.

Clarkson Research, Ltd. 1996b. The Clarkson Register's Monthly Update: January 1996. London: Clarkson Research.

Drewry Shipping Consultants. 1994. The International Oil Tanker Market: Supply, Demand and Profitability to 2000. London: Drewry.

Drewry Shipping Consultants. 1996. The Shipbuilding Market Analysis and Forecast of World Shipbuilding Demand, 1995-2010. London: Drewry.

Energy Information Administration (EIA). 1994. Petroleum Supply Annual 1994. Washington, D.C.: U.S. Department of Energy.

Energy Information Administration (EIA). 1996. Annual Energy Outlook 1996. Washington, D.C.: U.S. Department of Energy.

Institute of Shipping Analysis. 1996. Study prepared for the Committee on Oil Pollution Act of 1990 (Section 4115) Implementation, Göteborg, Sweden.

Jacobs & Partners Limited. World Tanker Review: July-December 1995. London: Jacobs & Partners Limited.

Navigistics Consulting. 1996. Tanker Supply and Demand Analysis, Task I and Task 2. Study prepared for the Committee on Oil Pollution Act of 1990 (Section 4115) Implementation Review . Washington, D.C., June.

Petroleum Industry Research Foundation, Inc. (PIRA). 1992, Transporting U.S. Oil Imports: The Impact of Oil Spill Legislation on the Tanker Market. Prepared for the U.S. Department of Energy. New York: Petroleum Industry Research Foundation. Inc.

Tanker Advisory Center. Inc. 1991. 1991 Guide to the Selection of Tankers. New York: Tanker Advisory Center.

Tanker Advisory Center, Inc. 1995. 1995 Guide to the Selection of Tankers. New York: Tanker Advisory Center.

Tanker Advisory Center, Inc. 1996. 1996 Guide to the Selection of Tankers. New York: Tanker Advisory Center.

Wilson, Gillette & Company. 1994. The Evaluation of Past and Future Crude Oil Lightering Operations in the U.S. Gulf Coast. Arlington, Va.:Wilson, Gillette & Company.