11

Social Policy Challenges and Dilemmas in Ex-Socialist Systems

Zsuzsa Ferge

THE NEED FOR SOCIAL POLICY REFORMS: THE GLOBAL SCENE

The reform of social policy is on the agenda everywhere, in the industrialized West, the developing countries, and the transition economies of Central and Eastern Europe and the former Soviet Union. The reasons and arguments for this are manifold. However, it should be recognized that there is also a neoliberal agenda that, in its extreme form, would like to put an end to the welfare state that evolved in Western Europe in the twentieth century (e.g., Marsland, 1996). A milder and more widespread variant of this agenda continues to emphasize the role of the individual, accepting the state's responsibility only with regard to care for the destitute.

Beliefs and values, like tastes, are difficult to dispute. In one of his many contributions to this debate, Barr (1994) helps us distinguish between values and rational reasoning by suggesting that we separate the issue of the scale from that of the structure of welfare spending. He argues that the scale of spending—the quantity spent—will depend not only on the resources available, but also on the values endorsed by a society, such as the weight accorded to social solidarity. In contrast, the structure of spending—the relative shares between the state and the market—should be seen as a technical issue that turns on questions of efficiency. Where markets are efficient, they should allocate resources, whereas in instances of grave market failure, state interven-

I would like to thank Dorothy and Adrian Sinfield for their many helpful comments.

tion may be justified. Barr's argument is useful, but the dividing line between scale and structure is not always clear, as illustrated, for instance, by the case of top-up vouchers (Glennerster, 1996). The argument also fails to deal with issues such as the techniques used in providing social benefits, which may matter a great deal.

Of course, changing conditions demand social-sector reform everywhere. Although the reasons for this may seem self-evident, they should be recapitulated briefly here because of their relevance to transition countries:

-

Globalization. Globalization demands (1) open and competitive economies, which can initiate an upward spiral in efficiency and a downward spiral in labor costs, and (2) basic changes in labor markets, the effects of which range from deindustrialization to large-scale, long-term unemployment. In countries undergoing transformation, the challenges posed by globalization are especially great, because they are undertaken in conditions of sharply reduced gross domestic products (GDPs) and abrupt increases in prices, unemployment, and black market activity (Standing, 1996).

-

Demographic trends. Demographic trends include (1) increasing longevity; (2) declines in fertility; and (3) changing family patterns, particularly the multiplication of single-parent families. In many transition countries, these problems are being aggravated by a general health crisis, including increasing mortality and the spread of infectious diseases (Cornia et al., 1996; Nauck and Joos, 1995).

-

Tendencies that weaken solidarity and increase individualism. Many of the relatively better off now espouse "postmodern" attitudes toward former social policy arrangements. They demand better value for their money, including more individually tailored services and more choices. They are also less willing to share the collective costs of change. All these phenomena are appearing in transition countries, perhaps in an accentuated form as a socio-psychological reaction to the sudden lifting of former oppressive controls.

The modern welfare state has not coped well with the consequences of these trends, even in the West. Hence we have seen the emergence, even in many of the most developed and relatively affluent societies, of social fragmentation and threats of massive social exclusion and disaffiliation.

These developments may not be inevitable, however. Resources in developed countries remain plentiful; it is only their distribution that has become more unequal (World Bank, 1996a; Atkinson et al., 1995). Many analysts are searching for new insights, arguments, and instruments to address these trends. In an interesting sign of this new thinking, the eminent capitalist and financier George Soros (1997) recently warned about the potentially dangerous social consequences of unconstrained market domination.

Civil society's increasing resistance to attempts to scale back the welfare state-as indicated by demonstrations in several Western European countries

in the spring of 1997—provides important evidence of democratic efforts to rebuff attempts at curtailing the welfare state. Many supranational agencies have also adopted new or stronger stances in opposition to this trend. The Council of Europe, in its recent revision of the European Social Charter, attempted to strengthen the safeguards for fundamental economic and social rights, while the United Nations declared the coming decade, 1997-2006, the International Decade for the Eradication of Poverty. The European Commission's "Comité des Sages," established in 1995, emphasized the importance of the social dimension in an integrated Europe. The committee's chair stated that "civic rights and social rights are becoming interdependent. . . . In the European tradition they are inseparable. . . . 'Freedom and the conditions of freedom' are the mirror image of 'democracy and development'" (European Commission, 1996:5).

There are, of course, additional reasons for welfare reform in the formerly state socialist countries of Central and Eastern Europe. Over and above what might be considered aggravated forms of the general Western problems enumerated above, there are the endemic flaws of the former welfare system to be corrected. Profound social transformation also has produced new problems that require new solutions.

The most basic flaw in the former welfare system is not that it was somehow premature or overly lavish, as some have suggested. The main defect of social policy in these states was that it was permeated with the totalitarian logic of the former political system. To mention just a few corollaries, because the legal system was arbitrarily dominated by politics, (1) rights remained illusory; (2) social policy, like everything else, was ideologically loaded; and (3) all measures were developed without citizens' participation or control or any attempts at consensus building. As but one example, inconvenient facts, such as poverty or unemployment, that did not correspond with official ideology were ignored and went unaddressed. Because of the domination of politics, all subsystems were deprived of autonomy. Instead of an interplay and compromise between social and economic rationality, the distinction was blurred in a fusion that was detrimental to both.

It is interesting to note that the current reform discourse seldom addresses the need for the democratization of (central) state welfare policy. Many recommend efforts to enhance the development of civil society and the non-governmental organization (NGO) movement, but they seldom recognize that civil society plays a dual function: a service function and a "voice" function. In the former, as a provider of welfare services, civil society can play a useful role, although it can not replace the state. Yet it is in the "voice" function—acting as an advocate for society's needs—that civil society plays its paramount democratizing role. Civil society may change state institutions through citizen participation, criticism, and supervision, although this contribution is

rarely evaluated positively by elites unused to criticism and countervailing pressures.

Another shortcoming of the reform debate is that whereas the existence of an autonomous economic logic is generally acknowledged, such recognition is denied to social processes and policy. This means social policy is once again subordinated to external requisites, this time to the logic of the economy, that is, the market.

With regard to new problems requiring new solutions, many of these—such as increasing poverty and the gap between world prices and local wages—are discussed in the next section. However, one factor connected with globalization deserves consideration here. Global pressures for adjustment to the newly emerging international community, and particularly to the "new economic order," have become very strong. This undoubtedly plays a greater role in the post-communist states and in Latin America than it does in the West, but no region is immune. Pressures for adjustment curtail the margin of freedom within which new democracies can develop relatively autonomously. While these pressures are very different from the political dictates of the former Soviet Union, which operated through duress and command, they preclude genuine national independence. Although less direct and less threatening, the new pressures coming from multinational organizations and supranational agencies also require compliance with rules and institutions that may be at odds with more organic trends in these countries, as well as with popular expectations, preferences, and values.

In response to this array of new and old problems, most countries in the region have begun the process of reforming their social policies. To summarize what might be called the changes in instruments, universalism has practically disappeared, while the risks covered by insurance have been both expanded (e.g., unemployment) and restricted (e.g., child benefits and death grants). Conditions relating to access are generally becoming more stringent, while standards are becoming lower, and targeted social assistance is gaining ground.

The changes in the number of actors involved in the provision of social services have meant rapid pluralization. This entails less responsibility in the hands of central state authorities (and state enterprises) and an increasing role for local authorities, civil society, families, and the market. This pluralization of social functions is important, but there may also be unforeseen drawbacks. The withdrawal of the state may escalate more rapidly in the post-communist states than in the West given the general weakness of civil society, and the consequences may prove to be more detrimental as a result of the prevailing atmosphere of economic and moral crisis.

CHALLENGES AND DILEMMAS FOR THE FUTURE

It is difficult to reflect on the future without distinguishing between the short and the long run, although the two can never be completely separated. In the formerly state socialist states, past fiascos cause everyone to shy away from attempts to plan the future. In no country is there any sort of project or outline for the society that is being created. Similarly, there have been few attempts to build consensus, even on partial issues such as whether there should be more or less integration, more or less inequality, or more or less social fragmentation. Slogans of "market" and "democracy," with no specification of their content, cannot fill this void. As there is no consensus about the future, there are no long-term commitments that can bind future governments. Reforms introduced by one government today can easily be revoked by the next tomorrow. We can only speculate about the future, taking the present as a starting point. This section examines, if only briefly the following issues:

-

The possible long-term consequences of the current mismatch between needs and resources

-

The possible impact of nation building based on full citizenship, if and when the social is individualized

-

Increased investment in human resources as the best means to ensure individual and collective "salvation," and the probability of this course of action

-

The controversial issue of existential security: a test case for democracy?

The Possible Long-Term Consequences of the Current Mismatch Between Needs and Resources

Needs are clearly escalating. Poverty in all its forms (absolute and relative, total and partial, lasting and temporary, objective and subjective) has increased throughout the region as a result of mass unemployment, the need to pay world prices for consumer goods, the increasing gap between foreign and domestic wage levels, increasing inequalities in income and wealth, deteriorating health services; and what many see as a deliberate decline in the real value of most social transfers.1

There is, of course, a great deal of variation in current trends in the region. In some countries (e.g., the Czech Republic and Slovenia), the increase in

poverty has probably ceased (although projected price increases may produce unknown results). In others, poverty continues to escalate or deepen or both. Countervailing trends, such as a reduction in poverty, have yet to be evidenced even in countries such as Poland, where economic growth has resumed.

Meanwhile the redistributive capacity of these states is diminishing. States have fewer resources because of the overall decline in production and GDP; the privatization of the most profitable industries and activities first, with control of the "losing propositions" being retained; the declining capacity of the state to collect taxes and contributions; frequent reductions in taxes in order not to discourage capital, especially foreign capital; the growth of the black economy; incestuous relations between new economic and political elites; and the fact that people are less willing to pay taxes or make contributions for deteriorating services. In countries that are heavily indebted, the burden of debt servicing intensifies these difficulties.

The potential consequences of this gap between needs and means are unclear and varied. Until late 1993 or 1994, the inertia of prior commitments, especially pensions, and the pressure of new needs pushed states to continue transfers at relatively high levels. As a result, the share of social transfers in declining GDPs actually increased. However, such figures are seriously misleading. On the one hand, a higher proportion of a shrinking GDP could still mean lower levels in absolute terms. On the other hand, if the unregistered black economy is indeed producing 15 to 40 percent of GDP and going unrecorded, the real figures for the share of social outlays will be considerably reduced.

More radical measures to lower family benefits, pensions, and sick pay have been initiated since 1993, and the results are already visible, both in terms of diminishing the proportion of social transfers relative to overall GDP and their real value (see Table 11-1 for Hungary). It should be recognized, however, that stringent measures in some fields increase the need for social assistance.

It seems almost impossible to devise a system of social assistance that will be both efficient and effective. This is because there is insufficient money to fund a decent safety net and insufficient administrative capacity to target the truly needy. This issue is so crucial that it merits a slightly more systematic discussion. The main difficulties hampering the implementation of an efficient and effective social assistance scheme are discussed below.

The average official wage is so low that recipients barely manage to stay above even a modest poverty line. If the poverty line is maintained at a decent level, there will be substantial disincentives to work. This clearly presents an unemployment trap, one that may be impossible to overcome as long as wages remain low.

It is impossible to determine the truly needy because of both the widespread resort to subsistence agricultural production and the prevalence of the

black economy. Production and incomes from household plots are difficult to calculate, while the black market is ubiquitous. The well-to-do use it to avoid taxes and perpetrate various fraudulent practices (for example, the self-employed and small-scale ventures can declare incomes that are sufficiently low to qualify for means-tested benefits). The poor use the black market to survive by accepting risky, dangerous, unprotected, and low-paid jobs (old forms of exploitation are indeed coming back). They also apply for assistance on the basis of their official, low incomes. However, the fraudulent poor are more visible than the cheating rich and invite closer scrutiny. As local authorities take on a greater role, the applications of the poor may be more frequently rejected, not only because of greater local knowledge, but also because discretion favors those who are closer to the administrators making the decisions.

There is an increasing reliance on workfare—making assistance after the expiration of unemployment insurance conditional on work (e.g., 5 days of communal work paid at the minimum wage or less). The poor may not take this ''opportunity." After all, the wage is less than they can earn in the black economy, and if they take time off from their unofficial work to qualify for government assistance, they may lose their black employment. No one should count on the poor's undertaking complex calculations of the long-term opportunity costs of this behavior. Rather, it should be anticipated that large numbers will lose their entitlements.

It is also worth noting that a culture of social rights is generally lacking in Central and Eastern Europe. Such a culture scarcely existed under the former system. It is interesting to note, however, that the "clients" are learning about claim rights more rapidly than the administrators. The latter love their discretionary power and are afraid of being accused of squandering money by helping those who are not "truly needy." This has led to a strong resistance to right-based assistance. The administrators also prefer behavior tests and home visits, which make them feel more secure in their decisions. Such intrusive measures, however, are detrimental to the development of a self-assured citizenry.

There is also a general lack of administrative capacity and know-how: social policy and social work became acknowledged disciplines only after the transition; budget cuts have hit local authorities hard, and they are unable to engage enough qualified people to administer complex assistance schemes. This has meant the emergence of extremely debatable solutions, such as contracting out home visits. Administrators also sometimes appeal to the populace to denounce frauds and encourage anonymous informants.

There are also widespread shortages of funds at the local level. Responsibility for some types of assistance may be shared with central authorities, but very often the locality is solely responsible, and its activities are funded by a block grant. Since there are many competing claims for

these funds, the locality may not be able to provide for all the needy. According to some evidence (World Bank, 1996b; Ferge et al., 1995), as many as 50 to 60 percent of the eligible poor are not receiving assistance, and many are refused assistance because of a lack of local funds. Of course, this is not meant as an indictment of local autonomy. The regaining of local autonomy after decades of stifling overcentralization is a fundamental achievement, and it is revitalizing localities. However, its success is contingent on adequate funding.

In sum, because of a whole series of problems, the level of poverty assistance is generally too low, and the procedures being developed for administering it are too often demeaning. The proud shy away from applying. Both client awareness of opportunities and the authorities' willingness to offer genuine help may be deficient. In the old system, poverty was taboo and therefore unaddressed; now it is seen as "natural" and perennial, making efforts to eradicate it seem futile. As a result, few if any officials, at the level of either discourse or institution building, are paying attention to issues of poverty or exclusion, albeit there were some positive changes in 1997..

This does not mean there are no efforts to discover alternatives. Many NGOs, particularly Western foundations, are dedicated to finding innovative solutions that will abolish long-term unemployment and reduce the worst aspects of workfare. However, these efforts reach only a tiny minority. The dominant political tendency is described by Standing (1996)—harsh workfare with many disincentives.

The foreseeable if not necessary or inevitable consequence of the gap between means and needs is lasting poverty and various forms of disaffiliation or exclusion. Although this may not necessarily produce a distinct underclass, the processes outlined above deeply harm social integration. In countries with a large deprived minority, such as the Romanis in Hungary or Slovakia, exclusion is already well advanced, strengthening racial prejudices.

The Possible Impact of Nation Building Based on Full Citizenship, If and When the Social Is Individualized

One objective of the European welfare states was to forge a more integrated society, to induce a general sense of belonging based on full citizenship, and to recognize the equal dignity of all. The reduction of inequalities in individuals' physical and social life chances was also an objective. Hence importance was attached not only to negative (freedom from), but also to positive (freedom to) freedoms, that is, to civil, political, economic, and social rights (Sen, 1990; Dasgupta, 1995). Public instruments to accomplish these goals included such nondiscriminatory transfers as social insurance and universal health benefits. These objectives were never fully attained anywhere, but headway was certainly made. It is also worth emphasizing that this project

was started in relatively poor countries (Sweden in the early 1930s, Britain after World War II), with the intent of overcoming deep social cleavages.

The importance of nation building or community building is not out of place in this discussion of trends in the "new democracies." People in these countries have undergone the alienating and atomizing experience of totalitarianism.2 In addition, current societal processes are producing a number of divisive tendencies, such as the spontaneous emergence of new social classes and groups with divergent or opposed interests, increases in inequalities of wealth and income, and the great divide between those with a job and the unemployed. Although social policy will never eliminate these new cleavages, appropriate measures can soften the edges. However, current trends in social policy reform neither endorse nor promote such efforts. Some of the reforms may accelerate these divisive processes, and it appears likely that a two-tier health and educational system will emerge in the post-communist states.

A particularly divisive strategy seems to be the rejection of the former unwritten contract between generations. While many deny the legitimacy or rationale for such a contract, which they largely deem fictive, there are many rational reasons to maintain it (Kohli, 1993; Walker, 1996). Judging from a recent Eurobarometer survey, the majority of citizens in Western countries have no intention of reneging on this obligation. When asked whether they agreed with the statement "Those in employment have a duty to ensure, through contributions or taxes, that older people have a decent standard of living," 85 percent of the respondents in 12 countries agreed, either strongly or slightly. Only 15 percent disagreed slightly or strongly (reproduced in Walker, 1996:4).

In the Central and Eastern European countries, however, changes in family benefit schemes and pension reforms (both those that have been adopted and those still under consideration) tend to undermine the intergenerational contract. This contract implies a continuity between generations and a common stake in the process of social reproduction. The abolition of universal family benefits has already damaged one side of this contract. Providing help only to the truly needy involves an institutionalized differentiation among children. It also makes it clear that the community does not see all children as potentially equal future social actors.3

The other side of the contract is even more problematic. Space here does not permit discussion of the intricacies of the two- and three-pillar schemes that are now on the agenda everywhere (one of the most elaborate versions is to be found in World Bank, 1994). The relative merits and demerits of pay-as-you-go versus funded schemes are also not particularly relevant from the

perspective of social integration, since even funded schemes may include elements of solidarity.

It is the so-called mandatory privately managed pillar that embodies the most disturbing elements. Optionally elected private saving contracts represent a positive development and enhance individuals' free choice in determining the use of their savings. This picture changes, however, when these contracts become mandatory and an integral part of retirement security, as is currently being proposed not only by the private banking and insurance sector, but by many supranational agencies as well. There are problems associated with money markets, and these are exacerbated in countries with fragile and inflation-prone economies, as well as underdeveloped banking systems. Slow economic growth and public commitments to those already on pensions may make the transition extremely expensive for both taxpayers and pensioners.

Summarizing the experiences with privately funded schemes, it is often observed that they have low potential coverage (never more than two-thirds of the population and often less); that the risk of noncoverage is particularly high for the chronically sick and disabled, as well as the long-term unemployed; and that, especially in the take-off period, but even beyond, they are much more costly than public schemes (Townsend and Walker, 1996; Myers, 1995; Kritzer, 1996). From the perspective of solidarity and integration, certain further elements should be mentioned. First, the benefit that will be received, particularly if it takes the form of an annuity, may suffer from the absence of solidarity. Annuities are actuarially calculated. Hence, women and men with exactly the same working careers will receive different benefits. A further divisive characteristic is the fact that the benefits one receives can potentially be related to prices, but they can never be related to wages. Thus the gap between the incomes of active and retired people may fluctuate or increase depending on prevailing economic trends.

Many different means are being used to bring home to people the message that the intergenerational contract should be abolished. The potential for conflict between the old and the young was noted by the demographer Samuel Preston over a decade ago when he suggested that "the social security system was becoming increasingly generous to the elderly while adopting a more severe attitude towards . . . welfare payments for children." He was, however, "careful in his address to avoid any explicit suggestion that children and the elderly were direct competitors for a fixed sum of public resources" (see Johnson and Falkingham, 1992:131-132).

In quite a few Organization for Economic Cooperation and Development (OECD) countries, at least some pensioners have indeed fared comparatively well recently because of relatively generous earnings related to pensions, but some of these advantages may not be sustainable over the long run. The poverty of children may have increased recently as well as a result of increased unemployment and parsimonious child benefits. Increasingly, the idea is being ad-

vanced that there could be a trade-off in the competition for scarce resources between the two groups—a proposition that is less than self-evident. This logic would hold that the elderly must be worse off for children to be better off, or that the problem is not that children are doing too badly, but that the aged are treated too well. A second disturbing aspect of this argument is that it has returned 10 years later, in the debate in the transition countries. Commenting on the poverty of children in Central and Eastern Europe, a World Bank expert declared: "I tell people in Eastern Europe that their pension policy is impoverishing their children. The demands of pensioners are taking food out of the mouths of working people's children" (Murphy, 1995:50).

No doubt the situation of children is deteriorating, partly because of the destruction of the former family benefit system. However, the data must be analyzed in more detail. In the less turbulent countries of Central and Eastern Europe, pensioners are better off, in terms of equivalent income, than households where the head is unemployed; however, they are worse off than families where the head is an active earner. The gap is large (15-35%) if there are no children. The income difference is lower if there are children: the equivalent income of pensioners is about 20 percent less, even if there are children. In other words, pensioners may not be among the main losers, but they are among the losers. The majority of pensioners are on the verge of poverty, and they are largely unrepresented in the top quintile of the population (see Table 11-1, and Ferge et al., 1995).4

Evidence abounds regarding the hardships faced by the majority of pensioners. The solution so often recommended—to lower pensions further or to target the relatively higher pensions for reductions—not only undermines the relative security of those involved, but also damages the contractual element that was enforced through earnings-related contributions. These recommendations also ignore the fact that citizens in Central and Eastern Europe are still very much in favor of maintaining solidarity with the elderly, as is clear from many surveys.

The foreseeable, if not necessary or inevitable, consequences of the individualization of the social are manifold. Differentiated and divisive health, pension, and other social systems may evolve. The poverty of children or discrimination against them may increase (even the positive discrimination entailed by sharpened targeting is divisive in that it accentuates the differences among children.) The coverage of the elderly by social insurance may easily shrink if access to pensions becomes much more restrictive. This in turn may entail large inequalities among the elderly and the poverty of all those with

TABLE 11-1 State Expenditures On Social Welfare-Social Policy, 19891996 (in percent of GDP and in real value, 1989 = 100)

|

In percent of GDP |

1996/1989 in Real Value |

|||||

|

Policy |

1989 |

1991 |

1993 |

1995 |

1996 |

|

|

Price subsidies Health Education,culure Housing subsidies Unemployment Pensions Social assistance Family benefits Sick pay |

2.6 5.7 7.0 3.5 0.0 9.1 0.3 4.0 1.2 |

1.8 7.6 9.3 2.5 0.7 11.3 0.9 4.6 1.3 |

0.6 7.6 9.3 1.1 1.7 10.5 1.8 4.1 1.0 |

0.6 6.4 8.5 1.2 0.9 9.5 1.7 2.7 0.7 |

0.7 5.3 7.7 0.9 0.7 9.1 1.6 2.2 0.5 |

23% 81% 96% 22% — 87% 464% 48% 36% |

|

Total, in percent of GDP |

33.4 |

39.9 |

37.6 |

32.2 |

28.6 |

75% |

|

Total, in real value, 1989 = 100 |

100 |

103 |

92 |

83 |

75 |

— |

|

SOURCE: TARKI (1997). |

||||||

atypical careers. Women may be particularly hard hit. Other forms of social solidarity—between generations and between the employed and unemployed—may be further weakened.

Increased Investment in Human Resources as a Means of Individual and Collective "Salvation"

It is widely recognized that the educational legacy of the countries of Central and Eastern Europe is largely positive. They had well-developed preschool networks and nearly universal and relatively good-quality basic educational institutions, and their students exhibited high levels of achievement in many fields. The weaknesses in this inheritance flow from the same source as do the weaknesses in social policy and the economy in general: the system was antidemocratic; overcentralized; overregulated; rife with inefficiencies; and, as a result of demands to meet the immediate "needs" of the economy, overspecialized (Barr, 1994).

The importance of education and training, both in promoting wealth formation on the national level and in improving each individual's opportunities, is too well known to be addressed here. In fact, some of the most rapidly developing countries (e.g., Singapore) achieved their amazing economic records by investing almost disproportionately in education.

The evidence regarding the current situation in education in the region is somewhat controversial. On the one hand, the share of GDP spent on public education is by and large on a par with expenditures in Western countries (between 3 and 7 percent, averaging around 5 percent). In some countries, Hungary for instance, this share even increased between 1986 and 1996—from 7.0 to 7.7 percent (see Table 11-1). This increased share is somewhat misleading, however. The real value of educational expenditures has declined everywhere, although the decrease may not have been proportional to the decline in GDP as a whole. On the other hand, many indicators show that similar shares of GDP may be yielding very different results, largely because the absolute levels may be much lower. Thus the secondary and tertiary enrollment ratios lag behind those of the OECD countries, although they remain very high if compared with those of the developing countries (Esping-Andersen, 1996:12; World Bank, 1996a:201).

Adult education and training are considered part of the package of social investment policies being used against unemployment, but they do not correspond very well to the needs of economic restructuring. Rates of enrollment appear not to be significantly different than those in the West, but if they are compared with the needs for retraining that flow from the previously distorted structure of skills, they are rather low.

Among recent developments in the field of education, some merit special attention:

-

In most countries, there has been a huge decline in preschool facilities, nurseries, and kindergartens. This is detrimental to both the current wellbeing and the future opportunities of children from the most deprived strata. It also constrains women's opportunities to pursue gainful occupations, albeit many (probably the culturally better endowed) have found ways of combining household responsibilities with work by initiating or participating in home-based ventures.

-

Scarce resources and the decentralization of financing have made it difficult to maintain the existing stock of educational institutions, and have rendered new investments or the expansion of the existing infrastructure practically impossible.

-

The wages of those working in the care-giving and teaching professions—doctors and nurses, teachers, and professors—were always low, but not dramatically lower than other wages. Over the course of the transition, significant differentiations have occurred between the private and public spheres and within the public sphere among various sectors. Those working in the care-giving and teaching professions in the public sector are now among the worst paid. Low wages and the threat of becoming redundant have driven many professionals out of these fields. The resulting brain drain has lowered standards and dampened the enthusiasm of those remaining.

-

The introduction of relatively high fees for school meals and so-called extracurricular activities with a high educational value (e.g., second languages and sports), as well as the extraordinary price increases for schoolbooks and other school equipment, may entail one of two consequences for public education (at the elementary and secondary levels): either children will be deprived of access to certain facilities, or they will have to receive means-tested help. Since children know everything about their peers, it will be difficult for those receiving assistance to overcome its stigmatizing effects. A more serious consequence may be increasing drop-out rates for the most deprived children, such as Romany children in Hungary. The increasing need for the money these children can earn—the opportunity cost to parents of keeping their children in school—will only aggravate this problem.

-

The introduction of fees in higher education, combined with price increases for all school-related equipment and facilities, will most probably increase the already existing inequalities in access.

-

Private or nonstate educational institutions and training courses are cropping up relatively quickly at all levels. A temporary problem stems from the lack of methods and institutions for accreditation: many of these courses represent quick profit-making ventures that provide no real benefit to their clients. However, the issue of increasing inequality of educational opportunity represents a much more serious and probably lasting problem. For-profit schools may offer better opportunities for success in later life.

To prepare for the future, these countries must not only overcome the inherited backwardness of their populations' skills, but also encourage new abilities and innovative thinking among the next generation of students. This is a must if the growing economic and social gaps among different parts of Europe are to be overcome. The basis for acceptably high growth—particularly in countries with scant natural resources—is a healthy and well-educated work force. Hence the soundest possible investments are in education, training, and health.5 It is perhaps understandable that the urgency of immediate needs pushed this concern into the background at the beginning of the transition. That is no longer the case. If there is continued deterioration in public education (which is likely to remain dominant even if the private tier grows rapidly), the deleterious effects may be incalculable. The opportunities missed now will be very difficult to overcome later.

There are foreseeable, if not necessary or inevitable, consequences of the increased costs to the individual of procuring a quality education, the neglect

of the public educational system, and the emergence of a two-tier educational system. One of the consequences on the macro level is that the full potential of the children of the less well off will remain untapped and therefore effectively be wasted. At the individual level, the consequence will be the further differentiation of opportunities.

The Controversial Issue of Existential Security: A Test-Case for Democracy?

According to Marris (1996), uncertainty is a fundamental condition of human life. But uncertainty also breeds anxiety, which can produce real suffering (Ferge, 1996a, 1996b). Some anxious feelings can be termed "essential anxieties" in that they arise from our biological or mortal nature, while others can be considered "existential anxieties" since they stem from social conditions. Both, it should be noted, are, in Freud's terms, "real" anxieties, not pathological or neurotic symptoms. One of the consequences of anxiety may be a paralysis of action. If one cannot be sure of being able to make the payments on one's home or tuition fees for one's children, one may forego attempting to maintain the home or to encourage the children to study.

Another consequence of anxiety may be actions to reduce it. When (with the advent of capitalism) risks multiplied and the former agents of existential security weakened, new institutions emerged. The most important of these were insurance companies. The market failures of the insurance market (Barr, 1994), coupled with the financial weakness of individuals and small communities, made imperative the creation of larger institutions, in which the state assumed some role in defraying the risks. Indeed, social insurance has been an appropriate societal response to the anxieties associated with industrialization and an increasingly dominant market.

These new institutions, collectively called social security, developed to a rather high level in the West European welfare states. They also made important headway in the totalitarian state socialist systems of the post-communist states, which started to implement these systems early in the twentieth century. Inasmuch as the former system of social security is still valued, this is precisely because of the existential security it offered to its "subjects" (they were not genuine citizens as they were deprived of civil rights) without stigma. People value their new freedoms, particularly the liberation from political oppression. But if they are unable to build up their defenses against uncertainty, they will not be able to enjoy or fully utilize these new freedoms.

When the transition was first initiated, freedom (which previously had been jeopardized or curtailed) was deemed at least as important as existential securities. Since then, however, freedom seems to have become an accepted part of social reality, and according to the SOCO results, people now feel it is securely established. In sharp contrast, there is a pervasive sentiment in all

these countries that basic securities—concerning income, employment, housing, and children's futures—are being threatened or undermined. In fact, the SOCO results show a significant deficit in desired securities. This deficit is most pronounced with regard to public safety, but is also strong with regard to incomes and children's futures (see Table 11-2).

The "security gap" is visible with respect to the full range of securities. When the difference between the importance attached to freedoms and to securities is calculated for each individual, it turns out that security is never treated lightly: it is of utmost importance even to those who value freedom above all. It also appears that the high value attached to existential security is not confined to Central and Eastern Europe; it is pervasive throughout Europe.

It may be surmised that the need for existential security is historically and culturally constructed and may therefore be "deconstructed," that is, that people can be resocialized to accord greater value to self-reliance and the absence of state intervention (see Green, 1993; Marsland, 1996). However, the success of such a project is doubtful. We can use the case of freedom as an analogy. Societies endured peacefully for millennia with individuals not experiencing freedom in its modern sense, but once freedom was discovered and tasted, people's desire for it could not be eradicated.

If this analogy is valid, the debate over existential security becomes a matter of form, not of content; the debate can only be about how it will be ensured. One school of thought contends that collectivist solutions that rely on a substantial measure of state responsibility should be maintained, with the proviso that they be better adjusted to the new economic and social environment. Many reform plans for existing public pay-as-you-go schemes fall into

TABLE 11-2 Degree to Which Security in Various Areas is Assured, Five SOCO Countries (scale of implementation of security/importance of security; importance of security = 100)

|

Area of Security |

Hungary |

Slovakia |

Czech R. |

Poland |

Germanya |

Five Countries |

|

Family |

90 |

88 |

81 |

88 |

82 |

87 |

|

Housing |

86 |

84 |

75 |

79 |

71 |

78 |

|

Health |

81 |

75 |

70 |

70 |

78 |

75 |

|

Politics |

62 |

68 |

80 |

65 |

58 |

64 |

|

Job |

72 |

73 |

64 |

70 |

54 |

67 |

|

Income |

51 |

54 |

63 |

53 |

63 |

58 |

|

Children's future |

56 |

59 |

60 |

56 |

58 |

57 |

|

Public safety |

44 |

50 |

41 |

51 |

42 |

45 |

|

Country mean |

69 |

69 |

66 |

66 |

64 |

67 |

|

NOTE: In the case of freedoms, all similar percentages are close to 100 percent (Ferge et al., 1995). a Only former East Germany. |

||||||

this category (Townsend and Walker, 1995; Augusztinovics, 1993), as do numerous proposals by the Hungarian Autonomous Pension Insurance Fund and the revived interest in basic income schemes in France, Germany, England, and elsewhere (Caillé and Laville, 1996; Mückenberger, 1994; Offe, 1994; Jordan, 1994). It should be added that at the beginning of the transition, Atkinson (1991) suggested that a basic income scheme in the Central and Eastern European countries would help overcome the major difficulties of social dislocation, prevent the worst forms of poverty, and facilitate small-scale entrepreneurship. Others reject these arguments, advocating individualized and privatized solutions.

All parties to the debate recognize that security is important, but the question remains whether it will be available to all or only to those who can afford it. A different question concerns the most appropriate role for the state in providing or ensuring security.

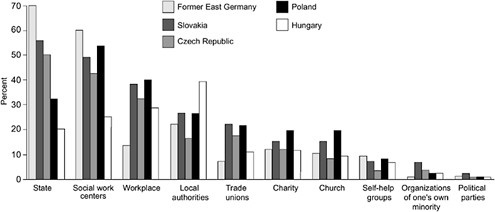

One would expect that people in the region, having experienced hated and oppressive party-states for decades, would reject any hint of state interference. It seems, however, that while people hated the party-state, they are willing to empower a democratic state. The SOCO data suggest that in all five countries, people would turn more willingly to public authorities when in need than to churches, nongovernmental organizations, or charitable institutions (see Figure 11-1). Undoubtedly, the populations of different countries and those within each country will differ in their expectations, and the anticipated role for the state will vary depending on the issue involved. Yet in all five countries, the populations expect the state to be least involved in the provision of day care for preschool children, the defraying of expenses associated with child rearing and with secondary and tertiary education, and the purchase of first homes. Similarly, in all of these countries a major role is accorded the state with respect to care for the handicapped, pensions, health care, primary education, and jobs, with pensions and care for the handicapped almost invariably ranking highest (see Table 11-3).

Citizens in Western Europe also accord great importance to the state's role in the provision of health, education, and pensions. This enthusiasm is maintained even where people are fully aware that they must pay more to receive better services or benefits. Recent evidence from Hungary demonstrates that despite very high rates of taxation, only a minority would opt for decreasing taxation at the expense of declining services. This proportion is higher than one would find today in England, but approximates figures obtained in Britain a decade ago.

Table 11-4 shows that there is very strong support, in both Eastern and Western Europe, for a substantial public role in protecting the population against major risks. Some condemn this as evidence of a ''dependency culture" that undermines people's moral fiber (Marsland, 1996) or breeds "learned

TABLE 11-3 Ranking of Items of State Responsibility (total of all five SOCO countries)

helplessness" (Marody, 1992). Some see it as nostalgia for the past, while others deem it "conservative": "The vast popular majorities in favor of the welfare state that opinion polls and election results regularly identify are essentially conservative ones because they rely on, and wish to perpetuate, a benefit structure that was put in place more than a generation ago'' (Esping-Andersen, 1996:267). This attachment to security may have been created over time, in part through purposive state action, but it has probably become by now an almost unshakable emotional and psychological need for modern men and women.

The weakening of public responsibility in ensuring existential securities may have many negative effects. The foreseeable if not necessary or inevitable consequences in the transition countries, where there is already a tremen-

TABLE 11-4 Preferences on Taxes and State Spending: England and Hungary

dous amount of unpredictability, include the further deterioration of mental and physical health as a result of stress and anxiety. Since overwhelming majorities believe certain basic securities should be the concern of the community and not left entirely to the individual, consensus building around this issue may well become a major test case for democracy. If governments ignore popular expectations, tensions may increase, and left- or right-wing populism may gain ground. Populism has rarely proved a fertile soil for democracy or for the strengthening of active citizenship.

CONCLUSION

Social policy reform is badly needed in Central and Eastern Europe and the New Independent States, not only to ensure the relative independence of the market, but also to safeguard democracy, genuine citizens' rights, state accountability, transparency, and adequate welfare arrangements. If the current level of resources does not permit the state to provide adequately for all needs, it is still possible for it to build a consensus in favor of short-term stringency measures. To achieve this consensus, the burdens of societal transformation should be shared more equitably, and people should be assured that any withdrawal from public responsibility does not represent a long-term strategy, but a response to overwhelming short-term necessity. They should further be assured that social rights and benefits will improve with increasing resources.

The costs of societal transformation have proven to be more formidable than was originally anticipated, and have fallen disproportionately on the shoulders of those who are the least able to bear them. It is neither new nor unusual that the most vulnerable bear the brunt of the costs of economic and social change. However, in the case of the transition in the formerly state socialist countries, these costs appear to have been unusually high.

If governments continue to neglect the short- and long-term consequences of present trends in impoverishment and diminished security, large-scale poverty, social disintegration, marginalization, and social exclusion may result. Such consequences would threaten both economic modernization and democratization. Governments' freedom of action may be restricted by economic scarcity, but there are always alternative places to make the necessary cuts. It should be remembered that social policies play a positive role in safeguarding the cohesion of societies experiencing transition, can assist in avoiding or minimizing the potential negative consequences enumerated above, and may thereby offer a more solid basis for long-term economic growth.

Our objectives should not be limited to finding better ways to meet various short-term needs or attempting to compensate for market failures. The elaboration and implementation of effective social policy must entail the cooperation between the state and an increasingly strong civil society. Both

improved policies and increased state-civil society cooepration will promote the mutifaceted process of transformation, by developing human resources and strengthening the institutions that promote social integration.

REFERENCES

Atkinson, A.B. 1991 The Social Safety Net. Paper prepared for the International Institute of Public Finance.

Atkinson, A.B., L. Rainwater, and T.M. Smeeding 1995 Income Distribution in OECD Countries. Evidence from the Luxembourg Income Study. Prepared by Organization for Economic Cooperation and Development. Paris: Organization For Economic Cooperation and Development.

Augusztinovics, M. 1993 A sensible pension reform—A conceptual framework. Vözgazdasági Szmle 40(5).

Barr, N., ed. 1994 Labor Markets and Social Policy in Central and Eastern Europe. The transition and beyond. Published for the World Bank and the London School of Economics and Political Science. A World Bank Book. Oxford, England: Oxford University Press.

Caillé, A., and J. Laville 1996 Pour ne pas entrer à reculons dans le XXle siècle. Le Débat (mars-avril).

Cornia, G.A., G. Fajth, A. Motivans, R. Paniccia, and E. Sborgi 1996 Policy, poverty and capabilities in the economies in transition. Most 6(1):149-172.

Dasgupta, P. 1995 An Inquiry into Well-Being and Destitution. Oxford, England: Clarendon Press.

Diamond, P.A., D.C. Lindeman, and H. Young, eds. 1996 Social Security: What Role for the Future? Washington, DC: National Academy of Insurance.

Esping-Andersen, G. 1996 Welfare States in Transition. National Adaptations in Global Economies, Gosta Esping-Andersen, ed. Thousand Oaks, CA: Sage Publications.

European Commission 1996 For a Europe of Civil and Social Rights. Report by the Comité des Sages chaired by Maria de Lourdes Pintasilgo. Brussels: Directorate-General for Employment, Industrial Relations and Social Affairs.

Ferge, Z. 1996a Social values and the evaluation of regime change. Innovation 9(3):261-277.

1996b Freedom and security. International Review of Comparative Public Policy (7).

1998 And what if the state fades away: The civilizing process and the state. In Attitudes Towards Welfare Policies in Comparative Perspective, P. Taylor-Gooby and S. Svalfors, eds. London: Blackwell.

Ferge, Z., et al. 1995 Societies in Transition. International Report on the Social Consequences of the Transition, a survey carried out as part of the SOCO project initiated and coordinated by the Institute for Human Studies, Vienna. Cross-national report on five countries, prepared by Zsuzsa Ferge, Endre Sik, Péter Róbert, Fruzsina Albert, Institute for Human Studies, Vienna.

Glennerster, H. 1996 Vouchers and quasi-vouchers in education. In Social Policy Review 8 (Social Policy Association), M. May, E. Brundson, and G. Craig, eds.

Green, D.G. 1993 Reinventing Civil Society. London: Institute of Economic Affairs.

Johnson, P., and J. Falkingham 1992 Aging and Economic Welfare. Newbury Park, CA: Sage Publications.

Jordan, B. 1994 Efficiency, justice and the obligations of citizenship: The basic income approach. In Social Policy in Transition, J. Ferris and R. Page, eds. Aldershot, England: Avebury Press.

Kohli, M. 1993 Public Solidarity between Generations: Historical and Comparative Elements. English manuscript published in French in C. Attias-Donfur, ed., 1995, Générations, Familles, État. Paris: Nathan.

Kritzer, B.E. 1996 Privatizing social security: The Chilean experience. Social Security Bulletin 59(3):45-55.

Marody, M. 1992 Building a competitive society: Challenges for social policy. In Towards a Competitive Society in Central and Eastern Europe: Social Dimensions. National Agency for Welfare and Health, Finland, and European Center for Social Welfare Policy and Research, Vienna.

Marris, P. 1996 The Politics of Uncertainty. London: Routledge.

Marsland, D. 1996 Welfare or Welfare State? Contradictions and Dilemmas in Social Policy. London: Macmillan Press Ltd.

May, M., E. Brunsdon, and G. Craig, eds. 1996 Social Policy Review 8. (Social Policy Association).

Mückenberger, U. 1994 Social integration or anomie? The welfare state challenged by individualism. In Social Policy in Transition, J. Ferris and R. Page, eds. Aldershot, England: Avebury Press.

Murphy, C. 1995 Eastern Europe's hungry children. The Economist (December 16):50.

Myers, E.R. 1995 Social security reform in Chile: Two views. In Social Security: What Role for the Future?, Diamond et al., eds. Washington, DC: National Academy of Insurance.

Nauck, B., and M. Joos 1995 East joins West: Child welfare and market reforms in the "special case" of the former GDR. Innocenti Occasional Papers. Florence, Italy: UNICEF, International Child Development Center.

Offe, C. 1994 A non-productive design for social policies. In Social Policy in Transition, J. Ferris and R. Page, eds. Aldershot, England: Avebury Press.

Preston, S.H. 1984 Children and the elderly: Divergent paths for America's dependents. Demography 21:435-57.

Sen, A. 1990 Individual freedom as social commitment. The New York Review of Books 37(10):49-54.

Soros, G. 1997 The capitalist threat. The Atlantic Monthly 279(2):45-55.

Standing, G. 1996 Social protection in Central and Eastern Europe: A tale of slipping anchors and torn safety nets. In Welfare States in Transition. National Adaptations in Global Economies, G. Esping-Andersen, ed. Thousand Oaks, CA: Sage Publications.

TÁRKI 1997 The Social Expenditures of the State in Hungary Between 1988 and 1996. Budapest: TÁRKI.

Taylor-Gooby, P. 1995 Comfortable, marginal and excluded: Who should pay higher taxes for a better welfare state? In British Social Attitudes: The 12th Report, R. Jowell, et al. Aldershot, England: Dartmouth Publishing Co.

Townsend, P., and A. Walker 1995 New Directions for Pensions. How to Revitalize National Insurance. European Labor Forum.

1996 Towards a Stakeholder's Pension System. Unpublished manuscript.

Voirin, M. 1993 La sécurité sociale dans les pays d'Europe centrale et orientale: Réformes et continuité. Revue Internationale de Sécurité Sociale (1):29-70.

Walker, A., ed. 1996 The New Generational Contract. Intergenerational Relations, Old Age and Welfare. London: UCL Press Ltd.

World Bank 1994 Averting the Old Age Crisis. Policies to Protect the Old and Promote Growth. Policy Research Report. Oxford, England: Oxford University Press.

1996a From Plan to Market. World Development Report. Washington, DC: The World Bank, and Oxford, England: Oxford University Press.

1996b Hungary: Poverty and Social Transfers. A World Bank Country Study. Washington, DC: The World Bank.