1

Property Rights in Transition Economies: A Commentary on What Economists Know

Alexandra Benham and Lee Benham

If Adam Smith were suddenly here today, what would impress him? The affluence of the developed world? Almost certainly. The progress in science and in medicine? Almost certainly. Advances in our understanding of the sources of economic growth or the transformation paths from state ownership to market economies? This is much more problematic. To reflect on the list of fundamental new insights we could present to the author of The Wealth of Nations is indeed sobering.

If compelled to argue the case that we have learned something important on this subject in the intervening two centuries, what concepts would we emphasize, and what evidence could we offer? We might choose property rights as a focus. Well-defined property rights are widely viewed as a source of improved economic performance.1 They occupy a central place in discus-

This paper draws substantially on an earlier study, Institutional Reform in Central and Eastern Europe: Altering Paths with Incentives and Information, supported and published under a grant from the International Center for Economic Growth, 1995. Michael Merithew, coauthor of that study, has contributed substantially to our survey of the literature on transition. His contributions, in both concepts and methods, are gratefully acknowledged. Support from the Center for New Institutional Economics, Washington University, is appreciated. We thank John Nye for insightful comments and many stimulating discussions. Comments by Thráinn Eggertsson, Sukkoo Kim, Douglass North, Bruce Petersen, Itai Sened, and two anonymous referees have been most helpful. The usual disclaimers apply.

sions concerning transformation in Central and Eastern Europe and the former Soviet Union. This general approach would not be new for Smith. Indeed, his students and admirers were involved in attempts at privatization in Russia in the early nineteenth century. We begin with a discussion of that early privatization approach. We then consider some theoretical insights of the twentieth century that may help us do better this time around.

Even before the publication of The Wealth of Nations, Smith's ideas were circulating in Russia, where they received support from those in high authority.2 Russia's first Minister of Economics, N. S. Mordvinov, who served in the Ministry from 1810 to 1825, had studied in England and was unbounded in his enthusiasm for Smith. He described Smith as ''one of the greatest geniuses" among those "benefiting mankind" and ranked him with Bacon and Newton (Alekseev, 1937:427).

Russia is gifted by nature and is destined to become wealthy once the spirit of competition starts to burn among the people; when productive forces are joined together, when private gain will be employed for social leadership, and when the government's leaders with warmth in their hearts . . . realize that private and public poverty is caused only because all the roads to wealth are barred, that the free action of the people is chained and that there is an artificial distinction between the wealth of the government and that of the people.

To achieve this goal, Mordvinov proposed an extensive set of reforms. They included opening land ownership to merchants, citizens, and even state-owned serfs; reducing tariffs; building roads between cities; redesigning com-

mercial banks; denationalizing government-owned factories; redesigning the financial system; and reducing military expenditures.3

Mordvinov tried for many decades to implement market reform.4 Writing in the last decade or so of his long life (1754-1845), he lamented (Alexandrin, 1993:178):

There will come a year in which people will turn towards the measures here proposed, but the times will be covered with a black shroud and we will realize that the time for doing good deeds has passed by. . . . There will be sorrow about such a great loss, but the quarrels and recriminations will be in vain—that time which is lost will never be regained.

Today's list of proposed reforms—in Russia or in any transitional country—differs little from Mordvinov's. Privatization was a central concern then and remains so now. What do we have to say to Adam Smith?

There are two theoretical insights closely intertwined with the concept of property rights that would be new for Smith, and that lend some insight to our understanding of the transition process. We discuss these briefly and then consider some historical examples that demonstrate the conditional nature of our understanding. We then ask why we do not know more by examining the revealed preferences of the economics profession concerning emphasis and

approach. Finally, we offer some comments on improving the supply and distribution of new knowledge concerning these issues.

PROPERTY RIGHTS, TRANSACTION COSTS, AND SOME HISTORICAL EXAMPLES

Ronald Coase (1960) provided a fundamental insight into the role of the determinants of property rights. He showed that in a hypothetical world in which it is costless to measure and monitor goods, to ascertain ownership, and to transfer goods, initial ownership will have no effect on the efficient allocation of goods. In that world, no matter what the initial allocation, property rights will flow to their highest valued use. However, that world is not ours. Coase (1988:174) is clear that the world we live in is not a world with zero costs of measuring, monitoring, enforcing, ascertaining ownership, trading, and obtaining information. In our real world, transaction costs determine property rights, ownership, the extent of trade, specialization, and productivity.5 If transaction costs decrease, property rights will be more clearly defined, more goods and services will be traded, the benefits of specialization will increase, and greater economic gains will be realized.

Improving the clarity of ownership is valuable in that it permits owners and potential owners to seek out more highly valued uses across a wider set of individuals and over a longer time horizon. For example, clarity of ownership allows the owners of assets to access capital markets by using those assets as collateral. Land reform that prevents the sale of land will eliminate land as collateral, greatly diminish the capital markets, and limit development. This argument for increasing the gains from trade by increasing clarity of ownership is the central economic argument for privatization, efficient court systems, stable rules, stable prices, low taxes, and the elimination of barriers to trade. Transaction costs are fundamental attributes of institutional innovation, and the entire character of the economic organization of a society will reflect these costs. Within any institutional structure, those organizations which have a comparative advantage in terms of transaction costs will tend to survive.

The second insight we wish to emphasize as a substantive conceptual advance is the Arrow (1963) impossibility theorem. This theorem proves that with two or more individuals and three or more alternatives, no social choice rule satisfying some minimal conditions of fairness can guarantee a transitive social ordering of the alternatives. This means that without some institutional

structure to restrict choices in all but trivial cases, disequilibrium will prevail. Any alternative can be defeated by some other alternative.

Constitutionally enforced property rights can be viewed in this context as ".. an attempt to remove issues from the domain of politics so as to reduce the opportunities to create unstable social outcomes" (Ordeshook, 1993:216). This view implies that placing more property under the direct control of the state will lead to greater instability of the polity because coalitions will form to compete for property in the public domain.6 This competition takes many forms. In systems with extensive state ownership of enterprises, controversies frequently arise concerning the amount and allocation of state subsidies. The budget deficits, capital market distortions, and inflation engendered by these subsidies add instability to the rights individuals hold over private property.

While the general principles emphasized in the work of Smith, Coase, and Arrow—low-cost trade, clear property rights, and credible constraints to limit instability—are all fundamentally important, the specific policy applications are often conditional on the circumstances. The following cases are chosen to illustrate two points. First, the general principles do provide great insight into organizational adaptation to specific circumstances. Second, although some choices may be invariant with respect to history, local conditions, the experience of the parties involved, ethnic configuration, and so on, others are not. This implies that a knowledge of history, of the paths previously taken, of the nature of the governance structure, and of the existing formal and informal enforcement mechanisms is necessary to understand the likely outcomes of alternative paths.

Transaction Costs: The Old Believers and Other Self-Governing Groups

The case of the Old Believers in Russia can be used to illustrate the insights of Coase and Arrow. Coase shows that in a setting with sufficiently low transaction costs, the initial distribution of property rights need not determine subsequent efficiency. This implies that even where individuals' property rights are not protected by the state, those groups which are able to lower transaction costs sufficiently can contract around the lack of enforcement by the state. They may do this, for example, by renting assets from those who do have property rights, be they other private individuals or agents of the state. In this way the gains from trade are not limited by the particular configuration of property rights.

Successful groups must also overcome Arrow's voting paradox problem. If low-cost transactions are to be achieved and maintained, the rules of the game within the trading group cannot be subject to rapid or arbitrary change. Collective decisions must have some stability. This stability can be accom-

plished in a variety of ways: by limiting those who can participate in decision making; by constitutionally constraining the items that can be placed on the agenda; or by making the preference ordering homogeneous through selection, socialization, or education. Often this is accomplished in the context of a group that shares strong religious beliefs. The likelihood that such groups will succeed depends on the extent of traditions of cooperation and self-governance, internal homogeneity, knowledge concerning what has worked elsewhere, and impediments caused by the government or by extralegal groups (Benham and Keefer, 1991). Groups that effectively resolve these problems can be expected to do well economically.

A case in point is provided by the experience of Russia's Old Believers (Gerschenkron, 1970). The Old Believers arose as a religious group in the 1600s to resist the state's ecclesiastic reforms. They subsequently opposed the enormous costs associated with Peter the Great's modernization programs.7 The Russian state began persecuting them in 1666 and continued discriminatory policies against them for almost 250 years. Initially, official state policy was extremely harsh: much of their property was confiscated, many of them were banished, and some were burned at the stake. Even during periods of less severe persecution, their rights were significantly restricted: on occasion they were assessed double taxes; they were prohibited from testifying in civil courts against members of the established church; they were excluded from holding local elective office; and they were forced to wear special conspicuous clothing, including, for women, hats bearing horns. Even in relatively good times, the state was not a reliable enforcer of contracts for them.

However, even under these circumstances, the Old Believers managed to be highly productive. In the eighteenth and nineteenth centuries, they became extremely successful economically, and they founded a number of merchant dynasties. Gerschenkron (1970:21) describes the contradictions thus: "The worshippers of religious immobility, the fanatical enemies of ecclesiastic reforms, the irrational adherents to letter and gesture appear as energetic modernizers in their very rational economic pursuits." How did this come about?

The external difficulties they confronted increased the desirability of cooperation within the group. Because exit from the group was costly and difficult, the relative costs of forging internal cooperation were reduced. Over time, the Old Believers came to emphasize cleanliness, honesty, reliability, frugality, industry, thrift, sobriety, and literacy. Since the state would not enforce their contracts, they learned to rely heavily on self-enforcing contracts. The bonds of mutual trust-—derived from external pressures and from

their religious faith—dramatically reduced their costs of obtaining reliable information, gaining access to capital, making credible commitments, and conducting trade generally.

All this gave them enormous flexibility in mobilizing resources. They were able to transact among themselves at very low cost, contracting across time and space at lower cost than others could. They contracted around impediments, state-imposed and otherwise. Members even borrowed funds from other members to buy their freedom from serf status. Their reputation for integrity and sobriety also made them attractive to outsiders as employees and as trading partners. They accumulated sufficient wealth to bribe state officials not to enforce the discriminatory laws. Through all these means, the Old Believers created great added value.

These results are consistent with the implications of Coase's argument. Formal state enforcement of property rights is not absolutely essential for a group to do well. If transaction costs are sufficiently low, even a group initially disadvantaged in the assignment and enforcement of property rights can still become highly productive. If extraordinary trust can be forged, if the voting paradox can be resolved, and if informal mechanisms of contract enforcement are sufficiently low in cost, extensive specialization and trade can still take place.

When are self-governing groups at the local and regional levels able—as the Old Believers were—to lower transaction costs and overall production costs for themselves? Within a country, the various ethnic, religious, and social groups are likely to vary widely in their ability to overcome the voting paradox, to define, enforce, and transact. There are many documented histories of groups—even relatively small homogeneous groups—that failed to cooperate although the prospective gains from cooperation were great.8 This is not surprising theoretically. More surprising are the instances of success. The elements associated with such success have been systematically investigated in a number of studies. Ostrom (1990:180) has examined the design principles used by a variety of self-governing groups in diverse settings, ranging from Japanese mountain villages to Mojave groundwater basins, and considered their relationship to successful or unsuccessful performance. Putnam (1993) has investigated the differing levels of cooperative behavior within regions of Italy and their implications for political and economic performance.

One detailed study of groups' choices concerning rules of the game and their subsequent economic performance examined more than 120 irrigation systems in Nepal, some farmer-managed and some government agency-managed (Ostrom, 1994:19-24). The investigator devised a scale of institutional

development based on monitoring and sanctioning rules.9 While 75 percent of the farmer-managed systems scored high on this scale, only 29 percent of the agency-managed systems did so. The farmer-managed systems averaged 20 percent more crop yield than the agency-managed systems.

When such groups prosper themselves, does the process benefit the larger society? Isolated ethnic or religious groups with low transaction costs can provide lessons concerning gains from trade and can induce transaction-cost innovations through competitive pressures in the larger society—and successful societies will recognize that these innovations are to be encouraged. These isolated successes, however, do not necessarily lead to overall development. Russia as a whole benefited from the economic activities of the Old Believers, but, as Mordvinov lamented, development in Russian was greatly hindered because the formal and informal rules leading to low transaction costs were not imbedded in the larger society.

Property Rights, Land Privatization, and the Mafia in Sicily

Privatizing the land has been a principal objective in almost all countries recently undergoing transformation. The historical experience of Sicily after the removal of feudal restrictions on land holding and the later privatization of church properties provides a cautionary tale, illustrating that a state-initiated program of privatization can have unanticipated and undesired consequences (Gambetta, 1993).

Feudalism was formally abolished in Sicily in 1812. A principal reform associated with its abolition was the removal of feudal restrictions that made land an inalienable commodity. For the first time, land was treated as a market commodity that could be traded. Between 1812 and 1860, the number of large landowners increased tenfold, from 2,000 to 20,000. Between 1860 and 1900, the number of hectares of land in private hands nearly tripled.

Land reform was accompanied by considerable strife, which persisted until after the conclusion of World War II. A major source of conflict throughout Italy was the hostility between church and state. Early Italian liberals were strongly anticlerical, and after the unification of Italy in 1861, the church's estates and property were expropriated, and much was auctioned off to private purchasers. Pope Pius IX countered by rejecting the legitimacy of the newly formed Italian state. In 1877 he ruled that no Catholic could run or vote in national elections. This policy reduced the legitimacy of the Italian state

and increased the reliance on private enforcement of contracts. Gambetta (1993:80) describes the process that began at that time:

At the same time [as the land reform], protection—the demand for which was dramatically increased by the abolition of feudalism and the widespread introduction of private property rights—did not undergo the customary process of centralization to become the monopoly of the state. Unlike land, protection, according to standard political theory, is not supposed to find its way onto the markets; but in southern Italy it did. The skills developed in the cities by the self-policing of trade fraternities and in the country by private guards, once released from baronial control, found new applications.10

Although the Mafia is associated with Sicily in general, in fact the Mafia's level of power and control differs significantly across regions (Gambetta, 1993:82, map). Eastern Sicily has been little influenced by the Mafia, while western Sicily has been severely affected by it. Gambetta suggests a reason for this striking regional difference. On the eastern side of Sicily, the ruling classes were relatively cohesive and included few absentee owners. In the words of a nineteenth-century observer, "The upper class [in the east] has managed to preserve the monopoly over force and has so far prevented villains rising from the lower classes from sharing it" (Gambetta, 1993:83). In those regions, the state managed to implement enforcement with relative ease. On the other hand, in much of western Sicily the local elites—particularly new landowners—were divided by conflict, and the state was less successful in establishing its authority. Where effective enforcement of property rights by the state was absent, landholders often turned to private contract enforcers to resolve their differences. As a result, the private protection industry flourished. The Italian state attempted to restrict the activities of this industry, but the protection groups made various adjustments to sustain a comparative advantage in many forms of trade.

The series of land reforms in nineteenth-century Italy thus had significant unintended consequences.11 The reforms that ended feudalism, confiscated church holdings, and allowed land to be bought and sold also increased the opportunity for private suppliers of protection—that is, private contract enforcement—to become independent and well established. Subsequently, as those suppliers established their credibility, that credibility itself became an asset for expanding into other activities, and the industry became self-sustaining.

The maintenance of the Mafia's credibility and its power to resolve disputes has not come without enormous costs. The Mafia has been deeply involved in manipulating the political process, including murdering judges and collaborating with politicians at the highest level. In 1992, the rate of Mafia-related murders per capita in the south of Italy was 48 times as high as the rate in the north (Leonardi, 1995). The Mafia continues to deform normal business practice, raise transaction costs, and reduce productivity. This is particularly the case in those activities where entry can be effectively controlled—such as the fish market in Palermo—or where resources are allocated through the political process. The similarity between conditions in nineteenth-century Sicily and conditions in late twentieth-century Russia is particularly striking.

The Mafia prospered by excluding other methods of contract enforcement and by taxing transactions. The evolution toward the Mafia type of specialized private enforcement industry is not inevitable. Nonetheless, in the Italian case, where the ex ante gains from privatization of land appeared to be so obvious, the experience is sobering.12 Privatization led to a new, sustained, and undesirable enforcement industry. This example is offered not to argue that privatization is bad (for very substantial costs are associated with state-owned property), or that incremental change is preferable to a big bang strategy, but to illustrate that many conditions are necessary for successful privatization. Privatization with and without effective state enforcement will proceed along very different paths. These paths need further examination by economists.

Credibility and the Glorious Revolution of 1688

When self-governing groups achieve cooperation to overcome common-pool problems, the groups involved clearly benefit. The larger society often benefits to some extent as well, but benefits at the national level also depend on the survival and expansion of these patterns of behavior and credibility. To this end, constitutional arrangements at the national level have frequently been crucial in facilitating cooperation and reducing transaction costs.

Microeconomists and macroeconomists, theorists and empiricists all agree: the economic rules of the game must be credible if the transition to a market economy is to succeed.13 A successful economy with a high degree of

specialization requires low costs of impersonal exchange across space and time. If this is to be achieved, a fundamental determinant of these costs—the state's commitment not to interfere arbitrarily in the functioning of the economy—must be credible.

When macroeconomic policy rules lack credibility, the resulting uncertainties about taxes, deficits, and inflation raise the costs of entering and enforcing contracts. Individuals respond on many margins, such as lending to the government only for short periods of time at high rates of interest, or investing and trading primarily in personalized contexts within the informal sector. During hyperinflation, time horizons shrink dramatically, and trade may be reduced to barter.

At the microeconomic level, a lack of credible rules concerning contract enforcement, property rights, or regulations raises the costs of exchange.14 Without low-cost impersonal exchange, the gains from specialization are lost.15 At the extreme, trade will be limited to spot-market exchange and personalized trade with self-enforcing mechanisms. As official third-party sources of contract enforcement become less certain, the comparative advantage of organizations such as the Mafia increases (Gambetta, 1993).

The significance of credibility in contract enforcement can be illustrated by the fall in interest rates following the Glorious Revolution of 1688 in England (North and Weingast, 1989). During the 10 years after the revolution, the interest rate the English Crown had to pay to obtain long-term loans fell from 14 to 7 percent. Over the next four decades, this rate continued to fall by more than half, to 3 percent. This was an extraordinary development that had profound implications for the subsequent prosperity of England.

How did this happen? North and Weingast argue that the revolution credibly constrained the ability of the Crown to manipulate the rules to the advantage of itself and its favored constituents. Prior to the revolution, the Crown had repeatedly reneged on previously agreed-upon terms. It had sold grants of monopoly that expropriated the value of existing investments and reduced the expected returns on all investments. Titles had been sold with promises of a fixed maximum number of sales, promises that were soon broken. Assets stored in the Tower of London for safety had been seized by the Crown. The Crown had paid judges' salaries and openly fired those who disagreed with it. All executive,

judicial, and legislative powers had been combined in the Crown, and few external checks existed.

The revolution changed the rules of the game. Restrictions on monopoly were enforced, all cases involving property were tried at common law, the Crown's control over the judiciary was eliminated (judges served subject to good behavior instead of at the King's pleasure), modifications in land tenure favored private rights and markets, and new political rights protected citizens against arbitrary violations of their economic rights. The dethroning of Charles I and James II provided visible precedents for retribution against irresponsible behavior by the Crown. The Crown could no longer legislate unilaterally or bypass Parliament. In short, the Crown was constrained.

Parliament also agreed to put the government on a sound financial footing. After these changes were instituted, people were more willing to trade over longer time spans, private long-term investments became more attractive, and interest rates fell. The lowered rates made clear the benefits of the new institutional arrangements to all parties, thereby helping to win permanent support for the new system.16

In many countries today, as in seventeenth-century England, private property is subject to excessive political influence and control. A study by Torstensson (1994) shows a strong negative relationship between rates of growth and an index of risk of arbitrary governmental seizure of private property. Boycko et al. (1995), as well as others, have argued that depoliticization is the major property rights issue for economies in transition: ''When firms are subject to political influence, they cater to politicians by producing goods that consumers do not want, employing too many people, delivering output below cost to buyers favored by politicians and engaging in other grossly inefficient practices" (Boycko et al., 1995:11). In Russia, VAZ—the state-owned producer of Lada cars—was able to develop a privatization program that directly served the bureaucrat-managers' interest. The total value of the firm as reflected by share price after "privatization" was $45 million. This was 2.3

percent of what Fiat had allegedly offered the Russian government previously for the firm.17

Systematic information concerning state-owned enterprises and characteristics of the environment that lead to different levels of performance and reform has been assembled in a World Bank (1995) study, Bureaucrats in Business. The study examines state-owned enterprises in 12 countries and finds the losses generated by this type of enterprise to be staggering. In India, the transfers to state-owned enterprises are over five times the central government's education budget. The World Bank study also examines reform efforts in these countries and the conditions under which these reforms are likely to succeed—when reform appears to be desirable, feasible, and credible. A remarkable feature of this study is that it appears to be the first large-scale, international empirical study of state-owned enterprises after more than a century and a half of heated debate about the merits of state ownership and socialism.

Discussion

The previous examples illustrate several points. First, even where official policy is hostile toward property rights and contract enforcement, a group with sufficiently low transaction costs may still prosper. Some systematic empirical studies illuminate the specific conditions under which such cooperation is more likely: local conditions, group homogeneity, incentives, and governance procedures affect the likelihood that the high transaction costs associated with common-pool problems can be overcome. Defection is not surprising, but not inevitable. Success at the national level involves in part learning from these islands of cooperation and efficiency, or at least not suppressing them. Second, privatization efforts can produce undesirable consequences, such as a high-cost system of contract enforcement with significant spillover consequences for the polity. This does not argue against privatization per se; rather it emphasizes that serious and systematic attention should be paid to historical privatization experience. Finally, political control over assets frequently increases transaction costs, induces inflation, diminishes time and trade horizons, and reduces asset value.18

The preceding discussion has illustrated how certain paths in certain cir-

cumstances have played out, but the question is how much systematic information economists possess on these issues. The ideas that dominate the field of economics influence the terms of debate and are often invoked by those who are structuring rules to implement policy. Our reading of the economics literature—which we view as indicating the revealed preferences of economists about which ideas are important—suggests that many issues at the core of the new institutional economics, such as transaction costs, credibility, and rules of the game, receive lip service, but scant systematic attention. We provide some information concerning this issue in the next section.

ECONOMISTS' REVEALED PREFERENCES IN THE LITERATURE ON TRANSITION

Within the literature concerning transition, reform, and property rights in Central and Eastern Europe and the former Soviet Union, manuscripts are being published more rapidly than any individual can read them. From sampling a few hundred of the thousands of published studies in this area, we gained certain impressions. Much of the work on reform appears to cluster in distinct islands of thought, leaving substantial gaps unfilled. Macroeconomic performance, privatization schemes, and "shock therapy" versus gradual reform have received much attention. These issues are indisputably important. But other significant issues have received little attention. When alternatives or tradeoffs are discussed, it is usually in the loosest of terms. There is little discussion of historical context considered at any level of generality. Although most economists agree that institutional reform is fundamental to successful transformation, little systematic attention has been given to many of the core elements of institutions: path dependence, transaction costs, incentives, measurement and monitoring, credible commitments, corruption, and local and regional government.19

To explore more systematically the allocation of resources within the economics profession, we investigated the frequency with which published works in economics include various terms and concepts. This method provides a proxy, albeit a rough one, for measuring the attention given to different concepts. It reflects the choices made by individual economists concerning their allocation of effort to specific research topics, as well as the preferences of journal editors and reviewers. The exercise obviously measures the average rather than the marginal effort.20 The average effort, however, indicates the ideas and approaches that are widely diffused through the profession. Broadly based efforts are particularly important for any research program that requires the systematic efforts of many investigators. One or even a few

brilliant papers will not provide the systematic body of knowledge needed to document patterns of institutional constraints and institutional change.

To measure the distribution of concepts, we conducted a computerized search through the titles and abstracts of the recent economics literature in English, using the bibliographic database EconLit.21 For selected subsets of this literature, we searched all titles and abstracts for mention of selected key words or groups of words. Our rationale was that if a concept is a central part of a study, it most likely will appear in the title, which is the author's statement of the issues of concern, or in the abstract, which summarizes the author's key arguments. Concepts important to authors and editors will obtain a large market share here; concepts considered unimportant will not. For each term, we counted the number of documents in which it appeared.

Various categories of concepts were included: a set of basic terms such as micro, macro, labor, and capital; concepts central to the new institutional economics, such as property rights, path dependence, credibility, transaction costs, and rules of the game; terms often mentioned in the work on transition, such as privatization and stabilization; and terms associated with research inquiry, such as model, hypothesis, data, and test.

We analyzed the frequency of terms for three distinct subsets of the economics literature (see Annex 1-1 for a detailed tabulation of the results): (1) all EconLit documents published January 1989-September 1995, (2) the subset of these documents dealing with transition and reform in Central and Eastern Europe and the former Soviet Union, and (3) the subset of these documents whose authors recently received tenure in high-ranking American economics departments.22 The general set of all economics documents pro-

vides a benchmark against which to compare the emphases and approaches displayed in the literature on transition. The publications of recently tenured faculty indicate the choices made by economists operating under the most competitive pressure and scrutiny.

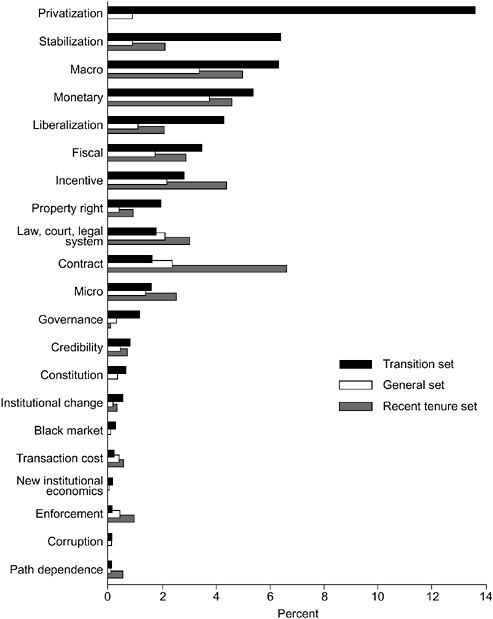

In the general economics literature, many concepts emphasized in the new institutional economics show up rarely (see Figure 1-1). Property rights appears in the title or abstract in only 0.4 percent of the documents, governance in 0.3 percent, institutional change in 0.1 percent, transaction costs in 0.4 percent, and new institutional economics in 0.1 percent.

In the transition set, the terms that appear frequently are not surprising: market, privatization, macro, and monetary are among the ten most common terms. However, many terms central to the new institutional economics appear either rarely or not at all. Transaction costs, corruption, criminal, civil service, and path dependence each appear in 5 or fewer documents (out of 2,564). Opportunity cost, bribery, organized crime, contract enforcement, rules of the game, and social capital do not appear at all.23

The set of publications by recently tenured economists in high-ranking departments should be congruent with the areas and approaches currently enjoying high recognition and reward in the economics profession. Although concepts of the new institutional economics receive more frequent mention here, most appear in 1 percent or fewer of the documents. This highly recognized and rewarded body of literature also includes very little work on transition and reform in Central and Eastern Europe and the former Soviet Union. Among these 949 documents, only two fall within the transition set, and these appear to be versions of the same working paper.

Overall, the market share of the new institutional economics concepts in the economics literature is in the 1 percent range. The procedures used here may understate the absolute level of interest in these topics among economists, but we have no reason to believe the relative ranking is skewed. There is little ambiguity about the market share these concepts receive in economists' writings, whether in the overall literature published in English, in the literature on transition, or in the publications of recently tenured faculty in highly ranked economics departments.

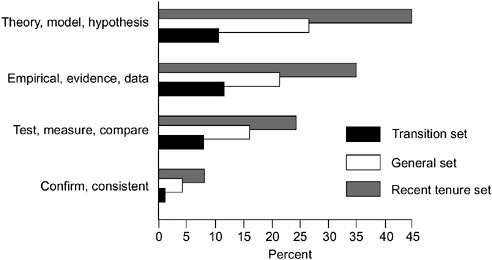

We also examined some questions concerning methods of investigation in the economics literature. In many disciplines, studies typically present a theoretical issue, model, or hypothesis for investigation. In work that is not purely theoretical, there is then some discussion of phenomena relevant to this issue-—data, case studies, historical examples, and so on. Comparisons or

FIGURE 1-1 Works in economics that mention various subject terms in title or abstract (in percent). SOURCE: Data from EconLit database, January 1989 September 1995.

measures or estimates are made. There is some assessment of whether the results are consistent or inconsistent with the original hypothesis. To what extent is this approach observed in the economics literature?

To investigate this question, we grouped terms referring to (1) theories, models, or hypotheses; (2) empirical observation, broadly defined; (3) testing;

FIGURE 1-2 Works in economics that mention various methodological terms in title or abstract (in percent). SOURCE: Data from Econ Lit database, January 1989-September 1995.

and (4) evaluation of findings.24Figure 1-2 shows the frequencies with which these categories of terms appear in the three bodies of literature. The highest frequencies occur among the publications of recently tenured economists and the lowest in the transition literature. The degree of underrepresentation in the latter as compared with the other two bodies of literature is striking. There are many reasons why the standard approach of testing theory with evidence has been difficult in the transition literature, but these numbers are not reassuring. It is also noteworthy that among the 2,564 documents in the transition set, only 22 include terms from each of the three categories referring to theory, empirical observation, and testing; none include terms from all four categories.

There do exist outstanding examples of comparative studies with long-term perspectives that collect the relevant institutional detail and link institutions with

property rights and performance. Excellent examples include the work of Ostrom (1990) and her colleagues on common-pool problems, a new volume edited by Weimer (1997) on the political economy of property rights, and the previously discussed World Bank (1995) study of state-owned enterprises in 12 countries. An elegant survey of the new institutional literature is provided by Eggertsson (1994b). A good overview of the state of the literature on transition is given by the World Bank (1996). It is noteworthy that most studies of this type were undertaken outside departments of economics.

CONCLUSIONS

A conversation with Adam Smith today on the issues just raised would not be particularly comfortable. When told of the current number of economists in the world, he might reasonably ask, "What have they been doing?" Our rather lame response is that we have done some things and that we can do better by focusing on improvements in incentives and trade for ideas.

Our own basic perspective is that successful reform will depend on local specialized knowledge and general technical skills, plus the aggregated knowledge of past experience in many locales. The inhabitants of an area have a comparative advantage in knowing about and dealing with the idiosyncratic features of their locale; however, they may lack the technical expertise of outside specialists. Also, the locals often do not know how reform experiments have played out elsewhere. There are obvious gains to be realized here from trade.

These considerations suggest the need to improve the marketplace for reform proposals. Economists emphasize the benefits of specialization. But for these gains to be realized, trade must take place. We believe there are gains to be made from specialization in terms of local knowledge and technical skills, but a coordinating mechanism—a counterpart to the market—is needed to aggregate this information effectively. Well-functioning markets depend on information that reflects the opportunity costs of the decisions made. The marketplace for reform proposals on Central and Eastern Europe and the former Soviet Union is underdeveloped along these dimensions. In their own scholarly work, economists often neglect to trade ideas and information beyond their own specialties.

Why does this state of affairs exist? One reason is that the academic reward system strongly emphasizes the quantity of publications produced. The 41 economists recently tenured at major economics departments each produced on average 23 publications and working papers in less than 7 years—one every 3.5 months. Empirical work, particularly that involving data collection, typically takes longer than papers that are purely theoretical. In addition, the rewards for doing collaborative work are diminished by the difficulty of appropriately crediting the various authors for their individual contributions.

The major economics journals rarely publish a discovery of significant facts without theoretical or technical accompaniment, although studies of this type appear frequently in the natural sciences. Finally, in the economics profession there is more consensus concerning the ranking of theoretical than empirical work; that consensus increases the emphasis on this field as a criterion for hiring and promoting. Thus for academic economists, the types of research recommended here go relatively unrewarded on virtually every margin. It is not surprising that a disproportionate share of the salient work of this type is being done outside of economics departments, and outside of academic settings.

These problems do not pertain solely to academic economists. As a referee has pointed out, and consistent with our experience, local experts in transitional economies often seem obsessed with their own uniqueness and pay little attention to the body of experience acquired elsewhere. The local experts' incentives to collaborate on long-term comparative studies are often very weak.

One key here is providing incentives for individuals and groups to collect and disseminate information about the performance and outcomes of different reforms.25 At present, the costs of gathering local policy information on a timely basis are considerable. The substantial efforts required to collect and aggregate such information have implications for the efficiency with which reform proposals can be assembled, assessed, and communicated.26 In contrast with chess, there is much ignorance about the games that have been played previously. Old mistakes are likely to be repeated.

Some policies have failed many times in many contexts. Why try them yet again? Some policies have succeeded in a variety of settings. These data should at least be known. Access to reliable information concerning reform experience elsewhere is important. Local experts can take this information, consider their own conditions and constraints, and try to predict what will work better or worse locally.

Klitgaard (1995a: 143-145) suggests that economists approach the transformation of economies and nations in the manner of soil scientists. We must carefully study the local conditions. We must discover the specific qualities of the local soil. We need to consider the wisdom accumulated from experience concerning which plants grow well in which conditions. For some questions, local conditions may not matter. But the ultimate goal is to produce full flowering and a rich harvest in the soil at hand.

Improved trade in reform ideas would improve reform performance. It

would also provide examples to inspire hope. An expert on the Glorious Revolution of 1688 has commented (Jones, 1972:6): "None of its architects could have predicted its effectiveness in securing the liberties, religion, property and independence of the nation after so many previous attempts had failed." They could not know, but we can.

ANNEX 1-1

For each term listed, Annex Table 1-1 shows the number of documents in the transition set and in the general set in which it is mentioned in title or abstract. (These sets of documents are described in footnote 22.) Terms are arranged by descending frequency of appearance in the transition literature.

Note that some of the terms are composite groups formed from several related concepts. In these cases, a positive hit is counted if any term in the group is mentioned. For example, consequence/implication is counted as being mentioned if either consequence or implication is mentioned. In general, applicable common variants (e.g., plurals and gerunds) of the terms shown are also counted as positive hits. In some cases, searches were conducted on root words that include several variants; for example brib* picks up bribe, bribes, bribery, bribing, and so forth. For clearer communication of the ideas, terms in the text are indicated in a fully spelled-out variant rather than in truncated form.

ANNEX TABLE 1-1 Number of Works in Economics That Mention Various Terms in Title or Abstract

|

Term |

Transition Set (N = 2,564) |

General Set (N = 132,005) |

|

Market |

663 |

15,710 |

|

Policy or Policies |

545 |

18,540 |

|

Privatiz* or Privatis* |

350 |

1,232 |

|

Theory, Model, Hypothesis (+pl) |

266 |

34,819 |

|

Test, Measure, Compare, Estimate (+v) |

189 |

21,140 |

|

Consequence, Implication (+pl) |

179 |

8,087 |

|

Empirical, Evidence, Data, Case Study, Sample (+v, pl) |

169 |

24,324 |

|

Macro * |

163 |

4,547 |

|

Labor |

161 |

7,081 |

|

Monetary |

138 |

5,040 |

|

History, Histories, Historical |

115 |

4,540 |

|

Capital |

113 |

7,337 |

|

Liberaliz* or Liberalis* |

111 |

1,492 |

|

Fiscal |

89 |

2,378 |

|

National |

82 |

4,274 |

|

Incentive* |

72 |

3,022 |

|

Stabiliz* or Stabilis* |

72 |

602 |

|

Business, -es |

60 |

4,223 |

|

Property Right* |

51 |

578 |

|

Law,-s, Court,-s, Legal System |

46 |

2,780 |

|

Sequenc* |

45 |

467 |

|

Contract* |

42 |

3,130 |

|

Micro* |

41 |

1,879 |

|

Decentraliz*, Decentralis* |

34 |

625 |

|

Federal |

33 |

2,319 |

|

Centraliz*, Centralis* |

32 |

341 |

|

Governance |

30 |

339 |

|

Ideolog* |

28 |

537 |

|

Local |

27 |

2,470 |

|

Entrepreneur* |

27 |

775 |

|

Priorit* |

27 |

504 |

|

Big Bang |

27 |

39 |

|

Bureaucrac*, Bureaucrat* |

26 |

419 |

|

Shock Therapy |

24 |

33 |

|

State-Owned Enterprise* |

23 |

103 |

|

Income Distribution |

19 |

733 |

|

Constitution* |

16 |

483 |

|

Credibil* |

16 |

432 |

|

Institutional Change |

14 |

142 |

|

Inequality |

13 |

1,047 |

|

Reject, Inconsistent |

12 |

1,458 |

|

Private Enterprise |

9 |

43 |

|

Black Market |

7 |

96 |

|

Monitor* |

6 |

614 |

|

Trade Off*, Tradeoff |

5 |

725 |

|

Substitute,-s |

5 |

587 |

REFERENCES

Alekseev, M.P. 1937 Adam Smith and his Russian admirers of the eighteenth century. Pp. 424-431 in Adam Smith as Student and Professor, William Robert Scott, ed. Glasgow, Scotland: Jackson, Son & Company.

Alexandrin, G. 1993 N. W. Mordvinov (1754-1845): Father of economic freedoms in Russia? International Journal of Social Economics 20:171 - 180.

Arrow, K.J. 1963 Social Choice and Individual Values. Second edition. New York: John Wiley & Sons, Inc.

Åslund, A. 1994 Comment on ''Macropolitics in transition to a market economy: A three-year perspective" by Balcerowicz and Gelb. Pp. 45-48 in Proceedings of the World Bank Annual Conference on Development Economics 1994. Washington, DC: The World Bank.

Barzel, Y. 1989 Economic Analysis of Property Rights. Cambridge, England: Cambridge University Press.

Benham, A., L. Benham, and M. Merithew 1995 Institutional Reform in Central and Eastern Europe: Altering Paths with Incentives and Information. San Francisco: International Center for Economic Growth.

Benham, L., and P. Keefer 1991 Voting in firms: The role of agenda control, size and voter homogeneity. Economic Inquiry 29:706-719.

Boycko, M., A. Shleifer, and R. Vishny 1995 Privatizing Russia. Cambridge, MA: The MIT Press.

Coase, R.H. 1960 The problem of social cost. Journal of Law and Economics 3:1-44.

1988 The Firm, the Market, and the Law. Chicago: University of Chicago Press.

Eggertsson, T. 1990 Economic Behavior and Institutions. Cambridge, England: Cambridge University Press.

1994a No Experiments, Monumental Disasters: Why It Took a Thousand Years to Develop a Specialized Fishing Industry in Iceland. Workshop in Political Theory and Policy Analysis, Indiana University, Bloomington, IN.

1994b The economics of institutions in transition economies. In Institutional Change and the Public Sector in Transitional Economies, World Bank Discussion Papers, Number 241, Salvatore Schiavo-Campo, ed. Washington, DC: The World Bank.

Gambetta, D. 1993 The Sicilian Mafia: The Business of Private Protection. Cambridge, MA: Harvard University Press.

Gerschenkron, A. 1970 Europe in the Russian Mirror: Four Lectures in Economic History. Cambridge, England: Cambridge University Press.

Jones, J.R. 1972 The Revolution of 1688 in England. London: Weidenfeld and Nicolson.

Klitgaard, R. 1991 Adjusting to Reality: Beyond "State versus Market" in Economic Development . San Francisco: ICS Press.

1995a Including culture in evaluation research. Pp. 135-146 in Evaluating Country Development Policies and Programs: New Approaches for a New Agenda, R. Picciotto and R.C. Rist, eds. San Francisco: Jossey-Bass Publishers.

1995b Institutional Adjustment and Adjusting to Institutions, World Bank Discussion Papers, Number 303. Washington, DC: The World Bank.

Kornai, J. 1993 The evolution of financial discipline under the postsocialist system. Kyklos 46:315-336.

Leonardi, R. 1995 Regional development in Italy: Social capital and the Mezzogiorno. Oxford Review of Economic Policy 11 (2):165-179.

Levy, B., and P.T. Spiller, eds. 1996 Regulations, Institutions, and Commitment: Comparative Studies of Telecommunications. Cambridge, England: Cambridge University Press.

Libecap, G. 1989 Contracting for Property Rights. Cambridge, England: Cambridge University Press.

Murrell, P. 1992 Evolution in economics and in the economic reform of the centrally planned economies. Pp. 35-53 in The Emergence of Market Economies in Eastern Europe, C. Clague and G.C. Rausser, eds. Cambridge, MA: Blackwell Publishers.

1995 The transition according to Cambridge, Mass. Journal of Economic Literature 33:164178.

North, D., and R. Thomas 1973 The Rise of the Western World: A New Economic History. Cambridge, England: Cambridge University Press.

North, D.C., and B.R. Weingast 1989 Constitutions and commitment: The evolution of institutions governing public choice in seventeenth-century England. The Journal of Economic History 49(4):803-832.

Ordeshook, P. 1993 Some rules of constitutional design. Social Philosophy and Policy 10(2):198-232.

Ostrom, E. 1990 Governing the Commons: The Evolution of Institutions for Collective Action. Cambridge, England: Cambridge University Press.

1994 Neither Market Nor State: Governance of Common-Pool Resources in the Twenty-First Century. Workshop in Political Theory and Policy Analysis, Indiana University, Bloomington, IN.

Pushkin, A. 1981 Eugene Onegin. Translated by Walter Arndt. Second edition, revised (originally published 1825-1833). New York: E.P. Dutton.

1983 A novel in letters. Pp. 50-61 in Complete Prose Fiction. Translated by Paul Debreczeny (originally published 1857). Stanford, CA: Stanford University Press.

Putnam, R.D. 1993 Making Democracy Work: Civic Traditions in Modern Italy. Princeton, NJ: Princeton University Press.

Riker, W.H., and I. Sened 1991 A political theory of the origin of property rights: Airport slots. American Journal of Political Science 35:951-969.

Riker, W.H., and D.L. Weimer 1995 The political economy of transformation: Liberalization and property rights. Pp. 80107 in Modern Political Economy: Old Topics, New Direction, J.S. Banks and E.A. Hanushek, eds. Cambridge, England: Cambridge University Press.

Smith, A. 1776 An Inquiry into the Nature and Causes of the Wealth of Nations. 1976 edition. Chicago: University of Chicago Press.

Torstensson, J. 1994 Property rights and economic growth: An empirical study. Kyklos 47:231-247.

Weimer, D.L., ed. 1997 The Political Economy of Property Rights. Cambridge, England: Cambridge University Press.

World Bank No date Transition: The Newsletter About Reforming Economies. Transition Economics Division, Policy Research Department. Washington, DC: The World Bank.

1995 Bureaucrats in Business: The Economics and Politics of Government Ownership. Washington, DC: The World Bank.

1996 World Development Report 1996: From Plan to Market. Oxford, England: Oxford University Press.