6

Manufacturing Optical Components and Systems

Introduction

Since the early part of this century the manufacturing of optical components and systems has changed dramatically throughout the world, both in the types of products that are made and in the approach that is taken to making them. Once devoted entirely to passive image-forming components (such as lenses and mirrors) and to the instruments made from them, the industry now also manufactures a wide range of active elements such as lasers and optical sensors. Until recently, the industry depended heavily on a craftsman-style approach to manufacturing, with much of the work being carried out on an order-by-order basis by very small businesses. As new mass consumer markets have emerged that rely on optical technology—such as compact disk (CD) players and laptop computer displays—the implementation of high-volume mass-manufacturing techniques similar to those of the electronics industry has revolutionized this segment of the optics industry.

To take just one example of this new manufacturing technology, more than 100 million diode lasers are now produced each year, on highly automated production lines. The availability of these inexpensive diode lasers has revolutionized entertainment (in CD players), made high-quality printing affordable for small businesses and home users (in laser printers), and made possible numerous other new products that together account for hundreds of billions of dollars in global business revenue each year.

These changes in manufacturing are exciting, but they are reflected most prominently in the globalization of the optics industry, rather than in the domestic development of U.S. industry. Indeed, almost all mass

production of optical components and systems now takes place outside the United States. There are only a handful of large U.S. optics companies engaged in the volume production of optical components, most of them in the plastic lens component business. This U.S. trend toward specialty products and small companies has been due in large part to the special technical needs of the Department of Defense, which has long been a vital customer for the industry. Government programs such as Small Business Innovative Research (SBIR) have also encouraged the formation of small, innovative optics companies. The main strength of the U.S. optics industry is now in high-precision manufacturing of low-volume specialty optical components and devices with high added value. This strategy has produced a strong industry based on the diverse activities of many small companies but lacking the manufacturing base required for expansion into mass consumer markets.

There are several thousand small optics and optics-related companies in the United States, with an average of 50 or 60 employees each. Together they account for more than 200,000 jobs and annual net revenues of about $30 billion for optical components and systems (excluding ophthalmics).1 Yet even these impressive statistics do not adequately indicate the strength that small businesses provide to the U.S. optics industry as a whole, by making available a broad range of technical skills. A key finding of this report is that despite the optics industry's significant contribution to the U.S. economy, this contribution comes in so many small pieces that it is not usually fully recognized and understood.

The enabling character of optics, a repeated theme of this report, is an especially important consideration for the manufacture of optical components. The value of a component such as a laser diode or an aspheric lens is usually small compared with the value of the optical system that it enables. It is even smaller compared with the value of the resulting high-level application. Advances in the manufacturing of optical components are greatly magnified into improved capabilities and economic advantages at the systems and applications level. Advanced optical components cannot be considered commodity items.

This chapter addresses two distinct challenges. First, how can we maintain and strengthen the U.S. optics industry's leadership in high-precision manufacturing of low-volume specialty products? Second, how can we ensure the U.S. optics industry's ability to compete internationally in the increasingly important mass markets, especially the new mass markets that continue to emerge? Following a brief history of optics manufacturing in the United States and a short overview of the current state of the industry, the chapter divides into two main parts: (1) low-volume manufacturing of high-performance specialty products

and (2) high-volume manufacturing for the mass markets. The chapter ends with a discussion of some crosscutting issues, such as metrology and design, and the industry's composition, size, and growth.

A Brief History

Before about 1910, the U.S. optics industry consisted of just a few manufacturers of optical instruments such as binoculars and inspection equipment. Virtually all such products were imported from Europe. World War I stimulated demands for a domestic capability, and the need to provide components for these instruments was the basis for the U.S. optics industry's growth throughout the early part of the century.

The 1920s and 1930s supported several medium-to-large optical companies, such as Bausch and Lomb, American Optical, and Eastman Kodak—high-volume producers of both traditional and new optical instruments. A well-organized photographic industry provided almost all the cameras demanded by U.S. consumers. Most microscopes, binoculars, telescopes, and optical inspection equipment were also manufactured domestically.

The needs of the military during World War II placed significant demands on the industry's capabilities, and when military contracts ceased abruptly at the end of the war, most optics companies fell on hard times. Demand for cameras and other optical instruments for consumer and civilian uses grew, but Japanese and European competitors could satisfy this demand more cheaply than most U.S. companies, many of which succumbed to the competition. The remaining domestic camera and instrument manufacturers cut costs by turning to component suppliers in the Pacific Rim, first in Japan and more recently in China and Malaysia.

From the 1950s through the 1970s, the industry became increasingly divided, with overseas suppliers dominant in the high-volume markets and U.S. industry focused on assembly, systems building, and low-volume specialty components. Small companies came to dominate the U.S. optics industry.

In 1960, the invention of the laser spawned an entirely new segment of optics manufacturing, a segment that has grown astonishingly. Technologies developed to take advantage of the laser's capabilities have led to additional major markets for optical fibers, optical communications systems, optical sensors, and a broad range of other new applications. Mass U.S. markets for these applications have been based on aggressive growth in overseas manufacturing of the basic components.

An Overview of the Industry Today

The nature of the optics industry continues to change. Mass production techniques are used to manufacture components for an increasing

number of high-volume optics applications. Among the products manufactured in this way are optical fiber for telecommunications and flat-panel displays for computers. Most of this type of manufacturing currently takes place overseas, not in the United States.

At the same time, demand remains strong for high-performance specialty products that are manufactured in small numbers. There are three main markets for these items: (1) the military, (2) other high-technology scientific and government programs, and (3) specialized industrial applications. Many high-performance military optical systems have very specialized capabilities but low production volumes. Some federal facilities for civilian research and development have similarly specialized needs. A key private-sector market for high-precision optical systems is the electronics industry, in which a relatively small market for photolithography systems enables the huge semiconductor business. The United States excels in this high-value, low-volume portion of the optics industry.

Most of the industry that serves the low-volume, high-accuracy component market remains dependent on very traditional fabrication methods, although it is increasingly facilitated by high-quality interferometric test equipment. This sector of the industry, made up mostly of small companies, faces increasing competition and must adapt to the new global marketplace. To maintain market share as overseas competitors improve their accuracy, domestic manufacturers will have to develop and use more deterministic fabrication methods that achieve the same results at lower cost with fewer high-skill workers.

For each of these types of manufacturer, an important element in the future growth of the industry is the growing integration of passive image-forming components with active sensors and light processors. The acceleration of this trend will mean a corresponding integration of the traditional optical component industry with the developers and suppliers of electrooptical materials and devices.

The challenges of the future will require new, faster, more flexible approaches to optical component fabrication, with less reliance on skill-intensive, iterative production methods. Some programs have already been established to promote this goal. For example, the Center for Optical Manufacturing has developed a series of computer-controlled generating machines that use diamond tools to produce accurate surfaces on glass elements. The Manufacturing Operations Development and Integration Laboratory (MODIL) has developed techniques for fabricating certain specialized laser components. Similar approaches are being implemented overseas. It is not clear, however, that such methods will be enough to revitalize U.S. production of high-volume general-purpose optical components, because most of the small shops that currently dominate the U.S. optics industry lack access to the investment capital necessary to upgrade their equipment.

Collaborative programs in optics manufacturing should include universities so that students are trained in the latest technical solutions to production problems.

The Department of Defense (DOD), the National Institute of Standards and Technology (NIST), and the Department of Energy (DOE) national laboratories should establish together a cooperative program that provides incentives and opportunities to develop new ideas into functioning methods for optics fabrication.

A critically important asset of the U.S. optics industry remains its strength in optical design. U.S. software companies set the world standard for optical design programs, although their products are of course widely used overseas. The development of sophisticated lens design programs, with good interaction with the designer, is remarkable. Programs that will run on a high-level personal computer now give any optical engineer access to modern design tools, and this easy availability has stimulated a widespread interest in optical design. There is as yet little integration of active components into the design process, however, and comprehensive software for physical optical design is still at a relatively rudimentary stage. U.S. accomplishments in optomechanical computer-assisted design (CAD) and thermal analysis software would be even more effective if fully integrated into optical design software.

Manufacturing of optical components and systems requires a large skilled and semiskilled workforce, and emerging new mass markets will increase the optics industry's need for trained workers. The quality and availability of optics training at the technician level is a widespread concern.

A key challenge for the future is the establishment of standards for the interchangeability of optical components, which is an important driver for cost-effective manufacturing. U.S. participation in international standards-setting activities lags far behind the activities of foreign organizations.

Low-Volume Manufacturing of Specialty Optics

There continues to be strong demand for high-performance specialty products that are manufactured in small numbers. For many of these products, the customer is the government, especially DOD, but certain high-value items are also vitally important in the commercial sector. Specialized high-value applications, such as lenses for photolithography, continue to be an area in which the U.S. optics industry can excel.

As described in Chapter 4, military optical systems tend to have high-performance and specialized requirements but low production volumes (Joint Precision Optics Technical Group, 1987). For example,

forward-looking infrared (FLIR) systems require expensive infrared-transmitting materials as well as environmentally resistant surfaces, coatings, and mountings. Ring laser gyroscopes require low-scatter surfaces and very high-precision optical components. High-performance aircraft and missiles require unusual aspheric components, conformal to the shape of the airflow. Affordability is becoming increasingly important to the Department of Defense, but despite its wish to use commercial products off the shelf where possible, DOD supports design and manufacturing development for a number of specialized optical technologies. The volume of demand for such items, even including the commercial applications, is often too small to ensure the necessary development of fabrication techniques by industry alone. DOD should continue to maintain technology assets and critical skills in optics manufacturing in order to meet future needs.

Some government projects require so many specialized optical components that they have a significant impact on the entire optics industry, despite the low volume for each of their individual components. Among these are the National Ignition Facility and the Atomic Vapor Laser Isotope Separation (AVLIS) program. These two DOE programs will consume thousands of medium-to-large optical components with high-precision surfaces and coatings resistant to high-power lasers. The overall size of these programs allows the private sector to plan some investments in improved machinery and processes.

Photolithography for manufacturing electronics is a key private-sector use of high-precision optical systems. The production of short-wavelength photolithography systems of ever-higher quality is essential for continued growth of the semiconductor industry. The Moore's law trend of increasing semiconductor miniaturization will drive photolithography through deep ultraviolet (UV) wavelengths and into the soft x-ray region by the turn of the century. At present, most imaging tools are produced overseas, but there are opportunities for U.S. industry to take the lead as systems move into the far UV, if economical methods can be found for producing moderate-sized aspheric surfaces with an accuracy better than 1 nm.

Specialized applications such as these incorporate a wide variety of traditional and modern optical technologies, each with its own manufacturing issues.

Spherical Lenses

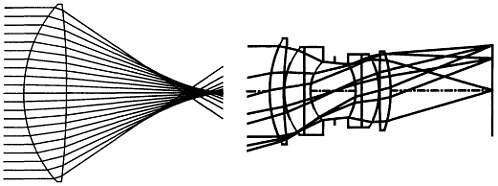

The curved surfaces of a lens cause rays of light from a point on a distant object to come to a focus. A single lens with spherical surfaces, although quite economical to manufacture, forms an image that is not a perfect point (see Figure 6.1). Optical design has traditionally been a search for combinations of spherical-surfaced components, made of

FIGURE 6.1 A single spherical-surfaced lens (left) forms an image that suffers from spherical aberration. To reduce this effect, a typical photographic or video lens (right) consists of many elements.

different types of optical glass, that result in nearly aberration-free images. In general, the wider the field of view or the more extended the spectral range required, the more elements will be needed.

The traditional approach to making spherical surfaces has been surface lapping, which can produce high-quality polished surfaces that deviate from the designer's specifications by as little as a few hundredths of a wavelength. This lapping or averaging method has been very successful in fabricating spherical and flat components, but it is by nature a time-consuming and craftsman-intensive activity. Improvements currently being investigated are directed toward deterministic fabrication, in which the accuracy of surface production is inherent in the machine carrying out the process rather than in the time-varying lapping of surfaces. Processes that are successful in finishing unusual materials, including optically active materials, have become more important.

There have been several attempts to improve and modernize the methods used for serial production. These approaches, however, such as high-speed surfacing, molding, and automated test and assembly machines, are usually directed at reducing the cost of a specific product. The improved production capability rarely extends to other products. A major improvement has been the very inexpensive production of plastic components. The use of plastic components is currently limited to systems of moderate and low quality, however, and to a limited range of environmental conditions. At least in the near term, most optical systems will continue to require glass components.

Currently, only one major domestic research and development program is directed toward the versatile production of economic spherical components. This is the Center for Optical Manufacturing (COM) at the University of Rochester, which has made significant progress in the development of high-speed machines to generate surfaces that require

minimal polishing. COM has also developed a promising experimental polishing process called magnetorheological finishing. In magnetorheological finishing, the conventional rigid polishing lap is replaced by a suspension of magnetic particles and polishing abrasives. A magnetic field locally stiffens the fluid, creating a polishing spot that can be scanned over the part to polish it and correct its surface figure.

Although most spherical optical components are produced for use in imaging systems, other applications are also important for a healthy U.S. optics industry. Many specialized components are needed for laser systems, data storage systems, telecommunications equipment, a variety of analytical instruments, and endoscopes or other optical devices for minimally invasive surgery. The U.S. catalog houses that distribute stock produced overseas meet only part of this need.

Aspheres

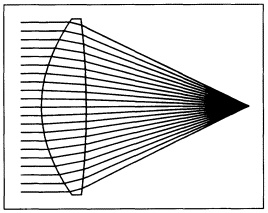

If the surfaces of an image-forming component are allowed to be nonspherical, a major advance occurs. The addition of definable high-order curvature to the usual second-order spherical surface permits independent correction or balancing of spherical aberration. This leads to a reduction in the number of lens surfaces needed for aberration-corrected imagery and permits simpler, better optical systems (see Figure 6.2). Asymmetrical aspheres are also becoming important, especially in conformal applications, in which the outer surface of an optical component must conform to the aerodynamic shape of an aircraft or missile.

Among the diverse applications of high-precision aspheres are military aerospace systems, optical data storage, photolithography, and astronomy. Lower-precision aspheres have an even wider range of application, including photography and video imaging (especially zoom lenses), projection television, medical instruments such as endoscopes, telecommunications, and document scanners and printers. At the low-end of the market, aspheres find use in such applications as condenser elements for illumination.

Some of these areas of application present valuable economic opportunities for the U.S. optics industry. The trend toward more compact optical systems with active or movable components—zoom lenses, for example—is increasingly driving designers toward aspheres. The future goals of the semiconductor industry (which will require asymmetrical reflective components for deep-UV photolithography), as well as other industrial and defense applications, cannot be achieved without the ability to produce high-quality aspheres cost-effectively.

FIGURE 6.2 A single element with an aspheric surface can have significantly reduced aberration (compare with Figure 6.1).

Aspherical surfaces cannot be produced by the traditional methods used for manufacturing spherical-surfaced components. Three technologies are required to manufacture precision aspheres: machining, polishing, and metrology. Successfully generating, polishing, and testing aspheres all require considerable skill, and investment in all three is mandatory for successful production.

The two current options for machining defined aspheric surfaces are single-point diamond turning and computer-controlled (CNC) generation. Diamond turning is used to make aspheres in ductile materials such as metals, but it leaves an intrinsic surface roughness that must be removed by polishing if the component is to be used at visible or near-infrared wavelengths. CNC generators are used to grind brittle materials such as glass. Several countries have programs directed toward defined-shape generation of aspheric surfaces. These programs are beginning to produce numerically controlled machinery that makes the use of multiple aspheric surfaces feasible. In the United States, a major new program funded by the Defense Advanced Research Programs Agency (DARPA) is investigating the fabrication of conformal optical components.

Except in some infrared applications, machined aspheric surfaces usually require a computer-controlled polishing or finishing step. This step has two purposes: to correct the surface figure to the proper shape and to smooth its microroughness to reduce light scattering. The achievable accuracy of aspheric surface figuring has improved a hundredfold in less than a decade, from 0.5 μm [root mean square (rms)] in 1988 to about 5 nm (rms) in 1996. A variety of approaches have been developed based on loose abrasive polishing. These include passive and active flexible laps, deformable rigid laps, and small tool polishers. All of these approaches aim to solve the problem that a rigid lap, as is used in the conventional polishing of spherical elements, will not maintain good contact with an aspheric surface as it moves over the part. Magnetorheological finishing is also under development, as mentioned above. Ion figuring has proved to be a predictable method for final shape correction, but it does not reduce surface roughness.

The third requirement is metrology of the surface figure. Comparing surface measurements to the design of the component produces the data needed to drive computer-controlled polishers. Thus, the metrology system not only qualifies the finished part but also is essential during the polishing process. Contact and noncontact profilometers are used, but these systems are slow, and more importantly, they measure the surface only along widely separated one-dimensional traces. An interferometer coupled with a null optic (refractive, reflective, or diffractive) is preferable because it provides an accurate full-area test of the surface profile. The null lens must be calibrated before

use. Asphere manufacturers find the use of null optics essential, but it is common for them to lament the high cost and long lead times.

All three of the above technologies need improvement, but the technology deficit is most severe in metrology, followed by polishing, and least severe in machining or generating. Also important for the future fabrication of precision aspheres will be the trend away from rotationally symmetric aspheres or their off-axis sections and toward generalized aspheres with little or no symmetry.

It is vital to the future of the U.S. optics industry that domestic production of aspherical optical components be made more cost-effective. Moderate-quality aspheres typically cost four to five times more than comparable spherical elements, so simply eliminating a spherical component from a design is rarely enough to make the economic case for using an asphere. Performance, size, or weight must be an additional driver. Thus, asphere fabrication technology has until now been driven by the needs of specific applications. More widespread application will require continued moves toward technology-based and computer-controlled manufacturing processes. These capabilities tend to lie in larger companies, and as a result, only a few U.S. manufacturers are currently able to produce aspheres economically. The ability to produce aspheres at a cost less than twice that of a spherical surface would open wider markets for such components. Without an incentive to develop a domestic capability, there is a real risk that precision asphere manufacturing will move offshore. Government agencies should continue to support the activities necessary to introduce cost-effective precision aspheric components into both military and commercial products.

Computer-Controlled Deterministic Grinding and Polishing

The primary reason high-volume manufacturing of image-forming components has left the United States is that current manufacturing techniques for these products are still operator resident, art driven, and based on labor-intensive machinery that often dates from the 1940s. As a result, the quality of the output depends on the skill and experience of the operator, rather than on computer controls and a scientific understanding of the manufacturing processes.

Revitalizing the industry will require a move toward transferable manufacturing processes that are based on smart operators and computer controls. This technology will be more capital intensive and less operator dependent than the current approach. Computer-controlled, deterministic processes will also lead to better consistency—all parts of identical quality and the first part as easy to produce as the last—and to significantly faster cycle times. A model to emulate is the metalworking

industry, in which computer-controlled machinery is now the norm and handbooks are widely available that list feeds and speeds for various materials and configurations.

To begin addressing these needs, three universities and the American Precision Optics Manufacturers Association, with Department of Defense sponsorship, have jointly established the Center for Optics Manufacturing. COM's major thrusts are the integration of computers into optical component manufacturing, the development of computer-controlled optical component manufacturing equipment, the development of deterministic processes using this equipment, and the transfer of the resulting technology to industry. Some of the key challenges being addressed include improved inspection techniques for in-line process control, new machine geometries for making aspherical parts, and improved tools for optomechanical design.

This new deterministic approach creates some educational challenges. Advanced-degree programs must integrate mechanics and materials science into the traditional optics manufacturing curriculum. At the technician level, mechanical and computer training are required as well as training in optics, to ensure that machine operators' skills are appropriate for computer-controlled fabrication equipment.

Diffractive Elements

The use of diffractive optical elements, in which light is manipulated by a microscopic pattern on a surface rather than by its macroscopic curvature, is a fundamentally new approach with tremendous potential. Diffractive components exploit the wave nature of light to form images by the effect of a series of zones generated on a base surface. Some of the features of such components are their low weight even at large apertures, their ability to correct spherical and other aberrations, and their reduced need for exotic materials. Applications generally use diffractive elements in combination with refractive and reflective elements. The fundamental building blocks for diffractive technology are in place, and as a result, interest in this approach has surged recently.

Designs that combine aspheric lenses and mirrors with surface-relief diffractive lenses offer significant potential to improve performance and reduce size, weight, and cost. Among their applications are head-mounted displays, advanced sensor systems, laser and broadband imaging, optical interconnections for high-speed data transfer, optical data storage, optical correlators for target acquisition systems, consumer digital imaging applications, and precision testing of complicated optical systems.

Diffractive optical elements have significant market potential. Estimated at between $15 million and $20 million in 1995, the market is expected to grow to between $150 million and $200 million by the turn of the century. Almost one-quarter of the market will be in

consumer products, with the remainder split roughly evenly between industrial and government customers. This projection represents 15 to 20% of the total optical component market in 2000.

To produce high-quality diffractive components, one must shape the surface profile within each diffraction zone with nanometer precision. There must be sharp transitions between adjacent zones, and the surface profile within each zone must be smooth. Several fabrication methods—including electron-beam and optical lithography, diamond turning, single-point laser pattern generation, and optical holography—have been used to create surface relief on ''master elements." These master elements are then used, with varying degrees of success, to replicate diffractive components. An advantage of this approach is that the precision is built into the tooling and reproduced in each part.

Diffractive optics technology is at a critical stage of development. The United States has made significant investments in basic research and currently has a leadership position, but most of the basic research has been done and the need now is for development and commercialization. Federal R&D programs can play an important role in preserving U.S. leadership by focusing on the development of low-cost manufacturing processes for high-precision applications.

Optical Coatings

The last step in making an optical component, especially a high-value component, is often to apply a thin film of light-controlling or protective coating. These coatings range from simple metallic reflectors, to antireflection coatings, to multiple-layer filters, to high-efficiency dielectric reflection-enhancing bandpass coatings. The optical parameters of high-precision coatings must often be maintained to within a few percent. Large-area production coatings usually require less optical precision but may have special environmental or processing requirements.

Optical coatings are used for many light-control purposes. Coatings with as many as three layers are commonly used on photographic and video objectives to enhance transmission and reduce ghost images. Multilayer coatings are used on prisms, beam splitters, and windows to select spectral regions for enhanced transmission or reflection. Special large-area coatings are use to control the appearance of video displays and enhance the contrast of military cockpit instruments. Industrial and military laser systems depend on protective coatings to provide survivable surfaces for high-energy reflection or transmission. Special sharp-cutting filters are required to implement the wavelength-division multiplexing (WDM) technique for optical telecommunications. Government applications typically require high-precision but relatively low production volumes. Many commercial applications also require small-batch orders and high- precision, but

some, such as coatings for projector lamps, require high-volume production at lower precision.

Several methods are used to apply optical coatings. Batch methods are typical for high-precision applications. Most infrared (IR) coatings for military and aerospace use are applied by evaporation. Visible or UV coatings, including some for commercial applications, can also be made by evaporation. Some coatings are densified by sputtering or ion-assisted evaporation to reduce porosity, which improves stability and environmental resistance. Moderate- and low-precision coatings with only a few layers can be applied using in-line flow machines, which process large areas efficiently. Roll coaters can be used for some low-precision applications on flexible substrates.

Among the technical issues for optical coatings are cost, durability, low body and surface scatter, high-efficiency, production yield, and environmental stability. There are technical problems related to lengthening the evaporation source lifetime, acquiring pure materials, and ensuring the long-term reliability of equipment and processes. Interest in plastic substrates is increasing, but further process improvements are required in this area. The failure of an optical coating on a high-value substrate can be expensive for the user, but despite this, for specialized coatings the failure rate is sometimes as high as 50%. There is a growing market for the removal and replacement of degraded coatings. Some technical areas in which federal R&D support is most needed include the fundamentals of adhesion, defect avoidance, scattering and absorption reduction, stress minimization, improved uniformity for multilayer coatings, and the development of cost-effective high-throughput coating processes.

The U.S. market for optical coatings was about $635 million in 1996. It is projected to grow to $920 million by 2001. Worldwide, the market is $1.6 billion, with projected growth to $2.3 billion by 2001. These figures include optical materials, coating products, coating services, and coating equipment. Companies tend to specialize either in high-volume production applications or in low-volume specialty coatings. In most segments of the market, there are one or two large suppliers and a myriad of small ones. U.S. suppliers dominate the market, especially for high-quality coatings, but offshore competition is growing rapidly. 2

Commercial coatings markets are growing by 15 to 30% per year. They offer long product lifetimes and attractive profit margins but require the coater to take on the risk of technology development. Some commercial markets have sufficiently high-volume to justify significant investment in development; applications in office automation equipment and photocopiers, for example, can achieve very high volumes. The keys to success in the commercial coating business are holding down costs and meeting performance specifications.

The government coatings market, in contrast, is declining by about 10% per year. In addition, it tends to have low production volumes (typically a few hundred parts per order) and to require considerable paperwork for a limited profit margin. As a result, the focus of larger companies is increasingly on commercial work. Maintaining continuity and a critical mass of expertise is of major concern if future government needs for specialty coatings are to be met. There is federal support for optical coatings R&D, but it is inefficient to develop coating processes at government laboratories and subsequently transfer them to industry. Sponsored development in industry would be a better approach. It should emphasize manufacturing issues and be linked to follow-on production activities.

Optical Glasses, Polymers, and Specialty Materials

A wide variety of optical materials are used in image-forming components. In addition to their optical properties such as transparency and index of refraction, practical considerations such as isotropy, homogeneity, and environmental stability are usually also important. Mechanical and electrical properties must be appropriate for each application, and it must be possible to produce a material and fabricate it into an optical component at an acceptable cost. Thus, although there are many opportunities to develop materials with new optical properties, there are also many practical limitations. For some materials, only incomplete and sometimes inaccurate data on mechanical properties are available; optomechanical designers need such information to develop durable system designs.

The most used material is optical glass. A century of development has resulted in inexpensive, extremely homogeneous glasses with very well-defined optical properties. Catalogs list more than 300 varieties, although in fact, fewer than 50 are available without special melting and about 10 glass types account for 90% of the optical glass that is actually used. Environmental restrictions have encouraged the elimination of many glasses, and the current passion to eliminate lead from industrial processes will further reduce the available variety; for most applications, however, designers actually have little need for more than a handful of glass types, perhaps about 16. Physical limits on the dispersion parameters of glassy materials make it unlikely that new glasses will be developed that fall outside the ranges available today.

The vast majority of glass blanks are less than 1 cm in diameter and are manufactured using a continuous batch approach for just a few cents each. Even when the value added by finishing is included, the cost of a typical, completed spherical-surfaced glass element in volume production rarely exceeds five or ten dollars. Furthermore, for only a few glass types does annual production exceed a few thousand kilo-

grams. Except in special cases, therefore, there is little incentive to invest in the development of new optical glass types.

The use of polymers in optical systems is increasing. Injection-molded plastic lenses have reached a quality that approaches that of glass lenses in many applications. Only a few useful optical polymers are known, however, and their use is limited by their low indices of refraction, relatively high dispersion, inhomogeneity, mechanical properties, and low tolerances to such environmental conditions as temperature and humidity. Great benefits could be obtained from the development of a few new good-quality optical polymers.

Certain specialized applications require other optical materials. For example, high-energy laser applications require reflective substrates that are resistant to thermal effects. A mirror that is reflecting a megawatt of power may have to dispose of as much as a kilowatt of heat. If absorbed in the substrate, this heat will lead to warping of the mirror's surface. One solution is to use a metal substrate below the mirror surface with channels for a circulating fluid coolant. Active cooling can be eliminated, simplifying both design and fabrication, by selecting substrates such as single-crystal silicon that are transparent at the wavelength of the laser radiation being used. This technique is used in space-based and airborne laser weapons, for example. The development of economic silicon boules for the semiconductor industry has permitted the manufacture of mirrors up to 30 cm in diameter for these applications. Other optical materials tailored for particular applications include ultrapure silica for optical fibers, erbium-doped glass for fiber amplifiers, and sol-gel materials for specialized filters and waveguide devices; some of these materials have become cornerstones of entire new industries.

Case Study: Photolithography Equipment

A key commercial application of high-value specialty optics is the equipment used for photolithography in the electronics industry. Advanced lenses for operation at 248 nm are crafted from pure fused silica, have 27 or more elements, weigh in excess of 1,000 pounds, and are a meter or more in length. Each element must be ground to exquisite tolerances in both figure and finish. The entire surface must be defect free, and the surface figure must be accurate to a few hundred angstroms. As lithography proceeds to even shorter wavelengths in order to achieve smaller feature sizes on the device, even more sophisticated optics will be required. There are many challenges in the design, manufacture, and implementation of these optical systems.

Lens Materials Issues

Conventional lenses that operate at I-line (365 nm) and g-line (424 nm) wavelengths have been the mainstay of optical lithography for

more than two decades. Many materials are available with the correct refractive index, transmission, and other optical and mechanical properties, so materials were not a limitation in these lens designs. At deep-UV wavelengths such as 248 and 193 nm, however, most conventional optical glasses and coating materials are far too absorbing for use in lenses. Fused-silica has become the standard for these applications. Current materials and material manufacturing methods simply cannot achieve the performance required if lithography tools are to produce devices with features smaller than 0.25 µm. Short-wavelength photolithography will increasingly depend on high-precision reflective aspheric components produced on stable fused-silica substrates. Among the many materials challenges at these shorter wavelengths are reducing absorption, increasing purity, and improving uniformity.

To yield a satisfactory lens, a glass must have almost perfect transmission. Photolithography lenses for operation at 248 nm or less need an optical path of a meter or more and must transmit at least 99% of the light; otherwise lens heating and defect generation become limiting factors. For 193-nm applications, inorganic materials such as CaF2, MgF2, and mixed-ion glasses are being studied, but these glasses are hydroscopic and difficult to polish because of their crystal structure.

Almost any impurity in a fused-silica structure will alter some property of the glass in an undesirable way. For example, most metals (including iron, sodium, cobalt, manganese, and magnesium) result in the generation of "color centers" after exposure to ultraviolet light. These color centers reduce the transmission of light and result in additional energy being absorbed in the bulk glass of the lens. Impurity levels must be kept at least below one part per billion and much lower than this for some elements, particularly iron and cobalt.

The refractive index and dispersion of the material drive the performance of the finished lens and must be uniform across the entire blank used to fabricate a lens element. This uniformity must be better than 10-7! Other optical properties, such as polarizability and reflectivity, must be similarly uniform.

Challenges for Next-Generation Photolithography Equipment

Photolithography lenses operate at the diffraction limit. That is, the resolution achieved is equal to or exceeds the wavelength of the light used for imaging. To achieve such astonishing performance the lens must be fabricated and assembled to near-perfect tolerances. Important manufacturing issues for future systems include image and tolerance modeling, surface figure, surface finish, metrology, asphere production, mounting, and production of short-wavelength sources.

The design of these complex systems will require massive computer simulations that exceed current capabilities. Models must be accurate

and robust. They must also be extremely fast since they will be used not only to design lenses but also to guide and control their manufacture.

Once the computer model tells the manufacturer the correct surface figure ("prescription") of each element, the glass must be ground and polished to the correct geometric shape, with an accuracy and precision of less than 1 nm. This precision is required even in elements that are often more than 20 cm in diameter and several centimeters thick! Removing or depositing material to such precision exceeds the capability of currently known methods.

Total reflectivity (summed over all surfaces) will have to be no more than 1 or 2%. Mechanical polishing will no longer be adequate to achieve this level of surface perfection, and plasma etching and ion milling techniques will be required. These techniques have not yet been developed to a degree that allows economical lens manufacture.

Metrology may be the single most difficult task. Material properties, lens figure, and surface finish must be measurable to at least 10 times better than the specification. Among the properties that must be measured are the following:

-

Refractive index to better than 10-7 in all three dimensions;

-

Phase interferometry of the projected wavefronts to better than λ/80 for both single elements and assembled lenses;

-

Surface finish to better than 0.1 nm over the entire lens surface, possibly using atomic force microscopy (AFM);

-

Glass purity and transmission; and

-

Glass damage characteristics at the operating wavelength under long-term, high-dose conditions.

Some aspheric components will be required to minimize on- and off-axis aberrations and reduce the number of elements in the assembled lens. Aspherics are essential to the fabrication of the reflective lithographic lenses that will be required for next-generation systems operating at the 13-nm wavelength. Technology remains to be developed to produce these aspheres economically. The development of fabrication technology will require support from both equipment manufacturers and equipment users.

Wavelengths in the 13-nm region will likely be used to produce features smaller than 0.1 µm, and reliable new short-wavelength sources will be needed. Excimer lasers, high average power laser-plasma drivers, and synchrotron radiation sources are being developed. Leading the development and production of such sources will be a major opportunity for the U.S. optics industry.

Case Study: Optics for the National Ignition Facility

Government programs are another major customer for high-value specialty optics. A prominent example is the National Ignition Facility

(NIF) at DOE's Lawrence Livermore National Laboratory (LLNL). The NIF is a 192-beam laser at 351 nm, capable of focusing 1.8 MJ of energy onto a target. (The goals and technology of the NIF are discussed in more detail in Chapter 3). About 8,500 meter-class optical elements will be required, with production at a peak rate of about 2,500 elements per year between 1999 and 2002. The combination of tight specifications, high production rates, and low-cost goals is a significant manufacturing challenge.

Construction of the NIF will have a major impact on the entire U.S. optics industry. From development through production, approximately $200 million will be spent on optical components for the program. This is a significant fraction of the total U.S. market for large optical components, which is currently between $350 million and $700 million per year. Industry can meet the technical specifications, but the planned production schedule will be a challenge. Furthermore, in some areas such as laser glass, current manufacturing technology cannot meet NIF's cost goals.

A development program is in progress to improve industry's ability to meet these cost and schedule requirements. Some of the manufacturing technologies being developed include continuous melting for phosphate laser glass, high-speed polishing and deterministic figuring, rapid growth of large potassium dihydrogen phosphate (KDP) and deuterated potassium dihydrogen phosphate (KD*P) crystal boules, improved process design and control for mirror and polarizer coatings, meniscus coating technology for gratings and sol-gel multilayer mirrors, and improved process control and optimized boule geometry for low-cost fused-silica. International Organization for Standardization (ISO) 10110 standards will be used for optics drawings. Metrology is a key concern, including 24-inch-diameter phase-shifting interferometry and characterization of mid-spatial-frequency errors by measurements of power spectral density.

As well as substantially reducing the cost of the NIF program, this development program will help the U.S. optics industry compete in the construction of large inertial-fusion lasers being considered in France, Japan, and Britain. The technology developed will also find a variety of other applications:

-

Laser glass melting and forming technology can be applied to making a variety of UV- and IR-transmitting glasses for applications in ozone detection, laser surgery, and medical spectroscopy.

-

Technology for the rapid growth of KDP and KD*P crystals can be adapted to improve the growth of other important crystals for applications such as frequency conversion and detectors for high-energy physics.

-

Improved coating capabilities will be applicable to expanding markets such as computer displays and medical instruments. Meniscus coating technology already developed is being used to manufacture high-efficiency gratings for high-power lasers.

-

Technology created to reduce the cost of transmitting fused-silica optical components for NIF will be applicable to the next generation of photolithography equipment.

Because of their size and technical sophistication, government programs such as NIF can have a major impact on the development of optics manufacturing, even though they do not themselves lead directly to large commercial markets.

Key Technical Challenges

Among the major challenges in the design and fabrication of low-volume optical components are the following:

-

The cost-effective manufacture of general aspherics and conformal components and their use in a wide variety of instruments and devices;

-

Deep-UV optics for microlithography to permit the continued reduction in feature size and enlargement of chip area that will take the semiconductor chip industry through several more cycles of economy and speed; and

-

Low-cost, low-volume, surge-capable optical manufacturing, which is essential to maintain efficiency and support the continued development of military optical systems.

High-Volume Manufacturing of Optics

The high-volume mass production portion of the optics industry uses manufacturing methods quite different from those discussed above and faces its own technical and structural challenges. In some cases, there can be a natural progression from low-volume specialty capabilities to high-volume manufacturing of similar items. For example, it may be possible to produce glass lenses in bulk using computer-controlled deterministic grinding and polishing machines. In other cases such as optoelectronic components, mass markets require quite different manufacturing techniques. Often these techniques are closely related to those used in the electronics industry, with which the optics industry is becoming increasingly integrated in both markets and manufacturing methods.

Although high-volume optical components tend to generate low profit margins, the ability to manufacture an essential component may be key to maintaining a strong position in the profitable systems markets that the component enables. For example, a diode laser is quite inexpensive but

is a key component in CD players and laser printers. The enabling character of optics is a theme found throughout this report.

The current U.S. strength in manufacturing molded glass and plastic image-forming components will probably continue, but prospects are doubtful for new ventures into mass production. There is currently little effort in the U.S. optics industry to develop mass production of integrated electrooptical systems with both active and passive components, although U.S. leadership in this area is a desirable goal. It is possible that investment in manufacturing techniques by DOD may help jumpstart the industry's efforts to enter high-volume markets.

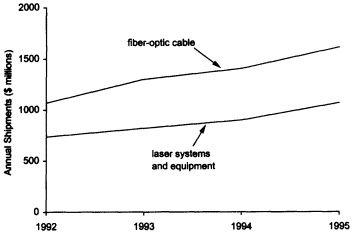

A key high-volume user of optical technology is the telecommunications industry. The revolution in communications technology has been enabled by advances in optical materials: materials for optical fibers for the transmission medium and compound semiconductor materials for optical sources and detectors. (See Box 6.1.) Serious development of both technologies began in the late 1960s and early 1970s. The advent of the erbium-doped optical amplifier in the late 1980s revolutionized systems design by eliminating the need to regenerate signals electronically every few tens of kilometers to compensate for attenuation by the optical fiber. Even more importantly, the optical amplifier made WDM practical for the first time, by making it possible to route individual wavelengths separately in a point-to-multipoint

|

BOX 6.1 THE IMPORTANCE OF MATERIALS SCIENCE AND ENGINEERING IN OPTICS MANUFACTURING Materials production and materials processing are essential enabling elements in the manufacture of optical devices and systems. Efficient materials preparation techniques are the foundation for cost-effective production of optically pumped lasers, nonlinear optical modulators, and harmonic generators. The epitaxial deposition of single-crystal structures for III-V semiconductor lasers is a triumph of materials control and finesse; further improvements in the understanding and control of materials processing could increase yields for semiconductor lasers as much as tenfold. Optical communications relies on controlled vapor deposition of fibers with better than part-per-billion purity, controlled composition, and controlled profile. Materials processing breakthroughs were key to the reduction of light losses in optical fibers. A landmark realization was that gas-phase oxidation of silicon tetrachloride (highly pure and readily available because it is used in the silicon semiconductor industry) could—under appropriate conditions of dopant and apparatus geometry, gas flow rates, and so on—produce high-purity, low-optical-loss dowel "preforms" from which fibers could be drawn. Additional materials challenges involved the invention and implementation of fiber drawing and coating processes capable of producing many kilometers of fiber with strength exceeding that of steel. Higher fiber draw speeds will require increased understanding of coating dynamics. |

communications network. These new systems designs created a demand for new low-cost photonic components for multiplexing, filtering, routing, and monitoring. Further advances in optical telecommunications will depend on continued cost reduction and increased functionality and integration. Such advances will require the introduction of high-volume manufacturing technology that incorporates automated production lines and on-line process controls.

Optical Fiber, Fiber Devices, and Waveguides

In 1996, the world market for optical fiber was about 2 x 1010 meters and increasing at about 15% per year. Fiber is currently being installed at close to 1,000 miles per hour! The deregulation of telecommunications in the United States and elsewhere has increased fiber demand such that the current world supply is insufficient.

The U.S. industry has been a leader in fiber manufacturing from the beginning, and it continues to be so. Japan and Europe are also major players.

Silica Optical Fiber

The technology for manufacturing optical fiber is now a relatively mature three-stage process: preform fabrication, fiber draw, and cabling. At each stage the speed of fabrication is critical, because throughput is what ultimately determines cost. Other critical issues are uniformity in geometry and composition, high purity in the fiber core, and uniform application of the polymer coating that protects the fiber surface. All of these properties continue to improve, and optical fiber is currently the most reliable and reproducible component of all photonic technology.

The cost of silica fiber has fallen below that of copper wire, and continued cost reduction can be anticipated. The transparency of the glass used is now close to the theoretical limit, so further improvements in fiber technology will mostly be in the areas of fiber design and cable technology for specific applications. One potential concern is the limited world supply of germanium, which is used to increase the refractive index of the fiber core. Germanium prices have soared in recent years.

Nonsilica Optical Fiber

For certain applications, plastic optical fiber can reduce overall systems costs by permitting the use of low-cost molded plastic connectors. Plastic has considerably higher attenuation than silica, however, so plastic fiber is practical only for short-distance uses such as on-premises distribution and applications in cars and airplanes. Until recently, high losses in the near-infrared prohibited applications in this spectral region, but a recent breakthrough with perfluorinated plastic fiber should now permit applications in the telecommunications window

from 1.3 to 1.55 µm. A great deal of development is still needed, on both materials and draw technology, to make low-cost manufacturing of plastic fiber feasible.

Fluoride fibers have also been studied as an alternative to silica. Because the optical transparency of silica fiber is limited by Rayleigh scattering from fluctuations in composition, researchers have searched for alternate materials having lower fundamental loss. Although fluoride-based fibers have exhibited lower scattering losses than silica, the technology to achieve lower absorption loss has not been developed. With the advent of optical amplifiers there is little incentive to continue the development of ultralow-loss fibers for telecommunications, especially since taking full advantage of fluoride fiber's potential would mean operating at longer wavelengths where other components are not as mature. Thus, the principal application of fluoride fibers will be for optical power transmission for medical and sensor applications beyond 2 µm.

Fiber Devices

Early devices fabricated by the controlled fusion of fibers, such as splitters and couplers, offered limited functionality as purely passive devices; introduction of the erbium-doped fiber amplifier began an entirely new class of devices. High-power fiber lasers, Raman amplifiers, dispersion compensators, and fiber-grating filters and reflectors are now reaching the commercial marketplace. Such devices will be integral parts of broadband telecommunications networks as well as non-telecommunications applications such as optical sensing, optical gyroscopes, automobile collision avoidance, and medical applications. These markets will exceed $100 million by the year 2000.

All these devices draw on the technology already in place for manufacturing transmission fiber, but device applications require additional understanding of dopant properties and the optimized design of geometries and dopant concentrations for specific applications. Key technical goals for fiber amplifiers are high- power output, high-efficiency, and flat gain over a broad spectral region.

The principal manufacturing challenges in meeting these goals for fiber devices are making doping more reproducible and reducing cost. Specialized splicing techniques are often needed to connect these specialty fibers to transmission fiber, but there are few major obstacles to achieving all of these goals as the markets develop.

Planar Waveguide Devices

Two waveguide technologies are currently in use: lithium niobate-based devices for the integration of electrooptic devices such as switches and modulators, and silica-on-silicon devices for the integration of passive waveguides. Both of these technologies are based on the formation of planar lightguiding films by diffusion or deposition, followed

by the definition of the waveguiding structures by photolithography. Manufacturing technologies are now quite well developed; lithium niobate modulators are in commercial use for cable television and highend communications systems, and planar silica waveguides are being used commercially in telecommunications as splitters, combiners, and WDM routers. As the need for functionality increases, more photonic devices will be integrated into monolithic structures to avoid complex assembly of discrete photonic devices.

There are several challenges for the low-cost manufacture of these devices. First, because they are planar, connecting them to fiber transmission lines is complex. Demanding alignment tolerances have until now required active alignment of individual fibers or fiber ribbons. Passive alignment techniques are under development. It is important for most applications that the waveguides be polarization independent, which further complicates the design of two-dimensional structures.

A more serious issue is the small size of the current market. Since discrete devices satisfy most current needs, the volume demand for integrated devices remains low and the sizable capital investment required keeps costs high. Japanese manufacturers have been steadfast in their commitment to integration, in the expectation that as the technology matures, higher levels of integration will eventually reduce costs. In contrast, investment in the United States remains small.

Semiconductor-Based Optoelectronic Components

The semiconductor-based optoelectronic components market, excluding flat-panel displays, generated nearly $6 billion in revenue in 1995. Over the next decade, growth to $20 billion is anticipated. This growth is linked to the increasing demands of the global information infrastructure, which it will support and enable. The major manufacturing challenges in this area include the following:

-

Reducing the cost of high-volume chip manufacturing, automated chip handling, measurement, testing, and package assembly;

-

Developing CAD tools for photonic devices and packaging, like those used in the silicon industry, to reduce design cycles and cost—this is becoming increasingly important as integration begins to place more functionality on each chip;

-

Improving laser performance (including linearity, speed, and tunability), laser arrays, low-cost packages, and higher-power lasers;

-

Developing practical green, blue, and ultraviolet lasers; and

-

Developing high-performance, low-cost imaging arrays.

For all photonic components, performance is critically dependent on materials quality, composition, and control (see Box 6.2).

|

BOX 6.2 PHOTONIC MATERIALS The performance of all photonic components is critically dependent on the quality, composition, and dimensional control of the materials used in their manufacture. For Instance, threading dislocations in the substrate wafer of a semiconductor device can propagate through the epitaxial film growth and adversely affect the yield of devices. Extremely small variations of epitaxial layer thickness can adversely affect the wavelength of operation of multilayer semiconductor structures. Every stage of crystal growth, materials processing, and device fabrication requires stringent control of defects, interfaces, and layer deposition rates and a precise knowledge of the interrelationships among material quality, process parameters, and device performance. Considerable progress has been made in recent years in improving the defect density of commercially important substrate crystals such as gallium arsenide, indium phosphide, and lithium niobate. For today's generation of small-area discrete devices, substrate quality is not typically a major limitation on device yield or performance. As materials processing improves and the integration of multiple photonic components on a chip becomes standard, however, continuous improvements will be required in substrate material quality. In the meantime, materials processing does remain the major limitation on the wafer yield of complex photonic devices, and improvement in all aspects of process control and equipment design will be essential in achieving the high yield and low cost required to make extensive photonic integration viable. For II-VI semiconductors, considerable improvements in crystal growth are required, since these materials do not yet enjoy the level of materials quality that is found in silicon. The growth of wide-bandgap semiconductors for blue lasers still requires a great deal of research on all aspects of materials growth and processing. An issue of concern is the declining talent in the United States in the area of bulk crystal growth. For many years, there have been few university centers that train new students in this area; most of the current university focus is on epitaxial growth. As a result, in the next decade there will be a shortage of talent in this important discipline. Some of the most impressive new nonlinear optical materials for the next generation of devices are being developed in China, which has nurtured expertise in bulk growth. |

Components for Long-Distance Transmission Systems

Long-distance telecommunications is dominated by optical fiber transmission systems that use high-performance 1.3- or 1.55-µm laser transmitters and p-i-n field-effect transistor (PIN/FET) receivers. (See Chapter 1 for details.) Many challenges remain to be overcome in manufacturing these components. The low-distortion requirements of analog cable-television systems place stringent demands on the linearity of lasers; the dominant factors in the price of these lasers are yield, packaging, and measurement and testing. Wavelength-division multiplexing systems require such stringent wavelength control that laser tunability or at least wavelength programmability will become necessary, but no broadly tunable communications lasers are yet

commercially available. Full WDM functionality will require optical cross-connects and optical frequency converters, devices that are still in their infancy with no commercial suppliers. Meeting the demands of fiber to the home will require very inexpensive bidirectional transceivers; increased automation of chip fabrication, handling, testing, and assembly; and alignment tolerances better than about 1 µm.

Data Communications Links

The demand for optical data communications (datacom) links has grown rapidly over the last few years. Most such links are low-cost, multimode systems based on large-diameter plastic (1-mm) or glass (0.2-mm) fiber. Their low cost is attributable largely to the low cost of connectorizing such fibers and the undemanding alignment tolerance of the photonic components. As datacom transmission rates and communication spans increase, single-mode systems incorporating laser or detector arrays are becoming desirable. Vertical cavity lasers (VCSELs) are attractive for such applications. At present, however, 1.3-µm VCSELs are hard to fabricate with high mirror reflectivity.

Through-the-Air Infrared Links

Through-the-air links are becoming ubiquitous in portable products. Links that operate at 115 kilobits per second (kb/s) are already used to download files from handheld calculators and printers. In 1995, a standard of 4 megabits per second (Mb/s) was agreed on, and the rate is expected to reach 65 Mb/s soon. At 4 Mb/s the requirement for the gallium aluminum arsenide (GaAlAs) light-emitting diodes (LEDs) can barely be met; high-power VCSEL arrays are the likely alternative. The challenge will be to develop VCSEL arrays in the 0.2- to 0.5-W range for a cost less than $2 per unit.

Semiconductor Lasers

The cost of GaAlAs lasers is dropping to $100 per watt in the 800-to 900-nm wavelength range, with a conversion efficiency of 25 to 40%. At 650 to 690 nm, the conversion efficiency is 20 to 25%. A recent advance in the cladding-pumped fiber laser is the enormous (approximately a thousandfold) brightness conversion of GaAlAs laser arrays in an optical fiber. Single-mode lasers have been fabricated that emit several watts. As power continues to increase, such lasers may be able to replace traditional gas and solid-state lasers in medical and industrial applications.

In CD players and CD-ROM applications, 780-nm GaAlAs lasers dominate. Increased storage density requires shorter wavelengths in the green and blue. Prototype ZnSe lasers have been demonstrated, but their lifetime is only a few hours. The GalnN system looks promising, but no prototype lasers have yet been demonstrated. As the brightness

of GaAlAs lasers increases, up-conversion to blue wavelengths may become practical.

Visible LEDs

Visible LEDs account for the largest segment of the indicators and display portion of the optoelectronic components industry. The challenges for future growth are threefold: higher efficiency, expanding the green and blue range, and lower cost per lumen. Visible emitters have considerably lower internal quantum efficiency (10 to 40%) than do IR emitters (approximately 100%). A better understanding of internal loss is key to progress.

The recent breakthrough in blue and green LEDs based on GalnN on a sapphire substrate, which has 3% external quantum efficiency, suggests that the entire visible spectrum may soon be covered by LEDs. The manufacturing challenge is formidable, however. The development of cost-effective, lattice-matched substrates (SiC, GaN, or AlN) may be required to improve performance.

Imaging Arrays

Imaging arrays are dominated by charge-coupled device (CCD) technology. On the high-end, 2000 x 2000 pixel arrays are used in low-volume civilian and military applications that cost $4,000 to $40,000 per array. At the low-end, video cameras with 300 to 400 lines sell for $35. The major challenge is to develop high-performance arrays with photographic resolution, since that would revolutionize amateur photography.

A recent challenge to CCDs, based on complementary metal oxide semiconductor (CMOS) technology, includes electronic circuitry integrated with the array that can greatly enhance imaging functionality. CMOS arrays can be manufactured on conventional production lines.

Laser and Waveguide Packaging

The history of laser and optical waveguide packaging has largely been one of adapting methods from electronics packaging (a much larger industry) to meet the needs of fragile and incompliant photonic devices. The most troublesome issue has no counterpoint in electronics, however. The issue is coupling an external optical fiber connection to an optical waveguide with submicron tolerances. Elaborate schemes for fiber attachment have gradually been replaced by simplified designs that use a few high-precision mass-produced parts, usually fabricated by photolithography. Market leadership in this area is determined largely by manufacturing improvements that reduce costs; the U.S. industry currently lags behind Japan.

The ideal package is easily assembled from inexpensive parts, provides a secure thermal and chemical environment for the device,

maintains appropriately stable optical and electrical connections, dissipates heat and various overstresses, and conforms to applicable standards. The design issues involved in meeting these goals fall into four categories: (1) optical design, including coupling, mode matching, minimization of reflections, polarization management, connectorization, and stability to submicron tolerances; (2) physical design, including support of the fragile photonic chip materials, stress, ease of assembly, and standards; (3) electrical design, including electrostatic discharge protection, radio-frequency (RF) supply, and power; and (4) environmental design, including heat dissipation and hermeticity.

Although packaging costs contribute at least half of the cost of final assembly, investment in packaging remains relatively small compared to investment in chip fabrication. Packaging R&D is relatively unglamorous, yet increased investment here has become essential for photonics component manufacturing. More attention to passive fiber attachment and low-cost packaging of high-end components, together with improved yield and automated device testing, are essential components of cost reduction and the ubiquitous use of photonic components. Only a few universities have attempted programs that emphasize packaging; in part because the technology changes so rapidly, skills in this area are typically acquired in the manufacturing environment.

At present, essentially all photonic components are discrete devices in individual packages. In this respect, photonics is in its infancy, much as silicon electronics was four decades ago. Improvements in yield and reductions in cost will bring increased integration. This trend has already begun. For example, the recently introduced integrated electroabsorption-modulated laser contains both a distributed-feedback laser and an external modulator, monolithically integrated on a single InP substrate. Similarly, optical transceiver packages based on silicon optical bench technology are now integrating lasers, WDM splitters, and detectors on a silicon platform. This hybrid integration within the package simplifies assembly and packaging.

Many of the challenges for photonics integration are closely related to those of silicon electronics. Because different photonic components are often based on different materials systems, integration relies on advanced photolithography methods. As in electronics, techniques to increase the level of integration and reduce device size typically exacerbate the interconnection problem; breakthrough technologies for interconnect design will be necessary to realize integration's full potential. Because photonic components are some three orders of magnitude larger than silicon transistors, however, photonic integration will not be done on the same scale as electronics.

Trends in telecommunications, especially the move toward WDM, will increase the demand for integration. As the use of optical amplifiers

based on erbium-doped fiber increases, so does the importance of other photonic components, including splitters and combiners, multiplexers, attenuator filters, dispersion compensators, and fiber lasers for amplifier pumps. These fiber devices are readily packaged in either capillaries or fiber reels and can be spliced directly into the fiber transmission line, but as waveguide packaging and integration advance, many of them will be integrated directly into the waveguide to reduce size and interconnection costs. In the long term, optical multichip modules will further simplify interconnection and integration with silicon electronics. Surface-emitting laser technology simplifies the packaging and testing of components, and successful commercialization of InP- or GaN-based VCSELs in addition to GaAs-based devices will radically change laser and optical waveguide packaging and interconnection. Indeed, the next generation of lasers will incorporate features to simplify packaging and interconnection into the semiconductor chip design itself.

Key Technical Challenges

Among the major challenges in the design and fabrication of high-volume optical components are the following:

-

Integrated design, fabrication, test, and assembly methods, including active optical components, which will permit the smooth advance of the hybrid optical devices of today into the fully integrated optical systems required for miniaturization and high-performance in future products; and

-

Development of an optical foundry for active and passive optical components, similar to the foundries of the silicon world, which will permit a new generation of integrated optoelectronic and optomechanical systems in the future.

Crosscutting Issues

There are some issues that cut across the diversity of optics manufacturing, including both the low-volume specialized applications and the high-volume mass markets. This section discusses two technical issues of this type, optical design and the role of metrology, and two structural concerns, the question of standards and the difficulty of identifying and characterizing the ''optics industry."

Optical Design and the Impact of Increased Computer Power

The development of effective and comprehensive optical design programs that are capable of handling a wide variety of optical components is a success story of the U.S. optics industry. These programs have

become world standards for use in the development of new optical systems and devices and have contributed to U.S. leadership in developing innovative optical systems. The programs are remarkably capable with passive optical components, although there is as yet little integration of active optical components into the design process. The dramatic increase in computing speed and the simultaneous dramatic fall in computing cost have greatly influenced the optical design process.

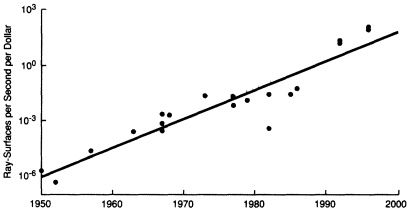

For several decades, software based on exact ray tracing has been the primary tool of the optical design engineer. The performance of such software is determined by how fast the computer can trace the path of light rays through the system being analyzed. Speed is measured in ray-surfaces per second (i.e., the number of refractions or reflections of a ray at a surface computed per second). As shown in Figure 6.3, from the 1950s through the 1980s, optical design required large mainframe computers that cost millions of dollars and could trace no more than about 10,000 ray-surfaces per second. Today, desktop computers that cost only a few thousand dollars can trace 300,000 ray-surfaces per second. There have been at least four major ramifications of this revolution in speed and cost: freedom from mainframes, wider access to design capabilities, full analysis of designs, and global optimization.

First, because optical designers are no longer tied to mainframe computers, they are no longer tied to the owners of those computers, typically large companies or other large organizations. Today, small firms and even individual consultants have access to full-featured optical design systems.

A second and related result is that many engineers with little or no formal training or experience in optical design can now afford the capability to design their own optical systems. Paradoxically, many optical component manufacturers cite this trend as a major problem. Manufacturers are often presented with designs that have not been fully

FIGURE 6.3 There has been a dramatic revolution in both the speed of ray tracing and the capital cost of the computers required. (note the logarithmic scale).

evaluated for tolerances, so they do not work when assembled or are impossible to build. There are less than a thousand expert optical design engineers in the United States, but many more people have access to design software. Experience plays a significant role in this field; it takes about 3 to 5 years of full-time effort for a competent designer to become comfortable with a wide range of applications.