2

Multinational Corporations and the Changing Global Environment

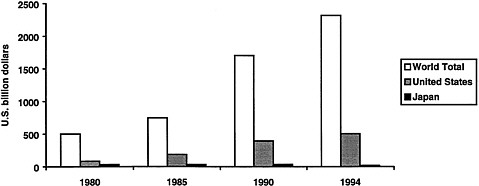

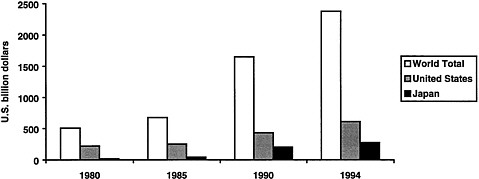

In addition to having the world's two largest economies, the United States and Japan also are among the leading “home countries,” or sources, of foreign direct investment (FDI) (see Figure 2-1 and Figure 2-2 and Table 2-1 ). 1 FDI is the mechanism used by MNCs to establish and maintain operations in the host countries where they invest and do business. 2 FDI and MNCs are central to the U.S.-Japan economic relationship. For example, “both U.S. subsidiaries in Japan and Japanese subsidiaries in the United States now report foreign sales that greatly exceed the total value of bilateral trade shipped between these two advanced economies.” 3 MNCs also play a significant role in technology development and the larger domestic economies of the two countries. Therefore, the future roles and functions of MNCs in world economic development, including their rights vis-à-vis national governments and their responsibilities toward home and host countries, are important issues for policy makers and private sector leaders in both Japan and the United States.

This chapter will set the context for considering U.S.-Japan MNC relationships by identifying the key global issues and trends that will impact international business activities in the coming years. The historical background of how FDI and MNCs have influenced the economic and technological development of the United States and Japan, and their economic relationship, is covered in Chapter 3 . Chapter 4 describes current trends and future issues in U.S.-Japan MNC relationships. Chapter 5 discusses the policy and business challenges raised by

FIGURE 2-1 Inward foreign direct investment stock. SOURCE: United Nations Conference on Trade and Development, World Investment Report 1995.NOTE: Amounts for 1994 are estimated.

the growth in global business and describes a framework for future activities aimed at reaching a shared understanding of the rights and responsibilities of MNCs in an age of technological interdependence.

FIGURE 2-2 Outward foreign direct investment stock. SOURCE: United Nations Conference on Trade and Development, World Investment Report 1995.NOTE: Amounts for 1994 are estimated.

OPPORTUNITIES

-

Global political, economic, and technological trends promise opportunities for growth in international business on a scale that is, perhaps, unprecedented.

The end of the Cold War, the dynamism of East Asia, and the emergence of new market economies means an improving political economy for global business. The dissolution of the Soviet Union and the end of the Cold War are, of course, geopolitical developments of profound importance. Although experts differ on the ultimate direction of political and economic changes, there is reason to hope that the relaxation of Cold War tensions will contribute to a more positive international environment for investment and long-term economic growth.

Even before the collapse of communism in Eastern and Central Europe, the trend of nations around the world has been toward market-oriented economic policies. The market-oriented East Asian economies have set the pace over the past several decades and, despite current difficulties, it is likely that economic growth will continue in the Asia Pacific region. China's economic growth has been conspicuous recently, but reforms have been implemented in India and a number of Latin American nations as well. As illustrated by the economic upheavals in Mexico in 1994 and 1995, transition to more open market systems continues to raise its own challenges for individual countries and international institutions. Progress is likely to be uneven, as explained in more detail below. Still, the overall trend remains powerful: emerging market economies in Europe, Asia, Latin America, and Africa have strong incentives to seek greater integration into the world economy.

TABLE 2-1 Leading Japanese and U.S. Multinational Corporations Ranked by Foreign Assets, 1993

|

Assets (billion dollars) |

Sales (billion dollars) |

Employment (thousands) |

||||||

|

Company |

Industry a |

World Rank |

Foreign |

Total |

Foreign |

Total |

Foreign |

Total |

|

Japan |

||||||||

|

Toyota |

Motor vehicles and parts |

6 |

97.6 |

41.1 |

94.6 |

23.8 |

110.5 |

|

|

Hitachi |

Electronics |

8 |

86.7 |

16.5 |

71.8 |

330.6 |

||

|

Sony |

Electronics |

9 |

41.5 |

26.3 |

36.3 |

70.0 |

130.0 |

|

|

Mitsubishi |

Trading |

10 |

85.2 |

65.3 |

168.4 |

157.9 |

||

|

Nissan Motor |

Motor vehicles and parts |

13 |

68.3 |

24.2 |

56.5 |

34.4 |

143.9 |

|

|

Matsushita Electric |

Electronics |

14 |

22.5 |

77.2 |

31.7 |

64.3 |

98.6 |

254.0 |

|

Mitsui |

Trading |

22 |

72.5 |

49.8 |

172.9 |

11.5 |

||

|

Nissho Iwai |

Trading |

28 |

45.6 |

36.6 |

100.0 |

2.0 |

7.2 |

|

|

Sumitomo |

Trading |

32 |

51.4 |

47.2 |

162.4 |

2.5 |

9.2 |

|

|

Itochu |

Trading |

37 |

11.5 |

61.4 |

43.0 |

165.8 |

3.3 |

7.5 |

|

Marubeni |

Trading |

43 |

10.4 |

68.5 |

36.2 |

151.4 |

2.8 |

10.0 |

|

Toshiba |

Electronics |

45 |

47.8 |

12.6 |

41.6 |

23.2 |

175.0 |

|

|

Honda |

Motor vehicles and parts |

48 |

9.9 |

28.3 |

25.0 |

37.5 |

3.6 |

91.3 |

|

Sharp |

Electronics |

50 |

19.9 |

7.3 |

14.6 |

29.0 |

42.8 |

|

|

Fujitsu |

Electronics |

51 |

9.1 |

35.0 |

7.9 |

30.6 |

65.0 |

163.0 |

|

Nippon Steel |

Metals |

55 |

42.3 |

5.0 |

26.8 |

15.0 |

50.4 |

|

|

NEC |

Electronics |

67 |

6.6 |

39.6 |

8.5 |

35.1 |

15.2 |

147.9 |

|

Bridgestone |

Rubber and plastics |

71 |

15.6 |

7.1 |

14.3 |

52.0 |

83.1 |

|

|

Sanyo |

Electronics |

74 |

21.9 |

7.2 |

16.6 |

8.1 |

58.4 |

|

|

Canon |

Computers |

76 |

19.3 |

11.3 |

16.4 |

27.8 |

64.5 |

|

|

Kobe Steel |

Metals |

99 |

23.3 |

2.2 |

12.1 |

3.5 |

20.2 |

|

|

United States |

||||||||

|

Exxon |

Petroleum refining |

2 |

47.4 |

84.1 |

87.7 |

111.2 |

57.0 |

91.0 |

|

IBM |

Computers |

3 |

44.1 |

81.1 |

37.0 |

64.1 |

130.6 |

256.2 |

|

General Motors |

Motor vehicles and parts |

4 |

36.9 |

167.4 |

28.6 |

133.6 |

272.0 |

750.0 |

|

General Electric |

Electronics |

5 |

31.6 |

251.5 |

11.2 |

60.5 |

59.0 |

222.0 |

|

Ford |

Motor vehicles and parts |

7 |

30.9 |

198.9 |

36.0 |

108.5 |

180.9 |

332.7 |

|

Mobil |

Petroleum refining |

12 |

23.1 |

40.7 |

42.5 |

63.5 |

28.6 |

61.9 |

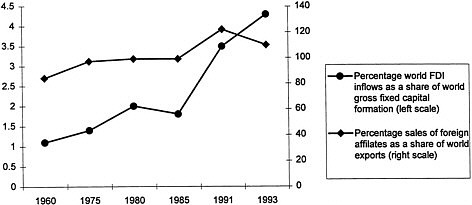

The role of MNCs in integrating production, transferring technology, and allocating resources will grow along with the global economy. Sales of overseas subsidiaries of MNCs already exceed the volume of world exports ( Figure 2-3 , FDI stock versus fixed capital, affiliate sales versus exports) and are increasing more rapidly. Although MNCs based in the United States, Japan, and Europe likely will remain in the forefront, MNCs based in the newly industrialized economies (NIEs), such as South Korea and Taiwan, the Association of Southeast Asian Nations (ASEAN), and other emerging economies, will play an increasingly prominent role, particularly within their own regions.

FIGURE 2-3 The role of foreign direct investment in world economic activity. SOURCE: United Nations Conference on Trade and Development.

The policy environment for FDI continues to improve around the world. Paralleling the global trend toward market economies and liberalized trade, greater openness toward foreign direct investment, particularly among developing countries, has been a key trend of the 1980s and 1990s. For example, in 1993 developing countries attracted an estimated $80 billion in FDI, which represents a record and is double the 1991 total. 4 This contrasts sharply with the situation of several decades ago, when MNCs more likely were seen as serious problems for national sovereignty. A number of developing countries pursued nationalization of some MNC operations, particularly in natural resource-related industries. As discussed below, tensions between MNCs and host governments will not disappear quickly in this new era and likely will become more complex as economic integration deepens. Still, suspicion and hostility toward MNCs on the part of host country governments are much more rare today.

Another important aspect of the trend toward policy liberalization is the recent completion of several multilateral agreements relevant to FDI issues, such as the Uruguay Round of the General Agreement on Tariffs and Trade (GATT), the North American Free Trade Agreement (NAFTA), and the Single European Market. 5 Although no broad multilateral framework governing FDI currently exists, these agreements have positive implications for freer trade and investment flows. 6

Technological changes will allow greater efficiencies and synergies in MNC management and operations.Throughout the history of international trade and business, and particularly over the past century, technological advances have enabled the efficient management of business organizations and activities of increasing complexity and geographical dispersion. During the 1950s, a period when many U.S.-based companies “went multinational,” MNCs took advantage of faster air travel and the spread of telecommunications technologies. At that time many manufacturing MNCs established international divisions to manage their overseas affiliates. Beginning in the 1960s, some MNCs moved toward a structure of global, multifunctional product divisions to better achieve manufacturing economies and marketing efficiencies on a worldwide scale.7

The rapid advances in information technologies occurring today enable further advances toward more efficient management structures, with some of the larger MNCs opting for integrated global operating divisions supported by regional, corporate-wide coordinating functions. Information technologies also make possible business and technological relationships between firms that are more flexible and responsive to market needs. In many cases international strategic alliances—which serve both as a substitute for and a complement to FDI, depending on the situation —allow companies to tap capabilities and reach markets around the world with a smaller international infrastructure than that traditionally required. Firms much smaller than traditional MNCs can achieve global reach and pursue a global business vision.

CHALLENGES

-

Despite the overall positive trends, national differences in government policies, economic institutions, and technological capabilities will persist, posing challenges to policy makers and business leaders.

Even as MNCs accelerate the trend toward integrated production systems, regional and national characteristics continue to cause frictions between systems. Despite the obvious benefits brought about by the end of the Cold War and other positive trends, movement toward a more integrated and liberalized world economic order continues to raise challenges. Some have predicted that economic conflicts among developed countries that were subsumed under the political imperatives of the Cold War will lead to more visible tension.8

Although formal barriers to trade and investment have fallen, particularly among developed countries, in some cases real reciprocal openness has not been achieved. In the United States and elsewhere, concerns about this lack of reciprocity have grown. For example, some have asked whether the United States should allow significant ownership of its high-technology industries by companies based in countries where U.S.-based firms are effectively blocked from owning significant high-technology assets. As a result of these and similar concerns, the focus of trade policy attention has moved to domestic practices and institutions that may differentially affect foreign and domestic companies. These include aspects of the legal system, financial structures, and systems for technology development and diffusion.

The discipline of the market is a two-edged sword. While promoting efficiency in the allocation of resources, the growing integration of the global economy can blunt or overwhelm efforts by national governments to control economic trends and outcomes. A good example is the setting of exchange rates under the floating-rate system. It is impossible for any government to significantly move the value of its currency against the judgment of the market in the short term,

and only sound fiscal and monetary policies can ensure a stable, sustainable exchange rate for the long term.

Naturally, since investment and trade barriers rooted in economic structures often are tightly linked to cultural values or domestic political arrangements, it is more difficult to eliminate them through international negotiations than the more obvious barriers of tariffs, quotas, and capital controls. But sharply different perspectives exist between nations and within the business and political leadership of individual countries over how national economic systems can be harmonized further to ensure long-term stability and mutual benefits. Some recent debate has revolved around the relative merits of various forms of capitalism, primarily comparing the Japanese and Anglo-American varieties.9 Since these issues are perhaps best illustrated by aspects of the U.S.-Japan relationship, they are examined in more detail in this report. Still, the problems and questions go beyond the U.S.-Japan bilateral relationship. The future shape and structure of the world economy will be influenced by how they are addressed in coming years.

Frictions between developed and developing countries also may take new forms as FDI linkages grow. Although most countries have moved toward more open policies regarding FDI in recent years, a wide variety of approaches remains. Among East Asian economies, for example, Hong Kong has followed an essentially noninterventionist policy toward FDI; Thailand and Malaysia have combined active industrial policies encouraging domestic firms with promotion of export-oriented FDI in selected industries; Singapore has encouraged FDI but has selectively intervened to encourage desirable technological activities and industrial upgrading by MNCs; and South Korea and Taiwan have followed the Japanese model, separating foreign technology from foreign capital through selective restrictions on FDI within the context of a broad industrial policy.10 All of these countries have experienced rapid growth, but the countries that have focused on acquiring foreign technology at arms length and diffusing it to targeted domestic industries—South Korea and Taiwan—have developed the most advanced technological capabilities. Emerging market economies, such as China and India, also appear to be taking different approaches to FDI. Governments' desire to maximize technology transfer and other benefits of FDI sometimes will conflict with the strategic imperatives of MNCs to maximize efficiencies and avoid creating future competitors.

THE IMPORTANCE OF EFFECTIVE U.S.-JAPAN LEADERSHIP FOR THE WORLD ECONOMY

-

It is critical for the world economy—and for the United States and Japan as the world's largest economies, techno-industrial powers, and direct investors —that progress continue toward more liberal trade and investment flow and toward stronger international institutions to support an increasingly integrated world economy.

The current framework of international institutions and agreements that undergirds the world economy was established in the early post World War II period through the active leadership of the United States. Over the years Japan and the other advanced democracies have increased their level of contribution and participation in these institutions. This report will explore in greater detail the areas in which the private and public sectors of the United States and Japan might focus their efforts to enhance the positive contributions of FDI and MNCs in the world economy, but it is important to note at this juncture that the United States and Japan—both at the official and corporate levels—will play a major role in defining the “rules of the game” for international

business in the twenty-first century. They can either play a positive role, through active leadership and collaboration, or a negative role, through failure to undertake this responsibility. It is useful to remember here that a significant degree of global economic integration was achieved in the pre World War I period. However, this progress proved fragile owing to the weakness of international institutions and individual country policies, and economic integration fell by the wayside during the next several decades of war and economic upheaval. Today's mainly positive environment for global business should not be taken for granted, particularly by the United States and Japan—the two countries with perhaps the greatest stake in maintainingand improving this environment.

NOTES AND REFERENCES

1 The 1993 gross domestic product (GDP) of the United States was $6.4 trillion, whereas Japan's GDP totaled $4.2 trillion. See Keizai Koho Center. 1994. Japan 1995: An International Comparison.Tokyo: Keizai Koho Center, p. 11. The U.S. outward stock of FDI was $539 billion in 1993, versus $264 billion for Japan. The United Kingdom, with a $247 billion outward FDI stock in 1993, was in third place. See United Nations Conference on Trade and Development. 1994. World Investment Report 1994.New York and Geneva: United Nations, p. 19.

2 Mechanisms for FDI include acquisition of existing businesses, minority stakes in existing businesses, “green field” establishment of new operations (including new joint ventures), and investments to expand existing operations. For overviews of FDI in the United States, see Graham, Edward and Paul Krugman. 1991. Foreign Direct Investment in the United States (second edition).Washington, D.C.: Institute for International Economics, and U.S. Department of Commerce. 1991. Foreign Direct Investment in the United States: Review and Analysis of Current Developments. Washington, D.C.: U.S. Government Printing Office.

3 Encarnation, Dennis J. 1992. Rivals Beyond Trade: America Versus Japan in Global Competition. Ithaca, N.Y.: Cornell University Press, p. 1.

4 United Nations, 1994, p. xix.

5 The Investment Experts Group of APEC developed a set of nonbinding investment principles that were endorsed at the Jakarta APEC Ministerial Meeting in 1994.

6 The OECD has established voluntary rules governing the practices of MNCs and government policies toward FDI. See OECD. 1992. The OECD Declaration and Decisions on International Investment and Multinational Enterprises: 1991 Review.Paris: OECD. In May 1995 the OECD Council committed the organization to developing a Multilateral Agreement on Investment (MAI) by 1997.

7 Humes, Samuel. 1993. Managing the Multinational: Confronting the Global-Local Dilemma. New York: Prentice-Hall, p. 24.

8 Bergsten, C. Fred, as quoted in Arrison, Thomas and Martha Caldwell Harris. 1992. Overview. p. 2 in Thomas Arrison, C. Fred Bergsten, Edward M. Graham, and Martha Caldwell Harris, eds. Japan's Growing Technological Capability: Implications for the U.S. Economy. Washington, D.C.: National Academy Press.

9 See Sakakibara, Eisuke. 1993. Beyond Capitalism: The Japanese Model of Market Economics. Lanham, Md.: The University Press of America and the Economic Strategy Institute.

10 United Nations, 1994, p. 72.