3

Foreign Direct Investment and the U.S.-Japan Economic and Technological Relationship

The U.S.-Japan economic and technological relationship is marked by dynamism and increasingly intense competition and cooperation. Nonetheless, patterns of interaction at the levels of the macroeconomy and individual corporate decisions reflect structural features of the economies and business systems of the two countries that often have deep historical roots. Policies and corporate strategies toward foreign direct investment (FDI) in both countries have played a major role in shaping this structural context. In order to make sense of where the relationship is today and where it might be headed, we need a clear understanding of this historical legacy.

THE PRE WORLD WAR II PERIOD

-

Even prior to World War II, the United States generally maintained an open environment for foreign direct investment. In contrast, Japan 's history includes both periods of severe restrictions on FDI and periods in which foreign manufacturing investments that upgraded indigenous technological capabilities were tolerated or encouraged.

Historically, American and Japanese approaches to inward FDI or investment made with the goal of establishing or gaining control over a foreign business entity have been marked by significant contrasts. FDI and foreign investment in general were important factors in U.S. economic growth throughout the nineteenth century, as the United States emerged as an advanced industrial power.1 In 1914 the United States was the leading host country for the FDI of foreign MNCs, as measured by the estimated accumulated value of global FDI stocks.2

Japan has exhibited a different approach. Even as early as the second half of the sixteenth century, when a growing Western trading and missionary presence in Japan coincided with a series of wars that led to political unification of the country, Japanese craftsmen exhibited an ability to acquire and improve technology imported by the international businesses of that time: The Portuguese traders. For example, even though Arabs, Indians, Chinese, and Native Americans had been exposed to Western firearms long before, only the Japanese proved able to master the technology and launch indigenous mass production of guns.3 Early MNCs, such as the British East India Company, experienced great difficulty in penetrating the Japanese market.4

In the seventeenth century Japan closed off contact with all Western traders except for a small Dutch mission located on an island near Nagasaki. Japan maintained this policy of sakoku (closed country) for two centuries, ending it in the late nineteenth century when foreign traders were allowed to establish operations in several designated port settlements, although foreign investment continued to be limited severely elsewhere. Under the “unequal treaties ” imposed by

Western powers at that time, the foreign signatories enjoyed extraterritorial legal authority in these settlements, and Japan's authority to set its own tariffs was limited.5

Japan liberalized treatment of foreign investment somewhat in 1899, with the revision of the unequal treaties. Although restrictions remained—for example, foreigners were not allowed to own land in Japan until 1926—the 1899 to 1930 period was marked by a relatively open stance on the part of the Japanese government and private sector toward FDI. This reflected recognition in Japan of the need to attract greater inflows of foreign capital and technology to support rapid economic development. U.S.-based high-technology companies of the time, such as Victor Talking Machine, Western Electric, and Ford Motor Company, invested in Japan, often with Japanese partners, and achieved great success. But, even during this period, characterized by one scholar as the “door ajar,” FDI in Japan was rather low in comparative international terms: FDI stocks in China were roughly 20 times those of Japan in 1930.6

While American and other foreign multinationals were establishing positions in Japan early in this century, Japanese companies, such as Yokohama Specie Bank, Ltd., and Mitsui Bussan, were establishing their first U.S. subsidiaries. In contrast to investments in Japan by foreign MNCs, many of which involved local manufacturing with extensive training and technology transfer, Japan's prewar FDI by banks and trading companies was focused on facilitating and controlling the flow and financing of Japan's imports and exports. For example, Japanese flag carriers transported two-thirds of Japan's imports and three-quarters of Japan's exports during the 1930s.7 Much of Japan's manufacturing FDI was directed at China.

By the 1930s Japanese industry had made significant strides in international competitiveness, and the Japanese economy maintained solid growth throughout the prewar decade. Although the economic environment provided foreign investors with ample incentive to invest, increasingly restrictive Japanese government policies, often strongly influenced by the private sector, discouraged new investments and forced most American companies already operating in Japan to withdraw.8 The outbreak of World War II marked a complete suspension in bilateral commercial relations, as enemy MNC assets were seized by both governments.

U.S. MNCS IN JAPAN

-

Since World War II formal and informal restrictions on imports and inward direct investment have depressed foreign participation in the Japanese economy. However, during the 1950 to 1980 period, a number of U.S. companies with superior technology, management, and the ability to mobilize political support in the Japanese business community overcame these obstacles and achieved long-term success. But in many instances the preference of Japanese government and industry for arms-length technology transfers in lieu of product imports or FDI prevailed. Although U.S. FDI in Japan has increased since barriers were lowered (particularly since 1980), foreign participation in the Japanese economy through FDI and direct imports remains low.

In Japan the policy framework for the regulation of FDI was established in two laws enacted during the U.S. Occupation but that continued in force with only minor modifications for the following two decades. The Foreign Investment Law (FIL) of 1950 regulated the acquisition, by foreign investors, of stocks and proprietary interests in Japan; required validation of technological assistance contracts longer than 1 year; and controlled loans between foreign investors and Japanese persons, where foreign exchange was a consideration.9 The Foreign Exchange and Foreign Trade Control Law (FECL) of 1949 governed international transactions

outside the FIL framework: specified transactions were prohibited without explicit government approval.10

Although the Foreign Investment Deliberation Council formally made decisions to grant or deny FIL approval, Japanese business, mediated through the Japanese government agency with jurisdiction over the industry in question, was central to the decision-making process.11 Most companies of whatever nationality with strong market positions are not eager to see powerful new entrants, and Japanese companies appear to be no different. During the period when FIL was in effect, Japanese companies often were able to act on these preferences and influence the process so that approvals were very difficult to achieve.

For foreign companies seeking to invest in Japan and to profit from its strong economic growth, enlisting powerful Japanese domestic allies often was necessary to achieve meaningful participation.12 For example, Coca-Cola was allowed to establish a Japanese franchise in 1956, but opposition by small Japanese fruit juice bottlers—financed by larger soft drink makers, such as Kirin, Asahi, and Sapporo—led to severe restrictions on Coke's operations.13 Several years later Shin Mitsubishi Heavy Industries (now Mitsubishi Heavy Industries, MHI), which had begun manufacturing Coca-Cola' s Japanese bottling equipment under license, saw that it would benefit from an expansion of Coke's presence in Japan. MHI, therefore, encouraged Kirin to negotiate an arrangement with Coca-Cola under which Kirin would own a majority share of the largest Coke franchise in Japan. At the same time, the government removed the most onerous restrictions on Coke's activities.

The case of Texas Instruments (TI) is similar.14 TI had begun exploring the possibility of manufacturing in Japan in the late 1950s and decided to move forward in the early 1960s. The approval for TI's investment came only after years of effort and was prompted by the growing strength of the domestic semiconductor industry. When Japanese companies began integrated circuit production in the early 1960s, Japan had not issued patents for TI's basic technologies and would not do so until 1989. Japanese companies, therefore, did not need to be concerned about infringement suits on Japanese sales. However, by the late 1960s the Japanese electronics industry had become strong enough to anticipate export sales, particularly indirect exports, as integrated circuits came to be incorporated in consumer electronics products. Since TI had been granted patents in the United States and other major markets outside Japan, infringing chips or products incorporating them could be excluded from these markets. Eager to reach licensing agreements with TI that would allow them to enter the export market, the major Japanese electronics companies pushed the Ministry of International Trade and Industry (MITI) to reach agreement with TI in 1968.

These Japanese policies toward FDI, implemented through close government-industry cooperation, made an important contribution to nurturing Japan's high-technology and other manufacturing industries. First, FDI and overall market restrictions gave Japanese companies time to hone their competitiveness to world-class levels before having to face foreign competitors in export markets. Second, and perhaps more important, the policies facilitated a substantial flow of inexpensive foreign technology into Japan and ensured that this technology was widely disseminated.

Most analysts and scholars studying the Japanese economy agree that imported technology has had a major impact on Japan's overall economic development. Some have asserted that a lack of effort and interest on the part of U.S. and other foreign companies was mainly responsible for the high level of licensing and the low level of direct investment by foreign companies over the postwar period.15 However, recently, most scholars studying the development of key Japanese industries support the assertion that public-private cooperation in dealing with foreign MNCs was critical in facilitating a greater arms-length flow of technology into Japan.16

Recognition of the importance of imported technology to Japan should in no way be interpreted as slighting the central contribution of Japanese firms in achieving the nation's current status as a techno-industrial superpower. Scholars nearly unanimously agree that superior management of the Japanese macroeconomy and individual firms was responsible for the rapid assimilation and utilization of this imported technology by Japanese companies.17

Rare foreign MNCs with an especially strong technological position and political acumen, such as IBM, were able to use their leverage to gain approval for establishing and expanding wholly owned manufacturing subsidiaries, often on the condition that key technologies be licensed to Japanese competitors.18 Other strong companies, such as Du Pont, were allowed to establish 50-50 or minority-owned joint ventures during the 1950s and 1960s.19 Companies without the technology or political clout to achieve even limited entry through joint ventures were left with technology licensing as the most feasible way of gaining a return in Japan on their technological investments. Fairchild, after being rebuffed when it sought to establish operations in Japan in the late 1950s, licensed its fundamental planar process for integrated circuit manufacturing to NEC.20 In the Fairchild case, as well as other critical technologies, there is evidence that MITI's role in approving licensing arrangements allowed Japanese firms to negotiate lower royalties with foreign companies than would have been the case had they acted on their own.21

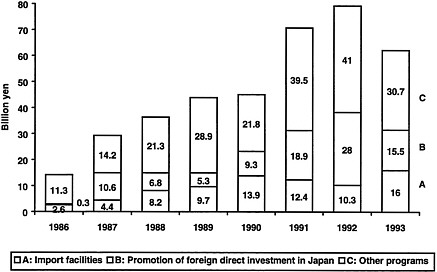

Through a long, gradual process that began in the late 1960s and continued through 1980, Japan lowered its formal restrictions on FDI. During the early phases of capital liberalization, the Japanese government issued lists of industries in which FDI would be approved automatically. However, the number of liberalized industries was limited, and included several that were unlikely to attract the interest of foreign MNCs, such as soy sauce and geta(traditional Japanese shoes).22 More substantial liberalization steps followed in the early 1970s; U.S. auto makers were allowed to acquire minority stakes in several troubled Japanese auto companies at that time. In May of 1973, MNCs were given automatic approval of new wholly owned subsidiaries in all but 22 exempted industries. Foreigners also were allowed to acquire existing Japanese companies if the target company agreed to the takeover. Still, Japanese government and industry retained considerable power to limit or delay the entry of MNCs they considered threatening during the 1970s. Computers, pharmaceuticals, and semiconductors were included among the 22 industries exempted from liberalization, and private sector arrangements, such as increases in cross-shareholding were undertaken by Japanese companies to forestall possible foreign acquisition.23 In 1980 Japan abolished the FIL and incorporated residual controls in a new FECL. Under this law foreign MNCs had only to notify the Japanese government of investment plans rather than seek approval, and the ban on hostile takeovers was removed.24 In recent years the Japanese government has even instituted some modest measures to encourage FDI in Japan25 (see Figure 3-1 ).

U.S. FDI in Japan has increased, following the final stages of liberalization, and Japan is now one of the top five host countries for U.S. FDI (see Table 3-1 ). In manufacturing investments, chemical and pharmaceutical MNCs have been among the leading sectors.26 For example, U.S. pharmaceutical maker Merck acquired a majority stake in long-time joint venture partner Banyu. Also, several large U.S.-Japan joint ventures in semiconductor manufacturing were launched following the conclusion of the U.S.-Japan Semiconductor Agreement in 1986, including the Tohoku Semiconductor joint venture between Toshiba and Motorola and the Nihon Semiconductor joint venture between LSI Logic and Kawasaki Steel.27 A growing number of U.S. companies have established successful businesses in Japan through direct investment and by other means.

FIGURE 3-1 Japan Development Bank loans to foreign companies in Japan. SOURCE: Japan Development Bank.

TABLE 3-1 U.S. FDI Position; Total and Top Five Host Countries, Year End Historical Cost, billion dollars

|

1983 |

1988 |

1994 |

|||

|

Total |

207.8 |

Total |

335.9 |

Total |

612.1 |

|

Canada |

44.3 |

Canada |

62.7 |

U.K. |

102.2 |

|

U.K. |

27.6 |

U.K. |

49.5 |

Canada |

72.8 |

|

West Germany |

15.3 |

West Germany |

21.8 |

Germany |

39.9 |

|

Switzerland |

14.1 |

Bermuda |

19.0 |

Japan |

37.0 |

|

Bermuda |

11.1 |

Switzerland |

18.7 |

Switzerland |

34.5 |

SOURCE: U.S. Department of Commerce data as compiled in Japan EconomicInstitute, JEI Report, various issues.

Despite these trends toward greater openness, FDI and overall foreign participation in the Japanese economy remain extremely low relative to other developed countries. Most analysts agree on the most important reasons for this but would assign these reasons different weights.28 First, with the sharp appreciation of the yen over the past decade and the rise in land prices during the “bubble” era of the late 1980s, the costs of doing business in Japan have become very high relative to other locations. Second, foreign companies often have trouble recruiting the most qualified Japanese employees because of the prevalence of life-time employment in Japan and

the general desire of the best new graduates to avoid employment with any but the strongest blue-chip Japanese companies. Third, although policies directly affecting FDI have been liberalized, formal regulations and informal business entry barriers—mainly in the form of administrative guidance and cartels—may serve to hinder or exclude foreign entrants in specific sectors.29 These barriers can include ownership or other tight linkages among manufacturers, suppliers, and distributors, and they often hinder new Japanese entrants to specific industries as well as foreign MNCs. Finally, Japan's business culture and corporate ownership patterns discourage acquisitions, which have been used by U.S. companies in other countries and by Japanese companies in the United States to achieve rapid entry.

JAPANESE MNCS IN THE UNITED STATES

-

Although the United States remained largely open to inward FDI during the postwar period, Japanese companies did not emerge as major overseas investors until relatively recently. The sharp appreciation of the yen and other factors prompted a boom in Japanese direct investment during the latter half of the 1980s, much of it directed at the United States. Activities of Japanese and other foreign MNCs have raised concerns in the United States about the possible impacts of asymmetrical access to technological assets. Although outward Japanese FDI in the United States has fallen substantially over the last several years, Japanese MNCs will continue to maintain a significant presence in U.S. manufacturing activities and the U.S. economy as a whole.30

As might be expected of a country recovering from a devastating war, early in the postwar period Japan targeted its capital almost exclusively at domestic investment opportunities, first for rebuilding the economy and then for rapid growth. Economic policies and institutions were created to encourage savings and the flow of these savings to targeted manufacturing industries.31 The FECL that played a large part in restricting entry by foreign MNCs also restricted the outward flow of capital: individual Japanese direct investments abroad required government approval. Japanese companies mainly accessed global markets through direct exports. With strong world economic growth and access to largely open markets in the United States and elsewhere, the environment was favorable for this approach.

Japan and Germany had similar levels of FDI in the United States prior to World War II, but by 1970 German FDI in the United States was six times the level of Japan's. Prior to the 1970s Japanese MNCs in the United States focused on establishing subsidiaries to market products exported from Japan or to procure food and raw materials to be shipped back to Japan for processing.32 Japanese manufacturers themselves gradually replaced trading companies in controlling this trade, establishing independent subsidiaries.33 During the 1970s and through the early 1980s, Japanese FDI in manufacturing began to increase from its low base. A number of Japanese companies in labor-intensive industries, such as textiles, moved production to Asia.34 In the United States Japanese companies began to establish manufacturing facilities, spurred by the end of fixed exchange rates and the appreciation of the yen, as well as by real or potential trade barriers. For example, pressure from U.S. producers led to voluntary restraints on Japanese exports (VERs) of steel (1969) and textiles (1971). In contrast to the gradual easing of restrictions on inward FDI, the Japanese government rapidly lifted restrictions on outward FDI in the early 1970s. Sony and Matsushita, for instance, made investments in U.S. television production before the 1977 orderly marketing agreement (OMA) restricting imports of Japanese televisions.

Despite its heightened activity in manufacturing investments, much of Japan's direct investment still flowed into wholesale trade subsidiaries to distribute exports from parent companies; during the late 1970s and early 1980s, Japanese FDI in the United States increased rapidly, along with direct Japanese exports.35 The pattern of trade barrier-avoiding FDI broadened to the automobile industry: Japanese automakers doubled their share of the U.S. market between 1978 and 1980. The recession of the early 1980s put additional pressures on U.S. automakers. In response to the threat of congressionally imposed limits on Japanese imports, MITI and the Japanese automakers agreed to voluntary limits in 1982. This VER on Japanese autos then spurred the large direct investments of Japanese automakers and their parts suppliers in the United States of the 1980s.

When in the mid 1980s the value of the yen rose sharply and the yen price of U.S. assets dropped, Japanese MNCs had an additional incentive to invest in the United States. Table 3-2 shows the resulting rapid rise in Japanese FDI and the trend in U.S. FDI in Japan since the mid 1980s. U.S. states have competed among themselves to offer attractive incentive packages to potential Japanese investors, and over 40 states have opened offices in Japan to market themselves to Japanese MNCs.36Table 3-3 shows changes in the long-term trend in the regional distribution of Japanese FDI, and Table 3-4 shows the industry distribution of current bilateral direct investment stocks.

Japanese FDI in the United States during the late 1980s through the first few years of the 1990s can be divided into several categories, some of which are more relevant than others to technology relationships between the two countries37 The first category relevant to technology relationships consists of major manufacturing investments. Japanese FDI concentrated in the automobile, steel, and electronics industries—both end-product manufacturers and suppliers— was motivated largely by a desire to maintain access to the U.S. market in the face of actual or prospective trade restrictions. In other industries Japanese MNCs made strategic acquisitions and other investments not explicitly linked to trade frictions.38 In recent years new investment has fallen off with overall Japanese investment. For example, in some labor cost-sensitive industries, such as consumer electronics, Japanese firms are moving U.S. manufacturing to Mexico and Southeast Asia.39 Still, Japanese companies in these manufacturing industries continue to have a significant presence in the United States.

TABLE 3-2 Foreign Direct Investment Positions; Historical Cost Basis, billion dollars

|

1984 |

1985 |

1986 |

1987 |

1988 |

1989 |

1990 |

1991 |

1992 |

1993 |

1994 |

|

|

Japanese FDI in the United States |

|||||||||||

|

Total |

16.0 |

19.3 |

26.8 |

34.4 |

51.1 |

67.3 |

83.1 |

93.8 |

97.5 |

96.2 |

103.1 |

|

Manufacturing |

2.5 |

2.7 |

3.6 |

5.0 |

11.1 |

15.6 |

17.1 |

18.3 |

18.3 |

17.7 |

18.7 |

|

U.S. FDI in Japan |

|||||||||||

|

Total |

7.9 |

9.2 |

11.5 |

15.7 |

17.9 |

19.9 |

22.6 |

25.4 |

26.6 |

31.4 |

37.0 |

|

Manufacturing |

3.9 |

4.6 |

5.4 |

8.1 |

8.9 |

10.1 |

11.2 |

11.5 |

11.8 |

13.6 |

15.8 |

SOURCE: U.S. Department of Commerce data as compiled in Japan EconomicInstitute, JEI Report, various issues.

TABLE 3-3 Japan's FDI Position Abroad; Total and Regional Distribution, billion dollars

|

1983 a |

Percentage |

1988 b |

Percentage |

1995 c |

Percentage |

|

|

Total |

61.3 |

186.4 |

463.6 |

|||

|

North America |

17.9 |

29 |

75.1 |

40 |

202.7 |

44 |

|

Europe |

7.1 |

12 |

30.2 |

16 |

89.9 |

19 |

|

Asia |

16.4 |

27 |

32.2 |

17 |

76.2 |

16 |

|

Latin America |

10.7 |

17 |

31.6 |

17 |

55.1 |

12 |

|

a As of March 31, 1984. b As of March 31, 1989. c As of March 31, 1994. SOURCE: Japan Ministry of Finance data as compiled in Japan EconomicInstitute, JEI Report, various issues. |

||||||

TABLE 3-4 Sectoral Distribution of U.S.-Japan Foreign Direct Investment Positions; 1994 Year End Historical Cost, billion dollars

|

U.S. Position in Japan |

Japanese Position in United States |

|

|

Petroleum |

6.1 |

0.3 |

|

Manufacturing |

15.8 |

18.7 |

|

Food products |

1.1 |

.9 |

|

Chemicals |

3.6 |

3.5 |

|

Metals |

0.3 |

1.1 |

|

Machinery |

5.6 |

|

|

Nonelectric machinery |

4.4 |

|

|

Electric machinery |

1.7 |

|

|

Transport equipment |

1.8 |

|

|

Other manufacturing |

2.9 |

7.6 |

|

Wholesale trade |

6.8 |

35.7 |

|

Retail trade |

1.1 |

|

|

Banking |

0.4 |

10.2 |

|

Finance, insurance, real estate |

6.4 |

|

|

Finance |

12.8 |

|

|

Insurance |

0.8 |

|

|

Real estate |

9.8 |

|

|

Services |

0.5 |

12.4 |

|

Other |

0.9 |

1.3 |

|

Total |

37.0 |

103.0 |

|

SOURCE: U.S. Department of Commerce data as compiled in Japan EconomicInsitute, JEI Report, September 15, 1995. |

||

There is some consensus among analysts that this category of Japanese investments has served to transfer technology to the United States.40 The technology transferred has mainly taken the form of superior methods of managing manufacturing and other process technologies, rather than specific product technology. In the automobile industry, which has been the most extensively studied, U.S. manufacturing has benefited from the implementation of manufacturing process management techniques developed in Japan. Most of the economic benefit of this new technology appears to have been realized through imitation and adoption by U.S.-owned manufacturing enterprises, rather than directly through the activities of Japanese subsidiaries. Therefore, it is difficult to determine the extent to which performance improvements by U.S.-owned automakers and parts suppliers have been due to simple competitive pressure or, alternatively, whether absorption of these management practices was significantly accelerated and enhanced by the presence of Japanese transplant facilities in the United States and by exposure to Japanese techniques in such joint ventures as New United Motors Inc.—the Toyota-General Motors joint venture. We do know that U.S. automakers have made significant strides in manufacturing and product development performance as Japanese transplants have increased their presence in recent years. The same appears to be true for other U.S. manufacturing industries, such as steel, machine tools, and tires.

Another category of Japanese direct investment in the United States, with implications for technology flow between the two countries, became quite visible and common during the late 1980s. These were investments aimed at tapping U.S. technological capabilities. Such investments took two forms: (1) acquisitions or minority stakes in small, innovative U.S. companies—in industries such as computer software, electronics, and advanced materials, and (2) investments in R&D facilities—both product development-oriented facilities concentrated in the automobile and electronics industries and laboratories aimed at more fundamental computer science and biomedical research.

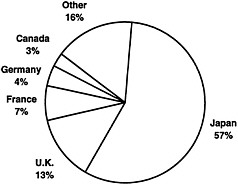

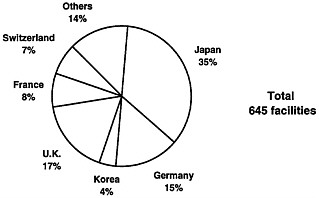

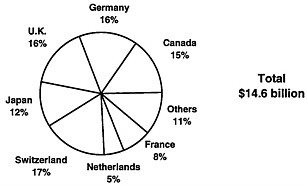

Figure 3-2 and Table 3-5 show the extent of foreign high-technology acquisitions during the late 1980s and early 1990s, and Figure 3-3 and Figure 3-4 show the nationality of foreign R&D investments in terms of facilities established and 1990 spending. Japanese MNCs have made a large proportion of both types of investment. These activities have raised concerns in the United

FIGURE 3-2 Foreign acquisitions of U.S. high-technology companies, October 1988-December 1993. SOURCE: Linda M. Spencer, Foreign Acqusitions of U.S. High-Technology Companies Database Report October 1988-December 1993(Washington, D.C.: Economic Strategy Institute, 1994).

States that foreign companies, particularly Japan-based MNCs, have been conducting a raid on U.S. innovative capabilities.41 Some have questioned whether technology acquired or developed by Japanese MNCs in the United States would be quickly incorporated into new products and sold back to us, leading to further competitive setbacks for U.S. manufacturers and eventually to deterioration in the trade balance. In addition to this general concern about the high-technology activities of foreign MNCs, specific attention has focused on their R&D relationships with U.S. research universities. It has been argued that foreign MNCs can enhance their competitiveness through access to the U.S. research base, which was built through years of federal support, but pay only an incremental cost for this access. U.S. MNCs abroad do not have comparable opportunities in countries which do not have as extensive or accessible a research base, such as Japan.

TABLE 3-5 Japanese Acquisitions of U.S. High-Technology Companies by Industry, 1993

|

1993 |

Oct. 1988-Dec. 1993 |

|

|

Computers |

11 |

114 |

|

Biotechnology |

1 |

29 |

|

Telecommunications |

2 |

35 |

|

Electronics |

1 |

38 |

|

Advanced materials |

2 |

41 |

|

Semiconductors |

2 |

54 |

|

Other |

5 |

127 |

|

Total |

24 |

438 |

|

SOURCE: Linda M. Spencer, Foreigen Acquisitions of U.S. High-Tecnology Compaines Database ReportOctober 1988-December 1993 (Washington, D.C.: Economic Strategy Institute, 1994). |

||

FIGURE 3-3 Foreign R&D facilities in the United States, selected country distribution, 1994. SOURCE: Donald H. Dalton and Manuel G. Serapio, Jr., Globalizing Industrial Research and Development, U.S. Department of Commerce, Office of Technology Policy, Asia-Pacific Technology Program, October 1995.

FIGURE 3-4 U.S. affiliates' R&D expenditures by country, 1993. SOURCE: Donald H. Dalton and Manuel G. Serapio, Jr., Globalizing Industrial Research and Development, U.S. Department of Commerce, Office Technology Policy, Asia-Pacific Technology Program, October 1995. NOTE: Canadian affiliates include a major U.S. chemical company with a minority Canadian investment.

Investments by Japanese MNCs in U.S. high-technology companies and R&D facilities fell off with overall Japanese investment, as illustrated by Table 3-6 , but there was renewed activity in this area in 1995, as a number of large Japanese companies established new U.S. R&D facilities.42 The overall impact, in terms of the concerns expressed by critics, is unclear at this point. The flood of Japanese investments has been followed by a competitive resurgence on the part of U.S. companies in several of the industries that were targeted most heavily. Although it is relatively straightforward to link the key technologies licensed in the past by U.S. and other MNCs to Japanese industry with subsequent Japanese competitive success, it is difficult today to link technologies acquired or developed by Japanese companies through U.S. investments with subsequent market success. It is also difficult to measure the contribution of these investments to the U.S. research base and innovative activity. Particularly for the fundamental research laboratories, one of the stated objectives of Japanese MNCs in establishing them was to contribute to the U.S. research base. In the next chapter we will return to a discussion of FDI and contributions to the host country technology base.

Although Japanese FDI in the United States has dropped considerably during the last several years, owing to the bursting of Japan's asset price bubble and to economic conditions in both countries, Japanese MNCs continue to maintain a significant presence in U.S. manufacturing activities, and they control a large proportion of U.S.-Japan trade. But despite the relative openness of the U.S. investment environment, Japanese companies have experienced a number of difficulties, particularly recently, which raises questions about how they will respond in the future. A number of Japanese subsidiaries in the United States have had difficulty in achieving profitability in recent years.43 In a survey released in 1994, Japanese MNCs mentioned several conditions that have caused difficulties;44 over half of the companies responding mentioned the harsh, competitive environment in the United States. In descending order, other problems mentioned were the strengthening of tax evasion enforcement, the difficulties in hiring labor and employing locals, and the requirements existing to source locally.45

Currently, formal laws and regulations governing inward FDI and MNC activities in the United States and Japan are fairly similar, as Table 3-7 shows. However, many of the conditions underlying the asymmetries in investment and technology access are likely to continue for at least the near term. The U.S. economy almost certainly will remain far more open to foreign participation through direct investment and trade than the Japanese economy. Still, the environment in Japan has improved, and attractive opportunities exist for U.S. companies in a variety of industries. We will explore more of the specifics in the next chapter.

TABLE 3-6 Strategic Mergers and Acquisitions Involving Japanese Companies

|

(Jan.-June) |

(Jan.-June) |

|||||

|

1991 |

1992 |

1993 |

1993 |

1994 |

||

|

Japanese companies acquiring Japanese companies |

302 (49.2%) |

260 (53.8%) |

259 (60.1%) |

147 (61%) |

136 (57.4%) |

|

|

Japanese companies acquiring foreign companies |

294 (47.9%) |

186 (38.5%) |

140 (32.5%) |

80 (33.2%) |

80 (33.8%) |

|

|

Foreign companies acquiring Japanese companies |

18 (2.9%) |

37 (7.7%) |

32 (7.4%) |

14 (5.8%) |

21 (8.8%) |

|

|

Total cases of mergers and acquisitions involving Japanese companies |

614 |

483 |

431 |

241 |

237 |

|

|

SOURCE: Yamaichi Securities, Strategic M&A Statistics, June 1994. |

||||||

TABLE 3-7 Selected Formal Restrictions on Foreign Direct Investment and Exceptions to National Treatment by Japan and the United States, 1993

NOTES AND REFERENCES

1 See Dunning, John H. 1993. Multinational Enterprises and the Global Economy.Wokingham, England: Addison-Wesley, particularly pp. 99-119.

2 See Mason, Mark. 1992. American Multinationals and Japan: The Political Economy of Japanese Capital Controls, 1899-1980.Cambridge, Mass.: Harvard University Press, p. 14.

3 Weistein, David E. 1994. “Structural impediments to investment in Japan: What have we learned over the last 450 years?” Paper prepared for Wharton Conference on Foreign Direct Investment in Japan: Why So Small and How to Encourage, October 1994, pp. 1-2.

4 Weistein, p. 3.

5 Mason, 1992, p. 17.

6 Mason, 1992, p. 46.

7 Encarnation, 1992, p. 106.

8 “These methods included controls imposed directly on the foreign investor, together with actions to assist domestic firms, which placed foreign-controlled subsidiaries at a competitive disadvantage.” Encarnation, p. 50.

9 The FIL made no distinction between direct and portfolio investment. Mason, 1992, pp. 155-156.

10 From 1956 to 1963 Japan also operated a system under which MNCs could receive national treatment if they reinvested yen earnings in Japan rather than remit them abroad. In contrast to FILapproved investments, which were mostly minority foreign owned, these yen-based subsidiaries were mostly majority owned. The yen-based system was suspended, following a sudden influx of foreign MNCs utilizing it in the early 1960s. See Encarnation, 1992, pp. 50-59.

11 This is Mason's central theme.

12 In addition to technological and political advantages, access to needed raw materials also facilitated foreign MNC entry into Japan. The most important example is the petroleum industry—the industry sector that attracted the most U.S. FDI in Japan through most of the postwar period up to 1988, when it was surpassed by wholesale trade. See Encarnation, 1992, p. 93.

13 Mason, 1992, pp. 161-173. For example, limits on foreign exchange restricted the amount of syrup that could be imported, the number of designated outlets was limited to 186 in the Tokyo area, retail dealers had to pledge to charge no less than 35 yen per bottle (competing domestic drinks sold for 20 yen), a luxury tax of 156 yen per 24-bottle case was imposed, and all Coca-Cola advertising via the media or in outdoor locations was banned throughout Japan.

14 Mason, 1992, pp. 174-187.

15 In particular Abegglen, James C. and George Stalk, Jr. 1985. Kaisha: The Japanese Corporation.New York, N.Y.: Basic Books, pp. 126-129. See also the Japanese working group's report in this publication.

16 In addition to work cited elsewhere, Christelow, Dorothy B. 1995. When Giants Converge: The Role of U.S.-Japan Direct Investment.Armonk, N.Y.: M.E. Sharpe, pp. 61-81. Acquisition of U.S. technology also was facilitated by U.S. approaches to antitrust enforcement and competition policy over this period, which often required dominant companies such as AT&T and IBM to license their innovations for reasonable royalties and licensing fees.

17 Fruin, W. Mark. 1992. The Japanese Enterprise System: Competitive Strategies and Cooperative Structures.Oxford: Oxford University Press, p. 5, discusses the capabilities needed for effective inward technology transfer.

18 Anchordoguy, Marie. 1989. Computers Inc.: Japan's Challenge to IBM.Cambridge, Mass.: Harvard University Press, pp. 22-26.

19 Several of these successful cases are described in the Japanese working group's report.

20 Mason, 1992, pp. 195-197.

21 Lynn, Leonard. 1994. “MITI's Successes and Failures in Controlling Japan's Technology Imports.” Hitotsubashi Journal of Commerce and Management.December: 15-33.

22 Mason, 1992, p. 202.

23 Mason, 1992, pp. 204-209.

24 More recently, the FECL has been modified further to require notification only following an investment.

25 See Ministry of International Trade and Industry. January 1992. Measures for Promoting Foreign Direct Investment in Japan.Tokyo: MITI. These programs include efforts to provide information to potential investors through the Japan External Trade Organization (JETRO) and low-interest loans through the Japan Development Bank (JDB) for the construction of R&D facilities, import facilities, and other projects.

26 Encarnation, 1992, p. 84.

27 See National Research Council. 1992. U.S.-Japan Strategic Alliances in the Semiconductor Industry: Technology Transfer, Competition, and Public Policy.Washington, D.C.: National Academy Press, p. 47 and pp. 91-101. LSI Logic recently acquired Kawasaki Steel's stake in Nihon Semiconductor. See Japan Economic Institute. February 1995. Japan-U.S. Business Report.Washington, D.C.: Japan Economic Institute, pp. 9-10.

28 See American Chamber of Commerce in Japan. 1991. Trade and Investment in Japan: The Current Environment.Tokyo: A.T. Kearney and ACCJ, p. 15.

29 “Administrative guidance,” gyosei shidoin Japanese, consists of informal directives to industry from government agencies.

30 In 1990 foreign-owned manufacturers accounted for about 13 percent of U.S. manufacturing output, with Japanese manufacturers accounting for about 13 percent of this, which is a little over 1.5 percent of U.S. manufacturing. British-owned companies accounted for about 3 percent of U.S. manufacturing. See U.S. Department of Commerce. 1995. Foreign Direct Investment in the United States: An Update. Washington, D.C.: U.S. Government Printing Office, pp. 67-68.

31 Patrick, Hugh and Henry Rosovsky. 1976. Asia's New Giant.Washington, D.C.: The Brookings Institution.

32 Encarnation, 1992, pp. 101-102.

33 Honda is an early example, entering the United States in 1959 and achieving sales leadership in the motorcycle market by 1964. See Encarnation, 1992, p. 109.

34 See Kojima, Kiyoshi. 1978. Japanese Foreign Direct Investment.Tokyo: Tuttle, p. 155. Kojima theorized that there was a distinctive Japanese-style FDI. In contrast to American and other MNCs that he believed engaged in oligopolistic, trade-destroying FDI in other developed countries, Kojima argued that Japanese MNCs investing in developing countries in industries where Japan was losing comparative advantage would create trade and aid economic development. Since that time, Japan's FDI patterns have shifted substantially.

35 Encarnation, 1992, p. 121.

36 Encarnation, 1992, p. 133-134.

37 Real estate investments, which rose dramatically during the “bubble economy” and fell just as dramatically after 1990; the large entertainment industry acquisitions by Japanese electronics companies (Sony-CBS Records, Sony-Columbia Pictures, and Matsushita-MCA); and large investments in financial services have had less impact on technology flows.

38 Bridgestone's acquisition of Firestone and Dainippon's acquisition of Sun are examples of strategic investment. Both are included in the Japanese working group's report.

39Fortune.1992. “How Japan Got Burned in the U.S.A.” June 15, pp. 114-116.

40 National Research Council. 1992. Japanese Investment and Technology Transfer: An Exploration of Its Impact.Washington, D.C.: National Research Council; Christelow, 1995, Chapter 5 and Chapter 6.

41 One example out of the extensive literature is Epstein, Stephanie. 1991. Buying the American Mind: Japan's Quest For U.S. Ideas In Science, Economic Policy And The Schools. Washington, D.C.: The Center for Public Integrity.

42 Mitsusada, Hisayuki. 1995. “R&D Goes Abroad for Fresh Twist on the Future.” The Nikkei Weekly, June 12, p. 1.

43 Japanese nonbank affiliates reported net losses of $6.6 billion on sales of almost $335 billion in 1992. See Zeile, William. 1994. “Foreign Direct Investment in the United States: 1992 Benchmark Survey Results.” Survey of Current Business.July: 154-185.

44 Tsushosangyosho Sangyo Seisaku Kyoku (MITI, Industrial Policy Bureau). 1994. Dai Go Kai Kaigai Jigyo Katsudo Kihon Chosa no Gaiyo(Outline of the 5th Survey on the Activities of Overseas Affiliates). Tokyo: MITI.

45 The United States does not impose formal local content requirements on foreign manufacturers. The rules of origin in NAFTA are applied to determine whether products qualify as “North American” for the purpose of trade within NAFTA. Also, the United States has sought and received voluntary commitments from Japanese automakers to increase purchases of components from U.S. manufacturers.