2

Manufacturing Supply Chains

Manufacturing can be defined as an activity which, utilizing a variety of capabilities, adds value to a material, thereby making possible different uses of that material. Each step in the manufacturing process adds value. The first manufacturers were probably artisans who worked by themselves to design and create products. They served as both supplier and manufacturer, gathering and managing the resources, and applying various processes to add value to the materials. Over time, manufacturing progressed to a series of specialists, each of whom supplied or added specific amounts and types of value. The benefits of this division of labor were that (1) more resources could be brought to bear on the task of adding value and (2) specialization tended to reduce costs and increase the efficiency, consistency, and quality of each operation.

As manufacturing industries developed, their products and processes became more complex. By 1920, well developed relationships between customers and suppliers facilitated the emergence of "mass production." At that time, many large OEMs were vertically integrated, purchasing only commodity products (e.g., steel, glass, and paint) and components that required specialized facilities or technology.

OUTSOURCING

As worldwide competition increased in the 1980s and 1990s, manufacturing profitability came under severe pressure. U.S. manufacturers, having substantially reduced internal costs, began searching for additional opportunities for increasing their competitiveness. This effort led to the so-called "outsourcing movement." As manufacturers analyzed the amount, costs, and types of value-added to products in their own

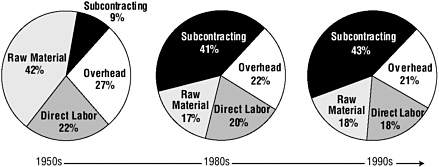

Figure 2-1 Increase in subcontracting in the defense industry (percentage of total product cost). Source: The Boeing Company, 1997.

facilities and compared them to capabilities available from outside suppliers, it became apparent that many elements of value could be purchased, or "outsourced," ("subcontracted" in the defense industry) more cost effectively. By the early 1990s, reengineering, downsizing, and outsourcing had become common business practices. Figure 2-1 shows the subcontracting trend in the defense industry.

The trend toward outsourcing was reinforced during the 1990s by Wall Street, as securities analysts increasingly focused on return on assets as a measure for valuing corporations. In response, OEMs have increasingly sold off parts-fabrication operations, which tend to require substantial investments in assets, and have focused on final assembly and services. As a result, OEMs have become increasingly dependent on outsourcing.

An estimated 22 percent of the world's gross domestic product consists of raw materials, components, and subassemblies purchased by OEMs. Thus, reducing the cost of these materials and making the procurement process more efficient can have a substantial effect on the global economy, as well as on the competitiveness of individual OEMs.

Case Study: Chrysler Corporation

Late in the twentieth century, two competitors in the automotive industry, Chrysler Corporation and General Motors (GM), made dramatically different choices regarding their respective supply chain structures. GM, which was consolidated into a massive, vertically integrated corporation early in the century, produced most of its components and subassemblies internally, although its Delphi parts operation was spun off in

1999. GM benefited by having direct control of its parts-making operations and from economies of scale.

Chrysler Corporation (now part of DaimlerChrysler AG), partly in response to its desperate financial condition in the 1980s, began leveraging its capabilities through extensive outsourcing. The company then reduced the number of redundant participants in its vast supply chain, providing more work for the remaining participants in return for lower prices. Remaining participants were also given increased responsibility for quality and just-in-time delivery. With this approach, Chrysler reduced its costs, its in-house inventories, and the number of product defects and increased the efficiency of its internal assembly lines. In an attempt to gain even more benefits from its suppliers, Chrysler is increasingly involving them in product development and mandating annual improvements in production efficiency. This has resulted in further cost reductions and faster development of increasingly innovative products.

Relationships between OEMs and suppliers in the U.S. auto industry have traditionally been adversarial. Products were designed with little input from suppliers; suppliers were selected by competitive bidding based almost solely on price; and purchasing agreements allowed suppliers little flexibility. Although the transition from an adversarial approach to a partnership arrangement with a free flow of ideas has been exceedingly difficult, Chrysler has made substantial progress. Instead of competitively rebidding supply contracts every two years, most of Chrysler's agreements now extend over the life of the model, and sometimes beyond. Essentially, Chrysler's business is the supplier's to keep as long as the supplier performs well on the current model and meets cost targets on the next.

The results of this approach have been dramatic (Dyer, 1996):

-

New vehicle development time was reduced from 234 weeks in the 1980s to approximately 160 weeks in the mid-1990s.

-

The cost of developing a new vehicle dropped by an estimated 20 to 40 percent.

-

Chrysler's average profit per vehicle increased from $250 in the mid-1980s to $2,100 in the mid-1990s.

-

Under the old system, 12 to 18 months of the development process were devoted to soliciting bids, analyzing quotes, rebidding, negotiating contracts, and tooling suppliers for production. Additional time was required to solve problems encountered by suppliers who, having bid successfully, attempted to manufacture components they had not designed. Under the new system, suppliers are involved throughout the process, from initial concept through

-

concurrent design and volume production. This has reduced parts incompatibility and allowed more time for resolving problems despite the shorter overall cycle time.

-

With early supplier involvement, prototypes are completed earlier, defects are found faster, and hard tooling is purchased only after most problems have been resolved. Tooling is purchased as much as 12 months closer to the initial production date, reducing the amount of tool rework, as well as the amount of capital invested.

-

As a result of longer commitments, suppliers have increased their own investments in assets dedicated to Chrysler, including plants, equipment, systems, processes, and people. Nearly all of them have purchased Chrysler's preferred computer-aided three-dimensional interactive application (CATIA) system, which is designed to enable concurrent engineering. With CATIA, the 1998 Concorde and Intrepid were designed and developed with an almost paperless process, reducing the development time for 1998 models by eight months and saving more than $75 million (Hong, 1998). Many suppliers have also relocated their facilities in closer geographical proximity to Chrysler plants.

The following factors were crucial to the transformation of Chrysler's supply chain (Dyer, 1996):

-

Strong, visionary leadership that drove the change to collaborative approaches for jointly creating value.

-

Multifunctional teams (''platform teams"), including suppliers' engineers, are now responsible for the product line, from concept through manufacturing, which has shortened the product development cycle. To speed up decision-making, platform teams include representatives of multiple functions, including engineering, manufacturing, finance, marketing, and procurement. This approach has stabilized priorities and reduced the conflicting demands to suppliers that were inherent in the old sequential development process.

-

Platform teams select suppliers early in the concept stage from lists of prequalified suppliers with the best track records and the most advanced engineering and manufacturing capabilities. Suppliers are given major responsibilities for component design, cost, quality, and on-time delivery. Suppliers indicate that this approach gives them greater flexibility to develop effective solutions to problems as they arise.

-

Changing from competitive bidding to target costing helped to shift the relationship with suppliers from a zero-sum to a positive-sum game and created an atmosphere in which OEMs and suppliers work together to achieve the target. This atmosphere has fostered a growing trust, which is essential for a successful partnership.

-

SCORE (the supplier cost reduction effort) continues to motivate suppliers to reduce costs and increase value. The program commits Chrysler to encouraging, reviewing, and acting on supplier ideas quickly and fairly and to sharing the benefits equitably. Suppliers are required to offer annual suggestions equaling 5 percent of their sales to Chrysler. Suppliers can claim up to half of the savings for themselves or share more of them with Chrysler to improve their supplier performance rating and perhaps obtain additional future business. Delighted suppliers throughout the chain have responded with a continuing flow of ideas for improvement.

-

To facilitate interactions, Chrysler established a common e-mail system with suppliers and schedules face-to-face meetings with them on a regular basis.

The late 1990s merger that created DaimlerChrysler is an example of the global trend toward consolidation in automobile manufacturing. Potential cost savings were a key motivator for the merger, and the new corporation immediately announced that it intended to optimize supplier performance further, building stronger relationships with key suppliers to more effectively manage the entire chain down to the raw material level. First-tier suppliers are expected to play increased roles in managing their own supply chains, producing better products at lower cost and taking the lead in programs, ranging from research and development to the design and production of complete modules.

Thus, Chrysler has achieved a temporary advantage over its competitors through careful outsourcing and management of an extensive supply chain. However, in so doing, they have also helped to create suppliers with extensive competence and muscle. This new situation raises several questions. Will Chrysler's supplier/partners, such as traditional seat suppliers Johnson Controls, Inc., and Lear Corporation, use their positions to seize a greater percentage of Chrysler's revenues and profits? If recent moves away from vertical integration were right for Chrysler, why has vertical integration by the seat suppliers increased their business success? Under what conditions is outsourcing better than vertical integration?

The answers to these questions appear to depend on complex, evolving, industry-specific business criteria, such as which manufacturer can provide the lowest cost capabilities and which capabilities must be

retained internally for competitive advantage. Traditionally, automakers competed on the basis of new products and manufacturing efficiency. Today, they are seeking allies to help them revamp their distribution systems, cut costs and inventories, and gain broad access to the Internet car-consumer market. Thus, one key to success is the ability to adapt the supply chain rapidly to changing conditions.

Benefits of Outsourcing

OEMs may reap the following benefits from outsourcing:

-

improved focus, quality, and simplification of remaining in-house operations

-

lower cost manufacturing operations, including reduction of in-house inventories

-

shorter product realization cycles (faster time to market) and lower product development costs if suppliers are directly involved in product design

-

access to capabilities and technologies that could not be readily developed or cost-effectively acquired

-

additional manufacturing capacity and faster response to changing market demands, often without additional capital investment by the OEM

Despite these benefits, OEMs may elect to retain aspects of vertical integration, such as capabilities that provide sustainable competitive advantage or identify a product with the OEM.

Outsourcing has also created substantial benefits for suppliers. Some of these opportunities, such as decisions by IBM and others in the 1980s to outsource PC operating systems to Microsoft and microprocessors to Intel, have led to the creation of huge fortunes. For example, automakers traditionally made or bought most of the parts for automotive seats and assembled the seats themselves. However, trends in the 1990s toward cost reduction, outsourcing, and reduction in the number of suppliers created expanded opportunities for surviving suppliers. Johnson Controls and Lear, which responded with cost controls, growth strategies, and acquisitions, have taken over the assembly task and are now the dominant Suppliers of fully assembled modular seating systems to GM, Ford, and DaimlerChrysler. The modules are delivered in sequence and installed directly into vehicles as they move along the assembly line.

On-time delivery, low costs, high quality, and low error rates are critical in this competitive, make-to-order business. Leveraging their low costs and global capabilities, Johnson Controls and Lear are now

acquiring makers of other interior components and are positioning themselves to supply fully integrated automotive interiors. For example, in March 1999, Lear purchased United Technologies Corporation's automotive-parts business, enabling it to deliver modules that include instrument panels, electrical wiring systems, and electronic seat controls. The automakers, in turn, are further integrating with these suppliers by hiring them to help in the design process, a high-margin activity that benefits both the OEMs and suppliers.

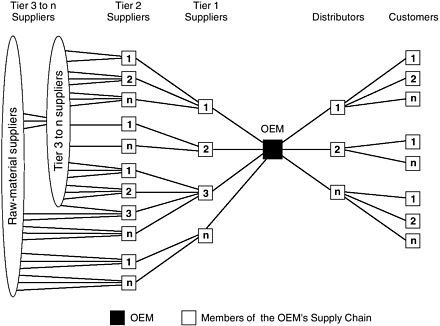

SUPPLY CHAINS

As manufacturing operations become increasingly specialized and complex, suppliers are relying more heavily on their own suppliers (often referred to as "lower tier" suppliers), who, in turn, rely on still others. This extended, chain-like system of companies, brought together to fulfill an end-customer demand, has come to be called a "supply chain." Figure 2-2 shows a typical supply chain structure.

The committee defined a supply chain as an association of customers and suppliers who, working together yet in their own best interests, buy, convert, distribute, and sell goods and services among themselves resulting in the creation of a specific end product. Thus, every company is necessarily part of at least one supply chain. It is not a matter of choice. The chains in which a company participates are defined by (1) the OEM and its suppliers, who together provide all of the capabilities required to create and support the end product, and (2) the customers who purchase it.

The supply chain includes all of the capabilities and functions required to design, fabricate, distribute, sell, support, use, and recycle or dispose of a product, as well as the associated information that flows up and down the chain. Supply chains are typically comprised of geographically dispersed facilities and capabilities, including sources of raw materials, product design and engineering organizations, manufacturing plants, distribution centers, retail outlets, and customers, as well as the transportation and communications links between them. OEMs typically have a supply chain for each product line, although the same capabilities are often used in multiple chains. Many suppliers participate in the supply chains of more than one OEM.

Many companies are adopting a supply chain structure similar to that of the construction industry, in which general contractors subcontract most of the work on an ad hoc basis. Contractors solicit bids for the skills and capabilities required for a specific job from subcontractors they know and trust. Subcontracts are typically awarded to those with the best combination of capabilities and prices, not necessarily just the lowest prices.

Figure 2-2 Structure of a typical supply chain. Source: Adapted from Lambert et al., 1998.

The contracts/partnerships that create this "virtual corporation" last for the duration of the job. New, ad hoc teams are formed and disbanded, as needed, for each new job or product. Similar examples can be found in the defense industry, where prime contractors create ad hoc teams, bringing together only the skills required to win and execute a specific contract. Subcontractors, in turn, have their own suppliers, who are also part of the chain.

The ad hoc supply chain structure has limited value. It tends to work best in industries in which (1) jobs or business opportunities are episodic and somewhat unpredictable, rather than continuous, (2) the required capability or skill mix varies from job to job, and (3) the costs of retaining a full spectrum of skills cannot be justified. For most industries, however, building long-term relationships based on trust and a high level of integration yields greater benefits. Developing trust within a supply chain takes time and effort. Even in the defense and construction industries, benefits can often be maximized through the nurturing of long-term relationships (within the letter of the law), even if the skill set is only used on a contract-by-contract basis.