sets are among the principal determinants of productivity growth and market expansion. These in turn affect growth in output and employment in a relatively open international economy. As a fraction of national income represented by GDP, investment in the United States is below that in other industrial countries, and saving trails investment by a striking amount. Both saving and investment need to rise significantly in the years ahead to meet the levels in other major industrial countries. The board views increases in the saving and investment rates as very important long-term economic goals that should be pursued systematically during the next decade.

HURDLE RATES AND INVESTMENT DECISIONS

We turn now to factors that have influenced the comparative investment performance of the U.S. economy. Substantial differences in investment rates between nations can be the result of differences in investment opportunities or differences in the criteria that managers use to evaluate new investments. Although these factors are not mutually exclusive, the board is not aware of any evidence suggesting that the opportunities for new investment are less attractive in the United States than in other industrialized nations. If anything, U.S. preeminence in scientific research and technological development and the strong flow of foreign investment capital into the United States during the 1980s suggest the opposite. The board concluded that differences in the way investment projects are evaluated in the United States and elsewhere are the principal source of differences in investment behavior.

To explain investment patterns, some economists believe that the high cost of capital in the United States relative to major foreign competitors has had a significant deterrent effect. The board has looked carefully at this issue. Simply documenting differences from country to country in the cost of capital, let alone explaining them, has turned out to be a challenging and complex problem. Several factors account for this difficulty. First, risk is an important variable with respect to equity investments and many kinds of fixed-income debts, and risk is notoriously hard to measure precisely. Second, increasing international integration of fixed-income securities markets means that for one important aspect of the cost of capital, namely, the cost of funds, recent historical data present a picture of a moving target. In addition, data tend to describe average returns, whereas investment decisions are based on marginal returns.

The conventional analysis of investment decisions focuses on a firm ’s

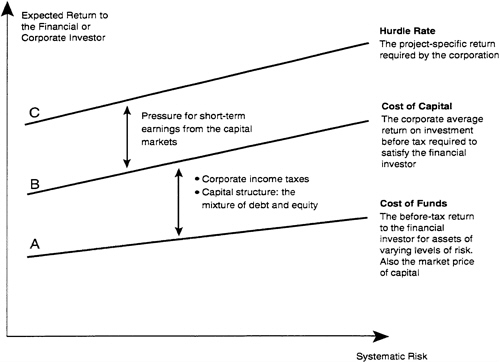

hurdle rate, the rate of return that managers expect a new project to earn before they are willing to undertake it. Hurdle rates vary across firms and types of projects and they are set by managers, not capital markets. This distinguishes the hurdle rate from the cost of capital, the rate of return before corporate taxes that the firm must earn on new investments to provide shareholders and bondholders with the returns they demand. The cost of capital is sometimes confused with one of its components, the cost of funds, which indicates the rate of return that financial investors demand on their investment income before taxes. The cost of funds depends on the required returns in the markets for both debt and equity. The cost of capital is the pre-tax return that a company must earn to deliver the cost of funds to investors. It therefore depends on the tax rules governing corporations as well as on the cost of funds. 7 A firm’s hurdle rate includes the cost of capital and also an internal risk premium considered applicable by management to the particular project at that particular time.8

Although differences in the cost of capital and the cost of funds across firms and nations have been the subject of numerous studies of investment spending, they may provide an incomplete explanation of what determines investment. Because financial investors cannot always ensure that managers follow their wishes, the hurdle rate may differ from the cost of capital. If managers set hurdle rates above the cost of capital, they are being more selective than their financial investors would like them to be, turning down some projects that might have earned returns that would fully satisfy their financiers. If the hurdle rate is below the cost of capital, managers are undertaking too many or too risky projects. Under these conditions, financial investors may try to change the managers’ hurdle rate or in extreme cases replace the management team.

The relationship among these concepts can be illustrated by means of a simple figure (Figure 3). Interest rates or costs of funds are set by the balancing of the supply and demand of funds in the financial markets (level A) and is where the saving rate has its effect. At level B, the tax system determines what return the corporation must achieve to satisfy the financial investors’ cost of funds requirements. At level C, other factors can cause management to elevate or reduce the return they want from

|

7 |

Other components of the tax system, such as the tax treatment of individuals and other investors, affect the cost of capital by changing investors’ before-tax required returns, hence the cost of funds. |

|

8 |

See R. Landau, “From Analysis to Action.” |

FIGURE 3 The relationships among the cost of funds, the cost of capital, and corporate hurdle rates.

new investment projects above or below the cost of capital.9 Fully integrated international capital markets tend to equalize returns or costs at level A.

Because hurdle rates are set by managers, not capital markets, they are more difficult to measure than either the cost of funds or the cost of capital. Data are not plentiful apart from data on profit rates in the United States and Japan. Nevertheless, Hatsopoulos and Poterba develop important evidence on hurdle rates in their comparison of the rates of return earned by nonfinancial corporations in the United States and Japan.10 They find that since 1975 the operating returns of Japanese nonfinancial corporations have averaged only 5.2 percent whereas comparable U.S. companies’ returns have averaged 10.8 percent. This supports the view that average hurdle rates are lower in Japanese than in U.S. companies. These findings are corroborated by a survey of top executives in

|

9 |

See page 36 for an illustration of how the tax system affects the relationship between the cost of funds and the cost of capital. |

|

10 |

George M. Hatsopoulos and James M. Poterba, “America’s Investment Shortfall: Probable Causes and Possible Fixes,” in the forthcoming companion volume. |