ADVANCED DISPLAYS AND VISUAL SYSTEMS

Damian Saccocio

The continued integration of electronics, together with advances in materials and manufacturing, is rapidly producing a new cliche in our digital age: The display is the computer. In the United States, the implications of this expression have created much angst among executives at large companies and policymakers alike. Such is not necessarily the case for numerous executives of smaller companies, however. If the United States is to have a robust domestic advanced display industry, it will be possible only through the perseverance and inventiveness of dozens of small companies.

The term “advanced electronic displays” refers to both the increasingly ubiquitous flat-panel display as well as to other new display technologies that typically involve projection. The world market for just flat-panel displays approached $4 billion in 1993 and is expected to more than double before the end of the decade. Almost all of this market has been captured by Japanese-based firms.

Most large American firms exited the advanced display market in the 1980s. In Japan, on the other hand, several large firms invested heavily and early in what is today’s dominant technology, active-matrix liquid crystal displays (AM-LCDs). Outside of portable computing devices, however, technologies other than LCDs are likely to dominate. The leaders in a number of these alternative technologies are small American firms.

Such firms face a multitude of challenges, although progress is being made on many fronts. The United States has lacked a robust display infrastructure in which to develop, test, and sell equipment. The supply of appropriately trained scientists and engineers has been agonizingly small.

Damian Saccocio was a National Academy of Engineering Fellow from 1994 to 1995. He is currently a strategic analyst with America On-Line.

This paper was prepared for a workshop on small companies in advanced electronic displays held 30 November and 1 December, 1993 at the National Academy of Sciences in Washington, D.C..

Moving from prototype development to volume manufacture involves large sums of capital that are difficult to obtain for small firms. And market experimentation is almost impossible for small firms, which often lack the time and resources to modify their products and processes.

But with rapidly advancing technology and new markets emerging, American industry is taking renewed interest in advanced displays. Lacking the internal expertise necessary, many large firms are today looking to partner with innovative small companies. Meanwhile, small firms are themselves organizing to address their problems and pursue opportunities, frequently with state and federal government support.

With momentum seemingly gathering, small firms in the advanced display industry face a promising but uncertain future. Whatever happens, however, it is they who have most clearly contributed to keeping a strong domestic technical base from which any new display efforts will be launched.

INDUSTRY BACKGROUND

Advanced displays are likely to be among the most critical and perhaps expensive components of the next generation of electronic products. Flat-panel displays are already used in full-color notebook computers, aircraft avionics, interactive computer games, and even automobile navigation systems. Projection display technologies are employed in computerized business presentation systems, large public displays, and wide-screen high-definition televisions. New applications such as headmounted displays are likely to drive display market growth even more so than replacement of older display technologies such as cathode-ray tubes (CRTs).

This background paper focuses on advanced electronic displays and their manufacture, including flat-panel displays, projection systems, and video presentation equipment. Much of the product and process hardware in this area is developing in parallel with software and computational hardware, as well as with advances in material technology such as liquid crystals, polymers, silicon, and gas-plasma technologies. Developments in all these areas are coming together to expand the functional ability of electronic systems.

Market Size, Structure, and International Position

The global electronic display market (CRTs and flat-panels) is very large; industry observers believe it to be approximately $20 billion (Tannas, 1994). The market for just flat-panel displays (FPDs) exceeded $3.7 billion in 1993 and is expected to almost triple to $9.4 billion over the next 6 years (Business Week, 1993a). A government report on display technologies in Japan noted that by the year 2000, half of all displays sold will be flat-panel displays (JTECH, 1992). The market for products that include displays as a key component will be many times these estimates.

Much of the production of current displays, mostly CRTs, is based in the Far East. In 1992, Korea, Taiwan, and Japan manufactured 76 percent of the 40.7 million CRT monitors produced worldwide; Taiwan alone has 70 manufacturers who accounted for approximately 39 percent of world CRT production (Alexander, 1993). In May 1993, Business Week reported that Japanese-based companies had captured 95 percent of the world FPD market (Business Week, 1993b).

In general, Japan dominates advanced display production. Several Japanese companies (e.g., Sharp, Hitachi, NEC) have plants that produce hundreds of thousands of high-information-content color and monochrome LCDs. There are no current, or planned, similar-scale manufacturing facilities in the United States. There is but one major flat-panel display manufacturing center now under construction in Europe. Several Korean firms, however, are rapidly ramping up to compete with the Japanese in volume manufacture of AM-LCDs in the coming years.

However, the display industry includes more than display manufacturers. It spans a wide range of suppliers, manufacturers, and users. The industry includes producers of components (glass, electronics, filters and polarizers, backlights, coatings, phosphors, and liquid crystals), manufacturing equipment (steppers; inspection, test, and repair equipment; deposition, etching, and handling equipment), display manufacturers (liquid crystal displays, electroluminescent, gas-plasma, field emitters), end-users (computers, business equipment, avionics, automotive, instrumentation, television, telephones, consumer electronics, and military), and many research universities and industrial laboratories.

In comparison with Japan especially, most of these industry segments in the United States are small and fragmented. Flat-panel display manufacturers, for example, consist of about a dozen small and medium-sized firms pursuing a variety of technologies. A few domestic companies have successfully positioned themselves as suppliers of either materials or display production equipment. But there is almost no U.S. presence in today’s multibillion-dollar LCD market. America’s relative strength seems to lie in its potential to develop innovative display technologies and its vibrant computer, communications, and entertainment industries, from which many of the advanced display applications will emerge.

Display Technologies

As is well known, the CRT dominates the electronic display market today. Continuing improvements in quality and especially cost make CRTs the obvious choice for most applications. However, significant market niches (for example, for portable computers) already exist where the CRT’s power and volume requirements cannot be satisfied and alternative display technologies must be used.1

Future market growth for such advanced display technologies is almost wholly dependent on technological advance in both product and process areas. For example, the ability to mass manufacture flat displays with good contrast and sufficient resolution is the sine qua non for the advent of affordable portable computing devices. Of a number of existing products, from personal digital assistants and portable computers to camcorders, none is very useful without a crisp visual interface. As yet, no one technology has emerged that is able to meet the requirements (e.g., cost, power consumption, image contrast, color, manufacturability) for all applications. Different technologies are evolving to meet the needs of different applications.

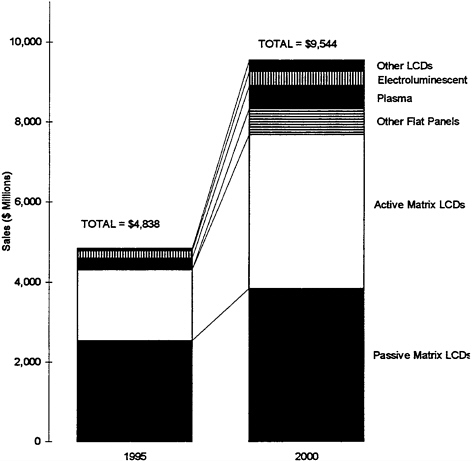

By far the current market leader in advanced displays is, nevertheless, a technology based on the use of LCDs. The market dominance of LCD modules is shown in Figure 1. Display industry experts generally agree that LCDs are especially well suited for use in small portable electronic devices and are likely to dominate that market for some time. LCD screens require relatively little power, and a type called active-matrix LCD is already able to achieve brilliant full-color for screen sizes less than 14 inches diagonal.

FIGURE 1 Projected sales of flat-panel displays, by technology: 1995 and 2000

Source: Data provided by David Mentley, Stanford Research Incorporated, 1993.

But LCD is not the only technology that can be used to produce flat-panel displays. At least two technologies—plasma and electroluminescence (EL)—are already strong contenders and several other emerging technologies offer intriguing possibilities (e.g., field emission displays, called FED or microtip displays, and vacuum-fluorescent displays, or VFD). Additionally, there are several derivations in LCD modules such as actively addressed passive LCD displays and plasma-addressed active-matrix LCDs that seek to combine the best attributes of each technology.

Several projection display technologies—including digital micromirror devices, single-crystal silicon, and light-valve LCDs—are also contending for market acceptance. Such technologies are easily scaled up and are being targeted at the expected market for very-large-screen displays.

The jury is still out on which display technology—whether AM-LCD, EL, plasma, or something else—is likely to be preeminent in future markets where display requirements differ. Each technology has its own strengths and weaknesses, making each suitable for particular applications.

Market History

Consumer Electronics

In the United States, efforts to commercialize advanced displays over the last decade have come largely from small companies. But as with many other technologies, advanced displays have much of their origin in the central research laboratories of America’s preeminent electronics firms of the 1960s and 1970s. The three largest consumer electronics firms of the time, General Electric (GE), Radio Corporation of America (RCA), and Westinghouse—the 4th, 15th, and 18th largest corporations in America, respectively, in 1968—were all actively involved in advanced display science and technology.

RCA was perhaps the most prominent of the three. As early as May 1968, for example, the New York Times reported that RCA had developed a new type of flat electronic display that used liquid crystals. Recognized even then was the displays potential for applications including “a thin television screen that can be hung on the living room wall like a painting” as well as “electronic clocks and watches with no moving parts” (Stevens, 1968). Yet RCA was never able to exploit its early lead because of internal decisions on resource allocation into other areas.

RCA was not alone among American companies with a strong research effort in liquid crystals during the 1970s. Researchers at Westinghouse’s Pittsburgh laboratories also had been conducting experiments in liquid crystals for some time. Among their most important discoveries was a technique of addressing the individual LCD pixels through the use of an “active matrix.”

Within Westinghouse, this work was led by Brody and Fischer, whose major support came from the Consumer Electronics division. They pumped millions of dollars into the work from the mid-1960s to the early 1970s. But then Westinghouse, having less than 5 percent of the TV market, stopped making televisions and related components in the mid-1970s. With no logical source of support in the company, but with the technology at the stage of prototype production, Westinghouse

had two options: to invest in an expensive and risky manufacturing effort, or to abandon the research. In 1979, Westinghouse canceled the project (see Florida and Browdy, 1991).

General Electric also had an advanced research and development effort on LCD technology during the 1970s and into the mid-1980s. Their efforts to enter into manufacturing were short-lived, however, as the mid-1980s divesture of their consumer electronics group and eventual sale of their avionic instruments division eliminated vital internal customers for the technology.

Additionally, during the 1970s, many large American companies (e.g., Timex, Hughes, and Motorola) were making products such as watches and calculators incorporating LED and later LCD technology. Although the specifics varied, few if any of these companies made money in LCDs once low-cost competitors entered the market. By the end of the 1970s, most U.S. consumer electronic companies had exited the market as LCDs had apparently become a commodity item.

Computer Market

With the exit of American firms from consumer electronics, only the computer and information technology firms appeared to have an interest in flat-panel displays. During the 1970s and early 1980s, almost every major player in computing, from IBM to AT&T and NCR, had active research efforts in LCD, plasma, or EL display technologies. As did many companies, Texas Instruments and Hewlett-Packard manufactured many products using their own LCDs. IBM, for its part, was producing tens of thousands of flat-panel plasma displays for the banking industry during the 1970s.

In the early 1980s, however, few large markets existed for such advanced technology displays. At IBM, for example, their major customer, the banking industry went back to using small CRTs instead of plasma displays. Moreover, consumers were increasingly demanding color in their displays. Among the leading flat-panel display technologies, only active-matrix LCDs could be expected to offer color in the near term. It was also clear, however, that the AM-LCDs would involve one of the most challenging and costly manufacturing processes ever attempted.

Meanwhile, Japanese companies started showing high-quality flat-panel displays and asserting costs that were much less than those of their American competitors. U.S. divisions concentrating on displays began to be sold outright and research efforts were greatly scaled back: Hewlett-Packard terminated its LCD research in 1980; Texas Instruments stopped its production of LCD and plasma displays in 1981; NCR ended its plasma research in 1984; AT&T stopped its plasma work in 1987. Even IBM sold its plasma research in 1987 (to a small start-up called Plasmaco).2 All in all, more than a dozen domestic flat-panel display groups were closed or sold during the 1980s. Two more American display manufacturers, Cherry Displays Products and Taliq (a subsidiary of Raychem), were closed in 1992. Table 1 provides a summary of these closings.

Table 1 The Closing of the Domestic Display Industry

|

Electro-Luminescent |

LCD |

Plasma Display |

Other |

|

Cherry Display, exited 1992 |

Raychem/Taliq, exited 1992 |

|

|

|

Sigmatron Nova, exited 1988 |

Alphasil, exited 1988 |

|

|

|

|

LC Sytems, exited 1988 |

|

|

|

GTE, exited 1987 |

|

IBM, exited 1987 |

|

|

|

AT&T, exited 1987 |

|

|

|

|

Panelvision, exited 1986 |

|

Epid/Exxon, exited 1986 |

|

|

Plasma Graphics, exited 1985 |

|

|

|

|

Crystal Vision, exited 1984 |

NCR, exited 1984 |

|

|

|

Kylex/Exxon, sold 1983 |

TI, exited 1983 |

|

|

|

TI, exited 1983 |

|

|

|

|

GE, exited 1980 |

Control Data, exited 1980 |

|

|

|

HP, exited 1980 |

|

|

|

Source: Office of Technology Assessment (1990), and personal data. |

|||

Defense Market

The exit of large firms also created market niches, such as the defense market, for a number of small companies. The light weight, small dimensions, and high resolution of advanced screen technology had the potential of greatly improving instrumentation across a range of military platforms— from cockpits, to tanks, to communication and control rooms on Navy ships. The U.S. military became an important advanced display market and a major supporter of related research. For example, EL displays became commercially practical when the United States helped to fund Planar, Inc. (a friendly split-off from Tektronix) in 1983.

Numerous large defense technology companies devoted considerable effort to developing displays for the military market. Hughes, for example, successfully produced a large, color flat-panel display using LCD technology for the command and control units on Navy ships. Honeywell funded a small LCD manufacturer called Alphasil to develop LCDs for avionic cockpit displays. Alphasil was forced to close in 1988 after Honeywell withdrew support in favor of purchasing such displays from Sony and Hoseidon of Japan.

CURRENT MARKET AND TECHNOLOGY ISSUES

Recently, several large domestic customers of electronic displays have teamed up with small display companies to commercialize novel display devices. For example, Motorola has invested $20 million in a joint venture with In Focus Systems to develop a novel LCD technology (Hill, 1992). Rockwell International has formed a strategic relationship with a small Massachusetts firm, Kopin, to develop AM-LCD screens based on Kopin’s Smart Slide technology (itself a result of a joint development with Standish and Sarnoff Research Center) (Young, 1992). Kopin has also signed a broad product-development effort with Philips North America Corporation, the world’s largest manufacturer of color picture tubes (Lieberman, 1994). Xerox is working with Standish to manufacture a very-high-resolution AM-LCD.

Such partnerships seem to be increasingly driven by strategic necessity of the large electronics firms; displays are becoming just as critical in the production of electronic systems as are materials, processing equipment, and semiconductors. Advanced displays are much more than a single component in the electronic system. They embody a plethora of supporting integrated circuit technologies such as IC drivers and controllers required to integrate the display into the system. In the future, displays are likely to represent an increasing fraction of total electronic system cost. Already, advanced screens account for more than one-third the cost of a laptop computer.

A Critical Technology

Government, for its part, has recognized displays and visual systems as a vital technology. Display technologies are featured prominently in lists of critical technologies. For example, the Report of the National Critical Technologies Panel (National Critical Technologies Panel, 1992) identifies “high-definition imaging and displays” as critical to national defense and economic prosperity and explicitly notes that flat-panel displays are a key technology that drive advances in lithography equipment, circuitry patterning, glass-sheet production, and thin-film techniques. In short, flat-panel displays are not only a huge potential market in and of themselves, but they are also believed to be a strategic enabling technology for a variety of electronic systems.

In recent years, governments around the world have attempted to nurture their own flat-panel display industries. U.S. government support has been primarily channeled through the Department of Defense, which views advanced displays as a critical national technology; in Japan, it was government interest in developing high-resolution screens for displays of Kanji and Katakana characters; in Korea, it was government support of high-tech industry; and in Europe, generous European Community support fell under the rubric of high-definition television.

Japanese Business Dominance

Japanese companies steadily invested in research into various display technologies during the 1970s and 1980s. Once AM-LCD screens started to make rapid advances, research on other display technologies was scaled back and companies scrambled to catch industry leaders Seiko-Epson and Sharp.3

Relatively low costs for capital, a strategic emphasis on displays, and fierce competition among the major firms drove Japanese investment in LCD production technology to more than $3 billion by 1993 (Business Week, 1993b). Spread across 15 companies (mostly the large vertically integrated electronics firms), this level of investment is making LCD technology the dominant FPD technology for the foreseeable future. In 1992, Japanese companies produced 98 percent of the world supply of flatpanel displays and essentially built all screens using active-matrix LCD technology. This situation is in stark contrast to that which evolved in United States, where to date there has been almost a complete absence of large investments in AM-LCD production.

It should be noted, however, that difficulty in achieving high yield rates has kept LCD prices higher than originally was expected. Monochrome LCDs still cost several hundred dollars each, while color AM-LCDs command a price premium of somewhat over a thousand dollars more per screen.

During the 1980s, Japanese companies also received some government support. However, government-led projects to industrialize large-screen thin displays have thus far played a minor role in the industry’s major developments.4

Entry of Korea and Taiwan

Korea and Taiwan are both aggressively planning to enter the LCD market. The Korean government has launched a 5 year program for high-resolution displays with a total investment of about $75 million. Plans are reportedly to develop 3- to 5-inch LCD screens by the end of 1992 with mass production by 1995, and 10- to 14-inch displays to be in mass production by 1996. Companies involved include Samsung, Hyundai, and Lucky-Goldstar Group; most of these companies already have licensed the technology from either Japanese or American firms. Taiwan reportedly has set aside $100 million to support LCD production over the 1993-to-1997 period.

The Dumping Case

In July 1990, a group of seven small U.S. companies filed a dumping complaint with U.S. Department of Commerce and the International Trade Commission. They charged a dozen Japanese companies with selling flat-panel displays below fair-market value in violation of the Tariff Act of 1930. The group called themselves the Advanced Display Manufacturers of America (ADMA) and included Cherry Display Products, Electro Plasma, Magnascreen, Optical Imaging Systems (OIS), Photonics Technology, Planar Systems, and Plasmaco. One of the most successful domestic FPD companies, In Focus Systems, was notably absent among the petitioners. The Japanese companies named in the petition were Toshiba, Hitachi, Fujitsu, Matsushita Electric Industrial, Seiko Epson, Sharp, Hoseidon Electronics, Kyocera, NEC, Optrex, Seiko Instruments and Electronics, and Matsushita Electronics. In August 1991, the International Trade Commission, an office within the U.S. Department of Commerce, ruled that Japanese FPD manufactures had in fact been dumping their product in the U.S. market, bringing harm to domestic suppliers. A 63-percent duty was imposed on imported AM-LCD displays (EL displays received a 7.02-percent duty, plasma displays received a less-than-1-percent duty, which was not collected, and passive matrix displays received no duties).5 After the ruling, major U.S. laptop computer makers such as Apple moved their production offshore to avoid tariffs because there were no domestic suppliers of the displays that they required (Magnusson, 1991).6 In a surprising development, however, OIS Inc.—the only AM-LCD manufacturer in the original group—reversed its position in the fall of 1992. In large part because of this, but also in light of the complaints from the computer manufacturers, on June 21, 1993, the Commerce Department revoked all import duties (Andrews, 1993).

Recent Developments

In addition to the changing tariff situation, wider technological and industrial trends are rapidly reshaping the display industry. For example, declining defense budgets are forcing many defense contractors to explore ways in which they might exploit their technological sophistication in the commercial market. Hughes, for instance, is reconsidering the consumer electronics market for its liquid crystal light-valve technology. In the spring of 1992, its division in Carlsbad, California, invested $62.5 million in an equally owned joint venture with Victor Company of Japan (JVC) to develop, produce, and market liquid crystal light-valve projectors, a technology developed for the U.S. Navy. Staffed with more than 100 employees from Hughes and a dozen technical experts from JVC, the venture hopes to combine the expertise and technology developed for defense with the consumer marketing, sales, and manufacturing talents of a major consumer electronics company.

In the context of U.S. companies holding less than 5 percent of the $3.5 billion display market, in May 1994 the U.S. Department of Defense (DOD) announced a 5-year, $500 million effort to support future domestic display manufacturing. DOD, however, has long been active in supporting display research with over $100 million distributed over the last few years. For example, in January 1994 the Advanced Research Projects Agency (ARPA) of DOD awarded a 3-year, $21.4 million grant to Xerox for continued development of its AM-LCD technology.

DOD funds have also gone beyond research to include the manufacture of displays. In May 1993, ARPA and Optical Imaging Systems (OIS) of Troy, Michigan, announced they would join to build a $100 million LCD plant in southeastern Michigan (Southerland, 1993). The displays would be for both military and commercial users. Support from ARPA would amount to $50 million over 2 years (Congress had already appropriated the first $25 million), and OIS would invest $50 million of its own money. Production of about 50,000 finished screens per year is expected to begin in 1995.

The state of Michigan also agreed to contribute $20 million to a new center for display technologies (The Center for Display Technology and Manufacturing) at the University of Michigan, whose research will be available to the industry at large.

In February 1993, ARPA awarded a multi-year infrastructure development grant of $12 million for the first year to the U.S. Display Consortium (USDC). The consortium was formed in the summer of 1992 to create a national manufacturing capability for AM-LCD displays. The consortium was led by Xerox and AT&T (with its NCR subsidiary) and included Standish/Hamlin, Sarnoff Research, OIS, as well as the American Display Consortium (ADC) composed of ElectroPlasma, Magnascreen, Photonics Imaging, Planar, Plasmaco, and Tektronix. The Semiconductor Equipment and Materials International (SEMI) announced a partnership with USDC in July 1993.

Also in 1993, ARPA started a Display Phosphor Center of Excellence at the Georgia Institute of Technology. Other members include University of Georgia, University of Florida, Penn State University, Oregon State University, the David Sarnoff Research Center, and American Display

Consortium. The National Center for Advanced Information Components Manufacturing (NCAICM) located at Sandia National Laboratory is another ARPA-funded initiative. Approximately half of NCAICM’s budget is directed toward display technology.

New Markets and Applications

Over the next 10 years, the development of entirely new applications, rather than replacement of CRTs, will drive growth in demand for advanced displays. Specific new applications are difficult to predict, but two likely large emerging markets include personal information devices and virtual reality systems. Numerous familiar electronic products, from the telephone to the television, will also undergo marked changes in design and function. Products already introduced range from pocket computers (e.g., Sharp’s Wizard) and intelligent pagers (Motorola’s Advisor incorporates a four-line screen) to advanced telephones (AT&T’s videophone), portable televisions (Sony’s Watchman), and personal electronic games (Nintendo’s Gameboy).

Personal Information Devices

While the nomenclature for personal information devices is not agreed upon (other descriptions include personal digital assistants, personal electronic appliances, palmtop computers, and sub-laptops), the evolution from solely computing devices to more user-friendly electronic appliances seems inevitable. Many system companies have stated their intent, albeit often delayed, to develop personal information devices of some sort, including Amstrad, Apple, AT&T, Casio, Dauphin, IBM, Matsushita, Motorola, Olivetti, Philips, Samsung, Sharp, Sony, Sun Microsystems, Tandy, and Toshiba. Advanced electronically integrated screens are likely to be key value-added components of such products. As such, the rate of market growth for such products will depend to a significant degree on the price and performance of displays.

Virtual Reality Systems

Advanced high-resolution displays are essential to achieving realistic virtual environments. In immersive applications, in which an artificial environment surrounds the participant, small light-weight displays are typically worn as eyeglasses. In non-immersive applications, such as flight simulators, large high-resolution displays are needed. Several companies are actively planning to create regional amusement parks based around large multiplayer virtual reality systems. Some such systems already exist for both entertainment and training (e.g., for tank crews).

Portable Computing

The $400 million LCD market for portable computers aptly illustrates the potential of new applications for display market growth. That displays can and will serve as product differentiators already can be seen in the success of IBM’s color Thinkpad series of laptop computers.

Smart Phones

The common telephone is likely to undergo a metamorphosis in the coming years. Thin displays will be used to take full advantage of a vast increase in bandwidth. Instead of audio instructions, companies will be able to transmit a menu of options or the requested information. The installed telephone base is likely to make this among the first major new markets for advanced displays.

Medical Devices

Display of information and images is critical in many medical applications. While large systems such as computerized tomography and magnetic resonance imaging machines will use large high-resolution displays, the portable-device arena will also employ significant numbers of advanced displays. For example, pen-based portable hand-held computers for entering patient record information are already on the market from several small and medium-sized companies.

Avionics

Aircraft control and instrumentation has long been and will continue to be a key, if relatively limited, market for advanced displays. The need for high-performance, small-volume displays for which price is relatively less important will continue to be an attractive market niche. Some of the technology can be transformed to commercial areas, but much is simply too expensive to be practical.

Military

All branches of the military have long been interested in rugged, light-weight, thin displays. From tanks to submarines, accurate and intuitive information display is considered critical to system success.

Video Capture

Almost all video cameras require small, high-resolution displays for viewing the recording in real time. Millions of such displays are needed each year. Advances in the quality and cost of these displays allowed Sharp to eliminate the viewfinder in its most recent camcorder, replacing it instead with a 4-inch color LCD monitor.

Advanced Television

The availability of inexpensive high-resolution displays will either hasten or greatly slow the advent of advanced television. Such displays not only must be easy to manufacture but must occupy significantly less volume relative to their screen size than CRTs of today.

Cost, size, weight, and power consumption are key factors in the success of such products. Future market growth will depend significantly on the degree to which the ratio of cost to quality for displays can be further improved.

THE ROLE OF SMALL COMPANIES

With the exit of most large American firms from the display market in the mid-1980s, a cadre of small firms emerged. Many failed when money ran out, but others managed to survive and even prosper. Today, these firms are being joined by several new ventures with innovative approaches. As several large firms re-enter the market (e.g., Motorola, TI, Hughes), the future role of small firms seems bound to be intertwined with that of large companies. Following is a summary of important issues in market and company development as they emerged at the National Academy of Engineering workshop on advanced displays and visual systems held in December 1993.

Product Research and Development

Small companies in the display industry do not conduct “research”; rather, they focus on product development and engineering (i.e., innovation). Few if any companies have grown solely from technological or scientific breakthroughs. The most successful small companies have identified a market need and adapted existing technology to meet that need.

Many of the active small companies appear, nevertheless, to be pursuing “technology-push” strategies. Most of these companies originally began as display units in larger companies. They became independent as larger companies decided in the 1980s to divest themselves of their display efforts. In recent years, such companies have often survived largely through the support of ARPA grants.

The reason they persevere is that with few exceptions, there is little agreement regarding which technologies are likely to dominate which applications. The market pull on technologies is undeveloped in many applications or potential applications. Therefore, there is still a proliferation of companies and approaches to both product characteristics and manufacturing processes.

The huge and thus far difficult Japanese investment in AM-LCDs has created a window of opportunity for other technologies. Active efforts are under way at a number of small firms in the areas of ferro-electric LCDs, field emission devices (also known as flat CRTs), poly-silicon, single-crystal

silicon (also referred to as MOSFET active matrix), micromirror devices, actively addressed supertwisted nematic (STN), “tiling” of LCDs, plasma, and electroluminescent (EL) displays. These last four technologies are all at the engineering or later stage of development. Indeed, both plasma and EL displays are currently being produced and provide substantial market niches for several small firms.

Manufacturing Research and Development

Producing flat-panel displays in volume is a fundamental hurdle for all small firms. They must carefully balance flexibility with economies of scale. Scaling up from prototype presents a range of challenges for all technologies. First among these challenges is obtaining sufficient capital. This is especially true of LCDs for which a single-volume plant may cost in excess of $300 million. In addition to capital, there are a number of serious technical challenges associated with the manufacture of displays.

A lack of standardized process equipment greatly complicates display manufacturing. Small would-be manufacturers are faced with the difficult task of adapting similar process technology, where available. For example, the manufacture of AM-LCDs is similar in technology to that of integrated circuit manufacturing. As such, fabrication facilities currently being constructed expect that over 70 percent of their internal equipment can be purchased domestically. Still, the materials and scale are vastly different. Large plate handling, thermal processing, test equipment, and automated inspection gear are specific areas where AM-LCD display manufacturing differs from IC production.

Some of the most promising display technologies are being explicitly developed to take advantage of existing domestic manufacturing expertise. For example, the manufacture of field emission displays is similar in many respects to the manufacture of CRTs, save some few but essential steps; single-crystal silicon displays use a manufacturing process that is almost identical to that used in the production of silicon-wafer-based integrated circuits; and micromirror devices are intended to be produced using a derivative of the well-established metal-oxide silicon manufacturing.

The flat-panel display community in the United States (including equipment suppliers, display manufacturers, and customers, as well as government) has confronted this poor state of infrastructure capability with an ambitious cooperative effort under the auspices of the United States Display Consortium. The goals of USDC are manifold and perhaps best summarized as “virtual vertical integration.” Among its priorities is the creation of a domestic manufacturing test-bed capability where equipment might be tested and calibrated. Presently there are only four display fabrication facilities existing or under construction in the United States, one of which is but a small prototype line owned by a Korean firm. Also important to USDC is the establishment of a culture of cooperation within the display community in such areas as standardization and intellectual property. The USDC is explicit in recognizing SEMATECH as a valuable model of these cooperative activities.

Upstream Issues

The very lack of a critical mass of manufacturing capability in the United States severely limits market opportunity for upstream equipment and component suppliers. Displays, however, offer one of the few examples of a technology-intensive manufacturing process where Japanese companies have been the pioneers. And while this has provided them with certain obvious advantages, including capturing 95 percent of the LCD market, they have also had to bear the cost of developing the first generation of manufacturing equipment. This has created a window of opportunity for U.S.-based firms, which can now optimize and perfect the most-promising approaches.

The accompanying challenge, however, is that existing and would-be upstream suppliers must sell in the Japanese and Asian markets. Selling abroad is intrinsically expensive for small firms. Selling in Japan presents even more arduous hurdles. Nevertheless, this is the major market for upstream display companies today. (Philips is currently constructing the only major flat-panel display manufacturing plant in Europe.) Some cooperative marketing efforts on behalf of the industry and government have been called for, but to date little progress has been made. Several states, however, actively seek to help small firms sell abroad as part of their general business development efforts.

To confront the problem of scarce resources, a number of small upstream equipment providers have formed strategic partnerships with their customers. This has provided greater access to markets, capital, and to some extent technology. Also of significant help have been government-supported research contracts through such agencies as the Defense Department’s ARPA, the U.S. Department of Energy, and the U.S. Department of Commerce.

Downstream Issues

The United States has large existing downstream markets for flat-panel displays and even larger potential markets (see above section on New Markets and Applications). Additionally, several substantial niche markets currently exist (e.g., military, avionic, and medical). But where as large Japanese companies appear to use niche markets to explore new business opportunities, this is rarely practiced in the United States where small companies are left to investigate market opportunities. These small companies generally do not have the wherewithal to participate in market experimentation. Large companies can release a new product into the market, see how it fares, modify it as appropriate, and then start the process over again if necessary; small companies cannot afford such approaches. They cannot afford any mistakes the first time. Cash flow must be generated almost immediately, or the money will simply run out and the company will cease to exist. In effect, this is what happened during the 1980s to a series of small display companies.

With large companies in the United States discontinuing their flat-panel display efforts in the early 1980s, the risks associated with downstream market development have been placed entirely on

small companies. There are, nevertheless, several small companies that have succeeded in downstream display markets. They have done so through selling products at the system level—as opposed to a component level—where margins are sufficient to allow for further product and process development.

Yet even when successful, small companies must typically turn to large companies for capital and resources if they wish to grow. One successful small company chose its larger strategic partner not for technology, or capital, but for its ability to conduct business in Japan.

The downstream markets for flat-panel displays might be characterized as (1) developed but not mature, (2) “obvious” and “huge” but unproven, (3) potential but neither obvious nor huge, and (4) undiscovered. In the first group, there are many products but only some product standards and almost no process technology standards. As a consequence, the cost of fabrication facilities can be enormous. The second group has some first-generation products and a few clues to eventual product technology standards. Once again, there are no process technology standards, and manufacturing and distribution costs are likely to be huge. The third group has some products being tested but almost no standards of any kind. Finally, in the fourth group, no product insight has yet emerged, but it is clear that price/performance changes in displays will have a great if unpredictable impact.

Human and External Resource Issues

People are fundamental to all businesses. Yet to a larger degree than one might suspect, the domestic flat-panel display industry depends on a small cadre of experts and an agonizingly narrow university pipeline. The short-supply of university-trained individuals was exacerbated by the divergence of academic and industrial research interests in the early and mid-1980s. For example, the academicians would attend the International Liquid Crystal Society annual meetings while industrialists would go only to the Society for Information Display’s gathering.

This divergence in interests seems to have been recognized, and efforts to reconcile interests are well under way. At Kent State University, the NSF Science and Technology Center on Advanced Liquid Crystalline Optical Materials (ALCOM) works with many small and large U.S. display companies. Temple University and the University of Michigan also have active AM-LCD research programs in which industry is an active participant. During the National Academy of Engineering workshop, other examples of cooperation were mentioned in Boston and San Francisco. In these cities, small display companies are said to be working closely with local universities to explore innovative technical and managerial approaches to their problems. Concerns regarding intellectual property and confidentiality of technical know-how have been expressed when working with universities. However, even small companies believe that one cannot really control diffusion of technical know-how and that the benefits of the existing system far outweigh costs of trying to tighten it up.

Work is also under way to enlarge the talent pool. For example, ARPA has helped established the Phosphor Center of Excellence at Georgia Institute of Technology. In the meantime, companies attempt to bring in specialists from related fields. For instance, equipment makers have hired engineers and managers from the integrated circuit industry.

Investment, Governance, and Strategy

In the United States, the flat-panel display community has become just that, a community. While display firms have always been a sort of technical club, today there are a variety of vehicles by which the club is becoming an industry, as small firms take on large corporate partners. Meanwhile, government agencies such as ARPA continue to invest, and entrepreneurs are striving to develop viable new ventures.

Yet during the 1980s, a gap seems to have emerged between the point where money for investigating ideas runs out and venture capital is available. Government procurement that leaves little room in the margins for R&D has not helped. This gap in “seed funding” or “launch money” appears to be quite large. As “the display becomes the computer” for many applications, this is an increasingly worrisome situation.

Obviously, technology alone will not solve the problem. It may help, but success must come first and foremost from meeting the needs of the market. Or, as one National Academy of Engineering workshop participant noted, the goal should be to “make money, not technology.”

CONCLUSIONS

The flat-panel display industry faces the special challenge of developing infrastructure, manufacturing, and markets—all at the same time. To meet this challenge will take the efforts of government, universities, and industry. Small companies will almost certainly continue to play a critical role in addressing this challenge.

APPENDIX: DESCRIPTIONS OF DISPLAY TECHNOLOGIES

The leading technologies developed for flat-panel displays include liquid-crystal display (LCD), plasma (gas discharge) display (PDP), electroluminescent display (EL), and field-emission display (FED).

An LCD cell consists of two sheets of glass separated by a sealed, normally transparent, liquid crystal material. Such screens require relatively little power. The LCDs currently fashionable, called active-matrix LCDs (AM-LCDs), are those with the ability to turn each picture cell, or pixel, on and off independently. In AM-LCDs, the two sheets of glass carry thin films of connected transistors etched onto their inner surfaces. Each minute transistor is, in effect, a switch that can be turned on or off rapidly to polarize the liquid crystal at that point, and thus let light through. Three transistors are needed to create a single pixel capable of displaying a range of colors.

So-called passive LCD screens do not incorporate these transistors for each pixel but rely on rows and columns of conducting lines to activate each pixel. They are therefore much simpler to manufacture. However, the brightness and color of passive LCDs have historically been far inferior to those attainable with active-matrix LCDs.

In May 1992 a new approach to passive LCD screens—now referred to as “active addressing”— was acclaimed as a breakthrough at the annual Society for Information Display conference, the premier international technical forum for display technology. The essence of the approach was to eliminate the propensity for passive LCDs to fade by refreshing each pixel hundreds of times per picture frame instead of once per frame. Though it sounds simple, deriving the correct mathematical algorithms so that the exact voltage is delivered to each pixel without interfering with other pixels at the same time was a major accomplishment.

A PDP is any display that operates on the basis of ionizing a gas and thus causing light to be emitted. Instead of rows and columns of transistorized pixels, the plasma display has a grid of tiny channels filled with gas—similar to a group of miniature fluorescent tubes. Turning on electrodes that run the length of the channels ionizes the gas inside them, and fires up a pixel where a row and column intersect. The display is fast enough to show full-motion video, and color plasma displays have been demonstrated. With no transistor array, such displays may be relatively less expensive to produce than other display technologies.

The EL display produces light in the same way as a cathode-ray tube (CRT): by bombarding a layer of phosphors with electrons. However, an EL is made as an LCD, with a thin film of luminescent phosphor sandwiched between two sheets of glass imprinted with rows and columns of electrodes. The display is bright, frugal with power, and capable of high resolution. Panels up to 46 centimeters in size have been built, but only in monochrome. Novel stacking of the electroluminescent layers has recently produced color panels.

FEDs are similar to CRTs. Whereas the electroluminescent display has solid-state electrodes, the FED has beams of electrons, like a CRT. However, whereas the CRT has a single electron gun sweeping across a phosphor-painted screen, the FED has countless guns, each a tiny vacuum tube a few microns high. In principle, such devices can offer an extremely bright, pin-sharp image that requires very little power and has exactly the same screen appearance as a CRT.

REFERENCES

Alexander, R. 1993. Computer monitors: The CRT still reigns. Information Display. September: 16–19.

Andrews, E.L. 1993. Duties ended on computer flat screens. New York Times. June 23. D1.

Business Week. July 5, 1993a. Did commerce pull the plug on flat screen Makers? P.32.

Business Week. May 10, 1993b. Can the U.S. put its screens in the picture? P.48.

Florida, R. and D.Browdy. 1993. The invention that got away. Technology Review. August/September.

Hill, C.G. 1992. Motorola and In Focus Systems launch joint venture in video display panels. Wall Street Journal. October 22. B10.

JTECH (Japanese Technology Evaluation Center) Panel Report. 1992. Display Technologies in Japan. Report No. PB92–100247. National Technical Information Service (NTIS). June.

Lieberman, D. 1994. Kopin, Phllips team on HDTV displays. Electronic Engineering Times. August 29. P.8.

Magnusson, P. 1992. Did Washington lose sight of the big picture? The tariff on liquid-crystal displays has U.S. laptop makers up in arms. Business Week. December 2. P.38.

National Critical Technologies Panel. 1992. Report of the National Critical Technologies Panel. March 22. Washington, D.C.: United States Government Printing Office.

Office of Technology Assessment, United States Congress. 1990. The Big Picture: HDTV and Advanced Display Systems. Washington, D.C.: United States Government Printing Office.

Southerland, D. 1993. U.S. Firm to Make Display Screens With the Help of Defense Department. May 1.

Stevens, W.K. 1968. Display devices crystallize for R.C.A. New York Times. May 29.

Tannas, L.E. 1994. Flat-panel display technologies in Japan. Information Display. February. Pp. 12–21.

Werner, K.I. 1993a. The Flat panel’s future. IEEE Spectrum. November. Pp.18–26.

Werner, K.I. 1993b. Sleepless in Seattle. Information Display. July and August. Pp.10–18.

Young, J. 1992. The inventor from the Ashram. Forbes. August 3. Pp.90–91. Younse, J.M. 1993. Mirrors on a chip. IEEE Spectrum. November. Pp. 18–26.