IMPLANTABLE AND SURGICAL MEDICAL DEVICES

Annetine Gelijns, Nathan Rosenberg, and Gerald Laubach

Medical devices encompass a heterogeneous group of products ranging from the low-tech and inexpensive (tongue depressors and disposable needles) to the sophisticated and expensive (lithotriptors and magnetic resonance imaging [MRI] machines). The U.S. Department of Commerce has grouped the medical device industry, according to Standard Industrial Classification (SIC) codes, into the following five categories:

-

Surgical and Medical Instruments and Apparatus (SIC 3841), which embraces such nonelectronic devices as bone drills, microsurgical instruments, and surgical stapling devices.

-

Orthopedic, Prosthetic, and Surgical Appliances and Supplies (SIC 3842), which consists of a diverse set of devices such as sterilized cotton, walkers, and orthopedic braces.

-

Dental Equipment and Supplies (SIC 3843), which includes enamels, orthodontic appliances, and artificial teeth.

-

X-ray Apparatus and Tubes (SIC 3844), which encompasses fluoroscopic and radiographic x-ray devices and gamma-ray irradiation equipment.

Annetine Gelijns is associate professor and director of the International Center for Health Outcomes and Innovation Research, Columbia University. Nathan Rosenberg is Fairleigh S.Dickenson Professor of Economics, Stanford University. Gerald Laubach is former president of Pfizer, Inc., and a member of the Committee on Technology, Management, and Capital in Small High-Tech Companies.

This paper was prepared for a National Academy of Engineering workshop on small medical device companies held December 5–6, 1993, at Columbia University.

-

Electromedical and Electrotherapeutic Apparatus (SIC 3845), including CT scanners, defibrillators, endoscopes, and lasers.1

The purpose of this paper is to examine the role of small firms in medical device innovation. Historically, medical device innovation, and the development of invasive procedures and implants in particular, has been heavily dependent on small firms. Frequently, such innovation has been characterized by collaborations between inventive, individual clinicians with venturesome, individual engineers. At the outset, however, it is important to underline that government policies have a powerful impact on the innovation practices of these small firms. Indeed, the federal government plays several distinctive roles in shaping R&D policy, some of which may have unintended as well as intended consequences. First, the federal government is a major source of medical R&D funding. Second, the federal government influences the nature of the development process through its premarketing approval regulations and policies for medical devices. Third, the government, primarily through the growth of Medicare and Medicaid, has become a major source of payment to the providers of medical care services. Government decisions concerning which services to pay for, and how much to pay for each service, are a dominating influence over the extent to which existing technologies are used. At the same time, however, those decisions exercise a powerful impact on the financial incentives in private industry to undertake specific kinds of research and development.

Currently, the environment within which these small, high-tech firms operate is experiencing major upheaval. First, several highly publicized problems involving implantable medical devices, and the passage of the Safe Medical Devices Act of 1990, have prompted the U.S. Food and Drug Administration (FDA) to become more rigorous in its regulation of medical devices. Second, the health care financing and delivery system in this country is undergoing rapid and radical transformation. Until recently, the U.S. health care system was essentially a cottage industry in which decision making was left largely to the discretion of individual physicians and surgeons, who avidly adopted new technology but were not particularly sensitive to the cost consequences. By contrast, the delivery system that is now emerging has many of the characteristics of a typical industrial market: large integrated units of health care providers where the adoption of technology is powerfully influenced by considerations of both cost and value. These changes have implications for the innovation strategies, the competitiveness, and even the viability of small medical device firms. Before exploring some of these potential consequences, however, we will briefly review the structure of the industry, its markets, and several fundamental characteristics of the innovation process in medical devices.

THE MEDICAL DEVICE INDUSTRY AND ITS MARKETS

By modern standards, the medical device industry remained relatively small until World War II. Then, wartime investment in R&D stimulated many advances in science and engineering, such as radar, ultrasound, and new materials, that would benefit the development of medical devices and stimulate growth in the device industry. At the same time, the market for medical devices was expanding rapidly. With the establishment of Medicare and Medicaid in the mid-1960s, medical insurance coverage of the U.S. population rose markedly. An increase in coverage related to these programs, coupled with the proliferation of generous benefit plans, fueled the demand for medical devices, and, in turn, growth of the device industry itself.

At present, there are roughly 1,700 different types of medical devices developed and manufactured by between 10,000 and 11,000 domestic or foreign device firms operating in the United States (FDA, 1992). The U.S. medical device industry dominates the world market. According to the U.S. Department of Commerce (1993), surgical and medical instruments, surgical appliances and

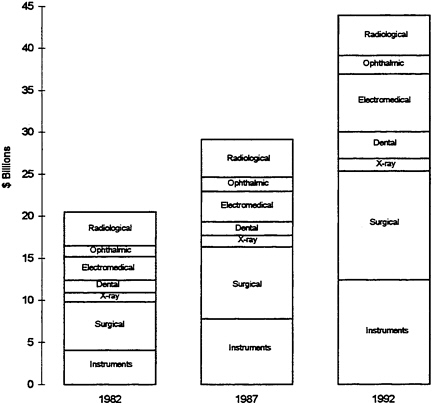

FIGURE 1 Value of shipments in the medical device industry: 1982, 1987, and 1992 (in billions).

Sources: 1987 Census of Manufactures, 1983 & 1988 Current Industrial Reports. Projected 1992 data: Based on 1992 Industrial Outlook projections for 1992 figures after adjusting to 1987 Census of Manufactures

supplies, electromedical equipment, and x-ray apparatus have recently been among the fastest-growing U.S. industry sectors (U.S. Industrial Outlook, 1993). Figure 1 depicts the increase in the value of medical device shipments by U.S. device firms over a 10-year period. Since World War II, the American medical device industry has performed extremely well in international markets, and a large share of its output has been exported in recent years. In 1993, 23 percent of total medical and dental shipments of $34.9 billion were exported. Electromedical and x-ray devices (which, in addition to imaging tools, include electromedical, fiber-optic endoscopes, and electrosurgical devices such as lasers) accounted for 44 percent of total exports in 1992. Yet, the most significant growth was registered in exports of medical and surgical instruments (e.g., stapling devices, catheters, and endoscopes), and orthopedic and prosthetic appliances. The regional shares of U.S. exports and imports for 1993 are depicted in Table 1. According to the Department of Commerce, the average annual growth rate for exports from 1989 to 1993 was estimated as 14.1 percent, versus 11.9 percent for imports.

As is apparent from Table 1, the European Community (particularly Germany) and Japan were the most important foreign suppliers of medical devices to the American market in 1993. According to the International Trade Commission, the Japanese industry is primarily focused on electronic, x-ray, and optically based medical equipment, whereas Germany has a more diversified industry that is capable of manufacturing high-technology electronic and x-ray apparatus, as well as highly specialized precision medical and surgical instruments (International Trade Commission, 1993).

The international market for medical and dental equipment was about $81 billion in 1993, with the United States representing, by far, the largest single market (U.S. Department of Commerce, 1994). This significant aggregate figure, however, conceals a very fragmented market. Indeed, the markets for individual device categories are relatively modest, ranging from tens to hundreds of millions of dollars. Within vascular surgery, for example, the size of the market in 1991 ranged from less than $10 million for vascular probes, to about $30 million for carotid shunts and about $70 million for vascular grafts (Wilkerson Group, 1995). Thus, it should not be concluded from the large size of

TABLE 1 Regional Share of U.S. Exports and Imports

|

|

Share of U.S. Exports |

Share of U.S. Imports |

|

European Community |

39% |

43% |

|

Japan |

14% |

23% |

|

Mexico/Canada |

18% |

14% |

|

East Asia Newly Industrialized Countries |

6% |

6% |

|

Other |

23% |

14% |

|

Source: U.S. Department of Commerce, 1994. |

||

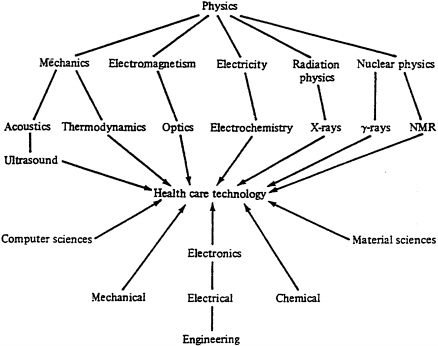

FIGURE 2 Innovation in medical devices.

Reiser and Anbar, eds. (1984). The Machine at the Bedside. Fig.2, p.25.

Reprinted with the permission of Cambridge University Press.

the total market for medical devices that the size of markets relevant to individual firms is also very large. Indeed, they may be extremely small.

SOME SALIENT CHARACTERISTICS OF MEDICAL DEVICE INNOVATION

Perhaps the most familiar pattern of medical innovation is that usually associated with pharmaceuticals and, more recently, biotechnology agents. It is important to recognize that the model for innovation in these sectors differs considerably from that of medical devices, especially in the proximity of pharmaceuticals to basic biomedical research.

The Science and Technology Interface

Innovation in medical devices, by contrast, is more closely linked to actual medical practice than to basic biomedical research. In fact, if we examine the knowledge base underlying medical devices, it is apparent that innovation in this area is highly dependent on the adaptation for medical use of scientific and technological advances from fields other than medicine. Consider, for example, the lithotriptor.

The concept of using shock waves for medical purposes emerged out of research at the German aircraft manufacturer Dornier, where physicists were investigating the causes of pitting, seen on the surface of spacecraft and supersonic airplanes (Gelijns, 1991). They found that a craft’s collision with micrometeorites or raindrops at high speeds created shock waves that had a destructive effect on surface structures. They also accidentally discovered that such shock waves could travel through the body without harming tissue, but that brittle materials in the body were destroyed. These findings led Dornier, in collaboration with urologists at the University of Munich, to develop the first lithotriptor for the treatment of kidney stones.

We have deliberately cited an instance of a major new medical technology that had its origin in the aircraft industry in order to highlight how the medical device sector differs from pharmaceuticals and biotechnology. The general point is that this sector looks far outside the realm of biomedical research for new technological capabilities. Indeed, if we look only at the most important contributions to diagnostic instruments, we would find that the CT scanner drew heavily on advances in computers and mathematics, ultrasound had its origins in submarine warfare, and MRI stemmed from the work of experimental physicists exploring the structure of the atom. Thus, medical device innovation is not only inherently interdisciplinary but also outward-looking by nature and depends on the transfer into medicine of advances in such diverse fields as electronics, optics, computers, and the material sciences (see Figure 2).

In the past, ongoing advances in these fields led to important opportunities for medical device development. Currently, however, the medical device industry may be confronted with the drying up of part of its technology base. In several major cases involving biomaterials, product liability litigation has reached back to the “deep pockets” of the original supplier of the material, even though the supplier had no direct role in the material’s ultimate use in a medical device. This has meant that material manufacturers may be faced with huge costs of litigation for products that account for only a small part of their sales. A case in point is DuPont’s Dacron polyester. The total market for this product is approximately $9 billion, whereas the market for its use in medical products is only around $185,000 (Benson, 1994). As a result of this situation, three major materials suppliers, Dow Chemical, Dow Corning, and DuPont, have severely restricted or ceased sales to the medical sector altogether. Their materials are used extensively as the primary component in implants, such as shunts or vascular grafts, or as electrical insulation in such devices as pacemakers. For many of these materials, no alternative suppliers exist. If alternative suppliers do exist, they increasingly require medical device manufacturers to sign financially stringent indemnification agreements. These agreements dramatically increase the risks of entrepreneurship and, in this sense, may be prohibitively costly for small, start-up companies that have few financial assets.

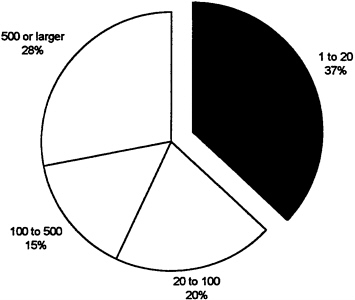

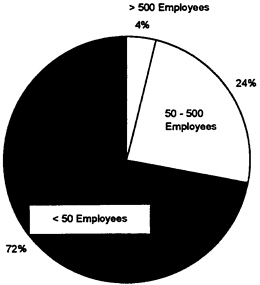

The above observation is particularly pertinent as the medical device industry is characterized by a large number of small firms; more than 70 percent of U.S. medical device manufacturers have fewer than 50 employees, and another 24 percent have between 50 and 500 employees (see Figure 3).

Fewer than 4 percent of all U.S. medical device manufacturers have more than 500 employees. There appear to be no major barriers to entry and, historically, “growth in medical devices has apparently occurred more by the addition of new companies than by the expansion of old ones” (Office of Technology Assessment, 1984, p. 37).

The Role of Small Versus Large Firms

A small number of analyses examining the division of labor within the industry by company size have concluded that small and large companies may play very different roles in the innovation process. It has been suggested that small companies—with some notable exceptions—tend to produce the majority of innovations in the early stages of developing a new class of devices, whereas large companies may be more prominent at later stages in the development process (Roberts, 1988).

Attempts to measure the innovative activity of firms as a function of their size have long been handicapped not only by methodological but by conceptual difficulties (for example, the absence of an unambiguous criterion for recognizing and therefore measuring innovations, or for distinguishing between “major” and “minor” innovations). Nevertheless, one study conducted in the early 1980s is, at the very least, highly suggestive. This study, performed by the Futures Group, defined large firms as those with more than 500 employees and small firms as those with less than 500 employees. It then examined more than 8,000 innovations published in trade journals in 1982 (a procedure, it should be emphasized, that is likely to overstate the contributions of large firms and to understate those of small

FIGURE 3 Size of medical device firms by number of employees.

Source: E.Jacobson, 1993.

ones). It then calculated rates of innovation per employee for each of the five SIC code medical device categories. The study concluded that, with the exception of the small ophthalmic goods category, small firms were more than twice as innovative per employee as large firms in the medical device industry (Office of Technology Assessment, 1984).

Differences in the primary function of small and large firms should not conceal the complex patterns of relationships that have emerged between the two. Large firms may sponsor research in small firms, often with the intent of acquiring them if their technologies are promising or successful. Furthermore, because recent changes in U.S. payment and regulatory policies have made venture capital funding more difficult, many small firms are seeking alliances with large firms to engage in joint product development, clinical testing, and manufacturing. In addition, large companies may assume most of the marketing and distribution functions for the industry. Recently, such large companies as Baxter, Abbott, and Johnson & Johnson have strengthened these capabilities with the establishment of so-called just-in-time hospital and medical supply warehousing and delivery systems (International Trade Commission, 1993).

University-Industry Interactions

In addition to a horizontal division of labor, a vertical division of labor exists within the medical device sector. That is, there is a division of labor between medical device firms on the one hand and universities (particularly academic medical centers) on the other. As the previous section indicates, innovation in this sector appears to provide a drastic departure from what might be regarded as the “normal” division of labor in biomedicine between academia and industrial firms. Medical device innovation does not depend nearly as heavily on the exploitation of basic scientific and technological capabilities generated upstream within medical schools as is the case, for example, in the pharmaceutical or the emerging biotechnology sector. The discovery of recombinant DNA technology by Boyer and Cohen at Stanford University and the University of California at San Francisco, for example, directly contributed to the industrial development of such biologicals as human insulin, the growth hormones, and tissue plasminogen activator (TPA). Device innovation, by contrast, relies heavily on the transfer of technological capabilities already generated outside of the medical sector— and, indeed, more commonly generated in the industrial world than the academic world.

Although medical schools may not be the dominant source of basic scientific and technological knowledge in medical device innovation (the “R” of R&D), they do nevertheless play a major and multifaceted role in the development of new medical devices (the “D” of R&D). In academic medical centers, it has been the clinician rather than basic medical researchers who has most commonly been crucial to the invention of medical devices. These clinicians not only identify the clinical need for a new device or for improvements in existing devices but, because of their role as eventual users, they may also be the innovators and builders of the original prototype. Von Hippel and Finkelstein (1978), for

example, underlined the importance of these users with regard to the invention of the automated clinical chemical analyzer. Other studies in the areas of renal dialysis, intrauterine devices, catheters, and endoscopes have presented similar findings (Gelijns, 1991; Gelijns and Rosenberg, 1995; Shaw, 1987). Thus, clinical practice itself is an important source of medical device innovation.

In addition to its role in prototype development, the academic medical profession, often in academic medical centers, is also indispensable in evaluating a device’s clinical potential during the premarketing development period. Feedback at this point may lead to important changes in the design of a medical device. Of course, the development process does not end with the more widespread introduction of a new product into practice. The reason is straightforward. Devices, in medicine as elsewhere, typically enter the world in a relatively primitive condition. Their eventual uses turn upon an extensive improvement process that vastly expands their initial application. This often prolonged process, in which important redesigning takes place, exploits the feedback of new information generated by users. Consider, for instance, the evolution of endoscopes. Today’s “cold-light” videoendoscope, which features a computer-chip camera at its tip and is useful in both diagnostic and therapeutic procedures, is a world apart from its predecessor during the early 1950s. During those years the lamp at the tip of the endoscope could cause serious burns, vision was often restricted, the quality of images poor, therapeutic applications essentially nonexistent, and obtaining some form of permanent documentation of the images highly problematic, at best. Feedback from the initial users led manufacturers to develop a radically improved endoscope, incorporating the new fiber optic technology. Whereas the evolution of endoscopic technology did indeed require a few major improvements, such as the introduction of fiber optics and video camera capabilities, its current characteristics depend heavily on a continuous flow of refinements. These modifications resulted in improved flexibility, maneuverability, miniaturization, and vision, vastly expanding the therapeutic possibilities of endoscopies (Gelijns and Rosenberg, 1995).

It is important to realize that new technologies not only come into the world in a primitive condition, but that they also often come into the world with properties and characteristics whose usefulness cannot be immediately appreciated. New and unexpected indications of use are often discovered only after extensive use in clinical practice. The laser is a case in point. It was originally introduced for ophthalmologic and dermatologic purposes but is currently being used for a wide variety of indications in gynecology, gastroenterology, and oncology, to name but a few. Numerous other examples of entirely new applications exist, in both the device world and the pharmaceutical world, including aspirin for antithrombosis and thalidomide for lepra and graft-versus-host disease. These observations underline two critical features of medical innovation: New technologies retain a high degree of uncertainty long after their initial adoption; and a close interaction between developers, often in industrial laboratories, and users is crucial to the development of new medical technologies.

In sum, the medical device industry depends heavily for its effective performance upon an infrastructure of firms and activities outside of its own boundaries. In addition to the country’s clinical

infrastructure, it exploits research and new technological capabilities and components that have been developed by the military, the electronics industry, and a range of firms manufacturing essential, specialized materials, such as high-quality glass for fiber optics or inert materials for prosthetic devices. The internal structure of the industry is, in turn, highly articulated as a reflection of the wide range of diverse products that constitute its output.

THE U.S. INNOVATION SYSTEM

In this section of the paper, we will discuss key aspects of the innovation system or infrastructure within which medical device firms operate. In particular, we will address venture capital, public support for biomedical R&D, academic medical centers and clinician-users, regulatory policies, and health care financing policies.

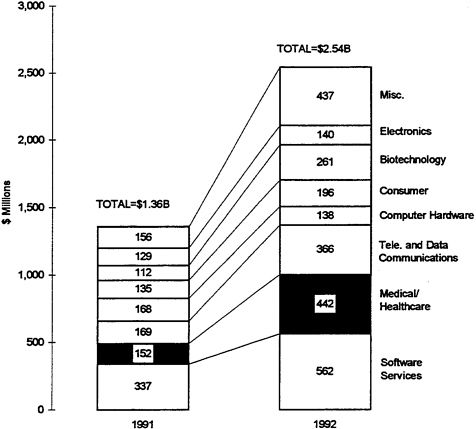

FIGURE 4 Venture capital disbursements in 1991 and 1992, by industry.

Source: National Venture Capital Association, 1992.

Sources Of Finance

Venture Capital

An important issue in the evolution of medical device firms is their ability to secure financing. Small start-up companies typically encounter difficulty in obtaining long-term debt or equity financing. As these firms generally have one or a few R&D projects at a time, investment in R&D efforts inevitably involves considerable risk. By contrast, large companies can often spread their risk over more R&D projects. Moreover, small firms are often new enterprises without a track record or solid management experience.

A1990 study by John Rapoport examined the financing of start-up medical device firms, which introduced their products from 1975 to 1988 (Rapoport, 1990). Almost all firms depended on multiple sources of funding. According to Rapoport, even when large sums were raised from the public sale of securities, this was preceded and occasionally followed by private financing, raised typically outside the established capital markets. In the time period under study, Rapoport notes a relatively limited use of venture capital. In 1988, the venture capital industry invested approximately $300 million in the medical device industry.

In recent years, this situation has changed. The venture capital industry invested about $5.6 billion in companies of all kinds in 1992 (National Venture Capital Association, 1992). That year, the medical/health care sector took second place, with venture capital investing $442 million, or 17 percent, of the total (see Figure 4). However, although funding increased from 1988 to 1992, the number of companies that received such funding decreased. In particular, a recent analysis found that the amount of “seed” capital for start-up companies diminished (Health Care Technology Institute, 1994). As a result, new firms are putting more emphasis on finding alternative sources of funding, especially early partnerships with larger firms through marketing agreements, sale of minority shares, joint ventures, mergers, or acquisitions. Among the factors that appear to play a role in the reluctance of venture capitalists to provide seed capital are the ongoing changes in the FDA’s policies toward medical devices and the major uncertainties surrounding the restructuring of the U.S. health care system.

Public Support of Biomedical R&D

As medical device innovation depends heavily on the transfer of scientific and technological findings from sectors other than medicine, public and private R&D investments in such fields, in effect, benefit the medical device sector and should be taken into account. Here, however, we focus on public R&D expenditures within biomedicine.

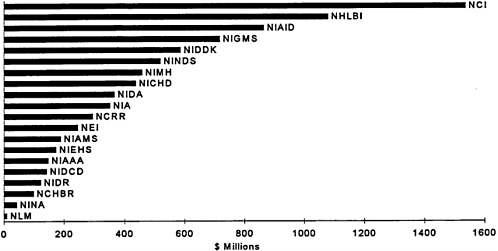

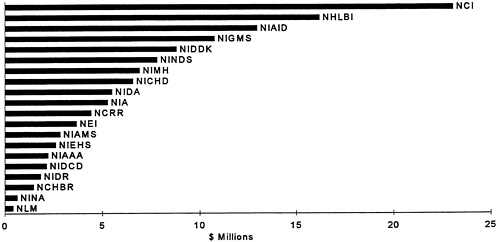

Currently, the National Institutes of Health (NIH) have an overall budget of about $11 billion a year. A small fraction of this is directed toward opportunities for the development of medical devices. Determining what portion of this budget is directly related to medical device R&D, however, is problematic. A recent congressional study estimates that the government invested about $422 million

in medical device R&D in 1992, a decrease of $27 million compared with the previous year (Littell, 1994). Although the government mainly supports research in academic medical centers and government labs, it also supports some applied research conducted in industrial settings. In the early 1980s, the federal government established the Small Business Innovation Research (SBIR) program. Figures 5 depicts the total budget of each NIH Institute, and Figure 6 shows the amount each institute set aside for the SBIR program.

Most important, however, from the perspective of medical device innovation, is that the federal funds for biomedical research strengthened the role of the university as the primary performer of R&D. It also contributed to tilting the medical education system toward specialization and subspecialization, a movement that has been crucial in speeding up, and perhaps altering the character of, technological change in medicine.

Academic Medical Centers and Physician-Users

The process of medical device innovation is strongly influenced by the evolution of hospitals, medical schools (and their teaching hospitals), as well as by the number of physicians and their patterns of specialization in a country. In the postwar years, government policies (e.g., the Hill-Burton Act) encouraged the construction of hospitals. At the same time, the expansion in federal support for biomedical R&D encouraged the emergence of a strong infrastructure of medical schools (see Table 2). The 120 or so medical schools turned out an increasing number of medical students, and the interdependency of technological change and specialty interests led to a diversification into subspecialties. Whereas in most European countries, 20 to 40 percent of doctors are trained as specialists, the number of specialists in the United States now approaches 70 percent of the total (American Medical Association, 1993). Moreover, this process of diversification has, if anything, been intensifying. In the last decade, 12 new subspecialties have formed within internal medicine alone. This trend toward specialization has important consequences for innovation and adoption, since technological change is powerfully shaped by distinct specialty interests.

The current reorganization of the medical sector, however, appears to be significantly reducing the demand for newly trained specialists. At the same time, academic medical centers, with their high overhead costs that are related to the unique roles of research and education, find it increasingly hard to compete in today’s cost-conscious environment. As a result, there is growing concern that the academic clinical infrastructure in the United States currently may be eroding.

FDA Regulatory Policies

The clinical testing of new medical devices which typically involves both device firms and clinicians is subject to regulatory policies. In most industrialized countries, the clinical development of new

medical devices is governed by regulatory schemes, either in the form of standards or pharmaceutical laws. The United States, by contrast, passed specific medical device regulation (the Medical Device Amendments of 1976) to ensure that new devices are safe as well as efficacious before they are marketed. These amendments divide medical devices into three classes depending on the potential risk they represent to patients.

Approximately 30 percent of all medical devices are grouped in class 1 (e.g., tongue depressors). This group comprises instruments which do not support or sustain human life and do not present a potentially unreasonable risk of illness or injury. These devices are subject to the general controls used before passage of the Medical Device Amendments, for example regulations regarding registration, premarketing notification, record keeping, labeling, and good manufacturing practices (GMP). About 60 percent of devices fall into class 2 (e.g., x-ray devices). These instruments may involve some degree of risk and are subject to federally defined performance standards. Finally, all devices that are life supporting or sustaining, that are of substantial importance in preventing impairment of health, or that have a potential for causing risk of injury or illness are grouped in class 3. For these devices, the sponsor must demonstrate safety and efficacy before the FDA grants marketing approval. Approximately 10 percent of medical devices, including left ventricular assist devices, DNA probes, and laser angioplasty devices, fall into class 3.

According to law, any device introduced since 1976 is automatically placed in class 3 unless the sponsor successfully petitions the FDA to reclassify it as “substantially equivalent” to a device that was on the market before the amendments took effect. Demonstration of this equivalence, called a 510(k) submission, is provided by descriptive, performance, and even clinical data. If a device is determined to

TABLE 2 The Growth of Academic Medicine: 1960, 1970, 1980, and 1990

|

|

1960 |

1970 |

1980 |

1990 |

|

Support from NIH (millions of $) |

1,320 |

3,028 |

5,419 |

8,407 |

|

Average medical school budget (millions of $) |

24.1 |

64.6 |

91.9 |

200.4 |

|

Full-time medical school faculty (no.) |

|

|||

|

Basic science |

4,023 |

8,283 |

12,816 |

15,579 |

|

Clinical |

7,201 |

19,256 |

37,716 |

65,913 |

|

Matriculated medical students (no.) |

30,288 |

40,487 |

65,189 |

66,142 |

|

Source: Expressed In 1992 dollars. Adapted from Iglehart, J.K. 1994. New England Journal of Medicine. |

||||

be substantially equivalent to a pre-1976 product, the manufacturer may rely on premarketing notification to the FDA. This route to the market is more expeditious than the premarket approval (PMA) route, and there is evidence that sponsors will attempt to change the design of devices accordingly. Indeed, a recent General Accounting Office (1988) report found that roughly 90 percent of medical devices reviewed by the FDA were marketed through 510(k) review; only 10 percent were subject to the full premarketing approval process.

To support a marketing approval decision, or in some instances a 510(k) submission, a sponsor must conduct clinical studies. If a device poses a significant risk, the sponsor submits a request for an investigational device exemption (IDE) to the FDA. The IDE application contains the investigational plan, information from prior investigations, the manufacturing process, and the amount to be charged for the investigational device. Following clinical studies, a device may be approved for marketing. In contrast to drug regulation, the device amendments require that advisory committees participate in the PMA decision for class 3 devices. In general, a PMA license is granted to a single developer for a particular device. Other developers of similar kinds of devices must submit a separate PMA and adequate clinical data.

FDA regulation of medical devices is currently undergoing significant change. The introduction of the Safe Medical Devices Act of 1990, for example, established new requirements for premarketing as well as postmarketing studies. As far as premarketing studies are concerned, device manufacturers are now required to conduct more rigorous studies with appropriate and, where possible, randomized controls. In the area of postmarketing surveillance, a number of separate mechanisms exist for collecting data. Device manufacturers as well as health care providers must report information indicating that a device may have caused or contributed to a death or serious injury. In the case of high-risk devices, companies must keep track of patients and, in certain cases, the FDA requires postapproval clinical studies to detect possible risks associated with device use, as well as to provide information on effectiveness. These changes should encourage higher-quality device evaluations and provide more useful information about safety and efficacy. At the same time, these changes also have important consequences for the speed with which new medical devices can be introduced and for the degree of risk and cost that medical device firms need to confront in the innovation process.

Health Care Financing Policies

Once a new medical device has been approved for marketing by the FDA, both public and private payers decide whether to cover the device and at what level to reimburse it. Generally, thirdparty payers base their decisions on whether a device is considered “reasonable and necessary,” which has been taken to mean “accepted by the medical community as a safe and efficacious treatment for a particular condition.” In the past, coverage decisions were typically based on subjective evidence

provided by panels of medical experts. Increasingly, however, formal evidence has become the basis for these decisions. Moreover, criteria for coverage seem to be changing. In addition to more narrowly defined safety and efficacy considerations, there is now a tendency to consider the cost-effectiveness of devices and their effect on the quality of life of patients. These changing criteria are affecting the clinical testing strategies of companies during the device development process as well as R&D priorities (see below).

Following a coverage decision, payers must determine the reimbursement level (i.e., price) for a new device. Recent years have seen major changes in reimbursement systems. During the 1960s and 1970s, the dominance of retrospective hospital reimbursement and fee-for-service physician payment systems meant that hospital and physician charges were generally met, and these systems insulated providers and patients from the immediate financial consequences of their medical care decisions. This meant that the price of a device generally was not a major factor in its adoption. In fact, as long as new technologies were seen as offering even small health benefits compared with existing practices, and as long as third-party payers covered the incremental costs, pressures arose in the system for adoption and regular use of these technologies. The enormous increases in spending for Medicare and Medicaid programs during the 1960s and 1970s also expanded the demand for new device technologies.

However, the introduction of the prospective payment system based on diagnosis-related groups (DRGs) for Medicare recipients in the early 1980s led to great changes in the financial incentives for hospitals. Cost-plus reimbursement, which had a built-in reward for maximizing resource use, was rapidly replaced by a reimbursement method that encouraged less diagnostic testing, shorter hospital stays, and a shift to outpatient care. In addition, the recent implementation of a resource-based fee schedule for physician payment, which reduces compensation for sophisticated technology-based services, is likely to diminish the financial incentives for the application of such services.

The most dramatic changes affecting medical devices can be found in the recent rapid growth in managed care, such as health maintenance organizations (HMOs) and preferred provider organizations (PPOs), and the consolidation of hospitals and clinics into large integrated delivery systems. The transition from a health care system in which hundreds of thousands of individual physicians are the major adopters toward one in which buying power is concentrated in a much smaller number of managed care organizations affects significantly both the quantity and price of medical interventions. These organizations increasingly reimburse health care on a capitated basis, which encourages the use of cost-effective technologies. Moreover, they promote cost-conscious purchasing by negotiating price discounts on high-volume procedures and by using selective contracting to concentrate sophisticated devices, and the related procedures, in a smaller number of institutions. How these changes in the delivery and financing of care, in combination with regulatory policies, may affect small device firms and their innovation practices is an important issue to which we now turn.

CONSEQUENCES FOR MEDICAL DEVICE INNOVATION

The above review of the U.S. innovation system reveals that powerful forces of supply and demand encouraged medical device innovation during the postwar years. The increase in federal funds for research strengthened the role of the university and encouraged a pattern of specialization and subspecialization. The growing number of practicing physicians typically had strong professional motivations to both develop and adopt new technology. Moreover, the prevailing fee-for-service payment system, bolstered by permissive third-party insurance schemes, provided strong economic incentives to use technology. These tendencies were often reinforced by hospital administrators who viewed the rapid adoption of the latest technologies as essential to competitive success in their respective communities. In this environment, new technologies could diffuse rapidly—often running ahead of the information base that would define their optimum usefulness. At the same time, these forces sent powerful signals to the R&D sector that new technologies would be adopted and paid for, with little concern regarding cost. In addition, the regulatory climate was relatively lenient. Until recently, most devices could be introduced into clinical practice through the 510(k) process and FDA regulatory requirements did not significantly slow device development. Furthermore, the environment in the United States (where venture capital was readily available) was particularly conducive to the creation of new, start-up firms.

The current major restructuring of the U.S. health care delivery system, in combination with shifts in regulatory policies, may change the U.S. innovation system in fundamental ways. Until recently, however, the U.S. innovation system appears to have contributed to a strong performance of the U.S. medical device industry.

R&D Investment

The medical device industry responded to the incentives embedded in the postwar health care system by becoming highly research intensive. In 1993, the industry invested the equivalent of just under 7 percent of its sales in R&D, surpassing R&D expenditures in the aerospace, chemical, and high-tech electronics industries, expressed again as a percentage of sales. In fact, the figure for medical device R&D is exceeded by only one industry: pharmaceuticals. These aggregate device R&D figures, however, conceal large variations according to company size and the product categories involved.

In the x-ray sector, for example, half of the firms spent more than 10.2 percent of sales on R&D, compared with 3.2 percent for orthopedic, prosthetic, and surgical appliances firms (see Table 3). Considerable variations also exist within these device categories. The category for orthopedic, prosthetic, and surgical appliances, for instance, comprises syringes, absorbent cotton, and adhesive tape, as well as artificial limbs and grafts, resulting in large differences in R&D investment. Similarly, within the electromedical and electrotherapeutic sector, half of companies had R&D expenditures

TABLE 3 Variation of R&D Spending Within the Device Industry, by SIC Code

|

|

SIC 2835 In Vitro and In Vitro Diagnostic Substances |

SIC 3841 Surgical, Medical Instruments and Supplies |

SIC 3842 Orthopedic, Prosthetic and Surgical Appliances and Supplies |

SIC 3843 Dental Equipment and Supplies Apparatus |

SIC 3844 X-ray Apparatus and Tubes and Related Irradiation Apparatus |

SIC 3845 Electromedical and Electrothera peutic Apparatus |

SIC 385 Ophthalmic Goods |

|

R&D Sales Distribution |

|

||||||

|

Number of Observations |

57 |

59 |

50 |

10 |

8 |

92 |

10 |

|

75% of companies have R&D costs greater than or equal to… |

10.0% |

2.6% |

1.4% |

2.0% |

4.0% |

6.8% |

3.2% |

|

50% of companies have R&D costs greater than or equal to… |

29.9% |

5.3% |

3.2% |

4.1% |

10.2% |

10.1% |

6.0% |

|

25% of companies have R&D costs greater than or equal to… |

126.7% |

8.0% |

5.7% |

28.0% |

19.5% |

23.4% |

25.9% |

|

Source: Price Waterhouse; Calculations based on Compustat data. Health Care Technology Institute: 1993 Reference Guide for the Health Care Technology Industry. |

|||||||

greater than or equal to 10.1 percent, whereas 25 percent of companies had expenditures greater than or equal to 23.4 percent (Health Care Technology Institute, 1993).

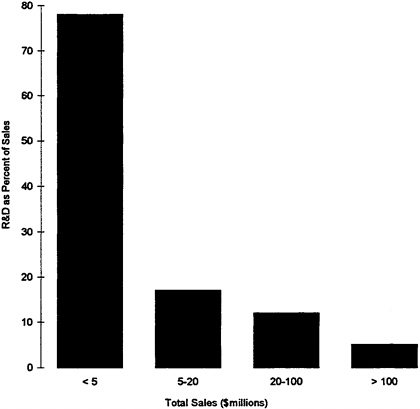

Large variations in R&D spending exist when firms are classified by size. The Health Care Technology Institute (1993) examined the Compustat files that contain financial statistics of companies. According to this analysis, device firms with less than $5 million in sales spent the equivalent of 77.5 percent of their sales on R&D, compared with 17.2 percent for firms with between $5 million and $20 million in sales, and 4.5 percent for firms with sales in excess of $100 million (see Figure 7). At first glance, this pattern appears similar to practices in the biotechnology industry, where small firms operate like research organizations. A telephone survey of the smallest venture capital-based companies, whose data were not publicly available, appeared to confirm this pattern. Of course, as already suggested, larger firms may invest in the R&D efforts of small companies in addition to their own R&D activities (Health Care Technology Institute, 1993). It appears, then, that there is an elaborate division of labor within the industry, not only by product line, but also by size of firm.

FIGURE 7 R&D as a percent of sales for medical technology companies, by total company sales, 1991.

Source: Price Waterhouse; Calculations based on Compustat data. Health Care Technology Institute: 1993 Reference Guide to the Health Care Technology Industry.

The Changing Rate of Medical Device R&D

There are few empirical analyses of the impact of the changing health care landscape on innovation in the device industry in general or on small firms in particular. Patent data constitute the primary source of information about trends in innovative activity. During the 1980s, the number of medical device patents granted annually by the U.S. Patent and Trademark Office more than doubled; 32 percent of these belonged to non-U.S. companies, mainly those based in Japan and Germany. During this period, the percentage of patents owned by the United States declined. More recently, however, the number of U.S.-owned patents increased to 75 percent, the highest level for the period (Littell, 1994).

Another important indicator of innovative activity is the number of devices that enter clinical investigation and are subsequently approved by the FDA. Tables 4 and 5 show the number of IDEs and PMAs issued during a 5-year period. These data reveal a decline in recent years in the number of IDE and PMA submissions to the FDA, with the number of PMAs falling to a low of 65 in 1992. This decline may be partially a result of the more rigorous FDA scrutiny of applications. In 1989, 67 percent of PMA submissions were approved, whereas by 1992 this percentage had declined to 19 percent (Littell, 1994). A similar trend can be noted for IDEs. In the past few years, IDEs have covered an increasingly broad range of products. But since 1980, the proportion of IDEs that on first “pass” through the system successfully completed their developmental evaluation has decreased 30 percent (although eventually 80 percent were approved). This decrease reflects the complicated safety and efficacy requirements that now surround new investigational devices, a more stringent regulatory climate, and the relative inexperience of many device manufacturers (80 percent of device developers have submitted only one IDE since 1980). Those who submitted seven or more IDEs since 1980 had an approval rate twice as high as those who submitted only one application (Blozan et al., 1987).

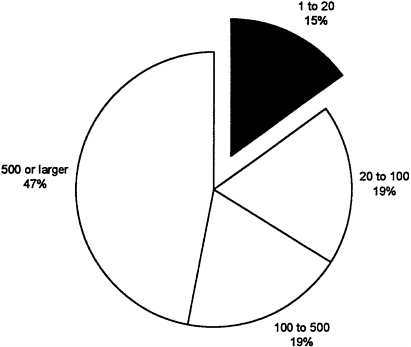

At the same time, the number of 510(k) submissions has shown a modest increase, with 6,590 submissions in 1992 (see Table 5). These figures suggest that firms are increasingly focusing on incremental innovations rather than radically new products. The review time for these products, however, has also increased substantially since 1988 (General Accounting Office, 1988; Littell, 1994). Figure 8 and Figure 9 break down the number of 510(k) and PMA submissions by size of firm. It is interesting to observe that nearly half of PMAs were submitted by very large firms which constitute only 2 percent of the industry. This may reflect the ability of larger companies to expend the resources required to shepherd new devices through the regulatory process and their acquisition of, or alliances with, small firms.

The major changes in FDA regulation, and the uncertainties surrounding market approval requirements, may have major implications for small medical device firms. For example, there is considerable evidence that the previous changes in FDA drug regulations have significantly affected the structure of the pharmaceutical industry, specifically the size distribution of firms. This effect has been

TABLE 4 FDA Original Investigational Device Exemptions (IDE), FY1987 through FY1991

TABLE 5 FDA Original Premarket Approval (PMA) Applications and Premarket Notifications (510(k)), FY1988 through FY1992

primarily to drive smaller firms out of the industry, because regulatory changes introduced financial hurdles that these firms could not meet.

It is possible that recent modifications in FDA regulatory mechanisms may have a similar effect on the medical device industry, which at present contains in excess of 10,000 mostly very small firms. According to a recent econometric study, the impact of the 1962 amendments to the Food, Drug, and Cosmetic Act, especially the increased requirements for pharmaceutical premarket testing, was extremely uneven. Specifically, “virtually all of the decline in the NCE [new chemical entities] introductions around 1962 was concentrated in the smallest U.S. drug firms, so much so that these firms ceased to innovate after that year” (Thomas, 1988, p. 498). Thomas also asserts that “the devastation of innovative and marketing productivities for smaller U.S. pharmaceuticals firms was not an inevitable consequence either of technical change or of essential regulation of drug safety (as practiced in the U.K.). Instead, this declining productivity was caused solely by additional incremental regulations exercised by the FDA in the United States” (p. 513).

The central intent of the 1962 amendments was to require a systematic, scientifically valid demonstration of the efficacy of new drugs. This policy inevitably increased the complexity and cost of the R&D process, to the relative disadvantage of smaller firms. The efficacy requirement doubtless also eliminated many prospective new drugs of marginal medical value, to the detriment of firms—large or small—that were unwilling or unable to meet the new, more stringent standards. The decline in the number of such firms as a result of higher regulatory hurdles was not necessarily to be greatly regretted. But even if this argument is broadly correct with respect to the pharmaceutical industry, the long-term consequences of stricter regulation may be very different in the medical device industry. The view is widely held that small firms in the medical device industry make a disproportionately large contribution to socially valuable innovation. If this view is even approximately correct, the effects of the new regulatory environment on the size distribution of firms in the industry, even if an unintended consequence of the regulations, may nevertheless be a matter of some concern.

Postponing the commencement of sales of new medical devices due to additional regulatory delay may be a powerful factor that weakens the incentive of private industry to commit resources to R&D. The impact may be especially strong on new and small firms, whose financial situations are typically precarious, and perhaps even greater on individuals contemplating entering into the industry. The reasoning is straightforward. Along with the normal uncertainties in securing financing for potential new products is the fact that, with few exceptions, the potential markets for new devices are rather small. Thus, in spite of a total annual sales of nearly $40 billion for the industry as a whole, individual medical devices can normally be expected to have only a rather modest market potential. Blockbuster innovations among medical devices are much less frequent than in the pharmaceutical industry. Consequently, a stretching out of the prospective time horizon, when positive cash flows may be expected, will have a deterrent effect on the incentive to undertake new product introductions.

These effects are likely to be reinforced by recent changes that are occurring in the medical marketplace. Preliminary analyses have suggested that the rate and direction of device innovation are particularly sensitive to changes in the financing and delivery of health care, including the level of reimbursement that new interventions will be able to attain (Gelijns and Rosenberg, 1994; Kane and Manoukian, 1989; Weisbrod, 1991). Coronary angioplasty, for example, was first assigned a surgical DRG, which provided a much higher level of reimbursement than the procedure itself cost. This stimulated a rapid adoption of angioplasty and a high level of incremental innovation in angioplasty catheters. By contrast, cochlear implants were placed in a DRG that covered only a fraction of the cost of the device. This led not only to limited diffusion but also, as might be expected, to markedly reduced subsequent R&D activity.

The Changing Direction of Medical Device R&D

The direction in which developers try to move their technologies is embedded in their selection of R&D projects. This necessarily reflects their expectations about prospects for future reimbursement. But, closely related, feedback from users suggests what improvements are needed in existing technologies. In the past, price considerations played much less of a role in the adoption of new medical technologies than in nonmedical fields, and feedback signals were often couched in terms of shortcomings in efficacy and safety and problems with the ease of operation—not cost reduction.

More recently, however, these signals appear to be changing. The growing importance of economic considerations in hospital purchasing and clinical adoption decisions is influencing technological change in the direction of explicitly developing cost-reducing technology. Less costly alternatives to widely practiced, expensive procedures—such as coronary artery bypass surgery, transurethral prostatectomies, and cholecystectomies—have become preferred R&D targets for pharmaceutical manufacturers, who attempt to develop pharmacological alternatives, and device manufacturers, who are aiming to develop a variety of minimally invasive devices. Moreover, competition on price and operating costs has begun to play a much more prominent role than it did in the past. Manufacturers of lithotriptors, for example, have replaced the expensive x-ray system and short-lived electrode configurations embedded in the original lithotriptor, introduced by Dornier, with less costly alternatives such as ultrasound technology. In the case of surgical laparoscopy, the first signs (e.g., the debate on reusables versus disposables, or the emerging preferences for the much cheaper electrocautery tools over lasers) are appearing that economic considerations will increasingly influence the direction of technical change in the years to come. In general, device firms may be expected to reduce development projects that lead to “me-too” technologies without a clear-cut clinical or economic advantage, unless the particular markets happen to be relatively large. Moreover, research on cost-increasing—but also potentially quality-increasing—technologies (such as PET scanners and certain artificial organs) may become less attractive. Thus, today’s more cost-conscious

health care system appears to be shifting the direction of medical innovation from those interventions that are mainly driven by the search for better clinical results to those that emphasize cost reduction. How successful medical device firms will be in their attempts to target cost-reducing technologies, now that the incentives to do so have been vastly strengthened, is not clear.

Although this paper is mainly concerned with the changing environment confronting medical device firms, it needs to be recognized that internal organizational or managerial changes may also have an important role to play. In fact, the current environmental changes have imposed severe new demands on the management of small, entrepreneurial device firms. The inquisitive surgeon and his sometime friend the engineer, tinkering in a garage, have of necessity been augmented by experts in regulatory compliance, clinical evaluation, law, international marketing, and, of course, finance, because all of the foregoing activity costs more money, over longer periods of time, with much greater uncertainty of outcome. Leadership of this new-style entrepreneurial enterprise demands more than entrepreneurship. Professional general managers and stronger, more active boards of directors are more prominent features of the industry landscape than was the case a decade ago.

CONCLUDING OBSERVATIONS

This preliminary review of the medical device industry suggests that there may be distinct roles to be played by firms of different sizes. Large firms such as GE have been successful not only because they enjoy economies of scale and scope, but also because they have the marketing and distribution sophistication that are essential in selling to physicians, clinics, and hospitals. This point has been confirmed with respect to recent “big-ticket” items such as CT scanners and MRI. Large firms in the United States have also been the repositories of skills that are important in an industry where safety and efficacy are so central to success. Large firms in the United States have had the know-how to work their way through the labyrinthine regulatory system with a much higher success rate than smaller and less experienced firms. We suspect that the frequent acquisition of small device firms by larger pharmaceutical companies represents, at least partially, a recognition of these distinctive advantages of large firms. Small firms, on the other hand, have served as points of entry for new ideas and concepts that have frequently brought outsiders into the industry. We speculate that a diversity of firms of different sizes may provide important advantages in this industry. Moreover, the ease with which new firms can be established is also a distinguishing characteristic of the medical device industry. It is a characteristic for which the venture capital industry, which can almost be called a uniquely American institutional innovation, has a large responsibility.

The experience in the United States, and also in Japan and Europe, suggests that the medical device industry requires nurturing from a diverse infrastructure of hospitals, university medical centers, and, of course, a public sector that can provide the highly expensive, long-term support for medical (including clinical) research that the industry needs. The role of the NIH has been critical for the U.S.

industry, and indirectly for the medical device industries of other advanced industrial countries, by providing a strong infrastructure of clinical research and practice.

The success of the U.S. medical device industry appears also to have been due to its large, and deep, industrial base. A distinctive feature of the medical device industry, as we have argued, is that it draws upon, and exploits, technologies that have been developed in other sectors of the economy remote from medical care, including defense technology, computers, electronics generally, lasers, and exotic materials. We believe that the history of the emergence of many new medical technologies in the United States demonstrates the centrality of this breadth and depth of other sectors of the economy.

Of course, it is difficult to anticipate where these distinctive—and persisting—American advantages will take the medical device industry and its capacity to generate new and improved technologies in the future. The industry, in the years immediately ahead, will doubtless continue to be dominated by the need to absorb the impact of altered government policies, changes in the financial and regulatory environments, as well as the impact of the ongoing structural changes within the health care delivery sector itself. Since the content of each of these sources of change is still full of uncertainties, the ultimate impact of their interactions is necessarily highly uncertain as well.

REFERENCES

American Medical Association. 1993. Physician Characteristics and Distribution in the U.S. Roback, Gene, Randolph, Lillian, Seidman, and Bradley, eds. Chicago, Ill.: Department of Physician Data Services.

Benson, J.S. 1994. Testimony before the Subcommittee on Regulation and Governmental Affairs, U.S. Senate, May 20.

Blozan C.F., N.C.Gieser, and S.A.Tucker. 1987. A Profile of Investigational Device Exemption Applications. Office of Planning and Evaluation, Study 76. Rockville, Md: Food and Drug Administration.

Food and Drug Administration, Office of Device Evaluation. 1992 Annual Report Fiscal Year 1992. Rockville, Md: Food and Drug Administration.

General Accounting Office. 1988. Medical Devices—FDA’s 510(k) Operations Could be Improved. Washington D.C.: Government Printing Office.

Gelijns, A.C., and N.Rosenberg. 1994. The dynamics of technological change in medicine. Health Affairs (Summer):28–46.

Gelijns, A.C., and N.Rosenberg. 1995. From the scalpel to the scope: Endoscopic innovations in gastroenterology, gynecology, and surgery. Pp. 67–96 in Medical Innovation at the Crossroads. Volume VI. Sources of Medical Technology: Universities and Industry, A.C.Gelijns and N.Rosenberg, eds. Washington, D.C.: National Academy Press.

Gelijns, A.C. 1991. Innovation in Clinical Practice: The Dynamics of Medical Technology Development. Washington, D.C.: National Academy Press.

Health Care Technology Institute. 1993. Insight: Variations in research and development spending within the medical technology industry. Washington, D.C.: Health Care Technology Institute.

Health Care Technology Institute. 1994. 1993 Reference Guide for the Health Care Technology Industry. Washington, D.C.: Health Care Technology Institute.

International Trade Commission. 1993. Industry & Trade Summary: Medical Goods. Publication #2674. Washington, D.C.: Government Printing Office.

Kane N.M., and P.D.Manoukian. 1989. The effect of the Medicare prospective system on the adoption of new technology: The case of cochlear implants. New England Journal of Medicine. 321:1378–1383.

Littell, C.L. 1994. Innovation in medical technology: Reading the indicators. Health Affairs (Summer): 226–235.

National Venture Capital Association. 1992. Venture Economics. 1992 Annual Report. Washington, D.C.: National Venture Capital Association.

Office of Technology Assessment. 1984. Federal Policies and the Medical Devices Industry. Washington, D.C.: Government Printing Office.

Rapoport, J. 1990. Financing of Product Innovation by Small Firms: Case Studies in the Medical Device Industry. Final Report, Small Business Administration. Washington, D.C.: Government Printing Office.

Reiser and Anbar, eds. 1984. The Machine at the Bedside. New York: Cambridge University Press.

Roberts, E.B. 1988. Technological innovation and medical devices. Pp. 35–47 in New Medical Devices: Invention, Development, and Use, K.B.Ekelman, ed. Washington, D.C.: National Academy Press.

Shaw, B.F. 1987. The role of the interaction between the manufacturer and the user in the technological innovation process. Ph.D. dissertation. University of Sussex, Sussex, United Kingdom.

Thomas, L.J. 1988. Federal support of medical device innovation. Pp. 51–61 in New Medical Devices: Invention, Development, and Use, K.B.Ekelman, ed. Washington, D.C.: National Academy Press.

U.S. Department of Commerce. 1993. U.S. Industrial Outlook. Washington, D.C.: U.S. Department of Commerce.

U.S. Department of Commerce. 1994. U.S. Industrial Outlook. Washington, D.C.: U.S. Department of Commerce.

Von Hippel, E., and S.Finkelstein. 1978. Product designs which encourage or discourage related innovation by users: An analysis of innovation in automatic clinical chemistry analyzers. MIT Press.

Weisbrod, B. 1991. The health care quadrilemma: An essay on technological change, insurance, quality of care, and cost containment. Journal of Economic Literature. 29 (June): 523–552.

The Wilkerson Group. 1995. Forces Reshaping the Performance and Contribution of the U.S. Medical Device Industry. Washington, D.C.: The Health Industry Manufacturers Association.