2

Research Restructuring and Assessment at IBM

James C. McGroddy

The introductory comments are right on the mark, but it is important to emphasize two dimensions to this. It is certainly true that in the case of IBM, one dimension of the need to restructure was driven by economic realities—the fact that the company had become very comfortable in terms of what its sources of revenue were without effectively planning ahead. The company found itself in financial trouble, and that resulted in a major downsizing.

There is another dimension to this that is probably more important: that is, the world is changing at a ferocious pace. The reason it is changing is because of what we do. The National Science Foundation invests funds to create scientific knowledge, which eventually becomes technology, which changes the world. This is particularly true with information technology, communications, and computing. When looked at in a historical perspective, these technologies are going to be seen as causing the same kind of changes in institutions that the printed word did, very fundamental changes in every institution in our society. The realization of these broader changes itself must drive the change in our research agenda and in how we operate, independent of whether the budget is growing, shrinking, or flat. It is much more difficult to make the changes associated with shifting the agenda in light of the anticipation of a shifting world when the budget is shrinking. It is very easy to do when the budget is growing.

THE ROLE OF RESEARCH AT IBM

For the past 15 years we have had a dual goal in IBM research. First, we have wanted to produce great science and technology, and that has set a very high goal as to what we should do. Second, we have wanted to make that research relevant in the environment we are in —to make it vital to IBM.

Our research has generally paid off for us, but there are other times when we failed to achieve our goals. For instance, the dynamic random-access memory (DRAM) chip was invented at IBM, but we were late in bringing it to market. Invented in 1968, it was put on the market only in the mid-1970s. The disk drive is a much better story. We started that and we continued to work on it, and IBM has done very well with it from an economic standpoint.

If you start with these goals, these very fundamental goals, what does it mean? What do you do to fulfill these goals? One way to approach this is to start with your goals and work outward. An alternative is to consider who pays the bill and what their view of value is —what do they think they are getting for this, what does the dual goal mean for them? Our budget is about a half a billion dollars a year, down about 20 percent over the last three or four years.

Looking at fulfilling our goal from the first perspective, we see that we have four tasks. First, we try to accelerate the pace of progress in each mainstream technology area, because after all, a good portion of our business years from now will be products that are direct descendants of those we are developing now. We make 16-and 64-megabit memory chips now. In five years we will be making gigabit memory chips. It is essential to be

appropriately connected within the organization to do that. We must have strong relationships with development and manufacturing, which we did not always have.

Second, we build and apply a technical base across a very broad spectrum of physics, chemistry, materials, mathematics, engineering, and computer science, sometimes building it without a clear, detailed view of how it will be applied. It is important to determine what is relevant and what is not, and to build the science underneath that.

Third, in our business, if you look back over a period of five years and examine where the growth in the industry has come from—we are in an industry that is worth about $600 billion now worldwide—you find that half the growth has been generated by technology or products that were not there before. So, if all you do is extend your mainstream technology, your business is probably going to shrink. Part of our job, therefore, is to provide the opportunity for new business. The normal reaction of people who are in a particular business, when you come up with a new idea, is that it sounds strange, that it is risky and that it might even be a threat to the business. You need some organization like the research organization to pursue new ideas. A good example is parallel computers that are not tied to mainframes, an innovation that resulted in IBM's SP-1 and SP-2. In that case, the research division played an important initiating role and made strong arguments, which were eventually accepted, for the need for such stand-alone parallel machines.

Then, finally, the world we are in is very science based. You have to have a set of people looking around, trying to let nature tell them what can be done next. What is the next display technology? What is the next way you can store bits? What is the next way you can advance some communications technology? You have to start at a very fundamental level, for instance with people studying materials, physicists who are in close contact with the peer research environment, who can recognize the importance of certain advances, and can then make the transformations necessary to focus those advances in appropriate directions.

So, this is the inside-out view. Another thing that we have done over the last five or six years—and it was driven largely by our focus on quality—is to start from the outside and work our way back in. What is this company about? What kind of businesses is it in? What is the customer's view of value? We do not leave it up to the company to figure out what that value is; we take the lead in figuring it out and then explain it to our sponsor. This is a very fundamental principle of research organizations. If you want to survive in the long run, you must understand what value is—what value is in the eyes of the sponsor. Researchers have to do that type of thinking and explain it to the sponsor.

It is also important to recognize that value can change radically. For example, the Cold War ends suddenly, and defense technology is no longer highest on the list of priorities—economic performance is higher. That directly affects what value is and must affect the resulting research agenda. For NSF, anticipating this kind of thinking about value is key. The law that we are discussing today is a good one, but in thinking about value, measuring how well we achieve it is necessary whether the law exists or not. And we are better off being out in front, not in a reactive mode, explaining value only after being asked.

I am quite sure that most of you are aware of the kind of problems we have experienced at IBM in recent years. After all, we lost $8 billion in 1993. Over a period of three years, we lost $18 billion. The chief executive officer (CEO) was replaced. A new CEO, Louis Gerstner, was hired in April 1993, and one of the first places he visited was the research division. He liked what he saw because we had begun this change before we had budget problems, before the company had financial problems, and before anybody in the company was pressuring us to make these changes.

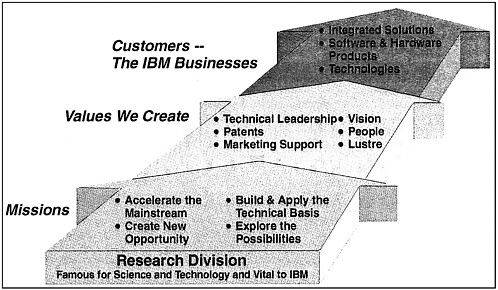

Figure 2.1 dates from around 1991. IBM is in three kinds of businesses. We are in the integrated solution business. That means, for instance, that we work with Bank A to help it compete with Bank B across a whole range of technologies—to help it translate technology into business value. Second, we have products. These are the source of most of our revenue today—software and hardware products, mainframes, personal computers (PCs), communications products, disk drives, and that sort of thing. Underneath that, we have a set of technology businesses, which were not always businesses. In an earlier time, they were merely suppliers to the internal customers. So, our semiconductor business did not sell anything outside. This situation has changed over the past few years. Last year, we sold more than a billion dollars worth of our semiconductor products outside IBM. That, in itself, relates to quality; contact with the outside world helps ensure our competitiveness.

Now let us turn to the outside-in view of value—value as seen and measured by the customer, the sponsor. For us, this means the measure of value as seen by our chairman. We have identified seven aspects of value, six of which are listed in Figure 2.1.

FIGURE 2.1 Research—and the values it creates—at IBM.

Technical Leadership. You want technical leadership in each of your businesses: technologies, products, and solutions. In each of these areas there is a clear opportunity for research to contribute to technical leadership. Let me give a product example. IBM Think Pads are a huge success in the marketplace due largely to the technical leadership in that product. It has a bigger and better display than anybody else's. Where did it come from? It came out of research, and we started a joint-venture manufacturing company in Japan to produce them. We invented a gadget that replaces the mouse, which has now been copied by most of our competitors; it also came out of research. The Think Pad has directed infrared links that allow you to set it down near your printer and print without connecting. That came out of research too. The newest model has a keyboard that expands to full size on a tiny computer. It too came out of research. Another example is our asynchronous transfer mode (ATM) products. ATM will be the future of communications. The architecture, the switch fabric, the integration with existing local-area network environments—all came directly out of research. These are examples of technical leadership that you can measure. While it is not possible to be precisely quantitative, the value is evident and large. We can demonstrate similar strong contributions to technical leadership in each of IBM's businesses.

Patents. At IBM we believe that our patent portfolio on an operational basis is worth several billion dollars a year to us. Our revenues are about $65 billion a year. In many cases, without our own patents we simply could not be in certain lines of business, because paying the royalties required would not leave us a decent economic model. Research produces about 30 percent of those patents, including many of the most valuable ones, such as the fundamental patent on the DRAM or the semiconductor laser, as well as patents in data storage technologies and reduced instruction set computer (RISC) technology. Another measure of the value of patents is how much revenue gets brought in by licensing —more than half a billion dollars a year, more than the company's entire research budget.

Marketing Support. We unabashedly support the company in selling its products, sometimes in subtle ways. We have worked a lot with our customers and we undertake projects with them, which is something I will return to later. Customers buy more from you when they work with you. For instance, one of the major petroleum companies has one of our mathematicians helping it with meshing on huge problems. They are trying analytically, by simulation,

to design for many of their processes furnaces that do not require scrubbers because they will not produce the amount of nitrogen oxides that would require scrubbers. This business is worth $50 million in capital to that company if it succeeds. When the company decides where to buy PCs—from Company X or from us—it will see that the prices are about the same and the products are not so different. But the company is more likely to buy them from IBM, because IBM is its partner. This changes the relationship you have with a customer.

Vision. We are uniquely charged with providing long-term vision for our company, with looking far ahead at everything we do and do not do. For the past 12 years or so, we have prepared something called the 10-year outlook, which in many cases can see only 3 years ahead because the world changes so quickly. Early on, this was used to look mostly at the course of technology over the next 10 years and what IBM should focus on. We now look at much more, including the impact that the technology will have on institutions, on society, and on individuals. We can do that well because we are in intimate contact with all kinds of customers. We use that information to drive a lot of investment in the company. Flat panel display technology in IBM is there only because in 1983 or so, we identified this as a critical technology. We picked the right one. We said that without this, we would be in terrible shape in building these small products, because the display will become the integration vehicle for these products.

People. Research is a natural entry point for the most talented technical people, and we consciously export people to the rest of the company. For example, we have a Ph.D. physicist who came from Columbia as a high-energy physicist. He knew he did not want to stay in that field and initially worked in electronic packaging. Within five years, he was running a laboratory and a plant in western Japan. After three years he came back and worked for me for a couple of years; he is now Lou Gerstner's technical assistant. We have technical people in key positions all over the company. We let it be known that if you want a senior management job in research, the worst thing you can do is remain here in research at IBM. Work someplace else. We will help you do that. Some people come back and some do not. Many find the world of products, of manufacturing, the world closer to customers, to be where their real interests lie. We view them all as part of the research diaspora.

We think of ourselves as having a large cluster of top-notch researchers. The fact that we do some things really well—that several people have been awarded the Nobel Prize, or that you see our research breakthroughs on the cover of magazines such as Science and Nature, or written up in Business Week—affects in a major way the customer's perception of our company. That has real value. We spend hundreds of millions of dollars a year in advertising to build the IBM image. The world's awareness of IBM as the creator of much of the technology of our industry, seen through the technical and trade press, creates similar value. Again, this is hard to quantify precisely, but there is enormous value when you are considered a leader in science and technology.

Fire Fighting. The final aspect of the value that we create, which is not represented in Figure 2.1, is what we call fire fighting. In any highly technical industry, you have problems from time to time, particularly in manufacturing, that are very mysterious to the people involved. We had a problem a number of years ago with the memory arrays that we make in Fishkill, New York. Every couple of months the error rate would go up enormously, by orders of magnitude, to the point where we could not ship the systems. Then it would gradually go down and later would spike again.

To make a long story short, what was happening was that one of our chemical suppliers bought plastic chemical bottles from a factory. After washing them, the supplier put an ionizer on the nozzle of the blower that was used to dry them, to prevent electrostatic charging. The ionizer was made from “sandpaper” made of little polonium particles, which emit about 5- or 6-megaelectron-volt alpha rays. Every couple of months, a particle that came off the sandpaper, Which was wet, would end up in the bottle and then in Fishkill. Fifty atoms of polonium on a chip was enough to put us out of business. Now, did the people in the factory discover that? No. We had to put our best scientific resources on it.

In another example, we had a product going into production, but the paint would not adhere to the plastic. The plant probably would have fixed that fairly quickly—say, in a couple of weeks. I sent some Ph.D. chemists to the plant, and the problem was solved in a day. We brought the tools of highly sophisticated surface physics. This may be overkill, but it has enormous economic value. Our people understand this, and it has to be built into the culture. In our industry, time is the most relevant variable and the most valuable commodity.

For NSF, the problem is different, but a view of value, as seen by the sponsor, is no less essential. NSF is not a research institution, and this is a great freedom. It is far easier to change the agenda when you are not the

institution doing the research. You can say, “Well, Dr. McGroddy, we have decided not to fund your proposal next year,” and not have to deal with me as an employee or with my laboratory as part of your assets.

REORGANIZATION OF RESEARCH AT IBM

Let me review briefly how we are structured at IBM. I report to Lou Gerstner, who is the chairman. We now have six laboratories. We just opened a lab in Beijing, which is a very important place for us to be for lots of reasons. When you think about what is going on in China and take the long view, you ask yourself, How can I not be in China?

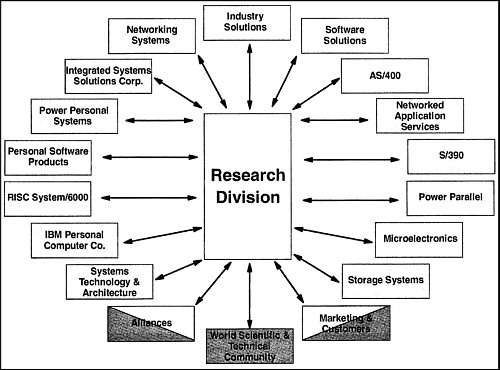

Figure 2.2 is not everybody's view of the corporate organization chart. There are a lot more people and units than those shown. In terms of impact, however, the point is that the research division is the hub at the middle of all these spokes. IBM has all these businesses, external alliances, and other elements that we must connect to. The research must not only touch these, but also be tightly connected to them in order to be effective in the way I have described.

Let me give you another view of our evolution. When I joined IBM, there was a time when Tom Watson actually cut the research budget because research was doing things that were too practical. Then, a division was put in place between research and development. There was a division called the Advanced Systems Development Division, whose purpose was to try to keep the researchers from becoming too practical. It is difficult to imagine such times now.

In the late 1970s, a couple of us went to Japan for patent negotiations and saw what was happening there. I remember that we thought about it on the way back and made some notes; we felt we had to connect with the people

FIGURE 2.2 Customers and partners of the research division.

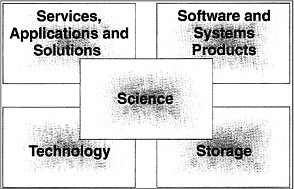

FIGURE 2.3 Research segmentation.

in development and move faster. We were working in silicon gate, semiconductor technology. The people who actually ran the factory had aluminum gate. We talked to each other, but we had no impact. FIGURE 2.2 Customers and partners of the research division.

We have rebuilt the process so that the “back” 25 percent of everything we do when we head toward product development is tightly connected to somebody in the product division, or increasingly to a unit that is building solutions for the marketplace. They invest in it; we invest in it. We share the funding, and we share the control. That is a tremendous vehicle. It is what moved us ahead in semiconductors when we were falling behind. And it has led to great success in storage technology and many other areas.

We started low in the value chain and we moved that concept up. Around 1990, we began to focus more specifically on our customers. Let me tell you why we did that. Remember what the business was like years ago: if you wanted to be in the computer business, you had to know how to pull single silicon crystals, to make transistors. The business was integrated vertically. There were IBM, UNIVAC, Honeywell, and RCA in the 1950s and 1960s. What happened over time is that the industry segmented horizontally. Today, there are a hundred thousand companies or more worldwide. The threshold for entry into most levels of this business is very low, and the industry has become very stratified. Whereas in the old days the technology was a mystery and you delivered a vertically integrated product—a black box—when you talk to customers now they are much more sophisticated. For instance, if the customer is a trucking business, it wants to apply technology in a way that is different from its competitors. The company wants us to help it do that.

What we asked ourselves around 1990 was, If we have this goal of being not only famous for our science and technology, but also vital to IBM, can we fulfill that role effectively if all our effort is in the deep technology? I do not have to tell you what the answer is; it is obvious. You must work in all levels of the value chain. A lot of people say that you cannot do research in solutions and services. They say service organizations do not use research or development, which is, of course, wrong. Arthur Andersen spends close to 10 percent of its revenue on research and development.

When we think about our research agenda, we use a schema shown as five boxes in Figure 2.3. Science is at the heart of the enterprise and drives most of what we do, and most of our science has tentacles that connect with one of these other pieces. Technology includes display devices, packaging, semiconductors, and some subsystems. We know what storage is, but why is it singled out in the figure? We integrated it into the other pieces because of the way IBM is organized. We have a separate business there and a separate research focus on it.

In 1992, about 5 percent of our effort was in services, applications, and solutions. We concluded that we were not moving fast enough in this area. We announced that we would have 20 percent of our effort in that area by the end of 1995. Today, that level of effort is 26 percent, while our emphasis on research in technology has decreased substantially. Our emphasis in the other three areas has remained about the same, or decreased slightly.

What made this change difficult was that by the time we were really involved in it, our budget had been reduced, due to IBM's financial problems. So, we accomplished this major restructuring during the same couple of

years in which our budget decreased by almost a quarter. The impact on those areas that shrank, in particular, was much greater than it would have been had the research budget stayed constant or grown.

That is the nature of the transformation that has taken place over the past few years. This transformation has been driven by the following set of principles. First of all, it is our job to maximize the value we create for our sponsor—IBM. It is for us to understand what value is and to explain it, not leave it for the company to figure out and tell us.

Research was the subject of a corporate audit during 1992. Ten IBM vice presidents visited for a couple of days and looked over everything. I am sure they arrived with the idea that they might find some significant piece that could be cut. We already had this view, described above, in place and the transformation was well under way. To make a long story short, they recommended no changes. The changed research organization is what Gerstner saw when he first arrived at IBM, and he has been enormously supportive of what we have been doing in research.

Second, you have got to build bridges across boundaries. NSF has done that with some of the programs it has put in place, the Engineering Research Center Program and some of the programs initiated more recently by Avner Friedman and others.

The third principle is that in almost anything you do, there is no such thing as too much contact with the marketplace, where things really happen. We all remember how in the Star Wars days one missile was launched and then another was sent up which hit the first dead on. People said that was amazing, but it turned out there was a transponder on the missile that was the actual target. What contact with the marketplace does is give you a transponder. You get signals back from what you are trying to hit. If we are working on a particular technology that we want to bring to market, I discuss this with some particularly demanding customers. They are very insistent about moving fast, keeping the cost down, and targeting correctly. Researchers like to talk to customers because they get an additional kind of feedback about the value of what they do, which makes them feel more valued.

I also said that you must be connected to the other parts of the company. We have a formal system of what is called “relationship managers.” These are people—two levels below me, typically directors, about 50 of them —who have the responsibility of managing one or more of the spokes in Figure 2.2, to make sure that we are working effectively with other parts of the company. They develop a shared vision with each partner and personalize it toward each part of the business. They discuss not only what the research division thinks is going to happen in the world, but what IBM should do in the world, including business strategies. The relationship managers are advocates for maximizing the value of research in their partner's business.

ASSESSING RESEARCH PERFORMANCE

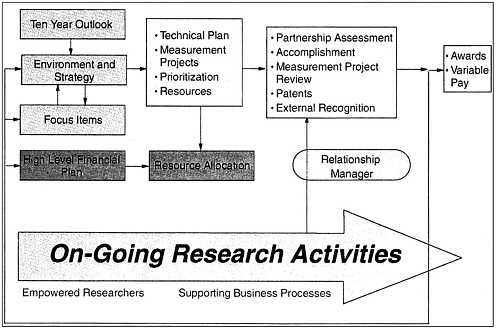

Let me say a little about how we plan and assess our business process. Figure 2.4 provides a very high level view of how we do things throughout the year. I told you earlier about the 10-year outlook. I keep trying to rename it the strategic outlook, to avoid the arbitrary 10-year period, but we have called it that for too long and so the name has stuck.

We begin the cycle by creating what we call an environmental strategy. This is done by the people in each of those five boxes in Figure 2.3. For each box there is a division vice president, reporting to me, who is responsible for that portfolio of activity around the world, and he or she leads the creation of this environmental strategy. This is what is going on in the world; this is what is likely to happen. Here is what the competition is doing; here is what IBM is doing. Here is what is good about that or what is not so good about that. This is what we think IBM ought to do, and this is what we think we ought to be doing in research. The result is a book of about 50 pages. Gerstner reads it from cover to cover and marks it up. I have a discussion scheduled with him next month for two hours on that subject.

As part of this process, we identify focus items, which we know require more attention but do not naturally get focused on in the process: for example, what is going on with the Internet, and its incredible technical and economic energy and confusion. The Internet is a focus item this year. We generate a separate short white paper on that.

In the fall, we prepare a technical plan, which is also done in a quite structured way. In that process there is a formal prioritization method in each of those five sectors, in which we decide what resources we are going to move from one sector to another. We do not look for bad work to stop because there is not any bad work. All the work is good. We take the work that we think has the least value, the bottom 10 percent, and put that on the table with the 10 percent of new initiatives that we want, but do not have the resources for. We prioritize them. This is a conscious mechanism to drive change, and the key is to have a mechanism for stopping good work to be able to do even better

FIGURE 2.4 Business processes of IBM's research division.

work. As I noted earlier, this is much more difficult for a research institution than for a funding agency. We cannot send a letter saying, “Dr. Brinkman, we are not going to renew your grant next year.” We have to deal with the people, skills, the capital investments, and all that.

Box 2.1 shows you some of the content of this review process. For each project —and there are close to 400 of these—the people doing the work have to generate a one-page project description. What are you trying to do? What have you been doing? What value will it have if you succeed? What do you need to do to achieve that value? Much of this is dependent on the people in the other divisions understanding and accepting our work. A great technical development will not matter if it is not accepted within the organization. Milestones and checkpoints need to be addressed. Finally, How am I going to measure the success and what resources do I need?

We have a program to assess quality, which focuses on four things: what results we achieve; how effective we are; what we should know about people, which includes exporting them; and how effective the processes that we use are.

We have a “contract” with the corporation as part of the measurement of our performance. It affects the variable pay of everybody in the division. It affects my pay in a significant way. A subset of the projects presented in the one-page project descriptions include things that we agree on with our partners as part of this shared process, in which they give us a score at the end of the year. We talk to them at the beginning of the year about agreement on what we are going to do, and at the end of the year, we are rated on how well we did, how much value we delivered.

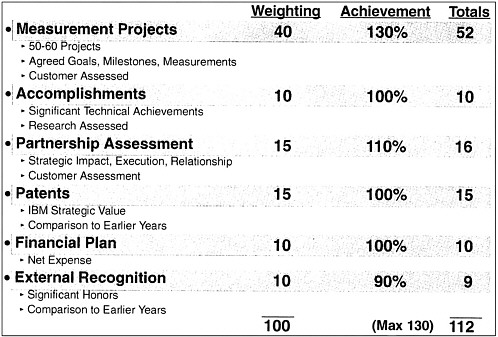

We have an internal process to measure the effectiveness of many of the things that are longer range, more basic, which we have had in place for a many years. We receive external input on this, and we have a set of standards for evaluating results, as shown in Figure 2.5. We assess more generally how well we are working with other parts of the business in a structured way every year. We measure the patents. Did we meet our financial plan? That always matters, although we cannot get more than 100 percent on that because we do not want people saving money by reducing output. Finally, how well are people recognized externally? Then you add up the score. We came in at 112 last year, which turned into money in people's pockets.

FIGURE 2.5 Evaluation of research results.

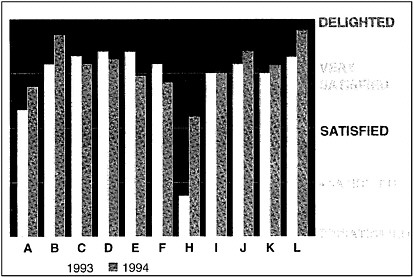

These are healthy processes. Figure 2.6 provides another example of how we measure performance—partnership scores two years in a row. It appears that unit H was really dissatisfied in the first year. You can say that it was not fair because one individual was mad for something beyond your control. That does not matter, however. It forces the unit to consider the problem.

These evaluations are linked to the individual through a process we call CDP, the contribution and development plan, which is summarized in Figure 2.7. This is an annual process for everyone. It focuses not only on what each employee did technically and in terms of business, but also on how the employee fared in terms of professional responsibilities and other outside efforts.

What about individual growth? In a world that changes fast, everybody had better be growing. A set of values also will be acquired that is enormously important in an institution. When people do not live by the values, no matter how good they are technically, they can be destructive to the company's achievement of value. These elements are then coupled to each employee's ranking, which is used to determine salary and variable pay.

GENERAL DISCUSSION

DR. ZRAKET: That was really a great presentation. I wanted to leave some time for questions, and I will start off with one on the last part. Who does the performance reviews, and do you have peer reviews?

DR. McGRODDY: The contribution and development plan evaluation has a couple of elements. It occurs annually. How did you do this year? The manager deals with each individual on that matter, except for one element. On living by the values, we use what is called the 360-degree approach, where people typically get input from a dozen or so peers, subordinates, and superiors. That is all done over the network, and it is pretty lightweight, but it is very, very effective. It forces you to have discussions. People may tell you that you are a great manager, but you always want the credit for yourself—a not uncommon problem. The ranking is a much longer-range process

FIGURE 2.6 Measuring performance—partnership scores.

FIGURE 2.7 Contribution and development plan (CDP)—linking evaluations to the individual.

that examines a three-to-five-year horizon and has much peer input. AT&T has done that, and we have done that for 25 years.

DR. HACKERMAN: You said that most of the people in the laboratory enjoy working with, quote, customers?

DR. McGRODDY: Yes. You take the basic scientists—a lot of them are very insecure about their status. They are not quite sure why IBM pays them to do this work. They really are insecure. If you get them connected with a customer and the customer reacts positively, they feel better.

DR. HACKERMAN: Even the people in the 3 percent category, the ones that are funded to do fundamental science?

DR. McGRODDY: Absolutely. A couple of months ago, we took the chief information officer of one of our large customers to one of our labs to have him move an atom by himself. That is not a big interaction with a

customer, but the customer feels great about it. This is a company that is really investing for the future; it buys more from us, even if nothing else has changed. And our lab scientist feels good about it.

DR. HACKERMAN: How would you translate that for NSF? It does not have customers in the same sense.

DR. McGRODDY: I think it would be rash of me to try to do any kind of translation in such a short time. There are principles that could be derived from these experiences that are very applicable, with the understanding that NSF is not an active research institution. NSF is a funding agency. Particularly applicable are the principles about value. Who pays the bill? What is the customer's measure of value? How can we help our sponsor understand this better, and how do we maximize the value it gets for its investment?

DR. HACKERMAN: I just wanted to make you repeat that because it seems to me to be an important part of what you said.

DR. McGRODDY: The fundamental principle we operate on is value.

DR. BELL: At the beginning of your talk, you said that financial performance is often a lagging indicator of corporate performance, but you did not indicate what is a leading indicator.

DR. McGRODDY: You have got to look at what is in the R&D pipeline. If you are a drug company, it is very easy because things march along a very long path. You can look at what is in the pipeline, a quarter of the way through the Food and Drug Administration's approval process, and this is going to produce money in a few years provided nothing bad happens.

There is an analogous process at IBM. For example, I can look at what we have in the pipeline for the Think Pads for the next couple of years. You cannot look 10 years ahead on that, but I know what is there on a shorter time scale.

You can look at many other things in a research and development organization or in a business. It is fundamentally the responsibility of research organizations in industry to drive change in the company, to be the best in everything they do, including running your buildings operations, personnel, and everything else.

Because financial performance can be a lagging indicator and it is the thing that everyone focuses on, change never happens fast enough in most companies. For instance, Cunard Line is not the dominant transporter of people across the Atlantic anymore, and RCA is not the predominant supplier of integrated circuits. In our company we have been lucky and have had some foresight. We made the change from not being in computing to being in computers, going from electromechanical to electronic, and doing a couple of similar things, building a single architecture in the 1960s. But you have to have mechanisms in the company for doing that because otherwise your fortunes will go up and then they will go back down.

DR. LINEBERGER: Jim, I have a question that I would like to ask you and that I will ask the other speakers. When one looks at the changes that must take place in order to remain competitive, they involve people, and frequently morale drops in the face of rapid change. How do you manage to continue to get people to work at their best? When organizations undergo wrenching changes, how do they keep people working at their best? How does IBM approach this? How should NSF approach this issue?

DR. McGRODDY: Well, I cannot give you an answer for NSF in a minute, but I can tell you some of what we did. We took a portfolio view of a lot of things. For example, we had about a half a dozen groups of researchers in gallium arsenide-related technology, which we started in our Zurich lab 30 years ago, with the idea that this technology was going to play an important role in the information technology industry. It became clear over time that silicon was outrunning it in terms of switching devices. We told those people, great people, that we were not going to continue to fund them. They had two choices to make, the fork in the road. Either they could do a different type of research within the company, or if they wanted to continue to do the same kind of work, they had to look elsewhere, and we would give them time to make the transition. Many of them sent out their resumes and became distinguished professors at different universities.

The world changes. It is wrong to think that you can work on organic molecules for 40 years. Maybe you can in a university, but I do not think it is healthy even there. It would certainly be rare for us to support it. In other cases, we simply agreed to part ways, but we did not have any layoffs. We did not simply say, “We laid off 20 percent because they—the corporate office—told us to do that.” We did a lot of retraining. Some of the people were not so great in science and were actually getting tired of it, and we had to legitimize change for them. For example, we gave courses in several new research areas. Some people made radical changes, unbelievable changes. One person, for example, is now our star researcher in object technology. These are intelligent people, who know much more than they think they do. They can do all kinds of things, but not until you legitimize it and help them.

DR. BLOCH: On a slightly different question, you are running one of the remaining central laboratories in the United States. What do you see as the future of the central laboratory—not yours, but the generic central laboratory—and how does it compare to what it was 20 or 30 years ago?

DR. McGRODDY: I do not think there is a generic answer. I already talked about the disconnection between the layers and the value chain. In a big company you start off with the disadvantage of some degrees of bigness—the bureaucracy and the slowness that goes with it—but the fact that you are operating all those pieces can be turned into a real advantage. One of the ways you make it a real advantage is by sharing along the way, by doing things that provide synergy between the layers; here, the different layers are usually different business units. Another thing we say internally and try to make true is that we have got to be part of the solution and not part of the problem. As a research organization you must focus on that and make the change before anybody tells you to.

DR. SANKEY: In your research process, you showed that you come up with an environment and strategy plan every year and out of this come focus items.

DR. McGRODDY: Those focus items are input.

DR. SANKEY: Well, right, an input to that plan, but presumably these focus items come from somewhere.

DR. McGRODDY: Me. It is my job to identify items that do not fit within the same existing paradigm. We are not working enough on systems management, for example. All product divisions say they are working on it, but we do not focus enough on the collective issue. We do not yet understand the impact of the Internet on our business. If it is just mixed in with all the other communications business, we will miss its significance.

DR. SANKEY: The question I had was, Does that stay constant? Is that changing on a year-to-year basis?

DR. McGRODDY: Every year, yes.

DR. SANKEY: In the basic research environment, a year is not really that long.

DR. McGRODDY: That is not an agenda. At this point, we are trying to lay out the backdrop against which we are going to make a plan, which is a resource investment. What is important, what is going on in the world, what is going to happen? In thinking about the Internet in a business sense, I have concluded that we are maybe a tenth of a percent of our way into that. We are at the very, very beginning by any reasonable measure. There was $20 million of commerce on the Internet last year. Twenty million dollars is not an interesting number, unless you are a university researcher.

It is that kind of thing we are trying to deal with. We are coming to a turn in the road; we have to be ready to go around it, and research must lead the way.