2

Benefits, Costs and Contemporary Use Patterns

BENEFITS OF PESTICIDES

Pesticides are an integral component of US agriculture and account for about 4.5% of total farm production costs (Aspelin and Grube, 1999). Pesticide use in the United States averaged over 1.2 billion pounds of active ingredient in 1997, and was associated with expenditures exceeding $11.9 billion; this use involved over 20,700 products and more than 890 active ingredients. Herbicides account for the greatest use in volume and expenditure; in 1997, 568 million pounds was used in agriculture, commerce, home, and garden. Insecticide applications constituted 168 million pounds, and fungicides 165 million pounds. Use patterns of pesticides vary with crop type, locality, climate, and user needs (Aspelin and Grube, 1999).

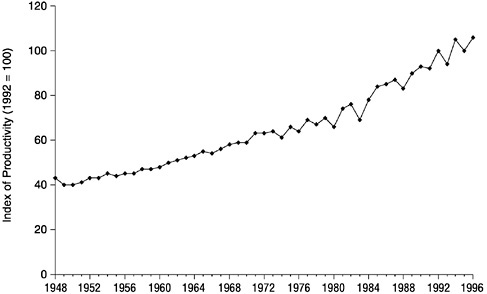

Pesticides are used so extensively because they provide many benefits to farmers and by extension to consumers. From the time when synthetic pesticides were developed after World War II, there have been major increases in agricultural productivity accompanied by an increase in efficiency, with fewer farmers on fewer farms producing more food for more people (Figure 2-1) (Rasmussen et al. 1998). A major factor in the changing productivity patterns, either directly or indirectly, has been the use of pesticides. In maize, for example, there has been 3-fold increase in yields since 1950. Although to a large extent this increase is attributable to the adoption of new hybrids with increased disease and insect resistance and with the ability to use more nitrogen fertilizer, another major factor

FIGURE 2-1 Index of farm productivity in the United States, 1948–1996.

aThe index of productivity was determined by dividing all input values (such as feed, seed, livestock purchases, and pesticides) by all output values (such as feed crops, poultry, and eggs). Input and output values are unit-free quantity indexes that measure change over time as weighted by price. They were determined with Fisher 's Ideal Index number procedure (also known as geometric mean of Laspayres and Paache indexes).

Source Data from Ball et al., 1997.

has been changes in planting practices facilitated by the availability of effective herbicides. Historically, for example, corn was planted in hills of three or more plants and, in many cases, in check rows, which allowed farmers to cultivate the corn in two directions for weed control. With the advent of effective herbicides, farmers switched from hill planting to drilled, narrow-row planting. The plant population increased from 10,000–12,000 plants per acre to 25,000–30,000 plants per acre. That led to the development of new high-yield hybrids that could tolerate the high population densities. Herbicides also allowed corn to be planted earlier in the growing season, and this resulted in a higher yield potential for the crop. Before herbicides, corn had to be planted later so that the first flushes of weeds could be killed with tillage. The development of soil-applied insecticides also allowed more farmers to grow maize for multiple years and increased productivity on an area-wide basis. Wheat production has

also benefited from the use of herbicides; earlier, broadleaf and grass weeds caused great losses in yield. Cultivation is not practical in cereals, in contrast with maize. The introduction of 2,4-D and grass herbicides increased yields by controlling the weeds without damaging the crop (Warren 1998).

The beneficial impact of insecticides is illustrated by patterns of cotton cultivation in the southern United States. When Anthonomus grandis, the boll weevil, crossed the Rio Grande in 1892, it rapidly spread through the lower Southeast and drove major cotton production out of many states. With the advent of synthetic organic insecticides, farmers were able to return previously infested areas to cotton cultivation. Boll weevil eradication programs combining chemical control with other management practices have further expanded acreage in cotton (Carlson and Sugiyama 1985). That example also illustrates the complexity of pesticide issues. After the boll weevil outbreaks exerted their initial damage, southern farmers were forced to diversify their crops. The long-term result was of such strong economic benefit that the citizens of Enterprise, Alabama, erected a monument in their town square inscribed “in profound appreciation of the boll weevil and what it has done as the herald of prosperity” (Pfadt 1978).

Plant disease can be devastating for crop production, as was tragically illustrated in the Irish potato famine of 1845–1847; indeed, this disaster led to the development of the science of plant pathology (Agrios 1988). Disease is still a major problem in potato production, and over 90% of the acreage in the United States is treated with a fungicide to prevent yield loss. In the Columbia Basin, a late blight epidemic (caused by new aggressive strains of Phytophthora infestans) occurred in 1995, and affected 65,000 ha (Johnson et al. 1997). This area accounts for about 20% of US potato production. Left unchecked, the late blight epidemic could have decreased yield by 30–100%. With the use of several fungicides, the epidemic was controlled, and there was only a 4–6% loss in yield and no increase in storage loss compared with previous years (Johnson et al. 1997).

One of the major benefits of pesticides is the protection of yield. According to one estimate (Oerke et al. 1994), yields of many crops could decrease by as much as 50%, particularly because of insect and disease damage, without crop-protection. Knutson et al. (1990) estimated that removing pesticides from US agriculture would cause crop-production to decline, particularly in the southern states, and increase cultivated acreage by 10% to compensate for crop yield losses. Crop yield losses were estimated at 24–57%, depending on the crop species, if no pesticides or alternative crop protection measures were used. Moreover, exports in this scenario would decrease by 50%, and consumer expenditures for food would increase by about $228 per year and be accompanied by an in-

crease in inflation as food prices increased. However, those estimates failed to take into account the possibility that other pest-control strategies could be used or that new technologies could be developed in the absence of chemical control (Jaenicke 1997).

A survey conducted by the Weed Science Society of America (Bridges and Anderson, 1992) estimated that the total US crop loss due to weeds is about $4 billion a year. In the absence of herbicides and best management practices, this loss could theoretically increase to $19.5 billion. The estimated loss in crops grown without herbicides ranged from 20% for corn and wheat up to 80% in peanuts (Bridges and Anderson, 1992).

Pesticide use also provides some benefits directly to consumers. Zilberman et al. (1991) estimated that every $1 increase in pesticide expenditure raises gross agricultural output by $3.00–6.50. Most of that benefit is passed on to consumers in the form of lower prices for food. Major losses prevented by pesticide use are those experienced during transport and storage. Oerke et al. (1994) estimated that about 50% of the harvested crop, particularly of such perishable crops as fruits and vegetables, could be lost in transport and storage because of insects and disease in the absence of pesticide use. Moreover, pesticide use can improve food quality in storage by reducing the incidence of such fungal contaminants as aflatoxins, known liver carcinogens, which are responsive to fungicides.

The use of herbicides has reduced the need for growers to cultivate to control weeds and that reduction has led to an increase in the practices associated with conservation tillage. These include no-till, ridge-till, striptill, and mulch-till—practices that leave at least 30% cover after planting. Leaving cover after planting reduces soil loss due to wind and water erosion up to 90%, and it increases crop residue (organic matter) on the soil surfaces up to 40% (CTIC, 1998a). Conservation tillage in the United States has increased from 26.1% of the total acreage in 1990 to 37.2% of the total acreage in 1998 (1998b). Without herbicides, widespread adoption of conservation tillage would likely not have taken place.

Although agriculture accounts for two-thirds of all expenditures on pesticides and three-fourths of total volume used, nonagricultural uses of pesticides are also substantial. Pesticides are used on some 2 million US farms but they are also used in some 74 million households (albeit at much lower rates). Expenditures for home and garden use of pesticides in US households were approaching $2 billion a year in 1996, most of it on insecticides ($1.34 billion), fungicides and repellents ($185 million), and herbicides ($479 million) (Aspelin and Grube, 1999).

Estimating the economic benefit of household pesticides is difficult in that in most cases no tangible product is sold for a profit. Benefits are often aesthetic rather than economic (although aesthetic improvement can increase traffic at a place of business or increase the resale value of a

residence). Even if difficult to measure, the aesthetic benefits of controlling pests in homes, gardens, and lawns, must be sufficient for homeowners to use pesticide products despite reservations about their safety (Potter and Bessin 1998); close to 85% of US households contain at least one pesticide product in storage (Whitmore et al., 1993).

Control of household pests can potentially provide health benefits because insect allergens (including those present in cockroach excrement and body parts) contribute to asthma, particularly in children. The presence of domiciliary cockroaches is strongly associated with sensitization to cockroach allergens, and sensitization has been associated with the incidence of bronchial asthma (Duffy et al., 1998). About 70% of urban residents with asthma are sensitive to cockroach allergens. The high mortality and morbidity of inner-city children due to asthma are linked to exposure to cockroach allergens (Petersen and Shurdut, 1999). That cockroach control could reduce the incidence of asthma is suggested by the positive correlation between the degree of cockroach sensitivity and the number of cockroaches seen in infested dwellings by residents. Helm et al. (1993), for example, established a quantitative relationship between cockroach density and the amount of cockroach aeroallergens. However, particularly in multifamily households, reducing cockroach numbers does not always lower the incidence of asthma (Gergen et al., 1999).

The decision of whether to treat for cockroaches at present is determined not by an economic injury level (EIL), but rather by an aesthetic level. EILs cannot be calculated, because an economic value of human life cannot be easily assessed. No-observed-effect levels (NOEL) based on detectable levels of cholinesterase depression, however, can be established for the organophosphate agents used for cockroach control. Assessments of air and surface residues and biological monitoring have been used to evaluate multiple exposures of residents of homes undergoing crack and crevice treatment with organophosphates (summarized in Peterson and Shurdut, 1999). Maximum daily exposures were calculated at 2.4–8% of the reference dose (RfD) for children and less than 1% of the RfD for adults (RfD is the dose at or below which aggregate exposure every day over the course of a lifetime does not pose a significant risk). Use of chlorpyrifos, the agent of choice for crack and crevice treatment, was thought to result in minimal exposures and did not pose an appreciable risk to residents. Thus, even if aesthetic and health benefits are difficult to quantify, they still are expected to be offset by very low risk factors for chemical agents currently in use. On June 8, 2000, US EPA revised their risk assessment for this compound based on the mandates of the Food Quality Protection Act (FQPA) and eliminated chlorpyrifos for residential use. After December 31, 2001, retailers will not be able to sell any chlorpyrifos for home use except in baits with child-resistant packaging

(EPA 2000). Risks are not so easily quantified for nonchemical alternatives for cockroach abatement (such as baits, cleaning, and microbial agents), but they are expected to be low (Peterson and Shurdut, 1999).

Control of stinging hymenopterans, which kill about 40 people in the United States every year (Merck & Co., 2000), has considerable health benefits, which are difficult to quantify given the problems associated with assigning value to human life.

In summary, in the context of production agriculture and ancillary enterprises, pesticides are intended to

-

Increase yields.

-

Increase farming efficiency.

-

Increase availability of fruits and vegetables.

-

Supply low-cost food and fiber for consumers.

-

Improve food quality.

-

Decrease loss of food during transport and storage.

-

Improve soil conservation.

-

Ensure a stable and predictable food supply.

Contemporary Pesticide Use on US Crops

Broadly speaking, pesticides are used extensively in US agriculture; but they are used most intensively on fruits and vegetables. Intensity of pesticide use is measured by the amounts applied per acreage— which is much higher for fruits and vegetables than for other crops. For example, vegetables represent less than 2% of the crop acreage but received 17% of the total pesticides used (Lin et al. 1995). Current information on pesticide use is available from USDA surveys on corn, wheat, soybeans, cotton, potatoes, other vegetables, citrus, apples, and other fruits (ERS, 1997). Those crops account for about 80% of both planted crop acreage and sales of agricultural products and can thus be taken as broadly representative of US agriculture (USDA, 1996). Data on pesticide use include amounts of active ingredients applied and shares of acreage treated in toto and by major category (ERS, 1997). In 1996, corn, wheat, cotton, and soybeans together accounted for almost two-thirds of all pesticides applied to those crops (ERS, 1997). Corn herbicides alone accounted for about one-third of the total, and soybean herbicides for about one-eighth. Herbicides and insecticides applied to cotton each accounted for 5–6% of the total, and herbicides applied to wheat accounted for 4%. Other pesticides applied to potatoes, mainly soil fumigants, accounted for over one-eighth of the total.

The extent of pesticide use on any given crop can also be captured by the share of acreage treated. By that measure, herbicide use is widespread.

Herbicides are applied to 92–97% of acreage planted in corn, cotton, soybeans, and citrus; 87% of potato acreage; three-fourths of vegetable acreage; and two-thirds of the acreage planted in apples and other fruit (ERS, 1997; see Table 2-1). Herbicide use is least extensive on winter wheat (56%). In contrast, insecticide use is much less widespread. Among row crops, insecticides are used most extensively in cotton, tobacco, and potatoes. About 30% of corn acreage is treated annually with insecticides, and insecticides are applied to 12% or less of wheat and soybean acreage. Insecticide use is quite prevalent, however, on fruit and vegetable crops. Nearly all apples, citrus, and potatoes and about 90% of other vegetable and other fruit crop acreage are treated with insecticides (ERS, 1997). Fungicide use is similarly highly prevalent on potatoes and fruit crops. Among row crops, only in cotton, tobacco and potato are fungicides used regularly; less than 10% of cotton acreage is typically treated with fungicides. The category “other pesticides ” includes defoliants, growth regulators, and soil fumigants, which are used widely on cotton and potatoes. Potatoes are particularly pesticide intensive—almost 90% of the acreage is treated, with fungicides and soil fumigants as the dominant types of treatment (ERS, 1997).

One measure of the intensity of pesticide use is reflected by calculat-

TABLE 2-1 Pesticide Use in US Row Crops, Fruits, and Vegetables

|

Proportion of Area Treated, % |

|||

|

Crop |

Herbicide |

Insecticide |

Fungicide |

|

Row cropsa |

|||

|

Maize |

97 |

30 |

<1 |

|

Cotton |

92 |

79 |

6 |

|

Soybean |

97 |

1 |

<1 |

|

Winter wheat |

56 |

12 |

1 |

|

Spring wheat |

88 |

3 |

<1 |

|

Tobacco |

75 |

96 |

49 |

|

Potato |

87 |

83 |

89 |

|

Fruits and vegetablesb |

|||

|

Apple |

63 |

98 |

93 |

|

Oranges |

97 |

94 |

69 |

|

Peaches |

66 |

97 |

97 |

|

Grapes |

74 |

67 |

90 |

|

Tomato, fresh |

52 |

94 |

91 |

|

Lettuce, head |

60 |

100 |

77 |

|

aData for 1996. Fungicide amounts do not include seed treatments. Source: Agricultural Chemical Usage 1996 Field Crop Summary USDA September 1997. bData for 1995. Source:Agricultural Statistics 1997, NASS Crop Branch (202) 720-2127. |

|||

ing the amount of active ingredient applied per treated acre. We do that by dividing the total amount of each material used by the number of treated acres, which we estimate by multiplying planted acreage by the fraction of acreage treated. If the fraction of acreage treated is not reported (for instance, for other pesticides used on fruits and vegetables), we use planted acreage instead (Table 2-2). Planted acreage is likely to be larger than treated acreage, because some acreage is not treated, so this procedure can result in an estimate of application rate that is lower than the actual rate.

Potatoes are the most pesticide-intensive US crop, because of their heavy use of soil fumigants (Table 2-3). Other vegetables and apples are the next most intensive, receiving a total of about 20 lb of pesticides per treated acre. Citrus (9.6 lb/acre) is also highly pesticide-intensive. (Lin et al., 1995). In contrast, cotton, the most pesticide-intensive of the major crops, received only about 5 lb/acre, about one-fourth to one-half as much as most fruit and vegetable crops. Corn received less than 3 lb/acre, and soybeans and wheat 1lb/acre or less. Only in the case of herbicides are application rates per treated acre comparable between major crops and fruits and vegetables. Corn and cotton receive roughly the same amounts of active ingredients per acre as potatoes, other vegetables, apples, and other fruits (Lin et al., 1995).

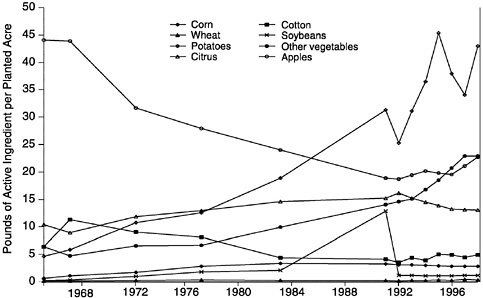

The total amount of pesticides applied to some major crops (Figure 2-2) increased over the last few years after declining for over a decade. Pesticide use in US agriculture increased steadily from the late 1940s until around 1980, because of the spread of herbicide use on corn and soybeans (ERS 1997, Osteen and Szmedra 1989). Pesticide use on major grain and oilseed crops has fallen consistently since the early 1980s. The adoption of pest-management programs that take advantage of the strengths of new pesticides has contributed to decreasing the amount of pesticides used. For example, a 1992 survey showed that pesticide use in Missouri grain crops had decreased by 6% since 1975 while the total quantity of herbicide and insecticide active ingredients had decreased by 38%; the decrease in herbicide use by Missouri corn and soybean farmers from 1984 to 1992 amounted to 3 million pounds. Those decreases were attributable to the availability of more effective herbicides with lower application rates (NAPIAP, 1997). Similarly, a survey in North Dakota in 1996 showed that many farmers had adopted new cultural and management practices that enhanced the effectiveness of pest management. For example, 75% of the farmers surveyed used field monitoring and crop rotation as part of their integrated program. In addition, several thousand wheat growers were trained in field monitoring, insect identification, and other practices, which resulted in a 75% decrease in the number of acres treated for orange wheat blossom midge.

Increases in pesticide use over the last 10 years are due for the most part to increases in the use of fungicides and other pesticides, mainly soil fumigants, on potatoes and other vegetables (Padgitt et al., 2000). Increases in pesticide use for a given crop can be the result of additional acreage being planted. For example, pesticide use in cotton has increased due largely to the resurgence of cotton production in the southeastern United States, which is itself attributable to the success of the boll weevil eradication program administered by USDA (Carlson et al., 1989).

Those trends suggest that differences in the intensity of pesticide use among crops appear to have become greater over time, mainly because of increases in the use of fungicides, such other pesticides as soil fumigants, and growth regulators. Over the last 2 decades, major crops (for example, grains, oilseeds, and cotton) have become less pesticide-intensive. Insecticide use and herbicide use on potatoes, other vegetables, citrus and apples have remained roughly constant since the early 1980s, whereas the use of fungicides and other pesticides has increased. The use of all types of pesticides on other fruits increased between 1980 and 1990 and has since remained roughly constant.

Pesticide-Related Productivity in US Agriculture

Gauging the productivity of pesticide use in agriculture is difficult. The aggregate concept “pesticides” has considerable currency in policy discussions but is hard to define precisely. Pesticides in the aggregate encompass a wide variety of chemicals with different properties and effects. As a result, there might be no consistent correlation between crop output and common measures of pesticide use, such as the amount of active ingredient applied or the acreage treated with pesticides. For example, reducing the application of a given compound might lead to reductions in output whereas a switch from a less-toxic to a more-toxic compound that results in the same reduction in weight of active ingredient applied might not. Despite the conceptual difficulties, it is important to have at least a rough sense of how pesticide use in the aggregate influences agricultural productivity.

Zilberman et al. (1991) pointed out that the productivity of pesticides —and thus the effects of reducing pesticide use—depends in large measure on substitution possibilities within the agricultural economy. Some substitutes are available only in the short term, when land allocations, cropping patterns, and consumption are fixed. Others are available in the long-term. Substitution between pesticides and other inputs can occur at the farm level or at the regional and national levels. Short-term substitutes for pesticides at the farm level include labor (such as, hand weeding), capital and energy (such as cultivation to control weeds),

TABLE 2-2 Pounds of Pesticide Active Ingredient per Planted Acre in Major US crops, 1990–1997

|

1964 |

1966 |

1971 |

1976 |

1982 |

1990 |

1991 |

1992 |

1993 |

1994 |

1995 |

1996 |

1997 |

|

|

Crop Herbicides |

|||||||||||||

|

Corn |

0.387 |

0.693 |

1.362 |

2.454 |

2.974 |

2.932 |

2.767 |

2.829 |

2.758 |

2.723 |

2.615 |

2.661 |

2.640 |

|

Cotton |

0.312 |

0.631 |

1.587 |

1.571 |

1.829 |

1.710 |

1.850 |

1.949 |

1.756 |

2.085 |

1.943 |

1.893 |

2.115 |

|

Wheat |

0.165 |

0.152 |

0.216 |

0.273 |

0.226 |

0.215 |

0.195 |

0.241 |

0.254 |

0.294 |

0.289 |

0.403 |

0.342 |

|

Soybeans |

0.133 |

0.279 |

0.840 |

1.614 |

1.880 |

12.870 |

1.181 |

1.139 |

1.066 |

1.124 |

1.088 |

1.212 |

1.181 |

|

Potatoes |

0.989 |

1.482 |

1.521 |

1.254 |

1.256 |

1.687 |

1.777 |

1.643 |

1.805 |

2.048 |

2.074 |

1.992 |

1.762 |

|

Other vegetables |

0.670 |

1.005 |

1.061 |

1.696 |

1.984 |

1.735 |

1.700 |

1.658 |

1.671 |

1.681 |

1.909 |

2.126 |

2.127 |

|

Citrus |

0.265 |

0.397 |

0.457 |

3.970 |

5.556 |

6.635 |

7.176 |

6.208 |

5.385 |

4.908 |

4.455 |

4.170 |

3.913 |

|

Apples |

0.617 |

0.924 |

0.389 |

1.427 |

1.548 |

0.815 |

0.823 |

0.883 |

0.868 |

1.307 |

1.739 |

1.735 |

1.987 |

|

Crop Insecticides |

|||||||||||||

|

Corn |

0.238 |

0.356 |

0.344 |

0.379 |

0.368 |

0.313 |

0.303 |

0.264 |

0.253 |

0.219 |

0.211 |

0.202 |

0.218 |

|

Cotton |

5.259 |

9.271 |

5.937 |

5.503 |

1.692 |

1.100 |

0.584 |

1.156 |

1.146 |

1.742 |

1.772 |

1.278 |

1.398 |

|

Wheat |

0.016 |

0.016 |

0.032 |

0.090 |

0.033 |

0.013 |

0.003 |

0.017 |

0.003 |

0.028 |

0.013 |

0.030 |

0.017 |

|

Soybeans |

0.158 |

0.086 |

0.129 |

0.157 |

0.164 |

0.000 |

0.007 |

0.007 |

0.005 |

0.003 |

0.008 |

0.006 |

0.011 |

|

Potatoes |

1.111 |

1.984 |

1.934 |

2.318 |

2.898 |

2.566 |

2.559 |

2.614 |

2.816 |

3.107 |

2.217 |

1.717 |

2.423 |

|

Other vegetables |

2.532 |

2.352 |

2.610 |

1.775 |

2.039 |

1.662 |

1.627 |

1.572 |

1.554 |

1.545 |

1.511 |

1.491 |

1.503 |

|

Citrus |

1.825 |

3.213 |

2.554 |

3.843 |

4.687 |

4.678 |

4.706 |

5.079 |

5.597 |

5.215 |

4.929 |

4.805 |

4.783 |

|

Apples |

23.993 |

20.185 |

12.011 |

8.960 |

7.898 |

8.220 |

8.230 |

8.609 |

8.894 |

8.279 |

7.609 |

7.375 |

7.285 |

|

Crop Fungicides |

|||||||||||||

|

Corn |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Cotton |

0.012 |

0.036 |

0.018 |

0.004 |

0.018 |

0.080 |

0.050 |

0.060 |

0.052 |

0.080 |

0.059 |

0.034 |

0.065 |

|

Wheat |

0.000 |

0.000 |

0.000 |

0.011 |

0.013 |

0.002 |

0.001 |

0.017 |

0.010 |

0.014 |

0.007 |

0.003 |

0.001 |

|

Soybeans |

0.000 |

0.000 |

0.000 |

0.004 |

0.001 |

0.000 |

0.000 |

0.001 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Potatoes |

2.463 |

2.357 |

2.880 |

2.962 |

3.094 |

2.006 |

2.274 |

2.689 |

3.177 |

4.449 |

5.722 |

4.945 |

7.930 |

|

Other vegetables |

1.384 |

1.179 |

1.789 |

1.581 |

3.056 |

4.553 |

4.738 |

4.946 |

5.482 |

6.045 |

6.469 |

6.902 |

6.920 |

|

Citrus |

6.314 |

4.559 |

7.754 |

4.922 |

4.312 |

3.950 |

4.235 |

3.837 |

3.485 |

3.681 |

3.791 |

3.626 |

3.478 |

|

Apples |

17.173 |

20.190 |

17.919 |

16.093 |

13.512 |

9.778 |

9.259 |

9.713 |

9.978 |

10.022 |

10.000 |

11.497 |

13.245 |

|

Crop Other pesticidesa |

|||||||||||||

|

Corn |

0.001 |

0.008 |

0.006 |

0.006 |

0.002 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Cotton |

0.838 |

1.373 |

1.513 |

1.088 |

0.824 |

1.230 |

1.103 |

1.193 |

0.945 |

1.137 |

1.163 |

1.278 |

1.340 |

|

Wheat |

0.000 |

0.001 |

0.005 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Soybeans |

0.000 |

0.001 |

0.001 |

0.040 |

0.034 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Potatoes |

0.069 |

0.006 |

4.467 |

6.095 |

11.658 |

25.055 |

18.621 |

24.122 |

28.664 |

35.734 |

27.969 |

25.343 |

30.837 |

|

Other vegetables |

1.777 |

0.164 |

1.084 |

1.584 |

2.834 |

6.100 |

6.510 |

6.918 |

8.062 |

9.217 |

10.764 |

12.341 |

12.337 |

|

Citrus |

1.971 |

0.766 |

1.072 |

0.179 |

0.006 |

0.016 |

–a |

–a |

–a |

0.102 |

0.200 |

0.600 |

1.100 |

|

Apples |

2.298 |

2.564 |

1.363 |

1.424 |

1.003 |

0.104 |

0.206 |

0.221 |

0.217 |

0.218 |

0.217 |

0.217 |

0.221 |

|

Crop All pesticide types |

|||||||||||||

|

Corn |

0.626 |

1.057 |

1.712 |

2.839 |

3.344 |

3.245 |

3.070 |

3.092 |

3.011 |

2.943 |

2.825 |

2.864 |

2.858 |

|

Cotton |

6.421 |

11.311 |

9.055 |

8.166 |

4.363 |

4.120 |

3,580 |

4.350 |

3.892 |

5.036 |

4.943 |

4.483 |

4.925 |

|

Wheat |

0.181 |

0.169 |

0.253 |

0.374 |

0.272 |

0.230 |

0.197 |

0.273 |

0.265 |

0.338 |

0.311 |

0.435 |

0.362 |

|

Soybeans |

0.291 |

0.366 |

0.970 |

1.815 |

2.079 |

12.870 |

1.190 |

1.146 |

1.071 |

1.127 |

1.098 |

1.216 |

1.193 |

|

Potatoes |

4.632 |

5.829 |

10.802 |

12.629 |

18.906 |

31.314 |

25.302 |

31.068 |

36.462 |

45.339 |

37.983 |

33.997 |

42.952 |

|

Other vegetables |

6.363 |

4.700 |

6.544 |

6.636 |

9.913 |

14.050 |

14.575 |

15.094 |

16.799 |

18.487 |

20.679 |

22.860 |

22.887 |

|

Citrus |

10.375 |

8.935 |

11.837 |

12.914 |

14.561 |

15.279 |

16.118 |

15.237 |

14.467 |

13.906 |

13.270 |

13.146 |

13.043 |

|

Apples |

44.081 |

43.863 |

31.682 |

27.904 |

23.961 |

18.917 |

18.724 |

19.426 |

20.174 |

19.826 |

19.565 |

21.041 |

22.737 |

|

anone reported or too little reported to make an estimate. Source: Lin et al.,1995; Padgitt et al., 2000. |

|||||||||||||

changes in cultural methods (such as changing planting dates), and human capital (such as scouting). Long-term substitutes at the farm level include shifts in crop varieties (for example, to more-resistant but possibly lower-yielding cultivars), biological pest controls (such as released predators and pheromone traps), crop rotation, and land allocations (increases or shifts in cultivated acreage). Long-term substitutes at the regional and national levels include regional shifts in production, such changes in consumption as increases in imports and decreases in exports, changes in diet composition, and changes in feed mixes.

In general, pesticide productivity will tend to be low in situations where substitution possibilities are large. For example, the United States has a great deal of land suitable for growing grain and oilseed crops. Real prices of fuel and electricity have been falling since 1980 while the price of durable equipment has remained roughly constant (Ball et al. 1997). The prices of both types of inputs have fallen relative to agricultural chemical prices; this suggests that cultivation has become more attractive relative to herbicides as a form of weed control. Because US grain and oilseed production is highly mechanized, those pricing patterns suggest an abundance of cost-effective substitutes for pesticides and thus relatively low pesticide productivity on these crops. In contrast, the United States has a limited supply of land in areas with climates suitable for growing fresh fruits and vegetables year-round. The prices of hired and self-employed labor have risen steadily, both in real terms and relative to agricultural chemical prices, and this suggests that labor-intensive pest-control methods, such as hand weeding and scouting, have become less attractive

relative to pesticide use. Fruit and vegetable production is relatively labor-intensive, so those facts suggest a greater paucity of cost-effective substitutes for pesticides and thus higher pesticide productivity on fruits and vegetables.

Pesticide productivity has been estimated in three general ways: with partial-budget models based on agronomic projections, with combinations of budget and market models, and with econometric models.

Partial-Budget Models

Partial-budget models estimate productivity effects of changes in pesticide use by constructing alternative production scenarios. Each scenario consists of a set of input usage rates and crop yields. Current production methods can be obtained from crop budgets when available. Otherwise, most studies rely on the opinions of experts familiar with crop-production conditions in different growing regions to construct scenarios characterizing current production methods and input usage sets likely to occur under various assumptions of pesticide-use reductions. Changes in yield are derived from pesticide field trials when available and from expert opinion otherwise. Current input and output prices are then used to translate changes in input use and crop yields into monetary terms.

The most widely cited studies on pesticide productivity, those of Pimentel and various coauthors, use this method (see, for example, Pimentel et al. 1978; 1991; 1992). Cramer's (1967) assessment of global crop losses also falls into this category, as does the Knutson et al. (1993)

TABLE 2-3 Acreage and Amounts of Pesticides Applied to Major US Crops, 1997

|

Crop |

Acresa |

Herbicidesb |

Insecticidesb |

Fungicidesb |

Other Pesticidesb |

All Pesticidesb |

Pounds per Acre |

|

Corn |

80,227 |

211,800 |

17,500 |

0 |

0 |

229,300 |

2.86 |

|

Cotton |

13,808 |

29,200 |

19,300 |

900 |

18,500 |

67,900 |

4.92 |

|

Wheat |

70,989 |

24,300 |

1,200 |

100 |

0 |

25,600 |

0.36 |

|

Soybeans |

70,850 |

83,700 |

800 |

0 |

0 |

84,500 |

1.19 |

|

Potatoes |

1,362 |

2,400 |

3,300 |

10,800 |

42,000 |

58,500 |

42.95 |

|

Other Vegetables |

3,526 |

7,500 |

5,300 |

24,400 |

43,500 |

80,700 |

22.89 |

|

Citrus |

1,150 |

450 |

5,500 |

4,000 |

1,100 |

11,050 |

9.61 |

|

Apples |

453 |

900 |

3,300 |

6,000 |

100 |

10,300 |

22.74 |

|

Total |

242,365 |

360,250 |

56,200 |

46,200 |

105,200 |

567,850 |

|

|

aIn thousands. bIn thousands of pounds. Source: Padgitt et al. 2000. |

|||||||

FIGURE 2-2 Total pesticides application on major US crops, 1964–1997.

Source: Padgitt et al., 2000.

study of pesticide use on fruit and vegetable crops. Those studies use data from field trials and expert opinion to estimate pest-induced losses crop by crop basis with current pesticide use, without pesticides, and with a 50% reduction in pesticide use. They construct alternative production scenarios for each crop to estimate changes in input use. Current prices are then used to value changes in per-acre production costs and per-acre yield losses, which are added to obtain an estimate of the costs of changes in pesticide use.

Pimentel and associates compile estimates of crop losses due to insects, diseases, and weeds crop by crop. They then add losses due to each class of pest on each crop to obtain estimates of aggregate crop losses in US agriculture. As they acknowledge, this procedure overestimates crop losses because of overlaps in damage caused by insects, diseases, and weeds. Crop losses are valued at current crop prices. One of the more recent of these studies (Pimentel et al. 1991) estimates that aggregate crop losses amounted to 37% of total output in 1986, up from 33% in 1974. Those estimates were compared with USDA assessments for the 1940s and 1950s, which estimated aggregate crop losses due to pests at 34% and 31% respectively, of total output. In comparison, Cramer (1967) estimated crop losses of around 28% due to all pests in all of North and Central America. Pimentel and associates interpret the temporal coincidence of

rising pesticide use and rising crop losses as additional evidence that US agriculture has been on a “pesticide treadmill” in which disruption of agroecosystems by pesticides forces farmers to use ever-increasing amounts of pesticides. The study also estimates that pesticide use could be reduced by 50% by the substitution of nonchemical pest controls, such as crop rotation, use of resistant crop varieties, scouting, and field sanitation. It estimates that such a reduction in pesticide use would not result in any additional crop losses but would increase pest-control costs by $1 billion, or 25%.

Partial-budget models of this kind generally overstate pesticide productivity (and thus the economic effects of changes in pesticide use) because they consider only a small subset of substitution possibilities (Lichtenberg et al. 1988). They consider only short-run substitution, that is, changes in production methods while land allocations (acreage, crop rotations, and cropping patterns) and consumption patterns are kept fixed. They generally consider only a single substitution possibility for each crop. At best, they consider one alternative production scenario per region. Input usage rates and yields are assumed to be constant on all farms, so input-output ratios (input use per unit of output) are treated as fixed. The models thus ignore even short-run, farm-level substitution possibilities caused by differences in land quality, human capital, and other characteristics of farm operations.

The data used by the studies are problematic. Crop losses cannot generally be observed directly, because they involve comparisons of actual output with output that would have been obtained under conditions that do not typically occur. The empirical basis of the experts' projections is thus not very rigorous. Field trials can hold constant all production practices except pesticide use, deliberately ignoring substitution possibilities. Moreover, they are often conducted in areas with heavier than normal pest pressure, where pesticide productivity is probably higher (Pimentel et al. 1991). As a result, studies that rely on data like those of Pimentel and associates tend to overestimate crop losses in US agriculture.

In addition, estimates of crop losses at 37% are questionably high. The costs of pesticides and nonchemical pest-control methods alike are low relative to crop prices and total production costs (see, for example, the crop budgets in Economic Research Service, 1997). Crop losses of the magnitude estimated by Pimentel et al. (1991) should be sufficient to make it profitable to use chemical and nonchemical pest controls at much greater rates than observed today. In other words, if crop losses were as high as Pimentel et al. (1991) estimate, pesticide use would not now be as low as it is in most crops.

Combined Budget-Market Models

Other studies have attempted to estimate pesticide related and effects of large reductions in pesticide use by combining partial- budget models with models of output markets. These studies use the same approach as partial-budget models in estimating yield and cost effects of changes in pesticide use. Alternative production scenarios consisting of input usage rates and crop yields are constructed for each crop, possibly varying across production regions. Most studies use expert opinion to construct the scenarios. Crop budgets are used to estimate changes in per-acre production expenses. Projected changes in per-acre expenses and yields are then incorporated into models of agricultural-commodity markets and used to project changes in output prices and consumption in market equilibrium.

Zilberman et al. (1991) used this approach to estimate the likely effects of pesticide bans such as the failed 1990 California ballot initiative 128, popularly know as the “Big Green,” on the production of five major fruit and vegetable crops. Zilberman et al. obtained alternative scenarios from crop scientists for production of five major California fruit and vegetable crops (almonds, grapes, lettuce, oranges, and strawberries) under current conditions and under restrictions on pesticide use that would be imposed by the Big Green initiative. Budgets were used to calculate changes in per-acre production expenses. Changes in per-acre production expenses and in crop yields were used to calculate shifts in the supply curves of each commodity (Lichtenberg et al. 1988). Estimates of supply and demand elasticities were then used to calculate changes in production and output prices for each crop. The authors found that Big Green would reduce output by 10 –25%, increase crop prices by 13–57%, and cost consumers $883 million, about 25% of expenditures on the five commodities at the time (if prices go up more than quantities go down, then expenditures increase).

Models of this type incorporate some, but by no means all, substitution possibilities. They tend to capture changes in land use, such as changes in cropping patterns and regional shifts in production. Because they rely on a limited set of production scenarios, however, they tend not to capture all possible short-term substitutes at the farm level, such as shifts in labor, energy, and machinery; use of biological pest controls; and long-term substitutes, such as changes in crop varieties or crop rotation. The Zilberman et al. (1991) findings indicate that the potential for substitution in fruit and vegetable crops is more limited than found in other crop production systems, so pesticide productivity is higher for these crops.

Econometric Models

It is possible to estimate pesticide productivity directly with econometric models. Statistical methods can be used to estimate parameters of models that link output with input use. Varied substitution possibilities are implicit in the parameters of these models. Specification of models that are nonlinear in input use allows rates of substitution between inputs to vary as input usage changes. Alternatively, nonstatistical methods can be used to derive input-output relationships. Models of this kind are commonly used to estimate factor productivity and productivity growth in the US agricultural economy (see, for example, Griliches 1963, Ball 1985, Capalbo and Antle 1988, Chavas and Cox 1988, Chambers and Pope 1994).

Econometric models capture all forms of substitution in production, including short-run and long-run substitutes for pesticides on individual farms and at the regional and national levels. They do have some limitations. The data used to estimate these models limit them to reflect only forms of substitution actually experienced. In addition, the models consider only supply (production) and so do not capture substitution possibilities in consumption, such as changes in diet composition, in feed mix, and in imports and exports. Separate models of demand and market clearing are needed to capture equilibrium changes in consumption.

Headley (1968) estimated such a model by using state-level cross-sectional data for the year 1963. He used crop sales to measure output and expenditures on fertilizers, labor, land and buildings, machinery, pesticides, and other inputs as measures of input use and found that an additional dollar spent on pesticides increased the value of output by about $4—a high level of productivity for that period. Such a finding also indicates that increasing pesticide use would increase the profitability of the agricultural sector substantially. Headley attributed his result to the fact that use of herbicides was still in a relatively early stage of diffusion at that time.

Headley's model, like most economic models, generates estimates of the marginal productivity associated with pesticides, that is, the additional amount (value) of output obtained by using an additional unit of pesticides. Economists believe that in most circumstances (including agriculture) marginal productivity is falling at actual input usage levels; this implies that marginal productivity is less than average productivity. Multiplying the marginal productivity of pesticides by the quantity of pesticides used as, for example, Pimentel et al. (1992) do thus understates the total value added by pesticides. The total value added can be calculated more accurately by multiplying the value of the average product of

pesticides (which exceeds the value of the marginal product) by the amount used.

Profit maximization implies using pesticides up to the amount where the value of their marginal product equals their unit price. Pesticides are for the most part relatively inexpensive in the United States, so one would expect the value of their marginal product to be correspondingly low. But a low value of marginal product does not imply a low total product. If the average product of an input is substantially higher than its marginal product, the total value added by the input will be quite high even if its value at the margin is low. Water is often cited as a case in point. The marginal value of water is low because so much is used, but its total value is large—perhaps even infinite —because it is essential for life.

There are several reasons to believe that Headley's estimate of marginal pesticide productivity could be too high. First, using sales as a measure of output tends to bias productivity estimates upward because output price tends to be positively correlated with input demand. Second, Headley's specification assumes that pesticides are an essential input, that is, that production is impossible without pesticides. This assumption, too, tends to bias the estimate of productivity upward. Finally, as Lichtenberg and Zilberman (1986) argue, the specification that Headley uses does not allow pesticide productivity to decline as fast as it should, again leading to upwardly biased estimates of pesticide productivity.

A useful approach to estimating pesticide productivity is that proposed by Lichtenberg and Zilberman (1986). They argue that pesticides do not generally affect potential output; rather, they prevent losses and are thus best conceptualized as producing damage abatement (avoidance of crop loss), an intermediate input. One appealing specification arising from this approach is treating realized output as the product of potential output and damage abatement. The former is produced by normal inputs, such as land, water, and fertilizer. The latter is produced by damage-control inputs, such as pesticides. Crop loss avoided (damage abated) must lie between 0 and 1. Crop losses can be estimated implicitly as the inverse of damage abatement (that is, as 1 minus the fraction of crop loss avoided).

Carrasco-Tauber and Moffitt (1992) applied this approach to state-level cross-sectional data on sales and input expenditures like those used by Headley (1968). Their use of sales as a dependent variable suggests that their estimate of pesticide productivity should be biased upward. Only one of the abatement specifications they used does not assume that pesticides are essential inputs. That specification generated an implicit estimate of aggregate US crop losses in 1987 of 7.3% at average pesticide use, far less than the Pimentel et al. (1991) estimate.

Chambers and Lichtenberg (1994) developed a dual form of this

model based on the assumptions of profit maximization and separability between normal and damage-control inputs. They used this dual formulation to specify production relationships under two specifications of damage abatement, neither of which imposed the assumption that pesticides are essential inputs. They estimated the parameters of these models for the aggregate US agricultural economy, using time-series data or aggregate input, output, and price index for the period 1948-1989 developed by Ball (1988). Those data have been used widely to investigate factor productivity in US agriculture (see, for example, Ball et al. 1997. As in most factor-productivity studies in agriculture, Chambers and Lichtenberg (1994) assumed constant returns to scale, so that all inputs and outputs were measured on a per-acre basis. A later paper compared four alternative damage-abatement specifications (Chambers and Lichtenberg, forth-coming). Statistical tests confirmed the hypothesis that pesticides are not essential. Statistical tests also showed that crop losses declined as pesticide use increased.

Implicit crop losses in 1987 estimated from those models ranged from 9% to 11%, close to the Carrasco-Tauber and Moffit (1992) estimate but only about one-fourth to one-third that size estimated by Pimentel et al. (1991). The estimated parameters of the models imply that a 50% reduction in pesticide use from 1989 would increase crop losses by 3–4 percentage points to as much as 12–15 percentage points under average pest pressure. Assuming no change in crop prices, farm income would decrease by about $3 billion, or 6%, considerably more than estimated by Pimentel et al. (1991). Because those are aggregate estimates, they give no indication of how those reductions in pesticide use—with consequent increases in damage—would be apportioned among crops; the general depiction of the importance of pesticides in US agriculture presented here suggests that the bulk of the reductions would come from grains and oilseeds. Finally, estimated crop losses with zero pesticide use ranged from 17% to 20%.

Quality, Storage, and Risk

Reducing crop loss is the primary motivation for pesticide use, but pesticides also render other important services in agricultural production: enhancing product quality, prolonging storage life, and reducing production and income risk.

Product Quality

Pesticides can enhance product quality by reducing mold, scarring, blemishes, contamination with insect parts and weeds, and other un

sightly and unsanitary features. The benefits of such enhanced product quality have several forms. Cleaner products can receive a higher price. For example, apple-growers are docked for impurities, and excessively blemished fruits might be salable only for low-value processing uses, such as juice. Processors set limits on impurities, such as insect parts or weeds in fruits and vegetables. They can impose price penalties on violative shipments or reject such shipments altogether. Federal food-purity regulations set limits on impurities in fresh produce; produce found to exceed the limits might not be salable. Federal and state grading standards for fresh fruits and vegetables prescribe lower grades—and thus lower prices—for produce that has more blemishes.

Some have argued that many forms of product quality are purely cosmetic and without a basis in health, nutritional value, or consumer demand (van den Bosch et al. 1975, Pimentel et al. 1991). Federal food-purity standards and grading standards have been especially criticized for that basis. It has been argued that those standards are stricter than necessary and that the stringency of these standards induces farmers to use pesticides more intensively than they otherwise would. Studies of purchases of peaches (Parker and Zilberman 1993), wheat (Ulrich et al. 1987), and other commodities show that consumers are willing to pay more for agricultural products that have fewer blemishes and impurities. Some consumer surveys also indicate unwillingness to purchase produce that has cosmetic defects or insect damage (see, for example, Ott 1990). Studies of pesticide productivity, such as those discussed previously, ignore quality considerations and thus understate benefits of pesticide use. In some cases, aesthetic quality is the primary consideration for pest control, however. Examples include such high-value ornamental crops as flowers, Christmas trees, and woody ornamentals.

Storage

Postharvest uses of pesticides include treatment with fungicides or growth regulators to prolong storage life and fumigation to prevent insect contamination. Prolongation of storage life of fresh fruits and vegetables increases consumer and producer welfare by increasing the availability of fresh produce between harvest seasons (Lichtenberg and Zilberman 1997). Prolongation of storage life of grains essentially lowers the cost of producing grain. As noted, insect parts in grain are considered impurities, and buyers might impose dockage or reject shipments; fumigation of grain thus enhances grain quality. Fumigation of fresh fruits and vegetables plays an important role in facilitating trade; many countries require fumigation to prevent inadvertent importation of exotic pest species (Yarkin et al. 1994). Fumigation has been required in interstate commerce in the

United States as well (for example, fumigation of citrus to prevent the spread of the Mediterranean fruit fly). Studies of pesticide productivity discussed previously ignore postharvest pesticide uses and thus also understate the benefits of pesticide use.

Risk

It has been argued (van den Bosch and Stern 1962, Carlson and Main 1976, Norgaard 1976) that aversion to risk is an important motivation for pesticide use, especially preventive insecticide treatment aimed at mobile insect pests. In this view, many preventive applications serve primarily to provide farmers with insurance; in other words, pesticide application provides little protection, because pest pressure in most years is too low to cause significant damage. Because pesticides are relatively inexpensive, farmers apply them as insurance against the (small) chance that pest pressure will be large enough to cause appreciable damage. That line of reasoning suggests that such applications could be eliminated at little or no cost in increased crop losses or reduced crop quality (van den Bosch and Stern 1962; Carlson and Main 1976; Norgaard 1976). Scouting and economic thresholds have been advocated as one means of eliminating such unnecessary preventive treatments. They have become quite prevalent in US agriculture. In 1994-1995, about 90% of cotton acreage, 85% of potato acreage, 80% of wheat acreage, 75% each of corn and soybean acreage, 65% of fruit acreage, and 21% of vegetable acreage were scouted for pests (ERS 1997). Public provision of all-peril crop insurance has been suggested as a means of eliminating incentives for uneconomical preventive treatment (Carlson and Main 1976, Norgaard 1976).

Preventive treatment might be economically efficient even if there is only a small probability that pest pressure will cause substantial damage and farmers are not risk-averse and thus have no demand for insurance. The average return on preventive treatment will be high when the value of the crop is high and when the material and application costs of the pesticide are low. The average return on reactive treatment will be low when scouting is expensive, when pest pressure is measured with low accuracy, and when the efficacy of rescue treatments is low. For example, by the time symptoms of disease in apples become observable, rescue treatment accomplishes little or nothing; preventive treatment with fungicides is thus standard in many growing regions (see, for example, Babcock et al. 1992). Under those circumstances (or combinations of them), growers will find preventive treatment more profitable (and hence less expenseive) on the average than reactive treatment, and the attractiveness of scouting will be limited; reducing or eliminating preventive treatment would reduce crop productivity and increase production cost.

Recent research suggests that in many circumstances pesticide use can increase income risk rather than reduce it. Theoretical analysis (Horowitz and Lichtenberg 1994) and simulation studies (Pannell 1991) show that pesticides tend to be risk-increasing when crop growth and pest pressure are positively correlated, as often occurs with weed and insect pressure in dryland farming. Econometric analyses of cotton in California (Farnsworth and Moffitt 1981), corn in the US corn belt (Horowitz and Lichtenberg 1993), and wheat in Kansas (Saha et al. 1997) and Switzerland (Gotsch and Regev 1996, Regev et al. 1997) confirm that greater pesticide use is associated with higher income variability for these crops.

Pesticides do play an important role in reducing risk when used to enforce quarantines and thereby prevent establishment of invasive pests. Such treatments can be applied either at the source or at the point of entry and can help to maintain interstate and international embargoes.

CURRENT PROBLEMS ASSOCIATED WITH PESTICIDES

Resistance to Pesticides

Resistance to pesticides (or, more specifically, synthetic organic chemicals) is almost universal among pest taxa (NRC 1986). Bacteria have developed resistance to antibiotics, protozoa to antimalarial drugs, green mold (Penicillium digitatum) to biphenyl fungicides, chickweed to the herbicide 2,4-D, schistosomiasis-carrying snails to the molluscicide sodiumpentachlorophenate, rats to warfarin, and pine voles to endrin. Resistance of nematodes to soil fumigants has not yet been observed but systemic nematocides are relatively new and it is probably only a matter of time until resistance appears. The evolution of resistance is more the rule than the exception in pest populations (Brattsten and Ahmad 1986).

Acquisition of resistance is an evolutionary phenomenon—that is, it is the result of changes in gene frequencies in a population over time. Normal unexposed populations are polymorphic in that some individuals are “preadapted” to cope with the selective agent. The application of selection pressure in the form of pesticide-induced mortality confers an advantage to those genotypes whose fitness is not affected by pesticide exposure; these genotypes reproduce preferentially, and as a consequence, population composition changes over time. It is important to note that the use of pesticides does not generally lead to resistance as a result of mutagenicity; although they can lower fitness, they do not, for the most part, act to change the genotype of an individual (indeed, genetically based resistance is not acquired during the lifetime of the individual).

It must also be noted that chemical pesticides are not the only mortal

ity agents that can select for resistance. For over 2 decades, crop rotation was used as the principal management strategy for corn rootworm (Diabrotica spp.) in the midwestern states. Eggs of these species are deposited in the soil by gravid females; in the spring, hatching grubs attack roots of corn and other graminaceous hosts. By alternating corn with soybeans, growers greatly reduced rootworm problems; that grubs hatched in soybean fields encountered no corn roots, emerged, and starved. However, rootworm problems began to arise in corn planted after soybeans throughout the region where rotation was heavily used. These problems were attributable to two kinds of responses. Populations of D. barberi rootworms with extended egg-stage diapause—lasting 2 years—appeared (Levine and Oloumi-Sadeghi 1991), as did populations of western corn rootworm (D. virgifera) in which individuals, on reaching maturity, abandoned cornfields to lay eggs in adjacent soybean fields (Onstad et al. 1999). Thus, even cultural methods of control are prone to counteradaptation by pests. Any control strategy that results in the death or reduced fitness of a substantial portion of the pest population is prone to the evolution of resistance. Pesticide resistance is conspicuous, however, because of the intensity of the selection pressure exerted by the pesticide chemicals, which are designed to effect high mortality.

That insects could become resistant to the toxic effects of insecticides was first recognized in 1908 (Melander 1914), when a strain of San Jose scale (Aspidiotus perniciosus) was discovered to be resistant to lime sulfur. California red scale resistance to hydrogen cyanide was reported in 1916, and resistance to lead arsenate was found in codling moths in 1917. The number of resistant species has since increased almost exponentially. In 1976, resistance was recorded in 364 insect species (Georghiou and Mellon 1983). In 1986, the number was over 400 (Ku 1987); and it now exceeds 500. Over 150 microbe species and 270 weed species are resistant to at least one chemical pesticide (Jacobsen 1997). The majority of cases of insecticide resistance involve chlorinated hydrocarbons which have been in widespread continuous use for the longest time. Depending on the taxon, resistance to these chemicals is usually acquired within 10 years of first exposure, and acquisition of one form of resistance can facilitate the acquisition of other forms. (For example, the kdr gene in insects played a key role in the genetic evolution of DDT resistance and it confers protection against pyrethroids, another class of pesticides that has the sodium channel as its target site). The naive notion that insects would not develop resistance to the so-called third- and fourth-generation insecticides (which rely on interfering with hormone or pheromone function) was shattered first by Dyte (1972), who described Tribolium castaneum populations that were cross-resistant to juvenile hormones. Cross or induced resistance was later observed in many species (Sparks and Hammock 1983).

In the middle 1950s, Harper (1957) predicted that herbicide-tolerant weed species and resistant phenotypes would become common in crop systems that received annual applications of herbicides. In 1970, triazine resistance was discovered in Senecio vulgaris; and by 1977, there were 188 documented cases of weeds that were herbicide-resistant in 42 countries to over 15 families of chemicals in 42 countries (Heap 1997). Most cases involve a weed species with a single resistance mechanism, but there are exceptions; Lolium rigidum in Australia, for example, has evolved multiple resistance to all the herbicides used in the cropping system (seven chemicals in five families). It is likely that auto lactate synthase (ALS) and acetyl-CoA carboxylase (ACCase) inhibitor resistant weeds will present farmers with major problems in the next 5 years because of their proportional representation in the large-acreage crop markets and the rapid evolution of resistance to herbicides with similar structure or modes of action. Thirty-eight weed species have evolved resistance to ALS inhibitors in cereal, corn and soybean, and rice production systems (Heap 1997).

Herbicide resistance is still relatively restricted and has been slower to develop than insecticide or fungicide resistance. The relative rarity of herbicide resistance is likely due to the low persistence of many herbicides relative to the generation time of the pest, the lower fitness of some resistant genotypes than of the susceptible genotypes, the ability of susceptible weeds that escape death to produce large amounts of seed, and a large reserve of susceptible genotypes in the seed bank (Radosevich et al. 1997). Herbicide-resistant weeds have the greatest economic impact on crop production when there are no alternative herbicides to control the resistant genotypes or when the available alternatives are relatively expensive. Weeds that have multiple resistance are therefore the greatest concern of producers.

If food production is to become more sustainable, it will be imperative to preserve the efficacy of acceptable weed-control methods by defending against weed adaptation. Rapid and continuing weed adaptation might explain the persistent nature of yield losses to weeds despite technological advances (Jordon and Jannink 1997).

Biological factors can affect the speed of selection. One important factor is the generation time (under selection pressure): the larger the number of generations per year, the faster the selection of resistance. Root maggots, such as Hylemya spp., with three or four generations per year evolved resistance to cyclodienes in only 3–4 years, whereas Diabrotica virgifera, the corn rootworm, with only one generation per year developed resistance in 8–10 years. According to Georghiou and Taylor (1976), “it would be safe to predict that none of us will be present when the 17-year locust, Magicicada septendecim, will have developed resistance.” The importance of generation time in evolution of resistance is underscored by

the paucity of predaceous insects that are resistant to insecticides. Although there are insecticide-resistant insect predators such as Coleomegilla maculata, they are far outnumbered by the resistant herbivores. Predators that have acquired resistance, notably predaceous mites (Hoy et al., 1998), have intrinsic reproductive rates comparable with those of prey species. Rosenheim and Tabashnik (1990), however, dispute the importance of generation time, mainly because the probability of mutation is the same in every generation. They examined the literature and found no correlation between the rapidity with which resistance is acquired and the number of generations per year.

Dispersal and migration also influence the rate of evolution of resistance; if susceptible immigrants invade a local population treated with insecticide every year, evolution of resistance will take longer. Curtis et al. (1978) applied the idea to a theoretical control program: grid-application to ensure a supply of susceptible immigrants. That approach is being used to delay acquisition of resistance to Bacillus thuringiensis endotoxin expressed in transgenic plants; interplanting transgenic plants with susceptible plants provides a refuge for susceptible genotypes. Fortuitous survival might be another factor in delaying resistance acquisition. Fortuitous survival may be a factor in cases of polyphagous insects only one of whose hosts is treated or insects that avoid contact with insecticides by concealment in plant structures.

Finally, operational factors affect the speed of evolution of resistance. The selection regimen most likely to result in resistance acquisition is to reach and destroy a high percentage of the population, use a pesticide with prolonged environmental persistence, apply a pesticide thoroughly so as to leave no refugia, apply at low population densities to reduce the probability of survival of susceptible genotypes, apply to every generation, and apply over a large area to prevent immigration of susceptible individuals into the target population (Georghiou 1972).

The standard economic conceptualization of resistance treats susceptibility to a pesticide (or class of pesticides) as an exhaustible resource that is depleted gradually by pesticide application. In many cases, as resistance spreads, pesticide application rates rise while pesticide effectiveness falls, so that growers experience gradually increasing pest-control costs and gradually decreasing yields (Hueth and Regev 1974). Growers can find it profitable to switch to an alternative pest-control method or even an alternative crop (Regev et al. 1983). Using crop rotation or cycling of pesticides to retard the spread of resistance or renew the level of susceptibility in the pest population is implicit in this conceptualization, although not developed explicitly in the literature.

Despite the widespread occurrence of resistance, its effects on US agriculture as a whole are difficult to quantify. US agriculture has experi

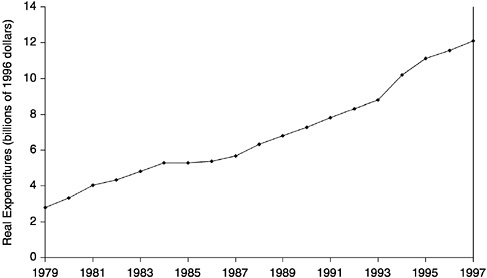

enced neither rising pest-control costs nor falling yields in the aggregate. From 1980 (when the diffusion of herbicide use was largely completed) to 1993, real pesticide expenditures remained roughly constant (Figure 2-3), while total factor productivity (output corrected for changes in input use) grew at an average annual rate of 2.6–2.9% (Ball et al. 1997). But growers have been able to switch to substitute chemicals and use alternative methods. For example, resistance had already led cotton growers to switch from DDT to organophosphate insecticides by the time the registration of DDT was canceled (Carlson 1977). In other cases, producers consciously rotate pesticides to prevent or retard the spread of resistance. Thus, the most easily measured impact of resistance to date has been to shorten economic life of some pesticides. Detailed economic studies documenting the costs (or lack of costs) of pesticide resistance in specific agricultural systems are needed to assess the economic impact of pesticide resistance.

Pesticide manufacturers have incentives to respond to resistance both by developing resistance-management strategies for existing chemicals and by searching for new substitutes. Development of resistance-management strategies helps to maintain market share of existing products. Because fixed R&D costs make up a large share of the total costs of producing pesticides, longer product life increases a manufacturer's return on investment. At the same time, resistance functions like planned obso-

FIGURE 2-3 Real pesticide expenditures in the United States, 1979 –1997.

Source: Data from Aspelin and Grube (1999) and deflated by the implicit GDP price deflator (1996=100) from the Council of Economic Advisors, (2000).

lescence, creating markets for new pesticides by reducing the effectiveness of well-established ones and thus increasing expected returns on investment in new-product development. It gives pesticide developers a chance to increase their market share at their rivals ' expense. It also decreases the window of opportunity to sell generic versions of established pesticides once their patent protection has lapsed, thereby increasing the share of time that developers receive patent protection.

Human Health Impacts

Occupational Effects and Risks: an Overview

Pesticides are designed to kill organisms that share many biochemical pathways and physiological processes with nontarget species in the agroecosystem, with domestic animals, and with humans. The biological commonalities make it difficult to develop pesticides that have ample margins of safety between the pest species and the nontarget organisms, including humans. Furthermore, the removal of “pest species”, which might be enhanced by effects on nontarget species, will produce changes in the treated ecosystems. When one considers that the usual agricultural practice of cropping in monoculture involves major departures from “natural ” ecosystems, the incremental impact of the use of pesticides on ecosystems becomes that much more difficult to estimate.

Candidate pesticides undergo extensive and rigorous laboratory and field testing. In most instances, the batteries of tests have been able to screen out chemicals that have undesirable characteristics. However, there are examples of failure of test protocols to warn against specific adverse effects that became apparent after pesticides came into common use. Two examples are the organophosphate insecticides Leptophos® and Mipafox®, which produce a delayed paralysis due to demyelination of motor axons (Johnson 1982). Workers exposed to the fumigant 1,2-dibromo-3-chloropropane unexpectedly experienced reduced or no sperm production (Thomas 1996). There have been many cases of poisoning and many more of suspected poisoning. However, most of the clinical cases have been due to gross overexposure in the course of misuse or suicidal use of the pesticide. (Levine 1991). In a survey of deaths from pesticide poisoning in England and Wales in 1945–1989, 73% of the recorded 1,012 deaths were due to suicides (Casey and Vale 1995).

It is difficult to generalize the toxicity of pesticides in a useful way. The target pest against which a pesticide is designed does not necessarily predict taxonomic risks of toxicity. For example, the fungicide methyl mercury has caused disproportionate mortality and morbidity in humans (Bakir et al. 1973, Hartung and Dinman 1972), and the herbicide paraquat

has been associated with a disproportionate number of suicides (Staiff et al. 1975). Nor does the chemical structure necessarily predict risk. In the case of the insecticides, the organophosphate insecticides range from the essentially nontoxic Abate®, which has been used to control mosquito larvae in drinking-water supplies, and Ruelene® , which has been used to control insect larvae that burrow into the skin of domestic animals, to the extremely toxic tetraethyl pyrophosphate, Systox®, Guthion®, and parathion, all of which are readily absorbed through the intact skin and by all other routes of exposures. The organophosphate insecticides differ substantially in toxicity and persistence. The basic mechanism of toxicity of all of the organophosphates is identical: inhibition of acetylcholinesterase (Mileson et al., 1998). However, that system is not the only one affected; organophosphates also inhibit other esterases to differing degrees, and some of these esterases are involved in the normal detoxification of organophosphate and carbamate insecticides. Consequently, combined exposures to several of these insecticides can result in synergistic, additive, and antagonistic responses (DuBois 1969).

Human exposures to pesticides occur through several routes (Ferrer and Cabral 1995). Exposures to pesticides in the general population tend to occur mainly through contact with residues in food or water but can also occur through accidental ingestion of seed prepared for sowing or through mistaken use of pesticides in food preparation because of their resemblance to food products. Occupational exposures to pesticides tend to occur mainly through dermal contact and inhalation. Occupational exposures constitute a distinct type and generally affect workers involved in the manufacture, transport, and application of these chemicals. Occupational epidemics tend to be more frequent in developing nations than in the United States, largely as a result of inappropriate technology transfer (for example, Senanayake and Peiris 1995). Nonetheless, occupational exposures have long been a source of concern in the United States.

The available statistics on poisoning by pesticides are difficult to compare because different agencies use different classifications and the classification schemes have changed over time. Reports on pesticide poisonings can be based on poison-control center reports, on hospital admission reports, and on reviewed clinical diagnoses. Even the quality of the information contained in death certificates is variable.

Manufacturing Risks

In general, the synthesis and formulation of pesticides are under better control than the later stages in the life cycle of a pesticide. Workers in manufacturing processes are under the direct or indirect supervision of occupational hygienists. Standards of permissible occupational exposures

are promulgated by the Occupational Safety and Health Administration, and threshold limit values proposed by the American Council of Governmental Industrial Hygienists for individual pesticides are enforced.

However, there have been excessive exposures and adverse effects associated with manufacturing processes. The best known of these are related to the production and synthesis of 2,4,5-trichlorophenol, the precursor of a number of chlorinated herbicides. The synthesis of 2,4,5-trichlorophenol was associated with the unavoidable trace byproduct 2,3,7,8-tetrachlorodibenzo-p-dioxin (TCDD). The major effects noted were chloracne and occasional liver damage (Firestone 1977, Pocchiari, F. et al. 1979, Coulston and Pocchiari 1983, Kimbrough et al. 1984) and porphyria (Bleiberg et al. 1964). Furthermore, TCDD has been shown to be carcinogenic in laboratory bioassays of rats and mice, and there is epidemiological evidence of its human carcinogenicity (Gallo et al. 1991). The herbicides that were based on 2,4,5-trichlorophenol have been removed from the market, because of the difficulties encountered in removing TCDD and related dioxin impurities.

Most of the chlorinated-hydrocarbon insecticides—such as DDT, dieldrin, aldrin, toxaphene, and chlordane, as well as TCDD—have been found to be carcinogenic in rodent bioassays. That experience has generally not been duplicated in humans. However, human exposures tend to be much lower, even under occupational conditions, than those attained during bioassays (Leber and Benya 1994). Many of the chlorinated-hydrocarbon pesticides are very fat-soluble and exhibit a tendency to bioaccumulate. For these reasons, most of the chlorinated hydrocarbon pesticides are no longer on the US market.

Packaging, Distribution, and Application Risks