7

Ethnic and Racial Differences in Welfare Receipt in the United States

Robert A.Moffitt and Peter T.Gottschalk

The general public in the United States has long linked welfare and race. This association has played a major role in attitudes toward the welfare system and in the politics of welfare reform. Attitudes toward welfare spending are correlated with racial attitudes (Bobo and Smith, 1994:389), and opposition to welfare among White voters has been shown to be related to attitudes toward race (Gilens, 1995, 1996). Many analysts have noted that the general popular perception that minority racial and ethnic groups dominate the welfare rolls has been historically incorrect, for minorities have historically accounted for no more of the welfare caseload than White families. Ethnic minorities do, however, have higher rates of participation in the welfare system than does the majority White population, given their lesser total numbers. Thus, the popular perception has some basis in fact, if interpreted to mean that minorities have higher propensities to make use of the welfare system.

A natural question to which this observation gives rise concerns the source of the ethnic and racial differences in welfare receipt rates. The research in this area has noted that there are two conflicting general views. One is that the differences arise from differences in the underlying risk factors associated with welfare receipt—rates of single motherhood, poverty, low earnings capability and job skills, high rates of unemployment, low levels of education, and similar variables. The other is that there are inherent differences in the propensity to take up welfare by different ethnic and racial groups, usually thought to arise from different cultural and social norms for the acceptability of being on welfare and different

degrees of stigma associated with welfare receipt. This stigma can be either transmitted across families in a given neighborhood or city or transmitted across generations, as children of welfare recipients themselves learn to find welfare receipt more acceptable.

This study documents and explores racial and ethnic differences in welfare-participation rates in the United States in two ways. First, we examine what those differences are today and how they have changed over the last decade. We find that substantial racial and ethnic differences in welfare participation exist, regardless of how they are measured, but we also find that these differences have not changed much over this period. Second, we explore the alternative sources for this difference by quantifying the relative importance of measurable risk factors, which differ across race and ethnic groups, on the one hand, and immeasurable differences, which include differences in cultural and social norms, on the other. We find that the majority of most differences in welfare receipt can be explained by measurable risk factors, including differences across race and ethnic groups in earnings and other forms of nonwelfare income, in family structure, in education, and in other variables representing disadvantaged status more generally. This implies that it is these underlying risk factors, and their underlying causes, that require policy attention if racial and ethnic disparities in welfare receipt are to be reduced.

THE U.S. WELFARE SYSTEM

The U.S. welfare system is composed of several distinct components. The most well known is the program that provides cash assistance to families with dependent children—defined as families in which one or both parents are not present—currently called the Temporary Assistance to Needy Families (TANF) program and called Aid to Families with Dependent Children (AFDC) prior to 1996. The AFDC program was created by the Social Security Act in 1935. It originally provided benefits primarily to poor widows, but in the 1960s its caseload shifted toward benefit provision to poor divorced and separated women with children, and has more recently shifted toward poor never-married women who have had out-of-wedlock births.1 These shifts in the composition of the caseload undoubtedly explain some of the changes in public attitudes toward the program. Eligibility for the program also requires low income and low levels of assets. Currently, the TANF program has strict work requirements and a maximum five-year time limit as well.

More important in both dollar and caseload terms today are the programs providing noncash benefits to low-income families. These include Food Stamps, Medicaid, low-income housing assistance, and a host of other programs including job training, Head Start, and a variety of food assistance programs other than Food Stamps. By one authoritative account, there are upwards of 80+programs in the United States providing cash or noncash assistance to low-income families (Burke, 1995). Eligibility for all the programs is restricted to those with low income and assets, and usually there are additional restrictions on eligibility. The three largest noncash programs are Food Stamps, Medicaid, and housing assistance. The Food Stamp program is unique in providing benefits to families and individuals regardless of family structure, for neither the presence of children nor the absence of a parent, for example, is required. The Medicaid program historically provided benefits primarily to AFDC families but today provides significant benefits to children of poor, nonwelfare families, resulting from a series of legislative expansions of eligibility in the late 1980s and early 1990s.2 Housing assistance is the only major noncash program that is not an entitlement, and serves all family types who are low income; however, priority has historically been given to AFDC families, which has resulted in a caseload that is disproportionately composed of unmarried women with children.

Aside from AFDC-TANF, the only major remaining cash-benefit program is the Supplemental Security Income (SSI) program, which provides cash benefits to aged, blind, and disabled adults and to blind and disabled children. Although it is not a transfer program, the Earned Income Tax Credit, if counted as a cash program, is also very large. Families with children and with earnings below certain thresholds receive tax credits and reductions in tax liability under the program.

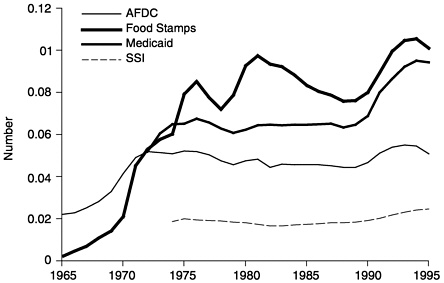

Figure 7–1 shows the trend in the per capita caseloads of four major programs—AFDC, Food Stamps, Medicaid, and SSI—over the last 30 years.3 The AFDC rolls grew tremendously during the late 1960s and early 1970s, a growth often attributed to relaxation of eligibility requirements and increased generosity of the benefit “package” associated with being on AFDC, but partly also a result of reductions in the stigma of welfare receipt. The AFDC rolls then flattened out from 1973 through 1989, a result usually thought to be attributable to decreasing real AFDC

|

2 |

Medicaid also provides benefits to the elderly and disabled. We do not discuss those groups in this study. |

|

3 |

Other programs are much smaller than these four. The Job Training Partnership Act and Head Start programs, for example, are less than 15 percent as extensive as SSI, the smallest of the four. Note that the Medicaid caseload numbers illustrated in Figure 7–1 include only dependent children and adults, not the elderly. |

FIGURE 7–1 Number of welfare recipients per capita, 1965 to 1995. SOURCE: U.S. Social Security Administration (1991, Table 7.E; 1997, Tables 7.A9, 9.G1, 9.H1, 8.E2), U.S. Department of Commerce (1996:8).

benefits during the period, and to 1981 legislation that restricted eligibility for the program. The AFDC caseload then grew substantially, starting in the late 1980s and early 1990s, for reasons not fully understood, but has been decreasing since around 1993. The latter decrease has been judged to be partly the result of favorable economic conditions and partly the result of policy changes, both those subsequent to the August 1996 Personal Responsibility and Work Reconciliation Act (PRWORA), as well as similar state policies that began before that legislation (Council of Economic Advisers, 1997).

Created by Congress in 1964, the Food Stamp Program caseload grew rapidly from the late 1960s through the early 1970s, and then grew more slowly in the late 1970s. The early 1970s growth resulted from a 1973 mandate that the program be extended nationwide, and the late 1970s growth was partly the result of the elimination of the purchase requirement (i.e., the requirement that families “buy” their Food Stamps with their own cash). The caseload decreased through most of the 1980s, but then grew again in the late 1980s and early 1990s, along with AFDC. Like that of the AFDC program, the Food Stamp caseload has recently decreased. Since 1975 the Food Stamp caseload has been larger than that of both AFDC and Medicaid.

The Medicaid program was created in 1965. Figures for the caseload of dependent children and adults with dependent children are available

only from 1975, and are shown in Figure 7–1. The caseload was relatively flat until the late 1980s, at which time it began to grow rapidly. Much of that growth was the result of expanded eligibility enacted by Congress that allowed coverage for many children who were not on the AFDC rolls. The Medicaid caseload has, like that of AFDC and Food Stamps, decreased since 1993.

The SSI program is considerably smaller than the other three but has grown markedly in percentage terms. Its caseload has doubled since 1974 and has grown by 50 percent since 1989 alone. This growth has been almost entirely among disabled adults and children, and larger for disabled children than adults. The numbers who qualify based on old age or blindness have remained constant or have even decreased. This growth was also partly a target of the 1996 PRWORA legislation.

WELFARE PARTICIPATION RATES BY RACE AND ETHNIC GROUP

Table 7–1 shows participation rates of U.S. households in four meanstested programs—AFDC, Food Stamps, Medicaid, and Housing assistance—during 1994 to 1996.4 Rates are shown for five broad race-ethnic groups: Hispanics, non-Hispanic Whites, non-Hispanic Blacks, American Indians and Alaska Natives, and Asian and Pacific Islanders. Participation rates vary markedly across the groups. American Indians and Alaska Natives have the highest rates of participation in all programs except housing assistance, and non-Hispanic Blacks have the second highest. Hispanics have high rates of participation in all programs except housing, and their rates overall are not far below those of non-Hispanic Blacks. Non-Hispanic Whites, and Asians and Pacific Islanders, on the other hand, have the lowest rates, with Asians and Pacific Islanders having somewhat higher rates of participation in most of the programs, especially Medicaid, than non-Hispanic Whites.

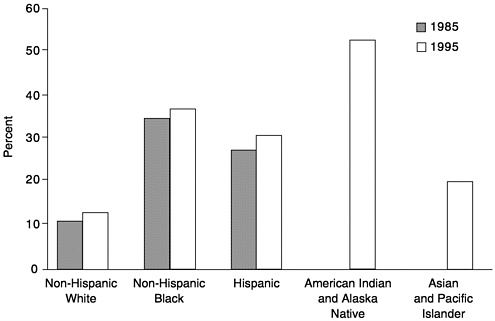

Figure 7–2 shows the rates of “any welfare participation” —i.e., receipt of benefits from any one of the four welfare programs—for 1985 and 1995. Slightly more than 50 percent of all American Indians and Alaska Natives received at least one type of benefit, and more than 30 percent of Hispanic and non-Hispanic Black households did. These groups are very broad and disguise much intragroup variation, but such high participation nev-

TABLE 7–1 Participation Rates of Households in Means-Tested Welfare Programs, 1994–1996 (percent)

|

|

AFDC |

Food Stamps |

Medicaid |

Housing Assistance |

|

Hispanic |

11.8 |

20.1 |

24.5 |

9.1 |

|

Non-Hispanic White |

2.7 |

5.7 |

8.3 |

3.5 |

|

Non-Hispanic Black |

14.0 |

23.3 |

27.0 |

15.3 |

|

American Indian and Aleut. Eskimo |

15.6 |

24.5 |

43.8 |

11.4 |

|

Asian and Pacific Islander |

4.9 |

7.1 |

13.5 |

5.3 |

|

SOURCE: Authors’ tabulations from the March 1994, 1995, and 1996 Current Population Surveys. |

||||

FIGURE 7–2 Percentage of benefit usage from any of the welfare programs, by race, 1985–1995. SOURCE: Authors’ tabulations from Current Population Survey.

ertheless signals racial and ethnic usage differences that should be a policy concern. That more than one-half of all American Indians and Alaska Natives, and more than one-third of non-Hispanic Blacks and Hispanics, receive benefits from at least one type of program reflects a disadvantaged status and degree of dependency that have to be regarded as very high.

TABLE 7–2 Persons with Welfare Income, 1992 (percent)

|

|

Persons with 50 Percent or More of Their Income from a Welfare Source |

|||

|

|

AFDC or Food Stamps |

SSI Only |

AFDC FS, or SSI |

Persons with any Welfare Income from AFDC, FS, or SSI |

|

All persons |

3.8 |

0.7 |

4.9 |

16.9 |

|

Non-Hispanic White |

1.8 |

0.4 |

2.4 |

11.0 |

|

Non-Hispanic Black |

12.3 |

2.1 |

15.9 |

41.0 |

|

Hispanic |

8.9 |

1.2 |

10.5 |

33.3 |

|

SOURCE: U.S. Department of Health and Human Services (1997:1–5 to 1–6). |

||||

Tables 7–2 and 7–3 illustrate this dependency in different ways. Table 7–2 shows the percentage of the population of different groups for whom benefits from welfare exceed 50 percent of income. This distinction helps separate those for whom welfare is merely a minor supplement to income from those for whom it is a major source of support. The figures in Table 7–2 are much lower than those in Table 7–1.5 In 1992, only 15.9 percent of non-Hispanic Blacks received more than 50 percent of their income from AFDC, Food Stamps, and SSI; and only 10.5 percent of Hispanics did. This puts a more favorable light on the degree of dependence, although these figures still represent millions of individuals. Moreover, the racial and ethnic differences are still large, which is a cause of concern. The rate of dependency for non-Hispanic Blacks is more than six times that of non-Hispanic Whites, and that of Hispanics is more than four times as high.

Table 7–3 illustrates welfare participation and dependence over a much longer period—1985 to 1992—and therefore represents something closer to what we might call “long-term” dependence. The figures represent dependence on one of several welfare programs (primarily AFDC, Food Stamps, and SSI). Over the eight-year period, almost 50 percent of non-Hispanic Black women and 36 percent of Hispanic women received benefits at some point; on average, the former were on welfare for 28 percent of the eight years and the latter were on for 17 percent of the period. The average rates of income dependence are quite low, however. When income dependence is examined, the rates remain high for non-

TABLE 7–3 Welfare Participation Over an Eight-Year Period Among U.S. Women Ages 15–44, 1985–1992

|

|

Percent of the Eight-Year Period on Welfare |

Percent of Income from Welfare Over the Period |

Percent with at Least 50% of Income from Welfare Over the Period |

||||

|

|

Percent Ever on Welfare |

All Persons |

Persons Ever On |

All Persons |

Persons Ever On |

All Persons |

Persons Ever On |

|

Non-Hispanic White |

11.9 |

4.9 |

41.0 |

2.0 |

16.7 |

1.2 |

10.3 |

|

Non-Hispanic Black |

49.7 |

28.2 |

56.7 |

20.2 |

40.6 |

14.5 |

29.3 |

|

Hispanic |

36.2 |

17.8 |

49.2 |

7.3 |

20.1 |

2.8 |

7.7 |

|

Other |

17.8 |

5.4 |

30.1 |

2.1 |

11.6 |

2.3 |

13.0 |

|

SOURCE: Authors’ tabulations from the Michigan Panel Study on Income Dynamics. Welfare includes AFDC, AFDC-UP, GA, Food Stamps, and SSI. |

|||||||

TABLE 7–4 Trends in Welfare Recipiency Among Households 1985–1995 (percent)

|

|

AFDC |

Food Stamps |

Medicaid |

Housing Assistance |

|

Hispanic |

||||

|

1995 |

11.8 |

20.1 |

24.5 |

9.1 |

|

1985 |

11.8 |

17.3 |

20.0 |

7.7 |

|

Non-Hispanic White |

||||

|

1995 |

2.7 |

5.7 |

8.3 |

3.5 |

|

1985 |

2.8 |

5.3 |

6.4 |

2.6 |

|

Non-Hispanic Black |

||||

|

1995 |

14.0 |

23.3 |

27.0 |

15.3 |

|

1985 |

15.3 |

23.7 |

26.0 |

12.8 |

|

SOURCE: Authors’ tabulations from the March 1984, 1985, 1986, 1994, 1995, and 1996 Current Population Surveys. |

||||

Hispanic Black women, but drop considerably for Hispanic women. Non-Hispanic Black women received, on average, 20 percent of their income over the eight-year period from welfare; and almost 15 percent of this group received at least 50 percent of their total income over the period from welfare. Respectively, the same numbers for Hispanic women are 7 percent and 3 percent, however.

Table 7–3 also illustrates, in a way that the other tables have not, how serious the degree of dependence is for those who receive some benefits. Non-Hispanic Black women who received some benefits during the eight years were on welfare for more than half of those years (56 percent of the period) and received more than 40 percent of their income from welfare. Hispanic women who received some benefits were on welfare for 49 percent of the period and received more than 20 percent of their income from this source. These figures suggest that although long-term dependence on the program is not always extensive, the dependence among those who do participate is often quite substantial for the groups with the highest participation rates.

Table 7–4 shows how participation rates among U.S. households have changed over the past decade.6 Participation rates in AFDC have been quite stable for all race-ethnic groups, while Food Stamp participation has grown slightly for all groups. Interesting to note is that participation in housing assistance has grown over the period as well, by almost 3 percent

for non-Hispanic Blacks and 1.5 percent for Hispanics. Medicaid participation has also grown over the decade, usually more than any of the other programs, no doubt reflecting the expanded eligibility noted earlier.7Figure 7–2 shows participation rates in 1985 for the three race-ethnic groups. Rates rose slightly, as the figure indicates.

The major conclusion from Table 7–4 and Figure 7–2 is that relative race-ethnic differentials in welfare participation have been fairly stable over the last decade. Although a somewhat greater increase in Medicaid and Food Stamp participation by Hispanics than by non-Hispanic Blacks and by Whites led to a somewhat higher rate of growth of overall welfare-program participation over the decade, the three race-ethnic groups did not change relative position. In both 1985 and 1995, participation rates among Hispanics and non-Hispanic Blacks were in the same ballpark, with Hispanic rates somewhat or slightly below those of non-Hispanic Blacks, and rates among non-Hispanic Whites far below that. Thus, it is reasonable to conclude that race and ethnic differentials in welfare-program participation have been relatively stable over time.

Although relative welfare-receipt rates were stable from 1985 to 1995, the AFDC-TANF caseload began to decrease precipitously for all races around 1993; and the decrease accelerated in 1996. In part, this decrease is a result of the improvement in the economy, and in part it is a result of the 1996 PRWORA legislation and the state waiver reforms that began prior to that. The decrease implies that all participation rates in AFDC-TANF have fallen from those shown in the tables as of 1995. There have been no significant changes in the racial-ethnic distribution of the caseload, however; hence, the relative participation rates shown in Tables 7–1 and 7–4 are still accurate.8

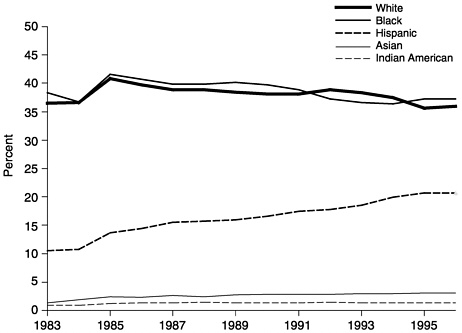

Finally, Figure 7–3 shows related trends, namely in the percent of different race-ethnic groups on AFDC (similar figures for the other welfare programs are not available). The percents of the AFDC caseload composed of White and Black families have been very close to one another over the period, but both have slowly decreased relative to that of Hispanics. But the growth of the Hispanic representation on AFDC is not, as Table 7–4 indicates, reflective of an increase in the propensity of the His-

FIGURE 7–3 Distribution of AFDC families by race of parent, 1983 to 1996.

SOURCE: U.S. Department of Health and Human Services (1998).

panic population to receive AFDC; instead, the growth is, simply, the result of growth in the size of the Hispanic population in the United States. This serves to illustrate the more general point that the percentages of different race-ethnic groups among welfare recipients are not very reliable indicators of the propensity of different groups to receive welfare, because those percentages reflect, in part, differences in relative population size. The participation rates shown in Tables 7–1 through 7–4 are more reliable indicators of the propensities that are the more important subjects of policy interest.

CORRELATES AND RISK FACTORS

An important question is why the differences in welfare-participation rates across race and ethnic groups are so large. A number of factors are known to be associated with welfare-program participation in general (for reviews, see Blank, 1997; Moffitt, 1992). Factors include low income and poverty, most obviously, but also family structure—in particular, whether the household is headed by an unmarried woman with children—as well as labor-force participation and earnings, urban-rural loca-

tion, educational levels, and other variables. The most conventional conceptual model of welfare participation presumes eligible women with children choosing between going onto welfare or not based on relative income and other circumstances on and off the rolls. The level of the benefit, the greater level of Medicaid coverage, possibly greater child-care support, and more free time to care for children are among the attracting forces of going onto welfare. The level of potential earnings and the availability of income from other sources (family, friends, etc.) affects the feasibility and desirability of being off welfare, together with the health insurance coverage and child care costs that result along with decreased time with children.

Many studies of welfare participation have examined whether racial differences in participation exist after these and similar variables measuring the risk factors for receipt and the relative incomes on and off the rolls are controlled for. The evidence to date is mixed. For example, of the studies of welfare participation through 1992 reviewed by Moffitt (1992: Tables 6 and 7), approximately two-thirds found no significant differences in participation across race groups after accounting for measurable variables. However, these studies usually did not examine race and ethnic differences fully; and in those studies that more fully explored race and ethnic differences, significant differences were found even after accounting for the measured variables (e.g., Fitzgerald, 1991).9 More recent studies have continued to find mixed results (see references in Edin and Harris, 1999).

We will report a new, updated examination of this issue, using a limited number of major risk factors and income variables but allowing these factors and variables free rein to “explain” race and ethnic differences in welfare receipt. The risk factors we use to explain welfare receipt are listed in Table 7–5, which shows the association of several risk factors with welfare-program participation by households, and also the composition of the population of each race and ethnic group relative to each risk factor. For example, the first four rows of the first column of the table show that household type is highly correlated with welfare participation, for almost 54 percent of all female heads of households with children— not restricted by income or any other characteristic—received either AFDC, Food Stamps, Medicaid, or housing assistance in the mid-1990s. This high rate reflects primarily the extremely low income of such households. Not surprising is the fact that households headed by unmarried

TABLE 7–5 Welfare Participation Rates by Risk Factors and Distribution of Risk Factors, 1994–1996

|

|

Welfare Participation Rates (All) |

Percent Distribution |

||||

|

Non-Hispanic White |

Non-Hispanic Black |

Hispanic |

American Indian/Eskimo |

Asian Pacific |

||

|

Household Type |

||||||

|

Female Head w. children |

53.7 |

5.5 |

24.1 |

15.3 |

18.8 |

5.4 |

|

Married w. children |

13.9 |

26.8 |

18.9 |

38.4 |

28.3 |

39.9 |

|

Unmarried w/o children |

7.0 |

31.7 |

41.7 |

18.3 |

15.5 |

25.7 |

|

Other |

18.9 |

36.0 |

15.3 |

28.1 |

37.5 |

29.0 |

|

Nonwelfare Household Income (quartile interval) |

|

|||||

|

0–25th quartile |

42.9 |

21.5 |

41.1 |

35.8 |

39.7 |

21.5 |

|

25th-50th quartile |

14.8 |

24.4 |

26.4 |

28.5 |

27.0 |

20.1 |

|

50th-75th quartile |

7.1 |

26.3 |

19.1 |

21.4 |

20.0 |

24.0 |

|

75th-100th quartile |

3.4 |

27.8 |

13.4 |

14.3 |

13.4 |

34.4 |

|

Household Earnings (quartile interval) |

|

|||||

|

0–25th quartile |

33.8 |

25.3 |

31.0 |

21.6 |

26.6 |

17.6 |

|

25th-50th quartile |

24.4 |

21.5 |

32.2 |

36.7 |

35.6 |

21.0 |

|

50th-75th quartile |

7.9 |

25.9 |

22.7 |

26.2 |

23.2 |

26.7 |

|

75th-100th quartile |

3.1 |

27.4 |

14.1 |

15.6 |

14.3 |

34.7 |

|

Employment Status of the Head |

|

|||||

|

Working |

11.6 |

71.1 |

65.2 |

72.3 |

71.2 |

77.0 |

|

Not Working |

30.5 |

28.9 |

34.8 |

27.7 |

28.8 |

23.0 |

|

Education of the Head |

|

|||||

|

<12 years |

35.5 |

14.8 |

26.6 |

43.4 |

27.0 |

13.4 |

|

12 years |

17.8 |

33.6 |

35.7 |

27.9 |

33.5 |

22.7 |

|

13–15 years |

13.2 |

25.7 |

24.9 |

18.8 |

30.2 |

21.5 |

|

16+years |

5.1 |

25.8 |

12.8 |

9.9 |

9.3 |

42.5 |

|

Age of the Head |

|

|||||

|

<25 |

31.0 |

4.5 |

6.0 |

7.9 |

8.0 |

6.0 |

|

25–45 |

17.2 |

40.2 |

45.4 |

54.1 |

49.9 |

51.59 |

|

45+ |

15.6 |

55.3 |

48.6 |

38.0 |

42.1 |

42.6 |

|

Urban-Rural |

|

|||||

|

Rural |

17.1 |

46.4 |

26.6 |

23.8 |

69.0 |

16.2 |

|

Urban |

17.1 |

53.6 |

73.4 |

76.2 |

31.1 |

83.8 |

|

Notes: Welfare participation is defined as receipt during the year of benefits from any of the four programs shown in Table 7–1. SOURCE: Authors’ tabulations from the March 1994, 1995, and 1996 Current Population Surveys. |

||||||

individuals without children had low participation rates (7.0 percent); other household types were in between these two extremes. The other columns in Table 7–5 show that race-ethnic groups differ markedly in their relative numbers comprising the different household types. More than 24 percent of non-Hispanic Black households and almost 19 percent of American Indian and Alaska Native families were headed by unmarried women with children, as compared to less than 6 percent for non-Hispanic White households. Interesting to note is that Hispanic households, despite their relatively heavy welfare-participation rates, as shown in prior tables, are not as likely to be headed by unmarried females, and are much more likely to be married with children, relative to non-Hispanic Blacks and American Indians. Marriage rates for Hispanics are, with those of Asians, the highest among the groups. Thus, household type is a less powerful indicator of welfare participation for Hispanics than it is for some of the other race-ethnic groups.

The other major risk factors are income and earnings. Table 7–5 shows the distribution, across nationwide quartiles, of household nonwelfare income and earnings of the different race-ethnic groups as well as how welfare-participation rates vary with such income.10 Nonwelfare income and earnings are strongly and negatively correlated with receipt of benefits, as would be expected. At the same time, the different groups have significantly different distributions of income and earnings. There are differences particularly between non-Hispanic Whites and Asians, on the one hand, and non-Hispanic Blacks, Hispanics, and American Indians and Alaska Natives, on the other. For example, about 20 percent of the former groups are in the lower quartile of the nonwelfare income distribution, whereas approximately 35 to 40 percent of the latter groups are. It is interesting to note that the differences are not nearly so large for household earnings, where, for example, there are more non-Hispanic Whites than Hispanics in the lowest quartile. The earnings differences, however, show up primarily in the second lowest quartile (between the 25th and 50th quartile points), where non-Hispanic Blacks, Hispanics, and American Indians and Alaska Natives have the greatest concentration. Still, because the differences in welfare-participation rates between the second-lowest earnings quartile interval (24.4 percent) and that in the next highest interval (7.9 percent) are so large, household earnings still go a long way toward explaining the higher welfare-participation rates among these three groups.

The other risk factors listed in Table 7–5 show the importance of the other factors in explaining the race-ethnic differences. There are differences in employment status of household heads across the groups, although not as large as one might have expected. Welfare participation rates do, however, correlate strongly with such status, with working heads of households having much lower rates (11.6 percent vs. 30.5 percent). Heads of households who have attained higher education levels also have much lower welfare receipt rates. At the same time, education levels are much lower among non-Hispanic Blacks and American Indians—especially among Hispanics—as compared to non-Hispanic Whites and Asians. Thus, education may prove to be a factor that is more important in explaining welfare-participation rates for Hispanics (which may also counter the lesser importance of family structure mentioned above). Age differences across the groups are not dramatic, although they are not minor either. Combined with the strong correlation of age with welfare participation, age difference explains some of the variance in rates across the groups; Hispanics and American Indians are the youngest, for example. On the other hand, urban-rural residential status, while differing strongly across the race-ethnic groups, is not correlated with welfare participation.

The degree to which these risk factors can explain welfare receipt across the various race and ethnic groups can be quantified using wellknown statistical methods. Working with a fixed set of measurable risk factors—those in Table 7–5, for example—one can determine how those risk factors correlate with welfare-participation rates for a particular race-ethnic group, say, Hispanics. This correlation is generally accomplished with a multivariate regression analysis, which yields an estimate of the “effect” of each risk factor on welfare-participation rates, holding all other factors fixed. The second step is to estimate welfare-participation rates for any specific group—Hispanics, for example—and what the rates would be if the levels of their risk factors were the same as those of the majority White population. Table 7–5 shows the difference in those levels. These predicted, “as if,” or “adjusted” welfare-participation rates, for the Hispanic population will be closer to those of Whites than the unadjusted rates shown in Table 7–1; but they will not be entirely equal to those of Whites, in general, because some of the differences in the welfare-participation rates of the two groups is a result of different propensities to be on welfare, even for households with the exact same levels of all the risk factors. The importance of the risk factors themselves, as opposed to differences in propensities to be on welfare across groups for the same levels of risk factors, is measurable quantitatively by how close the adjusted participation rates of each are to those of the majority White population.

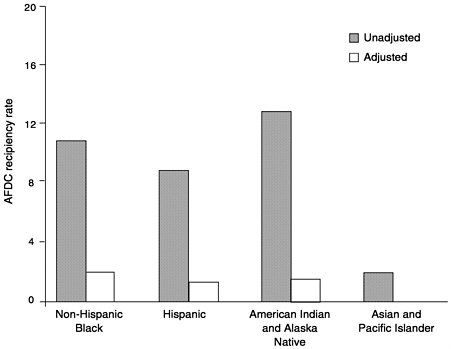

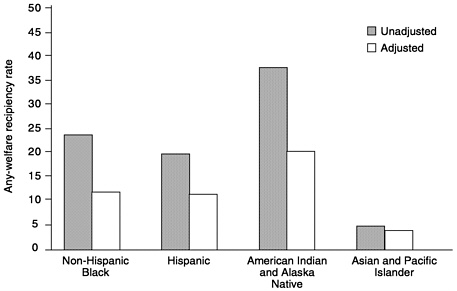

FIGURE 7–4 Adjusted and unadjusted race-ethnic differences in AFDC recipiency rates, relative to the White population, 1995.

FIGURE 7–5 Adjusted and unadjusted race-ethnic differences in any welfare recipiency rate, relative to the White population, 1995. SOURCE: Authors’ tabulations from Current Population Survey.

Figures 7–4 and 7–5 show the results of such calculations.11Figure 7–4 illustrates the results for the AFDC receipt rate, showing the unadjusted differences in AFDC-receipt rates between the group in question and the White population; for example, non-Hispanic Blacks have approximately 11 percent higher AFDC participation rates than non-Hispanic Whites (14.0–2.7=11.3, from Table 7–1). Also shown are adjusted rates—i.e., the difference in the participation rates of the two groups after adjusting for differences in levels of risk factors. The result immediately apparent from Figure 7–4 is that the vast majority of the differences are explainable by the risk factors; very little remains after the adjustment. Approximately 89 percent of the gap between non-Hispanic Blacks and non-Hispanic Whites is so-explained, and more than 95 percent is explained for Hispanics, American Indians and Alaska Natives, and Asians and Pacific Islanders. Thus, the differences across groups in factors that can be identified and measured—income, family structure, and related variables—provide the explanation for the higher welfare-participation rates of the four minority groups. This is, to some extent, a favorable result for policy because at least these variables provide mechanisms through which policy levers might be able to reduce the disparity in race-ethnic welfare-participation rates.

Figure 7–5 shows the unadjusted and adjusted differences in rates of “any welfare” recipiency. Although the adjusted differences are still considerably smaller than those for AFDC alone, the amount of reduction is not nearly so large. For most of the groups, the adjustments explain approximately 60 percent of the unadjusted gap. Nevertheless, this is still a sizable degree of explanation and implies that the majority of the differences are so-explained.

The remaining differences in welfare receipt, even though small, can be interpreted as a measure of the differences resulting from cultural and social norms toward welfare across the different groups. Some of these factors are, in principle, measurable but are not available in the census data, such as whether an individual’s parents were on welfare, an indication of intergenerational transmission of preferences for welfare; whether the community and neighborhood in which an individual resides has high numbers of welfare recipients, possibly leading to a reduction in stigma of welfare receipt; and so on.12 On the other hand, many risk factors are also omitted from Table 7–5, and these could, if measured and accounted for, lead to even higher explanatory power for such factors. For

example, one major risk factor omitted from the analysis (because it is not measurable in our data) is social networks—i.e., income and other forms of support from family, friends, and others in the community. The work of Edin and Lein (1997) and Edin and Harris (1999) suggests that there are major differences across the races in what they term the “private safety net,” and that this can explain much of the racial difference in welfare-participation rates. Also omitted from the list of risk factors are those that would enable a more accurate accounting for job availability and options in the labor market, including residential location and distance from jobs; variables measuring health and disability status; and variables measuring capital market constraints and constraints on ability to borrow.

There is a sense that estimates of percentage explained in Figures 7–4 and 7–5 are too high because the risk factors used for the adjustment are themselves, to some degree, a result of individual and household choices. This raises questions about the direction of causality in the relationship between welfare participation and the risk factors. If single mothers withdraw from the labor force when they go onto welfare, or if they have a child prior to marriage and simultaneously go onto welfare, it is not clear which event is causing which, or the degree to which the decisions are jointly made rather than one causing another. Although this issue is important for some purposes, the direction of causality is not a major issue here. The question addressed by the calculations shown in Figures 7–4 and 7–5 is whether, given the other decisions made by the different racial and ethnic groups, there is any remaining difference in their welfare-participation decisions, even if the other decisions are jointly made with the welfare decision. Thus the question addressed is whether there are any “pure” differences in welfare-participation propensities, holding fixed the propensities to make other decisions.

The policy implications to be drawn from the calculations are not necessarily that policies be implemented that directly alter income or female heading of households (it is difficult to imagine policies that would alter the latter, in any case). Rather, policy implications are that the underlying determinate of low income and earnings, and of females heading households—such as education, job skills, wage rates; and policy variables such as benefit levels, tax rates, and public programs for training— should be the subjects of policy attention. The results of the calculations here imply that if these underlying determinants of both welfare participation and low income and female heading of households were altered by policy, welfare-participation decisions would necessarily, and perforce, change as well. Thus, race and ethnic differences in welfare dependency could be greatly reduced by reducing the differentials in the underlying determinants of the risk factors.

SUMMARY

We have found in this study racial and ethnic disparities in welfare-program participation that are disturbingly large. American Indians and Alaska Natives have the highest probabilities of receiving benefits; more than one-half receive one of four major types of benefit. Non-Hispanic Black households and Hispanic households also have very high rates of receipt. For the populations of these three groups as a whole, long-term dependence on benefits is not extensive in either a participation or a monetary sense (i.e., the percentage of income coming from welfare sources); however, those in each group who do end up participating in the welfare system have relatively heavy dependence. These racial differences have been quite stable over the last decade, which is at least favorable if one were expecting them to widen (as some other racial differences have), but is still discouraging because it is desirable to see those differences reduced in magnitude.

We have found that most of the difference in welfare engagement across race and ethnic groups can be “explained” by differences in income, in family structure, in employment, and in the education and age of the head of household. We have found little evidence for an important role for differences in social norms, cultural attitudes, or differences in the stigma of welfare receipt across race-ethnic groups in explaining differentials in welfare dependency. Most of these risk factors for welfare participation are addressable by public policies. Although it does not seem likely that race-specific welfare policies are either likely in the near future or desirable, reducing the disparities in the underlying risk factors, or in their underlying causes, should have the beneficial by-product of reducing disparities in welfare receipt as well.

ACKNOWLEDGMENTS

We thank Zhong Zhao and Kevin Moore for research assistance and Sanders Korenman and Timothy Smeeding for their comments.

APPENDIX

The data used for the analysis are the pooled March Current Population Surveys for 1994, 1995, and 1996. The unit of observation is the household, and the survey universe is all U.S. households. The dependent variable in the regressions is either receipt of AFDC income by at least one member of the household in the prior calendar year, or receipt of income from one of the four programs shown in Table 7–1. Separate ordinary least-squares regressions are estimated for each of the five race-ethnic

groups.13 The independent variables in the regressions include dummies for the three household types shown in Table 7–5; third-order polynomials in nonwelfare household income and household earnings; an urban-rural dummy; the number of household members; a third-order polynomial in age; three education dummies (12, 13–15, and 16+completed years); eight regional dummies; and interactions between the education and age variables, the household type and household size variables, and the two income variables and a female-head dummy. The adjusted participation rates were obtained by inserting the non-Hispanic White means for these regressors into the estimated equation for each of the four minority groups. The estimated regression coefficients are available upon request.

REFERENCES

Blank, R. 1997 It Takes a Nation. New York: Russell Sage Foundation.

Bobo, L., and R.Smith 1994 Antipoverty policy, affirmative action, and racial attitudes. In Confronting Poverty, S.Danziger, G.Sandefur, and D.Weinberg, eds. Cambridge: Harvard University Press.

Burke, V. 1995 Cash and Noncash Benefits for Persons with Limited Income: Eligibility Rules, Recipient and Expenditure Data, FYs 1992–1994. Washington, D.C.: Congressional Research Service.

Council of Economic Advisers 1997 Technical Report: Explaining the Decline in Welfare Receipt, 1993–1996. Washington, D.C.: U.S. Government Printing Office.

Edin, K., and K.Harris 1999 Getting off and staying off: Racial differences in the work route off welfare. In Latinas and African American Women at Work: Race, Gender, and Economic Inequality. New York: Russell Sage Foundation.

Edin, K., and L.Lein 1997 Making Ends Meet: How Single Mothers Survive Welfare and Low-Wage Work. New York: Russell Sage Foundation.

Fitzgerald, J. 1991 Welfare durations and the marriage market: Evidence from the survey of income and program participation. Journal of Human Resources 25(Summer):545–561.

Gilens, M. 1995 Racial attitudes and opposition to welfare. Journal of Politics 57:994–1014.

1996 “Race coding” and White opposition to welfare. American Journal of Political Science 90:593–604.

Moffitt, R. 1992 Incentive effects of the U.S. welfare system: A review. Journal of Economic Literature 30(March):1–61.

U.S. Department of Commerce, Bureau of the Census 1996 Statistical Abstract of the United States: 1996. Washington, D.C.: U.S. Government Printing Office.

U.S. Department of Health and Human Services 1997 Indicators of Welfare Dependency: Annual Report to Congress. Washington, D.C.

1998 Aid to Families with Dependent Children: The Baseline. Washington, D.C.

1999 Characteristics and Financial Circumstances of TANF Recipients, July-September 1997. Washington, D.C.

U.S. Social Security Administration 1991 Annual Statistical Supplement to the Social Security Bulletin, 1991. Washington, D.C.: U.S. Government Printing Office.

1997 Social Security Bulletin: Annual Statistical Supplement, 1997. Washington, D.C.: U.S. Government Printing Office.