4

Helium Supply, Present and Future

Although the total terrestrial inventory of helium is estimated to be 17,000 trillion scf (470 trillion scm), most of this supply is in Earth's atmosphere at a concentration of only 5 ppm. Atmospheric helium is in dynamic equilibrium between the gain of helium diffusing from Earth's crust (as a product of radioactive decay of elements such as uranium and thorium) and losses of helium into space (Hwang and Weltmer, 1995).

Helium also exists in concentrations as high as 8 percent in certain natural gases. Most U.S. helium-rich natural gas is located in the Hugoton-Panhandle field in Texas, Oklahoma, and Kansas; the LaBarge field in the Riley Ridge area of Wyoming; and the federal facility in the Cliffside field near Amarillo, Texas (Figure 2.2). Generally, natural gas containing more than 0.3 percent helium is considered economic for helium extraction in the United States, although the economics of helium extraction often depend on the other products in a natural gas stream.

This chapter will examine the separation technologies used to produce purified helium, the helium reserves and resources currently identified, and the potential supply and availability of helium over the next 50 years.

SEPARATION TECHNOLOGIES

Although small quantities of helium can be extracted and purified—along with argon, neon, krypton, and xenon—from air,1 it is mainly extracted from natural gases. In some cases helium is

a natural by-product of the removal of nitrogen from the gas stream to increase its heating value. In other cases, process streams are designed specifically to remove helium.

The processing of helium from natural gas can generally be considered as occurring in two distinct processes, although both processes can and do occur at the same physical location. The first step is the extraction of crude helium (50 to 70 percent by volume) from the natural gas stream. The second step is further refining to purify the helium to commercial grades.

Crude Helium Extraction from Natural Gas

Helium is often separated from natural gases in the course of removing nitrogen to improve heating value. In the United States the lowest practical helium concentration that can economically justify extraction is typically around 0.3 percent by volume. Sometimes, however, the helium is not extracted from high-concentration natural gases and is simply vented to the atmosphere when the natural gas is burned as fuel.

Determining the feasibility of extracting helium from a particular source of natural gas is extremely complicated and is influenced by a combination of technological, logistical, and economic factors. For example, too small a reserve base may disfavor the installation of expensive helium extraction and/or purification facilities. Economic and technical considerations surrounding other products in the natural gas stream and contractual obligations can also affect the economics of helium extraction. All of these factors must be taken into account before a helium extraction site can be planned and established.

Extraction of crude helium from natural gas typically requires three processing steps. The first step is the removal of impurities. Amine and glycol absorption, dry desiccant adsorption, and/or other extraction processes typically remove water, carbon dioxide, and hydrogen sulfide from the gas. The second step is the extraction of the high-molecular-weight hydrocarbons. The third step is cryogenic processing, which removes most of the remaining methane gas. The product is a crude helium typically containing 50 to 70 percent helium, with the remainder being primarily nitrogen along with smaller amounts of argon, neon, and hydrogen.

Purification

Final purification of helium, prior to liquefaction, is typically done using either (a) activated charcoal absorbers at liquid-nitrogen temperatures and high pressure or (b) pressure-swing adsorption (PSA) processes. Low-temperature adsorption can yield helium purities of 99.9999 percent, while PSA processes recover helium at better than 99.99 percent purity (Hwang et al., 1995). PSA can be less costly for gaseous helium but may be more costly where liquefied helium production is desired. The PSA process is widely used to produce specification-pure helium in conjunction with cryogenic enrichment (Hwang and Weltmer, 1995).

TABLE 4.1 Refined Helium Sales Between 1966 and 1996 (bscf/yr)

|

|

Sales |

|||

|

|

1966 |

1976 |

1986 |

1996 |

|

U.S. government |

0.8 |

0.2 |

0.4 |

0.2 |

|

U.S. private sector |

0.1 |

0.4 |

1.1 |

2.4 |

|

Export |

0.0 |

0.1 |

0.4 |

0.8 |

|

Total |

0.9 |

0.7 |

1.9 |

3.4 |

|

SOURCE: Figures for 1966, 1976, and 1986, Campbell (1988) and for 1996, Peterson (1997). |

||||

Helium Reserves and Resources

The United States is the world's largest producer of helium. Table 4.1 summarizes U.S. helium sales over the last four decades. The two most important sources of helium in the United States are the Hugoton-Panhandle field complex, which is located in Texas, Oklahoma, and Kansas, and ExxonMobil's LaBarge field, which is located in the Riley Ridge area of southwestern Wyoming. Most production from the Hugoton-Panhandle complex is connected to or could be connected to the BLM helium pipeline and Cliffside storage facility near Amarillo, Texas. Approximately 2.8 billion scf (78 million scm) of helium was produced from this area in 1996, 2.2 billion scf (61 million scm) of which was sold and 0.6 billion scf (17 million scm) of which was stored in the Bush Dome reservoir. ExxonMobil's Shute Creek processing plant produces approximately 1.0 billion scf (28 million scm) from the LaBarge field, with the remaining 0.2 billion scf (5.5 million scm) coming from other facilities in Colorado and Utah.

ExxonMobil's LaBarge gas field and Shute Creek gas processing facility in Wyoming was originally designed to process approximately 480 million scf (13.3 million scm) per day of natural gas; it entailed an investment of approximately $1.5 billion. The field and processing facility currently produce around 650 million scf (18 million scm) per day of natural gas, with an anticipated upgrade expected to increase the capacity to approximately 700 million scf (19 million scm) per day. Gas produced from the field is 66.5 percent carbon dioxide, 20.5 percent methane, 7.4 percent nitrogen, 5.0 percent hydrogen sulfide, and 0.6 percent helium. The processing facility produces carbon dioxide (for enhanced oil recovery projects), methane, elemental sulfur, and helium. At peak production, the facility could produce as much as 4 million scf (110,000 scm) per day, or 1.4 billion scf (39 million scm) per year of helium.

Although the rate of return on investment has been disappointing, it is clear that ExxonMobil expects the facility to be profitable throughout its projected lifetime. Investments in equipment upgrades (including the helium processing facility) and well drilling in order to maintain deliverability are planned to continue. It was clear to the committee members who visited the facility that the facility is being operated in a manner consistent with ExxonMobil's stated goal of another 50 years of operation.

Helium is produced in small quantities outside the United States. Algeria produced about 0.5 billion scf (14 million scm) of helium in 1998. Much smaller amounts of helium are produced in Russia and Poland, China, and parts of Africa. Although the helium content of the native gas produced at the Algerian facility is only 0.17 percent, economics are favorable since

the gas is being converted to liquified natural gas for shipping, and the helium in it is more highly concentrated (Francis, 1998). Algerian helium principally serves the European market.

Categories of Helium Reserves and Resources

Evaluating U.S. helium reserves and resources is the responsibility of BLM. BLM has constructed a 19,000-sample database of helium concentrations, with much of the measuring having been done at its own laboratory in Amarillo. BLM also uses data from a variety of sources for its analyses, including Potential Gas Committee reports (see, for example, Colorado School of Mines, 1995) and data from private producers of helium-rich natural gas.

BLM categorizes helium reserves using a United States Geological Survey classification system that considers both physical uncertainty and economic viability. Physical uncertainty is conveyed by dividing resources into those that are "identified" and those that are "undiscovered." Identified resources are estimated from specific geological evidence, while undiscovered resources are postulated to occur in unexplored areas. Identified resources are further divided into ''measured," "indicated," and "inferred" resources. Measured resources are based on production tests and other measurements made during well drilling. Indicated and inferred resources are based on progressively less certain geological data. The combination of measured and indicated resources are referred to as "demonstrated."

Economic considerations are conveyed through a division of the resource into "reserves," "marginal reserves," and "subeconomic reserves." Reserves refer to resources that can be economically extracted. Marginal reserves border on being economically producible. Subeconomic reserves are clearly not economically producible.

The total identified U.S. helium resource base is estimated by BLM to have been approximately 589 billion scf (16 billion scm) as of December 31, 1996, of which 217 billion scf (6 billion scm) is classified as measured reserves. Of this total, 35 billion scf (1 billion scm) is in storage in the Bush Dome reservoir, 4 billion scf (110 million scm) of which is privately owned. The BLM category measured reserves comes closest to the definition of "proved reserves" used by the petroleum industry to signify actual anticipated recoverable volumes of a resource (Society of Petroleum Engineers/World Petroleum Congress, 1997). However, measured reserves are larger than proved reserves because BLM's measured resources numbers include both "nondepleting" reserves (i.e., known but not developed) as well as those from gas that is being produced but from which helium is not being extracted.

The terminology used by BLM makes it difficult to understand how much helium is potentially available. The classification scheme used by the natural gas industry is clearer, and all new helium resources are coming from that industry.

BLM estimates nondepleting measured reserves of helium to be around 53 billion scf (1.5 billion scm) of helium, the bulk of which lie in deposits in the Riley Ridge area (Gage and Driskill, 1998). The Riley Ridge nondepleting reserves are not likely to be produced in the foreseeable future because of poor gas quality. In addition, it is expected that only 60 to 65 percent of helium-rich natural gas is being processed for helium from the Hugoton-Panhandle complex (Gage and Driskill, 1998). Although this number is estimated to approach 75 percent (Gage and Driskill, 1998), a significant portion of these reserves will still be lost when helium-containing gas is ultimately burned as fuel. Accounting for these factors to attempt to arrive at a more realistic proved reserves estimate results in the data presented in Table 4.2.

TABLE 4.2 Estimate of Proved Reserves of Helium in the United States (bscf)

|

Location |

Estimated Proved Reserves |

|

Hugoton-Panhandle complex (except Cliffside) |

38 |

|

Native gas at Cliffside |

4 |

|

BLM storage at Cliffside |

31 |

|

Private storage at Cliffside |

4 |

|

Total Hugoton-Panhandle complex |

77 |

|

LaBarge field (ExxonMobil) |

67 |

|

Other |

3 |

|

Total |

147 |

At current usage of around 4 billion scf (110 million scm) per year, this reserve represents a reserve/production ratio of over 35 years. Several factors, however, could alter the situation. First, although the Hugoton-Panhandle field is rapidly depleting, operators are initiating programs (e.g., compression) to slow field decline. Such efforts could lead to future increases in natural gas production and thus to increased helium reserves. Second, there is evidence that an increasing fraction of Hugoton-Panhandle gas is being processed for helium. Plans for helium processing plant capacity increases on the storage pipeline suggest that this trend will probably continue. Third, there is evidence that natural gas processors in areas other than the Hugoton-Panhandle are becoming more interested in processing natural gas for helium, where feasible. All of these trends could act to increase helium reserves beyond those indicated above.

Future Helium Supply

A reasonable estimate of future production can be developed from the following observations. First, ExxonMobil is currently producing approximately 1 billion scf (28 million scm) per year from LaBarge, with this quantity anticipated to increase to perhaps 1.4 billion scf (39 million scm) per year in the near future. Further production from this facility is constrained by plant capacity, which is not expected to be increased further. However, such rates should be sustainable for the 50-year anticipated lifetime of the production and processing equipment.

Second, production from fields in the Hugoton-Panhandle complex is expected to decline. However, if it is assumed that the gas currently available at Cliffside (private storage plus public storage plus native gas) is eventually made available, then the lifetime of the helium processing facilities would suggest that production at current rates of around 3 billion scf (83 million scm) per year could be sustained for another 25 years.

Third, production from sources other than the Hugoton-Panhandle complex and LaBarge currently amount to only around 0.2 billion scf per year (5.5 million scm). Plants that are anticipated to come on stream in the near future are expected to approximately double this figure. Although this volume of helium would not make production from outside plants a major source, new plants in the longer-term future could make such outside production far more important.

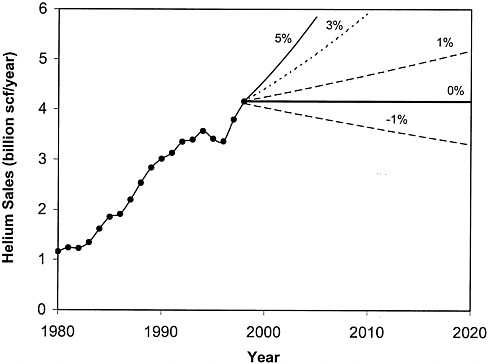

FIGURE 4.1 Historical data on helium sales for the past 20 years as well as scenarios for future sales at various rates of growth.

Forecasting the future supply of natural resources beyond what is currently being exploited is a much more difficult task, given the difficulties of assessing both geologic and economic uncertainty. However, because helium availability is tied to natural gas production and processing, analysis of the natural gas situation may be a useful means of gauging the possibility of future helium supplies.

As of December 31, 1997, proved reserves of natural gas in the United States were estimated to be 167 trillion scf (4.6 trillion scm) (U.S. Department of Energy, 1998a). During 1997, the U.S. produced 19.9 trillion scf (550 billion scm) of gas (U.S. Department of Energy, 1998b), for a reserves/production ratio of 8.4 years. Continued supplies of natural gas are a result of the dynamic natural gas industry in the United States, which is readily replacing produced reserves through new field exploration and improved recovery technology. Were this not so, such a low reserves/production ratio would result in rapid declines in the availability of natural gas. Using the production numbers above as a baseline, the committee generated Figures 4.1 and 4.2 to estimate when the private helium industry will need to buy the government-owned helium. Because the data on helium demand are inadequate for predicting future trends in helium use, the committee considered a range of possible scenarios for growth in helium consumption.

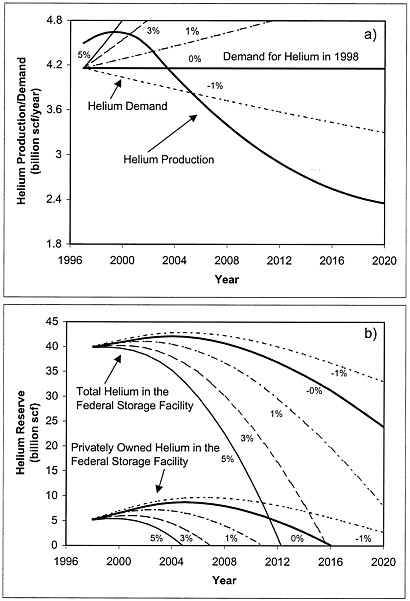

FIGURE 4.2 Part (a) shows scenarios for helium production assuming current trends (solid line) and demand based on the growth rates in Figure 4.1. Part (b) depicts the total and privately owned helium reserves assuming the growth scenarios indicated in part (a).

Figure 4.1 shows the helium sales data for the past 20 years along with curves depicting -1 percent, 0 percent, 1 percent, 3 percent, and 5 percent annual growth in helium sales.2 Although helium sales more than doubled between 1985 and 1995, the rate of increase has varied and appears to be declining. Thus, although helium consumption will probably continue to rise in the short term, it may flatten out at a level close to the current level or even decline.

For the purposes of this exercise, the committee assumed that no new sources of helium would be discovered. The solid curve in Figure 4.2a depicts this worst-case scenario of helium production vs. time based on current production trends and capacity. The peak in this curve is due to the increase in helium production at LaBarge. The overall decline in helium production is due to the depletion of the fields connected to the Hugoton-Panhandle complex. The other lines in the figure reproduce the consumption scenarios depicted in Figure 4.1.

Figure 4.2b indicates the total amount of helium in the reserve facility (top curves) and the amount of helium in the privately owned reserve (bottom curves), assuming the supply and demand scenarios shown in Figure 4.2a. If helium demand remains constant at the 1998 level, the curves indicate that there will be a net storage of helium until about 2004. At that time, helium suppliers will begin to draw down their private stores, which will be exhausted in about 2015. If helium use increases at 1 percent, 3 percent, or 5 percent per year, the private reserves will be exhausted in about 2010, 2007, or 2005 respectively. If helium use decreases at 1 percent per year, the private reserves will not be exhausted until after 2020. If the amount of helium available is greater than the worst-case estimate used in these scenarios, the private reserve will be exhausted even later.

In scenarios where helium consumption grows less than 3 percent per year, the amount of helium private industry will need to purchase from the government to meet demand will be less than the amount the Department of the Interior is required to offer for sale. In some scenarios the difference is substantial, and it is even larger if more helium becomes available than the committee had assumed.

One might well wonder what additional volumes of helium would become available if more helium-bearing natural gas is discovered. To address this issue, several things need to be taken into consideration. First, the U.S. helium-supply commercial industry is still young, having existed only since about 1960. Second, the industry has primarily been based on sources that were discovered and exploited for other gases (i.e., the Hugoton-Panhandle and LaBarge gas fields). Although helium may play a role in gas field development decisions, companies do not specifically target exploration for helium because its economic status is that of a minor byproduct. As a result, the geological characteristics and processes that form helium-rich gas deposits are not well known, making deliberate exploration for helium difficult. Natural gas producers and operators of natural gas processing plants are becoming increasingly aware of the economic rewards of helium extraction, however. BLM conservation and storage programs have played a large role in getting this industry going and in stimulating interest in extraction. As future uses of helium grow, the awareness of helium extraction is likely to grow, perhaps resulting in a larger percentage of helium being extracted from available natural gas streams or even in deliberate exploration for new sources of helium.

It is estimated that the total U.S. potential resource base of natural gas is an additional 1,100 to 1,900 trillion scf (31 to 53 trillion scm) over the proved reserve base (as of December 31, 1993). With this potential available in the United States, exploration for natural gas is likely to continue for a very long time. As stated above, the reserves/production ratio for U.S. helium is over 35

years. Although growth in consumption could reduce this ratio in the future, particularly if few new supplies are added to the resource base, the resource base could expand if the very large potential is realized.

In addition, the Riley Ridge area of Wyoming is estimated to contain a nondepleting resource of helium of approximately 47 billion scf (1.3 billion scm) (Gage and Driskill, 1998). This helium is contained in low-quality natural gas that is not currently economic to produce. Should it become so, perhaps as a result of increased helium prices, it would increase the current reserves/production ratio by over 13 years.

Similar observations could be made with regard to worldwide helium supplies. Liquefied natural gas is becoming an important component in the world's energy supplies. Because methane liquefaction concentrates the remaining gas stream, there are potentially other sources of helium throughout the world, even in low-helium-concentration gases (such as those found in Algeria).