5

Economics of the Helium Market

This chapter will examine some special economic factors that affect the helium market, the effect on the market of setting a fixed price for federal helium sales, and the economics of helium storage.

FACTORS AFFECTING THE HELIUM MARKET

The committee's analysis of the helium market was based on a comprehensive framework1 developed by Scherer (1971) and modified by Radetzki (1978) and Labys (1980) to incorporate special features of mineral commodities. These features include geological uncertainty, depletability, and multistage processing. Analysis of the helium market in particular requires the recognition of four special factors.

First, helium is a nonrenewable, finite resource.2 This fact leads to concerns about exhaustibility and complicates the optimal allocation of the resource. Scarcity and the variation in resource quality mean that future sources of helium will cost more to exploit. Present consumption from any given source thus forgoes future profits, and the value of the resource is this forgone profit. Theoretically, in a perfectly competitive market, this value will appreciate over time at the discount rate minus the cost escalation rate. Helium prices can be expected to follow this rising path, although the rise may be offset somewhat by the discovery of new deposits or the development and implementation of new technologies (e.g., for conservation and recycling). The rise might also be accelerated somewhat by increased demand. Because helium is a by-product of natural gas, extraction costs are minimal. The appreciation rate is therefore likely to be close to the real market interest rate, currently 2 to 3 percent (4 to 5 percent nominal). If new, plentiful, low-cost reserves were discovered, the situation would become one

|

1 |

The committee was unable to construct a fully articulated economic model of the helium market because historical data on the price of crude helium do not exist and the data on demand are insufficient for that task. |

|

2 |

As explained in Chapter 4, only geological sources of helium are in limited supply. Atmospheric helium is plentiful but in such a low concentration that extraction, although technically feasible, is uneconomical. |

of perpetual inventory replacement (see Adelman, 1997), with prices increased only by rising exploration and extraction costs, probably less than 1 percent per year. Factors such as the availability of substitutes or the substitution of capital for natural resources can mitigate nonrenewable resource scarcity (Krautkraemer, 1998). Moreover, because every unit of a nonrenewable resource that is produced and consumed today is one less unit available for the future, the value of helium to society may be more than its value to producers.

Second, demand for helium, as for most raw materials, is primarily a derived demand. That is, most consumers of helium use it not as a final product but as an input to the production of other goods and services. Predicting demand for helium thus depends on predicting demand for these other products. Technological breakthroughs in some of the applications discussed in Chapter 3 could result in substantial increases in helium demand. By the same token, other technological breakthroughs could decrease demand. Even for some existing applications, especially those related to national security, future demand is hard to predict.

Third, there is potential for consolidation among helium suppliers. The market has multiple stages, from the extraction and storage of crude helium to the refining, transportation, end use, and recycling of pure helium, but the product changes form only at the extraction and refining stages, and then only in terms of purity. This increases the potential for vertical integration among existing firms. In addition, new firms may be discouraged from entering the market by the dominant role of the natural gas market and the government's strong involvement in helium supply and pricing decisions. For example, the government has often (although not always) sold helium at a price that is below competitive levels.

Fourth, helium is a by-product of natural gas production, so the behavior of the helium market is dominated by conditions in the natural gas market. This fact has many implications, which are, however, not fully understood, because current economic models for the optimal extraction and storage of nonrenewable by-products are inadequate.

THE EFFECT OF A FIXED FEDERAL SALES PRICE

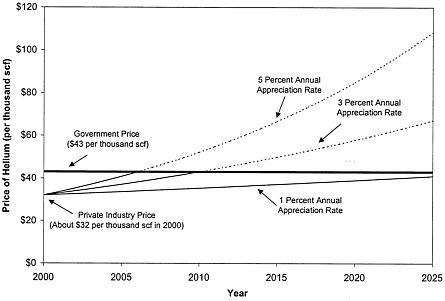

A formula in the Helium Privatization Act of 1996 specifies the future price for sales from the federal helium reserve. Mielke (1997) calculated this price to be $43 per thousand scf (in 1996 dollars). In contrast, the price in the private market is currently about $32 per thousand scf. Chapter 4 suggests that even in the relatively near future, helium producers will have to purchase some federal helium at the $43 price to compensate for production shortfalls (see Figure 4.2b). There are additional implications, however, if the government price remains constant.

First, the government price will eventually act as a cap on private market prices. The time at which that cap becomes relevant will depend on the rate at which private market prices appreciate. As shown in Figure 5.1, if real private prices rise by only 1 percent per year, the cap will not be reached until almost 2030. If they increase at 5 percent per year, the cap will be reached in 2006.3 At an intermediate appreciation rate of 3 percent, the cap will be reached in

|

3 |

If the appreciation rate was 5 percent, or if a significant risk premium was applicable to investment in the inventory, the implied growth in demand would be greater than that implied by the 3 percent appreciation rate. A 5 percent growth rate might make the reserve attractive to speculators. The 1 percent growth path would reflect mistaken judgement of those who recently invested in private inventories. This scenario would most likely involve choppy price movements rather than the smooth curve depicted in the figure. If the appreciation rate was negative (a scenario not depicted in Figure 5.1), then the price of private crude helium would never reach the $43 per thousand scf federal price. |

FIGURE 5.1 Trends for real private and government helium prices, assuming various appreciation rates for private sales. (The committee did not consider price decreases for crude helium because that would require developments on the demand or supply side that the committee deems quite unlikely.) The dotted curves indicate private prices that will not actually be attained because the government price will act as a cap. (The three rates shown are not meant to be forecasts; they merely illustrate the range of rates discussed in the text.)

2010, the midpoint of the projected federal sales period (as can be seen from to figure 4.2a, this rate of appreciation corresponds to a 1 percent per year increase in helium consumption according to the Hotelling model).4 In any of these scenarios, the private price will eventually appreciate again, once the bulk of the federally owned helium has been sold.

Second, private purchases from the federal helium reserve may accelerate somewhat as the market price approaches the government price. If demand grows substantially and no new high-quality deposits are discovered, the reserve could be drawn down to the target level earlier than expected. Or, speculative private purchases could accelerate the drawing down of the reserve. The latter case would not affect actual helium consumption, but it would shift ownership from the government to the private sector and mean that carrying costs would be borne by industry.

|

4 |

The idea that holders of an exhaustible resource will require a rate of return roughly equal to the real interest rate is the basic Hotelling model. This model implies that competitive private holders of helium inventory would sell all their holdings before the federal minimum sale price of $43 per thousand scf is reached, and provides a connection between the sales scenarios in Chapter 4 and the price scenarios depicted in Figure 5.1 For the scenarios in which the appreciation is close to the real interest rate, the date at which the price reaches the federal minimum price is the date that the private reserve is exhausted. |

ECONOMICS OF HELIUM STORAGE

How much helium should be kept in storage depends on several factors. Economists typically give primacy to market efficiency, but other issues may be just as important to policy makers, who must consider societal objectives such as equity and national security.5 In a normal competitive market, indications of static efficiency include the absence of major shortages or surpluses and a price that is equal to the marginal production cost plus the intertemporal opportunity cost (or user cost). The limited number of helium refiners makes assessment of competitiveness and static efficiency difficult, as does the practical difficulty of measuring user costs. Dynamic efficiency, which is concerned with the optimal time path of extraction and storage, is even more difficult to assess.

Storage is particularly important in the helium market because of the nature of the supply and the contract structure of the industry. The joint-product relationship between helium and natural gas, together with the seasonal fluctuation of natural gas demand, makes helium production quite variable. Events such as maintenance shutdowns can also significantly affect the regularity of supply, both within the United States and internationally. Storage helps to smooth this volatility and thus serves as a sort of insurance policy. Storage also facilitates the conservation of helium when high demand for natural gas would otherwise lead to helium production in excess of demand. In some industries, market institutions provide a similar "insurance" function. As shown in Table 5.1, however, the contract structure of the helium industry allows no futures market and only a limited spot market. The lack of these market institutions, especially the lack of a spot market, increases the importance of inventory holdings in the helium market.

What is the optimal quantity to store? Although the direct cost of helium storage is minimal, an idle asset yields no return on investment and thus has an opportunity cost. From a government perspective, the rationale for storage is usually the maintenance of a critical reserve supply for contingencies. For example, the Strategic Petroleum Reserve was created to insulate the economy from oil-price shocks. From a private perspective, the rationale for storage (of agricultural commodities, for example) is usually the desire to maximize returns as prices fluctuate.

The optimal storage quantity is reached when the marginal cost of additional inventory plus the marginal cost of storage equals the marginal benefit of inventories drawn from the stock (Bohi and Montgomery, 1982).6 If social costs and benefits are associated with the stored good, then the social marginal costs and marginal benefits must also be balanced. In either case, as noted earlier, the balancing is an inherently intertemporal decision reflecting expectations about future prices as well as the discounting of opportunity cost associated with resource extraction.

TABLE 5.1 Helium Market Institutions

|

Institution |

Existence |

Reason |

|

Field sales |

|

|

|

Spot market (1-year contract or specific quantity) |

Some |

Helium owner is different from extraction company |

|

Futures market |

No |

Contract may have price change limitations or may specify future price |

|

Long-term contract (multiyear) |

Yes |

Usually required to accept and pay for all helium produced (standard practice for extraction) |

|

Refinery sales |

|

|

|

Spot market |

Yes (very small) |

For specific experiment or short-term use |

|

Futures market |

No |

Contracts may have price change limitations |

|

Long-term contract (1 to 3 years) |

Yes (very common) |

Typical supply to users who have a continuous requirement |

|

Long-term contract (3 to 15 years) |

Yes (less common) |

Where supply requires large investment at customer site |

A formal model developed by Epple and Lave (1980) provides some approximate results for a particular set of parameters. In that model, storage is usually found to be desirable except when the discount rate is high (e.g., 10 percent).

If storage is determined to be desirable, the next question is whether the private sector will maintain a sufficient quantity on its own. Hitherto, government storage of helium has always been a given, so there is no experience with exclusively private-sector inventories. Epple and Lave (1980) suggest that an appropriate level of storage could be undertaken by the private sector. The optimal inventory size determined by the market could then be smaller than the optimal size determined by social criteria, however. For example, the private sector might undertake too little storage (from society's point of view) if its estimate of future prices understates helium's marginal social value. Even if private storage is smaller and more volatile than is socially desirable, however, there is an incentive, if prices fluctuate, for the private sector to hold precautionary and speculative inventories.

If the policy choice is a combination of public and private storage, the optimal mix depends not only on the factors that prevent private holdings from reaching the socially optimal level but also on the feedback effect of government reserves on the size of private reserves. In general, given information about the size of the public stockpile, the prospects for its sale, and the government's supply policy, including price, the private sector can be expected to adjust its inventory accordingly. Experience with the Strategic Petroleum Reserve demonstrates that government storage can crowd out private-sector storage and that expectations about government pricing and drawdown policy can significantly influence private-sector storage incentives (Bohi and Montgomery, 1996).

The private sector is already storing helium (see Chapter 2), but there is very little flexibility in its inventory decisions. The decision to store appears to be based on the prevailing long-term take-or-pay contracts and a desire to maintain future supplies, as reflected in the development of both spot (immediate to 30-day delivery) and forward markets (delivery approximately one year in the future). Because government helium storage has never been absent, however, it is unclear

to what extent the government has crowded out private-sector storage and what has been the effect of expectations about government releases on incentives to store. In other words, it is hard to know whether the quantity of private storage is likely to be adequate to allay legitimate concerns about a potential shortage for ''critical" government uses. Even if it is not, the shortfall does not necessarily imply a requirement for government storage (as distinguished from government provision of storage facilities, for example by lease to the private sector). Rather, economic incentives to induce additional private supply could be a viable alternative—e.g., government contracts for purchases of helium or reducing the profit tax rate applied to helium production (Epple and Lave, 1980). It is also important to note that these questions about storage are related to, but nonetheless separate from, provisions in the Helium Privatization Act, which prescribe the pace of disposal and the price at which federal sales are to occur.

Decisions regarding the optimal private and public storage of helium are severely restricted by the current reserve base, the long-term contract structure (including take-or-pay provisions), and the dominance of natural gas extraction. As shown in Figure 4.2, based on current trends the production of helium over the next few years is likely to be in excess of demand, resulting in increased private storage. The rate of helium production will not be reduced to eliminate the temporary supply surplus, because refiners must purchase all the helium by-product generated by natural gas extraction, which is driven by the market for natural gas, not helium. In the near future, however, helium production will fall below helium refiners' demand levels, with the deficit being covered during the first couple of years by private inventories. Thereafter, helium will be purchased from the federal reserve to make up the shortfall. There is little further flexibility in additions to or withdrawals from storage. The levels of public and private inventories will drop continuously unless additional reserves are discovered (or resources are translated into reserves).