CHAPTER 21

ECONOMICS AND THE PRESERVATION OF BIODIVERSITY

W.MICHAEL HANEMANN

Associate Professor, Department of Agricultural and Resource Economics, University of California, Berkeley, California

Aanalysis of the value of preserving biodiversity requires the attention of many disciplines. The chapters that follow in this section define the role of economics in this endeavor and assess its contribution. In this chapter, I offer a brief overview of some of the issues involved in the economics of biodiversity.

There are many different questions that economists ask in connection with biodiversity. Is economic growth harmful to biological diversity? What are the reasons why it may turn out to be harmful? How can harmful impacts be avoided? What institutions are required to ensure a better outcome? At a more specific level, the questions tend to focus on project analysis and specific environmental policy decisions. For example, what are the benefits and costs of a particular investment project or conservation program? Should they be undertaken?

These questions involve a mixture of normative and positive analyses. For the normative issues, economists have something to contribute—the criterion of economic efficiency—but we recognize the fundamental role of equity considerations and value judgments. Our theories reserve a place for the equity criterion and are capable of tracing its implications for private and public decisions, but as economists, we do not have a theory to explain what those value judgments should be. The positive issues are different, however; these fall squarely within our bailiwick and within those of the other social sciences that seek to explain and predict human behavior. As resource economists, it is one of our direct obligations to measure, explain, and predict how individuals and institutions manage natural resource systems, value biological diversity, and make decisions affecting its preservation.

We may disagree on techniques of measurement and theories of behavior, and some of our measurements and theories may be wrong, but as a discipline, we have standing in this area.

In explaining why anyone may rationally choose to deplete natural resources and destroy ecosystems, mainstream economists adduce a variety of arguments. The most important is intertemporal preferences and discounting. In contrast to conventional commodities, a distinctive feature of natural resources is that they are not instantly renewable; they can be restocked, if at all, only with time and subject to the constraints of biological processes. Consequently, harvesting these resources—whether for commercial gain or otherwise—involves a trade-off between present benefits and future costs that depends on how the latter are discounted relative to the former.

Economists have theories about how the interest rate level, the nature of the net benefit function and its movement over time, and the dynamics of the resource’s natural growth process combine to determine the optimal intertemporal path of exploitation—whether or not it is desirable to aim for a steady state and if so, what that steady state should be. Other things being equal, the higher the interest rate at which future consequences are discounted, the more it is optimal to deplete the resource now. We have theories about what interest rates will pertain if resource management decisions are determined by market forces side-by-side with commercial investment decisions, and we also have arguments about why market-based interest rates may be inappropriate for natural resource management (as well as other social investment policies).

With regard to the latter, Sen (1967) and Marglin (1963) in the 1960s put forth the following two arguments. First, a person acting in a public role, e.g., voting as a citizen on an issue of social policy, may place a different weight on the welfare of future generations than he or she does in making private market decisions. Second, even if each person has a single set of preferences, members of the present generation may be willing to join in a collective contract calling for more savings but all while being unwilling to save more in isolation. In effect, the act of sacrificing present consumption opportunities to benefit future generations is a collective good. Both arguments lead to the conclusion that the intertemporal allocations resulting from a decentralized market system may in fact be undesirable to the present generation. This is separate from the commonly voiced argument that the present generation may place too little weight, in terms of some external ethical criterion, on the welfare of future generations.

Not only may the act of conserving natural resources be a collective good, but the resources themselves frequently are collective goods. This is the second major reason why excessive depletion may occur. Either there may not be any well-defined property rights, or the property rights may not create adequate incentives to private individuals to engage in conservation activities. This can result, for example, in a prisoners’ dilemma situation: conservation may be the optimal strategy collectively, but it is not a dominant strategy for each individual privately.

The third distinctive feature of many natural systems is the often considerable degree of uncertainty concerning the future consequences of present conservation/ depletion actions. This is partly a consequence of the intertemporal aspects of

resource management—the further into the future the consequences, the harder to predict them—but it is also due to the enormous variability that is inherent in many natural systems.

There is a variety of economic theories about how uncertainty should be factored into decisions made by private persons or public policy makers. These theories focus on the implications of various forms of risk-averting behavior for the optimal pattern of resource conservation over time. To implement the theories, however, one needs empirical measurements of the type of risk preferences possessed by the decision makers, in the case of a positive analysis, or value judgments about the type of approach to decisions about risk that should be adopted, in the case of a normative analysis.

As with discounting, there are also economic arguments about why private decision makers may be more or less averse to risk than would be appropriate for making social decisions. For example, the presence of financial constraints may make individuals more averse to risk than society would wish to be. Moreover, as Arrow and Lind (1970) have pointed out, society may have opportunities to pool risks that are not available to individual decision makers; it could therefore be appropriate for society to treat small risks in a risk-neutral manner. An important exception, noted by Fisher (1973), is when collective risks cannot be pooled because one person’s assumption of the risk does not reduce the risk shouldered by others. Many environmental hazards, including the destruction of biodiversity, are likely to be categorized as collective risk and thus require the application of a risk premium even in public decision making. Why private decision makers might be insufficiently averse to risk has been discussed in some of the other social sciences, particularly in psychology, and by Kahneman et al. (1982), who have charted systematic patterns of bias in individual perceptions of risk. While economics is predisposed to assume rationality in human behavior, it is important to leave some room for other varieties of conduct—short-sightedness, wishful thinking, self-deception, and (occasionally) stupidity—as potent explanations of failures in resource management.

To the extent that the outcomes of some decisions may be irreversible, such as those leading to species extinction, there is an additional twist to the way in which uncertainty and time combine to influence decisions involving the concept of option value. Because the passing of time brings information about the consequences of present actions, there is a premium on actions that preserve the flexibility to exploit this information. If a current decision is physically or economically irreversible, that flexibility is abandoned. To the extent that decision makers disregard the potential value of future information, they will systematically undervalue policies, such as conservation programs, that maintain flexibility and preserve options for future action.

To these explanations of economic decisions that may lead to destruction of biodiversity, Norgaard adds another—the force of specialization on the basis of competitive advantage (see Chapter 23). Whereas an isolated region must produce all the natural resources that its members wish to consume, once the region enters into trade relations with other areas it can satisfy its wants by specializing in the production of a small set of goods and exchanging its surplus production for the

other needed commodities. Indeed, it is economically efficient to do this: given differences in relative production efficiencies among trading partners, everybody can gain from the exchange.

There are some qualifications to this conclusion. First, the argument applies in principle to trade between any areas not yet developed, and developing countries. Second, trade between developed and developing countries has historically involved elements of coercion that are extraneous to the argument based on efficiency. Third, the calculation of relative production efficiencies and the estimate of gains from trade involve trade-offs between gains to the present generation and potential losses to future generations through the depletion of nonrenewable resources and may be biased by the use of an inappropriate discount rate for the reasons mentioned above.

All these arguments apply to the management of natural resources in general as well as to the conservation of biological diversity in particular. Insofar as they offer explanations about why decentralized private behavior may result in decisions that are socially undesirable, they also suggest possible remedies, e.g., changes in institutions or specific government policies such as wilderness protection acts, procedures for reviewing proposed development projects, or interest rate subsidies for conservation programs. They are all, of course, economic explanations and, therefore, capture only part of the picture. Ecologists have their own explanations of species extinction, such as the perils of K-selection in a suddenly unstable environment, the requirement of a specialized habitat, or specialized feeding needs, for example. As long as the arguments of economists are regarded as explanations of human behavior rather than as an apologia, they have a legitimate claim to the attention of ecologists and other natural scientists concerned with the preservation of biodiversity.

So far I have focused on the larger questions that economists pose about biodiversity. The more specific questions (e.g., What are the benefits of preserving some particular ecosystem?) may be closer to what a lay audience expects of economists and may explain why it has doubts about their role. In this context, it is crucial to distinguish between positive questions (What value do people place on the preservation of the ecosystem?) and normative ones (What value ought they place on its preservation?) Economists deal professionally with the former; the latter is an ethical question about which they may have feeling but no particular expertise to provide an answer.

With respect to the positive analysis of ecosystem values, it is useful to distinguish between the environment as a marketed good, or an input to the production of marketed goods, and the environment as a nonmarketed good of concern to people in its own right. The first situation is certainly easier to deal with and represents, I believe, the stereotype of what economic analysis is about. The economist figures out the market price of alligator handbags, say, and multiplies that by the reduction in the quantity of alligator handbags resulting from the destruction of alligator habitat. Although that certainly is part of economic analysis, it has not been at the cutting edge of research in environmental economics for the past decade or more.

Environmental economists are interested in markets not because they want to use market prices to multiply something but because they are interested in measuring the preferences of individuals and ascertaining their trade-offs between environmental resources and money or conventional market commodities. Organized markets are one forum in which people reveal their preferences through the choices that they make—but markets are not the only forum, and they are not essential to the enterprise of environmental valuation. Instead, economists have come to rely quite extensively on simulated markets, or their analogs, in which individuals reveal their preferences through interviews or experimental games involving trade-offs between money and environmental outcomes. Moreover, when they do analyze actual markets, economists are interested not in the market prices per se but, rather, in the patterns of selection and the types of preferences that these imply.

Both direct and indirect techniques for eliciting or inferring the preferences of individuals have been greatly refined in recent years. Rather than attempting to summarize them, I will mention several potential limitations of general concern.

First, at what level of aggregation should the valuation be conducted? Should one analyze each species separately or the ecosystem as a whole? In principle, this is an empirical issue, and the solution depends on two sets of factors—the way in which individuals perceive and care for natural environments (What are the aspects that matter to them?) and the way in which the ecosystem functions (What are the biological linkages?) In practice, fashioning a sensible set of units of analysis requires an interdisciplinary approach—a dialog between the natural and social scientists.

The second pertains to the complex types of preferences involved when one is dealing with uncertain and intertemporal outcomes. There is conflicting empirical evidence on how people approach these issues and the types of decision rules they use. As noted above, we have a variety of axiomatic systems and theories about how uncertainty and time could be factored into decision making but much less empirical information on what people do in practice. Moreover, there is some evidence from psychologists that raises doubts about whether individuals have consistent risk or intertemporal preferences at all. At the very least, there is evidence that preferences depend on the type of choice available. To the extent that this is so, the problems of identifying the appropriate choice and appropriate measurement technique, or of extrapolating preferences revealed by one type of choice to the valuation of another, are indeed challenging.

Third, there is the problem of aggregating preferences or values across individuals. Preferences vary among people: some may even dislike biological diversity and prefer concrete parking lots to natural wilderness. In any case, a resource management program is likely to create both winners and losers. How should one sum the gains and losses and compare them with one another? Is everyone weighted equally (which, in principle, enshrines the existing income distribution), or do some count more than others? The question cannot be answered by economists alone: it must be resolved by reference to some philosophical or ethical system.

Fourth, the sheer difficulty of dealing with futurity in resource management and preservation issues can scarcely be overemphasized. So many consequences involve

future events, which are extremely difficult to predict—long-run ecosystem impacts, economic variables (such as future energy prices), and even the preferences of future generations, who are not around now for one to observe their behavior. Any economic analysis of the benefits and costs of biodiversity preservation involves predictions (i.e., guesses), some of which will inevitably be wrong. One can attempt to counteract this by choosing sophisticated analytical techniques and decision criteria that recognize the uncertainties and the potential for error, but the feeling of unease cannot be avoided.

Lastly, the postulate underlying the entire enterprise of positive analysis (the legitimacy of attempting to establish what value people place on biodiversity) is itself a value judgment and one that can be questioned. Consumer sovereignty, and the notion that people may have consistent and stable preferences, can be challenged. People may be ignorant, ill-informed, or fickle in their attitudes. Why should we care about what they think? A justification comes from the utilitarian ethical system that mainstream economics embraces. The issue is discussed eloquently by Randall in Chapter 25. The point I want to emphasize here is that this question defines both the strengths and the weaknesses of economic analysis. In their positive analysis, economists are essentially holding a mirror to society. If the picture is unattractive, that is, if people individually and collectively place a low value on the preservation of diversity (which I actually think is not the case), that is not the fault of the economist. It is critical to distinguish the legitimacy of the homocentric, instrumentalist, and utilitarian ethical framework from the degree of success with which economists measure human values. Moreover, there are the fundamental difficulties in making decisions on broad issues of resource preservation. Economics is certainly not immune to them, but neither is it uniquely susceptible to them. These difficulties must be confronted in any type of discourse about human affairs.

In concluding I will return to the special question of biodiversity in Third World countries. Within the economics profession, there has been too little communication between those who specialize in economic development and those who focus on natural resource economics. Except for minerals and energy resources, development economics has paid relatively little attention to biological and environmental implications of economic growth. For its part, environmental economics in countries like the United States, Britain, France, and Scandinavia has its intellectual origins in public finance and cost-benefit analysis. That is to say, it has a domestic focus. Like the doctors in George Bernard Shaw’s play, we resource economists have tended to specialize in the diseases of the rich. I hope that this book will help to alter this state of affairs.

In this context I should point out that when economists from the United States and other developed countries urge developing countries to preserve their biological resources, there is a certain awkwardness. It is like an aging rake urging chastity on a young man: the advice is certainly based on a wealth of experience, but it may not be entirely persuasive. It would carry more weight if it were backed up by financial incentives. That is to say, if we want developing countries to protect their biological resources we should be willing to pay them to do so. This topic

deserves immediate attention from policy makers as well as from the academic community.

REFERENCES

Arrow, K.J., and R.C.Lind. 1970. Uncertainty and the evaluation of public investment decisions. Am. Econ. Rev. 60(3):364–378.

Fisher, A.C. 1973. Environmental externalities and the Arrow-Lind public investment theorem. Am. Econ. Rev. 63(4):722–725.

Kahneman, D., P.Slovic, and A.Tversky, eds. 1982. Judgment Under Uncertainty: Heuristics and Biases. Cambridge University Press, New York. 555 pp.

Marglin, S. 1963. The social rate of discount and the optimal rate of investment. Q. J. Econ. 77(1):95–111.

Sen, A.K. 1967. Isolation, assurance, and the social rate of discount. Q. J. Econ. 81:112–124.

CHAPTER 22

COMMODITY, AMENITY, AND MORALITY

The Limits of Quantification in Valuing Biodiversity

BRYAN NORTON

Professor of Philosophy, Division of Humanities, New College of the University of South Florida, Sarasota, Florida

What is the value of the biological diversity of the planet? That question reminds me of a game we used to play at ice cream socials and church picnics when I was growing up in the Midwest. Someone on the entertainment committee would count an assortment of screws and gimcracks, or nuts and bolts, and put them into a mason jar. At the Christmas party, it was pecans, walnuts, and hickory nuts. Everybody else had to guess: How many whatchamacallits are in the jar?

Pretend we’re having an ice cream social on an improved version of the space shuttle. Someone looks down and says, “What’s the value of the life on that planet down there?” The closest guess wins a door prize.

But our question is tougher than nuts and bolts. Recently, scientists discovered bones from a dinosaur they have called seismosaurus. That animal was 18 feet tall, more than 100 feet long, and weighed 80 tons. The diversity in size between a seismosaurus and the smallest microbe is staggering. And I used to be thrown off when they put washers of two different sizes in the mason jar! Given the diversity in size among species, not to mention the fact that many species live inside others, it is not surprising that scientists have left themselves some latitude in their guesses as to how many species there are: they estimate that there are between 5 and 30 million species.

That’s O.K. I never did very well at the guessing game myself. One time I guessed that a jar contained 452 nuts and bolts. The correct answer was more than 2,000. I won the booby prize for being the farthest off; my prize was the jar and its contents.

But again, I can’t help mentioning how much more difficult our current task is. We would hardly have begun to place a value on biodiversity if we had known how many species there are. We’re supposed to put a value on them. In what terms?

When I looked into a jar, I was always a bit overwhelmed at first, so let’s not give up yet. Eventually, I’d decide to be systematic about my guess. I’d divide the jar into somewhat equal sections and try to do a rough count for one of them. Then, I’d multiply by the number of sections. Despite my lack of success, it’s a reasonable approach; we can call it the divide-and-conquer method. Economists and other policy analysts have adopted a similar method for valuing biotic resources. They usually try to estimate, however roughly, a value for one species (Fisher, 1981; Fisher and Hanemann, 1985). If they could assign a value to a few species, such as the snail darter, the Furbish lousewort, and the California condor, then we might average the values of those species and then multiply that average value by the number of species there are, if we only knew how many species there are.

All this averaging and multiplying will require that we use numerical values, so we might as well follow economists in trying to use present dollars as the unit of value. Before introducing the technical terms used by economists, let’s start with some ordinary concepts: species can have value as commodities and as amenities, and they can have moral value.

We’ll say that a species has commodity value if it can be made into a product that can be bought or sold in the marketplace. In this category, alligators have potential value in the manufacture of shoes, but they may also have indirect commodity value if it turns out that vinyl shoes stamped in an alligator pattern sell for more than plain vinyl shoes. Indirect value of this sort is especially important in the pharmaceutical industry, since many of our most valuable medicines are synthetic copies of biologically produced chemicals (Lewis and Elvin-Lewis, 1977; Myers, 1983).

A species has amenity value if its existence improves our lives in some nonmaterial way, e.g., when we experience joy at sighting a hummingbird or when we enjoy walks in the forest more when we sight a ladyslipper. Hiking, fishing, hunting, bird-watching, and other pursuits have a huge market value as recreation, and wild species contribute, as amenities, to these activities. Bald eagles, for example, have not only inspired the production of millions of dollars worth of Americana, but they also generate aesthetic excitement through a whole area that is blessed with a nesting pair of them.

Finally, species have moral value. Here, we begin to encounter controversy. Some philosophers would say that species have moral value on their own. They are, according to this view, valuable in themselves, and their value is not dependent on any uses to which we put them (Regan, 1981; Taylor, 1986). We will not be able to settle this issue. Suffice it to say that species have moral value even if that moral value depends on us. Here, Thoreau comes to mind. He believed that his careful observation of other species helped him to live a better life (Thoreau, 1942). I believe this also. So there are at least two people, and perhaps many others, who believe that species have value as a moral resource to humans, as a chance for humans to form, re-form, and improve their own value systems (Norton, 1984; Norton, in press).

Moral values that people attach to species are quite high. Responses to questionnaires have indicated that people place a surprisingly high value on just the knowledge that a thing exists independent of any use (Randall, 1986, and Chapter 25 of this book). Economists, using a method called contingent valuation, create shadow markets in which they can ask people how much they would be willing to pay to protect a species, quite independent of any use of the species (see Chapter 25). If existence values can be thought of as a rough indicator of moral values for present purposes, we can say that species also have considerable moral value, measurable in dollars.

So, we can say with some confidence that some species have considerable commodity, amenity, and moral value. The problem that economists have encountered is that these values are distributed very unevenly among species, at least given our current knowledge. For example, Hanemann and Fisher (1985) have surmised that under certain assumptions, a wild grass recently discovered in Mexico, a perennial related to corn, may prove to have a value of $6.82 billion annually, and they calculated its value for only one possible use—the creation of a perennial hybrid of corn (Fisher and Hanemann, 1985; see also Chapters 10 and 11 of this volume).

At present, however, we do not have sufficient knowledge to calculate the value of most species. Consequently, in addition to the known values that economists note with respect to some small number of species, they also calculate an option value for species of unknown worth, i.e., the value we should place on the possibility that a future discovery will make useful a species that we currently think useless (Fisher and Hanemann, 1985; see also Chapter 25 of this book). If we extinguish a species now, such discoveries are precluded. Fisher and Hanemann therefore define option value as the present benefit of holding open the possibility that some species we might eradicate today may prove valuable in the future. They would ask people how much they are willing to pay to retain the option of saving the species, given the possibility that new knowledge indicating its value may be discovered in the future.

One important aspect of option value is that it applies equally to commodity, amenity, and morality. As time passes, we gain knowledge in all of these areas, and new knowledge may lead to new commodity uses for a species or to a new level of aesthetic appreciation, or our moral values may change and some species will, in the future, prove to have moral value that we cannot now recognize.

If placing a dollar figure on these option values seems a daunting task, the situation is actually far worse than it first seems. Calculations of option value can only be begun after we identify a species, guess what uses that species might have, place some dollar value on those uses, and estimate the likelihood of such discoveries occurring at any future date (so that we can discount the values across time). Once we’ve done all that, we can try to figure out how to translate those future, possible values into present dollars. I think it is safe to say that despite the great theoretical interest in assigning use and option values to species, and some impressive strides in modeling these formally, it may be a long time before the total value of even one species can be stated in terms of present dollars (Norton, in press).

It is worth stepping back to look at the most difficult problems faced by the divide-and-conquer method. First, there is the problem of irreversibility. In general,

economists have trouble with decisions where one of the options cannot be reversed. This is an especially important problem for biodiversity. If we decide to have a dam and give up a species, blowing up the dam won’t bring the species back.

Second, we are forced to make present decisions under conditions of uncertainty—another problem for assigning present values. Our ignorance of species is mind-boggling. Suppose you’re walking on a hillside in Mexico. Your eyes fall on a few tufts of nondescript grass. Would you guess that grass is worth $6.82 billion annually? Only if you knew that it was a member of the corn family, that it is a perennial, that…, and so on. Scientists believe that they have identified and named approximately 15% of the species on Earth (Myers, 1979), and we have rudimentary knowledge of the life characteristics of only a few of them. It is an understatement to refer to this level of ignorance as mere “uncertainty.”

A third problem with the divide-and-conquer method derives from ecological knowledge. Species do not exist independently; they have coevolved in ecosystems on which they depend. This means that each individual species depends on some set of other species for its continued existence. A species may depend on just one other species for food, or it may depend on an entire complex of interrelated species. This seems to imply that if we now take actions that cause the extinction of any species, then the loss in future benefits should include losses accruing if any other dependent species succumbs as well. Species on which others depend therefore have contributory value in addition to their direct uses (Norton, in press). To extinguish a species on which two other species depend is to extinguish three species. Thus to get the full value of a species, we would somehow have to determine the values of all the other species that depend on it.

It also appears that some species are keystones in their ecosystems. For example, when the Florida alligator populations dipped dangerously low about 15 years ago, wildlife biologists noticed that many populations of other species also declined. During the dry winters in the Florida Everglades, other species depended on alligator wallows as their source of water (Taylor, 1986). Must we say then, that the value of the alligator includes the value of most of the wildlife in the Everglades?

In principle, these ecological facts add no complication. We need only factor in the ecological information regarding the interdependencies among species in ecosystems. Then, we could tally the direct uses and option values of a species and add to this the uses and option values of all dependent species, and so forth. But, of all the areas of biology and ecology, few are less understood than interspecific dependencies. Ecologists cannot even identify all the interdependencies in the systems they understand best. There is no hope that sufficient information will become available for us to determine the interdependencies in tropical forest ecosystems before the forests are destroyed.

Aside from all these problems, the divide-and-conquer method is not even asking the right question. The value of biological diversity is more than the sum of its parts. Even if we could place a value on the biological diversity represented by all species, we would be only part way to an answer to the question, “What is the value of biodiversity?” To answer that question, we would have to include also the genetic variation within species across populations and the variety of interrelationships in which species exist in different ecosystems.

The reason my guesses on nuts and bolts were often very far off, even with my divide-and-conquer method, was that I never completed my calculations before an answer was required. I was always overcome by the uncertainties involved. Did the little area I counted represent one-twentieth or one-twenty-fifth of the jar? Is it representative? In order to answer that, I’d shake the jar, only to discover all the small washers were at the bottom. So, I’d have to count again and recalculate. “Time’s up. Turn in the scrap of paper with your name and number. The game’s over.” I’d end up writing down a random number and suffering the embarrassment attendant thereto. As species become extinct at an ever-increasing rate, resulting in the loss of a fifth or a fourth of all species in the next two decades, according to various estimates, I fear economists and biologists are in a similar situation.

Rather than continuing my attempt to answer this difficult question on the value of diversity, it may make more sense to take a careful look at the question itself and why we are trying to answer it. The question says a lot about us, the questioners. It is a measure of our unique arrogance that we are the only species that calls symposia and writes books to address that question. The sense of arrogance is hardly diminished when we note our usual reasons for asking it. Why are some people so insistent that we put dollar values on species diversity? Because, we are told, important decisions are being made that may extinguish other species. These decisions must be based on some kind of analytic framework (which means each species must be given value in our economic system). If we do not put some dollar value on a species, it will get left out altogether. In other words, they want us to put dollar values on species so they can compare these to the value of real estate around reservoirs and to kilowatt-hours of hydroelectric power.

Suddenly, the fun goes out of our guessing game. A new analogy seems more apt: I have been in a terrible accident, and I wake up in a hospital bed on a life-support system. The hospital is short on funds, and the hospital administrators are having a meeting at my bedside. They say they have examined all the other methods to raise the necessary money, and they are proposing to sell a few spare parts from my life-support system at a yard sale. One of them says, “This equipment is so complicated, a few parts won’t be missed.” “How much do you think this part is worth?” asks another, pointing toward a piece of shiny metal. I try to see what the part is connected to, but it is screwed into a big metal box that looks important. “Or that one over there; it looks like it’s just cosmetic,” another of them suggests. I almost agree, and then I notice that a main power line passes through it. “Stop! Not that one,” I say. Just in time.

It is one thing to treat the valuation of biodiversity as a guessing game or as a set of very interesting theoretical problems in welfare economics. It is quite another thing to suggest that the guesses we make are to be the basis of decision making that will affect the functioning of the ecosystems on which we and our children will depend for life.

If we are not taken seriously unless we quantify our answer, I would like to suggest some new units of measurement. An oops is the smallest unit of chagrin that we would feel if we willfully extinguish a species we need later on. A boggle is the amount of ignorance encountered when an economist asks a biologist a question about species and ecosystems, and the biologist answers: “I don’t know,

and I’m so far from knowing, it boggles the mind.” If I understand what the economists are saying, irreversible oopses and boggles of uncertainty are the main factors in decisions affecting biodiversity. In the passion to express the values of a species in dollar figures, it will be unfortunate if we forget to count oopses and boggles as well.

I believe that we should abandon the divide-and-conquer approach. I suggest we use the big picture method instead. Now, the question is easier. The value of biodiversity is the value of everything there is. It is the summed value of all the GNPs of all countries from now until the end of the world. We know that, because our very lives and our economies are dependent upon biodiversity. If biodiversity is reduced sufficiently, and we do not know the disaster point, there will no longer be any conscious beings. With them will go all value—economic and otherwise.

I am afraid this answer will not be useful to those who want to know the value lost when they act to extinguish a species, but it seems a better answer than a guess, even a guess that counts oopses and boggles as well as dollars.

One thing we know: if we lose enough species, we will be sorry. The guessing game is really Russian roulette. Each species lost without serious consequences has been a blank in the chamber. But how can we know before we pull the trigger? That is the question we should be asking (Ehrlich and Ehrlich, 1981).

REFERENCES

Ehrlich, P.R., and A.Ehrlich. 1981. Extinction. The Causes and Consequences of the Disappearance of Species. Random House, New York. 305 pp.

Fisher, A.C. 1981. Economic Analysis and the Extinction of Species. Report No. ERG-WP-81–4. Energy and Resources Group, Berkeley, Calif. 19 pp.

Fisher, A.C., and W.M.Hanemann. 1985. Option Value and the Extinction of Species. California Agricultural Experiment Station, Berkeley. 35 pp.

Lewis, W.H., and M.P.F.Elvin-Lewis. 1977. Medical Botany. John Wiley & Sons, New York. 515 pp.

Myers, N. 1979. The Sinking Ark. Pergamon, Oxford. 307 pp.

Myers, N. 1983. A Wealth of Wild Species: Storehouse for Human Welfare. Westview Press, Boulder, Colo. 274 pp.

Norton, B.G. 1984. Environmental ethics and weak anthropocentrism. Environ. Ethics 6:131–148.

Norton, B.G. In press. Why Save Natural Variety? Princeton University Press, Princeton, N.J.

Randall, A. 1986, Human preferences, economics, and the preservation of species. Pp. 79–109 in B.G.Norton, ed. The Preservation of Species. Princeton University Press, Princeton, N.J.

Regan, T. 1981. The nature and possibility of an environmental ethic. Environ. Ethics 3:19–34.

Taylor, P.W. 1986. Respect for Nature. Princeton University Press, Princeton, N.J. 323 pp.

Thoreau, H.D. 1942. Walden. New American Library, New York. 221 pp.

CHAPTER 23

THE RISE OF THE GLOBAL EXCHANGE ECONOMY AND THE LOSS OF BIOLOGICAL DIVERSITY

RICHARD B.NORGAARD

Associate Professor of Agricultural and Resource Economics, University of California, Berkeley, California

The global loss of biological diversity has been described as a product of two phenomena. First, population levels have forced the transformation of heretofore relatively undisturbed areas into lands used for agriculture. Second, both industrial and agricultural pollutants have applied a new and narrowly uniform selective pressure on species. Population growth and technological changes have a multiple, rather than simply additive, impact on biological diversity. There has, however, been a third and probably equally important change that factors into the explanation. During this past century, world agriculture has been transformed from a patchwork quilt of nearly independent regions to a global exchange economy. This change in social organization also contributes to the loss of diversity.

While historians and anthropologists maintain a wealth of knowledge about our past, most people—including developmental economists, planners, and agricultural scientists—have little conceptual understanding of the development process prior to modernization. The past was traditional instead of modern, preindustrial instead of industrial, earlier on the road of progress, a void relative to the present. Neither neoclassical nor Marxist economic theory explains how the human population doubled eight times between the agricultural revolution and the industrial revolution without a proportionate accumulation of capital and use of materials and energy (Norgaard, 1984). A richer vision of the past might help us understand the present.

The world before the industrial revolution can be envisioned as a mosaic of coevolving social and ecological systems. Within each area of the mosaic, species

were selected for characteristics according to how well they fit the evolving values, knowledge, social organization, and technologies of the local people. At the same time, each of these components of the social system was also evolving under the selective pressure of how well it fit the evolving ecological system and the other social components. Local knowledge, embedded in myths and traditions, was correct, for it had proven fit and through selective evolutionary pressure, had become consistent with the components of social and ecological systems it explained (Norgaard, 1984).

Within the coevolving mosaic, the boundaries of each area were not distinct or fixed. Myths, values, social organization, technologies, and species spilled over the boundaries of the areas of the mosaic within which they initially coevolved to become exotics in other areas. Some of these exotics were preadapted and thrived; some coevolved; and some died out. But to some extent they all influenced the further coevolution of system characteristics in their new areas. Because of the many combinations of spillovers, the pattern of coevolving species, myths, organization, and technology remained patchy and constantly changing.

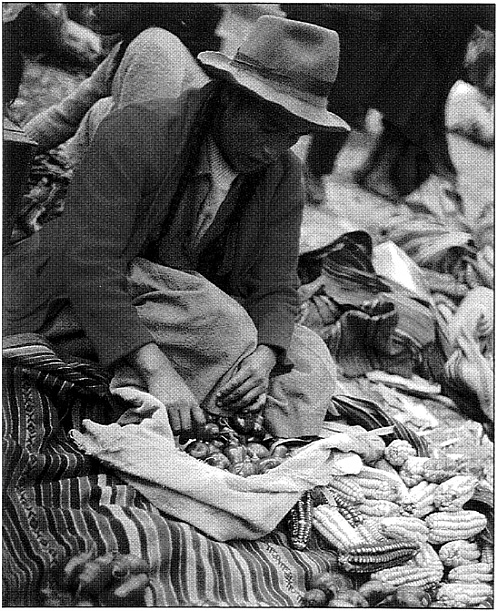

Tattered remnants of coevolutionary agricultural development remain today to give us clues to the past. A few agricultural scientists during the past decade have followed the path of anthropologists and discovered a wide array of traditional agroecosystems (Altieri and Letourneau, 1982; Chacon and Gliessman, 1982; Gliessman et al., 1981). In nearly all these systems, farmers deliberately intermix many crop and noncrop species and occasionally animal species. These agroecosystems coevolved with the values, beliefs about nature, technologies, and social organization of indigenous peoples over centuries, sometimes millennia. Farmers selected for adequate and stable rates of food production through as much of the growing season as possible. A dependable food supply was achieved in part by planting many different crops in different places at different times such that average production from year to year varied little because of the law of large numbers (Richards, 1985).

The increased interest in agroecology coincides with an increased recognition of people as biological participants. Whereas natural historians have consistently portrayed the influence of humans as destructive of natural systems, we are now beginning to learn how traditional people at low population densities were less destructive and under some circumstances contributed to the growth of genetic diversity (Alcorn, 1984; Altieri and Merrick, 1987; Brush, 1982). There traditional people created environments within which plants and microorganisms coevolved under selective pressures that were different from those that occur in environments only marginally disturbed by people. Environmental uniformity was not imposed; farmers developed different approaches to agriculture for different microenvironments, adding to variation in selective pressure (Richards, 1985).

Recent development has been distinctly different from the coevolving mosaic of the past. The mechanistic grid of universal truths developed by Western science has boldly overlaid and simplified most of the elaborate coevolutionary mosaic. The global adoption of Western knowledge and technologies has set disparate cultures on convergent paths. And the environment has not been immune to this globally unifying process. Environments are also merging due to the common

selective pressure from the cropping, fertilization, and pest control practices of modern agriculture. Global markets, global values, global social organizations, and global technologies have resulted in global criteria for environmental fitness. Diversity of all kinds has been lost.

The economic way of thinking sustains the global exchange economy. The concepts of comparative advantage, specialization, and the gains from exchange are central to the neoclassical economic model. Comparative advantage stems from differences in the productivities of people, tools, and land in various economic activities. It immediately follows that total output can be increased through specialization of people, tools, and land in those activities for which they have a comparative advantage. Specialization in particular activities leaves each producer with lots of one product. Producers then exchange with each other until they have a mix of goods, which makes each of them as happy as possible given the willingness of others to exchange. Comparative advantage, the efficiency of specialization, and the gains through exchange are basic to our understanding of economic systems and to our understanding of the development process.

The gain from trade arguments underlies many development policies and justifies many specific projects. Road construction, much of it financed by international lending agencies, has encouraged traditional farmers to switch to cash crop agriculture, specializing in only a few crops according to market prices rather than to criteria of sustainable environmental management. Farmers who once planted diverse crops for subsistence thus have become connected with the global exchange. Other subsistence farmers were simply bought out or moved out by larger commercial agricultural ventures. Since labor with specific skills as well as capital equipment can be purchased in the market, the pattern of agriculture tends to be determined by the physical environment. For this reason, large, physically homogeneous regions now specialize in only a few crops.

The reduction in the number of crop species grown results in an even larger reduction in the number of supporting species. The locally specific nitrogen-fixing bacteria, fungi that facilitate nutrient intake through mycorrhizal association, predators of pests, pollinators and seed dispersers, and other species that coevolved over centuries to provide environmental services to traditional agroecosystems have become extinct or their genetic base has been dramatically narrowed. Deprived of the flora with which they coevolved, soil microbes disappear. Specialization, exchange, and the consequent regional homogeneity of crop species have reduced biological diversity.

Participation in the global exchange economy also transforms local agroecosystems because it forces farmers to stay competitive with other farmers who have been put in the same bind. This encourages use of inputs common to modern agriculture worldwide—fertilizers, pesticides, and high-yielding seed varieties—thereby eliminating many of the remaining regional differences in selective pressure (Ehrlich and Ehrlich, 1981). The adoption of modern technologies, however, must be understood in context of the complementary change in social organization (de Janvry, 1981).

The global exchange economy also induces temporal variation for which species have not evolved the strategies needed to cope. Crop failures, new technologies,

changing tastes, variations in interest rates, changes in the strength of cartels, and variations in trade barriers—all these redefine comparative advantage. This redefinition is accommodated, at least in theory, by a shift in the specialization of people, tools, and land to different lines of production and by a new pattern of exchange. Economists assume that factors involved in production are mobile, i.e., labor, capital, and land can shift between lines of production in a way that optimizes benefit to all.

Other things being equal, these adjustments to exogenous change lead to economic well-being. With all producers adjusting to compensate for a change in the best possible way, the overall impact of the change is minimized. The adjustments keep aggregate well-being as close to the undisturbed maximum as possible and hence more stable than it would be if the adjustments did not take place. But this stabilizing process for humanity as a whole increases the amount of change for individuals in terms of who does what with which tools and land. Variation in aggregate economic welfare is reduced by increasing the variation for the individual components in the economic system.

The economic model is used for designing exchange policies based on the implicit assumption that land can move between uses much like people and tools. But environmental services cannot freely shift from the support of rice to the support of cotton, to suburban lawns, to concrete, to alfalfa, to marsh habitat for waterfowl, and back to rice much the same as a reasonably adaptive person might shift from being a farmer to an urban gardener, to a game warden, and back to being a farmer.

There are many similarities between economic and ecological models (Rapport and Turner, 1977). Economic models have people with different capabilities filling different niches much like different species fill different niches. But the two models differ dramatically with respect to how the systems are presumed to adjust to exogenous change. Biological species evolve to fill their niches. The recent shift from thinking of each species as having evolved individually in response to a changing physical environment to thinking that species coevolved has led to a new understanding of evolutionary dynamics (Lewin, 1986). The new emphasis also stresses how the coevolutionary process defines the niches themselves. Ecologists do not assume that predefined species sort themselves into predefined niches according to their comparative advantages, resulting in what is best for all given the exogenous influences at the time. The differences between economic and ecological understanding help explain why the global exchange economy has led to extinction.

May (1973) hypothesized that biological diversity is greater in the tropics than in the arctic because the climatic constancy facilitated the evolution of greater niche specialization. This conjecture matches theory with evidence very nicely and has considerable appeal. Climates with little variation lead to the coevolution of highly specialized, interdependent species dependent on particular conditions. Conversely, in a tropical rain forest ecosystem, a small change from the conditions in which species coevolved is more likely to lead to extinction than a change of comparable magnitude in an arctic tundra system. This explains why the tropical rain forests, with their great species diversity and the complex relationships among them, have proven so vulnerable to changes wrought by modern technologies.

There would not be a problem if the species that supply the environmental services appropriate to particular crops could coevolve to fill their supporting niches as fast as the global exchange economy leads farmers to shift crops. In this sense, the mismatch between economic and ecological models can be reduced to differences in the speed of their adjustment. Adjustment rates are important even within economics. Doctors can switch from treating a flu epidemic in March to advising on hay fever in April. The auto industry, however, cannot shift from the production of low-fuel- to high-fuel-efficiency cars and back again as fast as the Organization of Petroleum Exporting Countries coalesced and raised the price of oil and then collapsed and let the price fall. The oil price perturbations and differences in adjustment rates have resulted in the extinction of the specialized auto companies and many firms that supported the auto industry. Fluctuations in agricultural prices have similarly put farmers out of business. This understanding simply needs to be extended to biological species.

The tractable, formal models of economics dominate development policy and generate the arguments for exchange. But by linking with the global exchange, all participants in the economy are forced to respond to each other. The difficulties of adjustment imposed upon capitalists, entrepreneurs, and laborers are not a part of the tractable model. But the hardships are very well acknowledged informally and in practice. Every reasonably developed economy has additional mechanisms—unemployment insurance, the expending of moving costs, and capital loss write-offs—to cushion and reduce the hardships of adjustment. Our informal acknowledgment of the hardship, however, has not been extended to biological species. As a minimal remedial measure, we should protect biological species from the hardships of adjustment to the exchange economy much like we protect people.

People and the economic decisions they make are an integral part of the ecological system. To think of them separately is one of the unfortunate consequences of the idea of objective knowledge. The diversity of the ecological system is intimately linked to the diversity of economic decisions people make. There was considerable economic diversity in the past due to cultural diversity. How people interact with ecological systems today is heavily influenced by the signals—common over large areas, yet unstable over time—of the global exchange economy.

Economists heretofore have used economic reasoning to determine when extinction is economically rational, to estimate the economic value of species, and to suggest measures to correct the economic system to compensate for the absence of markets for diversity. In these efforts, the neoclassical economic model is used as the starting point. In this chapter, I have shown how this economic view of the world leads to extinction because of the presumption that gains will result from the shifting of production factors into activities for which they have a comparative advantage. Since biological species are generally less able than people to shift between lines of activity, the implications are clear. Economists should give more attention to the basic assumptions of their model and interpret the conclusions of economic arguments in the context of these limitations. The global economy is constantly being fine-tuned by the actions of each country as they amend their trade, aid, and lending and borrowing policies. These amendments should be made with more attention to ecological considerations.

REFERENCES

Alcorn, J.B. 1984. Development policy, forests, and peasant farms: Reflections on Huastec-managed forests’ contributions to commercial production and resource conservation. Econ. Bot. 38:389–406.

Altieri, M.A., and D.K.Letourneau. 1982. Vegetation management and biological control in agroecosystems. Crop Protect. 1:405–430.

Altieri, M.A., and L.C.Merrick. 1987. In situ conservation of crop genetic resources through maintenance of traditional farming systems. Econ. Bot. 41:86–96.

Brush, S.B. 1982. The natural and human environment of the central Andes. Mt. Res. Dev. 2:14–38.

Chacon, J.C., and S.R.Gliessman. 1982. Use of the “non-weed” concept in traditional agroecosystems of south-eastern Mexico. Agro-Ecosystems 8:1–11.

de Janvry, A. 1981. The Agrarian Question and Reformism in Latin America. Johns Hopkins University Press, Baltimore. 311 pp.

Ehrlich, P.R., and A.Ehrlich. 1981. Extinction. The Causes and Consequences of the Disappearance of Species. Random House, New York. 305 pp.

Gliessman, S.R., E.R.Garcia, and A.M.Amador. 1981. The ecological basis for the application of traditional agricultural technology in the management of tropical agro-ecosystems. Agro-Ecosystems 7:173–185.

Lewin, R. 1986. Punctuated equilibrium is now old hat. Science 231(Feb. 14):672–673.

May, R.M. 1973. Stability and Complexity of Model Ecosystems. Princeton University Press, Princeton, N.J. 235 pp.

Norgaard, R.B. 1984. Coevolutionary development potential. Land Econ. 60(2):160–173.

Rapport, D.J., and J.E.Turner. 1977. Economic models and ecology. Science 195(Jan. 28):367–373.

Richards, P. 1985. Indigenous Agricultural Revolution: Ecology and Food Production in West Africa. Hutchinson, London; Westview Press, Boulder, Colo. 192 pp.

CHAPTER 24

WHY PUT A VALUE ON BIODIVERSITY?

DAVID EHRENFELD

Professor of Biology, Cook College, Rutgers University, New Brunswick, New Jersey

In this chapter, I express a point of view in absolute terms to make it more vivid and understandable. There are exceptions to what I have written, but I will let others find them.

That it was considered necessary to have a section in this volume devoted to the value of biological diversity tells us a great deal about why biological diversity is in trouble. Two to three decades ago, the topic would not have been thought worth discussing, because few scientists and fewer laymen believed that biological diversity was—or could be—endangered in its totality. Three or four decades before that, a discussion of the value of biological diversity would probably have been scorned for a different reason. In the early part of this century, that value would have been taken for granted; the diversity of life was considered an integral part of life, and one of the nicest parts at that. Valuing diversity would, I suspect, have been thought both presumptuous and a terrible waste of time.

Now, in the last part of the twentieth century, we have meetings, papers, and entire books devoted to the subject of the value of biological diversity. It has become a kind of academic cottage industry, with dozens of us sitting at home at our word processors churning out economic, philosophical, and scientific reasons for or against keeping diversity. Why?

There are probably many explanations of why we feel compelled to place a value on diversity. One, for example, is that our ability to destroy diversity appears to place us on a plane above it, obliging us to judge and evaluate that which is in our power. A more straightforward explanation is that the dominant economic realities of our time—technological development, consumerism, the increasing size

of governmental, industrial, and agricultural enterprises, and the growth of human populations—are responsible for most of the loss of biological diversity. Our lives and futures are dominated by the economic manifestations of these often hidden processes, and survival itself is viewed as a matter of economics (we speak of tax shelters and safety nets), so it is hardly surprising that even we conservationists have begun to justify our efforts on behalf of diversity in economic terms.

It does not occur to us that nothing forces us to confront the process of destruction by using its own uncouth and self-destructive premises and terminology. It does not occur to us that by assigning value to diversity we merely legitimize the process that is wiping it out, the process that says, “The first thing that matters in any important decision is the tangible magnitude of the dollar costs and benefits.” People are afraid that if they do not express their fears and concerns in this language they will be laughed at, they will not be listened to. This may be true (although having philosophies that differ from the established ones is not necessarily inconsistent with political power). But true or not, it is certain that if we persist in this crusade to determine value where value ought to be evident, we will be left with nothing but our greed when the dust finally settles. I should make it clear that I am referring not just to the effort to put an actual price on biological diversity but also to the attempt to rephrase the price in terms of a nebulous survival value.

Two concrete examples that call into question this evaluating process come immediately to mind. The first is one that I first noticed a number of years ago: it was a paper written in the Journal of Political Economy by Clark (1973)—an applied mathematician at the University of British Columbia. That paper, which everyone who seeks to put a dollar value on biological diversity ought to read, is about the economics of killing blue whales. The question was whether it was economically advisable to halt the Japanese whaling of this species in order to give blue whales time to recover to the point where they could become a sustained economic resource. Clark demonstrated that in fact it was economically preferable to kill every blue whale left in the oceans as fast as possible and reinvest the profits in growth industries rather than to wait for the species to recover to the point where it could sustain an annual catch. He was not recommending this course—just pointing out a danger of relying heavily on economic justifications for conservation in that case.

Another example concerns the pharmaceutical industry. It used to be said, and to some extent still is, that the myriad plants and animals of the world’s remaining tropical moist forests may well contain a great many chemical compounds of potential benefit to human health—everything from safe contraceptives to cures for cancer. I think this is true, and for all I know, the pharmaceutical companies think it is true also, but the point is that this has become irrelevant. Pharmaceutical researchers now believe, rightly or wrongly, that they can get new drugs faster and cheaper by computer modeling of the molecular structures they find promising on theoretical grounds, followed by organic synthesis in the laboratory using a host of new technologies, including genetic engineering. There is no need, they claim, to waste time and money slogging around in the jungle. In a few short years, this so-called value of the tropical rain forest has fallen to the level of used computer printout.

In the long run, basing our conservation strategy on the economic value of diversity will only make things worse, because it keeps us from coping with the root cause of the loss of diversity. It makes us accept as givens the technological/ socioeconomic premises that make biological impoverishment of the world inevitable. If I were one of the many exploiters and destroyers of biological diversity, I would like nothing better than for my opponents, the conservationists, to be bogged down over the issue of valuing. As shown by the example of the faltering search for new drugs in the tropics, economic criteria of value are shifting, fluid, and utterly opportunistic in their practical application. This is the opposite of the value system needed to conserve biological diversity over the course of decades and centuries.

Value is an intrinsic part of diversity; it does not depend on the properties of the species in question, the uses to which particular species may or may not be put, or their alleged role in the balance of global ecosystems. For biological diversity, value is. Nothing more and nothing less. No cottage industry of expert evaluators is needed to assess this kind of value.

Having said this, I should stop, but I won’t, because I would like to say it in a different way.

There are two practical problems with assigning value to biological diversity. The first is a problem for economists: it is not possible to figure out the true economic value of any piece of biological diversity, let alone the value of diversity in the aggregate. We do not know enough about any gene, species, or ecosystem to be able to calculate its ecological and economic worth in the larger scheme of things. Even in relatively closed systems (or in systems that they pretend are closed), economists are poor at describing what is happening and terrible at making even short-term predictions based on available data. How then should ecologists and economists, dealing with huge, open systems, decide on the net present or future worth of any part of diversity? There is not even a way to assign numbers to many of the admittedly most important sources of value in the calculation. For example, we can figure out, more or less, the value of lost revenue in terms of lost fisherman-days when trout streams are destroyed by acid mine drainage, but what sort of value do we assign to the loss to the community when a whole generation of its children can never experience the streams in their environment as amenities or can never experience home as a place where one would like to stay, even after it becomes possible to leave.

Moreover, how do we deal with values of organisms whose very existence escapes our notice? Before we fully appreciated the vital role that mycorrhizal symbiosis plays in the lives of many plants, what kind of value would we have assigned to the tiny, threadlike fungi in the soil that make those relationships possible? Given these realities of life on this infinitely complex planet, it is no wonder that contemporary efforts to assign value to a species or ecosystem so often appear like clumsy rewrites of “The Emperor’s New Clothes.”

The second practical problem with assigning value to biological diversity is one for conservationists. In a chapter called “The Conservation Dilemma” in my book The Arrogance of Humanism, I discussed the problem of what I call nonresources (Ehrenfeld, 1981). The sad fact that few conservationists care to face is that many

species, perhaps most, do not seem to have any conventional value at all, even hidden conventional value. True, we can not be sure which particular species fall into this category, but it is hard to deny that there must be a great many of them. And unfortunately, the species whose members are the fewest in number, the rarest, the most narrowly distributed—in short, the ones most likely to become extinct—are obviously the ones least likely to be missed by the biosphere. Many of these species were never common or ecologically influential; by no stretch of the imagination can we make them out to be vital cogs in the ecological machine. If the California condor disappears forever from the California hills, it will be a tragedy: but don’t expect the chaparral to die, the redwoods to wither, the San Andreas fault to open up, or even the California tourist industry to suffer—they won’t.

So it is with plants (Ehrenfeld, 1986). We do not know how many species are needed to keep the planet green and healthy, but it seems very unlikely to be anywhere near the more than quarter of a million we have now. Even a mighty dominant like the American chestnut, extending over half a continent, all but disappeared without bringing the eastern deciduous forest down with it. And if we turn to the invertebrates, the source of nearly all biological diversity, what biologist is willing to find a value-conventional or ecological—for all 600,000-plus species of beetles?

I am not trying to deny the very real ecological dangers the world is facing; rather, I am pointing out that the danger of declining diversity is in great measure a separate danger, a danger in its own right. Nor am I trying to undermine conservation; in fact, I would like to see it find a sound footing outside the slick terrain of the economists and their philosophical allies.

If conservation is to succeed, the public must come to understand the inherent wrongness of the destruction of biological diversity. This notion of wrongness is a powerful argument with great breadth of appeal to all manner of personal philosophies.

Those who do not believe in God, for example, can still accept the fact that it is wrong to destroy biological diversity. The very existence of diversity is its own warrant for survival. As in law, long-established existence confers a powerful right to a continued existence. And if more human-centered values are still deemed necessary, there are plenty available—for example, the value of the wonder, excitement, and challenge of so many species arising from a few dozen elements of the periodic table.

And to countenance the destruction of diversity is equally wrong for those who believe in God, because it was God who, by whatever mechanism, caused this diversity to appear here in the first place. Diversity is God’s property, and we, who bear the relationship to it of strangers and sojourners, have no right to destroy it (Berry, 1981; Lamm, 1971). There is a much-told story (Hutchinson, 1959) about the great biologist, J.B.S.Haldane, who was not exactly an apostle of religion. Haldane was asked what his years of studying biology had taught him about the Creator. His rather snide reply was that God seems to have an “inordinate fondness for beetles.” Well why not? As God answered Job from the whirlwind in the section of the Bible that is perhaps most relevant to biological diversity, “Where were you

when I laid the foundations of the earth?” (Job 38:4). Assigning value to that which we do not own and whose purpose we can not understand except in the most superficial ways is the ultimate in presumptuous folly.

The great biochemist Erwin Chargaff, one of the founders of modern molecular biology, remarked not too many years ago, “I cannot help thinking of the deplorable fact that when the child has found out how its mechanical toy operates, there is no mechanical toy left” (Chargaff, 1978, p. 121). He was referring to the direction taken by modern scientific research, but the problem is a general one, and we can apply it to conservation as well. I cannot help thinking that when we finish assigning values to biological diversity, we will find that we don’t have very much biological diversity left.

REFERENCES

Berry, W. 1981. The gift of good land. Pp. 267–281 in The Gift of Good Land. North Point Press, San Francisco.

Chargaff, E. 1978. Heraclitean Fire: Sketches from a Life Before Nature. Rockefeller University Press, New York. 252 pp.

Clark, C.W. 1973. Profit maximization and the extinction of animal species. J. Pol. Econ. 81:950–961.

Ehrenfeld, D. 1981. The Arrogance of Humanism. Oxford University Press, New York. 286 pp.

Ehrenfeld, D. 1986. Thirty million cheers for diversity. New Sci. 110:38–43.

Hutchinson, G.E. 1959. Homage to Santa Rosalia, or Why are there so many kinds of animals? Am. Nat. 93:145–159.

Lamm, N. 1971. Ecology in Jewish law and theology. Pp. 161–185 in Faith and Doubt. Ktav Publishing House, New York.

CHAPTER 25

WHAT MAINSTREAM ECONOMISTS HAVE TO SAY ABOUT THE VALUE OF BIODIVERSITY

ALAN RANDALL

Professor of Agricultural Economics, Department of Agricultural Economics and Rural Sociology, Ohio State University, Columbus, Ohio

A wide variety of methodological and ideological perspectives has informed and directed economic inquiry. Nevertheless, in each of the topical areas where economists specialize, it seems that one or, at most, a few approaches are now recognized as mainstream. For evaluating proposed policies to influence the way resources are allocated, the welfare change measurement approach (which includes benefit-cost analysis, BCA) currently enjoys mainstream status. My purpose here is to explain what this approach can contribute to understanding the value of biodiversity. I will distill the basic message into a few simple propositions, stating them one by one and offering a few paragraphs of elaboration on each.

WELFARE CHANGE MEASUREMENT IMPLEMENTS AN EXPLICIT ETHICAL FRAMEWORK

Each human being is assumed to have a well-defined set of preferences. While the way these preferences are ordered should satisfy certain logical requirements, preferences may be about literally anything in the range of human concerns. Mainstream economists argue that preferences are seldom whimsical or capricious. Rather, people come by their preferences consciously, in a process that involves learning, acquisition of information, and introspection. The mainstream economic approach is doggedly nonjudgmental about people’s preferences: what the individual wants is presumed to be good for that individual.

The ethical framework built on this foundation is utilitarian, anthropocentric, and instrumentalist in the way that it treats biodiversity. It is utilitarian, in that things

count to the extent that people want them; anthropocentric, in that humans are assigning the values; and instrumentalist, in that biota is regarded as an instrument for human satisfaction.

There may be other views of the role of nonhuman life forms. For example, animals and plants may be seen as having a good of their own, possessing rights, or being the beneficiaries of duties and obligations arising from ethical principles incumbent on humans. Some people, including some economists, may subscribe to some of these views. Nevertheless, my purpose here is to confine myself to one particular instrumental, utilitarian, and anthropocentric formulation, exploring its implications for valuation. Implications of other approaches will, on their own merits, provide perspectives in addition to those offered here.

Having established preferences as a basis for valuation, any utilitarian formulation must come to grips with two additional issues: resource scarcity and interpersonal conflicts. The mainstream economic approach recognizes the role of ethical presumptions in resolving these conflicts and asserts two explicit ethical propositions. First, at the level of the individual, value emerges from the process in which each person maximizes satisfaction by choosing, on the bases of preference and relative cost, within a set of opportunities bounded by his or her own endowments (i.e., income, wealth, and rights). Thus, individuals with more expansive endowments have more to say about what is valued by society. Second, societal valuations are determined by simple algebraic summation of individual valuations. This means that from society’s perspective, a harm to one person is cancelled by an equal-size benefit to someone else. By way of comparison with the ethics of welfare change measurement, note that individualism, as an ethic, accepts the first of these propositions, but explicitly rejects the second and instead, argues for protections against individual harm for the benefit of society as a whole. The classical market, in which all exchange is voluntary, institutionalizes (in principle) the individualist ethic.

Many economists are to some extent uncomfortable with the propositions that underlie welfare change measurement—and they are sympathetic with the discomfort of noneconomists—but these propositions have the virtue of explicitness: at least, one knows where mainstream economics stands.

THE ECONOMIC APPROACH IS NOT LIMITED TO THE COMMERCIAL DOMAIN

The explicit ethical framework of mainstream economics leads to the following definitions of value. To the individual, the value of gain (i.e., a change to a preferred state) is the amount he or she is willing to pay (WTP) for it, and the value of a loss is the amount he or she would be willing to accept (WTA) as sufficient compensation for the loss. For society, the net value of a proposed change in resource allocation is the interpersonal sum of WTP for those who stand to gain minus the interpersonal sum of WTA for those who stand to lose as a result of the change.

Because most laypersons have encountered the ideas that economics is concerned with markets and that since Adam Smith economists have believed that an invisible

hand drives market behavior in socially useful directions, it is important for me to be precise about the relationship between economic values (WTP and WTA) and market prices. If everything people care about were private (in technical terms, rival and exclusive) and exchanged in small quantities in competitive markets, prices would reveal WTP and WTA for small changes. Conversely, prices are uninformative or positively misleading where any of the following is true: where people are concerned about goods and amenities that are in some sense public (i.e., nonexclusive or nonrival); where impediments to competitive markets are imposed (by governments or by private cartels and monopolies); and where the proposed change involves a big chunk rather than a marginal nibble of some good, amenity, or resource. The point is that market prices reveal value (in the mainstream economic sense of that term) not in general but only in a rather special and limiting case.

Most issues involved with biodiversity violate the special case where market price is a valid indicator of economic value. Nevertheless, the general theory of economic value encompasses these broader concerns. Here lies the distinction between economic values and commercial values; the essential premises for economic valuation are utility, function, and scarcity; organized markets are essential only to commerce. It is a fundamental mistake to assume that economics is concerned only with the commercial.

THERE IS AN (ALMOST) ADEQUATE CONCEPTUAL BASIS FOR ECONOMIC VALUATION OF BIODIVERSITY

The total value of a proposed reduction in biodiversity is the interpersonal sum of WTA. This total value has components that arise from current use, expected future use, and existence. Use values derive from any form of use, commercial or noncommercial, and including use as a source of raw materials, medicinal products, scientific and educational materials, aesthetic satisfaction, and adventure, personally experienced or vicarious. Future use values must take into account the aversion of humans to risks (e.g., the risk that the resource may no longer be available when some future demand arises) and the asymmetry between preservation and some kinds of uses (preservation now permits later conversion to other uses, whereas conversion now eliminates preservation as a later option). The concerns have encouraged the conceptualization of various kinds of option values, which are adjustments to total value to account for risk aversion and the irreversibility of some forms of development.

To keep the value of existence separate and distinct from the value of use, existence value must emerge independently of any kind of use, even vicarious use. That is a stringent requirement. Nevertheless, valid existence values can arise from human preference for the proper scheme of things. If some people derive satisfaction from just knowing that some particular ecosystem exists in a relatively undisturbed state, the resultant value of its existence is just as real as any other economic value.