APPENDIX C

Study of Fees and Payment System Characteristics for Clinical Laboratory Services

Zachary Dyckman, Ph.D.

CHPS Consulting (Center for Health Policy Studies), Columbia, Maryland

EXECUTIVE SUMMARY

The Institute of Medicine (IOM) is conducting a study of Medicare payment methodology for clinical laboratory services. In support of this study, CHPS Consulting (Center for Health Policy Studies) has been asked to conduct a survey of laboratory service payment rates used by different types of health care plans and to compare these payment rates to Medicare payment rates. This information should prove helpful to the IOM both in assessing the existing Medicare payment methodology and fees for clinical laboratory services and in evaluating alternatives for a new payment methodology.

Study Methodology

In February 2000, CHPS conducted a survey of selected Blue Cross/Blue Shield health care plans (payers)1 regarding payment rates for clinical laboratory services. The surveyed payers offer multiple types of benefit plans, such as indemnity, preferred provider organizations (PPO), point of service (POS), and health maintenance organizations (HMO) plans. A total of 10 payers provided data in response to the survey. The surveyed payers have diverse characteristics and operate in different market settings. The Blue Cross/Blue Shield payers:

-

serve markets characterized by low, moderate, and high managed care penetration;

-

have health insurance market shares ranging from less than 10 to more than 60 percent;

-

operate in areas characterized by substantially different population densities and by urban-rural mix;

-

operate in all four geographic regions; and

-

include for-profit and not-for-profit plans.

The payers were asked to provide current payment rates (fees) for 22 clinical laboratory services, including 21 laboratory tests and venipuncture specimen collection. The selected laboratory services included tests for which Medicare and private payers incur relatively high cost (due to high volume and/or high cost per test), tests of different degrees of complexity, and those that represent different subcategories of laboratory tests. Included in the survey are laboratory services covered under the Medicare laboratory fee schedule as well as anatomic and surgical pathology services that are paid for by Medicare under its fee schedule for physician services.

In addition to requesting data on fees for laboratory services, survey participants were asked to provide descriptions of the primary features of their laboratory payment methodologies as well as capitation rates used for laboratory services under managed care plans.

Study Findings

All of the payers that participated in the clinical laboratory payment survey offered and provided fees used under different types of health plans. The Medicare-private payer fee comparisons were made separately for each benefit plan type.

The primary findings from the clinical laboratory fee comparison are the following:

-

Private payer indemnity plan fees are on average 31 percent higher than Medicare fees.

-

Private payer PPO and POS plan fees are on average 8 percent higher than Medicare fees.

-

Private HMO (non-Medicare, non-Medicaid HMO) fees are on average 2 percent lower than Medicare fees.

-

Medicaid HMO fees are on average 12 percent lower than Medicare fees.2

Fee comparisons were also made between Medicare and Medicare HMO fees for laboratory services. However, the combination of a small sample of

survey respondents and a possible temporary fee anomaly for one respondent may have caused the results of the Medicare-Medicare HMO fee comparison to be misleading.

Only four payers reported using laboratory service capitation for their managed care programs. The per-member per-month (PMPM) laboratory service capitation rate varies from $0.62 to $0.83.3

There are a number of interesting findings relating to characteristics of the private payer PPO plans—the predominant type of private health benefit plan in terms of enrollment—including the following:

-

Most health plans require (as does Medicare) that a diagnosis be included with the laboratory claim for it to be approved for payment.

-

Unlike Medicare, most health plans allow a physician to bill for tests purchased by the physician from another laboratory.

-

There is considerable variation in whether health plans make a separate payment for venipuncture: some do not pay, some pay under all circumstances, and some pay only under specific circumstances—for example, to the physician when another laboratory performs and bills for the test.

-

Most health plans use Medicare fees in developing their own laboratory fee structure.

-

Some health plans pay higher fees to hospital laboratories than to physicians, and some pay higher fees to physicians than to contracted independent laboratories.

STUDY OBJECTIVES AND DESCRIPTION OF STUDY METHODOLOGY

Background and Study Objectives

The Institute of Medicine of the National Academies is conducting a study of Medicare payment methodology for clinical laboratory services. A primary objective of the study is to assess the strengths and weaknesses of the current Medicare payment methodology for clinical laboratory services. In addition, the study will identify and evaluate alternative payment methodologies that may be considered by Medicare for clinical laboratory services.

One item in the study committee’s statement of task is to “investigate and if possible secure and analyze information about costs of performing tests and about payments made by payers other than Medicare.” Current Medicare fees for many clinical laboratory tests are based largely on 1983 “prevailing charges,” which were imperfect measures of market prices even in 1983.

As part of the IOM study, the Center for Health Policy Studies has been engaged to examine laboratory service payment rates used by different types of

health care plans and to compare these to Medicare payment rates. The following are among the questions addressed in this study of comparative laboratory service payment rates:

-

Are Medicare fees for clinical laboratory services higher or lower than fees used by private payers?

-

How do private payer fees for clinical laboratory services differ among different types of health care plans, such as indemnity plans, PPO plans, POS plans, private HMO plans, Medicare HMO plans, and Medicaid HMO plans?

-

What are the characteristics of private payer payment methodologies for clinical laboratory services, including information used in setting fees, documentation requirements for medical necessity, and fee differences among different types of providers?

The following section provides a description of the methodology employed to collect and analyze laboratory payment rates used by payers other than Medicare.

Payment Rate Determination Methodology

The primary objective of the study is to obtain current, valid, and unbiased data on clinical laboratory payment rates used by different types of health plans. A mail and electronic survey with telephone follow-up was conducted of nine private payers that offer multiple types of health plans.4

The intent of the payment rate survey was to obtain clinical laboratory payment data for the following types of health benefit plans:

-

indemnity plans,

-

PPO plans,

-

POS plans,

-

HMO plans for private (non-Medicare, non-Medicaid) enrollees,

-

HMO plans for Medicare enrollees, and

-

HMO plans for Medicaid enrollees.

Not all of the surveyed payers offered and provided laboratory payment data for all of the health plan types listed above (see Table C.3). Nine of ten of the surveyed payers provided data for at least three of the health plan types listed above. Data were requested for both fee-for-service and capitation payment methodologies. Data were not sought on payment rates charged by laboratories to physicians. In addition to payment rate data, the survey also included questions relating to characteristics of the clinical laboratory payment systems.

As an incentive to participate in the survey, payers were told that they would receive comparative fee data, showing how their fees compare to statistical summary fee data for the other surveyed health plans. Also, participants in the survey were provided assurances that their data would be kept strictly confidential and that it would not be possible for anyone to tie data or information provided in response to the survey to specific payers.

Further detail of the clinical laboratory payment survey methodology is provided below.

Selection of Payers

We sought to satisfy several criteria in selecting payers for the laboratory payment survey. The primary criteria were that payers surveyed should:

-

offer multiple types of health plans for which we could obtain laboratory fee data (e.g., indemnity, PPO, POS, and HMO plans);

-

be representative of different managed care environments (e.g., HMO market concentration of less than 25, 25–50 and, more than 50 percent);

-

represent all four geographic regions and different urban and rural settings (e.g., primarily large metropolitan areas, primarily small to midsize metropolitan areas, relatively rural areas);

-

have substantial enrollment in non-HMO health plans that use, as does Medicare, contracted provider networks (e.g., PPO plans, managed indemnity plans); and

-

include both for-profit and not-for-profit payers.

Based on these criteria, we focused our survey solicitation efforts primarily, but not exclusively, on Blue Cross/Blue Shield plans. Blue Cross/Blue Shield payers were determined to be particularly well suited for this project because they tend to offer a wide variety of health plan types, they use contracted provider networks (as does Medicare) for their PPO and other non-HMO plans, and they serve all geographic regions and all significant health care market areas in the United States.

In February 2000, approximately 25 Blue Cross/Blue Shield payers were sent mail invitations to participate in the clinical laboratory payment survey. In addition four non-Blue Cross/Blue Shield payers were invited to participate. Nine payers, all Blue Cross/Blue Shield plans, agreed to participate in the survey. One of the nine payers subsequently decided not to participate. Two of the eight participating payers own health plans that operate relatively independently in two different markets. Thus, for all practical purposes, 10 health payers participated in this payment survey.

Selected characteristics of the 10 payers are shown in Table C.1. As a group, the participating payers operate in markets with diverse characteristics. Indicators of the survey health payers’ diversity include the following:

TABLE C.1 Characteristics of Surveyed Payers

|

Payers Characteristics |

Number of Surveyed Payers |

|

Region |

|

|

Northeast |

3 |

|

South |

4 |

|

Midwest |

2 |

|

West |

1 |

|

Population of Primary Metropolitan Area |

|

|

>5 million |

2 |

|

2–5 million |

2 |

|

<1–2 million |

2 |

|

1 million |

4 |

|

Managed Care (HMO) Concentrationa |

|

|

>50% |

2 |

|

30–50% |

3 |

|

20–30% |

3 |

|

<20% |

2 |

|

Profit-Nonprofit Status |

|

|

For-profit payers |

3 |

|

Not-for-profit payers |

7 |

|

aIn July 1998. |

|

-

They have private health insurance market shares of approximately 10 percent-60 percent.

-

They serve health care markets that are characterized by different levels of managed care penetration.5

-

They represent payers in all four geographic regions of the United States.

-

They represent payers that serve areas of widely different population sizes and of urban-rural mix.

-

They include for-profit and not-for-profit payers.

PPO plans represent the largest benefit plan type for Blue Cross/Blue Shield. This type of health benefit plan is more like the standard Medicare program than other types of private payer benefit plans for the following reasons. Under Medicare and the typical PPO program, enrollees may choose any participating provider and do not have to obtain prior authorization from the plan or from a primary care physician (as under most HMO plans) to see a specialist or to obtain a diagnostic test. Yet, both Medicare and PPO plans typically employ a comprehensive set of medical necessity rules and utilization review protocols. In addition, both Medicare and PPOs (in most markets) rely on relatively large contracted provider networks, and under both programs, contracted providers agree

not to balance-bill the patient for amounts above the payer-determined fee. (Many indemnity plans do not provide members with balance-billing protection.) Because of the balance-billing restrictions, both Medicare and PPOs have the flexibility to set fee levels below provider charge levels. However both Medicare and PPOs have to be concerned that fees are not set so low that the supply of quality providers willing to serve their enrollees is not adequate.

Selection of Clinical Laboratory Services

The intent, based on initial discussions with IOM project staff, was to collect and conduct a comparative assessment of payment rates (fees) for approximately 20 laboratory tests. These include the 12 tests used in the companion study of laboratory test costs being conducted by CHPS, as well as other laboratory tests. The primary criteria for selection of the additional laboratory tests for the fee survey are that these tests:

-

are among the laboratory services with relatively high Medicare payments, because of high volume and/or high per-test cost;

-

represent tests of different degrees of complexity and cost, with Medicare national maximum fees ranging from $5 to $175 per test; and

-

represent different subcategories of clinical laboratory tests, such as anatomic pathology and surgical pathology, and include tests that are paid under both the Medicare laboratory fee schedule and the Medicare fee schedule for physician services.

The 22 laboratory services for which payment rate data were collected are listed in Table C.2. In addition to laboratory tests, venipuncture, or drawing of specimen, is also included. This procedure is the highest-volume procedure and accounts for the highest aggregate payment of all procedures in the Medicare laboratory fee schedule.

Seventeen of the laboratory services included in the survey are paid for by Medicare under its laboratory fee schedule. Four laboratory tests in our sample, Current Procedural Terminology (CPT) codes 88164, 88305, 88307, and 88342, are classified as anatomic pathology or surgical pathology codes in the American Medical Association (AMA) CPT manual. These procedures are paid for by Medicare under its fee schedule for physician services, which uses the resource-based relative value scale (RBRVS). These procedures are included in the study because it is of interest to determine if the relationship between private payer and Medicare fee levels is similar for laboratory services paid under the Medicare laboratory fee schedule and laboratory services paid under the Medicare RBRVS fee schedule. CPT procedure code 88142 is a newly approved test under Medicare, for which fees (or fee limits) have not yet been determined at the national level. The fee for this procedure is currently determined at the local Medicare carrier level. Four of the tests included in the survey are designated in

TABLE C.2 Laboratory Procedure Codes Included in the Payer Survey

the administration’s FY 2001 budget to have their national payment limit cut by 30 percent (CPT codes 83036, 84153, 84443, and 87086).

Additional Information Included in the Survey

In addition to fees for specific clinical laboratory services, information relating to the primary characteristics of laboratory payment methodology was requested in the written survey or in follow-up questions addressed to survey respondents. The additional questions related to:

-

medical necessity documentation requirements;

-

whether payment could be made to a physician or other provider that pays another provider to perform the test;

TABLE C.3 Number of Laboratory Fee Schedules by Benefits Plan Type for the Ten Surveyed Payers

|

Number of different payers |

10 |

|

Indemnity fee schedule |

11a |

|

PPO or POS fee schedule |

14b |

|

Private HMO fee schedule |

9c |

|

Medicare HMO fee schedule |

4 |

|

Medicaid HMO fee schedule |

4 |

|

Total number of fee schedules |

42 |

|

a10 Indemnity+1 different independent lab. b10 PPO+3 different POS+1 different independent lab. c8 HMO+1 different POS. |

|

-

• whether separate payment is made for venipuncture or specimen collection;

• use of Medicare fees as a basis for determining payment rates for laboratory services;

• capitation rates used under HMO and POS plans; and

• Other characteristics of the payment methodology for clinical laboratory services.

A copy of the written survey instrument is provided as Exhibit C.1.

CLINICAL LABORATORY PAYMENT RATES

Introduction

In this section, we report on findings from the survey of clinical laboratory service payment rates. The survey methodology was described earlier. The survey instrument is provided in Exhibit C.1. As indicated earlier, a total of 10 Blue Cross/Blue Shield payers participated in and provided data in response to the laboratory payment survey. These 10 payers serve 10 different markets. Each payer offers, and provided data for, multiple benefit plans (e.g., indemnity, PPO, Medicare HMO). On average, each of the payers provided data for about four different types of benefit plans.

Table C.3 shows the number of different fee schedules that were submitted by the surveyed payers for each type of benefit plan and for which data are included in later tables. Note that where separate fee schedules were submitted for physician laboratory and independent laboratory claims, fees from both fee schedules are included in the fee comparison tables. Thus, ten payers provided fees from indemnity fee schedules, with one payer providing fees from different physician and independent laboratory fee schedules, for a total of eleven indemnity fee schedules.

As discussed in the section “Laboratory Payment System Characteristics,” several of the health plans use a single fee schedule for both hospital and other outpatient laboratory providers, while several use a different payment methodology for outpatient clinical laboratory claims submitted by hospital laboratories. Where a separate payment methodology is used for hospital laboratories, payment rates are typically based on discounted charges, incurred hospital costs, or other methodology that results in hospital-specific payment rates. Payment rates under these types of hospital payment methodologies are not included in this study.

PPO and POS plans are considered a single type of benefit plan for fee comparison purposes, and fee data for these plans are reported together in a single table. This is done because, often, there are minimal differences in characteristics between PPO and POS plans, and for most of the survey plans, the same fee schedule is used for both PPO and POS benefit plans. Where a particular health plan uses different fee schedules for PPO and POS plans, fees from both fee schedules are included in the reported data. Thus, data from 14 PPO-POS fee schedules are provided in this report, from 10 PPO fee schedules, 3 POS fee schedules that differ from the PPO fee schedules, and 1 independent laboratory fee schedule that differs from the PPO fee schedule used to pay physicians for laboratory services.

Clinical Laboratory Fee Data

Laboratory procedure fee data are presented in most tables both in dollar values and as a proportion of the Medicare fee in the specific geographic area served by the health plan. In interpreting findings regarding comparative laboratory procedure fee levels, the reader is cautioned to note the number of observations (i.e., the number of benefit plan fee schedules for which data are available for the particular procedure code).

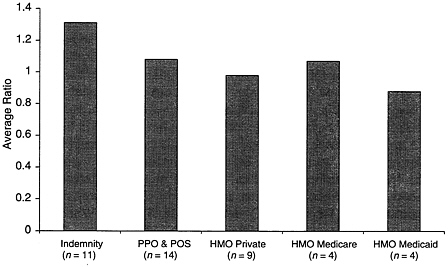

Figure C.1 provides, in bar chart form, summary information on the (unweighted) mean ratio (across procedures and across fee schedules) of health plan fees to Medicare fees for five types of health benefit plans. The ratios are computed without inclusion of the venipuncture procedure (G0001 for Medicare and CPT 36415 for private payers.)

As indicated in the discussion of laboratory service payment systems characteristics, there is considerable variation among private payers as to whether and under what circumstances a separate payment is made for venipuncture. For this reason, we excluded venipuncture from the average fee comparisons shown in Figure C.1.

As expected, Figure C.1 shows that indemnity fees are higher than PPO and POS plan fees, which in turn are higher than private HMO fees. Indemnity and PPO and POS fees are higher than Medicare fees, whereas private HMO fees are lower than Medicare fees. Although Medicare HMO fees appear to be comparable to PPO and POS fees and higher than private HMO fees according to Figure C.1, this may be an aberration due, in part, to only four health plans reporting

FIGURE C.1 Average (mean) ratio of private payer fees to Medicare fees, 2000.

Medicare HMO fees. This is discussed further below. Medicaid HMO fees are the lowest among fees for the five categories of health plans.

Tables C.4 through Table C.8 provide comparative laboratory fee data for each type of health plan. Shown in these tables are various statistics along with the average (mean) ratio of health plan fee to the local area Medicare fee for each of the individual laboratory procedure codes in our sample. All reported means are simple means, not weighted by claims volume or by health plan enrollment. Also shown in these tables for each procedure is the National Limitation Amount (NLA) of the Medicare laboratory fee schedule, which is the maximum fee that can be paid in any locality under this fee schedule. For procedures covered under the Medicare fee schedule for physician services, the fee shown in the NLA column is the maximum Medicare fee among all of the localities represented by the survey health plans.

The average ratio of the health plan fee to the Medicare fee in the health plan’s service area is shown in the last column of Table C.4. Thus, for CPT code 80049, 1.41 represents the average (mean) of the 11 ratios of indemnity plan fee to local Medicare fee for this code. The last row, last column shows the average across procedure codes of these ratios, inclusive and exclusive of the venipuncture procedure (G0001/36415).6 Indemnity health plan fees are shown in Table C.4.

There is considerable variation between the high and low fees among indemnity plans, with the high fee typically eight to ten times higher than the low fee.

The very large indemnity plan fee variation reflects, to a large extent, one indemnity plan using fees based on usual, customary, and reasonable (UCR) charges. Under this plan, the provider has not agreed not to balance-bill the patient for charges in excess of the payer fee. All of the other indemnity plans in the study survey use fee schedules (lower than UCR fees) under provider contracts where the providers have agreed to accept the health plan fee as payment in full, including any required copayments. UCR indemnity plans, although no longer very common, are more prevalent among indemnity plans offered by private health insurance companies (not included among survey plans) than among Blue Cross/Blue Shield plans.

The last rows in Table C.4 show the average ratio of plan fee to Medicare fee, with and without the venipuncture or specimen collection code. As noted above, and discussed in more detail below, some plans pay separately for venipuncture, while others do not. The average ratio of indemnity fee to Medicare fees across all procedures is 1.36 inclusive of test fees that include venipuncture and 1.31 exclusive of test fees that include venipuncture.

In focusing on the average health plan fee to Medicare fee ratios shown in the last column of Table C.4, most ratios are in a relatively narrow range of 1.20 to 1.45, indicating that, on average, indemnity fees are typically 20 to 45 percent higher than area Medicare fees. There is greater variation among the surgical and anatomical procedures paid under the Medicare fee schedule for physician services. For these procedures, the average fee ratio varies from 0.87 to 2.17 among the four procedures for which Medicare fees are available. The average fee ratio for venipuncture among the health plans that pay for this procedure is 2.27.

Table C.5 provides comparative laboratory fee data for PPO and POS plans. This category of health plans represents the largest enrollment among the different types of health benefit plans, for both the United States as a whole and the health plans included in the CHPS survey. It is reported that for those enrolled under employee health benefit plans, 1998 PPO and POS plan enrollment was 98 million while HMO enrollment (not including POS plans) was 59 million in 1998 (Preferred Provider Organization Report, 2000).

For most of the payers that operate both PPO and POS plans, fees are identical for both types, although several use lower fees for POS than for PPO plans. Data for 14 different PPO and POS fee schedules are reported in Table C.5. As indicated above, fees for both a PPO and a POS benefit plan from the same health plan are included in Table C.5 if each type benefit plan uses a different fee schedule.

There is considerable fee variation among different PPO and POS plans, although less so than among indemnity plans. For most laboratory procedure codes, the high fee is two to four times greater than the low fee among the 14 fee schedules.

TABLE C.4 Comparative Indemnity Plan Fees for Selected Clinical Laboratory Services, 2000

|

|

|

|

Indemnity Plans |

Avg. Ratio of Fee to Area Medicare Fee |

|||

|

CPT Code |

No. of Obs. |

Medicare NLA Fee ($) |

Low Fee ($) |

High Fee ($) |

Median Fee ($) |

Mean Fee ($) |

|

|

80049 |

11 |

11.29 |

4.93 |

49.00 |

13.00 |

15.83 |

1.41 |

|

80054 |

11 |

14.61 |

8.06 |

55.00 |

14.25 |

17.95 |

1.25 |

|

80061 |

11 |

18.51 |

10.60 |

70.00 |

20.25 |

23.79 |

1.32 |

|

80092 |

11 |

41.66 |

13.64 |

125.00 |

48.00 |

52.95 |

1.27 |

|

81000 |

11 |

4.37 |

3.04 |

21.00 |

5.00 |

6.84 |

1.56 |

|

83036 |

11 |

13.42 |

7.55 |

52.00 |

15.50 |

17.91 |

1.34 |

|

83970 |

11 |

57.04 |

42.00 |

150.00 |

62.74 |

68.82 |

1.21 |

|

84153 |

11 |

25.42 |

17.19 |

85.00 |

29.25 |

33.60 |

1.32 |

|

84154 |

10 |

25.42 |

17.03 |

100.00 |

27.96 |

35.18 |

1.38 |

|

84443 |

11 |

23.21 |

10.08 |

88.00 |

26.75 |

29.89 |

1.29 |

|

85024 |

11 |

11.70 |

3.60 |

37.00 |

12.87 |

13.50 |

1.21 |

|

85025 |

11 |

10.74 |

3.60 |

37.00 |

12.25 |

12.96 |

1.21 |

|

85610 |

11 |

5.43 |

3.99 |

26.00 |

6.25 |

7.76 |

1.45 |

|

86316 |

11 |

28.76 |

17.55 |

102.00 |

31.64 |

35.73 |

1.24 |

|

87086 |

11 |

11.16 |

6.53 |

46.00 |

12.75 |

14.94 |

1.34 |

|

87536 |

8 |

117.59 |

18.32 |

410.00 |

175.00 |

151.92 |

1.34 |

|

88142 |

9 |

N/A |

5.21 |

65.00 |

25.30 |

29.75 |

N/A |

|

88164* |

11 |

14.60 |

5.21 |

39.00 |

9.00 |

12.70 |

0.87 |

|

88305* |

11 |

86.71 |

30.81 |

240.00 |

74.00 |

88.08 |

1.12 |

|

88307* |

11 |

175.27 |

68.00 |

300.00 |

117.00 |

140.40 |

0.90 |

|

88342* |

11 |

44.52 |

54.58 |

150.00 |

67.00 |

81.63 |

2.17 |

|

G0001/36415* |

7 |

3.00 |

3.00 |

15.00 |

5.00 |

6.82 |

2.27 |

|

Average ratio with G0001 |

1.36 |

||||||

|

Average ratio without G0001 |

1.31 |

||||||

|

N/A = National Medicare fee is not yet available for this code. *Medicare pays for procedure based on the Medicare Fee schedule for physician services. |

|||||||

TABLE C.5 Comparative PPO and POS Plan Fees for Selected Clinical Laboratory Services, 2000

|

|

|

|

PPO and POS Plans |

Avg. Ratio of Fee to Area Medicare Fee |

|||

|

CPT Code |

No. of Obs. |

Medicare NLA Fee ($) |

Low Fee ($) |

High Fee ($) |

Median Fee ($) |

Mean Fee ($) |

|

|

80049 |

14 |

11.29 |

4.93 |

19.00 |

12.25 |

11.65 |

1.04 |

|

80054 |

14 |

14.61 |

5.70 |

23.00 |

14.38 |

13.54 |

0.97 |

|

80061 |

14 |

18.51 |

10.60 |

30.00 |

18.38 |

18.59 |

1.03 |

|

80092 |

14 |

41.66 |

13.64 |

67.00 |

45.00 |

42.87 |

1.05 |

|

81000 |

14 |

4.37 |

3.04 |

10.75 |

5.00 |

5.19 |

1.19 |

|

83036 |

14 |

13.42 |

7.55 |

21.00 |

14.25 |

14.04 |

1.06 |

|

83970 |

14 |

57.04 |

42.00 |

91.00 |

61.50 |

61.41 |

1.08 |

|

84153 |

14 |

25.42 |

19.00 |

41.00 |

29.63 |

28.33 |

1.11 |

|

84154 |

13 |

25.42 |

19.00 |

41.00 |

29.25 |

28.45 |

1.12 |

|

84443 |

14 |

23.21 |

10.08 |

37.00 |

24.00 |

23.40 |

1.03 |

|

85024 |

14 |

11.70 |

3.60 |

19.00 |

12.54 |

11.37 |

1.03 |

|

85025 |

14 |

10.74 |

3.60 |

17.00 |

11.50 |

10.53 |

1.00 |

|

85610 |

14 |

5.43 |

3.87 |

8.00 |

6.00 |

5.66 |

1.06 |

|

86316 |

14 |

28.76 |

17.55 |

46.00 |

29.50 |

29.67 |

1.05 |

|

87086 |

14 |

11.16 |

6.53 |

18.00 |

11.88 |

11.58 |

1.07 |

|

87536 |

11 |

117.59 |

18.32 |

210.00 |

150.00 |

115.26 |

1.40 |

|

88142 |

12 |

N/A |

5.21 |

45.00 |

19.00 |

25.52 |

N/A |

|

88164* |

14 |

14.60 |

5.21 |

14.00 |

9.00 |

9.87 |

0.70 |

|

88305* |

14 |

86.71 |

30.81 |

101.00 |

74.00 |

73.76 |

0.97 |

|

88307* |

14 |

175.27 |

68.00 |

176.00 |

125.00 |

126.83 |

0.85 |

|

88342* |

14 |

44.52 |

51.67 |

83.00 |

63.16 |

71.44 |

1.87 |

|

G0001/36415* |

10 |

3.00 |

3.00 |

15.00 |

5.25 |

7.25 |

2.35 |

|

Average ratio with G0001 |

1.14 |

||||||

|

Average ratio without G0001 |

1.08 |

||||||

|

N/A = National Medicare fee is not yet available for this code. *Medicare pays for procedure based on the Medicare Fee schedule for physician services. |

|||||||

Similar to the indemnity plan fee data, the average PPO and POS to Medicare fee ratio is within a relatively narrow range for most laboratory procedure codes, ranging from 1.00 to 1.12. Variation in this ratio is greatest among the anatomical and surgical pathology codes that are paid for by Medicare under its fee schedule for physician services.

The average ratio of PPO or POS plan fee to Medicare fee across all procedure codes is 1.08 (excluding venipuncture). Thus, PPO and POS laboratory fees (unweighted by volume) are 8 percent higher than Medicare fees. It was noted with reference to comparative fee data in both Tables C.4 and C.5 that there is less variation in the ratio of private health plan fee to Medicare fee for laboratory procedures that are included in Medicare’s laboratory fee schedule than for those that are included in its RBRVS fee schedule. One possible explanation for this is that many private payers set their laboratories’ fees as a fixed proportion of fees in the Medicare laboratory fee schedule (see “Laboratory Payment System Characteristics), while it is hypothesized, that many payers use the Medicare RBRVS fee schedule in a less structured way. If this hypothesis is correct, less variation can be expected in the private payer to Medicare fee ratio among procedures that are included in the Medicare laboratory fee schedule than among those that are not.

It was noted earlier that four laboratory procedure codes were designated in the administration’s FY 2001 budget to have their national payment limit reduced by 30 percent. These codes are shown below, along with the average ratio of PPO and POS plan fee to Medicare fee:

|

Code |

Ratio |

|

83036 |

1.06 |

|

84153 |

1.11 |

|

84443 |

1.03 |

|

87086 |

1.07 |

The ratios of PPO or POS plan fee to Medicare fee for these four codes are on average very close to the ratio for all laboratory test procedures (1.07 versus 1.08).

Table C.6 provides data for private HMO plans. On average, private HMO fees are very close to Medicare fees. For most procedure codes, the average ratio of private HMO to Medicare fee is within a range of 0.94 to 1.09. As with indemnity and PPO or POS benefit plans, variation in the average fee ratio is greatest for the anatomical and surgical pathology codes. Across all procedure codes, the average private HMO to Medicare fee ratio is 0.98 (1.01 including venipuncture).

Table C.7 provides fee data for four Medicare HMO plans. Only four of the ten payers that participated in the survey provided fee data for Medicare HMO plans. Because of the limited number of fee schedules and also because one of the four health plans pays higher fees under its private and Medicare HMO plans than it does under its non-managed care plans, the average Medicare HMO to

TABLE C.6 Comparative Private HMO Plan Fees for Selected Clinical Laboratory Services, 2000

|

|

|

|

Private HMO Plans |

Avg. Ratio of Fee to Area Medicare Fee |

|||

|

CPT Code |

No. Obs. |

Medicare NLA Fee ($) |

Low Fee ($) |

High Fee ($) |

Median Fee ($) |

Mean Fee ($) |

|

|

80049 |

9 |

11.29 |

4.93 |

22.98 |

11.29 |

10.93 |

0.97 |

|

80054 |

9 |

14.61 |

5.70 |

36.76 |

13.00 |

13.83 |

0.97 |

|

80061 |

9 |

18.51 |

10.60 |

31.43 |

18.25 |

17.64 |

1.01 |

|

80092 |

9 |

41.66 |

13.64 |

54.59 |

42.00 |

39.06 |

0.94 |

|

81000 |

9 |

4.37 |

3.04 |

10.75 |

4.00 |

4.77 |

1.09 |

|

83036 |

9 |

13.42 |

7.55 |

19.85 |

13.00 |

12.86 |

0.97 |

|

83970 |

9 |

57.04 |

42.00 |

86.85 |

57.00 |

56.68 |

0.99 |

|

84153 |

9 |

25.42 |

18.69 |

41.36 |

26.69 |

27.64 |

1.09 |

|

84154 |

8 |

25.42 |

17.03 |

30.00 |

26.35 |

25.80 |

1.01 |

|

84443 |

9 |

23.21 |

10.08 |

33.20 |

19.00 |

20.40 |

0.88 |

|

85024 |

9 |

11.70 |

3.60 |

15.71 |

10.00 |

9.15 |

0.83 |

|

85025 |

9 |

10.74 |

3.60 |

14.24 |

10.00 |

8.72 |

0.82 |

|

85610 |

9 |

5.43 |

3.87 |

6.62 |

5.00 |

5.12 |

0.96 |

|

86316 |

9 |

28.76 |

17.55 |

49.63 |

27.00 |

27.83 |

0.97 |

|

87086 |

9 |

11.16 |

6.53 |

16.54 |

11.00 |

10.37 |

0.93 |

|

87536 |

7 |

117.59 |

18.32 |

175.00 |

150.00 |

111.26 |

1.00 |

|

88142 |

7 |

N/A |

5.21 |

23.00 |

14.00 |

14.60 |

N/A |

|

88164* |

9 |

14.60 |

5.21 |

12.00 |

8.94 |

9.18 |

0.63 |

|

88305* |

9 |

86.71 |

30.81 |

91.00 |

64.00 |

64.73 |

0.85 |

|

88307* |

9 |

175.27 |

68.00 |

158.25 |

108.75 |

109.69 |

0.72 |

|

88342* |

9 |

44.52 |

45.00 |

158.66 |

56.52 |

69.47 |

1.91 |

|

G0001/36415* |

6 |

3.00 |

3.00 |

10.00 |

4.05 |

5.02 |

1.67 |

|

Average ratio with G0001 |

1.01 |

||||||

|

Average ratio without G0001 |

0.98 |

||||||

|

N/A: National Medicare fee is not yet available for this code. *Medicare pays for procedure based on the Medicare Fee schedule for physician services. |

|||||||

TABLE C.7 Comparative Medicare HMO Plan Fees for Selected Clinical Laboratory Services, 2000

|

|

|

|

Medicare HMO Plans |

Avg. Ratio of Fee to Area Medicare Fee |

|||

|

CPT Code |

No. Obs. |

Medicare NLA Fee ($) |

Low Fee ($) |

High Fee ($) |

Median Fee ($) |

Mean Fee ($) |

|

|

80049 |

4 |

11.29 |

4.93 |

22.98 |

12.65 |

13.30 |

1.18 |

|

80054 |

4 |

14.61 |

8.06 |

36.76 |

13.00 |

17.71 |

1.26 |

|

80061 |

4 |

18.51 |

12.63 |

31.43 |

18.50 |

20.27 |

1.22 |

|

80092 |

4 |

41.66 |

13.64 |

54.59 |

41.50 |

37.81 |

0.91 |

|

81000 |

4 |

4.37 |

3.04 |

5.79 |

5.00 |

4.71 |

1.08 |

|

83036 |

4 |

13.42 |

7.55 |

19.85 |

13.50 |

13.60 |

1.03 |

|

83970 |

4 |

57.04 |

48.76 |

86.85 |

63.50 |

65.65 |

1.15 |

|

84153 |

4 |

25.42 |

21.77 |

41.36 |

30.00 |

30.78 |

1.21 |

|

84154 |

3 |

25.42 |

17.03 |

30.00 |

25.70 |

24.24 |

0.95 |

|

84443 |

4 |

23.21 |

10.08 |

33.20 |

23.50 |

22.57 |

0.97 |

|

85024 |

4 |

11.70 |

3.90 |

15.71 |

11.00 |

10.40 |

0.92 |

|

85025 |

4 |

10.74 |

3.79 |

14.24 |

10.00 |

9.51 |

0.89 |

|

85610 |

4 |

5.43 |

3.99 |

6.62 |

6.00 |

5.65 |

1.06 |

|

86316 |

4 |

28.76 |

21.77 |

49.63 |

29.50 |

32.60 |

1.13 |

|

87086 |

4 |

11.16 |

6.53 |

16.54 |

10.50 |

11.02 |

0.99 |

|

87536 |

4 |

117.59 |

18.32 |

175.00 |

96.25 |

96.46 |

0.88 |

|

88142 |

4 |

N/A |

5.21 |

59.00 |

18.39 |

25.25 |

N/A |

|

88164* |

4 |

14.60 |

5.21 |

14.00 |

9.53 |

9.57 |

0.66 |

|

88305* |

4 |

86.71 |

30.81 |

84.00 |

66.89 |

62.15 |

0.80 |

|

88307* |

4 |

175.27 |

68.00 |

147.00 |

112.65 |

110.08 |

0.71 |

|

88342* |

4 |

44.52 |

52.78 |

158.66 |

66.00 |

85.86 |

2.33 |

|

G0001/36415* |

3 |

3.00 |

3.00 |

12.00 |

4.60 |

6.53 |

2.18 |

|

Average ratio with G0001 |

1.12 |

||||||

|

Average ratio without G0001 |

1.07 |

||||||

|

N/A: National Medicare fee is not yet available for this code. *Medicare pays for procedure based on the Medicare Fee schedule for physician services. |

|||||||

TABLE C.8 Comparative Medicaid HMO Plan Fees for Selected Clinical Laboratory Services, 2000

|

|

|

|

Medicaid HMO Plans |

Avg. Ratio of Fee to Area Medicare Fee |

|||

|

CPT Code |

No. Obs. |

Medicare NLA Fee ($) |

Low Fee ($) |

High Fee ($) |

Median Fee |

Mean Fee |

|

|

80049 |

4 |

11.29 |

4.93 |

12.00 |

11.27 |

9.87 |

0.88 |

|

80054 |

4 |

14.61 |

8.06 |

13.00 |

11.73 |

11.13 |

0.81 |

|

80061 |

4 |

18.51 |

12.63 |

19.00 |

14.60 |

15.21 |

0.92 |

|

80092 |

4 |

41.66 |

13.64 |

44.00 |

37.28 |

33.05 |

0.79 |

|

81000 |

4 |

4.37 |

3.04 |

5.00 |

4.00 |

4.01 |

0.92 |

|

83036 |

4 |

13.42 |

7.55 |

14.00 |

11.25 |

11.01 |

0.83 |

|

83970 |

4 |

57.04 |

48.76 |

59.00 |

57.50 |

55.69 |

0.98 |

|

84153 |

4 |

25.42 |

21.77 |

30.00 |

26.00 |

25.94 |

1.02 |

|

84154 |

3 |

25.42 |

17.03 |

26.00 |

26.00 |

23.01 |

0.91 |

|

84443 |

4 |

23.21 |

10.08 |

24.00 |

20.50 |

18.77 |

0.81 |

|

85024 |

4 |

11.70 |

3.90 |

12.00 |

7.00 |

7.48 |

0.67 |

|

85025 |

4 |

10.74 |

3.79 |

12.00 |

9.35 |

8.62 |

0.81 |

|

85610 |

4 |

5.43 |

3.99 |

6.00 |

5.00 |

5.00 |

0.93 |

|

86316 |

4 |

28.76 |

21.77 |

30.00 |

26.85 |

26.37 |

0.92 |

|

87086 |

4 |

11.16 |

6.53 |

11.00 |

9.50 |

9.13 |

0.82 |

|

87536 |

4 |

117.59 |

18.32 |

175.00 |

68.13 |

82.39 |

0.73 |

|

88142 |

4 |

N/A |

5.21 |

28.20 |

13.00 |

14.85 |

N/A |

|

88164* |

4 |

14.60 |

5.21 |

14.00 |

7.05 |

8.33 |

0.57 |

|

88305* |

4 |

86.71 |

30.81 |

84.00 |

51.00 |

54.20 |

0.71 |

|

88307* |

4 |

175.27 |

54.00 |

147.00 |

89.00 |

94.75 |

0.62 |

|

88342* |

4 |

44.52 |

15.00 |

158.66 |

61.50 |

74.17 |

2.04 |

|

G0001/36415* |

3 |

3.00 |

1.50 |

10.00 |

3.00 |

4.83 |

1.61 |

|

Average ratio with G0001 |

0.92 |

||||||

|

Average ratio without G0001 |

0.88 |

||||||

|

N/A: National Medicare fee is not yet available for this code. *Medicare pays for procedure based on the Medicare Fee schedule for physician services. |

|||||||

Medicare ratios should not be considered reliable.7 The average fee ratio among the four Medicare HMO plans, across all procedures, is 1.07 (1.12 including venipuncture).

Table C.8 provides fee data for Medicaid HMO plans, reflecting the experience of four such plans. On average, Medicaid HMO fees are 12 percent lower than Medicare fees (8 percent including venipuncture).

Summary data for each of the health plans that participated in the survey are provided in Table C.9. Shown in Table C.9, separately for each payer and— within payer—for each benefit plan type, is the average ratio (across procedures) of benefit plan fee to Medicare fee.8 Of interest is the pattern of fee variation within benefit plan type among the different payers. Also of interest is the fact that a majority of payers use the same fee schedule for different benefit plan types. Some payers use the same fee schedule for all of their benefit plans (Plans C, I, and J), whereas others use the same fee schedule for some but not all of their benefit plans (Plans B, D, F, and H). Some payers face unique contractual, regulatory, or other factors that can affect their fees under specific benefit plans. For example, payer B currently uses a higher fee schedule for its private and Medicare HMO plans than for its indemnity, PPO, and POS plans as a result of a temporary regulatory constraint on adjusting fees. This situation, we are told, is changing and HMO laboratory fees will be reduced in the near future.

Clinical Laboratory Capitation Data

The surveyed payers were asked to provide clinical laboratory service capitation payment data for their managed care plans in addition to fee data. Four of the ten payers that responded to the survey indicated that they use capitation for clinical laboratory services for at least one of their benefit plans. These health plans provided PMPM capitation rates. Table C.10 lists the rates and other characteristics of the capitation programs used by the four health plans.

The average capitation rate among the four health plans is $0.74. This is reasonably close to the $0.81 average PMPM clinical laboratory service capitation rate cited by Klipp (2000), based on a national survey of 700 HMOs in the fall of 1998. The reported PMPM clinical laboratory capitation rates in our sur-

|

7 |

CHPS has been told by payment system staff at this Blue Cross/Blue Shield plan that the relatively high Medicare HMO fee is a temporary anomaly that will be changed shortly. |

|

8 |

The ratios shown in Table C.9 do not include venipuncture. Also, the average ratios by benefit plan type (shown at the bottom of the table) are slightly different from those shown in Tables C.4 through C.8. This is due to the combined effects of (1) computing the average ratio across health plans in Table C.9 and computing the average ratios across procedures in Tables C.4 through C.8, and (2) missing fee data for some procedures, resulting in a different weighting of fee ratios between the two calculation approaches. |

TABLE C.9 Average Ratio of Private Payer Fees to Medicare Fees Across Different Benefit Plans

|

Plan |

Indemnity/ Medicare |

PPO/ Medicare |

POS/ Medicare |

HMO/ Medicare |

HMO Medicare/ Medicare |

HMO Medicaid/ Medicare |

|

A |

1.21 |

1.08 |

|

0.94 |

|

|

|

B |

1.11 |

1.00 |

1.00 |

1.42 |

1.42 |

0.80 |

|

C |

0.91 |

0.91 |

|

|||

|

D |

1.57 |

1.57 |

1.31 |

1.01 |

|

|

|

E |

3.54 |

1.37 |

0.86 |

|

||

|

F1* |

1.06 |

0.71 |

0.71 |

0.71 |

|

|

|

F2* |

0.73 |

0.67 |

0.67 |

0.67 |

|

|

|

G |

0.73 |

0.73 |

0.73 |

0.73 |

0.73 |

0.73 |

|

H |

1.08 |

1.08 |

1.06 |

0.95 |

1.06 |

0.95 |

|

I |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

|

J |

1.21 |

1.21 |

1.21 |

1.21 |

|

|

|

Average |

1.29 |

1.03 |

0.95 |

0.96 |

1.05 |

0.87 |

|

*Plan F submitted separate laboratory fee data for physicians and independent laboratories. |

||||||

TABLE C.10 Characteristics of Clinical Laboratory Service Capitation Programs, 2000

|

Benefit Plans |

PMPM Capitation Rate ($) |

Excluded Clinical Laboratory Services |

|

POS plan |

0.83 |

Surgical pathology |

|

POS, private HMO, Medicare HMO |

0.76 |

None |

|

Private HMO |

0.62 |

Cytology, histology |

|

Private HMO |

0.73 |

Urinalysis, complete blood count |

vey are each less than 1 percent of typical HMO PMPM premiums for all medical services of $120–$150.9

The four health plans that reported use of laboratory service capitation have diverse characteristics. They operate in highly urbanized and less urbanized environments, in markets with significantly different degrees of managed care plan penetration, and in three of the four geographic regions of the United States.

Comparison of Fees

It is of interest to compare the clinical laboratory fee data obtained in this study with current fee data from other sources. We identified one published source of relatively current fee data for clinical laboratory services. Lab Industry Strategic Outlook, published by Washington G-2 Reports, provides 1999 data on “managed care” fees for 20 laboratories in five cities based on payer fee surveys conducted by Caredata (Klipp, 2000). G-2 Reports provides three fees for each of the 20 procedure codes—high, typical, and low.

Four of the G-2 Reports procedure codes match procedure codes included in this survey, and two of the five cities in the G-2 Reports are in market areas represented by the Blue Cross/Blue Shield payers in this survey. We compared the 2000 CHPS PPO and POS fees with the 1999 G-2 Reports fees for the four procedures in the two cities. The following summarizes the results of the 12 fee comparison:10

-

for 10 of 12 fees, the CHPS fee was within G-2 Reports’ low to high range; and

-

for 8 of 12 fees, the CHPS fee was closer to the “typical” fee reported by G-2 Reports than to the low or high fee.

Based on the limited comparison of the CHPS survey fee data and the fee data included in G-2 Reports, the CHPS survey fees are certainly consistent with other fee survey data. Medicare fees fall within the range of fee schedules reported in the CHPS survey.

It was noted earlier that all of the private payers that participated in this survey are Blue Cross/Blue Shield payers. CHPS’ experience with Blue Cross/Blue Shield payers, as well as with other payers, indicates that there is considerable variation among localities in whether the Blue Cross/Blue Shield payers are among the lower payers, or the higher payers, to providers. Although this cannot be proved without considerably more research, it is the author’s view that the payer fee data reported in this study are not substantially different than aggregate payer experience for the indemnity, PPO and POS, and private HMO benefit plans.

CHARACTERISTICS OF LABORATORY SERVICE PAYMENT SYSTEMS

Survey Approach

In addition to comparative payment data, payers were also asked to provide information relating to characteristics of their provider payment systems. This information was obtained via responses to the written payer survey attached as Exhibit C.1, as well as responses to subsequent questions addressed to survey participants.

We are highly confident that accurate descriptions of payment characteristics were obtained for the payers’ PPO benefit plans, based on the written responses to the surveys as well as additional information provided in subsequent telephone and e-mail follow-up communications. For most of the survey payers, much if not all of the payment system features used for PPO programs are also applicable to the health plans’ indemnity and POS benefit plans.

Laboratory Payment System Characteristics

Table C.11 summarizes payment system characteristics for PPO benefit plans. For most health plans, this information would be similar for all of their benefit plans that pay for laboratory services based on fee for service, specifically, their indemnity, POS, and to some extent, HMO plans.11

The first row of Table C.11 addresses the issue of whether the health plan requires that a diagnosis be provided on the claim for clinical laboratory service

|

11 |

Payment system characteristics are provided in Table C.11 for nine health plans that reported useful data. |

in order for the claim to be paid. Although all health plans request diagnosis codes on their laboratory claims, two of the nine plans will pay the claim if diagnosis is missing.

The second issue addressed in Table C.11 is whether there are some clinical laboratory tests for which payment will not be made by the plan unless one or more specific diagnoses appear on the claim. Four of the nine health plans require specific diagnoses in order to approve coverage for selected laboratory tests.

Medicare and Medicaid do not allow payment to a provider for a laboratory test unless the provider has actually performed the test. In addition, several states have enacted laws imposing a similar payment restriction that is applicable to private payers. Thus, under Medicare, Medicaid, and private insurance and self-pay situations in a minority of states, a physician cannot bill for a test that is sent out to be performed by an independent laboratory. Two-thirds of the reporting health plans allow payment to the physician for tests that the physician purchases from other providers, regardless of the price paid by the physician for the tests.

The fourth row in Table C.11 addresses whether the health plan makes a separate payment for venipuncture, in addition to paying for the test itself and for an office visit (if it occurs). Payment for venipuncture varies across the plans. Two health plans allow payment for venipuncture under all circumstances; two plans never allow it; four plans allow payment only when the provider is not also billing for the test; and one plan allows payment only in the physician office setting but not in the independent or hospital laboratory setting.

In the previous chapter, we have noted that for most PPO and POS plans, the relative fee structure among the laboratory procedure codes that are covered under the Medicare laboratory fee schedule is very similar to Medicare’s relative fee structure. It turns out that this is no coincidence. Six of the nine health plans report that they use Medicare fees as a basis for setting their own fees for a significant portion of their laboratory services. However, these health plans’ fees may be set at a specific percentage above or below Medicare fees, and the fees may not be updated when Medicare fees are updated.

The next issue relates to whether the health plans use different fee schedules for laboratory service claims submitted by physicians and by independent laboratories. Five of the nine health plans use the same fee schedule for both physicians and independent laboratories. The remaining four health plans pay lower fees to at least some independent laboratories (not necessarily all) with whom they have contracts than they do to physicians.

The fee comparison tables provided earlier include separate independent laboratory fee schedules for only one health plan. This health plan, which operates in a state that does not allow payment for laboratory tests to a provider that has not performed the test, is the only health plan that submitted separate independent laboratory fee schedule data. The lack of inclusion in the fee comparison tables of additional independent laboratory fee data for other health plans that use a separate laboratory fee schedule may result in an upward bias in the reported health plan fees. However, this bias may be small since, based on pre-

vious analyses performed for Blue Cross/Blue Shield plans, most payments for laboratory services made by health plans that allow payments to physicians for tests performed by independent laboratories, are made to the physicians.

The last issue addressed in Table C.11 is whether health plans pay higher fees to hospital laboratories than they do to physicians. Five of the nine health plans pay hospitals different fees (typically, higher fees) for outpatient tests than the fees paid to physicians. For most of these health plans, payments are based on a cost reimbursement formula, on discounted hospital charges, or on special fee arrangements negotiated with specific hospitals. The fee comparison tables (Tables C.4–C.8) do not include any of these special fee arrangements for laboratory tests provided by hospital laboratories.

REFERENCES

Interstudy. 1999. Competitive Edge, Part III: Regional Market Analysis, Interstudy.

Klipp, J. 2000. Lab Industry Strategic Outlook 2000: Market Trends and Analysis, Washington, DC: Washington G-2 Reports.

Preferred Provider Organization Report: 1999 Edition. 2000. Chicago: American Association of Preferred Provider Associations.

TABLE C.11 Summary of Laboratory Service Payment System Characteristics for PPO Plans, 2000

|

Payment System Characteristics |

Health Plan A |

Health Plan B |

Health Plan C |

Health Plan D |

Health Plan E |

Health Plan F |

Health Plan G |

Health Plan H |

Health Plan I |

|

Requires diagnosis for payment of claim |

Yes |

Yes |

No |

Yes |

Yes |

Yes |

Yes |

No |

Yes |

|

Requires specific diagnosis for payment for selected tests |

No |

No |

Yes |

Yes |

No |

No |

No |

Yes |

Yes |

|

Allows physician to bill for test performed by another lab |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

No |

Yes |

No |

|

Pays separately for venipuncture (G0001/36415) |

Noa |

Noa |

No |

Yes |

Yes |

Yesb |

No |

Noa |

Noa |

|

Fee schedule based on Medicare fees |

No |

Yes |

Yes |

Yes |

Yes |

No |

No |

Yes |

Yes |

|

Pays higher fees to physicians than to independent labs |

No |

No |

No |

No |

Yes |

Yes |

Yes |

No |

Yesc |

|

Pays higher fees to hospital than to physicians |

Yes |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

|

aPayment is not made for venipuncture to a provider that submits a claim for the laboratory tests. Payment is made to a physician if another provider submits a claim for tests. bVenipuncture is paid for only in the physician office setting, regardless of whether the physician performs the test or it is sent out to an independent or hospital laboratory. cAs of December 1, 2000, the same fee schedule will be used for all laboratory types. |

|||||||||

EXHIBIT C.1: SURVEY INSTRUMENT FOR STUDY OF PAYMENT RATES FOR LABORATORY SERVICES

All information and data provided in this survey will be kept strictly confidential, within CHPS Consulting including the identification of health plans participating in the survey.

If you have any questions regarding this survey, please contact Zach Dyckman, Project Director, at:

Phone: (410) 715–9400 x320

Fax: (410) 715–9718

E-mail: zdyckman@chpsconsulting.com

Please return the completed form on or before March 25, 2000.

Dr. Zachary Dyckman

The Center for Health Policy Studies

10440 Little Patuxent Parkway, 10th Floor

Columbia, MD 21044

Responses to questions and payment data can be provided on this survey form, on separate pages, or through E-mail. If you use E-mail, please print out and return a copy of your responses to Dr. Dyckman, via Fax or mail.

Thank You

Section I. Background and General Description of Laboratory Payment Methodologies

-

Name of Health Plan: ________________________________________________

-

Individual primarily responsible for completing survey:

Name and title ______________________________________________________

Phone ______________FAX __________________________________________

E-mail address ______________________________________________________

-

Briefly describe the laboratory payment methodology used by each of your different types of benefit plans, e.g., indemnity, PPO, POS, HMO (private), HMO (Medicare, Medicaid), etc. Indicate whether you use a fee schedule, negotiated fees, discount on charges, capitation, or some other methods for each specific type of benefit plan.

_________________________________________________________________

_________________________________________________________________

-

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

-

Do you use different fees and/or different methods for setting fees for different types of lab providers, e.g., physicians, hospital labs, independent labs? If so, discuss briefly. Do you have an additional payment for “STAT” tests? Do you pay for venipuncture (specimen collection)? If so, indicate the code used and any restrictions that may exist for payment.

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

-

What documentation do you require from laboratories for payment of claims?

(Please attach copies of lab claim forms)

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

-

If capitation rates are used for lab services, do they cover all tests in the CPT 80000 range or are some types of tests excluded? Do capitation rates for the lab include specimen collection in the physician’s office and other specimen handling services? Do capitation rates to the lab differ by age, sex, or other member characteristics? Are risk corridors used for labs?

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

-

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

-

Please describe any other important characteristics of your payment methodology for laboratory tests.

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

Section II. Fee-for-Service Plans

Please provide in Table A, below, current fees paid (inclusive of patient copays) for the listed laboratory test codes under your benefit programs that pay for laboratory tests based on fee-for-service. Information on capitated payments for laboratory tests is requested in Section III. Provide fees for the following types of plans:

Indemnity

PPO

POS

HMO—private (nongovernment patients)

HMO—Medicare

HMO—Medicaid

If you use different fee schedules within one type of benefit plan (e.g., different fee schedules are used for two different HMO plans), provide the fees for the benefit plan with the largest enrollment. If you use different fee schedules for different markets, please make additional copies of Table A and provide data for each market area.

If different lab fees are used for different provider types (e.g., physicians, independent labs, and hospital labs), provide test fees for each and indicate how fees differ for other provider types (e.g., 10 percent higher for physicians than for independent labs).

If you use the same fee schedule for different types of plans (e.g., PPO and POS), provide the requested fee data for one plan and indicate with an asterisk that the same fees are used for the other plan(s).

TABLE A Laboratory Test Fees, 2000

|

CPT Code |

Indemnity Plan |

PPO Plan |

POS Plan |

HMO Plan (Private) |

HMO (Medicare) |

HMO (Medicaid) |

|

*G0001 |

$ |

$ |

$ |

$ |

$ |

$ |

|

80049 |

|

|||||

|

80054 |

|

|||||

|

80061 |

|

|||||

|

80092 |

|

|||||

|

81000 |

|

|||||

|

83036 |

|

|||||

|

83970 |

|

|||||

|

84153 |

|

|||||

|

84154 |

|

|||||

|

84443 |

|

|||||

|

85024 |

|

|||||

|

85025 |

|

|||||

|

85610 |

|

|||||

|

86316 |

|

|||||

|

87086 |

|

|||||

|

87536 |

|

|||||

|

88142 |

|

|||||

|

88164 |

|

|||||

|

88305 |

|

|||||

|

88307 |

|

|||||

|

88342 |

|

|||||

|

*G0001 (Medicare Code), or other code used for venipuncture-specimen collection. |

||||||

Section III. Capitated Plans

For health benefit plans for which laboratory capitation is used, please provide in Table B, below, the monthly capitation rates (PMPM) used. Note, space is

provided to list full or partial (some lab services excluded) laboratory capitation rates.

TABLE B PMPM Laboratory Test Capitation Rates, 2000

Section IV. Additional Comments

Please provide any additional information that you believe will be helpful in our understanding of your laboratory payment methodologies.

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________