2

Background and Environmental Trends

This chapter provides background on the clinical laboratory industry and analyzes trends in the health care environment that have affected the cost of providing clinical laboratory services, the quality of those services, and beneficiary access to care. An understanding of these factors, in addition to an appreciation of anticipated trends in laboratory technology (discussed in greater detail in Chapter 3) is necessary to design a forward-thinking, effective Medicare outpatient clinical laboratory payment system and anticipate its likely effects.1

A cautionary note is necessary at the beginning of this chapter. Reliable descriptive data on the clinical laboratory industry are extremely limited, and any picture the committee attempts to paint will be frustratingly hazy.2 There are a number of factors that influence the quality of available data. First, no single industry association or public agency oversees all aspects of this industry, and there is no unique census Standard Industrial Classification (SIC) business code

for clinical laboratory services; therefore, there are no standard data sources or common definitions used for data that are collected. Second, large companies and hospitals often provide other laboratory services in addition to clinical laboratory testing, and these services may be included in aggregate data for laboratory testing.3 Finally, laboratory services are only a small segment of a hospital’s or physician’s business and often are not calculated or are reported separately. Where necessary, this chapter cites several data sources when there is no obvious “right” one. The general direction of the trends described in this chapter is more important than the exact values of various figures.

BACKGROUND ON THE CLINICAL LABORATORY INDUSTRY

The clinical laboratory industry is very diverse. Understanding the different types of laboratories, their markets, and the types of services they provide is critical because each has an effect on the cost and quality of laboratory services, as well as beneficiary access to care. This section discusses the number, types, and geographic distribution of laboratories; testing volume; revenue distribution by type of laboratory; and an analysis of the trends in spending for laboratory services in relation to other health care services. It concludes with an analysis of the financial strength of the industry.

Sites of Service

In 1999, 170,102 laboratories conducted 5.7 billion laboratory tests for both inpatients and outpatients in the United States (Tables 2.1 and 2.2). There are three main types of laboratories that provide clinical laboratory services: hospital-based, independent, and physician office laboratories (POLs).

-

Hospital-based laboratories: Hospital-based laboratories conduct more tests than all other types of laboratories combined. They serve primarily the inpatient and outpatient testing needs of their hospital but may also conduct tests for patients not seen at their hospital, typically called “outreach testing.” In 1999, 8,560 hospital-based laboratories (Table 2.1) conducted almost 3 billion laboratory tests (Table 2.2). There are many more hospital-based laboratories than there are hospitals in the U.S. because some hospitals operate more than one laboratory. Independent laboratories run some hospital-based laboratories.

-

Independent laboratories: Independent laboratories conduct tests for physicians, hospitals, and other health care providers. These laboratories tend to be regional in nature, with single companies operating multiple laboratory fa-

TABLE 2.1 Number of Laboratories by Type of Facility; 1999-Early 2000

|

Type of Facility |

Number of Laboratories |

Percentage of Total |

|

Hospital laboratories |

8,560 |

5 |

|

Independent laboratories |

4,936 |

3 |

|

Physician office laboratories |

105,089 |

62 |

|

Other |

51,517 |

30 |

|

Total |

170,102 |

|

|

SOURCE: Health Care Financing Administration, 2000a. |

||

TABLE 2.2 Test Volume by Type of Facility; 1999-Early 2000

-

cilities. In 1999, 4,936 independent laboratories (Table 2.1) conducted almost 1.5 billion laboratory tests in the United States (26 percent) (Table 2.2). The number of independent laboratories is somewhat misleading because independent laboratories underwent rapid corporate consolidation during the 1990s, resulting in two large national and many other smaller independent laboratories.4 Multiple laboratories that may be counted separately are actually part of one corporate entity.

-

Physician office laboratories: POLs generally conduct relatively simple or moderately complex tests to provide immediate, on-site results to physicians. At 105,089, there are far more POLs than other types of laboratories (Table 2.1). While many POLs conduct only the most simple laboratory tests and have very

-

low test volume, others may serve large group practices and provide a range of tests at volumes comparable to those of independent laboratories.

-

Other laboratories: The remaining laboratories include testing facilities at end-stage renal disease (ESRD) centers, home health agencies, nursing homes, and other sites. Although these “other laboratories” account for slightly more than 30 percent of all laboratory facilities (Table 2.1), they conduct only 10 percent of all laboratory tests (Table 2.2) and are often not paid out of the Medicare outpatient laboratory benefit. Trends in numbers of laboratories and testing volume broken down by more specific type of service provider are presented in Appendix D.

Since some types of tests are complex or require special expertise, they may be sent from one laboratory to another. Laboratories that conduct tests for other laboratories are called “reference” laboratories. Reference laboratories are usually large and may be independent or hospital based. Some tests are so uncommon, complex, expensive, and dependent on specialized interpretation skill that they are labeled “esoteric.” Some tests previously considered esoteric, such as polymerase chain reaction (PCR) testing for HIV, have become so common that the esoteric label no longer applies. Laboratories that specialize in esoteric testing are usually affiliated with a university or research institution but may be independent.

Geographic Distribution

Clinical laboratories in the United States are geographically distributed much like the population. According to a 1995 summary report of the Clinical Laboratory Improvement Advisory Committee of the Centers for Disease Control and Prevention (CDC), Texas and California have the greatest number of laboratories, while Midwestern and rural New England states have the lowest concentration (CDC, 1995).

Size and Distribution of the Market

The clinical laboratory industry is a $30 billion to $35 billion industry5 (Dyckman and Cassidy, 2000; Klipp, 2000; Merrill Lynch, 1999) representing approximately 3.5 percent of the $1.0 trillion in total personal health care expenditures in the United States in 1998. Based on recent pricing trends, CHPS Consulting estimates that expenditures on laboratory tests in 1999 are expected to be 3–6 percent higher than for 1998 (Dyckman and Cassidy, 2000). Because hospitals are paid for inpatient care based largely on per-case and per diem payment methodologies, rather than on a fee-for-service (FFS) basis, payments for laboratory services provided in the inpatient setting are included within

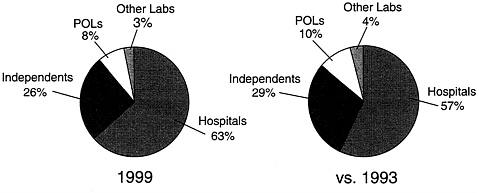

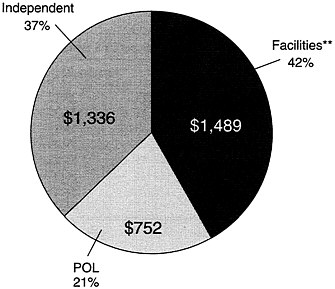

FIGURE 2.1 Laboratory industry revenue by segment, 1999. SOURCE: Klipp (2000).

payments for more broadly defined services. This is explained further in the discussion of environmental trends below.

Not surprisingly, hospital-based laboratories, which have the highest test volume, also have the largest market share in terms of revenue. Industry sources put the hospital-based market share at 63 percent for 1999. This is an increase from the estimated 57 percent share it held in 1993 (Figure 2.1). Independent laboratories hold about 26 percent of the market share, while “other” laboratories account for only 3 percent. Although POLs represent about 11 percent of test volume, they receive only 8 percent of the revenue because they tend to perform simpler, less expensive tests.

Trends in Expenditures for Laboratory Services

The early 1980s was a period of significant health care inflation, and during that time, clinical laboratories benefited from favorable payment policies. Beginning with implementation of the inpatient prospective payment system (PPS) in the mid-1980s, and with the growth of managed care in the late 1980s and 1990s, changes to both governmental and nongovernmental payment systems helped rein in health care spending and bring health care inflation back into the single digits.

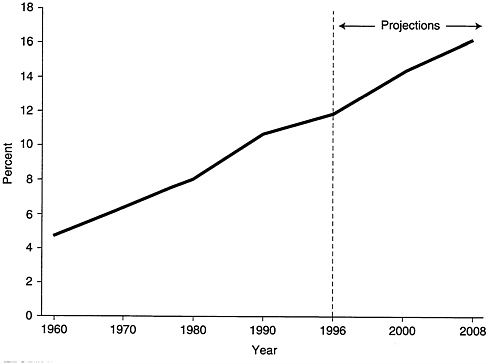

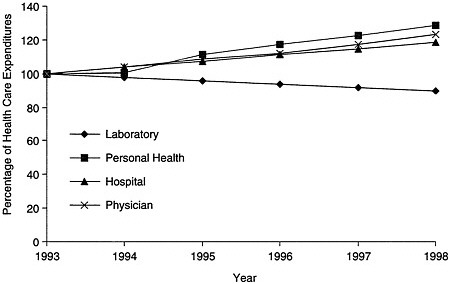

Expenditures for laboratory services have been particularly affected by efforts to control health care costs. While the rate of growth in national health expenditures has slowed, actual expenditures for most categories of health care spending have continued to increase even when controlling for inflation (Figure 2.2). In contrast, expenditures for laboratory services provided in all settings have declined steadily; expenditures in 1998 were more than 10 percent lower than in 1993 (Klipp, 2000). Figure 2.3 tracks the trends in health expenditures for the five years from 1993 to 1998 for total personal health care, laboratory, hospital, and physician services.

FIGURE 2.2 Personal health care expenditures as a percentage of Gross Domestic Product: 1960–2008. SOURCE: Health Care Financing Administration, data from the Office of Strategic Planning and the Office of National Health Statistics.

Financial Strength of the Laboratory Industry

The committee searched for direct evidence of the financial health of the clinical laboratory industry, but found little because most segments of the industry are not required to report financial information. POLs and outpatient hospital laboratories are not independent businesses, but integrated parts of physicians’ practices and hospitals, respectively. Also, many commercial independent laboratories, particularly relatively small laboratories, are not publicly held corporations and have no obligation to report financial data publicly. To assess the financial health of the industry, therefore, the committee reviewed a number of finance industry reports as well as recent market studies that provide some information on the commercial laboratory industry’s profitability, mostly for the largest laboratory firms (Donaldson, 1993; Lehman Brothers, 1993; Merrill Lynch, 1999; Smith Barney Research, 1990). The committee supplemented this information with indirect evidence of industry financial health, such as changes in number, volume, and market share of the different segments.

The committee found virtually no direct information on the financial performance of POLs; however, the number of POLs continues to grow, indicating that there is some incentive to provide these services. Because of incentives re-

FIGURE 2.3 Trends in expenditures for health care services, 1993–1998.

SOURCE: Laboratory data: CHPS Consulting analysis of information in Klipp (2000); other health services: Levit et. al. (2000).

lated to efficiency and convenience, physicians may provide laboratory services regardless of their independent profitability.

The committee also found no direct data to assess the financial well being of hospital-based laboratories. Hospital-based laboratories’ share of the total market grew during the 1990s, despite payment reductions and the aggressiveness of managed care contracting. Most, if not all, of this growth has been in the provision of laboratory services in the hospital’s outpatient department and for providers outside the hospital (outreach testing).

The growth in outreach testing can be attributed to diametrically opposed circumstances. Growth may suggest that, as a group, hospital-based laboratories are profitable. On the other hand, it could be a response to market changes that threaten the financial viability of hospitals, including global shifts from inpatient to outpatient care. In this case, growth may reflect an attempt by hospitals to spread fixed costs across an increased volume of services.

Available data do not reflect the experience of hospital laboratories after implementation of the Balanced Budget Act of 1997 (BBA), which changed inpatient payment and mandated a new payment methodology for outpatient services. The new prospective payment system for outpatient hospital services does not include laboratory services, but could affect the general financial status of hospitals. Changes mandated by the 1999 Balanced Budget Refinement Act (BBRA) for the new outpatient PPS is expected to lessen the negative projected financial effect on hospitals (Guterman, 2000).

Environmental factors during the 1990s, particularly reductions in Medicare fees and growth in managed care among both public and private payers, had a significant effect on the profitability of the independent laboratory sector (Hoerger et al., 1996). By 1995, all of the laboratory industry’s leading firms were either experiencing losses or sharply declining profits. According to Klipp (2000), in 1996, the top three independent laboratories had a combined net loss of $792 million on $4.58 billion of revenue.

Industry reports suggest that independent laboratories are again becoming profitable. Profit margins improved during the past two years, at least among the major laboratory firms, partly as a result of improved pricing for managed care business. The three largest laboratory firms were marginally profitable in 1998, with an average profit margin of 2.6 percent. In the first half of 1999, after Quest Diagnostics acquired SmithKline Beecham laboratories, the average profit margin for the two largest laboratories, Quest Diagnostics and LabCorp, was 1.2 percent (Klipp, 2000). Stock values for both increased substantially in the first half of 2000. Analysts predict that these companies will be able to streamline production and negotiate better rates for supplies. The committee found no direct financial information on the smaller independent laboratories, which mostly compete in local markets.

MEDICARE PART B CLINICAL LABORATORY TRENDS

Medicare is the largest single purchaser of clinical laboratory services. This section describes Medicare as a segment of the outpatient clinical laboratory market.

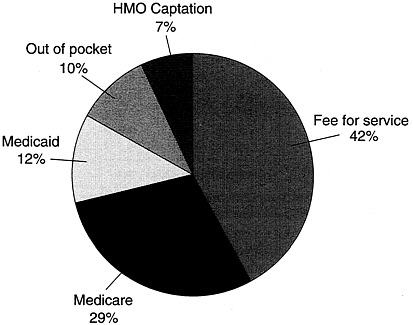

Medicare Part B Spending

Laboratory services paid for under the Medicare Part B clinical laboratory fee schedule represent a relatively small component of the annual Medicare budget—about 1.6 percent; however, they constitute a significant portion of the market for the laboratory industry, and Medicare’s policies appear to influence the behavior of other payers. According to industry estimates, Medicare pays approximately 29 percent of the nation’s laboratory bill when inpatient testing, FFS outpatient testing, and managed care are included (Figure 2.4). The Medicare Part B fee schedule for outpatient laboratory services accounts for approximately one-third of what Medicare spends for laboratory services (Gustafson, 2000).

The Health Care Financing Administration (HCFA) reports that Medicare Part B spending for clinical laboratory services fell from $3.8 billion in 1992 to

FIGURE 2.4 Laboratory industry payer mix by percentage of revenue, 1999.

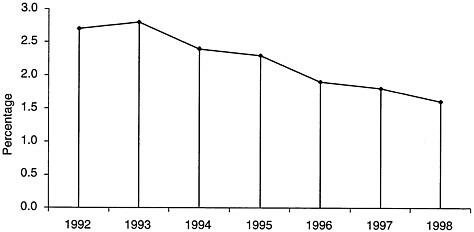

$3.6 billion in 1998, with a compound annual growth rate of −1.1 percent (Table 2.3) (Gustafson, 2000). Over the same period, total annual Medicare spending grew from $141 billion to $231 billion; a compound annual growth rate of 8.5 percent (Gustafson, 2000). Clinical laboratory spending as a percentage of total Medicare spending over time is presented in Figure 2.5. Payments for laboratory services per Medicare beneficiary in the FFS program declined during the mid 1990s, but, based on projections, have recently begun to rise (Table 2.4). The Office of the Actuary at HCFA projects that recent growth will continue.

Estimates provided by HCFA show that in 1998, Medicare paid facilities (outpatient-hospital laboratories plus ESRD clinics, nursing homes, home health, and other laboratories) $1,489 million, independent laboratories $1,336 million, and POLs $752 million (Figure 2.6).6

TABLE 2.3 Part B Clinical Laboratory Spending by

|

|

Calendar Year ($ millions) |

CAGR, 1992–1998 (%) |

||

|

Type of Laboratory |

1992 |

1995 |

1998 |

|

|

Independent |

1,761 |

1,871 |

1,336 |

−4.5 |

|

POL |

1,101 |

936 |

752 |

−6.2 |

|

Facilitya |

967 |

1,378 |

1,489 |

+7.5 |

|

Total |

3,829 |

4,185 |

3,577 |

−1.1 |

|

NOTE: CAGR = compound annual growth rate. aIncludes Part B payments to hospitals, nursing homes, home health agencies, and other laboratories paid by fiscal intermediaries. SOURCE: Gustafson, 2000. |

||||

FIGURE 2.5 Part B spending on clinical laboratory services as a percentage of total Medicare spending, 1992–1998. NOTE: Percentages are for total Part B spending on clinical laboratory services, including hospital outpatient/outreach services.

SOURCE: Health Care Financing Administration.

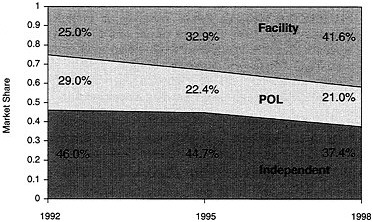

Trend data show that the Medicare Part B market share for facilities is growing (Figure 2.7).7 HCFA’s Office of the Actuary projects that this trend will continue. It projects that by 2001, 45 percent of expenditures for services on the clinical laboratory fee schedule will go to the facilities described above, and 55

FIGURE 2.6 Medicare Part B spending (in millions)* by laboratory type, 1998. Includes carrier and FI data for the laboratory fee schedule and some physician services such as pathology. **Includes outpatient hospital, ESRD, nursing homes, home health, and other laboratory services paid for by FIs. SOURCE: Health Care Financing Administration.

percent will go to independent and physician office laboratories (Steiner and Root, 1999).

Although the Medicare Part B fee schedule for clinical laboratory services covers approximately 1,100 different test codes, which reflect an even greater number of tests,8 the top 10 test codes account for 24 percent and the top 200 account for more than half of Part B laboratory expenditures (Gustafson, 2000).9

ENVIRONMENTAL TRENDS

Various environmental trends during the past two decades have put pressure on the clinical laboratory industry to cut costs and improve quality. This section reviews government regulatory efforts to improve quality, protect workers, and reduce waste and abuse. It also reviews cost-control efforts undertaken by both

|

8 |

Up from 881 codes in 1994. |

|

9 |

The fee schedule for each CPT code for each carrier region and the national limitation amount is available on the Internet at http://www.hcfa.gov/stats/cpt/clfdown.htm. |

TABLE 2.4 Part B Laboratory Payments Per FFS Beneficiary, 1995–2002

FIGURE 2.7 Medicare Part B market share trends, 1992–1998.

SOURCE: T.Gustafson, Health Care Financing Administration, presentation before the IOM committee, January 2000.

public and private payers, particularly new payment policies and aggressive managed care contracting. Although drawing broad conclusions is difficult because the laboratory industry is so diverse, it appears that overall, the quality of clinical laboratory testing has improved and Medicare spending for laboratory services has declined, even while the number of tests per beneficiary has increased. There is no evidence that beneficiary access to care has declined.

Regulatory Trends

Regulatory efforts designed to increase the quality of testing, protect worker safety, and reduce waste and abuse, have increased the cost and administrative burden of providing laboratory services. Data suggest that efforts to improve quality have been successful. Data regarding the effect of regulations to protect workers and reduce waste and abuse are not available.

Clinical Laboratory Improvement Amendments of 1988

Enactment of the Clinical Laboratory Improvement Amendments of 1988 (CLIA) was the most significant factor influencing the general regulatory structure of the laboratory industry in the United States during the past 20 years. In the mid-1980s, a series of Wall Street Journal articles exposed major deficiencies in cytology testing (Bogdanich, 1987a; 1987b; see also Inhorn et al., 1994).10 The medical literature also reported deficiencies in the overall quality of clinical laboratory services (Rej and Jenny, 1992). These articles raised public concern about the quality of the clinical laboratory industry and were a major impetus behind the passage of CLIA. Before the 1988 amendments, the original Clinical Laboratory Improvement Act (1967) regulated laboratories that engaged in interstate commerce, which included most independent laboratories. The 1988 amendments expanded the scope of regulatory authority.

The purpose of CLIA is to “ensure the accuracy, reliability, and timeliness of patient test results regardless of where the test was performed” (HCFA, 1998). The final regulations for CLIA11 established quality standards and a regulatory structure for all clinical laboratory testing. Under CLIA, a laboratory is defined as any facility that performs laboratory testing on specimens derived from humans for the purpose of providing information for the diagnosis, prevention, assessment, or treatment of disease or impairment of health.

CLIA brought many previously unregulated facilities, particularly POLs, into the regulatory structure. It linked the level of regulatory oversight to the complexity of the testing conducted in the laboratory, rather than focusing on the type of laboratory (physician office, independent, or hospital-based laboratory). This approach helped ensure test site neutrality and established the prem-

ise that the quality of testing and test results should be the same regardless of where the test is performed (Chapin and Baron, 1995).

Test Complexity and Laboratory Certification

CLIA requires tests to be designated as waived, moderate complexity, or high complexity. The Food and Drug Administration (FDA) has recently taken responsibility for categorizing the level of complexity of new tests.12 Waived tests are simple to conduct, highly trained staff is not needed, and the chances for error are small. Performance of moderate-complexity and high-complexity tests requires higher levels of expertise. Laboratories performing high-complexity testing must meet stringent personnel requirements.

Since the introduction of CLIA, there has been tremendous growth in the number of waived tests. As of June 2000, the CDC lists almost 750 different waived laboratory testing products for more than 40 types of tests (CDC, 2000). For example, there are 14 different rapid strep test products. For the past few years, waived tests have accounted for approximately 6 percent of all tests conducted, including both inpatient and outpatient testing (HCFA, 2000a). Approximately 40 percent of waived tests are performed in POLs and fewer than 4 percent are performed in independent laboratories.

Table 2.5 presents the most recent available breakdown of test volume for waived and nonwaived tests by type of laboratory. More detailed CLIA test volume data for 1996–2000 are provided in Appendix D.

TABLE 2.5 Waived versus Nonwaived Test Volume, 1999-Early 2000

|

|

Test Volume (millions) |

|||

|

Type of Facility |

Waived Testsa |

Nonwaived Tests |

Total |

Waived as a % of Total |

|

Hospital laboratories |

95.4 |

2,862.8 |

2,958.2 |

3.2 |

|

Independent laboratories |

15.1 |

1,499.1 |

1,514.2 |

1.0 |

|

Physician office laboratories |

160.0 |

496.4 |

656.4 |

24.4 |

|

Other |

112.5 |

484.6 |

597.1 |

18.8 |

|

Total |

383.0 |

5,342.9 |

5,725.9 |

6.7 |

|

aAccording to the CDC Web site, there are almost 750 testing products that the FDA (previously the CDC) has granted waived status. These tests can be performed in laboratories with minimal regulatory oversight. SOURCE: Health Care Financing Administration, 2000a. |

||||

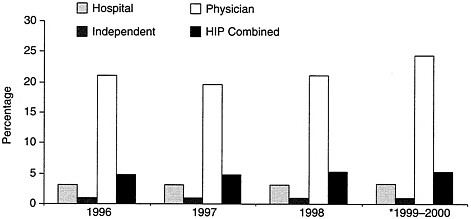

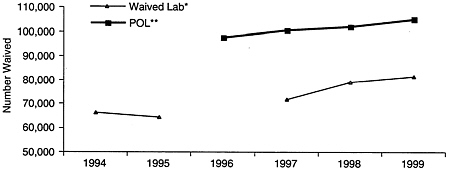

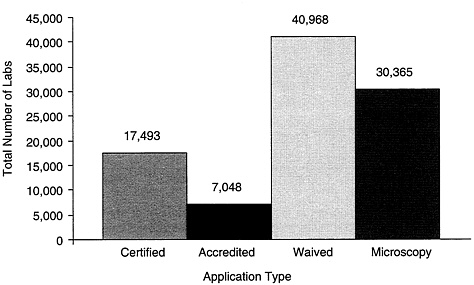

Since 1996 (the earliest date for which HCFA has CLIA test volume data), the ratio of waived to total tests conducted in the different types of facilities has remained relatively steady (see Figure 2.8).

The extent to which a laboratory can perform different levels of tests depends on its certification.13 Laboratories that perform tests that are more complex are subject to a higher level of federal regulatory oversight and must adhere to more stringent personnel requirements. Laboratories that wish to perform anything more complex than waived tests or provider-performed microscopy (PPM) are surveyed routinely by either HCFA state inspectors or a private accrediting organization (HCFA, 1998). They also must develop a comprehensive quality assurance and quality control (QA/QC) program.14

The CLIA QA/QC program requires laboratories to conduct proficiency (accuracy) testing (PT). PT surveys compare test results for identical samples across clinical laboratories. PT programs aim to identify laboratories with systematic problems that produce errors (as indicated by sustained unacceptable performance), rather than those with an occasional random mistake (Boone, 1992). CLIA requires that clinical laboratories identify the impact of errors by reporting incidents of errors that harmed, or had the potential to harm, the patient.15

|

13 |

Laboratories receive one of five different certification types: 1. Certificate of Waiver: This allows a laboratory to perform only waived tests. Laboratories must register with HCFA and follow the manufacturer’s instructions. 2. Certificate for Provider-Performed Microscopy (PPM) Procedures: This allows physicians, midlevel practitioners, or dentists to perform PPM procedures and to perform waived tests. A list of PPM procedures can be found at http://www.hcfa.gov/medicaid/clia/ppmplst.htm. 3. Certificate of Registration: This allows a laboratory to conduct moderate- or high-complexity laboratory testing or both until the entity is determined by survey to be in compliance with CLIA regulations. 4. Certificate of Compliance: This is issued to a laboratory after an inspection that finds the laboratory to be in compliance with all applicable CLIA requirements. 5. Certificate of Accreditation: This is issued to a laboratory on the basis of the laboratory’s accreditation by an organization approved by HCFA. To receive this certificate, the laboratory must be in compliance with all applicable CLIA requirements. |

|

14 |

This QA/QC program must cover evaluations of the effectiveness of clinical laboratory policies and procedures; identification and correction of problems; assurance of accurate, reliable, and timely reporting of test results; and assessments of the adequacy and competency of the staff. |

|

15 |

Concern about missing a case of disease has encouraged laboratories to over diagnose (label a result as positive if it is equivocal). Yet, over diagnosis also causes harm by leading to additional testing, anxiety, and even unnecessary treatment. |

FIGURE 2.8 Waived tests as a percentage of total test volume, 1996–1999, early 2000.

SOURCE: Health Care Financing Administration (2000a).

CLIA’s Impact on the Laboratory Industry

CLIA increased the regulatory burden for all laboratories. Because CLIA made POLs subject to regulation for the first time, a number of POLs chose to close rather than pay the added cost of licensing fees and QA/QC requirements. Peers & Co. estimated that POL market share (by revenue) decreased from 28 percent in 1986 to 15 percent in 1996 (Hoerger, et al., 1996). Surveys of practitioners both prior to and following CLIA implementation found the following:

-

Some physicians, particularly solo practitioners, chose to close their laboratories in response to CLIA.

-

Other physicians stopped providing moderate- and high-complexity tests.

-

Many physicians believed that CLIA increased the cost and administrative burden of providing laboratory services, but many also believed that CLIA contributed to higher-quality testing (Binns et al., 1998; Born and Thran, 1998; Roussel, 1996; Strauss et al., 1995).

While the cost of implementing CLIA may have been significant for some POLs, other findings suggest that POLs may have closed prematurely. A survey by the Office of the Inspector General (OIG) of a sample of POLs that decided to close found that more than half of the practices in the study reported closing between passage of the amendments in 1988 and their implementation in 1992. The final regulations were actually more liberal than those originally proposed.

As the industry has adjusted to the additional requirements imposed by CLIA, the POL sector has begun to grow again. In 1996, there were 97,542 CLIA-

FIGURE 2.9 Comparison of the growth in the number of waived laboratories and POLs, 1994–1999. *SOURCE: Health Care Financing Administration CLIA database (July 1999). Note: Does not include waived laboratories in exempt states, which most years comprised an additional 6,000–7,000 laboratories. Note also that data were unavailable for 1996. **SOURCE: HCFA CLIA database (March 2000). Note: datapoint for 1999 includes 2000 data through March.

registered POLs; by 2000, this number had grown to 105,089 (Figure 2.9 and Appendix D). The volume of testing by POLs also increased (see Appendix D).

There are various explanations for this growth. Some speculate that it is attributable to the dramatic increase in the number of new tests that have achieved waived status.16 This means that POLs can conduct more tests without facing the regulatory burdens associated with moderate- and high-complexity tests. In addition, the PPM subcategory was added for these types of tests performed by physicians for their own patients. POLs certified to perform PPM may also perform waived tests. Three-quarters of POLs conduct only PPM and waived tests (Figure 2.10). Others think that providers are simply becoming more comfortable with the regulatory environment, and some managed care organizations may be encouraging the use of POLs when it is cost-effective to do so (Auxter, 1999). Still others speculate that the rise may be due in part to pressure from HCFA to register previously unregistered POLs that are attempting to bill Medicare (Auxter, 1999). CLIA increased the cost of providing laboratory services in independent and hospital-based laboratories, but there is no clear evidence that CLIA has created barriers to beneficiary access.17 Minor declines in the numbers of hospital-based and independent laboratories are likely the result of the con-

FIGURE 2.10 Physician office laboratories under CLIA by certification type, 1999. Note: Total number of POLs registered = 96,701. SOURCE: Health Care Financing Administration CLIA database (July 1999).

solidation discussed in the final section of this chapter. A 1995 OIG report analyzed the impact of CLIA on the availability of clinical laboratory services (OIG, 1995). The OIG tracked the volume, type, and frequency of laboratory tests provided to Medicare patients between 1985 and 1993 and analyzed data from a 1 percent sample of claims extracted annually from HCFA’s Common Working File and its predecessor, the Part B Medicare Annual Data file. In order to learn more about CLIA’s effect on physician practices, the OIG collected and analyzed survey data from physicians, including those in rural practices that had discontinued providing clinical laboratory services. Although hospital outpatient data are incomplete, the OIG found continued growth in the overall volume of tests, the number of tests per patient, and expenditures for clinical laboratory services since the implementation of CLIA in 1992. Additionally, the OIG found that CLIA does not appear to have affected physicians’ ability to secure laboratory services for their patients. The OIG concluded that the 1988 amendments have not impaired the availability of laboratory services.

The CDC has requested comments on whether CLIA should be expanded to address the unique informed consent, ethical, and quality issues raised by genetic testing (Notice of Intent, 2000). This request is in response to studies that indicate a need to improve laboratory genetic testing practices and coordination between the laboratory, care provider, genetic counselor, and patient. The likely effect of an expanded CLIA on the cost of providing genetic testing is unknown.

CLIA’s Impact on Quality

Data indicate sharp increases in both PT performance and CLIA laboratory registration rates from 1995 to 1996. CLIA requires PT for 86 tests or analytes.18 Data show that in 1996, 87.4 percent of the scores from enrolled laboratories demonstrated no failures on PT19, compared to 69.4 percent in 1995 (HCFA, 2000b). PT results from previously unregulated laboratories, particularly POLs, are most likely to be unacceptable (MMWR, 1996; Stull et al., 1998). The data also indicate that 93.2 percent of the laboratories required to be enrolled in PT were actually enrolled in 1996, compared to 89.6 percent in 1995. HCFA’s target for fiscal year (FY) 1999 was that 90 percent of the scores for all 86 analytes requiring PT reported from all laboratories enrolled in PT should contain no failures and that 95 percent of all eligible laboratories would be participating.

Occupational Safety and Health Administration

Occupational Safety and Health Administration (OSHA) regulations protect the safety of workers, but also increase the cost of providing laboratory services. They touch almost every aspect of the provision of laboratory services. For instance, to minimize the transmission of infectious disease, health care workers and laboratory personnel are required to wear personal protective equipment (PPE) and to dispose of needles and other contaminated materials in specific ways. OSHA may require the use of “safety needles” in the future. Health care facilities, including physician offices, are required to have an occupational expo

sure control plan. Contaminated waste, including leftover specimen samples, must be disposed of in a way that is more costly than disposal of regular trash. In addition, the transportation of certain human tissues and body fluids requires special packaging to protect the handler.20 Each laboratory is required to develop a chemical hygiene plan which addresses the specific hazards found in its location and its approach to them (OSHA, 2000). Laboratories must also be equipped with proper ventilation to ensure safe air quality within the building (OSHA, 1999).

There are few data on the cost of compliance with OSHA regulations for the laboratory industry; however, tighter regulatory control usually means an increased financial and administrative burden. This burden has likely affected hospital-based, independent, and physician office laboratories and has implications for the cost of providing laboratory services.

MINIMIZING FRAUD, WASTE, AND ABUSE

The administration and Congress have tried to ensure that public funds are not wasted or abused by limiting physicians’ ability to refer patients to a laboratory in which they have a financial interest, by aggressively investigating certain billing practices, and by denying payment for Medicare claims that are not deemed medically necessary.

Stark Amendments

The Ethics in Patient Referral Act (1998), commonly referred to as the Stark Amendments,21 prohibits physicians from referring patients to laboratories and other designated health services in which they or their immediate family members have a financial interest.22 It also attaches civil penalties to entities receiving these inappropriate referrals if they bill Medicare or Medicaid. The main purpose of the law is to reduce the overuse of health care services that can occur when physicians have a financial incentive to refer patients for laboratory services. A previous Institute Of Medicine (IOM) report showed that physicians order more laboratory tests when they profit from laboratory services (Gray, 1986).

Implementation of the Stark Amendments has been controversial (Committee urges final rule on Stark self-referral law revisions, 1999). Because Stark II was so broad, Congress added a number of exemptions to the rule that allow physicians to operate in-office laboratories and permit referrals made within certain types of “group practices” (Kalb, 1999). Several of the law’s re-

quirements, however, raise concerns for physicians. For example, one of the requirements is that the physician or another member of the group must directly supervise the laboratory test. Direct supervision is more stringent than CLIA requirements because it means that the prescribing physician (or another physician member of the group) must be on site and immediately available during testing. There is anecdotal evidence that many laboratories are not aware of this requirement and, therefore, are not complying with its provisions. This is important because “the Stark laws contain no express requirement of intent; a physician can violate them even if he or she does not have any improper goal or purpose” (Kalb, 1999).

The Stark regulations also created a situation where independent physicians could no longer share laboratory facilities. Before these regulations, laboratories were commonly shared by independent practitioners to minimize expenses and provide a wider range of services than would be possible for a solo physician. Physicians must now either divest or form bona fide group practices to comply with the regulation.

In response to widespread confusion and public comment, HCFA attempted to clarify Stark II in a proposed rule (Proposed Rule, 1998). Because there was so much controversy and public comment in reaction to the proposed rule, the final rule has not been issued. HCFA is expected to issue a final rule later this year (Graziano, 2000). Several members of Congress have introduced legislation to bring the supervision requirement more in line with CLIA, but Congress has not acted on these proposals.

OIG Investigations

Spurred by concern during the last decade that laboratories were improperly billing the federal government, the OIG has conducted several major investigations that have resulted in significant settlements against providers of clinical laboratory services. These settlements have amounted to almost $1 billion dollars in recoveries, fines, and penalties (Grob, 2000). The OIG asserted that some laboratories were charging individually for tests that should have been billed as a panel at a lower rate (unbundling), using diagnosis codes that were never provided by a physician, providing kickbacks to physicians for patient referrals, double billing, and billing for unordered tests and tests that were not medically necessary (Grob, 2000). As a result of these cases, some laboratories not only paid large fines, but also signed agreements with the OIG called Corporate Integrity Agreements. The OIG has developed model compliance plans designed to assist clinical laboratories in developing internal controls that help prevent fraud, abuse, and waste (OIG, 2000).

Medical Necessity Review

In addition to retrospective reviews conducted by the OIG, Medicare contractors routinely review claims for certain tests against local medical criteria regarding the appropriateness of performing a particular test on a particular patient. This review is called local medical review policy (LMRP). Claims for laboratory tests that do not have a diagnosis code that is deemed to justify performance of the test may be denied even though the laboratory has no control over tests ordered by physicians. Contractors may also target certain providers, who have a history of inappropriate billing, for routine review.

Laboratory representatives testified that judgments regarding the medical appropriateness of laboratory tests, which are based solely on the presence or absence of particular International Classification of Diseases, Ninth Revision (ICD-9) diagnosis codes provided by the ordering physician, result in many inappropriate denials and a large administrative burden. The committee found a high rate of denials for some laboratory claims (Appendix E), but it was unable to determine what proportion of all outpatient laboratory claims were denied based on medical necessity criteria. HCFA data from 1998 showed that 12.3 percent of all POL claims were denied, but only 2.5 percent were denied because they were deemed medically unnecessary.

Appeals of denied claims are often expensive and time consuming. They also require participation of the physician who has little incentive to follow through. As a result, laboratory representatives testified that the current approach to assessment of medical necessity is misguided and results in an unfair financial burden on clinical laboratories.

PAYMENT TRENDS

Medicare payment trends for both inpatient and outpatient services, as well as some shift to capitated payments by both public and private payers, have squeezed the profit margins of the laboratory industry and limited the industry’s ability to shift costs from payer to payer and test to test.

Medicare Shift to Prospective Payment Systems

A 1983 revision in Medicare payment policy for inpatient hospital services radically altered financial incentives for hospital laboratory services. Specifically, Medicare shifted from a reasonable cost reimbursement to a per-case approach based on diagnosis-related groups (DRGs).23 The prospectively set payment amount was based on adjusted average historical costs and covers all services provided during the patient’s stay. As a result, some cases may cost the hospital more than the Medicare payment, whereas other cases cost less. The system is designed to give hospitals an incentive to manage care more effi-

ciently. Because of this change in payment policy, inpatient hospital laboratory testing became a cost center for Medicare patients rather than a profit center. The new payment policy thus created an incentive to reduce the number of tests ordered for hospital inpatients and to shift inpatient care to the outpatient setting.

The 1997 BBA mandated a change in the Medicare payment methodology for outpatient hospital services. Beginning in 2000, payments for outpatient services were also to be based on prospectively determined rates for bundled services. Clinical laboratory services provided under the clinical laboratory fee schedule are excluded from this change in payment methodology; however, significant payment policy changes were made in the way independent laboratories will be paid for pathology services. If a test is performed by an independent laboratory for a hospital outpatient department, the laboratory must bill the hospital for the technical component.24 The hospital recoups what it pays the laboratory in the bundled payment amount it receives for the outpatient service. Previously, the laboratory was able to bill Medicare directly for the technical component (College of American Pathologists, 2000). Implementation of this billing requirement was recently delayed due to an intense lobbying effort by independent laboratories and the College of American Pathologists. Any major change in payment policy has the potential to affect the financial stability of the provider organization (in this case, hospitals) and to alter payment incentive structures for the provision of care.

Growth of Managed Care

The growth in managed care for both public and private payers has resulted in reduced revenue for the clinical laboratory industry.25 Managed care organizations are typically defined as any third-party payer that uses cost-control or utilization-control mechanisms to direct the use of health care services. Almost all third-party payers now use managed care techniques to control costs. These techniques have reduced payments to laboratories and limited their ability to offset the cost of uncompensated services for patients who are uninsured, have limited coverage, or have coverage with particularly low payment rates.26

Because of their ability to negotiate volume discounts, managed care organizations commonly pay significantly lower fees than other payers for laboratory services. In addition, many managed care plans pay laboratories on a capitated basis (Hoerger et al., 1996). Under a capitated payment arrangement, a laboratory is paid a fixed amount per member per month to provide all or a specified range of laboratory services for an enrolled population. Unlike the situation in which physicians or health maintenance organizations (HMOs) receive capitated payments for provision of care to patients, independent laboratories have little control over the volume or type of laboratory tests that are ordered and covered by the capitation rate.

Capitation of laboratory services first began in the mid-1990s and by the end of 1998 accounted for 20–25 percent of testing volume at the three largest national independent laboratories (Klipp, 2000). Driven in large part by their fear of losing market share, some hospitals and independent laboratories aggressively cut prices in bids for managed care contracts. Many laboratories bid below their costs in order to win capitated managed care contracts in the hope that physicians in the managed care plans would also use their services for non-managed care patients; however, there is little evidence that these “pull-through” expectations have been met (Hoerger et al., 1996; Klipp, 2000).

Managed care organizations generally prefer to contract with fewer laboratories that can provide services across larger geographic areas. The independent national and regional laboratories, therefore, were better positioned to provide services under capitated contracts, giving them an advantage over hospital-based laboratories; however, because of poorly negotiated managed care contracts, increased market share did not result in increased revenue for independent laboratories. In fact, according to Washington G-2 Reports, (Klipp, 2000) independent laboratories saw testing revenue drop from $10.4 billion to $8.1 billion, between 1993 and 1999, a decrease of 22 percent. This decline was due in part to poorly negotiated managed care contracts.

There appears to be a recent trend among independent laboratories to “walk away” from unprofitable managed care contracts. Laboratories may simply have learned from their mistakes, or mergers and acquisitions among the independent laboratories, discussed in more detail in the next section, may have given the largest laboratory companies the strength to pass up unfavorably priced contracts. Chief executive officers of the top independent laboratories have stated that they are beginning to focus less on volume and more on profitability (Klipp, 2000). In addition, it appears as though the growth in managed care may be slowing. The Lewin Group (2000) reports that consumers are shifting to more flexible plans; there is a growing backlash against managed care that has resulted in legislatively imposed coverage mandates, which in turn have reduced HMO profits. A recent survey from the American Association of Health Plans reports that many third-party payers are dropping their contracts to provide Medicare+Choice plans, Medicare’s version of managed care (Morgan, 2000).

RESPONSE FROM THE INDUSTRY TO ENVIRONMENTAL TRENDS

The clinical laboratory industry has become very competitive despite the high degree of consolidation that has occurred in the independent laboratory sector. Changes in Medicare payment methodology, cuts in payment rates by Medicare and other payers, and the growth of managed care contracting have caused some laboratories, particularly hospital-based laboratories, to look to new markets in order to maintain profitability. These changes also have led to consolidation in both the independent and the hospital-based segments of the laboratory industry. In addition, hospital-based laboratories and independent laboratories have become engaged in head-to-head competition for market share as they strive to achieve levels of efficiency and critical mass that will allow them to compete effectively for outpatient, physician, and managed care business.

Market Consolidation and Network Development

Market consolidation has radically changed the face of the independent laboratory sector. In 1990, no single laboratory company had a major market share; rather, the eight largest companies accounted for 47 percent of the nationwide independent laboratory market (Hoerger et al., 1996). By 1999, two companies, Quest Diagnostics and LabCorp, largely through mergers and acquisitions, accounted for 61 percent of the testing conducted by independent laboratories (Klipp, 2000).

Some experts have raised concerns about the level of concentration in two national independent laboratories and the implications of that for industry competition. In the 1990s, laboratory consolidation was viewed as conferring an advantage for negotiating managed care contracts. Although two companies now dominate the independent laboratory market with an estimated 61 percent of total test volume, that is only 16 percent of the total clinical laboratory market share, including hospital-based and physicians’ office laboratories.

Hospitals also have responded to the changing health care marketplace by forming regional laboratory networks with other hospitals and independent laboratories. This consolidation began in earnest in the mid-1990s with the formation of integrated delivery systems. Networks have taken different approaches to how they consolidate their laboratories (including intralaboratory, interlaboratory, intrahospital, and interhospital consolidation), but they also have tried to reduce costs by increasing operational efficiencies (Farwell, 1995).

Some in the industry believe that hospital-based laboratories have an advantage over independent laboratories in the current environment (Steiner and Root, 1999). Hospitals are better situated than most commercial laboratories to provide STAT (literally, at once) testing and same-day test results. At the same time, commercial laboratories may be better positioned, in terms of the types of testing they do, to incorporate newer, more complex tests.

TABLE 2.6 Hospital Laboratory Outpatient-Outreach Test Volume as a Percentage of Total Hospital Testing, Selected Years

|

Staffed Acute Care Beds |

1987 |

1991 |

1993 |

1996 |

1998 |

|

150–300 |

25.8 |

30.6 |

38.0 |

40.9 |

42.8 |

|

>300 |

23.2 |

26.9 |

31.6 |

37.2 |

35.0 |

|

SOURCE: Klipp, 2000. |

|||||

Growth of Hospital-Based Laboratory Outreach Programs

During the 1990s, because of changes in inpatient payment policy (described above), hospitals shifted a great deal of inpatient services to the outpatient setting. To make up for the inpatient volume that was lost to nonhospital laboratories providing tests to outpatients, hospitals have developed outreach programs to bring testing into their laboratories from physicians outside the hospital.

Since the early 1990s, the average number of inpatient tests per discharge has declined, while outpatient test volume has grown as a percentage of total hospital-based testing. Table 2.6 presents outpatient and outreach volume as a percentage of total hospital-based testing since 1987. Change has been most significant in the 150- to 300-bed hospitals, with outpatient and outreach volume as a percentage of total hospital testing increasing almost 66 percent from 1987 to 1998. For hospitals with more than 300 beds, the increase over the same period was almost 51 percent.

While volume has been growing, revenue per outreach test has been shrinking. Washington G-2 Reports (Klipp, 2000) estimates that from 1994 to 1999, revenue per outreach test decreased from $16.50 to $11.50, a decline of more than 30 percent. Hospitals in areas of high managed care penetration have seen outreach test revenue decline even further, to less than $10 per test.

SUMMARY

The laboratory industry is composed of hospital-based, independent, and physician office laboratories. The industry appears to be both resilient and vulnerable to environmental trends. For instance, after being hit hard by global trends toward managed care and cost containment, the two largest independent laboratories not only have survived, but are rebounding. Hospital-based laboratories have been able to increase their outpatient and outreach business in response to declines in inpatient business. The numbers of POLs initially declined in response to federal regulatory policies designed to improve the quality of laboratory testing but are now increasing, partially in response to an increase in the number of waived tests available. Overall, test volume is up, but revenue per test and aggregate Medicare Part B spending for outpatient laboratory services are down.

Many factors have affected the cost of providing laboratory services. New regulatory requirements have increased the cost of doing business; however, the industry has also found ways to reduce costs through consolidation that provides economies of scale. Demand for laboratory services is likely to grow as the population ages and innovation makes new tests possible.

In many laboratories, innovative technologies and increased regulatory requirements have reduced the length of time it takes for the physician to receive laboratory test results and have improved quality and patient convenience. Improved quality has been demonstrated through proficiency testing. An increase in the number of waived tests has made it easier for patients to undergo testing during a visit to the doctor. In addition to being more convenient for patients, testing closer to the physician leads to faster turnaround time that may speed diagnosis and treatment.

Environmental trends, particularly payment trends, have the potential to affect beneficiary access to laboratory testing. Coding, coverage, and payment problems, such as delays in assigning codes to new technology and the current approach to determining medical necessity that leads to inappropriate denials, could create barriers to beneficiary access to care.

REFERENCES

Auxter, S. 1999. Are physician office laboratories making a comeback? Clinical Laboratory News, March.

Binns, H.J., S.LeBailly, and H.G.Gardner. 1998. The physicians’ office laboratory: 1988 and 1996 survey of Illinois pediatricians. Pediatric Practice Research Group [see comments]. Arch Pediatr Adolesc Med 152, No. 6:585–592. Comment in: Arch Pediatr Adolesc Med 1998; 152, No. 12:1248–1249.

Bogdanich, W. November 2, 1987a. Lax laboratories: The Pap test misses much cervical cancer through labs’ errors. Wall Street Journal.

Bogdanich, W. December 29, 1987b. Physicians’ carelessness with Pap tests is cited in procedure’s high volume failure rate. Wall Street Journal.

Boone, D.J. 1992. Literature review of research related to the Clinical Laboratory Improvement Amendments of 1988 [see comments]. Arch Pathol Lab Med 116, No. 7: 681–693. Comment in: Arch Pathol Lab Med 1992; 116, No. 7:679–680.

Born, P.H., and S.L.Thran. 1998. The influence of CLIA ‘88 on physician office laboratories. J Fam Pract 46, No. 4:319–327.

Centers for Disease Control and Prevention (CDC) 1995. Clinical Laboratory Improvement Committee Summary Report. Atlanta, GA: CDC.

CDC. 2000. CLIA Waived Test List. Web page accessed August 3, 2000. Available at http://www.phppo.cdc.gov/dls/clia/waived.asp.

Chapin, K., and E.J.Baron. 1995. Impact of CLIA 88 on the clinical microbiology laboratory. Diagn Microbiol Infect Dis 23, No. 1–2:35–43.

College of American Pathologists. 2000. Hospital Outpatient PPS Information for Pathologists. Web page accessed August 4, 2000. Available at http://www.cap.org/html/advocacy/capdocs/pps.html.

Committee urges final rule on Stark self-referral law revisions. June 7, 1999. AMA News.

Donaldson, Lufkin & Jenrette. 1993. Laboratory Services—Independent Clinical Laboratories. New York, NY: Donaldson, Lufkin & Jenrette.

Dyckman, Z., and B.B.Cassidy. 2000. Recent Developments and Trends in the Clinical Laboratory Industry (unpublished). Columbia, MD.

Ethics in Patient Referral Act. 1998. 42 USC 1385nn.

Farwell, D.C. 1995. Hospital laboratory consolidation. Reduce costs, improve service, enhance the workplace . Clin Lab Manage Rev 9, No. 5:411–420.

Gray, B.H. 1986. For-Profit Enterprise in Health Care. Washington, DC: National Academy Press.

Graziano, C. July 2000. “Stark II” rule expected soon. CAP Today, p. 116.

Grob, G. January 20, 2000. Testimony before the IOM Committee on Medicare Payment Methodology for Clinical Laboratory Services: Medicare payments for clinical laboratory services: Vulnerabilities and controls. Washington, DC.

Gustafson, T. January 20, 2000. Testimony before the IOM Committee on Medicare Payment Methodology for Clinical Laboratory Services. Washington, DC.

Guterman, S. 2000. Putting Medicare in Context: How Does the Balanced Budget Act Affect Hospitals? (unpublished). Washington, DC: The Urban Institute.

Health Care Financing Administration (HCFA). 1998. CLIA: General Program Description. Web page, accessed February 17, 2000. Available at www.hcfa.gov/medicaid/clia/progdesc.htm.

HCFA. 2000a. March 2000 CLIA Provider Files, Reported Annual Test Volume.

HCFA. 2000b. CLIA Performance Goal in HCFA’s Annual Performance Plan: Improve Laboratory Testing Accuracy. Web page accessed July 11, 2000. Available at http://www.hcfa.gov/medicaid/clia/perfmeas.htm.

Hoerger, T.J., J.L.Eggleston, and R.C.Lindrooth. 1996. Background Report on the Clinical Laboratory Industry, Draft Report. Research Triangle Park, NC.

Inhorn, S.L., J.E.Shalkham, and G.B.Mueller. 1994. Quality assurance programs to meet CLIA requirements. Diagn Cytopathol 11, No. 2:195–200.

Kalb, P.E. 1999. Health care fraud and abuse. JAMA 282, No. 12:1163–1168.

Klipp, J. 2000. Lab Industry Strategic Outlook 2000: Market Trends & Analysis. Washington, DC: Washington G-2 Reports.

Lehman Brothers. 1993. Corning: Trying to Get Comfortable with the Clinical Lab Business. New York, NY: Lehman Brothers.

Levit, K., C.Cowan, H.Lazenby, A.Sensenig, et al., 2000. Health spending in 1998: Signals of change. Health Affairs. 19, No. 1:124–132.

Lewin Group. 2000. Outlook for Medical Technology Innovation: Will Patients Get the Care They Need? Report 1: The State of the Industry. Washington, DC: Health Industry Manufacturers Association.

Merrill Lynch. 1999. Quest Diagnostics: Leader in Sector with Improving Fundamentals, reference #60126501. New York: Merril Lynch.

Morbidity and Mortality Weekly Report (MMWR). March 8, 1996. Clinical laboratory performance on proficiency test samples—United States, 1994. 45, No. 9:193–196.

Morgan, D. June 30, 2000. More health plans quit Medicare. Washington Post, section A, p. 8.

Notice of Intent; Genetic testing under the Clinical Laboratory Improvement Amendments. 2000. Federal Register 65, No. 87:25928–25934.

Office of the Inspector General (OIG). 1995. CLIA’s Impact on the Availability of Laboratory Services. Washington, DC: OIG.

OIG. 2000. Corporate Integrity Agreements (CIAs) and Settlement Agreements with Integrity Provisions. Web page accessed September 5, 2000. Available at http://www.dhhs.gov/oig/cia/index.htm.

Occupational Safety and Health Administration (OSHA). 1999. Ventilation. Web page accessed July 12, 2000. Available at http://www.osha-slc.gov/SLTC/ventilation/index.html.

OSHA. 2000. Laboratories. Web page accessed July 12, 2000. Available at http://www.osha-slc.gov/SLTC/laboratories/index.html.

Physician Payment Review Commission (PPRC). 1995. Annual Report to Congress, 1995. Washington, DC: PPRC.

Proposed Rule: Physicians’ referrals to health care entities with which they have financial relationships. 1998. Federal Register 63, No. 6:1659–1728.

Rej, R., and R.W.Jenny. 1992. How good are clinical laboratories? An assessment of current performance [published erratum appears in Clin Chem 1993; 39, No. 3:558]. Clin Chem 38, No. 7:1210–1217; discussion 1218–1225.

Roussel, P.L. 1996. Impact of CLIA on physician office laboratories in rural Washington State [published erratum appears in J Fam Pract 1997; 44, No. 2:214]. J Fam Pract 43, No. 3:249–254.

Smith Barney Research. 1990. The Clinical Laboratory Industry, Investment Outlook. New York, NY: Smith Barney.

Steiner, J.W., and J.M.Root. June 1999. The battle between hospital and commercial labs: Who’s winning? Clinical Laboratory News, p. 4.

Strauss, S., G.S.Cembrowski, and S.A.Adlis. 1995. CLIA’s effect on POLs (physicians’ office laboratories). MLO Med Lab Obs 27, No. 6:34–38.

Stull, T.M., Hearn, T.L., Hancock, J.S., Handsfield, J.H. et al., 1998. Variation in proficiency testing performance by testing site. JAMA 279, No. 6:463–467.