Page 19

4

Building a Case for Capital Reinvestment

Ronald Woody of the Office of the Architect of the Capitol, and Lucia Garsys, from Hillsborough County, Florida, described two very different strategies for making the case for capital reinvestment.

OFFICE OF THE ARCHITECT OF THE CAPITOL

Summary of a Presentation by Ronald Woody, Program Manager for Computer Aided Facilities Management and Technology, Office of the Architect of the Capitol

The mission of the Office of the Architect of the Capitol (AOC) is to support Congress and its facilities environment. To that end it manages the Capitol building, all House of Representatives and Senate office buildings, the Library of Congress, the Supreme Court, and the U.S. Botanic Gardens which together total 14 million square feet of space.

In 1998 the AOC began a 5-year plan to implement a computer-aided facilities management system (CAFM) after the architect made a top-down decision that a standardized process was needed to improve management, reporting, and operations. The decision was made to hire a consultant, Graphic Systems Inc., to assist in system and procedural development efforts. The goal is to create an enterprise-wide solution using a software package that allows the AOC to implement modules when time, momentum, and money become available. The AOC is using Peregrine Span 6.3a in an SQL server environment, but the AOC will soon migrate to the most current version called Facility Center and will run in an Oracle environment. Microstation CAD integrator is used for space management, designing, and floor plans. Brio One will become the standard reporting and executive information package to analyze data to make business process decisions.

The AOC established three priorities for automation: (1) the demand work order process; (2) preventive maintenance; and (3) facility projects. To date, the demand work order system has been implemented throughout Capitol Hill. The 420 users span a wide spectrum from superintendents to shop workers and foremen. In addition to installing hardware, a major challenge has been the installation of cabling and paying for the costs of providing network service to employees in all of the AOC's shops. Also, many shop workers had never used automated systems and others resisted putting standardized

Page 20

processes in place. Thus, the effort has presented cultural as well as infrastructure challenges.

To date, 109 “smart floor plans” are available over a secure intranet and more than 15,600 rooms have been loaded into CAFM and are being used to help design office floor plans for members of Congress and their staffs. More than 110,400 pieces of Senate furniture have been bar coded and tracked via the assets tracking module of the AOC's CAFM system.

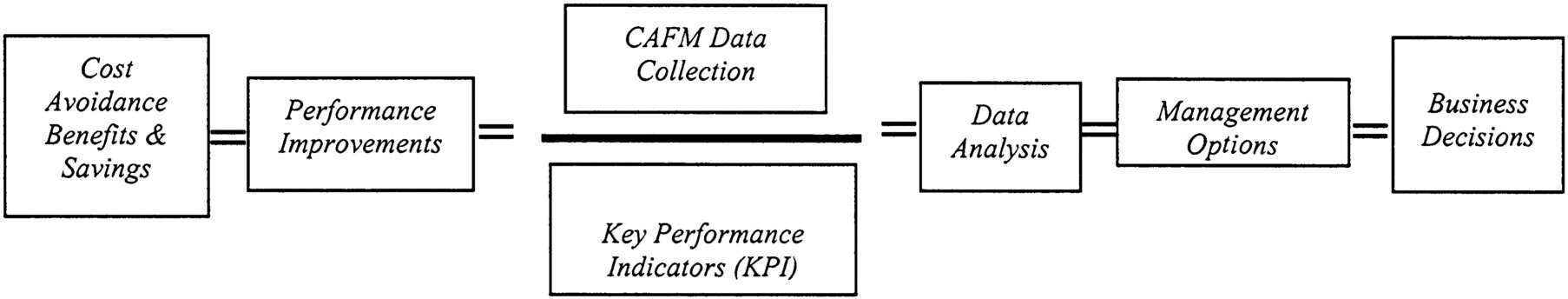

Automating these systems allows the AOC to capture information from management reports and to build a case for more resources for facility management and capital reinvestment. This business case is based on documenting program efficiencies that result in cost avoidance benefits and savings as shown on Figure 1.

~ enlarge ~

FIGURE 1 Documenting program efficiencies.

Source: Architect of the Capitol and Graphics Systems, Inc.

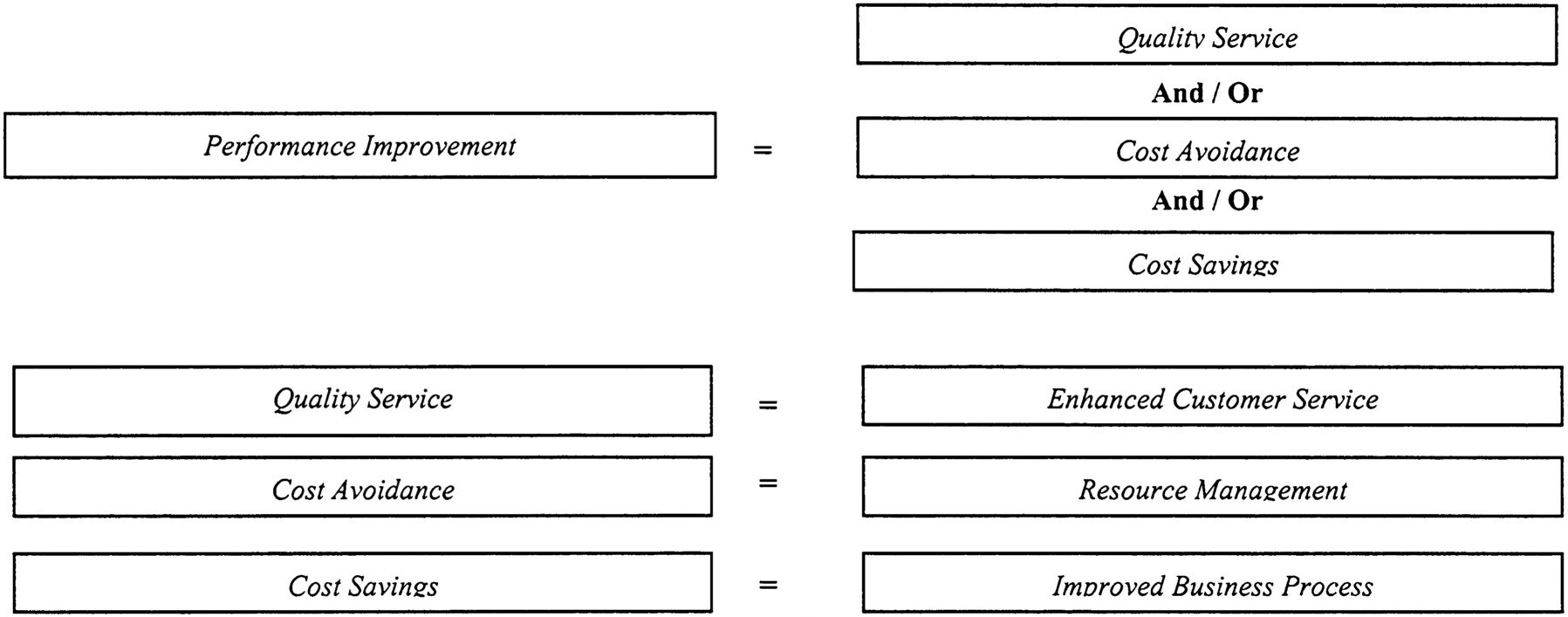

The AOC also looks at performance improvement by analyzing data for a set of key performance indicators (shown in Figure 2) and then uses the various reports and charts to develop a set of management options.

~ enlarge ~

FIGURE 2 Performance improvement indicators.

Source: Architect of the Capitol and Graphics Systems, Inc.

Page 21

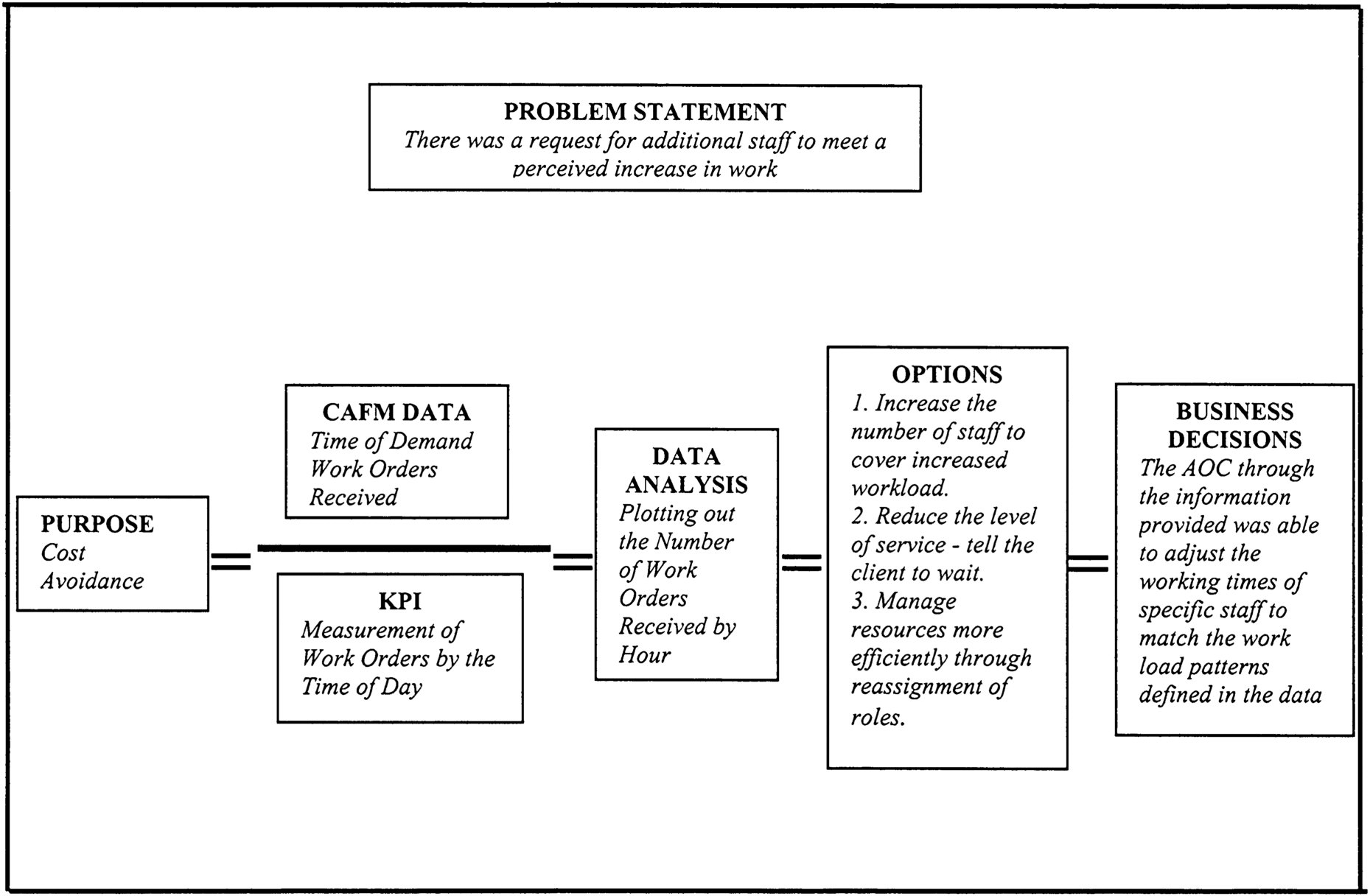

This process allows management to make a business decision about the most beneficial and efficient ways to operate. An example showing how this process works is summarized in Figure 3.

~ enlarge ~

FIGURE 3 Process for making a business decision.

Source: Architect of the Capitol and Graphics Systems, Inc.

HILLSBOROUGH COUNTY, FLORIDA

Summary of a Presentation by Lucia Garsys, Capital Program Administrator, Hillsborough County, Florida

Hillsborough County, Florida, has a population of approximately one million people and an area of about 1,000 square miles. There are three municipalities within the county including the city of Tampa. The County has an annual budget of $2.4 billion that includes a capital budget of $160 million. In recent years, one percent of the ad valorem taxes has been earmarked for the capital maintenance of the County's 350 buildings supporting the courts, libraries, parks, and other governmental functions. The current budget for this activity is $4.8 million per year. An additional $27.7 million was allocated from a Community Investment Tax over six-year period. A series of events and actions enabled Hillsborough County to recognize the need for capital maintenance and dedicate funding for it.

Page 22

A shift in focus from building new facilities to fixing existing ones. Until the mid-1990s, the county's capital construction program responded to the pressures of growth from the previous twenty-year period. Generally, once constructed and operational, facilities were forgotten unless they required emergency repairs. The replacement of a chiller in an existing facility could not compete for budget dollars against new libraries or parks. New facilities would generally win the budget battles. Around the mid-1990s the lack of maintenance began to take its toll. A large number of the facilities constructed in the previous 20 years needed immediate attention. Roofs had deteriorated to the point that books were damaged by water and equipment was rusting. Potholes in roadways were prevalent. The users of the facilities, the constituents, began to call for repairs.

Recognizing certain benefits of funding capital maintenance. The county was facing a dual challenge – repairing existing facilities while building new facilities to accommodate growth. As the issue developed, reoccurring operating costs of new facilities became an important component of the discussion. This was helpful to gain support for investment in existing facilities. It did not necessarily lead to an ‘either/or' conclusion, but it provided a helpful framework.

Other events provide synergy to obtain funding. Other events energized the movement to fund capital maintenance. A change in administration provided new perspectives and leadership. In addition, the community was facing a controversial question: “Should local tax dollars fund a new stadium for the Tampa Bay Buccaneers football team?” A voter referendum was scheduled to determine the outcome. The package of projects prepared for the referendum included not only a new stadium, but also maintenance improvements for libraries, fire stations, parks, and court buildings. Local community leaders worked with the newspapers and other community groups to inform voters about the issues. The referendum passed by a narrow margin, but nonetheless, a 30-year revenue was secured to fund many capital maintenance projects in the initial years.

Components to consider. These events and circumstances identified the minimum components needed to make a strong case for capital reinvestment. The components were:

-

Leadership: a person or group of people willing to shepherd the program along, speak for it, and provide vision.

-

Sponsors: newspapers, other media, and key organizations, such as chambers of commerce.

-

Users: the people who use the facilities. In local government, they are easy to identify. Users of federal facilities are more difficult to identify, but it is important in developing any strategies that federal agencies use to seek funding for capital reinvestment.

-

Voters: the people who let elected officials know there is an issue or a need. They could be users and sponsors as well.

-

Opportunity: it can be made or it can occur.

Lessons learned. Several lessons were learned from the effort to build support for capital reinvestment. The application of these depends on the legal and political framework of individual governments, agencies, or other community institutions.

Page 23

1. Target information. Identify the message, determine how to deliver it, and what you want to say to the audience.

2. Target language. Take the information and translate it into terms that are understood by the audience being targeted. For instance, when addressing residents or voters, discuss the need for capital investment in terms of home ownership, such as the need for repairs. When talking to business or church leaders, talk about the need for community reinvestment.

3. Use anecdotal stories and pictures to communicate the need. In Hillsborough county officials and citizens were taken on field trips and shown leaky roofs and the damage that can result from lack of maintenance.

4. Highlight mandates and requirements. Statutory mandates of the Americans with Disabilities Act, environmental laws, and union demands were detailed as part of the rationale for capital reinvestment.

5. Include constituents. They can be voters, sponsors, and users. Communicate with them and include them in the process.

6. Get the right spokesperson. Determine who is going to hear the message and from whom. Do not send a person with a social services background to talk to an investment banker. Their reference points are different and they consequently “speak different languages.” Parents of little leaguers make a good case to public officials about the need for lighting in ball fields.

7. Advertise achievements. Thank those groups who supported the effort because they will be important in continuing the program over the long term.

One thing leads to another. The capital maintenance discussion brought to light the need for funding. In addition to the capital maintenance dollars included in the referendum, the local elected officials committed one percent of the ad valorem taxes to capital maintenance. This amount may vary depending on the property taxes collected, but at present it is $4.8 million per year. It is used for re-roofings, new chillers, and other improvements that extend the useful life of a facility.

Capital maintenance institutionalized. The county has now institutionalized capital maintenance to address the backlog of maintenance needs. Capital maintenance falls under a new program known as R3M (Repairs/Renovation/Replacement and Maintenance). A dedicated funding source is provided through the ad valorem taxes and the Community Investment Tax. It is unclear if the funding sources will cover the needs, since the full gamut of needs was not articulated in the past. It is a solid beginning for a task that never ends.