Page 25

5

New Tools for Federal Agencies

Several speakers at the conference mentioned the relative absence of incentives to reward effective capital asset management in the federal government. In the final session, Robert Neary, Jr., of the Department of Veterans Affairs, outlined his agency's nine-year experience with a program that allows his department to convert its underperforming assets into productive assets by leasing its properties and/or facilities for up to 75 years to private or other public entities. David Bibb, of the General Services Administration (GSA), discussed proposed legislation that would give federal agencies important new tools for managing capital assets. Stanley Langfeld, also at GSA, described the government-wide real property information sharing program.

ENHANCED-USE LEASING PROGRAM

Summary of a Presentation by Robert Neary, Jr., Associate Chief Strategic Management Officer, Officeof Strategic Management, Department of Veterans Affairs

The Department of Veterans Affairs (VA) has reengineered its operations during the last five or six years. Much of the physical infrastructure used by its health care system was designed for in-patient hospital care, not the out-patient care that is such a large part of the care it delivers today. Some of its physical infrastructure is located in areas where the veteran population is less than projected. For these reasons the VA has closed some 50,000 hospital beds since 1995. During the same period the number of veterans throughout the nation using the VA for their health care has increased by 25 percent.

VA hospitals are often located in the vicinity of medical schools and large medical complexes in relatively affluent locations. Partly because of the shift of its service model from in-patient to out-patient service, some of its properties and facilities are partially vacant or underused. In 1991 Congress approved a three-year pilot program designed to make more productive those underperforming assets that the VA is not prepared to dispose of. The enhanced-use leasing program gave the VA authority to lease underused property and facilities to private or other public entities for up to 35 years in return for cash or in-kind consideration, such as services, goods, equipment, or facilities. The VA has used this authority to enter into 16 lease agreements. About 60 proposals are being considered.

Page 26

Signed lease agreements include:

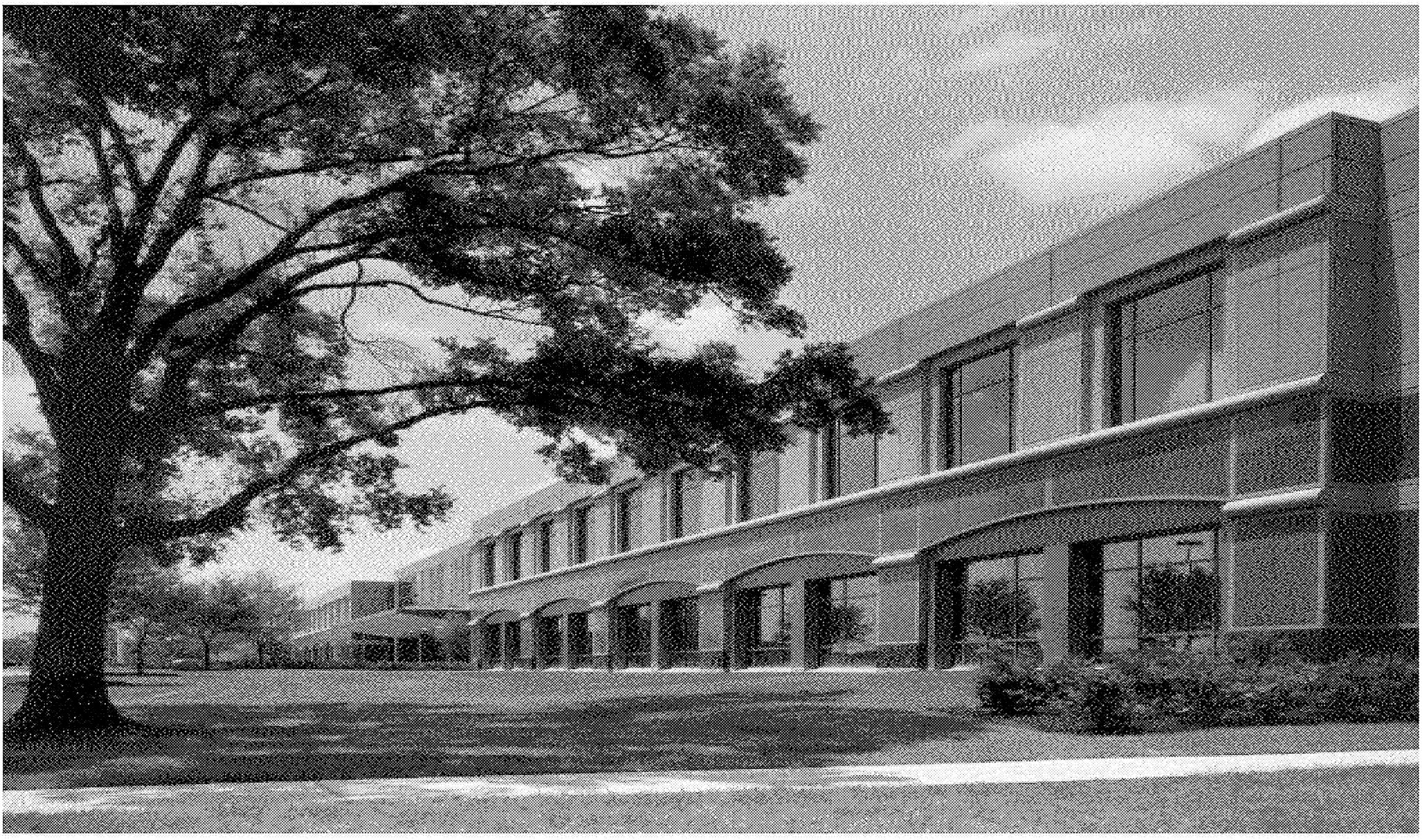

1. A regional office building and mixed-use development constructed on 20 acres on the grounds of a VA complex in Houston, Texas. The developer constructed the 140,000-square-foot building, and space was leased to the VA at heavily discounted rates. The developer was also allowed to build a small retail and services project and a second medical office that are leased to private sector tenants. In return the VA receives a share of the developer's lease revenue. The VA estimates a net savings of $17.7 million in construction costs and reduced operation and maintenance costs, and the VA receives revenues.

2. A 22-acre surplus property in Indianapolis, Indiana, leased to the state of Indiana for use as a mental health facility. The project allowed the VA to consolidate two facilities into one while meeting current out-patient health care needs and reducing operating costs. The VA estimates it obtained $15.7 million in financial benefits and $5 million per year in operational savings, while providing better service to veterans.

3. A 35-year ground lease at a VA hospital in Indianapolis, where Beverly Enterprises, Inc., is to open a 94-bed skilled nursing facility serving both the VA and the local community. The VA closed a nursing home in this area. The beds at the Beverly facility will be available to VA patients when construction is completed. The VA estimates more than $40 million in net present-value savings over the term of the lease in discounted rates for VA patients.

4. A 124-unit single-room-occupancy center built in Vancouver, Washington. The VA leased two acres of land to a local housing agency, which financed, designed, built, and operates the center. The VA obtains priority placement for up to 62 homeless veterans at no cost. Projected net-present-value savings in construction and reduced operation and maintenance costs are more than $20 million.

5. A 188,000-square-foot office building built by a redevelopment authority on 6 acres owned by the VA in Atlanta, Georgia. The arrangement allows the Veterans Benefit Administration to lease space at half the market rate for comparable space.

6. A cogeneration plant on VA property in Johnson City, Tennessee, that offers significantly discounted energy rates to the agency. The developer also provides energy to an adjacent state university, and other customers. The developer will complete $3 million in energy-related improvements throughout the VA campus. The VA will realize net-present-value savings of more than $36 million in construction and reduced operation and maintenance costs.

The enhanced-use leasing authority has been extended four times. In 1999, the VA's enhanced-use leasing authority was extended for 10 years. The VA is now allowed to lease properties for the sole purpose of generating revenues to improve services to veterans. The lease term was increased to as much as 75 years, and the VA was authorized to make capital contributions to joint ventures on agency properties.

Page 27

The enhanced-use leasing process begins with the identification of a requirement by VA officials when local market conditions will support a public-private partnership. Local VA officials develop a business plan. To provide incentives for VA managers to make better use of their facilities, the organization that initiates the proposal can retain proceeds, after expenses, from enhanced-use lease arrangements.

The business plan, often developed with support from outside consultants, identifies the proposed use, possible business terms, and other financial considerations. Public hearings are then held to give veterans' organizations and the public the opportunity to comment on the plan.

The proposal next goes to VA headquarters for approval. Projects that would cost more than $4 million if done by the VA must be approved by OMB. Federal Register notices are published to notify the public that the agency plans to negotiate an enhanced-use lease. The VA must wait 90 days after formal written notification to the Congress before proceeding to issue a request for proposals.

In selecting leases the VA's principal criteria are the experience of the developer, the quality of the team members, and financial considerations. Once the proposal is negotiated, Congress must be notified and the VA must wait 30 days before entering into a lease.

To date it has taken 16 to 17 months to work enhanced-use lease arrangements through the process, and some proposals have taken considerably longer. New procedures being put in place should allow the VA to decrease that time to 10 to 11 months, although complex projects may take longer.

From the VA's perspective the program works for several reasons. The business plan clearly and thoroughly outlines what is planned. It can be used as a document to obtain “buy-in” from and communicate what is planned to veterans, the local community, interest groups, and Congress. The selection procedures ensure process integrity. And the program provides incentives for local VA staff to operate more efficiently.

From the private sector perspective the program works because it provides developers security they can leverage when they seek financing. A long-term lease is often more financially favorable to the private sector than outright purchase of property. Because VA facilities sometimes have as many as 2,000 employees, developers gain access to this market and the market generated by community demand. Projects are governed by local building codes and requirements. And, developers can participate in the VA's sharing program, which authorizes the VA to enter into agreements to share medical services with outside entities.

Page 29

FEDERAL PROPERTY AND ADMINISTRATIVE SERVICES ACT REFORM

Summary of a Presentation by David Bibb, Deputy Associate Administrator, Office of Government-wide Policy, General Services Administration

Federal asset managers share common problems. There is not enough money for capital investment. Lacking the cash, we have to create new tools to help reverse the trend. Incentives, such as enhanced-use leasing, are not widely available in the federal government. Everywhere I turn, agency facility managers tell me, “we would love to do something with our property but we cannot tap the equity, we cannot keep the proceeds if we do so”. So what is the incentive if you have a hundred other things to do? There is none.

This lack of incentives leads to fixing things with Band-Aids. Sometimes this leads to leasing when it is not the most economical thing to do, not consolidating activities because capital funding is lacking, or holding properties that should be disposed of. Many of these problems can be traced to the Federal Property and Administrative Services Act of 1949, which has not been significantly amended in 50 years. It neglects property management and focuses on disposal. It does not allow federal agencies to use some of the best practices that have been identified in other governments and in the private sector.

More than two years ago GSA began an effort to seek the overhaul of the Property Act. GSA's proposal has been circulated to agencies twice for comments and has been cleared by OMB. The bill, the Federal Property Asset Management Reform Act of 2000 (S2805), was introduced in the Senate in June 2000 by Senators Fred Thompson and Joseph Lieberman, the chairman and ranking member of the Senate Governmental Affairs Committee, respectively. In the House of Representatives Congressman Pete Sessions has introduced HR3285, which authorizes public-private partnerships with unlimited lease terms.

The Senate bill would give agencies much needed flexibility to optimize real and personal property asset performance. All land-holding agencies covered by the Federal Property and Administrative Services Act could potentially have authority to sublease and outlease, including limited public-private partnership authority and exchange sales, as a means of acquiring replacement property. The bill also calls for a total life-cycle approach to property management (i.e., asset management principles, strategic real property planning, an agency real property officer, and a government-wide strategic real property database). It provides incentives for improvement by allowing agency use of property proceeds and streamlines and enhances processes. For example, an agency might own a building that is valuable because of its location but larger than the agency needs. Under S2805 the agency would not have to declare the building excess if it wanted to trade the building for a new building at a less valuable location nearby that still serves program needs. The bill does not affect any agency's existing authorities.

The bill would also give agencies some limited public-private partnership authority. Unlike HR3285, OMB explicitly directed that the Administration bill limit lease terms to 20 or 35 years and that the authority not be used primarily as a means of providing space for federal agencies. The authority could only be used to redevelop

Page 30

property and generate income from property that might be marginal for federal use. Some agencies, such as the Naval Facilities Engineering Command and the Coast Guard, have officials responsible for asset management, but some agencies do not. The bill would call for each property-holding agency to have a chief real property officer and asset planning linked to strategic planning. The bill provides some incentives for disposal or sale of assets. Agencies after taking assets through the public benefit discount process could put money generated into an agency account that would be available for capital expenditures without further congressional authorization.

In summary, the potential benefits of this bill, if enacted, are more efficient property management; more critical repairs undertaken; reduction in federal asset holdings; more property on local tax rolls; savings from cost avoidances; and better facilities.

GOVERNMENT-WIDE REAL PROPERTY INFORMATION SHARING

Summary of a Presentation by Stanley Langfeld, Director, Real Property Policy Division, Office of Government-wide Policy, General Services Administration

Twenty-one agencies are participating in the Government-wide Real Property Information Sharing (GRPIS) program, which seeks to foster collaboration, cooperation, and informal networking among federal real property professionals within given communities in the U.S. GSA's Office of Government-wide Policy has helped to catalyze the creation of regional inter-agency real property councils in several areas, including Seattle, New England, South Florida, and Arizona. Councils will soon be forming in Kansas City and Las Vegas. A council in Minneapolis is under study. The councils provide a forum for real property professionals to exchange solutions to common issues and problems and to improve real property asset management decisions. The underlying premise of GRPIS is that good information leads to good decisions.

A GRPIS Web page has been created with links to all regional councils. It includes GRPIS community studies with community profiles; local, federal, and real property agency contacts; and a list of facilities. The Web page also includes best practices, minutes of GRPIS council meetings, and follow-on initiatives.

The GRPIS process has acted as a catalyst for federal real property professionals to discover opportunities for partnering on projects. Some examples are:

1. The Coast Guard and the Job Corps were partners on a project to renovate the Miami Air Station and provided job training for students on how to do repairs and alterations. The Coast Guard saved over $150,000.

2. The U.S. Postal Service leased vacant space from the General Services Administration in Seattle. The USPS saved $300,000 over the life of the lease and GSA realized income for the federal buildings fund.

Page 31

3. In Natick, Massachusetts, GSA will be using part of the Army's military base for fleet management. In exchange, GSA will renovate a building on site to be used by the Army Soldier Systems Command and GSA.

The various GRPIS councils meet on a regular basis and are individually chartered to meet the federal community's needs and objectives. The councils are starting to come together, and GSA is optimistic that within the next 18 months a national network of councils will be formed.