Panel III

Strengthening the Supply Chain

Moderator: Jim Greenberger National Alliance for Advanced Technology Batteries

“If anybody had told us in 2008 that the federal government was going to put over $2 billion into advanced batteries and electric drive trains, we would have told that person that he is crazy,” said Mr. Greenberger, executive director of the National Alliance for Advanced Technology Batteries (NAATBatt). “It is hard to remember that we lived in a different world just two-and-a-half years ago when it came to advanced battery manufacturing.”

NAATBatt, Mr. Greenberger explained, is a trade association of battery manufacturers and other companies engaged in the advanced-battery supply chain. It was founded in 2008 to try to find a way to begin domestic manufacturing of lithium-ion batteries in the United States, he said. “Our mission is to grow the market for advanced electrochemical energy storage in North America.”

At the time NAATBatt was founded, America’s political leadership did not see petroleum dependence as being a problem, Mr. Greenberger recalled. “Certainly it was not a problem to be solved in this generation and certainly not by that particular Administration.” The alliance focuses on affordability, Mr. Greenberger said. “We have got to find ways to bring the cost of batteries down.”

The “light of lithium ion remained alive” in the U.S. “only through the work of some hardworking and very talented professionals” in the DOE and private industry, Mr. Greenberg said. Many of those entrepreneurs, he said, “have moved around a bit in the last 10 years.”

Now there is a “great, once-in-a-lifetime opportunity,” Mr. Greenberger said. “But it also is a tremendous responsibility. It is a responsibility of every one in this room to build an industry that is truly sustainable, to create jobs that are sustainable, and to make some real progress on moving our country away from petroleum dependence.”

This panel featured three experts on battery manufacturing and the related supply chain, Mr. Greenberger said. “They know something about what it is going to take to move our industry forward to create a sustainable industry and viable supply chain,” he said.

The first speaker, Tom Watson, is vice-president of technology for Johnson Controls Power Solutions and runs the business accelerator program, Mr. Greenberger noted. He hails from Wisconsin.

The next speaker, Mike Reed, joined Magna E-Car Systems in 2009 as general manager of the battery divisions, Mr. Greenberger noted. He started up Magna’s North American lithium-ion battery cell and pack manufacturing facility. Mr. Reed has more than 40 years of experience in the battery industry, he explained, with various technical and managerial roles at battery companies. He holds a degree in chemical engineering from Purdue and an MBA from Indiana University “and, I’m sure, some honorary degree from some Michigan university,” Mr. Greenberger said.

Building a supply chain for an advanced battery industry isn’t only about finished goods, Mr. Greenberger said. “You also are talking about the bottom end of that supply chain, the raw materials,” he said.

The next speaker, Linda Gaines of Argonne National Laboratory, addresses the raw materials. Dr. Gaines is a systems analyst at Argonne for transportation research, Mr. Greenberger explained. She holds a bachelor’s degree in chemistry and physics from Harvard and a Ph. D. from Columbia University. She began her 30 years of experience at Argonne by writing a series of handbooks on energy and material flows, petroleum refining, organic chemicals, and copper industries that provided background for studies of recycling packaging for discarded tires and other energy-intensive materials, he noted. Dr. Gaines’ most recent work has been on reducing petroleum use and other impacts in transportation by recycling batteries and reducing idling.

BATTERY MANUFACTURER PERSPECTIVE

Tom Watson Johnson Controls

Mr. Watson began by noting that he spent one year in Wisconsin, but 25 years in Ann Arbor. “So I still consider myself a Michigander,” he said.

Johnson Controls is involved “in every aspect of energy efficiency,” Mr. Watson explained, including devices for homes, workplaces, and autos. It also is committed to corporate sustainability, he added. “This is more than just the economic part of the corporate equation,” he said.

Although it must produce revenue and profits, Johnson Controls is committed to social responsibility, “which helps bring jobs to our local areas around the globe as well as support and build the industry.” The other part of the company’s sustainability model is environmental stewardship, Mr. Watson said. “That is where it touches on all three pieces of our company business,” he said. “We deliver greater fuel efficiency and lower emissions in our vehicles and reduce energy consumption in our buildings.” Johnson Controls uses a “triple bottom line” model, he said, “as opposed to the single bottom line.”

Johnson Controls-Saft, the company’s lithium-ion battery joint venture, was first to the market with a lithium-ion application for a mild hybrid vehicle, Mr.

Watson said. It began producing the 19-kilowatt S400 Hybrid battery system for Daimler in March 2009. The same system is used in the BMW 7 series.

Mr. Watson described the electric-vehicle battery supply chain as a “circle of life.” Johnson Controls must leverage its partners in materials supply, research-and-development expertise, and infrastructure for charging vehicles, he explained. Internally, it must leverage its own resources in terms of advanced manufacturing capability and energy-efficiency expertise in all parts the company for the lithium-ion business, he said. Because Johnson Controls is a large corporation, it also has the ability to service product warranties, “something our customers are extremely interested in,” he said.

Johnson Controls received a sizable grant through the Recovery Act to build a manufacturing plant in Michigan, he noted. “However, that won’t be sustained if we don’t continuously have new innovations that will drive higher levels of energy and power density and more cost-effectiveness in the products made in that plant.”

To keep innovating, Johnson Controls is collaborating with Argonne and Oak Ridge national laboratories and many universities, Mr. Watson said. Existing and future suppliers are working with the company on new materials. Johnson Controls also works with technology start-ups. “We can’t ignore the ability of some small, fast-moving innovators to come up with innovations even for a large company like ours,” he said.

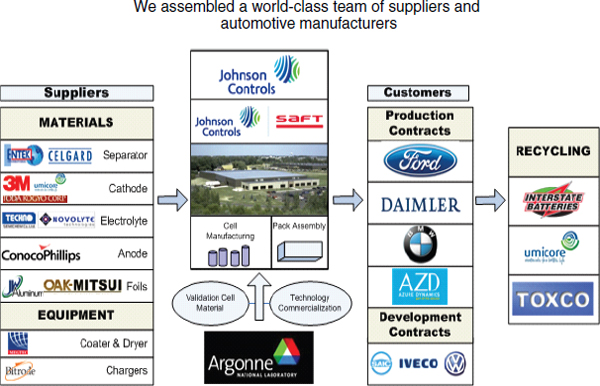

Johnson Controls has assembled a “world-class team” of suppliers and manufacturers for its supply chain, Mr. Watson said. “We have gone around the world to find what we believe are the best suppliers,” he said. The supply chain extends all the way to recycling. In addition to Toxco and Umicore, which are major recyclers, Johnson Controls itself is the world’s largest recycler of lead-acid batteries, Mr. Watson explained. It is leveraging this expertise in processing used batteries and recovering and reusing materials for its lithium-ion business.

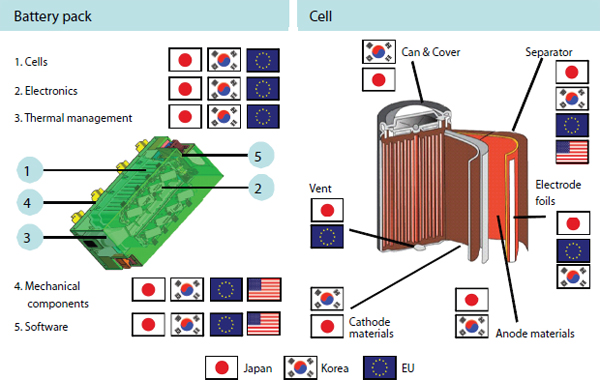

One problem is that most key suppliers are based overseas, Mr. Watson said. For Johnson Controls’ U.S.-based manufacturing plants, “we really like to work with local suppliers,” he said. “It follows along with the social responsibility of our Triple Bottom Line.” But the cells, separators, and cathode materials “pretty much are coming out of Europe, Japan, and Korea,” Mr. Watson explained. There is more U.S. involvement with battery packs in terms of software and mechanical components, Mr. Watson said. “But again, a lot of the supply base is offshore.

Some suppliers are developing capability in the U.S. Johnson Controls also is requiring foreign suppliers to set up manufacturing in the U.S., Mr. Watson said. “We need to do more in terms of capturing a larger part of the value chain

FIGURE 8 Johnson Controls’ supply chain.

SOURCE: Tom Watson, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

in the U.S.,” he said. “This is something we need to remedy not only with manufacturing but also with R&D.

Mr. Watson concluded with several quotes from Alexander Hamilton to show that the importance of manufacturing was recognized even at the foundations of the nation:

“Not only the wealth, but the independence and security of a country, appear to be materially connected with the prosperity of manufacturers. Every nation…ought to endeavor to possess within itself all the essentials of a national supply. These comprise the means of subsistence, habitation, clothing, and defense.”20

______________________

20 Alexander Hamilton, “Report to Congress on the Subject of Manufacturers,” Dec. 5, 1791, published in the Annals of the Second Congress, 1793.

FIGURE 9 Most of the key supply base is in foreign countries.

SOURCE: Tom Watson, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

DEFINING THE SUPPLY CHAIN: GAPS AND OPPORTUNITIES

Michael E. Reed Magna E-Car Systems

As one of the world’s largest tier-one suppliers to automobile manufacturers, Magna Steyr buys lithium ion cells from numerous companies. “We are in the middle of the supply chain,” explained Mr. Reed, who runs Magna E-Car Systems, the company’s lithium ion cell and battery pack division.

Magna is one of the largest, most diversified manufacturers in North America, Mr. Reed said. Based in Aurora, Ontario, the $17.6 billion company has 120 facilities in the U.S. and Canada and around 74,000 employees in 25 countries.

Magna Steyr divisions have been involved in electric vehicles for many years, Mr. Reed said. Magna Electronics, for example, makes charging and electric controls for hybrid and electric vehicles. Magna has been developing lithium-ion batteries for more than six years, especially in Europe. The Magna Cosma division makes electric vehicle structures. Magna Powertrain produces

everything from axels and start-stop systems to water pumps for electric vehicles.

Magna E-Car Systems was started in 2009 and has its headquarters in Auburn Hills, Mich. The unit is “the face to the customer” for all Magna products and services used in electric-vehicle programs of OEMs, Mr. Reed explained. “This is a new, focused effort by Magna to aggressively grow the whole vehicle electrification business,” he said. “Our chairman and founder, Frank Stronach, believes this can be as big as Magna itself in the next few years as our business evolves.”

Magna offers the gamut of services and products to automakers. It integrates components into vehicle systems, develops complete vehicle solutions, and designs and builds cars on a turnkey basis. In Auburn Hills, Magna E-Car has facilities for battery materials testing and builds hybrid, plug-in hybrid, and full-battery electric systems.

Magna E-Cars has a good view of the entire lithium-ion battery supply chain. It buys cells from various manufactures that it uses to make battery packs. “We probably have benchmarked about every available technology and continue to do that,” Mr. Reed said. It also is a buyer of technology and services to develop battery packs and the capital equipment for making batteries, as well as all of the materials and components

Having the supply base scattered across the globe, mainly in Asia presents, complicates logistics. “Obviously, this creates communications issues, due to both time zones and languages,” Mr. Reed said. “That is a challenge for us dealing with this particular type of technology.”

Transportation and customs-clearance also are serious issues. “Moving people and hazardous materials across borders is challenging,” Mr. Reed said. That is especially true with lithium-ion battery materials, which present safety concerns that are still evolving. Countries set a wide range of safety and material regulations for materials, machinery, and the products themselves. “The complexity of the supply chain obviously adds significant costs,” Mr. Reed said. Companies also must carry substantial inventories “to protect your operations when this very long and diverse supply chain is part of your business.”

There are several initiatives to invest in North American production of cells and materials. “But that is still a far cry short of the full supply chain that needs to be put into place,” Mr. Reed said. Conductive materials, foils, separators, and electrolytes all primarily come from Asia, he said, “although there are many potential qualified suppliers here in North America.” One significant material for a pouch sell, the laminate, “is almost exclusively confined to Japan at the moment,” he said.

One major advantage of big Asian lithium-ion battery companies is that they are vertically integrated or control their supply chains, Mr. Reed said. The supply chain was established essentially to support the electronics industry in Japan, he said. That provides major cost benefits to Japanese manufacturers and restricts access to key parts and materials. While still largely controlled by Japan,

the supply industry is expanding to South Korea and China. “But we have a lot of catch-up to do to become a viable competitor in this market,” he said.

Investment in North America in lithium-ion cell production in the past year has been “impressive,” Mr. Reed said. “But I don’t think it has been balanced by necessary investment in the supply chain itself,” he said. The uncertainty of market volumes and timing are causing many delays in investment, and government incentives have been “relatively short term,” he said. “In terms of the business cycle most battery manufacturers operate on, we need longer-term vision—five to seven years or longer—to make the incentives being considered more effective.”

Small volumes are another problem. Most electrified vehicle programs by automakers involve a few thousand vehicles a year. “Very few people are announcing programs in the tens of thousands per year or higher,” Mr. Reed pointed out. The costs of developing and validating products and applications for so many small programs “is really prohibitive in the way the industry is evolving at this point,” he said.

Companies are still investing in these areas, often thanks to federal incentives that cover “50 cents on the dollar,” Mr. Reed. “Still, big investments are required to make sure these products work, that they have a long-term performance capability, that they will meet customers’ requirements, and that they will not bankrupt a company because of any warranty exposure.”

The technologies involved also make the validation process long and expensive. Over the last 20 years, lithium-ion cell have learned a lot. “But they also have developed a product that is not suited for the automotive industry,” he said. “It is one thing to produce a cell that lasts two or three years in a laptop or cell phone before you turn it in for your next model. But people don’t turn in their vehicles that often.”

Government and industry could help by promoting standardization and testing, Mr. Reed said. Current testing standards for batteries are evolving and not fully developed. “Literally every OEM customer has its own special set of requirements that drives this whole process,” he said. “Often, you have cell or pack technology that has been developed and qualified to one set of standards, but you may still need to spend millions of dollars to re-qualify it for another OEM’s specific set of standards.”

There has been a lot of discussion of standardizing cell sizes, such as in Germany, Mr. Reed noted. His experience in the battery industry, however, “suggests that this is something that is not going to happen by committee,” he said. “It’s going to happen by success in the marketplace, and the winners will set the standards that will then help lower the costs long-term. It is going to require volume to get those answers.”

It also would help if producers of cells and components develop “truly automotive-grade hardware with well-known reliability and life-performance characteristics,” Mr. Reed said. That would enable car makers to engineer those components into their future vehicles. “Much of that does not exist today,” he

said. “It’s not just a cell-development issue. It is development of the many components that go into the battery pack.”

Continued investment is needed in advanced storage technology, Mr. Reed said. “But unlike in the past, when investment focused on the 10-year-plus time horizon, we need to be focusing on the development side of R&D to get us faster into applications so that we have products to sell.”

Government programs to boost demand also are very important, he said. “To pick winners by putting grant and loan guarantees into selective companies, and to pick winners too early, could end up being counter-productive if those companies cannot sustain themselves with volume,” Mr. Reed said. Policies that promote demand, develop a diverse supply base, and let companies compete and succeed are desirable, he said. “Anything we can do to increase volumes of hybrid and electric vehicles and reduce the uncertainty over when and how large this business is going to be will help move this business forward.”

BATTERY MATERIALS AVAILABILITY AND RECYCLING

Linda Gaines Argonne National Laboratory

The main motivation for the transportation electrification push is easing America’s dependence on imported petroleum said Dr. Gaines of Argonne’s Center for Transportation Research. But there also have been concerns about American dependence on an essential ingredient for advanced batteries—lithium. “The main motivation of this talk is to make sure we are not going to run out of something important,” she said. “There was a big scare produced by one individual, actually, that we might be running out of lithium for lithium ion batteries.”

David Howell and others at the Energy Department asked her to look into the issue, Dr. Gaines explained. Another part of her work is to look at the environmental impact of recycling batteries, she said.

Argonne tried to address the question of lithium supply “in the most logical way possible,” Dr. Gaines said. It asked how many electric cars there will be, how much lithium they will use, and how that compares to how much lithium there is.

The study used scenarios prepared for the DOE by Argonne’s Washington staff. One scenario was “business as usual.” Another assumed hydrogen vehicles would be successful. There also was a “maximum electric” scenario, Dr. Gaines said, which projected how many electric vehicles of different types would be on the market at different time scales.

Under the “maximum electric” scenario, hybrids would soon account for 25 percent of the U.S. car market by around 2020 and stay at that level through 2040. Demand for plug-in hybrids would take off around 2020 and take about 60

percent of U.S. car market in 2050. Full-battery electrics would become a factor after 2020 but still account for just 10 percent of the market in 2050.21 Dr. Gaines said she suspects the scenarios may be “a little pessimistic” in terms of when hybrids and plug-ins will penetrate the market. Even if those sales levels are achieved sooner, however, “it doesn’t change the basic numbers,” she said.

The next step was to calculate how much lithium ion would be needed in the batteries. “Luckily, Argonne has a really excellent battery-development group,” she said. Co-author Paul Nelson helped produce careful calculations for different battery chemistries for vehicles of different ranges.

The study looked at four different chemistries, all of which used lithium in the cathodes. They are nickel-cobalt-aluminum oxide (NCA), lithium iron phosphate (LFP), and two lithium manganese dioxide types, one (LMO) with a graphite anode and another (LMO-TiO) with a lithium-titanium based anode. The LMO-TiO was the only chemistry of the four using lithium in its anode. The others use graphite.

For vehicles with a 100-mile range, the most lithium required in a battery was 12.7 kilograms, Dr. Gaines said. That was for the battery using the LMO-TiO chemistry. “That is a fair amount, but most batteries use a lot less,” she explained. The NCA battery uses 7.4 kilograms in a car with a 100-mile range. The LMO version requires just 3.4 kilograms.

The batteries using the lithium-titanate anode, however, are unlikely to catch on for vehicles with a 100-mile range because they would weigh 500 kilograms. . Dr. Gaines said. “I can’t imagine a lot of people driving around with 1,000 pounds of battery,” she said.

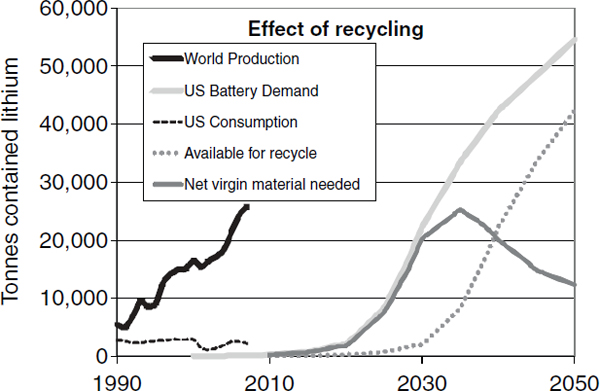

Based on these assumptions, 50,000 to 60,000 tons of lithium would be used in electric cars on American roads by 2050, Dr. Gaines said. Currently, less than 30,000 tons of lithium is produced in the world each year, but that is rising rapidly. It won’t be until around 2030 that U.S. lithium demand would match current production levels, even in the rapid penetration scenario.

Lithium production can be increased. Dr. Gaines noted that she recently attended a conference in Las Vegas called Lithium Supply and Markets 2010. “If you believe the people who were there, there are at least 100 companies exploring for lithium at 150 different sites. If they all produce what they expect to be producing, the production over the next 20 to 30 years could be way more than even the most optimistic demand scenarios,” she said.

Dr. Gaines cautioned that the demand projections are just based on scenarios. “They are not meant to be what we expect to happen,” she said. “It is a ‘what if,’ and is very optimistic.” It was an exercise to determine how much material would possibly be needed if “these vehicles come as quickly as we imagine,” she explained.

______________________

21 Phil Peterson, Margaret Singh, Steve Plotkin, and Jim Moore, “Multipath Transportation Futures Study: Results from Phase 1,” Office of Energy Efficiency and Renewable Energy, U.S. Department of Energy, March 9, 2007 (http://www1.eere.energy.gov/ba/pba/pdfs/multipath_ppt.pdf.

The team also looked at how much lithium would be needed it were recycled. More than 40,000 tons of the material used in 2050 could be recycled, the study concluded. As a result, the “net virgin material needed” for the U.S. electric car market would peak at around 25,000 tons a year in the 2030s and decline to less than 15,000 tons by 2050—below current world production. “Recycling drastically reduces the amount of virgin material that you would need,” she said. “We certainly know that recycling is feasible” because it is done with lead-acid batteries.

The re-use of car batteries at the end of their life would also affect lithium demand. While those batteries may not be good enough to operate a car, they may be fine for utility storage, she said. Re-use would raise the amount of lithium needed by about 10,000 tons annually because it would delay the material recovered through recycling.

All of these estimates apply only to U.S. consumption, however. Large volumes of lithium-ion batteries also will be required in the rest of the world, Dr. Gaines noted. The Argonne team used estimates from the International Energy Agency that an assumption “even more aggressive than what we did,” she said.

FIGURE 10 Recycling can drastically reduce virgin Lithium demand.

SOURCE: Linda Gaines, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

It assumed the target of reducing carbon by 80 percent would actually be accomplished, “largely through rapid introduction of electric vehicles in the world market,” she said. Dr. Gaines called that an “incredibly uncertain scenario.”

Developing global estimates is complicated because lithium demand is influenced by the size and range of the vehicle, Ms. Gaines explained. The IEA estimates assume cars will have batteries of 12 to 18 kilowatt hours of storage capacity, “which I think is rather large for the rest of the world,” she said. Electric vehicles also could be bicycles, she pointed out.

If these projections were true, however, world lithium demand would reach about 450,000 metric tons by 2050, Dr. Gaines said. If the average battery size of these vehicles is much smaller, demand would drop to around 200,000. And if these smaller batteries were recycled, lithium demand would drop to around 100,000 tons. In other words, lithium demand would grow to four times current production compared to 20 times if the more aggressive IEA assumptions are used. “It is not unreasonable to assume that you can increase current world production by a factor of four in 40 years,” she said.

Batteries account for one-quarter of global lithium use, and that share will keep rising, Dr. Gaines predicted. She also noted that use of lithium-ion batteries for cars is growing much faster than for electronics products.

When one looks even at conservative estimates of known lithium reserves in the world, however, “one sees that we are not about to use up all the material in the ground,” Dr. Gaines said. Cumulative demand for lithium until 2050 is estimated to be 6.5 million metric tons if large car batteries are used and there is no recycling, she said. That would drop to 2 million metric tons if smaller batteries are used and there is recycling.

The U.S. Geologic Survey estimates reserves in mines around the world at 9.9 million metric tons, with 7.5 million metric tons in Chile. The USGS puts known world reserves at 25.5 million metric tons.22 Other estimates are higher. In fact, U.S. demand could be met by domestic lithium resources in Nevada and California if they are developed and recycling is implemented, Dr. Gaines said.

There are concerns with materials besides lithium. Dr. Gaines noted that U.S. demand for cobalt and possibly nickel would make a serious dent in global reserves by 2050. “But I don’t suspect we will be using that much cobalt in batteries,” she said. “I suspect we will be moving away, as manufacturers already are, from cobalt as a significant component of the cathode material.” Demand for aluminum, phosphate, manganese, and titanium for car batteries would account for a far less significant share of global reserves.

The conclusion from these data is that “lithium ion batteries can at least give us a bridge to the future until something better comes along,” Dr. Gaines said. “I think it could be a fairly long term.”

______________________

22 Data: U.S. Geological Survey, revised January 2010 data. See (http://minerals.usgs.gov/minerals/pubs/commodity/lithium/mcs-2010-lithi.pdf). These numbers were revised again in 2011.

Many warnings over the years “that we are running out of something have been grossly wrong,” Dr. Gaines observed. The Club of Rome, for example, famously predicted in 1972 that the world would “run out of gold in 1981, mercury and silver by 1985, tin by 1987, and petroleum, copper, lead, and natural gas by 1992.”23 “So I don’t think we should be too alarmist,” she said.

In terms of recycling, “a pet project of mine,” different processes are currently being developed, Dr. Gaines said. “The interesting thing about them is that they recover material at different stages of the life cycle,” she said. Some processes go all the way to smelters. At the other extreme, processes try to recover lithium as battery-grade material that can quickly be put back into batteries, she said.

Smelting recovery processes are working now, Dr. Gaines said. “You can throw anything in and get cobalt, nickel, or whatever out the bottom,” she said. Lithium, however, goes into the slag. “It could be recovered, but it is not,” she said.

Toxco, a company that received a DOE grant, will be recovering lithium in a new plant in Ohio, Dr. Gaines noted. Another company, OnTo Technologies “has demonstrated it can take a uniform stream of batteries, break them up, recover the electrolyte, recover the cathode and anode material, and re-use the materials to make a new battery and have it perform reasonably well,” she said. “It is a low-energy process, you don’t need high temperature, and they do believe they can get battery-grade material back out.”

Argonne would like to now determine which of these processes “makes the most sense from an energy and environmental standpoint,” Dr. Gaines said. “Stay tuned for that.”

A new process being developed at Argonne, meanwhile, attempts to take waste plastics bags (and could use plastics from batteries) and turn them into carbon nano-tubes, Dr. Gaines said. “That would be a way to get that material back into batteries or up-cycle it into something even more valuable,” she said.

DISCUSSION

Mr. Greenberger said he was intrigued by Mr. Watson’s point about Johnson Controls’ foreign suppliers. “My quick count was that it seems about 80 percent of the materials you are buying for cells and components are not sourced in any major quantity in the United States,” he said. He asked Mr. Watson to elaborate and suggest what North America must do to expand its supply base for those components.

Materials that Johnson Controls uses to make cells in France come from Asia, Mr. Watson noted. “By and large, as we started to set up shop in North America, we found a lack of a supply base here in the U.S.,” he said.

______________________

23 Donella H. Meadows et al., The Limits to Growth, Universe Books; 2nd edition (February 18, 1974) The authors note that their purpose was not to make specific predictions, but to explore how exponential growth interacts with finite resources.

As a result, Johnson Controls has required each of its materials suppliers to build processing factories in the U.S. Each factory or supplier has a “variable degree of vertical integration” in the U.S. versus what they are doing overseas, he said. “We would really like to encourage a great mix of vertical integration in the U.S.”

One way to encourage that is to stimulate a strong R&D push “to get the new emerging suppliers as well as the established suppliers to be conducting their R&D onshore here,” Mr. Watson said.

Mr. Reed of Magna noted that Japanese suppliers are vertically integrated within their customer base as well. In consumer electronics, “they really got into batteries as a means to help sell what they have,” he said. “That means companies that are not a part of that keiretsu don’t get the same access to new R&D coming out of their labs as do those who are part of the keiretsu. So to be able to establish an R&D base in the U.S. at the material supply level will allow battery makers in the U.S. to do more collaboration with suppliers and compete more effectively.”

Mr. Reed said the biggest thing that can be done is to expand the U.S. market for electric vehicles. Generally, cells and battery packs for North American will be sourced in North America. Those sold in Europe will be sourced in Europe, and those sold in Asia will be sourced in Asia. “If you look at the history of the supply chain and the number of factories, I think it is unlikely any one country is going to dominate and export to the rest of the world over the long term,” he said. “I also think it is unlikely the U.S. is going to become the battery supplier to the world. So I think the faster we can grow the market, whether for automobiles or commercial vehicles, the faster we will drive the supply base that is necessary.”

Restoring U.S. lithium production would help, Dr. Gaines said. The U.S. produced lithium until cheaper South American sources became available, she said. “At least we will have raw material here,” she said. “Obviously, the battery manufacturers need the lithium compounds to make batteries.”

Dr. Gaines said it also seems feasible for some U.S. chemical companies to make lithium carbonate and metal oxides. “It seems unnecessary to send lithium carbonate made in the U.S. and shipped to Asia to be made into cathode materials that then are shipped back here to make batteries,” Dr. Gaines said.

Mr. Greenberger asked how much of an issue standardization is for the industry. “How much cost can we squeeze out of the process by standardization?” he asked. “And if it’s not going to happen by committee, how is it going to happen?”

It is good to many different developers of materials, cell designs, pack technology, and vehicles, Mr. Reed responded. “I think diversity is going to allow the winners to be developed and emerge,” he said. The first step is to standardize the way materials and cells are judged, Mr. Reed said. That way, potential suppliers “have a clear understanding of what the expectation is.” If expectations are fairly consistent across customers, then the costs of qualification and development “can be kept to a reasonable.”

Most of the DOE budget for batteries goes to development, Mr. Reed noted. “What people often lose sight of is that once you have a material, cell, or product, you then have to go through a full series of qualifications to get them into an OEM program,” he said. “It may cost you $2 million to $3 million to take a fully engineered cell through a full range of qualifications for one or more customers.” That process for a battery pack can take $10 million after it’s been developed all the way to make sure it has the life and durability to make sure it is a successful product, he said.

Still, Mr. Reed said he doesn’t expect standard products to emerge until high volumes of vehicles are produced. That will determine the “winners in the survival-of-the-fittest process,” he said. “Then I think we will have standards cells. But that is many years into the future.”

Mr. Watson said he does not see a rush toward standard cell sizes or capacity. Whether the customer is an automaker or consumer-electronics company, “I’m not sure that we as a battery maker want to dictate the way they do their businesses,” he said. Standardization could help testing, charging, handling, and transportation standards, he said.