Ronald Long, J.D.

Regulatory Affairs, Wells Fargo Advisors, LLC

Introduction

The scourge of elder financial abuse has received considerable attention from many over the past few years.7 The GAO (2012) cited it as “an epidemic with society-wide repercussions.” Almost by definition, the challenge for financial services companies is more direct and urgent as they are often holding “the keys to the kingdom” on which the abusers have set their sights. To respond to this daunting task, individual banks and brokerage firms, and the financial services industry as a whole, have undertaken a number of initiatives to detect, deter, and respond to the elder financial abuse events they are seeing more of every day. This paper outlines the efforts of one firm, Wells Fargo Advisors (WFA),8 which has created infrastructure, initiatives, and systems designed to detect, deter, and report third-party elder financial abuse.9

The Wells Fargo Advisors Inventory

A major part of the WFA effort in addressing elder financial abuse flows from the stark realization that what are generally described as reasons the elderly are targets precisely overlays the WFA client base. Elders are targeted for abuse because, as a group, they tend to possess more money. Older Americans are 47 percent wealthier than younger Americans (Censky, 2011). Persons over age 50 control more than 70 percent of the nation’s wealth (National Committee for the Prevention of Elder Abuse, 2008), and 81 percent of households headed by people 65 and older own

_____________________

7 See http://www.nij.gov/topics/crime/elder-abuse.

8 WFA is a non-bank affiliate of Wells Fargo & Company (“Wells Fargo”), a diversified financial services company providing banking, insurance, investments, mortgage, and consumer and commercial finance across the United States and internationally. Wells Fargo has $1.3 trillion in assets and more than 265,000 team members across 80-plus businesses. The elder financial abuse work is a corporate-wide initiative, but for ease of discussion, this paper will focus primarily on the effort in WFA. The paper will use the terms “WFA” and “Wells Fargo” interchangeably.

9 As a part of the highly regulated U.S. securities industry, WFA uses and relies on several layers of protection against any employee who may mistreat an elder client. The firm’s compliance systems and its federal, state, and private regulators all have this rarer issue uppermost in their missions. Accordingly, this paper will focus on the instances of preventing third-party elder financial abuse and essentially self-abuse through the client’s declining capacity.

their homes (Washington Post, 2012). Households headed by people 75 or older have the highest median net wealth of any age group (U.S. Census Bureau, 2012).

The statistics for WFA clients are almost mirror images of these national statistics. The majority of the $1.2 trillion in assets held by WFA are owned by clients who are over 60 years old. Even more, many of our clients are actually retired or soon to be retired, so safeguarding their nest eggs is even more critical because these clients will have no opportunity to find new employment income to make up for losses suffered due to elder abuse. With an estimated 10,000 persons turning 65 every day for the next 20 years, the potential for a WFA client to become a victim of elder financial abuse is increasing dramatically.

Training

An initial decision for a financial services company that desires to handle elder financial abuse is simply to raise internal awareness of this issue. For example, Wells Fargo requires annual training of the majority of its employees. At WFA, computer-based training on “Reporting Suspected Financial Abuse” is required annually for all brokerage employees, whether they deal with customers or not. The training outlines the elements of elder financial abuse, its impact on the victims, and procedures an employee should use to determine when to suspect elder abuse and where to report it.

In addition to this training, in April 2013 WFA launched its first live training for brokerage financial advisors and client associates (FAs and CAs)10 on elder financial abuse. FAs and CAs are often “first responders” to potential elder financial abuse. This training uses four brief video vignettes to help lead the trainees through group discussions about elder financial abuse scenarios that they might see in their dealings with clients. WFA plans to present this live training to other Wells Fargo FAs and CAs around the country.

Centralized Unit

Essential to a financial services’ company’s ability to address the epidemic of elder financial abuse is the creation of a centralized response unit. WFA’s field personnel are trained to contact their manager and also call a toll-free number for a centralized response unit designed to take reports of potential elder financial abuse. The response unit, which is currently located

_____________________

10 Financial advisors are the professionals holding one or more licenses permitting them to provide financial services to clients. Client associates are often also licensed and they assist the FAs in servicing their clients.

in the Legal Department of WFA, consists of lawyers and paralegals who do intake, gather clarifying or follow-up information to determine whether the matter is reportable as suspected elder abuse, and then take steps to see that a report is filed with the appropriate APS.11 While there is a split among the states as to whether financial services firms are “mandatory reporters,” Wells Fargo’s corporate policy is to consider itself a mandatory reporter of suspected elder and vulnerable adult abuse in all states.

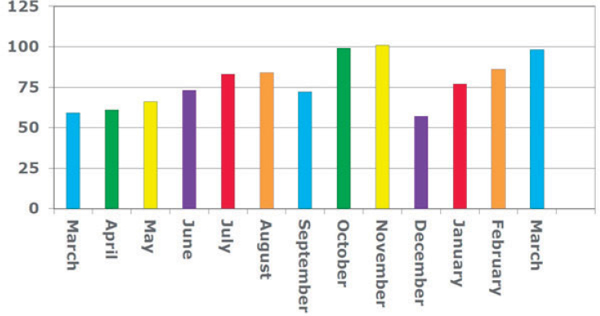

Having a centralized reporting unit for financial abuse offers many advantages. A consistent company response will be given no matter where the report has arisen. In a decentralized model, you may have those making reports in one state apply a completely different, and possibly contrary, method of handling cases from those in other states, even though the cases are similar. Another advantage of centralization is the inherent increase in the expertise level as the team members handle more cases and can share circumstances and nuances with each other. Centralization also allows the unit to work in an advisory role where situations occur that may not be reportable elder financial abuse matters, but where the FAs and CAs can benefit from a discussion of some possible resources. The response unit members have quarterly meetings with others at WFA who touch on some of the elder abuse issues (e.g., fraud investigators and regulatory lawyers) to discuss external challenges and case histories. Finally, the response unit has aided WFA in its effort to gather more data about the number and characteristics of cases of elder financial abuse arising in its nationwide brokerage network (see Figure II-1 for the number of cases coming into the centralized unit in the past year). This information hopefully will allow us to recognize new scam strategies at an earlier time and to refine our client education and FA/CA training on this topic.

Client-Focused Information

Properly designed and distributed information on elder issues can serve the role of a “vaccination” of older individuals against elder financial abuse. It is important that the information is clear, easy to understand, and delivered in a fashion that is balanced and not self-promoting. WFA makes available to the public a comprehensive brochure, Guide to Financial Protection for the Older Investor, which covers key topics such as suitable investments, misleading “senior” designations, and instructions on how to identify and report scams. With the assistance of the U.S. Administration on

_____________________

11 We will use “APS” to refer to state or local agencies that have a statutory obligation to assist older and vulnerable adults in some way. The appropriate name for these agencies and their mission will vary by state. This paper will nonetheless use APS to refer generally to all such agencies.

FIGURE II-1 Total elder matters opened March 2012-March 2013.

SOURCE: Wells Fargo Advisors, 2013.

Aging (AoA), WFA recently has started distributing to the public through its FAs and CAs a quick reference guide on elder financial abuse. The pocket-sized brochure describes signs, behaviors, and actions that may be early warnings of financial abuse or exploitation of an older individual. By asking people to speak up and not remain silent, this information will both help prevent potential abuse and increase the likelihood of earlier reporting of an abusive situation. In late spring 2013, Wells Fargo piloted an elder financial abuse awareness program targeting its client base and the public. The seminar provided an interactive forum where the public viewed a summary of a documentary on the challenges of elder financial abuse and then engaged in a discussion with others in the audience as well as experts in the field. WFA believes these client-focused outreach efforts permit financial services companies to work collaboratively with public agencies and other organizations within the community to protect the assets of older people from predators. WFA is evaluating the program for expansion to more locations in the country.

Educational Outreach

WFA is a retail brokerage operation staffed with skilled team members at all levels. With stark self-examination, however, it concluded that it was not as thoroughly educated on the field of elder financial abuse. Accordingly, WFA has taken affirmative steps to increase its knowledge and familiarity with the subject matter. For the past few years, WFA has had

a consulting arrangement with Michael Creedon, a well-recognized gerontologist. Creedon has brought his knowledge and expertise to the attention of numerous departments throughout WFA, covering multiple subjects related to elder financial abuse and other issues impacting older Americans.

WFA also sought to learn more about the subject of elder financial abuse by hosting eight half-day symposiums around the country. Joined by professionals from APS, securities regulators, law enforcement, academics, federal agencies, prosecutors, Alzheimer’s advocates, medical professions, and other financial services firms, WFA and the participants discussed some challenges facing those detecting and reporting elder financial abuse, particularly in the retail brokerage environment. Using short vignettes to reenact some of the scenarios that financial services firms face, attendees learned, in some instances for the first time, about the structural or attitudinal impediments that actually worked against the seamless and coordinated approach needed to investigate and remediate a case of elder financial abuse. For example, in one symposium, WFA learned that occasionally law enforcement could label a case of potential abuse a “civil matter,” and accordingly decline to act. In another instance, WFA learned that what would otherwise seem to be a perfectly well-supported referral to APS could be declined because there was no abuse of government funds or physical injury to the elder victim. While many participants commented after a symposium about how much they benefited from the interactions, the eight gatherings around the country served as an intense “cram” session for WFA as it gathered more insight into the challenges facing the various components of the infrastructure designed to combat elder financial abuse. Indeed, the variations in legislation and in regulations among states, along with the substantial differences around the nation in funding for APS and other response agencies, contribute to the complexity of this issue for multistate financial institutions.

The WFA educational outreach continues by sending staff to conferences and meetings where APS, mental health, and other social service entities often converge to share information and experiences. In 2012, WFA spoke on elder financial abuse at the Oregon Home Care Association’s annual conference. Since early 2012, WFA has begun to pair our visits to our state securities regulators with visits to the leadership of that same state’s APS agencies. WFA also participated in and presented at the National Adult Protective Services Association’s annual conference. At this conference, WFA had opportunities to listen to presentations from a number of APS professionals from around North America. WFA was invited to present at the 19th Annual New York State Abuse Training Institute, whose theme was Broken Trust: How to Recognize and Respond to Financial Exploitation. For financial institutions, it will be essential that they continuously educate themselves about elder and vulnerable adults and

their susceptibility to various forms of financial abuse. Likewise, financial institutions can contribute their expertise to the education of APS employees, police, and other public-sector professionals who respond to the many ways in which financial abuse can take place.

Partnerships

A final component of a financial institution’s inventory of tools to combat elder financial abuse should include a structured use of outside partnerships to help support those who may have a role in stemming the tide of elder financial abuse. As a corporate entity, Wells Fargo has traditionally donated to a number of charitable organizations which in whole or part provided assistance to those who have experienced elder financial or other abuse. Starting in 2012, the firm has embarked on a more focused partnership effort. WFA has joined with other financial services firms to participate in SAFE Team (Security for the Aged from Financial Exploitation Team), a group based in New York City focused on combating elder abuse through identifying and developing best practices for law enforcement, APS, financial institutions, and social services. The AoA has begun working with financial services companies and industry groups to promote programs and educational outreach to raise awareness. While the ink is not dry, Wells Fargo likely will help fund initiatives with some national nonprofits designed to increase training for APS workers on financial and other social service issues as well as training workers and volunteers to carry the prevention of elder abuse message to more seniors and others in communities throughout the country. Though clearly some partnerships are accompanied by an outflow of funds and resources from Wells Fargo, much more is returned to the firm as WFA gains a better and more detailed knowledge of the difficulties inherent in our nation’s existing infrastructure designed to handle the rapidly growing elder financial abuse case load.

Top Types of Financial Abuse

The types of financial abuse that affect financial services clients most often fall into the following broad and sometimes overlapping areas of (1) power of attorney (POA) abuse, family disputes, and caregivers; and (2) third-party scams (investments and sweepstakes).

POA Abuse, Family Disputes, and Caregivers

Older clients often use POA documents to give family members and “trusted others” the authority to help them with their financial affairs, partly as a convenience, and also partly in case the older person is suddenly

hospitalized, or has another emergency health situation, which may be temporary or permanent. The person who receives that power is referred to as an agent or sometimes an “attorney in fact.” The agent has fiduciary duties to the “principal” who granted the power. The agent might be an adult child of the client, a sibling, a caregiver, or a neighbor. When an elder becomes the focus of a dispute between adult children or other family members, over who will “assist” Dad (and Dad’s IRA or Dad’s bank accounts), it is difficult for a financial services company to figure out whether there are “good guys” or “bad guys.” Is this the time to make a report to APS, or do the family members all have Dad’s best interests at heart? If the broker is unable to reach the client on the phone to verify that he or she actually has signed a new POA putting her new caregiver on the account, and the caregiver is standing right in front of the broker with instructions to transfer a large sum of money to a new joint bank account, which the caregiver says is needed to pay the client’s moving expenses to an assisted living facility—how long should the broker delay that transaction?

The agent whom the older person has chosen is ideally a trusted other who understands that he has a fiduciary duty, and who uses the POA solely for the benefit of the older person. But the agent could also be a thief, who obtained the POA by threats or undue influence, or who sees the powers he has under the POA as a means to accelerate his or her inheritance. Due to recent state laws that were intended to encourage financial institutions to more readily accept POAs (by setting strict time periods, and limiting the reasons to reject a POA, with damages for violations of the law), financial institutions may accept POAs or allow transactions by agents that they would have once rejected as suspicious.

Third-Party Scams (Investments and Sweepstakes)

It is difficult to understand someone who falls victim to a third-party scam, such as the older person from the United States who cannot be shaken from the belief that he or she has won the Malaysian Lottery. Older people who are seemingly capable in every other way have become bitten with the sweepstakes bug, and nothing that law enforcement or the fraud prevention managers of a bank or brokerage tells them can counteract the poison that will cause the older person to deplete all of his or her retirement savings. This depletion occurs often despite protection measures such as giving them newspaper articles or Federal Trade Commission flyers about these scams. With no help from often-overwhelmed law enforcement, no protective services from APS because the client rejects the help, and no cease-and-desist orders from state regulators, it is difficult to impossible for banks and brokerage companies to keep the scammers away from these vulnerable elders.

OWN IT

It appears that mnemonics, acronyms, and catch phrases are often useful in helping drive home the elder financial abuse awareness message. SAFE in New York City and FAST (Financial Abuse Specialists Team) in Houston and other cities are potentially headline-grabbing acronyms that gain needed attention when trying to promote work done by multidisciplinary teams. To this end, WFA has started asking that individuals OWN IT when combating elder abuse. This messaging is summarized below:

Observe: Are there physical changes? Are patterns and habits different? Does the elder behave strangely? Is there a third party present with the elder whose behavior is odd?

Wonder Why: Why is this withdrawal multiples larger than before? Why has the elder just begun to send money to a foreign country?

Negotiate: Can the requested transaction be delayed? Can the check go in two names, elder and trusted third party? Can we only give a fraction of the money today, and more later?

Isolate: Get the elder alone, away from the suspected abuser—“Ms. Smith, please step into my office to confirm some account information,” or “Please come with me to discuss some confidential information.”

Tattle: Bring your concerns to a supervisor or manager immediately. Use your firm’s APS reporting process.

Conclusion

Financial services firms increasingly are playing a greater role in the universal and ongoing struggle to end elder financial abuse. Recounting the efforts of Wells Fargo provides some insight for traditional elder abuse professionals into the various tools and activities that the financial services industry has used. Ideally, this presentation will heighten the awareness of the attendees at the conference regarding challenges faced by these financial firms. In addition, this review may stimulate ideas and discussions on areas of greater collaboration among the financial services industry, the public service agencies that deal with elder abuse issues, and other community organizations that serve elders and their families. We must work together to support our elders and to enable them to have lives of dignity and freedom from abuse.