The Emerging Competitive Landscape

Because flexible electronics products have only begun to enter the market, most assessments of emerging national and regional advantage examine the apparent strengths and weaknesses of each country/region based on its existing human and institutional assets and, in some cases, recent performance in related sectors. At present, the three zones in which major developmental efforts in flexible electronics are under way are Europe, East Asia, and North America. Although countries located in each zone enjoy significant competitive strengths, no region is clearly poised to dominate the new industry.

In 2011, Germany’s National Academy of Science and Engineering published a study of Germany’s global competitive position in organic electronics. It surveyed more than three dozen German experts in the field asking, among other things, for an assessment of the regions of the world regarded as holding leadership in various thematic areas associated with organic electronics. (See Table 4-1.)

The acatech survey has not been updated, as of this writing, and while it is a useful benchmark of relative regional competitiveness, it has been overtaken by a number of events:

- The market for flexible photovoltaic electronics products, an area of U.S. and European strength, has been devastated by a global industry shakeout.1 A once promising U.S.-based organic photovoltaics (PV) maker, Konarka, went bankrupt in 2012, an event which has undermined prior U.S. leadership in organic PV.2

_______________

1 “Investments, Upheaval in the PV World,” Printed Electronics Now, September 2011.

2 “Konarka Technologies Files for Chapter 7 Bankruptcy Protection,” Printed Electronics Now, May 31, 2012.

TABLE 4-1 acatech Survey of Competitive Positions in Organic Electronics

| Thematic Area | Leading Region |

| Materials | Europe |

| Plant technology | Europe/Asia |

| Device technology | Europe/US/Asia |

| Products | US/Asia |

| OLED displays | Asia |

| OLED lighting | Europe |

| Organic FET | US/Europe |

| Organic PV | US/Europe |

SOURCE: acatech—National Academy of Science and Engineering, eds., Organic Electronics in Germany: Assessment and Recommendations (Munich: National Academy of Science and Engineering, 2011).

- Technological difficulties associated with the new flexible electronics materials and processes have delayed product introductions in all regions, including East Asia.3

- Asian producers of flat panel displays, including Samsung, LG, and AU Optronics, have moved to commercialize handsets, TVs, and e-readers utilizing flexible displays. They have developed techniques for converting their existing conventional liquid crystal display (LCD) manufacturing lines to produce flexible displays, consolidating Asian leadership in displays.

- Taiwanese and Japanese firms are joining hands to challenge emerging Korean leadership in displays.

- Small U.S. and European firms are entering niche applications markets, but no major device aggregators have emerged in either region comparable to the Asian makers of consumer displays, and Asian firms arguably lead in the “products” category.

- Numerous small U.S. and European firms that have developed significant proprietary technologies have been acquired by firms based outside of their regions, usually in Asia, strengthening Asia’s competitive standing in factory technology, materials, displays, and products.

_______________

3 In 2013, Samsung indicated that the introduction of smartphones with flexible displays by the end of the year might be delayed because of technical issues associated with Vitex System encapsulation technology, which reportedly slowed down the production process. “Samsung Delays its Flexible Displays,” PhoneArena.com, April 17, 2013; “Samsung Delays Flexible OLED Displays,” Plastic Electronics, October 2, 2012. Problems associated with manufacturing yields reportedly induced LG and Samsung to delay introduction of 55-inch organic light-emitting diode (OLED) televisions in 2012. “LG and Samsung Face Delay with OLED Televion,” Plastic Electronics, October 18, 2012. In 2012 Taiwan’s AUO announced a delay in its mass production of OLED displays for smartphones citing “issues with the fabrication.” “AUO Latest to Delay OLED Mass Production,” Plastic Electronics, October 31, 2012.

THE EAST ASIAN EDGE IN DISPLAYS

The shadow that looms over any competitive assessment of global competition in flexible electronics is the fact that East Asian firms manufacture virtually all of the world’s rigid consumer displays and are moving quickly to translate this leading position into a lasting competitive edge in flexible consumer displays. The Asian display makers possess deep, relevant manufacturing competencies, established supply chains that can be deployed to support new investments in flexible electronics, a proven ability to bring attractive products to market quickly, and the financial strength needed to make large, risky investments. (See Table 4-2.) Asian firms have acquired most of the critical intellectual property associated with OLED displays from Western sources.4 The prospect that large Asian industrial groups will enter the market for flexible displays is a factor underlying the apparent reluctance of most U.S. and European firms to enter commercial production of consumer displays, with the exception of proprietary niche technologies.

The 2011 study by the German National Academy of Science and Engineering drew a picture of a global market for organic electronics in which Asian firms were acquiring a virtually insurmountable leadership position in OLED displays. The study warned that

the initial situation as described is characterised by acute danger to Germany’s position in all facets of organic electronics. Material and factory technology from the Asian area are gaining an increasingly strong role on the global market, driven by technology synergies of the ambitious OLED displays. Even now, most of the materials for the displays are developed and produced in Asia as well.5

Asian prospects for success in flexible displays are enhanced by the fact that most of the enterprises that are preparing to commercialize flexible electronics technologies belong to large diversified industrial groups with extensive manufacturing capabilities. The groups are in a position to provide sustained financial support for investments in promising but risky new products and also frequently possess relevant technological and manufacturing expertise, experience, and resources in areas such as semiconductors, optoelectronics, rigid displays, chemistry, photovoltaic energy, batteries, specialty materials, inks, and printing. Several of these companies enjoy global market dominance with respect to current generation technologies with direct application to flexible electronics.6 The

_______________

4 IDTechEx, Printed, Organic & Flexible Electronics Forecasts: Forecasts, Players & Opportunities 2011-2021 (2011), 44–45.

5 Ibid., 24.

6 In the first quarter of 2011 Korea’s Samsung Mobile Displays (now merged into Samsung Display) held nearly 70 percent of the world market for OLEDs and nearly 99 percent of the global supply of active matrix organic light-emitting diodes (AMOLED) panels in the first quarter of 2011. “Samsung Mobile Display Starts Operation of New AMOLED Plant,” Yonhap, May 31, 2011; “Samsung, LG Display to Invest in High-end Display Market,” Yonhap, May 3, 2010.

TABLE 4-2 Asian Industrial Groups Commercializing Flexible Electronics Products

| Group | Country | Group Product Strengths | Flexible Electronics Group Member | Technology |

| Samsung Group | Korea | Semiconductors, LCDs, batteries, solar cells | Samsung Mobile Display | Flexible displays, resins |

| Samsung Group | Korea | Semiconductors, LCDs, batteries, solar cells | Samsung Electro-Mechanics | Inkjet print heads, copper ink |

| Toppan Printing | Japan | Photomasks, LCD filters | Toppan Forms | Nano silver printed electrodes |

| LG Group | Korea | OLED, displays, solar cells | LG Display | Flexible displays, e-paper |

| Fuji Electric Group | Japan | Power semiconductors, solar cells | Fuji Electronic Systems | Flexible solar cells |

| Chie-Mei Group | Taiwan | Materials, lighting technology, displays | Chin Lin Technology | e-paper, smart labels |

| Yuen Fuong Yu Group | Taiwan | Displays, paper | Prime View International (E Ink Holdings) | e-paper |

| Hanwha Group | Korea | Solar cells, batteries | Hanwha Chemical | Carbon nanotubes |

| Asahi Kasei Chemicals | Japan | Polymers, specialty chemicals | Asahi Kasei Finechem | Dopant for conductive polymers |

| BOE Technology Group | China | LCDs, photovoltaics | Ordos Yuansheng Optoelectronics Co. | AMOLED displays |

industrial groups enjoy distribution channels and customer relationships that will facilitate the development of markets for new flexible electronics products.

Particularly noteworthy are South Korea’s industrial groups, the chaebol, large conglomerate groups held together by cross-shareholdings, family ties, and inter-firm agreements.7 In 2012, Korea’s top 10 chaebol accounted for 52 percent of the output of all listed Korean companies, a figure that has grown from 44.9 percent in 2008, indicating increased economic concentration in the large groups.8 The larger chaebol have enormous financial resources—Samsung’s revenues, for example, exceed those of world-class U.S. information technology firms. (See Table 4-3.)

The chaebol have drawn global attention during the past decade with bold, risky investments and decisive execution that have repeatedly paid off in dramatic fashion. Samsung, perhaps the most widely studied of the chaebol groups, “spots markets that are about to take off and places huge bets on them,” a strategy that succeeded in dynamic random access memory (DRAM) devices, flash memory, LCDs, and mobile phones.9 An investment analyst commented in 2012 that

Samsung has set itself to be a dominant global force in every industry it enters, from smartphones to consumer electronics. The strength of its balance sheet will allow it to outspend most rivals in research, development and marketing while its ability to own the whole supply chain makes it unique. It is at the forefront of technology and I expect to see a phone with a flexible screen in the next year or so.10

Samsung is making massive investments in technologies applicable to flexible electronics products. In late 2012, it indicated it would invest 2 trillion won (about $1.8 billion) to increase its output of OLED screens, of which 300 billion won ($268 million) would be allocated to flexible displays. The Korea Times reported in November 2012 that

_______________

7 For recent academic perspectives on the chaebol, see Stephan Haggard, Wonhyuk Lim, and Euysung Kim, Economic Crisis and Corporate Restructuring in Korea: Reforming the Chaebol (Cambridge: Cambridge University Press, 2010); Seung-Rok Park and Ky-hyang Yuhn, “Has the Korean Chaebol Model Succeeded?” Journal of Economic Studies 39, no. 2 (2012); Charlotte Marquerite Powers, “The Changing Role of Chaebol: Multi-Conglomerates in South Korea’s National Economy,” Stanford Journal of East Asian Affairs, 2010, 105–116. Powers observes that notwithstanding well-publicized instances of corruption and arguments that the chaebol are obsolete, “by virtue of their size and capital reserves, the chaebol will be Korea’s key asset as globalization brings international firms into constant contact with one another. . . . In the globalized economy size matters, and the chaebol conglomerates enjoy the distinction of being among the largest in the world. . . . [T]he chaebol have ready access to the capital and manpower required to constantly develop new and more efficient ways of manufacturing goods to export [and] are also large enough to absorb potential market-entry failure; smaller firms might just collapse” (ibid., 112–113).

8 “Chaebol’s Economic Concentration at Record High,” The Korea Herald Online, February 6, 2012; “Chaebol Owners Tighten Their Grip,” JoongAng Daily Online, May 31, 2013.

9 “Asia’s New Model Company,” The Economist, October 1, 2011.

10 “Asia Major,” Money Marketing, March 1, 2012. “Samsung Electronics Striving to Win Absolute Superiority in Global Market Share This Year,” MK English News Online, January 6, 2010.

TABLE 4-3 2012 Revenues of Leading Electronics Firms

| Company | 2012 Revenues (Billions of Dollars) |

| Samsung Electronics | 178.6 |

| Apple | 156.5 |

| Hewlett-Packard | 120.4 |

| IBM | 104.5 |

| Dell | 56.9 |

SOURCE: Fortune Global 500 (2012).

[Samsung] is expected to roll out finished flexible products not prototypes from the latter half of next year [2013] while its biggest rival LG Display plans to start mass-producing plastic-based flexible OLED screens from the end of next year.11

OLED technology, which is self-illuminating and does not require an external light source for viewing, “is considered to be the solution for the next generation of flexible display.”12 Korean firms, which have already begun to commercialize OLED technology, are in the best position to dominate the emerging market for flexible displays.

LG Electronics, another Korean chaebol firm, is mounting a vigorous challenge to Samsung, entering production in 2013 of a 55-inch OLED TV with a curved screen, is expected to compete with Samsung in the flexible display smartphone market as well. In April 2013, the consultancy HSBC Global Research predicted that “we expect [LG Electronics] to be the biggest beneficiary of the commercialization of flexible display.”13 In January 2014, LG unveiled the world’s first flexible OLED TV, with a screen with degrees of curvature that can be modified by viewers using the TV remote.14

The other potential challenge facing Samsung in flexible displays comes from China, where an extraordinary national effort to establish a presence in conventional rigid displays has enabled domestic producers to capture about 20 percent of the global market.15 Chinese LCD makers, powerfully backed by local governments, are currently working to invest in the production of small AMOLED displays, aiming at the smartphone market where indigenous makers represent a

_______________

11 “Samsung to Invest $1.8 Billion on OLED,” Korea Times, November 14, 2012.

12 HSBC Global Research, Flexible Display: Fantastic Plastic—A Shape-Shifting Game Changer, April 2013, 22.

13 Ibid., 40. Competition between LG and Samsung has been sufficiently ferocious that the Korean government has reportedly taken a mediating stance between the two groups. “Government Expected to Step in to End Display Feud Between Samsung and LG Display,” OSA Direct, January 21, 2013.

14 “LG Unveils World’s First Flexible OLED TV,” Flexible Substrate, January 2014.

15 “China to Account for More Than 70% of Flat Panel Display Equipment Spending,” CTimes, February 7, 2014; “Rise of Chinese LCD Makers Threatens Local Makers,” Taipei Times, November 12, 2012; Tain-Jy Chen and Ying-Hua Ku, “Indigenous Innovation vs. Teng-Long Huan-Niao: Policy Conflicts in the Development of China’s Flat Panel Industry,” Industrial and Corporate Change, 2014.

potentially huge source of demand.16 China lacks a sophisticated, relevant basic research base to support flexible electronics, and most of the supply chain resides outside of China, but its move into AMOLED displays is seen as a competitive threat to Samsung.17

Korea’s recent successes in emerging electronic technologies tend to obscure systemic weaknesses that could limit its long-term prospects in flexible electronics. Professor Changhee Lee’s 2010 description of Korean flexible and printed electronic initiatives noted that Korea’s weaknesses were “lack of fundamental research and core IPs” and “materials.”18 He might have added that small businesses, which in many countries are the drivers of innovation, are seen as under-performing in Korea.19 Moreover, for the foreseeable future Korea’s emerging flexible electronics industry will remain dependent on technology, intellectual property, materials, and equipment that originate outside of Korea.

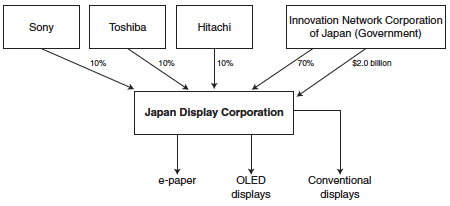

The ascendancy of South Korean chaebol firms in displays has been paralleled by the veritable implosion of the Japanese electronics giants that once dominated global markets for semiconductor memories, televisions, and displays. The Japanese electronics majors are seen as having failed to adjust to the digital revolution.20 In the fiscal year ended March 2012, Japan’s eight largest electronics firms suffered a combined net loss of more than $20 billion, roughly the equivalent of the gross domestic product of Paraguay.21 These firms, engaged in massive facilities downsizing and workforce reductions, were characterized by The Wall Street Journal in 2012 as “dinosaurs stumbling around after the asteroid hit.”22 The Japanese government has intervened with a $2 billion bailout, consolidating the displays operations of Sony, Toshiba, and Hitachi in a new entity, Japan Display Corporation, which is majority-owned by the government. (See Figure 4-1.) The new entity is expected to introduce OLED-based displays and e-paper products in an effort to counter the Korean competitive challenge.23 In late 2013, a joint venture between Sony and Panasonic to make OLED TVs

_______________

16 “iSuppli Sees China Targeting AMOLED Sector,” Optics.org (November 17, 2011); “China Aims to be Major Player in AMOLED Industry,” Yonhap (November 18, 2011).

17 “Potential Threat to Samsung: Chinese AMOLED Panels to Pour into Market,” Business Korea, May 2, 2014; “Can China Break Samsung’s AMOLED Grasp?” China Focus, April 8, 2014.

18 Changhee Lee, “Flexible and Printed Electronics—A Korean Initiative,” September 24, 2010.

19 “Non-Chaebol Firms Losing Ground to Chaebol in S. Korea,” Yonhap, July 3, 2013. “Do the Chaebol Choke Off Innovation?” Bloomberg Business Week, December 3, 2009.

20 “What Happened to Japan’s Electronics Giants?” BBC News Asia, April 1, 2013.

21 “Reshaping Japan’s Tech Sector a Struggle,” Financial Times, June 4, 2012; “Japanese Electronics Sector Teetering on the Brink of Collapse,” Dong-A Ilbo Online, May 30, 2012.

22 “Japan’s Electronic Giants Struggle to Reboot,” The Wall Street Journal, November 1, 2012.

23 “It’s Japan vs. Korea with Launch of Samsung Display, Japan Display,” PC Mag, April 2, 2012; “Japan Takes a Gamble on Displays,” The Wall Street Journal, April 10, 2012; “Japan Display Begins Production, OLED from 2013,” FlatpanelsHD, April 3, 2012; “New Prototype e-Paper Shown Off by Japan Display,” Good Reader, November 6, 2012.

FIGURE 4-1 The creation of Japan Display Corporation (2012).

SOURCE: “Panasonic to Sell TV Panel Factory to New Japan Display Venture,” CIO (November 15, 2011).

collapsed when the two firms failed to develop cost-effective production processes or durable panels.24

Notwithstanding the massive government resources deployed on behalf of Japan Display, the new company’s daunting market position underscores the extent of the challenge that it faces. (See Table 4-4.)

Taiwanese industry and government leaders, like those in Japan, have become increasingly concerned about the competitive challenge from Korea across a spectrum of electronics technologies.25 Japanese and Taiwanese organizations

_______________

24 The two companies did not provide details of the manufacturing cost issues that had proven insurmountable, but early in 2013 Sony issued a press release citing technical “challenges” confronting the joint venture. Smaller OLED TVs used low-temperature polysilicon thin-film transistors (TFTs) to force light through the OLED layer. Sony indicated, however, that “there were some challenges inherent in the manufacture of large OLED displays.” Accordingly, the company was attempting to fabricate larger displays using oxide semiconductor TFTs and incorporating Sony’s “Super Top Emission” technology, which “has a high aperture ratio and enables light to be extracted efficiently from the structure’s OLED layer.” While the combination of these two technologies enabled the development of a promising prototype, the two firms were apparently unable to develop cost-efficient production processes. The low sales achieved by LG and Samsung with respect to the rollout of 55-inch OLED TVs in 2013 were also cited as a possible factor underlying the Sony/Panasonic decision. “Sony Develops the World’s First and Largest ‘56-inch 4K OLED TV’ Prototype to be Exhibited at 2012 International CES,” Press release, January 7, 2013; “Technical Difficulties Foil Sony-Panasonic OLED Effort,” Flexible Substrate, January 2014.

25 “Samsung Cannot ‘Kill Taiwan’—CEOs,” Taipei Times, March 23, 2013. In 2013, Taiwan’s HTC Corp. said it had learned a lesson from its supply relationship with Samsung. HTC launched a mobile phone “HTC Desire” using an AMOLED display supplied by Samsung. “But once the HTC Desire was welcomed by global consumers and telecom operators at the time [2010] Samsung ‘strategically declined to supply its AMOLED displays to the smartphone maker.’” Jack Tang, President of HTC

TABLE 4-4 The Global Market Share for Displays (2012)

| Firm | 2012 Market Share (Percent) |

| Samsung Display (K) | 24.5 |

| LG Display (K) | 23.4 |

| Innolux (T) | 12.8 |

| AU Optronics (T) | 11.8 |

| Sharp (J) | 8.3 |

| Japan Display Inc. (J) | 3.5 |

| Other | 15.7 |

SOURCE: NPD Display Search, In “S. Korean Display Makers Increase Global Market Share,” Yonhap, February 7, 2013.

are responding to what is seen as a powerful challenge by Korean producers in electronics by forming Taiwan/Japan technology alliances, featuring Japanese technology and Taiwanese manufacturing competency and ability to bring products to market quickly. (See Table 4-5.) Terry Gou, Chairman of Taiwan’s Hon Hai Precision Industry (Foxconn), explained his company’s 2012 decision to acquire a 9.9 percent equity stake in the Japanese display maker Sharp, indicating that in his view Sharp’s technology was superior to that of Samsung:

The Sharp deal will help us defeat Samsung. . . . I respect the Japanese and especially like their execution and communication styles. Unlike the Koreans, they will not hit you from behind.26

The rapid emergence of a display industry in China is a final wild card in the emerging Asian competition in flexible displays. In the past decade numerous Chinese electronics firms, usually strongly backed by local governments, entered the LCD industry, placing strong downward price pressure on established Asian producers.27 A number of these firms, most notably BOE Technology, are undertaking multi-billion-dollar investments in the production of flexible AMOLED displays, challenging Korean dominance in this technology.28

_______________

North Asia, said that “we found that key component supply can be used as a competitive weapon.” “HTC Learns Lesson from Samsung Display Row,” Central News Agency, May 28, 2013.

26 “Hon Hai Vows to Beat Samsung Display in 3-5 Years,” Chosun Ilbo Online, June 20, 2012; Chosun Ilbo, a major Korean daily newspaper, attributed Gou’s apparent “personal animus” to “The Koreans” to an antitrust proceeding in which Samsung had reportedly presented testimony against Taiwanese firms. Ibid. On competitive tensions between Korea and Taiwan see generally “Anti-Korean Spleen in Taiwan,” Asia Sentinel, November 25, 2010.

27 “Analysis—China’s LCD Industry Fears Overcapacity,” Asian Pulse.

28 “AMOLED Production: Entering a New Era?” Information Display, March/April, 2013.

TABLE 4-5 Flexible Electronics—Taiwan/Japan Tie-ups

| Year | Entity | ||

| Taiwan | Japan | Scope of Collaboration | |

| 2013 | ITRI | Kaneka Corporation | Flexible substrates |

| 2013 | E Ink | Sony | Flexible e-paper for e-readers |

| 2012 | AU Optronics | Idemetsu Kokan | OLED materials for displays |

| 2012 | AU Optronics | Sony | OLED televisions |

| 2011 | Industrial Technology Investment Corporation (ITIC) | Mitsui Sumitomo Insurance Venture Capital | Investments in Taiwanese and Japanese firms |

SOURCES: ITRI and Kaneka Unveil New Flexible Display Technology,” ITRI Today, April 3, 2013; “The Glass is Half Full,” Flexible Substrate, May 2013; “AUO Signs Accord with Idemetsu to Manufacture OLEDs,” Taipei Times Online, February 3, 2012; “AUO, Soney Co-develop World’s 1st 4K OLED TV Panel,” Central News Agency, January 9, 2013; “Top Industrial Research Body Praised for Helping Japanese Firms,” Central News Agency, February 5, 2013.

INITIAL U.S. AND EUROPEAN ADVANTAGE IN MATERIALS

The manufacture of flexible electronics products requires a broad range of exotic materials, which are often proprietary and difficult to produce, as well as the competency to develop new materials as the demands of an evolving industry require. Although Asian firms are likely to dominate the manufacture of flexible displays, at least initially, they are dependent on U.S. and European firms for key materials. The U.S.-based Universal Display Corporation, for example, is the world’s leading supplier of phosphorescent emitter materials, the key elements in an OLED device.29 Corning produces Gorilla Glass, which is used for the front of current smartphones, and is introducing Willow Glass, a flexible glass product with many potential applications in flexible display products.30 The 2011 competitive assessment by Germany’s National Academy of Science and Engineering observed that “the organic materials, their synthesis and optimization, are of particularly high importance for the technology field of organic electronics” and were difficult to develop and produce. Germany’s leadership in chemistry and new materials was seen as its greatest asset in the emerging industry.

_______________

29 Universal Display Corporation Form 10-K, filed February 27, 2013, 5.

30 “Corning Willow Glass Used to Make Flexible Solar Power Roofing Shingles, Could Lower the Cost of Solar Power Significantly,” ExtremeTech, July 3, 2013. Corning received a FLEXI Award for Willow Glass from the FlexTech Alliance in 2013, an award given to recognize leading developments in flexible and printed electronics. Using a research grant from the FlexTech Alliance, Corning partnered with other firms to demonstrate the compatibility of a flexible glass web in R2R processing and printing of organic PV devices. “Top Flexible Electronics Developments Win 2013 FLEXI Awards,” Flexible Substrate, February 2013.

TABLE 4-6 Key Firms Supplying Materials for the Flexible Electronics Products

| U.S. Company | Relevant Material | Application |

| Corning | Mother glass | TFT |

| Fnt seal | OLED encapsulation | |

| Kodak | Fluorescent/phosphorescent materials | OLED emission materials |

| UDC | Fluorescent/phosphorescent materials | OLED common layer |

| HIL, HTL, ETL, EIL | ||

| DuPont Teijin | HIL, HTL, ETL, EIL | OLED common layer |

| PET, PEN film | Flexible substrate | |

SOURCE: HSBC Global Research, Flexible Display: Fantastic Plastic—A Shape Shifting Game Changer, April 2013; Universal Display Corporation Form 10-K filed February 27, 2013, 5.

The U.S. and European strength in materials means that both regions benefit economically, to a degree, from Asian sales of displays, because U.S. and European firms are integral parts of the supply chains of Asian firms. The existence, competencies, and intellectual property portfolios of these materials suppliers represent an important asset with respect to any future U.S. or European initiative to contest the consumer flexible display market.

MILITARY APPLICATIONS—U.S. EDGE

The U.S. defense establishment has a long history of funding research by universities and industry for defense applications, and many military research programs have given rise to thriving commercial industries.31 U.S. defense organizations have been sponsoring research efforts in flexible electronics since the late 1990s, and, at present, the most substantial center for flexible electronics R&D anywhere in North America is the Flexible Electronics and Display Center of Arizona State University, established with $100 million in support funding from the U.S. Army. No known program outside the United States has devoted a comparable level of sustained public support for flexible electronics technologies for military use, and it is highly likely that the United States and U.S.-based companies will dominate this field, notwithstanding the fact that some flexible electronics products for the military will probably be manufactured offshore.

The U.S. Army and other service branches that are supporting flexible electronics research represent an element that is often missing in this emerging field—that is, customers who know and can specify exactly what they want and are

_______________

31 See generally Stuart W. Leslie, “The Biggest Angel of All: The Military and the Making of Silicon Valley,” in Martin Kenney, ed., Understanding Silicon Valley: The Anatomy of an Entrepreneurial Region (Stanford: Stanford University Press, 2000); National Bureau of Standards, The Influence of Defense Procurement and Sponsorship of Research and Development on the Development of the Civilian Electronics Industry, June 30, 1977.

willing to pay for it according to an agreed fixed schedule. The U.S. armed services currently utilize conventional displays in aircraft, vehicles, and infantry units, but glass displays are relatively heavy, breakable, and require many extra pounds of protection around the glass, as well as batteries. Flexible OLED-based displays do not need a backlight, potentially are thinner, lighter, more durable, and do not need to receive power except when a soldier needs to change an image.32 The military service branches are funding a broad array of research projects intended to develop specific items of equipment based on flexible electronics technology.

In the past, U.S. military R&D programs have resulted in developments of devices for military use that are manufactured in small batches of extremely high cost relative to commercial products based on similar technologies. In flexible electronics, however, U.S. defense organizations are promoting the establishment of commercial industries that can supply devices for military use at the same price levels as those prevailing in the commercial marketplace.33 As a result, U.S. defense-related investments in flexible electronics may translate into commercial opportunities for U.S.-based industries.

U.S./EUROPEAN LEADERSHIP IN ORGANIC PHOTOVOLTAICS

An initial U.S./European edge in organic photovoltaics has been largely nullified by the collapse of world markets for solar panels after 2008. The 2011 assessment of global competition by the German National Academy of Science and Engineering observed that “while Asia has covered the field of organic displays, the U.S. seems to be striving for a leadership position in organic photovoltaics.” The assessment acknowledged that the United States was “an organic photovoltaic pioneer,” that a U.S. firm, Konarka, was “the current technology leader” and that the presence in the United States of other innovative companies, such as Plextronics, Solamer Energy, and Global Photonic Energy, “clearly show the intensity with which the U.S. drives commercialization of organic photovoltaics.” The study observed that

[t]he U.S. efforts of conquering the market for organic photovoltaics are mainly countered by the activities of the company Heliatek and its outstanding know-how in Germany. Even though Germany has a good general initial situation for organic photovoltaics, the intense activities in the U.S. are a threat to it.34

However, beginning in 2011, global demand for photovoltaic modules—whether conventional silicon-based or organic—declined substantially, reflecting decisions by some European countries to reduce subsidies for solar power

_______________

32 “Army-Backed Flexible Display Effort: A Symbol of Public-Private Partnership,” IEEE Computer Society, July-September 2006.

33 Dr. Eric W. Forsythe, “Flexible Communications,” Army AL&T Magazine, July-September 2012.

34 acatech—National Academy of Science and Engineering, eds., Organic Electronics in Germany: Assessment and Recommendations (Munich: National Academy of Science and Engineering, 2011), 24.

production.35 At the same time, producers in China, which had undertaken major investments in PV capacity, were undertaking a major export push, driving down prices of PV modules and placing severe economic pressure on U.S. and European manufacturers.36 The price of a silicon panel fell from $3.40 per watt in 2008 to $1.28 per watt by the end of 2011, and as of mid-2013 it was reportedly “heading toward 50 cents.”37 In 2012-2013, the United States and EU imposed antidumping duties on imports of Chinese solar panels.38

The collapse of global solar PV markets adversely affected organic PV makers as well as producers of silicon-based PV modules. Most dramatically, the U.S. technology leader, Konarka, went bankrupt in 2012.39 Plextronics, a U.S. startup that planned to develop solar ink cells with photovoltaic applications, filed for Chapter 11 protection in early 2014.40 In the UK, the Cardiff-based developer of flexible PV films, G240 Innovations, entered bankruptcy administration in December 2012.41 At present, industry analysts foresee modest growth in organic PV markets going forward, with demand reaching “only a few hundred million dollars in market size in the next decade.”42

THE FLOW OF TECHNOLOGY TO ASIA

The United States and Europe are centers for some of the world’s most advanced basic research into themes applicable to flexible electronics. That fact does not appear to place Japan, South Korea, and Taiwan at much of a disadvantage in the field, not only because these countries are developing their own research programs, but also because their companies can readily access the new materials, device, and process technologies being developed outside of Asia. In

_______________

35 “Twilight of an Industry: Bankruptcies Have German Solar on the Ropes,” Spiegel Online, April 3, 2012. According to a report by Forbes in mid-2012, supply of solar cells was nearly double total demand. “As a result, some companies are looking to sell below cost to gain market share, and ride at the losses as other companies go out of business.” “Solar Market Continues to Evolve,” Printed Electronics Now, July 2012.

36 “Sun Burn 2: Global Changes Slow Solar Growth,” Toledo Free Press, July 26, 2012; “China’s Photovoltaic Industry: Exporting on the Cheap,” Energy Tribune, September 3, 2009; “Cloudy Skies Remain for Taiwan’s PV Industry,” Taiwan Economic News, November 30, 2012; “PV Armageddon: The Rapid Market Swings Concealed Major Efficiency Gains,” Printed Circuit Design & Fab, April 2012.

37 “China Eclipsing Colorado Makers—Cheap Loans, Subsidies Giving Chinese Companies a Star Role,” The Denver Post, August 18, 2013.

38 “China Sun Panels Face EU Levies,” Financial Times, May 6, 2013; “U.S. Sets Antidumping Duties on China Solar Imports,” Bloomberg, October 10, 2012; “REC Regrets Escalation in Solar Industry Trade War, Denies Any Wrongdoing,” Printed Electronics Now, July 20, 2012.

39 “Solar Shakeout: Konarka Technologies Files for Bankruptcy,” PVTech, June 2, 2012.

40 “Local Tech Darling Files for Chapter 11,” Pittsburgh Post-Gazette, January 26, 2014.

41 “Restructured G24: Emerges Under New Ownership,” Flexible Substrate, May 2013. G24: has reportedly secured funding and emerged from administration under the name G24: Power Limited. Ibid.

42 “Flexible PV: Three-Fold Growth in the Next 5 Years,” Flexible Substrate, February 2013.

some cases, Asian companies and research organizations are direct participants in U.S. and European flexible electronics research programs.43 In addition, U.S. and European startups that have developed flexible electronics technologies and intellectual property are seeking Asian partners to manufacture and sell their products, or are being acquired outright by Asian manufacturers.

U.S. companies that have developed proprietary flexible electronics technologies commonly turn to arrangements with established Asian manufacturing firms to produce and commercialize their technologies from production bases in Asia, risking long-term loss of control of the technology as well as most of the value added.44 (See Table 4-7.) In April 2011, for example, U.S.-based Nova Centrix entered into an agreement with Japan’s Showa Denko (SDK) pursuant to which SDK will manufacture and sell nanoparticle inks developed by Nova Centrix:

Nova Centrix is one of several nanomaterials suppliers working with Japanese and other Asian partners to support production and commercialization of their technology. Experience of industrialized production methods can be leveraged as these technology developers try to commercialize their technologies, and much of the world’s display and electronics manufacturing occurs in Asia.45

In 2013, Ascent Solar Technologies, Inc., a Colorado-based company founded in 2005 producing thin-film flexible photovoltaic modules, entered into an agreement with the municipal government of Suqian, in China’s Jiangsu Province, to establish a factory in Suqian to manufacture Ascent’s proprietary technologies. Suqian will contribute capital, a factory site, and various incentives; Ascent will

_______________

43 In 2010, Arizona State University’s Flexible Display Center (FDC), established in conjunction with the U.S. Army Research Laboratory to accelerate the development of flexible displays in the United States, entered into a strategic research partnership with AU Optronics Corporation, the largest manufacturer of thin-film transistor LCDs in Taiwan. Another FDC strategic research partner, U.S.-based E Ink, was acquired by Prime View International, a Taiwanese company that is the largest manufacturer of electronic paper in the world. “The Flexible Display Center and AOU Enter Strategic Partnership to Accelerate Flexible AMOLED Development,” Nanowerk, November 16, 2010. MIT has conducted joint R&D with the Korea Institute of Science and Technology (KIST) to develop flexible transistors that could be incorporated in “wearable computers.” “Transistor Could Lead to Wearable Computers,” JoongAng Ilbo, October 9, 2007.

44 In 2010, Japan’s Konica Minolta Holdings entered into a partnership with U.S.-based Konarka Technologies Inc., a world-leading producer of organic thin-film photovoltaics with a broad portfolio of patents and technology licenses and a skilled technical, scientific, and manufacturing team. Pursuant to the agreement Konica Minolta invested $20 million in Konarka and into a R&D collaboration with Konarka to improve organic thin-film photovoltaic performance. The two companies agreed to establish a joint venture in Japan that would manufacture organic thin-film photovoltaic panels. “Konica Minolta and Konarka Join Forces to Develop Organic Thin Film Photovoltaics,” Nanowerk, March 4, 2010.

45 “Nanomaterials Firms Turn to Asia for Commercial Opportunities,” Plastic Electronics, April 15, 2011.

TABLE 4-7 U.S. Flexible Electronics Companies with Asian Production Arrangements

| U.S. Company | Technology | Asian Partner | Country |

| Nova Centrix | Nanoparticle inks | Showa Denko | Japan |

| Applied Nanotech | Copper ink for thin-film substrates | Ishihara Chemical | Japan |

| Plextronics | Photovoltaic panels | Korea Parts & Fasteners | Korea |

| Konarka | Thin-film photovoltaic panels | Konica Minolta | Japan |

| Ascent Solar | CIGs modules on flexible film | Municipal Government of Suqian | China |

SOURCES: “Nanomaterials Firms Turn to Asia for Commercial Opportunities,” Plastic Electronics, April 15, 2011; “Konica Minolta and Konarka Join Forces to Develop Organic Thin Film Photovoltaics,” Nanowerk, March 4, 2010.

contribute $1.6 million, its technology, and “certain equipment from its Colorado facility.”46

Companies based in Korea, Taiwan, and Japan have obtained important flexible electronics technologies through acquisition of, or significant equity investment in, U.S. and European companies with proprietary technologies.47 (See Table 4-8.) Most recently, in July 2013, Samsung indicated its intention to acquire Germany’s Novaled AG, a major developer of OLED technology, through an affiliate, Cheil Industries, for a reported price of more than $200 million.48 The

_______________

46 “China Eclipsing Colorado Makers—Cheap Loans, Subsidies Giving Chinese Companies a Star Role,” Denver Post, August 18, 2013. Ascent reported an accumulated deficit of $247.8 million as of December 31, 2013. Its survival is substantially attributable to large infusions of capital from TFG Radiant, a Shenzhen-based joint venture between China’s Radiant Group and Singapore-based Tertius Financial Group. Ascent Solar Form 10-K for 2013.

47 In 2009, the Taiwan Cement Group indicated that it planned to manufacture carbon nanotubes, which will be used as conductors in flexible electronics devices. According to Taiwan Cement Chairman Leslie Koo, “carbon nanotubes cost up to US $2,000 per gram, while cement costs about NY $2,000 per metric ton. Therefore the group plans to acquire a U.S. nano technology firm and work with local universities to develop and produce integral materials that are commonly used by the 3C and optoelectronic industries.” “Academic-Enterprise Cooperation Pact Inked to Promote Green Energy,” Central News Agency, September 24, 2009.

48 “Samsung to Buy Germany’s Novaled, Raising Bet on Next-Generation Success,” The Wall Street Journal, July 30, 2013. Samsung has been working with Novaled since 2005 on advanced OLED technology. In 2012 the two companies signed a strategic purchase agreement pursuant to which Samsung committed to purchase dopant materials used in the transport layers of its AMOLED display modules from Novaled, while the latter provided its PIN OLED technology for use in the manufacture of AMOLED display modules by Samsung Mobile Display. Jong-Woo Park, CEO of Cheil Industries, commented with respect to the acquisition that “[l]eadership in future display market will be determined by technological capacity. This acquisition is expected to generate significant synergy in new-generation OLED materials R&D and will play a critical role in enhancing Cheil Industries’ market position as a global leader in electronic materials.” “Samsung and the Growing Market for OLEDs,” Printed Electronics Now, August 2013.

Asian acquisitions appear to be based on the assumption that the Asian firms will commercialize and manufacture products based on technologies developed in the United States and Europe.49 Dr. Janglin Chen, Director of Taiwan’s ITRI Display Technology Center, the principal focus of flexible electronics technology development in Taiwan, observed in 2010 that

[r]ecent financial difficulty drove a wave of western start-up firms to seek fund infusion, or manufacturing partners in Asia. This trend has helped to bring to Taiwan a few important technologies in the flexible electronics area.50

Prominent examples of this phenomenon are the absorption of the U.S. firm E Ink, arguably the world leader in e-paper materials and intellectual property, into the Taiwanese Yuen Fuong Yu (PVI) Group and the acquisition of U.S.-based SiPix by Taiwan’s AU Optronics Corp. “E Ink had amassed a portfolio of hundreds of patent applications, including 150 in the United States, and the IEEE Spectrum ranked E Ink’s patent portfolio as number three worldwide for computer peripherals and storage.”51 E Ink had also developed technology alliances with numerous partners globally in the development of e-paper displays. Thus, with the acquisition, PVI “gained substantial intellectual property and employee talent, while securing a supply of critical components during the rapid growth phase of the market, and adding alliances and relationships across the e-paper and flexible display industry.”52 Thus between 2009 and 2012 much of the world’s e-reader technology became concentrated in Taiwan. Dr. Chen observes that “one firm’s demise happens to be the other firm’s fortune.”53

Recent European actions in the conventional photovoltaics sector may portend similar European initiatives in flexible and printed electronics, including flexible photovoltaics. Germany’s publicly supported Fraunhofer Institute for Solar Energy Systems (ISE) had collaborated with Schott Solar AG for more than 20 years in the development of crystalline silicon photovoltaics. In early 2013, as Schott Solar experienced increasing economic distress, Fraunhofer ISE purchased Schott’s portfolio of 111 patent families “covering the entire value chain of silicon photovoltaics, from crystallization to system installation” for an undisclosed

_______________

49 The CEO of NanoGram, a U.S.-based developer of nanomaterials design technology, commented on the 2010 acquisition of his company by Japan’s Teijin Limited, a chemicals manufacturer, that “our nanoparticle manufacturing technology, and the materials we have developed using the technology, have proven to have superior functionality in a variety of applications for solar, flexible displays and printed semiconductor applications. What NanoGram needs to take those materials to market is application expertise and the ability to scale quickly. Teijin recognized the potential in NanoGram and its technology. It will be the company that takes us to the next level.” “Teijin Acquires NanoGram Corporation—Will Accelerate Nanoparticle R&D for Printable Electronics,” Nanowerk, August 9, 2010.

50 Dr. Janglin (John) Chen, “Flexible Electronics Development in Taiwan,” September 24, 2010.

51 “Prime View Reaches Agreement to Acquire E Ink,” Flexible Substrate, June 2009.

52 Ibid.

53 Presentation of Dr. Janglin Chen, National Research Council, “Flexible Electronics for Security, Manufacturing and Growth in the United States,” 2013.

sum. Fraunhofer ISE indicated that “with this transfer, both partners ensure that comprehensive know-how in the photovoltaic sector remains in Europe.”54 (See Table 4-8.) Schott reportedly entered into the deal “rather than sell to the Asians . . . the purpose seems to be specifically to protect European expertise in the solar sector.” Fraunhofer ISE’s director, Eicke Weber,

has been busy over the past year trying to coordinate the European PV sector and EU funders to produce gigawatt-scale PV plants in Europe as a way of competing with the gigawatt-scale plants in Asia. . . . If Europe does not somehow protect this expertise during the current shakedown of the PV sector, Europe will quickly lose the entire industry.55

Japan is to some extent undergoing an experience similar to the United States and Europe relative to Korea and other Asian countries. In a growing number of cases, Japanese universities have conducted groundbreaking research but have found that the only companies willing and able to commercialize their ideas are in Korea. A Japanese professor, Sujio Ijima, discovered carbon nanotubes in 1991, flexible conducting carbon-based structures that can be used to create flexible electronics devices.56 But by 2010 Ijima, who is often cited as a possible Nobel Prize winner, was developing a graphene-based flexible touch screen panel with a team of researchers at Korea’s Sungkyunkwan University. Ijima commented that Japanese electronics companies are “lagging behind their South Korean rivals.” He has approached Japanese state-run research funding bodies but found their response was slow:

Even if research funds are provided in the next fiscal year’s budget, it would take a year and a half for the project to get underway. That is about the time frame in which Samsung could come out with a new product.57

In August 2013, Ijima delivered the opening address at the Nanocarbon Application Forum in Osaka, ruefully showing his audience the world’s first smartphone with a touchscreen made of carbon nanotubes, made not in Japan but in China, exemplifying the “loss of Japan’s leading edge regarding nanotube research.”58

Asian firms are now developing proprietary technologies in the field of flexible electronics that are potentially of interest to companies in North America and Europe. An ongoing subject of interest will be whether U.S. and European firms

_______________

54 Fraunhofer ISE, “Fraunhofer ISE Acquires Patent Portfolio from Schott Solar—Expertise on Crystalline Silicon Photovoltaics Remains in Europe,” Press Release, January 10, 2013.

55 “Fraunhofer Fights to Keep Solar Industry in Europe,” Renewables International, January 11, 2013.

56 Sujio Ijima, “Helical Microtubules of Graphitic Carbon,” Nature, November 7, 1991.

57 “South Korean Electronics Companies Are Beating Japanese Competitors to the Punch in Getting Cutting Edge Technologies Developed by Japanese Researchers into Their Product Ranges,” Asahi Shimbun, July 9, 2010.

58 “Japan Losing Out in Latest Applications for Carbon Nanotubes,” Nikkei Asian Review, November 20, 2013.

TABLE 4-8 Asian Acquisitions of U.S./European Flexible Electronics Enterprises

| Year | Investor | Country | Target | Country | Technology | Investment | Reported Sale Price (Millions of Dollars) |

| 2013 | Samsung | Korea | Novaled AG | Germany | OLED | Acquisition | 354 |

| 2009 | PVI | Taiwan | E Ink Corp. | US | e-paper displays | Acquisition | 215 |

| 2012 | E Ink | Taiwan | SiPix | US | e-paper | 31.58% equity | 50 |

| 2010 | Teijin | Japan | Nano Gram Corp | US | Inks, silicon nanoparticles, process technology | Acquisition | NA |

| 2011 | Hanwha Chemical | Korea | XG Sciences | US | Graphenes | 19% equity | 3 |

| 2011 | POSCO | Korea | XG Sciences | US | Graphenes | 20% equity | NA |

| 2009 | LG | Korea | Kodak OLED business | US | OLED | Acquisition | |

| 2007 | Sumitomo Chemical | Japan | Cambridge Display Technology | UK | Polymer OLED | Acquisition | 285 |

SOURCES: “Samsung to Buy Germany’s Novaled,” The Wall Street Journal, August 9, 2013; “Prime View International Acquires E-Ink for $215 Million,” ZD-Net, June 1, 2009; “E-Ink to Acquire Shares of SiPix, SiPix Imaging,” Telecompaper Asia and Africa, August 9, 2012; “Nanostart-Held Nano Gram to be Fully Acquired by Major Japanese Corporation,” Nanotechnology Now, August 9, 2010; “S. Korea’s Hanwha Chemical Buys Into U.S. Graphene Maker,” Asia Pulse, January 28, 2011; “POSCO Buys Into U.S. Graphene Maker,” Asia Pulse, June 8, 2011; “Sumitomo Chemical to Acquire Cambridge Display Technology Inc.,” JCN Network, July 31, 2007.

can obtain such technologies on a reciprocal basis. In 2013, Janglin Chen, the Director of Taiwan’s ITRI Flexible Display Center, said in an interview in 2013 that “ITRI being a government-funded institute, priority is given first to domestic companies when it comes to transfer of research results or technology.”59 In 2012, following the reported theft of Korean technology for AMOLED and white OLED displays from Samsung and LG Electronics by Israeli operatives, Yonhap, Korea’s semiofficial news agency, commented that “South Korea rigorously prohibits leakage of the technologies as it tags them as the nation’s core industrially strategic tech.”60

PERSPECTIVES FROM RECENT SWOT ANALYSES

The SWOT (strengths, weaknesses, opportunities, threats) analysis or matrix is a widely utilized analytic tool developed by Albert Humphrey, a business consultant, while working at the Stanford Research Institute. SWOT analysis identifies the business objectives of a company, industry, or country and the internal and external factors that are favorable or unfavorable to achieving that objective. Reflecting the fact that flexible electronics is a new and highly promising industry sector, SWOT analyses have been undertaken in Europe, North America, and Taiwan with an eye to assessing the prospects for national and regional business success in the field. SWOT analyses are necessarily subjective and do not quantify or assign relative value to individual strengths/weaknesses. However, the development of SWOT analyses in flexible electronics has usually engaged academic and industry leaders and other experts in the field in intensive strategic assessments of the emerging global competitive landscape. These analyses thus represent the informed “conventional wisdom” of individuals with deep knowledge of the subject. (See Table 4-9.)

TABLE 4-9 SWOT Analysis Matrix

| Helpful | Harmful | |

| Internal Origin | Strengths | Weaknesses |

| External Origin | Opportunities | Threats |

_______________

59 “Q&A: Dr. Janglin Chen of ITRI (Part 1),” The Emitter: Emerging Display Technologies, July 3, 2013.

60 A Korean official commented that the pilfered technologies were likely transferred to foreign rivals, and that “this may expectedly deal a massive economic blow to the entire nation and cause a sea change in the landscape of the global display market.” “Samsung, LG’s Key Display Technologies Leaked by Israeli Firm,” Yonhap, June 27, 2012.

European SWOT Analysis

In 2009, a SWOT analysis of the European competitive position in organic and large area electronics (OLAE) prepared by the European Commission was published under the auspices of the Commission’s Seventh Framework OPERA program, an initiative to “define a coherent strategy for the future of OLAE in Europe.”61 (See Table 4-10.)

The Commission credited Europe with a large market and established infrastructure and strong competencies in relevant materials and equipment. The OPERA task force that developed a strategic vision for Europe observed that the “level of R&D on organic materials is very high in Europe and companies like Merck, Novaled, CDT, AGFA, H.C. Storck and BASF are leading suppliers in the various OLAE markets.” Europe was also viewed as the global leader in organic device design: “Both in organic LED and solar cells, current record values are held by European groups. In transistors and other circuit development, Europe is leading as well.”62 The 2011 study by Germany’s National Academy of Science and Engineering echoed the OPERA findings from a German perspective:

One of Germany’s strengths is seen in the globally established and committed chemicals industry, which supports both development and production of materials for organic electronics. . . . The leadership position of Germany in printing technology and the printing machines industry should benefit successful economic implementation or organic electronics.63

The Commission’s SWOT analysis saw as a significant European weakness the fact that neither “giant” European companies nor startups were entering the market, raising the risk that “external companies will benefit from the research and investment done in Europe.” Similarly, the OPERA analysis observed that while Europe was strong in materials, equipment, and device design, “when it comes to manufacturing, the picture is less rosy. Although European toolmakers have made significant innovations like inline coating, novel printing techniques, and OVPD, the actual organic device manufacturing (being [at that time] only displays) is 100% Asian.”64 OPERA observed in 2011 that “only a few large-[European] companies [were] active in OLAE” and that the “organic display market [was] dominated by Asia.”65 The 2011 German study concurred:

A development that has already happened in other technologies before is becoming apparent: While Germany has great know-how in rather application-remote stages of technology development implementation of the excellent research

_______________

61 OPERA, Towards Green Electronic in Europe, December 28, 2009.

62 OPERA, Towards Green Electronics in Europe, 8–9.

63 acatech, Organic Electronics in Germany, 21.

64 OPERA, Towards Green Electronics in Europe, 9.

65 The FF7-ICT Coordination Action OPERA and the European Commission’s DG INFSO Unite G5 “Photonics,” An Overview of OLAE Innovation Clusters and Competence Centres, September 2011, 20.

TABLE 4-10 European Commission OLAE SWOT for Europe

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

SOURCE: OPERA, Towards Green Electronics in Europe, December 28, 2009.

results in products successful on the market is not driven with the required perseverance.66

The American World Technology Evaluation Center (WTEC) team that visited European flexible electronics research centers in 2010 was particularly impressed with the numerous European innovation centers working to develop flexible electronics systems and manufacturing processes. The centers leveraged the technical expertise and financial resources of multiple companies, academic laboratories, and national and EU government organizations. At the technical level

the centers foster a highly synergistic and interdisciplinary environment in which the complementary expertise of industrial, government and academic scientists is combined to achieve new systems design goals (e.g., ultra-low-power systems in foil) enhanced device performance, broader materials devices, and practical, low cost manufacturing approaches.67

The WTEC team was favorably impressed with the fact that multiple flexible electronics research projects were spread across Europe involving many university groups working in a complementary fashion. The EU had already prioritized flexible electronics for about a decade, the Europeans took a long-term perspective on the industry, and they had created strong research groups that worked together for many years. European basic research was particularly strong, and close collaboration existed between universities and basic research organizations, on the one hand, and applied research organizations and European industry, on the other. Facilities for prototyping and pilot-scale manufacturing existed at numerous research centers.68

_______________

66 acatech, Organic Electronics in Germany, 23.

67 WTEC Panel Report, European Research and Development in Hybrid Flexible Electronics, July 2010, 7.

68 WTEC, European Research and Development, xv–xvi.

Notwithstanding these strengths, European assessments acknowledge that in the face of the Asian competitive challenge, their efforts may prove futile. The 2011 study by the German National Academy of Science and Engineering stated that

[i]n the competition for the leadership position in organic electronics, Asia holds a decisive advantage: the local OEM like Samsung, LG or Sony rules the consumer electronics industry. Asia also holds a global market share of nearly 60 percent on the level of contracted work [contract manufacturing] for electronics, giving it a better initial situation than Germany has. These basic structural benefits are expressed in mainly compatible value-added chains and structures, e.g. in the production of LCD- and OLED-TVs. Quick commercialization of organic displays in Asia proves that the local industry there is able to play its advantages. Many experts assume that in particular mass production of OLED displays may move entirely to Asia in the future. . . . Even German pilot plants, e.g., in the COMEDD at the Fraunhofer IPMS in Dresden, are realized with Korean coating plants due to the advantages of Asian plant technology.69

Taiwan SWOT Analysis

In 2006, Taiwan’s research organization responsible for developing its flexible electronics industry released a SWOT analysis for Taiwan in flexible electronics. Although this analysis by the Industrial Technology Research Institute (ITRI) is now 7 years old, most of the factors cited remain pertinent today. The analysis also applies, at least to a degree, to South Korea. (See Table 4-11.)

American SWOT Analyses

The members of the American WTEC team that visited Europe in 2010 to study European research efforts in flexible electronics noted that their European colleagues were “nearly unanimous” in their praise of leading U.S. research universities and their Ph.D. programs, and the close connections between university-based research groups and the venture capital community, enabling “a well-developed process for moving innovation out from the academic laboratory.” European scientists saw as U.S. strengths the practical knowledge in creating startup companies, a highly developed venture capital infrastructure, the ability to attract talent from everywhere, and strong support from federal agencies such as the National Science Foundation, the Office of Naval Research, and the Departments of Defense and Energy.70 However, the WTEC team observed that

_______________

69 acatech, Organic Electronics in Germany, 23–24.

70 The 2011 organic electronics study by Germany’s National Academy of Science and Engineering faulted the German system of government research funding relative to that of the United States: “Foreign funding like the U.S. funding by the Department of Energy (DoE) is considered more dynamic and flexible in general by the experts.” acatech, Organic Electronics in Germany, 41.

TABLE 4-11 ITRI SWOT Analysis for Flexible Electronics Technology Development in Taiwan

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

SOURCE: Electronics and Optelectronics Research Laboratory, ITRI.

it was troubling that few of the groups the panel visited actually considered the United States as a threat in any sense, reserving that for Asian countries, particularly Korea and Japan, and organizations and companies based in these countries.71

In 2010, NorTec, a highly regarded public economic and innovation development organization based in Ohio, conducted a SWOT analysis in connection with the creation of a strategic roadmap for a flexible electronics innovation cluster in northeast Ohio, FlexMatters. Although the SWOT was concerned with the particular cluster, not the United States as a whole, the findings are arguably applicable to a considerable degree to an assessment of the American competitive position.72

_______________

71 WTEC, European Research and Development, xvi.

72 The SWOT was conducted with the assistance of Daniel Gamota, Chair of the International Electronics Manufacturing Initiative (iNEMI) Large Area Flexible Electronics Roadmap. Gamota, a leading expert in the field, was part of the WTEC team that surveyed European flexible electronics research efforts in 2009-2010. The SWOT analysis was based on online surveys followed up by one-

The NorTech SWOT analysis analyzed the three principal groups that comprised the FlexMatters cluster, small companies, large companies, and academia. The matrix in Table 4-12 is an abbreviated summary of the main findings.

The NorTech assessment noted the existence of a strong local university research base and innovative large and small companies capable of capitalizing on the opportunities offered by flexible electronics, but struggling with workforce issues and worried about competition from Asia and uncertainties with respect to regulation and availability of funding. Consistent with this assessment, the WTEC team that surveyed European flexible electronics laboratories in 2010 summed up the challenge facing the United States in this field as follows:

What the panel discerned from this study is that the relatively low prevalence of actual manufacturing and advanced systems research and development in the United States has led to an incomplete hybrid flexible electronics R&D scenario for this country: it is strong in basic research and in innovation but weak in advanced development for manufacturing, mirroring trends in some other sectors as well. Although the United States may be doing what it does best, manufacturing is moving to regions of the world that provide greater investment and commitment to product development. It then becomes questionable as to whether this approach is a healthy one and can be sustained in the long term.73

_______________

on-one interviews in which interviewees discussed “critical issues that affect their business growth and sustainability.” NorTech, FlexMatters Strategic Roadmap, November 2010.

73 WTEC, European Research and Development, xvi.

TABLE 4-12 NorTech SWOT Analysis—Northeast Ohio Flexible Electronics Cluster

| Strengths | Weaknesses |

| Academia | Academia |

Big Companies

Small Companies

|

Big Companies

Small Companies

|

| Opportunities | Threats |

| Academia | Academia |

Big Companies

Small Companies

|

Big Companies

Small Companies

|

SOURCE: NorTech, FlexMatters Strategic Roadmap, November 2010.