1

The Manufacturing Value Chain in Transition

Globalization, advances in computing power and robotics, and processes that improve efficiency and lead time have transformed the way things are conceived, designed, and made. These developments have in turn enabled huge improvements in productivity and made a large selection of goods available for lower costs. US companies continue to capture value throughout the manufacturing value chain, but manufacturing employment in the United States has declined. All these forces are causing increased pressures—on both companies and workers in the United States—that demand increased agility.

GLOBALIZATION

Perhaps the defining feature of the US and world economy over the past several decades has been globalization. The interconnection of economies around the world has fueled global trade, investment, technology, and knowledge flows that have profoundly influenced manufacturing value chains. While there has always been trade and investment between countries, the current global economic interconnectedness is unprecedented—and becomes more pronounced with each passing year. Globalization has increased competition as companies from around the world contend in the same markets as US-based companies. But it has also allowed companies to distribute activities along the value chain in locations across the world in search of efficiencies and profit. And it has allowed US companies to expand into new markets.

While US-based businesses as a group remain the world leader along multiple indicators of research and production of high-tech manufactured goods and services, competitors from emerging economies are advancing rapidly.

Increased Competition

Increased trade across national borders and the rise of multinational corporations around the world have increased the competition facing US-based businesses. Although as a group they remain the world leader along multiple indicators of research and production of high-tech manufactured goods and services,1 competitors from emerging economies are advancing rapidly.

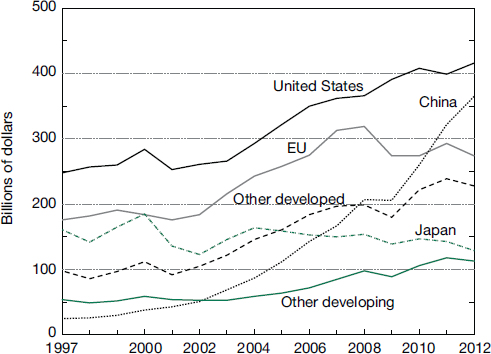

In the global economy, Chinese-based businesses lead the world in total output of manufactured goods, with $2.3 trillion compared to $1.8 trillion from US-based businesses.2 In high-tech manufacturing—aircraft, spacecraft, communication products, computers, pharmaceuticals, semiconductors, and technical instruments—US-based businesses lead the world (Figure 1-1). But competitors in developing countries, most prominently China, are rapidly increasing their output. As a result, the share of global value added from US-based businesses dropped from 34 percent in 2002 to 27 percent in 2012.

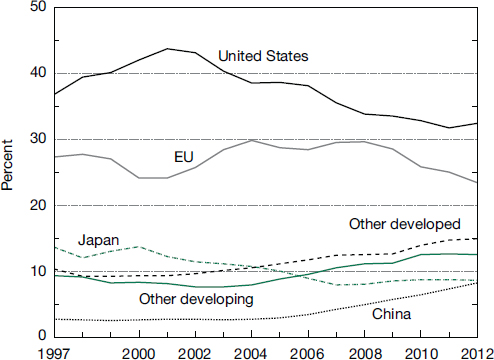

Competition has also increased in high-tech services. US-based companies account for the largest share of global value added in business, financial, and communication services; companies based in the European Union contribute the second largest share (Figure 1-2). However, the US share fell from approximately 44 percent in 2001 to 32 percent in 2012 as the output from developing countries, and certain developed countries (South Korea, Taiwan, Canada, and Australia), increased at a faster rate (NSB 2014).

Global Distribution of Value Chain Activities

The rapidly diminishing importance of geographical boundaries in production and trade affects the manufacturing and high-tech services environment in a number of ways. Businesses are becoming increasingly multinational, no longer located in or predominantly serving one country. They compete for customers around the globe and locate their facilities in countries that make the most business sense.

As a result of these trends, manufacturing value chains have become more widely distributed around the world. Between 1995 and 2009, the cross-border flows of intermediate goods and services as well as final products associated with manufacturing value chains significantly increased (Baldwin and Lopez-Gonzalez 2013). The global distribution of value chains is particularly prominent for final goods such as automobiles, consumer electronics, and pharmaceuticals. Around the world, 40 percent of final goods produced are destined for export. The globalization of intermediate goods such as fabricated metals has also increased but to a smaller extent; 16 percent of intermediate

______________

1 A full description of these indicators is provided in the Appendix.

2 Data from the World Bank, World Development Indicators. Available at http://data.worldbank.org/indicator/NV.IND.MANF.CD (accessed November 29, 2014).

FIGURE 1-1 Output of high-tech manufacturing industries for selected countries, 1997–2012. Source: NSB (2014).

Notes: EU = European Union. Output is on a value-added basis. Value added is the amount contributed by a country, firm, or other entity to the value of a good or service and excludes purchases of domestic and imported materials and inputs. High-tech manufacturing industries are classified by the Organization for Economic Cooperation and Development and include aircraft and spacecraft, communications, computers, pharmaceuticals, semiconductors, and testing, measuring, and control instruments. EU excludes Cyprus, Estonia, Latvia, Lithuania, Luxembourg, Malta, and Slovenia. China includes Hong Kong. Developed countries are classified as high-income countries by the World Bank. Developing countries are classified as upper- and lower-middle-income countries and low-income countries by the World Bank.

goods are now exported for the next stage of production (Baldwin and Lopez-Gonzalez 2013).

Factors Influencing the Location of Facilities

Decisions about where to locate plants and other facilities depend on the factors that are most important to the industry in question. Following are some of the factors that may play a role in the decision of companies to locate various facilities in the United States or in other countries.

FIGURE 1-2 Global share of commercial knowledge- and technology-intensive services for selected countries, 1997–2012. Source: NSB (2014).

Notes: EU = European Union. Output of knowledge- and technology-intensive industries is on a value-added basis. Value added is the amount contributed by a country, firm, or other entity to the value of a good or service and excludes purchases of domestic and imported materials and inputs. EU excludes Cyprus, Estonia, Latvia, Lithuania, Luxembourg, Malta, and Slovenia. China includes Hong Kong. Developed countries are classified as high-income countries by the World Bank. Developing countries are classified as upper- and lower-middle-income countries and low-income countries by the World Bank.

- Proximity to markets: Location of a plant near its markets can have a variety of benefits. If the products are expensive to transport (e.g., because they are heavy, bulky, or fragile), it makes sense to minimize transportation costs by locating near buyers; such products include industrial machinery and household appliances. Similarly, when just-in-time delivery is important, locating a plant as close as possible to customers is one way to improve delivery times. For manufacturers of food and beverage products, being near markets allows them to maintain freshness and minimize transportation times for perishable items. Proximity to customers also makes it easier to cater to local preferences.

- Proximity to raw materials: For companies that work with large quantities of raw materials (e.g., metal refiners and fabricators, petrochemical refiners, chemical and plastics manufacturers, food processers) proximity to those materials is crucial. It allows the companies to reduce transportation costs, take advantage of economies of scale, and, often, ensure access to the materials.

- Cost, availability, and reliability of energy: For products that require a great deal of energy to produce, the cost, availability, and reliability of energy can be a major factor in location decisions. Perhaps the most dramatic example is aluminum smelting (the production of aluminum from aluminum oxide), which is done by running a strong electric current through a solution containing the oxide. Smelters tend to be located near reliable and affordable energy sources, such as hydroelectric plants (EIA 2012).

- Location of supply chains: Certain industries, such as the automotive industry, have complex supply chains that must be carefully coordinated, so it makes sense to locate plants near suppliers.

- Access to skilled workers: Some companies need a variety of types of skilled workers, such as engineers, information technology workers, production workers, and craftsmen. While companies can—and often expect to—offer education and training programs to develop the necessary skills in workers, they prefer a pool of potential workers with enough education and skills that they will need a minimum amount of training before they can begin to contribute.

- Labor costs: For some product categories labor costs represent a significant percentage of the overall cost. This is the case, for example, with electronics: the final assembly of high-tech products as well as their support and maintenance after the sale both require significant labor. Countries with relatively low labor costs obviously have an advantage in this area.

- Government regulations and policies: The location of certain activities, particularly those seen as important to a nation’s competitiveness or economic security, may be subject to government regulations and policies. These may include trade restrictions, corporate tax rates and tax breaks aimed at encouraging capital investments, policies that support local production, and regulations concerning safety, product quality, and environmental quality. An example of the influence of government policies on production decisions can be seen in the recent overbuilding of the solar panel industry in China: government subsidies led to the development of a solar panel production capacity that far exceeded demand, which in turn drove down the price of solar panels and made it difficult for companies outside China to compete in the solar panel market (Plumer 2013).

- Ability to innovate: Particularly for value chains with rapid product cycles, in which the company that first brings a product to market has a major competitive advantage, the ability to innovate and develop new products rapidly is a major factor in a company’s success. These companies prefer to locate in areas with highly developed technological capabilities, necessary talent, and access to financing for research and development. Here too governments can play a major role by offering R&D incentives or funding, promoting higher education and applied research, and purchasing newly developed technologies.

Industry-Specific Location Considerations for Facilities across the Value Chain

The production of lighter-weight commodities such as fabrics and some chemicals can be done almost anywhere, independent of the location of design and sales activities. It therefore generally migrates to locations with the lowest associated costs for labor, energy, and raw materials.

For heavier products such as appliances and automobiles, as mentioned above, there are advantages to locating production close to market because of lower transportation costs (Manyika et al. 2012). Thus, for example, many of the vehicles sold in the United States are produced in the United States or Mexico. In addition to the location of automotive plants, there are advantages to locating the engineering and industrial designers near customers to understand their needs and wants. Designers in the United States can easily interact with people that purchase US vehicles and use the products themselves. Toyota, among others, has located much of the design and production of its minivans and large pickup trucks in the United States because it is home to many of the customers of these vehicles.3

In the case of research-intensive products such as those in the biomedical industry, research activities drive the location of activities in the latter stages of the value chain. The biomedical industry today includes a number of new medical devices, therapies, diagnostics, imaging, and medical genomic services that are highly research intensive.4 Production, testing, and treatment are best located close to the academic and medical center laboratories where the relevant research is done so that the companies can take advantage of their expertise. Biopharmaceutical companies therefore locate their activities in the regions where there is close and strong collaboration between the biotech industry and academic and clinical research. In particular, much of the production of

______________

3 Remarks of James Bonini at “Making Value for America: A National Conference on Value Creation and Opportunity in the United States,” February 27, 2014, Beckman Center of the National Academies, Irvine, Calif.

4 The biomedical industry is also a highly regulated industry, requiring careful navigation of many regulations. The regulatory environment in different countries is also an important factor influencing location decisions in this industry.

biologics, vaccines, and new therapies such as those based on stem cells is based in the United States and Europe because these highly innovative products require close integration of research, development, testing, and manufacturing. In contrast, the production of many older pharmaceutical products—those based on small molecules, where the technologies to produce them have been established for more than 50–60 years—is largely done in Asia, where production costs are lower. However, this is expected to change in the near future as research collaborations with academia grow in Shanghai and companies invest in facilities there.5

For products with short development cycles such as consumer electronics, it is important to be able to produce large quantities in a short period of time, so a significant portion of electronics manufacturing has moved to countries such as China that have the ability to scale up production very quickly. For example, Apple might be working with a nine- or ten-month product development cycle and need a supply of 10 million new iPods available in the month or so before Christmas. The rapid and massive scale-up necessary for such a feat requires a location with a mass of process engineers, tooling engineers, and production workers along with the tools and ability to build a new plant in a couple of months. As a result, Apple evolved from a system where manufacturing was done in the United States with parts made in Japan to manufacturing done in Singapore, Korea, Taiwan, and eventually China. And as more of the manufacturing was located in these places, more of the design was moved there as well. Today, although the design of products such as the Apple iMac and iPhone is still led out of California, the engineering designers there work very closely with companies in other countries that are carrying out a significant percentage of the design work on these products.6

In short, as value chain activities are distributed around the world, companies can choose to locate their facilities in the country and region that make the most business sense, all factors considered. The United States has certain advantages, such as a large market, a strong legal system, access to affordable and reliable energy, and highly developed R&D and supply chain capabilities that attract facilities where labor costs are relatively less important. Some of these factors are undergoing significant change.

The last decade has witnessed a dramatic change in the availability of low-cost energy in the United States. This is largely due to technological progress in horizontal drilling and hydraulic fracturing combined with the unique infrastructure and industrial ecosystem available to efficiently and cost-effectively

______________

5 Remarks of Paul McKenzie at “Making Value for America: A National Conference on Value Creation and Opportunity in the United States,” February 27, 2014, Beckman Center of the National Academies, Irvine, Calif.

6 Remarks of Jon Rubinstein at “Making Value for America: A National Conference on Value Creation and Opportunity in the United States,” February 27, 2014, Beckman Center of the National Academies, Irvine, Calif.

extract natural gas from shale formations. Coupled with the abundance of shale resources and the separation of US natural gas prices from global oil prices, the United States has a significant competitive advantage for a potentially long-term stable source of energy and feedstock for the electricity, manufacturing, and petrochemical industries (Krupnick et al. 2013; McCutcheon et al. 2011; MIT Energy Initiative 2012). Analyses by the American Chemistry Council (ACC) and the International Monetary Fund show that the shale gas boom has already reversed the US trade balance for the chemical industry from a $9.4 billion deficit in 2005 to a $3.4 billion surplus in 2013 and could reach a $30 billion surplus by 2018 (ACC 2014; IMF 2014). Detailed examination by the ACC of 97 chemical industry projects suggests remarkable growth and value that will occur for the United States (1) during the 10-year initial capital investment phase, when new equipment is purchased and plants constructed, and (2) as a result of ongoing increased chemical output, made possible by lower natural gas prices and increased availability of ethane. The ACC estimates these investments could create 1.2 million temporary jobs and 537,000 permanent jobs (ACC 2014).

On the other hand, the globalization of R&D and supply chain capabilities may present a challenge for the United States, which historically has had a competitive advantage in these areas. Now, other countries are developing research universities, supply chains, and other parts of their R&D and technological infrastructure. As a result, a number of businesses created in the United States are moving abroad to find the resources, supply chains, and capital they need to commercialize and manufacture their products (Box 1-1; Berger 2013). And as countries around the world continue to develop their capabilities, more value chain activities are likely to migrate abroad. If the United States wants to both retain and attract facilities along the manufacturing value chain, it needs to create an environment that supports continuous development of its innovation, manufacturing, and lifecycle services capabilities.

Emerging Markets as an Opportunity for US Growth

Discussions of the standing of US-based value chains in the global economy frequently focus on the challenges presented by other countries, especially a rapidly developing country such as China. With this perspective it is easy to fall into thinking of the situation as a zero-sum game: other countries “winning” the innovation game will inevitably mean that the United States is “losing.” But the greatest threat to American prosperity is not that other countries will get better and catch up to—or surpass—the United States; it is that the United States will fail to keep improving itself and thus fall behind as other countries continue to improve.

Charles Kenny, a senior fellow at the Center for Global Development, makes essentially this point in his book, The Upside of Down: Why the Rise

BOX 1-1

Do all companies have incentives to

carefully consider location decisions?

Inasmuch as companies weigh various factors to determine the best place to manufacture their products, it is natural to suppose that the United States can make itself more attractive to companies. But not all companies go through such a deliberate process when making a location decision, and it is important to understand why and what factors play a role in their decisions.

Consider, for example, FINsix, a company formed in 2010 to build power electronics devices that are smaller, lighter weight, and better performing than traditional power electronics. The company’s chief executive officer, Vanessa Green, spoke with the committee at the conference in February 2014 and had follow-up communications with the committee chair.

FINsix’s first product, the development of which was funded through a successful Kickstarter campaign, is the Dart, an AC/DC power converter for use with laptop computers that is smaller and lighter than standard laptop converters.a The Dart makes it possible to get rid of the “brick” laptop converters that weigh almost as much as some laptops.

At the time of Ms. Green’s communications with the committee, the company, headquartered in Menlo Park, California, was on track to deliver the first Darts to Kickstarter backers at the end of 2014. When asked whether the Dart would be manufactured in the United States, she said no and explained that they did not have the time. Companies such as FINsix have an incentive to bring their products to market as quickly as possible to satisfy their funders, and as a result it is difficult to devote much time to the latter stages of the value chain, such as production. FINsix focused mostly on the front end of the value chain, innovating and creating a product that works; once that was done it was time to build, ship, and scale—and begin seeing some income. In short, the selection of another country for manufacturing the Dart seemed to be a default decision: the company did not want to invest the time to determine the best place to make the Dart for different markets.

FINsix is now considering making the Dart in the United States for certain markets, such as laptop converters for the federal government and perhaps for customers who would prefer an American-made product. But it is worth asking what it would take for other US startups to look more closely at the United States for manufacturing their products.

______________________________

a “Dart: The world’s smallest laptop adapter.” Information available at the Kickstarter website, https://www.kickstarter.com/projects/215201435/dart-the-worlds-smallest-laptop-adapter (accessed May 20, 2014).

of the Rest Is Good for the West (Kenny 2014a). There are more benefits than disadvantages to other countries getting wealthier and growing their economies, he argues, even if, in the case of China, a country’s economy becomes larger and more powerful than that of the United States. If the United States has only the world’s second largest economy, for example, the dollar might lose its dominance as the currency that central banks prefer for their reserves, which could increase US borrowing costs. But Kenny contends that any negative consequences will be outweighed by the benefits of other countries getting wealthier. For instance, US companies will have larger export markets, which will allow them to hire more workers and increase their profits. And other countries’ advances in innovating and making value will improve lives in the United States:

The rest of the world is also inventing more stuff, from modular building techniques in China to new drug therapies and low-water cement-manufacturing processes in India to mobile banking applications in Kenya. We can benefit from those inventions as much as we already benefit from foreign innovators coming to the United States. Among the patents awarded in 2011 to teams at the 10 most innovative American universities, for example, three-quarters involved a foreign-born researcher, according to the Partnership for a New American Economy. As more people in developing countries go to college and as more firms there research and develop new products, there’s a potential for increased innovation in both the West and the Rest. That could bring faster progress in a number of different areas here at home, from connectivity to health. (Kenny 2014b)

Perhaps the best way to think of the challenge facing the United States is not in terms of competing with other countries to be the very best in the world, although there are certainly consequences to falling too far behind. Instead, the challenge is to find an approach to strengthen innovation and value creation in the United States, recognizing that the development of other countries can serve as a positive force to achieve this goal.

A particularly important fact to keep in mind is that as the rest of the world—especially the emerging economies—continues to develop, there will be a steadily rising demand for innovative goods and services. This rising demand represents a major opportunity for any US company, large or small, that has the vision and the capability to take advantage of it.

A 2012 report by the consulting firm McKinsey and Company projects that annual consumption in the world’s developing countries will reach $30 trillion by 2025 and characterizes this development as “the biggest growth opportunity in the history of capitalism” (Atsmon et al. 2012). The report also predicts that consumption in emerging markets will by then account for approximately half of the world’s total consumption, versus just 32 percent in 2010; that 60 percent of the world’s 1 billion households with total earnings of at least $20,000 per year will be in developing countries; and that the overwhelming majority

of sales of certain types of products, such as electronics and major appliances, will take place in emerging markets. Accordingly, the report predicts that the preferences of consumers in emerging markets will shape a great deal of the world’s innovation:

As e-commerce and mobile-payment systems spread to even the most remote hamlets, emerging consumers are shaping, not just participating in, the digital revolution and leapfrogging developed-market norms, creating new champions like Baidu, M-Pesa, and Tencent. The preferences of emerging-market consumers also will drive global innovation in product design, manufacturing, distribution channels, and supply chain management, to name just a few areas. (Atsmon et al. 2012, p. 7)

The authors make the point that these trends indicate crucial opportunities that policymakers and others who influence US business and innovation will ignore at their peril.

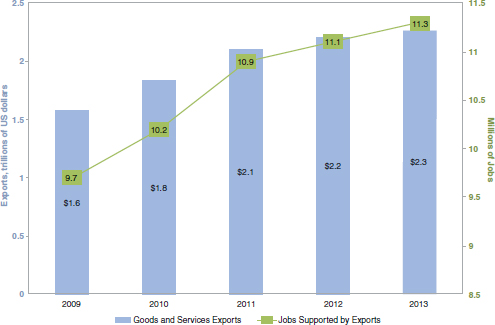

The importance to the United States of making value for the rest of the world is nothing new, of course. For example, another McKinsey study discussed the importance of trade in creating jobs: The increase in US exports between 2000 and 2009 supported 2 million more jobs in the US workforce than would have existed without the exports (Roxburgh et al. 2012). These jobs were mainly in knowledge-intensive sectors, such as high-tech manufacturing and business services and their suppliers. Since 2009, US exports have continued to grow, from $1.58 billion to $2.2 billion in 2012, supporting an additional 1.3 million jobs (Figure 1-3).

Metropolitan areas in particular have benefited from attention to the export market. According to a 2013 report from the Brookings Institution and JPMorgan Chase, exports were crucial to postrecession growth in the country’s 100 largest metropolitan areas (McDearman et al. 2013). Between 2009 and 2012, exports were responsible for an average 54 percent of the growth in output in those areas, versus only 37 percent for the country as a whole. Growth in export intensity was also correlated with growth in overall economic output. Between 2003 and 2012, the 10 US metropolitan areas with the greatest growth in export intensity saw an average annual growth in economic output of 3 percent, versus 1.7 percent among those with the least growth in export intensity (McDearman et al. 2013).

Despite the clear benefits of paying attention to the export market, however, many US businesses fail to take advantage of the opportunities. There are a variety of reasons for this failure. A 2009 OECD study identified the major barriers that small and medium-sized businesses face in expanding to foreign markets: shortage of working capital to finance exports, difficulty identifying foreign business opportunities, limited information with which to locate and analyze potential foreign markets, and inability to contact potential overseas

FIGURE 1-3 US exports and estimated jobs supported by exports. Sources: Foreign Trade Division, US Census Bureau; Johnson and Rasmussen (2014).

customers (OECD 2009). Many of these barriers are simply the result of a lack of information and connections to international partners.

In short, emerging markets will offer tremendous potential for US companies in the coming decades, but only if companies and policymakers recognize the potential and then act to develop and maintain the capabilities to take advantage of it.

ADVANCES IN COMPUTING POWER AND AUTOMATION

The ongoing digital revolution is a second major factor driving changes in the US and global economy. Characterized by continual growth in computing power, rapidly improving communication and analytical capabilities, and advances in robotics and control systems, this revolution has had reverberations in every sector of the economy, from the use of global positioning systems on farms and in factories to computer graphics in the entertainment industry. But perhaps no segment has been more deeply affected than manufacturing, where developments such as automation (the control of routine processes by mechanical and electrical devices) and computer-aided design, engineering, and production have dramatically increased productivity and efficiency, reduced lead time, and improved responsiveness to customer needs and preferences.

Technological advances in computing and automation are allowing companies to increase productivity and efficiency, reduce lead times, and gain customer insights in their manufacturing, design, and development activities along the value chain.

Automobile manufacturing offers a good example of this transformation. Gary Cowger, former president of General Motors (GM) North America and group vice president of GM global manufacturing and labor relations, described the company’s experience.7 In the mid-1960s, he said, a typical GM assembly plant employed about 5,000 workers and produced around 120,000 cars a year. Today, the same sort of assembly plant employs only about 1,500 people to produce the same number of vehicles, but the vehicles are of much higher quality and have more—and much more sophisticated—individual components. The difference, he explained, lies in the usefulness and effectiveness of the manufacturing technology used in the plant.

Greater computing power led to more automation in the assembly plants. At first the automation saved little time because the company was using machines to put together vehicles that had been designed for manual assembly, but over time the company began designing its vehicles with automated assembly in mind, and the automation realized its potential as a mechanism for lowering costs, decreasing production time, and increasing quality.

Implementation of technology throughout the value chain continued, with the development of higher-speed computers, much more advanced sensor technologies, and numerous materials advances. The result: with more advanced manufacturing systems and an integrated approach to designing, manufacturing, and assembling vehicles, it now takes only 30 percent as many people to run an automobile manufacturing plant as it took in 1965, while the quality, sophistication, timely delivery, and variety of vehicles have all dramatically improved.

Besides improving the quality of design and manufacturing directly, new computing tools provide entirely new ways for engineers to get feedback from customers. For example, Keith Diefenderfer, principal technology director in the advanced technology center at Rockwell Collins, described the use of virtual reality immersion labs at the company to let customers try out design variations before a design is finalized.8 These labs provide a three-dimensional virtual experience of a new technology, making it possible for individuals to “use” the

______________

7 Remarks of Gary Cowger at “Workshop on Making Value: Integrating Manufacturing, Design, and Innovation to Thrive in the Changing Global Economy,” June 11, 2012, Venable LLC Conference Center, Washington, DC.

8 Presentation by Keith Diefenderfer at meeting of the Foundational Committee on Best Practices of the Making Value for America Study, December 3, 2013, National Academies Keck Center, Washington, DC.

technology before it is built and offer their insights into any issues or problems with the design. Rockwell Collins can make changes to the virtual environment and then refine a design in response to a customer’s comments in as little as an hour. It is a modern approach to prototyping that both increases the chances of meeting a customer’s needs and improves productivity by reducing the time and effort needed to create physical prototypes.9

A number of other companies are also using immersion labs. A recent study reported that 14 percent of companies surveyed were using this tool and found it highly effective (Booz & Company 2014). For example, Caterpillar, the construction and mining equipment maker, brings in customers as well as assembly line workers and service technicians to test virtual machines and provide feedback on aspects such as usability, ease of manufacturing, and serviceability (Jaruzelski et al. 2013).

Technological advances in computing and automation are allowing companies to increase productivity and efficiency, reduce lead times, and gain customer insights in their manufacturing, design, and development activities along the value chain.

The US automotive industry realized that new technologies were not paying off as expected in terms of improved productivity and began to accept that changes in the processes used in design, testing, manufacturing, and assembly were necessary to achieve the full potential of the new technologies.

IMPROVED PROCESSES

A third factor that has been transforming industry in the United States and around the world is the development and application of new organizational processes, such as lean manufacturing and design for manufacturability that improve productivity and decrease lead time. A number of these processes started in the automotive industry and then spread to other industries, such as aerospace and electronics.

Much of the impetus for new processes over the past few decades has come from the development of new technologies, which required different processes in order to realize their full benefits. As GM’s Cowger noted, although the automotive industry began adopting new computer-driven technologies in the 1970s, it was not until the mid-1980s that there were significant changes in the operation of the company’s assembly lines. The industry realized that the new technologies were not paying off as expected in terms of improved

______________

9 Ibid.

productivity and began to accept that a greater degree of integration on the enterprise level was necessary to achieve improvements in efficiency. This in turn required changes in the processes used in the design, testing, manufacturing, and assembly of vehicles.10

One such change was the growing emphasis on design for manufacturability—the idea that engineers should pay more attention to manufacturing considerations when designing new products. To do this, engineers needed to work more closely with both the people who were assembling the products and the engineers who designed the assembly equipment. No longer could product engineers simply hand off their designs to the manufacturing engineers and forget about them; similarly, the manufacturing engineers could no longer pass their designs to the workers on the factory floor and expect them to take care of things from there. Instead, people began thinking about the interplay between the different components of the process—and transformed the way GM designed its products. It became clear that the upfront design, engineering, and development of a vehicle account for only about 5 percent of the vehicle’s total lifecycle cost but the decisions made during this stage determine nearly 75 percent of the lifecycle cost. The company thus began paying more attention to “designing for manufacturability,” and engineers and factory workers began communicating more with each other.

Adoption of Lean Production

An even more profound change was the transition from mass production to lean production. In 1990 three researchers from the Massachusetts Institute of Technology published The Machine That Changed the World, which described in detail the lean production system developed by the Toyota Motor Company and documented its advantages over the system of mass production that GM and most other automotive companies had been using since Henry Ford popularized the assembly line for constructing cars (Womack et al. 1990). The book quickly led many large companies, in the automotive and other industries, to reconsider their organizational goals and processes. Cowger reported that people began to think of “Big M Manufacturing”—manufacturing in terms of the entire system instead of just along the assembly line—and came to recognize that the problems they had experienced in making new technologies pay off were not just technology problems but also management problems. Since then the lean production system, with its emphasis on a company working collaboratively with employees, suppliers, dealers, and customers, has become the gold standard for production systems.

______________

10 Remarks of Gary Cowger at “Workshop on Making Value: Integrating Manufacturing, Design, and Innovation to Thrive in the Changing Global Economy,” June 11, 2012, Venable LLC Conference Center, Washington, DC.

Toyota’s production system involves three interconnected elements: (1) The organizational culture puts the customer first, recognizes that the company’s most important asset is its employees, and expects continuous improvement. (2) Processes allow operations to be both extremely efficient and focused on quality and problem solving. An important principle of the processes is “just in time,” meaning that people and things move through the operations continuously, at the exact time they are needed, with very little waiting. A second, related principle calls for instant attention to production problems: there is an immediate loud signal and a problem solver or team of problem solvers works very quickly to diagnose the problem, contain it, and determine what can be done to prevent it from happening again. (3) Management focuses on developing employees to identify and solve problems to improve operations, and provides the training and incentives for employees to work together as a team to accomplish shared goals.

The practices and principles of Toyota’s production system were adapted and applied to many other industries to improve competitiveness. In aerospace, companies such as Boeing and Airbus are constantly looking for ways to improve their operations by streamlining their supply chains and enhancing the efficiency of their factories. Boeing, for example, measures and tracks the day-to-day performance of teams and individuals, looking for weaknesses and ways to improve, and expects its suppliers to do the same. It encourages self-directed work teams to devise ways to improve their work, and the teams work with their supervisors to implement the suggested changes. That empowerment of workers is one of the main reasons that Boeing was able to improve its production efficiency by 50 percent over the past 10 years.

Impacts of Lean Production

A number of studies have reported advantages to the lean production system in manufacturing. One found that firms that had adopted most of its practices were significantly less energy intensive and more productive (Bloom et al. 2008): companies in the 75th percentile in performance of these practices were 17.4 percent less energy intensive than companies in the 25th percentile. The conclusions were based on data from more than 300 manufacturing firms in the United Kingdom.

According to a more recent study based on data from more than 30,000 manufacturing establishments in the United States, companies that adopted lean production principles were significantly more successful than those that did not, according to a variety of measures of success (Bloom et al. 2013). Companies that adopted practices related to monitoring performance, setting targets, and offering incentives were significantly more productive, more profitable, and more innovative and grew faster than those that did not, and the greater the extent to which a company adopted these practices, the more

successful it was. This held true after accounting for other factors, such as the company’s industry, education level of its workforce, and age of either the company or the particular establishment. Moving from the 10th percentile to the 90th percentile in the performance of lean production practices is associated with a 12 percent increase in value added per employee, a 9.4 percent rise in productivity, a 6 percent growth in employment, and a 2 percent increase in profitability per sale (Bloom et al. 2013).

Between 2005 and 2010 there was a clear increase in the percentage of firms implementing lean production practices, particularly practices involving data collection and analysis. This trend might be due to more companies adopting modern information technologies, such as enterprise resource planning systems. Because these technologies make it easier and cheaper to collect and process data, companies that use them may find that they smooth the way to adoption of principles of lean production (Bloom et al. 2013).

THE NATURE OF WORK IN TRANSITION

Pushed by the forces of increasing globalization, technological advances, and improved processes, employment across the value chain has changed. The manufacturing sector has become more efficient and productive at a faster rate than the rest of the economy, reducing the demand for production workers. At the same time, the nature of work in jobs across the value chain is changing, shifting the education and skills that are in demand.

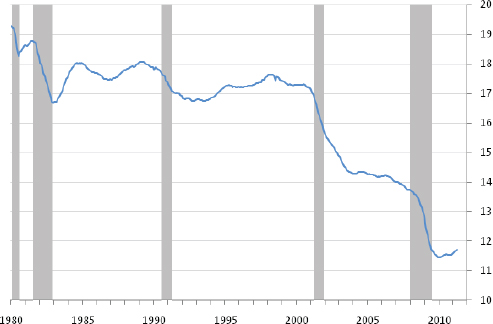

Effects on Manufacturing Employment

Globalization of manufacturing and pronounced increases in worker productivity have dramatically affected US manufacturing employment. According to the Bureau of Labor Statistics Current Employment Statistics Survey, total manufacturing employment in the United States dropped from approximately 19 million in 1980 to 11.5 million in 2010 (Figure 1-4). It has increased somewhat since then, to 12.1 million in 2014, largely because of growth in three sectors—transportation equipment, machinery, and fabricated metals—that together accounted for about half a million new manufacturing jobs during that period. But it is difficult to know whether this increase marks the start of a trend or is just a momentary upswing in a longer trend of declining manufacturing employment.

The overall employment decline over the past three decades is due in part to jobs being shipped overseas—as when most US apparel manufacturing moved to India and other lower-wage countries—and in part to the increasing efficiency that allows 1,500 workers to assemble the same number of automobiles that took 5,000 workers in 1965. Of course, the push to increase efficiency has itself been driven in part by growing competition from overseas.

FIGURE 1-4 Monthly US manufacturing employment, in millions, 1980–2011. Source: Bureau of Labor Statistics Current Employment Statistics survey, available at www.bls.gov/ces/.

Note: Shading indicates recession.

But enhanced efficiency has also made it possible for some companies to move their manufacturing operations back to the United States, as lean production practices have made them competitive with manufacturers in Korea, China, and Japan (Fishman 2012). These companies are thus able to achieve significant cost savings while creating jobs in the United States (Box 1-2).

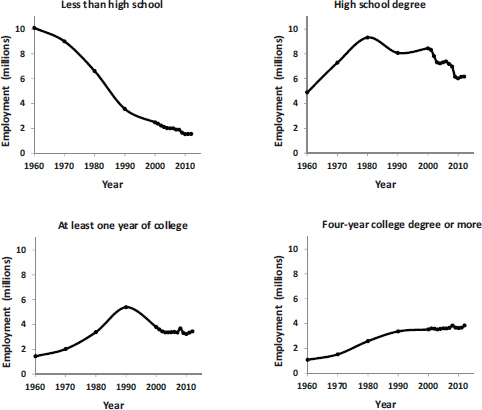

The number of employees in manufacturing without a high school degree declined from 10 million to less than 2 million in 1960–2010, and manufacturing employment requiring a college or more advanced degree increased by more than 2 million jobs.

Changing Nature of Work

The decrease in production jobs does not tell the complete story of employment in manufacturing or the larger value chain. Examining employment trends by level of education shows that manufacturing job losses were concentrated in the portion of the workforce without a high school degree (Figure 1-5). Indeed, while manufacturing employment in this part of the workforce declined

BOX 1-2

Return of US production made possible

by lean manufacturing

Over the past two decades, GE Appliances, a $5 billion manufacturing arm of General Electric (GE), had gone through a long period of outsourcing in an effort to remain profitable in the face of global competition and an increasingly commoditized industry. But in 2012 GE began making cutting-edge, high-efficiency water heaters and refrigerators in its Appliance Park plant in Louisville, Kentucky. In a dramatic example of reshoring—bringing back to the United States manufacturing that had been offshored—the company opened the first new assembly lines in 55 years in Appliance Park, which at its peak in the 1960s turned out 60,000 appliances a week (Fishman 2012). The committee heard from Kevin Nolan, GE’s vice president of technology, who offered some insights into why his company chose to resume making appliances in the United States that, just a few years earlier, it would have made overseas.a

GE had been outsourcing its appliance manufacturing to LG and Samsung, Nolan said. It was a good model at first, because the cost of labor was three times lower than in the United States and the company was still able to bring out new products, designed partly by GE engineers and partly through outsourcing. But shipping the products from oversees meant high transportation costs and a lot of cash tied up in inventory. More importantly, the company faced concerns that it would lose engineering and manufacturing skills and that it would become hard to differentiate its products from those of its competitors. When the 2009 recession hit and sales dropped, it became clear the outsourcing model was not sustainable. After trying unsuccessfully to sell the appliance business, GE decided to make a major investment to reshore its manufacturing. It spent $1 billion on new product facilities and manufacturing plants, tearing down existing lines and rebuilding from the ground up so that its new lines are cutting-edge.

In evaluating the reshoring decision, several factors were key, Nolan said. One advantage of reshoring was transportation costs: by locating closer to customers—the new plants were aimed at the US market—the company would see significant cost savings. Shipping a major appliance overseas typically costs about $50 per unit, and it is also expensive to ship from Mexico by rail.

Another important factor was the ability to colocate manufacturing with product engineering and design. GE still had a great deal of its design and engineering capabilities in the United States, and reshoring made it possible to keep them physically near the manufacturing capabilities, especially as GE Appliances is working to create a close connection between the two. Much of the design and engineering of the electronics and software is still done in Korea because the engineers with that expertise are there, but if there are US engineers with equivalent or near-equivalent skills, GE uses them because of the advantages of colocation. Generally speaking, there must be a significant difference in skill sets to do the work in Korea because of the efficiency losses of not being colocated.

However, to take advantage of the lower transportation costs and colocation benefits of manufacturing in the United States, GE needed to dramatically improve the efficiency of its domestic manufacturing for the move to make sense. LG and Samsung

have done a much better job of adopting lean manufacturing principles, and they have been doing it for a long time. GE learned that in the United States it generally took about 9 to 10 hours of labor to assemble a refrigerator, in Mexico approximately 10 to 11 hours—and in Korea only about 2 hours. Fortunately, from its work with LG and Samsung, GE had observed their huge efficiency gains from adopting lean manufacturing principles and practices, and it is now working to put those in place at its Appliance Park facilities.

One of the most important principles Nolan pointed to was that labor and management had to work together to develop the manufacturing process. A key factor in the effective implementation of lean manufacturing is the role of operators in problem solving and continuous improvement. Since operators see problems firsthand, they must be empowered to address the problem, with a system in place to support them in solving it quickly. That requires a different way of thinking, Nolan said, and is not easy to accomplish.

Both labor and management had to change their approaches to make the operation a success. Management must recognize the importance of respecting labor and view the production operator as the center of the business. The engineers who design the appliances now recognize that their job is to make it as easy as possible for the operators to do their job.

Labor has also changed its approach, embracing the need to reimagine how manufacturing can be done. In Appliance Park, labor works together with management to improve the efficiency of operations. That is a new approach for labor that is critical to improving efficiency to allow plants in the United States to compete with those anywhere in the world.

On a comparative basis, GE Appliance’s reengineered operations are now competitive with the lowest-price producers around the world. And with a continuous focus on production efficiency, their competitiveness continues to improve. Ultimately, GE’s bet is that the production line and engineering employees in its new facilities are going to innovate and improve productivity and product features faster than any other company.

Can lean manufacturing lead more companies to bring production back to the United States? Nolan said the potential is great. Companies such as Herman Miller, Caterpillar, and Whirlpool are examples. For heavier products—such as the appliances, furniture, and industrial equipment these companies produce—there is a large incentive to produce them closer to market to reduce transportation costs. For smaller products, manufacturing in the United States will require more automation, Nolan said, to reduce labor costs. But it should be possible to produce heavier products in the United States at lower total costs even without much automation by implementing lean manufacturing practices.

______________________________

a Kevin Nolan, interview by Christopher Johnson and Kate S. Whitefoot, May 18, 2014. Since the interview, GE announced the sale of its appliances business to Electrolux for $3.3 billion, following a string of divestments in plastics, insurance, and financial services so as to concentrate on infrastructure and technology products and services. GE credits the reshoring of the appliances division and implementation of lean principles as the reason the business was sold at a high price.

FIGURE 1-5 Trends in employment in the manufacturing sector by level of education, 1960–2012. Data source: Integrated Public Use Microdata Series database (IPUMS-USA; Ruggles et al. 2010).

from 10 million to less than 2 million between 1960 and 2010, manufacturing employment requiring at least a college degree increased by more than 2 million jobs (Figure 1-5).

Changing Skill and Education Requirements

Production work in the United States is shifting to require more specialized skills. At Boeing’s plant in Everett, Washington, for example, workers control high-tech machines that use indoor GPS and laser-positioning systems to assemble the 787’s advanced composite parts, and Boeing expects more automation in its facilities over the next 20 years. There will be increasing emphasis on workers with specialty skills for robotics-controlled maintenance, composites work, precision craftsmanship, computer operations, and radio-frequency identification of parts. Conversely, there will be a significant decline

in the subset of manufacturing jobs that consist of repetitive manual skills. Boeing expects that current jobs involving simple tasks such as drilling aluminum and riveting with a bucking bar will continue to decrease and be replaced with higher-skill jobs as new technologies come online.

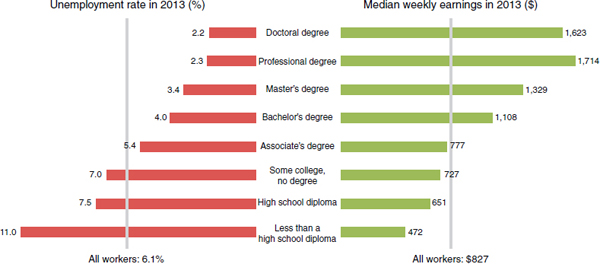

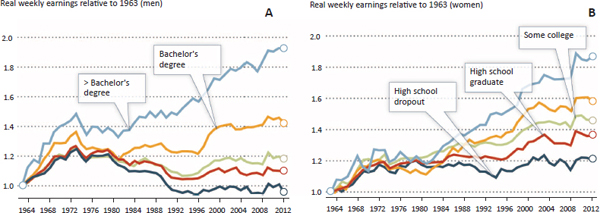

The shift in the skills needed for production jobs is indicative of a larger transformation across all aspects of the value chain and all sectors of the US economy. In particular, less-educated workers are likely to see declining job prospects and lower wages. Workers without an associate’s degree already face much higher unemployment rates—in 2013, 7.5 percent of workers with a high school diploma but no college degree and 11 percent of high school dropouts were unemployed compared to an average of 6.1 percent (Figure 1-6). Wages of men without a college degree have declined 11 percent since 1980 and those of male high school dropouts declined 22 percent, whereas wages of men with a college or advanced degree increased between 20 percent and 56 percent, with the largest gains among those with advanced degrees (Autor 2014). The contrast was less extreme for women, but real earnings growth for women without at least some college education was relatively modest (Figure 1-7).

Many middle-skill jobs are repetitive and procedural and therefore comparatively easy to automate, whereas workers whose jobs depend on manual tasks, such as truck drivers and home health aides, have been more challenging to automate. But this is likely to change in the near future.

Impacts of Automation

The workers who have been hit the hardest are those in so-called middle-skill jobs such as production, operator, clerical, and sales positions, while those in lower-skill jobs such as personal services have actually seen increases in employment and wages. Several economists have attributed this polarization of jobs to increasing automation (e.g., Autor 2010; Brynjolfsson and McAfee 2011).

Many middle-skill jobs are repetitive and procedural and therefore comparatively easy to automate, whereas jobs that depend on manual tasks, such as those of truck drivers and home health aides, have been more challenging to automate. But this is likely to change in the near future. Advances in computing power, machine learning, and robotics are enabling machines to scan a scene, discover patterns, and manipulate objects, enabling innovations such as Google’s self-driving car. These trends suggest that in the next 20 years innovations such as truck-packing robots will start to displace the jobs of workers who perform this and other manual tasks. Unless these workers advance their skills, they are likely to see lower wages and declining job prospects.

FIGURE 1-6 Earnings and unemployment rates by educational attainment, 2013. Source: Current Population Survey, US Bureau of Labor Statistics, US Department of Labor.

Note: Data are for persons age 25 and over. Earnings are for full-time wage and salary workers.

FIGURE 1-7 Change in real wage levels of full-time US workers by sex and education, 1963–2012.

Source: Reprinted with permission from Autor (2014).

The displacement of middle-skill jobs poses serious concerns for the United States. Jobs at this level of pay were important to the growth of the US middle class in the 20th century: many of them were manufacturing jobs, generally at unionized factories, and available to workers without a college degree; they allowed for enough advancement that a worker could stay on a single career path for much of his or her life. The downward pressure on these middle-skill jobs and on lower-skill jobs in areas such as transportation and sales is likely to have a dramatic impact on a large portion of the US workforce. According to one study, almost 50 percent of US jobs are at risk of disruption by advances in computerization (Frey and Osborne 2013).

Growing Skill Mismatches

In addition to—and somewhat related to—the decline of middle-skill jobs, many employers believe there is a growing mismatch between the skills of potential workers and the skills required. An increasing number of jobs—particularly high-wage jobs—require high skills in particular areas, such as engineering and computer programming, and not enough people are acquiring these skills. A Global Talent Management and Rewards Survey of more than 1,600 companies around the world found that 72 percent of them reported that they had trouble finding and hiring critical-skill employees. The situation was only slightly better in the United States, where 61 percent of the responding companies said they had problems recruiting employees with critical skills (Towers Watson 2012). The problem is particularly apparent in the information technology (IT) sector, where as of December 2013 there were some 580,000 vacant positions in the United States (Partovi 2014), and one estimate projected 1.4 million new computing jobs in the United States by 2020 but only 400,000 computer science graduates to fill them (Kuranda 2013).

One major reason that so many jobs are going unfilled is that employers are looking for increasingly specialized capabilities in their new hires. It is not enough, for instance, for an IT worker to be proficient in technical issues; because of the ever more integrated and collaborative nature of jobs and companies, employers would like their IT workers to understand the analytical and business development side of their jobs as well, and such employees are much harder to find than workers who can do just one or the other (Kuranda 2013).

The apparent paradox of employers claiming great difficulty filling engineering jobs and the large number of unemployed engineers in the United States seems to be due to the increasingly specific skills employers expect in their hires (Begley 2005). The result is that workers with the right combination of skills are in high demand and get paid exceptionally well (McBride 2013), while those with skills that do not fit the particular demands of the marketplace often cannot find jobs.

These job market issues, if not resolved, may seriously challenge efforts to create value in the United States.

REFERENCES

ACC [American Chemical Council]. 2014. Keys to Export Growth for the Chemical Sector. Available at www.americanchemistry.com/Policy/Trade/Keys-to-Export-Growth-for-the-ChemicalSector.pdf (accessed February 2, 2015).

Atsmon Y, Child P, Dobbs R, Narasimhan L. 2012. Winning the $30 trillion decathlon: Going for gold in emerging markets. McKinsey Quarterly. Available at www.mckinsey.com/insights/strategy/winning_the_30_trillion_decathlon_going_for_gold_in_emerging_markets (accessed July 15, 2014).

Autor D. 2010. The Polarization of Job Opportunities in the US Labor Market: Implications for Employment and Earnings. Paper jointly released by the Center for American Progress and the Hamilton Project of the Brookings Institution. Washington.

Autor DH. 2014. Skills, education, and the rise of earnings inequality among the “other 99 percent.” Science 344(6186):843–851.

Baldwin R, Lopez-Gonzalez J. 2013. Supply-Chain Trade: A Portrait of Global Patterns and Several Testable Hypotheses. Working Paper 18957. Cambridge, MA: National Bureau of Economic Research.

Begley S. 2005. Behind “shortage” of engineers: Employers grow more choosy. Wall Street Journal, November 16. Available at http://online.wsj.com/news/articles/SB113210508287498432 (accessed April 25, 2014).

Berger S. 2013. Making in America: From Innovation to Market. Cambridge, MA: MIT Press.

Bloom N, Genakos C, Martin R, Sadun R. 2008. Modern management: Good for the environment or just hot air? Working paper 14394. Cambridge, MA: National Bureau of Economic Research. Available at www.nber.org/papers/w14394.pdf (accessed April 7, 2014).

Bloom N, Brynjolfsson E, Foster L, Jarmin R, Saporta-Eksten I, Van Reenen J. 2013. Management in America. CES 13-01. Washington: US Census Bureau, Center for Economic Studies. Available at www2.census.gov/ces/wp/2013/CES-WP-13-01.pdf (accessed April 7, 2014).

Booz & Company. 2014. The Global Innovation 1000: Navigating the Digital Future. Available at www.strategy-business.com/article/00221?pg=all (accessed February 2, 2015).

Brynjolfsson E, McAfee A. 2011. Race Against the Machine: How the Digital Revolution Is Accelerating Innovation, Driving Productivity and Irreversibly Transforming Employment and the Economy. Digital Frontier Press.

EIA [US Energy Information Administration]. 2012. Energy needed to produce aluminum. August 16. Washington: US Department of Energy. Available at www.eia.gov/todayinenergy/detail.cfm?id=7570 (accessed April 4, 2014).

Fishman C. 2012. The insourcing boom. The Atlantic, December. Available at www.theatlantic.com/magazine/archive/2012/12/the-insourcing-boom/309166/ (accessed May 22, 2014).

Frey CB, Osborne MA. 2013. The future of employment: How susceptible are jobs to computerisation? Paper. Oxford Martin School, Oxford University, Oxford, UK.

IMF [International Monetary Fund]. 2014. World Economic Outlook: Legacies, Clouds, Uncertainties. Available at www.imf.org/external/pubs/ft/weo/2014/02/pdf/text.pdf (accessed February 2, 2015).

Jaruzelski B, Loehr J, Holman R. 2013. The Global Innovation 1000: Navigating the digital future. Booz & Company. Available at www.strategyand.pwc.com/media/file/Strategyand_2013Global-Innovation-1000-Study-Navigating-the-Digital-Future.pdf (accessed April 11, 2014).

Johnson M, Rasmussen C. 2014. Jobs Supported by Exports 2013: An Update. Washington: International Trade Administration.

Kenny C. 2014a. The Upside of Down: Why the Rise of the Rest Is Good for the West. New York: Basic Books.

Kenny C. 2014b. America is No. 2! And that’s great news. Washington Post, January 17. Available at www.washingtonpost.com/opinions/america-is-no-2-and-thats-great-news/2014/01/17/09c10f50-7c97-11e3-9556-4a4bf7bcbd84_story.html (accessed January 17, 2014).

Krupnick A, Wong Z, Wong Y. 2013. Sector Effects of the Shale Gas Revolution in the United States. Washington: Resources for the Future. Available at www.rff.org/RFF/Documents/RFF-DP-13-21.pdf (accessed February 2, 2015).

Kuranda S. 2013. Nice work if you can get it: The IT shortage is more serious than you think. CRN, November 4. Available at www.crn.com/news/channel-programs/240163468/nice-work-if-youcan-get-it-the-it-talent-shortage-is-more-serious-than-you-think.htm (accessed April 25, 2014).

Manyika J, Sinclair J, Dobbs R, Strube G, Rassey L, Mischke J, Remes J, Roxburgh C, George K, O’Halloran D, Ramaswamy S. 2012. Manufacturing the Future: The Next Era of Global Growth and Innovation. London: McKenzie Global Institute. Available at www.mckinsey.com/insights/manufacturing/the_future_of_manufacturing (accessed April 4, 2014).

McBride S. 2013. Twitter pays engineer $10 million as Silicon Valley tussles for talent. Reuters, October 13. Available at www.reuters.com/article/2013/10/13/net-us-siliconvalley-engineerstwitter-idUSBRE99C03R20131013 (accessed April 25, 2014).

McCutcheon R, Schlosser P, Misthal B. 2011. Shale gas: A renaissance in US manufacturing? PWC Report. December. Available at www.pwc.com/us/en/industrial-products/publications/shale-gas.jhtml (accessed February 2, 2015).

McDearman B, Donohue R, Marchio N. 2013. Export Nation 2013: US Growth Post-Recession. Global Cities Initiative: A Joint Project of Brookings and JPMorgan Chase. Available at www.brookings.edu/~/media/Research/Files/Reports/2013/09/17%20export%20nation/ExportNation2013Survey.pdf (accessed July 15, 2014).

MIT Energy Initiative. 2012. The Future of Natural Gas. An Interdisciplinary MIT Study. Available at https://mitei.mit.edu/system/files/NaturalGas_Report.pdf (accessed February 2, 2015).

NSB [National Science Board]. 2014. Science and Engineering Indicators 2014. NS B14-01. Arlington, VA: National Science Foundation.

OECD [Organization for Economic Cooperation and Development]. 2009. Top barriers and drivers to SME internationalization. Report by the OECD Working Party on SMEs and Entrepreneurship. Paris. Available at www.oecd.org/cfe/smes/43357832.pdf (accessed July 15, 2014).

Partovi H. 2014. Testimony before Committee on Science, Space, and Technology; Subcommittee on Research and Technology; US House of Representatives. January 9. Available at http://docs.house.gov/meetings/SY/SY15/20140109/101630/HHRG-113-SY15-WstatePartoviH-20140109.pdf (accessed April 25, 2014).

Plumer B. 2013. China may soon stop flooding the world with solar panels. Washington Post, March 23. Available at www.washingtonpost.com/blogs/wonkblog/wp/2013/03/23/chinamight-stop-providing-the-world-with-cheap-solar-panels/ (accessed April 5, 2014).

Roxburgh C, Manyika J, Dobbs R, Mischke J. 2012. Trading Myths: Addressing Misconceptions about Trade, Jobs, and Competitiveness. McKinsey Global Institute. Available at www.mckinsey.com/insights/economic_studies/six_myths_about_trade (accessed July 15, 2014).

Ruggles SJ, Alexander T, Genadek K, Goeken R, Schroeder MB, Sobek M. 2010. Integrated Public Use Microdata Series: Version 5.0 [Machine-readable database]. Minneapolis: Minnesota Population Center.

Towers Watson. 2012. The next high-stakes quest: Balancing employer and employee priorities. 2012–2013 Global Talent Management and Rewards Study. Available at www.towerswatson.com/en-US/Insights/IC-Types/Survey-Research-Results/2012/09/2012-Global-TalentManagement-and-Rewards-Study (accessed April 23, 2014).

Womack JP, Jones DT, Roos D. 1990. The Machine That Changed the World: Based on the Massachusetts Institute of Technology 5-Million-Dollar 5-Year Study on the Future of the Automobile. Riverside, NJ: Simon & Schuster.