Technology Challenges to Trade Policy

DAVID B. YOFFIE

The demands for trade intervention in high-technology industries are expanding. Policymakers everywhere seem to believe that the externalities of industries like semiconductors and telecommunications are so great that fewer and fewer want to leave the fate of these businesses open to the vagaries of the "free market." Despite a worldwide movement toward greater conservatism on government policy, trade policies in high-technology sectors have spread beyond Japan, France, and a few newly industrializing countries to North America and the European Community at large. We have witnessed in the 1980s trilateral trade warfare among Europe, the United States, and Japan in sectors such as semiconductors and high-definition television, with numerous bilateral conflicts in sectors such as aircraft (between the United States and Europe), VCRs (between Europe and Japan), and telecommunications (between the United States and Japan).

I will argue in this paper that such conflicts are dangerous and potentially self-defeating. The postwar trading system was developed to solve the problems of the industries of its day—mainly tariffs and quotas in traditional manufacturing industries. Neither the trading system nor trade policies are well suited to deal with the problems posed by high-technology sectors.

I begin by suggesting how high-technology industries are different from the traditional manufacturing sectors and by discussing the consequences of those differences for trade policy in the decade ahead. Perhaps most significant is that high-technology businesses are characterized by huge R&D investments, high risks, and rapid growth. These and other issues pose unique problems for firms and nations. Moreover, the process of making trade policy in mature manufacturing sectors does not fit well the requirements of high-technology industries. U.S. trade law and the dispute-settlement mech-

anism in the General Agreement on Tariffs and Trade (GATT) are slow, litigious processes designed to inhibit government intervention in international trade. But if a government does intervene in high-technology industries, the lack of a speedy response by other countries can undermine the competitiveness of a firm or nation.

Finally, I will argue that the urge to use trade policy for managing the inflows of goods and services in high-technology sectors should be resisted. The best use for trade policy in the 1990s is to eliminate the vestiges of the past—namely, foreign trade barriers that continue to pervade many countries—and ensure expanded market access. Technology policies, industrial policies, and even military procurement policies are probably better mechanisms by which governments can promote their domestic high-technology sectors. I will use an extended illustration of the U.S.-Japan semiconductor trade agreement to suggest why trade policy is so difficult to fine tune.

WHY IS HIGH TECHNOLOGY DIFFERENT?

First, from a trade policy perspective, why should anyone care about high technology? Or to paraphrase Office of Management and Budget director Richard G. Darman's oft-quoted comment, ''potato chips or silicon chips, who cares—they are both chips." How much the national interest depends on silicon versus potatoes will be left to other papers for the conference. However, the efficacy of trade policy does very much depend on the nature of the industry we are discussing.

Most trade law was designed to deal with non-technology-intensive manufacturing businesses, such as steel, textiles, cars, and footwear. Today's higher technology industries did not exist during the formation of the GATT and the creation of most modern trade law; and even agriculture was largely excluded from GATT scrutiny until the most recent Uruguay Round of negotiations. Although these traditional industries were diverse, they were typically characterized by long product life cycles (for example, it took almost 15 years for the textile industry to shift production from cotton materials into synthetics and blends); limited capital mobility (few steel companies, for instance, moved their manufacturing offshore during the 30 years of their relative decline in the industrial countries); and no problems of appropriating the value of their intellectual property (for example, the relatively low level of investment in R&D meant that managers in steel, textiles, cars, and footwear rarely had to worry about the consequences of foreign competitors reverse engineering their products and recouping their investments in design).

Formulating trade policies in such mature manufacturing businesses was a relatively straightforward task. If industries were in distress because of

international competition, governments could adjust tariffs and quotas to regulate trade. While short-term profits would suffer if the process was lengthy, the nation would not suffer as a result. Consumers benefited in the short term from low-priced products. And in the longer run, the government's objectives were met because simple tariffs and quotas could effectively raise domestic production and prices. The flip side of this story was that trade liberalization was also a relatively straightforward task: governments, either bilaterally or through the GATT, could negotiate to reduce protectionist tariff and quota barriers and facilitate increased trading activity across national boundaries. Again, if the process of liberalization was slow, it might reduce short-term national welfare, but once trade barriers came down, countries could trade according to their comparative advantage, allowing firms to exploit their "natural" country-based cost advantages or advantages that might be associated with static, scale-based efficiencies.

High-technology sectors create an entirely different problem set for both managers and trade policymakers. Some of the most commonly cited features of technology-intensive industries in the 1990s are (1) high embedded R&D content; (2) difficulty in appropriating the value of the R&D in intellectual property; (3) short and shortening product life cycles (often as quick as two to three years); (4) steep learning curves, which allow prices to decline sharply over time; (5) the role of standards and switching costs; (6) a low ratio of transportation costs to value; and (7) a high degree of capital mobility. These last two items, taken together, allow firms to disperse production and geographically separate research and manufacturing activities.

Each of these features poses challenges for the formulation of trade policy. Perhaps the most obvious problem is that success in high-technology industries comes from dynamic, not static, economies. Actions taken or not taken today have critical implications for the positions of those industries tomorrow. In sectors with short product life cycles, for instance, firms must not only make heavy up-front investments in intangible assets (R&D), they must find ways to make a return on those investments quickly—before the next generation of product becomes available. Such high R&D content also creates added risk for the firm: unlike the investment in tangible assets, which can often be resold, investment in R&D represents a sunk cost to firms, which have little or no value when the product life cycle is over. This issue is exacerbated in industries where reverse engineering or illegal copying of designs make it difficult for the firms to appropriate the value of their investment. In addition, in some industries, such as commercial aircraft, the up-front intangible investments are so risky that the firm has to bet the company with each new product introduction.

Moreover, dynamic learning economies and the high switching costs associated with many high-technology products create the possibility of

"first-mover advantages;" that is, early winners in the marketplace may sustain lower costs for long periods of time, or early winners may be able to make it costly for their customers to switch vendors. Consider two well-known examples: dynamic random access memory chips (DRAMs) and operating system software. For DRAMs, costs generally decline about 30 percent for every doubling of volume. Ever since Japanese manufacturers moved ahead of the U.S. and European manufacturers in production of 64-kilobit DRAMs in the early 1980s, it has been difficult for new vendors (even with high government subsidies) to dislodge the first movers. The leaders in one generation of DRAMs have an advantage in the next generation because learning takes place across products: what counts is not new modern factories or low labor costs, but cumulative experience. Regardless of whether a new (country or business) entrant would have a "natural" comparative advantage because of lower wage or capital costs, dynamic learning economies may shut out future competitors.

A different kind of first-mover advantage may emerge when the early winner in a market creates a standard, which ties customers to a particular vendor. The best-known example of first movers creating a standard and high switching costs is the operating systems for personal computers. When IBM set the standard for its personal computers with its choice of Microsoft's disk operating system (MS-DOS), independent software companies wrote applications designed for that system. Over the decade of the 1980s, users of IBM PCs and PC-compatible computers invested more than $30 billion in software written exclusively for MS-DOS-based machines, which made it costly for the average PC customer to switch to machines based on other disk operating systems.

WHY TRADE POLICY IN HIGH TECHNOLOGY IS DIFFERENT

The combination of added risk, short product life cycles, limited appropriability, and first-mover advantages collectively alter the challenge of trade policy for any national government. The most important challenge is posed by speed: slow resolution of trade policy disputes are potentially disastrous to the firm and crippling to certain sectors of a nation. When foreign firms or governments use subsidies, predatory pricing, or other "unfair" practices as defined by the GATT, domestic firms may be seriously weakened or out of business. Although the same is true in traditional sectors, if foreign firms later try to raise prices in mature manufacturing businesses, domestic firms can reenter those businesses and retain national welfare gains from trade.

Not so in high-technology industries. Where first-mover advantages exist, the barriers to reentry may be insurmountably high. Once a firm (or

nation) leaves the DRAM business, for instance, and assuming there are no new technological revolutions that obsolete past advantages, the new firm would have to replicate the cumulative learning of its Japanese competitors. Similarly, once Microsoft creates a standard for PC software, in theory it could exercise monopoly power and make it virtually impossible for latecomers to drive down prices.1

Yet the very structure of GATT's dispute-settlement mechanism and U.S. trade law, especially the escape clause (Section 201), antidumping and countervailing duties, and unfair trade practices (Section 301), promote slow actions. Even with fast-track provisions under the 1988 trade law, industries in the United States can rarely expect the government to respond in less than a year (see Table 1).2

Fast actions against definable trade violations are only part of the trade policy dilemma in high-technology industries. An equally significant issue is the separation of R&D from manufacturing and the potential mobility of production. In traditional sectors, trade policy serves relatively simple objectives that are easy to observe and measure. For example, the United States and Europe protected the textile industry to ensure employment; the Japanese long protected their steel industry to build a domestic production base. Whether these policies were welfare maximizing is a matter for serious debate; nonetheless, trade policy was a viable tool to achieve the state's objectives.

In high-technology sectors, however, the role of trade policy is much more amorphous. Governments typically want to use trade policy to maintain or build certain industries, but the primary objective is not employment or domestic production, per se; rather it is to reap the "externalities" associated with high research and development activities. Countries want to maintain such industries as semiconductors, computers, aircraft, and telecommunications because they see benefits in investing in businesses where knowledge "spills over" into related sectors. The object is to keep high value-added activities within the country in order to foster the broadest base of growth opportunities.

The problem is that high value-added activities and manufacturing are not necessarily the same thing in high-technology businesses. But trade policy is most effective at targeting an industry's production activities—not the other activities that might produce spillovers. Take, for example, the central-office switch business in telecommunications. Physically, a digital, central-office switch consists of arrays of several hundred circuit boards, containing thousands of integrated circuits, wired together in metal cabinets of 400 to 1,000 cubic feet in size. The products are manufactured in high-volume assembly plants around the world. AT&T has factories in the United States, Holland, Spain, Korea, and Taiwan; NEC assembles in Japan, a variety of developing countries, and Texas; Siemens manufactures in Eu-

TABLE 1 Summary of Most Commonly Used U.S. Trade Laws

|

|

Escape Clause |

National Security Clause |

Retaliation |

Duties |

Antidumping |

|

U.S. Law |

Section 201 1974 Trade Act |

Section 232 1962 Trade Act |

Section 301 1974 Trade Act |

Section 303 1930 Tariff Act |

Section 731 1930 Tariff Act |

|

Modified |

1979, 1984, 1988 |

1974, 1979, 1988 |

1984, 1988 |

1974, 1984, 1988 |

1974, 1979, 1984 |

|

Rule |

Increased imports cause or threaten to cause substantial injury |

Imports threaten to impair national security by weakening vital domestic industry |

Barriers restrict U.S. commerce; No injury test |

Export subsidy causes or threatens to cause material injury |

Price below "fair market value" causes or threatens to cause material injury |

|

Penalty |

Duty, quota, orderly marketing agreement or trade adjustment assistance, or other action |

At President's discretion |

Determined by U.S. Trade Representative, subject to direction of Presidenta |

Tariff which offsets subsidy or negotiated settlement |

Tariff which raised price to fair market value, or negotiated settlement |

|

Investigating Agency |

International Trade Commission |

Department of Commerce, International Trade Administration |

U.S. Trade Representative |

Commerce (ITA) and ITC |

Commerce (ITA) and ITC |

|

Recommendation due |

6 months |

270 daysb |

12-18 monthsa |

160-300 days |

235-420 days |

|

Decision maker |

President, based on ITC's proposed remedy |

President |

USTR, subject to direction of Presidenta |

Commerce (International Trade Administration) |

|

|

Decision due |

60 days |

No deadline |

Included in recommendation, 30 day implementation limita |

Upon recommendation |

|

|

Congressional override |

Yes, within 90 days if President rejects |

No |

No |

No |

No |

|

a In 1983, penalty was determined by the President, who was the decision maker in 301 cases. The U.S. Trade Representative's recommendation was due in 9 to 14 months, depending on the nature of the unfair practice. The decision was due 21 days after the USTR's report to the President. The OTA of 1988 gave this authority to the USTR. b In 1983, recommendation was due in 12 months. SOURCE: Yoffie et al. (1987, p. 18). |

|||||

rope, assembles in developing countries and Florida. Yet the most significant portion of the value (and development costs) of a digital switch is not manufacturing and assembly, but software. Estimates suggest that software might account for as much as 40 or 50 percent of the value of a switch. It costs approximately $1 billion in development costs for each new generation, and annual expenses for software modifications are as much as $200 million per firm. Both AT&T and NEC do all of their significant software development at home; and while Siemens distributes some of its R&D, the bulk of its activities remain in Germany.

The dilemma for trade policy in an industry like telecommunications is precisely this separation of R&D from manufacturing. If the purpose of trade policy is to help build a domestic business in central-office switches, trade policy is a particularly ineffective tool. Even though tariffs or quotas can be used to encourage foreign firms to produce locally and even use local content (e.g., semiconductors and boards), such trade policies will not necessarily promote the ''right" value-added activities for a particular geographic location.

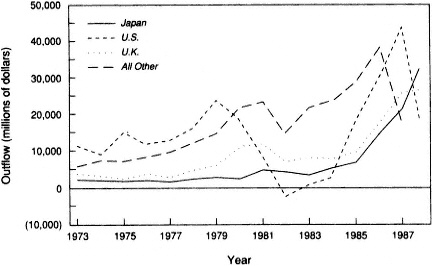

Looking at this issue from a firm's perspective, one comes to the same conclusion. The separation of R&D from production makes it easier for a firm to avoid the intent of trade policy. When a government wants to promote its domestic industry through trade policy, it often uses some form of protectionist barrier. The corporate solution is simple: invest around the barrier with assembly or even fully integrated manufacturing. In the past five years, it has been easy for long-term capital to flow across national boundaries (see Figures 1 and 2). Even if some manufacturing economies are lost through such foreign investments, the firm can still maintain its most important economies of scale in R&D at home.

The conundrum that heavy cross-investment creates for trade policy is obvious today in industries like high-definition television (HDTV). Since European and Japanese firms had long established presence in North America in the mature TV business, those same facilities provide platforms for manufacturing new, related businesses, like HDTV. The governments in the European and Japanese blocs have each strategically intervened in their domestic industries by setting of local standards that do not conform to the standards of others. In the meantime, Japanese and European firms are lobbying against American-owned firms to set the standard in the United States. The question one must pose is, What is the value of trade policy to the U.S. government when the American-owned firm, Zenith, produces its TVs in Mexico, Thomson of France own's RCA's production in the United States, and Matsushita of Japan has factories in Chicago?

Perhaps the greatest challenge for trade policy in high-technology businesses is not even the concrete actions taken by governments but the im-

plicit role that government can play. Just the threat of foreign government intervention in these sectors can undermine domestic firms' investment strategies. When firms must bet their business in order to take advantage of a new technology, they will hesitate to make those investments if foreign governments commit to subsidizing their firms. Even without paying a dollar, when a foreign government says it will underwrite a competitor, a domestic firm will worry that its future profits may disappear. Imagine that Europe announced it planned to subsidize Airbus indefinitely. If U.S. manufacturers of commercial aircraft have no credible commitment of American government trade policy (or subsidies) to countervail actions by the foreign government, then the rational response by American manufacturers would be to underinvest. The risk for a firm like McDonnell Douglas to invest in the next generation of aircraft might outweigh the possible returns.

In sum, high-technology industries place new demands on trade policymaking to act more strategically. Governments not only require knowledge of their domestic industry to be successful, but must also understand the behavior and motives of foreign governments as well. Discipline, judgment, and brinkmanship, skills more typically associated with business than trade policymaking in any country, become necessary ingredients for success.

AN ILLUSTRATION: U.S.-JAPAN SEMICONDUCTOR TRADE AGREEMENT

The U.S.-Japan semiconductor trade agreement (SCTA), signed in 1986, is perhaps the best example of why trade policy is a blunt weapon in an age when precision bombing is required. The evolution of the agreement illustrates how speed, capital mobility, technical complexity, and brinkmanship are needed to make trade policy work in high-technology businesses; it also demonstrates how difficult it is to cover all the inevitable contingencies in high-technology sectors.

In many ways, the SCTA is a model for trade policy in high-technology industries. It was the first major U.S. trade agreement motivated by concerns about the loss of competitiveness in a high-tech strategic sector rather than concerns about employment. It was the first U.S. trade agreement dedicated to improving market access abroad rather than restricting market access at home. Unlike previous bilateral trade deals, it attempted to regulate trade not only in the United States and Japan but also in other global markets.

The purpose of the SCTA was to address two nagging issues in U.S.-Japanese high-technology trade: inadequate access by U.S. firms to the Japanese market and dumping by Japanese firms in the U.S. and world markets. Almost one year after the industry association filed an unfair trade practices case (under Section 301 of U.S. trade law) and nine months after dumping suits were filed, the two sides came to agreement: the

United States agreed to suspend dumping and Section 301 retaliation in return for stipulated actions by the Japanese government to improve market access for American companies and for Japanese firms to cease from dumping.

On the market access issue, the official agreement said that the government of Japan would provide sales assistance to help U.S. and other foreign companies sell in Japan and would encourage long-term relationships between Japanese users and foreign suppliers. It also said that both governments anticipated improved opportunities for foreign sales in Japan. In a confidential side-letter to the official agreement, the Japanese government went further and stated that it "understood, welcomed, and would make efforts to assist foreign companies in reaching their goal of a 20 percent market share within five years." The 20 percent figure meant an effective doubling of the foreign share of the Japanese market.

The SCTA suspended investigations of Japanese dumping of DRAM and erasable programmable read-only memory (EPROM) devices without the imposition of duties. As part of the suspension agreement, the Japanese producers agreed not to sell their products at prices below their (average) cost of production, plus an 8 percent profit margin in the U.S. market. The Japanese agreed to have their Ministry of International Trade and Industry monitor export prices on a wide range of semiconductor products, including EPROMs, 256K DRAMs, and 8- and 16-bit microprocessors, to prevent Japanese producers from selling at less than fair market values in the United States or in third countries. The Department of Commerce, in turn, was given the responsibility to calculate foreign market values for each Japanese producer for each product, based on that producer's costs, and to monitor the production costs and prices of all Japanese products covered by the agreement. The United States reserved the right to add or drop products from the monitoring arrangement in the future.

The SCTA tried to deal with many of the problems described above involving trade policy in high-technology industries. For instance, recognizing the need for fast action in dumping suits and the problems of government commitment to facilitate investments, the SCTA allowed for the monitoring of costs and prices on a wide range of products, including several that had not been the subject of the pending dumping investigations. It was anticipated that this arrangement would deter or prevent dumping of such products in the future. It had long been a complaint of the semiconductor industry and other industries that by the time a finding of dumping is actually made, substantial and irreparable harm has been done to American producers. The SCTA tried to address this complaint by heading off dumping before it occurred.

But how did the agreement work? On market access, the quantitative evidence suggests that after the U.S. government retaliated against Japan in

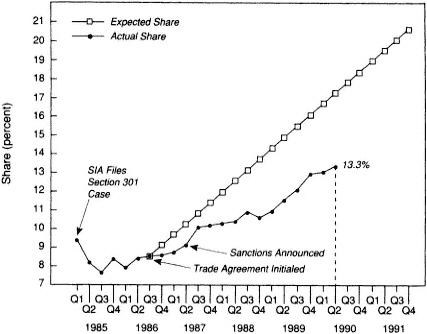

Figure 3 Foreign semiconductor market share in Japan. SOURCE: Yoffie (1989).

March 1987, market share did rise (see Figure 3). As of the end of 1990, the foreign share of the Japanese market was approximately 13.3 percent, substantially below the ultimate goal of 20 percent but up from 8.5 percent when the agreement was signed, and at its highest level ever.3

The pricing side of the agreement, however, was not such a success. In the first few months after the conclusion of the agreement, prices of semiconductor memory devices exported from Japan jumped sharply. U.S. customers reported that prices of 256K DRAMs had risen anywhere from two to eight times the pre-agreement price. Sustained price increases came after the imposition of sanctions on Japanese companies for failure to comply with the provisions of the agreement. Prices of DRAMs began what was to become a sharp increase lasting through the end of 1988. Spot prices for 256K DRAMs tripled over a four-month period,4 and American consumers reported significant difficulties in obtaining adequate supplies at any price. The price hikes and supply interruptions caused several U.S. system vendors to ration memory shipments, delay new product introductions, and increase prices. The increase in spot prices for DRAMs was especially severe—spot prices rose three to six times higher than long-term contract

prices, with the result that the effective prices paid by consumers depended heavily on the percentage of demand they had to purchase on the spot market.

Since early 1989 there have been adequate supplies, and the gap between spot and large contract prices has disappeared. But Flamm (1990) estimates that higher prices meant about $4 billion of annual profits on approximately $10 billion in global DRAM sales in 1988. Since the Japanese had the lion's share of the DRAM market, they earned the lion's share of these so-called bubble profits.5

Although the SCTA did not directly ''cause" these higher prices, U.S. trade policy had the perverse effect of helping Japanese companies build a temporary cartel while simultaneously hurting U.S. computer firms.6 Despite all the safeguards and efforts to deal with the problems of speed, technical complexity, and political discipline, unintended consequences undermined at least half (the pricing side of the agreement) of what the U.S. government and the U.S. semiconductor industry wanted to achieve. The SCTA has also stimulated significant foreign investment by Japanese semiconductor manufacturers into the United States. Future efforts to use trade policy to affect the balance in the United States between Japanese-produced chips versus American-produced chips will verge on the impossible.

LESSONS OF THE SCTA

The lessons of the SCTA may be important for thinking more broadly about the role of trade policy in high-technology sectors. The most successful piece of the SCTA was helping American (and other non-Japanese) firms gain greater access to a formerly closed market. The value of trade policy was that it helped induce Japanese policymakers and private actors to eliminate many of the vestiges of the past that have kept the market implicitly as well as explicitly closed to foreigners. Where trade and other barriers to high-technology trade persist in markets around the world, trade policy remains an appropriate tool. The renewed SCTA that was signed in 1991 recognized this point and focused exclusively on the issue of market access.

But to facilitate a high-technology industry's vitality, to manage production or pricing in such sectors, and to stimulate entry, trade policy is probably obsolete. The dynamics of high-technology products and process, the rapidity of change, the ability of firms to circumvent legal agreement as well as a policy's intent, all suggest trade policy is inappropriate. If a government wishes to assist domestic high-technology firms, the direct approach—subsidies, antitrust exemptions, and other forms of direct intervention—remains the best option.

NOTES

REFERENCES

Froot, K. A., and D. B. Yoffie. 1991. Strategic trade policies in a tripolar world. The International Spectator 26(July-September).

Flamm, K. 1990. Measurement of DRAM prices: Technology and market share. Working Paper, November. Washington, D.C.: Brookings Institution.

Tyson L., and D. Yoffie. 1991. Semiconductors: From manipulated to managed trade. Unpublished manuscript, Harvard University and the Berkeley Roundtable on the International Economy.

Yoffie, D. B. 1989. Semiconductor Trade Association and the Trade Dispute with Japan (D). HBS case 9-388-104. Boston, Mass.: Harvard Business School.

Yoffie, D. B., A. G. Wint, R. Phelps, and D. Dobrowolski. 1987. United States trade law. HBS Case 9-387-137. Boston, Mass.: Harvard Business School.