4

Government Support for Deployment of Plug-in Electric Vehicles

The successful deployment of plug-in electric vehicles (PEVs) involves many entities and will require the resolution of many complex issues. The present report focuses on individual strategies for overcoming barriers related to purchasing and charging PEVs, and this chapter specifically explores how federal, state, and local governments and their various administrative arms can be more supportive and implement policies to sustain beneficial strategies for PEV deployment. Although electric utilities can also provide institutional support for PEV deployment, they and their associated policies are discussed in Chapter 6. Where opportunities exist to improve the viability of PEVs but no single institution is clearly positioned to capitalize on the opportunity, the committee highlights possible partnerships that might fill these voids. The committee’s findings and recommendations are provided throughout this chapter.

FEDERAL GOVERNMENT RESEARCH FUNDING TO SUPPORT DEPLOYMENT OF PLUG-IN ELECTRIC VEHICLES

Funding research is one of the most important ways the federal government can lower barriers to PEV deployment. Research is needed in two areas in particular. As discussed in Chapter 2, the first is basic science and engineering research to lower the cost and improve the energy density and other performance characteristics of batteries. The second critical area concerns PEV deployment, especially the role of infrastructure in spurring vehicle sales and increasing electric vehicle miles traveled (eVMT). Fundamental and applied science and engineering research for vehicle energy storage is being undertaken by vehicle manufacturers and in the laboratories of the U.S. Department of Energy (DOE), the Department of Defense (DOD), and academic institutions. Research into the deployment of PEV infrastructure and markets is much less developed. Both areas are discussed below.

Engineering Research and Development of Battery Science

As discussed in Chapter 2, the battery is the most costly component of PEVs and represents the majority of the cost differential between PEVs and internal-combustion engine (ICE) vehicles. Battery cost will need to decrease substantially to allow PEVs to become cost competitive with ICE vehicles (see Chapters 2 and 7). Thus, the current goal of battery research and development is to increase the energy density of PEV batteries and to lower their cost. The improved battery technology can then be used to lower vehicle cost, increase vehicle range, or both, and those improvements would likely lead to increased PEV deployment.

As in many areas of fundamental research and development, the federal government has an important role to play. Although basic science and engineering research is funded by both government and the private sector, the government role is to fund long-term, exploratory research that has the potential for positive national impact. Stable funding for exploratory research allows investments in research facilities and human capital that are necessary for the research to bear fruit. The federal government has directly supported battery research and development for electric vehicles since 1976 (Electric and Hybrid Vehicle Research, Development, and Demonstration Act 1976, Pub. L. 94-413). Past investment in research and development contributed to the development of the NiMH batteries used in early hybrid electric vehicles (HEVs) and to the lithium-ion battery technology used in the Chevrolet Volt (DOE 2008).

The largest funder of energy storage research in the federal government is DOE, followed by DOD. From 2009 to 2012, across all areas of the federal government, investment in energy-storage research, development, and technology deployment totaled $1.3 billion, which includes batteries for all applications, not only vehicles (GAO 2012a). In Fiscal Year (FY) 2013, the DOE Vehicle Technology Office funded $88 million for battery research and development focused on vehicle applications (DOE 2014a). Much of the funding is for grants or cooperative research agreements with government, industry, or university laboratories, but a growing proportion is also funding loan guarantees to deploy new technologies. Worthy DOE goals for battery storage improvements include halving the size and weight of PEV batteries and reducing the production costs to one quarter of its 2012 value by 2022 (DOE 2013a). Recently, DOE has initiated and supported several collaborative research programs with even more ambitious goals to accelerate basic and applied research,

development, and deployment. They include Energy Frontier Research Centers, several Advanced Research Projects Agency-Energy (ARPA-E) programs in energy storage, and the Battery and Energy Storage Hub, which is funded at up to $25 million per year for 5 years and aims to increase battery energy density five times and reduce cost by 80 percent (DOE 2013b).

Finding: Investment in battery research is critical for producing lower cost, higher performing batteries that give PEVs the range consumers expect from ICE vehicles.

Recommendation: The federal government should continue to sponsor fundamental and applied research to facilitate and expedite the development of lower cost, higher performing vehicle batteries. Stable funding is critical and should focus on improving energy density and addressing durability and safety.

Research on Deployment of Plug-in Electric Vehicles

In contrast to the substantial investment in battery research and development, research on PEV deployment is much less advanced. A critical research need is understanding the relationship between PEV deployment and infrastructure deployment. Supporting that research is an appropriate role for the federal government given that it might be motivated to deploy infrastructure if by doing so it encourages PEV deployment and increases eVMT.

The primary DOE effort to understand PEV vehicle and infrastructure deployment is the EV Project, an infrastructure deployment and evaluation program managed by the Idaho National Laboratory (INL) in partnership with ECOtality. Around the time of the most recent wave of PEVs in 2009, DOE awarded in 2009 a $99.8 million grant for deployment of charging infrastructure in private residences and in public areas in 20 of the target launch markets of the Nissan Leaf and the Chevrolet Volt, including San Francisco, Seattle, San Diego, Los Angeles, Portland, and Nashville. The program has grown with an additional $15 million grant from DOE and partner matches from the vehicle manufacturers and charging providers to a total of $230 million (ECOtality 2013; INL 2014a). When it concluded collecting data in December 2013, over 8,200 vehicles were participating and over 8,200 residential chargers, 3,500 public AC level 2 chargers, and 107 DC fast chargers had been installed (Smart and White 2014; INL 2014b).

The EV Project included data collection on where and when the vehicles in the project charged so that DOE could learn more about how drivers were using the vehicles and the associated charging infrastructure. Thus, the data provided important information about early adopters of PEVs in large metropolitan areas, including location of charging, eVMT, impacts on utilities, impact of workplace charging, and regional variations in charging behavior. Because privacy is an important consideration in the United States, there were clearly limitations on the tracking data that could be shared with researchers. Data collection ended as of December 2013, but data analysis continues.

Finding: Research is critically needed in understanding the relationship between infrastructure deployment and PEV adoption and use.

Recommendation: The federal government should fund research to understand the role of public charging infrastructure (as compared with home and workplace charging) in encouraging PEV adoption and use.

Recommendation: A new research protocol should be designed that would facilitate access to raw charging data to relevant stakeholders within the confines of privacy laws.

INSTITUTIONAL SUPPORT FOR PROMOTING PLUG-IN ELECTRIC VEHICLE READINESS

The concept of PEV readiness refers to an entire ecosystem of automotive technology, including its supporting infrastructure, regulations, financial incentives, consumer information, and public policies, programs, and plans that can make PEVs a viable choice for drivers. Several tools have been created to assess whether a given organization, community, state, or even country has in place the essential elements to be considered PEV ready. Examples of assessment tools include the Rocky Mountain Institute’s Project Get Ready (Rocky Mountain Institute 2014), DOE’s Plug-in Electric Vehicle Readiness Scorecard (DOE 2014a), Michigan Clean Energy Coalition’s Plug-in Ready Michigan (Michigan Clean Energy Coalition 2011), California PEV Collaborative’s PEV Readiness Toolkit (CAL PEV 2012a), and the Center for Climate and Energy Solutions’ State DOT PEV Action Tool (C2ES 2014). Furthermore, $8.5 million has been provided through the DOE Clean Cities program to 16 projects across 24 states to assess PEV readiness and develop specific plans to enable the communities to become PEV ready (DOE 2014a). Table 4-1 indicates the many common factors that constitute PEV readiness and the different institutions or organizations that might have a role to play.

State governments will be particularly important actors in supporting PEV deployment. Most supportive PEV actions at the state level can be carried out by various administrative agencies, including environmental and clean air agencies, utility commissions, departments of energy, transportation agencies, licensing and inspection agencies, general services agencies, and workforce training or education agencies. In the committee’s interim report, the committee noted several areas where the federal government could play a convening role to coordinate state and local government activities in support of the emerging PEV sector (NRC 2013, pp. 2, 4, 52).

TABLE 4-1 Factors Determining PEV Readiness and Organizations Involved

| Readiness Feature | Federal Government | State Government | Municipal Government | Electric Utility | Private Industry |

| Permit streamlining | __ | Environmental and archeological | Building and electrical codes | __ | __ |

| Utility regulatory policies | __ | PUC regulation of cost recovery and retail markets | Muni-owned cost recovery policies | __ | __ |

| Building code requirements | Model ordinances | Model state ordinances | Local ordinances | __ | PEV-ready buildings |

| Infrastructure deployment plans | DOE funding, assistance, and dissemination | Interregional and interstate plans | Regional and metropolitan area plans | Distribution network and capacity | Strategic investment plans and sites |

| Land use and uniform signage | Federal regulations | State regulations and policies | Comprehensive plans and zoning | __ | __ |

| Electricity pricing policies | NIST metering and pricing standards | State laws and PUC rate regulation | Muni-owned policies and technology | Smart grid and metering technologies | EVSE pricing strategies |

| Training personnel | __ | Workforce training and permits | First-responder safe practices | __ | Skilled trades |

| Vehicle financial incentives | PEV subsidies | Rebates, tax exemptions from registration, tolls | Utility taxes, parking fees | Rebates | Equity investments, financing |

| Infrastructure financial incentives | Equipment subsidies | Equipment subsidies | Equipment subsidies, land gifts | Cost sharing in any upgrades, equipment subsidies | Workplace and fleet charging |

| Energy policies | Clean energy programs | Zero-emission-vehicle standards | TOU or special PEV rates | TOU or special PEV rates | Green power programs |

| Dealership franchise laws | __ | State laws and regulations | __ | __ | Vehicle manufacturers’ policies and practices |

| Environmental policies | EPA regulations | Clean air laws and regulations | Carbon reduction plans | Clean power generation | __ |

| Procurement policies and goals | GSA regulations and policies | State purchasing | Purchasing cooperatives and bulk orders | __ | Bulk purchase discounts |

| Business policies and permissible models | Research and demonstration projects | State-backed financing assistance | Municipal-owned infrastructure | Own or operate EVSE | Innovative financing |

NOTE: DOE, U.S. Department of Energy; EPA, U.S. Environmental Protection Agency; EVSE, electric vehicle supply equipment; GSA, General Services Administration; NIST, National Institute of Standards and Technology; PEV, plug-in electric vehicle; PUC, public utility commission; TOU, time of use.

TRANSPORTATION TAXATION AND FINANCING ISSUES RELATED TO PLUG-IN ELECTRIC VEHICLES

One potential barrier for PEV adoption that is solely within the government’s direct control is taxation of PEVs, 1 in particular, taxation for the purpose of recovering the cost of maintaining, repairing, and improving the roadways. As described below, the paradigm for roadway taxation in the United States has depended on motor fuel taxes, which are indirect user fees. The advent of PEVs poses a dilemma for public officials responsible for transportation-tax policy because battery electric vehicles (BEVs) use no gasoline and plug-in hybrid electric vehicles (PHEVs) use much less than ICE vehicles.2 To further complicate matters, there appears to be widespread misunderstanding about the extent to which PEVs currently pay transportation taxes and the resulting fiscal impacts to transportation budgets both now and into the future. This section explores the issue in depth, attempts to bring more clarity to current tax policy and impacts, and makes recommendations for how transportation-tax policy might be harmonized with a transportation innovation policy for PEVs.

Current State of Transportation Taxation

Motor fuel taxes have been the most important single source of revenue for funding highways for nearly a century and have also been an important source of transit funding since the 1980s (TRB 2006, pp. 24-36). The state of Oregon instituted the nation’s first per-gallon tax on gasoline in 1919 (ODOT 2007). Within 10 years after that, every state had enacted a fuel tax. The federal government did not enact a fuel tax until 1932 and did not dedicate the tax to transportation

_____________

1 Chapter 7 addresses the issue of tax incentives; this chapter discusses tax disincentives.

2 The amount of gasoline used by a PHEV depends on the all-electric range and the frequency with which the vehicle is charged.

projects until 1956 (FHWA 1997, Chapter IV). At the time of their introduction, fuel taxes were viewed as the most economical method of collecting a fee for roadway construction and maintenance from those who directly benefited: motor-vehicle operators. However, the share of highway spending covered by fuel-tax revenues has been declining. In 2012, fuel taxes accounted for 59 percent of all federal, state, and local highway-user revenues (fuel taxes, fees, and tolls) used for highways and 28 percent of total government disbursements for highways (FHWA 2014, Table HF-10).

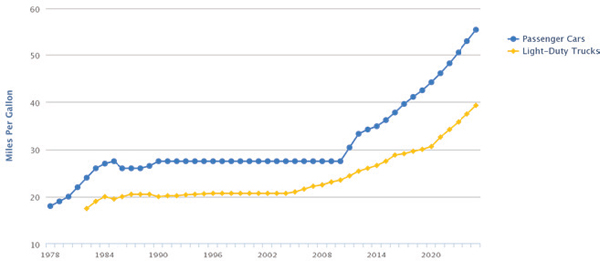

For most of the past century, the fuel tax has been viewed as a reasonably fair and reliable tax revenue to fund transportation. The fuel economy of most vehicles remained fairly consistent across different models (NSTIFC 2009) as there were no strong incentives (such as increasing gasoline prices or stricter government regulation) to improve fuel economy. However, the 1973 Yom Kippur War and resulting oil Arab embargo served as the marker for the U.S. policy shift to reduce the nation’s petroleum dependence by improving vehicle fuel economy. In later years, the federal government enacted Corporate Average Fuel Economy (CAFE) regulations, which essentially mandated improved fuel economy in passenger vehicles (see Figure 4-1).

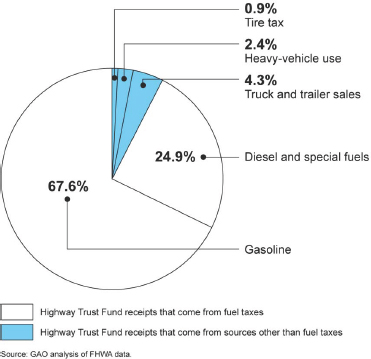

Both the federal government (see Figure 4-2) and the states rely heavily on motor-fuel tax revenue, which includes taxes on gasoline and diesel, to maintain the transportation system. At the federal level and in the vast majority of states, fuel taxes are based on a flat cents-per-gallon tax levied on motor fuel; the extent of reliance on the fuel taxes varies from state to state (Rall 2013). For example, gasoline taxes range from $0.08 per gallon in Alaska to $0.53 per gallon in California (the nationwide average is $0.31 per gallon) (Rall 2013). Of all government tax and fee revenues used for highways in 2012, 20 percent came from the federal government, 49 percent from state governments, and 31 percent from local governments (FHWA 2014, Table HF-10).

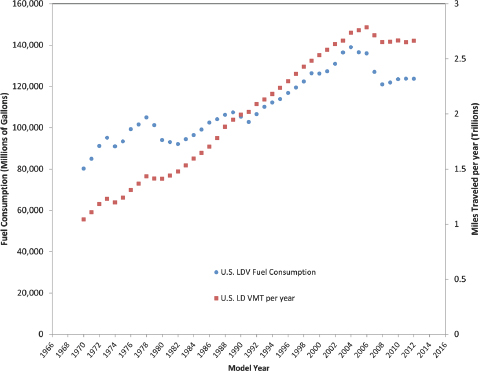

Fuel consumption depends on both the number of miles driven and the fuel economy of the vehicle fleet. Therefore, any decrease in the number of miles driven or increase in the fuel economy of the vehicle fleet will result in less tax revenue generated for a cost-per-gallon tax. One of those factors can offset the other and moderate the negative effect on the revenue stream. For example, the fuel economy of the light-duty vehicle fleet has been increasing since 2005 (EPA 2013). From 2005 to 2007, light-duty vehicle miles traveled (VMT) also increased, which helped mask the negative effect on the revenue stream of improving fleet fuel economy. However, VMT and fuel consumption both declined with the recession in 2007 and 2008 and have remained flat since then (Figure 4-3). Without the revenue-bolstering effect from increasing VMT, transportation budgeters and policy makers have become acutely aware of how rising fleet vehicle economy affects transportation fund balances.

Federal and State Concerns

With the recent increases in federal CAFE standards,3 the flattening of VMT, and political opposition to raising the tax rate itself, federal and state officials are increasingly concerned with the potential effects of high-mpg vehicles on their transportation budgets. The poster child for their worries is the BEV, which uses no gasoline and whose drivers therefore pay no fuel tax.

A recent survey of 50 state departments of transportation (DOTs) reflected the strong sentiment that PEVs threaten loss of revenue for transportation. The majority of state DOTs responded that they would support federally led field tests of mileage fees for PEVs to improve the equity and sustainability of Highway Trust Fund revenues (GAO 2012b, p. 45).

FIGURE 4-1 Corporate Average Fuel Economy requirements by year. SOURCE: DOE (2013c).

_____________

3 49 CFR Parts 523, 531, 533 et al., 2017 and Later Model Year Light-Duty Vehicle Greenhouse Gas Emissions and Corporate Average Fuel Economy Standards; Final Rule.

FIGURE 4-2 Sources of revenue for the federal Highway Trust Fund, FY 2010. These revenue sources exclude transfers from the general fund because those are not considered revenues in the federal nomenclature. SOURCE: GAO (2012b, p. 6).

A common refrain is that “PEVs pay nothing to use the highways” because they use little if any gasoline (Battaglia 2013). That is not, however, the case. At the federal level, the highway trust fund has relied on transfers of general tax revenues to maintain sufficient balances to meet its transportation funding obligations (GAO 2011). Therefore, all U.S. taxpayers—including PEV drivers—are paying for the federal transportation system from their general tax payments, in addition to the 18.4 cent per gallon federal gasoline tax.

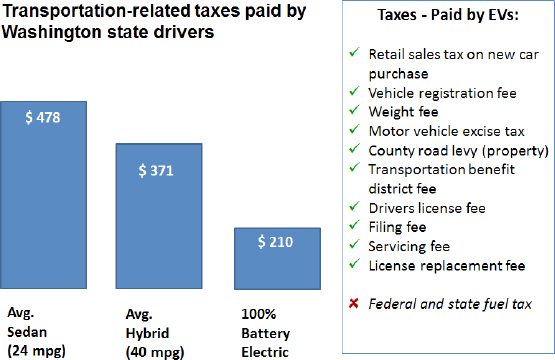

That misunderstanding is even more acute at the state level, where many states and local governments levy a myriad of taxes and fees that are dedicated to transportation, including roadway funding.4 Specifically, most local transportation funding comes from property taxes, general fund appropriations, and fares for mass transit; at the state level, motor fuel taxes are significant, but motor vehicle taxes, fees, and other revenue, such as sales taxes, play important roles. Washington State recently estimated that, on average, BEV drivers pay $210 per year in transportation-related state and local taxes and fees even though they pay no fuel taxes (WSDOT 2013).5 That equates to 44 percent of what is paid by the average gasoline-powered passenger vehicle in that state. Figure 4-4 compares transportation-related taxes paid by Washington state drivers of different classes of vehicles.

The committee recognizes that PEVs and current transportation tax policies raise the following important questions:

- Is the difference in transportation taxes collected from PEVs and ICE vehicles significant in the context of federal or state transportation budgets, either now or in the near future?

- Even if the amount of unrealized revenue is negligible, do PEVs raise issues of fairness in the user-pays principle underlying the U.S. transportation tax system that has been in place for almost a century?

- To remedy the issues inherent in the first two questions, should PEVs be a focus for new methods of taxation, considering that the unrealized revenue from high-mpg vehicles will dwarf that of PEVs?

- Are there other intervening policy considerations that might trump the general transportation tax paradigm of user pays, at least for a period of time?

Finding: It is not true that PEV drivers pay nothing for the maintenance and use of the transportation system given various transportation-related taxes and fees that must be paid by all vehicle drivers. It is true that BEVs pay no federal or state gasoline taxes, and it is also true that PHEVs, such as the Chevrolet Volt, might pay proportionately very little in gasoline taxes.

Recommendation: Governments (federal, state, and local) should fully and fairly disclose all transportation-related tax-

_____________

4 For a breakdown of transportation funding sources at the federal, state and local levels, see http://www.transportation-finance.org/funding_financing/funding/.

5 Calculations are based on the 11,489 miles per year driven, on average, by drivers residing in the greater Seattle metro area.

FIGURE 4-3 U.S. annual light-duty fuel consumption and VMT. NOTE: VMT, vehicle miles traveled; LDV, light-duty vehicle. SOURCE: DOE (2014b).

es and fees currently paid by all vehicles, including average passenger vehicles, alternative-fuel vehicles (such as compressed natural gas), HEVs, PHEVs, and BEVs. Providing that information to elected officials and the public will give them an accurate baseline against which policy discussions and choices can be made.

Impacts on Transportation Budgets

As noted, the first policy question is whether, from a fiscal viewpoint, the lack of fuel taxes paid by PEVs is having a negative effect on federal or state transportation budgets, either now or within the next 10 years. At the federal level, estimates can be made of the unrealized fuel tax revenues from PEVs; the results are shown in Table 4-2. On the basis of the number of PEVs sold through 2013, an additional $14 million annually could be generated for the federal Highway Trust Fund if each PEV was required to pay $96 per year, the same amount paid by a driver of a 22 mpg gasoline-powered sedan. To put that amount in context, the federal Highway Trust Fund collects fuel-tax revenues of about $33 billion each year (CBO 2013).

PEV industry analysts have also examined the impact of PEVs on transportation budgets. The California PEV Collaborative—a public-private consortium of governments, private businesses, vehicle manufacturers, and nongovernment organizations allied to promote PEVs—recently found that if the Obama administration goal of putting 1 million PEVs on the road by 2015 were met with BEVs, the resulting unrealized revenue from motor fuel taxes would be less than 0.5 percent of the total projected revenue shortfall for the federal Highway Trust Fund (CAL PEV 2012b).

Finding: For the next few years, the fiscal impact of not collecting a fuel tax from PEVs is negligible.

Fairness and Equity in Transportation Taxes

The second policy question is whether PEV drivers who pay little or no fuel taxes raise issues of fairness, given the strong user-fee paradigm for funding the expenses of the highway infrastructure in the United States. Even though the government would only derive an extremely small share of revenue by taxing PEVs, the sentiment among elected officials and the general public remains that PEV drivers should be paying the fuel tax (or its equivalent) as their fair share for maintaining and improving the roadways on which they drive. Although its study did not focus on equity issues related to taxation of PEVs, TRB (2011) did identify strongly held notions of fairness and equity that are inherent in the transportation tax system and that are important for public policy making; they are summarized in Table 4-3.

The fairness issue in the tax treatment of PEVs appears to be more acute at the state and local levels, where many elected officials are actively considering fuel-tax increases to reduce the backlog of roadway maintenance and improve-

FIGURE 4-4 Annual transportation-related taxes paid by Washington state drivers. SOURCE: WSDOT (2013).

ment projects. As noted by the TRB (2011, p. 103), for politicians and other decision makers, one of the first hurdles to overcome in embarking on a new transportation initiative—which will require financing, perhaps through an increase in the fuel tax—is to gain public support. Decision makers go to great lengths to ensure that the burdens (taxes) and benefits (capital projects) are allocated in ways that are perceived as fair. It is in trying to rally public support for tax increases that some politicians have sought to remedy the perceived unfairness concerning unrealized revenue from PEV drivers (Vekshin 2013). Washington, Virginia, North Carolina, South Carolina, New Jersey, Indiana, Arizona, Michigan, Oregon, and Texas have all considered or, in some cases, enacted legislation that imposes a fee or tax on PEVs. Many of the efforts were undertaken as part of, or coincident with, proposals to increase the fuel tax on all motorists.

Finding: Perceptions of fairness and equity are important factors to consider in PEV tax policies, even though the actual revenue impact of PEV taxation is negligible in the short run and likely to remain minimal over the next decade.

Government Responses to Plug-in Electric Vehicles and High-Mileage Vehicles

The third policy question raised is the extent to which PEVs should be a specific focus for new methods of taxation, considering the much larger impact other high-mileage vehicles will have on transportation funding levels, particularly once the 2025 CAFE standards (54.5 mpg) take effect. The fuel economy of the entire light-duty passenger vehicle fleet is increasing and will continue to increase in the coming decades largely due to federal CAFE standards (see Figure 4-1). The Congressional Budget Office (CBO) estimated that the new CAFE standards would gradually lower federal gasoline-tax revenues, eventually causing them to fall by 21 percent. The CBO analysis demonstrated that from 2012 through 2022, which is before the most stringent CAFE standards take effect, there will be a $57 billion drop in revenues (CBO 2012).

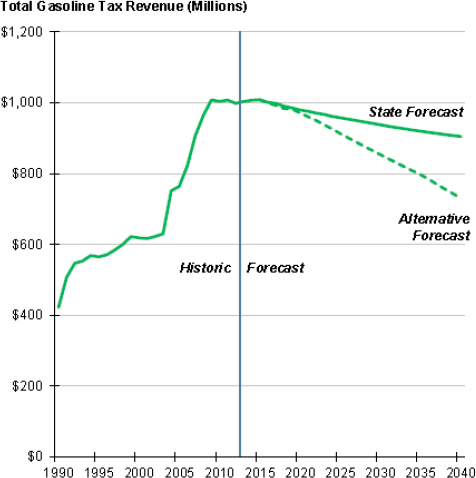

In addition to federal consideration of the impacts of high-mileage vehicles, many states are now actively exploring potential solutions to the forecasted revenue shortfalls (see Figure 4-5). At least one state (Washington) has forecast the potential transportation-revenue shortfalls attributable to improving fuel economy and to alternative-fuel vehicles, such as PEVs, and found that the potential drop in revenues ranges from 10 to 28 percent over the next 25 years (WSTC 2014).

Both federal and state policy makers and the public are becoming increasingly aware of the impact that high-mileage and alternative-fuel vehicles will have on roadway funding (Weissmann 2012). The Texas Transportation Institute recently convened several focus groups to better understand public sentiment. Participants strongly preferred mileage fees for vehicles that might only pay state vehicle registration and title fees for their road use (GAO 2012b).

| Vehicle Type | U.S. Total 2013a | Average Annual VMT | Fuel Economy (MPG or MPGe) | Annual Gallons Consumed | Federal Gas Tax Rate | Annual Unrealized Revenue |

| Avg. Sedanb | — | 11,489 | 22 | 522 gal | $0.184 | $96 per vehicled |

| BEV | 72,028 | 11,489 | — | — | $0.184 | $6.9 million |

| PHEVc | 95,589 | 11,489 | 98 | 117 gal | $0.184 | $7.1 million |

a Electric Drive Transportation Association Sales Dashboard, Totals from December 2010 to December 2013.

b The data comprising the base case are adapted from GAO (2012b, p. 9).

c Because PHEV models vary widely, the Chevrolet Volt was used as the reference case as it has the longest all-electric range of the PHEVs on the market.

d This estimate is the baseline annual gasoline tax paid per vehicle, not annual unrealized revenue.

NOTE: BEV, battery electric vehicle; MPG, miles per gallon; MPGe, miles per gallon gasoline equivalent; PHEV, plug-in hybrid electric vehicle; VMT, vehicle miles traveled.

TABLE 4-3 Types of Equity and Examples in the Transportation Tax System

| Type of Equity | Simple Definition | Transportation Example |

| Benefits received | I get what I pay for | People who use a facility the most pay the most. |

| Ability to pay | I pay more because I have more money | A project is financed through a progressive tax that is disproportionately paid by higher income people. |

| Return to source | We get back what we put in | Transit investment in each county is matched to that county’s share of metropolitan tax revenues used for transit. |

| Costs imposed | I pay for the burden I impose on others | Extra expense required to provide express bus service for suburb-to-city commuters is recovered by charging fares for this service. |

| Process (or participation) | I had a voice when the decision was made | Public outreach regarding proposed new high-occupancy-toll lanes provides transparent information and seeks to involve all affected parties in public hearings and workshops. |

SOURCE: TRB (2011, p. 41).

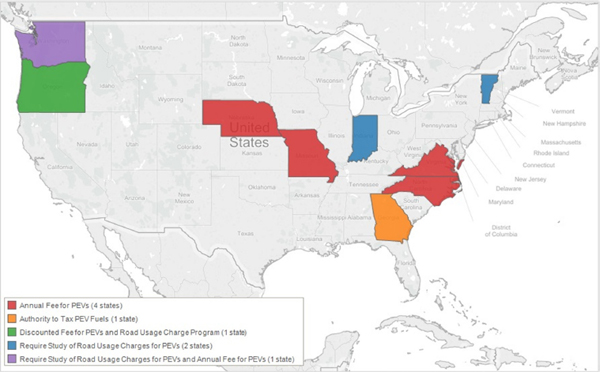

Whether the concern is limited to PEVs or more broadly centered on high-mileage vehicles, states are beginning to take action. Several states have enacted special taxes on PEVs or are considering how to tax them. Other states are exploring new transportation-tax methods to address not only PEVs but all high-mileage vehicles (see Figure 4-6).

Two congressionally chartered transportation funding and financing commissions—the National Surface Transportation Policy and Revenue Study Commission and the National Surface Transportation Infrastructure Financing Commission—have independently called for a transition from the current fuel-tax system to a mileage-based fee system to fund the nation’s highway infrastructure (NSTPRSC 2007, pp. 51-54; NSTIFC 2009, p. 7). A recent report by the Government Accountability Office (GAO) examined the feasibility of mileage fees and recommended a federally sponsored pilot program to evaluate the viability, costs, and benefits of mileage fee systems, particularly for commercial trucks and PEVs (GAO 2012b). GAO (2012b, p. 45) found that two-thirds of state DOTs (34 of 51, including the District of Columbia) reported that they would support federally led field tests of mileage-based fees for PEVs; none reported that they would be opposed to such tests for PEVs. The Road Usage Fee Pilot Program Act of 2013 was introduced in the U.S. House of Representatives to authorize, fund, and partner with states to conduct VMT pilot projects across the nation.

Separate from the federal government efforts, over 20 states are actively studying, testing, or, in the case of Oregon, implementing some version of a mileage-based fee, also known as road usage charges or VMT fees or simply taxes (D’Artagnan Consulting 2012). The fundamental concept is that drivers would be assessed a cents-per-mile tax for every mile that is driven within the taxing jurisdiction (region, state, or nation), regardless of the vehicle type, fuel source, or engine technology.

Recommendation: In jurisdictions that do impose special taxes, fees, or surcharges on PEVs as a means of requiring contribution to roadway upkeep, governments should ensure that such taxes are proportionate to actual usage, just as current motor fuel taxes are proportionate to usage.

FIGURE 4-5 Historic and forecast gasoline-tax revenue for Washington state, FY 1990 to FY 2040. SOURCE: WSTC (2014, p. 5).

Intervening Policy Considerations in the Taxation of Plug-in Electric Vehicles

The last policy issue examined is whether other intervening policy considerations might trump the general transportation-tax paradigm of user pays, at least until PEVs have reached some level of market penetration. U.S. tax policy has a long and successful track record of encouraging innovation (Reuters 2013). There are many examples in the current U.S. tax code (and state tax codes) where taxes are exempted, credited, or rebated to promote the development or proliferation of services, assets, or activities deemed to provide a public benefit, such as dependent-care tax benefits and research and development or manufacturing tax credits. That tax forbearance acts as the public’s investment in the societal good produced.

Most tax incentives are limited in scope, duration, or amount, so as to target more carefully the specific activity to be encouraged and to limit the public’s subsidization (or investment). The current federal $7,500 tax credit for PEVs is a good example of a narrowly targeted federal subsidy (IRS 2009). As currently enacted, the amount of the credit increases on the basis of the capacity of the PEV battery because the battery is the most expensive component unique to PEVs and most in need of technological breakthrough. The tax credit is also limited in the amount available per taxpayer ($7,500) and limited in duration (credit is phased out after the manufacturer reaches vehicle sales of 200,000).

In contrast, there is no intentional or targeted tax incentive to encourage PEVs to drive on public roadways.6 Instead, the government’s pro-PEV scheme consists of tax credits, rebates, fee reductions, and exemptions for the purchase and ownership of the PEV—but not for its use of public roadways. The fact that PEVs do not pay the fuel tax or a similar road usage tax stands apart from the vast majority of tax policies that are transparent, legislatively granted, and targeted in scope, quantity, or duration.

To the extent policy makers wish to continue providing PEV drivers with the financial benefit of not paying the fuel tax (or alternative road user charge), serious consideration should be given to explicitly and intentionally adopting such a policy in the same manner as other tax incentives. Although it might initially seem odd to enact a law or regulation that specifically exempts an activity (PEV driving) that is already

_____________

6 One could argue that allowing PEVs to drive in the high-occupancy-vehicle lane is an incentive to drive, as opposed to an incentive to own, and that the resulting loss of occupancy in the lane for other vehicles represents a public “investment.”

FIGURE 4-6 PEV-specific measures for transportation funding. NOTE: PEV, plug-in electric vehicle. SOURCE: Based on data from C2ES (2015). Courtesy of the Center for Climate and Energy Solutions.

untaxed, it could be an effective strategy for addressing the perceived issues around fairness and more clearly elaborating the government’s innovation policy by setting criteria like those for other tax incentives found in the U.S. and state tax codes.

Recommendation: Federal and state governments should adopt a PEV innovation policy where PEVs remain free from special roadway or registration surcharges for a limited time to encourage their adoption.

STREAMLINING CODES, PERMITS, AND REGULATIONS

Although there are some applicable federal and state permitting processes that affect PEV infrastructure deployment—such as federal environmental laws (for example, the National Environmental Policy Act, NEPA) and state regulations—cities, counties, and regional governments are at ground-zero for consumer adoption and use of PEVs. Travel distances, trip patterns, and vehicle registration data show that most PEV registrations and travel will be within urbanized areas. The usefulness of the vehicles will largely depend on the availability of charging infrastructure, whether at home, at work, or in public locations (see Chapter 5 for an in-depth discussion of charging infrastructure needs).

Electrical permit requirements appear to vary widely from jurisdiction to jurisdiction (see Table 4-4), as does the amount of time required to apply for and process permits and to obtain a final electrical inspection to certify compliance with applicable electrical codes. Consumer interest in PEVs could be seriously impeded if PEV buyers must bear high permit and installation costs and experience delay in the activation of their home chargers.

Some forward-looking jurisdictions are making adjustments in their electrical codes and permit processes to expedite installation and activation of a home-based charger.7 Furthermore, many jurisdictions are proactively amending their building codes to require that new construction be “forward compatible” with devices for charging at home (DOE 2014c).

In its interim report, the committee suggested that state and local governments ensure that their permit processes are appropriate for the type of infrastructure project and poten-

_____________

7 Portland, Oregon; Raleigh, North Carolina; and San Francisco, California are three municipalities that have instituted programs to expedite electrical permit processes.

tial impact to the site or broader environment (NRC 2013). There are instances where extensive permit processes and environmental review have been undertaken that would have been appropriate for a highway expansion project but are ill suited for the simple installation of a DC fast-charging station (C2ES 2012). For example, Oregon DOT has reported that even though the DC fast-charging stations installed in Oregon were provided under a master contract by a single vendor, the environmental permit process for each station differed based on the source of funding used to pay the contractor for otherwise identical stations (A. Horvat, Oregon Department of Transportation, personal communication, June 2014). If the charging station was funded with U.S. DOT money through the federal Transportation Investment Generating Economic Recovery (TIGER) grant program, each station was required to undergo heightened NEPA permitting, including an assessment of potential underground hazardous materials. However, if the station was to be funded through DOE, there were no permit requirements beyond those for ordinary state and local permits.

Finding: Regulatory and environmental officials often do not understand the nature, uses, and potential site impacts of charging stations. As a result, unnecessary permit burdens and costs have been introduced to the installation process for public charging stations.

Recommendation: Federal officials should examine current NEPA and other permitting requirements to determine the most appropriate requirements for the class of infrastructure to be installed; the federal government should adopt uniform rules that would apply to all charging installations of a similar asset class, regardless of the capital funding source used to pay for them.

Finding: The permitting and approval processes for home-based and public charging installations need more clarity, predictability, and speed.

Recommendation: Local governments should streamline permitting and adopt building codes that require new construction to be capable of supporting future charging installations. Governments could implement new approaches, perhaps on a trial basis, to learn more about their effectiveness while still ensuring personal and environmental safety.

ANCILLARY INSTITUTIONAL ISSUES RELATED TO SUPPORT FOR PLUG-IN ELECTRIC VEHICLES

Battery Recycling and Disposal

PEV battery recycling and disposal needs will affect the costs and acceptance of PEVs and the infrastructure requirements to support them. At the end of its useful life in the vehicle, the battery must be disposed of, either by applying it to a secondary use (for example, as a back-up power source in a stationary application) or by reusing materials and components that have value and disposing of the remainder as waste. The cost of disposal, less any value in secondary use or of recycled parts and materials, ultimately must be paid by the vehicle owner. Actions that reduce this cost will lower a cost barrier to PEV use.

PEV manufacturers, waste disposal firms, and others are working to create PEV battery recycling and disposal systems. If their efforts lag expansion of the PEV market, it is conceivable that when significant numbers of PEVs begin to reach the end of their lives, a battery-disposal bottleneck could present an obstacle to PEV production and sales. PEV and battery manufacturers have stated that lithium batteries contain no toxic substances that would preclude their disposal in the ordinary waste stream (Kelty 2008; Panasonic 2014). However, because reducing the environmental effects of motor vehicle transportation motivates public support of the PEV market and is attractive to many PEV purchasers, PEV producers have an incentive to develop recycling and reuse options for the batteries.

TABLE 4-4 Variation in Residential Electric Permit Fees by City or State

| Region | Number of Permits | Permit Fee ($) | ||

| Average | Minimum | Maximum | ||

| Arizona | 66 | 96.11 | 26.25 | 280.80 |

| Los Angeles | 109 | 83.99 | 45.70 | 218.76 |

| San Diego | 496 | 213.30 | 12.00 | 409.23 |

| San Francisco | 401 | 147.57 | 29.00 | 500.00 |

| Tennessee | 322 | 47.15 | 7.50 | 108.00 |

| Oregon | 316 | 40.98 | 12.84 | 355.04 |

| Washington | 497 | 78.27 | 27.70 | 317.25 |

SOURCE: ECOtality (2013).

In the longer term, recycling of high-value materials or components could be important for restraining PEV battery costs. Although projections indicate that material shortages are unlikely to seriously constrain PEV battery production, large-scale conversion of the fleet to PEVs probably would increase consumption of certain materials, including lithium and cobalt, enough to raise prices significantly. Efficient recycling would moderate material price increases (Gaines and Nelson 2010).

The sections below describe the status of recycling technology; the regulations and standards affecting recycling; prospects for secondary uses of batteries; present involvement of vehicle and battery manufacturers, recycling firms, and others; and possible areas for federal action.

Finding: Reducing the environmental impact of motor vehicle transportation attracts buyer interest and public support for PEVs. Therefore, although the disposal of lithium-ion PEV batteries does not appear to present adverse health risks nor does it have substantial financial advantages, provision for environmentally sound battery disposal will facilitate development of the PEV market.

Recycling Technology

Technologies available today for lithium-ion battery recycling recover certain elementary materials from the battery structure and the cathode, such as cobalt and nickel. The lithium in the cathode is not recovered (ANL 2013; Gaines 2014). Most of the materials obtainable from recycling lithium-ion batteries are of little value compared with the cost of recovery, and newer battery designs that use less expensive materials (in particular, cathodes that do not contain cobalt) yield even less value in recycling. Therefore, recycling is not economical (Kumar 2011; Gaines 2012). Processes under development seek to recover intact, reusable cathode materials that have more value than their elemental components (ANL 2013).

Standards and Regulations

Battery standards are essential for efficient and safe disposal and recycling. Designing batteries with recycling in mind reduces the cost of recycling, and standardization of designs simplifies the operation of recycling facilities. Labeling is necessary to ensure that batteries of different composition can be properly sorted for recycling. Design standards also could facilitate secondary uses.

The Society of Automotive Engineers (SAE) is actively engaged in vehicle electrification standards. Standards under development related to battery disposal include Vehicle Battery Labeling Guidelines (J2936), Identification of Transportation Battery Systems for Recycling Recommended Practice (J2984), Standards for Battery Secondary Use (J3097), and Recommended Practices for Transportation and Handling of Automotive-type Rechargeable Energy Storage Systems (J2950) (SAE International 2014).

No federal or state laws yet require recycling of the batteries contained in PEVs. California and New York require recycling of small rechargeable batteries. In New York, sellers are required to receive used batteries of that type, and battery manufacturers are required to develop plans for collection and recycling. The California law requires sellers to accept used batteries (Gaines 2014). Those laws could provide a pattern for future laws applying to PEV batteries. The federal government regulates the transportation of batteries as hazardous materials (PRBA 2014), but the transport regulations appear to be aimed mainly at the risk of fire from sparks or short circuits.

European Union regulations have established requirements for collection and recycling of all batteries sold to consumers in the European Union. The manufacturer or distributor of the consumer product is responsible for compliance (European Commission 2014).

Finding: Industry standards regarding design and labeling of PEV batteries are necessary for efficient and safe recycling.

Secondary Uses

PEV battery performance (energy storage capacity) declines with use until it becomes unacceptable for powering a vehicle. A battery in this condition, however, might still be usable for other applications, such as energy storage by utilities to satisfy peak demand, storage of energy from an intermittent generator like a solar energy facility, or as backup power in a residence. Developing the market for such secondary uses would reduce the cost of the battery to its initial owner, the PEV purchaser. Reuse delays but does not eliminate the need for eventual recycling or disposal of the battery.

It is most helpful to view battery secondary use (B2U) as an economic ecosystem—a collection of independent stakeholders that could co-evolve around a value chain to bring depleted batteries from the PEV into a secondary system. The maximum potential and limitations of the B2U ecosystem are set by the original design and architecture of the vehicle-battery system. Because the vehicle manufacturers specify the design for the vehicle-battery pack and the parameters for its production, they are currently the most critical player in the development of such an ecosystem. To enable a B2U market to evolve, the vehicle manufacturers must find enough value from participating in the B2U ecosystem to develop a strategy that complements their proprietary PEV technologies.

A B2U strategy must consider the design, development, and manufacture of a battery system with the intent to serve two purposes: (1) the initial use in the vehicle and (2) another application, most likely stationary. An optimal B2U strategy requires the design and use of the battery to maximize the value of the system over its entire extended life cycle. Bowl-

er (2014) developed a model to evaluate trade-offs along the secondary use value chain. The modeling showed that circumstances can exist in which the economic incentives for secondary use become attractive, but this can only be accomplished with the active participation of all the stakeholders in the B2U value chain.

Each vehicle manufacturer could independently develop and use such a model to integrate its own technical parameters into the development of a proprietary B2U strategy. Current evidence suggests that the market will begin with such proprietary deployments. For example, Nissan was first to announce the use of an on-vehicle battery to supplement electric energy to a demonstration home near its headquarters (Pentland 2011). The removal of a depleted PEV battery that had been optimized for stationary use would seem a logical next step. Ford, Tesla, and Toyota have been reported as pursuing various strategies (Woody 2014).

PEV manufacturers are engaged in developing technology and exploring the market for stationary battery applications. Most such efforts are in early stages and include the following examples:

- Nissan Motor Company and Sumitomo Corporation have formed a joint venture (4R Energy Corporation) to store energy from solar generators and other applications using PEV batteries (Srebnik 2012; 4R Energy 2013; Sumitomo 2014). Sumitomo announced installation of a prototype system assembled from 16 used PEV batteries at a solar farm in Japan in February 2014. A battery system has been installed in an apartment building in Tokyo (Nissan Motor Corporation 2013). The venture is working on developing additional applications for used batteries.

- Tesla Motors is supplying batteries to SolarCity, a company that leases and installs solar panels for residential and business customers. The battery is a component of the solar panel system. Trial residential systems were installed in 2013 (Woody 2013). The system is not reported to be reusing PEV batteries but represents a potential market for reuse.

- A Toyota subsidiary (Toyota Turbine) has begun reusing Toyota HEV NiMH batteries in solar panel energy management systems that have been sold to Toyota vehicle dealerships (Toyota Turbine 2013; Nikkei Asian Review 2014).

- General Motors and ABB in 2012 demonstrated a system that packaged five used Chevrolet Volt batteries in a stationary back-up power unit for residential or business applications (General Motors 2012).

Alternatively, the federal government could develop a common public framework that would disseminate information on the actions and processes that create second-use value to the potential participants in a national B2U value chain. That approach might become appropriate as standardization increases among vehicle batteries, charging systems, and the national electric grid.

Finding: Vehicle manufacturers appear to recognize a practical responsibility for disposal of batteries from their vehicles, although their willingness to bear this responsibility voluntarily as PEV sales grow and the fleet ages remains to be seen. Unlike the European Union, the United States imposes no legal requirements for battery disposal on manufacturers or sellers.

Finding: There is a potential market for secondary uses of PEV batteries that are no longer suitable for automotive use but retain a large share of their storage capacity. Whether led by private companies or public agencies, an effective collaboration among the entities that design and manufacture PEVs, the vehicle owners, and the users and purveyors of stationary electric systems can materially assist the development of an economically efficient secondary-use marketplace.

Recycling Arrangements and Capabilities

The principal participants in the PEV battery recycling system will be the vehicle owner, the party that accepts or is required to accept the responsibility for battery disposal (most likely the vehicle manufacturer), companies in the recycling industry, and producers and purchasers of stationary storage units that can reuse PEV batteries. At present, most PEV batteries that have gone out of use probably have passed through PEV dealerships, and manufacturers appear to recognize that they will be expected to provide for battery disposal.

Lead-acid battery recycling is well established in the United States and internationally and is sustained by the value of the recycled lead (that is, recyclers pay for the used batteries they process). Nearly all lead-acid batteries are recycled. The established firms with experience in recycling technology and in the logistics of battery collection, transport, and handling can provide the industrial base for PEV battery recycling (Gaines 2014). The U.S. battery recycling firm Retriev Technologies (until 2013 known as Toxco Industries) recycles lithium-ion PEV batteries (Retriev Technologies 2014). Retriev and the U.K. battery recycling firm Ecobat Technologies are reported to be developing processes for recovery of intact cathode materials from PEV batteries (ANL 2012), a process that has potential for reducing the net cost of battery production and disposal. The Belgian materials and recycling firm Umicore has established a facility in North Carolina to dismantle PEV and HEV batteries before shipment of components to its processing plant in Belgium (Umicore 2014).

Vehicle manufacturers have arrangements with recyclers for battery disposal and have had some involvement in developing improved processes. For example, Tesla has arrangements with recycling companies in Europe and North America for recycling and disposal of used battery packs

(Kelty 2011) and plans to recycle batteries in-house at what it calls the Gigafactory, a battery plant that it intends to build (Tesla 2014).

Finding: The solid waste disposal industry has developed technologies for acceptable disposal of PEV batteries, and technological improvements might succeed in extracting greater net value from recycled materials. However, PEV battery recycling will not pay for itself from the value of recycled materials.

Finding: Battery disposal is not a near-term obstacle to PEV deployment; PEV batteries can be safely disposed of in the general waste stream, and regulating battery disposal at this time could increase the cost of PEV ownership. Thus, federal regulatory action does not appear necessary at this time.

Finding: PEV manufacturers, the solid waste industry, and standards organizations are working to develop disposal, recycling, and reuse technologies. Although federal action is not required, there appear to be opportunities for federal support of industry efforts.

Recommendation: Although battery recycling does not present a barrier to PEVs in the near term, the federal government should monitor the developments in this area and be prepared to engage in research to establish the following: efficient recycling technologies, standards for battery design and labeling that will facilitate safe handling of used batteries and efficient recycling, and regulation to ensure safe transportation and environmentally acceptable disposal of batteries that promotes efficient recycling and avoids creating unintended obstacles.

Emergency Response

Police, firefighters, and emergency medical services (EMS) personnel responding to road crashes that involve PEVs must be aware of the hazards associated with PEVs that differ from the hazards associated with gasoline-powered vehicles in wrecks, and they must be trained in procedures for mitigating these hazards. The hazards are risks of electrical shock, fire, and exposure to toxic substances (NHTSA 2012, p. 2). Because highway emergency response in the United States is the responsibility of thousands of independent local police, fire, and EMS organizations, training and communication of information are challenging activities. All the emergency responders will require training and access to the necessary equipment to discharge batteries safely after an accident and on other safe handling procedures.

The most important nationwide PEV emergency response training activity is Electric Vehicle Safety Training, a project of the National Fire Protection Association (NFPA). NFPA is a nonprofit membership organization engaged in development of codes and standards, training, and research. The training program is funded by a grant from DOE, as part of the department’s effort to promote PEV use (NFPA 2014). The NFPA project has developed a variety of training materials and programs and information resources and has conducted a series of courses to train instructors. The NFPA training program is supported by research, involving full-scale testing, to determine best practices for response to incidents involving PEVs. The research has been supported by DOE, the National Highway Traffic Safety Administration (NHTSA), and the automotive industry (Long et al. 2013).

At the federal level, NHTSA develops and distributes EMS training standards and curricula, organizes cooperative activities, maintains databases, and evaluates state EMS systems (NHTSA 2014a). NHTSA has published guidance on safety precautions for vehicle occupants, emergency responders, and towing and repair workers when a PEV is damaged by a collision (NHTSA 2012; NHTSA 2014b). The guidance is brief and general and does not contain detailed technical information or response instructions.

Recommendation: DOE and NHTSA should cooperate in long-term monitoring of the implementation and effectiveness of the NFPA EV Safety Training program. The monitoring should determine whether the program is reaching local emergency responders, whether the skills it teaches prove useful in practice, and whether it is timely.

ANL (Argonne National Laboratory). 2012. “Advanced Battery Research, Development, and Testing.” http://www.transportation.anl.gov/batteries/index.html. Accessed March 14, 2013.

ANL. 2013. “PHEV Batteries.” http://www.transportation.anl.gov/batteries/phev_batteries.html.

Battaglia, S. 2013. Are You Willing to Pay an Extra Tax to Drive Your Electric Vehicle? Your Energy Blog, February 28. http://www.yourenergyblog.com/are-you-willing-to-pay-an-extra-tax-to-drive-your-electric-vehicle/. Accessed March 1, 2015.

Bowler, M. 2014. “Battery Second Use: A Framework for Evaluating the Combination of Two Value Chains.” Unpublished Doctoral Dissertation, Clemson University.

CAL PEV (California Plug-in Electric Vehicle Collaborative). 2012a. “A Toolkit for Community Plug-in Electric Vehicle Readiness.” August. http://www.pevcollaborative.org/sites/all/themes/pev/files/docs/toolkit_final_web-site.pdf.

CAL PEV. 2012b. “Transportation Funding Consensus Statement.” September. http://www.evcollaborative.org/sites/all/themes/pev/files/TransportationFunding_PEVC_ConsensusStatement_120924_Final.pdf.

CBO (Congressional Budget Office). 2012. “How Would Proposed Fuel Economy Standards Affect the Highway

Trust Fund?” May. http://www.cbo.gov/sites/default/files/cbofiles/attachments/05-02-CAFE_brief.pdf.

CBO. 2013. “Testimony on the Status of the Highway Trust Fund before the Subcommittee on Highways and Transit, Committee on Transportation and Infrastructure, and U.S. House of Representatives.” Washington, DC. July 23. http://www.cbo.gov/sites/default/files/cbofiles/attachments/44434-HighwayTrustFund_Testimony.pdf.

C2ES (Center for Climate and Energy Solutions). 2012. “Peer Exchange for State DOTs on Electric Vehicles—Charging Infrastructure Workshop.” Raleigh, NC, June 25-26. http://www.c2es.org/initiatives/pev/implementing-action-plan/state-dots-electric-vehicles#ChargingInfrastructureWorkshop.

C2ES. 2014. “PEV Action Tool.” http://www.c2es.org/pevaction-tool. Accessed October 23, 2014.

C2ES. 2015. “PEV-Specific Measures for Transportation Funding.” Accessed March 1, 2015. http://www.c2es.org/initiatives/pev/maps/pev-specific-measures-infrastructure-funding.

D’Artagnan Consulting. 2012. “Washington State Road Usage Charge Assessment: Domestic and International Review and Policy Context.” Steering Committee Briefing, September 13. http://waroadusagecharge.files.wordpress.com/2012/08/international-domestic-review_final.pdf.

DOE (U.S. Department of Energy). 2008. “Linkages of DOE’s Energy Storage R&D to Batteries and Ultracapacitors for Hybrid, Plug-in Hybrid, and Electric Vehicles.” http://www1.eere.energy.gov/ba/pba/pdfs/vehicle_energy_storage_r_and_d_linkages.pdf.

DOE. 2013a. 2013 Annual Merit Review Results Report. http://energy.gov/sites/prod/files/2014/04/f14/2013_amr_02.pdf.

DOE. 2013b. “Energy Innovation Hub: Batteries and Energy Storage.” Joint Center for Energy Storage Research. http://science.energy.gov/~/media/bes/pdf/hubs/JCESR_Fact_Sheet.pdf.

DOE. 2013c. “Maps and Data.” Alternative Fuels Data Center. http://www.afdc.energy.gov/data/categories/fuel-consumption-and-efficiency#10562.

DOE. 2014a. Fiscal Year 2013 Annual Progress Report for Energy Storage R&D. Publication No. DOE/EE-10-38. Washington, DC. http://energy.gov/eere/vehicles/downloads/vehicle-technologies-office-2013-energy-storage-rd-progress-report-sections.

DOE. 2014b. “Electric Vehicle Community Readiness Projects.” http://www1.eere.energy.gov/cleancities/electric_vehicle_projects.html.

DOE. 2014c. “State Laws and Incentives.” Alternative Fuels Data Center. http://www.afdc.energy.gov/laws/search?utf8=%E2%9C%93&keyword=building+code&search_by=keyword.

ECOtality. 2013. “The EV Project.” http://www.theevproject.com/overview.php. Accessed March 1, 2015.

EPA (U.S. Environmental Protection Agency). 2013. “Light-Duty Automotive Technology and Fuel Economy Trends: 1975 Through 2013.” http://www.epa.gov/otaq/fetrends.htm. Accessed March 1, 2015.

European Commission. 2014. “Frequently Asked Questions on Directive 2006/66/EU on Batteries and Accumulators and Waste Batteries and Accumulators.” http://ec.europa.eu/environment/waste/batteries/pdf/faq.pdf.

FHWA (Federal Highway Administration). 1997. “Highway Finance.” https://www.fhwa.dot.gov/ohim/hs97/hfpage.htm.

FHWA. 2014. “Highway Statistics, 2012. Table HF-10.” Office of Highway Policy Information: Highway Statistics Series, March. http://www.fhwa.dot.gov/policyinformation/statistics/2012/hf10.cfm.

4R Energy Corporation. 2013. “Business Model.” http://www.4r-energy.com/en/services/. Accessed December 3, 2013.

Gaines, L. 2012. To recycle, or not to recycle, that is the question: Insights from life-cycle analysis. MRS Bulletin 37(4): 333-338.

Gaines, L. 2014. “The Future of Automobile Battery Recycling.” Presentation to the Committee on Overcoming Barriers to Electric-Vehicle Deployment, Washington, DC, February 25.

Gaines, L., and P. Nelson. 2010. “Lithium-ion Batteries: Examining Material Demand and Recycling Issues.” http://www.transportation.anl.gov/pdfs/B/626.PDF.

GAO (U.S. Government Accountability Office). 2011. Highway Trust Fund: All States Received More Funding Than They Contributed in Highway Taxes from 2005 to 2009. GAO-11-918. Washington, DC, September. http://www.gao.gov/assets/520/511454.pdf.

GAO. 2012a. Batteries and Energy Storage: Federal Initiatives Supported Similar Technologies and Goals but Had Key Differences. GAO-12-842. Washington, DC, August. http://www.gao.gov/assets/650/647742.pdf.

GAO. 2012b. Highway Trust Fund: Pilot Program Could Help Determine Viability of Mileage Fees for Certain Vehicles. GAO 13-77. Washington, DC, December. http://www.gao.gov/assets/660/650863.pdf.

General Motors Corporation. 2012. “GM, ABB Demonstrate Chevrolet Volt Battery Reuse Unit.” November. http://media.gm.com/media/us/en/gm/news.detail.html/content/Pages/news/us/en/2012/Nov/electrification/1114_reuse.html.

INL (Idaho National Laboratory). 2014a. “The EV Project.” http://avt.inel.gov/evproject.shtml. Accessed October 23, 2014.

INL. 2014b. Observations from The EV Project in Q4 2013. http://avt.inel.gov/pdf/EVProj/EVProjectSummaryReportQ42013FINAL.pdf.

IRS (Internal Revenue Service). 2009. “Notice 2009-89, New Qualified Plug-in Electric Drive Motor Vehicle Credit.” Internal Revenue Bulletin 2009-48. http://www.irs.gov/irb/2009-48_IRB/ar09.html.

Kelty, K. 2008. “Mythbusters Part 3: Recycling Our Non-Toxic Battery Packs.” Tesla Blog, March 11. http://www.teslamotors.com/blog/mythbusters-part-3-recycling-our-non-toxic-battery-packs.

Kelty, K. 2011. Tesla’s Closed-Loop Battery Recycling Program. Tesla Blog, January 26. http://www.teslamotors.com/blog/teslas-closed-loop-battery-recycling-program.

Kumar, A. 2011. The lithium battery recycling challenge. Waste Management World12(4).http://www.waste-management-world.com/articles/print/volume-12/issue-4/features/the-lithium-battery-recycling-challenge.html.

Long, R., A. Blum, T. Bress, and B. Cotts. 2013. Best Practices for Emergency Response to Incidents Involving Electric Vehicles Battery Hazards: A Report on Full-Scale Testing Results. Fire Protection Research Foundation, June. http://www.nfpa.org/research/fire-protectionresearch-foundation/reports-and-proceedings/electricalsafety/new-technologies-and-electrical-safety/emergency-response-to-incident-involving-electric-vehiclebattery-hazards.

Michigan Clean Energy Coalition. 2011. “Plug-in Ready Michigan: An Electric Vehicle Preparedness Plan.” http://cecmi.org/wp-content/uploads/2011/11/Plug-In-Ready-Michigan.pdf.

NFPA (National Fire Protection Association). 2014. “About the Project.” Electric Vehicle Safety Training. http://www.evsafetytraining.org/about-us.aspx.

NHTSA (National Highway Traffic Safety Administration). 2012. Interim Guidance for Electric and Hybrid-Electric Vehicles Equipped with High Voltage Batteries. DOT HS 811 574. January.

NHTSA. 2014a. “About NHTSA EMS.” http://www.ems.gov/mission.htm. Accessed October 23, 2014.

NHTSA. 2014b. “Interim Guidance for Electric and Hybrid-Electric Vehicles Equipped with High Voltage Batteries: Version 2.” DOT HS 811 576. Washington, DC. March.

Nikkei Asian Review. 2014. “Toyota Spruces Up Green Credentials with Battery Recycling.” January 28. http://asia.nikkei.com/Business/Companies/Toyota-raising-green-profile-by-spearheading-recycling-of-used-HV-batteries.

Nissan Motor Corporation. 2013. “The Compact Lithium-ion Battery.” Environmental Activities. http://www.nissanglobal.com/EN/ENVIRONMENT/CAR/FUEL_BATTERY/DEVELOPMENT/LITHIUM_ION_BATTERY/. Accessed February 25, 2014.

NRC (National Research Council). 2013. Overcoming Barriers to Electric-Vehicle Deployment: Interim Report. Washington, DC: The National Academies Press.

NSTIFC (National Surface Transportation Infrastructure Financing Commission). 2009. Paying Our Way: A New Framework for Transportation Finance. February. http://financecommission.dot.gov/Documents/NSTIF_Commission_Final_Report_Mar09FNL.pdf.

NSTPRSC (National Surface Transportation Policy and Revenue Study Commission). 2007. Report of the National Surface Transportation Policy and Revenue Study Commission: Transportation for Tomorrow. December. http://transportationfortomorrow.com/final_report/.

ODOT (Oregon Department of Transportation). 2007. “Financial Services Update: Fuels Tax Revenue.” ODOT Financial Services, February. http://www.oregon.gov/ODOT/CS/FS/news/vo2-no2_fsupdate.pdf.

Panasonic. 2014. “Panasonic Batteries.” Product Information Sheet. http://na.industrial.panasonic.com/products/batteries/rechargeable-batteries/lithium-ion. Accessed March 1, 2015.

Pentland, W. 2011. “Nissan Leaf to Power Homes.” Forbes, August 5. http://www.forbes.com/sites/williampentland/2011/08/05/nissan-leaf-to-power-homes/?partner=yahootix.

PRBA (Portable Rechargeable Battery Association). 2014. Information on Batteries in Transport: Packaging and Shipping Batteries Safely. http://www.prba.org/publications/batteries-in-transport-shipping-batteries-safely/.

Rall, J. 2013. Sustainable State Transportation Funding and Spending. National Conference of State Legislatures. NCSL NRI Committee 2014 Spring Webinar Series, April 24. http://www.ncsl.org/documents/transportation/Jamie.pdf.

Retriev Technologies. 2014. “Lithium Ion.” http://www.retrievtech.com/recycling/lithium-ion. Accessed March 1, 2015.

Reuters. 2013. “Thomson Reuters Names the World’s Top 100 Most Innovative Organizations for 2013.” Press Release, October 7. http://thomsonreuters.com/press-releases/102013/thomson-reuters-2013-top-100-global-innovators.

Road Usage Fee Pilot Program. 2013. H.R. 3638, 113th Congress. https://www.congress.gov/bill/113th-congress/house-bill/3638.

Rocky Mountain Institute. 2014. “Project Get Ready.” http://www.rmi.org/project_get_ready. Accessed October 23, 2014.

SAE International. 2014. Vehicle Electrification Standards. http://www.sae.org/standardsdev/vehicleelectrification.htm.

Smart, J., and S. White. 2014. “Electric Vehicle Charging Infrastructure Usage Observed in Large-Scale Charging Infrastructure Demonstrations.” Presentation to the Committee on Overcoming Barriers to Electric-Vehicle Deployment, Irvine, CA, February 25.

Srebnik, K. 2012. “Nissan Leaf Innovation and Strategy.” http://chargedsv.org/wp-content/uploads/2012/08/Srebnik_Charged2012SV_08232012.pdf.

Sumitomo Corporation. 2014. “World’s First Large-Scale Power Storage System Made from Reused EV Batteries Completed in Japan.” February 7. http://www.sumitomocorp.co.jp/english/news/detail/id=27673.

Tesla. 2014. “Gigafactory.” Tesla Blog, February 26. http://www.teslamotors.com/blog/gigafactory.

Toyota Turbine and Systems Inc. 2013. “Enrich Lifestyles by Using Energy Efficiently for the Better Future of the Environment.” http://www.toyota-global.com/company/profile/non_automotive_business/new_business_enterprises/pdf/toyota_turbine_and_systems_e.pdf.

TRB (Transportation Research Board). 2006. The Fuel Tax and Alternatives for Transportation Funding: Special Report 285. Washington, DC: The National Academies Press.

TRB. 2011. Equity of Evolving Transportation Finance Mechanisms: Special Report 303. Washington, DC: The National Academies Press.

Umicore. 2014. “Supply: Hybrid Electric Vehicles/Electric Vehicles.” http://www.batteryrecycling.umicore.com/supply/HEV_EV/. Accessed October 23, 2014.

Vekshin, A. 2013. “Electric-Car Owners Get Taxed for Not Paying Gas Taxes.” Bloomberg BusinessWeek, June 6. http://www.businessweek.com/articles/2013-06-06/electric-car-owners-get-taxed-for-not-paying-gas-taxes.

Weissmann, J. 2012. “Why Your Prius Will Bankrupt Our Highways.” Atlantic, February 2. http://www.theatlantic.com/business/archive/2012/02/why-your-prius-will-bankrupt-our-highways/252397/.

Woody, T. 2013. “How Tesla Batteries Are Powering an Energy Revolution.” Atlantic, December 5. http://www.theatlantic.com/technology/archive/2013/12/how-tesla-batteries-are-powering-an-energy-revolution/282056/.

Woody, T. 2014. “Car Companies Take Expertise in Battery Power Beyond the Garage.” New York Times, March 25.

WSDOT (Washington State Department of Transportation). 2013. “EV Tax and Fee Comparison.” Presentation at EV Roadmap Six Conference, Portland, OR, July 30.

WSTC (Washington State Transportation Commission). 2014. Washington State Road Usage Charge Assessment: Business Case Evaluation Final Report. http://waroadusagecharge.files.wordpress.com/2014/01/wa-ruc-business-case-evaluation_01-07-14.pdf.