5

Charging Infrastructure for Plug-in Electric Vehicles

The deployment of plug-in electric vehicles (PEVs) and the fraction of vehicle miles traveled that are fueled by electricity (eVMT) depend critically on charging infrastructure. PEV charging infrastructure (described in Chapter 2) is fundamentally different from the well-developed infrastructure for gasoline fueling. It can be found in a variety of locations, from a PEV owner’s home to a workplace to parking lots of restaurants, malls, and airports. A variety of charging options are available, from AC level 1 chargers that use 120 V ac electric circuits that are present in almost every building to DC fast chargers that do not yet have a technology standard. The charging rate also varies from slow (time-insensitive) charging to fast (time-sensitive) charging. Each infrastructure category also has different upfront and ongoing investment costs and returns and different entities that would have an incentive to build such infrastructure, ranging from vehicle owners who might spend about $1,000 to upgrade their home outlet or electric panel to corporations and governments that could spend $100,000 to build a DC fast-charging station. The public charging stations might also require technology to monitor usage and bill customers. PEV deployment and eVMT will be constrained if charging infrastructure is not conveniently located or if the available infrastructure does not facilitate charging within a convenient time frame. Thus, critical questions for vehicle manufacturers and policy makers are how are vehicle deployment and eVMT affected by the availability of various charging infrastructure types and what is the cost effectiveness of infrastructure investments relative to other investments that manufacturers and the government could make to overcome barriers to PEV deployment.

This chapter considers scenarios for deploying PEV charging infrastructure and the potential effect of that infrastructure on PEV deployment and eVMT. The committee has categorized infrastructure by location (home, workplace, intracity, intercity, and interstate) and power (AC level 1, AC level 2, and DC fast). The infrastructure categories are ranked in order of importance for increasing PEV deployment and eVMT from the perspective of owners of the four PEV classes as defined in Chapter 2. The experience and needs of current early adopters were considered by the committee, but deployment scenarios are focused on mainstream PEV deployment. The chapter concludes by considering which entities might have an incentive to build each category of charging infrastructure, with particular attention to how infrastructure investments would be recovered. The committee provides its findings and recommendations throughout this chapter.

In this chapter, the committee’s analysis of infrastructure deployment assumes (1) no disruptive changes to current PEV performance and only gradual improvements in battery capacity over time, (2) early majority buyers who do not plan to make changes to their lifestyles to acquire a PEV, (3) electricity costs that are significantly less expensive than those of gasoline per mile of travel, and (4) a cost for public and workplace charging that is at least as high as that for home charging. The committee notes that the need for charging infrastructure could conceivably be mitigated by investments in battery swapping stations, which use robotic processes and allow drivers to swap batteries in less than 3 minutes. The first major initiative for battery swapping services was launched by Better Place, which built networks of stations in Israel and Denmark but declared bankruptcy in May 2013. Tesla has announced a plan to add battery-swap technology at its network of fast-charging stations (Vance 2013). However, this model is not widely available at this time and is not discussed further in this report.

As discussed in Chapter 2, today’s charging infrastructure technology consists of AC level 1 and AC level 2 chargers, which are typically used when charging time is not a prime consideration, and DC fast chargers, which are typically used when charging time is an important consideration. All PEVs can charge with AC level 1 and level 2 chargers, and most battery electric vehicles (BEVs) can also charge at DC fast chargers. In the future, some plug-in hybrid electric vehicles (PHEVs) might be equipped to use DC fast chargers, but there is little motivation to make such a change because PHEVs can use their internal-combustion engines (ICEs) to circumvent the need to charge. Charging infrastructure locations and investments range widely from an existing extensive network of private chargers (or simply ordinary outlets) at homes and workplaces to an expanding infrastructure of public chargers,

such as those at retailers or shopping malls or along highways. Workplace and public charging infrastructure might require payment for electricity or time occupying the charger or be restricted to vehicles belonging to a subscription plan or to a certain vehicle manufacturer.

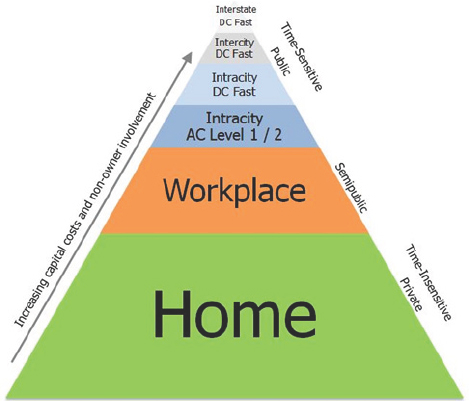

In the mature market, the ideal number, location, and type of charging infrastructure will depend on the demand for different types of PEVs, their use, and their geographic distribution. Conversely, although there has been little research on the relationship between charging-station deployment and PEV deployment, the availability of charging infrastructure and the rate of its deployment might itself influence PEV deployment and use. Figure 5-1 shows six categories of charging-infrastructure deployment, ranked in a pyramid that reflects their relative importance as assessed by the committee. As noted above, the categories are defined by location and power. The term intercity refers to travel over distances less than twice the range of limited-range BEVs, and interstate refers to travel over longer distances.

Table 5-1 provides the committee’s assessment of the effect of charging infrastructure on different PEV classes. Evaluating infrastructure by type of PEV might help to address misconceptions about charging infrastructure needs. For example, PHEVs do not require electric charging for range extension because drivers have the option of fueling with gasoline. BEVs, which have only electricity as a fuel option, are much more affected by the availability of charging infrastructure. That does not mean that electric-charging infrastructure is not important for PHEV deployment, however. PHEV drivers might still heavily use charging at private and public locations to maximize their value proposition in terms of cheaper charging, convenience, or personal values, such as environmental concerns. For example, data from the EV Project on early adopters of the Chevrolet Volt show that 14 percent of charging events occurred away from home, which is similar to the percentage of charging away from home (16 percent) for Nissan Leaf drivers (ECOtality 2013; Smart and Schey 2012). Each charging-infrastructure category and the impact of each category on different PEV classes are discussed in detail in the sections below.

Home Charging

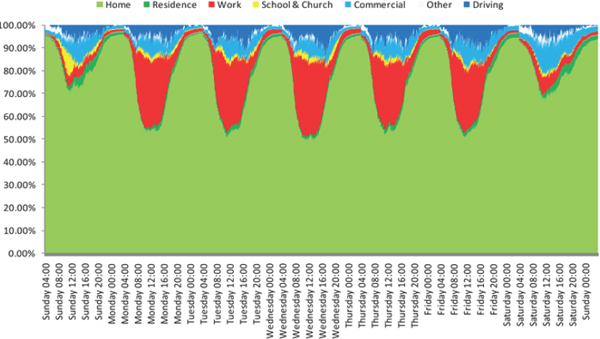

Home charging is a virtual necessity for mainstream PEV buyers of all four vehicle classes given that the vehicle is typically parked at a residence for the longest portion of the day. As shown in Figure 5-2, the U.S. vehicle fleet spends about 80 percent of its time parked at home, and more than 50 percent of the U.S. vehicle fleet is parked at home even during weekday work hours. Most early adopters of PEVs have satisfied their charging needs primarily by plugging their vehicles into 120 V (AC level 1) or 240 V (AC level 2) receptacles at home during overnight hours or other periods when it is convenient to leave their vehicles idle. Even the

FIGURE 5-1 PEV charging infrastructure categories, ranked by their likely importance to PEV deployment, with the most important, home charging, on the bottom, and the least important, interstate DC fast charging, at the top. NOTE: AC, alternating current; DC, direct current.

FIGURE 5-2 Vehicle locations throughout the week on the basis of data from the 2001 National Household Travel Survey. SOURCE: Tate and Savagian (2009). Reprinted with permission from SAE paper 2009-01-1311 Copyright © 2009 SAE International.

large 85 kWh battery in a Model S can be fully charged overnight with the 10 kW AC level 2 charger recommended by Tesla for home use. A full battery charge will not usually be needed each night because such charging will typically replace only the electricity used for the previous day’s driving. For typical daily trip distances, only a few hours of charging will be required for all types of PEVs.

Home charging is a paradigm shift in refueling behavior for drivers accustomed to refueling quickly at gasoline stations. Many find home charging more convenient than refueling at public stations. For example, in the EV Project study, about 85 percent of Volt charging events and 80 percent of Leaf charging events occurred at home (Smart 2014a).

Home-charging infrastructure is not a barrier to PEV deployment for households with a dedicated parking spot with an electric outlet nearby. According to the U.S. Census Bureau (2011a), nearly two-thirds of U.S. housing structures have garages or carports.1 Similarly, a representative telephone survey of 1,004 U.S. adults found that 84 percent of respondents had dedicated off-street parking and 52 percent of respondents had a garage or dedicated parking spot with access to an outlet (Consumers Union and the Union of Concerned Scientists 2013). Traut et al. (2013) used data from the U.S. Census and the U.S. Department of Energy (DOE) Residential Energy Consumption Survey to estimate the potential for residential charging of PEVs using various assumptions about missing data on, for example, the presence and size of driveways, the usability of electric outlets, and the number of parking spaces actually available for parking. Although 79 percent of U.S. households have dedicated off-street parking, many households have multiple vehicles, and under base-case assumptions, only 56 percent of vehicles have dedicated off-street parking, and only 47 percent at an owned residence. Additionally, although 38 percent of all U.S. households are estimated to have charging access for at least some vehicles, only an estimated 22 percent of all U.S. vehicles have a dedicated home parking space within reach of an outlet sufficient to recharge a small PEV battery overnight.

Given the number of households with access to dedicated parking with an outlet, PEVs could become a much larger share of the U.S. vehicle market while still relying on ubiquitous residential circuits to accommodate most charging needs. Given the large number of households that do not yet drive PEVs and could take advantage of the convenience of charging at home, the scenario that seems most likely to emerge over the next decade is one in which the growth of demand for PEVs comes primarily from households who

_____________

1 Some of the structures accommodate multiple households.

TABLE 5-1 Effect of Charging-Infrastructure Categories on Mainstream PEV Owners by PEV Classa

| Infrastructure Category | PEV Class | Effect of Infrastructure on Mainstream PEV Owners |

| Interstate | Long-range BEV | Range extension, expands market |

| DC fast charge | Limited-range BEV | Not practical for long trips |

| Range-extended PHEV | NA – not equipped | |

| Minimal PHEV | NA – not equipped | |

| Intercity | Long-range BEV | Range extension, expands market |

| DC fast chargeb | Limited-range BEV | 2 × Range extension, increases confidence |

| Range-extended PHEV | NA – not equipped | |

| Minimal PHEV | NA – not equipped | |

| Intracity | Long-range BEV | Not necessary |

| DC fast chargeb | Limited-range BEV | Range extension, increases confidence |

| Range-extended PHEV | NA – not equipped | |

| Minimal PHEV | NA – not equipped | |

| Intracity | Long-range BEV | Not necessary |

| AC levels 1 and 2b | Limited-range BEV | Range extension, increases confidence |

| Range-extended PHEV | Increases eVMT and value proposition | |

| Minimal PHEV | Increases eVMT and value proposition | |

| Workplace | Long-range BEV | Range extension, expands market |

| Limited-range BEV | Range extension, expands market | |

| Range-extended PHEV | Increases eVMT and value proposition; expands market | |

| Minimal PHEV | Increases eVMT and value proposition; expands market | |

| Home | Long-range BEV | Virtual necessity |

| Limited-range BEV | Virtual necessity | |

| Range-extended PHEV | Virtual necessity | |

| Minimal PHEV | Virtual necessity |

a Assumptions in this analysis are that electricity costs would be cheaper than gasoline costs, that away-from-home charging would generally cost as much as or more than home charging, that people would not plan to change their mobility needs to acquire a PEV, and that there would be no disruptive changes to current PEV performance and only gradual improvements in battery capacity over time.

b It is possible that these infrastructure categories could expand the market for the various types of PEVs as appropriate, but that link is more tenuous than the cases noted in the table for other infrastructure categories.

NOTE: AC, alternating current; BEV, battery electric vehicle; DC, direct current; eVMT, electric vehicle miles traveled; NA, not applicable; PEV, plug-in electric vehicle; PHEV, plug-in hybrid electric vehicle.

intend to meet their charging needs predominantly through slow charging at home.

Lack of access to charging infrastructure at home will constitute a significant barrier to PEV deployment for households without a dedicated parking spot or for whom the parking location is far from access to electricity. Those demographic groups include many owners and renters of housing in multifamily dwellings and many households in large cities with on-street parking. About 25 percent of U.S. households live in multifamily residential complexes (U.S. Census Bureau 2011b), and the telephone survey noted above indicated that although 61 percent of single-family houses had access to charging, only 27 percent of multifamily dwellings had parking spaces with access to charging (Consumers Union and the Union of Concerned Scientists 2013). Multifamily residential complexes can face many challenges in installing PEV charging equipment; some are similar to a typical commercial building, and others are unique to multifamily dwellings. Similar to commercial buildings, the electrical panel might be far from the desired charging location, and installation can therefore be costly.

Unique to multifamily residential complexes are the ownership, responsibility, liability, and control of each individual parking space. Multifamily residential complexes have many

ways to assign parking to their residents, including dedicated, shared, and leased parking. For residents who have dedicated spaces, the main challenges besides the installation costs are questions within the governance structure for multifamily residential complexes concerning (1) who should bear the cost of upgrading the main panel (if needed) and (2) who will pay for the electricity for charging the PEV. Those costs can be prohibitive for an individual consumer if he or she is responsible for upgrading service to the main panel for the multifamily dwelling. For residents who have shared spaces, additional questions need to be resolved within the governance structure of the multifamily residential complex concerning installation costs, use of charge-enabled spaces, and payment for the electricity. Because no charging space is dedicated to a specific resident, an individual is discouraged from investing in the installation of a charging station because that would not necessarily guarantee him or her the right to use it. In addition, the use of the charging station can no longer be tied to an individual and raises the question of who should pay for the electricity. Lastly, for leased or rented spaces, there is the question of ownership of the PEV charging equipment: which entity should pay for the PEV charging equipment and how should liability be assigned? If tenants are liable for all upgrades, they have a disincentive to perform the upgrades because they might leave. If the owners are liable for all upgrades, they have a disincentive to install them unless they can charge a premium for them or otherwise be compensated.

For residents who do not have any parking available and must rely on on-street parking, the same challenges exist except that the owner or deciding body is not the multifamily residential complex. Instead, it is the local city government that must make policy decisions surrounding installation and operation of PEV charging equipment (Peterson 2011).

Lack of home charging at multifamily complexes or in neighborhoods with on-street parking is a barrier to deployment for owners of all types of PEVs, but most importantly BEVs, particularly limited-range BEVs for which daily charging cannot, like PHEVs, be replaced with gasoline or, like long-range BEVs, postponed. It is also a barrier to increased eVMT for all PEV owners. Overcoming lack of home charging at multifamily residential complexes and in neighborhoods with on-street parking requires providing such consumers with designated parking spaces to charge their vehicles during prolonged times when their vehicles are not in use, such as at workplaces. Although retrofits of multifamily housing for PEV charging might be difficult, facilitating installation of home-charging infrastructure can be accomplished by preparing the sites for installation during initial construction. California mandatory building codes will require new multifamily dwellings to be capable of supporting future charging installations (DOE 2014a).2 Additionally, multifamily dwelling owners might choose to contract with a charging provider to facilitate installation and payment for charging services. Another interesting model for extending PEV driving to households without access to home charging is to deploy PEVs in car-sharing fleets. That approach is particularly important for the large portion of multifamily dwelling residents who are not in the new vehicle market as compared with single-family home residents. Car sharing is discussed from a consumer perspective in Chapter 3.

Finding: Homes are and will likely remain the most important location for charging infrastructure.

Finding: Lack of access to charging infrastructure for residents of multifamily dwellings is a barrier that will need to be overcome to promote PEV deployment to that segment.

Workplace Charging

Charging at workplaces provides an important opportunity to encourage the adoption of PEVs and increase eVMT. BEV drivers could potentially double their daily range as long as their vehicles could be fully charged both at work and at home, and PHEV drivers could potentially double their all-electric miles. Extending the electric range of PHEVs with workplace charging improves the value proposition for PHEV drivers because electric fueling is less expensive than gasoline. For BEVs and PHEVs, workplace charging could expand the number of people whose needs could be served by a PEV, thereby expanding the market for PEVs. Workplace charging might also allow households that lack access to residential charging the opportunity to commute with a PEV. Furthermore, Peterson and Michalek (2013) estimated that installing workplace charging was more cost-effective than installing public charging; however, it should be noted that installing workplace or public charging was substantially less cost effective than improving the all-electric range of a vehicle.

Data from early adopters in the EV Project shows that workplace charging is used when it is available (Table 5-2). Specifically, Nissan Leaf drivers who had access to workplace charging obtained 30 percent of their charging energy at work, and Chevrolet Volt drivers who had access to workplace charging obtained 37 percent at work. Furthermore, there is some evidence that workplace charging enables longer routine commutes or more daily miles. Of Nissan Leafs that had workplace charging, 14 percent routinely required workplace charging to complete their daily mileage (at least 50 percent of days), but another 43 percent of the Leaf vehicles required workplace charging to complete their daily miles on some days (at least 5 percent of days). Moreover, Nissan Leaf drivers extended their range by 15 miles or 26 percent on days when charging was needed to complete their trips (such days averaged 73 miles traveled) and by 12 percent on days when they charged even though a charge was not required to complete their trips (Smart 2014b).

In considering whether to provide workplace charging, employers confront a number of challenges. One set of chal-

_____________

2 For an explanation of these codes, see California Green Building Code A4.106.8.2 and California AB 1092.

TABLE 5-2 Charging Patterns for Nissan Leafs and Chevrolet Volts

| Vehicle | Percent Charging Energy Obtained at Various Locations | |||

| Home | Work | Other | ||

| All Drivers | ||||

| Nissan Leaf | 86 | — | 14 | |

| Chevrolet Volt | 85 | — | 15 | |

| Drivers with Access to Workplace Charging | ||||

| Nissan Leaf (~12%)a | 68 | 30 | 2 | |

| Chevrolet Volt (~5%)a | 60 | 37 | 3 | |

a Numbers in parentheses are percentage of drivers known to have access to workplace charging.

SOURCE: Based on data from ECOtality (2014a,b).

lenges is to determine the rate of PEV adoption by employees, what level of charging would be sufficient for their needs, and how access to chargers can be ensured as the number of PEVs increases. A worker who relies on workplace charging of a BEV might not be able to return home if no charger is available. There is also the possibility that electricity provided to employees will have to be paid for by the employees or taxed as income (IRS 2014).3 A requirement to assess the value of the charging or report the imputed income could be an impediment to workplace charging. Yet another potential impediment arises from the surcharges that utilities impose on companies that draw more than a threshold level of power. Such demand charges (discussed in Chapter 6) can be substantial.

Workplace charging is becoming available at a small but growing number of companies that offer it as a way of attracting and retaining employees and as a way of distinguishing themselves as green companies.4 It is an attractive perk if the employer provides charging for the same price or less than is available at home. In assessing the reasons for offering workplace charging, some employers anticipate that concerns about carbon emissions from commuting will eventually generate much stronger pressures for workplace charging and are attempting to move expeditiously by expanding their network of charging stations now (Ahmed 2013). Because of the costs involved and the fact that adding a charging station leaves fewer parking spaces available for employees who do not drive PEVs, Cisco has a policy of increasing the number of workplace charging stations in proportion to the number of employees who express an interest in using them. This tends to have positive feedback effects as increases in the number employees who use workplace charging stations stimulate other employees’ interests in acquiring PEVs (Jennings 2013), thereby contributing to a continuing expansion in the number of workplace chargers. Other firms, however, have been reluctant to provide workplace charging on grounds of equity, expressing concerns about providing a perk that would benefit only a relatively small number of employees, at least initially (Musgrove 2013). Recognizing workplace charging as an important opportunity to expand PEV deployment and eVMT, DOE supports the EV Everywhere Workplace Charging Challenge. The Workplace Charging Challenge and the Clean Cities program both provide several guides and resources for employers to simplify the process of adding workplace charging (DOE 2014b; DOE 2013).

Finding: Workplace charging could be an alternative to home charging for those who do not have access to charging infrastructure at home.

Finding: Charging at workplaces provides an important opportunity to encourage PEV adoption and increase the fraction of miles that are fueled by electricity.

Finding: The administrative cost to assess the value of charging or report the imputed income could be an impediment to workplaces to install charging.

Recommendation: The federal government should explicitly address whether the provision of workplace charging at the expense of employers should be included in the recipient’s pay or regarded as a benefit that is exempted from taxation.

Public Charging Infrastructure

A critical question to answer is whether lack of public

_____________

3 IRS Publication 15-B states that any fringe benefit is taxable and must be included in the recipient’s pay unless the law explicitly excludes it. Although exclusions currently apply to many fringe benefits, the issue of excluding electricity that employers provide at workplace chargers has apparently not yet been explicitly addressed. The issue does not arise at workplaces that engage an outside entity (the installer of the charging infrastructure) to manage the charging units and collect a monthly fee from workers who use them.

4 To facilitate the process, the Department of Energy (DOE), under the Workplace Charging Challenge launched in January 2013, offers various resources to interested employers, building owners, employees, and others. The resources include information about PEVs, their charging needs, and activities that DOE and communities across the country are doing to support PEV deployment.

charging infrastructure is a barrier to PEV deployment.5 As shown in Figure 5-1, home charging infrastructure is and is expected to remain more convenient and more critical to PEV deployment than public charging infrastructure. There is no consensus in the research and policy communities, however, on the impact of public charging infrastructure on PEV deployment. Experience in Japan indicates that increased availability of public charging stations reduces range anxiety and leads to more miles driven by BEVs. For example, the building of a single additional fast charger for a TEPCO fleet of BEVs increased eVMT from 203 km/month to 1,472 km/ month. Interestingly, no additional energy consumption from the public charger was observed after building the second charger, but drivers allowed their state of charge to go below 50 percent, a sign that their fear of running out of charge had been alleviated (Anegawa 2010).

DOE (2015) estimates that there were more than 9,300 public charging stations in the United States as of April 2015; many stations, however, are only accessible to members of associated subscription-based plans or to vehicles produced by individual manufacturers. Interactive maps of charging stations are updated frequently on the DOE Alternative Fuels Database and through the PlugShare website (DOE 2015; Recargo 2014). Nearly 8,700 of the public charging stations provide AC level 2 chargers, which can add about 10-20 miles of range to a vehicle for each hour of charging, depending on the model and driving conditions. More than 800 public DC fast-charging stations had also been installed by April 2015 (DOE 2015). Networks of DC fast chargers have been installed in Washington, Oregon, and California; along the East Coast I-95 corridor; and the “Tennessee Triangle,” which connects Nashville, Chattanooga, and Knoxville. Clusters of DC fast chargers are also in Dallas-Fort Worth, Houston, Phoenix, Atlanta, Chicago, and Southern Florida. Tesla and Nissan Motors—manufacturers of the vehicles that have led BEV sales in the United States—have been actively engaged in expanding their networks of fast chargers. In fact, most of the chargers outside of the regions noted above are part of the proprietary Tesla network of Superchargers (see Chapter 2, Figure 2-10). Tesla had installed more than 190 charging stations in the continental United States and Canada by April 2015 and has plans to expand its network to several hundred stations by the end of 2015, with the stated goal that 98 percent of U.S. drivers are within 100 miles of a Supercharger by 2015 (Tesla 2014). Nissan has announced plans to add at least 500 fast-charging stations by mid-2015 and has partnered with CarCharging to expand networks in California and on the East Coast and with NRG/ eVgo to develop a network in the Washington, D.C. area (CarCharging 2013; Nissan 2013).

Several studies have modeled optimal numbers and locations of PEV charging sites from the perspective of limited-range BEV drivers, who have the greatest need for charging. One study looked at the locations where light-duty vehicles parked and modeled optimal charging locations assuming similar trip needs for PEV drivers and ICE drivers (Chen et al. 2013). Other studies have examined trip diary data from such cities as Seattle and Chicago and such states as California to see which trips were not likely to be completed with today’s BEVs and sought to place chargers to allow completion of these “failed” trips. Models were optimized by minimizing time or distance deviations from trips required to drive to charging locations. The study of California drivers found that with an 80-mile limited-range BEV, 71.2 percent of the total miles driven and 95 percent of trips could be completed with no public charging required. Optimal placement of 200 DC fast chargers in the state would allow those drivers to complete over 90 percent of miles with two or fewer charges (Nicholas et al. 2013). The data from Chicago and Seattle metro areas showed that no public charging was needed to complete 94 percent and 97 percent of trips, respectively, and optimally locating 100 or 50 stations with 10 AC level 2 chargers each in Chicago or Seattle resulted in mean route deviations of only 1.6 and 0.3 miles, respectively, to make the remaining trips (Andrews et al. 2013). As noted, most studies have not investigated the effect of charging infrastructure deployment on vehicle deployment.

The majority of public charging stations are not yet heavily used. For example, public DC fast chargers in the EV Project were occupied on average 2.3 percent of the time from October-December 2013, and public AC level 2 chargers were occupied 5.5 percent of the time on average (INL 2014). Despite that low utilization, it is not unusual at some popular stations for drivers to have to wait for a charging plug to become available. In addressing the adequacy of the existing network of public charging infrastructure, it is important to understand the factors that contribute to both over-utilization and underutilization. The factors include the ratio of charging stations to PEVs in any given area, the location of charging stations, the cost of using the stations, the amount of time it takes to recharge, and restrictions on station use associated with either subscription-membership requirements or incompatible hardware. Low utilization of the charging stations in a given area does not necessarily imply that the network of charging infrastructure is adequate and could instead reflect any combination of the factors noted. Similarly, queuing at charging stations does not necessarily imply that more charging stations should be built, but it is unlikely that most potential customers would be willing to wait for multiple charges to be completed. To the extent that the demand to use charging stations is not uniformly distributed over time and that investments in charging stations are costly, a certain degree of queuing is inherent in a network of charging stations that optimally balances the cost of waiting to charge against the cost of building more charging stations. In addition, at stations that do not impose usage fees or charges for electricity consumed, queuing might partly reflect the fact

_____________

5 The term public charging infrastructure refers to charging infrastructure that is located in public spaces but does not imply that the services are offered for free.

that using those stations is cheaper than charging at home. For some locations, such as retail establishments, medical facilities, and commercial parking lots, for-pay AC level 2 infrastructure is used more frequently than free public AC level 2 infrastructure; this might indicate better siting of or more chargers to reduce queueing at for-pay infrastructure (Smart and White 2014).

Over the course of its study, the committee heard concerns that public funding combined with pressures to install public infrastructure quickly has led to some poor siting decisions. So, the fundamental questions remain—how much public infrastructure is needed and where should it be located? There are many complexities associated with installing public charging infrastructure that need to be considered. It can be located within cities, such as at malls or parking lots, or along interstate highways or other corridors. It can include AC level 1, AC level 2, and DC fast charging. It can be costly to install and maintain, and its effect on deployment and eVMT remains unclear, although it enables PEV drivers to extend the electric range of their vehicles beyond the mileage that can be driven on a single charge and might encourage the adoption of limited-range BEVs by mitigating concerns about becoming stranded. However, a substantial amount of public charging infrastructure that is obviously unused could become a symbol that PEVs are not as practical as had been hoped. The following sections consider the location of public infrastructure and its effects on PEV deployment and eVMT.

Finding: Public charging infrastructure has the potential to provide range confidence and extend the range for limited-range BEV drivers, to allow long-distance travel for long-range BEV drivers, and to increase eVMT and the value proposition for PHEV drivers.

Finding: More research and market experience are needed to determine how much public infrastructure is needed and where it should be sited to promote PEV deployment and to encourage PEV owners to optimize vehicle usage.

Recommendation: The federal government through the Departments of Energy or Transportation should sponsor research to study the impact of the public charging infrastructure, including the extent to which its availability affects PEV adoption.

Intracity AC Level 1 and Level 2 Charging Infrastructure

Public AC level 1 and level 2 chargers are now available in some cities, especially where PEV deployment has been relatively strong. Because AC level 1 chargers provide about 4-5 miles of operation per hour of charge, they could be used when charging time is not a primary concern, such as at airports and train stations, where people park their cars for prolonged periods. They can also be installed easily using accessible 120 V outlets. AC level 2 chargers are also becoming increasingly available at locations where vehicles are often parked for just an hour or two, such as at shopping malls, museums, libraries, and restaurants. Installation of chargers at those locations is often seen as a way for businesses to attract customers. Charging providers are also installing AC level 1 and AC level 2 within cities as part of their subscription-based business model. Some utilities are also installing infrastructure and are motivated to provide public charging to encourage PEV deployment and hence sell more electricity to residential customers with PEVs. Infrastructure-deployment models are discussed in more detail at the conclusion of this chapter.

Although the committee did not attempt to establish guidelines for locating public charging infrastructure, it seems reasonable to assume that to maximize the use of intracity charging infrastructure, chargers must be dispersed around metropolitan areas and placed at convenient locations. Siting of public charging stations is driven by a variety of motivations, and the stations are operated by both public and for-profit entities. Charging providers might locate public stations to maximize revenue from for-pay stations, to establish their image as a green business or government, to induce customers to stop at their establishments, to take advantage of favorable conditions (such as no-cost land or easy access to electricity source), to increase deployment of vehicles, to increase eVMT, or to relieve range anxiety. Data from intracity AC level 2 infrastructure associated with the EV Project indicate that chargers located at parking lots and garages, transportation hubs, workplaces, and public or municipal sites were used most frequently. Least frequently used sites were at educational institutions, multifamily residences, and medical facilities (Smart 2014c).

The effects of intracity AC level 1 and level 2 charging infrastructure vary by PEV class as seen in Table 5-1. Long-range BEVs will have little use for slow charging in public locations as there will be little value of charging slowly given their sufficient all-electric range. However, they might choose to top-off their charge when convenient or if perks, such as free parking at an airport, are available. Limited-range BEVs are expected to experience the most utility from intracity AC level 1 and level 2 charging by assuring them that they will not be stranded if their charge is depleted and by allowing them to extend their daily mileage beyond a full battery charge. With limited battery ranges and no other choice for fuel, charging in public is an attractive option for limited-range BEVs. Both minimal and extended-range PHEVs are predicted to use intracity AC level 1 and level 2 charging for increased eVMT and hence to realize an increased value proposition of their vehicles. However, they do not need intracity chargers for range extension or range confidence because they can also fuel on gasoline. Increased eVMT from charging in public might be particularly useful for minimal PHEVs whose smaller batteries could be nearly fully charged in a shorter time, thus extending their small ranges substantially if they are able to charge frequently throughout the day.

Intracity DC Fast-Charging Infrastructure

DC fast-charging technology was described in Chapter 2. Although DC fast chargers are often considered for corridor travel, such as between cities or states, the majority of the fast-charge infrastructure is installed within cities and their metro areas. There are some data to indicate that BEV owners prefer fast charging to complete a journey or otherwise to create options for using the vehicle beyond its routine range. EV Project data on the percent of DC fast charges that occurred on trips of a given length provide information on charging behavior of Nissan Leaf drivers (Smart and White 2014; J. Smart, Idaho National Laboratory, personal communication, November 6, 2014). In the fourth quarter of 2013, after the institution of fees to charge at some DC fast-charging locations, 56 percent of outings that included a fast charge were greater than 60 miles round trip, and 44 percent of outings that included a fast charge were less than 60 miles round trip. Some of the less than 60 mile round-trips that included a DC fast charge might reflect the value a driver places on a DC fast charge even when it is not required to complete the trip. However, many of the short trips (63 percent) started with a less than full battery, indicating that the charge might have been required to return home. When an outing included a DC fast charge and began with a full battery, average round trip distance was 87.5 miles. That observation again indicates that many trips that include a DC fast charge required a charge to complete, and DC fast charging might have been the most convenient way to acquire the charge.

The impact of intracity DC fast-charging infrastructure varies by PEV type, as noted in Table 5-1. Long-range BEVs will have little use for fast charging in cities as their vehicle range is unlikely to require range extension or range confidence. However, charging at a DC fast-charging station would allow them to acquire a full battery charge more quickly than home charging; this option might be valuable to a long-range BEV owner, particularly one who does not have a place to charge at home. The committee notes that Tesla—the only current producer of a long-range BEV—is implementing a model in which charging at its DC fast charger stations is included in the price of the vehicle. Limited-range BEVs are expected to experience the most utility from intracity DC fast charging as it provides range confidence that they will not be stranded and range extension in less time than that required for AC level 1 or level 2 charging. In April 2014, Nissan began offering new Leaf buyers in several markets free public charging through a special card that allows using several charging providers. Range-extended and minimal PHEVs are unable to use DC fast-charging infrastructure, so this segment of infrastructure deployment does not apply to PHEV owners.

Intercity and Interstate DC Fast-Charging Infrastructure

The availability of DC fast chargers along highways connecting cities and states has facilitated regional travel for limited-range BEVs and enabled long-distance travel for long-range BEVs. An example of such a network is the corridor of DC fast chargers installed at about 40-mile intervals along Interstate 5 in Washington and Oregon. Such infrastructure provides long-range BEVs with multiple places to acquire a charge on an extended trip and enables limited-range BEVs to travel between two cities in the same region. For travel between cities where stops to charge might be inconvenient, DC fast chargers are expected to be used primarily for range extension and are expected to receive less use than DC fast chargers within cities. Although data from the EV Project is primarily from cities, a preliminary study of charging along the I-5 corridor shows that most charges do in fact occur within cities rather than between them (Smart 2014d). Although some early adopters of limited-range BEVs have chosen to drive their vehicles long distances requiring multiple battery charges, the committee’s view is that the vast majority of limited-range BEV drivers will restrict themselves to a range that requires at most one full charge between neighboring cities. As noted, PHEVs are not equipped to use DC fast-charging stations and can extend their range by refueling on gasoline.

Thus, interstate DC fast chargers are projected to be the least important type of infrastructure for PEVs because it will not (or cannot) be used by PHEVs and will be inconvenient for limited-range BEVs. However, it should be noted that there are alternative scenarios in which interstate DC fast chargers do become an important type of infrastructure. An example of such a scenario is if the market becomes dominated by long-range BEVs that are used as primary vehicles. If that is the case, home charging infrastructure will continue to be most important for drivers’ everyday usage, and workplace and intracity infrastructure will be relatively unimportant. Intercity and interstate charging would, in that scenario, enable long-range BEVs to take longer trips with relative ease. Vehicle manufacturers, especially those focused on BEVs, are building intracity, intercity, and interstate DC fast-charging infrastructure; this indicates that they think it is valuable. It is not clear whether they are doing this for marketing or business strategy reasons or to spur vehicle deployment in the near term or whether they believe that this type of infrastructure will be necessary in the future.

MODELS FOR INFRASTRUCTURE DEPLOYMENT

To understand how best to overcome any infrastructure barriers to PEV deployment, one must consider the installation and operating costs for the different categories of charging infrastructure, the possible deployment models, and who might have an incentive to build such infrastructure. Several different entities might have an incentive to build or operate charging infrastructure; these include vehicle owners, workplaces, retailers, charging providers, utilities, vehicle manufacturers, and the government. Their motivations might include generating revenue, improving air quality, selling more electricity, or selling more PEVs. On the basis of information

TABLE 5-3 Entities That Might Have an Incentive to Install Each Charging Infrastructure Category

| Infrastructure Category | Who Has an Incentive to Install? | |

| Location | Type | |

| Interstate | DC fast | Vehicle manufacturer, government |

| Intercity | DC fast | Vehicle manufacturer, government |

| Intracity | DC fast | Vehicle manufacturer, government, charging provider, utility |

| Intracity | AC level 1 or level 2 | Utility, retailer, charging provider, vehicle manufacturer |

| Workplace | AC level 1 or level 2 | Business owner, utility |

| Home or fleet base | AC level 1 or level 2 | Vehicle owner, utility |

NOTE: AC, alternating current; DC, direct current.

received during site visits and from presentations from various infrastructure providers, the committee’s assessment of the possible builders of each infrastructure category is summarized in Table 5-3. It should be noted that the most critical infrastructure (home charging) is also the least logistically complicated and least expensive to build, and the costs and complications generally increase for faster charging and more public locations. The following paragraphs discuss the infrastructure-deployment models associated with each infrastructure segment and the installation and operating costs.

Home Charging

Private charging infrastructure at home is likely to be funded by the homeowner. Financing and logistics of installing home charging infrastructure is not considered to be an important barrier for homeowners who have dedicated parking spots adjacent to their homes. Homeowners who own PEVs have a clear incentive to install home charging. Many will also find the expense of upgrading to AC level 2 infrastructure to be a good investment, especially owners of long-range BEVs who might want to charge their vehicle batteries more quickly. Aside from vehicle owners paying to install charging infrastructure, other deployment models are being implemented. Some providers of subscription-based charging have expanded into providing residential charging infrastructure as part of their subscription service. Utilities might also have an interest in providing residential charging infrastructure as it would increase electricity usage at the residence.

As discussed previously, multifamily residential home charging faces many more barriers, and it is not clear that many owners of complexes, drivers of vehicles, or municipalities will have incentive to install charging at multifamily residences or at on-street charging locations in residential neighborhoods. However, owners of multifamily residences might be motivated to install chargers because they can earn points toward Leadership in Energy and Environmental Design certification (AeroVironment 2010). They might also be able to market their property as green and offer charging as an attractive amenity to prospective renters.

Workplace Charging

Private charging infrastructure at workplaces is likely to be funded by the businesses or organizations. The installation and operating costs of workplace charging might be justified by the employer as a perk to attract and retain employees or to brand the company with a green image. Because vehicles are parked at work for long periods of time (see Figure 5-2), many workplaces do not find it necessary to upgrade even to AC level 2 charging. Some parking lots might already have AC level 1 outlets that can be repurposed for vehicle charging; however, more convenient or upgraded infrastructure might also be installed. Another entity that might have an interest in installing workplace charging is a utility, which could earn additional revenue from the sale of electricity at worksites.

The cost of installing charging varies from workplace to workplace but is generally higher than that for installing single-family home charging and lower than that for public charging infrastructure. The costs of labor and conduit for installing charging units in existing parking lots and garages depend mainly on how much digging and resurfacing is involved. There are also potential costs associated with electric service upgrades for AC level 2 chargers, which might be the best choice for most currently available PEVs that have large electric ranges. Cisco provided a set of ballpark estimates to the committee and indicated that the average cost of installing an AC level 2 charging station has been $10,000-$15,000 (with economies of scale), that the ongoing costs of paying a vendor to manage the stations has averaged about $25 per station per month, and that the electricity costs have been low (Ahmed 2013). However, Bordon and Boske (2013) suggest that the cost of installing an AC level 2 charger in a commercial garage or on a public street ranges from $2,000 to $8,000 on the basis of estimates from three separate sources.

In addition to installation costs, operating costs of providing charging to employees must be considered. The committee received reports that the costs of electricity were not a barrier to deployment of workplace charging, but two logisti-

cal concerns were raised. As mentioned above and discussed further in Chapter 6, demand charges that could increase the cost of electricity to the employer could be a cost barrier to workplaces installing charging for employees. Also, the potential need to classify workplace charging as imputed income has resulted in logistical barriers given the associated administrative requirements for monitoring charging time or energy and making associated payroll adjustments. In part to avoid that potential problem and also to outsource charger installation and maintenance, some employers have chosen to contract with charging providers to install and operate charging infrastructure, including charging for the electricity provided.

Finding: Some workplaces appear to have incentives for installing charging infrastructure, including fostering an environmentally friendly image and providing the perk to retain and recruit employees.

Recommendation: Local governments should engage with and encourage workplaces to consider investments in charging infrastructure and provide information about best practices.

Public Charging Infrastructure

As discussed above, charging infrastructure generally becomes more complicated and more costly to build and operate as it becomes more publicly accessible and delivers faster charging. The potential owners and operators of public charging infrastructure are discussed in the sections below. Generally, companies that install and operate public charging stations have five sources from which they can seek to cover their capital and operating costs: the government, utilities, vehicle manufacturers, charging-station hosts, and drivers. Most companies have depended on government grants to finance a large part of their investments to date, and it is difficult to tell whether their business models will be sustainable in the absence of public funding.

The costs of DC fast-charging stations are generally much higher than the costs of AC level 2 stations. In general, the capital costs depend on several factors: whether the property must be purchased, leased, or rented; what distance must be spanned to connect to higher voltage supply lines; whether upgrades are required, for example, because of insufficient transformer capacity; how much trenching and conduit are needed to reach the charging station; and how much repaving or restriping of the parking area is required to accommodate the charging station. In total, the costs can range from $100,000 to $200,000. As an example, Table 5-4 shows the average costs of installing charging stations in Washington State with DC fast chargers and AC level 2 chargers as part of the publicly funded West Coast Electric Highway project. The totals shown in the table—ranging from $109,500 to $122,000—exclude the costs of purchasing, renting, or leasing land. The basic cost of a DC fast-charging station is about $10,000 to $15,000, but the total equipment cost of the Washington state stations averaged $58,000, reflecting the auxiliary services and features needed for a publicly accessible unit, including warranty, maintenance, customer authentication, and networking with point-of-sale capabilities to collect payment from customers. Installation costs can also vary because of other enhanced safety and security measures that are often required by local permitting authorities, such as lighting and revenue-grade meters. Those options can add up to $90,000 to the basic cost of the fast-charging equipment itself. Additional costs might also be incurred if multiple plugs are required for compatibility.

Retailers

A number of major retailers have shown interest in providing space for charging stations (Motavalli 2013),6 particularly when the capital costs are subsidized. Such infrastructure can attract customers to park and spend time and money in the retail establishments and might also provide favorable branding for the retailers. Most of the charging units that retailers have provided to date have been AC level 1 or level 2 stations, which are used primarily for intracity charging. The costs of building charging infrastructure at retail establishments range widely but are probably similar to workplaces and related to the amount of conduit required to provide electric access at parking spots. It is not clear that the extra money spent in retail establishments by customers who use the charging stations is sufficient to provide retailers with incentives to incur the capital costs of installing charging stations, as distinct from simply covering electricity charges and service costs. When capital costs are covered by others, however, retailers have tended to contract with charging providers to build and maintain charging stations and possibly charge customers for their use.

Electric Utilities

The electric utility companies could emerge as a willing source of capital for public charging stations. That conclusion reflects the prospect that a network of public charging stations would induce more utility customers to purchase PEVs, which would lead not only to electricity consumption at the public chargers, but also to much greater consumption of electricity at residences served by the utilities. If public charging infrastructure drives greater eVMT and greater deployment of vehicles, capital and variable costs for public infrastructure might be covered by the incremental revenue from additional electricity that PEV drivers consume at home, where roughly 80 percent of PEV charging takes place (Francfort 2011). Most such charging infrastructure is expected to be built intracity. Austin Energy (2012), with the help of a series of federal government grants, is an example of a utility that has chosen

_____________

6 Major retail companies that have installed or plan to install charging stations for their customers include Best Buy, Chili’s, Cracker Barrel, Kroger, Macy’s, 7-Eleven, Tim Hortons, Walgreens, and Whole Foods.

TABLE 5-4 Costs of Installing Public DC Fast-Charging Stations for the West Coast Electric Highway Projecta

| Component | Cost |

DC fast-charging equipment

|

$58,000 per unit |

Level 2 charger colocated next to DC fast-charging station

|

$2,500 per unit |

Equipment installation (labor and electric-panel upgrade)

|

$26,000 per location |

Utility interconnection

|

$12,500 to $25,000 per location |

Host-site identification, analysis, and screening

|

$5,000 per location |

Negotiation, legal review, and execution of lease

|

$6,000 per location |

| Total for DC fast charger and 3-year service | $109,500 to $122,000 |

a Land costs are not included here.

b Point-of-sale capabilities might include radiofrequency identification authentication and networking to back-office functions (such as account management and customer billing), equipment status signals, and credit card transactions.

c Additional costs could be incurred if addition of multiple chargers increases demand charges or requires additional electricity service upgrades.

NOTE: A, amperes; AC, alternating current; DC, direct current; kW, kilowatt; V, volt.

SOURCE: Based on data from PB (2009).

to install a network of AC level 2 charging stations in its service area, where it is the only electricity provider, and to offer its residential customers unlimited use of the chargers for less than $5 a month. In addition, Austin Energy provides incentives for a range of additional infrastructure charging categories as part of its strategic objectives in demand management and ancillary services (K. Popham, Austin Energy, personal communication, December 18, 2014).

The committee notes that theoretically all utilities servicing a given geographical area would collectively have a viable business model if there were a mechanism to (1) separate out and pool the electricity sales to all households that owned PEVs within that area and (2) share the revenues from that pool in proportion to the amounts that the different utilities contributed to investments in public charging infrastructure. Such a mechanism would not have to rely on government subsidies or cross subsidization from households that did not own a PEV. That said, whether utilities that invested their own capital in charging stations could earn a respectable rate of return over time would depend on state-level regulatory policies that are used to encourage utility investment.

Commercial Charging Providers

Mostly in response to government grants, several private companies have entered the business of installing and managing public charging stations. These charging stations are a mix of AC level 2 and DC fast chargers and are located both between and within cities. The companies have been

experimenting with different models in their efforts to recover their capital costs and the costs of electricity. For example, ChargePoint (2014) is pricing on a per-charge-event basis, while NRG/eVgo (2014) relies on both a monthly subscription fee and a fee per minute of plug-in time. Depending on state legislative and regulatory rulings, charging providers might avoid being regulated as utilities by not charging in proportion to the amount of electricity consumed (see further discussion in Chapter 6). NRG/eVgo relies on its fee per minute of plug-in time as a mechanism for encouraging drivers to limit the amount of time that their vehicles occupy the parking spaces adjacent to the chargers.

Although it might be easy to cover the variable costs of their operations from the various fees paid by customers (for example, monthly subscription fees or fees per charging event or per minute of charging time), generating an attractive rate of return on invested capital is much more challenging. One of the early providers of charging infrastructure, ECOtality, encountered financial difficulties and filed for bankruptcy in October 2013; its Blink assets, including the network of Blink charging stations, have been purchased by CarCharging (Wald 2013).

The infrastructure-deployment model adopted by NRG/ eVgo provides a unique approach. It is oriented toward providing a simple and complete set of services to residential customers. NRG/eVgo (2014) offers its Houston customers a 1-year contract for a $15 monthly fee that covers the installation of charging equipment at home and provides unlimited access to its network of public stations at 10 cents per minute of plug-in time. And unlike most other public stations, its Freedom Chargers include DC fast chargers and AC level 2 chargers and are located mainly along major transportation corridors within the metropolitan areas it serves.7

Box 5-1 provides a hypothetical calculation for the economics of providing public charging stations using a business model that collects monthly subscription fees and also charges customers for charging time. The calculation suggests that it might be difficult for charging providers to survive unless their capital costs are at least partially subsidized by public funding or by others, such as vehicle manufacturers. That said, the committee heard concerns from private charging developers that subsidizing infrastructure investments tended to undermine the business models of firms that were prepared to finance infrastructure with their own capital.

Vehicle Manufacturers

Vehicle manufacturers might deploy public charging infrastructure to drive sales of PEVs or to position themselves in the market. They might be one of the only private sector entities with a motive to install fast charging along intercity and interstate highways, as this type of infrastructure is the most expensive to build and is unlikely to generate high returns from for-pay charging. As noted earlier, Tesla has launched a program to install several hundred supercharging stations along major long-distance transportation corridors throughout the United States, while Nissan has launched several joint ventures to increase substantially the number of fast chargers available in key market areas (DeMorro 2014).

In the absence of government subsidies, it seems unlikely that any companies other than BEV manufacturers could have a business case for covering the installation and maintenance costs of DC fast-charging infrastructure deployed in intercity and interstate highway corridors. Whether the infrastructure would be publicly accessible is uncertain as a vehicle manufacturer would have little incentive for providing charging infrastructure for PEVs that it did not produce. For example, only Tesla customers can use Tesla-built chargers because of a Tesla-specific plug. In the case of Nissan, which is also building and subsidizing chargers, their chargers can be used by many types of PEVs but might require payment from those not covered under Nissan’s No-Charge-to-Charge plan.

Federal Government

If a category of charging infrastructure is deemed to be particularly effective at inducing PEV deployment but no private sector entity has a strong case for building such infrastructure, the federal government might consider funding it as a worthwhile investment. The committee heard concerns that government money was likely to crowd out private investments in infrastructure and to lead to poor siting decisions in some cases. To ensure that charging infrastructure developers have an incentive to site chargers so that they will be well used, government infrastructure funding should comprise only a portion of the funding for a charging station and should not go toward stations that would be deployed without government funding. Also, more research should be done to ascertain what categories of charging infrastructure lead to increases in deployment and eVMT.

Finding: Utilities that can capture the entire residential electricity consumption of PEV owners appear to have a viable business model for investing in public charging infrastructure.

Finding: Initiatives undertaken by Tesla and Nissan suggest that vehicle manufacturers that wish to penetrate the market for BEVs perceive a business case for investing in extensive networks of DC fast-charging stations.

Finding: Apart from BEV manufacturers and utilities (or groups of utilities), the committee has not been able to identify any private sector entities that have an attractive business case for absorbing the full capital costs of investments in public charging infrastructure.

_____________

7 eVgo areas include Houston, Dallas-Fort Worth, Los Angeles, San Francisco, San Diego, the San Joaquin Valley, and Washington, D.C. To the extent that the provision of a network of fast-charging stations helps catalyze PEV sales, total electricity consumption will increase by much more than electricity consumption at the eVgo charging stations and provide additional profits for NRG, which generates electricity.

BOX 5-1 Some Hypothetical Economics for Providers of Public Charging

This box considers the economics of providing a network of K public AC level 2 charging stations to serve N customers who rely primarily on residential charging but, on average, add 30 minutes of charge four times a month (or 1 hour of charge twice a month) at public chargers.

Assume that each charging station involves a capital outlay of $10,000 and that the investor requires a payback in 3 years, which in round terms amounts to about $3,600 per year per station, or $300 per month per station.

Assume that customers are charged 10 cents for each minute of plug-in time and that each hour of charging generates $2 of revenue over and above electricity costs plus maintenance costs. Thus, use of the charging network generates net revenues of $4N per month.

Assume that customers are willing to pay a subscription fee of $F per month for the assurance of access to the network of stations, implying subscription revenue of $NF per month.

Then the break-even value of N, calculated as a function of F, must satisfy NF = 300K - 4N, or

N = 300K/(F + 4)

And the break-even value of F as a function of K/N can be expressed as

F = 300(K/N) - 4

This suggests that a firm with 200 subscribers for every 10 charging stations could break even by charging a subscription fee of $11 per month.

Note, however, that the economics becomes much more difficult for networks of DC fast chargers, which require much larger capital outlays, or for AC level 2 networks that have to compete with networks of fast chargers.

Finding: The federal government might decide that providing public charging infrastructure serves a public good when others do not have a business case or other incentive to do so.

Recommendation: The federal government should refrain from additional direct investment in the installation of public charging infrastructure pending an evaluation of the relationship between the availability of public charging and PEV adoption or use.

AeroVironment. 2010. “EVs and LEED Certification.” AV Connect, October. http://www.avinc.com/plugin/nl002/evs_and_leed_certification.

Ahmed, A. 2013. “Workplace Electric Vehicle Charging.” Presentation to the Committee on Overcoming Barriers to Electric-Vehicle Deployment, Washington, DC, August 13.

Andrews, M., M.K. Dogru, J.D. Hobby, Y. Jin, and G.H. Tucci. 2013. “Modeling and Optimization for Electric Vehicle Charging Infrastructure.” Innovative Smart Grid Technologies Conference, Washington, DC, February 24-27.

Anegawa, T. 2010. “Development of Quick Charging System for Electric Vehicle.” World Energy Congress, Montreal, Canada, September 12-16. http://89.206.150.89/documents/congresspapers/322.pdf.

Austin Energy. 2012. “For Less Than $5 Per Month, Austin Energy Offers Unlimited Electric Vehicle Charging at More Than 100 EVerywhere™ Stations.” Press release, March 2.

Borden, E.J., and L.B. Boske. 2013. Electric Vehicles and Public Charging Infrastructure: Impediments and Opportunities for Success in the United States. Center for Transportation Research, University of Texas at Austin, July.

CarCharging. 2013. “Nissan and CarCharging to Expand Electric Vehicle Quick Charger Network.” News release, May 14. http://www.carcharging.com/about/news/all/nissan-and-carcharging-to-expand-electric-vehicle-quickcharger-network/.

ChargePoint. 2014. “Start Charging Today.” https://www.chargepoint.com/get-started/. Accessed October 23, 2014.

Chen, T.D., K.M. Kockelman, and M. Khan. 2013. “The Electric Vehicle Charging Station Location Problem: A Parking-Based Assignment Method for Seattle.” Presented at the 92nd Annual Meeting of the Transportation Research Board, Washington, DC, January 13-17. http://www.caee.utexas.edu/prof/kockelman/public_html/TRB13EVparking.pdf.

Consumers Union and the Union of Concerned Scientists. 2013. “Electric Vehicle Survey Methodology and Assumptions: American Driving Habits, Vehicle Needs, and

Attitudes Towards Electric Vehicles.” December. http://www.ucsusa.org/assets/documents/clean_vehicles/UCSand-CU-Electric-Vehicle-Survey-Methodology.pdf.

DeMorro, C. 2014. “Nissan Launches “No Charge to Charge” Program for LEAF Buyers.” Clean Technica, July 10. http://cleantechnica.com/2014/07/10/nissan-launchescharge-charge-program-leaf-buyers.

DOE (U.S. Department of Energy). 2013. Plug-In Electric Vehicle Handbook for Workplace Charging Hosts. Clean Cities, August. http://www.afdc.energy.gov/uploads/publication/pev_workplace_charging_hosts.pdf.

DOE. 2014a. “California Laws and Incentives.” Alternative Fuels Data Center. Last updated November 2014. http://www.afdc.energy.gov/laws/state_summary?state=CA.

DOE. 2014b. “EV Everywhere Workplace Charging Challenge.” http://energy.gov/eere/vehicles/ev-everywhereworkplace-charging-challenge. Accessed December 30, 2014.

DOE. 2015. “Alternative Fuels Data Center: Alternative Fuels Station Locator.” http://www.afdc.energy.gov/locator/stations. Accessed April 8, 2015.

ECOtality. 2013. “What Kind of Charging Infrastructure Do Chevrolet Volt Drivers in The EV Project Use?” The EV Project. Lessons Learned White Paper. September. http://avt.inl.gov/pdf/EVProj/VoltChargingInfrastructureUsageSep2013.pdf.

ECOtality. 2014a. “Where Do Nissan Leaf Drivers in The EV Project Charge When They Have the Opportunity to Charge at Work?” The EV Project. Lessons Learned White Paper. March. http://avt.inel.gov/pdf/EVProj/ChargingLocation-WorkplaceLeafsMar2014.pdf.

ECOtality. 2014b. “Where Do Chevrolet Volt Drivers in The EV Project Charge When They Have the Opportunity to Charge at Work?” The EV Project. Lessons Learned White Paper. March. http://avt.inel.gov/pdf/EVProj/ChargingLocation-WorkplaceVoltsMar2014.pdf.

Francfort, J. 2011. “U.S. Department of Energy’s Vehicle Technology Program: Plug-in Electric Vehicle Real World Data from DOE’s AVTA. Idaho National Laboratory, EPRI Infrastructure Working Council, Tempe, AZ.:” December. http://mydocs.epri.com/docs/publicmeetingmaterials/1112/PDNNSH5Q3Z2/Day%201%20PlugIn%20Electric%20Vehicle%20Codes%20&%20Standards.pdf.

INL (Idaho National Laboratory). 2014. EV Project Electric Vehicle Charging Infrastructure Summary Report: October 2013 through December 2013. INL/MIS-10-19479. http://avt.inel.gov/pdf/EVProj/EVProjectInfrastructureQ42013.pdf.

IRS (Internal Revenue Service). 2014. Publication 15-B: Employer’s Tax Guide to Fringe Benefits. Washington, DC: Government Printing Office.

Jennings, D. 2013. “EV Charging at Lynda.com.” Presentation to the Committee on Overcoming Barriers to Electric-Vehicle Deployment, Washington, DC, August 13.

Motavalli, J. 2013. “Shop While You Charge: Consumers and Retailers Are Plugging In.” New York Times, July 9.

Musgrove, R. 2013. “Global Vehicles.” Presentation to the Committee on Overcoming Barriers to Electric-Vehicle Deployment, Washington, DC, December 3.

Nicholas, M., G. Tal, and J. Woodjack. 2013. “California Statewide Charging Assessment Model for Plug-in Electric Vehicles: Learning from Statewide Travel Surveys.” Working Paper UCD-ITS-WP-13-01. Institute of Transportation Studies, University of California, Davis. January.

Nissan. 2013. “Nissan to Triple Electric Vehicle Fast-Chargers; Partners with NRG Energy to Build First Fast-Charge Network in Washington D.C. Area.” Press release, January 31. http://nissannews.com/en-US/nissan/usa/releases/nissan-to-triple-electric-vehicle-fast-chargers-partners-with-nrg-energy-to-build-first-fast-charge-network-inwashington-d-c-area.

Nissan. 2014. “Nissan launches programs to make LEAF charging free and ‘EZ.’ Press release, April 16. http://nissannews.com/en-US/nissan/usa/releases/nissan-launches-programs-to-make-leaf-charging-free-and-ez.

NRG/eVgo. 2014. “Electric Car Charging Plans.” http://www.nrgevgo.com.

PB (Parsons Brinckerhoff). 2009. “Alternative Fuels Corridor Economic Feasibility Study.” Prepared for Washington State Department of Transportation, Office of Public/Private Partnerships, January 23. http://www.wsdot.wa.gov/NR/rdonlyres/5C14E610-713A-4600-A88D-C567AF49D096/0/AltFuelsFinalReport.pdf.

Peterson, D. 2011. Addressing Challenges to Electric Vehicle Charging in Multifamily Residential Buildings. The Luskin Center for Innovation. Los Angeles, CA. June. http://www.luskin.ucla.edu/sites/default/files/EV_Multifamily_Report_10_2011.pdf.

Peterson, S., and J. Michalek. 2013. Cost effectiveness of plug-in hybrid electric vehicle battery capacity and charging infrastructure investment for reducing U.S. gasoline consumption. Energy Policy 52: 429-438.

Recargo. 2014. “Charging Station Finder.” http://www.plugshare.com/. Accessed October 23, 2014.

Smart, J. 2014a. “PEV Infrastructure Deployment Costs and Drivers’ Charging Preferences in the EV Project.” SAE 2014 Hybrid and Electric Vehicle Technologies Symposium, La Jolla, CA, February 11. http://avt.inl.gov/pdf/EVProj/SAEHybridEVSympFeb2014.pdf.

Smart, J. 2014b. “Workplace Lessons Learned through the Nation’s Largest PEV Charging Projects.” DOE Workplace Charging Challenge Summit, Alexandria, VA, November 18. http://avt.inl.gov/pdf/EVProj/WorkplaceChargingDataInsights.pdf.

Smart, J. 2014c. “EV Charging Infrastructure Usage in Large-Scale Charging Infrastructure Demonstrations: Public Charging Station Case Studies for ARB.” Plug-in Electric Vehicle Infrastructure Information Gathering Meeting,

July 15. http://avt.inel.gov/pdf/EVProj/EVInfrastructureUsageARBJul2014.pdf.

Smart, J. 2014d. “Latest Insights from The EV Project and ChargePoint America PEV Infrastructure Demos.” Presentation at the GITT meeting at INL, August 12. http://avt.inel.gov/pdf/EVProj/GITTEVProjectAug2014.pdf.

Smart, J., and S. Schey. 2012. Battery electric vehicle driving and charging behavior observed early in the EV Project. SAE International Journal of Alternative Powertrains 1(1): 37-33.

Smart, J., and S. White. 2014. “Electric Vehicle Charging Infrastructure Usage Observed in Large-scale Charging Infrastructure Demonstrations.” Presentation to the Committee on Overcoming Barriers to Electric-Vehicle Deployment, Irvine, CA, February 25.

Tate, E., and P. Savagian. 2009. “The CO2 Benefits of Electrification E-REVs, PHEVs and Charging Scenarios.” SAE Technical Paper 2009-01-1311. SAE International, Warrendale, PA.

Tesla. 2014. “Supercharger: The Fastest Charging Station on the Planet.” http://www.teslamotors.com/supercharger. Accessed May 18, 2014.

Traut, E.J., C.C. TsuWei, C. Hendrickson, and J.J. Michalek. 2013. US residential charging potential for electric vehicles. Transportation Research Part D 25: 139-145.

U.S. Census Bureau. 2011a. “2011 American Housing Survey for the United States, Table C-02-AH.” http://www.census.gov/housing/ahs/data/national.html.

U.S. Census Bureau. 2011b. “2011 American Housing Survey for the United States, Table C-01-AH.” http://www.census.gov/housing/ahs/data/national.html.

Vance, A. 2013. “Gone in 90 Seconds: Tesla’s Battery-Swapping Magic.” Bloomberg Businessweek, June 21. http://www.businessweek.com/articles/2013-06-21/gone-in90-seconds-teslas-battery-swapping-magic.

Wald, M. 2013. “A Recharging Industry Rises.” New York Times, November 12. http://www.nytimes.com/2013/11/13/business/energy-environment/electric-cars-give-rise-to-a-recharging-industry.html.