Consumer Impacts and Acceptance Issues

The success of the Corporate Average Fuel Economy/Greenhouse Gas (CAFE/GHG) national program depends in important ways on how consumers respond to the more fuel-efficient vehicles of the future. The vehicles that will be needed for compliance with the rules will implement fuel economy and other vehicle changes in a variety of ways that the consumer may or may not perceive, and they will have higher initial costs. How much will consumers value and be willing to pay for better fuel economy? Will consumers accept vehicle models with new fuel economy technologies? How will they trade off fuel economy improvements with other attributes? What are the prospects for alternative fuel vehicles (AFVs) and advanced technology vehicles (ATVs) in terms of cost, performance, and overall sales compared with conventional vehicles? This chapter addresses these and related questions of consumer impacts and acceptance of fuel economy technologies.

The chapter begins by looking at trends in the new vehicle characteristics over time. This provides context for the fuel economy standards and improvements in technology that have allowed for increases in both fuel economy and performance. The chapter then explores the issue of how consumers value fuel economy. A key premise of the regulation and a central part of the analysis of the costs and benefits of the new rules is that consumers undervalue fuel economy when they are considering new car purchases. This is evidenced by the net private savings for consumers in fuel costs relative to vehicle purchase price attributed to the rule (EPA/NHTSA 2012a, 62627). Despite a large body of literature on this issue, there appears to be no consensus on the extent to which consumers undervalue fuel economy or on how attitudes on this issue vary across the population. The chapter then turns to look in detail at evidence about consumer reaction to new technologies for fuel economy or to vehicles currently in the market. The chapter concludes with an assessment of the effect of the rules on affordability and sales.

TRENDS IN VEHICLE CHARACTERISTICS

Vehicle technology has been improving over time, and it is useful to look at the relative changes in characteristics during periods when fuel economy standards were increasing and when they were constant.

Evidence on Past Changes in Technology and Vehicle Characteristics

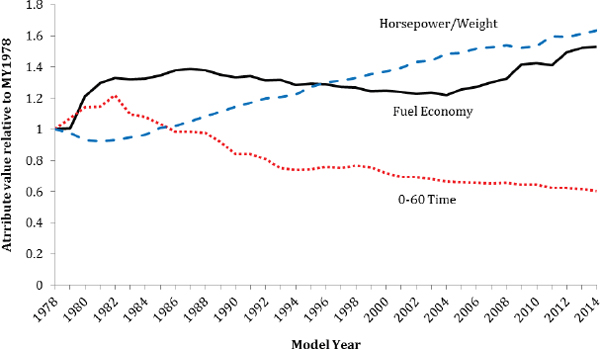

There is much data on average characteristics of the vehicle fleet over the past 40 years. This historical evidence shows trends in vehicle characteristics and technological change and indicates how those might be affected by such events as changes in fuel prices and fuel economy standards. Figure 9.1 shows the relative change in label fuel economy, the horsepower/weight ratio, and time to accelerate from 0 to 60 mph since 1975, using sales-weighted averages across the fleet. The average horsepower/weight ratio stayed relatively constant during the late 1970s while fuel economy increased rapidly. Both horsepower and weight were declining, but the ratio remained relatively constant. This was during the time when gasoline prices were relatively high and rising and the first CAFE standards were put in place.

The period from about 1985 to 2005 was a time with relatively low gasoline prices and constant CAFE standards for vehicles. There was substantial technological progress for vehicles during this period, and it appeared to go almost exclusively into better performance, such as horsepower and acceleration (EPA 2013; Knittel 2012). During this time there was a shift to larger vehicles in the on-road fleet—toward trucks and SUVs and away from cars. Average weight of vehicles increased, but Figure 9.1 shows that horsepower increased even more rapidly, so the horsepower/weight ratio increased while fuel economy stayed the same or fell slightly. Time to accelerate from 0 to 60 has been continually decreasing since 1982. According to MacKenzie and Heywood, “Ninety-five percent of vehicles sold today achieve a level of acceleration performance that beats the average from 1992,

FIGURE 9.1 Label fuel economy, horsepower/weight ratio, and 0-60 mph acceleration time for MY 1978-2014 light-duty vehicles.

SOURCE: EPA (2014).

and would have put them in the top 5% in 1985” (2012). However, the rate of improvement in acceleration time has been decreasing in recent years.

The final period, from 2005, reflects important changes. Real gasoline prices started to increase rapidly around 2004, and new fuel economy standards were put in place: for light-duty trucks starting in 2005, further tightened in 2008, and for cars in the 2011 MY. Both the higher gas prices and stricter fuel economy standards tend to push fuel economy of the fleet higher, and fuel economy trended upward over this period.

The difficulty in drawing conclusions from Figure 9.1 about the relationship between performance, standards, and fuel economy is that a number of different factors are changing at the same time—gasoline prices, vehicle mix, CAFE standards, and the technologies. The variables may also not be independent of each other. For example, CAFE standards themselves have the effect of accelerating technological change in the vehicle market. Some have argued that the standards spur the rate of technology change or encourage the development of new technologies that would not otherwise have been developed (Jaffe et al. 2003). Those technologies have impacts not only on fuel economy but on other vehicle attributes as well. Klier and Linn (2013) find some statistical evidence that the light truck standards the U.S. adopted in 2007 contributed to technical change during the period from 2008 to 2012. It is unclear how much of the recent trend in greater fuel economy is due to new technology going to improved fuel economy of specific vehicles and how much is due to vehicle mix (more of the more fuel-efficient vehicles being purchased). Khanna and Linn (2013) look at this issue for 2000 to 2012 and find that about half of the improvement of roughly 4 mpg in the overall fleet is due to change in vehicle mix (market shares) and the other half to changes in technologies applied to specific vehicles.

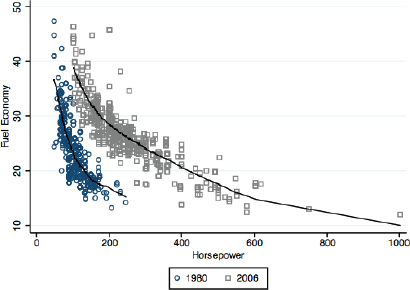

It is clear from Figure 9.1 that vehicle technology has been continually improving over time. Figure 9.2 further illustrates this point. Knittel (2011) estimated the tradeoff between fuel economy and performance (measured in horsepower) in 1980 (blue dots) and 2006 (grey squares) and found that technological change has allowed for improvements in both fuel economy and horsepower over this period. The rate of improvement is approximately 2 percent per year.

Figure 9.2 shows the general trade-off between performance and fuel economy as well as the improvements in both vehicle characteristics between 1980 and 2006. Knittel (2012) extended his original analysis through MY 2011 and found continued technological progress, consistent with improvements in fuel economy of 1.97 and 1.51 percent per year from 2006 to 2011 for passenger cars and light-duty trucks, respectively, holding other attributes constant. These technology improvements provided opportunities for increases in both horsepower and fuel economy. A combination of market choices and regulations is likely to continue to determine the allocation of future technology change between performance and fuel economy.

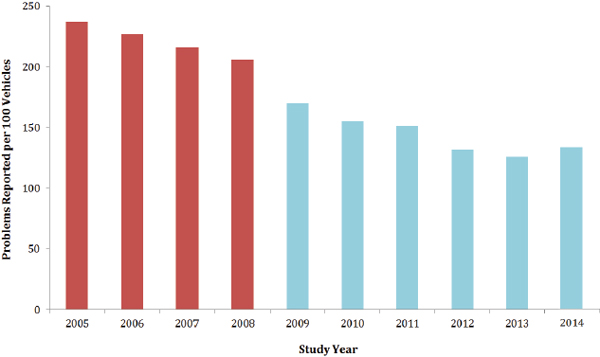

Improvements in technology have also led to greater reliability. Figure 9.3 shows the results of a vehicle depend-

FIGURE 9.2 Fuel economy in miles per gallon (two-cycle certification CAFE) vs. horsepower, passenger cars in 1980 (blue dots) and in 2006 (grey squares).

SOURCE: Knittel (2011).

FIGURE 9.3 Results of J.D. Power U.S. Vehicle Dependability Study, in which owners of 3-year-old vehicles report problems they have experienced with their vehicles. Reported problems range from safety issues that required repair to consumer dissatisfaction with vehicle attributes. The figure colors change in 2008 to indicate a change in methodology in that year, preventing comparisons between the two periods, though the trend remains consistently downward.

SOURCE: Data from J.D. Power (2013).

ability study from 2013 that covers the years 2005-2013. Over this time period, owners of 3-year-old vehicles reported fewer problems in each subsequent year. Some of this increased reliability may be due to changes made to meet the longer warranty requirements for emissions control equipment and enhanced systems robustness with tightened onboard diagnostic monitoring requirements. In large part because vehicles are more dependable, they last longer in the fleet. The average age of both cars and trucks increased over the last 20 years, with the average age of vehicles increasing from 8.4 years in 1995 to 11.4 years in 2013.

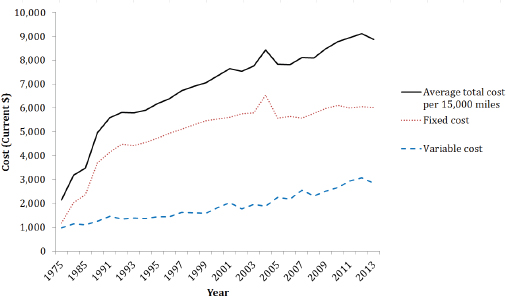

Despite the many improvements in vehicle attributes and performance, the price of a new vehicle has risen relatively slowly over the last 20 years, increasing only about 5 percent since 1996 according to the Bureau of Labor Statistics (BLS 2014). In addition to the small increase in purchase price for new cars, there has been a shift in the variable versus fixed cost for driving new cars. Figure 9.4 compares variable and fixed costs of driving 15,000 miles, which is roughly a year of driving. Variable costs include fuel and maintenance costs and fixed costs include insurance, license, registration, taxes, depreciation, and finance charges. In the 1990s, declining gas prices and increases in fixed costs led to a declining share of total cost of driving attributed to fuel costs (or variable costs). However, in recent years, variable costs as a share of the total have been rising as a result of higher gasoline prices. Gas prices will continue to vary, increasing or decreasing the impact of fuel costs on the variable costs of driving.

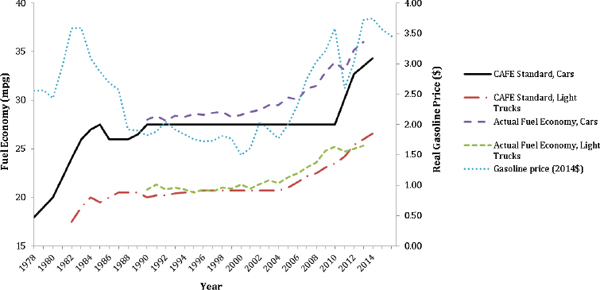

Gasoline costs are likely to play an important role in how smoothly the CAFE standards are implemented in the coming years. There is evidence that consumers are more likely to purchase fuel-efficient vehicles when gasoline prices are high and less likely when gasoline prices are low. Figure 9.5 shows the trends in real gasoline prices, actual fuel economy, and the fuel economy standards for cars and trucks over time. Gasoline prices varied over the period but were generally high in the early 1980s, decreasing beginning in 1984, and were flat in real terms between 1988 and 2004. Since 2004, gasoline prices have trended upward except during the recession starting in 2008 and in the recent period starting at the end of 2014. Figure 9.5 also shows that the fuel economy standards themselves were relatively unchanged during the period from 1985 to 2011 (2004 for trucks) when real gasoline prices remained relatively low.

The actual fuel economy data in Figure 9.5 start in 1990 and show that fuel economy remains fairly flat through the 90s, starting to trend up when real gasoline prices begin to rise around 2004. Actual fuel economy continues to increase through the rest of the decade both because gas prices were sharply increasing until 2009 and because of increasing fuel economy standards for trucks starting in 2005 and cars starting in 2011. Some of the increases in fuel economy before 2008 may have been in anticipation of the standards as automakers overcomplied to bank credits for later use. Actual fuel economy is above the standards in nearly all of the years for this period except for trucks beginning in 2013. If real gasoline prices fall and remain low in the future and consumers choose larger vehicles or less-efficient used vehicles, the new, stronger CAFE/GHG standards may not deliver as much benefit as originally predicted, due to reduced sales of the more costly low-fuel-consuming vehicles.

FIGURE 9.4 Average annual cost of driving a new car. The costs are an annual average over the first 5 years, assuming 15,000 miles driven per year, in current dollars. Variable costs include gasoline, maintenance, and tire costs. Fixed costs include insurance, taxes, depreciation, finance charges, license, and registration.

SOURCE: American Automobile Association (2013).

FIGURE 9.5 Fuel economy standards and actual fuel economy of cars and trucks by year plotted against real gasoline prices in 2014 dollars. All fuel economy standard and actual values are the certification fuel economy values.

SOURCE: DOT (2014); BTS (2014); EIA (2014).

Recent Changes in Fuel Economy

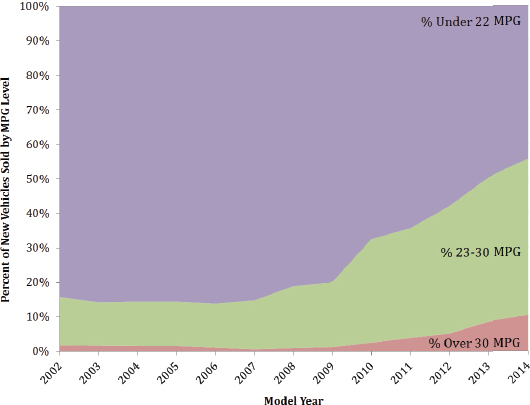

As shown in Figure 9.5, year-over-year improvements in fuel economy have occurred since about 2004 and will continue to occur at an accelerated rate due to stricter standards. Figure 9.6 illustrates some of the improvement that began in earnest from 2007 to 2010, focusing on the percent of vehicles in different miles per gallon categories. The percent of vehicles above 23 mpg increased from 14 percent to 50% percent in those 12 years.

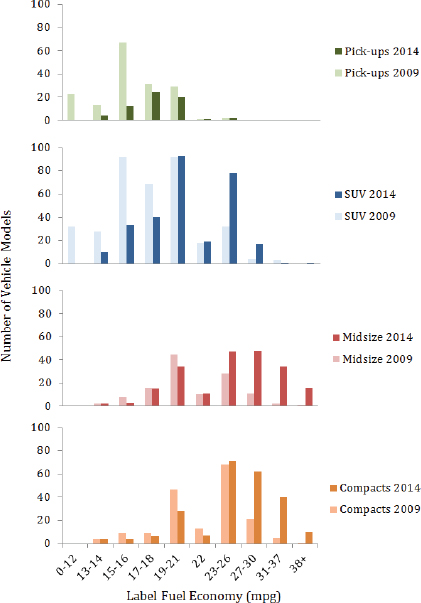

Improvements in fuel economy were achieved across segments from 2009 to 2014, shown in Figure 9.7. Each segment showed a shift to a greater number of more fuel-efficient vehicle models in that period, though the study does not recognize the difference between SUVs and CUVs, nor does it describe how the fuel economy improvements were achieved.

In summary, technology used in vehicles has dramatically improved over the last three decades. The potential to trade-off fuel economy, horsepower, and other attributes has not remained fixed over time; innovation has pushed out the technology frontier for improvements to both fuel economy and other attributes. In recent years, some of this improvement has gone into better fuel economy or reliability, but much has gone to improving other vehicle attributes such as horsepower and acceleration. Fuel economy standards have impacted vehicle characteristics, but so have consumer preferences and gasoline prices. How consumers value fuel economy and other attributes is a critical question for the Agencies in setting standards and for vehicle manufacturers in selling vehicles. The economic theories attempting to understand consumer behavior are explained in the following sections, as are consumer responses to changing vehicle characteristics.

CONSUMER VALUATION OF FUEL ECONOMY: THE ENERGY PARADOX?

How consumers value fuel economy when they purchase a new or used car is critically important to evaluating the benefits and costs of fuel economy standards. The standards are essentially set based on the Agencies’ assessment of what technologies will be available and technically feasible, as long as the benefit of the entire rule exceeds the costs. Standard setting is further discussed in Chapter 10. Key considerations in understanding the standards’ impacts on consumers, automakers, and the country are whether or not the market undervalues future fuel savings relative to their expected full-lifetime discounted economic value, how that impacts the sales of vehicles with varying fuel economy, and how that bears on the need for standards, as well as the costs and benefits of these standards.

FIGURE 9.6 Percent of passenger vehicles in different label fuel economy categories by year. The percent of vehicles over 23 mpg increased from 14 percent to over 50 percent between 2002 and 2014.

SOURCE: Committee-generated, using data from Consumer Federation of America (2014).

What Is the Energy Paradox?

The “energy paradox” describes the seeming failure of markets for energy-using durable goods to adopt apparently cost-effective, energy-efficient technology (see Gillingham and Palmer 2013; Allcott and Greenstone 2012; Jaffe and Stavins 1994; Sanstad and Howarth 1994). In well-functioning markets, energy-efficient technologies should be applied up to the point where the cost of the last technology adopted equals the present value of the energy it will save. The existence of a substantial technological potential for cost-effective energy efficiency improvement that has not been implemented in the market contradicts the premise of a well-functioning market, hence the paradox. If the energy paradox exists, there are net energy savings for consumers, savings they would value, that are not being realized. Whether or not an energy paradox actually exists is the subject of continuing debate.

The Final Rule for the 2017 and later model year standards asserts that the rule will achieve cost-effective energy savings for car-buyers, implying the existence of an energy paradox:

Although the agencies estimate that technologies used to meet the standards will add, on average, about $1,800 to the cost of a new light duty vehicle in MY 2025, consumers who drive their MY 2025 vehicle for its entire lifetime will save, on average, $5,700 to $7,400 (7 and 3 percent discount rates, respectively) in fuel, for a net lifetime savings of $3,400 to $5,000. (EPA/NHTSA 2012a, 62627)

Whether such favorable results can be achieved by the standards not only affects their costs and benefits as reflected in consumers’ satisfaction with new vehicles but also affects manufacturers’ revenues, profits, and employment by virtue of the demand for new vehicles. If the Agencies’ estimates are correct and consumers perceive an increase in the value of an average new car of more than $5,000 at a cost of only $1,800, sales should increase. On the other hand, if consumers substantially undervalue future fuel savings (or if the Agencies’ estimates of the costs are incorrect), a price increase for fuel economy technologies would lead to decreased sales. If the market for fuel economy is already functioning optimally, consumers will be less satisfied, and sales and industry profits will be reduced. If, however, there are inefficiencies in the fuel economy market, public policy could save consumers money and increase industry profits (see Fischer et al. 2007; Allcott, Mullainathan, and Taubinsky 2012).

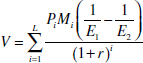

When comparing vehicles, the rational consumer of economic theory equates the additional cost of a more fuel-efficient vehicle to the present value of the future fuel

FIGURE 9.7 Number of models in several categories of label fuel economy. Between 2009 and 2014, there was a greater choice of vehicle models with better fuel economy across a variety of vehicle classes. Shown is the number of vehicle models available in 2014 and in 2009 by fuel economy range for both midsize vehicles and SUVs as an example.

NOTE: Compacts include small station wagons, and midsize includes midsize station wagons.

SOURCE: Data from Consumer Federation of America (2014).

savings it would provide, other things being equal. If consumers acted based on this model, then they should obtain the private benefits of fuel economy technologies without regulations. Mathematically, the present value, V, of future savings is the sum over the vehicle’s useful lifetime, L, of the product of the price of fuel in year i, Pi, miles traveled in year i, Mi, and the difference in fuel consumption per mile (1/E = 1/miles per gallon) between the lower (1) and the higher (2) fuel economy vehicle, (1/E1 − 1/E2), converted to present value at discount rate r.

There is no doubt that typical consumers do not conform precisely to the fully informed, economically rational model. Obtaining accurate information about fuel economy improvements and costs, especially within vehicle packages, may be difficult if not impossible. Also, in calculating costs and benefits, the CAFE/GHG standards assume technolo-

gies are applied to fuel economy rather than performance, though in the real market, consumers will value and choose between many different attributes, some of which may be competing. While the above calculation may be beyond the capabilities of many vehicle buyers, they might develop accurate intuition based on their experiences or obtain the estimate from another source, such as a website or a mobile application. The question is how great the differences are and whether they cause important deviations from the ideal model in ways that fuel economy standards might either correct or exacerbate.

Undervaluation of fuel economy improvement creates what Herrnstein et al. (1993) termed an “internality,” a welfare loss that consumers impose on themselves when they fail to make optimal decisions.1 Internality inefficiencies affect only the efficiency of energy-using durable goods and not their utilization.2 This is in contrast to externalities associated with energy use, such as carbon dioxide emissions, which imply both underinvestment in energy efficiency and excessive consumption of energy services (e.g., vehicle travel). If both energy efficiency investment inefficiency internalities and energy use externalities are present, then it would be appropriate to implement a combination of policies targeting vehicle fuel economy, such as the CAFE/GHG standards and externality taxes. The distinction between externalities and energy efficiency investment inefficiencies is important because it provides a theoretical basis for economically efficient fuel economy regulations.

A fuel tax could be a policy means to correct a market externality, but it might not correct market inefficiencies in investments in fuel economy. If consumers undervalue fuel economy, then a tax on fuel equal to the marginal externality costs of fuel use would not lead to a social-welfare-maximizing market outcome for fuel economy. This is because consumers would continue to undervalue the savings (fuel cost plus tax) due to improved fuel economy. Under such conditions, Allcott et al. (2012) show that a combination of an externality tax on fuel and subsidies to efficient vehicles can maximize social welfare. If properly designed, a “feebate” consisting of a fee on inefficient vehicles with rebates to efficient vehicles can be an efficient internality tax. Likewise, an efficiency regulation that induces an appropriate shadow price on energy efficiency combined with a tax on petroleum can also be an economically efficient solution. If markets systematically underinvest in fuel economy, regulatory standards could be part of an economically efficient solution.

Why an Energy Paradox?

Numerous potential explanations for the energy paradox have been proposed. Market inefficiencies can be caused by existing regulations, asymmetric information, transaction costs, inefficient capital markets, bounded rationality,3 and deviations from perfect market assumptions (Sanstad and Howarth 1994). Some explanations focus on the difficulty of obtaining accurate information and limitations on consumers’ cognitive skills. More recently, behavioral psychologists have added behavioral anomalies to the list of possible explanations causing deviations from the economic model of the rational, utility-maximizing consumer (see Kahneman 2011). Researchers have identified several systematic behaviors that cause decision utility (the satisfaction consumers maximize when they make a choice) to differ from experienced utility (the satisfaction consumers receive when experiencing the consequences of their choice) (Gillingham and Palmer 2013).

Loss aversion, the most firmly established theory of behavioral economics, has also been proposed as a possible explanation for the energy paradox (Greene et al. 2010). In theory, the rational economic consumer possesses all the information and computational skills necessary to make an optimal choice. Yet, as Jaffe and Stavins (1994) pointed out, markets may inadequately provide information to consumers creating uncertainty about the values of different products, about a vehicle’s fuel economy, for example. Behavioral psychologists have demonstrated that human beings faced with a risky bet typically consider potential losses to be twice as important as potential gains (Kahneman 2011). Paying a higher purchase price to obtain future fuel savings is, in fact, a risky bet (Greene et al. 2010). What a vehicle’s fuel economy will be in actual use,4 what the price of fuel will be in the future, how long a vehicle will last, and how many miles it will be driven are all uncertain at the time of purchase. These uncertainties make the value of future fuel savings a probability distribution rather than a fixed quantity. By quantifying the uncertainty about future fuel savings, Greene (2011) showed that loss aversion alone could explain undervaluing future fuel savings by a factor of two or more relative to expected value.

A key property of loss aversion is that it is context-dependent. That is, if consumers do not perceive their choices as risky bets, loss aversion does not come into play. This could be relevant to evaluating fuel economy regulations, where the context will be a choice between two vehicles,

_____________

1 Under the loss aversion model presented subsequently, the failure to optimize is in fact only a failure to optimize based on the expected value of fuel savings.

2 Energy efficiency indirectly affects vehicle utilization via the energy cost per mile driven, but an undervaluation of fuel economy internality does not directly affect vehicle utilization.

3 The concept of bounded rationality acknowledges that not all consumers will have the technical skills or the time needed to make optimal decisions even if all the necessary information is available to them.

4 Rated fuel economy values are estimates of the average fuel economy for all drivers. The fuel economy an individual driver gets will vary with driving style, traffic conditions, temperature, terrain, and more. Lin and Greene (2011) found that while EPA label miles per gallon estimates were relatively unbiased predictors of fuel economy estimates reported by individuals, the variance was quite large: a 2 standard deviation interval was approximately +/− 30 percent.

both of which are more fuel efficient and more expensive, rather than a choice between two vehicles, one of which has lower fuel economy and a lower price and the other of which has higher fuel economy and a higher price. If a consumer faces the choice of paying a few thousand dollars more for a hybrid vehicle that promises much better fuel economy than a nearly identical conventional vehicle, the choice may be seen as a risky bet. On the other hand, if fuel economy regulation raises the price and fuel economy of every vehicle in the market, consumers might not perceive the marketwide increase in fuel economy as a risky bet, so loss aversion would not apply. As noted above, standards will not remove all uncertainty from the consumer decision, but the uncertainty surrounding whether to pay for fuel economy technology will be reduced as there will only be higher fuel economy, higher priced choices. Uncertainty associated with being in the new vehicle market as opposed to the used vehicle market will also decrease as used vehicles improve in fuel economy. Scientific research in this area is at a very early stage, however, and there is as yet no consensus on how the theories of behavioral economics should be applied to consumers’ decisions about fuel economy. There are many more statistical and econometric analyses of consumers’ fuel economy choices, yet the evidence on the existence of the energy paradox is inconclusive.

Empirical Evidence of How Consumers Value Fuel Economy

Much of the prima facie evidence for the existence of an energy paradox comes from engineering–economic assessments of the cost and efficiency potential of energy technologies. Past NHTSA rulemakings (e.g., EPA/NHTSA 2012a), past NRC evaluations (e.g., NRC 2002, 2011), and other studies (see, e.g., Greene and DeCicco 2000, who review older studies) found substantial potential for fuel economy increases for which future fuel savings exceed the upfront cost but which the market had not adopted. However, none of these studies account for the opportunity cost of using technologies to improve fuel economy rather than to improve the acceleration performance or increase the size of vehicles. The potential significance of opportunity cost to the consumer is discussed later in this chapter. The impact of the possible opportunity cost on the overall cost and benefit of the regulation is discussed in Chapter 10.

During its information-gathering process, the committee found that auto manufacturers perceive that typical consumers would pay upfront for only one to four years of fuel savings, a fraction of the lifetime-discounted present value. Short payback periods imply high discount rates for fuel economy, which may indicate undervaluation of fuel economy relative to its net present value, though, as discussed below, there are other explanations for the apparent short payback periods. The academic literature, on the other hand, is nearly evenly divided between supporting and contradicting the existence of an energy paradox for motor vehicle fuel economy.

Despite the economic importance of the fuel economy standards, there has been relatively little research aimed at understanding how consumers use fuel economy information when making vehicle purchase decisions. In apparently the only study of its kind, Turrentine and Kurani (2007) conducted in-depth interviews with 57 California households across nine “life-style sectors” about their entire histories of car-buying decisions and the role that fuel economy played in their choices. They began by compiling a history of the households’ car ownership decisions and asking about the reasons for buying and selling the vehicles, eventually guiding the respondents to talk about fuel economy. They found that none of the 57 California households they interviewed had ever analyzed their fuel costs in a systematic way in their vehicle purchases. Very few kept track of their gasoline costs over time or factored them into household budgets. The researchers concluded that

One effect of this lack of knowledge and information is that when consumers buy a vehicle, they do not have the basic building blocks of knowledge assumed by the model of economically rational decision making, and they make large errors estimating gasoline cost savings over time. (Turrentine and Kurani 2007, 1213)

Lack of knowledge about fuel savings could be overcome by expert services if consumers’ willingness to pay for those services exceeded their costs (or if the service were free). Yet Turrentine and Kurani’s (2007) research found that the consumers in their survey did not take advantage of such services when making purchase decisions. Sallee (2013) concluded that average consumer losses due to making fuel economy choices based on incomplete information would be $100 to $300 per vehicle. Although this is not large enough to explain all of the undervaluation of fuel economy technologies, it could be one of several contributing factors.

Consumer ability to intuitively estimate fuel cost savings when comparing automobiles was tested by Allcott (2013) using a nationally representative computer-aided survey of 2,100 U.S. households. Consumers’ estimates of the fuel cost differences between the vehicle they chose to purchase and a second best alternative were divided by the “true” fuel cost difference to produce a “valuation ratio.” However, the “true” cost differences were calculated based on EPA label ratings. This raises two difficulties for interpreting the results. First, any given consumer’s actual on-road fuel economy will differ from the EPA rating due to driving style, traffic conditions, trip lengths, speed, temperature, terrain, and other factors. Second, although there is empirical evidence concerning the bias of the EPA label ratings used until 2008 (see Lin and Greene 2010; Hellman and Murrell et al. 1984), there has been inadequate empirical measurement of the bias of the ratings revised in 2008 versus real-world experiences of motor-

ists. Thus, the “true” fuel cost estimate may or may not be a biased estimate of the mean fuel costs for all consumers and will, in general, not be an accurate estimate of the fuel costs of a particular consumer. The results from Allcott (2013) indicate that consumers undervalue fuel economy, on average by 12 percent, and that 50 percent of consumers undervalue it by 30 percent or more. A complication is that the fuel economy and fuel cost differences between consumers’ first and second choice vehicles were often small. Also, because the EPA ratings are not likely to be the actual fuel economy achieved by any given respondent, the accuracy of consumers’ estimates is confounded with the accuracy of Allcott’s measure of “true” fuel costs.

Larrick and Soll (2008) found that consumers significantly undervalued fuel economy improvements for low-mpg vehicles and overvalued improvements for high-mpg vehicles. This “mpg illusion” caused consumers to value miles per gallon differences equally, regardless of the level of fuel economy. Thus, the 10 mpg difference between a 10 mpg and a 20 mpg vehicle tended to be considered equivalent to the 10 mpg difference between a 30 mpg and a 40 mpg vehicle, even though the fuel savings would be six times as great for the 10 mpg to 20 mpg difference. The mpg illusion implies that car buyers will overvalue fuel economy increases for high-mpg vehicles relative to low-mpg vehicles, but it does not necessarily imply a general underutilization of fuel economy technologies. Allcott (2013) also found that his survey results supported the existence of an mpg illusion, though the magnitude of the effect was small.

A recent survey of the econometric literature from 1980 to 2009 found it nearly evenly split between studies that support the hypothesis of rational economic behavior toward automotive fuel economy and those that support a significant undervaluing of fuel economy by car buyers (Greene 2010). Summarizing the evidence from econometric studies of vehicle choice, Helfand and Wolverton (2011) concluded that 12 studies found significant undervaluing of fuel economy relative to its expected value, 8 studies concluded that consumers were close to the expected value, and 5 studies found consumers significantly overvalued fuel economy (Table 9.1). The authors attributed the widely varying results to difficulties in statistical inference in the complex, multiattribute vehicle choice decision and to the lack of a clear theoretical consensus about how consumers actually do evaluate fuel economy when comparing vehicles. Further complicating the issue is the fact that consumers are heterogeneous in their willingness to pay for fuel economy due to differing rates of vehicle use and differing discount rates among other factors (Allcott and Wozny 2014).

Studies published since the literature reviews have also reached mixed conclusions. The effects of gasoline price on consumer willingness to pay for vehicles of different fuel economies were analyzed by Busse et al. (2013). As the authors state, their analysis estimates the short-run effect of gasoline prices on consumer willingness to pay in that it is based on consumer comparisons among existing makes and models. It did not consider the long-run effect of manufacturers redesigning vehicles and adding fuel economy technologies. Testing a variety of assumptions about vehicle usage, lifetime, and price elasticities of supply and demand, the study inferred implicit discount rates for future fuel costs ranging from 20.9 percent per year to 6.8 percent per year, with an overall average of 6.8 percent, and averages for new and used vehicles of 2.6 percent and 8.8 percent, respectively. The mean values imply discount rates consistent with consumers’ borrowing costs over the period of the study. The authors interpreted the estimates as not supporting undervaluation of future fuel costs by car buyers.

Whether consumers value future fuel savings at more or less than their discounted present value was evaluated by Allcott and Wozny (2014) using data on transaction prices of 83 million used-vehicle sales from 1999 to 2008. Discounted present value was calculated based on each vehicle’s estimated remaining lifetime and miles. A discount rate of 6 percent was used, derived from a weighted average of actual automobile loan interest rates and the opportunity cost

TABLE 9.1 Studies on Consumer Valuation of Fuel Economy

| Undervaluation of Fuel Economy | “About Right” Valuation of Fuel Economy | Overvaluation of Fuel Economy |

| Allcott and Wozny (2009)a | Brownstone et al. (1996) | Brownstone et al. (2000) |

| Arguea et al. (1994) | Dasgupta et al. (2007) | Cambridge Econometrics (2008) |

| Berry et al. (1995) | Espey and Nair (2005) | Gramlich (2008) |

| Bhat and Sen (2006) | Goldberg (1995) | Sawhill (2008) |

| Busse et al. (2009) | Goldberg (1998) | Vance and Mehlin (2009) |

| Eftec (2008) | Klier and Linn (2008) | |

| Fan and Rubin (2010) | McManus (2007) | |

| Feng et al. (2005) | Sallee et al. (2010) | |

| Fifer and Bunn (2009) | ||

| Kilian and Sims (2006) | ||

| Langer and Miller (2008) | ||

| Train and Winston (2007) | ||

a This is an earlier version of Allcott and Wozny 2014.

SOURCE: Helfand and Wolverton (2011).

of capital (for purchases made with cash). How consumers value future fuel costs was inferred based on the effects of changes in gasoline price on vehicle transaction prices. A key factor is consumers’ expectations regarding future fuel prices. Two alternatives were considered: (1) estimates based on oil market futures prices and (2) the assumption that current price was the best predictor of future prices. The latter “no change” assumption is consistent with the findings of an extensive analysis of national survey data on consumers’ expectations about future gasoline prices from 1993 to 2010 (Anderson, Kellogg, and Sallee 2011). It is also consistent with the observation that oil prices from 1947 to 2008 are not statistically different from a random walk without drift (Hamilton 2009; Alquist and Killian 2010; Alquist et al. 2010). Allcott and Wozny found that, on average, consumers undervalued future fuel costs by about 45 percent using the better supported assumption and 24 percent if price forecasts based on futures markets were used. Consumer response to fuel price changes may be more complicated. Kilian and Sims (2006) found that consumers appear to fully value future fuel costs when gasoline prices increase but virtually ignore them when gasoline prices decrease.

Implicit consumer discount rates for the fuel savings of hybrid vehicles were estimated for the United States by Gallagher and Muehlegger (2011). The estimation assumed static fuel price expectations (consistent with fuel prices following a random walk). It also assumed that hybrid buyers would not count fuel savings over the entire expected life of the vehicle. The latter assumption was justified on the basis of either consumer short-sightedness or the failure of used car markets to attach any value to the hybrids’ higher fuel economy. Of course, neither assumption is consistent with the model of the economically rational consumer. Five different model formulations were tested as well. The estimated discount rates ranged from a low of 13.0 percent for an assumed 5-year vehicle life to 41.8 percent for an 8-year life. Since U.S. light-duty vehicles typically last 14 years or more, these results would imply very high discounting of future fuel savings over the full expected life of a typical vehicle (NHTSA 2006; Davis et al. 2013, Table 3.12).

There is also empirical evidence supporting loss aversion as a possible cause of the energy paradox. Greene (2011) showed that if consumers accurately perceived the upfront cost of fuel economy improvements and the uncertainty of fuel economy estimates, the future price of fuel, and other factors affecting the present value of fuel savings, the loss-averse consumers among them would appear to act as if they had very high discount rates or required payback periods of about 3 years. Weighing potential losses (the possibility that upfront cost would exceed uncertain future savings) twice as much as potential gains results in a similar undervaluing of future fuel savings relative to their expected value. Four nationwide random sample surveys of 1,000 respondents each, conducted between 2004 and 2013, showed that consumers considered fuel economy ratings and future fuel prices to be very uncertain (Greene, Evans, and Hiestand 2013). The surveys also produced consistent evidence that consumer willingness to pay for fuel savings implies average payback periods of 2-3 years. Some respondents were asked about their willingness to pay for a given annual fuel savings while others were asked about the fuel savings that would justify a given price increase. The distribution of payback periods was very similar regardless of which way the question was posed. Nearly identical distributions of payback periods were observed for respondents who typically purchased new vehicles and those who purchased used, indicating no difference in the way fuel economy is valued in the two markets. The responses showed a wide dispersion of implied payback periods that were not strongly correlated with the attributes of the respondents, a result that is consistent with evidence about loss aversion from behavioral psychology studies. The payback periods calculated in these studies are also consistent with automobile manufacturers’ statements to the committee about consumer willingness to pay for fuel economy improvements.

Public perception of the standards should be weighed along with other evidence concerning the nature of the market for fuel economy. If fuel economy standards force manufacturers to produce vehicles with too much fuel economy, too little performance and size, and too high of a price, one might expect the public to disapprove of the standards. On the other hand, if consumers are satisfied with the new, higher fuel economy vehicles (as, for example, the theory of loss aversion would imply) one would expect them to approve of the standards. There is a great deal of survey research on consumers’ opinions of the desirability of raising fuel economy standards and the results are remarkably consistent over time.

Public Perception of Fuel Economy Standards

The public’s perception of the CAFE standards and support for raising the standards has been highly positive for the past 25 years. Seven surveys conducted between 1988 and 1997 by groups including the American Automobile Association and the Alliance to Save Energy reported public support for raising fuel economy standards ranging from 72 percent to 95 percent (Greene and Liu 1998, Table 3). Most surveys did not make statements about the pros or cons of the fuel economy standards before asking respondents’ opinions of them; however, those that did showed decreases in support when costs of the standards were asserted in framing the question. More recent polls continue to reflect high levels of public support for fuel economy standards (Table 9.2).

The consistently high support for raising fuel economy standards is noteworthy. It is possible that after almost 35 years of experience with fuel economy standards consumers do not understand that they pay more for higher fuel economy vehicles or sacrifice other vehicle attributes. Manufacturers generally expressed concern that consumers would not be willing to pay for the price increases necessary

TABLE 9.2 Recent Surveys Show High Public Support for Fuel Economy Standards

| Study | Result | |

| Knowledge Networks for Program on International Policy Attitudes, January 2005 | 77% supported higher fuel economy standards even when they were told, “. . . it would cost more to buy or lease a car.” | |

| Pew Research Center, 2006 | 86% favored requiring better fuel efficiency for cars, trucks and SUVs while only 12% opposed | |

| The Mellman Group (for Public Opinion Strategies), November 2007 | 86% answered “favored” or “strongly favored” to the following question: “Do you favor or oppose requiring the auto industry to increase fuel efficiency, that is, increase the average miles per gallon of gasoline that cars, trucks and SUVs get? 71% answered strongly favored | |

| Gallup, March 2009 | 80% of Americans said they favored higher fuel efficiency standards for automobiles, with 19% opposed. | |

| Consumer Federation of America, May 2011 | “Do you support or oppose the federal government requiring auto companies to increase the fuel economy of the vehicles they manufacture?” Among Republicans, 70% chose somewhat or strongly support; support by Independents and Independents leaning Republican was 69%; support among Democratic voters was 81% and 85% of Independents leaning Democratic supported fuel economy requirements. | |

| Pew Clean Energy Program, July 2011 | 82% of respondents supported increasing fuel economy standards to 56 mpg by 2025 | |

| Consumer Reports, October 2011 | 77% of the public supported increased fuel economy standards in a U.S. nationally representative probability poll | |

to cover the increased costs of vehicles that could meet the 2025 standards. It is also possible that consumers do understand that standards increase the price of vehicles as well as their fuel economy and prefer the higher fuel economy outcome. In either case the overwhelmingly positive and consistent public support for fuel economy standards casts further doubt on the fully informed, economically rational model as applied to consumers’ fuel economy choices.

Summary of Consumer Valuation of Fuel Economy

How markets actually value increases in new vehicle fuel economy is critical to evaluating the costs and benefits of fuel economy and GHG standards. Unfortunately, the scientific literature does not provide a definitive answer at present. Academic studies that have analyzed the evidence on consumer willingness to pay for increased fuel economy are mixed, with some studies finding little evidence of undervaluation and others finding evidence of significant undervaluation. A range of theories and explanations is put forward for why consumers may undervalue fuel economy, and some have argued that what appears to be undervaluation may in some cases be differences in preferences and circumstances among consumers. Automobile manufacturers’ statements and survey evidence tend to support the view that consumers expect a quick payback for a vehicle with higher fuel economy, all else being equal. Survey evidence also indicates broad and consistent public support for raising fuel economy standards over the past 30 years.

In the committee’s judgment, there is a good deal of evidence that the market appears to undervalue fuel economy relative to its expected present value, but recent work suggests that there could be many reasons underlying this, and that it may not be true for all consumers. Given the importance of this question to the rationale for regulatory standards and their costs and benefits, an improved understanding of consumer behavior about this issue would be of great value.

AUTOMAKERS’ RISK AVERSION TO SUPPLYING GREATER FUEL ECONOMY

In addition to inefficiencies in how consumers value fuel economy, the Agencies in their Final Rule also raise a supply-side problem—that automakers may be risk-averse to investing in fuel efficiency and therefore undersupplying fuel economy to the marketplace in the absence of regulation (EPA/NHTSA 2012a, 2012b). The Agencies posit two reasons why this could be true: uncertainty of future consumer demand for improved fuel economy and irreversibility of the large capital investments required. While the Agencies note that risk aversion by itself does not necessarily indicate a market failure, they state that manufacturer risk aversion would lead to an underprovision of fuel economy and that increasing fuel economy standards can lead to a more optimal solution by reducing the risk for manufacturers of investing in fuel economy.

Besides poor understanding of how consumers currently value fuel efficiency, the Agencies point out that automakers face additional uncertainty in predicting future consumer demand because it appears to evolve based on a number of factors that are difficult to forecast, such as future fuel prices, economic cycles, especially recessions, and the impact of marketing efforts. The Agencies point out that consumer valuation of fuel efficiency can change more rapidly than the industry is able to change its product offerings. Long lead times for production decisions exacerbate the uncertainty since automakers must make decisions on the level of fuel efficiency years in advance, but consumer demand can

change in much shorter time frames in reaction to external events such as fuel price increases and recessions.

The Agencies also raise the possibility that in the absence of higher standards, automakers are risk-averse due to the “irreversibility” of the large capital investments necessary to develop and market fuel-efficiency technologies. According to the Agencies, the effect of this irreversibility is that for a risk adverse company, being a first mover may appear to have a greater downside risk than upside risk; that is, there is a “first mover disadvantage.” If the Agencies are correct, the risk of oversupplying the market is greater than the risk of undersupplying the market. The risk of oversupplying the market is that a manufacturer will not be able to recoup its investment. The risk of undersupplying the market is a loss of market share in the short run, but the manufacturer still has the option of investing in fuel efficiency and regaining some if not all of its lost market share. If the industry as a whole is risk-averse, then large-scale adoption of fuel-efficiency technologies may not occur. Sunding and Zilberman (2001) showed that for a risk-averse company, delaying adoption of a new technology in order to gain more information may be more profitable than adopting a new technology. Blumstein and Taylor (2013) note that firms may choose not to produce a more efficient product because the product will increase costs without creating a long-term competitive advantage. There is some evidence that the auto industry exhibits risk-averse behavior. In explaining the lack of innovation in the highly concentrated auto industry in the mid-1980s, Kwoka (1984) noted that quality was considered too uncertain and risky to create a competitive advantage and safer bets were comfort, convenience, power, and style.

As noted by the Agencies, requiring all manufacturers to increase fuel economy can reduce the manufacturer’s perceived or actual risk of investing in a fuel economy strategy and potentially lead to a more optimal provision of fuel economy in the marketplace. Furthermore, since consumers tend to be risk-averse in adopting new technologies, having more widespread penetration of the new technologies reduces the perceived consumer riskiness of that new technology. Finally, higher volumes will bring down the costs of the fuel efficiency technologies through economies of scale, learning curves, and more rapid innovation. Reducing the costs will reduce the riskiness of the investment by accelerating consumer adoption, allowing for faster cost recovery.

As noted by Blumenstein and Taylor (2013), economic theory says that the rate of innovation is likely to be suboptimal when the returns to society from innovation are greater than the returns to the innovator. Innovation to improve fuel economy has important social benefits from reduced oil use and lower GHG emissions, so subsidizing R&D efforts for fuel economy, such as through tax credits or grants for companies, could have important spillover social benefits. Blumstein and Taylor 2013 also note that in the literature there is anecdotal evidence that suggests the existence of supply-side problems in the energy efficiency markets, including principal/agent problems, first mover disadvantage, price discrimination, and suppression of new technology. Principal/agent problems are a type of market failure where the person making the investment, in this case in fuel economy, is not the person who will reap the benefits. Fischer (2010) finds that market power gives manufacturers a strategic incentive to price-discriminate by overproviding fuel economy in vehicle classes whose consumers, on average, value it more than consumers of vehicles of other classes, and underproviding it in classes whose consumers value it less.

The recent era of higher gasoline prices (2005 to 2014) provides some anecdotal evidence that tighter standards can play an important role in providing longer-term planning certainty for automakers. The 2008-2011 MY light-truck fuel economy standards and the first National Program standards for 2012-2016 MY helped create a predictable, stable regulatory environment that provided greater certainty for the automakers’ investment plans. These standards may have also motivated some manufacturers to overcomply with the CAFE/GHG standards in these years to earn credits to be used in future years. The Alliance of Automobile Manufacturers, one of the primary industry associations for automakers, voiced its members’ support for the 2009 National Program agreement, in large part due to this long-term planning certainty (Alliance of Automobile Manufacturers 2009). Domestic manufacturers of large vehicles have particularly benefited from the new footprint standards since it provides them an incentive to improve all their vehicles rather than shift to smaller cars. According to an Automotive News article from 2011

Many automakers believe that the work they’ve done since the last big [gas] price surge, and in anticipation of higher government fuel-economy standards, leaves them better prepared this time, with stables of more competitive small cars and crossovers. . . . It could be a fairer fight this time. GM and Ford not only have more competitive small cars, but hot-selling crossovers such as the Chevrolet Equinox and Ford Edge that could benefit if consumers abandon big SUVs. (Colias 2011)

Another way of viewing the auto industry is that there is substantial competition between original equipment manufacturers (OEMs) that prompts them to take innovative risks to see what customers will buy. In order to mitigate risk while pursuing innovation, an OEM is likely to start implementation on a small scale and gauge consumer reaction over a period of time. Even in the presence of risk aversion, this innovation could eventually lead to efficient provision of fuel economy if consumers demonstrate willingness to pay full value for a technology. If a manufacturer found that market share (and maybe higher-than-average profits) could be gained by providing an efficient level of fuel economy, others would follow. Once the industry learned that consumers were willing to pay the full expected lifetime-discounted

value for fuel savings, essentially all manufacturers would provide it.

EVIDENCE ON CONSUMER VALUE FOR VEHICLE ATTRIBUTES

To better understand the impact of fuel economy standards on consumers, it is important to look not just at how consumers value fuel economy, but also at how they value other attributes in the bundle of vehicle characteristics. This can suggest how they might trade-off characteristics as a result of the standards.

It is clear from past trends in vehicle performance that buyers value attributes such as horsepower and acceleration. There have been some attempts to infer the value that consumers place on different vehicle attributes (Greene and Liu 1988). Whitefoot and Skerlos (2012) summarize the ranges of values that can be inferred from this literature (Table 9.3).

The estimates vary a great deal for all of the attributes. There are a number of reasons for this. One is that there are very few studies that have attempted to carefully estimate the value of these attributes to consumers. A major difficulty with empirical estimates is that the attributes tend to be related (i.e., not independent of each other). This makes statistical analyses that attempt to value each separately very challenging. Though the Whitefoot and Skerlos study shows that the value to consumers of fuel economy is greater than the value of acceleration (Table 9.3), Klier and Linn (2012) recently attempted to carefully address the interdependence issue and found that, on average, the value of a proportionate improvement in acceleration is greater than a similar percentage improvement in fuel economy. Another reason for the variation in estimates is that consumers are different, and the range of estimates may simply reflect these differences in value for a variety of vehicle attributes.

Given the value of different attributes, it is important to ask how the characteristics of the vehicle fleet will change in the future: first in the absence of the new standards and then with the standards. The Agencies’ assessments rely on the central Annual Energy Outlook forecasts of gasoline prices, which have them rising only slightly above 2012 levels in real terms by 2025 ($3.87/gal) (EPA 2012, 491). With relatively constant gasoline prices, the Agencies assume that manufacturers in the reference case without standards will not adopt more fuel-efficient technologies on their own and cite the evidence discussed above in the section Trends and Vehicle Characteristics for 1985-2005 as justification.

TABLE 9.3 Inferred Willingness of Consumers to Pay for Vehicle Attributes

| Vehicle Attribute | Range of Willingness to Pay for Attribute ($) |

| Additional square foot of vehicle size | 366-2,150 |

| Increase of 0.01 hp/lb in acceleration | 97-3,345 |

| Reduction in fuel consumption of 1 gal/100 miles | 468-3,826 |

SOURCE: Whitefoot and Skerlos (2012).

However, technological progress is likely to continue and other characteristics are likely to improve as they have in the past. If technology in the absence of the standards were to increase horsepower, for example, the horsepower function would continue to rise while fuel economy would remain flat (weight could increase if the fleet mix shifts toward larger vehicles). With the standards in place, fuel economy would improve and the Agencies would hold horsepower and other characteristics constant in evaluating the cost and effectiveness of technologies that could be used to meet the standards. The Agencies do acknowledge that maintaining a reference or baseline case that shows no change in other attributes in the absence of standards is a potential problem with their analysis but do not attempt to address it (NHTSA 2012, 813). The technology frontier is likely to continue to shift out, so there will be opportunity costs that are not being considered. This issue is addressed more fully in the assessment of costs and benefits in Chapter 10.

The Agencies suggest a different argument in the Final Rule: that the market for the other attributes that the technologies could provide—greater power, acceleration, and size—may not have been bundled optimally for consumers in the past. One example of this is that consumers have been switching from the less-fuel-efficient, truck-based SUVs to more fuel-efficient, car-based crossover utility vehicles (CUVs) which have less capability for towing and off-road uses. It turns out that manufacturers may have been oversupplying the market with vehicles having greater heavy-duty capabilities compared to what consumers might otherwise have chosen.

It is important to assess the value consumers place on fuel economy and other vehicle attributes and how those values may change over time. The next section reviews consumer responses to recent technologies available on vehicles in the market today.

Consumer Responses to Recent Changes in Technology

New technologies will be introduced to improve performance and fuel economy, some of which elicit consumer responses that could affect overall vehicle sales. Called “consumer-facing” technologies, these new technologies include hybrids (HEVs), plug-in electric vehicles (PEVs), turbocharged engines, new types of transmissions, such as dual clutch transmissions (DCTs), and diesel vehicles, among others. In addition to the greater fuel economy accompanying new fuel efficiency technologies, consumers may have other positive user experiences:

- Improved low-speed torque (turbocharged engines, HEVs, PEVs);

- Improved acceleration, shift quality, and reduced engine noise while cruising (transmissions with more gears and larger ratio spreads);

- Smoother acceleration and a quiet ride (HEVs);

- Greater convenience of refueling at home (PEVs); and

- Lower and more certain fuel costs (electricity vs. gasoline for PEVs).

There may also be a reduction in attributes:

- Shorter range between refueling (limited-range battery electric vehicles [BEVs]);

- Loss of trunk space (compressed natural gas vehicles, CNGVs, and hydrogen fuel cell vehicles [FCEVs]);

- Performance issues (e.g., shift optimization resulting in noise, vibration, and harshness (NVH) and shift busyness, start-stop hesitation, turbo lag, and drivability concerns with dual-clutch transmissions (DCTs)); and

- Consumer dissatisfaction with and distrust of label fuel economy relative to in-use fuel economy, particularly for high-fuel-economy vehicles.

When the committee was formed in early 2012, concerns existed about the evolving utility of vehicles due to new technologies such as BEV range anxiety and the NVH of driving a vehicle equipped with a dual-clutch transmission or stop-start. Now, more than 2 years later, manufacturers have made tremendous strides in addressing flaws and limitations of some new gearboxes and other technologies. Concerns and issues still exist, but the speed with which manufacturers can and have addressed problems is impressive. These rapid improvements are due in large part to the fact that so many of the powertrains and technologies of today are electronic or computer-assisted, allowing for minute adjustments and calibrations to very complex machinery.

General Motors (GM) recently employed a short time frame for changes to its Chevrolet Malibu, for example. The vehicle was completely redone for MY 2013 but GM announced a change to its 2.5L four-cylinder engine, adding stop-start technology for MY 2014. “The days of waiting to make changes based on traditional timing cycles is a thing of the past,” said John Hanh, brand marketing manager for the Chevrolet Malibu. “We’re going to react to customers as quickly as we can when we develop new technology and the customer needs it” (Mateja 2013; Pund 2013). GM stop-start implementation has been well received in the marketplace (Nagy 2014).

Not all consumer dissatisfaction with new technologies is as easily fixed, however. Some manufacturers have received such negative responses about the performance of some implementations of stop-start technology, for example, that they provide the option of disabling stop-start at each vehicle start. Other consumers have requested adjustments to the transmission shift calibration because they felt the shifts from gear to gear were too obvious or frequent, particularly on seven-, eight-, and nine-gear boxes. Some technologies require new behavior from the driver, as happened when antilock brakes were introduced, while others involve a consumer learning the new feel of driving a car with, for example, more gears.

A look at history shows examples of American consumers knowingly sacrificing some fuel economy for convenience and performance. For example, until recently, standard transmissions typically experienced better fuel economy than an automatic when used in like-for-like products, but so few Americans purchased standard transmissions that only a few OEMs even offered them on a handful of products. This trade-off is being altered by technology improvement. New technologies developed for automatic transmissions such as dual-clutch provide both the convenience of an automatic and better fuel economy than standard versions. Consumer wishes remain paramount, however, and dry DCTs came under harsh criticism from consumers and enthusiasts alike when introduced. Wet DCTs have not faced the same criticism, however, and even dry clutch versions are being improved to enhance drivability.

The diesel engine is an example of the complexity of the decisions customers must make when purchasing a new vehicle. The value to the consumer is arrived at differently than for a gasoline vehicle: the diesel-powered vehicle is more expensive than its gasoline equivalent, the fuel consumption is considerably lower, diesel fuel costs more than gasoline, and the residual value is higher (see Chapter 3). The market is also different, with fewer vehicle manufacturers offering fewer models from which to choose. Through November 2014, the German brands of VW, Audi, Mercedes, BMW, and Porsche combined made up 82 percent of the diesel car market in the United States, excluding pickup trucks from GM, Ford, and Chrysler. Newcomers like the Chevrolet Cruze and Chrysler Jeep Grand Cherokee provide more diversity for the consumer, and these new offerings could result in increased diesel penetration. The higher residual value of a diesel-powered vehicle and the lower net cost of fuel results in a diesel vehicle having a total cost of ownership lower than equivalent gasoline vehicles over a period of 3 years and 5 years. This fact, if realized by the purchaser, will have a positive effect on sales, but other negative considerations also prevail, such as fewer fueling stations, costs of maintenance of the aftertreatment system, and the net effect on the environment, such as perceived greater criteria emissions from diesel engines. EPA notes a projection for diesel penetration of 1.5 percent for passenger cars and light trucks in 2014 (EPA 2014), however sales of diesels in 2014 were 0.84 percent of all light- duty vehicle sales (Cobb 2015). This compares to over 50 percent penetration in Europe and even a 50 percent penetration in the light-heavy pickup trucks in the United States (Class 2b and 3).

Concerns about new technology implementation are not unique to fuel economy technologies. In today’s high-

technology world, consumers judge the utility of vehicles in ways unimaginable just a few years ago. Starting in 2006, after BMW, Audi, and Mercedes-Benz introduced new in-cabin vehicle system interface technologies, J.D. Power changed its initial quality survey (IQS) criteria to evaluate these types of systems. Vehicle owners had significant difficulties adjusting to the new, centralized functions. A manufacturer saw reliability scores for two brands plummet in new car surveys—not because of anything related to whether the engine turned on every morning, but instead related to the telematics and human–machine interface (HMI) installed in the vehicle (Bowman 2011; Consumer Reports 2012b). “It is not technology per se that generates new problems, but rather its integration and execution,” Neal Oddes, Director of Product Research and Analysis at J.D. Power, noted (Janes 2013), an observation that could be made for some of the fuel-saving technologies being launched today. The reliability ratings show that the perceived value and utility of a vehicle declines precipitously if the technology does not enhance the consumer’s ownership experience. This is true of consumer-facing fuel economy technologies as well.

Market Trends That Have Led to Greater Fuel Economy

Some consumer choices result in improved fuel economy. These include reduction in the number of cylinders as well as the transition from body-on-frame to unibody. With the considerable improvements in fuel economy and performance in internal combustion engines (ICEs), particularly when mated to a high-efficiency transmission, consumers have migrated away from V8 engines to more fuel efficient six- and four-cylinder engines. The average number of cylinders for light-duty vehicles dropped from 5.90 in MY 2004 to 5.27 in MY 2010 (EPA 2013). This is one of the other reasons fuel economy has improved 22 percent (5.5 mpg) since 2005 (EPA 2013). In addition, six- and four-cylinder engines benefited from significant investment in maximizing the fuel efficiency of these engines and mated transmissions. These improvements in fuel economy in ICE vehicles with familiar technologies provide the consumer with less incentive to invest in new technologies and new vehicles.

The shift from SUVs to CUVs is another example of a consumer choice that resulted in improved fuel economy. In the last 12 years, the U.S. new car buyer has moved away from traditional, truck-based SUVs like the Chevrolet Suburban or the Toyota 4-Runner toward more fuel-efficient, car-based CUVs such as the Nissan Rogue and BMW X5. According to IHS Automotive, in 2000, just 3 percent of all vehicles sold in the United States were CUVs and 17 percent were SUVs. By the end of 2012, the numbers had changed dramatically, with 26 percent of new vehicles designated as CUVs and 7.5 percent as SUVs according to WardsAuto.

This migration toward lighter, more fuel-efficient vehicles preceded the 2008 spike in fuel prices, although gas prices were rising at a slow but steady pace for the previous few years. The 2008 fuel price spike only spurred more demand for, development of, and introduction of CUVs. The sharp increase in CUV demand initially occurred outside of any direct policy mandates (see Figure 9.8).

CUVs are lighter and more fuel efficient than their SUV counterparts. Manufacturers began introducing CUVs into the United States in a trickle, with the Toyota RAV-4 arguably the first CUV to debut, in 1997, followed closely by the Honda CR-V and the Subaru Forester the next year. Lexus rolled out the venerable RX for premium buyers in 1998. As shown in Figure 9.8, the rise in CUV sales corresponded with a fall in market share for both minivans and SUVs, reflecting changing consumer preferences as new buyers, such as Generation Xers, entered the market. CUVs provide the consumer with many valued attributes such as commanding ride height, seating for 5-8 passengers, and all-wheel drive. These attributes come in a lighter, more fuel-efficient package than that of SUVs along with faster acceleration, easier handling, and a softer, more comfortable ride. Due to unibody versus body-on-frame construction and to the choices manufacturers have made about which vehicle traits to offer, most CUV models have reduced off-road capabilities, along with a lower tow rating and minimal low gear range. Most consumers do not need such rugged attributes but do value the cargo room, high seating position, comfort, and fuel efficiency the crossover affords. In a 2012 report from the Mintel Group, 60 percent of respondents said “off-road and snow capabilities” were “important” and 51 percent said “towing ability” was “important,” while 93 percent said “fuel efficiency” and “steering and handling” were important. Reliability, safety, and comfort all scored even higher for importance.

As consumer acceptance of CUVs spread, more manufacturers traded out truck-based vehicle architecture for car-based, including in iconic vehicles like the Ford Explorer and the long-running Nissan Pathfinder. When Ford discontinued the truck-based Explorer in MY 2010, the label fuel economy for the XLT four-door with a V6 and five-speed automatic transmission was 14 mpg city, 20 mpg highway. The car-based 2014 XLT Explorer has a new, more fuel- efficient V6 engine and a more efficient six-speed automatic transmission and is labeled at 17 mpg city and 24 mpg highway, a full 20 percent improvement in fuel economy.

The transition from SUVs to CUVs over the last decade is one reason that average certification fuel economy for new light-duty vehicles has risen from 24.8 mpg in MY 2005 to 30.3 mpg in MY 2014 (EPA 2013). During that time, fuel prices rose from just $2.39/gal in 2007 to $3.37/gal as of February 3, 2014 (EIA 2014). During this gas price rise, customers continued to purchase what they perceived to be “trucks”—CUVs, SUVs, pickups, and vans—with the market consistently split 50/50 between cars and CUVs/SUVs/pickups/vans (Experian Automotive 2014). In reality, at least from a vehicle architecture perspective, the market shifted

FIGURE 9.8 Light truck share of vehicle fleet by type of vehicle, showing the breakdown of the light-truck segment into CUVs, SUVs, minivans, pickups, and vans. CUVs rose in market share over the period.

SOURCE: Autodata (June 2013).

substantially in that time to more fuel-efficient car-based vehicles, which include CUVs. Shares of car-based vehicles (cars, minivans, and CUVs) increased from 66.4 percent in 2005 to 78.9 percent in 2012 (Baum 2014). The transition from V8 to V6 engines and from SUVs to CUVs indicates that consumers will make trade-offs of attributes they don’t value in order to gain better fuel economy.

Alternative Technology Vehicles

Manufacturers are also introducing a host of alternative technology vehicles (ATVs) that encompass an array of fuel-saving technologies, including HEVs and PEVs as well as AFVs such as biodiesel, compressed natural gas (CNG), propane, and hydrogen fuel cell vehicles. These vehicles are helping the United States to reduce its dependence on petroleum and to reduce vehicle emissions, but availability often varies by state, and there are barriers to deployment including cost, infrastructure, technological advancements, and consumer acceptance.

Hybrid and Electric Vehicles

Sales of hybrid vehicles have gained ground since their introduction. Recently, many models have been offered in a range of vehicle classes. Market share of hybrid vehicles grew steadily from 2011 to 2013, although sales were down 8.8 percent in 2014 vs. 2013 (Autodata September 2014; Cobb 2015). In MY 2013, 19 different brands offered a total of 41 different hybrid models, featuring everything from the lowest-priced Honda Insight Hatchback ($18,725), the segment-leading Toyota Prius Hatchback ($24,200), up to the priciest model, the $120,060 Lexus LS 600h L Sedan, and the biggest, the 19-foot long Chevrolet Silverado 1500 Crew Cab pickup, now discontinued (all prices from Edmunds.com 2014). Among the 41 individual models available in 2013, 11 offered all-wheel-drive and 6 showed four-wheel-drive, including two pickup trucks from GM. The 2014 Toyota Prius offered the best label fuel economy at 51 mpg city, 48 mpg highway, while the pricey 2014 Lexus LS 600h offered the worst at just 19 mpg city, 23 mpg highway, a point below GM’s five full-size truck offerings, which get 20 mpg city, 23 mpg highway.

Despite all of these models displaying an array of utility, price, fuel economy, and brands, hybrid sales accounted for just 3.4 percent of new vehicles sales in 2013, up a fraction from 3.3 percent in 2012, according to Autodata (December 2013). In 2014, hybrids represented only 2.75 percent of new light-duty vehicle sales, probably as a result of falling gasoline prices (Cobb 2015). The Toyota Prius lineup is the most

popular hybrid vehicle model series, recording a 42 percent hybrid market share in 2014, down from a 45 percent market share in 2013 and 49 percent in 2012.

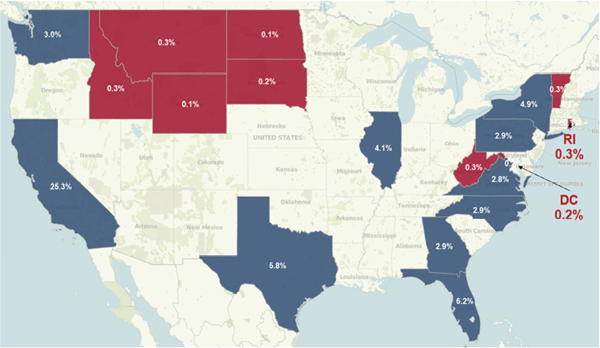

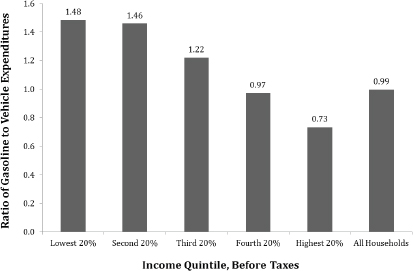

Consumer surveys show that there has been no upward trend in interest in purchasing an HEV or PEV in recent years (Strategic Vision, Annual surveys), although there is very wide regional variation in hybrid sales. In California, for example, the market share for conventional hybrids in 2013 was 6.8 percent of all light-duty sales. The Toyota Prius was the single best-selling model of all passenger cars, including both ICEs and ATVs, in California in 2013 (California New Dealer Association 2014). According to Experian Automotive, California accounted for 25.3 percent of all hybrids and PEVs sold in the United States in 2013. Florida, with 6.2 percent share of hybrid and PEV sales, was a very distant second (see Figure 9.9). This variation can often be attributed to the demographics and values of the consumers in each state but also localized incentive programs such as rebates, tax credits, access to HOV lanes, and availability of supporting infrastructure.

The modest size of the hybrid market does not necessarily reflect a lack of consumer demand for fuel efficiency overall but may be more a reflection of consumer perception of the lack of value for the hybrid drivetrain in particular. Furthermore, due to higher, size-based fuel economy standards in recent years, there is increasing availability of more fuel-efficient vehicles in every market segment, including pickup trucks. According to Automotive News, “improvements in the fuel economy of many mid-sized cars mean consumers now can save money without drastically reducing the size of their vehicles.” (Bunkley 2013)

Other Alternative Fuel Vehicles

As mentioned above, other vehicles using alternative fuels such as biodiesel, CNG, propane, and hydrogen are in the market, each with its own set of challenges and opportunities. Unlike hybrid vehicles, which run on gasoline, alternative fuel vehicle challenges include establishing a fueling infrastructure. Hydrogen fuel cell vehicles in particular have the potential to be two to three times more efficient than an ICE and offer the opportunity to dramatically decrease petroleum consumption and GHG emissions, though they will require an entirely new fueling infrastructure. Currently, the infrastructure is very limited, with just 10 stations in the United States at the end of 2013 (see Chapter 4). Hyundai just released its Tucson fuel cell vehicle for lease in Southern California, where nearly all of the hydrogen fueling stations

FIGURE 9.9 Uptake of hybrid and electric drivetrains is highly regional. States with the highest percent registrations of HEVs and PEVs are shown in blue, while those with the lowest percent registrations are shown in red.

SOURCE: Experian Automotive as of December 31, 2013 (U.S. light-duty vehicles only).

are currently located. The midsize crossover has a driving range up to 265 miles and takes just 10 minutes to refuel.

Natural gas vehicles come in two varieties: CNG and liquefied natural gas (LNG). Both fuels are commercially available, relatively low in price, and burn with lower emissions of criteria pollutants than gasoline or diesel, though all must meet the same tailpipe emissions standards. Vehicles equipped with CNG get about the same fuel efficiency as gasoline-powered vehicles. LNG, currently used mostly by medium- and heavy-duty trucks, has volumetric energy density about 65 percent that of gasoline, requiring about 1.5 gallons of LNG to provide the same energy as a gallon of gasoline. There are currently 737 CNG stations in various parts of the United States but only 58 LNG stations. The only car that can currently fuel with natural gas is the 2014 Honda Civic Natural Gas, but the all-new 2015 Chevrolet Impala can run on either gasoline or natural gas, using bi-fuel technology.