3

Federal Policies and Investments Supporting Parents and Children in the United States

Many of the parenting competencies described in Chapter 2 are reflected in federal policies and investments designed to improve the well-being of children and support parents in their efforts to create safe, supportive, and nurturing environments for their children. The U.S. government has a more than 100-year history of investing in programs and services for families that are designed to promote positive outcomes and reduce negative circumstances for children (see Box 3-1 for an overview). The parent- and child-focused policies and programs funded with public dollars and administered or augmented at the state and local levels by government agencies, businesses, community-based organizations, and foundations are aimed at promoting a host of positive outcomes, including keeping children safe from harm; making sure they do not go to bed hungry; and reducing disparities in outcomes associated with parental characteristics, especially those related to income, race/ethnicity, and place of birth. Each year billions of dollars are spent on these policies and programs at the federal level.

This chapter is intended to serve as a bridge between the description of core parenting knowledge, attitudes, and practices in Chapter 2 and the review of available evidence on what works to support and enhance these knowledge, attitudes, and practices in Chapters 4 and 5. The policies and investments described suggest an implicit governmental goal of promoting parenting knowledge, attitudes, and practices; facilitating the job of parenting; and ensuring that children are well cared for. However, no explicit link is evident between these policies and investments and a well-organized and articulated effort to promote the knowledge, attitudes, and practices they are designed to support. Likewise, the connection between the policies and

investments and the evidence, taken as a whole, is tenuous and at times incongruous. It is important to note that the policies and investments were instituted and amended over many years, reflecting various political and philosophical approaches, and often predate the evidence on what works that is described in the next two chapters. The connections across and among the knowledge, attitudes, and practices; federal policies and investments; and the evidence are relatively haphazard. As a result, the collection of policies and investments designed to strengthen and support parenting represents a piecemeal approach rather than a coherent system that has interconnected and cohesive goals and is informed by current knowledge about what works.

This chapter begins by describing examples of recent public health successes in changing parenting knowledge, attitudes, and practices to achieve better outcomes for children. Next, the chapter provides a brief overview of the federal budget supporting parents and children to help the reader understand the overall scale of the federal investment in promoting positive outcomes for children and families. The chapter then turns to a description of federal policies and investments supporting parents and children, which include policies and investments that are universal or near-universal and those that are more targeted. The latter category encompasses economic support for low-income families and children, investments in child and parent education, support for parents of children with special needs and parents facing adversity, and policies and programs focused on family and parental leave. Note that the discussion here is intended as an overview and does not include all federal policies and investments that support parents and children. The impacts on outcomes for families, including parenting, for several but not all of the programs reviewed in this chapter are discussed in Chapter 4. The chapter concludes with a summary.

PUBLIC HEALTH SUCCESSES

A central premise of this study is that, based on historical data, it is possible to shift the knowledge, attitudes, and practices of parents, and the nation, so as to create a safer and healthier environment for children. Three major successes in the field of public health illustrate this point: child passenger safety, the Safe to Sleep campaign, and reductions in smoking and drinking during pregnancy. These initiatives have been successful, in part, because their behavior change messages are relatively straightforward and consistently reinforced and are presented to parents through multiple, influential media and trusted sources. In most cases, these positive messages are coupled with society’s changing norms and expectations regarding the behavior of parents. These three examples demonstrate what can be accomplished when policy and practice are aligned across service systems and

provide some idea of what is possible in improving parenting behavior. They are focused to a large extent, though not exclusively, on the parents of young children, and all three have advantaged young children and their families in notable ways. Taken together, these examples demonstrate how parenting knowledge about what to do and why it matters for keeping children safe and well can lead to changes in parenting practices within a relatively short period of time based on the advice, recommendations, and encouragement of trusted information sources, as well as the potential benefit of a penalty for not complying (child passenger safety in particular). While not exhaustive, they also illustrate how marrying evidence, policies, and financing and supporting parents and families can lead to better outcomes for children.

Child Passenger Safety

Progress has been seen in child passenger safety, although motor vehicle collisions remain a leading cause of death for young children (Centers for Disease Control and Prevention, 2015a). Less than 40 years ago, children were allowed to play unrestrained while riding in a car; today, multiple efforts are focused on ensuring that all children have the right size of car seat and are properly buckled up. Advocacy for child passenger safety by families and community members, physicians, traffic safety experts, and researchers has influenced state and federal policy makers, car manufacturers, and an entire industry with respect to making car seats for babies, toddlers, and children. Among children ages 0-8, use of restraints increased from 51 percent in 1999 to 80 percent in 2007 (Children’s Hospital of Philadelphia, 2008). Parents face potential social pressure from family members and friends to buckle up themselves and their children, and fines are levied if they are stopped for a moving violation and found not to be using proper restraints.

The Safe to Sleep Campaign

A second example of a major shift in parenting behavior accomplished in less than a generation is what was originally launched as the Back to Sleep public education campaign in 1995 and is now called Safe to Sleep. This initiative, led by the Eunice Kennedy Shriver National Institute of Child Health and Human Development, is designed to reduce the incidence of sudden infant death syndrome (SIDS) by having all caregivers place children to sleep on their backs rather than their bellies, remove all soft bedding in sleeping areas, and ensure that sleeping spaces outside of the home (e.g., at child care, when traveling) are just as safe as those in the home. From 1990 to 2014, the rate of SIDS decreased from 130.3 to 38.7 deaths per 100,000 live births (Centers for Disease Control and Prevention, 2015b).

Reduced Smoking and Drinking during Pregnancy

Finally, prenatal care visits and an emphasis on the known toxic effects of exposure to tobacco and alcohol on the developing fetus have led to dramatic decreases in the numbers of women who smoke and drink while pregnant in the past 25 years. Women are exposed to reminders not to smoke and drink during prenatal visits with health care providers and through signage in many restaurants and bars. Approximately 20 percent of women reported smoking during pregnancy in 1989, compared with 8.5 percent in 2013, although rates remain much higher among Native Americans (Child Trends, 2015). In surveys conducted before 2001, 20 percent of women reported consuming alcohol during pregnancy (Bhuvaneswar et al., 2007); in a Centers for Disease Control and Prevention analysis of Behavioral Risk Factor Surveillance System data for 2006 to 2010, this percentage had declined to 8 percent (Centers for Disease Control and Prevention, 2012).

FEDERAL BUDGET SUPPORTING PARENTS AND CHILDREN

As noted earlier, significant federal fiscal support is dedicated to children and to helping their parents provide for their basic needs. This funding and the selected policies and investments described in the sections below, among others, are interrelated and form a platform upon which a national framework for more robustly meeting the needs of parents and improving outcomes for children could be organized, as described in Chapter 2.

It is important to note that this federal spending is augmented publicly and privately in various ways by states and localities, private businesses, organizations, and foundations.1 Therefore, none of the estimates provided herein represents a full picture of national spending on children and families. Estimates of the total amount of federal money spent on children and families also vary based on the methodology used. The committee drew on data from Kids’ Share (Isaacs et al., 2015), which describes the share of the federal budget dedicated to children and to families with children through age 18. To the committee’s knowledge, a review of the budget specifically with respect to parenting does not exist, and the amount spent on improving parenting knowledge, attitudes, and practices cannot be isolated in the federal budget.

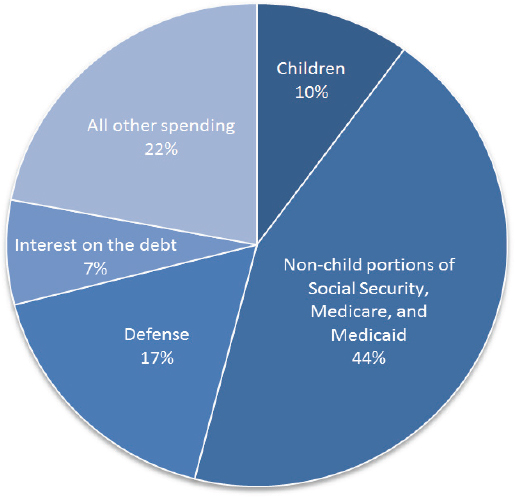

In 2014, 10 percent of total federal expenditures—amounting to $463 billion—was on children (see Figure 3-1) (Isaacs et al., 2015). Most spending on children in 2014 was for child-related tax provisions (e.g., the

___________________

1 Three-fifths of the total public funding for children is provided by state and local governments, the bulk of which is spent on public schools. In 2011, for example, 62 percent of the total funds spent on children ($12,770 per child) was from state and local sources (Isaacs et al., 2015).

SOURCE: Adapted from Isaacs et al. (2015).

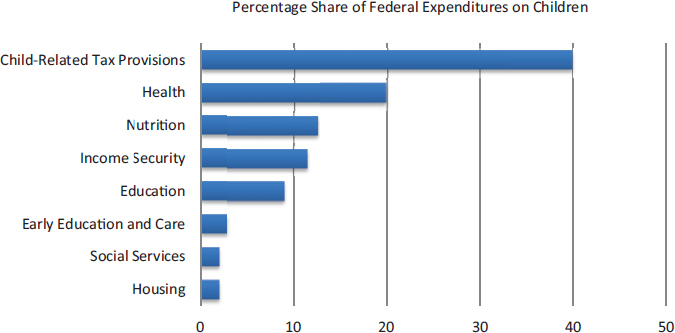

Earned Income Tax Credit [EITC], the Child Tax Credit, the dependent exemption), followed by health, nutrition, income security (e.g., Temporary Assistance for Needy Families [TANF]), education, early education and care, and social services and housing (see Figure 3-2 and Table 3-1).

FEDERAL POLICIES AND INVESTMENTS SUPPORTING PARENTS AND CHILDREN

Some of the federal expenditures that provide families with direct economic support or services to enable them to better meet the needs of their children are universal, while others are tied to family income. Federal funding is also directed at a number of programs available to parents seeking information and support in caring for their children. This section highlights some of the programs that are discussed further in Chapter 4; while this review is not exhaustive, it should serve to illustrate the scale of these investments.

NOTES: Categories representing less than 1 percent of federal expenditures are not depicted. The Child-Related Tax Provision estimate was calculated by adding estimates (from Table 3-1 below) for refundable portions of tax credits, tax expenditures, and the dependent exemption and dividing by total expenditures on children ($463 billion). Table 3-1 lists programs included in these and each of the other categories shown on the figure.

SOURCE: Adapted from Isaacs et al. (2015).

Universal and Near-Universal Policies and Investments

Child-Related Tax Provisions

By far the largest portion of the budget that goes to helping families with children is in the form of tax provisions that include (1) refundable components of tax credits, such as the EITC, the Child Tax Credit, and a set of other smaller credits (almost $76 billion in 2014) and (2) tax expenditures, such as exclusions for employer-sponsored health insurance, the nonrefundable portions of the EITC and the Child Tax Credit, and other small expenditures ($71 billion in 2014) (Isaacs et al., 2015).

Established by Congress in 1975, the EITC is currently the largest poverty alleviation program for the nonelderly in the United States. In 2013, it is estimated to have lifted 6.2 million people, including 3.2 million children, out of poverty (Center on Budget and Policy Priorities, 2015e). EITC benefits are paid by the federal government, as well as 26 states and the District of Columbia, which set their own EITCs as a percentage of the federal credit (Center on Budget and Policy Priorities, 2015e). Benefits are

TABLE 3-1 Federal Expenditures on Children by Program, 2014 (in billions of dollars)

| 2014 | |

|---|---|

| Health | 92.6 |

| Medicaid | 77.6 |

| Children’s Health Insurance Program (CHIP) | 9.0 |

| Vaccines for children | 3.6 |

| Other health | 2.4 |

| Nutrition | 58.3 |

| Supplemental Nutrition Assistance Program (SNAP) (formerly the Food Stamp Program) | 33.4 |

| Child nutrition | 19.4 |

| Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) | 5.5 |

| Commodity Supplemental Food Program (CSFP) | * |

| Income Security | 52.6 |

| Social Security | 21.0 |

| Temporary Assistance for Needy Families | 12.2 |

| Supplemental Security Income | 11.3 |

| Veterans disability compensation | 3.9 |

| Child support enforcement | 3.4 |

| Other income security | 0.8 |

| Education | 41.8 |

| Education for the Disadvantaged (Title I, part A) | 15.8 |

| Special education/Individuals with Disabilities Education Act | 12.6 |

| School improvement | 4.4 |

| Impact Aid | 1.1 |

| Dependents’ schools abroad | 1.2 |

| Innovation and improvement | 1.2 |

| State Fiscal Stabilization Fund | 1.1 |

| Other education | 4.3 |

| Early Education and Care | 12.8 |

| Head Start (including Early Head Start) | 7.7 |

| Child Care and Development Fund | 5.1 |

| 2014 | |

|---|---|

| Social Services | 9.3 |

| Foster care | 4.3 |

| Adoption assistance | 2.3 |

| Other social services | 2.7 |

| Housing | 9.3 |

| Section 8 low-income housing assistance | 7.3 |

| Low-rent public housing | 1.1 |

| Other housing | 1.0 |

| Training | 1.2 |

| Refundable Portions of Tax Credits | 75.9 |

| Earned Income Tax Credit | 53.6 |

| Child Tax Credit | 21.5 |

| Other refundable tax credits | 0.8 |

| Tax Expenditures | 71.3 |

| Exclusion for employer-sponsored health insurance | 33.8 |

| Child Tax Credit (nonrefundable portion) | 25.6 |

| Dependent care credit | 4.3 |

| Earned Income Tax Credit (nonrefundable portion) | 3.3 |

| Other tax expenditures | 4.4 |

| Dependent Exemption | 37.9 |

| TOTAL EXPENDITURES ON CHILDREN | 463.1 |

| Outlays Subtotal | 353.8 |

| Tax Expenditures Subtotal (including tax expenditures and dependent exemption) | 109.2 |

NOTES: * = Less than $50 million. Does not sum to 100 because of rounding.

SOURCE: Isaacs et al. (2015).

paid as a function of earned income and thus are intended to incentivize employment (i.e., encourage individuals to leave welfare for work and increase work hours). Despite the benefits of this credit, there is significant underparticipation (about 21% nationally) (Internal Revenue Service, 2015b). While there are no data to explain this underparticipation, it may be due, in part, to lack of awareness and clarity about the credit, eligibility criteria, and how to apply. In 2014, federal expenditures for the refundable portion of the EITC were 53.6 billion (Isaacs et al., 2015).

The EITC reduces the amount owed in federal taxes. If the credit exceeds a worker’s income tax liability, the remainder is provided as a refund (Center on Budget and Policy Priorities, 2015e). Eligibility and the amount of the credit received depend on filing status, income, and number of qualifying children (Internal Revenue Service, 2015a).2 In the 2015 tax year, the credit ranged from a maximum of $503 for filers with no qualifying children, to $3,359 for those with one qualifying child, to $6,242 for those with three or more qualifying children (Internal Revenue Service, 2015a). Eligibility for the federal EITC has been expanded several times (Marr et al., 2015).

The Child Tax Credit, enacted in 1997, helps offset the costs of raising children for working families with qualifying children up to age 16. Like the EITC, the Child Tax Credit is designed to incentivize employment, increasing with earnings up to a certain level. Families receive a tax refund that amounts to 15 percent of their earnings above $3,000, with a maximum $1,000 refund per child (Center on Budget and Policy Priorities, 2015a). Whereas the EITC is aimed at low-income families, both low- and middle-income families are eligible for the Child Tax Credit; for married individuals filing jointly, phaseout begins at $110,000 (Internal Revenue Service, 2015c). Also like the EITC, the Child Tax Credit has lifted many families out of poverty. In 2013, it moved 3.1 million people and 1.7 million children out of poverty and reduced poverty for another 13.7 million people, including 6.8 million children (Center on Budget and Policy Priorities, 2016). The Child Tax Credit is paid by the federal government and a few states that have their own programs. In the early and late 2000s, the federal program underwent expansions that vastly increased the number of eligible families (Mattingly, 2009). Expenditures for the refundable portion of the Child Tax Credit were $21.5 billion in 2014 (Isaacs et al., 2015).

Finally, the Child and Dependent Care Tax Credit refunds individuals for 20 to 35 percent of the amount paid to someone to care for a qualifying child under age 13 (or for a spouse or dependent who is unable to care for him- or herself) so that filers can work or look for work (Internal Revenue Service, 2015d). Allowable expenses are up to $3,000 for one child or other dependent and $6,000 for two or more dependents. Families with lower incomes qualify for higher refunds. It is estimated that 6.3 million returns claimed the credit in 2013 (Tax Policy Center, 2015). How many of these were for children is unclear.

___________________

2 For individuals who were single or widowed in 2015, both earned income and adjusted gross income limits to qualify for the credit were $39,131 for those with one child, $44,454 for those with two children, and $47,747 for those with three or more children. For married couples filing jointly in 2015, income limits were $44,651 for one child, $49,974 for two children, and $53,267 for three or more children (Internal Revenue Service, 2015a).

Support for Health Care

The second largest category of federal investments in children and families focuses on helping parents access health care for their children and themselves. Health care policies and programs can benefit the health of children directly, as well as benefit the health and financial well-being of parents, with potential spillover effects on their children.

The passage of the Patient Protection and Affordable Care Act (ACA) of 2010 resulted in a number of policy changes that increase access to health care and supportive services for parents. Among other enhancements, the ACA expanded Medicaid and improved child coverage; increased access to essential health benefits such as maternity and newborn care, pediatric services, and mental health and substance abuse services; and allowed parents to select a pediatrician for their child.

Medicaid ($77.6 billion in federal expenditures for children in 2014) and the Children’s Health Insurance Program (CHIP) ($9 billion) play an important role in child coverage, and as of fiscal year (FY) 2014 provided insurance coverage for more than one in three (more than 43 million) U.S. children (Burwell, 2016; Isaacs et al., 2015). CHIP gives states federal aid to provide programs for children in families whose incomes exceed Medicaid thresholds but are not high enough for them to afford private health insurance. Among disadvantaged populations, Medicaid and CHIP are principally responsible for increasing children’s health insurance coverage. The programs have had positive effects not only on coverage but also on access to care and health status among participants (American Academy of Pediatrics, 2014; Paradise, 2014). Previous state public health insurance expansions for parents show that such expansions may lead to higher rates of child participation in Medicaid (Dubay and Kenney, 2003).

The Maternal, Infant, and Early Childhood Home Visiting Program (established in 2010 as part of the ACA and currently funded through FY 2017) helps expectant and new at-risk parents prepare for and support children from birth to kindergarten. The implementation of evidence-based home visiting is a defining feature of this program. Health, social service, and child development specialists make regularly scheduled visits to provide hands-on guidance and referrals based on family needs. The program is designed to help parents develop and refine the skills they need to promote the well-being of children so they are physically and emotionally healthy and ready to learn. In FY 2014, more than 115,000 parents and their children received home visits through this program (Health Resources Services Administration, 2015). Both congressionally mandated performance measures and a rigorous impact evaluation are used to determine the program’s effectiveness in enhancing parent-child outcomes and improving child outcomes in the health and psychoeducational domains. Total funding from

2011 through 2015 was more than $1.5 billion (Health Resources Services Administration, 2015). Home visiting also is provided nationally through many other funding streams.

Economic Support for Lower-Income Families and Children

Nutrition Assistance Policies and Programs

Proper nutrition can help people reach and maintain a healthy weight, reduce chronic disease risk, lower pregnancy-related risks, support fetal development, and promote overall health. Conversely, food insecurity3 is associated with health issues, such as diabetes, heart disease, depression, and obesity, and can cause difficulty during pregnancy (Institute of Medicine, 2011; Lee et al., 2012). In 2014, federal investment in nutrition-related programs for children was $58.3 billion (Isaacs et al., 2015). Such programs include the Supplemental Nutrition Assistance Program (SNAP), the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), and the National School Breakfast and National School Lunch Programs.

SNAP, formerly known as the Food Stamp Program, is the largest nutrition program in the United States. Almost 60 percent of federal expenditures on children for nutrition in 2014 ($33.4 billion) was for SNAP (Isaacs et al., 2015). Administered by the U.S. Department of Agriculture, SNAP provides nutrition assistance to low-income individuals and families, with eligibility requirements that are less restrictive than those of other programs. In FY 2015, an average of 45 million people participated in SNAP each month, with an average monthly per household benefit of approximately $258 (U.S. Department of Agriculture, 2016c). Most households receiving SNAP (76% in 2014) include a child or an elderly or disabled individual (Gray and Kochhar, 2015), and many are very poor (with incomes less than 59% of the federal poverty level) (Food Research Action Center, 2015).

WIC, another long-standing program, is a federal grant program that provides vouchers for the purchase of nutritious food, as well as nutrition education, breastfeeding support, and referrals to social services and community supports for low-income women who are pregnant, postpartum, and breastfeeding as well as their children up to age 5. In FY 2015, the program served more than 8 million women, infants, and children, providing an average of $43.37 in monthly benefits per person (U.S. Department

___________________

3 Food insecurity is defined as limited or uncertain availability of nutritionally adequate and safe foods or limited or uncertain ability to acquire such foods in a socially acceptable way (National Research Council, 2006; U.S. Department of Agriculture, 2015).

of Agriculture, 2016d). The 2014 expenditures totaled $5.5 billion (Isaacs et al., 2015).

Federal programs promoting child nutrition also include the National School Breakfast Program and the National School Lunch Program, both of which are offered in schools as well as in residential child care institutions. While meals are available to all children through both programs, children from families meeting income requirements are eligible to receive meals at low or no cost. In FY 2015, an average of 12 million and 20 million children per month received reduced-price or free meals through the National School Breakfast and National School Lunch Programs, respectively (U.S. Department of Agriculture, 2016a, 2016b). After-school snacks also are provided to children meeting income eligibility criteria (U.S. Department of Agriculture, 2013). Additional school-based nutrition programs include the Special Milk Program, the Fresh Fruit and Vegetable Program, and the Summer Food Service Program. In addition to ensuring children’s nutrition, these programs can be viewed as income supports to parents and also as stress reducers because they reduce time demands on parents.

Income Security Policies and Programs

Another large area of federal spending on children takes the form of income security, totaling about $53 billion in 2014 (Isaacs et al., 2015). The largest income support to help parents and caregivers raise children after the death of a parent is Old Age and Survivors Insurance, part of Social Security, which covers insured workers. While not traditionally regarded as a program targeting children and their parents, it represents the largest income support for families with children. Child-related expenditures in 2014 were $21 billion for Social Security benefits to survivors and dependents (Isaacs et al., 2015).

TANF helps families achieve self-sufficiency through an assortment of services, such as direct cash payments, child care, education, job training, and transportation assistance. Block grants are provided to states, territories, and tribes, which have some discretion in determining eligibility criteria and services, so the program varies by location (Center on Budget and Policy Priorities, 2015b). Created through the Personal Responsibility and Work Opportunity Reconciliation Act of 1996, which was designed to increase labor market participation among individuals receiving public assistance, TANF requires jurisdictions to impose work requirements for participation, and assistance is reduced or eliminated for work-eligible individuals not meeting those requirements. In FY 2015, the average number of families served by TANF monthly was 1.35 million; these families included 3.12 million total recipients, 2.37 million of whom were children (Office

of Family Assistance, 2015). Expenditures on children for TANF in 2014 totaled $12.2 billion (Isaacs et al., 2015).

The federal Child Support Enforcement Program aims to encourage parental responsibility “so that children receive financial, emotional, and medical support from both parents, even when they live in separate households” (Office of Child Support Enforcement, 2015a). The program’s services, which may include assistance in locating parents, establishing legal paternity, enforcing support orders, increasing health care coverage for children, and removing barriers to child support payment (e.g., providing referrals for employment services, supporting healthy co-parenting), are available through local child support offices to any family with children in which one parent is not living in the same home as the children (First Focus, 2015; Office of Child Support Enforcement, 2016). Either parent may apply for services, as may grandparents or other custodians. Services are automatically provided to all families participating in TANF that could benefit. In FY 2014, the Child Support Enforcement Program served 16 million children and collected nearly $32 billion in child support, 95 percent of which went to families (Office of Child Support Enforcement, 2015b). Federal expenditures for child support enforcement in 2014 totaled $3.4 billion (Isaacs et al., 2015).

Housing Policies and Programs

Housing programs support parents in meeting various objectives for their children—including their health; safety; and emotional, social, and cognitive well-being—by offsetting a number of stressors. Across various income groups, housing-related expenses (e.g., shelter, utilities, furniture) accounted for the largest share of families’ expenditures on children in 2013, totaling 30-33 percent of all expenses in mother and father families with two children (Lino, 2014).

Federal support helps millions of low-income households with children afford housing in the United States (Center on Budget and Policy Priorities, 2015c). The funding flows mainly through programs in the U.S. Department of Housing and Urban Development, including Tenant-Based Rental Assistance, Project-Based Rental Assistance, and the Public Housing Operating Fund. Together, these funding streams contributed more than $9 billion to federal spending on children in 2015, representing nearly 80 percent of all housing investments that impact children (Isaacs et al., 2015).

The Housing Choice Voucher Program (HCVP) (often referred to as Section 8) helps more than 5 million people in low-income families access affordable rental housing in the private market that meets health and safety standards (Center on Budget and Policy Priorities, 2015d; U.S. Department of Housing and Urban Development, 2016b), supporting families in creat-

ing safe households for their children. Seventy-five percent of the vouchers distributed to new participants each year are provided to extremely low-income households.4 Currently, children reside in 46 percent of households that are HCVP recipients (Center on Budget and Policy Priorities, 2015d). Family unification vouchers are provided to families participating in HCVP that are at risk of having their children placed in out-of-home care because of a lack of adequate housing and to those for whom reunification is delayed because of lack of adequate housing (U.S. Department of Housing and Urban Development, 2016a).

Investments in Child and Parent Education

In terms of state and local funding as well as federal investments, education is by far the largest form of societal investment in children in the United States. In addition to direct expenditures on education, from early childhood through college, the federal government provides or supports access to child care for children through both tax credits and direct support.

While most child care and education expenditures are focused exclusively on the care and education of children, the U.S. Department of Health and Human Services (HHS) and the U.S. Department of Education fund and administer a number of early childhood care and education programs for children ages 0-8, many of which are focused on helping parents engage in parenting practices associated with healthy child development. HHS manages two large programs—Head Start (including Early Head Start) and the Child Care and Development Fund (CCDF). The U.S. Department of Education manages more than 80 federally funded education programs, including special education programs, benefiting children of all ages, from infants to high school students preparing for college; from all states and territories; and across all income groups. State and local funding for public education for children ages 5-8 dwarfs federal funding for children in this age range.

The Head Start Program was established in 1965 to support the school readiness of low-income children ages 3-5 through the provision of preschool education and supportive services to families. Early Head Start, which became a part of Head Start programming following the reauthorization of the Head Start Act in 1994, provides services for low-income pregnant women and families of children ages 0-3 for the purpose of supporting children’s healthy development and strengthening family and community partnerships (U.S. Department of Health and Human Services, 2015). Delivered in about 1,700 community agencies located throughout

___________________

4 Defined as household income not above 30 percent of the local median or the federal poverty line, whichever is higher (Center on Budget and Policy Priorities, 2015d).

the United States (U.S. Department of Health and Human Services, 2015), Head Start and Early Head Start represent scaled-up, means-tested, and rigorously evaluated approaches to two-generation programs, which target parents and children from the same family. In addition to education services directed at children, they typically provide parenting education; self-sufficiency services; and resources and referrals to community providers to meet families’ needs in a range of areas, such as transportation, housing, and health care. The government spent $7.7 billion on Head Start and Early Head Start in 2014 (Isaacs et al., 2015). In the 2014-2015 program year, almost 1.1 million children ages 0-5 and pregnant women were served by the two programs (Office of Head Start, 2015).

CCDF makes funding available to states, tribes, and territories to help qualifying low-income families obtain child care so that parents can work or attend classes or training. The program works to improve the quality of child care so that children will have positive and enriching experiences. Nearly 1.5 million children receive a child care subsidy from the program every month (Administration for Children and Families, 2015). State Quality Rating and Improvement Systems (QRIS), developed to help states evaluate the quality of care and education programs for children, are funded largely through CCDF and include incentives for child care providers to improve the quality of their programs (Administration for Children and Families, 2016a). Implementation of QRIS was encouraged by their inclusion in the U.S. Department of Education’s Race-to-the-Top Early Learning Challenge grants, which also required QRIS validation studies. Many of these efforts were joint HHS-Department of Education early care and education initiatives with funding targeted to different parts of the service delivery system that supports parents of young children. Programs such as CCDF may positively impact parenting by providing parents access to services that promote self-sufficiency and parenting practices associated with healthy child development.

Preschool Development Grants support states in building or enhancing infrastructure for preschool programs to enable the delivery of high-quality preschool services to children, as well as in expanding high-quality preschool programs in targeted communities that can serve as models for extending preschool to all 4-year-olds from low- and moderate-income families. In 2015, 18 states were awarded $237 million for year 2 of this grant program (U.S. Department of Education, 2015).

Support for Parents of Children with Special Needs and Parents Facing Adversity

In addition to the policies and programs discussed above that are directed at ensuring the well-being of children of all ages and that reach

a large number of families, particularly low-income families, investments are made to support parents who face situational or personal challenges. Although families may face singular challenges, such as intimate partner violence, challenges often cluster together. Substance abuse, mental illness, involvement with the child welfare system, financial hardship, and other challenges can overlap in families, with profound consequences for the development and well-being of young children. A variety of federal investments are designed to support parents who face such challenges. Many families experiencing these challenges have access to and utilize the universal and widely used supports discussed above, but these, even along with community and family supports, often are insufficient.

Some investments for such families are part of broader spending on health and education, such as that for programs for children with mental, behavioral, and developmental disabilities. The Individuals with Disabilities Education Act (IDEA) Part C, Grants for Children and Families, for example, assists states in providing early intervention services for young children with disabilities and their families. IDEA Part C allocations in 2015 totaled $438.6 million (First Focus, 2015), and those funds are included in the federal budget for education described above.

In the area of child welfare, there are investments in programs that are aimed at preventing and addressing child maltreatment and that provide assistance to kinship and foster parents. In 2015, for instance, nearly $445 million in mandatory funding was allocated for the Promoting Safe and Stable Families Program, which, through state grants, aims to prevent unnecessary separation of children from their families and promote child permanency. In 2015, $99 million was allocated for assistance payments to grandparents and other kinship caregivers with legal guardianship of children (First Focus, 2015).

Family and Parental Leave Policies and Programs

Newborns and infants require substantial, focused, and responsive care. Parents of newborns need time to bond with their child and adjust to the demands of caring for an infant while also overseeing their child’s healthy development. In addition, parents need time to rest and recover from pregnancy and childbirth. As described in Chapter 2, breastfeeding is a critical nutritional issue for infants. Mothers who are breastfeeding need to be available to their infants and toddlers or need time to pump breast milk during the day when they are not with their baby. Also, children have considerable preventive (e.g., routine well-child visits), acute, and chronic health care needs to which parents need to attend. Nonetheless, current state and federal policies regarding parental and family medical leave cover some but not all parents and employers, and among those covered, the poli-

cies address some but not all of their needs. For some parents, taking time off from work to care for a newborn or a sick child means losing income or even risking their job.

Most parents of young children are in the labor force (Bureau of Labor Statistics, 2016). To meet their children’s needs, employees in the United States tend to rely on a mix of support that combines employer benefits (if offered) with federal, state, and local leave laws and programs (Schuster et al., 2011). The Pregnancy Discrimination Act of 1978 requires that employers provide women who have medical conditions associated with pregnancy and childbirth the same leave as is provided to employees who are temporarily unable to work because of other medical conditions (e.g., a broken leg or a heart attack) (U.S. Equal Employment Opportunity Commission, 2016). The act does not require employers to provide paid leave, but if they provide paid leave or disability benefits for some medical conditions, they must do so for conditions related to pregnancy and childbirth as well.

The Family and Medical Leave Act of 1993 (FMLA) provides up to 12 weeks a year of unpaid leave with job protection to eligible employees for their own serious health conditions; for the birth of a child or to care for the employee’s newly born, adopted, or foster child; or to care for a family member (spouse, child, or parent) with a serious health condition. Eligibility is restricted to those who work for employers with 50 or more employees and have worked at least 1,250 hours for the same employer in the past 12 months (U.S. Department of Labor, 2016). Although 60 percent of employees meet all eligibility criteria for FMLA (U.S. Department of Labor, 2015), many employees cannot afford to take unpaid leave (Han and Waldfogel, 2003).

Finally, although not federal policy, some states currently have or are considering paid parental leave policies. The implications of these policies for parents and children, as well as for employers, the economy, and society, are yet to be determined.

SUMMARY

Federal funding that supports parents and children in the United States is distributed across the federal budget, and responsibility for administering the funded programs resides with a range of agencies, including those at the state and local levels. There is no easy way to map the evidence-based parenting knowledge, attitudes, and practices identified in Chapter 2 to the federal budget; however, a review of the budget and a general understanding of the policy and funding structure provides an overview of the existing framework for the programs reviewed in Chapters 4 and 5. Although many children interface with specific programs, the committee notes that there is no simple way to compute how many children receive services through mul-

tiple programs at the same time or what percentage of those serve young children ages 0-8—an important question for understanding the return on investment in programs. What the existing funding streams and service delivery platforms do provide are settings and systems with the potential to be linked more systematically to offer support for parenting knowledge, attitudes, and practices that is grounded in evidence-based programming and practice (see Chapter 7). As noted in subsequent chapters, new approaches to developing interventions are being tested. Understanding how federal funding flows into programs directly and indirectly to support parents and children informs the development and financing of a new framework for providing this support.

The following key points emerged from the committee’s review of federal policies and investments supporting parents and children:

- The United States has a long history of funding policies and programs with the goal of improving children’s outcomes and the well-being of families and society. These policies and programs are not limited to young children; however, young children and their parents are within the larger populations served.

- Large-scale policies and programs designed to change parenting behavior in some areas have been effective in improving targeted outcomes at the population level. However, support for parents is not isolated in these policies and programs, and there is little information about parents’ awareness of how various policies and programs can support them in their parenting role.

- The specific policy and program approaches reflected in the federal budget are a mix of child-related tax provisions, policies and programs designed to promote well-being and positive outcomes for all children and families, and policies and programs targeted at providing a safety net for children and families facing adversity and various risk factors.

REFERENCES

Administration for Children and Families. (2015). Administration for Children and Families: Child Care Development Fund. Available: https://www.acf.hhs.gov/sites/default/files/olab/sec2c_ccdf_2015cj_complete.pdf [January 2016].

Administration for Children and Families. (2016a). About QRIS. Available: https://qrisguide.acf.hhs.gov/index.cfm?do=qrisabout [May 2016].

Administration for Children and Families. (2016b). History. Available: http://www.acf.hhs.gov/programs/cb/about/history [May 2016].

American Academy of Pediatrics. (2014). Children’s Health Insurance Program (CHIP): Accomplishments, challenges, and policy recommendations. Pediatrics, 133(3), e784-e793.

Bhuvaneswar, C.G., Chang, G., Epstein, L.A., and Stern, T.A. (2007). Alcohol use during pregnancy: Prevalence and impact. Primary Care Companion to The Journal of Clinical Psychiatry, 9(6), 455-460.

Bureau of Labor Statistics. (2016). Employment Characteristics of Families Summary. Available: http://www.bls.gov/news.release/famee.nr0.htm [May 2016].

Burwell, S.M. (2016). The Department of Health and Human Services 2015 Annual Report on the Quality of Care for Children in Medicaid and CHIP. Washington, DC: U.S. Department of Health and Human Services.

Center on Budget and Policy Priorities. (2015a). Chart Book: The Earned Income Tax Credit and Child Tax Credit. Available: http://www.cbpp.org/research/federal-tax/chart-book-the-earned-income-tax-credit-and-child-tax-credit#PartOne [February 2016].

Center on Budget and Policy Priorities. (2015b). Policy Basics: An Introduction to TANF. Available: http://www.cbpp.org/research/policy-basics-an-introduction-to-tanf [October 2016].

Center on Budget and Policy Priorities. (2015c). Policy Basics: Federal Rental Assistance. Available: http://www.cbpp.org/research/housing/policy-basics-federal-rental-assistance [October 2016].

Center on Budget and Policy Priorities. (2015d). Policy Basics: The Housing Choice Voucher Program. Available: http://www.cbpp.org/research/housing/policy-basics-the-housing-choice-voucher-program [October 2016].

Center on Budget and Policy Priorities. (2015e). Policy Basics: The Earned Income Tax Credit. Available: http://www.cbpp.org/research/policy-basics-the-earned-income-tax-credit [August 2015].

Center on Budget and Policy Priorities. (2016). Policy Basics: The Child Tax Credit. Available: http://www.cbpp.org/research/policy-basics-the-child-tax-credit [October 2016].

Centers for Disease Control and Prevention. (2012). Alcohol use and binge drinking among women of childbearing age—United States, 2006-2010. Morbidity and Mortality Weekly Report, 61(28), 534-538.

Centers for Disease Control and Prevention. (2015a). Leading Causes of Death Reports: National and Regional, 1999-2014. Available: http://webappa.cdc.gov/sasweb/ncipc/leadcaus10_us.html [May 2016].

Centers for Disease Control and Prevention. (2015b). Sudden Unexpected Infant Death and Sudden Infant Death Syndrome: Data and Statistics. Available: http://www.cdc.gov/sids/data.htm [January 2016].

Child Trends. (2015). Mothers Who Smoke While Pregnant: Indicators on Children and Youth. Bethesda, MD: Child Trends.

Children’s Hospital of Philadelphia. (2008). 2008 Partners for Child Passenger Safety (PCPS): Fact and Trend Report. Available: https://injury.research.chop.edu/sites/default/files/documents/2008_ft.pdf [January 2016].

Dubay, L., and Kenney, G. (2003). Expanding public health insurance to parents: Effects on children’s coverage under Medicaid. Health Services Research, 38(5), 1283-1302.

First Focus. (2015). Children’s Budget 2015. Washington, DC: First Focus.

Food Research Action Center. (2015). SNAP: The latest research on participant characteristics and program. Food Insecurity and Hunger in the U.S.: New Research, 6.

Gray, K.F., and Kochhar, S. (2015). Characteristics of Supplemental Nutrition Assistance Program Households: Fiscal Year 2014. Report No. SNAP-15-CHAR. Alexandria, VA: U.S. Department of Agriculture, Food and Nutrition Service, Office of Policy Support.

Han, W.J., and Waldfogel, J. (2003). Parental leave: The impact of recent legislation on parents’ leave taking. Demography, 40(1), 191-200.

Health Resources Services Administration. (2015). Maternal, Infant, and Early Childhood Home Visiting. Available: http://mchb.hrsa.gov/programs/homevisiting [January 2016].

Institute of Medicine. (2011). Hunger and Obesity: Understanding a Food Insecurity Paradigm—Workshop Summary. L.M. Troy, E.A. Miller, and S. Olson (Rapporteurs). Food and Nutrition Board. Washington, DC: The National Academies Press.

Internal Revenue Service. (2015a). 2015 EITC Income Limits, Maximum Credit Amounts and Tax Law Updates. Available: https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/eitc-income-limits-maximum-credit-amounts [October 2016].

Internal Revenue Service. (2015b). EITC Participation Rate by States. Available: https://www.eitc.irs.gov/EITC-Central/Participation-Rate [February 2016].

Internal Revenue Service. (2015c). Ten Facts about the Child Tax Credit. Available: https://www.irs.gov/uac/Ten-Facts-about-the-Child-Tax-Credit [February 2016].

Internal Revenue Service. (2015d). Reduce your Taxes with the Child and Dependent Care Tax Credit. Available: https://www.irs.gov/uac/Reduce-Your-Taxes-with-the-Child-and-Dependent-Care-Tax-Credit [February 2016].

Isaacs, J., Edelstein, S., Hahn, H., Steele, E., and Stuerle, C.E. (2015). Kids’ Share 2015: Report on Federal Expenditures on Children in 2014 and Future Projections. Washington, DC: Urban Institute.

Lee, J.S., Gundersen, C., Cook, J., Laraia, B., and Johnson, M.A. (2012). Food insecurity and health across the lifespan. Advances in Nutrition: An International Review Journal, 3(5), 744-745.

Lino, M. (2014). Expenditures on Children by Families, 2013. Publication No. 1528-2013. Washington, DC: U.S. Department of Agriculture, Center for Nutrition Policy and Promotion.

Marr, C., Huang, C., Sherman, A., and DeBot, B. (2015). EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds. Washington, DC: Center on Budget and Policy Priorities.

Mattingly, M.J. (2009). Child Tax Credit Expansion Increases Number of Families Eligible for a Refund. Issue Brief No. 4. Durham: University of New Hampshire, Carsey Institute.

National Research Council. (2006). Food Insecurity and Hunger in the United States: An Assessment of the Measure. G.S. Wunderlich and J.L. Norwood (Eds.). Panel to Review the U.S. Department of Agriculture’s Measurement of Food Insecurity and Hunger; Committee on National Statistics, Division of Behavioral and Social Sciences and Education. Washington, DC: The National Academies Press.

Office of Child Support Enforcement. (2015a). About the Office of Child Support Enforcement (OCSE). Available: http://www.acf.hhs.gov/css/about [October 2016].

Office of Child Support Enforcement. (2015b). Child Support 2014: More Money for Families. Available: https://www.acf.hhs.gov/sites/default/files/programs/css/2014_preliminary_report_infographic.pdf [May 2016].

Office of Child Support Enforcement. (2016). OCSE Fact Sheet. Available: http://www.acf.hhs.gov/programs/css/resource/ocse-fact-sheet [May 2016].

Office of Family Assistance. (2015). TANF Caseload Data 2015. Available: http://www.acf.hhs.gov/programs/ofa/resource/tanf-caseload-data-2015 [October 2016].

Office of Head Start. (2015). Office of Head Start—Services Snapshot: National All Programs (2014-2015). Available: http://eclkc.ohs.acf.hhs.gov/hslc/data/psr/2015/servicessnapshot-all-programs-2014-2015.pdf [January 2016].

Paradise, J. (2014). The Impact of the Children’s Health Insurance Program (CHIP): What Does the Research Tell Us? Available: https://kaiserfamilyfoundation.files.wordpress.com/2014/07/8615-the-impact-of-the-children_s-health-insurance-program-chip-whatdoes-the-research-tell-us.pdf [May 2016].

Schuster, M.A., Chung, P.J., and Vestal, K.D. (2011). Children with health issues. Future Child, 21(2), 91-116.

Tax Policy Center. (2015). Historical Dependent Care Credits. Available: http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=180 [February 2016].

U.S. Department of Agriculture. (2013). The School-Based After School Snack Program. Available: http://www.fns.usda.gov/sites/default/files/AfterschoolFactSheet.pdf [May 2016].

U.S. Department of Agriculture. (2015). Supplemental Nutrition Assistance Program Participation and Costs. Available: http://www.fns.usda.gov/sites/default/files/pd/SNAPsummary.pdf [October 2016].

U.S. Department of Agriculture. (2016a). National School Lunch Program: Participation and Lunches Served. Available: http://www.fns.usda.gov/sites/default/files/pd/slsummar.pdf [May 2016].

U.S. Department of Agriculture. (2016b). School Breakfast Program Participation and Meals Served. Available: http://www.fns.usda.gov/sites/default/files/pd/sbsummar.pdf [May 2016].

U.S. Department of Agriculture. (2016c). Supplemental Nutrition Assistance Program: FY13 through FY16 National View Summary. Available: http://www.fns.usda.gov/sites/default/files/pd/34SNAPmonthly.pdf [June 2016].

U.S. Department of Agriculture. (2016d). WIC Program Participation and Costs. Available: http://www.fns.usda.gov/sites/default/files/pd/wisummary.pdf [May 2016].

U.S. Department of Education. (2015). U.S. Departments of Education and Health and Human Services Award $237M in Early Education Grants to 18 States. Available: http://www.ed.gov/news/press-releases/us-departments-education-and-health-and-human-services-award-237m-early-education-grants-18-states [January 2016].

U.S. Department of Health and Human Services. (2015). Head Start Services. Available: http://www.acf.hhs.gov/programs/ohs/about/head-start [February 2016].

U.S. Department of Housing and Urban Development. (2016a). Family Unification Program. Available: http://portal.hud.gov/hudportal/HUD?src=/program_offices/public_indian_housing/programs/hcv/family [May 2016].

U.S. Department of Housing and Urban Development. (2016b). Housing Choice Vouchers Fact Sheet. Available: http://portal.hud.gov/hudportal/HUD?src=/program_offices/public_indian_housing/programs/hcv/about/fact_sheet [May 2016].

U.S. Department of Labor. (2015). FMLA Is Working. Available: http://www.dol.gov/whd/fmla/survey/FMLA_Survey_factsheet.pdf [May 2016].

U.S. Department of Labor. (2016). Family and Medical Leave Act. Overview. Available: https://www.dol.gov/whd/fmla/index.htm [May 2016].

U.S. Equal Employment Opportunity Commission. (2016). Pregnancy Discrimination. Available: https://www.eeoc.gov/eeoc/publications/fs-preg.cfm [May 2016].

This page intentionally left blank.